Topic outline

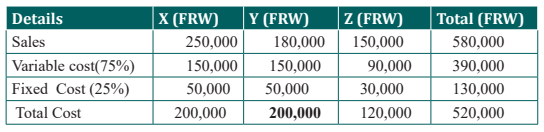

UNIT 1: THE STRUCTURE OF COSTING SYSTEM WITHIN AN ORGANIZATION

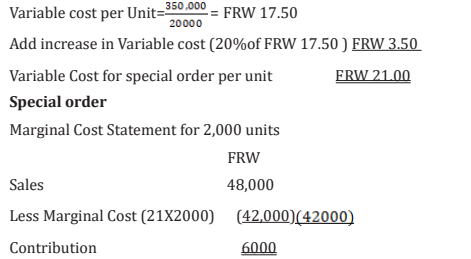

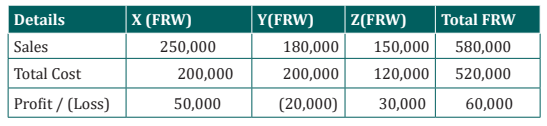

Key Unit Competence: Explain the structure of costing system within anorganization

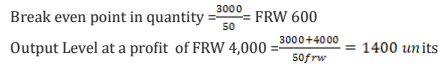

Introductory activity

The Brothers Ltd Co. is a hospitality company operating in Huye District. It

has been hired by its potential customer Neza to serve her wedding ceremony.

The company has been requested to perform different activities: decoration,

meal provision and soft drinks to host such an event, transport facilities from

the beginning to the end of the ceremony, as well as the coordination of

ceremony and to entertain guests. Before signing a contract, The Brothers Ltd

co. exhorted its accountant to firstly assess various costs that will occur for

activities to be performed in order to set affordable price, but the company

was not well informed about the number of people to be hosted for proper

financial valuation of resources to be used in the job completion. Later the

client informed the company that 750 people were approved to attend the

wedding. The company policy is to compute the cost based on material

used, skills required, direct expenses, overhead and the quality of service.

However, accountant has revealed that the amount of money to be spent for

individual item was structured as follows: meal as a product: FRW 3500 and

soft drinks FRW 1,400 per person; decoration and transport as services were

FRW 650,000 and FRW 300,000 respectively as fixed cost; and FRW 150,000

to Master of Ceremony (MC) for his coordinating and organizing role duringthe event.

Question:

1. Basing on the above case study, what is about the scenario?

2. Outline different activities that require cost.

3. Define costing?4. Explain the main costing methods as used in product costing

1.1 Introduction to costing systemLearning Activity 1.1

Ruberwa is soler trader producing and selling bread, juice and biscuits.

Ruberwa as an entrepreneur does not have sufficient skills and necessary

information to compute the cost of each product; he estimates the cost of

product based only on ingredients recorded during the production process.

While selling, he gets many customers due to the lower price resulting

from wrong costing system comparatively to surroundings business.

Considering high sales and getting a lot of money in the pocket, he thinks

that really, he will get high profit; unfortunately, he gets loss at the end of

the year in his financial statement. He decided to hire an accountant for

monitoring and controlling exist costs so as to know the main cause of this

problem. The accountant revealed that information used in computation

of the cost of product was incomplete for each product because the owner

only considered the portion of direct material cost recorded and did not

consider labor cost, direct expenses and overhead incurred during andafter the production process.

RUBERWA was surprised by the cost review report provided by

accountant, the later has been requested to calculate the cost of each

product appropriately. In next accounting period, RUBERWA recognized a

significant profit resulting from good computation of the production costand setting affordable price.

Questions

1. From the above scenario, what do you understand by a costing

system?

2. Identify the lesson you learnt from this case study.

3. As an accountant of Ruberwa, explain he main advantages forinstalling a good costing system in your organization.

1.1.1. Definition of key concepts

Today different business and industry needs different methods for calculating,

monitoring and controlling cost to meet their individual requirements. It

is not possible to devise a single costing system to fulfill everybody’s needs.

Different methods of costing for different industries depending upon the type

of manufacturing and their nature have been developed. Various methods

of ascertaining costs are available to suit the business needs. But the basic

principles are the same in every method.

• Product cost

Product cost refers to the costs incurred to make or produce a product. These

costs include direct labor, direct materials, direct expenses and overhead cost.

• costing

Costing’ refers to the methods and processes of determining costs of a product

manufactured or services rendered. or costing is the technique and process of

ascertaining costs.

• Costing system

Costing system is that system in which we calculate different cost with different

methods and also monitor cost for reducing wastages and misuse of resources.

Costing system comprises of a set of forms, processes, controls and reports that

are designed to aggregate and report to the management about revenue, costs

and profitability. It ascertains product profitability and helps management in

planning and control of business operations.

1.1.2. Characteristics of a good costing system

A good Costing System will consist of the following characteristics:

• The Costing System adopted in a particular organization must suit its

nature and size of business and its information needs.

• The Costing System must be economical to the organization and the benefits

derived from the system should be more than its cost of installation and

operation.

• The system should be more flexible enough to take care of changing

business situations and information needs of the organization.

• The system should be simple to understand and easy to operate. The users

of costing data should be convinced of the Costing System from which the

data is derived.

• The Costing System should ensure proper accounting for materials, labour

and overheads and proper classification of transactions should be done at

the level of recording.

• The Costing System should clearly mention the details of records to be

maintained and the degree of accuracy of data required.

• Since the Costing System is for internal control purpose, it should meet the

requirements of management and its information needs.

• The costing system should fix up the duties and responsibilities of costing

department staff and the cooperation that can be sought from other

departments.

1.1.3. Effective conditions for a good costing system installation

As a system designer, the cost accountant should be able to perceive the needs

of the management at various levels and design such a system as will meet

those needs promptly, effectively and efficiently. The following conditions and

factors must be taken into account when designing a costing system:• Preliminary investigations must be made before a system is installed. ThisThe following factors must be taken into account before finalising the cost

help to discover weaknesses and inefficiencies

• For accuracy of cost records, a system of material cost, labour cost and

production overhead cost is essential

• Nature of business enterprise must be put into consideration when

designing a cost system accounting system. the system developed should

be practical and must suit the business.

• The system must be cost effective in that the benefits derived from the

system must be greater than the cost of running it.

management system• The system must be designed in such a way as to meet managerial1.1.4. Advantages of installation a costing system.

information needs. There should be no duplication in reporting.

• The factory layout and production sequence. This is important for the

identification of the sequence of production.

• The nature of material used affect the system adopted. This is because it

affects the recording and issue of raw materials and method of pricing.

• Control exercise over production: the cost data must focus on specific

areas of control so that any variance between actual and standard cost can

be identified by the individual department.

• The deployment of workers, who may work as a team or as individuals.

This affects the method of remuneration and analysis of time worked.

• Key personnel and office staff, their cooperation is vital for success of the

system. In addition, the system needs to be simple and easy to understand

to enhance acceptability.

• Need for uniformity; a business needs to observe the industrial norms and

thus follow the industrial practices as regards the accounting.

• The cost benefit analysis should be carried out and it is only reasonable to

run a system which has more benefits than cost.

• The system should be capable of adapting to changing conditions.• It should be logical and simple.

Cost accounting has now become the norm in most industries and firms.

Almost all businesses rely on cost accounting information to supplement

the information provided by financial accounting. In fact, cost accounting is

essential not only to businessmen and the management but also to the economy

as a whole.

a. Measuring and Improving efficiency

Cost accounting allows for data that enables the firm to measure efficiency.

This isefficiency in respect to cost, time, expenses etc. Standard costing is then

used to compare actual outcomes with the industry or economy standards to

indicate changes in efficiency.

b. Identification of Unprofitable Activities:

Just because a firm is making overall profits, it does not mean all activities

are profitable. Cost accounting system will help us identify the profitable and

unprofitable activities of the firm. Activities that cause the firm losses can be

made profitable or eliminated. This can happen due to the cost ascertainment

done in cost accounting.

c. Fixing the price

Costing system makes the distinction between fixed and variable cost, which

allows the firm to fix prices in different economic scenario. prices that we fix

without the help of costing system can be too high or too Low and both cause

losses to the business.

c. Control over Stock

Costing system helps with restocking and control over materials. Cost accounting

system will help us determine the most ideal and economic re-order level and

quantities. This will ensure that the firm is never overstocked or understocked.

e. Evaluates the Reasons for Losses

Every firm has to deal with periods of profits and losses, hence they must

always evaluate or investigate the reasons for the losses suffered. This will help

to tackle the problem or overcome the cause by some other means necessary. if

the cause can not be eliminated then at least minimize the losses.

f. Aids Future Planning

One of the biggest advantages of cost accounting system is that it will help the

management with future plans they may have. For any production or selling

plans, it is important to have detailed data about the machines, the labour

capacity, output levels, levels of efficiency of each process.

1.1.5. Challenges in installing of costing system

There are different challenges facing the business at the time of installation a

Costing System:

a. Lack of Support from Top Management

The basic objective of Cost Accounting System is to provide necessary

information to the internal management for the purpose of problem solving,

decision making and control. Without support and recognition from the top

management, the very purpose of Cost System is insignificant.

b. Resistance from Existing Accounting Staff

The existing accounting staff may resist the introduction of Cost Accounting

System in the organization due to fear of loosing job recognition and importance

after the implementation of the system.

c. Lack of Cooperation from other Departments

The employees of other departments may not cooperate for the installation of

Cost Accounting System due to fear of increase in workload as it brings-out

inefficiency etc.

d. Resistance from Operating Level Workers

The foremen, supervisors, workers and other operating level staff may resent

the introduction of cost system on the ground that it will increase their job

responsibilities and paperwork and may fear that it may cause change in wage

structure.

e. Shortage of Trained Staff

The installation and implementation of cost system requires trained, qualified

and experienced staff which may not be available.

