UNIT 3 : ACCOUNTING FOR TANGIBLE NON-CURRENT ASSETS

Key unit competence: To be able to measure and record tangible non current assets

Introductory activity

Observe the above picture and answer the following questions:

Based on International Accounting Standard (IAS) 16,

1) Why is it necessary to account for tangible fixed assets? Justify

your answer.

2) What is the meaning of carrying amount of fixed asset?3) What is Residual value of tangible fixed asset?.

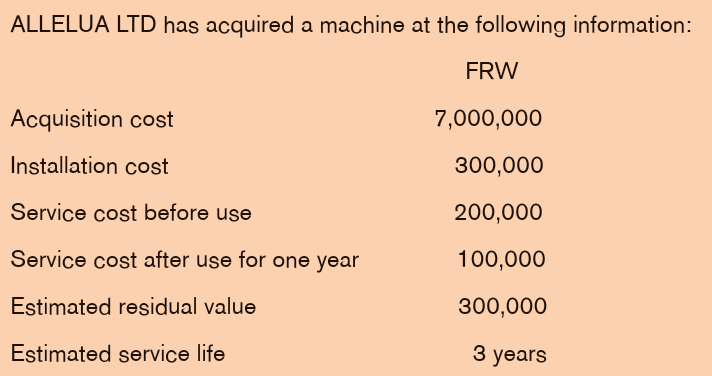

3.1 Determination of the cost for non-current assetsLearning Activity 3.1

Required:

Is it necessary to recognize for this new asset in the books of ALLERUALTD? If yes, what is the meaning of recognition of intangible fixed asset?

3.1.1 International Accounting Standard (IAS) 16

IAS 16 covers keys aspect of accounting for property, plant and equipment.

This represents the bulk of items which are “tangible non-current assets”.

• Objective

IAS 16 Property, Plant and Equipment outlines the accounting treatment for

most types of property, plant and equipment. The Standard addresses the

recognition, measurement and disclose of all property, plant and equipment

pertaining to the entity.

• Scope

Property, plant and equipment are tangible assets that:

i. Are held for use in the production or supply of goods or services, for rental

to others, or for administrative purposes.

ii. Are expected to be used during more than one period

Carrying amount is the amount at which an asset is recognized in the

statement of financial position after deducting any accumulated depreciationand accumulated impairment losses.

IAS 16 should be followed when accounting for property, plant and equipment

unless another international accounting standard requires a different treatmentIAS 16 does not apply to the following:

a) Biological assets related to agricultural activity, apart from bearer

biological assets

b) Mineral rights and mineral reserves, such as oil, gas and non

regenerative resources

c) Property, plant and equipment classified as held for sale.

However, the standard applies to property, plant and equipment used to develop

these assets.

A bearer biological asset is living plant that:

a) Is used in the production or supply of agricultural produce

b) Is expected to bear produce for more than one period; and

c) Has a remote likelihood of being sold as agricultural produce, exceptfor incidental scrap sales?

• Recognition

In this context, recognition simply means incorporation of the item in the

business’s accounts, in this case as a non-current asset. The recognition of

property, plant and equipment depends on the two criteria:

i. It is probable that future economic benefits associated with the asset will

flow to the entity;

ii. The cost of the asset to the entity can be measured reliably.

Cost is the amount of cash or cash equivalents paid or the fair value of the

other consideration given to acquire an asset at the time of its acquisition orconstruction.

Property, plant and equipment can amount to substantial amounts in financial

statements, affecting the presentation of the company’s financial position and

the profitability of the entity, through depreciation and also if an asset is wronglyclassified as an expense and taken to profit or loss.

First criterion: Future economic benefits

The degree of certainty attached to flow of future of economic benefits must

be assessed. This should be based on the evidence available at the date of initial

recognition (usually the date of purchase). The entity should be assured that it

will receive the rewards attached to the asset and it will incur the associated

risks, which will only be the case when the rewards and risks have actuallypassed to the entity. Until then, the asset should not be recognized

Second criterion: cost measured reliably

It is generally easy to measure the cost of an asset as the transfer amount on

purchase, i.e what was paid for it. Self-constructed assets can also be measured

easily by adding together the purchase price of all the constituent parts (labor,material etc.) paid to external parties.

