UNIT 4: THE CASH MANAGEMENT PROCEDURES IN ORGANIZATION

Key unit competence: Describe the cash management procedures in organization

Introductory activity

1. Analyze the above picture and answer the questions that follow:

i) Identify the different activities shown on above picture.

ii) Which kind of agents intervening in the specified activities?

iii) Are all agents having the same intention? Which ones and in which

way?

iv)Which cash management procedures are involved in the above

activities?

1.1. Introduction to cash management

Learning Activity 4.1

HEMA PLC is profit oriented company processing many products from two

cereals, which are maize and wheat, for sales in Rwanda. The products

produced in that enterprise are Maize flour super, Maize flour Bugesera,

Wheat flour porridge and Wheat Flour Baker all of which were experiencing

sharp growth of sales and profitability to the whole business.

In the post Covid-19 period, HEMA PLC improved its organizational

management strategy and announced an implementation plan of 2 years.

The plan shows that Cash receipts from sales and Investments are estimated

to be FRW 10,000,000 and FRW 35,500,000, respectively; FRW 12,500,000

cash payments on supplies; Salaries of FRW 25,000,000 payables in the

period in which they occur; Other cash payments estimated as being

FRW 4,200,000 and Opening cash balance was FRW 300,000. Because

of external factors from business environment which made cereals to

become scarce, HEMA PLC borrowed FRW 3,000,000, as liquid cash, from

its Comercial bank to finance its new strategy. Its strategic restructuring

of the management strategy, the expected results are high financial and

non-financial performance. As shown in the financial statements and other

report of performance, as the story of HEMA PLC illustrates, management

accountant must understand how cash management procedures are

followed, analyzed, and reported to managerial decision makers.

Management accountant must be able reconcile financial and nonfinancial

information from various business activities for internal and externalreporting.

Questions:

1. According to the story of HEMA PLC explain the situation faced up to

liquidity borrowing.2. Name the management accounting terms used in HEMA PLC story.

4.1.1. Definition of concepts

a. Cash-flows

Cash flows are inflows and outflows in cash equivalent. These cash equivalent

are cash received and paid on operating, investing, or financing activities in thestatement of cash flows, and depending also on the nature of the transaction.

These cash equivalents consist of the temporary investments of cash not

required at present by the business, such as funds put on short-term deposit

with a bank. Such investments must be readily convertible into cash, or availableas cash within three months.

b. Cash management

Cash management is about dealing with liquidity management and the

investment of funds. Cash management function ensures that minimum

requirements for liquidity in the organization are met and that any investments

are within the organization’s rules and regulations, as well as offering the bestreturn, risk and liquidity available.

c. Cash flow statement

Cash flow statement is a statement that provides valuable information about

a company’s gross payments and receipts and allows insights into its future

income needs.

Frank W. (2005) notes that Cash-Flow shows us exactly where the cash has

come from during the year, exactly what we have done with it and helps us to

throw some light on to the cash situation. For him, it is important to ensure

that:

– Sufficient profits are made to finance the business activities.– Sufficient cash funds are available as and when needed.

4.1.2. Types of cash flow activities

The three categories of cash flow activities are operating activities, investing

activities, and financing activities. Operating activities include cash activities

related to net income. Investing activities include cash activities related

to noncurrent assets. Financing activities include cash activities related to

noncurrent liabilities and owners’ equity.

Operating activities include cash activities related to net income. For example,

cash generated from the sale of goods (revenue) and cash paid for merchandise

(expense) are operating activities because revenues and expenses are included

in net income.

Investing activities include cash activities related to noncurrent assets.

Noncurrent assets include (1) long-term investments; (2) property, plant, and

equipment; and (3) the principal amount of loans made to other entities. For

example, cash generated from the sale of land and cash paid for an investment

in another company are included in this category.

Financing activities include cash activities related to noncurrent liabilities

and owners’ equity. Noncurrent liabilities and owners’ equity items include (1)

the principal amount of long-term debt, (2) stock sales and repurchases, and

(3) dividend payments. (Note that interest paid on long-term debt is included

in operating activities.)

Examples of Cash-flow Activity by category

Operating Activity (activities related to net income)

Cash receipts from the following: 1) Sales of goods or services, 2), 3);

Cash payments for the following: 1) Merchandise purchases from suppliers, 2)

material used to manufacture products, 3) employee payroll, 4) interests paid

to lenders, 5) Income taxes, 6) other operating expenses.

Investing activities (activities related to noncurrent assets)

Cash receipts from the following: 1) Sale of long-term Investment (e.g., bonds

and stocks of other companies), 2) sale of property, equipment, and plant, 3)

collection of principal for loans made to other entities

Cash payments for the following: 1) Purchase of long-term Investment (e.g.,

bonds and stocks of other companies), 2) purchase of property, plant andEquipment, 3) loans made to other entities

Financing activities (related to noncurrent liabilities and owners’ equity)

Cash receipts from the following: 1) Issuance of notes (e.g., a loan with bank),2) issuance of bonds, 3) issuance of common bonds,

Cash payments for the following: 1) principal amount of loans, principal amountof bonds, 3) repurchase of common stocks (treasury stocks), 4) cash dividends.

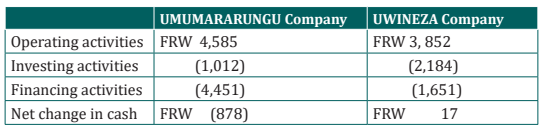

Example of Cash Activity at UMUMARARUNGU Company and UWINEZA

Company. UMUMARARUNGU Company and UWINEZA Company are wholesale

business which has stores of cooking oil and throughout Kigali. A review of

the statements of cash flows for both companies reveals the following cash

activities. Positive amounts are cash inflows, and negative amounts are cashoutflows.

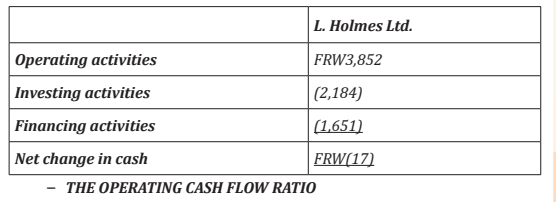

This information shows that both companies generated significant amounts of

cash from daily operating activities; FRW 4,585 for UMUMARARUNGU Company

and FRW 3,852 for UWINEZA Company. It is interesting to note both companies

spent significant amounts of cash to acquire property and equipment and long term

investments as reflected in the negative investing activities amounts. For

both companies, a significant amount of cash outflows from financing activities

were for the repurchase of common stock. Apparently, both companies chose toreturn cash to owners by repurchasing stock.

