UNIT 6: IDENTIFICATION OF COST ACCOUNTS

Key unit competence: Identify and recording cost accounts used in organizationIntroductory activity

URURABO MANUFACTURING PLC located in Musanze, manufacturing

three products: biscuits, banana juice and banana beer using many

different costs. During the year 2020, it made a number of transactions

like payment of workers, purchase of raw materials and others activities

for producing a product. But they did not know how much was used for

producing each product. This is because it was not aware of cost used

in purchasing of raw materials during the period and transport made.

URURABO also had no idea on other expenditures for the same period.

Besides, it was very hard for URURABO to know what to plan for the

forthcoming year. It advised itself to go for deep checking on invoices for

the period, but failed because some invoices were missing! Due to that

critical situation.

Questions?

1. What was the mistake URURABO MANUFACTURING PLC did?

2. What do you think as a sustainable answer to avoid that mistakefrom happening again?

6.1. Introduction to cost accounts

Learning Activity 6.1Analyse the picture below and answer questions that follow:

Question:

1. According to your observation, what do you see in this picture?

2. What are they doing?

6.1.1. Inter-locking accounting system

A control account is a summary account in the general ledger that is supported

in details by individual accounts in a subsidiary ledger.

In cost accounting the cost books are basically maintained under the two

systems namely Non-Integral or non-integrated cost accounting orInterlocking accounts and Integral or integrated cost accounting.

It is known as non- integrated accounting system referring to a traditional system.

Under this system, the enterprise keeps separate cost accounts from financial

accounts. The cost ledgers are quite independent of the financial ledgers. In

other words, Interlocking accounting system is a system in which company

records its transactions on the basis of

financial accounting principles and cost accounting principles separately. It

means there will be two records of accounts; one is financial accounts recordand second is cost accounts record.

The cost accounts use the same basic data as the financial accounts but

frequently adopt different bases for matters such as depreciation and stock

valuation. Interlocking accounts is a system in which the cost accounts are

distinct from the financial, the two sets of accounts being kept continuously inagreement by the use of control accounts.

The separate ledgers are kept and cost accounts display the following features:

a) There are no double entries that span the two ledgers

b) There is control account (General ledger adjustment account) in the

cost ledger. This account helps to complete the double entry and make

the cost ledger self-balancing.

c) The financial ledger is the normal ledger that is found in bookkeeping.It is not in any way affected by the existence of the cost ledger.

The financial accounting department maintain the following financial

ledgers:a) General ledger that contains all real, nominal and personal accountsThe cost accounting department maintains the following cost ledgers:

except for account receivable and account payable.

b) Accounts receivable ledger that has all personal accounts of trade

debtors

c) Accounts payable ledger that has all personal accounts of trade

creditors.a) Store ledger containing all accounts of individual items of rawCONTROL ACCOUNTS

materials, components and consumable stores.

b) Work-in-progress ledger containing all cost of material, wages and

overheads for each job or manufacturing in progress are posted to the

respective job accounts in this ledger.

c) Finished goods/stock ledger containing accounts of all types of

finished goods. A separate account is opened for each type of finished

product.

d) Cost ledger: recording impersonal accounts i.e accounts relating toincome and expenditure.

A control account is a summary account where entries are made for totals of

transactions for a period and kept for each subsidiary ledger.

The main purpose of cost control accounts is to minimize and detect accounting

errors such as non-posting, incorrect postings, check that all effective expenditure

is accounted for in the cost accounts with double entry proof, provide an

effective system of internal check since there is cross checking of work done by

different persons. This leads to greater accuracy of records, summarize masses

of detailed information contained in the subsidiary ledger and this provides

immense help to management in policy formulation and facilitate compilationof financial accounts and reconciliation with financial accounts.

