UNIT 8 :CONSOLIDATED FINANCIAL STATEMENTS

Key unit competence: To be able to consolidate financial statements

Introductory activity

Companies frequently refer to the use of aggregate reporting of the

entire firm when using the term “consolidation” in the company’s financial

reporting.

1. What are the financial statements that are important for the financial

reporting of group companies?

8.1. Introduction to consolidated financial statements

Learning Activity 8.1

There are few fundamental strategies to expand business operations, like

purchasing a foreign company or its shares, launching altogether a new

company, forming a joint venture with someone else

1. Define the following terms;

i) A parent Company

ii) A subsidiary Company

iii) A group

8.1.1 An overview on Groups and consolidation

This topic discusses issues in relation to group accounting and the provisions

of the IFRSs that give guidance on how to disclose items in the financial

statements. It gives important definitions and explains the need for consolidation

and how relevant consolidated financial statements are for the users. One of the

IFRSs that guide consolidation process is IFRS 10, the objective of IFRS 10

‘Consolidated Financial Statements’ is to establish principles for preparation

and presentations of consolidated financial statements when an entity controls

one or more other entities.

The need to develop an IFRS to deal specifically with issues of consolidated

accounts arose due to inherent weaknesses in IAS 27. While recognizing that

the basic model for consolidated accounts was fine in IAS 27, inconsistency in

applying the provisions of IAS 27 necessitated the need for a single combined

model that meets the needs of both those preparing financial statements andthe end users of financial information in a consistent manner.

Non-controlling interest: Equity in a subsidiary not attributable, directly or

indirectly.

IFRS 10 establishes principles for presenting and preparing consolidated

financial statements when an entity controls one or more other entities. IFRS 10:

• Requires an entity (the parent) that controls one or more other entities

(subsidiaries) to present consolidated financial statements;

• Defines the principle of control, and establishes control as the basis for

consolidation;

• Sets out how to apply the principle of control to identify whether an

investor controls an investee and therefore must consolidate the investee;

• Sets out the accounting requirements for the preparation of consolidated

financial statements; and

• Defines an investment entity and sets out an exception to consolidating

particular subsidiaries of an investment entity.

Consolidated financial statements are financial statements that present the

assets, liabilities, equity, income, expenses and cash flows of a parent and its

subsidiaries as those of a single economic entity.

Consolidation means presenting the results, assets and liabilities of a group ofcompanies as if they were one company.

Example

There are two companies, Mukungu and Shaiga. Mukungu owns 70% of the

shares in Shaiga. Mukungu has a land worth 120 FRW million. Shaiga has

buildings worth RWF100 million. Keep in mind that consolidation refers to thepresentation of the results of two or more businesses as if they were one.

Answer

You add together all the values of the land and buildings to get the values of the

assets. In group accounts take the share for Mukungu plus the share for Shaiga

and this is how is done;

FRW120 Million + FRW 100 million=FRW 220 Million. So, this what is

consolidation?

Intra-group debts

a) Suppose Mukungu has receivables of FRW 60 Million and FRW40

million for shaiga. Shaiga owes Mukungu 4Million (included in his

receivables).

Consolidation = FRW 60Million + FRW40 Million-FRW 4Million= FRW96Million.

This implies that, figures as treated as for one company. What Shaiga owes

Mukungu is there internal matters.

b) Suppose Mukungu has FRW50Million payables and Shaiga has

FRW30Million payables still Shaiga owes Mukungu FRW 5Million

payables.

Consolidation payables =50Million+30Million-5Million= 75Million

The total receivables and payables show that correct figure in the books of

Mukungu company.

From the above we conclude that Mukungu controls Shaiga and mukungu’s

directors have the right to control shaiga as a subsidiary company. In this case,

the total assets for the company is equal to FRW 220Million.

From the above activity FRW 142,000 Million is the total non-current assets ofMukiza ltd.

8.1.2 Subsidiary

A subsidiary is an entity controlled by another entity.

