UNIT 3: BASIC PRINCIPLE OF COSTING

Key Unit Competence: Identify and recording cost accounts used in organization

Introductory activity

“Making a profit on a project/product depends on pricing it correctly”.

AKARABO located in Kimironko Kigali city, is one of the Kigali’s largest

manufacturers of flat-screen televisions and mobile phones. In 2015,

AKARABO sold FRW 15million from phone cover and FRW 20 million

of cables of flat screen in Kigali city. Many of material used in shop of

flat-screen for well looks, AKARABO Spends FRW 40 million Annually

on the procurement of stand table of flat-screen, speakers, cables of

mobile phone and other materials. Until 2020, AKARABO did not have

a centralized procurement system to leverage its scale and to control

supply costs. Instead, the company had a decentralized system riddled

with wasteful spending and inefficiencies. To respond to these challenges,

AKARABO hired its first chief procurement officer introducing activity

-based costing (A.B.C) as solution. ABC Analysis of the company’s

procurements system revealed that most company resources were

applied to administrative and not strategic tasks. Furthermore, the

administrative tasks were done manually and at very high cost. A team

of manager and employees in AKARABO are responsible for costing and

pricing of its flat-screen and mobile phone. For each product, account

managers carefully examine and verify job costs as part of a competitive

bidding process. AKARABO business managers are also responsible for

identifying any potential problems with each product and determining

any alternative necessary to unsure high quality, on time delivery within

the original product budget. AKARABO received an order (command)

for new product of producing a computer. Manager at AKARABO need to

know how much it costs to manufacture its new product. Knowing the

cost and profitability of new job helps manager pursue their businessstrategies.

Of course, when making decisions, managers combine cost information

with non-cost information such as personal observations of operations,

and non-financial performance measures, such as quality and customer

satisfaction.

Questions1. State the products produced by AKARABO manufacturing co..3.1. Costing methods

2. What does the manager need for decision making?

3. According to your observation identify the costing methods thatcan be used from the above scenario.

Learning Activity 3.1

Question

a) What do you observe on the above picture?b) What do you think the man is going to do?

3.1.1. Introduction to costing methods

Costing methods is the approach or style or tactic adopted by an organization

to collect cost data in a more appropriate manner so as to establish the total

cost and cost per unit of final product produced or manufactured. The finalproduct can either be physical goods or services.

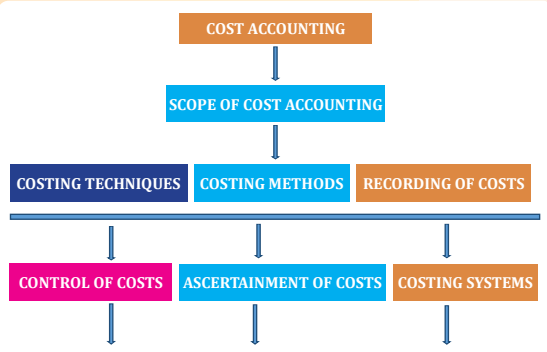

Costing methods is an approach of cost data collection which is “under

ascertainment of cost” umbrella and you know that ascertainment of cost aspect

is a thematic sub-topic of scope of cost accounting as show in above diagram.

These are several methodologies utilized by different organizations, which is

determined by the nature of products being manufactured. The viewpoint of

the diverse needs of different organisations necessitates consideration of the

criteria used in classifying the costing methods.

• Characteristics of Costing Method

The method is applicable to products which have common characteristics.

The ascertainment of cost in most of the times involves some repeated activities

or repetitive processes.

The process of cost ascertainment is within a specific period of time usually a

year.

• Costing methods entails both the determination of the overall cost and the

unit profitability of the products.

• The activity of costing method is periodical in the sense that the aspect of

cost ascertainment is limited to a specific accounting period.

• In addition to economic costs, the costing method incorporates other costsinform of normal and abnormal losses.

• Advantages of costing method

a. Minimization of production cost

By reducing inefficiencies associated with wastages and loses during production

therefore minimizing overall cost incurred in production.

b. Help in the profitability determination

Ascertainment of the costs guides the producer to know exactly the total cost of

the final product so as to set an appropriate profit margin in setting the selling

price.

c. Basis on purchase or manufacture of a component decision.

The cost ascertainment approach is timely in guiding the management on

whether it is economical to produce or purchase a certain component.

d. Control of costs

Costing methods help in comparing \previous year’s cost level so as to manage

the consumption of the economic resources. This can be achieved by use of

budgeting tool.

e. Tax matters

Taxation of firm’s profit by the government is pegged on the cost of production.

This helps the government to ensure that fairness prevails to avoid over or

under taxation.

f. Bargaining power.

The employee’s or worker’s union may use the cost of production as per cost

ascertainment to argue their case.

g. Delegation of responsibilities to employees.

The workers are assigned their duties based on the costing method used. This

helps in ensuring that no idle employees who are paid.

h. Preparation of financial statements

Costing method is a tool which is helpful in financial accounting during

preparation of end of the year financial reports. This is because reports such

as closing inventory for finished goods, work in progress and raw materials are

associated with preparation of financial statements.

i. Avoidance of collusion and fraud by workers

Costing methods are ways of ensuring that material and other inputs are not misused

by corrupted workers who may sell some to make personal gain at the expense of the

quality of the goods being produced.

Disadvantages of costing methods

Here are clarified limitations of the costing methods

a. Historical data

The data which is always readily available in the books of accounts of the

business is the financial data which is historical which is not much needed for

costing methods as they deal with the future decision making, for which the

data is missing or scanty. This disparity in need gap curtails costing method

procedures.

b. Under-Utilized Capacity

Costing methods works with the assumption that production capacity is fully

utilized. If this is not the case, then the results presented at the end of the year

will be misleading.

c. Problem of over and under absorption of overheads

Since costing methods is a process which has to do with estimation of the total

cost of a product. Some aspects are standardized or pre-determined and so,

when actual outcome takes place, it can be a case of over or under absorption

of overheads. this brings inconvenience of planning.

d. Lagged costing methods information

Most of the times, costing require furnishing of timely information to the costing

department which may not be the case for the various departments concerned

with this exercise may have individual departmental challenges which can

result to failure on timely costing exercise.

e. Non-flexibility of a costing system.

Some costing system which are concerned with recording of the costing

information may be faulty or rigid and this hiccup may deny the objective of

ascertaining of cost on a particular product, hence adversely affect costingmethod used.

3.1.2. Calculation based on costing methods

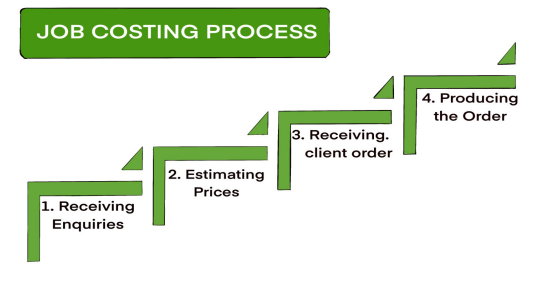

A. Job Costing

This method is also called as Job order costing method. This costing method is

used in firms which work based on job work. There are some manufacturing

units which undertake job work and are called as job order units. The main

feature of these organizations is that they produce according to the requirements

and specifications of the customers. Each job may be different from each other.

Production is only on specific order and there is no pre demand production. In

this system, each job is treated separately and a job cost sheet is prepared tofind out the cost of the job.

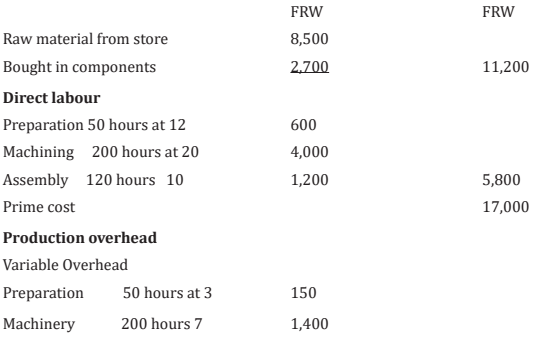

Illustration

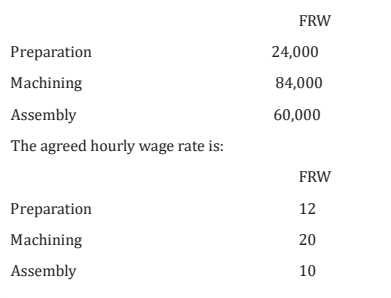

XYX Engineering ltd has three departments: preparation, machining and

assembly. The budgeted direct labor hours for these three departments are8,000, 12,000 and 10,000 respectively.

Factory fixed overheads are budgeted at FRW 180,000 for the year and variable

overheads are as under:

Administration and selling Overheads are to be abosorbed by adding 10% of all

other costs. Profit is charged at 25% of total costs.

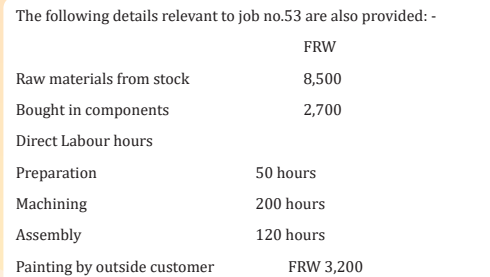

You are required: to determine the cost estimate for job.no.53

ANSWERS:

XYZ ENGENNERING LTD

COST ESTIMETE FOR JOB NO:53Direct materials

• Characteristics of job costing

Job costing is a costing method with the following features:

a. The order is specific,

It means that the task to be performed is subject to strict guidelines. There are

terms of reference of the customer or client.

b. It is possible to closely track the cost elements associated with the

order.

The job being performed is sufficiently diverse to allow the manufacturer to

associate the specific input materials, labor, and overhead associated with that

job completion.

c. The executed jobs differ from each other.

Since the customers are diverse, the jobs are also diverse. That is, they are

not similar. This is because the manufacturer may be dealing with different

customers or the same customer/client but with different types of orders.

d. The overhead cost allocation is carried out according to the relevant

criteria.

The indirect costs associated with the production of the relevant order number

are determined by a unique basis from the other orders such as area, size of the

order, etc.

e. Keeping a separate account for each job.

Since the jobs are different in most cases, the accounts are required for each job.

That is, all costs associated with that specific order are charged to that specific

account with a unique account number, and the costs posted therein form the

total cost for that order.

a. The production process is not continuous

Each order is independent of the next and therefore there is no continuity as

with the process cost method. Therefore, the jobs are broken in the real sense.

That is, an order is initiated based on an order placed by the customer.

a. The profitability of each job is determined separately

The profitability margin for each job is determined by the total cost of the

inputs consumed by that particular job. So each job has its own cost calculation

and determination of the profits from it.