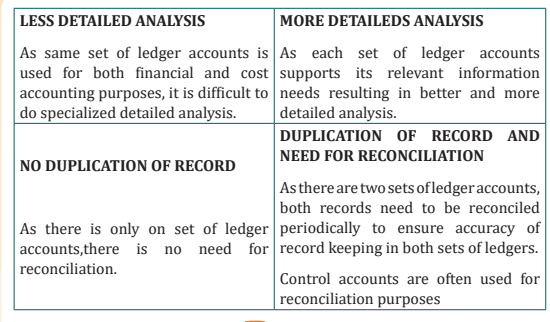

– Advantage of interlocking accounting systemMain benefit of interlocking accounting system is for big companies tokeep

double record by independent accountants. So, there is less chance of fraud

and mistake because in reconciliation process, such fraud and mistake can be

found by auditor.-Disadvantages of interlocking accounting systemHence we keep double set of accounts (cost and financial ) we therefore need

the reconciliation of cost and financial accounts for finding the reason of not

matching of cost accounts records with financial accounts records from the

same period of time. Due to its separate accounting staff for keeping two

separate sets of accounts, the system becomes costly. Finally the periodic result

(cost profit and financial profit) from both systems confuses the users.

6.1.2. Integrated accounting system

Integrated accounting is defined by the Chartered Institute of Management

Accountants (CIMA) as “a collection of accounting records that offers financial

and cost accounts using a common data input for all accounting purposes.” This

is a single accounting system which contains both financial and cost accounts

that is, there is no division between financial and cost accounts.– Advantages of integrated system• Accounting policies are standardized

• There is no need for duplication source documents

• There is no problem of reconciliation as there will only be one profit

amount.

• Cost data can be presented promptly and regularly

• The system is economical and easy to understand

• Integrated accounting helps in widening the outlook of the accountant

and his staff and in return they appreciate the entire accounting system.

• All cost data and accounts are automatically checked and thus cost figures

are accurate.

• All the accounts are maintained in an objective form; the process of cost

ascertainment and cost control is facilitated.– Disadvantages of integrated system• It is costly system

• Integrated accounting system is comparatively more sophisticated and

hence its handling requires trained and more efficient persons

• Not suitable if cost and financial data are required to be separately

presented.– Factors that should be considered before established an integratedcost accounting system.

• Degree of integration

This should be determined early in advance. Some business firms may

integrate up to the stage of prime cost or factory cost. On the other hand, many

undertakings integrate the whole of the records.

Provisions for accrued expenses,

Prepayments and stocks should be dealt with by transfer to suitable suspense

accounts, so that the balance remaining in each control account represents the

charges for the period.

• Control accounts

In place of classifying expenditure according to its nature, control accounts

may be prepared for each of the elements of cost, such as ;material control

account, direct labour control account, factory overheads control account,

administration overhead control account, selling and distribution overheads

control account.

• Cost accumulation purposes

Full details about the cost the cost data are provided to the cost accounting

department so as to achieve the following objectives. To form the basis of

journal entries so that the control accounts can be charged to suitable revenue

accounts resulting into a cost of sales accounts and to provide the necessary

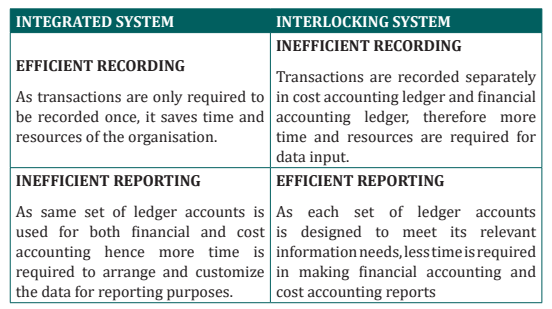

costing data.– Comparison between integrated system and interlocking system

Application activity 6.1

1. Explain the meaning of the following terms in regard to the cost and

financial accounting systems:

i) integrated cost accounts

ii) interlocking cost accounts

iii) cost ledger control account

2. Identify two factors that should be considered before establishingan integrated cost accounting system.

6.2. Recording and analysis of information relating to cost accounts.Learning Activity 6.2

We have many professions and careers to be engaged in. Some people

become teachers, medical doctors, other people become engineers and

yet others work as priests, pastors, sheikhs, traders or farmers. In the

business world, some of the mostly heads or leaders of business companies

are accountants by profession. What accountants do is very important for

every business or enterprise because accountants help in the management

of finances for a service enterprise or a manufacturing company. As a

manager of manufacturing company, you don’t need to be an accountant

by profession but you need to have basic knowledge and skills of recording

and analyzing accounting information. The need to know the basics of

accounting is crucial even if you are running a small enterprise and cannot

afford to employ a fulltime accountant. Knowledge of accounting also helps

you make informed decisions, because accounting is the language of all

kind of business.

