Topic outline

UNIT 1 : REGULATORY FRAMEWORK

Key unit competence: To be able to explain the Regulatory

Framework of Accounting

Introductory activity

Last time, the accounting was not well prepared; it was planned on each

personal understanding without respecting common rules and regulations

to conduct things in the same direction. As the time are replaced,

accounting preparation has been improved so that it was not prepared

based on a particular country’s rules and regulations but it was prepared

in the same manner through the world where the regulatory framework

exists on national and international levels.

Required: What accounting bodies should do in order to standardize

the different accounting policies and practices followed by

different business concerns?

1.1 Regulatory System

Learning Activity 1.1

Many figures in financial statements are derived from the application of

judgment in applying fundamental accounting assumptions and conventions.

This can lead to subjectivity.

Required: In attempt to deal with this subjectivity, and to achieve comparability

between different organizations, what can you develop?

In Accounting, the regulatory framework provides a set of rules and regulations

for accounting. Compliance and regulatory frameworks are sets of guidelines

and best practices. Organizations follow these guidelines to meet regulatory

requirements, improve processes, strengthen security, and achieve other

business objectives (such as becoming a public company, or selling cloud

solutions to government agencies).

Regulatory framework of accounting refers to the collection of accounting

standards, Laws, Codes, rules and regulations that are issued by

accounting bodies, government and regulatory units, which qualified accountant

must abide by. Remember, the IASB and FASB I mentioned earlier. They are

accounting standards setting bodies.

1.1.1 Introduction

Although new to the subject, you will be aware from your reading of the press

that there have been some considerable upheavals in financial reporting, mainly

in response to criticism. The details of the regulatory framework of accounting,

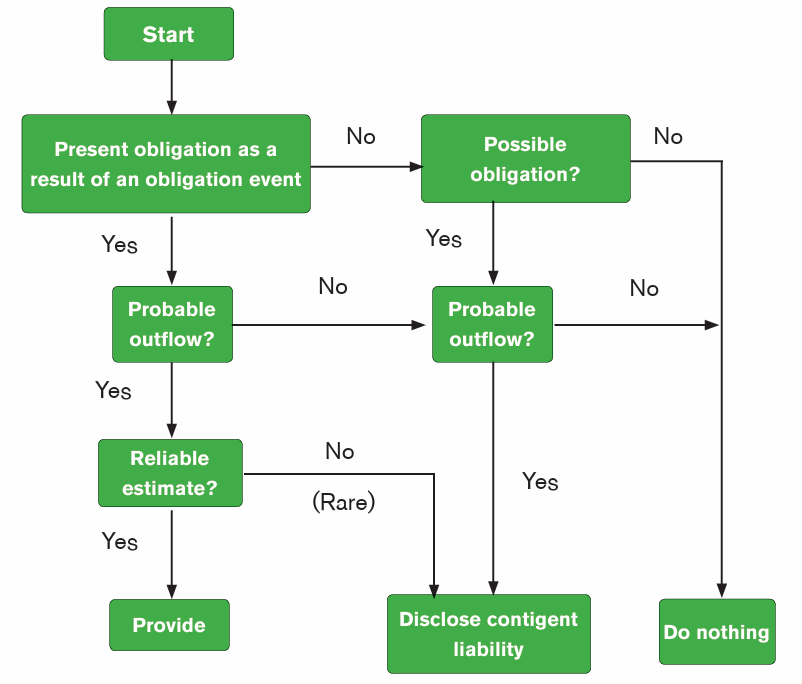

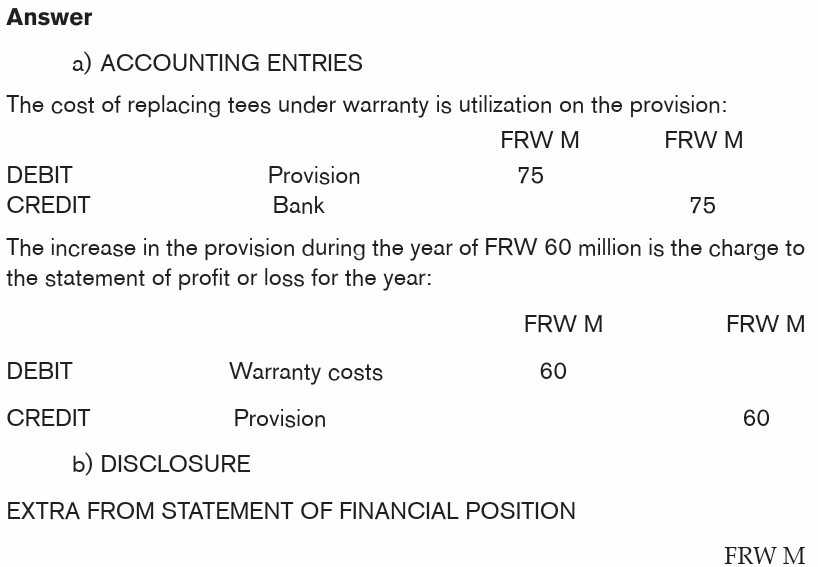

and the technical aspects of the changes made, will be covered later in this unit

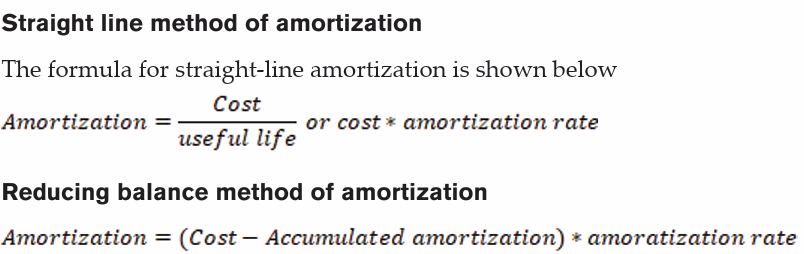

and in your more advanced studies. The purpose of this unit is to give a general

picture of some of the factors which have shaped Financial Accounting. We

will concentrate on the accounts of limited liability companies, as these are the

accounts most closely regulated by statute or otherwise.

The following factors that have shaped Financial Accounting can be identified:

• National/local legislation

• Accounting concepts and individual judgment

• Accounting standards

• Other international influences

• Generally Accepted Accounting Principles (GAAP)

• Fair presentation

1.1.2 National/local legislation

In most countries, limited liability companies are required by law to prepare and

publish accounts annually. The form and content of the accounts is regulated

primarily by national legislation. In Rwanda, the main legislation is the Law

Governing Companies 17/2018

1.1.3 Accounting concepts and individual judgment

Many figures in financial statements are derived from the application of judgment

in applying fundamental accounting assumptions and conventions. This can

lead to subjectivity. Accounting standards were developed to try to address this

subjectivity.

Financial statements are prepared on the basis of a number of fundamental

accounting assumptions and conventions. Many figures in financial statements

are derived from the application of judgment in putting these assumptions into

practice.

It is clear that different people exercising their judgment on the same facts can

arrive at very different conclusions.

Case study

An accountancy training firm has an excellent reputation among students and

employers. How would you value this? The firm may have relatively little in the

form of assets that you can touch; perhaps a building, desks and chairs. If you

simply drew up a statement of financial position showing the cost of the assets

owned, then the business would not see to be worth much, yet its income

earning potential might be high. This is true of many service organizations where

the people are among the most valuable assets.

Other examples of areas where the judgment of different people may vary are

as follows.

• Valuation of buildings in times of rising property prices

• Research and development: is it right to treat his only as an expense?

In a sense it is an investment to generate future revenue

• Accounting for inflation

• Brands such as ‘Coca-Cola’ and ‘High Land Tea’. Are they assets in the

same way that a fork lift truck is an asset?

Working from the same data, different groups of people produce very different

financial statements. If the exercise of judgment is completely unfettered, there

will be no comparability between the accounts of different organizations. This

will be all the more significant in cases where deliberate manipulation occurs, in

order to present accounts in the most favorable light.

1.1.4 Accounting standards

In an attempt to deal with some of the subjectivity, and to achieve comparability

between different organizations, accounting standards were developed. These

are developed at both a national level (in most countries) and an international

level. The Financial Accounting syllabus is concerned with International

Financial Reporting Standards (IFRS Standards).

IFRS Standards are produced by the International Accounting Standards

Board (IASB).

Accounting is a vital part of business operations that involves managing and

reporting the financial operations of companies.

Accounting standards allow

accounting departments nationally and internationally to use similar practices

and produce similar quality accounting. If you work or plan to work in the

accounting field, it may be helpful to learn about accounting standards and why

they matter. In this article, we explain what accounting standards are, discuss

why they are important and describe how organizations use them.

Definition

Accounting standards are a set of procedures and measures that inform how

businesses conduct their accounting activities. They contain best practices for

recording, measuring and disclosing financial transactions. They apply to all

parts of a company’s activities, including revenue, expenses, noncash expenses,

assets, liabilities, equity and reporting. The primary purpose of accounting

standards is to provide accurate financial information that banks, government

agencies and investors can use when interacting with private companies.

Objectives of accounting standards

Primary objectives of accounting standards are:

• To provide a standard for the diverse accounting policies and principles.