4.1.3. Objectives of cash management

The prime objective of cash management is to channelize the flow of cash from

the surplus to deficit units to maintain the appropriate liquidity position of the

organization. Other important objectives of cash management are discussed asfollows:

a. Planning of Cash Flows

This objective refers to scheduling the cash inflow and outflow of an organization

over a period of time. The planning of cash flow helps in maintaining an adequateamount of capital to finance day-to-day- functions of the organization.

b. Synchronizing Cash Flows

This objective refers to developing equilibrium between inflow and outflow of

cash in the business. If the amount of cash receipts (inflow) is equal to the cashpayment (outflow) then there would be no requirement of holding extra cash.

c. Optimizing Cash Holding

This objective refers to determining the appropriate amount of cash to be kept

in the business to meet the contingency needs. It is the duty of the finance

manager to decide the optimal cash holding to avoid any excess or deficit ofcash.

4.1.4. Tools of cash management

Cash management tools are financial management mechanism that determine

the expected cash inflows and cash requirements. They assist the business in

determining the optimum level of cash. There are a number of tools that cash

managers can draw on to support an efficient cash management structure.

These include:

Working capital tools to improve the liquidity available to the organizations

using only commercial flows, and not requiring the assistance of any externalfinancial institution.

Control over the cycle of payments and receipts to reduce the volatility

of intra-month cash balances and improve application of corporate policies

regarding supplier and customer payment terms.

Internal processes to accelerate the allocation of receipts to customer

accounts, thereby increasing the liquidity available for corporate uses and

better customer credit management.

An optimized banking structure that uses a limited number of banks and

bank accounts,

Structures that concentrate available balances in fewer locations and thereby

enabling economies of scale, greater risk diversification and a reduction inoperational risk.

4.1.5. Techniques of cash-flow management

There are various techniques of cash-flow management used in an organization.

Some of the cash-flow management techniques are mainly related to

1) Accelerating Cash Inflows and

2) Slowing Cash Outflows.

Accelerating cash inflows includes:

a) Prompting Customers for Timely Payment,

b) Quick Conversion of Payment into Cash,

c) Improving Average Collection Period;

Slowing cash outflows includes:

a) Paying on Last Date,

b) Paying by Draft,

c) Centralization of Payment,

d) Adjusting Payroll Funds,

e) Use of Float.

Also, some additional cash-flow management techniques include:

1) Effective Inventory Management,

2) Minimizing Operational Cost,

3) Reducing the Time Span of Production Cycle,

4) Fast Cash Transaction,

5) Speedy Conversion of Securities into Cash,

6) Effective Management of Account Receivable,

7) Concentration Banking,8) Lock-Box System.

4.1.7. Purpose of cash management

a. To Control Cash Flows

This purpose is clear-cut because most business owners want to increase the

amount of money flowing into their business and at the same time minimizing

the cash leaving their business, by reducing operational expenses and other

costs. A currency recycler, for example, recycles the same cash that comes in

through transactions to fund the employee floats and cash registers.

b. To Optimize Cash Levels for the Business

Optimizing cash levels is essential to control the cash flow. If the business inflow

in terms of cash are not available for use (e.g., when the business manager has

outstanding unpaid invoices or money is held in the cash registers), he may

not have liquidity that business needs. The cash management system allows

optimizing the cash levels by creating a better liquidity. A good example is the

store float. If the manager of the company is unsure about what the inflows will

look like for the day, he might set the float higher than he need to. However,

the money is held in the petty cash fund or smart safe, when it could be paying

debts or held in a deposit account earning interests.Equally, if the manager of

the company puts all his/her cash on deposit, he/she has hampered his/her

liquidity. When an unexpected cost comes up, he/she may find him/her-self

without the cash to cover them.

Thus, the need of any cash management software which might have functions

that help optimize the cash levels, including:

Cash analytics: Provide data around the movement of cash from tills to vault

holdings. This allows to manage cash balances, reconciliation, and deposit

reporting more effectively

Cash forecasting: Provides insights into trends to forecast the cash needs and

replenishments, while enabling to see cash on hand and what one need on a

frequent basis to operate the business efficiently.

Cash status: Gives the view into the available cash on hand and frequency of

denomination usage. One would better understand which notes and coins are

most in demand, so that he/she may always have enough cash on hand.

c. To Enable More Efficient Cash Planning

The right cash management system helps optimize cash and this allows cash

manager to plan more effectively. The use of Automated cash management

systems to collect and provide data, will help to make more informed decisions.

d. To enable more Effective Cash Management

A good management system allows the business owner to see cash movements

through the business, giving him/her a bird’s eye view of where and when cash

is leaving the business and where and when it’s entering. The business owner

will also make better decisions about how to manage cashflow in the business,

such as when to deposit it or how much to hold back. All of his/her decisions

will be backed by data to both streamline and improve cash management andcashflows.

Application activity 4.1

1. Define the following concepts:

– Cash flows

– Cash flow statement

– Cash management

2. Which section of the statement of cash flows is regarded by most

financial experts to be most important?

3. State the objectives of cash management

4. Explain the purpose of cash management

4.2. Cash-flow statement

Learning Activity 4.2

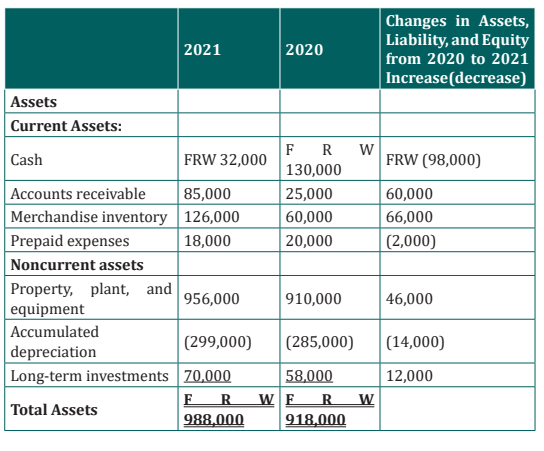

John Karamaga, CEO and founder of Home Furniture Company has

reviewed the company’s income statement and balance sheet for the most

recent fiscal year ended December 31, 2021. Home furniture Company

has grown rapidly this year, with sales and net income showing significant

gains compared to 2020. Although John is satisfied with the increase in

profitability, he noticed a significant decline in cash. John decides to pursue

this with Linda Uwimana (CFO) and Steve Kayira (treasurer) in their

regular meeting:

John

I just received the income statement and balance sheet for 2021. Profits

look great, but our cash position seems to have deteriorated. We had

FRW130,000 in cash to start the year and ended with only FRW32,000.

I noticed cash was declining throughout the year when I reviewed our

monthly financial statements, but I’m concerned about how far our cash

balance has dropped.

Steve

You’re right, John. We encountered cash flow problems several times

throughout the year despite increased sales and profits. On several

occasions, I had to delay payments to creditors because of cash flow issues.

John

Seems to me we shouldn’t have this problem. Where is our cash going?

