UNIT 6 : PREPARATION OF FINANCIAL STATEMENTS FOR A LIMITED LIABILITY COMPANY

Key unit competence: To be able to prepare financial statements for alimited liability

Introductory activity

Read the following information and answer the question that follows

for the year ended 31st March 2010 from the financial records of Watt

Limited:

Distribution Costs FRW 5,470; Interest Costs FRW 647; Cost of Sales

FRW 18,230, Sales FRW 44,870; Income Tax Expense FRW 1,617;

Administrative Expenses FRW 9,740; an asset originally cost FRW 10

,000 and was revalued to FRW 15,000

a) Which financial statement to be prepared by Watt Limited?

b) Which parts of that statement of Watt Limited?c) What income statement and other comprehensive?

6.1. Statement of comprehensive income

Learning Activity 6.1

KEZA is accountant of ABC ltd she has been prepared well ledger and

trial balance the next step is to be sure if they obtain net profits or net loss

for the period.

Required:

1. Which financial statement KEZA is going to prepare?2. Give five examples of elements included in this financial statement.

6.1.1 Trading and Profit or loss account

Objective and scope

As well as covering accounting policies and other general considerations

governing financial statements, IAS 1 Presentation of Financial Statements gives

substantial guidance on the form and content of published financial statements.

IAS 1 gives guidance on the format and content of all of these, apart from thestatement of cash flows, which is covered by IAS 7.

The entity should identify each component of the financial statements very

clearly. IAS 1 also requires disclosure of the following information in a prominent

position. If necessary it should be repeated wherever it is felt to be of use to the

readers in their understanding of the information presented.

After extracting a trial balance, the next step is to determine the amount of profit

or loss that the business has made during the trading period. This is done bypreparing two accounts namely:

There are basically two formats that are used to prepare a trading account.

• Horizontal• Vertical format

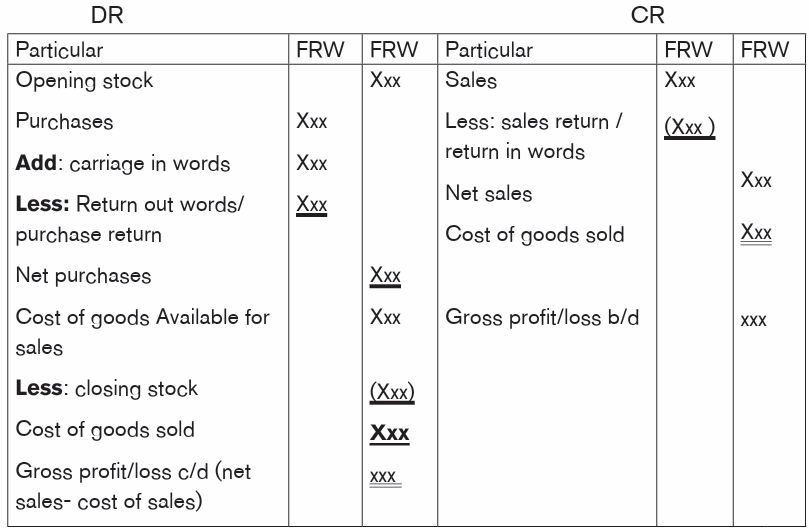

Horizontal T-formatABC limited trading account for the year ending ……./……./……../

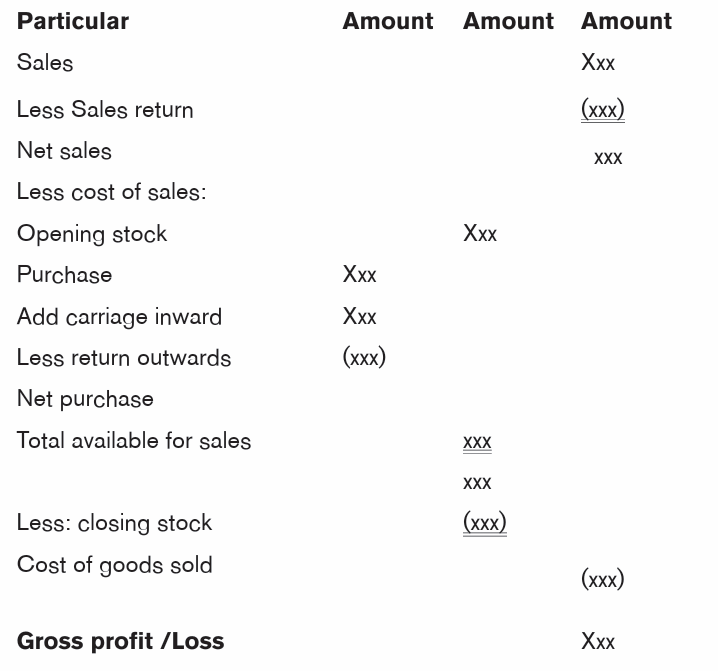

(Vertical format)

ABC Limited (name of company) trading account for the yearended………./…../…../

Trading account

• Trading account is an account which is prepared to determine the gross

profit or gross loss of the business concern. It shows the revenues from

sales, the cost of those sales or goods sold and the gross profit from

for the specific period ended. It is prepared after the preparation of the

trial balance. Trading account is where the value of the gross profit or

gross loss is determined by deducting the cost of goods sold from net

sales i.e Gross Profit = Net Sales – Cost of Sales, or Gross Loss=

Cost of Goods Sold - Net Sales.

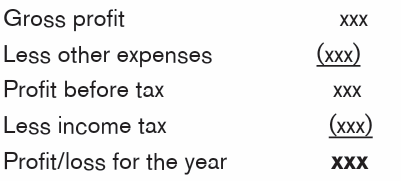

• Profit and loss Account where the value of net profit or Net loss is

calculated by deducting total operating expenses from the gross profitsi.e Gross profit – total expenses.

Items found in a trading account.

i. Sales: Refer to the value of goods which were bought for resale and have

been sold by the business. It is revenue earned from goods sold. They are

entered in the trading account for the purpose of calculating gross profit or loss.

ii. Sales return: Value of goods that were previously sold but have been

returned to the business.

iii. Net sales = Sales – Return inwards/ Sales Return

iv. Opening stock: Unsold goods in the business available at the beginning

of the new trading period.

v. purchases: Goods bought by the business for resale

vi. Purchases return: Goods previously bought by the business for sale

but have been sent back to the suppliers. This value is treated in the

trading account and it is subtracted from the purchases to get the net

purchases i.e.

Net purchases = purchases – return outwards/purchase returns

vii. Carriage in wards: refers to the cost of transporting the goods or bring

the goods up to the premises. It forms part of the goods bought henceadded to purchases the trading account.

viii. Warehouse wages: These are payments made directly for purchases

activity. Only wages paid directly for purchases in trading account to

determine the gross profit or gross loss. Net purchases = Purchases +Carriage Inwards +Wages -Purchases Return.

ix. Closing stock: Goods not sold by the business at the end of a trading

period. It’s included in the trading account and it is subtracted from thegoods available for sale to get cost of sales.

Cost of Goods Sold (CoGS) = Cost of Goods Available for Sale

(CoGAS) – closing stock.

Operating expenses (to be found in Profit and Loss Account):

These are the expenses incurred by the business on services that help in the

normal operation and running of the business. Such expenses include; transport,

electricity, rent insurance/premium, carriage outwards, salaries, water bills,

postage, discount allowed, advertising, communication, depreciation and bad

debts. In the profit and loss account the total operating expenses are subtractedfrom the total income or gross income to get net profit or net loss

Operating expenses fall into three major categories, namely:

i. Administrative expenses: comprising of office salaries and wages,

office rent and rates, office lighting, electricity and power, office stationery,

telephones, insurances, etc.

ii. Selling and distribution expenses: comprising of motor running

expenses, advertising, showroom, salesman salaries, carriage on sales etc.

iii. General and financial expenses: comprising of interest charges on

loan, and overdraft, bank charges, discount allowed, sundry or generalexpenses, etc.

Managers’ salaries

The salary of a sole trader or a partner in a partnership is not a charge to the

statement of profit or loss but is an appropriation of profit. The salary of a manager

or member of management board of a limited liability company, however, is an

expense in the statement of profit or loss, even when the manager is a shareholderin the company. Management salaries are included in administrative expenses.

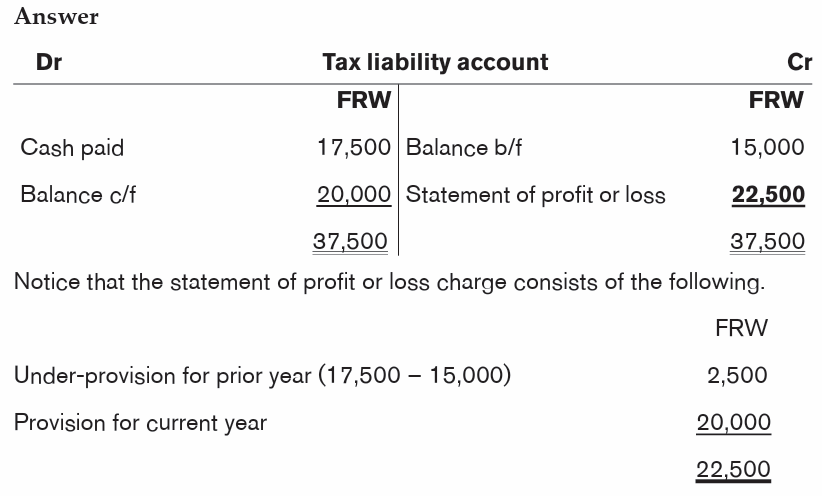

Taxation

Taxation affects both the statement of financial position and the statement of

profit or loss. All companies pay some kind of corporate taxation on the profits

they earn, which we will call income tax in line with the terminology in IAS 1, but

which you may find called ‘corporation tax’

Note that because a company has a separate legal personality, its tax is included

in its accounts. An unincorporated business would not show personal income

tax in its accounts, as it would not be a business expense but the personal affairof the proprietors.

i. The charge for income tax on profits for the year is shown as a deductionfrom profit for the year.

ii. In the statements of financial position, tax payable to the Government is

generally shown as a current liability, as it is usually due within 12 monthsof the year end.

iii. For various reasons, the tax on profits in the statement of profit or loss and

the tax payable in the statement of financial position are not normally thesame amount

Example

A company has a tax liability brought forward of FRW 15,000. The liability is

finally agreed at FRW 17,500 and this is paid during the year. The company

estimates that the tax liability based on the current year’s profits will be FRW20,000.

Prepare the tax liability account for the year.

Inter-relationship of statement of profit or loss and statement of

financial position

When we were dealing with the financial statements of sole traders, we

transferred the profit for the year to the capital account. In the case of limited

liability companies, the profit for the year is transferred to retained earnings in

the statement of changes in equity.

The closing balance of the accounts in the statement of changes in equity isthen transferred to the statement of financial position.

Gains on property revaluation

Gains on property revaluation arise when a property is revalued. The revaluation

is recognized in the other comprehensive income part of the statement of profit

or loss and other comprehensive income and shown in the statement of changesin equity as a movement in the revaluation surplus.

For example, an asset originally cost FRW 10 million and was revalued to FRW

15 million. The gain on the revaluation is recognized in the statement of profit

or loss and other comprehensive income (in the other comprehensive incomesection) and then shown as a movement in the revaluation surplus

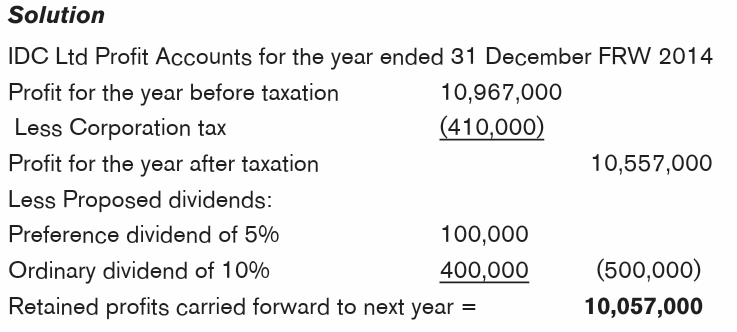

Illustration

IDC Ltd has share capital of 400,000 ordinary shares of FRW 10 each and

200,000 5 per cent preference shares of FRW 10 each.

The net profits for the first three years of business ended 31 December are:

2014, FRW 10,967,000; 2015 FRW 4,864,000; and 2016 FRW 15,822,000.

Transfers to reserves are made as follows: 2014 nil; 2015, general reserve,

FRW 10,000; and 2016, fixed assets replacement reserve, FRW 22,500.

Dividends were proposed for each year on the preference shares at 5 per cent

and on the ordinary shares at: 2014, 10 per cent; 2015, 12.5 per cent; 2016,15 per cent.

Corporation tax, based on the net profits of each year, is 2014 FRW 410,000;

2015 FRW 525,000; 2016 FRW 630,000Required: Prepare profit or loss account IDC Ltd

6.1.2 Presentation of statement of profit or loss and other

comprehensive income

We have considered just the statement of profit or loss. However, IAS 1 requires

entities to include a statement of profit or loss and other comprehensive income,

either as a single statement or as two separate statements:

Statement of profit or loss and a statement of other comprehensive

income

The statement of profit or loss and other comprehensive income takes the

statement of profit or loss and adjusts it for certain gains and losses. At Financial

Accounting level, this just means gains on revaluations of property, plant and

equipment.

