UNIT 5: CASH BALANCES MANAGEMENT

Key Unit competence: Use effectively and efficiently cash balances for better

managementIntroductory activity

MK Ltd is an enterprise which sells agro-processed goods such as packed

maize flour, soya oil and sorghum flour at Rwamagana. Raw materials

used to make maize flour are purchased from Ngoma farmers, soya grains

are imported from Zambia and payment transfers are done electronically

while sorghum cereals are supplied by a trader from Musanze who

require direct cash payment. The acquisition of raw materials is managed

by Linda M. who is the chief accountant. Rutayisire who manages the

department of Human Resources had submitted payroll for the month

of January 2022 and M. Kayisire, Chief Finance Officer prepared the

statement of cash flows. The department of finance has a cash balance of

FRW 50 millions as at 31 December 2021. During January, cash receipts

are estimated to be FRW 15 millions, cash payments FRW 26m and a

depreciation charge of FRW 7 millions. Goods produced are sold both

for cash as well as on credit. In the case of credit sales, the pending bills

are realised at a later date. This cycle continues to be repeated in an

accounting year several times. Thus, the flow of cash in a business passes

through various channels. The magnitude of the flows in terms of time(days) may be depicted in the analysis made by M. Kayisire.

Question

a) Which is the report that provides the appropriate financial

information used to measure the use of cash for good

management?

b) What should be the appropriate procedures for cash balancesmanagement?

5.1 Liquidity and cash balance management toolsLearning Activity 5.1

Questions:

a) What should be the appropriate responsibilities of the lady with

question mark signs?

b) The EBM as a cash and inventory management tool may help in

what kind of cash flows?

5.1.1 Definition of liquidity

Liquidity is the amount of cash a company can obtain quickly to settle its debts

(and possibly to meet other unforeseen demands for cash payments too). It is

the ability of a company to pay its suppliers on time, meet its operational costs

such as wages and salaries and to pay any longer-term outstanding amounts

such as loan repayments.

5.1.2. Liquidity assets

• Cash

Cash is the most liquid asset possible as it is already in the form of money.

This includes physical cash, savings account balances, and checking account

balances. It also includes cash from foreign countries, though some foreign

currency may be difficult to convert to a more local currency.

• Inventory

Inventory is a liquid asset because it gets converted to cash as part of normal

business operations. However, the business slows in a recession and inventory

may not be as liquid.

• Short-term investment

A short-term investment is a highly liquid financial asset to mean that it can

be easily converted to cash. Short-term investments are commonly called

marketable securities or temporary investments. Most are converted to cash,

or sold, within 12 months of the investment being made.

• Fixed term

Are deposits with a bank or building society for example, six month deposits

with a bank. Term deposit is a type of savings Account which holds a specific

amount of money for a specified duration i.e. 1 month, 2 months or longer at a

pre- agreed interest rate with the bank.

• Trades receivables

There are defined as the amount owed to a business by its customers following

the sale of goods or services on credit. Also known as accounts receivable,

trade receivables are classified as current assets on the statement of financial

position/balance sheet.

5.1.3. Cash balance Management Tools

Checking/current account

It’s a bank account used for everyday deposits and withdrawals. It means all

transactions related to putting money into the bank account and taking them

out using a cheque or using your debit card in the place of cash.

Money market account

Money market accounts (MMA) are offered by banks and credit unions and

provide the benefits and features of both savings and checking accounts. Money

market account are suited for short-term goals rather than long-term financial

planning.

Certificate of deposit

A certificate of deposit (CD) is a savings product that earns interest on a lump

sum for a fixed period of time. CDs differ from savings accounts because the

money must remain untouched for the entirety of their term or risk penalty fees

or lost interest. CDs usually have higher interest rates than savings accounts as

an incentive for lost liquidity.

Saving bonds

Savings bonds are debt securities issued by the Treasury Department in Central

Bank to help pay for the Government’s borrowing needs. Government savings

bonds are considered one of the safest investments because they are backed by

the full faith and credit of the Central Government, especially the Ministry ofFinance.