1.1.6. Overcoming challenges to costing system

The management of business after finding the above challenges should set

strategies to overcome them. The following are the proposed solutions:

• The management should be convinced of the benefits which can be derived

by installation and operation of a Costing System.

• Non-cooperation and resistance can be overcome by explaining the

simplicity and use of the system and should be assured that the system will

benefit the organization and increase its profitability. They should be given

assurance that the system will not reduce the importance of existing staff.

• To overcome resistance, the existing staff should be properly trained to

take up the responsibilities in the Costing System

• All levels of staff and managers in the organization should be properly

trained and made familiar with the Costing Procedures.

• The system should be simple to understand and easy to operate.

• The benefits derived from Costing System should be more than the costs

incurred on its installation and operation.

• A qualified and experienced cost accountant should be assigned with

responsibility to achieve the desired objectives of the Costing System. He

should be capable of coordinating with other departments.

• The Costing System designed and installed should meet specific

requirements of the concern and it should reduce unnecessary paperwork

of the organization.

• Regular meetings with accounting staff and user departments will clarify

all doubts about the system and eliminate ambiguity.

1.1.7. Steps for installing a good costing system

The steps to be taken into consideration in installing a costing system are given

below:

a. Objective to be achieved through the Costing System

The costing system will be simple if the objective is only to determine cost, but

it will have to be elaborated if the objective is to have information which will

help management in exercising control and taking decisions.

b. Studying the Existing Organisation and Routine

In this connection the points to be noted are the nature of the business and

of the operations or process carried on, extent of responsibility and authority

attached to the various functions, the methods of dealing with wastage of

materials, the system of time recording and the methods of computing and

paying wage.

c. Deciding the Structure of Cost Accounts:

The structure of cost accounts should follow the natural production line; the

sequence can be simple, analytical or synthetic.

d. Determining the Cost Rates

This entails a thorough study of factory conditions and decisions are to be made

about classification of cost into direct and indirect, grouping of indirect costs

into production, selling, administration etc., treatment of wastes of all kinds,

methods of pricing issues, methods of recovering overheads and calculation of

overhead rates.

e. Introducing the System

No costing system can be expected to function effectively unless co-operation

of all the officials could be obtained. Before the system is implemented, the

implications of the system should be explained to all indicating to them the

benefits that will accrue to each and to the business as a whole.

f. Organising the Cost Office

It is always better that the cost office is situated adjacent to the factory so that

delay in routing out documents or in clearing up discrepancies and doubts, is

avoided. The costing staff must be allowed to have access to the works if they

are to perform their duties properly.

1.1.8. Factors to consider for installation of a good costing

system

It is necessary that the costing system is properly installed in an organization.

Costing system installed in an organization should be simple to understand,

easy to operate, highly reliable and suitable to the organization. In designing

and installation of a good costing system, the following factors should be given

due consideration:

a. Size of the firm

Size of the firm is an extremely important factor in designing a cost accounting

system. As the size of the firm and its business grows, the volume and complexity

of the cost data also grows. In such situation, the cost accounting system should

be capable of supplying such information.

b. Manufacturing Process:

Process of manufacturing changes from industry to industry. In some industries,

there may be a continuous process of production while in some batch or job

type of production may be in operation. A cost accounting system should be

such that the manufacturing process is taken into consideration and cost data

is collected accordingly.

c. Nature and Number of Products

If a single product is produced, all costs like material, labor and indirect

expenses can be directly allocated to that product. But if more than one

product is manufactured, the question of allocation and apportionment as

well as absorption of indirect expenses (Overheads) arises and hence the cost

accounting system should be designed accordingly as more complex data will

be required.

d. Management Control Needs: The designing of a cost accounting system in

a business organization is guided by the management control requirements.

The costing system should supply data to persons at different levels in the

organization to take suitable action in their respective areas.

e. Raw Materials: The designing of a cost accounting system in a business is

also guided by the raw materials required for production. The nature of raw

materials and the degree of waste therein influence the designing of costing

system. There are some materials which have a high degree of spoilage.

The costing system should be such that identification of spoilage, keeping

records of materials, pricing of the issues etc are taken into consideration.

f. Organization Structure: The structure of the organization also plays a vital

role in designing a costing system. The system should correspond to thehierarchy of the organization.

Application activity 1.1

1. What are the main characteristics of a good costing system?

2. Complete the following sentences by given terms :

I. Costing refers to the techniques and processes of __________

A. ascertainment of costs.

B. allocation of costs.

C. apportionment of costs.

D. distribution of costs.

II. Cost of sales plus profit is __________.

A. selling price.

B. value of finished product.

C. value of goods produced.D. value of stocks

1.2. Information required in costing systemLearning Activity 1.2

RAVIM Ltd is a manufacturing business which produces high-quality

Soaps compared to existing soap market. The management is not able

to determine the cost of one soap and it sets soap price in reference to

the price of similar soap. At the end of six months, the company prepared

interim financial statement and finds that it made a loss. The management

hired an accountant for installation of a good costing system which could

help the company to determine the cost of the product but the accountant

has not found necessary data to install a good costing system and prepares

a cost sheet which indicates the data needed in his exercise such as cost

of material used, number of employees used , processing cost, number of

hours available per day and overhead absorption cost , the wasted materials

cost during the production process , water and electricity cost, pay rate per

day, packaging cost, overhead cost and the quantity produced during this

period . Accountant decides to meet with different business managers

to collect necessary data related to production process and delivery. After

this exercise he/ she gets necessary data that could allow him/her to

determine the cost of each soap produced and get the opportunity to advise

the managers on the strategies that they can use to reduce the cost of each

department as well as the cost of the soap. This may include reducing theduplication use of resources and reusing existing resources.

Questions

Identify information that an accountant needs to design a good costing system

1.2.1 Identify information required in costing system.

A costing system should collect statistical data for significant operations, analyse

the data, and make it available to the management to support managerial

decision making.

Businesses or industries need sufficient information for installation of costing

system in organization but the type of information required depends on

whether you are a service, trading or manufacturing organization and how you

have structured your cost system. Business needs the following information,

including: volume, material quantities, expected output or yield, scrap factor,

standard time, business capacity, labor hours available, material cost, labor

cost and overhead etc

1.2.2. Explain information required in costing system

The availability of information is the lifeblood of any cost and management

accounting system. It is vital that input information is properly controlled in

order that output information is useful. Such information must be relevant

for management‘s planning, control and decision-making purposes. The

information used in cost and management accounting may be quantitative or

qualitative.

• Quantitative information is information which may be measured in

monetary terms or other physical units eg material may be expressed as

FRW 200 or 500 Kilos. It is easily objectively expressed.

• Qualitative information: is that information which cannot be objectively

expressed. It is therefore very difficult to quantify such information and

for this reason, it is largely subjective. The management accounting mainly

utilizes mixture of the two but mainly quantitative information.

The information required for installation a good costing system are:

• Volume

The volume levels usually drive the number of resources required or consumed

by the organization. It is the starting point for any budgeting or forecasting

exercise and is a critical element to determine capacity utilization and its

impact on the cost structure of the organization.

• Materials quantities

This information is important for business organizations and will generally

be found in the bill of materials. It provides the quantities required of each

component or ingredient that is used to manufacture the product. In some

service organizations, materials may also represent significant costs, for

example, a power generation facility typically consumes a significant amount

of carbon or fuel in the production of electricity.

• Expected output or yield

For process manufacturers, each product should have an expected or theoretical

output for each process based on the key ingredient. In service organizations,

the expected yield represents the expected output of a process based on a fixed

level of input.

• Scrap factor

This factor will reflect how much materials are lost as a normal part of the

process. Discrete manufacturers commonly use the scrap factor to recognize

expected materials losses resulting from breakage, spillage, equipment failures,

and operator errors.

• Process parameters.

Process parameters are used to determine the time standards, particularly

for machine-paced operations. They generally describe the cycle time of the

process such as bottles or capsules per minute and the number of workers

required to run the operation. Process parameters vary significantly from

industry to industry.

• Business process Capacity.

The team should determine the practical and available capacity of each

major business process and how much of this capacity is being utilized. This

information can help identify improvements in capacity utilization and is used

to isolate the cost of excess capacity in the unit cost.

• Materials costs.

This cost represents the actual, standard, forecasted, or estimated cost of

the material components or ingredients that are consumed by the product or

service. The materials costs usually includes the purchase price of the goods

plus other costs such as freight, insurance, royalty payments, tax, brokerage

fees, and duties. In organizations that have high materials costs, focusing on

this area can produce significant cost savings.

• Labor and overhead costs.

This information is necessary to calculate the labor and overhead rate that will

be used to assign these costs to the items being measured. Usually organizations

budget and collect labor and overhead costs by work areas or departments. The

team should ensure that the way the organization is currently collecting actual

costs is consistent with the system design.

Application activity 1.2

1. Explain the information needed to design a good costing system in

organization

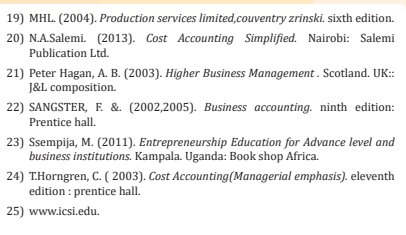

2. Matching questionMatch up the following services with their typical cost units

1.3. Types of costing system

Learning Activity 1.3

PIKU co. is a company which produces and provide different products

such as manufacturing of modern plastic bucket, manufacturing motor

vehicles, construction services and road maintenance, it receives two

purchase orders, one for 2000 plastic buckets and second 5 motor vehicles

and winning two tenders, one for construction a mega building house and

second for road maintenance. The main problem in this company is to

know the method that should be used to calculate the cost of each product.

