UNIT 1 : REGULATORY FRAMEWORK

Key unit competence: To be able to explain the Regulatory

Framework of Accounting

Introductory activity

Last time, the accounting was not well prepared; it was planned on each

personal understanding without respecting common rules and regulations

to conduct things in the same direction. As the time are replaced,

accounting preparation has been improved so that it was not prepared

based on a particular country’s rules and regulations but it was prepared

in the same manner through the world where the regulatory framework

exists on national and international levels.

Required: What accounting bodies should do in order to standardize

the different accounting policies and practices followed by

different business concerns?

1.1 Regulatory System

Learning Activity 1.1

Many figures in financial statements are derived from the application of

judgment in applying fundamental accounting assumptions and conventions.

This can lead to subjectivity.

Required: In attempt to deal with this subjectivity, and to achieve comparability

between different organizations, what can you develop?

In Accounting, the regulatory framework provides a set of rules and regulations

for accounting. Compliance and regulatory frameworks are sets of guidelines

and best practices. Organizations follow these guidelines to meet regulatory

requirements, improve processes, strengthen security, and achieve other

business objectives (such as becoming a public company, or selling cloud

solutions to government agencies).

Regulatory framework of accounting refers to the collection of accounting

standards, Laws, Codes, rules and regulations that are issued by

accounting bodies, government and regulatory units, which qualified accountant

must abide by. Remember, the IASB and FASB I mentioned earlier. They are

accounting standards setting bodies.

1.1.1 Introduction

Although new to the subject, you will be aware from your reading of the press

that there have been some considerable upheavals in financial reporting, mainly

in response to criticism. The details of the regulatory framework of accounting,

and the technical aspects of the changes made, will be covered later in this unit

and in your more advanced studies. The purpose of this unit is to give a general

picture of some of the factors which have shaped Financial Accounting. We

will concentrate on the accounts of limited liability companies, as these are the

accounts most closely regulated by statute or otherwise.

The following factors that have shaped Financial Accounting can be identified:

• National/local legislation

• Accounting concepts and individual judgment

• Accounting standards

• Other international influences

• Generally Accepted Accounting Principles (GAAP)

• Fair presentation

1.1.2 National/local legislation

In most countries, limited liability companies are required by law to prepare and

publish accounts annually. The form and content of the accounts is regulated

primarily by national legislation. In Rwanda, the main legislation is the Law

Governing Companies 17/2018

1.1.3 Accounting concepts and individual judgment

Many figures in financial statements are derived from the application of judgment

in applying fundamental accounting assumptions and conventions. This can

lead to subjectivity. Accounting standards were developed to try to address this

subjectivity.

Financial statements are prepared on the basis of a number of fundamental

accounting assumptions and conventions. Many figures in financial statements

are derived from the application of judgment in putting these assumptions into

practice.

It is clear that different people exercising their judgment on the same facts can

arrive at very different conclusions.

Case study

An accountancy training firm has an excellent reputation among students and

employers. How would you value this? The firm may have relatively little in the

form of assets that you can touch; perhaps a building, desks and chairs. If you

simply drew up a statement of financial position showing the cost of the assets

owned, then the business would not see to be worth much, yet its income

earning potential might be high. This is true of many service organizations where

the people are among the most valuable assets.

Other examples of areas where the judgment of different people may vary are

as follows.

• Valuation of buildings in times of rising property prices

• Research and development: is it right to treat his only as an expense?

In a sense it is an investment to generate future revenue

• Accounting for inflation

• Brands such as ‘Coca-Cola’ and ‘High Land Tea’. Are they assets in the

same way that a fork lift truck is an asset?

Working from the same data, different groups of people produce very different

financial statements. If the exercise of judgment is completely unfettered, there

will be no comparability between the accounts of different organizations. This

will be all the more significant in cases where deliberate manipulation occurs, in

order to present accounts in the most favorable light.

1.1.4 Accounting standards

In an attempt to deal with some of the subjectivity, and to achieve comparability

between different organizations, accounting standards were developed. These

are developed at both a national level (in most countries) and an international

level. The Financial Accounting syllabus is concerned with International

Financial Reporting Standards (IFRS Standards).

IFRS Standards are produced by the International Accounting Standards

Board (IASB).

Accounting is a vital part of business operations that involves managing and

reporting the financial operations of companies.

