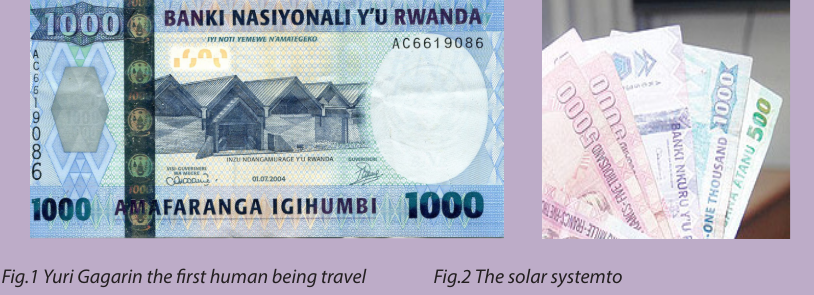

UNIT 6: Money

UNIT 6: MONEY

Key Unit Competence:Language use in the context of money

Introductory activity:

Answer the following questions: 1. Assume that you won one million Rwandan francs in a lottery. Discuss

1. Assume that you won one million Rwandan francs in a lottery. Discuss

three ways you could use this money.

2. Of what importance are taxes and budget for national development?

3. State three income generating activities.

4. Suppose that you earned any income from a given activity. Explain what

percentage of it you would save and for what purpose.

5. What do you understand by:

a. Government Debtb. Annual Deficit

6.1. Describing Types of Income

6.1.1. Reading and Writing: Types of Income

There are three main types of income: earned, portfolio and passive. There is also a

small subset of passive income called non-passive income.

Earned income is a direct result of your labour. This income is usually in the form

of wages or as small business income. Portfolio income is income generated from

selling an asset, and if you sell that asset for a higher price than what you paid for it

originally, you will have a gain. Depending on the holding period of the asset, and

other factors, that gain might be taxed at ordinary income tax rates or capital gains

tax rates. Interest and dividends are other examples of portfolio income. Portfolio

income is not subjected to self-employment taxes, but it might be subjected to net

investment income surtax.

Passive income bluntly is income that could continue to generate if you died. This

type of income would continue to generate even if you decided to do nothing and

sunbathe on some beach. Passive income includes rental income, royalties and

income from businesses or investment partnerships where you do not materially

participate. Passive income is also not subjected to self-employment taxes. But

similar to portfolio income, it might be subjected to net investment income tax. So, if

you own a rental house, the income generated from it is considered passive income.

Additionally, if you wrote a book and receive royalty checks, that income is also

passive and not subjected to self-employment taxes. But, if you write several books

and consider yourself a writer, then you are materially participating in your activity

and your income is earned income. Then you would pay self-employment taxes on

that income.

But there is another funny thing. There is another type of income generated from an

activity in which you materially participate. This is considered non-passive income.

It is not necessarily earned income and it is not passive income. It is something inbetween, but definitely without the social security and medical tax element.

Adapted from https://www.watsoncpagroup.com/kb/three-types-of-income_263.html Retrieved on March 20th, 2018

Read the text on pages 130-131 and answer the following questions1. State and explain the types of income.Example:

2. Based on the above text, state income generating activities that the youth

(boys and girls) can participate in.