Questions

1. What do you think accountants do?

2. What do you think the accounting is for?

3. Is it necessary for company to record and analyze accounting

information?

6.2.1. Recording by inter-locking system.

This is a system of cost accounting in which the cost accounts have no double

entry connection with the financial accounts but use the same basic data.

Under this system, cost ledger and financial ledger are maintained separately.

Cost profit and financial profit do not agree in most of the cases and these arereconciled at the end of the year. Cost ledger contains only impersonal accounts.

There are normally four ledgers in costing department:

1. Cost ledger,

2. Store ledger,

3. Work-in-progress ledger and4. Finished goods ledger.

For all these ledger, one control account is maintained in the cost ledger.

The main cost control accounts maintained in the cost ledger are:

1. General ledger adjustment account

This account is also called “Cost ledger control account” or “cost ledger

contra account”

This account takes place of the personal accounts because in cost ledger only

impersonal accounts are maintained. All entries from financial accounts to cost

accounts should pass through this account.

The main objective of this account is to complete the double entry in the cost

ledger.

Any entry which is to be made in real accounts or personal accounts is made in

this account.

The balance in the “general ledger adjustment account “ represents the total of

all the balances of the impersonal accounts. 2. Stores ledger control account

This account shows the receipt of materials purchased and issues of materials

to production department.

The returns of materials to suppliers or returns from production department

are also recorded in this account.

3. Wages control account

It is under this account that all types of wages and labour cost incurred are

recorded. this accounts acts as a clearing house for wages incurred and

absorbed.direct wages are normally transferred to work-in- progress accounts

and indirect wages are transferred to respective overheads control accounts.

This account shows the total wages paid to the employees.

This account does not have any closing balance.

4. Production Overhead Account

This account shows the production overhead expenditure incurred and charged

to production.

This accounts contains the factory expenses.it is debited with indirect expenses

and credited with the amount of overheads recovered. Overheads allocated to

work-in-progress are carried over to next period. The balance in the control

represents under or over absorption and is transferred to costing profit and

loss accounts.

5. Administration Overhead Account

This account shows the administration overhead expenditure incurred and

charged.

The administrative overheads incurred is debited on this accounts and credited

with the amount of overheads recovered, any balance on account is transferred

to costing profit and loss account.

6. Selling and Distribution Overhead Account

This account shows the Selling and distribution overhead expenditure incurred

and charged.

Selling and distribution costs are debited to this account and the credit side

captures the overheads recovered from goods sold. In case of any balance on

this account, it is transferred to costing profit and loss account.

7. Work-in-progress Ledger control Account

This account shows the material cost, direct wages, production overhead

allocated and cost of finished goods.

The balance in this account represents the value of the Work-In-Progress at the

end of the year

8. Finished goods Ledger control Account

This account shows the material cost of completed jobs and cost of finished

goods sold.

9. Cost of Sales Account

This account shows the total cost of goods sold during a specific year.

10. Costing Profit and Loss Account

This account shows the sales, total cost of sales, adjustments regarding over orunder charge of overheads and costing profit for a specific year.

FOR EXAMPLE1. Materials

a) Purchase of materials for stock (cash or credit basis)

Dr Stores ledger control a/c

Cr General Ledger adjustment a/c

b) Returns to suppliers:

Dr General Ledger adjustment a/c

Cr stores ledger control a/c

c) Material purchased for a specific job ( i. e direct issue)

Dr Work-in-progress control a/c

Cr General ledger adjustment a/c

d) Direct material issued from stores to job

Dr Work- in- progress control a/c

Cr stores ledger control a/c

e) Material returned from jobs to stores:

Dr Stores ledger control a/c

Cr Work-in- progress control a/c

f) Issue of indirect materials:

Dr Factory overheads control a/c

Cr stores ledger control a/c

g) Transfer of material from one job to another:

Dr Receiving job a/c

Cr giving job a/c

h) Normal wastage of material and stores:

Dr Factory overheads control a/c

Cr stores ledger control a/c

i) Abnormal wastage of materials:

Dr Costing P & L a/cCr stores ledger control a/c

j) Abnormal gain of materials:

Dr Stores ledger control a/cCr costing P &L a/c

2. LABOUR

a) Payment of direct wages:3. DIRECT EXPENSES

Dr Wages control a/c

Cr General ledger adjustment a/c

b) Allocation of direct labour:

Dr Work-in- progress a/c

Cr wage control a/c

c) Payment of indirect labour cost:

Dr Wages control a/c

Cr To General ledger adjustment a/c

d) Allocation of indirect labour cost:

Dr Overheads control a/c

Cr wages control a/c

e) Normal Idle time cost :

Dr Factory overheads control a/c

Cr wages control a/c

f) Abnormal Idles time cost:

Dr Costing P & L a/c

Cr wages control a/cDr Work-in-progress control a/cCr General ledger adjustment a/c

4. OVERHEADSa) for recording overheads incurred and accrued:

Dr Factory control a/c

Dr Administration control a/c

Dr Selling and distribution control a/c

Cr To General ledger adjustments a/c

b)Allocation of factory overheads:

Dr Work- in-progress control a/c

Cr Factory overheads control a/c

c)Absorption of administration overheads

Dr Finished stock ledger control a/c

Cr administration overheads control a/c

d)absorption of selling and distribution overheads

Dr cost of sales a/c

Cr selling and distribution overheads control a/c

e) If under/over absorbed amounts are carried forward to subsequent year,

the balance of each overheads a/c will have to be transferred to respective

overheads suspencse (or reserve) account as follows

i) Dr production overheads a/c

Cr productions overheads suspense a/c

( for over recovery)

ii) Dr Administration overheads suspense a/c

Cr administration overheads a/c

(for under recovery)

iii) Dr selling and distribution overheads suspense a/c

Cr selling and distribution overheads a/c(for under recovery)

f) In case of under/over absorbed are transferredto costing P& L a/c then there levant entries will be as follows:

i) For over recovery.

Dr Overhead control a/c

Cr costing profit and loss a/c

ii) For under recovery

Dr costing P&L a/c

Cr Overhead control a/c5. FINISHED GOODS or COMPLETED JOBS

a. Transfer of completed jobs or finished goods produced to finished

goods ledger

Dr Finished stock ledger control a/c

Cr work-in-progress control a/c

b. Transfer of finished goods sold:

Dr Cost of sales a/c

Cr finished stock ledger control a/c

c. Transfer of cost of sales a/c to P&L a/c

Dr costing P&L a/c

Cr cost of sales a/c

d)To records sales:

Dr General ledger adjustment a/c

Cr costing P&L a/c

6. TRANSFER OF PROFIT OR LOSS

a. In case of profitDr Costing P&L a/cCr To General ledger adjustment a/cTREATMENT OF CARRIAGE INWARDS

b. In case of loss:

Dr General ledger adjustment a/cCr To Costing P&L a/c

The carriage inwards should be normally added to the purchase price of

materials. However, this expenses can be also recovered through production

overhead. In this case:

Carriage Inward

Dr: Production overhead account

Cr: General ledger adjustment account

CAPITAL ORDERS

If capital expenditure is incurred, it is transferred to an appropriate asset

account. The improvements to plant and machinery, tools and buildings are

mostly carried out by the workers of a manufacturing company. A capital

order account is opened for each item of capital work to be performed and all

expenditure incurred is charged to that capital order.

When a capital order is completed, the entries are made as under,

Dr: Capital order account

Cr: Work-in-progress ledger account.

The asset when capitalized is transferred to the financial ledger by the following

order:

Dr: General ledger adjustment account

Cr: Capital order account.

SPECIAL REPAIRS ORDERS

Sometimes special repairs orders are received by the production department.

When the repairs are completed, these repairs orders are closed.

On completion, the following entries are made:

Dr: Special repairs order account

Cr: Work-in-progress ledger control account.

The cost of the repair is then charged to the department for which the work

was carried out. In this case:

Dr: The respective department (e.g. production O.H account or selling and

distribution O.H account)Cr: Special repairs order account.