• Classification of job costing method

Job costing method is further broken down to:

a. Contract costing method

Contract costing method is also known as terminal costing method and it

involves doing some assignment with set specification for another person for

payment.

The contract costing method of ascertaining cost for a contract. once the

contract is completed as per the agreement of the two parties, the assignment

is closed down.

b. Factory costing method

Factory job costing is entails undertaking a clients ‘assignment or job in a

factory. The focus is the assignment at hand and on its completion, the output

is delivered to the client.

c. Batch costing method

Batch costing method is an approach of assigning costs on a task which is

completed in batches. It entails manufacture of a large number of products or

goods at the same time.

• Advantages of job costing– Help in determining the level of profitability of company products in the

future. The current record of how costs have been allocated to the current

product provides a guide for determining the profit margins to be achieved.

– Having clear cost data available helps management determine the selling

price of the end product (final product). The selling price set depends on the

amount of cost accumulation, so when the cost is higher, the selling price is

high and vice versa is true.

– Optimal allocation of economic resources. The job costing method is set in

such a way that it is possible to monitor the use of the available resources.

Thus, the manufacturer or producer is able to identify instances of waste

and mistakes for each specific job and avoid such situations.

– Job costing assists in the adoption of predetermined overhead rates, which

in turn assists in the application of the budgetary control system. That is,

before the actual costs are incurred, the producer can plan earlier to know

how to control the costs/inputs for the inputs needed estimated using the

cost method provided.– The job costing method encourages the activity of delegating tasksamong employees. The job costing method helps in delegating tasks to beDisadvantages of job costing method

performed by each employee in the workplace. Therefore, accountability to

a department or an individual employee is enhanced.

– Avoidance of duplication. The manufacturer is able to separate one order

from another and avoid duplication in production that can lead to wasted

resources.

– Increased production efficiency. The manufacturer is able to assess the level

of inputs and outputs and ensure that the former are minimized, improving

the efficiency and quality of the final product.– Unnecessary expenses or costs incurred between two processes can beB. Process costing method

unavoidable. The job costing method is a difficult and costly/expensive

endeavor for small businesses due to the lack of economies of scale.

– The job costing method does not consider any standard procedure

for estimating the costs paid or incurred. This means that the jobs are

different and are approached differently than in activity-based costing,

in which the uniformity of the products prevails.

– The job costing method is not applicable/suitable for fast moving jobs.

The category of short-lived jobs may not benefit from this costing

method approach. Because the cost efficiency is naturally low.

– The job costing method requires a lot of paperwork to accomplish

a specific task. There are several logistics areas that require a lot of

paperwork when estimating a job to capture all the details of the cost

elements. This is a cumbersome approach.

– The job costing method is sunken or historical in nature. Sunk costs are

costs that have already been incurred and are never suitable for future

decisions. You see the producer relies on the already completed tasks

according to past records showing the incurred/actual costs of similartype of work and therefore is not a suitable tool for future decisions.

• Definition

Process costing is a form of operational costing used when cost units go through

a series of clearly defined processes before the final product is completed. The

main feature of this method is that the finished output of one process becomes

the input of the next process. In this case, all costs (direct and indirect) are

charged to each process.

This method is used in industries like chemicals, soaps, paper, paints, oil

products, etc

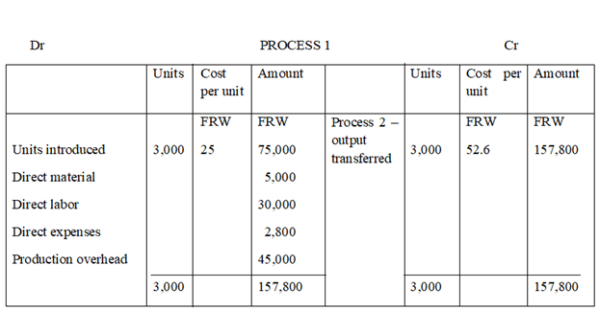

• Elements of process cost

Final goods are produced after a specific number of processes. An account is

kept for each process or operation. All costs incurred to complete a process are

debited to process account.

The elements of process cost are:

• Materials

In process costing, raw material is issued to process 1, where after processing

it is transferred to process 2 and so on. Some more materials are added to

the original material at each process. The materials used at each process are

debited to the respective process account.

• Labor

Direct labor of each process is debited to the respective process account.

• Direct expenses

Expenses incurred in respect of any particular process are debited to the

process account.

An example of direct expenses is packing cost of biscuits.

• Production overhead

In process costing, the proportion of production overhead is comparatively

high. Each process is charged with a reasonable share of production overhead.

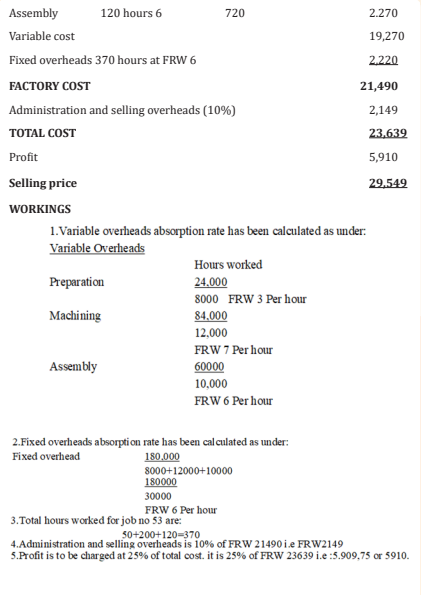

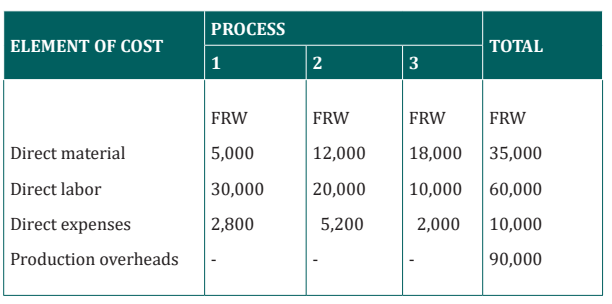

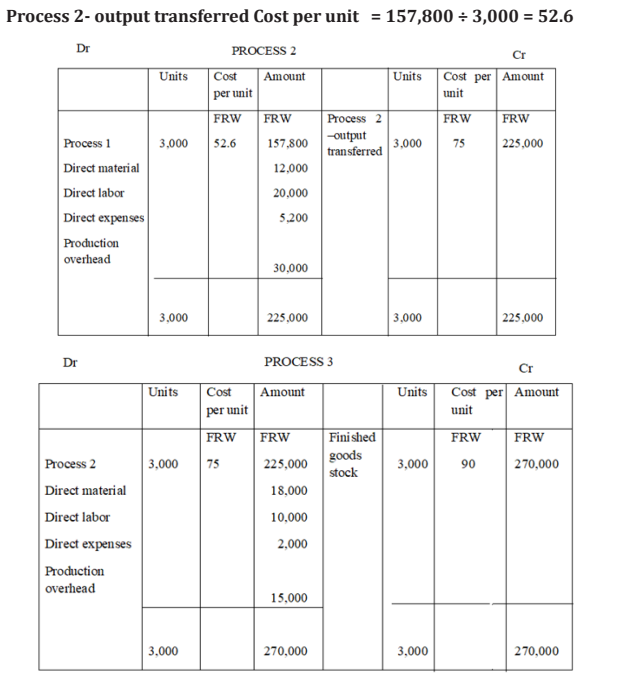

Example 1:

The manufacture of product ‘G’ requires three distinct processes numbered 1-3.

On completion, the product is passed from process 3 to finished goods stock.

The following information was obtained in respect of product ‘G’ for the month

of July.

3,000 units of raw material at FRW 25 were issued to process 1 and costsincurred are given below:

Production overhead is absorbed by each process at 150% of direct labor. There

was no stock of raw material or work-in-progress either at the beginning or atthe end of the period.

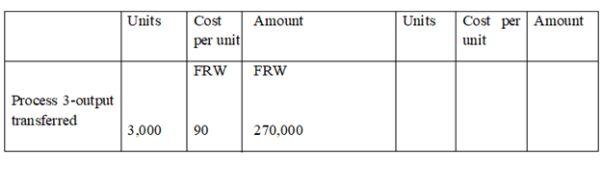

You are required to prepare the process accounts.ANSWER

FINISHED GOODS STOCK ACCOUNT

• Process loss, scrap and waste

These terms are used frequently in process costing. Mostly the quantity or

weight of output of a process is less than input of that process. The loss of

weight or volume arises in the course of manufacture. This loss mainly arises

where distillation or disintegration by heat or chemical action is involved. The

reasons of this loss are evaporation, residuals, ash, spoilage.

C. PROCESS LOSS

This is the loss of weight or volume of material during a process.

It may be Normal process loss or abnormal process loss.

Normal process loss represents the loss which is expected under normal

conditions. This loss is unavoidable in view of the nature of the production

process. This loss is caused by such factors as evaporation and this is calculated

in advance on the basis of past experience.

The cost of normal loss is absorbed in the cost of production for good production.

If defective units in respect of normal loss can be sold for at a reduced value

then the proceeds (amount you get after selling ) of these units are subtractedfrom total cost of good products. In this case the following formulas are used.

Cost per unit=Total Process Cost/Estimated Production

Abnormal process loss represents the loss which occurs under abnormal

conditions. Abnormal loss cannot be foreseen. The main causes of abnormal

loss are plant breakdown, industrial accidents, inefficiency of workers or

defective raw materials. If actual loss is greater than the normal loss then this

difference is called as abnormal process loss. Abnormal process loss is costedon the same basis as good production.

It is treated as:– Value of Abnormal LossDr: Abnormal Loss Account

Cr: Process Account– Scrap value of abnormal lossDr: Scrap Debtors AccountCr: Abnormal Loss Account

The balance in the abnormal loss account is transferred to the profit and loss

account at the end of the year.

ABNORMAL GAIN

If normal process loss is less than expectations then the difference between the

actual loss and normal loss is known as abnormal gain. The value of abnormal

gain is calculated on the same basis as good production.

It is treated as:– Value of Abnormal GainDr: Process Account

Cr: Abnormal Gain Account– wasteWaste is the material arising in production process that has no value. It means

waste refers to anything which has no value.

If waste is part of the normal loss then the cost will be absorbed by the good

production and in case of abnormal loss, it will be transferred to abnormal lossaccount.

– scrapScrap is the material that can no longer be used for its original purpose (e.g.

broken parts).

It can be sold at much lower price than the cost. The income from sale of scrap

is taken into consideration and process loss is reduced by that amount.

