UNIT 5: MATERIAL AND INVENTORY MANAGEMENT IN ORGANIZATION

Key unit competence: Explain different types of material inventory and methods used in inventory management.

Introductory activity.

KARENZI is permanent worker at MINIMEX PLC. He is carrying the duties on the post of storekeeper, in Muhanga town at branch of MINIMEX PLC. He is a well-known storekeeper, with the best quality of merchandises. Recently, he started to process maize and produce flour. This new business was very demanding to an extent that KARENZI was obliged to hire a worker responsible for shop management, as he caters for maize processing business. KARENZI became very busy, to the level that he was no longer able to carry out inventory control, monitor changes in the marketplace and cater for the needs of customers. So, designing, planning, executing, controlling, and monitoring of supply chain activities became responsibilities of the new employee. As the new employee was not experienced about procurement procedures, stock and inventory management as well as proper identification and follow up on clients’ needs, there were often missing items in the stock, despite raised need by clients. On the other hand, a considerable number of goods were rejected due to the expiration and damage. After a while, KARENZI just noticed that the number of customers and his revenues were decreasing.

Questions

1. What are the main reasons of poor inventory control from the above story?

2. Identify main effects of poor stock management and inventory control on a given business.

3. Diagnose the advice you can give to KARENZI and his employee in relation to proper business management?

4. As a storekeeper, what can you do in order to avoid incidents related to poor stock management in your business? Draw an easy and efficient strategy to use.

5.1 Types of material inventory

Activity 5.1

The store department is responsible to receive the materials and hold these materials until they are required by the production department. Store record is also maintained by the store department manager adequately. The location of stores department should be properly arranged and it should be nearer to production department. The layout of stores department requires careful planning; shelves and tables must be situated in clearly defined lines so that it is easy to access all parts of stores. The stores can vary according to organization scale that leads to one central warehouse, sub stores on the basis of imprest inventory.

After analyzing above scenario, you are required to answer the following question:

1. Define material inventory.

2. Identify correctly features of good store-keeping.

3. What are the types of stores included in above statement.

5.1.1 Definition of material inventory

It refers to all items, goods and materials held by a business to be manufactured in specific period of time. Material inventory again is one component of a manufacture’s inventory. Sometime referred as store or raw materials.

5.1.2 Stockkeeping

Stockkeeping (also known as storekeeping) is the task of maintaining safe custody of all items of supplies, raw materials, finished parts, purchased parts, and other items. These items are held in a storeroom for which a storekeeper acts as a trustee. As such, storekeeping can be defined as process of receiving and distributing stores or supplies.

5.1.3 Features of effective and good storekeeping

• Immediate location materials of materials

• Speed receipt and issue of materials.

• Keeping correct and up to date record of receipt, issues and stock balance of materials.

• Full identification of all materials at all times.

• Production of materials against pilferage and deterioration.

• Protection of materials against fire and theft

• Economic use of storage space

5.1.4 Types of stocks

The main types of stores are:

• Centralized stores

• Decentralized stores

• Imprest stores

a. Centralized stores

When materials are kept in one central warehouse and these are issued from one central point only then it is called centralized stores.

Advantages of central stores

• Smaller stocks are needed

• Less staff required

• Paper work is reduced

• Control of stock level is easy and simple

• Better security measures can be introduced

• Less risk of duplication of items in stock

Disadvantages of central stores

• Higher transport cost and increased handling

• Possibility of breakdown of transport vehicle

• Inconvenience to personnel

• Increasing fire risk

• Delay in supplying material to branches and departments at distant places.

b. Decentralized stores

When materials are held and issued by sub stores in each department or branch then it is called as decentralized store. Advantages of centralized store are disadvantages of decentralized stores. Similarly the disadvantages of centralized stores are advantages of decentralized stores.

c. Imprest stores

In this case, all materials are received by central stores but some items of these materials are issued to some sub stores on the basis of imprest system.

A specific quantity of each item material is issued to the storekeeper of specific department at the start of any period.

At the end of this period the storekeeper will inform about the number of items of any material used for production. This specific number of item of the materials will be replaced at the start of the next period.

For examples, if the consumption of materials 0521 is 2000 units per week then imprest of 2000 units is arranged. If at the end of any specific week the storekeeper remains with 150 units then will get 1850 more units of this material at the start of the following week. In this case, the imprest quantity 2000 units will be restored.

Note1: Types of inventories

It is the inventory for the manufacturing and selling of goods. Based on the value addition or stage of completion, the manufacturing inventories are further classified into 3 types of inventory.

• Raw materials: these are the materials or goods purchased by the manufacturer.

• Work –in –progress: These are the partly processed raw materials lying on the production floor. They may or may not be saleable. It is also known as semi-finished goods. It is unavoidable inventory that almost any manufacturing business creates.

• Inventory of Finished goods: These are the final products after the manufacturing process of raw materials. They are sold in market.

Note2: MRO Goods (Maintenance, Repairs, and Operating supplies):

They are also called consumables in various parts of the world. They are like a support function. Maintenance and repairs goods like, lubricating oil, bolt, nuts, are used in the machine that will be used for production. Operating supplies means the stationery used for operating business.

5.1.5 Store records documents

Stock records refer to documents which give information regarding the movement of stock.

This includes records kept both for accounts and costing purposes.

There are individual accounts for each item of stock on which are recorded all receipts and issues of that particular item and thus the balance at hand.

Stock records are maintained in the following documents

• Store ledger card

• Bin card

• Goods delivery note

• Goods received note

* Store ledger

Store ledger is similar to the financial ledger. It shows the quantities and monetary value of the stock items. There are three main columns in this ledger. These are for receipts, issues, and stock balance in hand.

