UNIT 4 : INTANGIBLE ASSETS

Key unit competence: To be able to measure and record intangibleassets

Introductory activity

Coca cola, Microsoft and Google are examples of the products that have

given the world their best and they are biggest trade mark since their

registration. The good reputation built over the years was catalyzed by

innovation and advertisements in big tournaments or events streamlined

through world class media.

What do you think these trademarks are in their books of accounts?

a) Company’s name

b) Asset

c) Equityd) Revenue

4.1 Introduction

Learning Activity 4.1

Required: Analyze the above picture and answer the following questions:

1) What does the picture demonstrate?2) Is a computer software an intangible asset ? Justify your answer.

4.1.1 Objective and scope

• Objective

The objective of this Standard is to prescribe the accounting treatment

for intangible assets that are not dealt with specifically in another Standard.

This Standard requires an entity to recognize an intangible asset if, and only

if, specified criteria are met. The Standard also specifies how to measure

the carrying amount of intangible assets and requires specified disclosuresabout intangible assets

• Scope

This standard shall be applied in accounting for intangible assets

except:

i. Intangible assets that are within the scope of another standard

ii. Financial assets

iii. Recognition and measurement of exploration and evaluation assets

iv. Expenditure on the development and extraction of minerals, oil, natural gas

and similar non-regenerative resources.

Note: If another Standard prescribes the accounting for a specific type

of intangible asset, an entity applies that Standard instead of this Standard.

a) This Standard applies to, among other things, expenditure on

advertising, training, start-up, and research and development activities.

Research and development activities are directed to the development

of knowledge. Therefore, although these activities may result in an

asset with physical substance (e.g: a prototype), the physical element

of the asset is secondary to its intangible component, i.e the knowledgeembodied in it.

b) Rights held by a lessee under licensing agreements for items such as

motion picture films, video recordings, plays, manuscripts, patents and

copyrights are within the scope of this Standard

Intangible assets that contain physical subsistence

Some intangible assets may be contained in or on a physical substance such as

a compact disc (in the case of computer software), legal documentation (in thecase of a license or patent) or film.

In determining whether an asset that incorporates both intangible and tangible

elements should be treated under IAS 16 Property, Plant and Equipment or as

an intangible asset under this Standard, an entity uses judgement to assess

which element is more significant. For example, computer software for a

computer-controlled machine tool that cannot operate without that specific

software is an integral part of the related hardware and it is treated as property,

plant and equipment. The same applies to the operating system of a computer.

When the software is not an integral part of the related hardware, computersoftware is treated as an intangible asset.

4.1.2 Definition and criteria to recognize intangible assets

• Definition

The following terms are used in this Standard with the meanings specified therein

i. Intangible assets: Intangible assets are non-current assets with no

physical substance, but which can be recognized in the statement of

financial position if they meet certain criteria.

ii. Amortization: is the decrease in the value of intangible asset due to its

use.

iii. Asset: is a resource controlled by an entity as a result of past events and

from which future economic benefits are expected to flow to the entity.

iv. Carrying amount is the amount at which an asset is recognized in the

statement of financial position after deducting accumulated amortization

and accumulated impairment losses thereon.

v. Depreciable amount is the cost of an asset, or other amount substituted

for cost less its residual amount

vi. Research is the original and planned investigation undertaken with

the prospect of gaining new scientific or technical knowledge and

understanding.

vii. Development is the application of reach findings or other knowledge

to a plan or design for the production of the new or improved materials,

products or system before start of commercial production or use

viii. Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

measurement date

ix. Impairment loss: is the amount which the carrying amount of an asset

exceeds its recoverable amount

x. Residual value of intangible assets: is the estimated amount that an

entity would currently obtain from disposal of the asset, after deducting

the estimated costs of disposal.

xi. Useful life: Useful life is the period over which an asset is expected tobe available for use by an entity.

• Criteria necessary to recognize intangible assets

The intangible asset is recognized if the following three criteria are fully met

i. The intangible asset should be identifiable

Intangible asset is identifiable when

a) It is separable, i.e is capable of being separated or divided from the

entity and sold, transferred, licensed, rented or exchanged, either

individually or together with a related contract, identifiable asset or

liability, regardless of whether the entity intends to do so

b) Arises from contractual or other legal rights, regardless of whether

those rights are transferable or separable from the entity or from other

rights and obligations

ii. Intangible asset is controlled by entity

An entity controls an intangible asset if the entity has the power to obtain the

future economic benefits flowing from the underlying resource and to restrict

the access of others to those benefits.