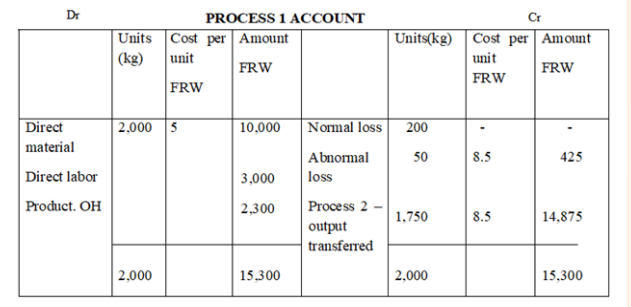

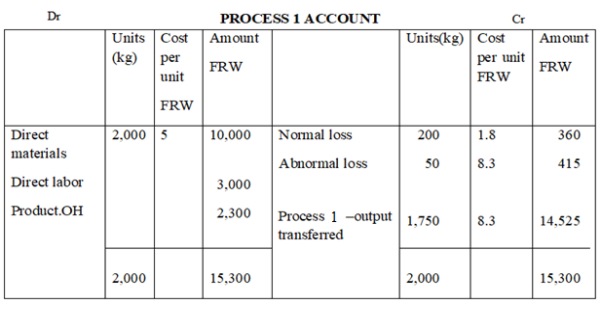

Example 2

In the manufacture of product “Pee”, 2,000 kg of material at FRW 5 per kg were

supplied to process 1. Labor costs amounted to FRW 3,000 and production

overheads ofFRW 2,300 were incurred. The normal loss has been estimated at10%. The actual production was 1,750 kg.

Prepare the process account and calculate cost per unit

Answer

Normal loss calculation

Estimated loss 10% of 2,000 kg =200kg

Abnormal loss calculation

Estimated production (2,000-200) = 1 ,800 kg

Actual production 1,750 kgAbnormal loss 50 kg

Unit cost of normal production

Cost per unit=Total process cost/Estimated production

= FRW 15,300 /1,800 = FRW 8.5

Value of abnormal loss =50 kg* FRW 8.5= FRW425

Value of good production =1,750kg* FRW8.5 = FRW 14,875

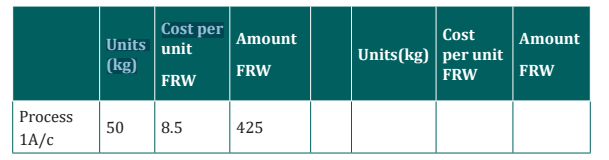

Abnormal Loss Account Units (kg) Cost per

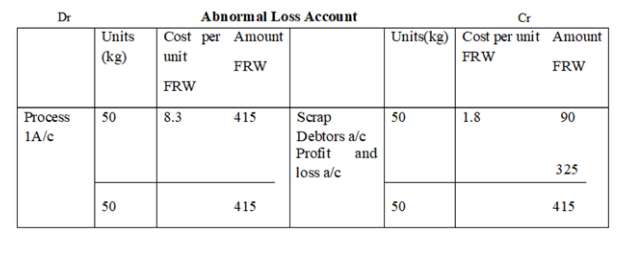

EXAMPLE 3

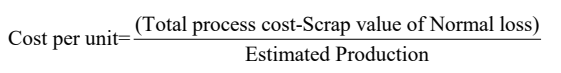

Assume the same data as in example 2 except that the scrap value of normal

loss and abnormal loss was FRW1.8 per kg. Prepare the process 1 account andcalculate cost per unit.

Unit cost of Normal Production

Cost per unit= (Total process cost-Scrap value of normal loss)/Estimated

production= FRW (15,300-360) /1,800 = FRW 8.3

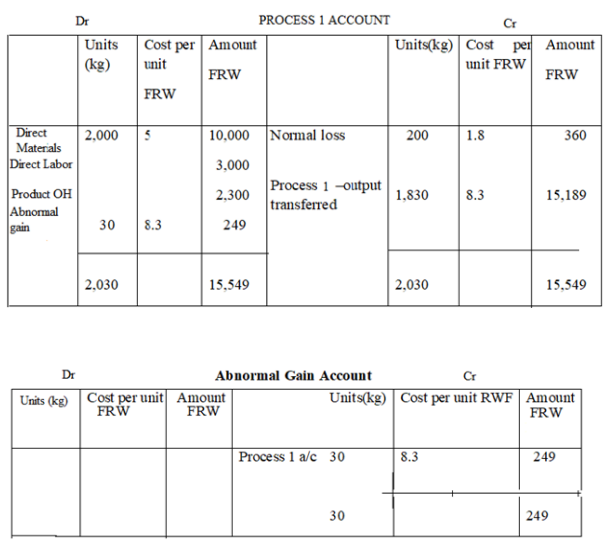

Example 4:

Assume the same data in example 2 except that the scrap value of normal loss

was FRW 1.8 per kg and actual production was 1,830 units. Calculate the normalgain and show the relevant accounts.

Answer

Expected production= 1,800 kg

Actual production = 1830 kgAbnormal gain = 30 kg

Note: If actual production is greater than expected production then this

excessive production is the abnormal gain.Cost per unit will be the same as in example 3

– JOINT PRODUCTS AND BY-PRODUCTS

These represent outputs that simultaneously result from some joint process.

Joint products are two or more products which are output from the same

processing operation but are not distinguishable up to their point of separation.This point of separation is known as split-off – point or separation point.

Before this point of separation, one cannot distinguish the products involved

because they are in mixed form and all costs incurred cannot be attributed to

any product. They form the main or target products the firm plans to produce.

An increase in the output of one product will bring about an increase in the

quantity of others, or vice versa, but not necessarily in the same proportion.

Joint products may be sold off immediately after the split – off point or may

be further processed if they are not in saleable condition. At whatever stage

joint products are sold, they have a substantial sales value as compared to by products.

A by-product is that which is similarly produced at the same time and from

the same process as the main product. The by-product has low sales value

compared to the main product and is usually incidental to the process. They

are not always the company’s target and cannot influence the manager’s

production decision as to whether the main product should be produced or

not. Examples of industries that produce both joint and by-products include

chemicals, oil refining, mining, flour milling and gas manufacturing. Specific

examples of such products include petrol, paraffin and grease which represents

a by-product.

The major distinguishing features of joint-products and by-products are Joint

products have substantial sales value whereas by-products have minor sales

value. Joint products are the major or main products of the firm and form

manufacturing objective of the firm but by-products are incidental products

to the production process. Joint products influence the production decision of

the firm since they are major products whereas by-products don’t influence

production decision. Accounting for Joint products:

The major constraint in accounting for joint products is the presence of joint or

common costs that have been incurred prior the split-off point which cannot

be identified with joint products. Since the aim of costing is to ascertain each

product’s unit cost, then common costs must be apportioned or allocated tojoint products.

Such apportionment is necessary for two reasons including providing productvaluations required for financial accounting, and other regulations.

Coordinating the activities of decision – makers in a decentralized organization.

Though many scholars have come up with many methods used to assign

joint costs to joint products, none of them is superior to the other but their

applicability is influenced by certain factors.The following methods are commonly used to assign joint costs:

1) Physical units/measures method.

2) Sales value or market value method

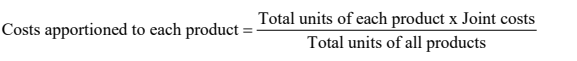

D. Physical units method

Under this method, common or joint costs are assigned to products on the

basis of volume of output. Joint costs are allocated in proportion to the number

of units produced or their relative weights. For this method to be suitable

quantity of the joint products must be in the same state or else, the methodcannot be applied.

The major weakness of this method is that it assumes that all products are equal

in terms of value. Costs are therefore assigned to products in equal proportions

which is very unrealistic because products cannot be equal in terms of value

and even resources required to produce each. Since the method does not assign

joint costs to products on the basis of revenue generating power of individual

products, cost information will mislead decision makers.Example 1:

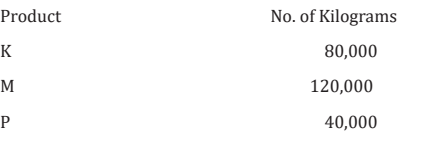

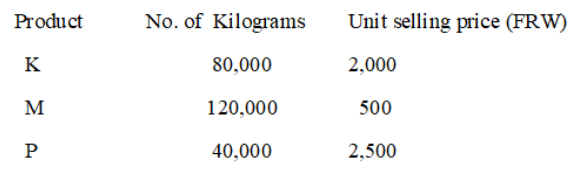

A manufacturing firm produces three products ( K, M & P) through a joint

process. Prior to the split – off point, common or joint costs amounting to FRW

24,000,000 were incurred. The units produced according to each product areas follows:-

The firm uses physical units method for apportioning joint costs to joint

products.Required: Apportion joint costs and determine the unit cost of each product.

Solution

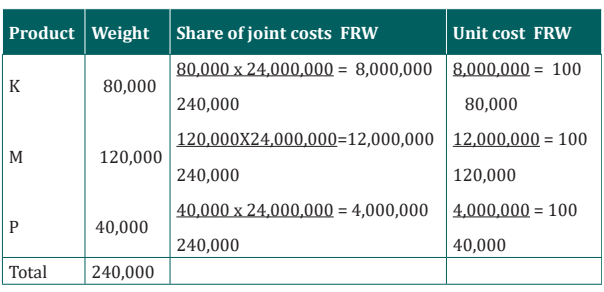

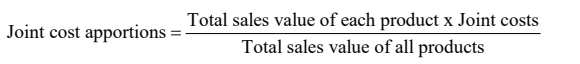

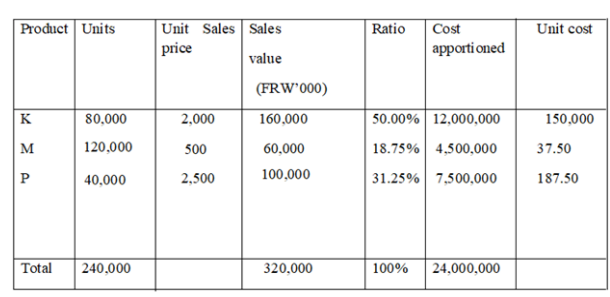

E. Sales value method:

This method apportions or assigns joint costs to joint products on the basis of

value attached to each joint product. The ratio of sales value of each product

at split-off to total sales of all joint products is ascertained and multiplied by

the joint costs incurred. The resulting amount will represent the joint costsassigned to each joint product. The formula is given below:

This method addresses the shortcomings of physical units method because the

assignment of joint costs to products depends on the value of each joint productand therefore, joint products cannot have a uniform unit cost.

Illustration:

Using the same data in example 1, assume the company selling prices of jointproducts are as follows:

Required: Apportion joint costs and determine the unit cost of each Product.Solution:

Note: Sales value = Units involved * unit selling price.

Ratio= Individual product sales/Total sales * 100Unit cost = Cost apportioned/individual units of product.