3. Explain the cases in which writing books can be:

a. Earned income

b. Passive income

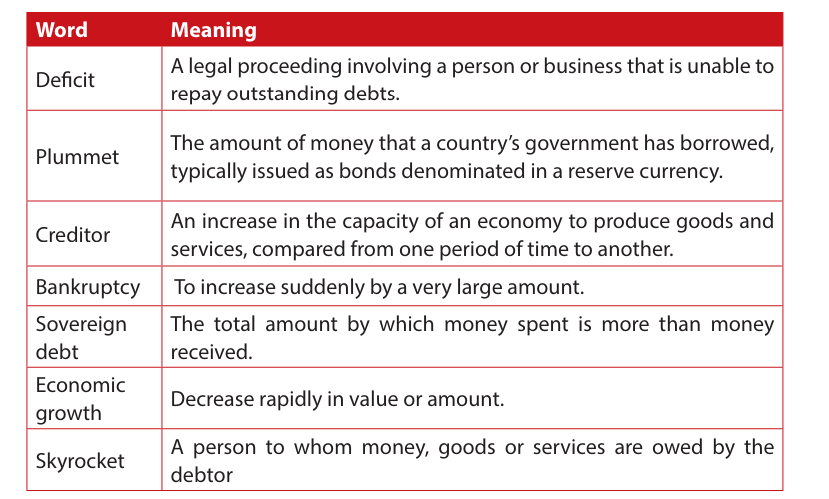

4. Match the words or phrases in Column A with their corresponding meanings

in Column B of the table below. In your exercise notebook, write youranswers in complete sentences.

The word ‘tax’ means a compulsory contribution to state revenue, levied bythe government on workers’ income and business profits.

6.1.2. Application Activities I. Summarize the types of income as detailed in the above passage. Apply the6.1.3 Sounds and Spelling

I. Summarize the types of income as detailed in the above passage. Apply the6.1.3 Sounds and Spelling

rules for summary writing.

II. Write a 350 word composition focusing on how men and women relate in a

complementary manner, on the following Topic:

III. “Both wives and husbands should participate in income generatingactivities.

Having in mind the importance and use of stress in the English language, practice the

pronunciation of the words below found in the above text. You can use a dictionaryif you find it necessary

6.2. Describing Tax and Incomes

6.2.1. Reading and Writing: The Use of Taxes

In order to provide the citizens with all their needs, the government must generate

enough finance. As we all know the government is responsible for providing the

people with several services that they need. These include hospitals, sanitation,

roads, schools, etc.

The government should build hospitals and provide different health services to

the public. It is still tits responsibility to establish linkages of communication and

transportation to different places throughout the country. The government should

ensure security to the people by providing the armed forces the armaments as well

as establishing national defense programs. In food security; still the government

should contribute to the production of sustainable food for the people.

The government should establish proper sanitation for a clean environment. In

the maintenance of natural resources; it is the responsibility of the government to

protect and utilize natural environment. The government is also responsible for the

sustenance of energy supply for the country’s use. These are just some of the many

functions of the government.

In order to deal with all of these, the government needs a huge amount of money

to cater for all the finances. All the above mentioned services need fund to run.

The funds for paying the workforce such as doctors, teachers, soldiers and other

professionals that are hired by the government for their services, are very much

needed.

How does the government produce funds for this? The answer is through the

method of taxation. Taxes are collected by the government from different people,

establishments, organizations, companies and institutions all over the country. Taxes

are collected from products or services on the market and with these the government

is able to produce fund for all its expenses. Because of further needs of fund and to

be able to provide better services, government officials realize that there is a need

to collect more taxes. With this the VAT or value added tax was implemented in the

taxation programme.

As they say, VAT assures us that better services will be implemented by the

government as they collect additional funds from taxes taken from taxpayers. The

VAT calculation has been made and we can see this as we purchase items or services

from different establishments, or in malls or stores. With this, the public expected

that there would be better services that are way ahead. The VAT calculation that we

can see from the products or services that we purchase allows us to see how muchwe provide to bring our contribution to the government.

Adapted from https://businessandfinance.expertscolumn.com/uses-taxes-economy Retrieved on March20th, 2018

Read the above text and answer the following questions1. According to the text on pages 133-134, what is the importance of taxes?

2. State and explain five uses of taxes.

3. As a good citizen of Rwanda, explain the right attitude towards paying

taxes.

4. Based on what you have read in this text, advise people who still try to avoid

paying taxes.

5. Considering the importance of taxes for the country, explain why fraud is a

crime.