• To put an end to the non-comparability of financial statements.

• To increase the reliability of the financial statements.

• To provide standards which are transparent for users.

• To define the standards which are comparable over all periods

presented.

• To provide a suitable starting point for accounting.

• It contains high quality information to generate the financial reports.

This can be done at a cost that does not exceed the benefits.

• For the eradication the huge amount of variation in the treatment of

accounting standards.

• To facilitate ease of both inter-firm and intra-firm comparison.

Main objective of accounting standards is to standardize the different accounting

policies and practices followed by different business concerns.

Importance of Accounting Standards

Accounting standards play a very efficient role in the whole accounting system.

Some of its important roles are discussed below:

• Brings uniformity in accounting system

• Easy comparability of financial statements

• Assists auditors

• Makes accounting informative easy and simple

• Avoids frauds and manipulations

• Provides reliability to financial statements

• Measures management performance

Relevance of accounting standards

An accounting standard is a standardized guiding principle that determines

the policies and practices of financial accounting. Accounting standards not

only improve the transparency of financial reporting but also facilitates financial

accountability. An accounting standard is relevant to a company’s financial

reporting.

Accounting standards ensure the financial statements from multiple companies

are comparable. Because all entities follow the same rules, accounting standards

make the financial statements credible and allow for more economic decisions

based on accurate and consistent information.

Generally Accepted Accounting Principles (US GAAP or GAAP)

Generally Accepted Accounting Principles refers to the standards framework,

principles and procedures used by the companies for financial accounting. The

principles are issued by Financial Accounting Standard Board (FASB). It is a set

of accounting standards that consist of standard ways and rules for recording

and reporting of the financial data, that is, balance sheet, income statement, cash

flow statement, etc. The framework is adopted by publicly traded companies

and a maximum number of private companies in the United States.

GAAP principles are updated at periodical intervals to meet with current financial

requirements. It ensures the transparency and consistency of the financial

statement. The information provided as per GAAP by the financial statement

is helpful to the economic decision makers such as investors, creditors,

shareholders, etc.

Key differences between GAAP and IFRS

The important difference between GAAP and IFRS are explained as under:

• GAAP stands for Generally Accepted Accounting Principles. IFRS is

an abbreviation for International Financial Reporting Standards.

• GAPP is a set of accounting guidelines and procedures, used by the

companies to prepare their financial statements. IFRS is the universal

business language followed by the companies while reporting financial

statements.

• Financial Accounting Standard Board (FASB) issues GAAP whereas

International Accounting Standard Board (IASB) issued IFRS (i.e

GAAP is developed by FASB whereas IFRS is developed by IASB.

• Use of Last in First out (LIFO) in inventory valuation is not permissible

as per IFRS which is not in the case of GAAP, that is, GAAP uses

LIFO, FIFO and Weighted Average Method but IFRS uses FIFO and

Weighted Average Method only.

• Extraordinary items are shown below the statement of income in case

of GAAP. Conversely, in IFRS, such items are not segregated in the

statement of income.

• Development Cost is treated as an expense in GAAP, while in IFRS, the

cost is capitalized provided the specified conditions are met.

• Inventory reversal is strictly prohibited under GAAP, but IFRS allows

inventory reversal subject to specific conditions.

• IFRS is based on principles, whereas GAAP is based on rules.

Note that as efforts are continuously made to converge these two standards, so

it can be said that there is no comparison between GAAP and IFRS. Moreover,

the differences between the two are as per a particular point of time that may

get a change in the future.

www.accounting.com/resources/gaap/

Similarities

Both are guiding principles that help in the preparation and presentation of

a statement of accounts. A professional accounting body issues them, and

that is why they are adopted in many countries of the world. Both of the two

provides relevance, reliability, transparency, comparability, understandability of

the financial statement.

Application activity 1.1

1. Mention the main objectives of the IASB when it develops IFRS

Standards.

2. Which of the following is not an objective of the accounting

standards?

a) Standardize the different accounting policies and practices

followed by different business concerns.

c) Increase the reliability of the financial statements.

b) Provide a standard for the diverse accounting policies and

principles.

d) Put an end to the non-comparability of financial statements.

e) Increase the huge amount of variation in the treatment of

accounting standards.

3. Explain the important difference between GAAP and IFRS.

4. Explain how there is subjectivity in financial statements.

5. Discuss the important roles of accounting standards in the whole

accounting system.

1.2 Structure of International Accounting Standards

Committee (IASC) Foundation

Learning Activity 1.2

Accounting standards are developed at both national and international

levels in order to raise the standard of financial reporting and eventually

bring about global harmonization of accounting standards.

Required: Mention at least two international bodies in charge of developing

these accounting standards.

1.2.1 History and structure of IASC Foundation

History of IASC Foundation

The IASC Foundation is an independent body, not controlled by any particular

Government or professional organization. Its main purpose is to oversee the

IASB in setting the accounting principles which are used by business and other

organizations around the world concerned with financial reporting.

The IASC was formed in June 1973 in London through an agreement made

by professional accountancy bodies from Australia, Canada, France, Germany,

Ireland, Japan, Mexico, the Netherlands, the UK and the USA with a view

to harmonizing the international diversity of company reporting practices.

Between its founding in 1973 and its dissolution in 2001, it developed a set of

International Accounting Standards (IAS) that gradually acquired a degree of

acceptance in countries around the world. Although the IASC came to include

some organizations representing preparers and users of financial statements, it

largely remained an initiative of the accountancy profession. On 1 April 2001,

it was replaced by the International Accounting Standards Board (IASB), an

independent standard-setting body. The IASC Foundation is the parent entity

of the International Accounting Standards Board, an independent accounting

standard-setter based in London, UK. The IASB adopted the extant corpus of

IAS which it continued to develop as International Financial Reporting Standards.

The structure of IASC Foundation

• The IASC Foundation is an independent organization having two main

bodies, the Trustees and the IASB, as well as a Standards Advisory

Council and the International Financial Reporting Interpretations

Committee.

• The IASC Foundation Trustees appoint the IASB members, exercise

oversight and raise the funds needed, but the IASB has sole responsibility

for setting accounting standards.

1.2.2 International Accounting Standards Board (IASB)

The IASB develops International Financial Reporting Standards (IFRS

Standards). The main objectives of the IFRS Foundation are to raise the

standard of financial reporting and eventually bring about global harmonization

of accounting standards. The IASB is an independent, privately funded body

that develops and approves IFRS Standards.

Prior to 2003, standards were issued as International Accounting Standards

(IAS Standards). In 2003 IFRS 1 was issued and all new standards are now

designated as IFRS Standards. Therefore, IFRS Standards encompass both

IFRS Standards, and IAS Standards still in force (eg: IAS 7).

Note: Throughout this text, we will use the abbreviation IFRS Standards to

include both IFRSs and IAS Standards.

The members of the IASB come from several countries and have a variety of

backgrounds, with a mix of auditors, preparers of financial statements, users of

financial statements and academics. The IASB operates under the oversight of

the IFRS Foundation.

The IFRS Foundation

IFRS standards are International Financial Reporting Standards (IFRS) that

consist of a set of accounting rules that determine how transactions and other

accounting events are required to be reported in financial statements. They are

designed to maintain credibility and transparency in the financial world, which

enables users, such as, investors and business operators to make informed

financial decisions or rational economic decisions with information about the

financial position, performance, profitability and liquidity of the company.

IFRS standards are issued and maintained by the International Accounting

Standards Board. Formerly, they are known as International Accounting

Standards (IAS). The standards are used for the preparation and presentation

of the financial statement that is, balance sheet, income statement, cash flow

statement, changes in equity and footnotes, etc. I FRS were created to establish

a common language so that financial statements can easily be interpreted

from company to company and country to country.

The IFRS Foundation (formally called the International Accounting Standards

Committee Foundation or IASCF) is a not for profit, private sector body that

oversees the IASB.

The objectives of the IFRS Foundation, summarized from its document IFRS

Foundation Constitution, are to:

• Develop a single set of high quality, understandable, enforceable and

globally accepted IFRS Standards through its standard-setting body,

the IASB;

• Promote the use and rigorous application of those standards;

• Take account of the financial reporting needs of emerging economies

and small-and medium-sized entities (SMEs); and

• Bring about convergence of national accounting standards and IFRS

Standards to high quality solutions.

In late 2018, the IFRS Foundation Constitution had been amended mainly

regarding the tenure terms which the Trustee Chair and Vice-Chairs may hold

their positions for, and how they can be appointed. The main four objectives

have not changed.

As at January 2019, the IFRS Foundation is made up of 22 named trustees,

who essentially monitor and fund the IASB, the IFRS Advisory Council and the

IFRS Interpretations Committee. The Trustees are appointed from a variety of

geographical and functional backgrounds.The structure of the IFRS Foundation and related bodies is shown below.

• IFRS Advisory Council

The IFRS Advisory Council (formally called the Standards Advisory Council or

SAC) is essentially a forum used by the IASB to consult with the outside world.