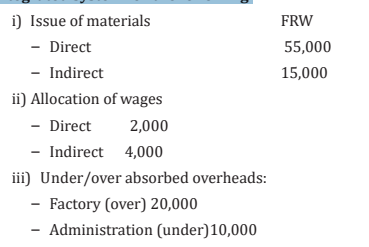

EXAMPLE: Prepare journal entries in the cost books maintained on non-integrated system for the following:

Answer

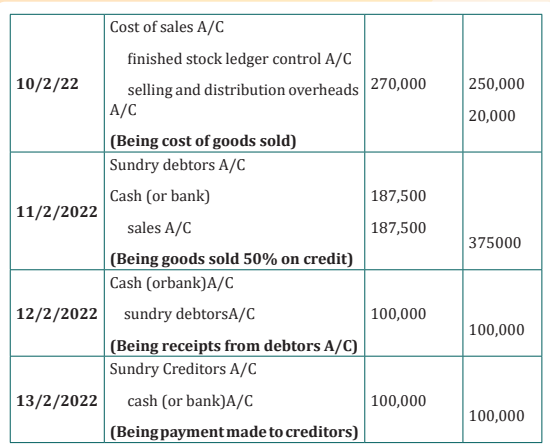

6.2.2. Reconciliation of cost and financial accounts

In case of interlocking accounts, the difference can arise between the profits

shown by the cost accounts and the financial accounts. It is essential to reconcileit these differences to ensure that there are no errors in both sets of accounts.

The differences in financial and costing profit can arise due to the following

items:

a. Items shown only by one set of accounts

There are some items which appear only in one set of accounts.

Some items appear only in the financial accounts and similarly some itemsappear only in the cost accounts.

The following items appear only in the financial accounts:

* Financial expenses * Financial income

1. Fines and penalties 1. Rent receivable

2. Donations 2. Interest received on bank deposits

3. Interest on bank loans 3. Dividends received

4. Stamp duty paid on issue of shares 4. Profit from sale of fixed assets5. Losses from sale of fixed assets

The following items appear only in cost accounts:

* Notional interest: is that interest which is charged by the management on

the capital invested by the Owners (the main purpose of this

charge is to show the nominal cost of the capital employed in the business

rather than investing it outside the business)

* Notional rent: shows the nominal rent charge of premises owned by thecompany.

This shows the cost of these premises rather than renting these premises to

outsiders.

Note: Notional interest and notional rent do not affect reconciliation between

financial and cost accounts, because in the reconciliation statement we start

with costing profit.

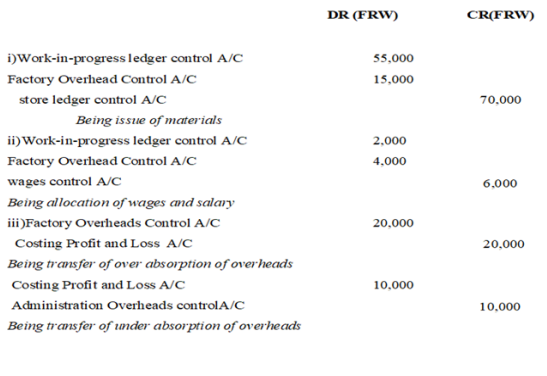

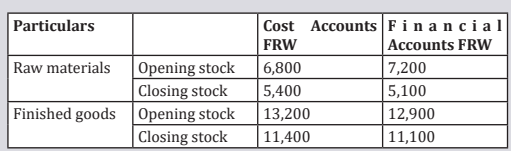

b. Difference bases of stock valuation

Different bases of stock valuation are adopted in the financial accounts and cost

accounts.

In financial accounting, stock is valued either at cost or net realisable value

whichever is the lower.

In cost accounting, different methods of stock valuation are adopted (LIFO,

FIFO, Average price, AVCO,...)

The differences in stock valuation will affect the profits or losses shown by the

two sets of accounts.