The idea is to present all gains and losses, both those recognized in profit or

loss (in the statement of profit or loss) as well as those recognized directly in

equity, such as the revaluation surplus (in other comprehensive income).

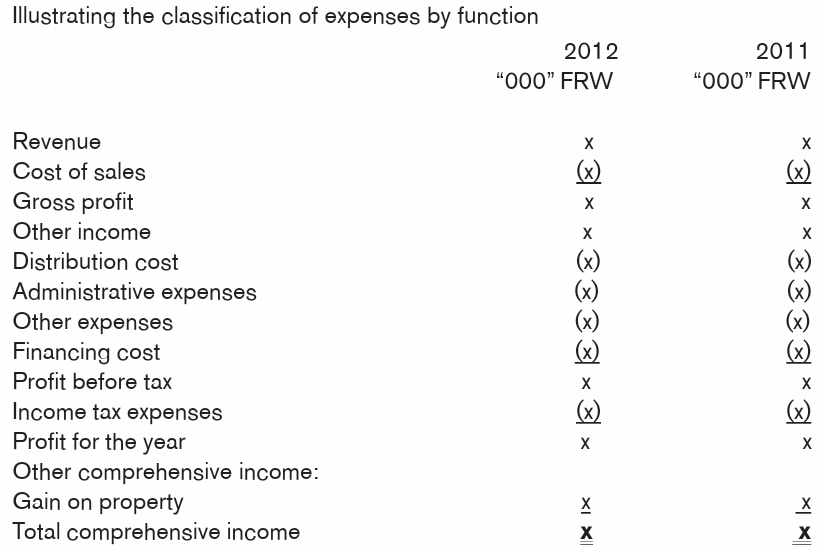

IAS 1 gives the following suggested format for a statement of profit or loss andother comprehensive income

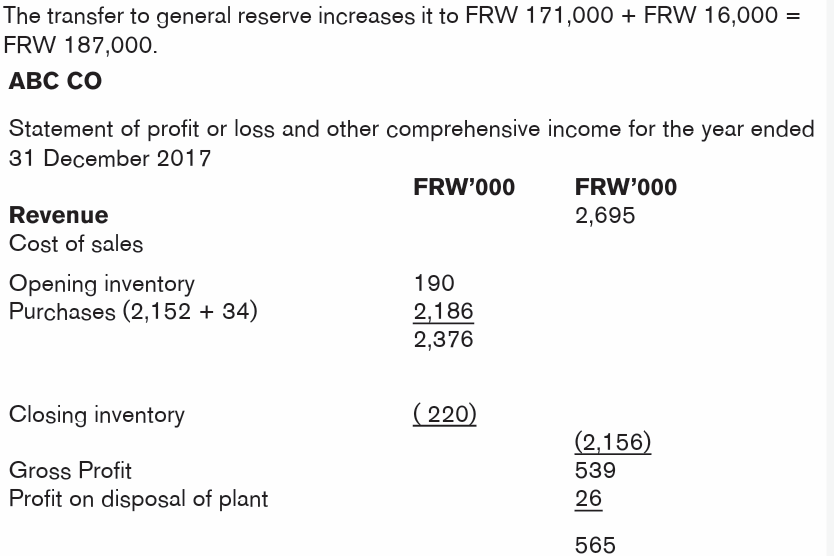

ABC CO

Statement of profit or loss and other comprehensive income forthe year ended 31 December 2012

Or

Statement of profit or loss and other comprehensive income for theyear ended 31 December 20x8 Extract

Other comprehensive income:

Gain on property on revaluation

Total comprehensive income = Profit for the year + other

comprehensive income =

Format of a trading account

Note:

• A reference to other comprehensive income means the last three lines

in the statement above. However, a reference to statement of profit

or loss and other comprehensive income means the whole statement

shown above.

• At the Financial Accounting level, the only items of other comprehensive

income are gains on revaluations of property, plant and equipment.

• Income statement is a financial statement that reports a company’s

financial performance over a specific accounting period. Financial

performance is assessed by giving a summary of how the business

incurs its revenues and expenses through both operating and nonoperating activities.

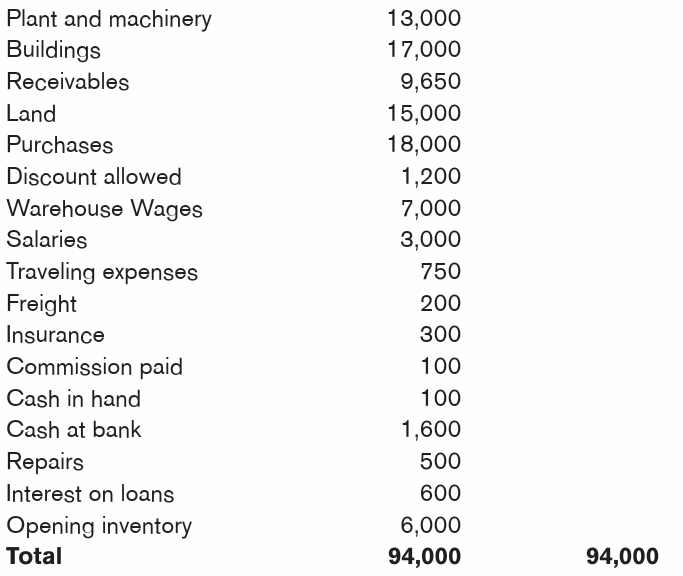

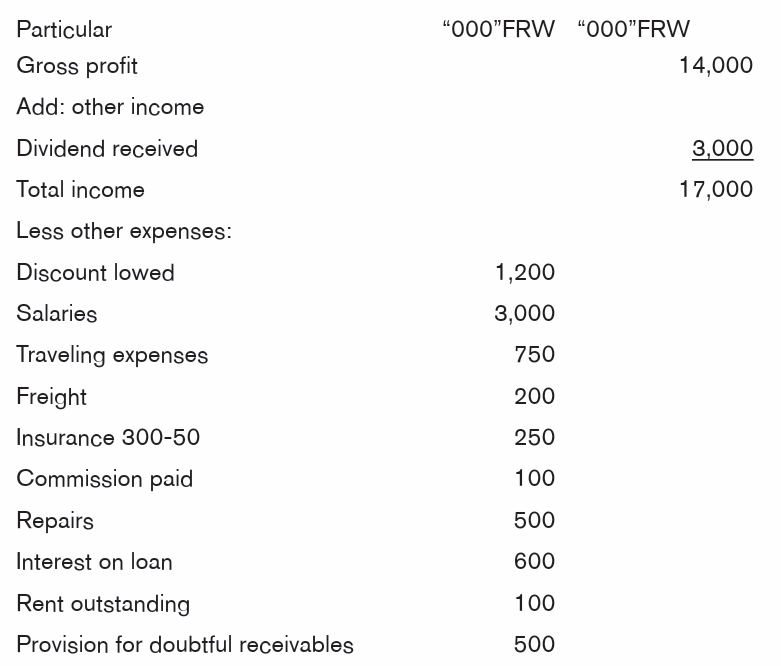

Illustration

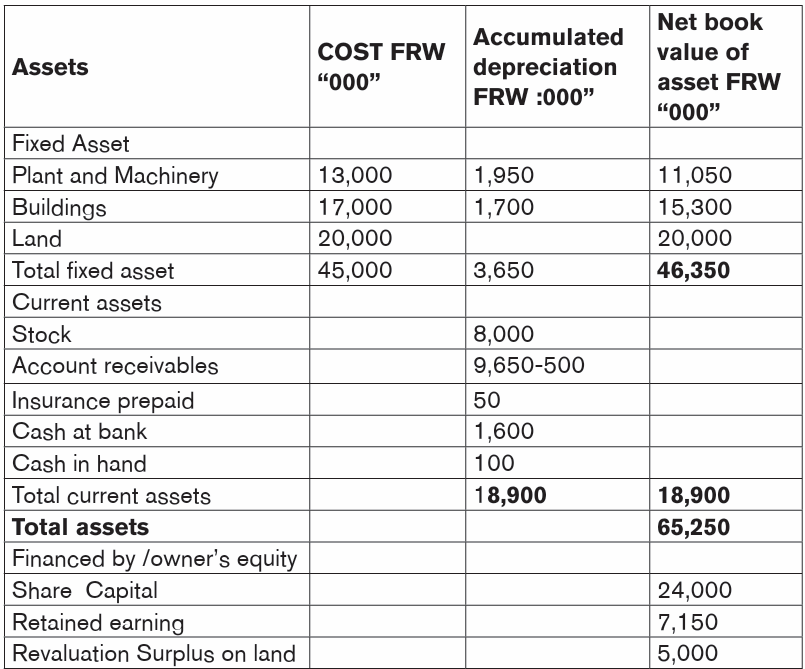

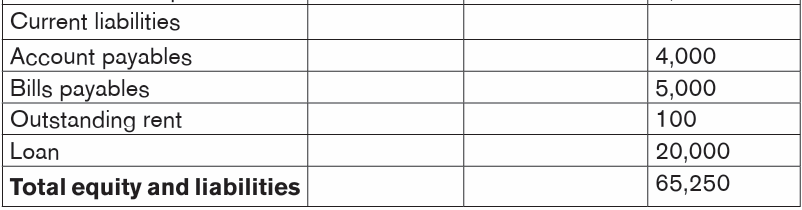

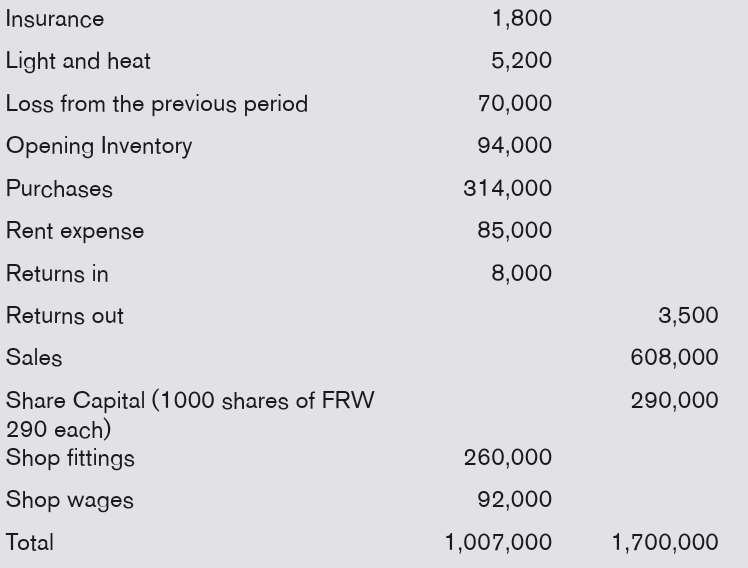

ABC ltd company trial balance on 31/12/2019

Notes:

a) Closing inventory FRW 8,000

b) Depreciation on plant and machinery at 15% buildings 10%

c) Provision for doubtful receivables FRW 500

d) Insurance prepaid FRW 50

e) Outstanding rent

f) An asset (land) originally cost FRW 15 million and was revalued toFRW 20 million.

Required:

i) To Prepare a statement of profit or loss and other comprehensive incomefor the year ended 31 December 2019

Answer:

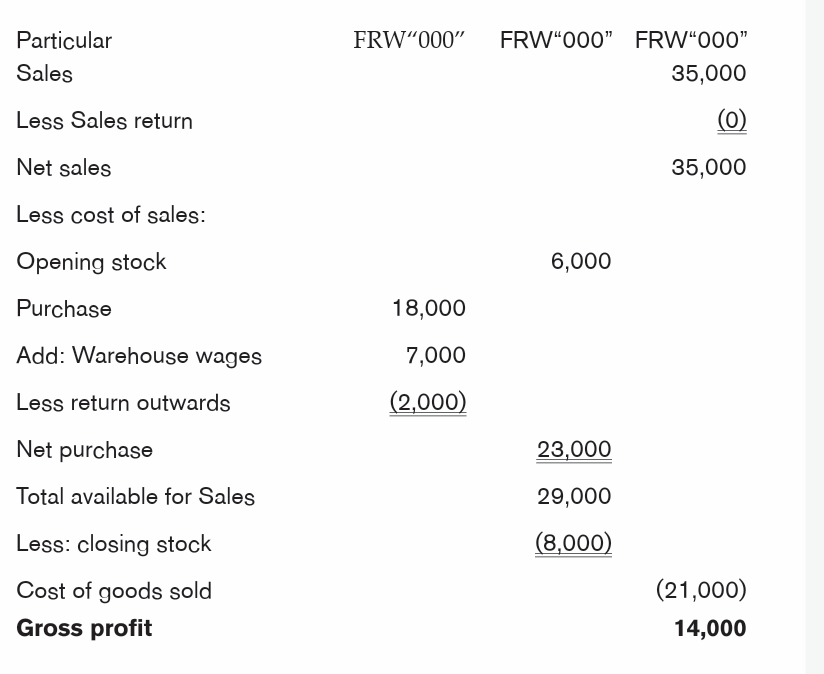

Vertical formatABC ltd Company trading account on 31/12/2019

Answer:

Vertical format

i) Statement of profit or loss and other comprehensive income for the yearended 31 December 2019.

Application activity 6.1

ABC Ltd has share capital of 400,000 ordinary shares of FRW 10 each

and 200,000 5 per cent preference shares of FRW 10 each.