Accounting standards allow

accounting departments nationally and internationally to use similar practices

and produce similar quality accounting. If you work or plan to work in the

accounting field, it may be helpful to learn about accounting standards and why

they matter. In this article, we explain what accounting standards are, discuss

why they are important and describe how organizations use them.

Definition

Accounting standards are a set of procedures and measures that inform how

businesses conduct their accounting activities. They contain best practices for

recording, measuring and disclosing financial transactions. They apply to all

parts of a company’s activities, including revenue, expenses, noncash expenses,

assets, liabilities, equity and reporting. The primary purpose of accounting

standards is to provide accurate financial information that banks, government

agencies and investors can use when interacting with private companies.

Objectives of accounting standards

Primary objectives of accounting standards are:

• To provide a standard for the diverse accounting policies and principles.

• To put an end to the non-comparability of financial statements.

• To increase the reliability of the financial statements.

• To provide standards which are transparent for users.

• To define the standards which are comparable over all periods

presented.

• To provide a suitable starting point for accounting.

• It contains high quality information to generate the financial reports.

This can be done at a cost that does not exceed the benefits.

• For the eradication the huge amount of variation in the treatment of

accounting standards.

• To facilitate ease of both inter-firm and intra-firm comparison.

Main objective of accounting standards is to standardize the different accounting

policies and practices followed by different business concerns.

Importance of Accounting Standards

Accounting standards play a very efficient role in the whole accounting system.

Some of its important roles are discussed below:

• Brings uniformity in accounting system

• Easy comparability of financial statements

• Assists auditors

• Makes accounting informative easy and simple

• Avoids frauds and manipulations

• Provides reliability to financial statements

• Measures management performance

Relevance of accounting standards

An accounting standard is a standardized guiding principle that determines

the policies and practices of financial accounting. Accounting standards not

only improve the transparency of financial reporting but also facilitates financial

accountability. An accounting standard is relevant to a company’s financial

reporting.

Accounting standards ensure the financial statements from multiple companies

are comparable. Because all entities follow the same rules, accounting standards

make the financial statements credible and allow for more economic decisions

based on accurate and consistent information.

Generally Accepted Accounting Principles (US GAAP or GAAP)

Generally Accepted Accounting Principles refers to the standards framework,

principles and procedures used by the companies for financial accounting. The

principles are issued by Financial Accounting Standard Board (FASB). It is a set

of accounting standards that consist of standard ways and rules for recording

and reporting of the financial data, that is, balance sheet, income statement, cash

flow statement, etc. The framework is adopted by publicly traded companies

and a maximum number of private companies in the United States.

GAAP principles are updated at periodical intervals to meet with current financial

requirements. It ensures the transparency and consistency of the financial

statement. The information provided as per GAAP by the financial statement

is helpful to the economic decision makers such as investors, creditors,

shareholders, etc.

Key differences between GAAP and IFRS

The important difference between GAAP and IFRS are explained as under:

• GAAP stands for Generally Accepted Accounting Principles. IFRS is

an abbreviation for International Financial Reporting Standards.

• GAPP is a set of accounting guidelines and procedures, used by the

companies to prepare their financial statements. IFRS is the universal

business language followed by the companies while reporting financial

statements.

• Financial Accounting Standard Board (FASB) issues GAAP whereas

International Accounting Standard Board (IASB) issued IFRS (i.e

GAAP is developed by FASB whereas IFRS is developed by IASB.

• Use of Last in First out (LIFO) in inventory valuation is not permissible

as per IFRS which is not in the case of GAAP, that is, GAAP uses

LIFO, FIFO and Weighted Average Method but IFRS uses FIFO and

Weighted Average Method only.

• Extraordinary items are shown below the statement of income in case

of GAAP. Conversely, in IFRS, such items are not segregated in the

statement of income.

• Development Cost is treated as an expense in GAAP, while in IFRS, the

cost is capitalized provided the specified conditions are met.

• Inventory reversal is strictly prohibited under GAAP, but IFRS allows

inventory reversal subject to specific conditions.

• IFRS is based on principles, whereas GAAP is based on rules.

Note that as efforts are continuously made to converge these two standards, so

it can be said that there is no comparison between GAAP and IFRS. Moreover,

the differences between the two are as per a particular point of time that may

get a change in the future.

www.accounting.com/resources/gaap/

Similarities

Both are guiding principles that help in the preparation and presentation of

a statement of accounts. A professional accounting body issues them, and

that is why they are adopted in many countries of the world. Both of the two

provides relevance, reliability, transparency, comparability, understandability of

the financial statement.