There are relevant IFRS standards for consolidation;

ISA 27 Separate Financial statements

ISA 28 Investments Associates and joint ventures

IFRS 3 Business Combination

IFRS 10 Consolidated Financial Statements

ISA 27 consolidated and separate financial statement is set out to enhance

the relevance, reliability and comparability of information provided by the parent

company in its separate financial statements and in its consolidated financial

statements where it has entities under control.

It outlines the conditions under which consolidated financial statements are

necessary, how to account for the changes in the ownership and how to account

for the loss of control. Additionally, it specifies disclosure rules pertaining to the

connection between the parent company and its subsidiaries.

The standard applies to a group of entities under control of a parent and to

associate and joint ventures where they elect, or are required to present separate

financial statements.

ISA 28 Investment in associates

ISA 28 outlines the accounting treatment of investment in associates which also

provides specifics on how to apply the equity method to account for investmentsin associates and joint ventures.

IFRS 3 Business combinations

When a parent company acquires control of a business, the accounting rules

for goodwill on acquisition and non-controlling interests are outlined in IFRS

3 Business combinations. It also establishes what information must be made

available to financial statement users.

IFRS 10 Consolidated financial statements

When an entity controls one or more other entities, IFRS 10 consolidated

financial statements specifies the guidelines for production and presentation

of consolidated financial statements. It provides controls as the foundation for

consolidation, mandates that the parent entity presents consolidated financialstatements and defines the principle of control.

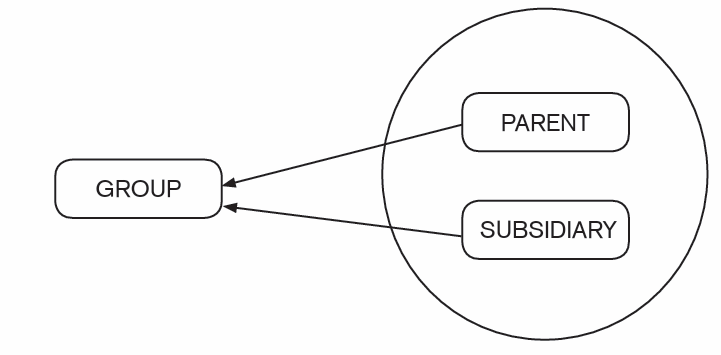

Definitions

Although some of the concepts will be covered in greater depth later, they are

helpful now because they offer you a general idea about consolidation.

Control: when an investor is exposed to, has a claim to, variable returns as

a result of its participation with an investee and has power to influence those

returns due to that power over investee, the investor is said to have control over

the investee.

Power: Existing rights that allow the present to control the essential activities.

Subsidiary: is an entity that is controlled by another entity known as the parent

Parent: is an entity that control one or more entities

Group: is a parent and all of its entities (subsidiaries)

Consolidated Financial Statements: The financial statements of a group

in which the assets, liabilities, equity, income, expenses and cash flows of the

parent company and the subsidiaries are presented as of those of a singleeconomic entity.

Non-Controlling interest: The equity in subsidiary that is not directly or

indirectly related to the parent company. Please refer to IFRS 10

A trade or investment: is a stake kept foe wealth accumulation in the stockof another company is not an affiliate or subsidiary.

Investments in subsidiaries

You should be able to tell from the definitions above the concept of control.

The parent or the holding company will often control the majority of ordinary

shares in the subsidiary company (to which normal voting rights are attached).

There are circumstances, however, when the parent company owns merely

minority of the voting rights in the subsidiary, yet the parent still have control

over the subsidiary. For example, when the parent company own more than

a half of the company’s voting rights i.e more than 50%, control is typically

considered to exist until it can be demonstrated that such ownership does not

constitute control but these situations will be rare.

What about the circumstances in which this ownership criterion is absent?

Below examples illustrate instances in which control even exists when a parent

owns just 50% or less of the voting entity.

• By agreement with other investors, the parent has control over more

than 50% of the voting rights.

• By statute or agreement, the parent has the authority to control the

entity’s financial and operational policies.

• The parent has the authority to control or dismiss the majority of the

board of directors

• At the board of directors meeting, the parent has the power to vote forthe majority of votes.