The net profits for the first three years of business ended 31 December

are: 2014, FRW 10,967,000

2015 FRW 14,864,000; and 2016 FRW 15,822,000.

Transfers to reserves are made as follows: 2014 nil; 2015, general reserve,

FRW 100,000; and 2016, fixed assets replacement reserve, FRW 225,000.

Dividends were proposed for each year on the preference shares at 5 per

cent and on the ordinary shares at: 2014, 10 per cent; 2015, 12.5 per

cent; 2016, 15 per cent.

Corporation tax, based on the net profits of each year, is 2014 FRW

410,000; 2015 FRW 525,000; 2016 FRW 630,000

Required: Prepare profit or loss account ABC Ltd at ended 31 Decemberare: 2015, 2016

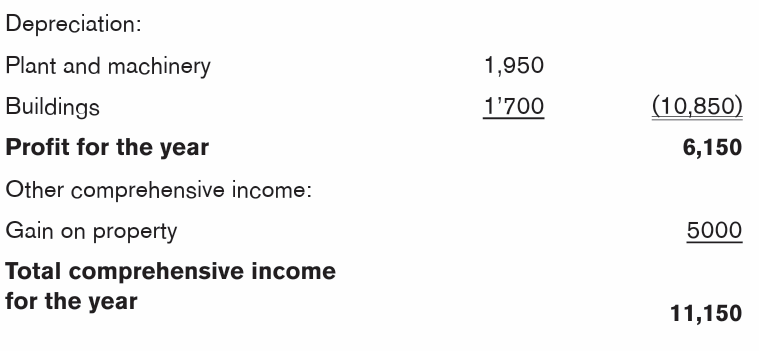

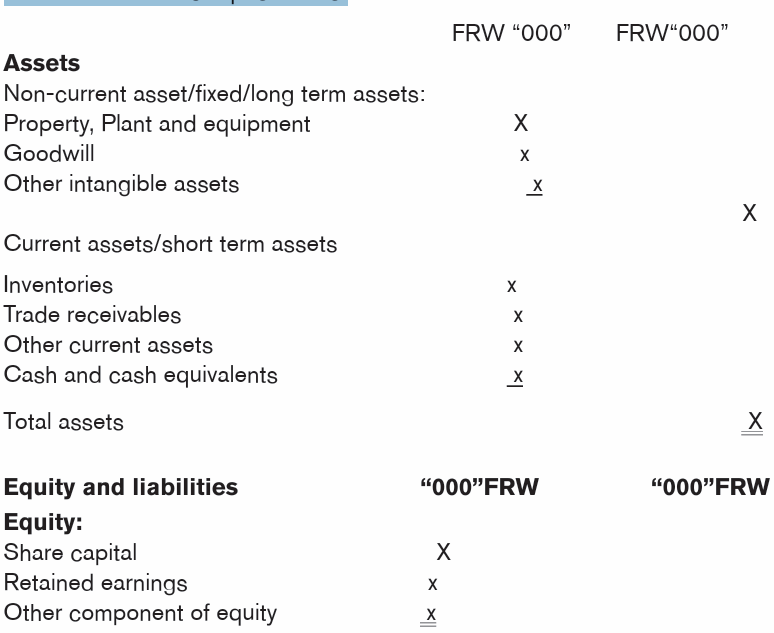

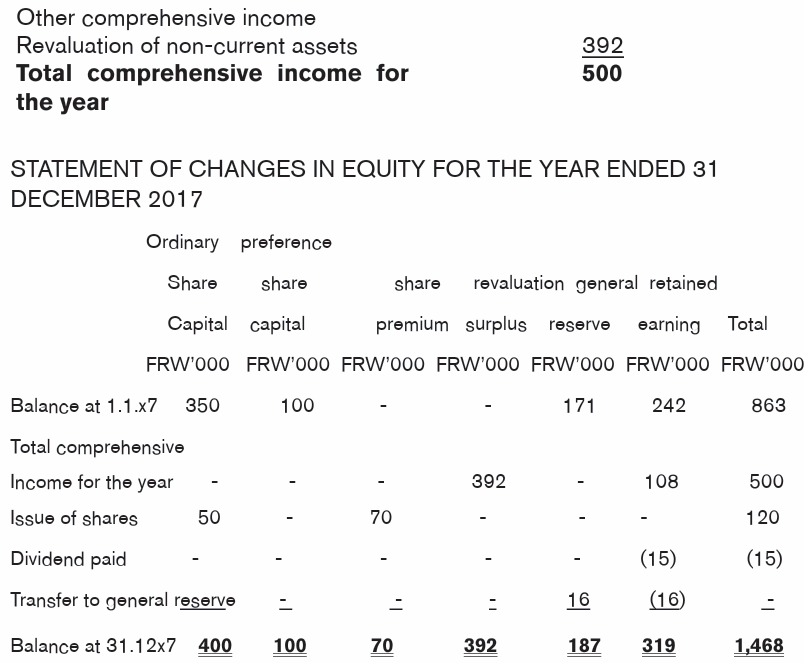

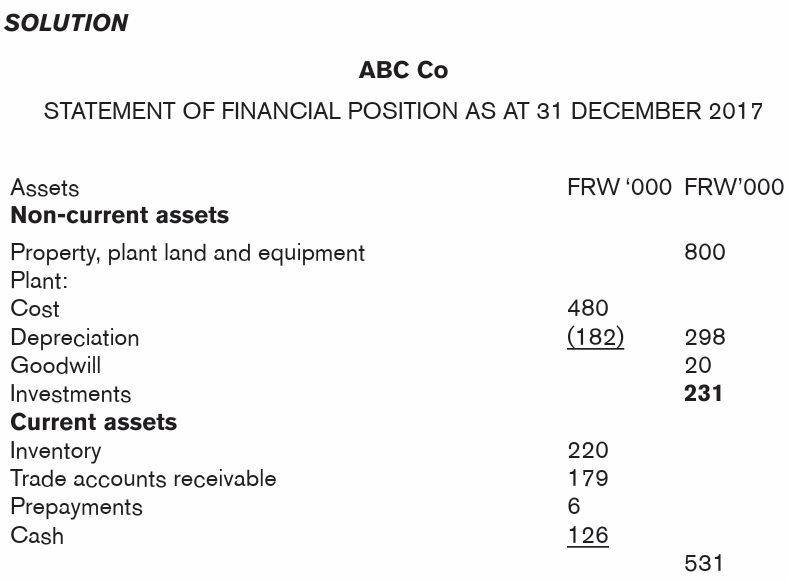

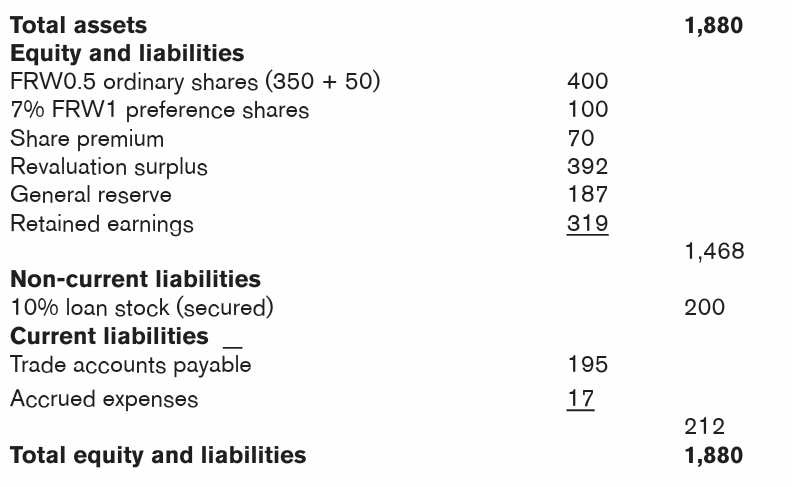

6.2 Statements of Financial Position

Learning Activity 6.2

ABC Company is closing its Financial period and they need to know the

company’s Financial Position. As a hired accountant,

You are asked to:

1. Tell which statement that shows the Financial Statements of abusiness and its elements.

6.2.1 Presentation of statement of financial position

ABC CompanyStatement of financial position as

6.2.2 Element of statement of Financial position

The statement of financial position makes use of accounting equation concepts:

Assets = Capital+ liabilities

The statement of financial position is also prepared according to the businessentity convention/concept, that a business is separate from its owners.

Assets

The assets are exactly the same as those we would expect to find in the account

of a sole trader.

The only difference is that the detail is given in notes. Only the totals are shownon the face of the statement of financial position.

Equity

Capital reserves usually have to be set up by law, whereas revenue reserves

are appropriations of profit. With a sole trader, profit was added to capital.

However, in a limited company, share capital and profit have to be disclosed

separately share capital, reserve, retained earnings, dividends, because profit

is distributable as a dividend but share capital cannot be distributed. Therefore,any retained profits are kept in the retained earnings reserve.

Liabilities

Liabilities are split between current and non-current

Users of financial statements need to be able to identify current assets and

current liabilities in order to determine the company’s financial position. Where

current assets are greater than current liabilities, the net excess is often called

‘working capital’ or ‘net current assets.

Each entity should decide whether it wishes to present current/non-current

assets and current/ non-current liabilities as separate classifications in the

statement of financial position. This decision should be based on the nature of the

entity’s operations. Where an entity does not choose to make this classification,

it should present assets and liabilities broadly in order of their liquidity.

In either case, the entity should disclose any portion of an asset or liability which

is expected to be recovered or settled after more than 12 months. For example,

for an amount receivable which is due in installment over 18 months, the portiondue after more than 12 months must be disclosed.

Current assets

An asset should be classified as a current asset when it is:

– Expected to be realized in, or is held for sale or consumption in, the

entity’s normal operating cycle

– Held primarily for the purpose of being traded

– Expected to be realized within 12 months after the reporting date

– Cash or a cash equivalent which is not restricted in its use all other

assets should be classified as non-current assets.

All other assets should be classified as non-current assets

Non-current assets include tangible, intangibles operating and financial assets

of a long –term nature. Other term with the same meaning can be used (“fixed”

“long-term”).

The term operating cycle of an entity is the time between the acquisition of

asset for processing and their realization in cash or cash equivalent. Current

assets therefore include assets (such as inventories and trade receivables) that

are sold or realized as part of the normal operating cycle. This is the case evenwhere they are not expected to be realized within 12 months.

Current liabilities

A liability should be classified as a current liability when it is:

– Expected to be settled in the entity’s normal operating cycle

– Due to be settled within 12 months of the reporting date– Held primarily for the purpose of being traded

All other liabilities should be classified as non-current liabilities.

The categorization of current liabilities is very similar to that of current assets.

Thus, some current liabilities are part of the working capital used in the normal

operating cycle of the business (i.e trade payables and accruals for employee

and other operating costs). Such items will be classed as current liabilities even

where they are due to be settled more than 12 months after the reporting date.

There are also current liabilities which are not settled as part of the normal

operating cycle, but which are due to be settled within 12 months of the

reporting date. These include bank overdrafts, income taxes, other non-trade

payables and the current portion of interest-bearing liabilities. Any interest

bearing liabilities that are used to finance working capital on a long-term basis,

and that are not due for settlement within 12 months, should be classed asnon-current liabilities.