Linda

Good question. Let me round up our cash flow information for the year.

I’ll have something for you by next week.

John

Great! I’d like to start next week’s meeting by discussing how much cash we

generated in 2021 from our daily operations. I realize net income is shown

on an accrual basis, but I’d like to know how much net income was received

in the form of cash.

Linda

No problem. I’ll have it for you next week.

Question

a) What kind of employees are having discussion?

b) Which finance report must be prepared by Steve, Joh and Linda ?c) Which are the ways in which cash flows are reported? Give ideas.

4.2.1. Purpose of cash-flow statement

Financial accounting courses covered in the first three statements in detail and

often provide an overview of the statement of cash flows. The preparation of

cash flows statement and using the resulting cash flow information for analytical

purposes, leads to the purpose of information provided in the statement of cashflows.

The purpose of the statement of cash flows is to provide a summary of cash

inflows and cash outflows information for a period of time and to reconcile

the difference between beginning and ending cash balances shown on thestatement of financial position.

4.2.2. Steps of preparing the cash-flow statement

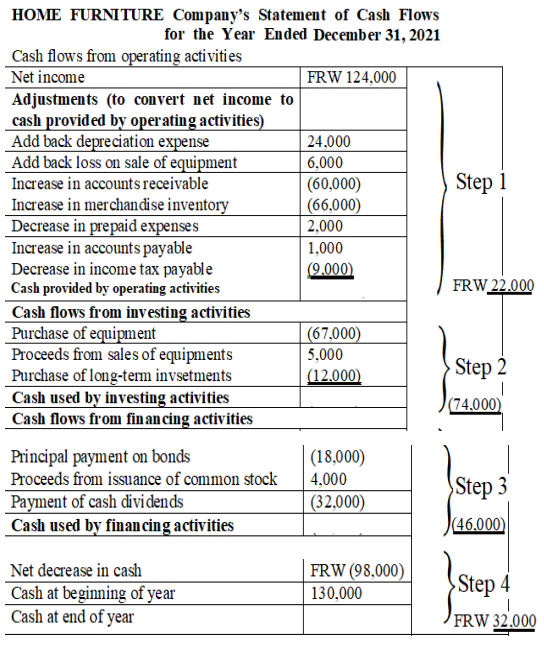

The four steps required to prepare the statement of cash flows are described

as follows:

Step1.

Prepare the operating activities section by converting net income from an

accrual basis to a cash basis. This step will be done using indirect method

throughout this chapter. The indirect method begins with net income from

the income statement and makes several adjustments related to changes in

current assets, current liabilities, and other items to arrive at cash provided

by operating activities (or used by operating activities if the result is a cash

outflow). Cash provided by operating activities represents net income on a cash

basis. It tells the reader how much cash was received from the daily operations

of the business.

Step 2.

Prepare the investing activities section by presenting cash activity for

noncurrent assets.

This step focuses on the effect changes in noncurrent assets have on cash.

Noncurrent asset balances found on the the statement of financial position or

balance sheet, coupled with other information (e.g., cash proceeds from sale of

equipment) are used to perform this step.

Step 3.

Prepare the financing activities section by presenting cash activity for

noncurrent liabilities and owners’ equity. This step focuses on the effect changes

in noncurrent liabilities and owners’ equity have on cash. Noncurrent liabilities

and owners’ equity balances found on the balance sheet, coupled with other

information (e.g., cash dividends paid) are used to perform this step.

Step 4.

Reconcile the change in cash. Each section of the statement of cash flows

described in steps 1, 2, and 3, will show the total cash provided by (increase)

or used by (decrease) the activity. Step 4 simply confirms that the net of these

changes equates to the change in cash on the statement of financial positionbalance sheet

Example 1,

Using the information extracted in the accounting information system of Home

Furniture Company, assume the balance sheet shows cash totaled FRW100

at the end of last year from 2020 and FRW140 at the end of the current year

2021. Thus cash increased by FRW40 over the course of the current year. Step

4 reconciles this change with the changes shown in the three sections of the

statement of cash flows. Suppose operating activities provided cash of FRW170,

investing activities used cash of FRW160, and financing activities provided cash

of FRW30. These 3 amounts netted together reconcile to the FRW40 increase in

cash shown on the balance sheet (= FRW170 − FRW160 + FRW30).

4.2.3. Methods used to prepare the cash-flow statements

There are two Methods of preparing a cashflow statement:

a. Direct method for the preparation of cash flow statement

The direct method for creating a cash flow statement reports major classes of

gross cash receipts and payments (Cash inflow and cash outflow). At the end

of that given period, the business will have a surplus if cash inflows are morethan the cash outflows or deficit if cash inflows are less than the cash outflows.

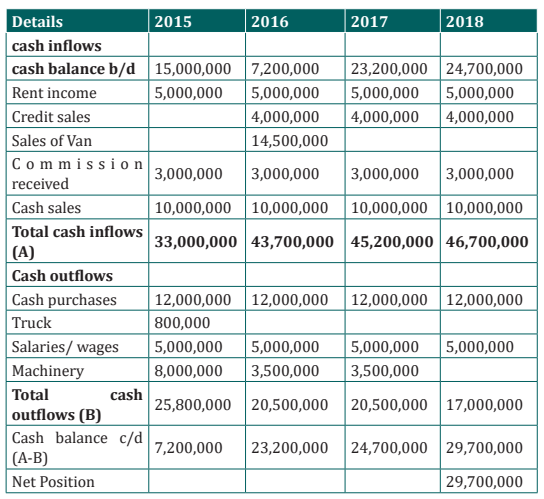

Illustration:

Prepare Iraguha’s cash flow for the years 2015, 2016, 2017 and 2018, given the

following information below:

Cash balance b/d or b/f in January 2015 was FRW 15,000,000

Yearly rent income was FRW 5,000,000

Yearly credit sales to be paid in the next year were FRW 4,000,000

Sold a business van in 2016 FRW 14,500,000

Yearly commission received was FRW 3,000,000

Yearly cash sales FRW 10,000,000

Yearly cash purchases FRW 12,000,000

Bought a truck in 2015 for FRW 800,000

Yearly salaries and wages FRW 5,000,000

Bought machinery worth FRW 15,000,000, payment of FRW 8,000,000 was

made in 2015 and the balance was paid in two equal instalments during themonth of February and March.

SolutionIRAGUHA’S CASH FLOW STATEMENT FOR 2015, 2016, 2017 and 2018

b. Indirect method for the preparation of cash flow statement

The indirect method uses net-income as a starting point, makes adjustments

for all transactions for non-cash items, then adjusts from all cash-based

transactions. An increase in currentasset account is subtracted from net income,

and an increase in a current liability account is added back to net income. This

method converts accrual-basis net income (or loss) into cash flow by using aseries of additions and deductions.