Application activity 1.1

1. Mention the main objectives of the IASB when it develops IFRS

Standards.

2. Which of the following is not an objective of the accounting

standards?

a) Standardize the different accounting policies and practices

followed by different business concerns.

c) Increase the reliability of the financial statements.

b) Provide a standard for the diverse accounting policies and

principles.

d) Put an end to the non-comparability of financial statements.

e) Increase the huge amount of variation in the treatment of

accounting standards.

3. Explain the important difference between GAAP and IFRS.

4. Explain how there is subjectivity in financial statements.

5. Discuss the important roles of accounting standards in the whole

accounting system.

1.2 Structure of International Accounting Standards

Committee (IASC) Foundation

Learning Activity 1.2

Accounting standards are developed at both national and international

levels in order to raise the standard of financial reporting and eventually

bring about global harmonization of accounting standards.

Required: Mention at least two international bodies in charge of developing

these accounting standards.

1.2.1 History and structure of IASC Foundation

History of IASC Foundation

The IASC Foundation is an independent body, not controlled by any particular

Government or professional organization. Its main purpose is to oversee the

IASB in setting the accounting principles which are used by business and other

organizations around the world concerned with financial reporting.

The IASC was formed in June 1973 in London through an agreement made

by professional accountancy bodies from Australia, Canada, France, Germany,

Ireland, Japan, Mexico, the Netherlands, the UK and the USA with a view

to harmonizing the international diversity of company reporting practices.

Between its founding in 1973 and its dissolution in 2001, it developed a set of

International Accounting Standards (IAS) that gradually acquired a degree of

acceptance in countries around the world. Although the IASC came to include

some organizations representing preparers and users of financial statements, it

largely remained an initiative of the accountancy profession. On 1 April 2001,

it was replaced by the International Accounting Standards Board (IASB), an

independent standard-setting body. The IASC Foundation is the parent entity

of the International Accounting Standards Board, an independent accounting

standard-setter based in London, UK. The IASB adopted the extant corpus of

IAS which it continued to develop as International Financial Reporting Standards.

The structure of IASC Foundation

• The IASC Foundation is an independent organization having two main

bodies, the Trustees and the IASB, as well as a Standards Advisory

Council and the International Financial Reporting Interpretations

Committee.

• The IASC Foundation Trustees appoint the IASB members, exercise

oversight and raise the funds needed, but the IASB has sole responsibility

for setting accounting standards.

1.2.2 International Accounting Standards Board (IASB)

The IASB develops International Financial Reporting Standards (IFRS

Standards). The main objectives of the IFRS Foundation are to raise the

standard of financial reporting and eventually bring about global harmonization

of accounting standards. The IASB is an independent, privately funded body

that develops and approves IFRS Standards.

Prior to 2003, standards were issued as International Accounting Standards

(IAS Standards). In 2003 IFRS 1 was issued and all new standards are now

designated as IFRS Standards. Therefore, IFRS Standards encompass both

IFRS Standards, and IAS Standards still in force (eg: IAS 7).

Note: Throughout this text, we will use the abbreviation IFRS Standards to

include both IFRSs and IAS Standards.

The members of the IASB come from several countries and have a variety of

backgrounds, with a mix of auditors, preparers of financial statements, users of

financial statements and academics. The IASB operates under the oversight of

the IFRS Foundation.

The IFRS Foundation

IFRS standards are International Financial Reporting Standards (IFRS) that

consist of a set of accounting rules that determine how transactions and other

accounting events are required to be reported in financial statements. They are

designed to maintain credibility and transparency in the financial world, which

enables users, such as, investors and business operators to make informed

financial decisions or rational economic decisions with information about the

financial position, performance, profitability and liquidity of the company.

IFRS standards are issued and maintained by the International Accounting

Standards Board. Formerly, they are known as International Accounting

Standards (IAS). The standards are used for the preparation and presentation

of the financial statement that is, balance sheet, income statement, cash flow

statement, changes in equity and footnotes, etc. I FRS were created to establish

a common language so that financial statements can easily be interpreted

from company to company and country to country.

The IFRS Foundation (formally called the International Accounting Standards

Committee Foundation or IASCF) is a not for profit, private sector body that

oversees the IASB.