3.1.2 Measurement

• Initial measurement

Once an item of property, plant and equipment qualifies for recognition as anasset, it will initially be measured at cost

i. Components of cost

The standard lists the components of the cost of an item of Property, plant and

equipment.

a) Purchase price, less any trade discount or rebate

b) Import duties and non-refundable purchase taxes

c) Direct attributable costs of bringing the asset to working condition for

its intended use, eg:

– The cost of site preparation

– Initial delivery and handling costs

– Installation costs

– Testing (net of any proceeds on the sale of items produced)

– Professional fees (architects, engineers)

Initial estimate of unavoidable cost of dismantling and removing the asset

and restoring the site on which it is located

IAS 16 provides guidance on directly attributable costs included in the

cost of an item of property, plant and equipment.

a) The cost bringing the asset to the location and working conditions

necessary for it to be capable of operating in manner intended by

management, including those costs to test whether the asset is

functioning properly.

b) They are determined after deducting the net proceeds from selling any

items produced when bringing the asset to its location and condition.

Income and related expenses of operations that are incidental to the

construction or development of an item of property, plant and equipment should

be recognized in profit or loss.

The following costs will not be part of the cost of property, plant and

equipment unless they can be attributed directly to the asset’s acquisition, or

bringing it into its working condition:

– Administration and other general overhead costs

– Start-up and similar pre-production costs

– Initial operating losses before the asset reaches planned performance

All of these will be recognized as an expense rather than an asset.

In the case of self-constructed assets, the same principles are applied as

for acquired assets. If the entity’s normal course of business is to make these

assets and sell them externally, then the cost of the asset will be the cost of

its production. This also means that abnormal costs (wasted material, labor or

downtime costs) are excluded from the cost of the asset. An example of a selfconstructed asset is when a building company builds its own office.

ii. Subsequent expenditure

The recognition criteria apply to subsequent expenditure as well as costs

incurred initially. There are no separate criteria for recognizing subsequent

expenditure. For example, if a shop building is extended to include a new café

as revenue source, then this meets the criteria of probable future economic

benefits, and so should be recognized as property, plant and equipment.

However, if the shop building is maintained or repaired, it does not enhance the

future economic benefits, it merely sustains the existing economic benefits and

therefore the costs must be expensed.

iii. Exchanges of assets

IAS 16 specifies that exchange of items of property, plant and equipment,

regardless of whether the assets are similar, are measured at fair value, unless

the exchange transaction lacks commercial substance or the fair value

of neither of the assets exchanged can be measured reliably. If the acquired

item is not measured at fair value, its cost is measured at the carrying amountof the asset given up.

• Measurement subsequent to initial recognition

The standard offers two possible treatments here, essentially a choice between

keeping an asset recorded at cost of revaluing it to fair value

i. Cost model. Carry the asset at its cost less depreciation and any

accumulated impairment loss.

ii. Revaluation model. Carry the asset at a revalued amount, being its fair at

the date of the revaluation less any subsequent accumulated depreciation

and subsequent accumulated impairment losses. The revised IAS 16

makes clear that the revaluation model is available only if the fairvalue of the item can be measured reliably.

Revaluations

The market value of land and buildings usually represents fair value, assuming

existing use and line of business. Such valuations are usually carried out by

professionally qualified valuers

In the case of plant and equipment, fair value can also be taken as market

value. Where a market value is not available, however, depreciated replacement

cost should be used. There may be not market value where types of plant and

equipment are sold only rarely or because of their specialised nature (i.e they

would normally only be sold as part of an ongoing business).

The frequency of valuation depends on the volatility of the fair values of

individual items of property, plant and equipment, the more volatile the fair value,

the more frequently revaluations should be carried out. Where the current fair

value is very different from the carrying amount then a revaluation should be

carried out.

Most importantly, when an item of property, plant and equipment is revalued,

the whole class of assets to which it belongs should be revalued.

All the items within in class should be revalued at the same time, to prevent

selective revaluations of certain assets and avoid disclosing a mixture of costs

and values from different dates in the financial statements. A rolling basis of

revaluation is allowed if the revaluations are kept up to date and the revaluationof the whole class is completed in a short time.

