UNIT 5: ACCOUNTING FOR PROVISIONS, CONTINGENT LIABILITIES AND CONTINGENT ASSETS

Key unit competence: To be able to ensure that the appropriate

recognition rules and measurement bases are

applied to provisions

Introductory activity

A manufacturer company of Mercedes-Benz car, follows accounting

standards developed at both national and international levels so that its

business runs very well. Units of cars purchased are covered by a standard

three-year warranty, whereby the company will replace any defective cars.

The customer does not have to pay for this three-year warranty. At the

end of the last year 31 December 2019, some amount representing a

liability of uncertain timing or amount was made. During this year another

amount was paid for the cost of replacing cars under warranty. At the end

of this year, the company estimated that amount of liability of uncertain

timing o r amount beyond the cost of replacing was needed.

REQUIRED: At the end of year 31 December 2020, what type of

account used to record the cost of replacing cars under warranty? How

this warranty should be recorded in financial statement?

5.1. Provisions

Learning Activity 5.1

A manufacturer of a technical equipment sells goods with a standard

warranty under which customers are covered for the cost of repairs of any

manufacturing defect that becomes apparent within the year of purchase.

What account that will appear in statement of financial position of a

manufacturer?

A provision should be recognized:

• When an entity has incurred a present obligation

• When it is probable that a transfer of economic benefits will be required

to settle it

• When a reliable estimate can be made of the amount involved

5.1.1 Objective and scope

Objective

The objective of IAS 37 Provisions is to ensure that appropriate recognition

criteria and measurement bases are applied to provisions, contingent liabilities

and contingent assets and that sufficient information is disclosed in the notes to

the financial statements to enable users to understand their nature, timing and

amount. The standard aims to ensure that only genuine obligations are dealtwith in the financial statements.

Scope

IAS 37 covers provisions arising from other accounting standards, but excludes

obligations and contingencies arising from financial instruments covered under

IAS 39 and IFRS 9 and insurance contracts covered under IFRS 4.

5.1.2 Definitions

IAS 37 Provisions, Contingent Liabilities and Contingent Assets views a

provision as a liability

‘A provision is a liability of uncertain timing or amount.’

‘A liability is a present obligation of the entity arising from past events, the

settlement of which is expected to result in an outflow from the entity of resources

embodying economic benefits.’

IAS 37 distinguishes provisions from other liabilities, such as trade payables

and accruals. This is on the basis that for a provision there is uncertainty about

the timing or amount of the future expenditure.

While uncertainty is clearly present in the case of certain accruals, the uncertainty

is generally much less than for provisions.

An estimate is still required for an accrual but it is more reliable than provision.

Provision is only made for future expenses, whereas accrual is for both costs

and revenue.

The provisions are expected and uncertain, whereas accrual is certain, probable,

and easily foreseen. Accrual and provision are made before the reports of the

company are reported.

Example of an accrual

If a company has a savings account that earns interest, the interest that has

been earned but not yet paid would be recorded as an accrual on the company’s

financial statements.

Examples of provisions include bad debts, depreciation, doubtful debts,

guarantees (product warranties), income taxes, inventory obsolescence,

pension, restructuring liabilities and sales allowances. Often provision amounts

need to be estimated.

IAS 37 states that a provision should be recognized (which simply means

‘included’) as a liability in the financial statements when all three of the following

conditions are met.

• An entity has a present obligation (legal or constructive) as a result of

a past event.

• It is probable (that is more than 50% likely) that a transfer of economic

benefits will be required to settle the obligation.

• A reliable estimate can be made of the obligation.

What do we mean by a legal or constructive obligation? An obligation means

in simple terms that the business owes something to someone else. A legal

obligation usually arises from a contract and might, for example, include

warranties sold with products to make good any repairs required within a

certain time frame. A constructive obligation arises through past behavior

and actions where the entity has raised a valid expectation that it will carry

out a particular action. For example, a constructive obligation would arise if a

business which doesn’t offer warranties on its products has a history of usually

carrying out free small repairs on its products, so that customers have come to

expect this benefit when they make a purchase.

5.1.3 Provisions: Ledger accounting entries

When a business first sets up a provision, the full amount of the provision should

be debited to the statement of profit or loss and credited to the statement of

financial position as follows.

DEBIT Expenses (statement of profit or loss)

CREDIT Provisions (statement of financial position)

In subsequent years, adjustments may be needed to the amount of the provision.