Purchase order 1: For manufacturing plastic bucket, Kaneza requests 2000

plastic bucket of 10 liters with the following specification: 1000 plastic

bucket should be in a yellow color and the remaining should be in a white

color and the purchase order should be delivered within 15 days. And the

payment will be made on condition that the company supplies all quantity

required in time.

Purchase order 2: For manufacturing the motor vehicle, Muzika Ltd in

its purchase order requests motor vehicle materials that can be used to

manufacture 5 motor vehicle (V6 Tesla) and assembling will be done in

its premises after physical testing; and the payment will be done based on

batch tested.

Tender 1. Rwanda Housing Authority requests PIKU in its bidding

documents to construct a mega Building in Kigali City and the payment will

be done after completing this activity.

Tender 2. Road maintenance: Rwanda Housing Authority has contracted

PIKU Co. to maintain the Huye – Kigali Road of 154 kilometers in a period

of 1 year and the payment will be done on quarterly basis based on workdone. Consider that the maintenance cost of 1 kilometer is FRW 3000,000.

Question

1. What do you understand by costing methods?

2. Explain costing methods that can be used on

a) purchase order one and twob) tender one and two

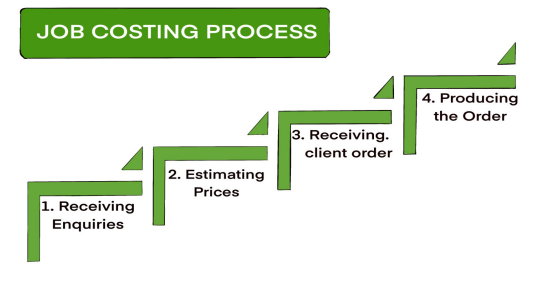

1.3.1. Job Costing

Job Costing: This method is used in Industries or businesses where the

production is per the requirements of the customer. In Job Order, the production

is not on continuous basis, rather it is only when order from customers is

received and made as per the specifications of the customers. Consequently,

each job is different from the other one. Method used in such type of business

organizations is the Job Costing or Job Order Costing.

A costing system is designed to suit the way goods are processed or

manufactured or the way services are provided. Each organisation’s costing

method will therefore have unique features but costing methods of firms in the

same line of business will more than likely have common aspects.

The objective of this method of costing is to determine the cost of each job by

preparing a Job Cost Sheet. A job may be a product, unit, batch, sales order,

project, contract, service, specific program or any other cost objective that is

distinguishable clearly and unique in terms of materials and other services

used. The cost of completed job will be the materials used for the job, the

direct labor employed for the same and the production overheads and other

overheads if any charged to the job

1.3.2. Batch Costing

Batch Costing: In the job costing, we have seen that the production is as per the

orders of the

customers and according to the specifications mentioned by them. On the

other hand, batch costing is used where units of a product are manufactured

in batches and used in the assembly of the final product. Thus, components of

products like television, radio sets, motor vehicle and other consumer goods

are manufactured in batches to maintain uniformity in all respects.

It is not possible here to manufacture as per the requirements of customers and

hence rather than manufacturing a single unit, several units of the component are

manufactured as group. For example, rather than manufacturing a single unit, it

will be always beneficial to manufacture say, 75,000 units of the component as

it will reduce the cost of production substantially and bring standardization in

the quality and other aspects of the product. The finished units are held in stock

and normal inventory control techniques are used for controlling the inventory.

Batch number is given to each batch manufactured and accordingly the cost isdetermined.

1.3.3. Service Costing

Cost Accounting has been traditionally associated with manufacturing

companies. However, in the modern competitive market, cost accounting has

been increasingly applied in service industries like banks, insurance companies,

transportation organizations, electricity generating companies, hospitals,

road transport and railway transport, hotels, road maintenance, educational

institutions, road lighting, canteens, port trusts and several other service

organizations. The costing method applied in these industries is known as

‘Operating Costing’. operating costing is, ‘that form of operating costing which

applies where standardized services are provided either by an undertaking or

by a service cost center within an undertaking’.

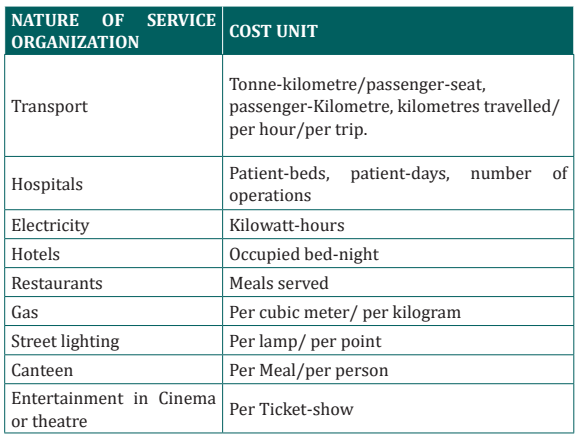

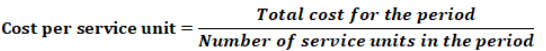

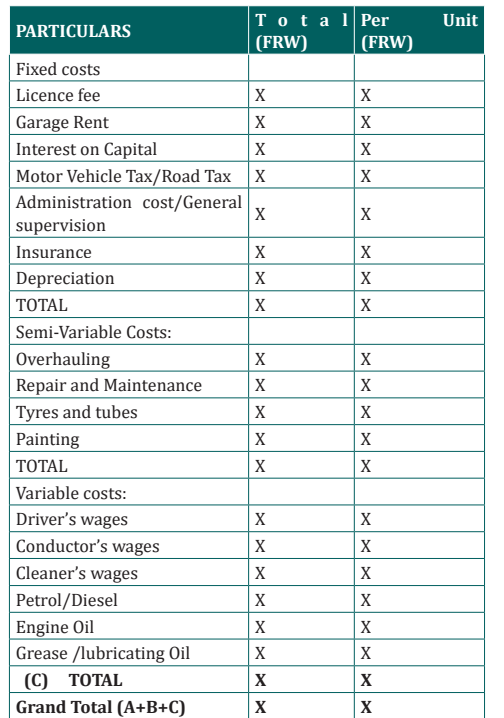

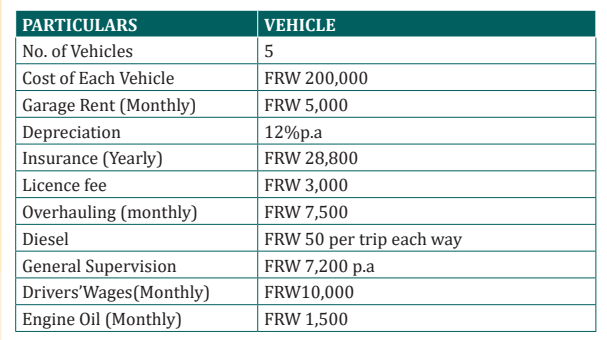

• Nature of Operating Costing:

The main objective of operating costing is to compute the cost of the services

offered by the organization. For doing this, it is necessary to decide the cost

unitin such cases. The cost units vary from industry to industry. For example,

in goods transport industry, cost per tonnne perkilometer is to be ascertained

while in case of passenger transport, cost per passenger per kilometer is to be

computed

1.3.4. Contract Costing

Contract Costing: Contract Costing is a method used in construction industry

to find out the cost and profit of a particular construction assignment.

The principles of job costing are also applicable in contract costing. Contract

Costing can be termed as an extension of Job Costing as each contract is nothing

but a job completed. Contract Costing is used by concerns like construction

firms, civil engineering contractors, and engineering firms. One of the important

features of contract costing is that most of the expenses can be traced to a

particular contract. Those expenses that cannot be traced to a particularcontract are apportioned to the contract on some suitable basis.

Application activity 1.3

1. Differentiate costing method from costing technique.

2. Choose the best alternative.

A. Which of the following organizations should not be advised to

use service costing?

a) Freight rail company

b) IT department company

c) Catering company

d) Clothing company

B. Operating costing is suitable for ___________.

a) job order business.

b) contractors.

c) sugar industries.

d) service industries.

C. Process costing is suitable for _________.

a) hospitals.

b) oil reefing firms.

c) transport firms.d) brick laying firms.

Skills Lab 1

Imagine in your school, students need to consume bread every day and no

one produces bread near the school. Your business club members bring the

idea of bakery but none among the club members has information on what

it requires to produce bread (ingredients, equipments, required skills etc),

As club members research on:

1) Ingredients

2) Equipments3) Skills required in producing bread.

End unit assessment 1

1. Differentiate costing and costing system?

2. complete the following sentence with appropriate words

A. Job costing is used in ..........

a) a) furniture making

b) b) repair shoes

c) c)press printing

d) d) all the above

B. In a job cost system, costs are accumulated

a) On a monthly basis

b) By specific job

c) By department or process

d) By kind of material used

C. Operating costing is suitable for ___________.

a) job order business.

b) contractors.

c) sugar industries.

d) service industries.

1. Suggest the challenges faced during installation of a good costing

system and propose the possible solution for each challenge.

2. BAHO is a profit oriented business which produces and sells

different products such as jeans clothing, Television Manufacturing,

transport services and civil engineering contractors services , its

sales and marketing department has the task to search for themarket of its products.