6. Referring to the text above, construct one sentence with each of the words

and phrases below.a. … financing … (paragraph one)b. … sanitation … (paragraph two)c. … linkages of communication..... (paragraph two)d. … sustainable … (paragraph two)e. … sustenance … (paragraph three)f. … to deal with … (paragraph four)g. … cater for … (paragraph four)h. … implemented … (paragraph five)i. … additional fund … (paragraph five)Find the synonyms of the words in the first column and fill in the table below.j. … purchased … (paragraph five)

6.2.2. Sound and Spelling

Practise the pronunciation of the words and phrases below. Pay attention to whereyou put stress. You can use a dictionary where necessary.

6.2.3. Application Activities

I. Write a summary point out the uses of tax.

II. Debate on the following motion: “Some governments don’t need taxes to

function.”

6.3. Talking About Debts

6.3.1. Reading and Writing: How to Manage Your Debt

It’s nearly impossible to live debt-free these days. Most of us don’t have ready cash

to pay for our cars, homes or college costs. However, holding some amount of debt

isn’t necessarily a bad thing. A mortgage, for example, can provide you with certain

tax advantages and may replace the rent you could otherwise have to pay. A student

loan could help you earn a college degree that may lead to a rewarding career.

But what about taking on debts for things you don’t need and couldn’t afford-like an

expensive handbag, a lake cruise or a new sports car? That kind of debt could put a

real drain on your wallet, damage relationships and limit your ability to reach more

important goals like saving for retirement. However, there are suggestions to help

you think through what’s best for you and your money.

Debt can pile up for all kinds of reasons. Paying it down can be pretty straightforward

but for that to happen you have to be honest about your spending. Gather all your

credit card, car and student loans, and other debt information. Then, you should

make a note of the balance, interest rate, due date, the minimum payment and how

long it will take to pay off the balance for each. This could help you put your spending

into perspective so you can start developing a plan to get yourself in better financial

shape. If you are married or have a partner, you should ask your loved one to do the

same so you could work together at reducing your debt.

Rather than lamenting that you have too much debt, you should imagine how much

better your life could be if you had less. Then you should set specific financial goals

with a focus on debt reduction. For example, you would decide not to take on any

new credit until your current bills are totally paid off. You should put as many of

your credit card and/or loan payments on auto-pay from your checking or savings

account as you can. That way, you will be sure to avoid any sky-high late fees.

If you can’t pay all your debts each month, you should prioritize what you can pay.

Give high priority to debts secured by a house or car, necessities like utilities and

debts you couldn’t discharge, including student loans. Then you should tackle

unsecured debt like credit cards. Generally speaking, you will want to identify the

credit card with the highest interest rate and pay that one off first. That way, you

would save yourself money by avoiding unnecessary and excessive interest rate

charges over the life of your debt.

Also see if you can obtain a lower interest rate by calling your credit card company.

Often, they will reduce your interest rate to keep you from transferring your credit

card balance to a competitor. If that didn’t work earlier, you should transfer your

balance to a credit card with a substantially lower interest rate. But first make sure

you understand if a balance-transfer fee applies and what the interest rate will be

when the introductory rate ends, typically a year to eighteen months after the first

billing cycle closes.

In case you paid off the first card, you should use the “snowball effect” to keep going.

You could take every penny you were putting toward the first card’s payment and

add it to what you were paying on the card with the next highest interest rate. When

that card is paid off, do the same thing with the next card, and so on. Going forward,

commit to paying every balance in full each month and living within or below your

means.

It may seem old fashioned, but you should avoid paying with plastic and start using

cash, check or debit card instead. Sure, it will take a little extra planning to make sure

you have sufficient cash in your wallet, but if you did so, it could help you clearly

connect to where your money goes each day. It would also help you avoid impulse

purchases and other unhealthy spending.

Many people believe they don’t have enough money to put toward debt reduction.

A spending calculator or a simple budget could help you find the “fat” in your

spending and redirect those funds to reducing your debt more quickly. Ask yourself:

Do I really need a latte every morning, special cell phone services, premium cable

or that new designer shirt? Sticking to a budget isn’t easy, but if you found ways to

save small amounts and add them together, you could be able to pay off your debt

that much faster.