The procedure to be followed then is as follows.

a) Calculate the new provision required.

b) Compare it with the existing balance on the provision account (that is the

balance b/f from the previous accounting period).

c) Calculate increase or decrease required.

i. If a higher provision is required now:

DEBIT Expenses (statement of profit or loss)

CREDIT Provisions (statement of financial position)

With the amount of the increase

ii. If a lower provision is needed now than before:

DEBIT Provisions (statement of financial position)

CREDIT Expenses (statement of profit or loss)

With the amount of the decrease

Example

A business has been told by its lawyers that it is likely to have to pay FRW

10,000,000 damages for a product that failed. The business duly set up a

provision at 31 December 2017. However, the following year, the lawyers found

that damages were more likely to be FRW 50,000,000.

Required

How is the provision treated in the accounts at

a) 31 December 2017?

b) 31 December 2018?

Answer

a) The business needs to set up provision as follows.

FRW’000 FRW’000

DEBIT Damages (SPL) 10,000

CREDIT Provision (SOFP) 10,000

Extract from statement of profit or loss

FRW’000

Expenses

Provision for damages 10,000

Extract from statement of financial position

FRW’000

Non-current liabilities*

Provision for damages 10,000

*Because it is uncertain when the amount relating to the provision will be paid,

or indeed if it definitely will be paid, it is classified as a non-current liability.

b) The business needs to increase the provision.

FRW’000 FRW’ 000

DEBIT Damages (SPL) 40,000

CREDIT Provision (SOFP) 40,000

Do not forget that the provision account already has a balance brought forward of

FRW 10,000,000 so we only need to account for the increase in the provision.

Extract statement of profit or loss

FRW’000

Expenses

Provision for damages 40,000

Extract from statement of financial position

Non-current liabilities FRW’000

Provision for damages (10,000,000 + 40,000,000) 50,000

5.1.4 Measurement of provisions

The amount recognized as a provision should be the best estimate of the

expenditure required to settle the present obligation at the end of the reporting

period. The estimates will be determined by the judgment of the entity’s

management supplemented by the experience of similar transactions. If the

provision relates to just one item, the best estimate of the expenditure will be

the most likely outcome.

When a provision is needed that involves a lot of items (for example, a warranty

provision, where each item sold has a warranty attached to it), then the provision

is calculated using the expected value approach. The expected value approach

takes each possible outcome (ie the amount of money that will need to be paid

under each circumstance) and weights it according to the probability of that

outcome happening. This is illustrated in the following example.

Warranty provisions are also covered under IFRS 15 Revenue from contracts

with customers. IFRS 15 will affect any warranty where there is a specific

contract between the customer and the seller, for example, where the customer

has paid for an extended warranty (over and above the standard manufacturer’s

warranty).

Here, we are only concerned with standard warranties where the organization

may be expecting a certain percentage of faults and therefore set aside a sum

of money to cover such costs.

Example

Garanti Ltd sells goods with a standard warranty under which customers are

covered for the cost of repairs of any manufacturing defect that becomes

apparent within the first six months of purchase. The company’s past experience

and future expectations indicate the following pattern of likely repairs. The

customer does not have to pay for these warranties.

Calculate the warranty provision that should be included in Garanti Ltd’s

financial statements

Answer

Garanti Ltd should provide on the basis of the expected cost of the repairs

under warranty. The expected cost is calculated as (75% × FRW 0 million) +

(20% × FRW 1.0 million) + (5% × FRW 4.0 million) = FRW 0.4 million, that is,

FRW 400,000.

Garanti Ltd should include a provision of FRW 400,000 in the financial

statements.

Application activity 5.1

1. What are the three conditions necessary for the recognition of a

provision as a liability?

2. What are provisions of IFRS?

3. Mention the difference between provision and accrual.

4. What are the examples of IAS 37 provision?

5. How can a provision be recognized in accordance with IAS 37?

6. An entity sells goods with a warranty covering customers for the cost

of repairs of any defects that are discovered within the first two months

after purchase. Past experience suggests that 80% of the goods sold

will have no defects, 15% will have minor defects and 5% will have

major defects. If minor defects were detected in all products sold the

cost of repairs would be FRW 30,000; if major defects were detected

in all products sold, the cost would be FRW 150,000.

Required: What amount of provision should be made?