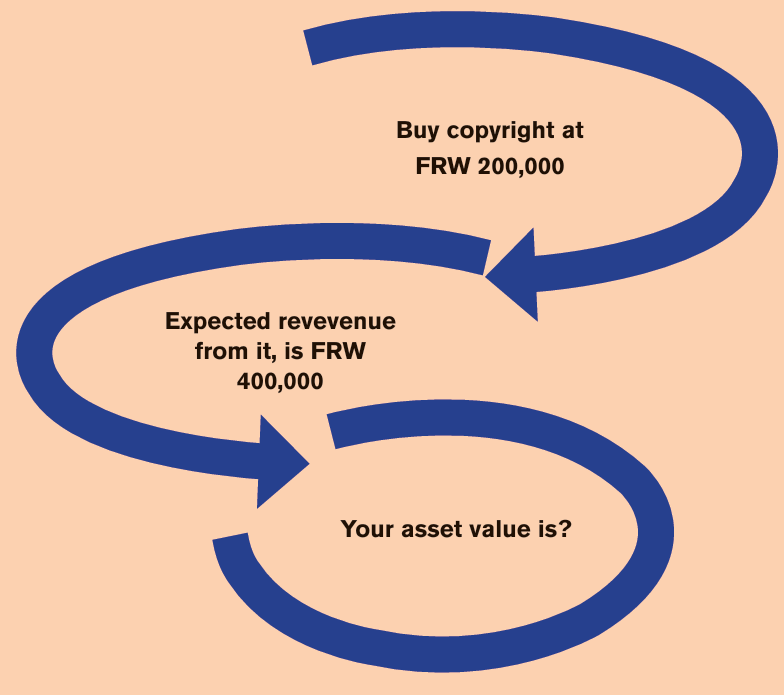

iii. Intangible asset has expected future economic benefits

An item can only be recognized as an intangible asset if economic benefits

are expected to flow in the future from ownership of the asset. This economic

benefit could be revenue from the sale of products or services, cost savings, orother benefits resulting from the use of that intangible asset by the entity.

4.1.3 Exchange of asset

How to determine value of the exchanged asset?

If one intangible asset is acquired by way of exchanged for another, the cost of

the intangible asset is measured at fair value unless:

• The exchange transaction lacks commercial substance i.e no way to

determine market value ; or

• The fair value of neither the asset received nor the asset given up can

reliably be measured.

If the acquired asset is not measured at fair value, its cost is measured atthe carrying amount of the asset given up.

Example

Kigali Education Board is government business enterprises that comply with

IFRS and IAS for reporting purpose.

On 01 January 2021, Kigali education board (KEB) decides to acquire Clients’

Management System (CMS) that will serve as client management information

system. With this system, the clients can register, request service, and pay

through the system. Despite the need of the system, the management had no

funds to finance it and they decided to exchange one of their motor vehicles into

this system. The cost of this given up motor vehicle was FRW 20 million while its

accumulated depreciation as of 01 January 2021 was FRW 4 million. Because

the system was new in Rwanda, Kigali Education Board failed to determinemarket value of that system.

Required: Determine the value that will be assigned to this Client Management

System in KEB’s books of account

Answer

IAS 38 provides that if the acquired asset through exchange is not measured

at fair value, its cost is measured at the carrying amount of the asset given up.

Therefore, the fact that Kigali Education Board failed to determine fair value

of the system, the carrying amount of the given-up asset which is now motor

vehicle will serve the basis to determine initial value of the system.

Therefore, the value to be assigned to this Client Management System is FRW

16 million deemed to be carrying amount of motor vehicle, computed as follows

FRW 20 million – FRW 4 million.

4.1.4 Types of intangible assets

• Goodwill

Goodwill is an intangible asset that arises when one company acquires another.