For example:

kawu co has invested its share in the following companies;

Name of the company Equity shares Non-equity shares held

Koco co 70% Nil

Koba co 35% 90%Kabu co 48% 25%

Kawu co has appointed five out of seven directors of Kabu co

Which of the above investments is considered as subsidiary in the consolidated

accounts of Kawu co group?

Answer

Let’s examine each invest in turn to see if the control exists and if so, whether

they should be treated as a subsidiary in accounting terms.

Koco co –By looking at the equity shares, Kawu has more than 50% (i.e. 70%)

so, it is a subsidiary

Koba co- has less than 50 % of equity shares, despite having majority of non

equity shares (these do not give voting power) Kawu co does not have control,

so it is not a subsidiary

Kabu co- has less than 50% of equity shares you may incorrectly conclude that

it doesn’t have control over Kabu co but because it appointed five directors out

of seven, it has the voting right, thus its decision will impact on the returns of thecompany. In conclusion therefore, Kabu co is a subsidiary.

8.1.3 Associates and trade investments

Associate is a business that is partially owned by the parent company. A parent

company will hold minority or non-controlling interests. A corporation in which

another has sizeable portion of voting shares, typically, 20-50% in accounting

and business valuation. Associates are accounted in the consolidated statementsof a group using equity method.

Investment in Associates

Investment in associates is less than investment is subsidiary but more than a

simple trade investment. Here the key criterion is the significant influence.

Significant influence means the ability to influence the investee’s financial and

operational policy decisions without having sole or shared control over those

decisions. Similar to control, considerable influence can be assessed based on

who holds voting rights (which are typically linked common shares) in the entity.

According to IAS 28, unless it can be demonstrated clearly that this is not the

case it can be assumed that an investor has significant control over the entity

if they hold 20% or more of the voting power of the entity. If the investor owns

less than 20% of the entity’s voting power, significant influence can generally

be assumed to not exist unless proven differently.

The existence of significant influence by an entity is usually evidenced in one or

more of the following ways:

a) Representation on the board of directors or equivalent governing body

of the investee;

b) Participation in policy-making processes, including participation in

decisions about dividends or other distributions;

c) Material transactions between the entity and its investee;

d) Interchange of managerial personnel; ore) Provision of essential technical information.

Equity method

For investments in associates, IAS 28 mandates the use of the equity method of

accounting (often known as “equity accounting”) (with certain exceptions, butthese are beyond the scope of this syllabus).

Trade investments

A trade investment is a simple investment in the shares of another entity that is

not an associate or a subsidiary.

Trade investments are simply shown as investments under non-current assets inthe consolidated statement of financial position of the group

8.1.4 Content of consolidated financial statements

Consolidated financial statements present the results of the group; they do not

replace the separate financial statements of the individual group companies.

Consolidated financial statements do not replace parent or subsidiary individual

statements. Consolidated financial statements are issued to the shareholders

of the parent company and provide information for those shareholders on all the

companies controlled by the parent company.

Most of the parent companies present their own individual accounts and their

group accounts in a single package. The package typically comprises the

following.

Parent Company financial statements, which will include investments in

subsidiary undertaking’ as an asset in the statement of financial position, and

income from subsidiaries (dividends) in the statement of profit and loss andother comprehensive income

Consolidated statement of financial position

Consolidated statement of profit and loss and other comprehensive income

Note: The other comprehensive income elements of the consolidated financialstatements will not be covered in this unit.

Application activity 8.1

Mukiza ltd own 60 %of Ruzinda ltd. Mukiza has non-current assets of FRW

100 Million and Ruzinda has non-current assets of FRW70Million.Required: Calculate the consolidated non-current assets

8.2 Consolidated Financial statements

Learning Activity 8.2

During the consolidation process, a

parent company has to compile financial reports from the subsidiaries.

Required: What are the procedures of consolidated statement of financialposition?

8.2.1 Consolidated Statement of Profit or Loss

The main principle of equity accounting states that whether or not as associate,

GARU ltd, pays its gains as dividends, the investing business MURT ltd, should

account for its portion of those gains. MURT ltd accomplishes this by including

the group’s portion of GARU Ltd’s post tax profit in the consolidated earnings.