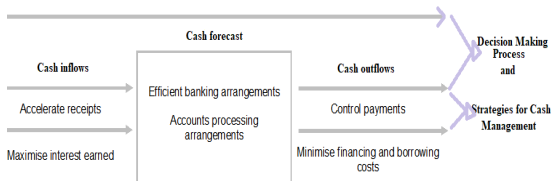

5.1.4. Make informed decisions regarding the managementof cash balances within an organization

The elements of effective cash management based on the efficient decision

making include:

a) Accurate and timely cash flow analysis and forecasting as the efficient

decision making process,

b) Maximizing returns from cash balances as the receipts acceleration

strategy

c) Minimizing financing and borrowing costs as a good strategy to

manage outflows

d) Efficient banking arrangements. For example, centralization and

rationalization of bank accounts enables economies of scale and

a reduction in bank fees and administration costs, while access to

electronic payment and collection methods increases efficiency.

e) Efficient accounts processing arrangements for receipts and payments

reduce transaction costs. For example, centralized infrastructure

for accounts processing enables economies of scale benefits to be

achieved, while the use of a central financial system minimizes risks

associated with accessing and using information from disparate

systems.

f) Efficient management and collection of receivables/debtors

g) Effective control of payments and disbursements.

5.1.1. Characteristics of the main types of cash receipts and

payments

a. Regular revenue receipts

Revenue receipts can be defined as those receipts which neither create any

liability nor cause any reduction in the assets of the government. They are

regular and recurring in nature and the government receives them in the

normal course of activities.

b. Capital receipts

Capital receipts are receipts that create liabilities or reduce financial assets.

They also refer to incoming cash flows. Capital receipts can be both non-debt

and debt receipts. Loans from the banks or public entities, foreign financial

market or Central bank form a crucial part of capital receipts.

c. Exceptional receipts and payments

It means any cash received by or paid to or for the account of any person not in

the ordinary course of business, including tax refunds, pension plan reversions,

proceeds of insurance (other than proceeds of business interruption insurance

to the extent such proceeds constitute compensation for lost earnings),

condemnation awards (and payments in lieu thereof), indemnity payments

and any purchase price adjustments. These receipts and payments depend on

how the receipt or payment is important or critical to the ordinary course of

business. Examples are taxes, pension fees, insurance premium, indemnity fees.

d. Drawings.

It refers to the act of withdrawing cash or assets from the company by theowner(s) for personal use.

Application activity 5.1

Question 1: Choose the best answer.

In a retail business, where payment is received from customers by cash,

cheque and debit/credit card, what reconciliation should be carried out at

the end of each day?

A. Reconciliation to bank statement

B. Reconciliation to trade receivables

C. Reconciliation to cash book

D. Reconciliation to amount of cash/cheques/credit card vouchers

Question 2

Analyze the elements of an informed decisions process regarding the

management of cash balances within an organization.

5.2. Explain and apply cash management measuresLearning Activity 5.2

A sole trader is making FRW 40,000 a year profits. However, his drawings

have been over FRW 60,000 a year for some time.

A company has been over-generous with credit terms to debtors, and last

year extended the time in which debtors could pay from one month to three

months. In addition, it has a few customers who are not creditworthy and

such sales may result in bad debts in the future.

A partnership whose products will not be on the market for quite a long

time has invested in some very expensive machinery. A lot of money has

been spent now, but no income will result in the near future.

In all of these cases, each of the businesses could easily run out of cash. In

fact, many businesses fail and are wound up because of cash shortages,

despite adequate profits being made. cash management measures can help

to signal the development of such problems.

Question

What do many people think about profitability at the end of the year?

5.2.1. Cash management measures.

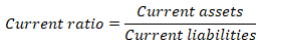

• Current ratio

The standard test of liquidity is the current ratio. Recall that the working capitalof the business is the current assets of the business less the current liabilities.

When calculated, the ratio may be expressed as either a ratio to 1, with current

liabilities being set to 1, or as a ‘number of times’, representing the relative size ofthe amount of total current assets compared with total current liabilities.

For example, see 4.3.6, B.1• Quick ratio

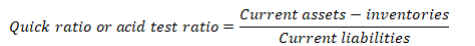

Provided that creditors and debtors are paid at approximately the same time, a

view might be made as to whether the business has sufficient liquid resources to

meet its current liabilities. This ratio should ideally be at least 1 for companies

with a slow inventory turnover. For companies with a fast inventory turnover,

a quick ratio can be less than 1 without indicating that the company is in cash

flow difficulties.