Things like the value of a company name and brand, customer loyalty, or even

good employee retention are examples of a goodwill asset. You can calculate a

rough estimate of a goodwill asset by using this formula:

Goodwill= P - (A - L)

P = Purchase price of the target company

A = Fair market value of assets

L = Fair market value of liabilities

Goodwill acquired always makes it on to a balance sheet and will show up on a

separate line than other intangible assets.

• Brand equity: This represents a well-recognized brand with ability

to boost profit of the company. With good brand, the customers are

willing to order and buy goods from you at highest price compared to

similar product in the same industry

• Intellectual properties: Example of intellectual properties

includes: Copyrights, patents, franchises.

• Licensing: This is another type of intangible assets whereby a company

could buy license to use formula or software to make sales

• Customer lists

A strong customer lists is an asset to the company that own it, because

this is a tool that can increase company’s profit

Application activity 4.1

Highland Ltd is a company that manufactures ink for big printers. During the

year that ended 31 December 2021, the company acquired multisystem

machine that will be used to produce the ink for new developed SPC360SN

card printer. The machine requires software to operate and the software

was successfully installed in the machine at cost of FRW 50 million. The

machine could not operate without that software.

The FRW 50 million cost incurred to buy software will be treated

as part of

a) IAS 38-Intangible assets

b) IAS 16-Property plant and Equipment

c) IFRS 16-Leased) None of the above

4.2 Measurement of Intangible asset

Learning Activity 4.2

4.2.1 Internally generated goodwill

In some cases, expenditure is incurred to generate future economic benefits, but

it does not result in the creation of an intangible asset that meets the recognition

criteria in this Standard. Such expenditure is often described as contributing to

internally generated goodwill. Internally generated goodwill is not recognized as

an asset because it is not an identifiable resource (ie it is not separable nor does

it arise from contractual or other legal rights) controlled by the entity that can be

measured reliably at cost.

How does internally generated goodwill arise?

In some instance, entity believes that the difference between fair value of entity’s

net assets and its carrying amount could represent goodwill.

However, that is wrong interpretation because the Differences between the fair

value of an entity and the carrying amount of its identifiable net assets at any time

may capture a range of factors that affect the fair value of the entity. Therefore,

such differences do not represent the cost of intangible assets controlled bythe entity

4.2.2 Initial measurement and subsequent measurement

• Initial measurement

Intangible assets are initially recognized at cost. This is either the purchase

price, or the internally generated cost (see research and development later in

this unit).

• Subsequent measurement

After initial recognition, the Standard allows two methods of valuation forintangible assets. The entity shall choose either:

i. Cost model and

ii. Revaluation model

The methods used for subsequent measurement of intangible assets areexplained below

a) Cost Model

This method applies when an intangible asset is carried at its cost, less any

accumulated amortization and less any accumulated impairment losses.

Computation of accumulated amortization is shown in learning outcome 4.2.3of this book.

b) Revaluation model

The revaluation model allows an intangible asset to be carried at a revalued

amount, which is its fair value at the date of revaluation, less any subsequent

accumulated amortization and any subsequent accumulated impairment losses.

The standard states that there will not usually be an active market in an intangible

asset; therefore, the revaluation model will usually not be available. For example,

although copyrights, publishing rights and film rights can be sold, each has a

unique sale value. In such cases, revaluation to fair value would be inappropriate.

A fair value might be obtainable however for assets such as fishing rights orquotas or taxi cab licenses.

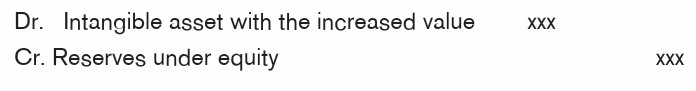

Treatment of Valuation surplus and deficit

Where an intangible asset is revalued upwards i.e fair value exceed carrying

amount, the amount of the revaluation should be credited directly to equityunder the heading of a revaluation surplus (other comprehensive income).

Example

The intangible asset that cost FRW 10 million was revalued on 31 December

2022 at FRW 8 million. The accumulated amortization at the date of revaluation

was FRW 4 million.

