UNIT 9 : FINANCIAL STATEMENTS ANALYSIS

Key unit competence: To be able to analyze financial statements for anentity

Introductory activity

JWZ is a partnership business of lawyers operating its activities in

Bugesera District. The business accountant prepared all needed financial

statements for the year ended 31 December 2022 horizontally. Some

users of financial statements information are trying to convince him not to

use the horizontal format and the accountant is trying to explain to themthat there are different forms of financial statement analysis.

You are asked:

1. What is financial Statement analysis?2. What are the formats of Financial Statements?

9.1. Introduction to financial statement analysis

Learning Activity 9.1

An Audit conducted in Rwanda, in 2022 revealed that some businesses are

not preparing financial statements. Asking them why, some answered that

they do have enough knowledge on financial statements and thus they do

not know about the financial statements analysis. As an accountant student,

your asked to help them about:

a) Explain the term financial Statements analysis?

b) What is involved in Financial statements analysis?c) What are the advantages of financial statements analysis?

Financial Statement consists of Statement of Financial Position, Financial reports

and other financial reports which are to be framed according to applicable

financial reporting framework and auditor and various other analysts analyze

the financial statements and give their report on the same but this analysis has

certain limitations because of volatile industry, business conditions, and otherfactors.

9.1.1 Introduction

Financial statements are prepared and presented, in accordance with generally

accepted accounting principles, to give readers an overview of the financial

results and condition of a business. However, it is the analysis of financial

statements that gives true representation of what is going on inside the company.

It is necessary to analyses the numbers in the statements to get a true and clear

picture of the company. The financial statements are analyzed with the help of

different tools such as comparative statements, common size statements, ratioanalysis, trend analysis and funds flow analysis.

Financial statement analysis (or financial analysis) is the process of reviewing and

analyzing a company’s financial statements to make better economic decisions.

These statements include the income statement, balance sheet, statement ofcash flows, a statement of retained earnings.

9.1.2 Meaning of financial statements analysis

Financial statement analysis is a method or process involving specific

techniques for evaluating risks, performance, financial health, and future

prospects of an organization.

Financial statement analysis (or financial analysis) is the process of reviewing and

analyzing a company’s financial statements to make better economic decisions.

These statements include the income statement, balance sheet, statement ofcash flows, a statement of retained earnings.

Financial statement analysis is one of the most fundamental practices in financial

research and analysis. In layman’s terms, it is the process of analyzing financialstatements so that decision-makers have access to the right data.

Financial statement analysis is also used to take the pulse of a business.

Since statements center on a company’s key financial details, they are useful

for evaluating activities. This is essential to understanding the firm’s overallperformance.

Financial statement analysis involves:

• Assessment of the firm’s past, present and future financial condition

• Finding out a firm’s financial strengths and weaknesses

• Comparison through time (Trend)

• Comparison among companies (industrial analysis)

Advantages of a financial statement Analysis

• To meet their financial reporting obligations and to assist in strategic

decision-making, firms prepare financial statements. However, “the

information provided in the financial statements is not an end in itself as

no meaningful conclusions can be drawn from these statements alone.”

Firms employ financial analysts to read, compare and interpret the data

as necessary for quantitative analysis and decision- making.

• Financial analysis determines a company’s health and stability.

• The data gives you an intuitive understanding of how the company

conducts business

• Stockholders can find out how management employs resources and

whether they use them properly.

• Governments and regulatory authorities use financial statements to

determine the legality of a company’s fiscal decisions and whether the

firm is following correct accounting procedures

• Government agencies, such as the Internal Revenue Service, use

financial statement analysis to decide the correct taxation for thecompany.

Financial statements

Measures of financial performance and position are developed from a firm’s

financial information organized into 3 main statements:

– Statement of Profit or Loss

– Statement of Financial Position– Statement of Cash Flow

According to IFRS, a complete set of financial statements comprises the

following:

– Statement of financial Position

– Statement of Profit or Loss

– Statement of changes in equity

– Statement of cash flow– Accounting policies and notes

Entities are encouraged to furnish other related financial and non-financial

information in addition to the financial statements. The statement of changes

in equity reflects information about the increase or decrease in net assets orwealth.