Accounting for revaluations

How should any increase in value be treated when a revaluation takes place?

The debit will be the increase in value in the statement of financial position, but

what about the credit? IAS 16 requires the increase to be credited to other

comprehensive income and accumulated in a revaluation surplus (ie part of

owner’s equity), unless there was previously a decrease on the revaluation ofthe same asset.

DEBIT Carrying amount (statement of financial position)

CREDIT Other comprehensive income (revaluation Surplus)

Reversing a previous decrease in value

If the asset has previously suffered a decrease in value that was charged to profit

or loss, any increase in value on subsequent revaluation should be recognized

in profit or loss to the extent that it reverses the previous decrease. The amount

of the reversal is not necessarily the same as the amount of previous decrease-

the cumulative effect of differences in depreciation charged to profit or loss

as a result of the previous decrease must be considered. Any excess is then

recognized in other comprehensive income and accumulated in a revaluationsurplus.

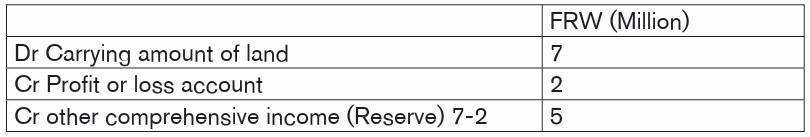

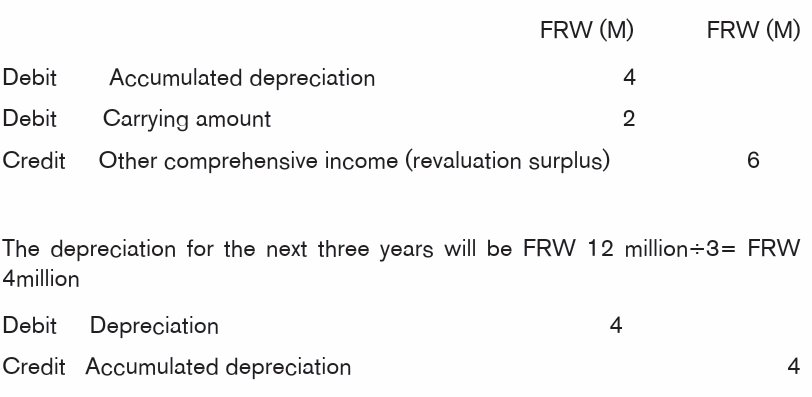

Example

ABC Ltd has an item of land carried in its books at FRW 13 million as at 31

March 2018. Two years previously, at 31 March 2016, a slump in land values

led the company to reduce the carrying amount from FRW 15 million. This was

taken as an expense in profit or loss. There has been a surge in land prices in

the current year and the land is now worth FRW 20 million.Account for revaluation in the current year ending 31 March 2018.

Answer

The double entry is:

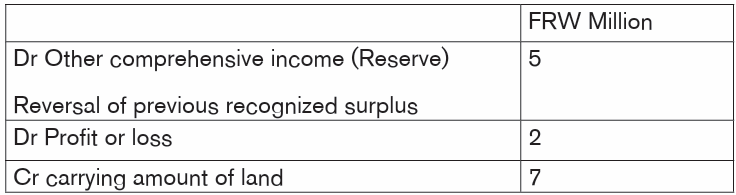

The case is similar for a Decrease in value on revaluation. Any decrease should

be recognized as an expense, except where it offsets a previous increase taken

as a revaluation surplus in owners’ equity. Any decease greater than the previousupwards increase in value must be taken as an expense in the profit or loss.

Example:

Let us simply swap round the example given above. The original cost was FRW

15 million, revalued upwards to FRW 20 million two years’ ego, for the period

ending 31 March 2016. The value has now fallen to FRW 13 million as of 31

March2018.Account for the decrease in value.

Remember that IAS 16 requires the initial increase here to be credited to other

comprehensive income and accumulated in a revaluation surplus (i.e part of

owners’ equity), therefore the increase in 31 march 2016 will be taken to other

comprehensive income and held in the revaluation surplus.

Once the value decreases, the original increase in value must be reversed

and any amounts over and above that should be taken to the statement of profit

or loss.