For example see 4.3.6,

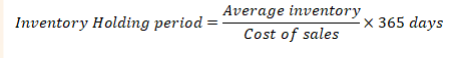

• Inventory holding ratio

It is useful for management to have an indication of how long inventory is

being held. In some businesses, inventory must be sold, or turned over, quickly,

for example, if it consists of perishable foods. However, in other businesses,

inventory may be held for some considerable time before it is sold (eg in the

construction industry).

For example see 4.3.6,

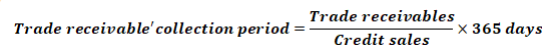

• Trade receivable collection period ratio

The trade receivables collection period ratio, also known as ‘trade receivables’

days, is a measure that shows how long it is taking for the trade receivables ofthe business to pay.

A long trade payables period means that the business is delaying payment to

its suppliers. This could be viewed as sensible cash flow management as the

business is using its suppliers as a form of finance or it could be indicative of abusiness that is having cash flow difficulties and is unable to pay.

Example (Mariam Manufacturing Ltd below)

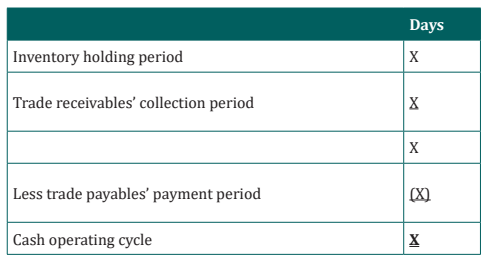

• Cash operating cycle/ratio

It measures the length of time taken for funds to flow through the organization.

It is the period of time between the time cash is paid out for raw materials

and the time cash is received from customers for goods sold. We can use the

inventory, trade receivables and trade payables ratios to calculate the cashoperating cycle of a business in days as follows:

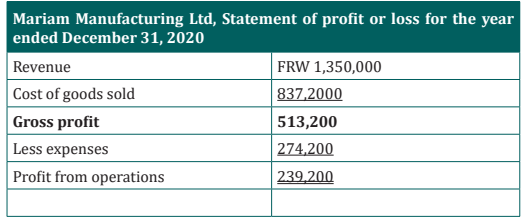

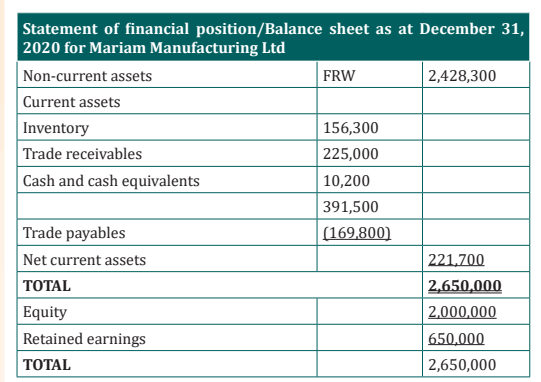

Illustration:

Set out below are the statement of profit or loss and statement of financialposition for Mariam Manufacturing Ltd:

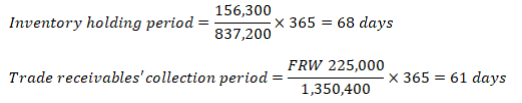

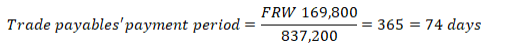

Let’s calculate the individual working capital ratios,

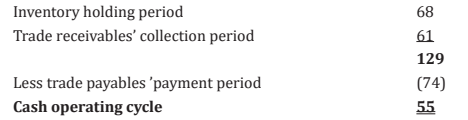

We can use the inventory, trade receivables and trade payables ratios to calculate

the cash operating cycle or cash ratio for Mariam Manufacturing Ltd, as follow :

Therefore, 55 days elapses between Mariam Manufacturing Ltd paying for its

raw materials and then getting cash in from the customer who has purchased

the goods that these materials have been made into.