It consults with national standard setters, academics, user groups and a host

of other interested parties to advise the IASB on a range of issues, from the

IASB’s work program for developing new IFRS Standards to giving practical

advice on the implementation of particular standards.

The IFRS Advisory Council meets the IASB at least three times a year and putsforward the views of its members on current standard-setting projects.

• IFRS Interpretations Committee

The IFRS Interpretations Committee (formally called the International Financial

Reporting Interpretations Committee or IFRIC) was set up in March 2002 and

provides guidance on specific practical issues in the interpretation of IFRS

Standards. Note that despite the name change, interpretations issued by the

IFRS Interpretations Committee are still known as IFRIC Interpretations. In

your exam, you may see the IFRS Interpretations Committee referred to as the

IFRSIC.

The IFRS Interpretations Committee has two main responsibilities:

i. To review, on a timely basis, newly identified financial reporting issues not

specifically addressed in IFRS Standards.

ii. To clarify issues where unsatisfactory or conflicting interpretations have

developed, or seem likely to develop in the absence of authoritative

guidance, with a view to reaching a consensus on the appropriatetreatment.

Application activity 1.2

1. What is the purpose of IAS 37?

2. What is IFRS?

3. Discuss the main objectives of IFRS Foundation.

4. What are the objectives of the IFRS Foundation as they are included

in the document of the IFRS Foundation Constitution?

5. Explain the two main responsibilities of the IFRS Interpretations Committee.

1.3 International Financial Reporting Standards (IFRS

Standards)

Learning Activity 1.3

International Financial Reporting Standards (IFRS) that consist of a set

of accounting rules that determine how transactions and other accounting

events are required to be reported in financial statements.

Required: Mention any two IFRS Standards or IAS that you know.

IFRS Standards are created in accordance with due process. There are currently25 IAS Standards and 16 IFRS Standards in issue.

1.3.1 The use and application of IFRS Standards

The IFRS Standards have helped to both improve and harmonize financial

reporting around the world. The standards are used in the following ways:

• As national requirements

• As the basis for all or some national requirements

• As an international benchmark for those countries which develop

their own requirements

• By regulatory authorities for domestic and foreign companies• By companies themselves

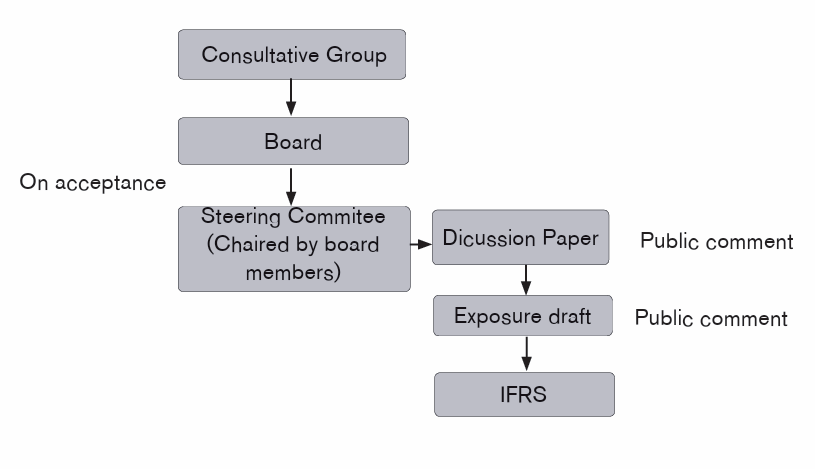

1.3.2 Standards-setting process

The IASB prepares IFRS Standards in accordance with due process. You do

not need this for your exam, but the following diagram may be of interest.The procedure can be summarized as follows.

Current IFRS Standards

The current list is as follows. Those examinable in Financial Accounting are

marked with a *.

Conceptual Framework for Financial Reporting 2018 *

IFRS 1 First-time adoption of International Financial Reporting Standards

IFRS 2 Share-based payment

IFRS 3 * Business combinations

IFRS 4 Insurance contracts

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 6 Exploration for the evaluation of mineral resources

IFRS 7 Financial instruments: disclosures

IFRS 8 Operating segments

IFRS 9 Financial instruments

IFRS 10 * Consolidated financial statements

IFRS 11 Joint arrangements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 14 Regulatory deferral accounts

IFRS 15 Revenue from contracts with customers

IFRS 16 * Leases

IAS 1 * Presentation of financial statements

IAS 2 * Inventories

IAS 7 * Statement of cash flows

IAS 8 Accounting policies, changes in accounting estimates and errors

IAS 10 * Events after the reporting period

IAS 12 Income taxes

IAS 16 * Property, plant and equipment

IAS 19 Employee benefits (2011)

IAS 20 Accounting for government grants and disclosure of government

assistance

IAS 21 The effects of changes in foreign exchange rates

IAS 23 Borrowing costs

IAS 24 Related party disclosure

IAS 26 Accounting and reporting by retirement benefit plans

IAS 27 * Separate financial statements (2011)

IAS 28 * Investments in associates and joint ventures (2011)

IAS 29 Financial reporting in hyperinflationary economies

IAS 32 Financial instruments: presentation

IAS 33 Earnings per share

IAS 34 Interim financial reporting

IAS 36 Impairment of assets

IAS 37 * Provisions, contingent liabilities and contingent assets

IAS 38 * Intangible assets

IAS 39 Financial instruments: recognition and measurement

IAS 40 Investment property

IAS 41 Agriculture

Various exposure drafts and discussion papers are currently at different stages

within the IFRS process, but these are not concern to you at this stage.

1.3.3 Scope and application of IFRS Standards

Scope

Any limitation of the applicability of a specific IFRS is made clear within that

standard. IFRS Standards are not intended to be applied to immaterial items,

nor are they retrospective. Each individual standard lays out its scope at the

beginning of the standard.

Application

Within each individual country, local regulations govern to a greater or lesser

degree, the issue of financial statements. These local regulations include

accounting standards issued by the national regulatory bodies and/or

professional accountancy bodies in the country concerned.

Application activity 1.3

1. How many IAS Standards and IFRS Standards are currently in

issue?

2. In which ways the IFRS Standards are used?

Skills Lab

Students must visit any company and analyze operating environment, they

will then discuss if the company applies any regulatory system, accounting

standards developed by International Accounting Standards Committee

(IASC) Foundation and International Financial Reporting Standards (IFRS

Standards) arising from their operations.

End unit assessment

1. Which of the following is not an objective of the IFRS Foundation?

a) To enforce IFRS Standards in most countries

b) To develop IFRS Standards through the IASB

c) To bring about convergence of accounting standards and IFRS

Standards

d) To take account of the financial reporting needs of SMEs

2. Fill in the blanks.

The IFRS…………………………………issues…………………….

……………. which aid users’ interpretation of IFRS Standards.

3. How many IAS Standards and IFRS Standards are currently in

issue?

4. The IFRS Foundation is a government-controlled body, based in the

EU. True or False?

5. The IASB is responsible for the standard-setting process. True or

False?

6. Olivier is a trainee accountant with ICPAR. One of his friends, who

works in a local supermarket, said the following: “I don’t know why

you waste your time getting qualified-everyone does whatever they

like when it comes to accounting.

Required:

List and describe the various regulations that need to be considered

when performing the financial accounting function within a business.

7. There are those who suggest that any standard-setting body is

redundant because accounting standards are unnecessary.

Required:

Discuss the statement that accounting standards are unnecessaryfor the purpose of regulating financial statements.

UNIT 2: CONCEPTUAL FRAMEWORK FOR FINANCIAL REPORTING

Key unit competence: To be able to apply the conceptual framework inpreparation of financial statements.

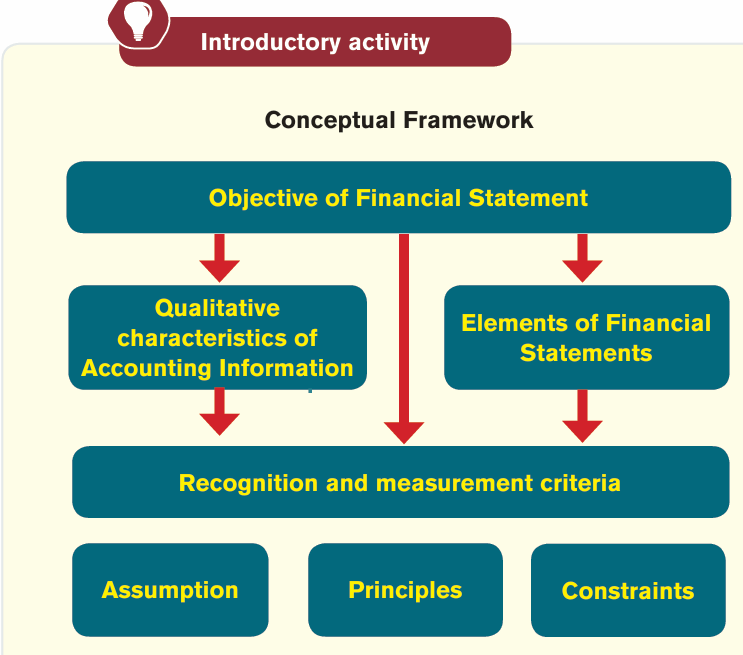

a) Describe the picture above and list elements of Financial

Statements

b) How to recognize and derecognize elements of FinancialStatements?