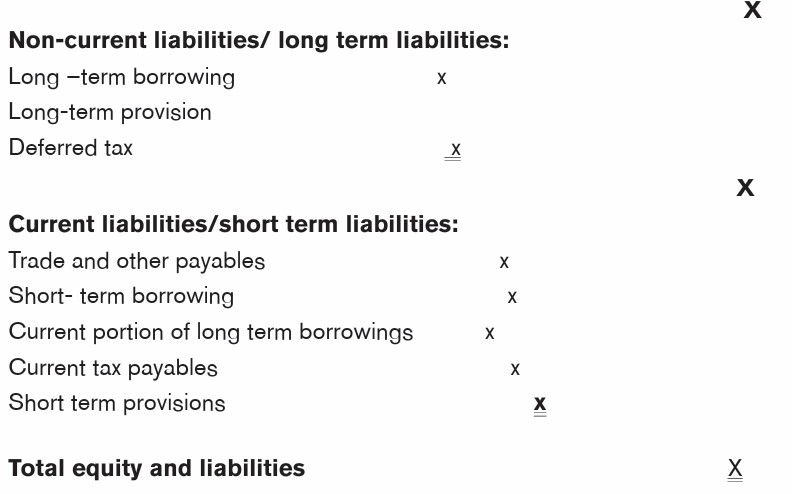

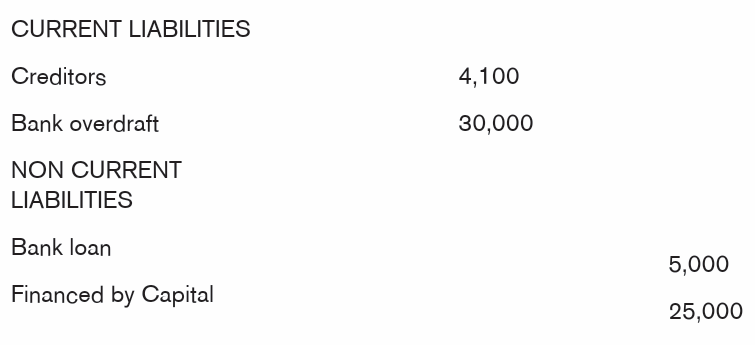

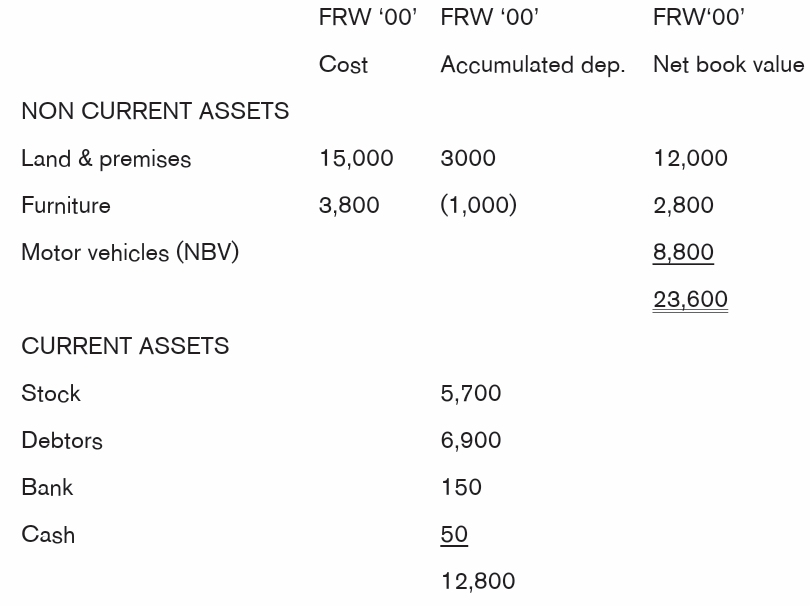

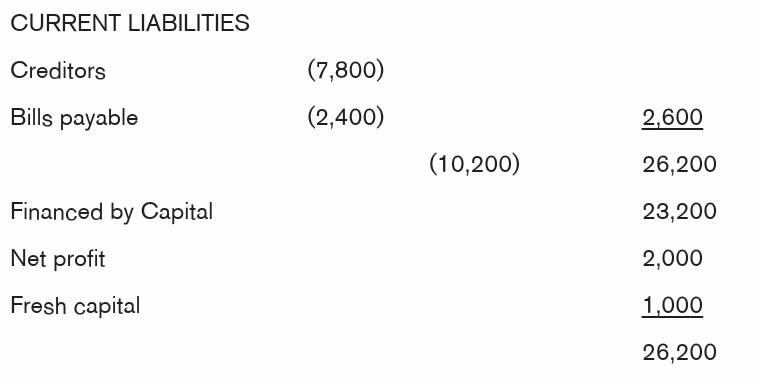

Example:

From the example 6.2.2.1 Present statement of financial position of ABC limitedCompany for the ended 31 December 2019 in vertical format.

Statement of financial position of ABC Limited Company for the ended31 Dec 2019

Application activity 6.2

The following balances were extracted from the book of KASAYA limitedas at 30 September 2010 in FRW”000”

Additional information:

1. The balance on corporation tax account represents an over provision

of tax for the previous year.

tax expenses for the current year is estimated at FRW 3 million.

2. On the 15 September 2010 the directors of the company proposed

to pay the dividend due to the ordinary preference shareholders

and also to pay a final dividend of FRW 2 million to the ordinary

shareholders.

3. A building whose net book value is 5million is to be revalued to FRW9 million.

Required:

Prepare Statement of financial position for the year ended 30 September 2010

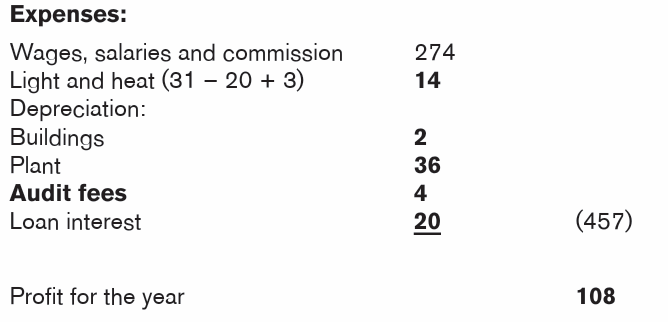

6.3. Statement of changes in equity

Learning Activity 6.3

There are two businesses A&B which are operating in Kamonyi District

where A is a Sole trader and B is a company. There are showing you their

Financial Statements.

Required: To Differentiate statement of sole trader from Statement of

financial position of company based on element of owners’ equity?

6.3.1 Presentation statement of changes in equity

IAS 1 requires an entity to provide a statement of changes in equity. The

statement of changes in equity shows the movements in the entity’s equity for

the period.

The statement of profit or loss and other comprehensive income is a straight

forward measure of the financial performance of the entity, in that it shows all

items of income and expense recognized in a period. It is then necessary to link

this result with the results of transactions with owners of the business, such as

share issues and dividends. The statement making the link is the statement of

changes in equity.

The statement of changes in equity simply takes the equity section of the

statement of financial position and shows the movements during the year. The

bottom line shows the amounts for the current statement of financial position.

As we saw above, the total comprehensive income for the year is split between

the gains on revaluation of property, which is credited to the revaluation surplus,

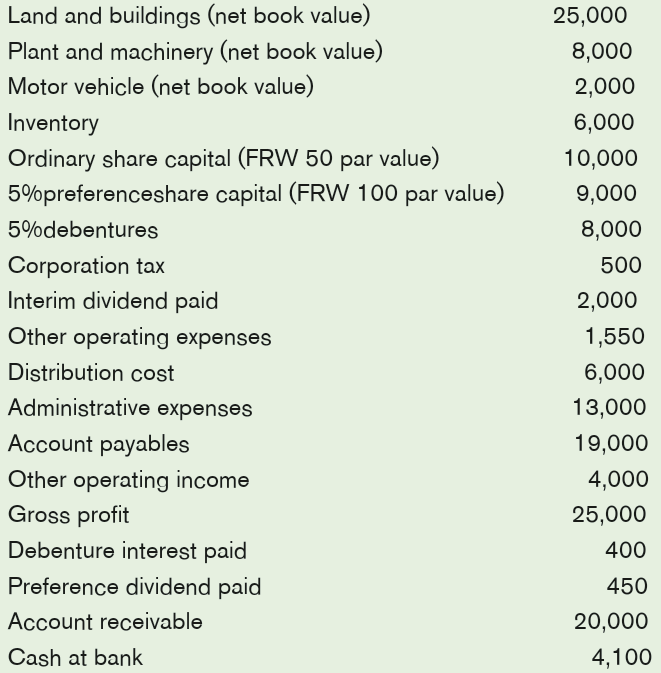

and the profit for the year, which is credited to retained earnings.An example statement of changes in equity is shown below

6.3.2 Elements of statement of changes in equity

ABC co statement of changes in equity for the year ended 31 December 2012

Dividends paid during the year are not shown on the statement of profit or lossaccount, they are shown in the statement of changes in equity.

Example 1:

Opening balances of all equity account

Share capital FRW 5000,000

Retained earnings FRW 2,350,000

Accumulated other comprehensive income FRW 650,000

Preliminary financial data:

Revenue was FRW 15,000,000 and expenses were FRW 8,500,000 for the

year.

A cash dividend of FRW 500,000 was declared and paid in the current year.

The other comprehensive income for the year is FRW 900,000Prepare and present statement changes in equity for the year.

Application activity 6.3

The published accounts of XYZ Co, the profit for the period is FRW

350,000. The balance of retained earnings at the beginning of the year is

FRW 50,000. If dividends of FRW 250,000 were paid, what is the closing

balance of retained earnings?

a) FRW 400,000

b) FRW 150,000

c) FRW 50,000d) FRW 100,000

6.4 Statement of cash-flow

Learning Activity 6.4

Analyze the above picture and answer the question follow:

a) Is there the movement of money? Explain

b) List two examples of each movement of money

The standard gives the following definition, the most important of which are

cash and cash equivalents.

– Cash comprises cash on hand and demand deposits.

– Cash equivalents are short-term, highly liquid investments that are

readily convertible to known amounts of cash and which are subject toan insignificant risk of changes in value.

Cash flows are inflows and outflows of cash and cash equivalents.

– Operating activities are the principal revenue-producing activities of the

entity and other activities that are not investing or financing activities.

– Investing activities are the acquisition and disposal of long term assets

and other investments not included in cash equivalents.

– Financing activities are activities that result in changes in the size and

composition of the contributed equity capital and borrowings of theentity.

6.4.1 Presentation of a statement of cash flows

IAS 7 requires statements of cash flows to report cash flows during the period

classified by operating, investing and financing activities.

The manner of presentation of cash flows from operating, investing and financing

activities depends on the nature of the enterprise.

By classifying cash flows between different activities in this way, users can see

the impact on cash and cash equivalents of each one, and their relationshipswith each other. We can look at each in more detail.

Component of cash flow:

1. Operating activities:

This is perhaps the key part of the statement of cash flows because it shows

whether, and to what extent, companies can generate cash from their operations.

It is these operating cash flows which must, in the end, pay for all cash outflows

relating to other activities, ie paying loan interest, dividends and so on.

Most of the components of cash flows from operating activities will be those

items which determine the net profit or loss of the enterprise, i.e they relate tothe main revenue-producing activities of the enterprise.

The standard gives the following as examples of cash flows from operating

activities.

a) Cash receipts from the sale of goods and the rendering of services

b) Cash receipts from royalties, fees, commissions and other revenue

c) Cash payments to suppliers for goods and servicesd) Cash payments to and on behalf of employees

Certain items may be included in the net profit or loss for the period which do

not relate to operational cash flows; for example, the profit or loss on the sale of

a piece of plant will be included in net profit or loss, but the cash flows will beclassed as investing.

2. Investing activities

The cash flows classified under this heading show the extent of new investment

in assets which will generate future profit and cash flows.

The standard gives the following examples of cash flows arising from investing

activities

a) Cash payments to acquire property, plant and equipment, intangibles

and other non-current assets, including those relating to capitalized

development costs and self-constructed property, plant and equipment

b) Cash receipts from sales of property, plant and equipment, intangibles

and other non-current assets

c) Cash payments to acquire shares or loan notes of other entities

d) Cash receipts from sales of shares or loan notes of other entities

e) Cash advances and loans made to other parties

f) Cash receipts from the repayment of advances and loans made toother parties

3. Financing activities

This section, of the statement of cash flows shows the share of cash which the

entity’s capital providers have claimed during the period. This is an indicator of

likely future interest and dividend payments. The standard gives the following

examples of cash flows which might arise under these headings.

a) Cash proceeds from issuing shares

b) Cash payments to owners to acquire or redeem the entity’s shares

c) Cash proceeds from issuing loans, bonds, mortgages and other short-

or long-term borrowings

d) Cash repayments of amounts borrowed

e) Cash payments by a lessee for the reduction of the outstanding liabilityrelating to a lease

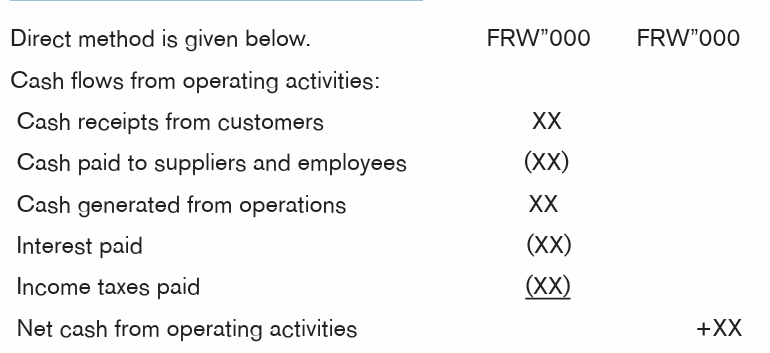

Reporting cash flows from operating activities

a) Direct method: disclose major classes of gross cash receipts and

gross cash payments

b) Indirect method: net profit or loss is adjusted for the effects of

transactions of a non-cash nature, any deferrals or accruals of past

or future operating cash receipts or payments, and items of income or

expense associated with investing or financing cash flows

a. Using the direct method:

There are different ways in which the information about gross cash receipts

and payments can be obtained. The most obvious way is simply to extract theinformation from the accounting records.

Example

ABC Ltd had the following transactions during the year:

a) Purchases from suppliers were FRW 19,500,000 of which FRW

2,550,000 was unpaid at the year end. Brought forward payables

were FRW 1,000,000.

b) Wages and salaries amounted to FRW 10,500,000 of which FRW

750,000 was unpaid at the year end. The accounts for the previous

year showed an accrual for wages and salaries of FRW 1,500,000.

c) Interest of FRW 2,100,000 on a long-term loan was paid in the year.

d) Sales revenue was FRW 33,400,000, including FRW 900,000

receivables at the year end. Brought forward receivables were FRW400,000.