Paying off debt isn’t a free pass to put your retirement savings on hold. Even if you

regularly paid a high interest rate on your credit card debt, the fifty percent match

on your retirement savings would make your retirement plan contribution the

better deal. Most important, if you find you owe more than you can manage, don’t

be reluctant to get help. You should have an experienced financial professional to

guide you through the process of eliminating your debt. That could also make adifference.

Adapted from https://www.northwesternmutual.com/life-and-money/how-to-manage-your-debt-7-stepsto-take/ Retrieved on March 21st, 2018

Read the above text and answer the following questions1. Distinguish between reasonable and unreasonable debts as highlighted in

the first two paragraphs.2. What should a married couple (husband and wife) do to support each otherin reducing debts that would be a threat to their family budget and savingplanning?

3. According to the above passage, state at least five strategies that can help

avoid or reduce debts.4. What is the importance of paying off one’s debts?

5. After reading this text, explain why it is difficult to live debt-free these days.

6. Find the meanings of these words as they are used in the text that you have

just read.a. … mortgage …(paragraph one)b. … drain … (paragraph two)c. … sky-high late … (paragraph four)d. … lamenting … (paragraph four)e. … substantially … (paragraph six)f. … penny … (paragraph seven)g. … snowball effect … (paragraph seven)h. … latte … (paragraph nine)i. … high interest rate … (paragraph ten)j. … reluctant … (paragraph ten)7. Look carefully at the words and phrases below. They are taken from theabove text. Search for their meaning from the dictionary and construct onemeaningful sentence with each of them focusing on the context of money.a. … rewarding career … (paragraph one)b. … straightforward … (paragraph three)c. … discharge … (paragraph five)d. … utilities … (paragraph five)e. … impulse purchase … (paragraph eight)6.3.2. Listening and Speaking : Debate

The motion: “It is impossible to live debt-free nowadays.”

6.3.3. Language structure: The Second Conditional with Modal Verbs

Conditional sentences in English are used to talk about events and

their results. The second conditional is the present hypothetical

conditional. Hypothetical means imaginary or not real.

We use the second conditional when we want to imagine that the present, right

now, is different than it really is. We wish that our present situation, or someone else’s

present situation was different. It is possible but very unlikely, that the condition willbe fulfilled for things are to or will change.

We use the simple past in this case even though we are talking about a present

situation.

The second conditional sentence structure:If + simple past, would + verb• In the second conditional, when the verb in the if-clause is a form of the verbto be, we use for example were instead of was. Note that this use of were, isrecommended with all subjects.• The sentence can begin with an if-clause or a main clause. If the sentencebegins with an ‘if-clause’, put a comma between the if-clause and the mainclause.

Example1. What would you do if you won one billion Rwandan francs in a lottery?2. If I won the lottery, I could take my family on a trip around the world.3. I would buy a new car if I had more money.4. If I were a president, I shouldn’t cut taxes.6.3.4. Application ActivityConstruct ten meaningful sentences using would, could, should, and mightinterchangeably to express possibility with the second conditional. Make sureyour sentences are built in accordance with the context of money6.4. Talking About Budget and Savings 6.4.1. Picture Observation and Interpretation

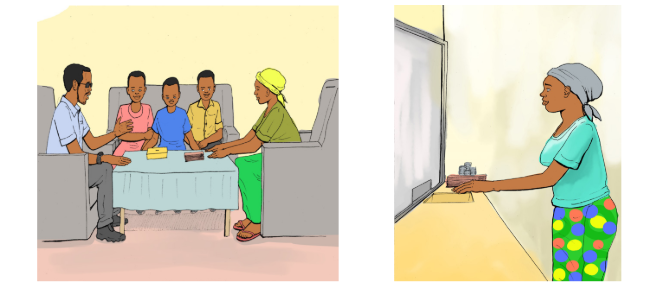

6.4.1. Picture Observation and Interpretation

Observe the pictures above and discuss what the people in the pictures are doing.