Take note of the distinction between this method and consolidating the financial

performance of a subsidiary firm. If MURT ltd owned 100% of GARU ltd, it

would be entitled to all of GARU Ltd’s sales revenues, cost of sales, etc.

Using the equity accounting, sales revenues, cost of sales and other financial

measures for associate are not combined with those of the group instead the

profit after tax of associate is merely added to the group profit in the form of thegroup share.

8.2.2 Consolidated statement of financial position (Balance sheet)

In this lesson we are going to learn about the statements of financial position

also known as the Balance sheet.

Consolidated financial statements are financial statements of a group presented

as those of a single economic entity (IFRS 10). When a parent company issues

consolidated financial statements, it should consolidate all subsidiaries, both

domestic and foreign. The first step in any consolidation is to identify the

subsidiaries using the definitions as set out in IFRS 10.

Consolidated financial position includes investments in associate’s amount that

must be declared at the cost at the moment the associate was acquired.

This amount will arise or fall annually in proportion to the group’s portion of theconnected company’s post-acquisition retained reserve growth or decline.

Basic steps

The following are the procedures for consolidated statements of financial

position;

• In the individual statements of the parent company and each subsidiary,

items that appear as an asset in one company and a liability in another

should be cancelled out.

• After cancellation, add together the remaining assets and liabilitiesthrough the group.

Items to be cancelled may include;

• The assets, investment or shares in subsidiary in the parent company’s

statement of financial position will be matched with the share capital in

the subsidiaries’ accounts.

• Any intra-group trading needs to be cancelled accordingly. E.g the

parent company records a receivable for selling goods to its subsidiary

and the subsidiary likewise recording a payable relating to the parent

company. This means that there is a trading between a parent andsubsidiary company (trading group).