Required:To calculate the cash flow from operating activities using the direct method

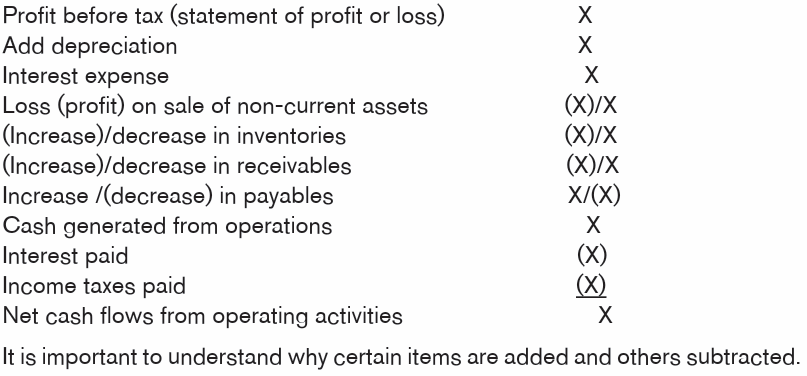

B. Using the indirect method

This method is undoubtedly easier from the point of view of the preparer of the

statement of cash flows. The net profit or loss for the period is adjusted for the

following.

a) Changes during the period in inventories, operating receivables and

payables

b) Non-cash items, eg depreciation, provisions, profits/losses on the

sales of assets

c) Other items, the cash flows from which should be classified underinvesting or financing activities

a) Depreciation is not a cash expense, but is deducted in arriving at the

profit figure in the statement of profit or loss. It makes sense, therefore,

to eliminate it by adding it back.

b) By the same logic, a loss on a disposal of a non-current asset (arising

through under-provision of depreciation) needs to be added back and

a profit deducted.

c) An increase in inventories means less cash – you have spent cash on

buying inventory.

d) An increase in receivables means the company’s receivables have not

paid as much, and therefore there is less cash.

e) If we pay off payables, causing the figure to decrease, again we haveless cash.

• Interest and dividends

Cash flows from interest and dividends received and paid should each be

disclosed separately. Each should be classified in a consistent manner from

period to period (IAS 7,

A financial institution shows interest paid and interest and dividends received as

operating cash flows, because its business model is based around generatingreceipts of interest and dividends.

For entities that are not financial institutions:

a) Interest paid should be classified as an operating cash flow or a

financing cash flow.

b) Interest received and dividends received should be classified as

investing cash flows.

c) Dividends paid by the entity may be classified as a financing cash

flow, showing the cost of obtaining financial resources or alternatively

as an operating cash flow, so that users can assess the entity’s abilityto pay dividends out of operating cash flows. (IAS 7

• Taxes on income

Cash flows arising from taxes on income should be separately disclosed and

should be classified as cash flows from operating activities unless they can bespecifically identified with financing and investing activities

• The advantages of cash flow accounting

a) Survival in business depends on the ability to generate cash. Cash

flow accounting directs attention towards this critical issue.

b) Cash flow is more comprehensive than ‘profit’ which is dependent on

accounting conventions and concepts.

c) Creditors of the business (both long and short term) are more

interested in an enterprise’s ability to repay them than in its profitability.

While ‘profits’ might indicate that cash is likely to be available, cash

flow accounting gives clearer information.

d) Cash flow reporting provides a better means of comparing the results

of different companies than traditional profit reporting.

e) Cash flow reporting satisfies the needs of all users better.

i) For management, it provides the sort of information on which decisions

should be taken (in management accounting, ‘relevant costs’ to a decision

are future cash flows). Traditional profit accounting does not help with

decision making.

ii) For shareholders and auditors, cash flow accounting can provide a

satisfactory basis for stewardship accounting.

iii) As described previously, the information needs of creditors andemployees will be better served by cash flow accounting.

a) Cash flow forecasts are easier to prepare, as well as more useful, than

profit forecasts.

b) They can in some respects be audited more easily than accounts

based on the accruals concept.

c) The accruals concept is confusing, and cash flows are more easilyunderstood.

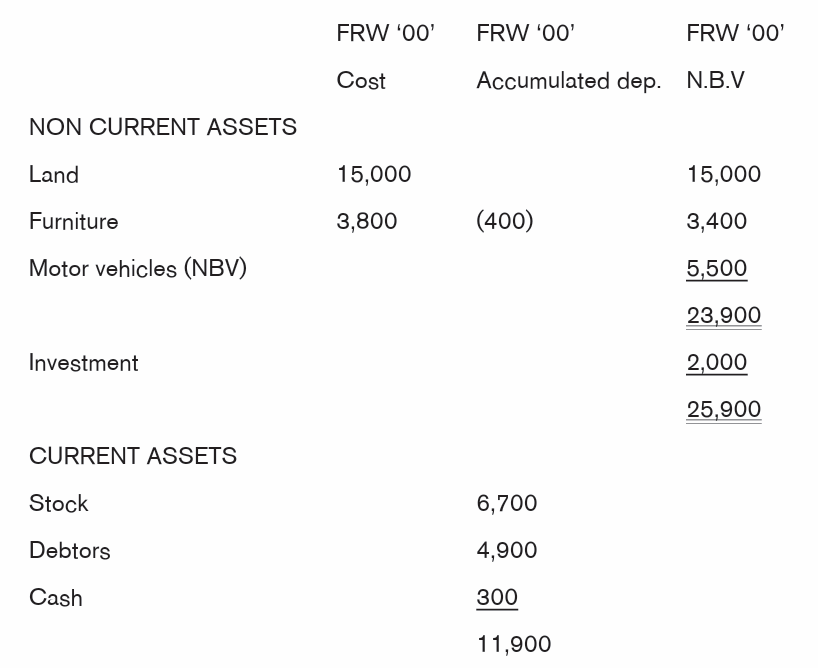

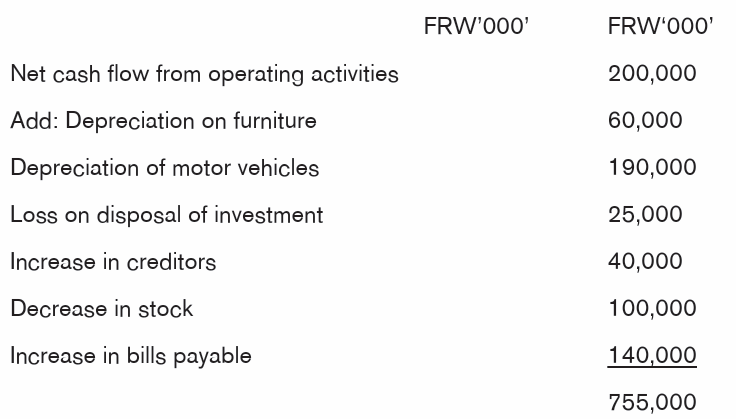

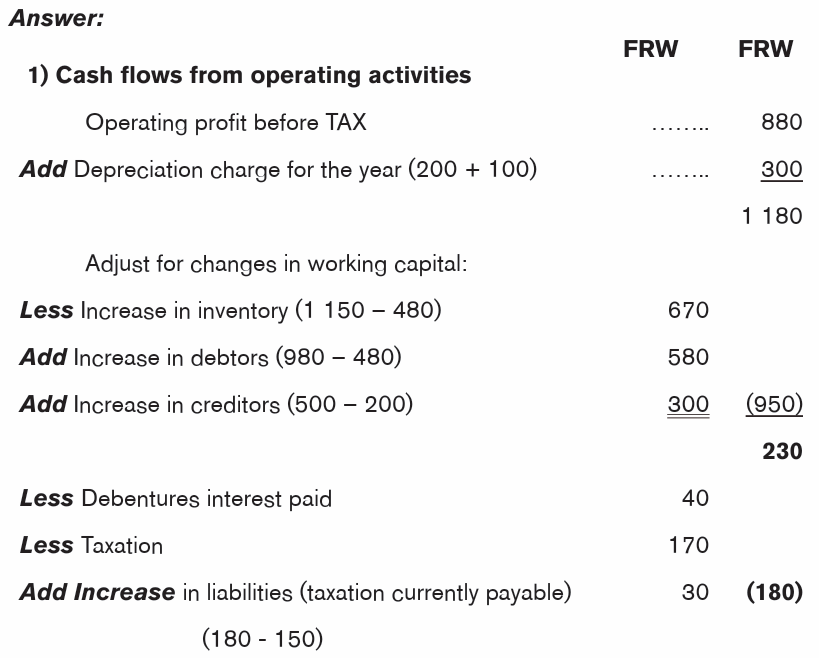

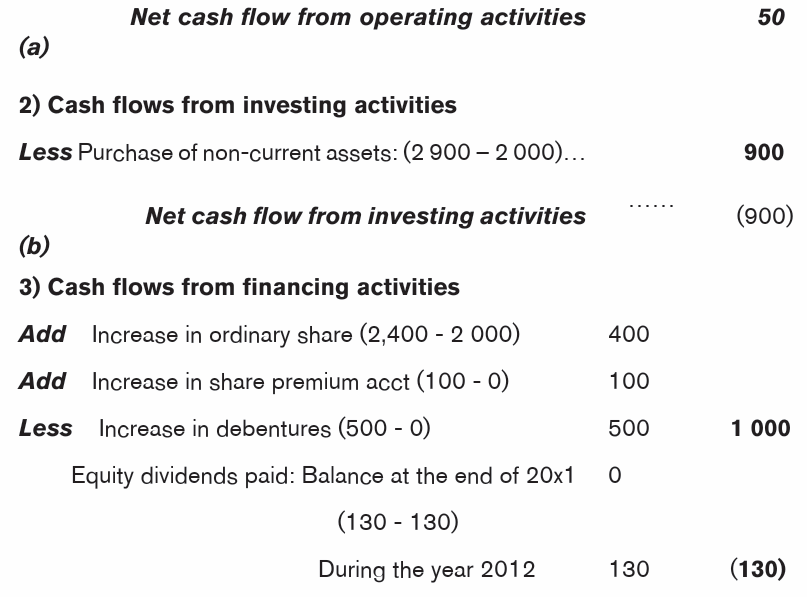

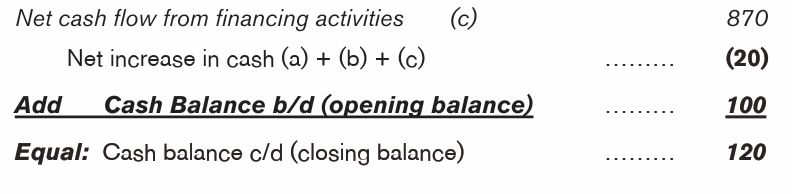

ILLUSTRATION 1

The following are balance sheets of Neema private ltd for the years ended 31stDec 2003 and 2004 respectively Neema private company.

Balance sheet/ statement of financial position as at 31st Dec 2003

NEEMA PRIVATE LTD

Balance sheet/ Statement of Financial Position as at 31st Dec 2004

Additional information:

i. A piece of land was sold in July 2004 for FRW 610,000 and investment in

October 2004 for FRW 175,000

ii. Some motor vehicle was bought in 2004 for FRW 520,000. No furniture

was bought or sold during the year.

Required: To prepare a statement of Cash Flow to explain the change in cash

Solution

Adjustments:

a) Gain on disposal (land) = 610,000-(1,500,000-1,200,000) =

610,000-300,000=310,000

b) Loss on disposal (investment)= 200,000-175,000= 25,000

c) Depreciation on furniture= 100,000-40,000=60,000

or NBV for 2nd year-NBV for 1st year= 3,400-2,800=600x100=60,000

a) Depreciation on Motor Vehicle= 520,000-(880,000-550,000) =190,000

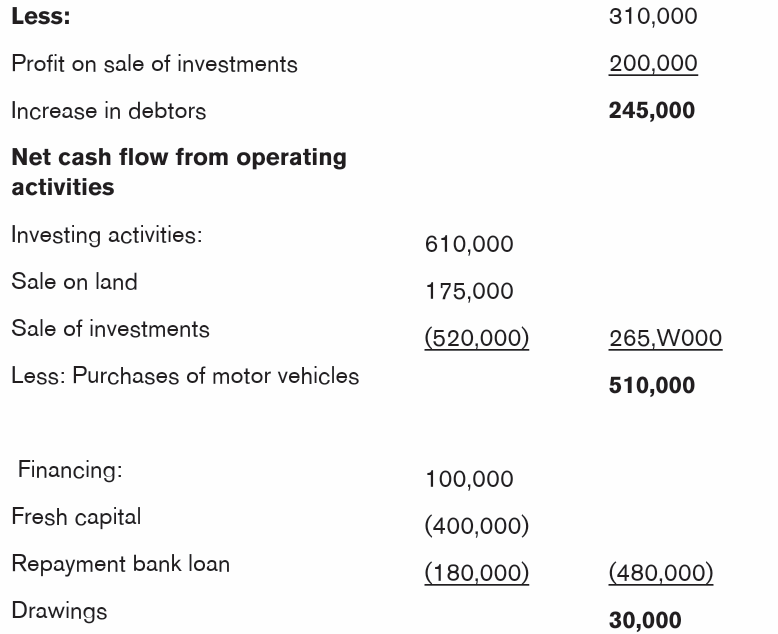

NEEMA PRIVATE LTDSTATEMENT CASH FLOW (INDIRECT METHOD)