2.1 Introduction

Learning Activity 2.1

Conceptual framework Assist preparers to develop consistent accounting

policies, standard applies to particular transaction or other event, and assist

all parties to understand and interpret the standard.

Required: Why is necessary to follow a certain guidance and accountingstandards in accountant field.

2.1.1 Definition of conceptual framework

• Going concern concept

Going concern is explained in the way that the financial statements are normally

prepared on the assumption that company will continue in operation for the

foreseeable future. Hence, it is assumed that the entity has neither the intention

nor the need to enter into liquidation or to cease trading. If such an intention

or need exists, the financial statements may have to be prepared on a different

basis. If so, the financial statements describe the basis used. This concept

assumes that, when entity preparing a normal set of accounts, the business will

continue to operate in approximately the same manner for the foreseeable

future (at least the next 12 months). In particular, the entity will not go into

liquidation or scale down its operations in a material way.

The main significance of the going concern concept is that the assets should

not be valued at their ‘break-up’ value (the amount they would sell for if theywere sold off piecemeal and the business were broken up).

Example

A retailer commences business on 1 January and buys inventory of 20 washing

machines, each costing FRW 800,000. During the year they sold 17 machines

at FRW 1,000,000 each. How should the remaining machines be valued at 31

December in the following circumstances?

i) They are forced to close down their business at the end of the year and

the remaining machines will realize only FRW 600,000 each in a forced

sale

ii) They intend to continue their business into the next year.

Answer

i) If the business is to be closed down, the remaining three machines must

be valued at the amount they will realize in a forced sale, i.e. 3*FRW

600,000 = FRW 1,800,000.

ii) If the business is regarded as a going concern, the inventory unsold at 31

December will be carried forward into the following year, when the cost of

the three machines will be matched against the eventual sale proceeds in

computing that year’s profits. The three machines will therefore be valued

at cost, 3*FRW 800,000 = FRW 2,400,000.

If the going concern assumption is not followed, that fact must be

disclosed, together with the following information.

i) The basis on which the financial statements have been prepared Accruals

ii) The reasons why the entity is not considered to be a going concern

• Accrual basis.

The effects of transactions and other events are recognized when they occur

(and not as cash or its equivalent is received or paid) and they are recorded in

the accounting records and reported in the financial statements of the periods

to which they relate.

The accruals basis is not an underlying assumption, the Conceptual Framework

for Financial Reporting makes it clear that financial statements should be

prepared on an accruals basis. Entities should prepare their financial statements

on the basis that transactions are recorded in them, not as the cash is paid

or received, but as the revenues or expenses are earned or incurred in the

accounting period to which they relate.

According to the accruals assumption, in computing profit revenue earned must

be matched against the expenditure incurred in earning it. This is also known

as the matching convention.

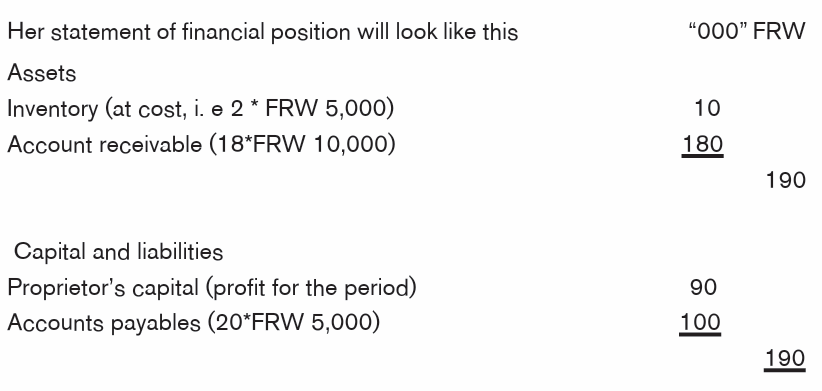

Example

Accrual basis KAMARIZA purchases 20 T-shirts in her first month of trading

(May) at a cost of FRW 5,000 each. She then sells all of them for FRW 10,000

each.

KAMARIZA has therefore made a profit of FRW 100,000, by matching the

revenue (FRW 200,000) earned against the cost (FRW 100,000) of acquiring

them. All of KAMARIZA’s sales and purchases are on credit and no cash has

been received or paid.

If, however, KAMARIZA only sells 18 T-shirts, it is incorrect to charge her

statement of profit or loss with the cost of 20 T-shirts, as she still has two T-shirts

in inventory. Therefore, only the purchase cost of 18 T-shirts (18*FRW 5,000

= FRW 90,000) should be matched with her sales revenue (18 units*FRW10,000 = FRW 180,000), leaving her with a profit of FRW 90,000.

However, if KAMARIZA had decided to give up selling T-shirts, then the going

concern assumption no longer applies and the value of the two T-shirts in the

statement of financial position is their break-up valuation, not cost. Similarly, if

the two unsold T-shirts are unlikely to be sold at more than their cost of FRW

5,000 each (say, because of damage or a fall in demand) then they should

be recorded on the statement of financial position at their net realizable value

(i.e. the likely eventual sales price less any expenses incurred to make them

saleable) rather than cost. This shows the application of the prudence concept.

The Conceptual Framework views prudence as a component of neutrality, whichis a characteristic of faithful representation.

Prudence is described as:

The exercise of caution when making judgments under conditions of uncertainty.

The exercise of prudence means that assets and income are not overstated and

liabilities and expenses are not understated, as an accountant, it is important

to exercise caution when making accounting estimates. In the example above,

the concepts of going concern and accruals are linked. Since the business is

assumed to be a going concern, it is possible to carry forward the cost of theunsold T-shirts as a charge against profits of the next period.

• The business entity concept

Financial statements always treat the business as a separate entity. It is crucial

that you understand that the convention adopted in preparing accounts (the

business entity concept) is always to treat a business as a separate entity from

its owner(s). This means the transactions of the owner should never be mixed

with the business’s transactions. This applies whether or not the business isrecognized in law as a separate legal entity.

2.1.2. The objective of general purpose of financial reporting

The objective of general-purpose financial reporting its to provide financial

information about the reporting entity that is useful to existing and potential

investors, lenders and other creditors in making decision relating to providing

resources to the entity. Those decisions involve decision about:

a) Buying, selling or holding equity and debt instrument

b) Providing or settling loans and other forms of credit

c) Exercising rights to vote on, or otherwise influence, management’sactions that affect the use of the entity’s economic resources.

The decisions described depend on the returns that existing and potential

investors, lenders and other creditors expect, for example, dividends, principal

and interest payment or market price increases. Investors, lenders and other

creditors’ expectation about returns depend on their assessment of the amount,

timing and uncertainty of (the prospects for) future net cash inflows to the entity

on their assessment of management’s stewardship of the entity’s economic

resources. Existing and potential investors, lenders and other creditors need

information to help them make those assessments.

Application activity 2.1

1) Explain the objective of financial statements

2) Explain 5 elements of Financial Statements as per IAS1.

3) Briefly explain (4) different users of the Financial information andtheir needs in the Financial information.

2.2 Qualitative characteristics of useful financial information

Learning Activity 2.2

Financial Accounting states that accounting source documents must

contain information that is certain and trusted.Required: Explain when information is certain and trusted.

2.2.1 Two fundamental qualitative characteristics

For financial reporting purposes, fundamental qualitative characteristics are two;

• Relevance

Only relevant information can be useful. Information should be released on a

timely basis to be relevant to users.

Relevant financial information is capable of making a difference in the decisions

made by user. Financial information is capable of making a difference in decisions

if it has predictive value, confirmatory value or both.

The predictive and confirmatory roles of information are interrelated. Information

on financial position and performance is often used to predict future position

and performance and other things of interest to the user, eg likely dividend,

wage rises. The manner of showing information will enhance the ability to make

predictions, eg by highlighting unusual items.

The relevance of information is affected by its nature and materiality.

• Materiality

Information is material if omitting it or misstating it could influence decisions

that the primary users of general-purpose financial reports make on the basis

of those reports which provide financial information about a specific reporting

entity.

Information may be judged relevant simply because of its nature. In other cases,

both the nature and materiality of the information are important. An error which

is too trivial to affect anyone’s understanding of the accounts is referred to as

immaterial.

In preparing accounts, it is important to assess what is material and what is not,so that time and money are not wasted in the pursuit of excessive detail.

Determining whether or not an item is material is a very subjective exercise.

There is no absolute measure of materiality. It is common to apply a convenient

rule of thumb (for example, material items are those with a value greater than 5%

of net profits). However, some items disclosed in the accounts are regarded

as particularly sensitive and even a very small misstatement of such an item

is taken as a material error. An example, in the accounts of a limited liability

company, is the amount of remuneration (salaries and other rewards) paid todirectors of the company.

The assessment of an item as material or immaterial may affect its treatment

in the accounts. For example, the statement of profit or loss of a business

shows the expenses incurred grouped under suitable captions (administrative

expenses, distribution expenses etc); but in the case of very small expenses,

it may be appropriate to lump them together as ‘sundry expenses’, because a

more detailed breakdown is inappropriate for such immaterial amounts.