Importance of Statement of Financial Position

The statement of Financial Position helps to know the three origins of economic

resources used by a firm:

• Contribution of shareholders or owners

• Long, medium and short term liabilities

• Internal financing (retained earnings and reserves)

Succinctly, sources of capital used by a business are:

• Personal resources

• Borrowings from friends or banks

• Trade credits• Bank overdraft

The Statement of Financial Position helps to know the use of economic resources

which are:

• Fixed assets (Fixed capital)

• Current assets (Stocks, receivables, cash)

Structural equilibrium of the enterprise

The structural equilibrium is based on the following general principles:

1. Owner’s equity should be greater than liabilities.

2. Capital employed (owner’s equity plus long term liabilities) should cover

the fixed assets and part of current liabilities.

3. Current liabilities should be invested only into current assets and basicallyin cash and receivables so to be easily reimbursed.

Application activity 9.1

As an accountant student:

a) What do you understand by financial statements analysis?

b) Is it necessary to have financial statement Analysis? Justify your answer

9.2 Uses of financial statement analysis

Learning Activity 9.2

Your classmates of senior six Accounting are discussing about preparation

of financial statements. They are not aware and asked you to:

Explain the key measures in determining the financial strength of the

business?

Final accounts or financial Statements are outputs of an accounting system,

they are prepared at the end of the financial year, hence the name final accounts.

However, interim financial statements can be prepared before the end offinancial year.

External users of accounting information (Banks, shareholders or investors,

creditors, donors, funding agencies, government, competitors and general

public) are more interested in final accounts or financial statements than booksof accounts.

Final accounts are prepared from trial balance after end year adjustments

are incorporated. The types of financial statements prepared vary from one

organization to another depending upon its nature and size among other factors.

However, the major financial statements prepared by profit making organizationsfor disclosure purpose are:

• Statement of profit or Loss

• Statement of Financial Position

The income statement should be prepared before the balance Sheet/Statement

of Financial Position because the ending figure after subtracting expenses from

incomes (net profit or net Loss) connects the income statement/Statement of

Profit or Loss and statement of financial Position, thus, there are two accounts

that are in both final accounts:

• Closing stock• Net profit/Loss

9.2.1 Statement analysis for different users

The users of information can be divided into two:

• Internal users: who are parties within the organization e.g. the

management or the employees.

• External users: who on the other hand, are parties outside the

organization e.g. the shareholder, creditors, government, customers,etc.

Stakeholders including current and potential investors, creditors, customers,

employees, government, bankers and stock exchanges all have an interest in the

financial performance (and other aspects) of a company. Financiers and credit

providers are concerned about the financial performance and creditworthiness

of a company, especially before providing any loans or securities. Stakeholderswill have enhanced confidence in a company if it has strong ratios compared

The need for financial analysis

Financial statements are prepared for decision-making purposes. Good decision

making is driven by effective analysis and interpretation of financial statements

(also referred to as financial analysis). Analysis provides a meaningful conclusion

by drawing a meaningful relationship between the various items of the two

financial statements:

• the profit and loss account or income statement

• the balance sheet or statement of financial position.

These are the indicators of profitability and financial soundness of a businessentity for a given period.

Interested parties and managers

Different parties are interested in financial statements and their analysis for

various reasons. As discussed above, they provide useful financial information to

external and internal users in making financial decisions. For example, investors

want to know the earning capacity of the business, the wellbeing of the business

and its future prospects. Understanding the company’s financial position andrecent performance helps management direct the business.

Shareholders entrust the board of directors with the responsibility for managing

the resources entrusted to them by giving it direction and providing both control

and strategy. The board employs managers to implement their strategic visionand to help ensure the investments of owners are maximized.

Owners put mechanisms in place to monitor managerial behavior. For example,

the UK Corporate Governance Code provides guidelines that require directors

to conduct business with integrity, responsibility and accountability. An

obligation of stewards or the directors is to provide relevant and reliable financialinformation, including analysis of financial statements using various techniques.

Key financial indicators

The purpose of financial analysis is to assess the financial strength and weakness

of the business by assessing the efficiency and performance of an entity. The

key measures in determining the financial strength of the business are as listedbelow.

• Profitability: the main objective of a business and its management

(the agent) is to earn a satisfactory return on the funds invested by

the investors or shareholders. Financial analysis ascertains whether

adequate profits are being earned on the capital invested. It is also useful

to understand the earning capacity of a business, its wellbeing and its

prospects, including the capacity to pay the interest and dividends.

• Trend of achievements: analysis can be done through the comparison

of financial statements with previous years, especially trends regarding

various expenses, purchases, sales, gross profits and net profit. Users

can compare the value of assets and liabilities, and forecast the future

prospects of the business.