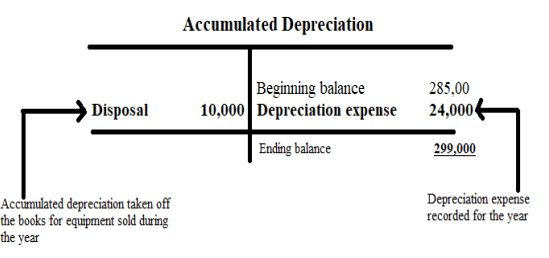

4.2.3. Prepare cash-flow statement

As stated earlier, the information needed to prepare the statement of cash

flows includes the statement of financial position, income statement, and otherselected data.

Illustration

Using the financial statement’s information below and Other additional data of

Home Furniture Company for 2021, let’s prepare the statement of cash flows

as follows:

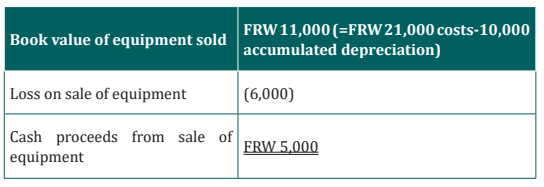

Sold equipment with a book value of FRW11,000 (= FRW21,000 cost −

FRW10,000 accumulated depreciation) for FRW5,000 cash, purchased

equipment for FRW67,000 cash, Long-term investments were purchased

for FRW12,000 cash. There were no sales of long-term investments, Bonds

were paid with a principal amount of FRW18,000, Issued common stock forFRW4,000 cash, Declared and paid FRW32,000 in cash dividends

With these information provided, we can start preparing the statement of

cash flows using the indirect method. It is important to note that all positive

amounts shown in the statement of cash flows denote an increase in cash, and

all negative amounts denote a decrease in cash.

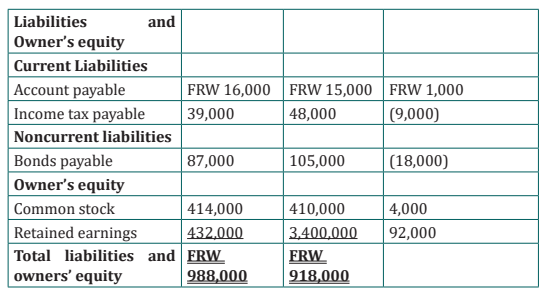

Furniture Company, statement of financial position as at December31st,2020 and December 31st, 2021

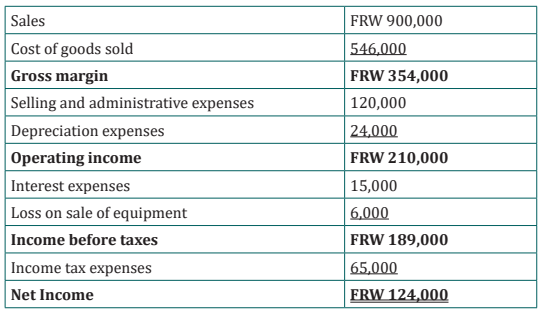

Home Furniture Company’s Income Statement, for the Year Ended December

31st, 2021

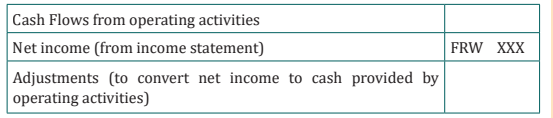

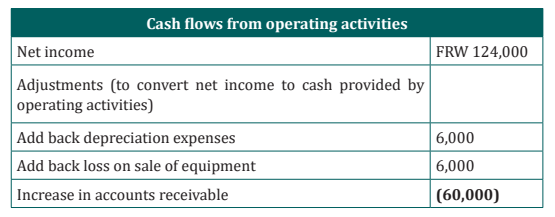

Step 1: Prepare the Operating Activities Section

The Format of Cash Flows from Operating activities

The first adjustment to net income involves adding back expenses that do not

affect cash (often called noncash expenses). The second adjustment to net

income involves adding back losses and deducting gains related to investing

activities. However, this loss is not related to the daily operations of the business.

Remember, we are trying to find the cash provided by operating activities in

this section of the statement of cash flows. Since equipment is a noncurrent

asset, cash activity related to the disposal of equipment should be included in

the investment activities section of the statement of cash flows. The third type

of adjustment to net income involves analyzing the changes in all current assets

(except cash) and current liabilities from the beginning of the period to the

end of the period. Two important rules must be followed to determine how the

change is reflected as an adjustment to net income.Study these two rules carefully:

1. Current assets. Increases in current assets are deducted from net income;

decreases in current assets are added to net income.

2. Current liabilities. Increases in current liabilities are added to netincome; decreases in current liabilities are deducted from net income.

Operating Activities Section of Statement of Cash Flows for Home FurnitureCompany

With the above information, Home Furniture Company received FRW 22,000 in

cash for the year related to daily operations of the business.

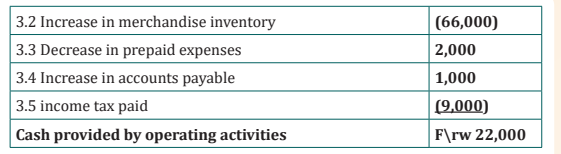

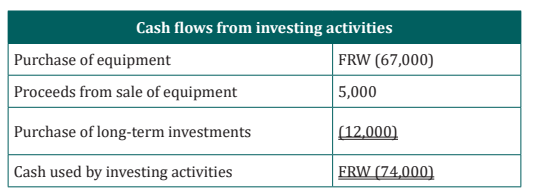

Step 2: Prepare the Investing Activities Section

Now that we have completed the operating activities section for Home

Furniture Company, the next step is to prepare the investing activities section.

The statement of cash flows focuses on cash activities related to noncurrent

assets. Three noncurrent asset items must be analyzed to determine how to

present cash flow information in the investing activities section.

1. Property, plant, and equipment increased by FRW46,000.

The additional information provided for 2021 indicates two types of transactions

which caused this increase. First, the company purchased equipment for

FRW67,000 cash and Second, the company sold equipment for FRW5,000 cash

(often called a disposal of equipment). The net effect of these 2 entries is an

increase of FRW46,000 (= FRW67,000 − FRW21,000). This is summarized in

the following T-account:

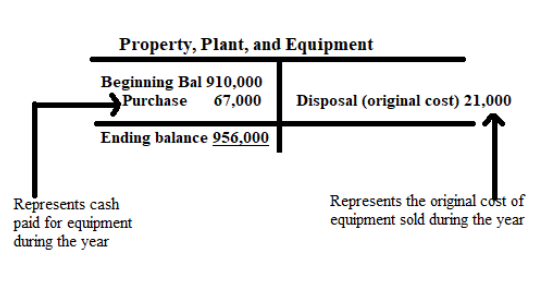

2. Accumulated depreciation decreased noncurrent assets by

FRW14,000.