The objectives of the IFRS Foundation, summarized from its document IFRS

Foundation Constitution, are to:

• Develop a single set of high quality, understandable, enforceable and

globally accepted IFRS Standards through its standard-setting body,

the IASB;

• Promote the use and rigorous application of those standards;

• Take account of the financial reporting needs of emerging economies

and small-and medium-sized entities (SMEs); and

• Bring about convergence of national accounting standards and IFRS

Standards to high quality solutions.

In late 2018, the IFRS Foundation Constitution had been amended mainly

regarding the tenure terms which the Trustee Chair and Vice-Chairs may hold

their positions for, and how they can be appointed. The main four objectives

have not changed.

As at January 2019, the IFRS Foundation is made up of 22 named trustees,

who essentially monitor and fund the IASB, the IFRS Advisory Council and the

IFRS Interpretations Committee. The Trustees are appointed from a variety of

geographical and functional backgrounds.The structure of the IFRS Foundation and related bodies is shown below.

• IFRS Advisory Council

The IFRS Advisory Council (formally called the Standards Advisory Council or

SAC) is essentially a forum used by the IASB to consult with the outside world.

It consults with national standard setters, academics, user groups and a host

of other interested parties to advise the IASB on a range of issues, from the

IASB’s work program for developing new IFRS Standards to giving practical

advice on the implementation of particular standards.

The IFRS Advisory Council meets the IASB at least three times a year and putsforward the views of its members on current standard-setting projects.

• IFRS Interpretations Committee

The IFRS Interpretations Committee (formally called the International Financial

Reporting Interpretations Committee or IFRIC) was set up in March 2002 and

provides guidance on specific practical issues in the interpretation of IFRS

Standards. Note that despite the name change, interpretations issued by the

IFRS Interpretations Committee are still known as IFRIC Interpretations. In

your exam, you may see the IFRS Interpretations Committee referred to as the

IFRSIC.

The IFRS Interpretations Committee has two main responsibilities:

i. To review, on a timely basis, newly identified financial reporting issues not

specifically addressed in IFRS Standards.

ii. To clarify issues where unsatisfactory or conflicting interpretations have

developed, or seem likely to develop in the absence of authoritative

guidance, with a view to reaching a consensus on the appropriatetreatment.

Application activity 1.2

1. What is the purpose of IAS 37?

2. What is IFRS?

3. Discuss the main objectives of IFRS Foundation.

4. What are the objectives of the IFRS Foundation as they are included

in the document of the IFRS Foundation Constitution?

5. Explain the two main responsibilities of the IFRS Interpretations Committee.

1.3 International Financial Reporting Standards (IFRS

Standards)

Learning Activity 1.3

International Financial Reporting Standards (IFRS) that consist of a set

of accounting rules that determine how transactions and other accounting

events are required to be reported in financial statements.

Required: Mention any two IFRS Standards or IAS that you know.

IFRS Standards are created in accordance with due process. There are currently25 IAS Standards and 16 IFRS Standards in issue.

1.3.1 The use and application of IFRS Standards

The IFRS Standards have helped to both improve and harmonize financial

reporting around the world. The standards are used in the following ways:

• As national requirements

• As the basis for all or some national requirements

• As an international benchmark for those countries which develop

their own requirements

• By regulatory authorities for domestic and foreign companies• By companies themselves

1.3.2 Standards-setting process

The IASB prepares IFRS Standards in accordance with due process. You do

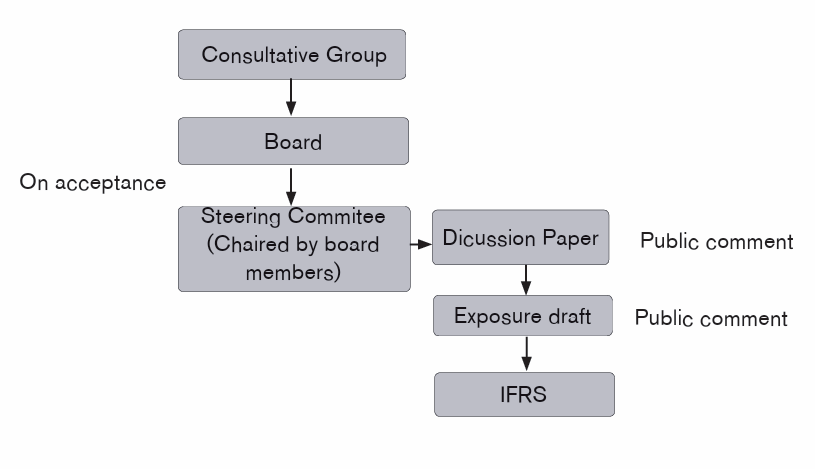

not need this for your exam, but the following diagram may be of interest.The procedure can be summarized as follows.