ILLUSTRATION 2

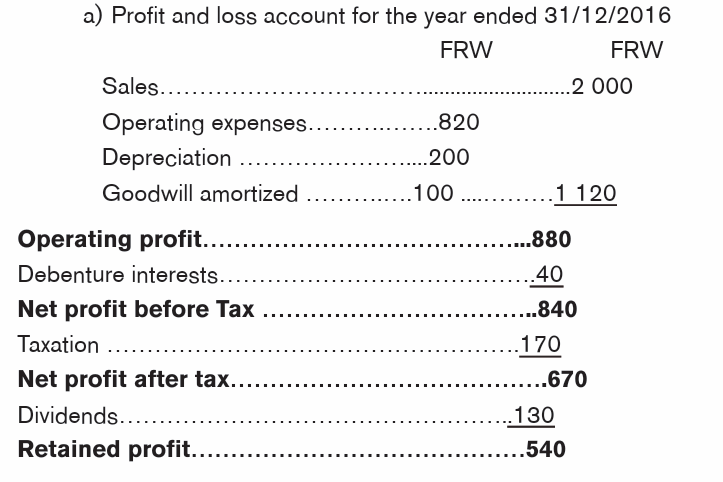

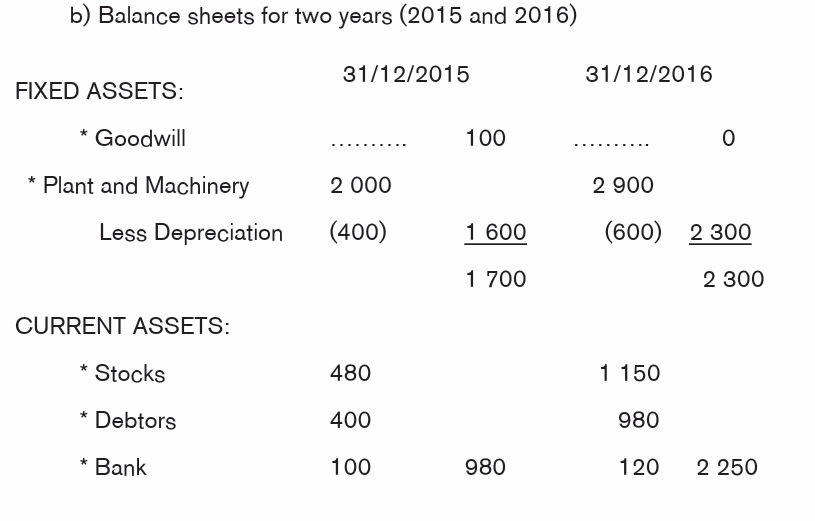

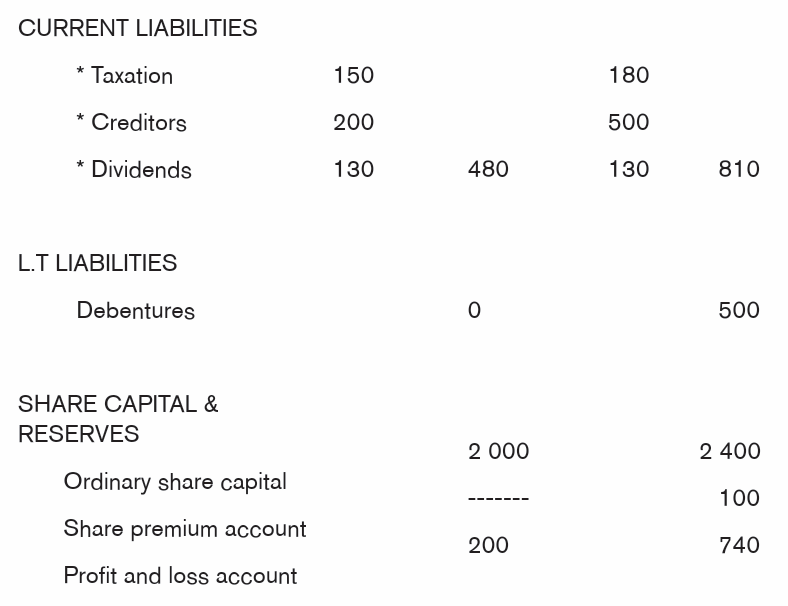

The following information is extracted from the financial statement of AMANI ltdon 31/12/2016:

You are required to prepare a statement of Cash Flow

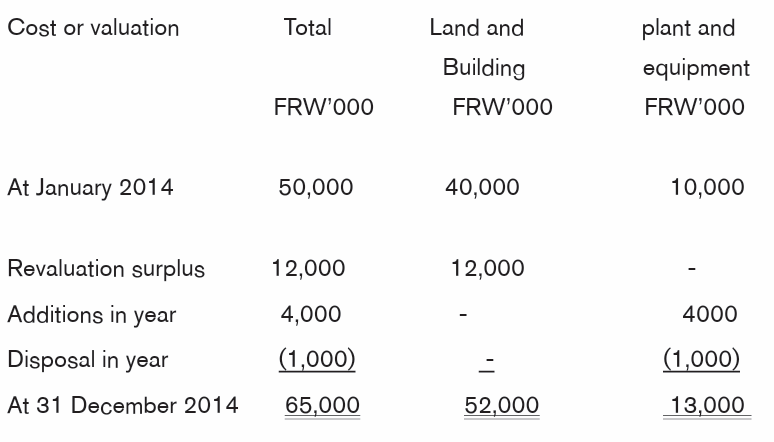

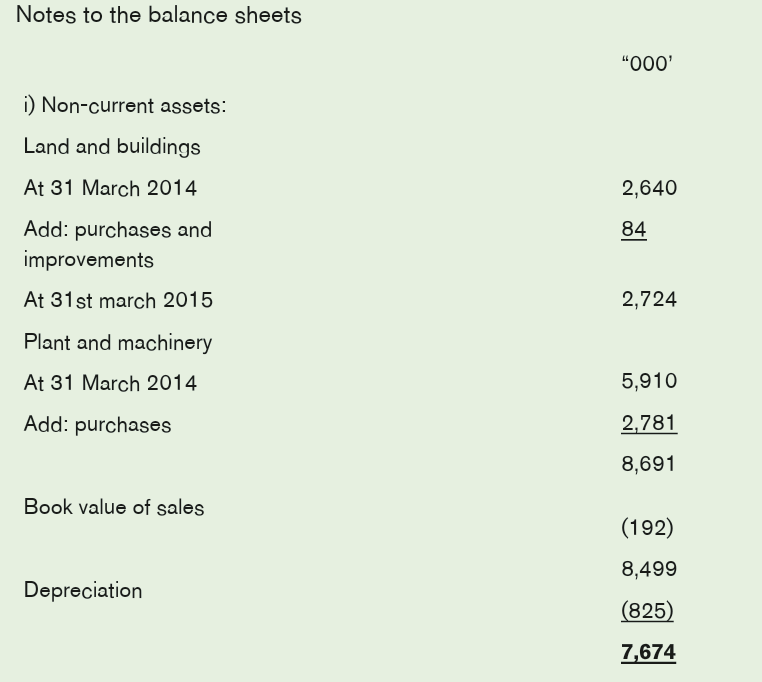

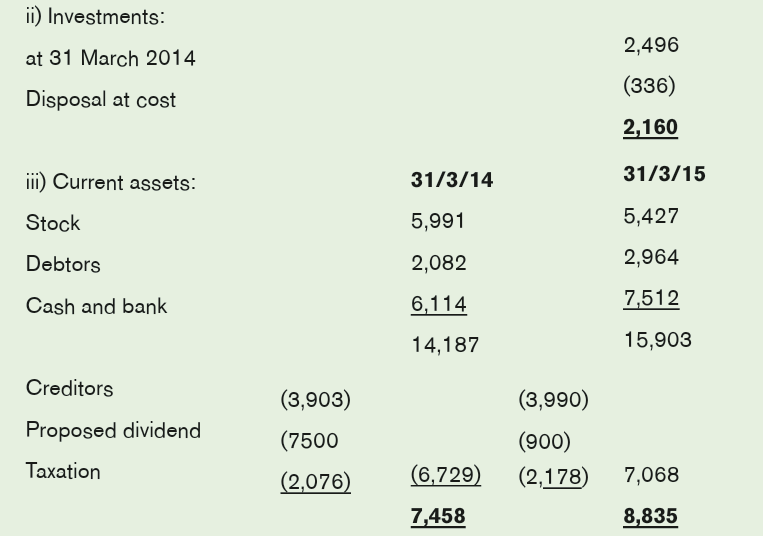

6.4.2 Notes to financial statement

Note to financial information are included in a set of financial statement

to give users extra information.

Notes to financial statements provide more details for the users of the accounts

about the information in the statement of profit or loss and other comprehensive

income, the statement of financial position, the statement of cash flows and the

statement of changes in equity.

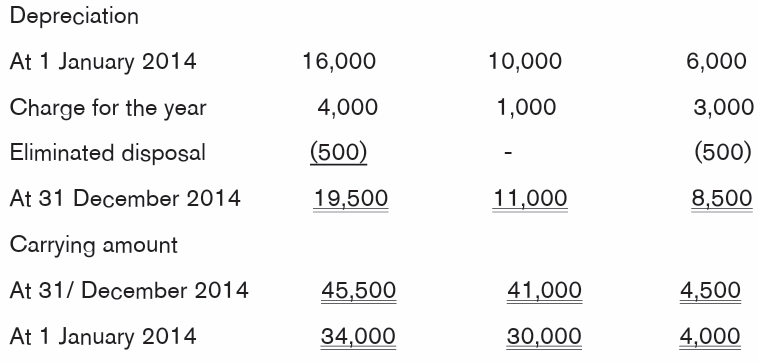

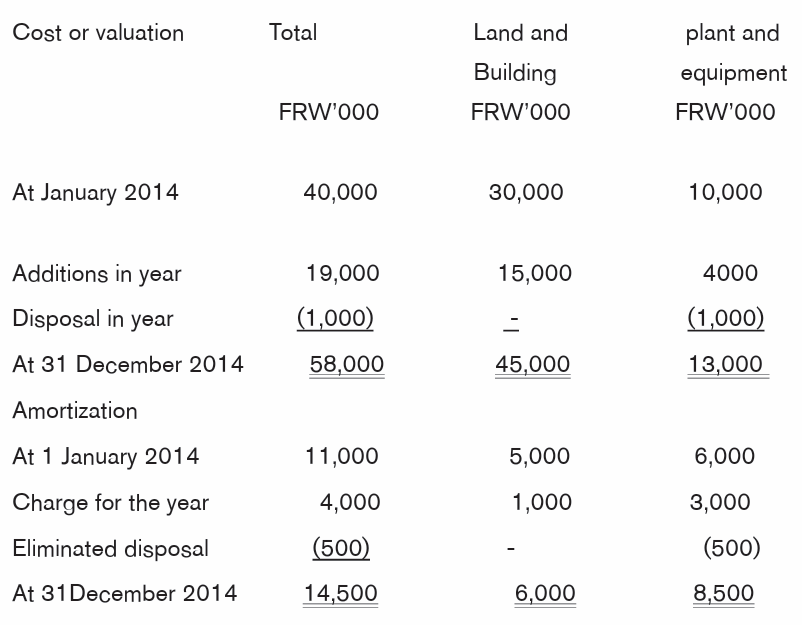

For example, the statement of financial position shows just the total carrying

amount of property,

Plant and equipment owned by an entity. The notes to the financial statements

then break down this total into the different categories of assets, the cost, any

revaluation, the accumulated depreciation and the depreciation charge for the year.

A reconciliation to the opening and closing amount at the beginning and end of

the period, asShown below:

As well as the reconciliation above, the financial statements should disclose the

following.

i) An accounting policy note should disclose the measurement bases used

for determining the amounts at which depreciable assets are stated, along

with the other accounting policies.

ii) For each class of property, plant and equipment:

For each class of property, plant and equipment: IAS 16

– Depreciation methods used

– Useful lives or the depreciation rates used

– Total depreciation allocated for the period

– Gross amount of depreciable assets and the related accumulated

depreciation at the beginning and end of the period

iii) For revalued assets:

For revalued assets:

a) Effective date of the revaluation

b) Whether an independent valuer was involved

c) Carrying amount of each class of property, plant and equipment that

would have been included in the financial statements had the assets

been carried at cost less depreciation

d) Revaluation surplus, indicating the movement for the period and

any restrictions on the distribution of the balance to shareholders.

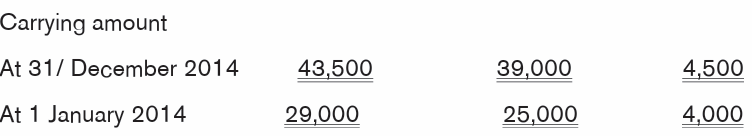

Intangible non-current assets

A reconciliation of the carrying amount of intangible assets at the beginning andend of the period, as shown below

As well as the reconciliation above, the financial statements should disclose the

following

– The accounting policies for intangible assets that have been adopted.

– For each class of intangible assets (including development costs),

disclosure is required of the following:

The method of amortization used: IAS 38

a) The useful life of the assets or the amortization rate used

b) The gross carrying amount, the accumulated amortization and the

accumulated impairment losses as at the beginning and end of the period

c) The carrying amount of internally generated intangible assets

d) The line item(s) of the statement of profit or loss in which anyamortization of intangible assets is included

Contingent liabilities

Disclose for each contingent liability:

i) A brief description of its nature; and where practicable

ii) An estimate of the financial effect

iii) An indication of the uncertainties relating to the amount or timing of any

outflowiv) The possibility of any reimbursement

Contingent assets

Where an inflow of economic benefits is probable, an entity should disclose:

i) A brief description of its nature; and where practicableii) An estimate of the financial effect.

Inventories

Inventories are valued at the lower of cost and NRV. Cost is determined using

the first in, first out (FIFO) method. NRV is the estimated selling price in theordinary course of business, less the costs estimated to make the sale.

6.4.3 Company accounts for internal purposes

The large amount of information in this unit so far has really been geared towards

the financial statements companies produce for external reporting purposes. In

particular, the IFRS Standards discussed here are all concerned with external

disclosure. However, companies to produce financial accounts for internal

purposes.

It will often be the case that financial accounts used internally look very similar

to those produced for external reporting for various reasons.

a) The information required by internal users is similar to that required

by external users. Any additional information for managers is usually

provided by management accounts.

b) Financial accounts produced for internal purposes can be used for

external reporting with very little further adjustment.