• X: is financial Accounting

• Y: is cost accounting

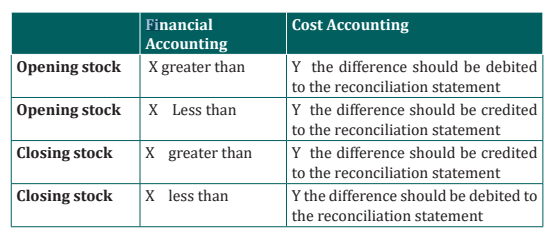

c. Overheads

In the financial accounts, the actual overhead expenses are charged to profitand loss account.

In cost accounts the overheads are absorbed at predetermined rates. The

differences in overheads affect the reconciliation between the financial andcost account.

If overheads charged in financial accounts are greater than cost accounts, thenthis difference should be debited to reconciliation statement and vice versa.

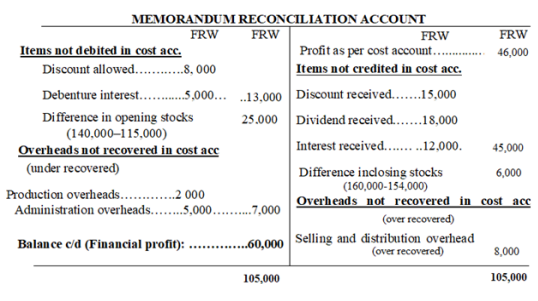

A memorandum reconciliation account is prepared to reconcile financial profitand cost accounting profit.

The following procedure is adopted in this case:– Start with the costing profit6.2.3. Memorandum reconciliation account

– Insert the differences on the debit and credit sides– The balancing figure will be identical to the financial profit

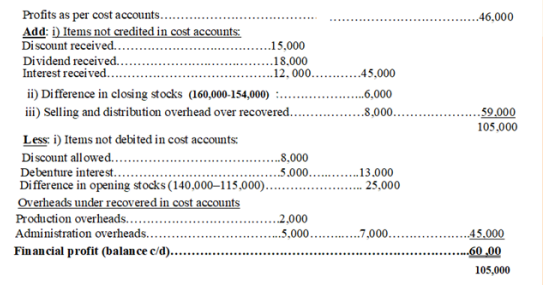

Reconciliation of Cost and Financial Accounts is the process to find all the

reasons behind disagreement in profit which is calculated as per cost accounts

and as per financial accounts. A reconciliation statement is a statement which

is prepared to reconcile the profit as per cost accounts with the profit as per

financial accounts by suitably treating the causes for the difference betweenthe cost and financial profit.

– Reconciliation Memorandum account formatProfit as per cost accounts XXXX

Add: Excess of opening stock value in cost A/C over financial A/Cs XXXX

Excess of closing stock value in financial A/Cs over cost A/Cs XXXX

Excess of depreciation charge in cost A/C over financial A/C XXXX

Dividends received XXXX

Profit on sales of fixed assets XXXXInterest received (other income) XXXX

Less: Excess of opening stock value in Financial A/C over cost A/Cs (XXXX)

Excess of closing stock value in cost A/Cs over financial A/Cs ( XXXX)

Excess of depreciation charge in cost A/C over financial A/Cs (XXXX)

Dividends Paid/proposed (XXXX)

Interest Paid (XXXX)Tax Paid (XXXX)

PROFIT AS PER FINANCIAL A/Cs XXXX

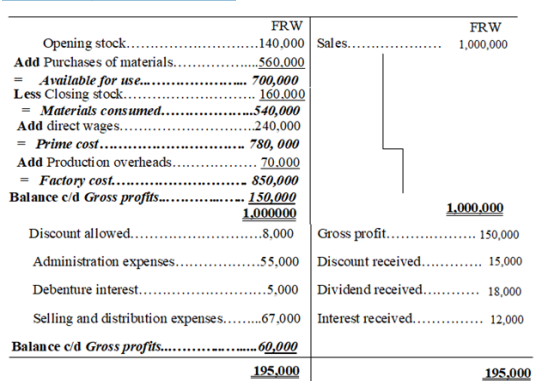

Illustration.