F. Accounting for By-product costing

Because by-products are generally of secondary importance, cost allocation

differs from that applied to joint products. Common methods used are:a) By-product receipts are treated as incidental or other income. OtherHere, the sales revenue or proceeds received from the sale of the by-product are

income realized from sale of by-product is transferred to profit and

loss account as miscellaneous income.

b) By-product net realizable value is deducted from the total cost of joint

products

credited to the total production costs of manufacturing the main product. If there are

any selling and distribution costs incurred for selling the by-product, the same are

deducted from the sales value of the by-products and the net amount is either credited

to process account or is deducted from the total cost. When a by-product requires

further processing after split-off, the processing cost as well as selling cost, if any is

deducted from the same value, and the net value of the by-product is deducted from

the cost of the main product or credited to the relevant process account.

c) By-product sales being treated as additional sales hence increasingturnover figures of the firm.

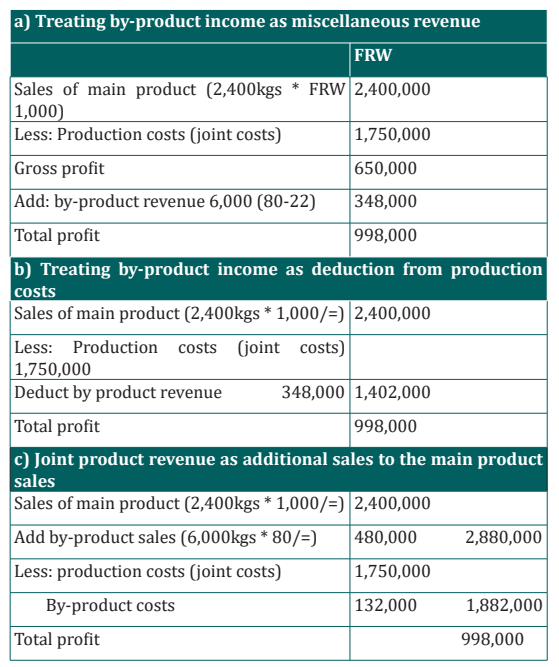

Illustration

A company processes 2,400kg of beef in a month and this was sold at FRW 1,000.

per kilogram. The total costs of products arising from the main production

process were FRW 1,750,000. 6,000kg of bones were obtained and sold at

FRW 80 per kilogram. The company spent FRW 22. per kilo for packing and

distribution of the bones.

Required

Prepare the income statement for the firm using at least three different methods of

accounting for by-product costing.

Solution

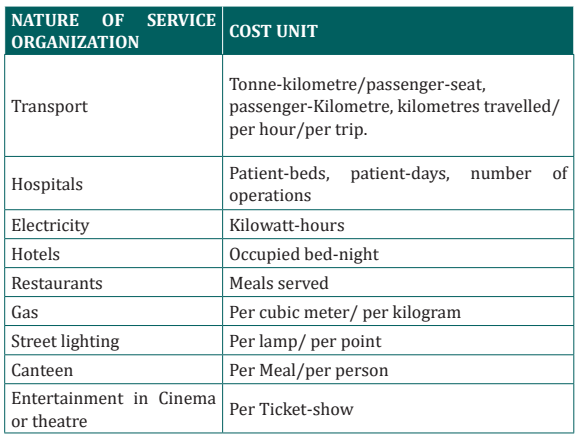

G. Services costing

Definition

The term service costing or operating costing refers to the calculation of the

total operating costs incurred for each unit of the intangible product. These

intangible products or services can either be in the form of internal services

provided by industries as activities supporting the production of goods. Or in

the form of external services offered by the companies in the service sector as

an essential product for customers.

Service costing is an essential concept because every service organization needs

to determine its business overheads. It is intended to ensure fair pricing of theproducts or services; and to maintain control of its fixed and variable costs.

COST UNIT

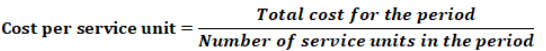

Calculation of cost per unit: The formula for computing the cost of each service

unit (i.e, cost per unit)is given below

In addition, we will discuss transportation cost as an example of service costing.

Therefore, in this section we will look at the calculation of transport costs.

Transportation is one of the most important service industries nowadays, and

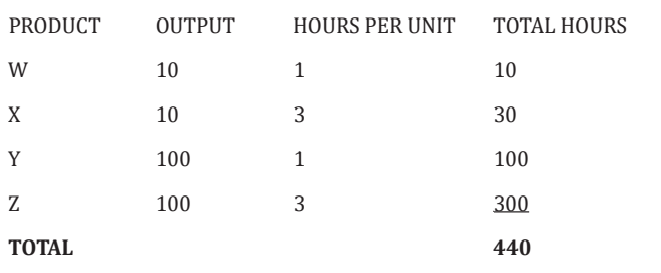

it is important to have an insight into the pro forma to determine the operatingcosts of such organisations :

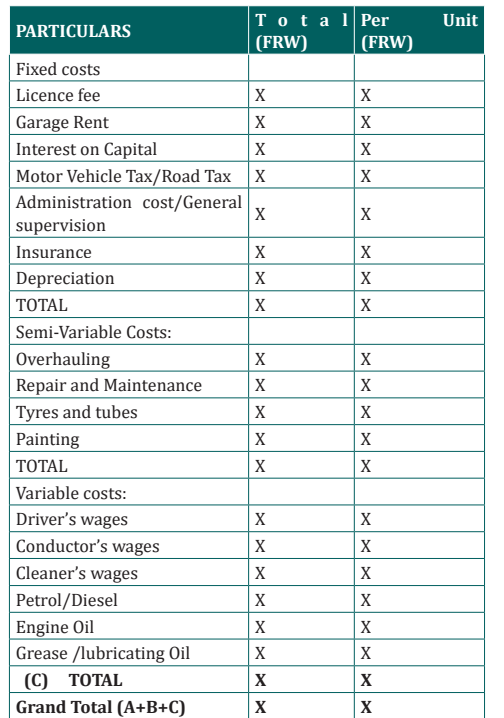

Illustration:

Note that:

We have assumed that the licence fee was calculated every month. Also, each

vehicle has the capacity of 2-tonne of goods.

If, each vehicle covers a distance of a 100 miles each way daily to and from the

city; each vehicle runs on an average of 20 days a month; and while going to

the city, the capacity was full and while returning the capacity is 25% occupied;

find out the following:

Operating cost per tonne-mile; and Rate per trip to be charged, if the companyplans to make 40% profit on freightage.

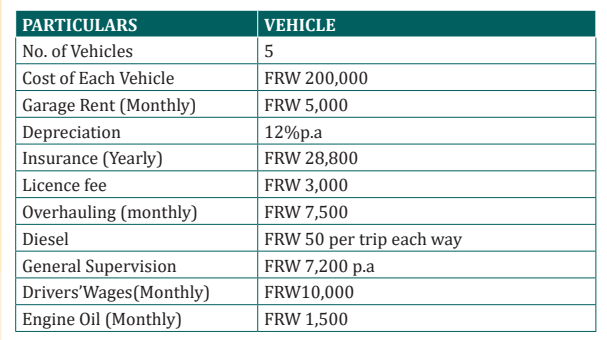

ANSWER:

WORKINGS

No. of Cost Units:

On the first way of the trip: 100% capacity was occupied, i.e., 2-tonnes

No. of Cost Units = Distance * Capacity Occupied *Working Days *No. of Vehicles

No. of Cost Units=100*2*20*5 = 20,000 tonne-miles

On the second way of the trip: 25% capacity was occupied, i.e., 0.5-tonnes; Similarly,

No. of Cost Units= 100*0.5*20*5= 5,000 tonne-miles

Hence, Total No. of Cost Units= 20,000 + 5,000 = 25,000 tonne-miles

General Supervision:

Itis given annually, therefore;

Monthly expense on general supervision=7200/12= FRW 600

Insurance:

It is given annually, therefore;Monthly expense on insurance=28800/12= FRW 2400

Depreciation:

It is given annually, therefore; Monthly depreciation=(Total Cost of 5

Vehicles*Rate of Depreciation)/(100*12)

Monthly depreciation=(1000000*12)/(100*12)= FRW 10000

Diesel:

Monthly expense on diesel=Cost per Trip*No. of Ways per Trip*No. of Working

Days*No. of VehiclesMonthly expense on diesel=50*2*20*5= FRW 10000

H. Activity Based Costing (ABC)

Many companies use a traditional cost system such as job-order costing or

process costing, or some hybrid of the two. This traditional system may provide

distorted product cost information. In fact, companies selling multiple products

are making critical decisions about product pricing, making bids, or product

mix, based on inaccurate cost data. These prime costs are traceable to individual

products, and most conventional cost systems are designed to ensure that this

tracing takes place.

The problem is not with assigning the costs of direct labor or direct materials,

but, the assignment of overhead costs to individual products is the main

issue. Using the traditional methods of assigning overhead costs to products

where a single predetermined overhead rate based on any single activity

measure, can produce distorted product costs. The growth in the automation

of manufacturing (such as increased use of robotics, high-tech machinery, and

other computer-driven processes) has changed the nature of manufacturing

and the composition of total product cost. The significance of direct labor

cost has diminished and overhead costs have increased. In this environment,

overhead application rates based on direct labor or any other volume-based

cost driver may not provide accurate overhead charges since they no longerrepresent cause and effect relationships between output and overhead costs.

Activity-based costing (ABC) attempts to get around this problem. An ABC system

assigns costs to products based on the product`s use of activities, not product

volume. It has proved to produce more accurate product costing results in an

environment where there is diversity in product line and services coming out

of the same shop. A recent survey by the Institute of Management Accounting

shows that over 30 percent of the companies which responded currently areusing ABC systems to replace their existing traditional cost systems.

An activity-based cost system is one which first traces costs to activities and then

to products. Traditional product costing also involves two stages, but in the first

stage costs are traced to departments, not to activities. In both traditional andactivity-based costing, the second stage consists of tracing costs to the product.

The principal difference between the two methods is the number of cost drivers

used. Activity-based costing uses a much larger number of cost drivers than the

one or two volume-based cost drivers typical in a conventional system. In fact,

the approach separates overhead costs into overhead cost pools, where each cost

pool is associated with a different cost driver. Then a predetermined overhead

rate is computed for each cost pool and each cost driver. In consequence, this

method has enhanced accuracy.

Activity-based costing (ABC) is not an alternative costing system to job costing

or process costing. It focuses on activities as the principal cost objects. ABC is

a method of assigning costs to goods and services that assumes all costs are

caused by the activities used to produce those goods and services. This method

provides more insight into the causes of costs than conventional costingmethods.