• Growth potential of the business: financial analysis indicates the

growth potential of the business.

• Comparative position in relation to similar businesses: financial

analysis helps the management to study the competitive position of their

firm in respect of sales, expenses, profitability and capital utilization.

• Overall financial strength and solvency of the entity: analysis

helps users make decisions by determining whether funds required

for the purchase of new machines and equipment are provided from

internal sources or received from external sources, and whether it hassufficient funds to meet its short-term and long-term liabilities.

9.2.2 Analysis of income statement and balance sheet

Tools of financial statements analysis

• Comparative financial statement

• Common size financial statements

• Trend percentages analysis

• Ratio analysis, cash flow statement analysis etc.

What Is Horizontal Analysis?

Horizontal analysis is used in financial statement analysis to compare historical

data, such as ratios, or line items, over a number of accounting periods.

Horizontal analysis can either use absolute comparisons or percentage

comparisons, where the numbers in each succeeding period are expressed as

a percentage of the amount in the baseline year, with the baseline amount being

listed as 100%. This is also known as base-year analysis.

Horizontal analysis shows the changes between years in the financial data in

both FRW and percentage form

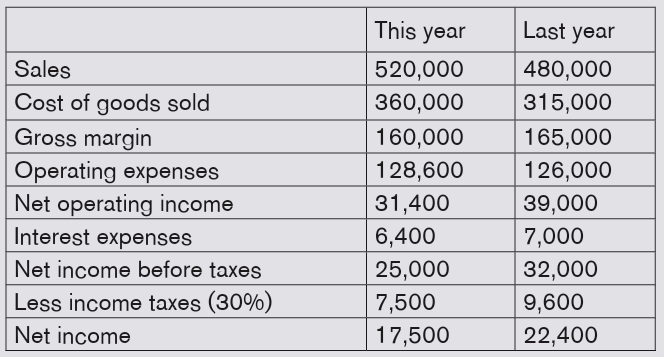

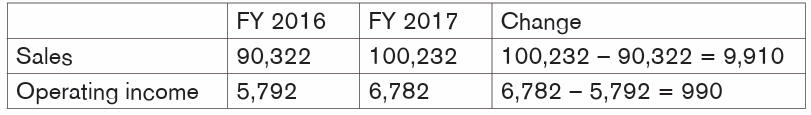

Illustration1

Norique Ltd had the following sales and operating income in FY 2016 and FY2017 (amounts are in FRW millions).

The change calculated shows that the sales have increased by FRW 9,910

million in FY 2017, with the corresponding increase in the operating income byFRW 990 million.

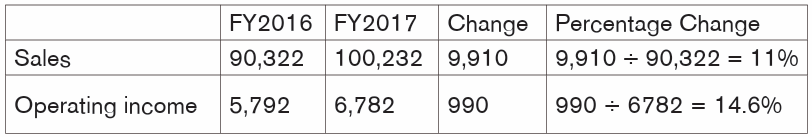

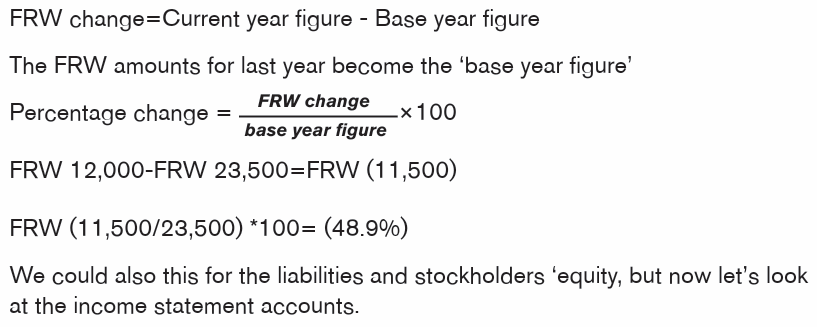

A better trend analysis is provided by the change in percentage, calculated as:

Percent change = (Current period amount – Base period amount) ÷ Base

period amountPercentage change for Norique Ltd is as follows.

The above calculations show sales have increased by 11% from FY2016 to

FY2017, whereas operating income has increased by 14.6%. This requiresfurther investigation.