Current IFRS Standards

The current list is as follows. Those examinable in Financial Accounting are

marked with a *.

Conceptual Framework for Financial Reporting 2018 *

IFRS 1 First-time adoption of International Financial Reporting Standards

IFRS 2 Share-based payment

IFRS 3 * Business combinations

IFRS 4 Insurance contracts

IFRS 5 Non-current assets held for sale and discontinued operations

IFRS 6 Exploration for the evaluation of mineral resources

IFRS 7 Financial instruments: disclosures

IFRS 8 Operating segments

IFRS 9 Financial instruments

IFRS 10 * Consolidated financial statements

IFRS 11 Joint arrangements

IFRS 12 Disclosure of interests in other entities

IFRS 13 Fair value measurement

IFRS 14 Regulatory deferral accounts

IFRS 15 Revenue from contracts with customers

IFRS 16 * Leases

IAS 1 * Presentation of financial statements

IAS 2 * Inventories

IAS 7 * Statement of cash flows

IAS 8 Accounting policies, changes in accounting estimates and errors

IAS 10 * Events after the reporting period

IAS 12 Income taxes

IAS 16 * Property, plant and equipment

IAS 19 Employee benefits (2011)

IAS 20 Accounting for government grants and disclosure of government

assistance

IAS 21 The effects of changes in foreign exchange rates

IAS 23 Borrowing costs

IAS 24 Related party disclosure

IAS 26 Accounting and reporting by retirement benefit plans

IAS 27 * Separate financial statements (2011)

IAS 28 * Investments in associates and joint ventures (2011)

IAS 29 Financial reporting in hyperinflationary economies

IAS 32 Financial instruments: presentation

IAS 33 Earnings per share

IAS 34 Interim financial reporting

IAS 36 Impairment of assets

IAS 37 * Provisions, contingent liabilities and contingent assets

IAS 38 * Intangible assets

IAS 39 Financial instruments: recognition and measurement

IAS 40 Investment property

IAS 41 Agriculture

Various exposure drafts and discussion papers are currently at different stages

within the IFRS process, but these are not concern to you at this stage.

1.3.3 Scope and application of IFRS Standards

Scope

Any limitation of the applicability of a specific IFRS is made clear within that

standard. IFRS Standards are not intended to be applied to immaterial items,

nor are they retrospective. Each individual standard lays out its scope at the

beginning of the standard.

Application

Within each individual country, local regulations govern to a greater or lesser

degree, the issue of financial statements. These local regulations include

accounting standards issued by the national regulatory bodies and/or

professional accountancy bodies in the country concerned.

Application activity 1.3

1. How many IAS Standards and IFRS Standards are currently in

issue?

2. In which ways the IFRS Standards are used?

Skills Lab

Students must visit any company and analyze operating environment, they

will then discuss if the company applies any regulatory system, accounting

standards developed by International Accounting Standards Committee

(IASC) Foundation and International Financial Reporting Standards (IFRS

Standards) arising from their operations.

End unit assessment

1. Which of the following is not an objective of the IFRS Foundation?

a) To enforce IFRS Standards in most countries

b) To develop IFRS Standards through the IASB

c) To bring about convergence of accounting standards and IFRS

Standards

d) To take account of the financial reporting needs of SMEs

2. Fill in the blanks.

The IFRS…………………………………issues…………………….

……………. which aid users’ interpretation of IFRS Standards.

3. How many IAS Standards and IFRS Standards are currently in

issue?

4. The IFRS Foundation is a government-controlled body, based in the

EU. True or False?

5. The IASB is responsible for the standard-setting process. True or

False?

6. Olivier is a trainee accountant with ICPAR. One of his friends, who

works in a local supermarket, said the following: “I don’t know why

you waste your time getting qualified-everyone does whatever they

like when it comes to accounting.

Required:

List and describe the various regulations that need to be considered

when performing the financial accounting function within a business.

7. There are those who suggest that any standard-setting body is

redundant because accounting standards are unnecessary.

Required:

Discuss the statement that accounting standards are unnecessaryfor the purpose of regulating financial statements.