Revaluation of depreciated assets

There is a further complication when a revalued asset is being depreciated. As

we have seen, an upward revaluation means that the depreciation charge will

increase. Normally, a revaluation surplus is only realized when the asset is sold.

However, when it is being depreciated, part of that surplus is being realized as

the asset is used.

The amount of the surplus realized is the difference between depreciation

charged on the revalued amount and the (lower) depreciation which would have

been charged on the asset’s original cost. This amount can be transferred

to retained (realized) earnings but NOT through profit or loss.

Example:

KBG Ltd bought an asset for FRW 10 million at the beginning of 2016. It had

a useful life of 5 years. On January 2018 the asset was revalued to FRW 12

million. The expected useful life has remained uncharged (i.e three years remain).

Account for the revaluation and state the treatment for depreciation from 2018

onwards.

On 1st January 2018 the carrying amount of the asset has changed to FRW 12

million. Up to 1 January 2018, the company has depreciated the asset by FRW

4 million (FRW 10 million/5years*2) to reflect that the asset has been realized

through use. This means that the carrying amount was therefore FRW 6 million

(FRW 10 million- FRW 4 million), which is credited to other comprehensive income.

Due to the increased value, it appears that none of the asset’s original cost has

been used up in the past two years; therefore, we must also reverse theaccumulated depreciation:

The new depreciation is FRW 4 million compared to depreciation on the original

cost of 10m÷5= FRW 2m. So each year, the extra FRW 2 million can be treatedas part of the revaluation surplus that has become realized:

This is the movement on owners’ equity only and it will be shown in the statement

of changes in equity it is not an item in profit or loss.

Complex assets

For very large and specialized items, an apparently single asset should be

broken down into its composite parts. This occurs where the different parts

have different useful lives and different depreciation rates are applied to each

part, e.g an aircraft, where the body and engines are separated as they havedifferent useful lives.

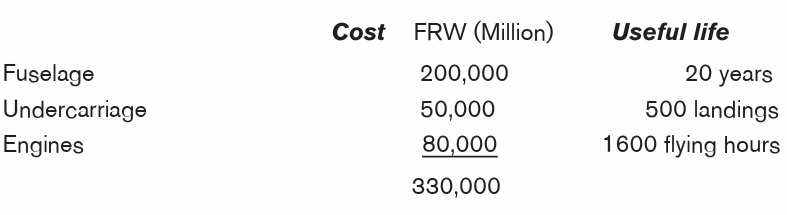

Example

A company purchases an aircraft for FRW 330,000 million. Show how the asset

should be accounted for at the end of the first financial year if the following is alist of its component parts:

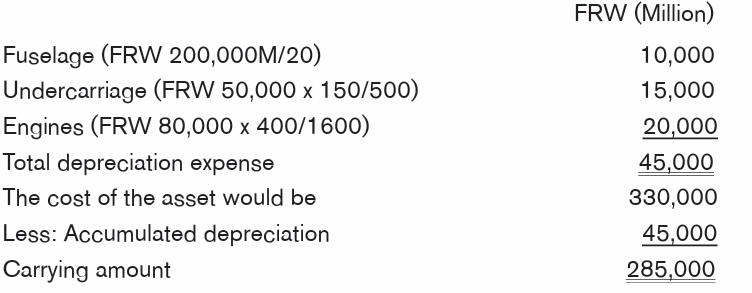

Answer

Depreciation at the end of the first year, in which 150 flights totaling 400 hourswere made, would then be:

Retirements and disposals

When an asset is permanently withdrawn from use, or sold or scrapped,

and no future benefits are expected from its disposal, it should be derecognized

from the statement of financial position.

Gain or losses are the difference between the estimated net disposal proceeds

and the carrying amount of the asset. They should be recognized as income orexpense in profit or loss.

Derecognition

An entity is required to derecognize the carrying amount of an item of

property, plant or equipment that it disposes of on the date the criteria for the

sale in IFRS 15 Revenue from contracts with customers would be met. Thisalso applies to parts of an asset.