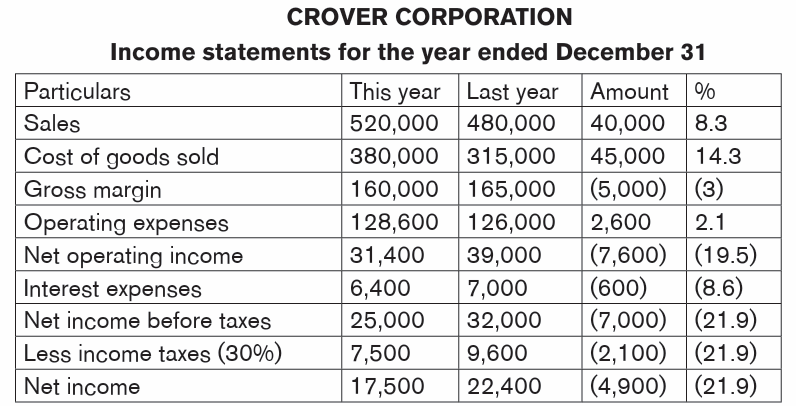

Illustration2.

Clover Corporation’s balance sheets for the year endedDecember 31

Sales increased by 8.3%, yet net income decreased by 21.9%

There were increases in both cost of goods sold 14.3% and operating expenses

2.2%. These increased costs more than offset the increase in sales, yielding an

overall decrease in net income.

Vertical analysis or Common size statements

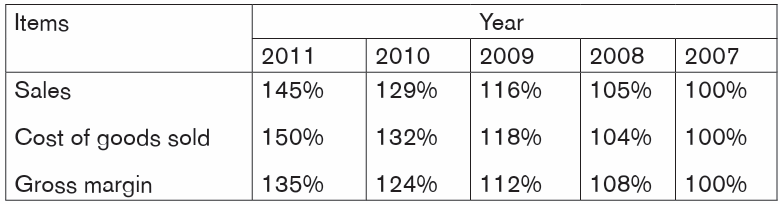

Trend Analysis

Trend percentages state several years’ financial data in terms of a base year,which equals 100 percent

Working:

The base year is 2007, and its amounts will equal 100%.

2008 amount/2007 amount*100%

(290,000/275,000) *100%=105%

(198,000/190,000) *100%=104%(92,000/85,000) *100%=108%

By analyzing the trends for Berry Products, we can see that cost of goods sold

is increasing faster than sales, which is slowing the increase in gross margin.

Vertical analysis is a proportional analysis where each item of financial

statement is shown as a percentage of base items. Usually, line items in the

income statement are shown as a percentage of sales, while line items in the

balance sheet are shown as a percentage of the total assets. It helps to provide

a greater understanding of how sales revenue is being consumed within the

business, thus requiring further investigation if the level of activity is not as

expected

Vertical analysis: focuses on the relationships among financial statement

items at a given point in time.

In Income statements, all items usually are expressed as a percentage of sales.

In Balance sheets, all items usually are expressed as a percentage of total

assets.

Common-size financial statements are particularly useful when comparing datafrom different companies.

Interpreting Horizontal and Vertical Analyses

There are several interpretations that can come out of Horizontal analysis, the

following are examples:

Under horizontal analysis,

• Increase in total asset may mean company growth

• Increase in company’s inventory and fixed asset may be due to

expending business by opening new stores, branches, etc. However,

increase in inventory may also mean weakness because as a general

rule, retail companies are in business to sell, not hold, inventory. When

we see a build-up in inventory we know that the company is facing a

soft business environment. We cannot generate cash unless we sell

inventory.

• Significant Decrease in cash position from one period to another may

be a warning sign since the cash weakening hurt the liquidity of the

company.

• A comparative analysis on income statement reveals an increase/

decrease in income/expense from one year to another and this would

explain a decrease or increase in the resulting net income.

Under vertical analysis:

• Under balance sheet any other item is expressed as a percentage of

asset, so important figure is gauged depending on how much they are

compared to total asset for example: A higher % of debt may mean a

highly leveraged company and Vice versa.

• Under income statement important figures are determined depending

on how much they are compared to sales; for e.g. if COGS and

operating expenses are important compared to sale, one can evaluate

the effectiveness of management looking at how well the management

controls operating expenses and COGS. The increase in % of COGS

or Operating expense as compared to sales may mean an adversesituation given that it would worsen the net income.

9.2.3 Limitations of financial analysis

• The cost principle is used to prepare financial statements. Financial

data is not adjusted for price changes or inflation/deflation.

• Companies may have different fiscal year ends making comparison

difficult if the industry is cyclical.

• Diversified companies are difficult to classify for comparison purposes

• Financial statement analysis does not provide answers to all the users’questions. In fact, it usually generates more questions!