Two items caused the change in the accumulated depreciation account. First,

the sale of equipment during the year caused the company to take FRW10,000

in accumulated depreciation off the books. Second, FRW24,000 in depreciation

expense was recorded during the year (with a corresponding entry to

acc4.2.5. Cash-flow information analysis

Companies and analysts tend to use income statement and balance sheet

information to evaluate financial performance. In fact, financial results

presented to the investing public typically focus on earnings per share. Analysis

of cash flow information is becoming increasingly important to managers,

auditors, and financial analysts. Three common cash flow measures used to

evaluate organizations are (1) operating cash flow ratio, (2) capital expenditure

ratio, and (3) free cash flow. umulated depreciation). This information is summarized in the followingT-account:

How is accumulated depreciation information used in the statement of cash

flows for Home Furniture Company?

3. Long-term investments increased by FRW12,000.

The additional information provided for 2021 indicates there were no sales of

long-term investments during the year. The increase of FRW12,000 is solelyfrom purchasing long-term investments with cash.

The following paragraph shows the three investing activities described

previously:

1. a FRW67,000 decrease in cash from the purchase of equipment,

2. a FRW5,000 increase in cash from the sale of equipment, and

3. a FRW12,000 decrease in cash from the purchase of long-term

investments.

There is also the impact of these three items on cash and the resulting cashused by investing activities of FRW74,000.

The company used FRW 74,000 in cash for investing activities.

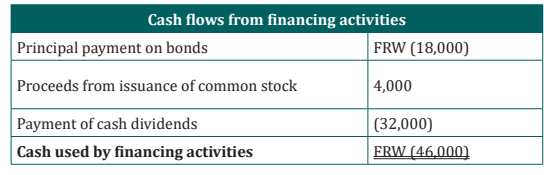

Step 3: Prepare the Financing Activities Section

What information is used for this section, and how is it prepared? The financing

activities section of the statement of cash flows focuses on cash activities related

to noncurrent liabilities and owners’ equity (i.e., cash activities related to long term

company financing). One noncurrent liability item (bonds payable) and

two owners’ equity items (common stock and retained earnings) must be

analyzed to determine how to present cash flow information in the financing

activities section. How is this information used in the statement of cash flows?

Step 4: Reconcile the Change in Cash

The following table provides a summary of cash flows for operating activities,

investing activities, and financing activities for Home Furniture Company,along with the resulting total decrease in cash of FRW 98,000

4.2.5. Cash-flow information analysis

Companies and analysts tend to use income statement and balance sheet

information to evaluate financial performance. In fact, financial results

presented to the investing public typically focus on earnings per share. Analysis

of cash flow information is becoming increasingly important to managers,

auditors, and financial analysts. Three common cash flow measures used to

evaluate organizations are (1) operating cash flow ratio, (2) capital expenditure

ratio, and (3) free cash flow.

Example

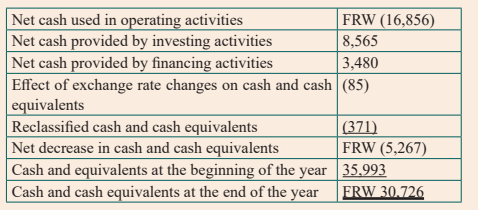

The following statement of cash flow for L. Holmes Ltd., were prepared for theperiod ending 31 January 2022

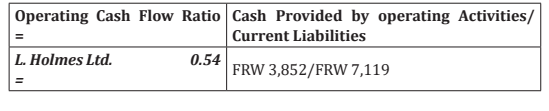

Is cash provided by operating activities divided by current liabilities. This ratio

measures the company’s ability to generate enough cash from daily operations

over the course of a year to cover current obligations. Although similar to the

commonly used current ratio, this ratio replaces current assets in the numerator

with cash provided by operating activities. The operating cash flow ratio is asfollows for L. Holmes Ltd.:

The numerator, cash provided by operating activities, comes from the

bottom of the operating activities section of the statement of cash flows. The

denominator, current liabilities, comes from the liabilities section of thestatement of financial position/balance sheet.

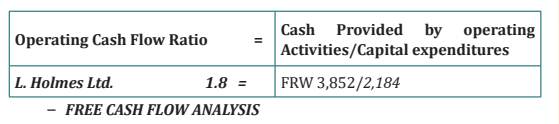

– CAPITAL EXPENDITURE RATIO

Is cash provided by operating activities divided by capital expenditures. Thisratio measures the company’s ability to generate enough cash from daily

operations to cover capital expenditures. A ratio in excess of 1.0, for example,indicates the company was able to generate enough operating cash to cover

investments in property, plant, and equipment. The capital expenditure ratio

for L. Holmes Ltd.is as follows:

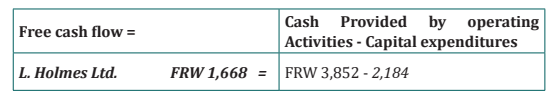

Free cash flow is cash provided by operating activities minus capital expenditures

as follows:

Free cash flow = Cash provided by operating activities − Capital

expenditures

The cash provided by operating activities comes from the bottom of the

operating activities section of the statement of cash flows. The capital

expenditures amount comes from information within the investing activities

section of the statement of cash flows. The free cash flow amount is calculatedusing information from each company’s statement of cash flows.

The results tell us that the company generates enough cash (FRW 1,668 ) from

daily operations to cover capital expenditures (FRW2,184)

Application activity 3.2

Question 1

Define the following ratios, and how they are calculated.

a) Free cash flow ratio

b) capital expenditure ratio

c) operating cash flow ratio

Question 2The following information is from the consolidated statement of cashflows for BMC Motors for the year ended December 31, 2022

Required:

An investment advisor recently reviewed BMC Motors’ statement of cash

flows and statement of financial position and stated: “BMC Motors is doing

great! They are holding cash of more than FRW 30,000. There is no cash

flow problem with this company!”

Do you agree with this statement.? Support your conclusion with an

analysis of BMC Motors’ cash flows.

Question 3

Using the statement of financial position and income statement attached

herewith, you are required to prepare the statement of cash flows using the

indirect method

4.3. Use of financial and nonfinancial performancemeasuresLearning Activity 4.3

Sandy Masaka is the CEO of a fast-food restaurant called Chicken Remix.

The company operates five restaurants throughout Kigali City and is

choosing between two suppliers of soft drinks: ABC Fizz Ltd and BIG Fizz

Ltd. Consumer surveys indicate no significant preference between the

two. Sandy is meeting with Dave Gasana, the CFO, and Karen Mugwiza, the

purchasing manager, to discuss the company’s options. Chicken Remix is

facing a supplier choice decision which is common to many companies.