Required: Show how the above transaction will be treated in books of accounts

Answer: If the intangible asset is revalued, the first step you compute carrying

amount of the revalued intangible asset at revaluation date. The carrying amountin this case is, FRW 6 million

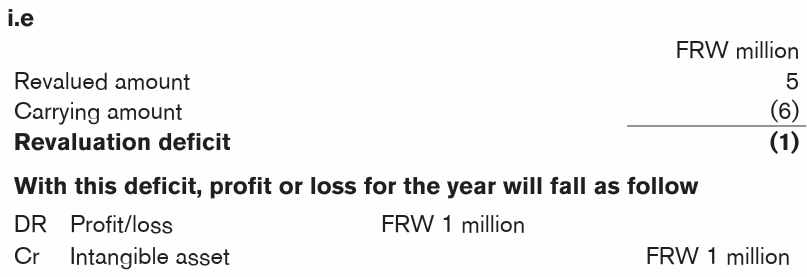

Where the carrying amount of an intangible asset is revalued downwards, the

amount of the downward revaluation should be recognized in profit or loss,

unless the asset has previously been revalued upwards in which case the

revaluation decrease should be first charged against any previous revaluation

surplus in respect of that asset.

Example: In our example above, let assume that the intangible asset was

revalued at FRW 5 million. Therefore, this implies revaluation decrease asrevalued amount falls short to carrying amount. The deficit is FRW 1 million

4.2.3 Useful life of intangible asset and amortization method

1. What is useful life of intangible asset

Useful life is the period over which an asset is expected to be available for use

by an entity

An entity should assess the useful life of an intangible asset, which may be finite

or indefinite. An intangible asset has an indefinite useful life when there is no

foreseeable limit to the period over which the asset is expected to generate net

cash inflows for the entity.

Many factors are considered in determining the useful life of an

intangible asset, including:

• Expected usage

• Typical product life cycles

• Technical, technological, commercial or other types of obsolescence

• The stability of the industry; expected actions by competitors

• The level of maintenance expenditure required

• Legal or similar limits on the use of the asset, such as the expiry dates

of related leases

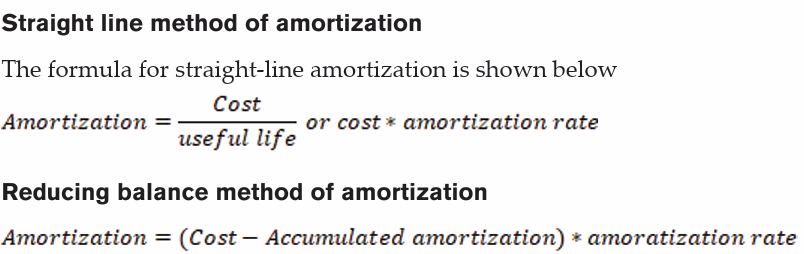

2. Amortization of intangible assets

An intangible asset with a finite useful life should be amortized over its expected

useful life. Amortization is calculated in the same way as depreciation for tangible

assets.

When shall entity start and cease to compute amortization of intangible

asset?

Amortization should start when the asset is available for use while amortization

should cease at the earlier of the date the asset is classified as held for sale in

accordance with IFRS 5

The residual value of an intangible asset with a finite useful life is assumed to be

zero unless a third party is committed to buy the intangible asset at the end of

its useful life or unless there is an active market for that type of asset (so that its

expected residual value can be measured) and it is probable that there will be amarket for the asset at the end of its useful life

4.2.4 Intangible assets with indefinite useful lives

An intangible asset with an indefinite useful life should not be amortized. (IAS

36 requires that such asset is tested for impairment at least annually). However,

the appropriateness of deeming the useful life of the asset as indefinite should

be reviewed each year. If the useful life of the asset is deemed to be finite rather

than indefinite this may indicate that the asset may be impaired and it should betested for impairment.

4.2.5 Disposal/retirements of intangible assets

a) When to derecognize intangible asset in the accounts

An intangible asset shall be derecognized

• On disposal

• When no future economic benefits are expected from its use or disposal.

b) Treatment of gain or loss on disposal

The gain or loss arising from the derecognition of an intangible asset shall be

determined as the difference between the net disposal proceeds, if any, and

the carrying amount of the asset. It shall be recognized in profit or loss when theasset is derecognized.