6.4.2. Reading and Writing: How to Budget and Save Money?

Budgeting and saving money doesn’t come naturally to many people, for obvious

reasons: it’s easy and tempting to spend money on non-essentials, even if your

budget is tight. It’s all about awareness. Many people discovered that if they had

had enough information, they would have been successful in their budgeting and

saving plan. So how can you get on track with a realistic budget and save money?

There are steps you should have taken to reorganize your finances, prioritize

your spending, deal with any debt you may have, and reduce your taxes if you

had discovered the easy way. These strategies, taken together, have the very real

potential to improve your financial situation. You may never prosper financially until

you develop a realistic budget and stick to it. Such a budget should take care of

indulgences and emergencies.

Budgeting for your money is the cornerstone of a sound financial plan. If you had

scoffed at the idea of creating a budget, after all, you should have known what

you spend every month, especially on big-ticket items like rent/mortgage or car

payment. But try this anyway: Creating a budget and then following it can help you

spot areas where you are spending more than you earn. Here you will find tips on

how to create a budget and track expenses along with other money management

techniques.

Developing your budget will help you spot areas where you are spending more

than you realized. But the next step is more difficult: cutting down your spending

on unnecessary items. This will require some soul-searching on items both large and

small. For example, do you really need a five dollar coffee every morning? Some willsay yes, while for others the answer is no. You could have done with a smaller, older

car if you had realized the outcome. Instead of an expensive vacation this summer,

could you try a staycation, where you stay home (much cheaper) and relax there?

All these choices are very personal and many factors come into play, so there’s no

right answer for most of them. But if you had laid them out, they would have helped

you prioritize your spending, and spot places where you can save money.

Few people get far in adulthood without accumulating some form of debt: credit

cards, student loans, car loans, and mortgage payments are common. In fact, debt

could have been a good thing, if we had used them wisely (who has the money to

buy a house outright?). Credit cards and other forms of debt can be an essential

part of your financial toolbox, but you must exercise care when using these tools.

Understanding the difference between good debt and bad debt will go a long way

in making sure you create and maintain a good credit history.

To build wealth, you have to start somewhere. Therefore, the ability to save money is

the cornerstone of building wealth. In order to save money, you need to spend less

than you earn. This may seem obvious, but so often, it’s easier said than done. Things

could have changed for the better if people had done it this way. Fortunately, there

are several devices you can use when beginning to save money, even when your

budget is tight.

The most important of these is automatic savings. If you had opened a savings

account, and set up your checking account, you should have automatically

transferred a set amount each month into your savings account. You don’t have to

transfer much money, start with whatever your budget can afford. But making this

automatic and then resisting the urge to spend the money impulsively will get you

on the road to long-term savings.

Nobody likes paying taxes, but they are an important aspect of any financial plan.

Even if you don’t make much money, you might be surprised to learn how certain

tax strategies and decisions can impact your finances. Learning how to minimize the

impact that taxes have on your finances can ensure that more money is going into

your pocket and being put to use towards your financial goals.Adapted from https://www.thebalance.com/how-to-budget-and-save-money-in-5-easy-steps-4056838

Retrieved on March 21st, 2018Read the text above and answer the questions below:

1. State two ways explained in paragraph one that can help avoid spending

money on non-essentials.2. Explain how reasonable budget improves one’s financial situation.Of what

importance is a reasonable debt?

3. Discuss three strategies that one should take to save money.

4. Study the meanings of the words and phrases below used in this text. Then

build one correct sentence with each of them:a. … financial plan … (paragraph three)b. … cornerstone … (paragraph three)c. … mortgage … (paragraph three)d. … soul-searching … (paragraph four)e. … made do with … (paragraph four)f. … staycation … (paragraph four)g. … financial toolbox … (paragraph six)h. … devices … (paragraph seven)i. … urge … (paragraph eight)j. … afford … (paragraph eight)5. Find antonyms for each of the following words from the above passage:a. … tight … (paragraph one)b. … indulgence … (paragraph two)c. … scoff at … (paragraph three)d. … spot … (paragraph three)e. … impulsively … (paragraph eight)6.4.3. Application Activity

Write a 350 word composition focusing on the importance of budgeting and

saving.