In assessing whether or not an item is material, it is not only the value of the itemwhich needs to be considered. The context is also important.

a) If a statement of financial position shows non-current assets of FRW

2,000 million and inventories of FRW30 million an error of FRW

200,000 in the depreciation calculations might not be regarded as

material. However, an error of FRW 20 million in the inventory valuation

would be material. In other words, the total of which balance the errorforms, must be considered.

b) If a business has a bank loan of FRW 50 million and a FRW 55 million

balance on bank deposit account, it will be a material misstatement if

these two amounts are netted off on the statement of financial position

as ‘cash at bank FRW 5 million. In other words, incorrect presentation

may amount to material misstatement even if there is a very small oreven no monetary error.

2.2.2 Faithful representation

Faithful representation: Financial reports represent economic phenomena

in words and numbers. To be useful, financial information must not only

represent relevant phenomena but must faithfully represent the substance of

the phenomena that it purports to represent. To be a faithful representation,

information must be complete, neutral and free from error

A complete depiction includes all information necessary for a user to understand

the phenomenon being depicted, including all necessary descriptions and

explanations.

A neutral depiction is without bias in the selection or presentation of financial

information. A neutral depiction is not slanted, weighted, emphasized or

otherwise manipulated to increase the probability that financial information will

be received favorably or unfavorably by users.

Neutrality is supported by the exercise of prudence. Prudence is the exercise

of caution when making judgments under conditions of uncertainty

Free from error means there are no errors or omissions in the description of

the phenomenon and the process used to produce the reported information

has been selected and applied with no errors in the process. In this context free

from error does not mean perfectly accurate in all respects.

Prudence was removed from the 2010 Conceptual Framework as it was

deemed to be implied within the depiction of neutrality, and that the term was

being interpreted in different ways. However, it was felt that the exercise of

prudence, along with understanding the substance of the transitions, ratherthan the pure legality of them, was required to be explicitly stated.

2.2.3 Enhancing qualitative characteristics

• Comparability

Comparability is the qualitative characteristic that enables users to identify and

understand similarities in, and differences among items

Information about a reporting entity is more useful if it can be compared with

similar information about other entities and with similar information about the

same entity for another period or date.

Consistency, although related to comparability, is not the same. Consistency

refers to the use of the same methods for the same items (ie consistency of

treatment) either from period to period within a reporting entity or in a single

period across entities.

The disclosure of accounting policies is particularly important here. Users

must be able to distinguish between different accounting policies in order to

be able to make a valid comparison of similar items in the accounts of different

entities.

Comparability is not the same as uniformity. Entities should change

accounting policies if those policies become inappropriate.

Corresponding information for preceding periods should be shown to

enable comparison to be made over time.

• Verifiability

Verifiability helps assure users that information faithfully represents the economic

phenomena it purports to represent. It means that different knowledgeable

and independent observers could reach consensus, although not necessarily

complete agreement, that a particular depiction is a faithful representation.

Information that can be independently verified is generally more decision-useful

than information that cannot.

• Timeliness

Timeliness means having information available to decision-makers in time to be

capable of influencing their decisions. Generally, the older information is the less

useful it is Information may become less useful if there is a delay in reporting it.

There is a balance between timeliness and the provision of reliable information.

If information is reported on a timely basis when not all aspects of the transaction

are known, it may not be complete or free from error. Conversely, if every detail

of a transaction is known, it may be too late to publish the information because

it has become irrelevant. The overriding consideration is how best to satisfy the

economic decision-making needs of the users.

• Understandability

Understandability classifying, characterizing and presenting information clearly

and concisely makes it understandable financial reports are prepared for users

who have a reasonable knowledge of business and economic activities and who

review and analyses the information diligently.

Some phenomena are inherently complex and cannot be made easy to understand.

Excluding information on those phenomena might make the information easier

to understand, but without it those reports would be incomplete and therefore

misleading. Therefore, matters should not be left out of financial statements

simply due to their difficulty, as even well-informed and diligent users may

sometimes need the aid of an adviser to understand information about complex

economic phenomena.

• Reliability

Reliable information is the information free from material error and bias and can

be depended upon by users. The following factors contribute to reliability:

i) Faithful representation

ii) Substance over form

iii) Neutrality

iv) Prudencev) Completeness

Application activity 2.2Explain qualitative characteristics of financial information

2.3 Elements of financial statements

Learning Activity 2.3

ABC company ltd produce and sell the following items water, Juice and

Milk, it has invested money in purchasing the asset, including premises and

motor vehicles, some transactions are by cash, bank and others on credit, in

the second year of trading it has enjoyed an increased number of customer.

But accountant is not aware of the documents to be prepared at the end

of the year.

What kind of financial statement that accountant should prepare at the endof the year.

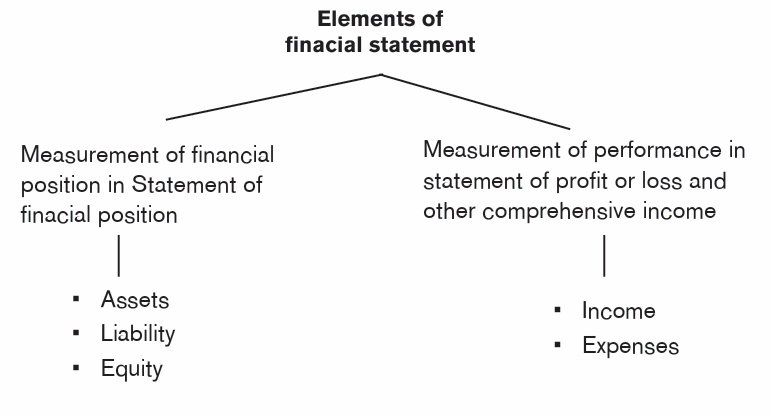

2.3.1 Conceptual Framework of Financial statements

The Conceptual Framework outlined the following elements of financialstatements:

A process of sub-classification then takes place for presentation in the financial

statements, eg assets are classified by their nature or function in the business

to show information in the best way for users to take economic decisions.

• Statement of Financial position

The elements affecting financial position are assets, liabilities and equity

i. Assets

Asset is a present economic resource controlled by the entity as a result of

past events. An economic resource is a right that has the potential to produce

economic benefits. Assets are usually employed to produce goods or services

for customers; customers will then pay for these. Cash itself renders a service

to the entity due to its command over other resources

The economic benefits can come in various forms, including:

a) Cash flows, such as returns on investment sources

b) Exchange of goods, such as by trading, selling goods, provision of services

c) Reduction or avoidance of liabilities, such as paying loans.

ii. Liabilities

Liability is a present obligation of the entity to transfer an economic resource as

a result of past events.

For a liability to exist, three criteria must all be satisfied:

a) The entity has an obligation

b) The obligation is to transfer an economic resource

c) The obligation is a present obligation that exists as a result of past events

Obligation- A duty or responsibility that the entity has no practical ability to

avoid, an essential characteristic of a liability is that the entity has an obligation.

A present obligation exists as a result of past events if the entity has already

obtained economic benefits or taken an action, and as a consequence, the entity

will or may have to transfer an economic resource that it would not otherwisehave had to transfer.

It is important to distinguish between a present obligation and a future

commitment. A management decision to purchase assets in the future doesnot, in itself, give rise to a present obligation.

Example

Consider the following situations in each case do we have an asset or liability

within the definitions given by the Conceptual Framework? Give reasons for

your answer.

a) Mucyo Ltd has purchased a patent for FRW 20,000,000. The patent

gives the company sole use of a particular manufacturing process

which will save FRW 3,000,000 a year for the next five years.

b) Kalisa Ltd paid René Gatera FRW 10,000,000 to set up a car repair

shop, on condition that priority treatment is given to cars from the

company’s fleet.

c) Deals on Wheels Ltd provides a warranty with every car sold.

Answer

a) This is an asset, an intangible one. There is a past event, control and

future economic benefit (through cost savings)

b) This cannot be classified as an asset. Kalisa Ltd has no control over

the car repair shop and it is difficult to argue that there are ‘future

economic benefits’.

c) The warranty provided constitutes a liability; the business has taken

on an obligation. It would be recognized when the warranty is issuedrather than when a claim is made:

iii. Equity

Equity is the residual interest in the assets of the entity after deducting all

its liabilities or Equity represents the net assets owned by the owners (the

shareholders).

Thought equity is defined above as a residual, but it may be sub-classified in

the statement of financial position. This will indicate legal or other restrictions on

the ability of the entity to distribute or otherwise apply its equity. Some reserves

are required by statute or other law, eg for the future protection of creditors.

The amount shown for equity depends on the measurement of assets and

liabilities. It has nothing to do with the market value of the entity’s shares.

• Statement of financial performance

The elements affecting financial performance are income and expenses.

Profit is used as a measure of performance or as a basis for other measures

(e.g: earnings per share). It depends directly on the measurement of income

and expenses, which in turn depend (in part) on the concepts of capital and

capital maintenance adopted.