On 1 January 2023 the company received a purchase order for 1000 jeans

for men and 1000 jeans for women from Terimbere and each jeans should

be delivered at 15000FRW.

On 1 January 2023 the company received a purchase order of 1200

Televisions from AGAHOZO TV shop and each television should be

delivered at 200,000FRW and the payment will be done based on batchdelivered.

15 January 2023 the management was contracted by REB for transporting

students from their homes to their schools and payment was to be made

when all students reached to their schools.

On 20th January 2023 won a tender of constructing model village in

Nyamagabe. The contract specify the terms of payment, first term the

company will receive a half of total amount and the remaining half will be

paid after official handover

Required

a) As cost accountant, some costing method are appropriate to the

above case, highlight at least four and propose a brief explanation

on the Indicator / activities for each costing method using BAHOcase.

UNIT 2: COST BEHAVIOR ANALYSIS

Key Unit Competence: Analyze Cost behavior for decision making

Introductory activity

VUDUKA express Ltd is a transport company operating its business

activities in Rwanda. It has a policy of increasing the numbers of

customers and minimizing costs resulting to the rise of profit.

In June and July 2022 the company incurred different costs; variable and

Fixed. for example in June the company purchased 2 coasters for FRW

10,000,000 each, in June and July the company rented 5 offices for FRW

100,000 each per month , June and July company paid taxes of FRW

80,000, in June salaries FRW 1,700,000 and in July salaries of FRW

2,000,000 ; June Paid electricity bills of FRW 150,000 and in July was

FRW 200,000 and maintenance cost of FRW 400,000 in June and FRW

450,000 in July . It was noted that the company costs of fuel depend on

the length of travel covered; but in June Fuel cost was FRW 1,100,000

and in July fuel cost was FRW 1,200,000 , Telephone bills in june was

FRW 150,000 , the cost of telephone was FRW 100,000 and Airtime was

FRW 50,000 but in July the cost of telephone remained constant and

the cost of airtime was FRW 80,000. Additionally, the company keeps

the drivers’ allowances of FRW 800,000 per month for attracting andmaintaining the drivers.

Questions:

1. Differentiate fixed cost from variable cost.

2. Calculate:

• Total Variable (June and July )

• Fixed cost (June and July)• semi variable cost (June and July)

2.1 Introduction to cost behaviorLearning Activity 2.1

Question

Classify above costs based on its behaviour.

2.1.1 Main classification of cost behavior

Cost behavior refers to the change in costs (increase or decrease) as the

output level changes, i.e. as we increase output, are the costs rising, dropping or

remaining the same. Cost behavior can be used to produce various classifications

of costs such as:

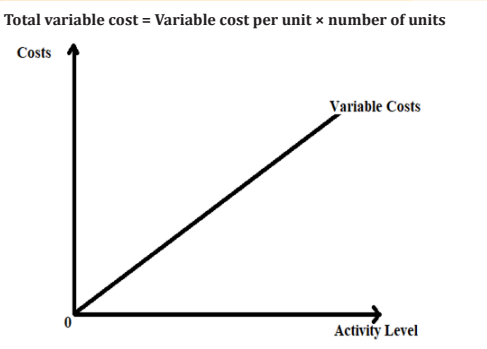

a. Variable Costs

Are costs that increase or decrease proportionately with the level of activity

i.e. cost of an activity that changes with the level of output or level of activities.

The total amount of variable cost tends to change in respect to changes in

production volume but the variable cost per unit stays at the same level under

the same level under the same manufacturing environment and production

methods. For example if 1kg of a material is needed for each cost unit then

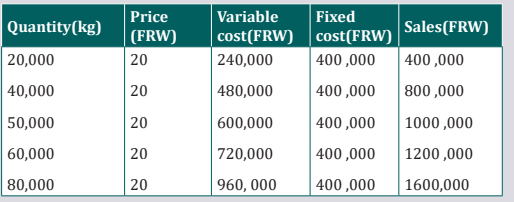

100,000 kg will be required for 100,000 units of production and 500,000 kg for500,000 units of production. The total variable cost can be expressed as:

Note that with variable costs, the cost is zero when production level is zero.

The cost increases in proportion due to the increase in the activity level, thus

the variable cost function is represented by a straight line from the origin. The

gradient of the function indicates the variable cost per unit.

b. Fixed Cost

Fixed cost is the cost which does not vary with the change in the volume of

activity in the short run. These costs are not affected by temporary fluctuation

in activity of an enterprise. These are also known as period costs. This may

include the rent of a factory or straight-line depreciation of plant and machinery.

The classification of cost into fixed and variable costs would only hold within

a relevant range beyond which all costs are variable. The relevant range is the

activity limits within which the cost behaviour can be predicted.

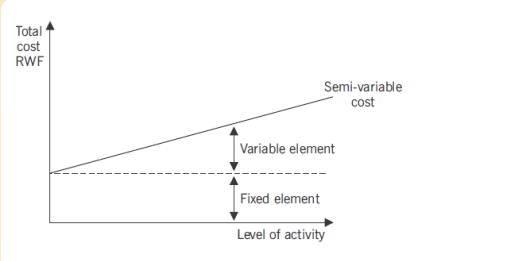

c. Semi variable costs

Are costs with both a fixed and variable cost component. The fixed component

is that portion which is constant irrespective of the level of activity.

The fixed part of semi variable cost represent minimum fees for making

particular item or services available . For example, a telephone bill includes a

fixed element being the fixed line rental for the period and a variable element

that will increase as the number of calls increase, the behavior of Semi variablecost is shown below:

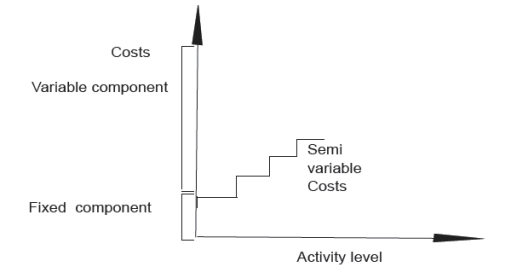

a. Stepped cost or Semi Fixed Costs

Are costs with both a fixed and variable cost component. The fixed component

is that portion which is constant irrespective of the level of activity. They are

variable within certain activity levels but areFixed within other activity levels as shown below:

Consider the depreciation of a machine which may be fixed if production

remains below 1,000 units per month. If production exceeds 1,000 units,

a second machine may be required, and the cost of depreciation (on twomachines) would go up a step.

2.1.2. Calculating the fixed and variable elements of

semi-variables costs.

A semi-variable cost is “a cost containing both fixed and variable elements

and which is thus partly affected by fluctuations in the level of activity”. A

typical example of a semi-variable cost is telephone charges containing a fixed

element i.e rental of telephone instrument, and a variable element i.e the cost

of telephone calls made.

Semi-variable cost should be separated into fixed and variable elements by

using the three methods:

a) Comparison method

b) Least squares method or Regression method,

c) High and low points or Range method

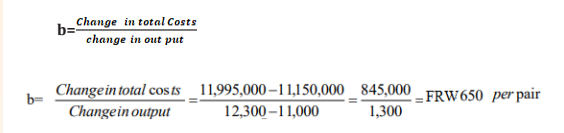

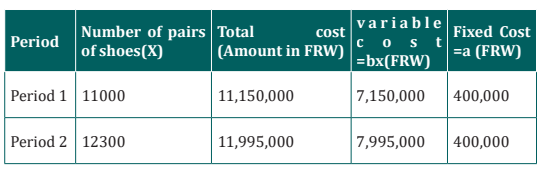

a. Comparison method

In this method, cost of two periods or two activity levels are compared. The

difference in these costs is considered as variable cost because it is assumed

that the fixed overhead of two periods or two activity levels is the same. From

this difference of costs, variable cost per unit is calculated.

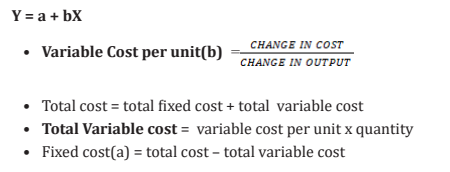

Cost function

The cost estimating function is a linear equation i.e an expression of therelationship between variables, the independent and the dependent variables.

• Total cost = total fixed cost + total variable cost

• Total Variable cost = variable cost per unit x quantity

• Fixed cost(a) = total cost – total variable cost

Where:

Y represents the dependent variable or the total cost

a represents fixed cost component of the total cost (Constant amount)

bX represents the variable costs component of the total cost

b represents the unit variable cost (this is the gradient of the equation)

X represents independent variable or the output level

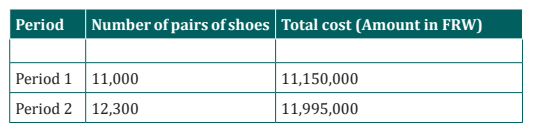

Example

The manager of a shoe factory wishes to develop a method of forecasting

the total costs in any period. The following past costs have been recorded atdifferent levels of activity:

Required:

a) Calculate the variable cost per pair of shoes and show Fixed and

Variable costs.

b) What would be the total costs if the current year’s estimate of 12,800

pairs of shoes were actually produced?