Application activity 3.1

An equipment was purchased from England at CIF Mombasa value of

FRW 10,000,000. Transportation fees to Kigali Magerwa costs FRW

1,500,000; imports duties and fees amounted to FRW 1,900,000. The

installation cost was FRW 2,000,000 while trial runs and commissioning

amounted to FRW 2,600,000.

Required: Determine the original cost for that equipment

3.2 Compute depreciation charge and carrying amount

Learning Activity 3.2

A machine was bought at a cost of FRW 6,500,000; total non-refundable

taxes paid on the purchase transaction amounted to FRW 1,500,000 while

the installation cost was FRW 2,000,000. The scrap value is estimated atFRW 256,000 at the end of the estimated lifetime of 4 years.

Required: Based on the above information explain the following terms:

a) Capital expenditure

b) Depreciationc) Residual value

d) Useful life

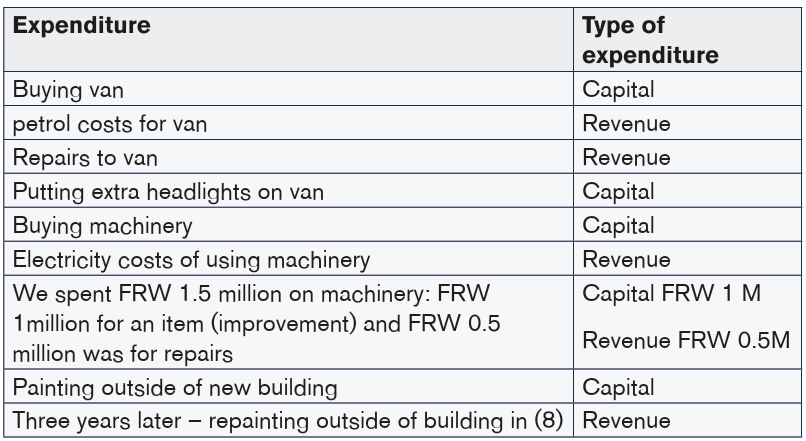

Capital and Revenue Expenditure

Capital expenditure is money spent by a business on the purchase of fixed

assets for use in the business and not for immediate resale, or on their alteration

or improvement; it includes any costs of delivering or installing fixed assets, andthe legal costs of buying a non-current asset.

Revenue expenditure is money spent on the running expenses of a business:

that is, maintenance of fixed assets, the cost of administering the business and

selling and distributing goods, and the cost of stock of goods acquired withintention of resale.

Differences between capital and revenue expenditure

Depreciation

Depreciation accounting is governing by IAS 16 property, plant and equipment.These are some of IAS 16 definitions concerning depreciation.

Depreciation is the systematic allocation of the depreciable amount of an asset

over its estimated useful life. Depreciation for the accounting period is chargedas an expense to net profit or loss for the period either directly or indirectly.

Depreciable assets are assets which:

• Are expected to be used during more than one accounting period

• Have a limited useful life

• Are held by an entity for use in the production or supply of goods and

services, for rental to others, or administrative purposes.

Useful life is one of two things:

• The period over which a depreciable asset is expected to be used by

the entity; or

• The number of production or similar units expected to be obtained fromthe asset by the entity.

Depreciable amount of a depreciable asset is the historical cost or other

amount substituted for cost in the financial statement, less its estimated residual

value.

An amount substituted for cost’ will normally be a current market value after a

revaluation has taken place.

Residual value is the net amount which the entity expects to obtain for an

asset at the end of its useful life after deducting the expected costs of disposal.

If an asset’s life extends over more than one accounting period, it earns profits

over more than one period. It is a non-current asset.

With the exception of land, every non-current asset eventually wears out over

time. Machines, cars and other vehicles, fixtures and fittings, and even buildings

do not last forever. When a business acquires non-current asset, it will have

some idea about how long its useful life will be, and it might decide what to do

with it.

• Keep on using the non-current asset until becomes completely worn

out, useless and worthless.

• Sell off the non-current asset at the end of its useful life, either by

selling it as a second hand item or as scrap.

Since a non-current asset has a cost, and a limited useful life, and its value

eventually declines, it follows that a charge should be made in profit or loss to

reflect the use that is made of the asset by the business. This charge is calleddepreciation.