Other limitations

The analysis is based on past and present data and conditions: The

analysis of the auditor and various analysts are based on past data and present

conditions and results. They compare the past data with the present position

and if there is the improvement they will issue the positive reports and otherwise

the qualified report, but they do not consider the future plans of the enterprise

and future economic and market conditions as these conditions can change

at any point of time due to unpredictable nature. The report which shows the

favorable points is based on conditions which can be changed hence it is not

necessary that report will always show the points in the future also.

Reliability of the data presented: Auditor and various analyst make reliability

on the reports and financial statements presented by the management of the

enterprise and they only verify the figures on test check bases but in the world of

competition everyone wants to attract the investors and hence one can do the

same by window dressing of accounts and showing the better position of the

company. Hence the reports issued by independent third parties are subject to

the limitation of reliability and transparency by management.

Valuation by different methods of accounting policies and estimates:

The valuations made by management like valuation of inventory, valuation of

Fixed assets, valuation of investments, etc. are based on different methods

and accounting policies and estimates by the management. And the auditor or

financial analyst cannot question on the method or policy adopted unless being

not acceptable by law. The different methods and estimates show different

results and accordingly different financial positions.

Change in accounting methods enforced by law: There are situations

when an enterprise is following one accounting method for years and suddenly

the law changes and enterprise have to change the accounting policies or

methods as required by law. Hence because of different accounting policies

from past periods it is not justifiable to compare the statement with the past

data. Analysts and auditor while analyzing should keep this limitation in mind.

Inflationary effects are being ignored: As inflation is increasing day by day

and it affects every business organization which results into rise in expenses and

probably a decrease in profits. With this, too every investor, analyst or auditor

make the comparison of the current position with the past data but they should

also keep that limitation in mind that the time value of money changes.

Limitations of methods application for analysis: Every analyst whether

the auditor or the market analyst analyzes and make reports based on the

experience and skills of the analyst and we must take this fact in mind that the

experience and skill of analysts is not the same in any manner. Hence the reports

issued by them are subject to limitation as it is based on personal judgments of

the analyst.

The Reports of the Analysis should not create the assessment of

managerial Ability: On the basis of the reports issued by an analyst, the

people or some stock analyst question the management about their inability

to bring the company at the industry standards and forget the truth that it is

based on market conditions, situations, the response from buyers, the attitude

of employees, credit worthiness etc. hence one should keep the fact in mind

that unfavorable result doesn’t mean the poor managerial or performance ability.

Change of business conditions: The market is highly unpredictable, the

market situations and conditions can change at any point of time, sometimes

results into recession sometimes favorable conditions. Hence being an analyst,

one should make clear that the reports are subject to the current conditions and

which may or may not be the same all the time and can change in the future, theunfavorable conditions can turn into favorable and vice versa.

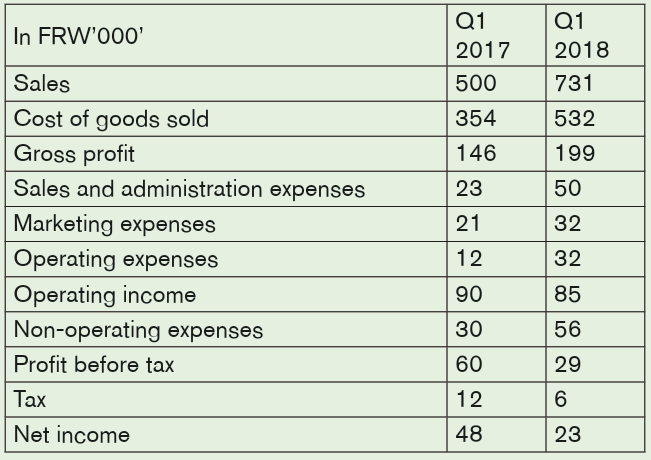

Application activity 9.2

a) Disco LLP has finalized its quarterly results for Q1 FY 2018. The team

has also included the previous years’ financials. Can you determine thehorizontal trends?

End unit assessment

1. What do you understand about horizontal analysis?

2. Which of the following statement describes horizontal analysis?

a) A statement that shows items appearing on it in percentage and

dollar form.

b) A side-by-side comparison of two or more years’ financial

statements.

c) A comparison of the account balances on the current year’s

financial statements.

d) None of the above.

Let’s take the above information from the comparative income statements

of Clover Corporation for this year and last year.Determine the vertical trend.