Answer

a) We know that Y=a+ bx : total cost = total fixed cost + total variable

cost

Total Variable cost = variable cost per unit x quantityFixed cost =total cost – total variable cost

a) Total cost of 12800 pairs of shoes : y=a+bx

Y=400,000+650(12800) = FRW 12,320,000

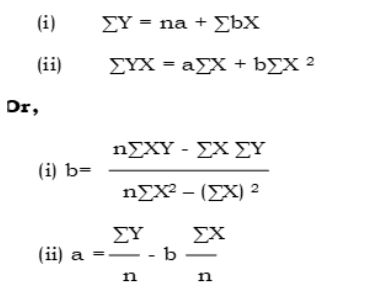

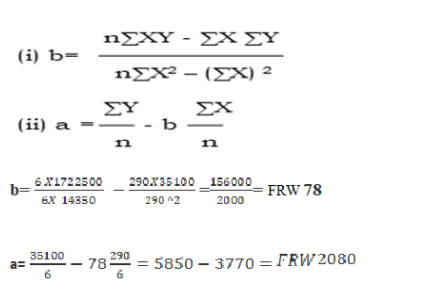

a. Least square Methods

The least-squares method is a crucial statistical method that is used to find a

regression line or a best-fit line for the given pattern. This method is described

by an equation with specific parameters. The method of least squares is

generously used in evaluation and regression. The general formulas used to

compute fixed cost (a) and variable cost (b)are listed below. The equations aresolved simultaneously to obtain the values.

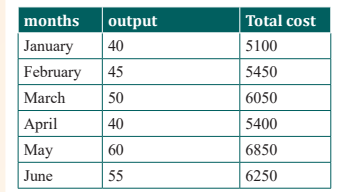

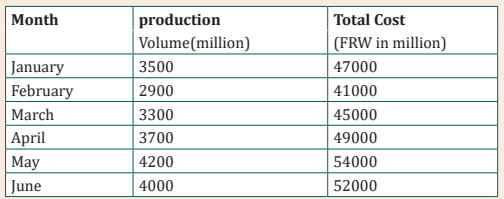

The following data relates to ABC Company limited for the half year period just

ended.

Required:

1. Determine the business fixed and variable costs for its manufacturing

overheads by using least square method

2. Write down the cost equation in the form of Y=a + bX.

Answer1. Determine the business fixed and variable costs

i) ΣY=na +b Σx

ii) ΣXY- aΣX + b ΣX2

i) 35100= 6a+290b

ii) 1722500=290a+14350b

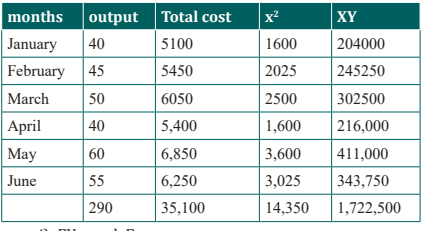

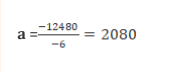

Multiply equation (i) by 290 and equation (ii) by 6, to eliminate one unknown

variable

i) 35100= 6a+290b ……………x 290………….10179000 =1740a+84100b

ii) 1722500=290a+14350b…….X 6…………….10335000=1740a+86100biii) Difference (new equation ) 156000 = 0 2000b

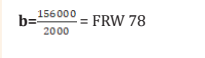

To obtain a, substitute b in equation (i)

v. 35100=6a+290(78)

-6a=22620-35100-6a=-12480

2. the cost equation in the form of Y=a + bX……………………….Y= 2080 +78x

OrDetermine the business fixed and variable costs

2. Equation Y= 2080 +78x

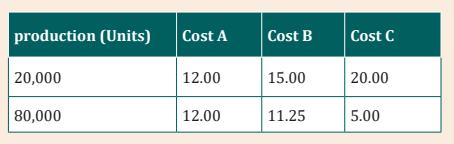

c. High-Low Method

This is a cost estimation based on the relationship between past cost and past

level of activity. Variable cost is based on the relationship between costs at the

highest level of activity and the lowest level of activity. The difference in cost

between high and low activity level is taken to be the total variable cost from

which the unit variable cost can be computed by dividing it by the change in

output level.

The goal of the high-low method is to describe this line mathematically in the

form of an equation stated as f(x) = a+ bX, which requires calculating both the

total fixed costs amount (a) and per unit variable cost amount (b). Four steps

are required to achieve this using the high-low method:

Step 1. Identify the high and low activity levels and the corresponding costs

from the data set.

Step 2. Calculate the variable cost per unit (b).

Step 3. Calculate the total fixed cost (a) or Y

Step 4. State the results in equation form f(x) =Y = a + bX.

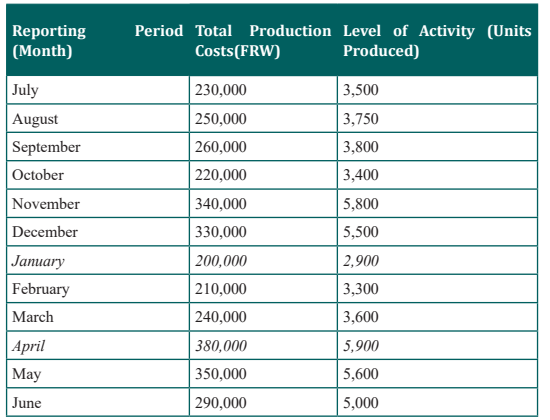

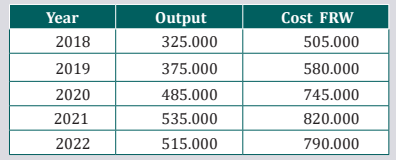

Illustration: The following is an extract of the cost data of loyal industries for

the previous year; you are required to determine the variable rate and the fixed

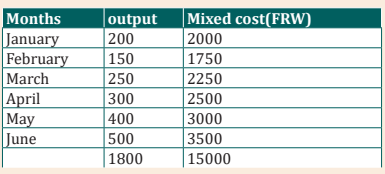

component and construct an equation estimating the total cost for the samecompany.

Step 1. Identify the high and low activity levels from the data set.

The highest level of activity (level of production) occurred in the month of April

(5,900 units; FRW 380,000 production costs), and the lowest level of activity

occurred in the month of January (2,900 units; FRW 200,000 production costs).Step 2. Calculate the variable cost per unit (b).

Step 3. Calculate the total fixed cost (fx) or Y

After completing step 2, the equation to describe the line is partially complete

and stated as /Y = a+FRW60X. The goal of step 3 is to calculate a value for total

fixed cost (a). Simply select either the high or low activity level, and fill in the

data to solve for a (total fixed costs), as shown. Using the low activity level of

2,900 units and FRW 200,000,

Y=a+bX

200,000 = a + ( 60×2,900 units)

a = 200,000 − (60×2,900 units)

a = 200,000 − 174,000

a = FRW 26,000

Thus total fixed costs total FRW 26,000. (Try this using the high activity level

of 5,900 units and FRW 380,000. You will get the same result as long as the per

unit variable cost is not rounded off.)

iv) State the results in equation form f(x) =Y = a + bX.

We know from step 2 that the variable cost per unit is FRW 60, and from step

3 that total fixed cost is FRW 26,000. Thus we can state the equation used to

estimate total costs asf(x) or Y = FRW 26,000 + FRW 60X

Application activity 2.1

Question

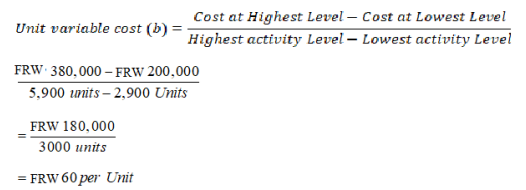

1. The Cost perunit amount of three different production costs forDalius Ltd are as follows:

What type of cost is each of these three costs?

a) Cost A is mixed, Cost B is variable, Cost C is mixed

b) Cost A is fixed, Cost B is mixed, Cost C is variable.

c) Cost A is fixed, Cost B is variable, Cost C is mixed.d) Cost A is variable, Cost B is mixed, Cost C is fixed

2. The following information is extracted from the books of INYANGEIndustries Ltd for the year ended 31st December 2022.

You are required to seperate the above costs into fixed and variable elements

using the following methods of Ordinary Least Squares and High and lowpoints or Range method.

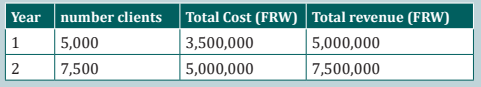

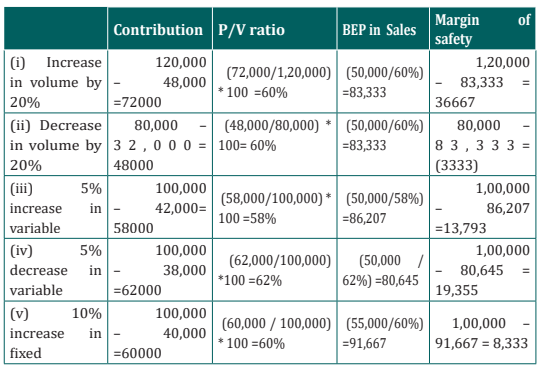

2.2. Cost-Volume-Profit (CVP) Analysis.

Learning Activity 2.2

Bank of Kigali is a commercial bank operating its business activities in

Rwanda. It uses its Agents to provide good services to its customers. Bank

of Kigali paid its agent a commision of 5% on deposit FRW 10,000 and the

commission is only source of income to the Bank of Kigali agent. The Bank

of Kigali agent fixed cost is FRW 200,000 per month (Salary and Rent) and

variable cost is FRW 350 per client deposited FRW 10,000 and average

number of client served per month is 4000 clients.

The Bank of Kigali has collected information about the customer satisfaction

and revealed that the customers are complaining for the high bank charges

on agent services.

The management of Bank of Kigali after a deep analysis of this situation, has

just announced a revised payment schedule of 4% commission on deposit

FRW 10,000. Fixed cost remains constant and variable cost has reduced to

FRW 300 per client served and the bank expected that the average number

of clients will increase to 5000 clients.