Conventional costing methods divide the total costs by the number of units to

compute a unit cost. In contrast, activity-based costing starts with the detailed

activities required to produce a product or service and computes a product`scost using the following four steps:

1. Identify the activities that consume resources and assign costs to those

activities. Inspection would be an activity, for example.

2. Identify the cost driver (s) associated with each activity or group of

activities, known as a cost pool. A cost driver is a factor that causes, or

“drives,” an activity`s costs. The number of inspections would be a cost

driver. So could the number of times a new drawing is needed because a

product has been redesigned.

3. Calculate an applied rate for each activity pool. The pool rate could be

for example the cost per purchase order.

4. Assign costs to products by multiplying the cost pool rate by the number

of cost driver units consumed by the product. For example, the cost per

inspection times the number of inspections required for Product X for

the month of March would measure the cost of inspection activity forProduct X for March.

Note: ABC is also applicable to service, merchandising, and nonprofit sectors as

well as manufacturing companies.

First-Stage Procedure:

In the first stage of activity-based costing, overhead costs are divided into

homogeneous cost pools. A homogeneous cost pool is a collection of overhead

costs for which cost variations can be explained by a single cost driver. Overhead

activities are homogeneous whenever they have the same consumption ratiosfor all products.

Once a cost pool is defined, the cost per unit of the cost driver is computed

for that pool. This is referred to as the pool rate. Computation of the pool rate

completes the first stage. Thus, the first stage produces two outcomes: (1) a setof homogeneous cost pools and (2) a pool rate.

Second-Stage Procedure:

In the second stage, the costs of each overhead pool are traced to products. This

is done using the pool rate computed in the first stage and the measure of the

amount of resources consumed by each product. This measure is simply the

quantity of the cost driver used by each product. In our example, that would

be the number of production runs and machine hours used by each product.

Thus, the overhead assigned from each cost pool to each product is computed

as follows:Applied overhead = Pool rate x Cost driver units used

The total overhead cost per unit of product is obtained by first tracing the

overhead costs from the pools to the individual products. This total is then

divided by the number of units produced. The result is the unit overhead

cost. Adding the per-unit overhead cost to the per-unit prime cost yields the

manufacturing cost per unit. Illustration see (Team ltd below)Advantages of ABC method :

1. The complexity of manufacturing has increased, with wider product

ranges, shorter product life cycles and more complex production

processes. ABC recognises this complexity with its multiple costdrivers.

2. In a more competitive environment, companies must be able to assess

product profitability realistically. ABC facilitates a good understanding

of what drives overheads costs.

3. In modern manufacturing systems, overheads functions include a lot

of non-factory floor activities such as product design, quality control,

production planning and customer services. ABC is concerned with all

overhead cost and so it can take management accounting beyond itstraditional floor boundaries.

Disadvantages of (ABC)/criticisms of( ABC)

1. Cost apportionment may still be required at the cost pooling stage

for shared items of cost, such as rent, rate, building depreciation.

Apportionment can be an arbitrary way of sharing costs

2. A single cost driver may not explain the cost behaviour of all items in a

cost pool. An activity may have two or more cost drivers.

3. Unless cost are ‘driven’ by an activity that is measurable in quantitativeterms, cost drivers cannot be used.

4. There must be reason for using a system of ABC must provide

meaningful product costs or extra information that managements will

use. If management is not going to use ABC information for any practical

purpose, a traditional absorption costing system would be simpler to

operate and just as good.

5. The cost of implementing and maintaining an ABC system can exceed

the benefits of improved accuracy in product costs.

6. Implementing ABC is often problematic due to problems with

understanding activities and their costs.

7. ABC is an absorption costing which has only limited value for managementaccounting purpose.

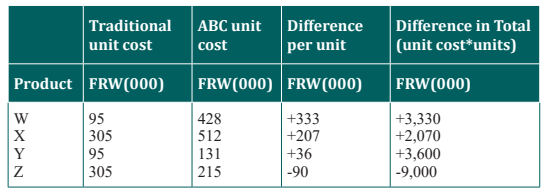

Illustration:

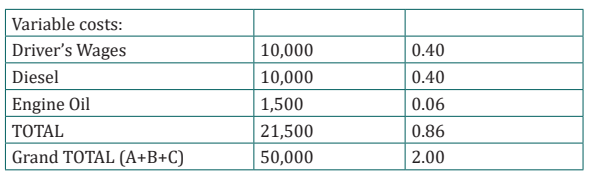

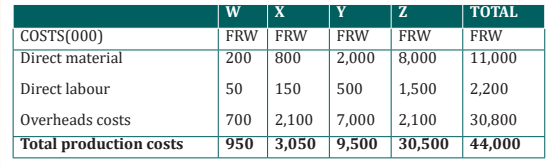

Team ltd manufacture four products W,X,Y and Z. Output and cost data for theperiod just ending are as follows :

Direct labour cost per hour = FRW 5

Overheads cost (common costs) FRW’ (000)

Overheads variable costs 3,080

Set- up costs 10,920

Scheduling costs 9,100

Material handling costs 7,70030,800

REQUIRED

Use both traditional /conventional cost system and ABC systems to determine

the cost of each product.

Compare the results got using the two systems and comment accordingly.

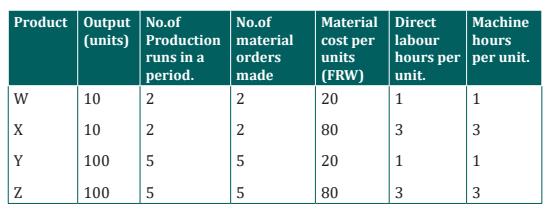

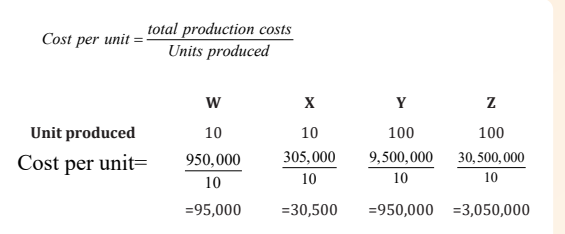

ANSWER:A) Using traditional costing system direct labour hour or machine hours

can be used as bases of apportionment and hence the product costwould be as follows :

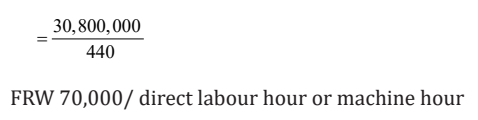

Overhead absorption rate (O.A.R)=Overheads cost/no.of Direct labour hours,

machine hours

Determination of each product’

Overhead absorbed by each product =number of hours per unit*O.A.R

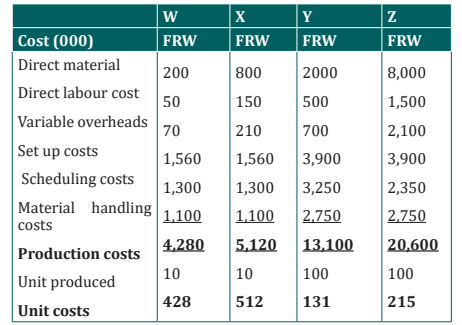

(b) Using ABC, and assuming that the number of production runs is the cost

driver for set up cost and scheduling cost, number of orders for material handlingcosts and that machine hours are the cost drivers for overheads variable costs.

ANSWER :

Cost driver rate= Overheads/ Quantity of cost driver(FRW 000) (000)

1. 3,080÷440 Machine hours= FRW 7 per machine hour.

2. 10,920 ÷14 production runs= FRW 780 per production run

3. 9,100 ÷14 production run = FRW 650 per production run

4. 7,700÷14 no.of orders = FRW 550 per order

Overhead assigned to products=Cost driver rate*number of activities.

E.g. Set up costs has been absorbed as follows :

Product W=2(production runs)*780,000=(cost driver rate)=1,560,000

Product X=2(production runs)*780,000=(cost driver rate)=1,560,000

Product Y=5(production runs)*780,000=(cost driver rate)=3,900000Product W=5(production runs)*780,000=(cost driver rate)=3,900000

SUMMARY OF THE COMPARISONS :

The figures suggest that the traditional volume related costing system gives

misleading cost information. It underallocates overhead cost to low-volume

products (i.e W&X with ten units of output) and over allocates overheads to

higher volume products (i.e Z in particular) This confirms the earlier statementsmade.

Application activity 3.1

1.Choose the correct sentence related to activity-based costinga) ABC uses a plant-wide overhead rate to assign overhead2. Which of the following is a limitation of activity-based costing

b) ABC is not expensive to implement

c) ABC typically applies overhead cost using direct labor-hours

d) ABC uses multiple activity ratesa) costs are accumulated by each major activity

b) A variety of activity measures are usedc) All cost in an activity cost pool pertain to a single activityeach cost pool is strictly proportional to its cost measure

d) Activity-based costing relies on the assumption that the cost in

3.Define the following concepts:

1. By-product

2. Joint product

4.Vehicle carries 8 tonnes on a trip and delivers as follows:

3tonnes after 20km, 2tonnes after a further 10km, and the remaining

5tonnes after a further 30km, it then returns empty, covering a distance of60km. The following information in respect of costs is provided

FRW

Fuel and lubricants 100

Wages driver 150Mate 80

Share of annual costs like insurance, maintenance, administration,

depreciation etc. charged to this trip amounts to FRW 320

You are required to calculate:a) Cost per tonne-kilometre3.2. Decision makingb) Cost per kilometre.

Learning Activity 3.2

RTS Ltd is a manufacturing company which produces and sells radios. It

has two main challenges such as setting competitive market price and a

stiff competition with foreign companies. The management has hired a

cost accountant to set different pricing strategies. The cost accountant

has proposed and submitted the following strategies for decision makingpurpose:

1. The company should set the price based on cost of materials used

during production process and the cost of each activity required to

complete the production and delivery of product to the customer

as well; as a result, the price becomes high compared to the market

price of similar radios and the contribution margin has negativefigures.

2. The company should set the price based on cost of additional

unit; and a consider the fixed cost absorbed during the production

process, then marginal contribution has a positive figures and net

operating profit.

3. The company set the price based on cost of last unit produced and

considers the fixed cost absorbed during the production process; in

this case the contribution margin is positive and net operating loss.

4. The company should purchase radio materials from foreign

specialized company and assemble them locally, this strategy

reduces 3% on existing cost. The contribution margin is positive and

net operating profit has a negative figure.

5. The company should purchase radios from specialized foreign

company and resell them to the market, in case of adopting this

strategy, the selling price of imported radios is less than the variable

cost required to produce a radio. In that case the contribution margin

has negative figures and net operating loss

After a deep analysis, the management of company has selected the strategy

which brings to the company a positive contribution and a positive netoperating profit.