Financial stability is an important factor in choosing on a supplier, along

with the quality of product and reliability of service. Chicken Remix must

analyse financial information for ABC Fizz Ltd and BIG Fizz Ltd to determine

the financial condition of each company. The analysis of a company’s

financial information typically follows a three-pronged approach. First,

trends within a company’s own financial information are analyzed, such as

sales and earnings from one year to the next, using two methods. Second,

financial measures are compared between competitors. Finally, the ratios

are analyzed and are compared to industry averages.

Question

What should be the accounting responsibilities of each person attending

the meeting?

Do you have any idea about the kind of analysis which might be made by

Finance Department?

Which one may be appropriate?

4.3.1. Introduction to Financial and non-financial performance measures

For any business which is a going concern, the owner is always afraid of business

activities performances. For different reasons the performances are measured

on one hand using financial criteria (statistical) and non financial measures

(Qualitative assumptions) on other hand.

4.3.2. Financial performance measures

a. Trend analysis

Trend analysis evaluates an organization’s financial information over a period

of time. Periods may be measured in months, quarters, or years, depending

on the circumstances. The goal is to calculate and analyze the amount change

and percent change from one period to the next. Trend analysis is often used

to evaluate each line item on the income statement and statement of financial

position. The percent change is calculated as the current year amount minus

the base year amount, divided by the base year amount.

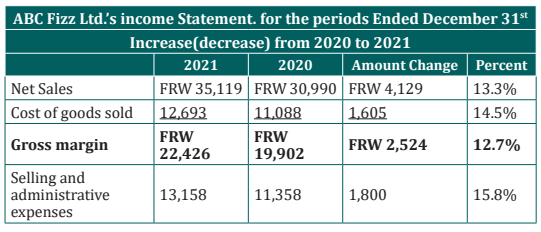

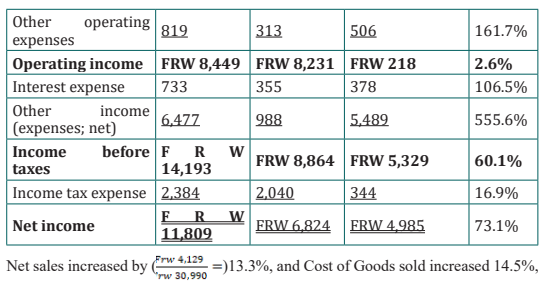

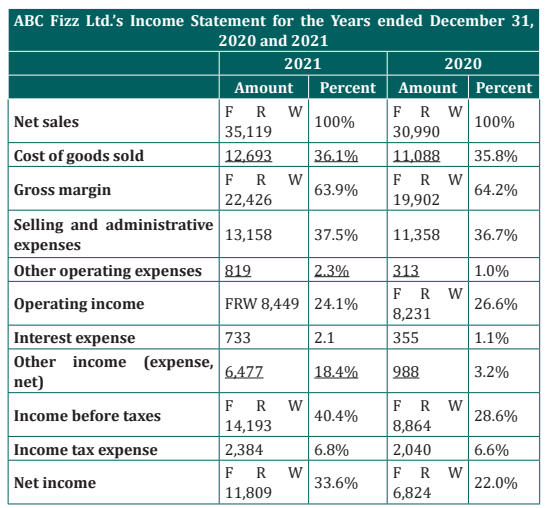

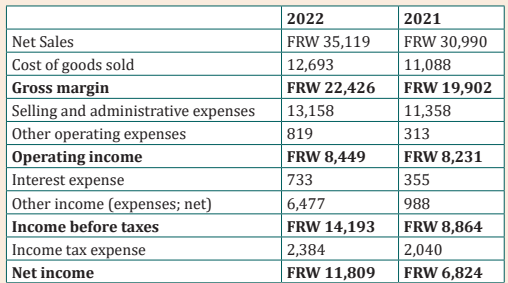

Example: The following shows ABC Fizz Ltd.’s income statement trend analysisor horizontal analysis

resulting in a 12.7% increase in gross margin. Good news for ABC Fizz Ltd! Selling

and administrative expenses increased 15.8%, while other operating expenses

increased 161.7%. operating income increased 2.6%, interest expense increased

106.5%, and other income increased 555.6% (related to a one-time acquisition

gain). Income before taxes increased 60.1% resulting in a 16.9% increase in income

tax expense. Net income increased a substantial 73.1% (much of this was related toa one-time acquisition gain).

b. Common-size analysis of Financial statement

Common-size analysis (also called vertical analysis) converts each line of

financial statement data to an easily comparable, or common-size, amount

measured as a percent. This is done by stating income statement items as a

percent of net sales and statement of financial position items as a percent of

total assets (or total liabilities and shareholders’ equity). For example, ABC Fizz

Ltd had net income of FRW 11,809 and net sales of FRW 35,119 for 2020. The

common-size percent is simply net income divided by net sales, or 33.6 percent

(= FRW 1,809 / FRW 35,119).

There are two reasons to use common-size analysis:

1. To evaluate information from one period to the next within a company

and

2. To evaluate a company relative to its competitors.

Common-size analysis answers such questions as “how do our current assets

as a percentage of total assets compare with last year?” and “how does our net

income as a percentage of net sales compare with that of our competitors?”