Question

1. What do you understand by cost, volume profit?

2. Calculate the number of customers, the BK agent are able to serve at

Break Even Point before and after revising the payment structure.

3. After revising the cost structure, BK agent set a targeted profit of FRW

500,000, how many customers the agent will be required to serve to get

this profit.

2.2.1 Introduction to cost-volume Analysis

Cost-Volume-Profit analysis is the study of the effects on changes on future

profit of changes in fixed cost, variable cost, sale price, quantity, and mix. There

is a direct relationship between cost, volume of output and profit. CVP analysis

examines the relationship of cost and profit to the volume of production to

maximize the profit of the firm. It is a logical extension of marginal costing and

is used as a very powerful tool by the management in the process of budgeting

and profit planning.

a. Elements of CVP analysis

CVP analysis establishes a relationship between cost, volume of output and

profit. It evaluates the effect on profit due to changes in cost and volume of

output. This analysis consists of several integral parts or components which

are as follows:

i) Marginal Cost equation

ii) Contribution

iii) Profit/volume (P/V) Ratio

iv)Break-Even Point (BEP)

v) Margin of safety

2.2.2. Marginal Costing

a. Marginal Cost Equation

Marginal Cost Equation exhibits the relationship between contribution, fixed

cost and profit. It explains that the excess of sales over the variable cost is

the contribution towards fixed cost and profit. Marginal Cost Equation can be

developed as follows:

Sales S Total Cost Profit P= +

or

Total Cost Fixed cost F Variable Cost V =+

Therefore S F V P or S V F P = + + −= +

b. Contribution

Contribution is the excess of sales over variable cost. More clearly, contribution

is that portion of sales which remains after recovering the variable cost to that

extent of sales. This contribution is available towards fixed cost and profit.Mathematically, contribution can be expressed as follows:

Sales xxx

Less: Variable cost xxx

Contribution xxx

Less: Fixed cost xxx

Operating Profit xxx

Therefore

Sales - Variable cost = Contribution

Fixed cost + Profit = ContributionFixed cost - Loss = Contribution

XYZ Ltd produces 2,000 units of a product X, are sold at FRW 10 per unit,

Variable cost of manufacturing the product is FRW 6 per unit and the total fixed

cost is FRW 5,000. Calculate the contribution from the given data.

Sales 10

Less: Variable cost 6

Contribution 4 X2000

Less: Fixed cost 5000

Operating Profit 3000

Total contribution = contribution per unity * Quantity = 4X2000 = 8000

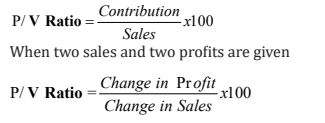

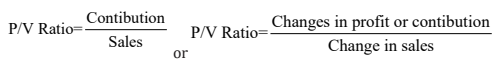

FRWa. Profit- Volume (P/V) Ratio / Contribution margin ratio

Profit-Volume ratio is the ratio of contribution and sales. It is generally expressed

in percentage. It exhibits the percentage of contribution included in sales. It

indicates the effects on the profit for a given change in sales. Mathematically,P/V Ratio can be expressed as follows:

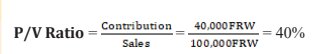

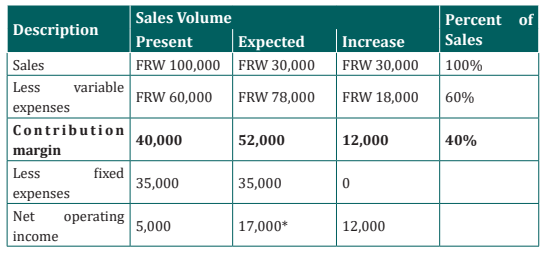

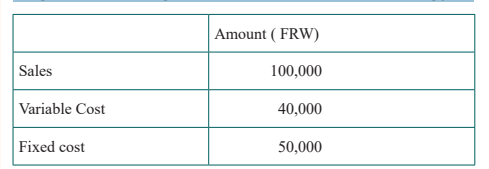

Illustration : Consider the following contribution margin P/V Ratio format

income statement of Alpha & Son Ltd.in which sales revenues, variable expenses,

and contribution margin are expressed as percentage of sales.

Description Total(FRW) Per Unit(FRW) Percent of Sales

Sales (400 units) 100,000 FRW 250 100%

Less variable expenses 60,000FRW 150 60%

Contribution margin 40,000 FRW FRW 100 40%

Less fixed expenses 35,000

Net operating income 5,000 FRW

According to above data of Alpha & Son Ltd. the computations are:

In a company that has only one product such as Alph & Son Ltd P/V ratio can alsobe calculated as follows:

The impact on net operating income of any given cash change in total sales can

be computed in seconds by simply applying the CM ratio (P/V Ratio) to the cash

change.

For example if the Alpha & Son Ltd plans a FRW 30,000 increase in sales during

the coming month, the contribution margin should increase by FRW 12,000

(30,000 INCREASED sales * CM ratio of 40%). As we noted above, net operating

income will also increase by FRW 12,000 if fixed costs do not change. This is

verified by the following table:

* Expected net operating income of FRW 17,000 can also be calculated

directly by using the following formula:

[P*= (Sales × CM ratio) – Fixed Cost]P* = Profit

2.2.3. Break - Even Point (BEP)

Breakeven point is the level of output or sales at which the business does not

make profit nor incur loss. At that level, total revenue is equal to the total cost

or Break-even point is point where the business is neither incurring profit nor

loss. This is the turnover that enables enterprise to cover all expenses without

profit or loss.

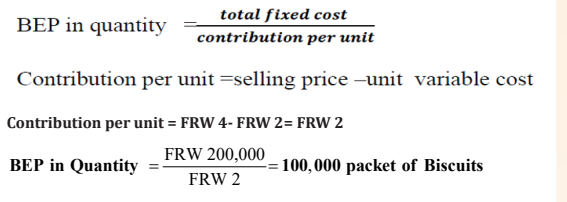

a. Break-Even Point Calculation

Break-Even point is the level of sales at which profit is zero. At break-Even point

sales are equal to fixed cost plus variable cost (Sales = fixed cost + variable

cost).

The break-Even point can be calculated using either Equation method orContribution margin method.

Equation method

The equation method centers on the contribution approach to the income

statement.

According to the definition of Break Even point, Break Even point is the level of

sales where profits are zero. Therefore the Break Even point can be computed

by finding that point where sales just equal the total of the variable expensesplus fixed expenses and profit is zero.

Example:

Given data are as follow:

• Sales price per unit = FRW250

• Variable cost per unit = FRW150

• Total Fixed expenses = FRW35,000

Formula of Break Even Point: Sales = Variable expenses + Fixed expenses +

Profit

FRW 250Q* = FRW 150Q* + FRW 35,000 + FRW 0

FRW 100Q = FRW 35000

Q = FRW35,000 /FRW 100

Q = 350 Units

Q* = Number (Quantity) of units sold.

The Break-Even point in sales dollars can be computed by multiplying the

break-even level of unit sales by the selling price per unit. 350 Units × FRW 250

per unit = FRW 87,500

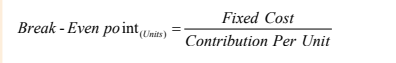

– Contribution margin method

The contribution margin method is actually a short cut conversion of the

equation method already described. The approach centers on the idea discussed

earlier that each unit sold provides a certain amount of contribution margin

that goes toward covering fixed costs. To find out how many units must be soldto break even, divide the total fixed costs by the unit contribution margin.

FRW 35,000 / FRW 100* per unit =350 Units

*S250 (Sales) – FRW 150 (Variable exp.)

A variation of this method uses the CM ratio (P/V Ratio) instead of the unit

contribution margin. The result is the Break-Even in total sales dollars rather

than in total units sold.

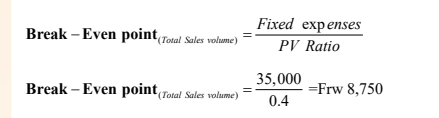

Example 1. Alpha bakery producing biscuits wants to evaluate the company

performance based on information recorded. If its fixed cost are FRW 200,000

and its variable cost to produce one packet of biscuit is Rwf 2 and its selling

price for each packet of biscuits is FRW 4,Calculate break even point of alphabakery.

Answer

Break even point in value =100,000 X 4 = FRW 400,000

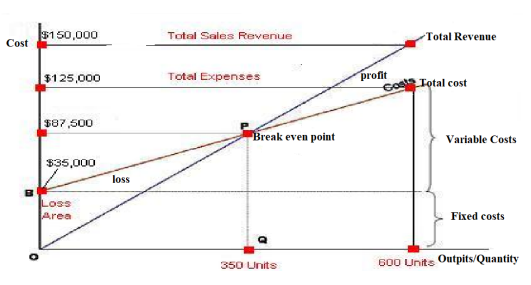

b. Cost Volume Profit (CVP) Relationship in Graphic Form

The relationships among revenue, cost, profit and volume can be expressed

graphically by preparing a cost-volume-profit (CVP) graph or break-even chart.

A CVP graph highlights CVP relationships over wide ranges of activity and can

give managers a perspective that can be obtained in no other way

Preparing a CVP Graph or Break-Even Chart

In a CVP graph sometimes called a break-even chart, unit volume is commonly

represented on the horizontal (X) axis and cost and revenues on the vertical(Y) axis. Preparing a CVP graph involves ploting the total revenue and total cost

curves and the point of intersection of the two is the the breakeven point.