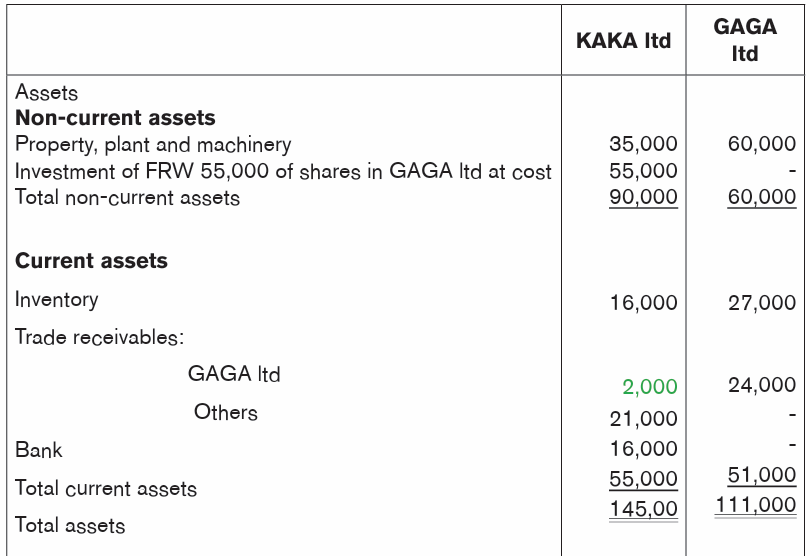

ExampleStatement of financial position as at 31 December 2021

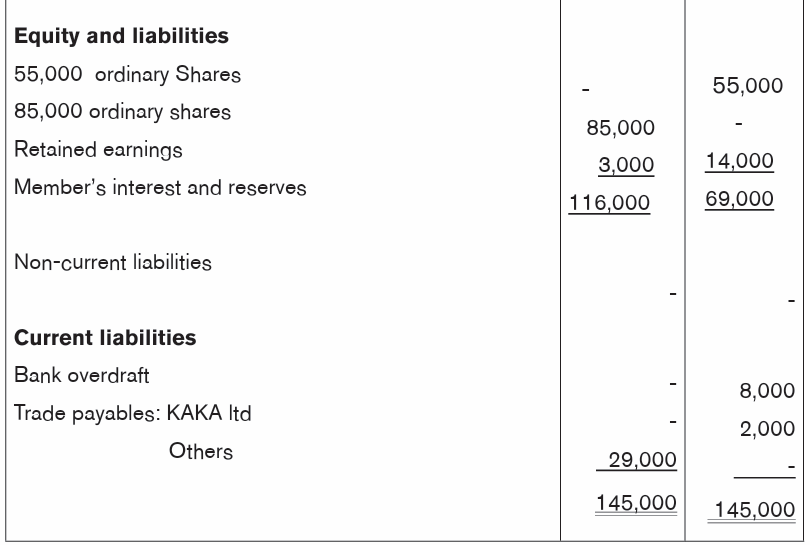

Consolidated statement of financial position as at 31 December 2021

Intra-group trading

We are going to look the consolidated financial statements specifically on intra

group trading explain what it is and have examples.

If intra-group trading transactions are undertaken at cost, there would be no issue

in dealing with profits due to intra-group trading. However, with each company

in a group being a separate trading entity, other group companies are treated

in the same way as any other outside customer. In this case, if a company is

selling say a parent company to a subsidiary company or a subsidiary company

to another, their selling prices should be the same as they say to outsiders.

In the consolidated statement of financial position, the only profits recognized

should be those earned by the group in providing goods or services to outsiders.

Inventory should also be valued at cost to the group.

Scenario

GAGA ltd (subsidiary) buys goods at one price and sells them at a higher price

to kaka ltd (a parent company). The accounts of GAGA ltd will properly include

the profit earned on sales to KAKA ltd. KAKA Ltd’s statement of financial position

will also include inventories at their cost of purchase from GARU ltd.

The problem arising from the above transaction

1. Although GAGA ltd makes a profit as soon as it sells goods to KAKA

ltd, the group does not make a sale or achieve a profit until an outside

customer buys the goods from KAKA ltd. This is because the inventories

are still in the group until they get an outsider to come and buy goods.

2. Any purchases from GAGA ltd which remain unsold by KAKA ltd at the

end of the year will be included in KAKA Ltd’s inventory. Their value in the

statement of financial positions will be at their cost to KAKA ltd, which isnot the same as their cost to the group.

EXAMPLE

GAGA ltd buys goods for FRW 5,000 and sells to its parent company KAKA ltd

for FRW 7,000. The goods are in KAKA Ltd’s store at the end of the year and

appear in KAKA Ltd’s statement of financial position at FRW 7,000.

In this case GAGA ltd made a profit of FRW 2,000 as it bought goods on FRW

5,000 and sold them to KAKA ltd a parent company at FRW 7,000. This will

be recorded in GAGA Ltd’s individual account. Let’s see how to record in an

intra- group

Consolidated financial statement for intra-group company

Cost of the group FRW 5,000

External sales

Closing stock at the cost to the group FRW 5,000

Profit or loss to the group

Because the group account is overstated by FRW 2,000 from KAKA ltdindividual statement of financial position, it must be cancelled.

Consolidation adjustment

Dr Cr

Group retained earnings 2,000Group inventory 2,000

Steps to follow when you have non-controlling interest

1. Intra-group sales and purchases should be eliminated

2. Any unrealized profit is eliminated by trading to the cost of sales

3. I f the subsidiary made the sale; the figure for the subsidiary’s net profit

used to non-controlling interest must be adjusted for the unrealized profit.