It remains true, nevertheless, that financial accounts for internal use can follow

whichever format manager wishes.

They may be more detailed in some areas than external financial accounts

(perhaps giving breakdown of sales and profits by region or by product), but

may also exclude some items.

For example, the taxation charge and dividend may be missed out of thestatement of profit or loss.

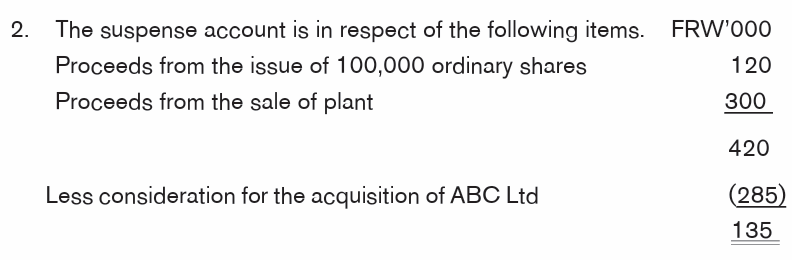

EXAMPLE

The accountant of ABC Ltd has prepared the following trial balance as at 31December 2017

Notes

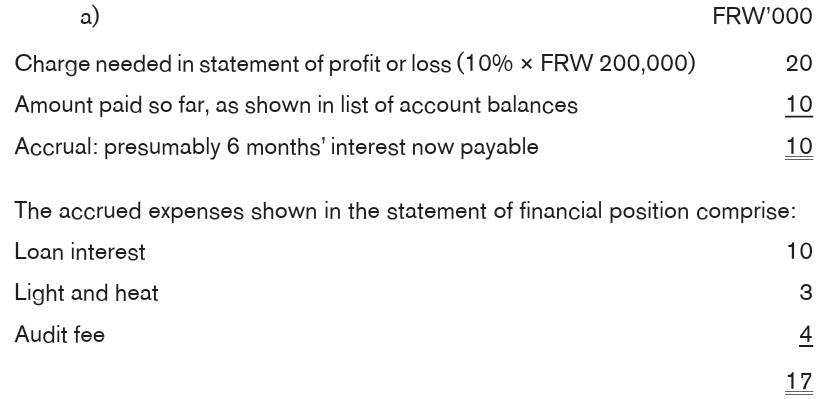

1. Sundry expenses include FRW 9,000 paid in respect of insurance for

the year ending 1 September 2018. Light and heat does not include

an invoice of FRW 3,000 for electricity for the three months ending 2

January 2018, which was paid in February 2018. Light and heat alsoincludes FRW 20,000 relating to salespeople’s commission.

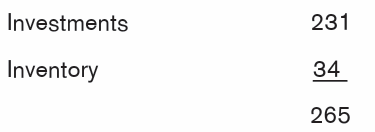

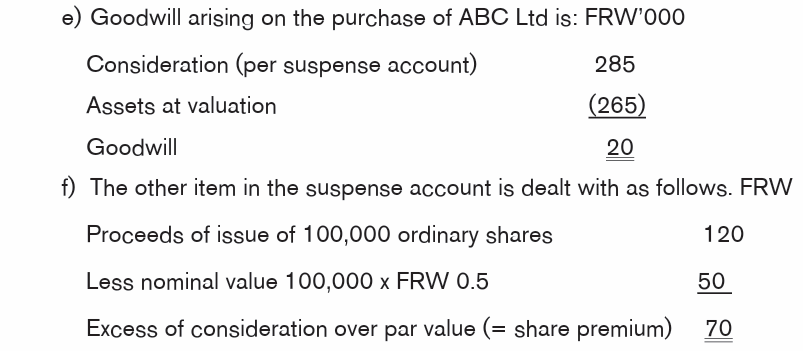

3. The net assets of ABC Ltd were purchased on 3 March 2017. Assets

were valued as follows. FRW’000

All the inventory acquired was sold during 2017. The investments were still held

by ABC at 31.12.2017.

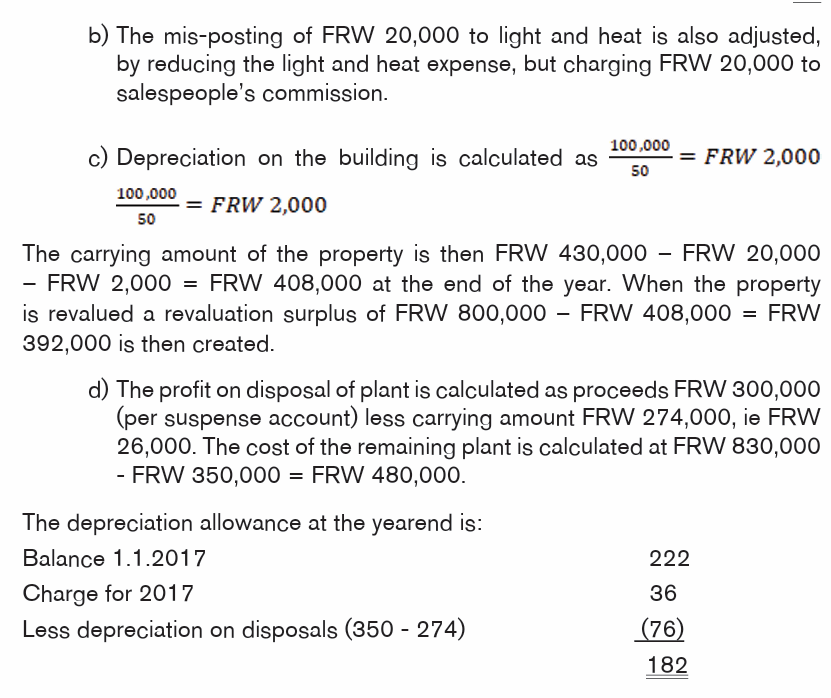

4. The property was acquired some years ago. The buildings element of the

cost was estimated at FRW 100,000 and the estimated useful life of the

assets was 50 years at the time of purchase. As at 31 December 2017

the property is to be revalued at FRW 800,000.

5. The plant which was sold had cost FRW 350,000 and had a carrying

amount of FRW 274,000 as at 1 January 2017. FRW 36,000 depreciations

are to be charged on plant and machinery for 2017.

6. The loan stock has been in issue for some years. The FRW 0.5 ordinary

shares all rank for dividends at the end of the year.

7. The management wish to provide for:

1. Loan stock interest due

2. A transfer to general reserve of FRW 16,000

3. Audit fees of FRW4,000

8. Inventory as at 31 December 2017 was valued at FRW 220,000 (cost).9. Taxation is to be ignored.

Required:

Prepare the financial statements of ABC Co as at 31 December 2017, including

the statement of financial position, the statement of profit or loss and other

comprehensive income, and the statement of changes in equity. No other notes

are required.

SOLUTION:

1. Normal adjustments are needed for accruals and prepayments (insurance,

light and heat, loan interest and audit fees). The loan interest accrued iscalculated as follows.

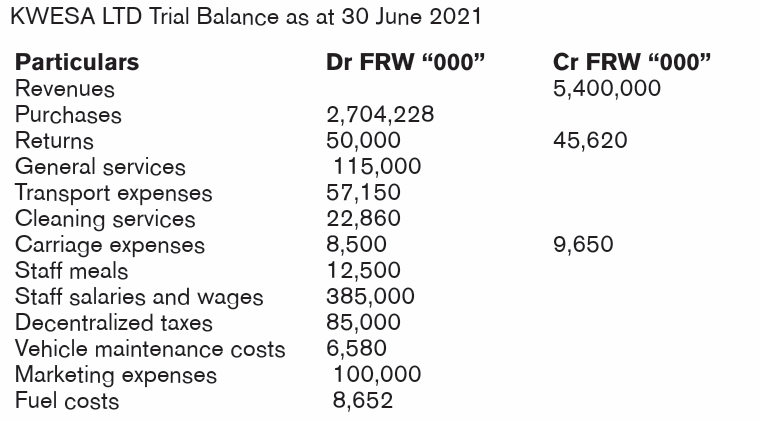

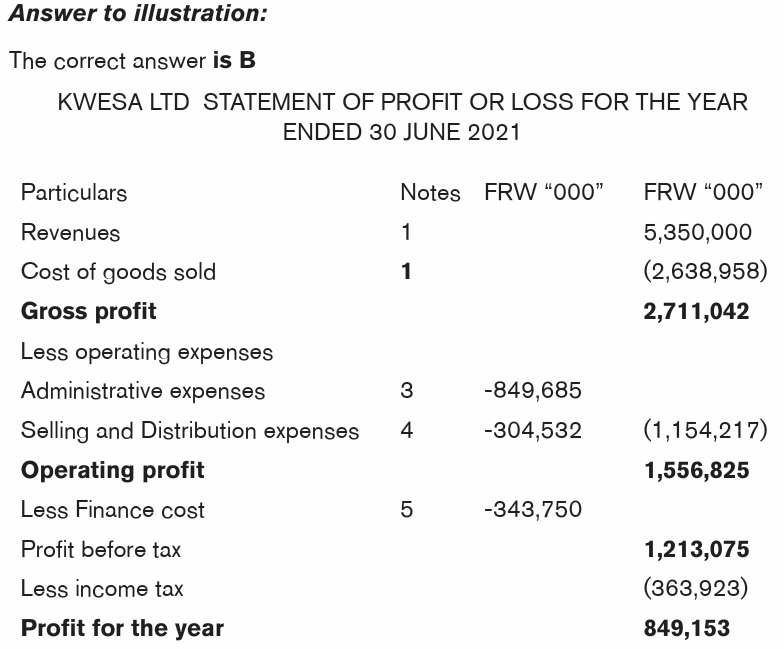

Illustration

1. Which of the following is not a component of financial statements?

a) Statement of Financial Position

b) Cashbook

c) Statement of Profit or Loss D Statement of Changes in Equity

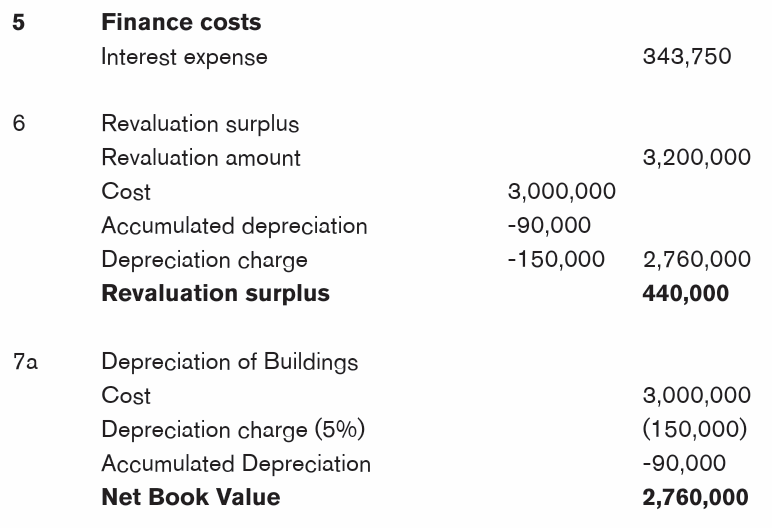

2. The following trial balance was extracted from the books of accounts ofKWESA LTD for the year ended 20 June 2021:

The following additional information is relevant for the preparation of financial

statements

1. The loan was obtained from Cogenenk Plc. ON 1stseptemeber 2020

at an annual rate of 16.5% and the interest was not yet settled as at

30thJune 2021.