6.4.4. Listening and Speaking: Oral Discussion

Discuss the importance of budget and saving at the family level.

6.4.5. Language Structure: The Third Conditional with Modal Verbs1. The Third Conditional refers to situations in the past.2. An action could have happened in the past if a certain condition had beenfulfilled.3. Things were different then, however.4. We just imagine, what would have happened if the situation had beenfulfilled.The Structure of the Third Conditional:If+ past perfect, would have+ past participleExample1. If she had saved more money, she couldn’t have been in debt.2. He could have had more money in reserve if he had spent less.3. If she hadn’t spent so much on rent, she should have saved more.4. He couldn’t have owed so much if he had been more careful with hismoney.5. If Kamana had had an idea about budgeting, she could have used hermoney wisely.6.4.6. Application Activity

Construct five correct sentences with the Third Conditional. Your sentences should

be related to the context of money.6.5. Describing Government Debt and Annual Deficit

6.5.1. Reading and Writing: Debts and Budget Deficit

A budget deficit is when spending exceeds income. The term usually applies to

governments, although individuals, companies, and other organizations can run

deficits as well. There are immediate penalties for most organizations that run

persistent deficits. If an individual or family does so, their creditors come in.

As the bills go unpaid, their credit score plummets. That makes new credit more

expensive. Eventually, they may declare bankruptcy. The same applies to companies

who have ongoing budget deficits. Their bond rating falls. When that happens, they

have to pay higher interest rates if they are to get any loans.

Governments are different. They receive income from taxes. Their expenses benefit

the people who pay the taxes. Government leaders retain popular support by

providing services. If they want to continue being elected, they will spend as much

as possible. That’s because most voters don’t care about the impact of the debt.

Government bonds finance the deficit. Most creditors think that the government is

highly likely to repay its creditors. That makes government bonds more attractive

than riskier corporate bonds.As a result, government interest rates remain relatively low. That allows governments

to keep running deficits for years.

Each year the deficit adds to a country’s sovereign debt. As the debt grows, it increases

the deficit in two ways. First, the interest on the debt must be paid each year. This

increases spending while not providing any benefits. If the interest payments get

high enough, it creates a drag on economic growth, as those funds could have been

used to stimulate the economy.

Second, higher debt levels can make it more difficult for the government to raise

funds. Creditors become concerned about a country’s ability to repay its debt. When

this happens, they demand higher interest rates rise to provide a greater return on

this higher risk. That increases the deficit each year.

It becomes a self-defeating loop, as countries take on new debt to repay their old

debt. Interest rates on the new debt skyrockets. It becomes ever more expensive for

countries to roll over debt.