The elements of income and expense are therefore defined as below:

i. Income

‘Increases in assets, or decreases in liabilities, that result in increases in equity,

other than those relating to contributions from holders of equity claims.’

Revenue arises in the course of ordinary activities of an entity. ‘Increases in

assets’ include those arising on the disposal of non-current assets. The definition

of income also includes unrealized gains, e.g on revaluation of marketable

securities

ii. Expenses

Expense stand for decreases in assets, or increases in liabilities, that result

in decreases in equity other than those relating to distributions to holders of

equity claims.’ Expenses include losses as well as those expenses that arise in

the course of ordinary activities of an entity. Losses will include those arising on

the disposal of non-current assets. The definition of expenses will also include

unrealized losses, e.g the fall in value of an investment.

Income and expenses can be presented in different ways in the statement of

profit or loss and other comprehensive income, to provide information relevant

for economic decision making. For example, income and expenses which relate

to continuing operations are distinguished from the results of discontinued

operations.

2.3.2 Recognition and derecognition of element of financial statement

Recognition of element of financial statement

Only items that meet the definition of an asset, a liability or equity are recognized

in the statement of financial position. Similarly, only items that meet the

definition of income or expenses are recognized in the statement(s) of financial

performance. However, not all items that meet the definition of one of those

elements are recognized

Recognition

The process of capturing for inclusion in the statement of financial position or

statement(s) of profit or loss and other comprehensive income an item that

meets the definition of one of the elements of financial statements

• An asset,

• Liability,

• Equity,

• Income

• Expense.

An asset or liability should be recognized if it will be both relevant and provide

users of the financial statements with a faithful representation of the transactions

of that entity. The Conceptual Framework takes these fundamental qualitative

characteristics along with the definitions of the elements of the financial

statements as the key components of recognition.

Previously, recognition of elements would have been affected by the probability

of whether the event was going to happen and the reliability of the measurement.

The International accounting standards Board (IASB) has revised this as they

believed this set too rigid criteria as entities may not disclose relevant information

which would be necessary for the user of the financial statements because of

the difficulty of estimating both the likelihood and the amount of the element.

Even if an item is not recognized, then the preparers of the financial statements

should consider whether, in order to meet the faithful representation requirement,

there should be a description in the notes to the financial statements.

• Assets

An asset is recognized in the balance sheet when it is probable that the future

economic benefits will flow to the entity and the asset has a cost or value

that can be measured reliably. The economic benefits contribute, directly or

indirectly, in the form of cash or cash equivalents.

Even though many assets are in physical form, such as machinery, the physical

form is not essentials. For example, patents and intellectual property are assets

controlled by the entity and have future economic benefits.

• A liability

Liability is recognized in the balance sheet when it is probable that an outflow

of resources embodying economic benefits will result from the settlement of a

present obligation and the amount at which the settlement will take place can

be measured reliably. For example, accounts payables are present obligations,

which will result in an outflow of resources embodying economic benefit.

• Income

Income is recognized in the income statement when an increase in future

economic benefit related to an increase in an asset or a decrease of a liability

has arisen that can be measured reliably. In effect, the recognition of income

occurs simultaneously with the recognition of increases in assets or decreases

in liabilities. For example, when a sale is made, it results in a net increase in

assets (cash). Income includes both revenues and gains, such as from sale of

assets that are not a part of the normal business activity.

• Expenses

Expense is recognized when a decrease in future economic benefit related to a

decrease in an asset or an increase of a liability has arisen that can be measured

reliably. In effect, the recognition of expenses occurs simultaneously with the

recognition of an increase in liabilities or a decrease in assets. For example, the

depreciation of an asset decreases the asset and the expense is recognized.

Expenses include both expenses and losses.

Derecognition of elements of financial statement

Derecognition is the removal of all or part of a recognized asset or liability from

an entity’s statement of financial position. Derecognition normally occurs when

that item no longer meets the definition of an asset or liability.

The Conceptual Framework considers derecognition to be a factor when the

following occurs:

• Loss of control or all or part of the recognized asset

• The entity no longer has an obligation for a liability. The International

accounting standards boards (IASB) has brought these concepts of

recognition and derecognition into the Conceptual Framework so that

they can be revisited when visiting new standards or revising existing

ones.

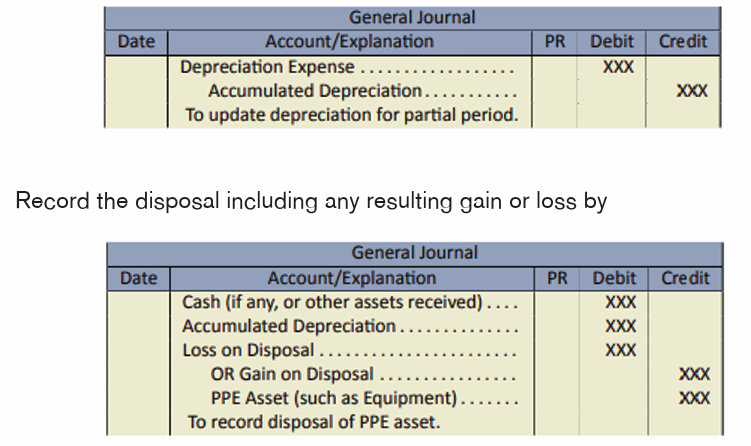

Derecognition of Property, Plant, and Equipment-PPE

Property, Plant, and Equipment is derecognized (that is, the cost and any related

accumulated depreciation are removed from the accounting records) when it

is sold or when no future economic benefit is expected. To account for the

disposal of a PPE asset, the following must occur.

If the disposal occurs part way through the accounting period, depreciationmust be updated to the date of disposal by

A loss arises whenever the carrying amount of the asset is greater than the

proceeds received. A gain results when the carrying amount is less than anyproceeds received.

2.3.3 Measurement of elements of financial statements

Measurement is the process of determining the monetary amounts at which

the elements of the financial statements are to be recognized and carried

in the balance sheet and income statement. This involves the selection of theparticular basis of measurement.

i. Cost Model

After recognition, the asset should be carried in the Statement of Financial

Position at:

a) Cost

b) Less Accumulated Depreciationc) Less Accumulated Impairment Losses.

ii. Revaluation Model

After recognition, an asset, whose fair value can be measured reliably, should

be carried at a revalued amount. The revalued amount is the fair value of the

asset at the date of revaluation less subsequent accumulated depreciation and

impairment losses

The fair value of property is based on its market value, as assessed by a

professionally qualified value. The fair value of plant and equipment is usuallytheir market value, determined by appraisal.

If there is no market-based evidence of fair value because the asset is of a

specialized nature and is rarely sold, then the fair value of that asset will have

to be estimated using an income or a depreciated replacement cost approach.

All revaluations should be made at such a frequency that the carrying amount

does not differ materially from the fair value at the Statement of Financial Positiondate.

If an item of property, plant and equipment is revalued, then the entire class of

property, plant and equipment to which the asset belongs shall be revalued.

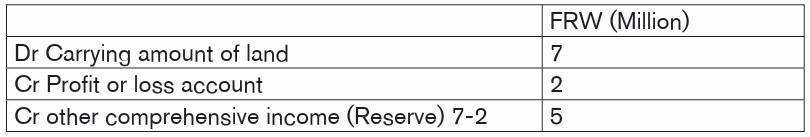

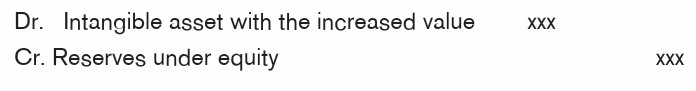

Treatment of revaluation surplus

If an asset is revalued upwards:

Debit: Asset

Credit; Revaluation Surplus

With the amount of the increase

However, if the revaluation gains reverse a previous revaluation loss, which was

recognized as an expense, then the gain should be recognized in the income

statement (but only to the extent of the previous loss of the same asset). Any

excess over the amount of the original loss goes to the Revaluation Surplus.

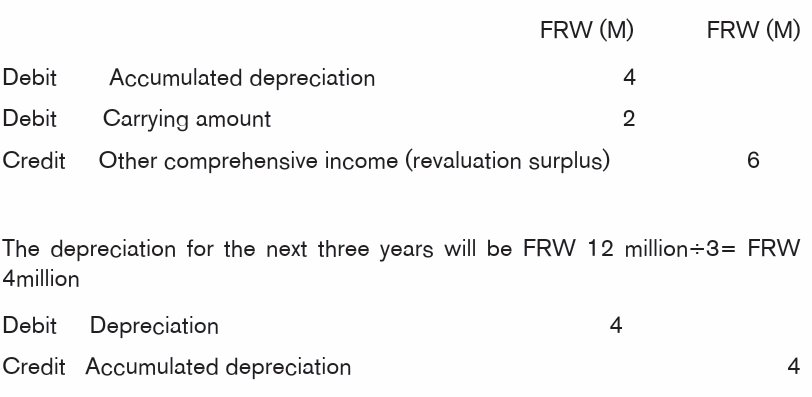

Example:

GJ Limited has land in its books with a carrying value of FRW 14 million. Two

years ago, the land was worth FRW 16 million. The loss was recorded in the

Income Statement. This year the land has been valued at 20 million FRW.