4. If the parent made a sale, there will be no effect on the non-controllinginterest.

Example

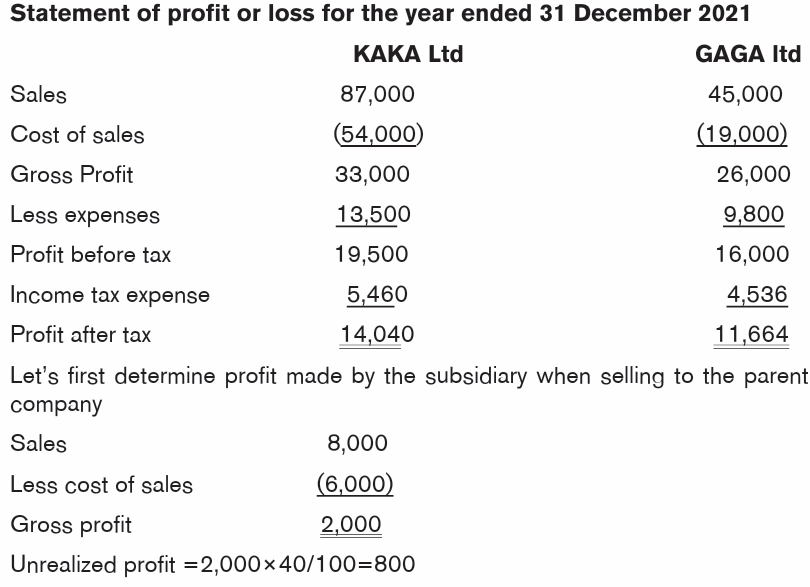

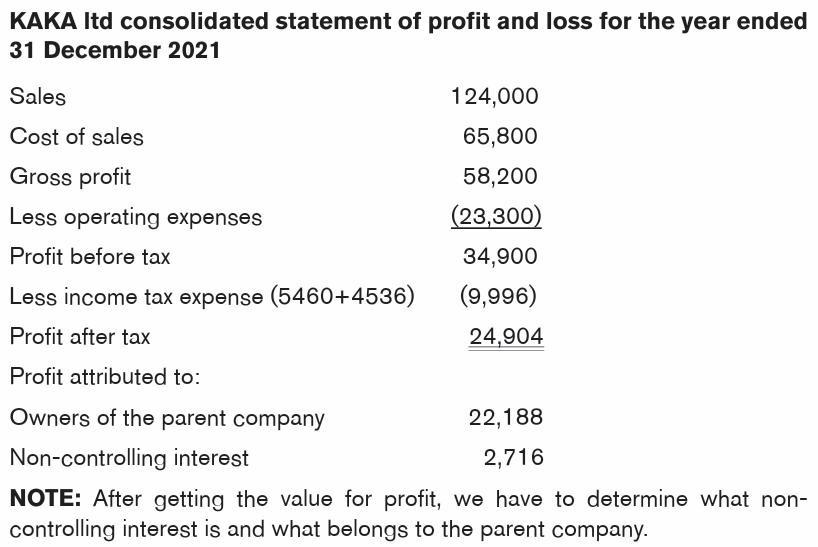

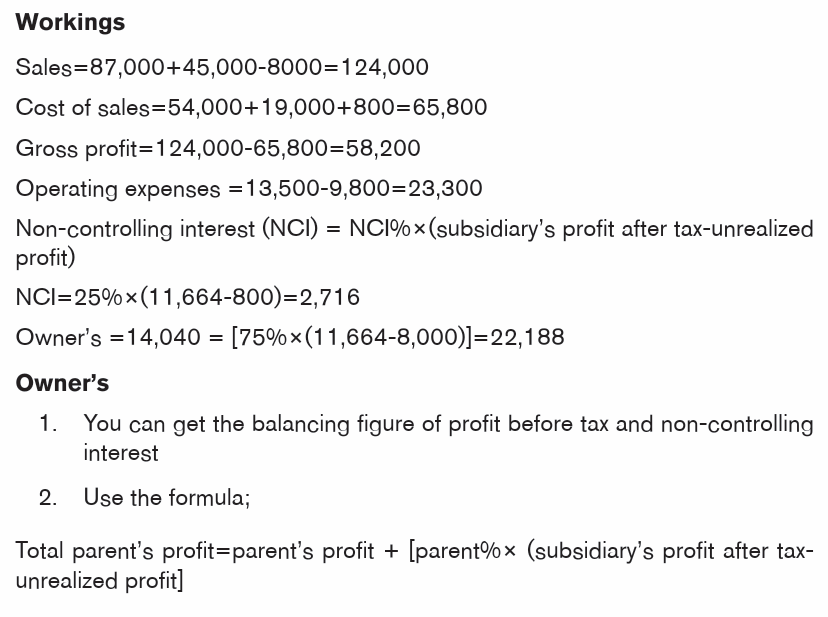

KAKA ltd acquires 75% of the ordinary shares of the GAGA ltd, which it has

owned since GAGA Ltd’s incorporation. The summarized statements of profit

or loss of the two companies for the year ending 31 December 2021 are given

below. GAGA ltd sold goods to KAKA ltd for FRW8, 000. It has bought these

goods for FRW 6,000. 40% of these goods remained in KAKA Ltd’s inventoryat 31 December 2021.