If it continues long enough, a country may default on its debt.Adapted fromhttps://www.thebalance.com/budget-deficit-definition-and-how-it-affects-the-economy3305820Retrieved on March 22nd, 2018Read the text on pages 143-144 and answer the questions below:1. Explain how a budget deficit occurs and the effect that it has on the debtor’scredit score.2. Discuss two impacts that cumulative deficit has on the sovereign debt.3. How does increasing deficit affect the interest rates of the debt?4. According to what you have read in the above passage, what is the rightattitude that you would adopt about taxes if you were a taxpayer?5. You came across the words in Column A of the chart below while readingthe above passage. Carefully study them and math them with theircorresponding meanings in Column B. Then write one correct sentencewith each of them in your exercise notebook. 6.5.2. Summary WritingIn an 80 words paragraph, summarize the above passage explaining Governmentdebt and Annual deficit.6.5.3. Listening and SpeakingDiscuss about the impact of persisting deficit on national economy growth.6.6. UNIT SELF-ASSESSMENT6.6.1. Comprehension and VocabularyThe importance of savingAs parents, it is your obligation to teach your children about some life lessons,including saving money at an early age of life. You have to show them the truevalue of money and ensure that you are setting a good example to them as well.Being frugal is one thing you need to inculcate to your children. However, becareful on how you approach this lifelong experience. You must be cautious onnot going overboard with frugality, for it might send your children the wrongimpression. Simply show them real-life situations to make them understandmore what frugality means.Apparently, being frugal is not just a lesson, rather a lifestyle. It needs to be partof each family’s daily life. Hence, here are some reasons why it is important tosave money for your family:As a family, there will always be some unforeseen expenses that will come yourway. Your car might need some repair, an appliance needs to be replaced, oryour children have some school expenses to be paid. Worse, if you encountera legal matter, like domestic violence, and this will certainly cost you a lot. It isbetter that you have money at hand. At the same time, learn to seek help fromthe experts, like lawyers regarding this matter as money will not be enough ifyou don’t have knowledge on this issue. Whatever the reason might be, youhave to ensure that you’re able to save money for these unpredictable scenarios.No matter how much we want to get rid of emergencies, they still do happen.In case an emergency happens to your family, you have to be prepared for itfinancially. When a family member gets sick or gets involved in an accident,then you have to get ready for the expenses. Most of the time emergencies canbe costly, so it is really important that you have savings. This way, you can besure that you are able to pay for the cost right away.Always remember that whatever your children see from you has an impact tothem. If you want them to do good at all times, then you have to be a good rolemodel to them. They will actually learn more from your actions than your words,so always watch your actions. Teaching them about controlling spending shouldstart with you and you can pass it on to them.By saving money today, you will be able to improve your life in the future. There

6.5.2. Summary WritingIn an 80 words paragraph, summarize the above passage explaining Governmentdebt and Annual deficit.6.5.3. Listening and SpeakingDiscuss about the impact of persisting deficit on national economy growth.6.6. UNIT SELF-ASSESSMENT6.6.1. Comprehension and VocabularyThe importance of savingAs parents, it is your obligation to teach your children about some life lessons,including saving money at an early age of life. You have to show them the truevalue of money and ensure that you are setting a good example to them as well.Being frugal is one thing you need to inculcate to your children. However, becareful on how you approach this lifelong experience. You must be cautious onnot going overboard with frugality, for it might send your children the wrongimpression. Simply show them real-life situations to make them understandmore what frugality means.Apparently, being frugal is not just a lesson, rather a lifestyle. It needs to be partof each family’s daily life. Hence, here are some reasons why it is important tosave money for your family:As a family, there will always be some unforeseen expenses that will come yourway. Your car might need some repair, an appliance needs to be replaced, oryour children have some school expenses to be paid. Worse, if you encountera legal matter, like domestic violence, and this will certainly cost you a lot. It isbetter that you have money at hand. At the same time, learn to seek help fromthe experts, like lawyers regarding this matter as money will not be enough ifyou don’t have knowledge on this issue. Whatever the reason might be, youhave to ensure that you’re able to save money for these unpredictable scenarios.No matter how much we want to get rid of emergencies, they still do happen.In case an emergency happens to your family, you have to be prepared for itfinancially. When a family member gets sick or gets involved in an accident,then you have to get ready for the expenses. Most of the time emergencies canbe costly, so it is really important that you have savings. This way, you can besure that you are able to pay for the cost right away.Always remember that whatever your children see from you has an impact tothem. If you want them to do good at all times, then you have to be a good rolemodel to them. They will actually learn more from your actions than your words,so always watch your actions. Teaching them about controlling spending shouldstart with you and you can pass it on to them.By saving money today, you will be able to improve your life in the future. There

is nothing more important than having a peace of mind and not worrying about

your life in later years because you don’t have savings. Thus, you can start saving

now for your family and reap the fruit of your sacrifices at the right time.Adapted from http://missfrugalmommy.com/the-importance-of-saving-money-for-the-family/

All in all, saving money for you and your loved ones should be one of your top

priorities in life. With the useful tips mentioned above, you are sure enough that

you can overcome any problems or emergencies that will come along the way

as well as be able to secure the future of your entire family.