Dr Land FRW 6 million

Cr Income statement FRW 2 million

Cr Revaluation surplus FRW 4 million

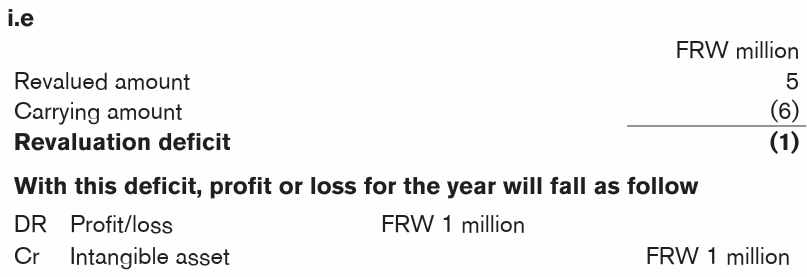

Treatment of revaluation deficit

Debit: income statement

Credit; asset

With the amount of the decrease

However, the decrease should be debited directly to the revaluation surplus to

the extent of any credit balance existing in the revaluation surplus in respect of

that asset.

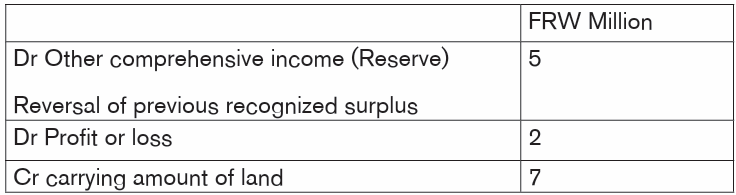

Example:

G J Limited has land in its books with a carrying value of FRW 20 million. Two

years ago, the land was worth FRW 15 million. The gain was credited to the

Revaluation Surplus. This year the land has been valued at FRW 13 million.

Dr Income statement FRW 5 million

Dr Revaluation surplus FRW 2 million

Cr Land FRW 7 Million

Note that the Revaluation Surplus is part of owners’ equity.

A number of different measurement bases are employed to different degreesand in varying combinations in financial statements. They include the following:

a. Historical cost.

Assets are recorded at the amount of cash or cash equivalents paid or the fair

value of the consideration given to acquire them at the time of their acquisition.

Liabilities are recorded at the amount of proceeds received in exchange for

the obligation, or in some circumstances (for example, income taxes), at the

amounts of cash or cash equivalents expected to be paid to satisfy the liability

in the normal course of business.

b. Current cost.

Assets are carried at the amount of cash or cash equivalents that would have to

be paid if the same or an equivalent asset was acquired currently.

Liabilities are carried at the undiscounted amount of cash or cash equivalents

that would be required to settle the obligation currently.

c. Realizable (settlement) value.

Assets are carried at the amount of cash or cash equivalents that could currently

be obtained by selling the asset in an orderly disposal.

Liabilities are carried at their settlement values; that is, the undiscounted

amounts of cash or cash equivalents expected to be paid to satisfy the liabilities

in the normal course of business.

d. Present value.

Assets are carried at the present discounted value of the future net cash inflows

that the item is expected to generate in the normal course of business. Liabilities

are carried at the present discounted value of the future net cash outflows

that are expected to be required to settle the liabilities in the normal course

of business. The measurement basis most commonly adopted by entities in

preparing their financial statements is historical cost. This is usually combined

with other measurement bases.

For example, inventories are usually carried at the lower of cost and net realizable

value, marketable securities may be carried at market value and pension liabilitiesare carried at their present value.

2.3.4 Presentation and disclosures of financial statement

A reporting entity communicates information about its assets, liabilities, equity,

income and expenses by presenting and disclosing information in its financial

statements.

Effective communication of information in financial statements makes that

information more relevant and contributes to a faithful representation of an

entity’s assets, liabilities, equity, income and expenses.

It also enhances the understandability and comparability of information infinancial statements.

Effective communication of information in financial statements requires:

• Focusing on presentation and disclosure objectives and principles

rather than focusing on rules.

• Classifying information in a manner that groups similar items and

separates dissimilar items

Just as cost constrains other financial reporting decisions, it also constrains

decisions about presentation and disclosure. Hence, in making decisions about

presentation and disclosure, it is important to consider whether the benefits

provided to users of financial statements by presenting or disclosing particularinformation are likely to justify the cost of providing and using that information.

Classification

Classification is the sorting of assets, liabilities, equity, income or expenses on

the basis of shared characteristics for presentation and disclosure purposes.

Such characteristics include—but are not limited to the nature of the item, its

role (or function) within the business activities conducted by the entity, and howit is measured.

Classifying dissimilar assets, liabilities, equity, income or expenses together can

obscure relevant information, reduce understandability and comparability and

may not provide a faithful representation of what it purports to represent.

• Classification of assets and liabilities

Classification is applied to the unit of account selected for an asset or liability.

However, it may sometimes be appropriate to separate an asset or liability into

component that have different characteristics and to classify those components

separately. That would be appropriate when classifying those componentsseparately.

For example, it could be appropriate to separate an asset or liability into current

and non-current components and to classify those components separately.

Offsetting

Offsetting occurs when an entity recognizes and measures both an asset and

liability as separate units of account, but groups them into a single net amount in

the statement of financial position. Offsetting classifies dissimilar items together

and therefore is generally not appropriate.

Offsetting assets and liabilities differs from treating a set of rights and obligations

as a single unit of account

• Classification of equity

To provide useful information, it may be necessary to classify equity claims

separately if those equity claims have different characteristics.

Similarly, to provide useful information, it may be necessary to classify components

of equity separately if some of those components are subject to particular legal,

regulatory or other requirements. For example, in some jurisdictions, an entity

is permitted to make distributions to holders of equity jurisdictions, an entity is

permitted to make distributions to holders of equity. Separate presentation or

disclosure of those reserves may provide useful information.

• Classification of income and expenses

Classification is applied to: components of such income and expenses if those

components have different characteristics and are identified separately. For

example, a change in the current value of an asset can include the effects of

value changes and the accrual of interest. It would be appropriate to classify

those components separately if doing so would enhance the usefulness of the

resulting financial information.

• Profit or loss and other comprehensive income

Income and expenses are classified and included either:

a) in the statement of profit or loss or

b) Outside the statement of profit or loss, in other comprehensive income.

The statement of profit or loss is the primary source of information about an

entity’s financial performance for the reporting period. That statement contains

a total for profit or loss that provides a highly summarized depiction of the entity

of the financial performance for the period. Many users of financial statements

incorporate that total in their analysis either as a starting point for that analysisor as the main indicator of the entity’s financial performance for the period.

The statement of profit or loss is primary source of information about an entity’s

financial performance for the period, all income and expenses are, in principle,

included in that statement. However, in developing standards the board may

decide in exceptional circumstance that income or expenses arising from a

change in the current value of an asset or liability are to be statement of profit or

loss providing more relevant information, or providing more faithful representationof the entity’s financial performance for that period.

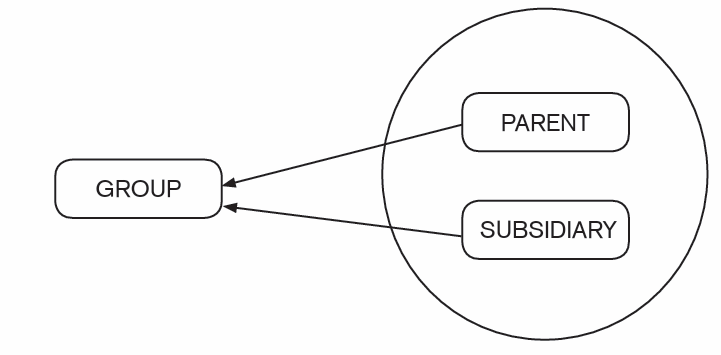

2.3.5 The reporting entity

A reporting entity is an entity that is required, or chooses, to prepare financial

statements

A reporting entity can be a single entity or a portion of an entity can comprise more

than one entity. A reporting entity is not necessarily a legal entity. Sometimes one

entity (parent) has control over another entity (subsidiary). If a reporting entity

comprises both the parent and its subsidiaries, the reporting entity’s financial

statements are referred to as ‘consolidated financial statements.

If the reporting entity is the parent a reporting a lone, the reporting entity’s

financial statements are referred to as “unconsolidated financial statements”

If a reporting entity comprises two or more entities that are not all linked by

a parent-subsidiary relationship, the reporting entity’s financial statements arereferred to as ‘combined financial statements

2.3.6 Concepts of capital and capital maintenance concepts of capital

a. Concepts of capital

A financial concept of capital is adopted by most entities in preparing their

financial statement. Under a financial concept of capital, such as invested

money or invested purchasing power, capital is synonymous with the net asset

or equity of the entity.

Under physical concept of capital, such as operating activity, capital is regarded

as productive capacity of the entity based on for example, units of output per day.

The selection of the appropriate concept of capital by an entity should be based

on the needs of the users of its financial statements. Thus, a financial

concept of capital should be adopted if the users of financial statement are

primarily concerned with maintenance of nominal invested capital or thepurchasing power of invested capital.