The need to depreciate non-current assets arises from the accruals

assumption. If money is expended in purchasing an asset, then the amount

expended must at some time be charged against profits. If the asset is one

which contributes to an entity’s revenue over a number of accounting periods it

would be inappropriate to charge any single period (e.g the period in which the

asset was acquired) with the whole of the expenditure. Instead, some method

must be found of spreading the cost of the asset over its estimated useful life.

It is worth mentioning here two common misconceptions about the purpose

and effects of depreciation:

• It is sometimes thought that the carrying amount of an asset is equal to

its net realizable value and that the object of charging depreciation is to

reflect the fall in value of an asset over its life. This misconception is the

basis of a common, but incorrect, argument which says that freehold

properties need not be depreciated in times when property values arearising.

It is true that historical cost statements of financial position often give a misleading

impression when a property’s carrying amount is much below its market value,

but in such a case it is open to a business to incorporate a revaluation into

its books, or even to prepare its accounts based on current costs. This is a

separate problem from that of allocating the property’s cost over successiveaccounting periods.

• Another misconception is that depreciation is provided so that an

asset can be replaced at the end of its useful life. This is not the

case :

– If there is no intention of replacing the asset, it could then be argued

that there is no need to provide for any depreciation at all.

– If prices are rising, the replacement cost of the asset will exceed theamount of depreciation provided.

There are situations where, over a period, an asset has increased in value, i.e its

current value is greater than the carrying amount in the financial statements. You

might think that in such situations it would not be necessary to depreciate the

asset. The standard states, however, that this is irrelevant, and that depreciation

should still be charged to each accounting period, based on the depreciableamount, irrespective of a rise in value.

An entity is required to begin depreciating an item of property, plant and

equipment when it is available for use and continue depreciating it until it isderecognized even if it is idle during the period.

Useful life

The following factors should be considered when estimating the useful life of

depreciable asset.

• Expected physical wear and tear

• Obsolescence

• Legal or other limits on the use of the assets

Once decided, the useful life should be reviewed at least every financial year end

and depreciation rates adjusted for the current and future periods if expectations

vary significantly from the original estimates. The effect of the changes shouldbe disclosed in the accounting period in which the change takes place.

The assessment of useful requires judgment based on previous experience with

similar assets or classes of asset. When a completely new type of asset is

required (through technological advancement or through use in producing a

brand new product or service) it is still necessary to estimate useful life, eventhough the exercise will be much difficult.

Land and buildings are dealt with separately when it comes to depreciation,

even when they are acquired together, because land normally has unlimited life

and is therefore not depreciated. In contrast buildings do have a limited life and

must be depreciated. Any increase in the value of land on which a building isstanding will have no impact on the determination of building; useful life.

Review of useful life

A review or the useful life of property, plant and equipment should be carried out

at least each financial year end and the depreciation charge for the current

and future periods should be adjusted if expectations have changed significantly

from previous estimates. Changes are changes in accounting estimates and areaccounted for prospectively as adjustments to future depreciation.

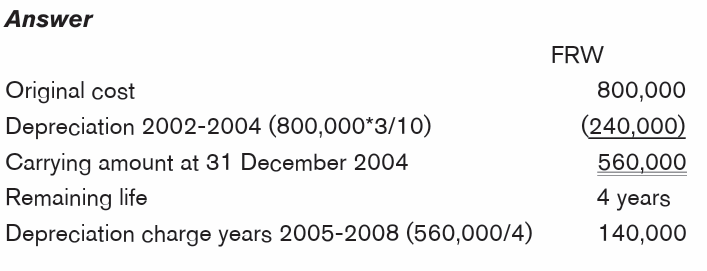

Example:

ABC Ltd acquired a non-current asset on 1 January 2002 for FRW 800,000.

It had no residual value and a useful life of ten years. On 1 January 2005, the

remaining useful life was reviewed and revised to 4 years.What will be the depreciation charge for 2005?

Residual value

In most cases the residual value of an asset is likely to be immaterial. If

it is likely to be of any significant value, that value must be estimated at the

date of purchase or any subsequent revaluation. The amount of residual value

estimated based on the current situation with other similar assets, used in the

same way, which are now at the end of their useful lives. Any expected costs ofdisposal should be offset against the gross residual value.