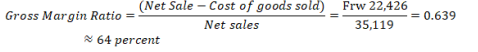

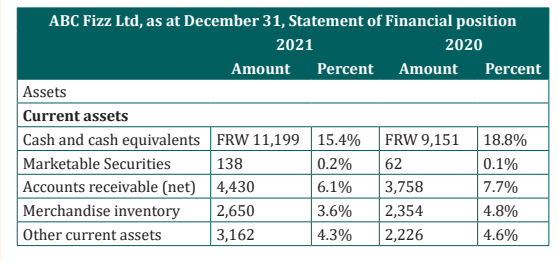

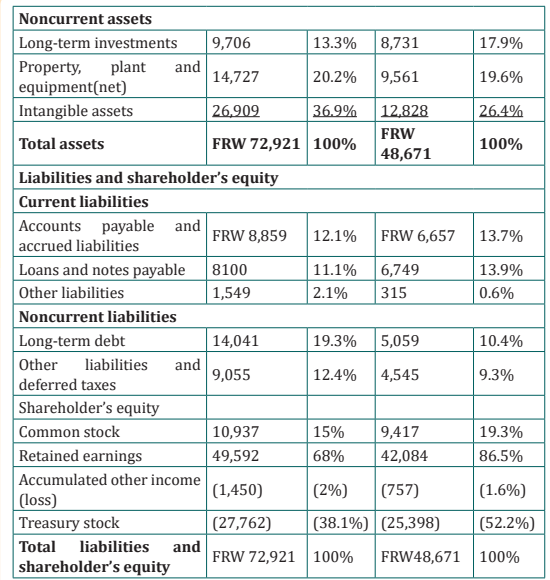

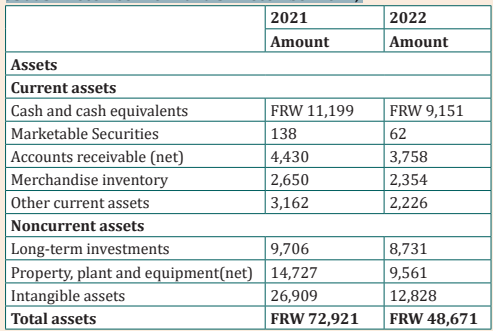

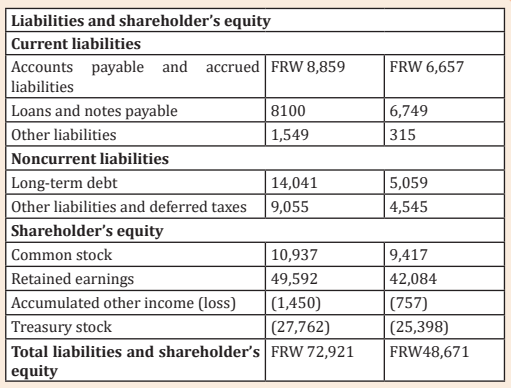

Example: The following presents the common-size analysis for ABC Fizz Ltd.’s

income statement. As you look at these figures, notice that net sales are used as

the base for the income Statement. That is, for the income statement, each item

is measured as a percent of net sales.

Cost of goods sold increased from 35.8% of net sales in 2020 to 36.1% in 2021,

which resulted in a decrease in gross margin from 64.2% to 63.9%. selling and

administrative expenses increased from 36.7% to 37.5%, while other operating

expenses increased from 1% to 2.3%. operating income decreased from 26.6%

to 24.1%. interest expense increased from 1.1% to 2.1% and other income

increased from 3.2% to 18.4%. income before taxes increased from 28.6% to

40.4%. income taxes increased slightly. Net income increased from 22% to

33.6%.

In general, managers prefer expenses as a percentage of net sales to decrease

over time, and profit figures as a percent of net sales to increase over time.C. Ratio analysis

Although trends and common-size analysis provides an excellent starting

point for analyzing financial information, managers, investors, and other

stakeholders also use various ratios to assess the financial performance and

financial condition of organizations.

The four categories of ratios presented in this point are as follows:

• Ratios used to measure profitability (focus is on the income statement)

• Ratios used to measure short-term liquidity (focus is on short-term

liabilities)

• Ratios used to measure long-term solvency (focus is on long-term liabilities)

• Ratios used to measure market valuation (focus is on market value of thecompany)

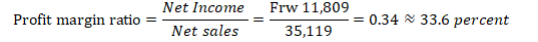

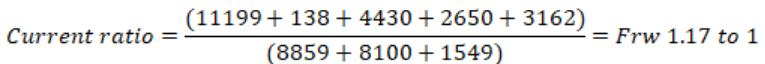

Profitability Measures for ABC Fizz Ltd for the year ended December 31,

2020

– Gross margin ratio indicates the gross margin generated for each

Rwandan franc in net sales and is calculated as gross margin (which isnet sales minus cost of goods sold) divided by net sales

– Profit margin ratio indicates the profit generated for each Rwandan

franc in net sales and It is calculated as net income divided by net sales:

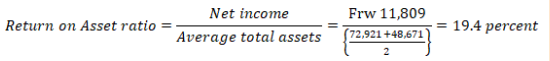

– Return on assets indicates how much net income was generated from

each Rwandan franc in average assets invested. Return on assets is netincome divided by average total assets:

– Return on common shareholder’s equity ratio indicates how much

net income was generated from each Rwandan Franc of common

shareholders’ equity. If the company does not have any outstanding

preferred stock, as is the case with ABC Fizz Ltd, the preferred

dividends amount is zero. Average common shareholders’ equity in the

denominator is found by adding together all items in the shareholders’

equity section of the statement of financial position at the end of the

current year and previous year (2020 and 2021 for this example),except preferred stock items, and dividing by two.\

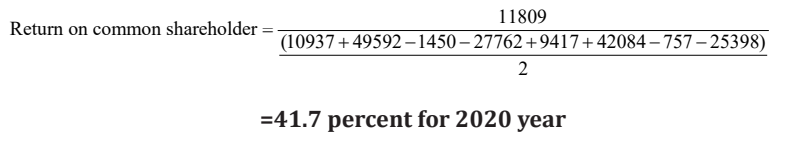

• Short-Term Liquidity Measures

– Current ratio indicates whether a company has sufficient current

assets to cover current liabilities. It is found by dividing current assets

by current liabilities (Current assts/current liabilities). In general, a

current ratio above 2 to 1 is preferable, which indicates the company

has sufficient current assets to cover current liabilities. However,

finding the ideal minimum current ratio is dependent on many factors,

such as the industry, the overall financial condition of the company and

the composition of the company’s current assets and current liabilities.

Because of variations in these factors from one company to the next, amore stringent measure of short-term liquidity is often used.

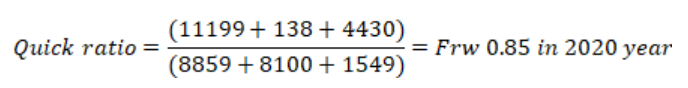

– Quick ratio (also called acid-test ratio) indicates whether a company

has sufficient quick assets to cover current liabilities. The quick ratio is

quick assets divided by current liabilities (current assets – Inventory /current liabilities).

The quick ratio indicates that ABC Fizz Ltd had FRW 0.85 in quick assets for every

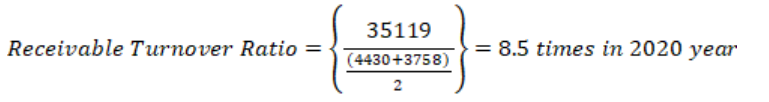

Rwandan franc in current liabilities.– Receivables Turnover Ratio indicates how many times receivables

are collected in a given period. Receivables Turnover Ratio is found

by dividing credit sales by average accounts receivable (credit sales/accounts receivables).