Question

1. Identify the costing techniques used on each price strategy

2. From this case study, select the pricing strategies, the company mayadopt and justify the reasons.

3.2.1. Introduction to decision making

In management accounting, decision‑making may be simply defined as

choosing the best course of action among the alternatives available. If there are

no alternatives, then no decision is required. The assumption is that the best

decision is the one that generates the most revenue or the least amount of cost.

The process of making decisions is generally considered to involve the following

steps:

i) Identify the various alternatives for a given type of decision.

ii) Obtain the necessary data necessary to evaluate the various alternatives.

iii) Analyze and determine the consequences of each alternative.

iv) Select the alternative that appears to best achieve the desired goals or

objectives.

v) Implement the chosen alternative.

vi) At an appropriate time, evaluate the results of the decisions againststandards or other desired results.

Respond to the variancesIn management accounting, it is useful to classify decisions as:

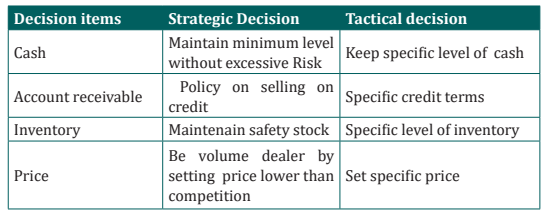

1. Strategic and tactical2. Short‑run and long-run Strategic andTactical Decisions

In management accounting, the objective is not necessarily to make the

best decision but to make a good decision. Because of complex interacting

relationships, it is very difficult, even if possible, to determine the best decision.

Management decision‑making is highly subjective.

Whether a decision is good or acceptable depends on the goals and objectives

of management. Consequently, a prerequisite to decision‑making is that

management have set the organization’s goals and objectives. For example,

management must decide strategic objectives such as the company’s product

line, pricing strategy, quality of product, willingness to assume risk and profit

objective. In setting goals and objectives, it is useful to distinguish between

strategic and tactical decisions. Strategic decisions are broad‑based, qualitative

type of decisions which include or reflect goals and objectives. Strategic

decisions are non quantitative in nature. Strategic decisions are based on the

subjective thinking of management concerning goals and objectives. Examples

of strategic decisions and tactical decisions from a management accountingpoint of view include:

3.2.2. Marginal costing and decision making

Marginal costing, as one of the tools of management accounting helps

management in making certain decisions. It provides management with

information regarding the behavior of costs and the incidence of such costs

on the profitability of an undertaking. Marginal costing is the ascertainment of

marginal costs by differentiating between fixed costs and variable costs and to

see the effects on profit of changes in volume or type of output. Thus, marginal

costing includes two things i.e. The ascertainment marginal cost and the cost

volume profit relationship. In this technique of costing only variable costs are

charged to operations, processes or products leaving all indirect costs to bewritten off against profits in the period in which they arise.

A. Ascertainment of marginal cost

Marginal cost is incremental/additional cost of production which arises due to

one –unit increase in production quantity. Variable costs have direct relationship

with the volume of output and fixed costs remains constant irrespective ofvolume of production.

– Marginal costing decisions

• Contribution

Contribution is the reward for the efforts of the entrepreneur or owner of a

business concern. From this, one can get in his mind that contribution means

profit. But it is not so.

Contribution is helpful in determination of profitability of the products and/

or priorities for profitability of the products. When there are two or more

products, the product having more contribution is more profitable.

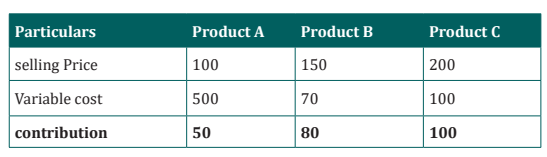

For example: The following are three products with selling price and costdetails:

In the above example, one can say that the product ‘C’ is more profitable because,

it has more contribution. This proposition of product having more contribution

is more profitable is valid, as long as, there are no limitations on any factor of

production.CHOICE OF A PRODUCT FROM VARIOUS ALTERNATIVES

A company can produce different types of goods on a machine, in this case the

choice is to be made\ from various alternatives. The company will prefer toproduce that product which gives maximum contribution.

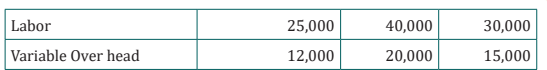

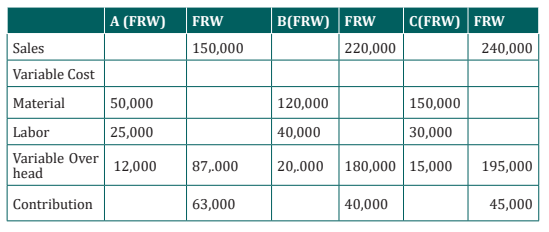

Illustration:

ABC Ltd is a manufacturing company which can produce three products A, B

and C on Machine “P”. The following information is provided in respect ofthese three products for a specific period.

You are required to advise the company regarding the choice of best product.

ANSWER

The company should produce A because this product has maximum contribution.

The ranking of these products from the point of view of contribution will be:Product

A :1st B:3rd C:2ndThe profit from these products will be:

• ACCEPTANCE AND REJECTION OF A SPECIAL ORDER

Sometimes, a company has to decide regarding the acceptance or rejection of

a special order. In this case also the gain or loss on contribution is the decision

factor .

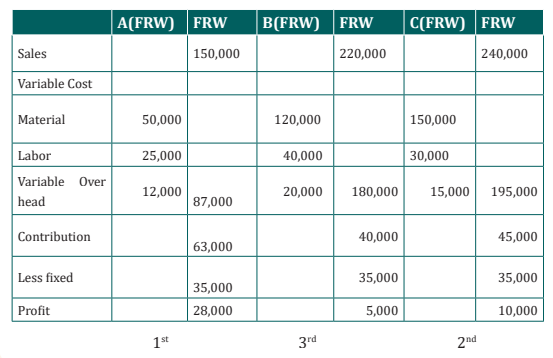

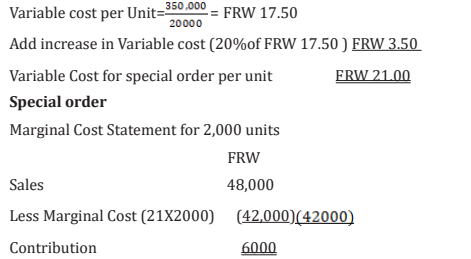

EXPO Ltd manufactures a product Zed which they sell for FRW 25 per unit.

Current output is 20,000 units per month which represent a 100% of the

capacity. They received an order of 2,000 units which they can produce by

working extra time during the month.

The selling price is FRW 48,000.

The total quantity of the last month were FRW 420,000 which include fixed costs

of FRW 70,000. If the special order for 2,000 units is received, then the variable

cost per unit will increase by 20% but the fixed cost will remain unchanged.

You are required to advise the company whether to accept or reject this order.Answer

This order will increase the contribution of the current month by FRW 6000 .so

it should be accepted. The final decision also depends upon some other factors

like the willingness of the workers to work for extra time and the possibility ofthe repeat orders from the same customers.

DROPPING A PRODUCT

If a company has a range of products and one of which is deemed to be

unprofitable, the company may consider to drop this product and to increasethe production of more profitable products.

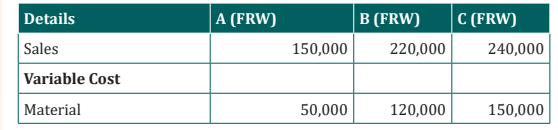

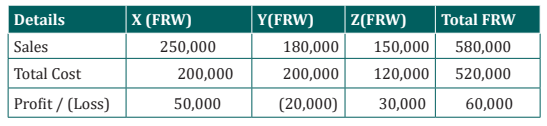

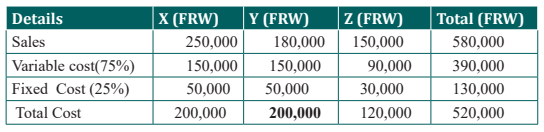

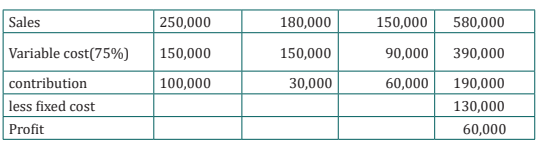

Example . a company produces three products for which the following datahave been provided :

Total cost comprises of 75% Variable cost and 25% fixed cost

The director of company consider that the product “Y’ Shows a loss, so it should

be discontinued. You are required to advise the management whether to dropthe product “Y’ or not?

ANSWER

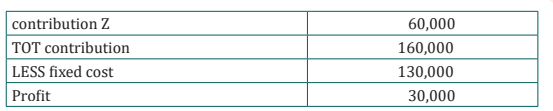

• MARGINAL COST STATEMENT PRODUCT

If the product “Y” is dropped then the position would be as under

The dropping of product “Y” reduces the profit of the company from FRW

60,000 to FRW 30,000 which is the amount of contribution lost from product

Y. In this situation the product Y should not dropped inspite of the fact that it

gives a loss FRW 20,000. If the sales of other products can be increased then the

product Y can be dropped and same resources should then be used to increasethe production of X and Z.

• Make or Buy Decisions

When the management is confronted with the problem whether it would be

economical to purchase a component or a product from outside sources, or to

manufacture it internally, marginal cost analysis renders useful assistance in

the matter. Under such circumstances, a misleading decision would be taken on

the basis of the total cost analysis. In case the proposal is to buy from outside

then, what is already being made, then the price quoted by the outsider should

be lower than the marginal cost of manufacturing it internally. If the proposal is

to make something what is being purchased outside, the cost of making should

include all additional costs like depreciation on new plant, interest on capitalinvolved and that cost should be compared with the purchase price.

The decision to make or buy is based on comparison of the marginal cost of

manufacturing internally and the purchase price of an external supplier of the

component. The choice is guided by the objective of minimizing cost and hencechoose the option which is cheaper.

Illustration

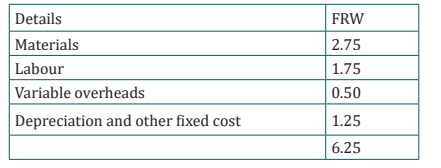

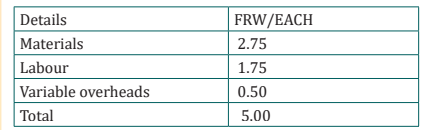

A T.V. manufacturing company finds that while it incurs costs to make component

X, the same is available in the market at FRW 5.75 each, with all assurance ofcontinued supply. The breakdown of cost per unit incurred by the company is:

a) Should the company make or buy the component?

b) What should be your decision if the supplier offered component atFRW 4.85 each?