Application activity 4.2

Mahoro supermarket has development expenditure of RWF5 million. Its

policy is to amortized development expenditure at 5% per annum using

straight line method. Accumulated amortization brought forward is

RWF500,000

What is the charge in the statement of profit or loss for the year’s

amortization?

a) FRW 250,000

b) FRW 225,000

c) FRW 500,000d) FRW 4,500,000

4.3 Internally generated intangible assets

Learning Activity 4.3

List some examples of activities that might be included in either research ordevelopment

4.3.1 Research and development cost

• Criteria to recognize internally developed intangible asset

To assess whether an internally generated intangible asset meets the criteria for

recognition, an entity classifies the generation of the asset into:

i. research phase; and

ii. development phase.

a. Research phase

Research activities by definition do not meet the criteria for recognition under

IAS 38. This is because, at the research stage of a project, it cannot be certain

that future economic benefits will probably flow to the entity from the project.

There is too much uncertainty about the likely success or otherwise of the

project. Research costs should therefore be written off as an expense as they

are incurred.

b. Development

Development costs may qualify for recognition as intangible assets provided

that the following strict criteria can be demonstrated.

– The technical feasibility of completing the intangible asset so that it will

be available for use or sale.

– Its intention to complete the intangible asset and use or sell it.

– Its ability to use or sell the intangible asset.

– There will be future economic benefits for the entity. The entity should

demonstrate the existence of a market for the output of the intangible

asset or the intangible asset itself or the usefulness of the intangible

asset to the business.

– The availability of technical, financial and other resources to complete

the development and to use or sell the intangible asset.

– Its ability to reliably measure the expenditure attributable to the intangibleasset during its development.

Note: If an entity cannot distinguish the research phase from the development

phase of an internal project to create an intangible asset, the entity treats the

expenditure on that project as if it were incurred in the research phase only.

• Cost of an internally generated intangible asset

The cost of an internally generated intangible asset is the sum of expenditure

incurred from the date when the intangible asset first meets the recognition

criteria. The IAS 38 prohibits reinstatement of expenditure previously recognizedas an expense.

The cost of an internally generated intangible asset comprises all directly

attributable costs necessary to create, produce, and prepare the asset to be

capable of operating in the manner intended by management.

Examples of directly attributable costs are:

i. Costs of materials and services used or consumed in generating the

intangible asset;

ii. Costs of employee benefits (salaries-wages) arising from the generation

of the intangible asset;

iii. Fees to register a legal right; andiv. Amortization of patents and licenses that are used to generate the

intangible asset

The following are not components of the cost of an internally

generated intangible asset:

a) Selling, administrative and other general overhead expenditure unless

this expenditure can be directly attributed to preparing the asset for use

b) Identified inefficiencies and initial operating losses incurred before the

asset achieves planned performance; and

c) Expenditure on training staff to operate the asset.

• Recognition of an expense

Expenditure on an intangible item shall be recognized as an expense when it is

incurred unless:

i. It forms part of the cost of an intangible asset that meets the recognition

criteria

ii. The item is acquired in a business combination and cannot be recognized

as an intangible asset. If this is the case, it forms part of the amount

recognized as goodwill at the acquisition date

• Past expenses not to be recognized as an asset

Expenditure on an intangible item that was initially recognized as an expenseshall not be recognized as part of the cost of an intangible asset at a later date.

Learning Activity 4.3

Igicuruzwa Ltd is developing a new production process. During 2020,

expenditure incurred was RWF1,000,000 of which RWF900,000 was

incurred before 1 December 2020 and RWF100,000 between 1 December

2020 and 31 December 2020. Igicuruzwa Ltd can demonstrate that, at 1

December 2020, the production process met the criteria for recognition as

an intangible asset. The recoverable amount of the know-how embodied inthe process is estimated to be RWF500,000

Required: How should the expenditure be treated?

Skills Lab

Visit local business center and try to identify or choose one company/

business with a good reputation compared to others and discuss on how

that reputation will increase value of the business when its acquisition happen

End unit assessment

1. A business buys a patent for RWF50 million. It expects to use the

patent for the next ten years, after which it will be valueless.

Required: Calculate the amortization charge for each year and

show the double entry to record it.

2. What do you think intangible assets is?

a) Non-current asset

b) Current asset

c) Revenue expenditure

d) Deferred expenditure3. Explain the accounting treatment of internally generated goodwil