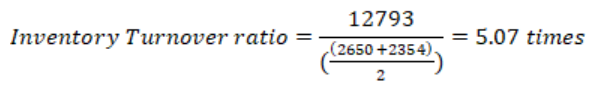

– Inventory Turnover Ratio indicates how many times inventory is

sold and restocked in a given period. It is calculated as cost of goodssold divided by average inventory(cost of sales/average inventory)

The inventory turnover ratio indicates that ABC Fizz Ltd sold and restocked

inventory 5.07 times during 2021

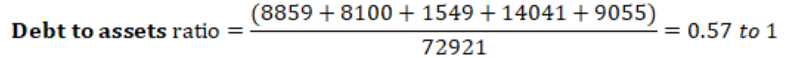

• Long-Term Solvency Measures– Debt to Assets ratio indicates the percentage of assets funded by

creditors and is used to evaluate the financial leverage of a company. The

higher the percentage, the higher the financial leverage automatically

the higher the percentage of assets funded by the shareholder. Debt to

assets is found by dividing total liabilities by total assets:

– The debt to equity ratio indicates the amount of debt incurred for

each Rwandan franc that owners provide. The debt to equity ratio

is total liabilities divided by total shareholders’ equity indicates the

company’s ability to cover its interest expense related to long-term

debt with current period earnings. This ratio indicates the amount

of debt incurred for each Rwandan franc that owners provide. It also

measures the balance of liabilities and shareholders’ equity used to

fund assets.

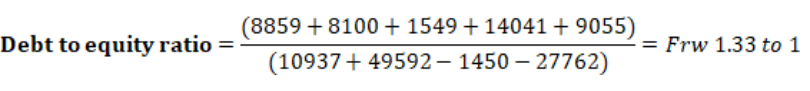

The debt to equity ratio is total liabilities divided by total shareholders’ equityThe debt to equity ratio for ABC Fizz Ltd is calculated as follows

The debt to equity ratio indicates that ABC Fizz Ltd had FRW 1.33 in liabilities for

each Rwandan in shareholders’ equity

• Market Valuation Measures

– Market capitalization (also called market cap) indicates the value

of a company at a point in time. is determined by multiplying market

price per share times the number of shares outstanding.

– The price-earnings ratio (also called P/E ratio) indicates the

premium investors are willing to pay for shares of stock relative to

the company’s earnings. The price-earnings ratio is found by dividing

market price per share by earnings per share.

4.3.3. Non-financial performance measures

Many organizations use a mix of financial and nonfinancial measures to evaluate

performance. For example, airlines companies track on-time arrival percentages

carefully, and delivery companies such as those ones which deliver goods

purchased online, monitor percentages of on-time deliveries. The balancedscorecard uses several alternative measures to evaluate performance.

The balanced scorecard is a balanced set of measures that organizations use to

motivate employees and evaluate performance. These measures are typically

separated into four perspectives:

Financial perspective, measures that shareholders, creditors, and other

stakeholders use to evaluate financial performance.

Internal business process perspective, measures that management uses to

evaluate efficiency of existing business processes.

Learning and growth perspective, measures that management uses to

evaluate effectiveness of employee training.

Customer perspective, measures that management uses to evaluate whetherthe organization is meeting customer expectations.

Application activity 4.3

Question 1

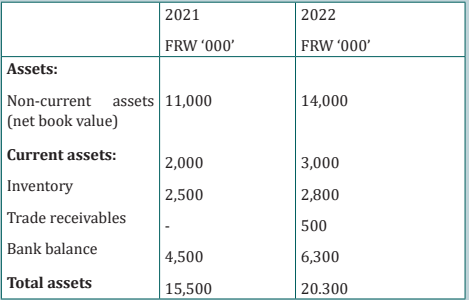

Ruhinguka Corneille, has the following statement of financial positionas at 31 December 2022 and 31 December 2021,

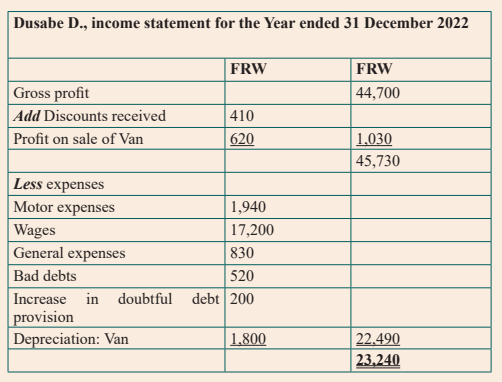

And the following Income Statement, Ruhinguka Corneille, for the year

endend 31 December 2022 and 31 December 2022

Required

Use the above financial statement and answer the following questiona) Demonstrate a meaningful trend analysis. Explain how theSkills Lab 4

percent change from one period to the next is calculated.

b) Using the appropriate information from above financial

statement show your financial analysis and interpretation with

the common-size analysis.

c) Name and explain three ratios used to evaluate profitability.

Assess at least two of the profitability ratios and interpret themwith the use of above financial information.

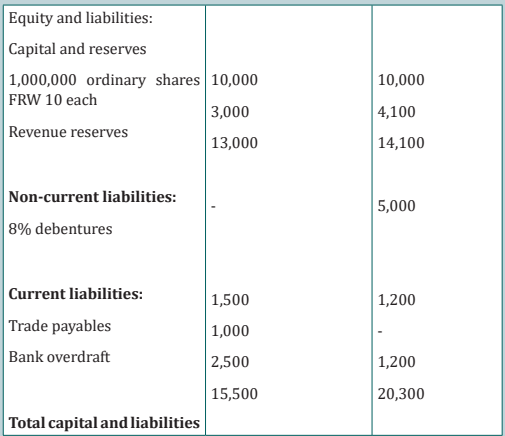

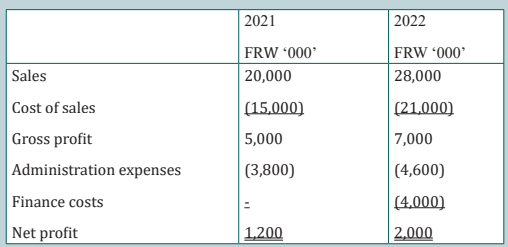

Students visit one of businesses operating near their school “MUGABO

ENTERPRISE”. One businessman called Mugabo presents to them the

financial statements of his Enterprise for the year ended 31 January 2021and 31 January 2022 as follow:

Mugabo Enterprise

Statement of Financial Position (Balance Sheet)

As at 31 January

Mugabo Enterprise Income Statement for the year ended 31 January

Inventory on 1 February 2020 was FRW 5,000,000

You are Required to calculate for 2021 and 2022 the:

i) Gross profit margin

ii) Inventory turnover

iii) Return on sales

iv)Acid test ratio

v) Current ratioEnd of unit assessment 4

Question 1

a) What are the 3 general areas or aspects which analysts are

normally concerned about?

Question 2: Which of the following ratios includes a component that

is not from the Statement of financial position balance sheet?

a) Acid-test ratio

b) Debt ratio

c) Accounts receivable turnover

d) Current ratio

Question 3:

– Use the Free cash flow ratio to explain and interpret the cash flowschanges from one period to the next

– With the information from above financial statements, produce

your financial analysis and interpretation of cash flows with the

capital expenditure ratio