Example1.

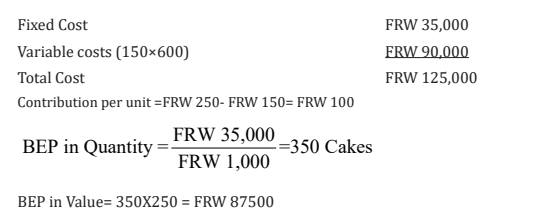

OLAN LTD is a bakery business which produces 600units (Cakes) and each

Cake is sold at FRW 250 and the variable cost per unit is FRW 150. Calculate

the breakeven point in quantity and in value and then plot these informationon graph.

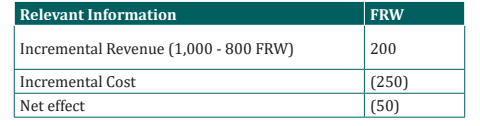

c. Target Profit Analysis

Cost volume profit (CVP) formulas can be used to determine the sales volume

needed to achieve a target profit.

Example:

DANI Ltd has the following cost information in its books:

• Sales price per unit = FRW 250

• variable cost per unit = FRW 150

• Total fixed expenses = FRW 35,000

• Target Profit = FRW 40,000

Required: How many units would have to be sold to earn a profit of 40,000?

Solution:

The CVP Equation Method:

Under equation method: Instead of solving the equation where profits are zero,

we solve the equation where profits are FRW 40,000.

Sales = Variable expenses + Fixed expenses + Profit

250Q = 150Q + FRW 35,000+ FRW 40,000

100Q = FRW 75,000

Q = 75,000 / 100 per unit

Q = 750 Units

Thus the target profit can be achieved by selling 750 units per month, whichrepresents FRW 187,500 in total sales (250* 750 units).

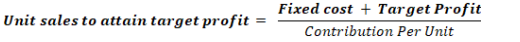

d. The Contribution Margin Approach

A second approach involves expanding the contribution margin formula to includethe target profit.

This approach gives the same answer as the equation method since it is simply

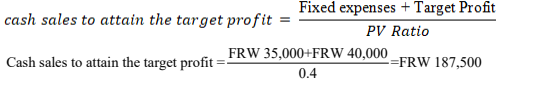

a short cut version of the equation method. Similarly, the sales value needed toattain the target profit can be computed as follows:

e. Margin of Safety

The margin of safety is the excess of budgeted or actual sales over the breakeven

volume of sales. It states the amount by which sales can drop before losses

begin to be incurred. The higher the margin of safety, the lower the risk of not

breaking even.Margin of Safety Formula

The formula for the calculation of margin of safety in sales value is:

Illustration

Sales (400 units @ FRW 250) ----- FRW 100,000

Break even sales---------------- FRW 87,500

Required: Calculate margin of safety in sales value.

Solution

Sales (400 units @ FRW 250) FRW 100,000

Break even units (at 350 units) FRW 87,500Margin of safety in sales value FRW 12,500

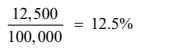

Margin of safety as a percentage of sales

Margin of safety as a percentage = [(Budgeted or Actual sales – Breakevensales)/Budgeted or Actual sales]

It means that at the current level of sales and with the company’s current prices

and cost structure, a reduction in sales of 12,500 FRW, or 12.5%, would result

in just breaking even. In a single product firm, the margin of safety can also

be expressed in terms of the number of units sold by dividing the margin of

safety in dollars by the selling price per unit. In this case, the margin of safety

is 50 units (12,500 ÷ 250 units = 50 units) or Budgeted or Actual sales units –Breakeven units

Limitations of breakeven analysis

Breakeven analysis is a useful tool for problem solving and decision making,

but some of the limitations should be noted:1. The breakeven analysis assumes that cost and revenue behaviour patternsApplication activity 2.2

are known and that the change in activity levels can be represented by a

straight line, which is not always the case.

2. It may not always be feasible to split costs into variable and fixed

categories. Some costs show mixed behaviour.

3. The breakeven analysis assumes that fixed costs remain constant over

the volume range under consideration. If that is not the case, then

the graph of total costs will have a step in it where the fixed costs are

expected to increase.

4. Breakeven analysis, as described so far in this book, assumes production

and sales volumes are the same, so that there is no build-up of stocks and

work-in-progress.

5. Breakeven charts and simple analyses can only deal with one product at

a time.

6. It is assumed that cost behaviour depends entirely on volume. Theselimitations may be overcome by modifying the breakeven analysis.

Q1. Choose the correct answer.

ABC Company sells shoes for FRW 450 per pair of shoes. The variable cost

is FRW 200 per pair of shoes. The fixed costs are FRW 750,000. What is the

breakeven in sales?a) FRW 750,000Q2. IHIRWE Ltd has recorded the following semi-variable cost over

b) FRW 937,500

c) FRW 1,350,000d) FRW 1,687,500

the past six months:

Estimate IHIRWE Ltds’ fixed cost and variable cost by using the high/low

method.

Skills Lab 2

Gs Ubumenyi has the policy of promoting entrepreneurship clubs, During

the set up and the running of their student business club at their school, the

school administators committed to cover the fixed costs and other costs to

be covered by entrepreneurship club members. The club has prepared

a business estimates of operating a saloon business at school. In theirbusiness plan the following expected cost and revenues were presented.

The management of Gs ubumenyi has approved the above business

estimates and requested the students to determine the contribution

of the school and that of the club members. After reviewing the above

information, using comparison method:

1. Calculate the contribution (Variable costs) of students in this

business

2. Calculate the contribution of the school (Fixed costs) in this business

3. Prepare a short report to be presented to the club members and

the school management advising them on how their contributionwould be collected.

End of unit assessment 2

Questions1. Define break-even point.An activity level that the company expects to operate at is called a

2. Complete the following sentence by choosing the best answer from

the choices givena) Margin of SafetyOver the last five years, Amahoro Ltd has recorded the following costs:

b) Relevant range

c) Contribution margin

d) Target net income

Amahoro Ltd wants to estimate the cost for 2023,when they expect toproduce 52,000units.

Q4. ABC Ltd provides below information to professional accountant to

get his professional advise. The management requires the professional

accountant to determine the break- even point in units and Value and todetermine the quantity required to get a profit of FRW 1,200,000

a) The management requires the professional accountant to

determine the break- even point in units and in Valueb) Determine the quantity required to get a profit of FRW 1,200,000

UNIT 3: BASIC PRINCIPLE OF COSTING

Key Unit Competence: Identify and recording cost accounts used in organization

Introductory activity

“Making a profit on a project/product depends on pricing it correctly”.

AKARABO located in Kimironko Kigali city, is one of the Kigali’s largest

manufacturers of flat-screen televisions and mobile phones. In 2015,

AKARABO sold FRW 15million from phone cover and FRW 20 million

of cables of flat screen in Kigali city. Many of material used in shop of

flat-screen for well looks, AKARABO Spends FRW 40 million Annually

on the procurement of stand table of flat-screen, speakers, cables of

mobile phone and other materials. Until 2020, AKARABO did not have

a centralized procurement system to leverage its scale and to control

supply costs. Instead, the company had a decentralized system riddled

with wasteful spending and inefficiencies. To respond to these challenges,

AKARABO hired its first chief procurement officer introducing activity

-based costing (A.B.C) as solution. ABC Analysis of the company’s

procurements system revealed that most company resources were

applied to administrative and not strategic tasks. Furthermore, the

administrative tasks were done manually and at very high cost. A team

of manager and employees in AKARABO are responsible for costing and

pricing of its flat-screen and mobile phone. For each product, account

managers carefully examine and verify job costs as part of a competitive

bidding process. AKARABO business managers are also responsible for

identifying any potential problems with each product and determining

any alternative necessary to unsure high quality, on time delivery within

the original product budget. AKARABO received an order (command)

for new product of producing a computer. Manager at AKARABO need to

know how much it costs to manufacture its new product. Knowing the

cost and profitability of new job helps manager pursue their businessstrategies.

Of course, when making decisions, managers combine cost information

with non-cost information such as personal observations of operations,

and non-financial performance measures, such as quality and customer

satisfaction.

Questions1. State the products produced by AKARABO manufacturing co..3.1. Costing methods

2. What does the manager need for decision making?

3. According to your observation identify the costing methods thatcan be used from the above scenario.

Learning Activity 3.1

Question

a) What do you observe on the above picture?b) What do you think the man is going to do?

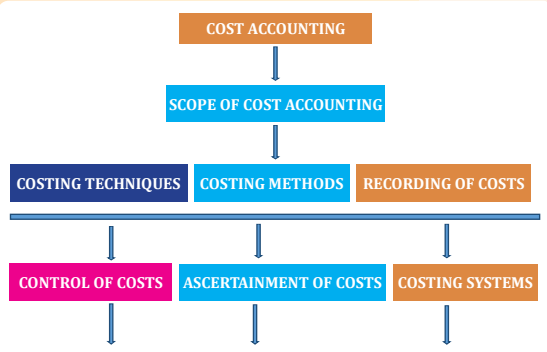

3.1.1. Introduction to costing methods

Costing methods is the approach or style or tactic adopted by an organization

to collect cost data in a more appropriate manner so as to establish the total

cost and cost per unit of final product produced or manufactured. The finalproduct can either be physical goods or services.

Costing methods is an approach of cost data collection which is “under

ascertainment of cost” umbrella and you know that ascertainment of cost aspect

is a thematic sub-topic of scope of cost accounting as show in above diagram.