Goodwill arising on consolidation

Goodwill is simply reputation of the business. Goodwill is recognized only

when it has been acquired for the value consideration and represents advance

payment made by the acquirer for the future economic benefit.

On consolidation, goodwill is reported as an intangible asset in consolidated

group balance sheet. One of the simplest methods of calculating goodwill is by

subtracting the fair market value of a company’s net identifiable assets from theprice paid for ....

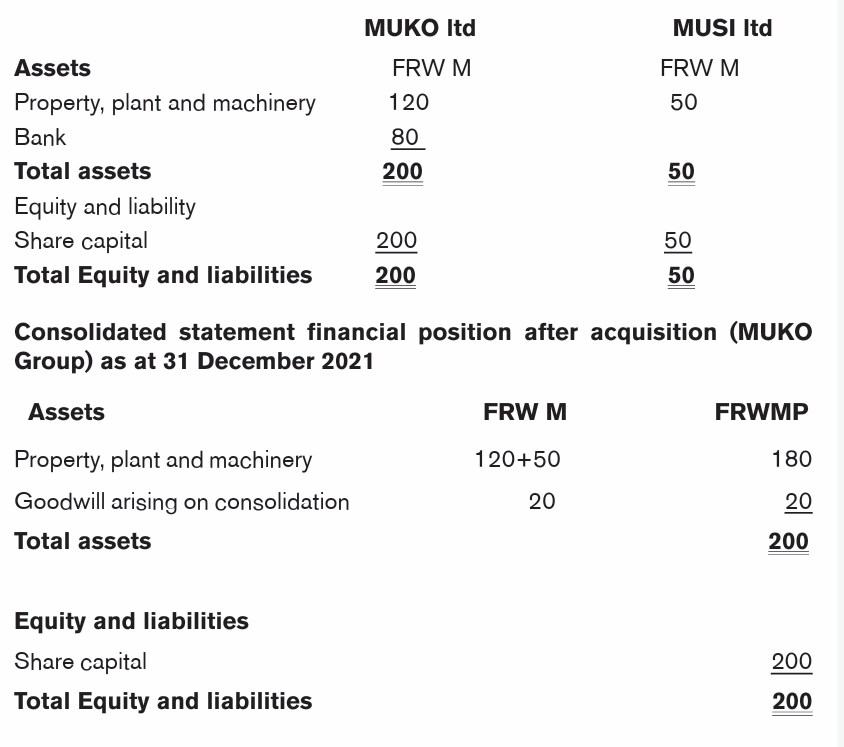

Example

Muko ltd buys all the shares of 50,000 FRW 1,000 of Musi ltd at 80 million in

by using cheque. The following is the statement of financial position before theacquisition of Musi ltd.

Statement of financial position as at 31 December 2021

NOTE: Since MUKO Ltd bought 50,000 shares at FRW 1,000 and paid 80

Million which is above the value of the shares, the difference (the premiumamount) is the goodwill. In this case, 30 Million is goodwill

Application activity 8.2

1) Why do parent companies need to prepare consolidated financial

statements?

2) Outline their limitations of financial statement

3) Mucyo Co ltd acquired 100% of Mukama Co ltd at a cost of FRW

100M. On the date of acquisition, the fair value of the identifiable

assets of Mukama Co ltd was FRW 75M.Required: Calculate the goodwill arising on acquisition.

End unit assessment

1. The following statements of financial position were extracted from the

books of two companies-GIKI LTD and KAWU LTD at 31 December 2020

GIKI LTD acquired all of the share capital of KAWU LTD one year ago. The

retained earnings of KAWU LTD stood at FRW 2,000,000 on the day of

acquisition. Goodwill is calculated using the fair value method and there

has been no impairment of goodwill since acquisition.

Required: Prepare the consolidated statement of financial position of GIKILTD as at 31 December 2020.