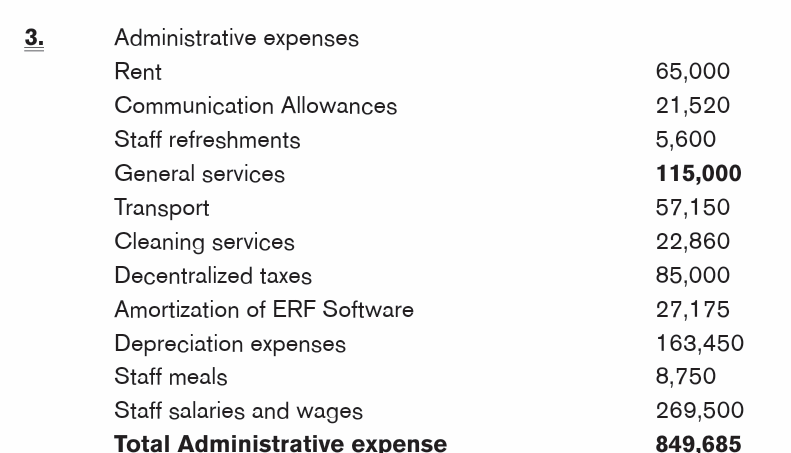

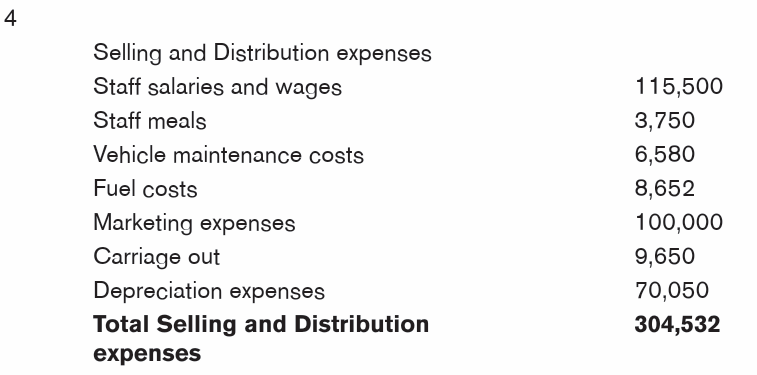

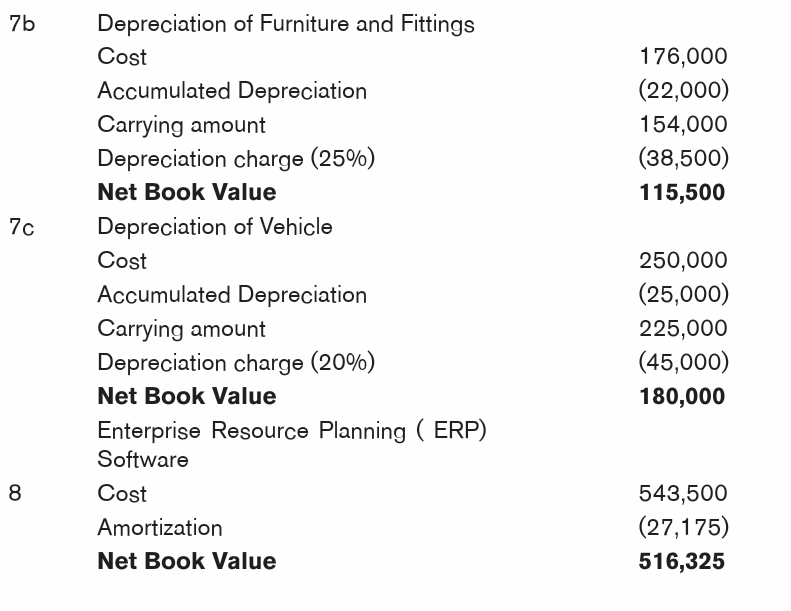

2. Depreciation, Staff meals and staff salaries and wages are to be allocated

to both selling and Distribution and administrative expenses in the ration

of 30% to 70% respectively.

3. The following rate will be applicable in the depreciation of the followingassets:

– Buildings 5% straight line

– Furniture and fittings 25% reducing balance– Vehicles 20% reducing balance

4. The buildings were revalued at 30 June 2021 at FRW 3.2 billion

5. Income tax expense is to be charged at 30% of the profit

6. On 1st January 2021, the company acquired a new ERP software worth

FRW 543.5 million with a definitive useful life of 10 years. This software

has not been recorded in the financial statements.

Required: In accordance with IAS, Prepare:

a) Statement of profit or loss and comprehensive incomes of KWESA

LTD for the year ended 30 June 2021b) Statement of financial position of KWESA LTD as at 30 June 2021

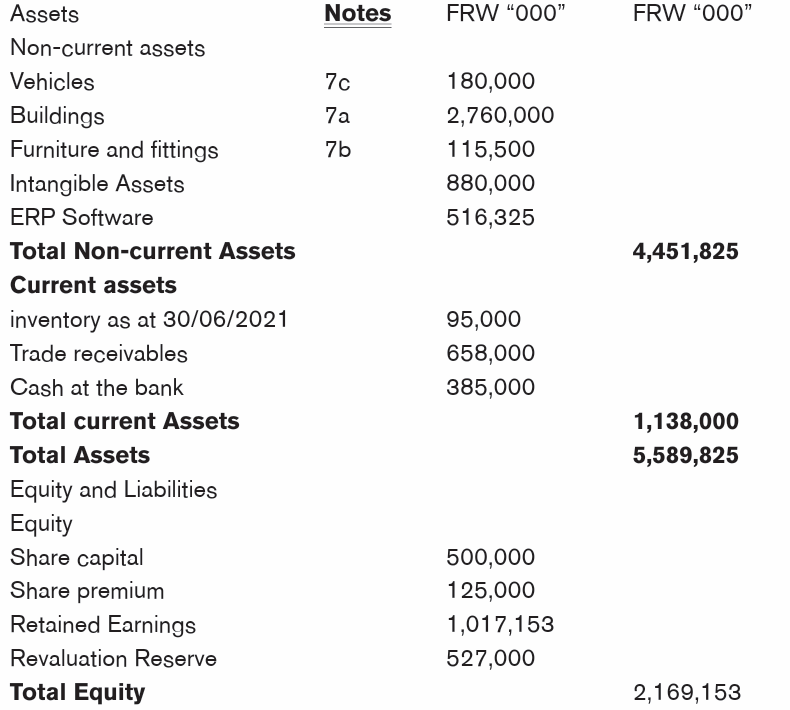

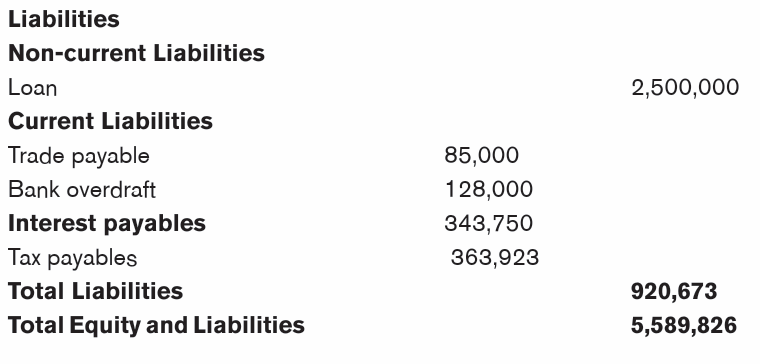

KWESA LTD STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021

Application activity 6.4

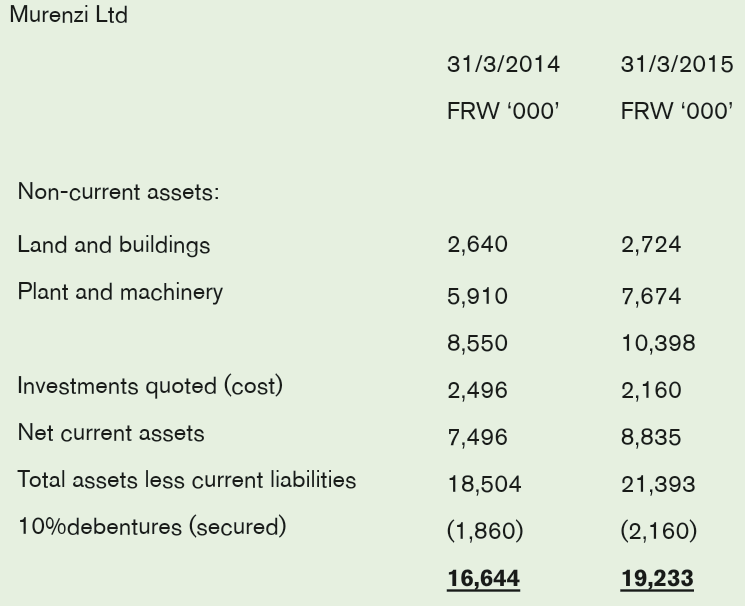

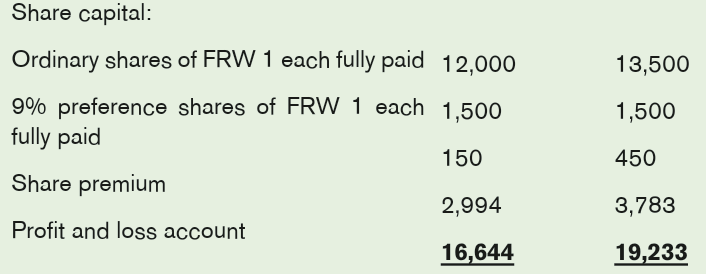

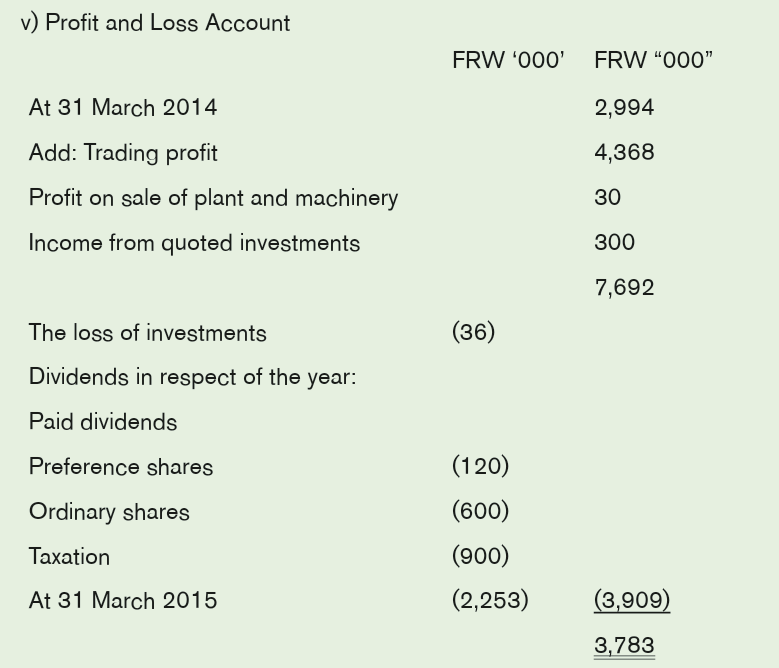

The following is a summarized balance sheet of MURENZI Ltd as at 31st

March 2014, together with the comparative figures relating to the previous year.

iv) Capital raising operations

a) During the year ended 31 March 2015 there was a right issue of

FRW 1 ordinary shares for every 8 held, being issued at a price

of FRW 1.20 per fully paid share.

b) There was an issue of FRW 300,000 10% debenture stock. Bothof these issues were fully subscribed.

NOTE: the trading profit was arrived at after charging the FRW 201,000

debenture interest.

Required:

Prepare the statement OF Cash Flow for MURENZI Ltd for the year ended

31 March 2015

2. What must include in note to financial statement for property, plantand equipment: IAS 16

Skills Lab

Students in small groups prepare financial statements of a limited liability

company from case studies.

Through a case study, students conduct a field visit to see how financial

statements are prepared in a selected limited liability company and presentwhat they have observed.

End assessment

1. According to IAS 1, which of the following items must appear on

the face of the statement of profit or loss and other comprehensive

income?

i) Tax expense

ii) Revenue

iii) Cost of sales

iv) Profit or loss

a) (iv) only

b) (ii) and (iv)

c) (i), (ii) and (iv)

d) (ii) and (iii)

2. According to IAS 1, which of the following items make up a complete

set of financial statements?

i) Statement of changes in equity

ii) Statement of cash flows

iii) Notes to the accounts

iv) Statement of financial position

v) Statement of profit or loss and other comprehensive income

vi) Chairman’s report

a) All of the items

b) (i), (ii), (iv) and (v)

c) (i), (ii), (iii), (iv) and (v)

d) (iii), (iv) and (v)

3. Which of the following items are non-current assets?

i) Land

ii) Machinery

iii) Bank loan

iv) Inventory

a) only

b) (i)and (ii)

c) (i), (ii) and (iii)

d) (ii), (iii) and (iv)

4. How is a bank overdraft classified in the statement of financial position?

a) Non-current asset

b) Current asset

c) Current liability

d) Non-current liability

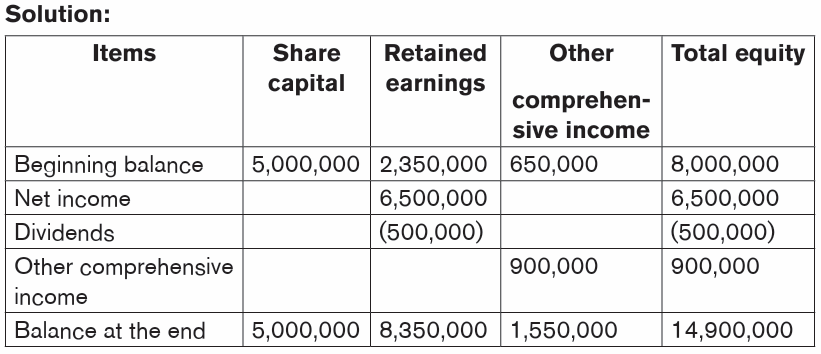

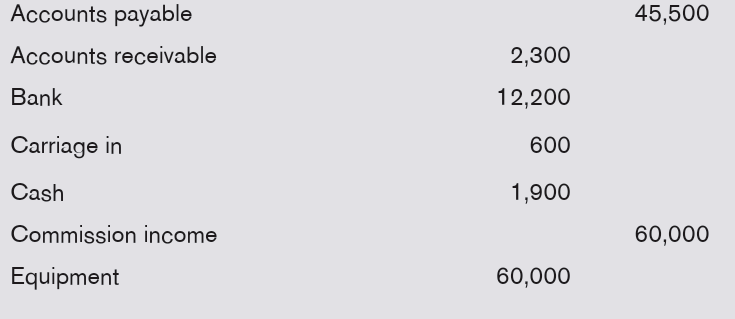

5. The following account balances were extracted from the books of XYZ

LTD, a company owning a computer store in Nyarugenge, at the endof her financial year 30 June 2020:

The inventory at the end of the year was valued at FRW 8,800

You are required to prepare (For Internal Purpose):

a) XYZ’s Statement of Profit or Loss for the year ended 30 June

2020 (10 Marks)b) XYZ’s Statement of Financial Position as at 30 June 2020