7. An entity has to rectify a serious fault in a piece of equipment that it had

sold to a customer. The individual most likely outcome is that the repair

will succeed at the first attempt at a cost of FRW 50,000, but there is

a chance that a further attempt will be necessary, increasing the total

cost to FRW 80,000.

Required: What amount of provision should be made?

8. The company’s lawyer has advised that it is likely to have conscience

to pay FRW 5,000,000 money compensation for defective

equipment. The company respects the lawyer’s advice and sets up

a provision on 31 December 2020. Therefore, the lawyer discovers

that damages are more likely to be FRW 25,000,000 the following

year. You are asked to show how the provision is treated in the

accounts at:

i) 31 December 2020.

ii) 31 December 2021.

5.2 Contingent Liabilities and Contingent Assets

Learning Activity 5.2

During 2018, KEZA Ltd borrowings from Twisungane Co. Ltd were

guaranteed. At that time KEZA’s financial situation was good. During 2020,

the financial situation of KEZA Ltd was deteriorated due to Covid-19

negative effects. On 31 November 2020 KEZA Ltd makes its declaration

for protection from its creditor.

Required: Show accounting treatment required in the KEZA Ltd financial

statements at the end of the both years.

A contingent liability must not be recognized as a liability in the financial

statements. Instead, it should be disclosed in the notes to the accounts, unless

the possibility of an outflow of economic benefits is remote. A contingent asset

must not be recognized as an asset in the financial statements. Instead, it should

be disclosed in the notes to the accounts if it is probable that the economic

benefits associated with the asset will flow to the entity.

5.2.1 Contingent Liabilities

Contingent liabilities are defined as follows.

IAS 37 defines a contingent liability as:

• ‘a possible obligation that arises from past events and whose existence

will be confirmed only by the occurrence or non-occurrence of one or

more uncertain future events not wholly within the control of the entity;

or

• a present obligation that arises from past events but is not recognized

because:

– It is not probable that a transfer of economic benefits will be required

to settle the obligation; or

– The amount of the obligation cannot be measured with sufficient

reliability.’

As a general rule, probable means more than 50% likely. If an obligation is

probable, it is not a contingent liability – instead, a provision is needed.

If the obligation is remote, it does not need to be disclosed in the accounts.

Contingent liabilities should not be recognized in financial statements

but they should be disclosed in the notes.

The required disclosures are:

• A brief description of the nature of the contingent liability

• An estimate of its financial effect

• An indication of the uncertainties that exist

• The possibility of any reimbursement

5.2.2 Contingent assets

IAS 37 defines a contingent asset as a possible asset that arises from past

events and whose existence will be confirmed only by the occurrence or non

occurrence of one or more uncertain future events not wholly within the control

of the entity’.

A contingent asset must not be recognized in the accounts, but should be

disclosed if it is probable that the economic benefits associated with the asset

will flow to the entity.

A brief description of the contingent asset should be provided, along with an

estimate of its likely financial effect.

If the flow of economic benefits associated with the contingent asset becomes

virtually certain, it should then be recognized as an asset in the statement of

financial position, as it is no longer a contingent asset.

For example, a company expects to receive damages of FRW 1,000,000 and this

is virtually certain. An asset is recognized. If, however, the company expects to

probably receive damages of FRW 1,000,000, a contingent asset is disclosed.