Depreciation methods

Consistent is important. The depreciation method selected should be applied

consistently from period to period unless altered circumstances justify a charge.

When the method is changed, the effect should be quantified and disclosedand the reason for the change should be stated.

Various methods of allocating depreciation to accounting periods are available,

but whichever is chosen must be applied consistently to ensure comparability

from period to period. Change of policy is not allowed simply because of theprofitability situation of the entity.

Depreciation methods were covered extensively in senior 5. The most common

accepted methods of allocating depreciation are straight-line method and

reducing balance method.

Under straight-line method, the depreciable amount is charged in equal

installments over the asset’s expected useful life. This method is best when

the business enjoys the benefits of the asset in equal measure over the asset’s

useful life. It is useful where there is an estimated realizable or scrap value after

a set period, for example, a van may be used by a business for four years, but

with the aim of selling it back to the motor company for an agreed amount of

money after that time.

Under the reducing balance method, the annual depreciation charge is a fixed

percentage of the carrying amount, as at the end of the accounting period.

Examples include machinery which has a higher productivity in the earlier years

of its usage.

The reducing balance method should be used when it is considered fair to

allocate a greater proportion of the total depreciable to the earlier years and a

lower amount in the later years, on the assumption that the benefits obtained by

the business from using the asset decline over time. Examples would includecomputer hardware or production machinery that gets less efficient as it ages.

Review of depreciation method

The depreciation method should also be reviewed at least at each financial

year end and, if there has been a significant change in the expected pattern of

economic benefits from the assets, the method should be changed to suit this

changed pattern. When such a change in depreciation method takes place the

change should be accounted for as a change in accounting estimate and the

depreciation charge for the current and future periods should be adjusted.

Impairment of carrying amounts of non-current assets

An impairment loss is the amount by which the carrying amount of an asset

exceeds its recoverable amount.

An impairment loss should be treated in the same way as revaluation

decrease i.e the decrease should be recognized as an expense. However, arevaluation decrease (impairment loss) should be charged directly against any

related revaluation surplus to the extent that the decrease does not exceed the

amount held in the revaluation surplus in respect of that same asset.

A reversal of an impairment loss should be treated in the same way as a

revaluation increase, i.e a revaluation increase should be recognized as an

income to the extent that it reverses a revaluation decrease or an impairment

loss of the same asset previously recognized as an expense.

Disclosure

The standard has a long list of disclosure requirements, for each class of

property, plant and equipment.

• Measurement bases for determining the gross carrying amount (if more

than one, the gross carrying amount for that basis in each category)

• Depreciation method used

• Useful lives or depreciation rates used

• Gross carrying amount and accumulated depreciation (aggregated

with accumulated impairment losses) at the beginning and end of the

period

• Reconciliation of the carrying amount at the beginning and end of the

period showing:

– Additions

– Disposals

– Acquisitions through business combinations

– Increases/decreases during the period from revaluations and from

impairment losses

– Impairment losses recognized in profit or loss

– Impairment losses reversed in profit or loss

– Depreciation

– Net exchange differences (from translation of statements of e foreign

entity)

– Any other movements

The financial statements should also disclose the following:

• Any recoverable amounts of property, plant and equipment

• Existence and amounts of restrictions on title, and items pledged as

security for liabilities

• Accounting policy for the estimated costs of restoring the site

• Amount of expenditures on account of items in the course of construction

• Amount of commitments to acquisitions

• Accounting policy disclosing the valuation bases used for determining

the amounts at which depreciable assets are stated.

IAS 16 also requires the following to be disclosed for major class of depreciable

asset:

Revalued assets require further disclosures:

• Basis used to revalue the assets

• Effective date of the revaluation

• Whether an independent valuer was involved

• Nature of any indices used to determine replacement cost

• Carrying amount of each class of property, plant and equipment that

would have been included in the financial statements had the assets

been carried at cost less accumulated depreciation and accumulated

impairment losses

• Revaluation surplus, indicating the movement for the period and any

restrictions on the distribution of the balance to shareholders.