The cost accounting profit of XYZ Ltd for the year ended 31st December 2020

was FRW 46,000 whereas the financial profit for the same period was FRW

60,000. You are required to prepare a reconciliation statement given thefollowing information:

* The cost accounting records show:a) The opening and closing stocks were FRW 115,000 and FRW 154,000The financial trading and profit and loss account XYZ Ltd for the year ending

respectively,

b) Production overheads recovered was FRW 68,000

c) Administration overhead was absorbed at 5% of sales

d) Selling and distribution overhead was recovered at 7½% of sales

e) Notional rent and interest on capital were FRW8,000 and FRW 6,000respectively.

December 31, 2020 was as under:

Answer

Workings

Administration overhead charged in cost accounts was 5% of sales:

1,000,000 x 5% = FRW 50,000

Selling and distribution overhead charged in cost account 7.5% of sales:

1,000,000 x 7.5% = FRW 75,000

Note: Notional rent and notional interest on capital do not affect reconciliationstatement

MEMORANDUM RECONCILIATION ACCOUNT

Alternative method (vertical format)

MEMORANDUM RECONCILIATION ACCOUNT

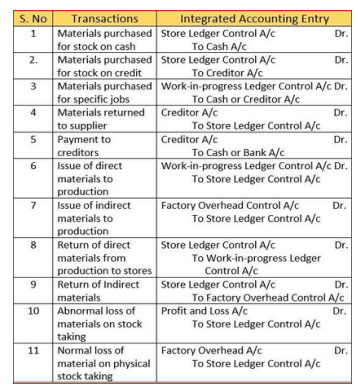

6.2.4. Integrated accounts /integrated system.

This is a single set of account which provides both financial and cost accounting

information This system is also known as integrated accounting system.

Under this system, personal and impersonal accounts are maintained in the

ledger.

Cost profit and financial profit are similar and there is no need of reconcilingthe cost and financial acc.

Although, the usual real and personal accounts are maintained but the nominal

accounts follow the principlesof cost accounting system. It means there

are accounts for stock, production, administration, selling and distributionoverheads followed by such final accounts as cost of sales, profit and loss etc

In integrated accounting system, the following two methods can be adopted:a) The double entry methodThe double entry methodb) The third entry method

In this system, the cost ledger includes the creditors’ control account, the

cash account, the provision for depreciation account and the debtors’ controlaccount in place of the general ledger cost control account.

The third entry method

This method is similar to the double entry method but incorporates an extra

account called the cost control account in which the costs are collected that canbe analyzed in memorandum account which is outside the double entry system.

The cost control account then enables the costs to be charged to finished goodsaccount and other accounts by using it as the double entry