5.2.2. Statutory and other regulations relating to the

management of cash balances

In the organisations, treasury function is responsible for dealing with cash

management and the investment of funds. It is this function of the organization

which has the responsibility for ensuring the minimum requirements for cash

in the organization are met and any investments within the organization’s rules,

regulations offer the best return, low risk and ensure liquidity availability

The treasury function actions in an organization including :

1. Centralized cash management avoids having a mix of cash surpluses and

overdrafts in different localized bank accounts,

2. Larger volumes of cash are available to invest so that better rates can be

negotiated,

3. Borrowing can be arranged in bulk at lower interest rates than for

smaller borrowings,

4. A centralized pool of buffer funds will be smaller than the sum of the

separate buffer funds that would be held by the individual operations,

5. A separate team will be able to monitor performance of the function

more effectively.– Procedures for dealing with cashWhen payments are received in the form of cash, cheques, debit or credit cards,

• Reconciliation of cash received

then a list of all receipts taken during the day must be kept and this list must

then be reconciled with the amount of cash in the till, cash box or safe at the

end of the day.

• Physical safeguards

The cheque or cash should be kept under lock and key, either in a cash box,

lockable till or safe with only authorised individuals having access to the keys.

• Checking for valid payment

If cheques are accepted as payment, then they must be supported by a valid

cheque guarantee card and be correctly drawn up, dated and signed. If debit

or credit cards are accepted, then basic checks should be made on the card and

signature, and authorization must be sought for payments which exceed the

floor limit.

• Banking procedures

Any cash, cheques, debit and credit card vouchers (if the business does not

use Electronic Funds Transfer at Point of Sale (EFTPOS)) should be banked

as soon as possible. This helps the business in not only the money being used

by employees for unauthorized purposes it is earning for the business the

maximum amount of interest. If it is not possible to bank the takings until the

following day, then either the cash must be left in a locked safe overnight or in

the bank’s overnight safe.

• Recording procedures

For security purposes, the paying-in slip for the bank should be made out by

someone other than the person paying the money into the bank. The total on

the paying-in slip should also be reconciled to the till records or cash list for the

day.

Application activity 5.2

Question 1

What is the difference between the formulae for the current ratio and the

acid test ratio?

Question 2

Which of the following is the quick ratio?

a) Current assets/Current liabilities

b) Current assets less inventories/Current liabilities

c) Profit/revenues

d) Trade receivables/Credit sales

Question 3:

A business has a cash operating cycle of 65 days. Its inventory holding

period is 38 days and its trade payables’ payment period is 45 days.

Required

What is the trade receivables’ collection period in days?

a. 7 days, b. 20 days, c. 27 days, d. 72 days

Skills Lab 5

With the reference to successful entrepreneurs operating in Rwanda,

MUKARUTESI Ltd is an enterprise which sells agro-processed goods such

as packed wheat flour, palm oil, maize flour at Rwamagana. Raw materials

used to make maize flour are purchased from Ngoma farmers, soya grains

are imported from Zambia and payment transfers are done electronically

while sorghum cereals are supplied by a trader from Musanze who require

direct cash payment. The acquisition of raw materials is managed by Linda

M. who is the chief accountant. Rutayisire who manages the department

of Human Resources had submitted payroll for the year 2022 and M.

MUKARUTESI Ltd, Chief Finance Officer prepared the statement of cash

flows. The department of finance has a cash balance of FRW 50 millions as

at 31 December 2022 During January 2023, cash receipts are estimated to

be FRW 25 million, cash payments FRW 26m and a depreciation charge of

FRW 7 millions.

Goods produced are sold both for cash as well as on credit. In the case

of credit sales, the pending bills are realized at a later date. This cycle

continues to be repeated in an accounting year several times. Thus, the

flow of cash in a business passes through various channels. The magnitude

of the flows in terms of time (days) may be depicted in the analysis made

by MUKARUTESI Ltd.

Required

– Think of a financial statement that is appropriate to report this

financial information.

– What will be the forecast cash balance for 31 January 2023?

a) FRW 61m

b) (FRW 11m)

c) FRWF 39m

d) FRWF 32m

End of unit assessment 5Question 1

1. What do you think is meant by ‘cash’? (Hint: which are the truly

liquid assets?)

2. Can you think of any more examples? Spend a minute thinking

about this and then write down any you come up with.

Question 2:

A business has an inventory holding period of 84 days, a trade receivables’

collection period of 51days and a trade payables’ payment period of 43

days.

Required:

What is the cash operating cycle in days?a. 10 days, b. 76 days, c. 92 days, d. 178 days