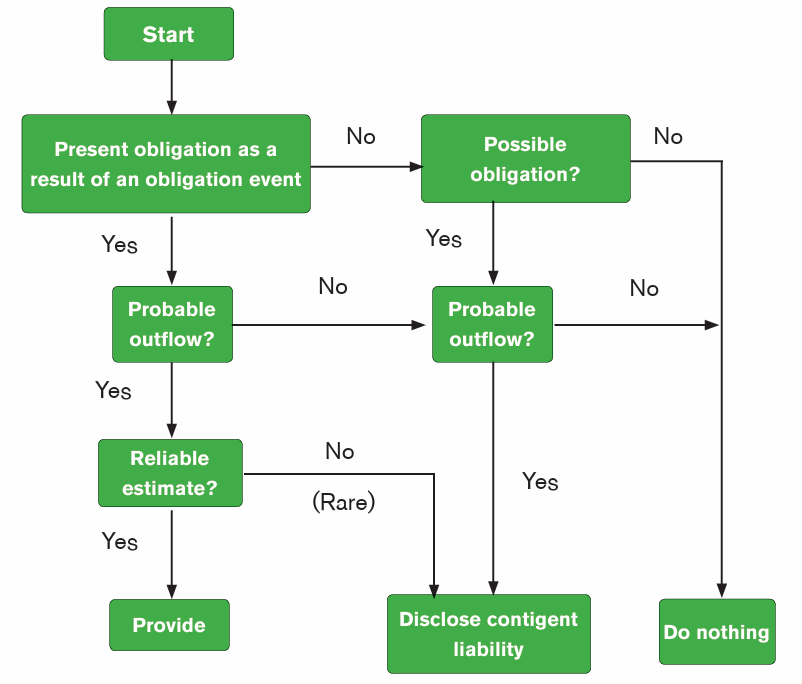

5.2.3 IAS 37 flow chart

You must practice the questions below to get the hang of the IAS 37 rules on

contingencies. But first, study the flow chart, taken from IAS 37, which is a good

summary of its requirements.

Example

During 2019 Umuhigo Ltd gives a guarantee of certain borrowings of Ubuhinzi

Ltd, whose financial condition at that time is sound. During 2020, the financial

condition of Ubuhinzi Ltd deteriorates and at 30 June 2020 Ubuhinzi Ltd files

for protection from its creditors.

What accounting treatment is required in the financial statements of Umuhigo

Ltd:

a) At 31 December 2019?

b) At 31 December 2020?

Answer

a) At 31 December 2019

There is a present obligation as a result of a past obligating event. The obligating

event is the giving of the guarantee, which gives rise to a legal obligation.

However, at 31 December 2019 no transfer of economic benefits is probable

in settlement of the obligation.

No provision is recognized. The guarantee is disclosed as a contingent liability

unless the probability of any transfer is regarded as remote.

An appropriate note to the accounts would be as follows.

Contingent liability

The company has given a guarantee in respect of the bank borrowings (currently

FRW 5 million) of Ubuhinzi Ltd. At the reporting date, Ubuhinzi Ltd was sound

and it is unlikely that the company will be required to fulfil its guarantee.

b) At 31 December 2020

As above, there is a present obligation as a result of a past obligating event,

namely the giving of the guarantee.

At 31 December 2020 it is probable that a transfer of economic benefits will be

required to settle the obligation. A provision is therefore recognized for the best

estimate of the obligation.

Application activity 5.2

1. What are contingent liabilities according to IAS 37?

2. What is the treatment of contingent liabilities in the financial

statements?

3. How shall a contingent asset be recognized in the financial

statements in line with IAS 37?

4. What is the proper treatment of contingent asset?

5. Why are contingent assets not recognized?

6. (a) Twihangirumurimo Co. Ltd issued a one-year guarantee for on

equipment that it sells to its customer. At the company’s year end,

the company is being sued by one of its customers for refusing to

repair equipment within the guarantee period.

Twihangirumurimo Co. Ltd is of the view that the fault is not covered

by the guarantee as it believes that it has arisen because the customer

incorrectly followed the instructions on using the equipment.

Twihangirumurimo Co. Ltd’s lawyer has advised that it is more likely

than not that they will be found liable. This would result in the company

being forced to repair the equipment plus pay legal expenses amounting

to approximately FRW 20,000,000.

(b)The company also manufactures another line of equipment which

it sells to wholesalers. The company sold 2,000 items of this type this

year, which also has a one-year guarantee if the equipment fails. Based

on past experience, 10% of items sold are returned for repair. In each

case, 40% of the items returned are able to be repaired at a cost of

FRW 100,000, while the remaining 60% need significant repair at a

cost of FRW 300,000.

Required: Discuss the accounting treatment of the above situations.

5.3 Disclosure in Financial Statements

Learning Activity 5.3

Kundumurimo Co. Ltd is a manufacturer of Cellular Phone TECHNO. Cellular

Phones purchased on 1 January 2020 are covered by a standard one-year

warranty. A condition is that the company will replace any defective Cellular

Phones. The customer does not have to pay for this one-year warranty. Until

the end of the year 2020 different provisions was made including the cost

of replacing Cellular Phones under warranty.

a) The possibility of an outflow of economic benefits is not recognized

as the liability in financial statement of Kundumurimo Co. Ltd,

where this liability is included?

b) How do you call this liability?