If, however, the main concern of the users is with the operating capability of the

entity, physical concept of capita should be used.

The concept chosen indicates the goal to be attained in determining profit,

even though there may be some measurement difficulties in making the conceptoperational.

b. Concepts of capital maintenance

The concept of capital gives the following concepts of capital maintenance:

Physical capital maintenance: under this concept a profit is earned only if

the physical productive capacity (operating capacity) of the entity (resources

or funds needs to achieve that capacity) at the end of the period exceeds the

physical productive capacity at the beginning of the period, after excluding any

distributions to, and contributions from, owners during the period.

Financial capital maintenance: under this concept a profit is earned only if

financial (or money) amount of net assets at the end of the period exceeds the

financial (or money) amount of net assets at the beginning of the period after

excluding any distribution to, and contribution from owners during the period.

Financial capacity maintenance can be measured in their normal monetary units

or units of constant purchasing power.

The concept of capital maintenance is concerned with how an entity defines the

capital that it seeks to maintain.

It provides the linkages between the concept of capital and the concept of profit

because it provides the point of reference by which profit is measured, it is

prerequisite for distinguishing between an entity’s return on capital and its return

of capital, only in flow of assets in excess of amount needed to maintain capital

may be regarded as profit and therefore as a return on capital. Hence, profit is

the residual amount that remains after expenses (including capital maintenance,

adjustment, where appropriate) have been deducted from income. If expenses

exceed income the residual amount is loss.

The principal difference between the two concepts of capital maintenance is

the treatment of the effects of changes in the prices of assets and liabilities of

the entity. In general terms, an entity has maintained its capital if it has as much

capital at the end of the period as it had at the beginning of the period

Any amount over and above that required to maintain the capital at the beginning

of the period is profit.

Example of the physical concept of capital:

An entity is established on 1 January 2022 with 20,000 ordinary shares at FRW

1,000 each.

It then buys FRW 20,000,000 worth of stock, which they sold it during the year

for FRW 25,000,000.

At the end of the year the purchase price of the stock increased on FRW

23,000,000.

Required: Compute profit using capital maintenance concept

Using the physical capital maintenance concept, the profit for the reporting

period is: FRW 2,000,000 i.e FRW 25,000,000 - FRW 23,000,000.

If the financial capital maintenance concept is used, the profit for the year is:

FRW 5,000,000, but if the company paid out the FRW 5,000,000 profit to

shareholders, it would be unable to buy the same stock again as the purchase

price arisen.

Note: Most entities use the financial capital maintenance concept as it is the

easiest to apply because it uses actual prices paid for goods, rather than

making adjustments.

Investors prefer to use the financial capital maintenance concept as they

allow them to assess increasing and maximizing the returns they get on theirinvestment.

Application activity 2.3

a) Fill in the blanks.

i) The elements affecting Financial position are:…..., ………... and

………...

ii) The elements affecting financial performance are …………. and

……………….

iii) ………………. .is a present economic resource controlled by the

entity as a result of past events. An economic resource is a right that

has the potential to produce economic benefits.

iv) ……………………is a present obligation of the entity to transfer an

economic resource as a result of past events.

v) ……………. is the residual interest in the assets of the entity after

deducting all its liabilities?

b) Explain derecognition as used in accounting

c) Explain when to recognize the elements of statements of financial performance

Skills Lab

Visit small business located near the school and request for a trial balance.

From the trial balance select elements to appear in financial performanceand element to appear in financial position.

End unit assessment

1. Making an allowance for receivables is an example of which concept?

a) Accruals

b) Going concern

c) Materiality

d) Fair presentation

2. What does ‘relevance’ mean in the context of financial statements?

3. Based on Conceptual Framework, identify the fundamental

characteristics and the enhancing qualitative characteristics of

financial statements.

4. An obligation may be recognized when:

a) The obligation is fulfilled

b) When an obligation meets the definition of a liability

c) When it is probable that economic benefits will be received

d) When the obligation can be faithfully represented, even if it is

irrelevant to a user

5. An entity is established on 1 January 2022 with 40,000ordinary

shares at FRW 2,000 each. They then bought FRW 40,000,000

worth of stock, which generated sales during the year of FRW

50,000,000. At the end of the year the purchase price of the stock

increased on FRW 46,000,000. Calculate profit under financial

capital maintenance concept and physical capital maintenance concept.UNIT 3 : ACCOUNTING FOR TANGIBLE NON-CURRENT ASSETS

Key unit competence: To be able to measure and record tangible non current assets

Introductory activity

Observe the above picture and answer the following questions:

Based on International Accounting Standard (IAS) 16,

1) Why is it necessary to account for tangible fixed assets? Justify

your answer.

2) What is the meaning of carrying amount of fixed asset?3) What is Residual value of tangible fixed asset?.

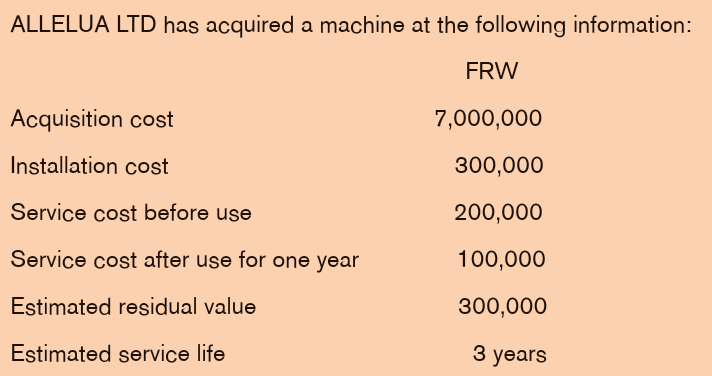

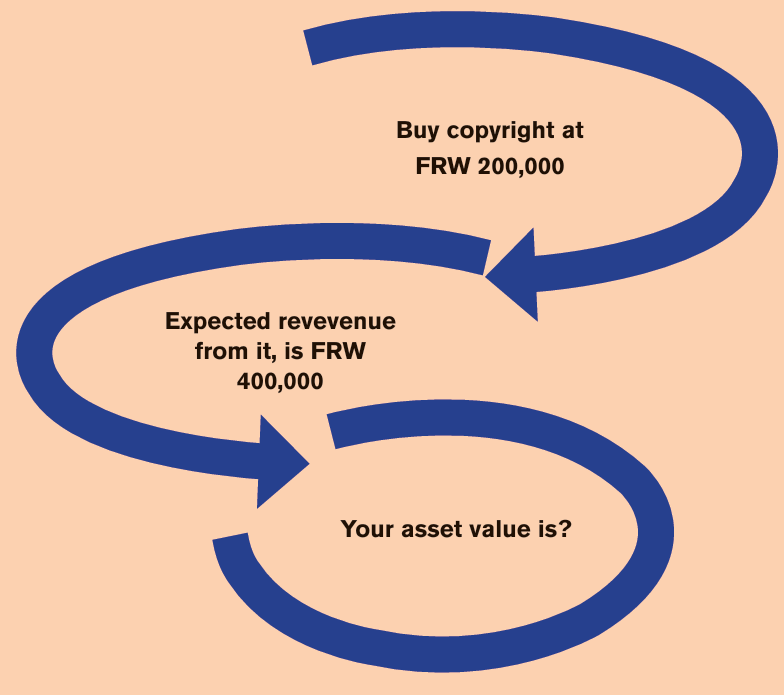

3.1 Determination of the cost for non-current assetsLearning Activity 3.1

Required:

Is it necessary to recognize for this new asset in the books of ALLERUALTD? If yes, what is the meaning of recognition of intangible fixed asset?

3.1.1 International Accounting Standard (IAS) 16

IAS 16 covers keys aspect of accounting for property, plant and equipment.

This represents the bulk of items which are “tangible non-current assets”.

• Objective

IAS 16 Property, Plant and Equipment outlines the accounting treatment for

most types of property, plant and equipment. The Standard addresses the

recognition, measurement and disclose of all property, plant and equipment

pertaining to the entity.

• Scope

Property, plant and equipment are tangible assets that:

i. Are held for use in the production or supply of goods or services, for rental

to others, or for administrative purposes.

ii. Are expected to be used during more than one period

Carrying amount is the amount at which an asset is recognized in the

statement of financial position after deducting any accumulated depreciationand accumulated impairment losses.

IAS 16 should be followed when accounting for property, plant and equipment

unless another international accounting standard requires a different treatmentIAS 16 does not apply to the following:

a) Biological assets related to agricultural activity, apart from bearer

biological assets

b) Mineral rights and mineral reserves, such as oil, gas and non

regenerative resources

c) Property, plant and equipment classified as held for sale.

However, the standard applies to property, plant and equipment used to develop

these assets.

A bearer biological asset is living plant that:

a) Is used in the production or supply of agricultural produce

b) Is expected to bear produce for more than one period; and

c) Has a remote likelihood of being sold as agricultural produce, exceptfor incidental scrap sales?

• Recognition

In this context, recognition simply means incorporation of the item in the