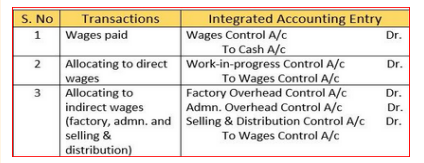

Materials

Labor

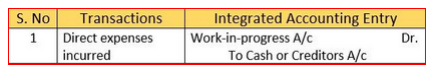

Direct expense

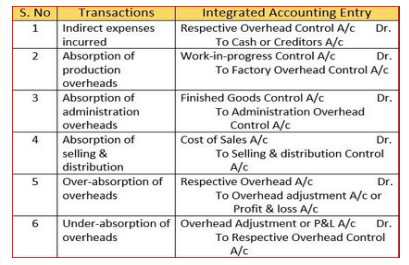

Overheads

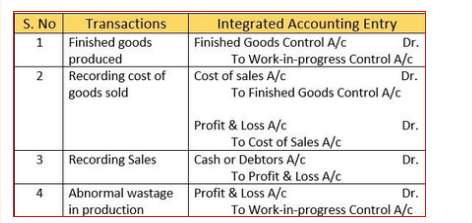

Other transaction

Illustration

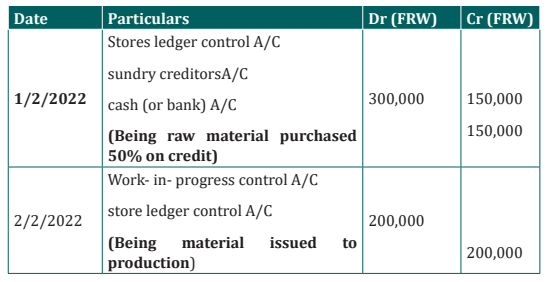

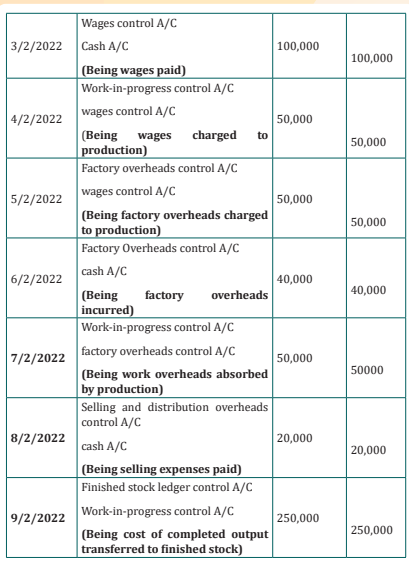

URURABO Enterprise operates an integrated system of accounting.

Journalize the following transactions:

1/1/2022. Raw material purchased (50% on credit) FRW 300,000

2/1/2022. Material issued to production FRW 200,000

3/2/2022. Wages paid (50%Direct) FRW 100,000

4/2/2022. Wages charged to production FRW 50,000

5/2/2022. Factory overheads incurred FRW 40,000

6/2/2022. Factory overheads charged to production FRW 50,000

7/2/2022. Selling and Distribution overheads incurred FRW 20,000

8/2/2022. Finished goods at cost FRW 250,000

9/2/2022. Sales (50%credit) FRW 375000

10/2/200. Closing stock nil

11/2/2022. Receipts from debtors FRW 100,000

12/2/2022. Payments to creditors FRW 100,000

ANSWER

Journal Entries (integrated system)

Application activity 6.2

1) Explain the meaning of the following terms in the context of cost

accounting under interlocking system.a) Notional rent2) Outline the advantages to a business firm of using an integrated

b) Dividends received

c) Notional interest

d) The double entry method

e) The third entry method

cost accounting system.

3) State possible causes of differences between reported profit in cost

accounting and financial accounting under the non-integrated cost

accounting system.

Skills Lab 6

Identify any Manufacturing Company in around your location. Visit that

company and find out if the company keeps any records. Identify the

records that are kept and the kind of company information such records

capture. Analyze the identified records, interpret them and advice this

company on what to do to be able to earn desired profit. Generate a reportof your findings.

End of unit assessment 6

I. Choose the correct answer1) Issue of material is credited to:2) The cost of materials, wages and overheads of each job undertaken

a) Stores ledger control A/C

b) Work-in progress control A/C

c) Overheads control A/C

d) Cost ledger A/C

is posted ina) General ledger adjustment account3) Non-integrated system of accounting is also known as

b) Stores ledger control accounts

c) Work- in-progress ledger

d) Finished goods control accounta) Cost ledger accounting4) Ledger control account is :

b) Interlocking accounting system

c) Cost ledger accounting or interlocking accounting system

d) Cost Centre accountinga) An account in the cost ledger to record financial accounting itemsThe financial accountsof NMG manufacturing Company showed a profit

b) An accounting in financial ledger to record financial accounting

items

c) An account that summarized outstanding payables balances

d) An accounting that summarizes outstanding receivables balances

of FRW 22,700 and for the same period the cost accounts showed a

profit of FRW 23,100. Comparison of the two sets of accounts revealed

the following:

a) Stock valuations:

No rent is shown in the financial accounts but a notional rent of FRW

1,500 was charged in the cost accounts during the period.b) During the period the company sold an old machine and madeRequired: Prepare a Memorandum reconciliation account for NMG

a loss of FRW2,100 on the sale.This was not recorded in the

cost accounts.

c) Depreciation charge in the financial accounts was FRW2,500 based

on the straightline method. In the cost accounts depreciation

was charged at a rate of FRW 5 per unit produced. During the

period, the company produced 600units.

d) Other items appearing only in financial accounts include:

– Dividends received FRW 1,300

– Interests paid of FRW 800

– Corporation tax paid FRW 3,300

– Interest income FRW 1,900

– Company donations FRW 800

– Dividends paid FRW 700

– Miscellaneous income FRW 2,800manufacturing company