Answer

a) The purchase cost of the above component is FRW 5.75 each. If the

company is having spare capacity which cannot be filled with more

profitable jobs, it is recommended that the above component be

manufactured in the company since the marginal cost at FRW 5.00

each is less than the purchase cost of FRW 5.75.

b) In the event that the purchase cost is FRW 4.85 each which is less

than the marginal cost of FRW 5.00 each, it is recommended that the

component be bought from the supplier as this results in a saving of

FRW 0.15 each. The spare capacity thus available can be utilised forother purposes, as far as possible.

3.2.3. Absorption costing and decision making

Absorption costing means that all of the manufacturing costs are absorbed

by the total units produced. In short, the cost of a finished unit in inventory

will include direct materials, direct labour, and both variable and fixed

manufacturing overhead. As a result, absorption costing is also referred to as

full costing or the full absorption method. Absorption costing is often contrasted

with variable costing or direct costing. Under variable or direct costing, the fixed

manufacturing overhead costs are not allocated to the products manufactured.

Variable costing is often useful for management’s decision-making. However,

absorption costing is required for external financial reporting and for income

tax reporting. It is also referred to as full- cost techniqueA. PROFIT CALCULATION FROM ABSORPTION COSTING

Absorption costing is a costing technique that includes all manufacturing

costs, in the form of direct materials, direct labour, and both variable and fixed

manufacturing overheads, while determining the cost per unit of a product.In the context of costing of a product/service, an absorption costing considers

a share of all costs incurred by a business to each of its products/services. In

absorption costing technique; costs are classified according to their functions.

The gross profit is calculated after deducting production costs from sales and

from gross profit, costs incurred in relation to other business functions are

deducted to arrive at the net profit. Absorption costing gives better informationfor pricing products as it includes both variable and fixed costs.

Absorption costing technique absorbed fixed manufacturing overhead into

the cost of goods produced and are only charged against profit in the period

in which those goods are sold. In absorption costing income statement,

adjustment pertaining to under or over-absorption of overheads is also made

to arrive at the profit. Absorption costing is a simple and fundamental methodof ascertaining the cost of a product or service.

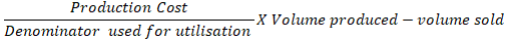

• Inventory valuation

Finished goods inventories are over-stated in absorption costing as it includes

one more cost element in inventory value than under variable costing, i.e thefixed manufacturing cost.

Inventory value under absorption costing

= Direct material+ Direct labour +variable manufacturing costs+ Fixed

manufacturing costs

The differences between the profits revealed by absorption costing andmarginal costing can be computed with the help of the following formula:

Illustration

A company makes and sells a single product. At the beginning of period 1, there

was no opening stock of the product, for which the variable production cost

was FRW 4 and the sale price was FRW 6 per unit. Fixed costs are FRW 2,000

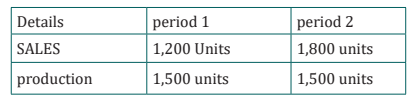

per period of which FRW 1,500 are fixed production costs. The following detailsare available:

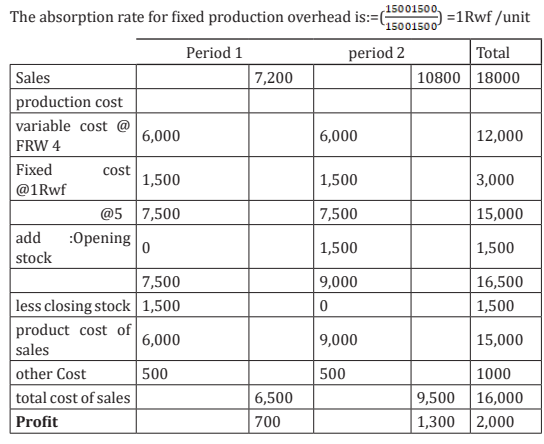

What would be the profit in each period using - a) Absorption costing. (Assume normal output is 1,500 units per period);Answer

a) Absorption costing. (Assume normal output is 1,500 units per period);Answer

and

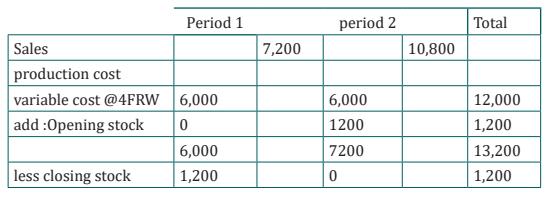

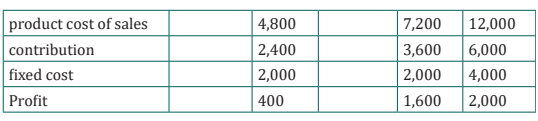

b) Marginal costing?a. Absorption Costing Method

b. Marginal Cost Method:

B. Absorption Decision making

1. Profit planning

There are four ways in which profit performance of a business can be

improved:by increasing volume, by increasing selling price; by decreasing

variable costs; and by decreasing fixed costs. Profit planning is the planning of

future operations to attain maximum profit or to maintain a specified level of

profit. Profitability of the different sectors of the business whenever there is a

change in selling price, variable costs or fixed cost absorbed. Best product isproduct which generates a high profit compare to others

2. Evaluation of Performance

The various section of a concern such as a department, a product line, or a

particular market or sales division, have different revenue earning potentialities.

A company always concentrates on the departments or product lines which

yield more net profit than others. The performance of each such sector can be

brought out by means of higher profit generation. The analysis will help thecompany to take decision that will maximize the profits.

3. Alternative Use of Production Facilities

When alternative use of production facilities or alternative methods of

manufacturing a product are available, contribution analysis should be used to

arrive at the final choice. The alternative which will yield highest contribution

shall generally and obviously be selected.

3.2.4. Break-even point and decision making

1. Contribution

The contribution from a product is the amount by which its selling price

exceeds its variable cost. The idea of contribution is central to breakeven

analysis in evaluating the effects of various decisions. Once the contribution

per unit is known it can be compared with the fixed costs. The business does

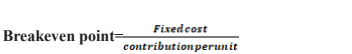

not begin to make a profit until the fixed costs are covered, so the formula isapplied as:

Covering fixed costs and making a profit

To find the level of sales necessary to cover fixed costs and make a specified

profit a knowledge of selling price per unit, variable cost per unit, and the fixedcosts together with the desired profit. These are set out in the data table.

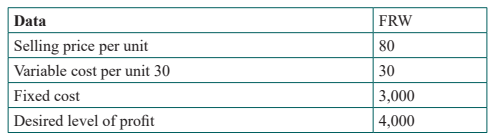

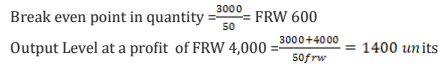

Example1.AKEZA produces the following cost data related to the production of product Y.

a) Calculate the break evenpoint ?

b) Calculate the level of output that can help the company to generate

FRW 4,000 as a profit?

ANSWERContribution =80-30 = FRW 50

2. Sensitivity Analysis

Beyond the breakeven point the fixed costs are covered and the sales of further

units are making a contribution to profit. The higher the contribution per unit,

the greater the profit from any particular level of activity

a. Margin of safety

The margin of safety has been defined as the difference between the breakeven

sales and the normal level of sales, measured in units or in Cash of sales.

b. Change in selling price

If the selling price per unit increases and costs remain constant, then the

contribution per unit will increase and the breakeven volume will be lower.

Take as an example the dry-cleaning business of the previous illustration

c. Change in variable cost

The effect of a change in variable cost is very similar to the effect of a change in

selling price. If the variable cost per unit increases, then the contribution per

unit will decrease, with the result that more items will have to be sold in order

to reach the breakeven point. If it is possible to reduce variable costs, then the

contribution per unit will increase. The enterprise will reach the breakeven

point at a lower level of activity and will then be earning profits at a faster rate.

d. Change in fixed costs

If fixed costs increase, then more units have to be sold in order to reach the

breakeven point. Where the fixed costs of an operation are relatively high, there

is a perception of greater risk because a cutback in activity for any reason is

more likely to lead to a loss. Where an organisation has relatively low fixed

costs, there may be less concern about margins of safety because the breakeven

point is correspondingly lower.

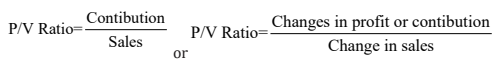

3. Profit Volume Ratio (P/V Ratio) or Contribution Ratio:

The P/V ratio is very important ratio studying the profitability of operations

of a business and established relationship between the contribution and sales.

In order to find out which product is most profitable, we have to calculate the

profit-volume ratio of the different products. The product which gives the

maximum P/V ratio is the most profitable. Every concern tries to maximise P/V

ratio, as higher P/V ratio gives an indication of more profit. It can be increased

by: Increasing the selling price of the product.

i) Decreasing the variable cost of the product and

ii) Shifting to the production of those products which are more profitable or

having more P/V ratio. With the help of this ratio variable costs can also

be calculated by the following: Variable costs = Sales(1-P/V ratio)

For example: Gross profit ratio: It may be expressed as:

• Sales is 4 times that of gross profit• Gross profit ratio is 25%

4. Margin of Safety

Margin of safety is the difference between the actual sales and sales at breakeven

point. At breakeven point ,we have seen there is no profit or loss. It is only after

the breakeven point that the business starts making profit.The more the actual

sales are from the breakeven point the more margin of safety will be. Margin

of safety indicates the strength of the business. If the production or sales are

increased from the breakeven point the margin of safety will increase. The more

the margin of safety the more beneficial it is for the business. Every concern

tries to increase the margin of safety in order to increase the strength of the

business. Margin of safety can be increased by the following steps: Increase the

level of production, Increase the selling price, Reduce the fixed costs or variablecosts or both, Substitute the existing product by more profitable products.

Margin of Safety in sales = Total Sales – Break Even Sales (1)Total Sales = Break Even Sales + Margin of Safety Sales (2)

Illustration

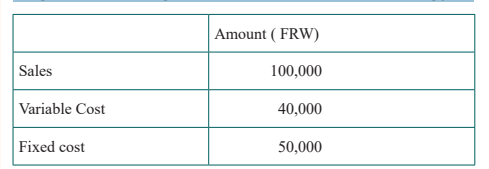

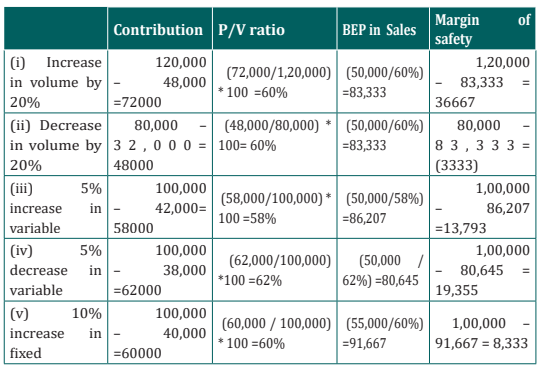

Magasin Sport Class is a sports material manufacturing company and hasbudgeted the following revenues and costs data for the coming year.