IAS 37 requires certain items for provisions and contingent assets and liabilities

to be disclosed in the financial statements.

5.3.1 Disclosures for Provisions

Disclosures required in the financial statements for provisions fall into two parts.

• Disclosure of details of the change in carrying amount of a provision

from the beginning to the end of the year, including additional provisions

made, amounts used and other movements.

• For each class of provision, disclosure of the background to the making

of the provision and the uncertainties affecting its outcome, including:

i) A brief description of the nature of the provision and the expected timing

of any resulting outflows relating to the provision

ii) An indication of the uncertainties about the amount or timing of those

outflows and, where necessary to provide adequate information, the major

assumptions made concerning future events

iii) The amount of any expected reimbursement relating to the provision

and whether any asset that has been recognized for that expectedreimbursement.

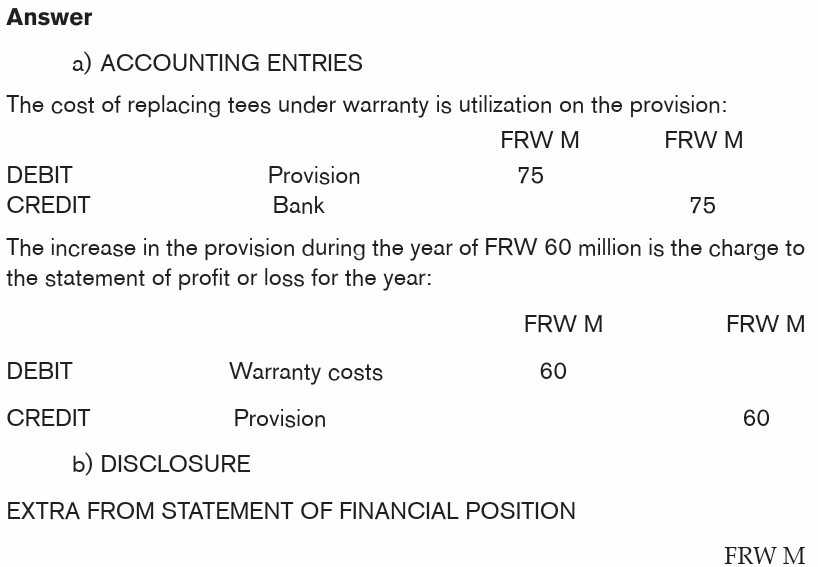

Example

Umukino Ltd is a manufacturer of golf tees. Tees purchased are covered by a

standard three-year warranty, whereby the company will replace any defective

tees. The customer does not have to pay for this three-year warranty.

At the end of last year on 31 March 20X6, a provision of FRW 150 million was

made. During this year, FRW 75 million was paid for the cost of replacing tees

under warranty. At the end of this year, the company estimated that a provision

of FRW 135 million was needed.

Provide the following for the year ended 31 March 20X7:

a) Accounting entrees to record the movement in the warranty provision

b) How the warranty provision should be disclosed in the financial

statements?c) The general ledger account for the warranty provision

Non-current liabilities

Warranty provision 135

Below is an example of how the warranty provision might be disclosed in thenotes to the financial statements.

Note X: Provisions

Warranty provision

FRW M

At 1 April 2016 150

Increase in the provision during the year 60

Amounts used during year (75)

At 31 March 2017 135

The warranty provision relates to estimated claims on those products sold in

the year ended 31 March 2017 which come with a three-year warranty. The

expected value method is used to provide a best estimate. It is expected thatthe expenditure will be incurred in the next three years.

The table above is essentially a T-account, as set out below.

5.3.2 Disclosures for Contingent Liabilities

Unless remote, disclose for each contingent liability:

• A brief description of its nature, and where practicable

• An estimate of the financial effect

• An indication of the uncertainties relating to the amount or timing of any

outflow• The possibility of any reimbursement

5.3.3 Disclosures for Contingent Assets

Where an inflow of economic benefits is probable, an entity should disclose:

• A brief description of its nature, and where practicable• An estimate of the financial effect

Application activity 5.3

1. Rwanda Tourism Company (RTC) is a company registered in 2012

to facilitate foreign tourism coming in Rwanda to visit different place.