The standard also encourages disclosure of additional information, which the

users of financial statements may find useful:

• The carrying amount of temporarily idle property, plant and equipment

• The gross carrying amount of any fully depreciated property, plant and

equipment that is still in use

• The carrying amount of property, plant and equipment retired from

active use and held for disposal

• The fair value of property, plant and equipment when this is materiallydifferent from the carrying amount

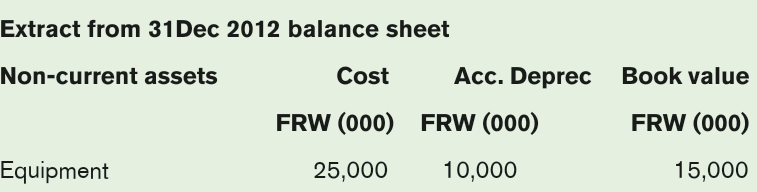

Application activity 3.2The following information relates to BGM LTD:

On Feb 2013, an additional equipment was bought at a cost of FRW

2,500,000. Due to expansion in the market for serviced plots, another

equipment, was bought on 24th June 2013 at a cost of FRW 3,750,000.

On Feb 2013, an additional equipment was bought at a cost of FRW

2,500,000. Due to expansion in the market for serviced plots, another

equipment, was bought on 24th June 2013 at a cost of FRW 3,750,000.

However, an equipment which had been acquired at a cost of FRW

2,000,000 on 7th April2010 and was expected to have a useful life of

5years and a scrap value of FRW 125,000 could not cope up with bigger

projects efficiently, as a result on 5 July 2013, management disposed it off

at FRW 750,000.

Another equipment which was bought on 20th May 2010 at a cost of FRW

4,000,000 and was expected to have a residual value of FRW 250,000 at

the end of tenth year broke down was disposed of at FRW 1,750,000 on3 September 2013.

The company’s policy is to charge full depreciation in the year of purchase

and none at all in the year of sale (disposal).

The company followed straight line method of depreciation but changed

to charge depreciation at rate of 10% on cost for the equipment which

was available by the end of 31 December 2013. All transactions were by

cheque.

Required:

Prepare the following accounts as at 31 December 2013:

a) Equipment A/C

b) Equipment disposal A/Cc) Accumulated depreciation-equipment A/C

End unit assessment

1) KABALISA Ltd acquired a building in KIGALI on 1st January 2011 for

FRW 200 million. The building was judged to have a useful life of 50

years. On 31 December 2013, the property was revalued at FRW 210

million. On January 2016 the property was independently valued atFRW 170 million, the useful life was unchanged.

Required

Calculated the effect of the property on the statement of profit or loss forthe year ended 31st December 2016.

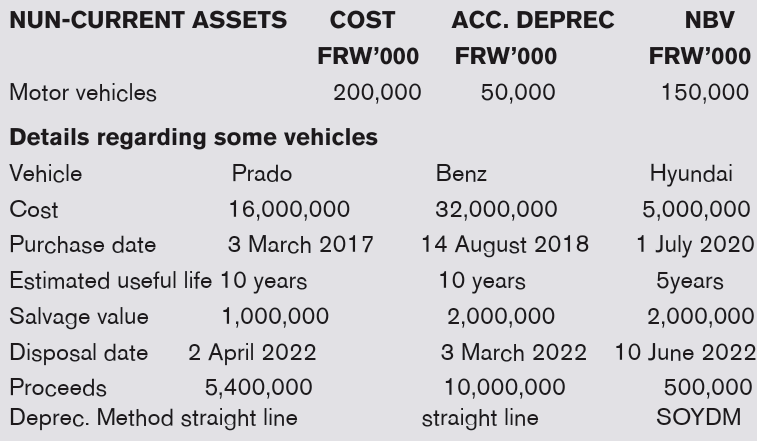

2) The following information was got from the balance sheet of GASABOTOURS as at 31 December 2021

SOYDM: Sum of Years Digits method

All transactions were by cheque. It is the company’s policy to charge a full

year’s depreciation in the year of purchase and none in the year of disposal.

All motor vehicles that are not disposed by 31December 2022 should be

depreciated by 20% on cost. The company’s financial year runs from 1January to 31 December.

Required:

i. Motor vehicles A/C

ii. Motor vehicles Accumulated depreciation A/Ciii. Motor vehicles disposal A/C