Calculate a) P/V Ratio, B.E.P in sales and Margin of Safety in sales

a) P/V Ratio, B.E.P in sales and Margin of Safety in sales

b) Evaluate the effect of the policy adopted on the profitability

i) 20% increase in sales volume

ii) 20% decrease in sales volume

iii) 5% increase in variable costs

iv)5% decrease in variable costs

v) 10% increase in fixed costsAnswer

a) P/V ratio, B.E.P and Margin of Safety

Contribution = Sales – Variable cost

= 1,00,000 – 40,000 = FRW 60,000

P/V Ratio = (Contribution / Sales) x 100

= (60,000 / 1,00,000) x 100 = 60%

B.E.P sales = Fixed cost / PV ratio

= 50,000 / 60% = FRW 83,333

Margin of Safety = Total sales – B.E.P sales

= 1,00,000 – 83,333 = FRW 16,667 This is considered as a

profit

3.2.5. Activity-Based costing and decision making

The features of ABC are as under

i) Activity-based costing (ABC) is a two-stage product costing method that

first assigns costs to activities and then allocates them to products based

on each product’s consumption of activities.

ii) Activity-based costing is based on the concept that products consume

activities and activities consume resources.

iii) Activity-based costing can be used by any organization that wants a

better understanding of the costs of the goods and services it provides,including manufacturing, service, and even nonprofit organizations.

USES OF ACTIVITY BASED COSTING

The areas in which activity based information is used for decision making are

as under: -

1. Activity costs: ABC is designed to track the cost of activities, so we can

use it to see if activity costs are in line with industry standards. If not,

ABC is an excellent feedback tool for measuring the ongoing cost of

specific services as management focuses on cost reduction.

2. Customer profitability: Though most of the costs incurred for

individual customers are simply product costs, there is also an overhead

component, such as unusually high customer service levels, product

return handling, and cooperative marketing agreements. An ABC system

can sort through these additional overhead costs and determine which

customers are providing a reasonable profit. This analysis may result

in some unprofitable customers being turned away, or more emphasis

being placed on those customers who are contributing more in profits.

3. Distribution cost: Organisation uses a variety of distribution channels

to sell its products, such as retail, Internet, distributors, and mail order

catalogs. Most of the structural cost of maintaining a distribution

channel is overhead, so if we can make a reasonable determination of

which distribution channels are using overhead, we can make decisions

to alter how distribution channels are used, or even to drop unprofitable

channels.

4. Make or buy: ABC enables the manager to decide whether he should get

the activity done within the firm or outsource it. Outsourcing may be

done if the firm is incurring higher overhead costs as compared to the

outsourcer or vice-versa.

5. Margins: With proper overhead allocation from an ABC system, we can

determine the margins of various products, product lines, and entire

subsidiaries. This can be quite useful for determining where to position

company resources to earn the largest margins.

6. Minimum price: Product pricing is really based on the price that the

market will bear, but the marketing manager should know what the

cost of the product is, in order to avoid selling a product that will lose a

company money on every sale. ABC is very good for determining which

overhead costs should be included in this minimum cost, dependingupon the circumstances under which products are being sold.

3.2.6. Processing costing and decision making

Process costing Decisions.

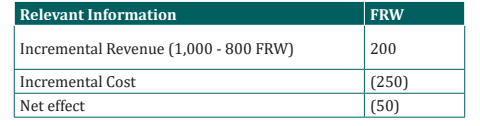

1. Sell or Process-Further

Decision rule: when incremental revenues exceed incremental costs (may also

need to consider opportunity costs), the company should further process the

products. Do not assume all separable costs in joint-cost allocations are alwaysincremental costs.

Illustration

DG Ltd is a souvenir supplier which makes and sells gold coins. The gold coins

are finished either rough or further polished.

• Rough gold coin can be sold for FRW 800 each and the polished gold coin can

be sold for FRW 1,000 each.

• Platinum, the direct material, costs FRW 120 per pound.

• Processing costs are FRW 16,000 to convert 40 pounds of platinum into 80

rough gold coins.

• Fixed manufacturing cost amounted to FRW 120 per gold coin.

• For polished gold coin, it needs an additional processing cost of FRW

250 each. However, it does not need additional platinum and fixed

manufacturing overheads.

Required: Should DG Ltd further process rough gold coin into polished gold

coin?

ANSWER

I cannot advise DG Ltd to further process this rough gold coins because there isa negative effect of FRW 50 for further processing.

2. Make or Buy Decisions

Decisions about whether a producer of goods or services will make it

internernally or outsource. Surveys of companies indicate that managers

consider quality, dependability of suppliers, and costs as the most important

factors in the make-or-buy decision.

Example .ABC firm can purchase a spare part from an outside source at FRW

6500 per unit. There is a proposal that the spare part be produced in the factory

itself and cost of processing has identified and recorded. For the purpose of

making the spare part a machine costing FRW 1,000,000 with an annual capacity

of 20,000 units and a life of 10 years, will be required. Materials required will

be FRW 1,750 per unit and wages FRW 1,900 per unit, direct, Expenses for FRW

1,000 per unit Variable overheads are FRW 1,250. Advise the firm whether the

proposal should be accepted.Answer

Purchase price FRW 6500

Variable cost FRW

MATERIAL COST 1,750

Labor Cost /wages 1,900

Direct expenses 2,000

Variable overhead 1,250 (6,900)

Contribution form purchase outside FRW (400)Advice the firm whether the proposal should be accepted,

The proposal should not be accepted because the company has obtained a

negative contribution of FRW 400. The firm should continue to purchase spare

part outside instead of producing them internally.

3. Dropping a product

A Manufacturing company has a range of products and if one of which is deemed

to be unprofitable, due to high processing cost, the company may consider todrop this product and to increase the production of more profitable products.

3.2.7. CVP and decision making

Cost Volume Profit decisions

1. Special order to use up spare capacity

In the short term, a business must ensure that the revenue from each item of

activity at least covers variable costs and makes a contribution to fixed costs.

Once the fixed costs are covered by contribution, the greater the level of activity,

the higher the profit.

When the business reaches full capacity there will be a new element of fixed

cost to consider should the business decide to increase its capacity. If there is

no increase in capacity, then the business should concentrate on those activities

producing the highest contribution per unit or per item. the special order is

acceptable provided the sales price per item covers the variable costs per item

and provided there is no alternative use for the spare capacity which could

result in a higher contribution per item.

2. Abandonment of a line of business

The allocation of fixed costs to products is a process which is somewhat arbitrary

in nature, and is not relevant to decision making because the fixed costs are

incurred irrespective of whether any business activity takes place. When a line

of business comes under scrutiny as to its profitability, cost–volume–profit

analysis shows that in the short term it is worth continuing with the line if it

makes a contribution to fixed costs. If the line of business is abandoned and

nothing better takes its place, then that contribution is lost but the fixed costsrun on regardless.

3. Existence of a limiting factor

In the short term, it may be that one of the inputs to a business activity is

restricted in its availability. There may be a shortage of raw materials or a

limited supply of skilled labour. There may be a delivery delay on machinery

or a planning restriction which prevents the . The item which is restricted in

availability is called the limiting factor. Cost–volume–profit analysis shows

that maximization of profit will occur if the activity is chosen which gives thehighest contribution per unit of limiting factor.

4. In-house activity versus bought-in contract

For a manufacturing business, there may be a decision between making a

component in-house as compared with buying the item ready-made. Cost–

volume–profit analysis shows that the decision should be based on comparison

of variable costs per unit, relating this to the difference in fixed costs betweenthe options.

Application activity 3.2

Q1. A business has budgeted sales of its single product of 38,000units.The

selling price per unit is FRW 57,000 and the variable costs production are

FRW 45,000. The fixed costs of the business are FRW360,000,000. Choose

the correct breakeven point in units from the following.

– A 3,529

– B 8,000

– C 9,474

– D 30,000

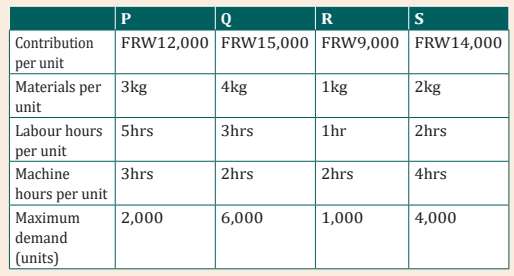

Q2. ABC Ltd produces four products (P,Q,R and S)and the following details

are provided:

Machine hours are limited to38,000 hours. Labour hours are limited to

40,000 hours and materials are limited to 30,000kg. Determine whether

any of the resource limits will prevent the maximum demand beingproduced.

Skills Lab 3

Senior five accountancy students started business club named

“Birashoboka” by using their money. They invested in Piggery and Poultry.

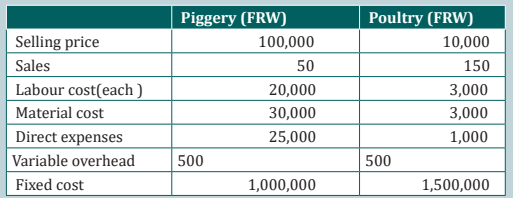

The financial information related to business income and expenditure areindicated in this table below.

Three Senior five students as owners and the

supervisors of these projects, They find it difficult to run both projects

because of their limited number that is insufficient to share all their routine

responsibilities of keeping hens and pigs. Some pigs and hens started

dying because of little care given to them. The headmaster of the school

has advised the students to perform only one project because hefound that

it is difficult to manage both at ago. In the annual general meeting, the

club management has decided to drop one business and continue with one

which is more profitable.

Imagine you are one the management team and you are requested to

explain to the entire club members on which project to maintain, what

would you say while selecting the best project? Draft a summary report

and use the following methods to inform your decision / communication

to the club.a) Marginal contributionEnd of unit assessment 3

b) Breakeven pointc) Net profit by using marginal costing

1. Define margin of safety?

2. A business has fixed costs of FRW 910million. It produces and sells

a single product at a selling price of FRW 24,000 and the variable

costs of production and sales are FRW 17,000 per unit. How many

units of the product must the business produce and sell inorder to

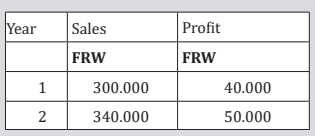

make a profit of FRW 500 million?– A 909,9933. NYIRANEZA’s sales turnover and profit during two years were as

– B 130,000

– C 201,429

– D 22,195follow :

Calculate

i) P/V Ratio

ii) BreakEven Point

iii) The sales required to earn a profit of FRW 80,000