Retrieved on March 25th, 2018Read the text on pages 146-147 and answer the questions below:

I. After reading the above text, explain how parents can inculcate the culture

of saving into their children.

II. State three reasons why it is very important to save money.

III. According to the above text, what is the right time to start saving and why?

IV. Build a correct sentence with each of the words and phrases below. They

have been taken from the above text.a. … frugal … (paragraph two)b. … overboard … (paragraph two)c. … unforeseen … (paragraph four)d. … appliance … (paragraph four)e. … get rid of … (paragraph five)f. … reap … (paragraph seven)6.6.2. Grammar and Phonology

I. Choose the correct tense and form of the verbs in brackets paying attention

to the appropriate type of conditional sentence that applies in order to

complete the sentences below:

1. She …………… (owe) so much if she had been more careful with her

money.

2. If Munyana ………. (know) the importance of taxes, she would pay them

on time.3. My uncle should have saved money for his retirement if he ……….

(have) income generating activities.

4. Families ………….. (solve) many of their financial problems if they

applied strategies about budgeting and saving.

5. If they had paid their debts on time, they …………. (declare) bankrupt

6. Maina ……….. (fail) in her business if she avoided fraud.

7. If Musoni had listened to his wife, he …………. (have) all these

problems with his creditors.

8. I would collaborate closely with Rwanda Revenue Authority if I ……..

(be) a taxpayer.

9. If Nyarwaya had spent less, he …………. (save) more money for

emergencies.

10. My father ………… (be) in debt if he didn’t borrow so much.

II. Read the following words and phrase aloud and correctly. Put the stress at

the right place where necessary.

1. Frugal

2. Overboard

3. Unforeseen

4. Appliance

5. Reap6.6.3. Summary

Carefully read the passage that follows, then write a 70 words paragraph

summarizing the objectives and importance of taxes.

Objectives and importance of taxes.

There are many responsibilities of the state to its countrymen. The State is

represented by the government. Hence, the government of any country performs

a number of activities in order to maintain law and order, peace and security,

satisfying the requirement of basic needs and public utilities etc.

It also initiates various development programmes and maintains diplomatic and

friendly relations with other nations in the world. In order to carry out all these

activities and discharge its overall responsibilities towards the people, it needs

sufficient revenue. Such a revenue is known as government or public revenue.Government revenue is collected through various sources according to the provisions of the financial acts, rules and regulations. Among them, tax is the main

source of collecting the government revenue.The concept of tax was initiated with a view to generate government revenue

in its very beginning stage. In course of time, it has been utilized for various

purposes. The first objective was to raise government revenue for development

and welfare programmes in the country. The second was to maintain economic

equalities by imposing tax to the income earners and improving the economic

condition of the general people. The third was to encourage the production

and distribution of the products of basic needs and discourage the production

of harmful ones. The last was to discourage import trade and protect the

national industries.Tax is a major source of government revenue and it contributes for the overall

development and prosperity of a country. Taxes are important since they enable

the government to raise revenue in terms of income tax, custom duty, excise

duty, entertainment tax, VAT, land revenue tax and so on from various sectors

in order to initiate development and welfare programmes. Secondly, through

taxes, the government maintains economic stability by reducing economic

inequalities. The government ensures that there is equitable distribution

of wealth by way of imposing tax to the income earners and improving the

economic condition of the general people.

Thirdly, the government regulates the economic sectors into the right direction by

encouraging the production and distribution of useful goods and discouraging

the harmful products by imposing high tax rate on them. In addition, through

a good taxation system, the government builds and strengthens the national

economy by encouraging and protecting national industries and promoting

export trade. Finally, the government reduces regional economic disparity by

encouraging the entrepreneurs to establish industries in remote and backward

regions by giving tax exemptions, rebates and concessions etc.Adapted from http://www.wisenepali.com/2014/12/importance-of-tax-types-and-objectives.

html Retrieved on March 25th, 20186.6.4. Essay WritingWrite an essay of not less than 300 words on the following topic: “Saving savesLife”.