During the year that ended 30 June 2020, 10 customers booked to visit

Rwanda as they were motivated by Visit Rwanda promotion. However, due

to Covid-19 outbreak, all of these 10-tourists failed to travel to Rwanda

because of flight restrictions. Toward the end of fiscal year, RTC received

refund request from those customers but no payment made till end of year

which resulted into court case. The legal advisor of the company estimated

that RTC would pay damaged totaling FRW 50 million but it is not remote.

Required: Explain disclosure requirement per IAS 37 in respect of the

above pending legal case.

2. What is IAS 37 disclosure requirements?

3. What is disclosed for a contingent asset?

4. During the year to 31 December 2021, customer started legal

proceedings against company, claiming that one of the food products

that it manufactures had caused several members of his family to

become seriously ill. The company’s lawyers have advised that thisaction will probably not succeed.

Required: Should the company disclosure this in its financial statements?

5. Turwanyubukene Co. Ltd planted at Gakiriro is manufacturing MUVERO

used for cooking. The company gives promise to the customer that

the defective MUVERO will be replaced and MUVERO purchased

are covered by a standard five months’ warranty. Three months after

purchase, at the end of last year on 31 December 2021, a provision

of FRW 3 million was made. During this year, FRW 1.5 million was

paid for the cost of replacing MUVERO under warranty. The company

estimated that a provision of 2.5 million was needed at the end of this year.

At the end of year on 31 December 2022, you are asked to provide

the following:

i. Accounting entrees to record the movement in the warranty provision.

ii. How the warranty provision should be disclosed in the financial

statements?iii. The general ledger account for the warranty provision.

Skills Lab

Students must visit any company and analyze operating environment, they

will then discuss if the company has any provision, contingent liability andcontingent asset arising from their operations.

End unit assessment

1. A company is being sued for FRW 10 million by a customer. The

company’s lawyers reckon that it is likely that the claim will be upheld.

Legal fees are currently FRW 5 million.

How should the company account for this?

2. Given the facts in 1 above, how much of a provision should be made

if further legal fees, relating to the case, of FRW 2 million are likely to

be incurred in the future?

a) FRW 10 million

b) FRW 5 million

c) FRW 15 million

d) FRW 12 million

3. A company has a provision for warranty claims b/f of FRW 50 million. It

does a review and decides that the provision needed in future should

be FRW 40 million. What is the effect on the financial statements?

Statement of profit or loss Statement of financial position

a) Increase expenses by FRW 5 m Provision FRW 50 m

b) Increase expenses by FRW 5 m Provision FRW 45 m

c) Decrease expenses by FRW 5 m Provision FRW 50 m

d) Decrease expenses by FRW 5 m Provision FRW 45 m

4. A contingent liability is always disclosed on the face of the statement

of financial position.

True or False?

5. How does a company account for a contingent asset that is not

probable?

a) By way of note

b) As an asset in the statement of financial position

c) It does nothing

d) Offset against any associated liability

6. A company provides a two warranty on all their sales of technical

equipment. During 2019, they made sales of 200,000 units of technical

equipment at the value of FRW 20 million. History has shown that 5%

of all sales will require repairs, averaging FRW 100 each and 1% of all

sales will need to be replaced at a cost of FRW 200 each.

What is the journal entry to reflect the warranty to be provided on the

current year sales?

7. Bazizane Ltd is preparing its financial statements for the year ended

31 December 2016. A number of issues must be accounted for before

they can be finalized.

The following circumstances have arisen during the year:

i) Bazizane Ltd has a machine that needs regular overhauls every year

in order to be allowed to operate. Each overhaul costs FRW 5 million.

ii) Bazizane Ltd has set up a new division to produce a product for

which the market is still small. It expects this division to run at a loss

for two years.

iii) Bazizane Ltd sells goods with a one-year warranty. Customers are

not required to pay additional amounts for the warranty. Goods may

require minor or major repairs during the warranty period. If all of the

goods sold during the year to 30 December 2016 were to require

minor repairs, the total cost would be FRW 50 million. If all of the

goods sold required major repairs the cost would be FRW 120

million. In any year Bazizane Ltd expects 5% of goods sold to bereturned for major repairs and 16% to be returned for minor repairs.

Required

a) Which of circumstances (i) to (iii) above will give rise to a provision

and why?

b) What amount should be shown as a warranty provision in the

statement of financial position of Bazizane Ltd at 31 December 2016?

8. What is the difference between a trade payable, an accrual, a provision

and a contingent liability and how will they each appear in the financialstatements?