These are several methodologies utilized by different organizations, which is

determined by the nature of products being manufactured. The viewpoint of

the diverse needs of different organisations necessitates consideration of the

criteria used in classifying the costing methods.

• Characteristics of Costing Method

The method is applicable to products which have common characteristics.

The ascertainment of cost in most of the times involves some repeated activities

or repetitive processes.

The process of cost ascertainment is within a specific period of time usually a

year.

• Costing methods entails both the determination of the overall cost and the

unit profitability of the products.

• The activity of costing method is periodical in the sense that the aspect of

cost ascertainment is limited to a specific accounting period.

• In addition to economic costs, the costing method incorporates other costsinform of normal and abnormal losses.

• Advantages of costing method

a. Minimization of production cost

By reducing inefficiencies associated with wastages and loses during production

therefore minimizing overall cost incurred in production.

b. Help in the profitability determination

Ascertainment of the costs guides the producer to know exactly the total cost of

the final product so as to set an appropriate profit margin in setting the selling

price.

c. Basis on purchase or manufacture of a component decision.

The cost ascertainment approach is timely in guiding the management on

whether it is economical to produce or purchase a certain component.

d. Control of costs

Costing methods help in comparing \previous year’s cost level so as to manage

the consumption of the economic resources. This can be achieved by use of

budgeting tool.

e. Tax matters

Taxation of firm’s profit by the government is pegged on the cost of production.

This helps the government to ensure that fairness prevails to avoid over or

under taxation.

f. Bargaining power.

The employee’s or worker’s union may use the cost of production as per cost

ascertainment to argue their case.

g. Delegation of responsibilities to employees.

The workers are assigned their duties based on the costing method used. This

helps in ensuring that no idle employees who are paid.

h. Preparation of financial statements

Costing method is a tool which is helpful in financial accounting during

preparation of end of the year financial reports. This is because reports such

as closing inventory for finished goods, work in progress and raw materials are

associated with preparation of financial statements.

i. Avoidance of collusion and fraud by workers

Costing methods are ways of ensuring that material and other inputs are not misused

by corrupted workers who may sell some to make personal gain at the expense of the

quality of the goods being produced.

Disadvantages of costing methods

Here are clarified limitations of the costing methods

a. Historical data

The data which is always readily available in the books of accounts of the

business is the financial data which is historical which is not much needed for

costing methods as they deal with the future decision making, for which the

data is missing or scanty. This disparity in need gap curtails costing method

procedures.

b. Under-Utilized Capacity

Costing methods works with the assumption that production capacity is fully

utilized. If this is not the case, then the results presented at the end of the year

will be misleading.

c. Problem of over and under absorption of overheads

Since costing methods is a process which has to do with estimation of the total

cost of a product. Some aspects are standardized or pre-determined and so,

when actual outcome takes place, it can be a case of over or under absorption

of overheads. this brings inconvenience of planning.

d. Lagged costing methods information

Most of the times, costing require furnishing of timely information to the costing

department which may not be the case for the various departments concerned

with this exercise may have individual departmental challenges which can

result to failure on timely costing exercise.

e. Non-flexibility of a costing system.

Some costing system which are concerned with recording of the costing

information may be faulty or rigid and this hiccup may deny the objective of

ascertaining of cost on a particular product, hence adversely affect costingmethod used.

3.1.2. Calculation based on costing methods

A. Job Costing

This method is also called as Job order costing method. This costing method is

used in firms which work based on job work. There are some manufacturing

units which undertake job work and are called as job order units. The main

feature of these organizations is that they produce according to the requirements

and specifications of the customers. Each job may be different from each other.

Production is only on specific order and there is no pre demand production. In

this system, each job is treated separately and a job cost sheet is prepared tofind out the cost of the job.

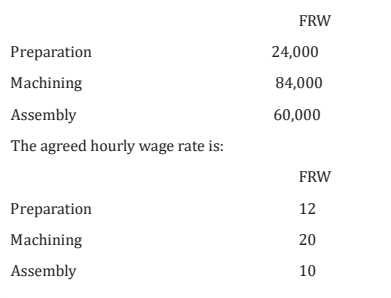

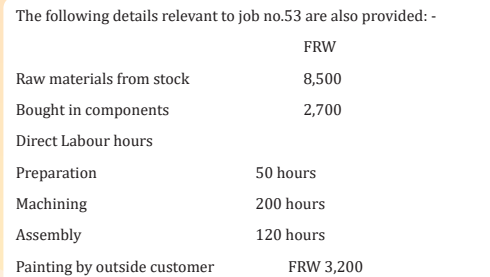

Illustration

XYX Engineering ltd has three departments: preparation, machining and

assembly. The budgeted direct labor hours for these three departments are8,000, 12,000 and 10,000 respectively.

Factory fixed overheads are budgeted at FRW 180,000 for the year and variable

overheads are as under:

Administration and selling Overheads are to be abosorbed by adding 10% of all

other costs. Profit is charged at 25% of total costs.

You are required: to determine the cost estimate for job.no.53

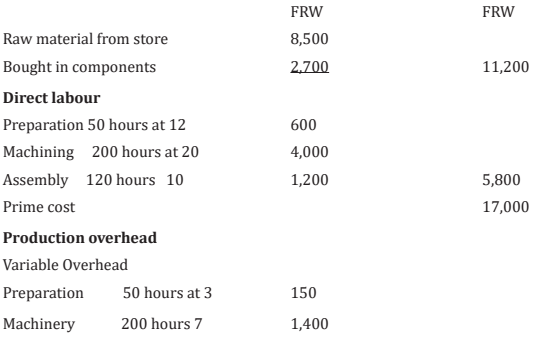

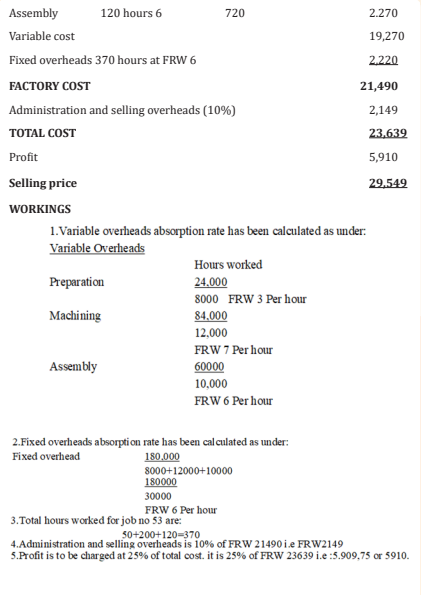

ANSWERS:

XYZ ENGENNERING LTD

COST ESTIMETE FOR JOB NO:53Direct materials

• Characteristics of job costing

Job costing is a costing method with the following features:

a. The order is specific,

It means that the task to be performed is subject to strict guidelines. There are

terms of reference of the customer or client.

b. It is possible to closely track the cost elements associated with the

order.

The job being performed is sufficiently diverse to allow the manufacturer to

associate the specific input materials, labor, and overhead associated with that

job completion.

c. The executed jobs differ from each other.

Since the customers are diverse, the jobs are also diverse. That is, they are

not similar. This is because the manufacturer may be dealing with different

customers or the same customer/client but with different types of orders.

d. The overhead cost allocation is carried out according to the relevant

criteria.

The indirect costs associated with the production of the relevant order number

are determined by a unique basis from the other orders such as area, size of the

order, etc.

e. Keeping a separate account for each job.

Since the jobs are different in most cases, the accounts are required for each job.

That is, all costs associated with that specific order are charged to that specific

account with a unique account number, and the costs posted therein form the

total cost for that order.

a. The production process is not continuous

Each order is independent of the next and therefore there is no continuity as

with the process cost method. Therefore, the jobs are broken in the real sense.

That is, an order is initiated based on an order placed by the customer.

a. The profitability of each job is determined separately

The profitability margin for each job is determined by the total cost of the

inputs consumed by that particular job. So each job has its own cost calculation

and determination of the profits from it.

• Classification of job costing method

Job costing method is further broken down to:

a. Contract costing method

Contract costing method is also known as terminal costing method and it

involves doing some assignment with set specification for another person for

payment.

The contract costing method of ascertaining cost for a contract. once the

contract is completed as per the agreement of the two parties, the assignment

is closed down.

b. Factory costing method

Factory job costing is entails undertaking a clients ‘assignment or job in a

factory. The focus is the assignment at hand and on its completion, the output

is delivered to the client.

c. Batch costing method

Batch costing method is an approach of assigning costs on a task which is

completed in batches. It entails manufacture of a large number of products or

goods at the same time.

• Advantages of job costing– Help in determining the level of profitability of company products in the

future. The current record of how costs have been allocated to the current

product provides a guide for determining the profit margins to be achieved.

– Having clear cost data available helps management determine the selling

price of the end product (final product). The selling price set depends on the

amount of cost accumulation, so when the cost is higher, the selling price is

high and vice versa is true.

– Optimal allocation of economic resources. The job costing method is set in

such a way that it is possible to monitor the use of the available resources.

Thus, the manufacturer or producer is able to identify instances of waste

and mistakes for each specific job and avoid such situations.

– Job costing assists in the adoption of predetermined overhead rates, which

in turn assists in the application of the budgetary control system. That is,

before the actual costs are incurred, the producer can plan earlier to know

how to control the costs/inputs for the inputs needed estimated using the

cost method provided.– The job costing method encourages the activity of delegating tasksamong employees. The job costing method helps in delegating tasks to beDisadvantages of job costing method

performed by each employee in the workplace. Therefore, accountability to

a department or an individual employee is enhanced.

– Avoidance of duplication. The manufacturer is able to separate one order