Goods received are entered in receipt column showing quantity, price, and value. Issue column shows the goods issued by the storekeeper. This column also has three columns for showing quantity, price and value. In the balance column, the quantity and value of remaining stock are shown. It may be kept in stores department or costing department.

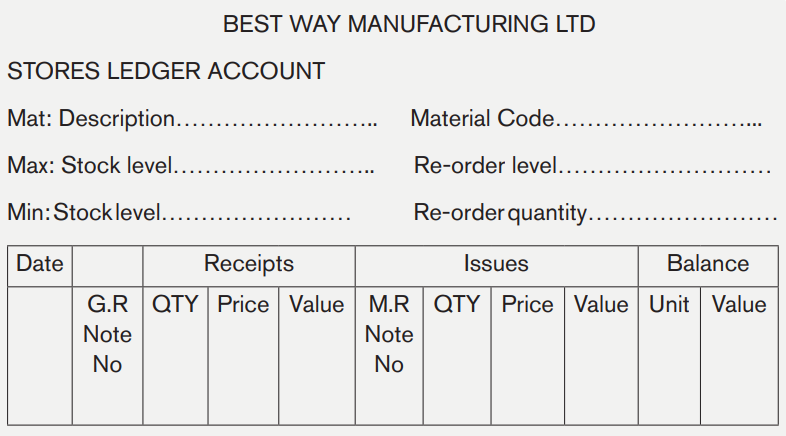

The format of store ledger

* Bin Card

A bin card is stiff card which is kept where the relevant stock item is stored. Goods or materials are stored I in drawers, shelves or racks. A separate bin card is used for each kind of goods. The bin shows the details of all receipts, issues and stock in hand. The bin card helps to find out the number of various items in stores on particular date. The final column of bin card shows the quantity in hand. The money values of the stores items are not recorded on the bin cards.

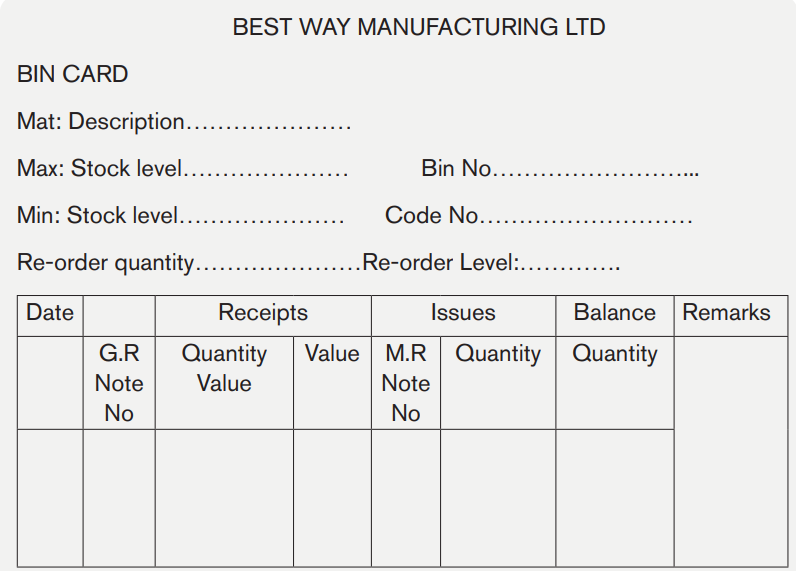

The format of a bin card

Note3: G.R. No: Goods Received Note Number

M.R No: Material Requisition Note Number

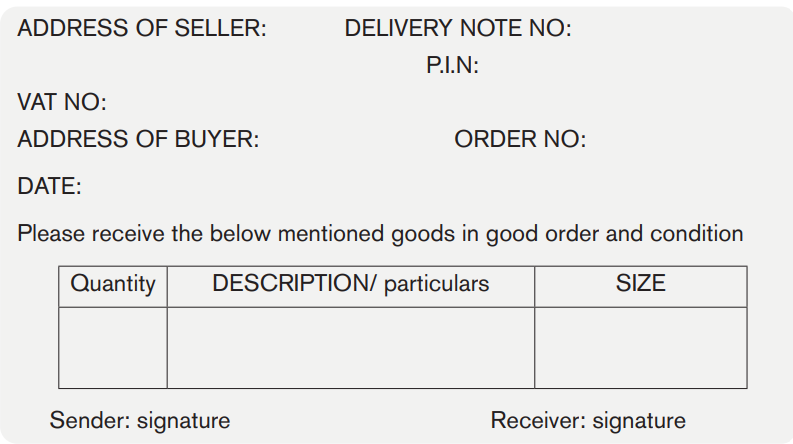

* Delivery note

The delivery note is a document issued by a seller and sent to a buyer at the moment of the delivery goods, when the invoice will be sent subsequently. It serves to verify if the goods delivered are conforming to the order.

It gives the details of the transactions the date delivery, the name of the buyer, the nature and quantity of delivered goods. The name of the transport’s means.

Format of delivery note

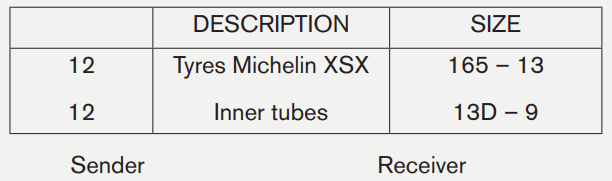

Eg: On October 19th 2007, BAMBA Ltd had ordered the following goods (items):

• 12 tyres Michelin xzx – size: 165 – 13

• 12 inner tubes size 13D – 9

After receiving this purchased order, BESTWAY MANUFACTURING LTD, supplier makes the arrangement to deliver those goods.

Required: Present the delivery note on October 19th, 2008

Answer:

BESTWAY MANUFACTURING LTD

P.O BOX 54781 NAIROBI

DELIVERY NOTE No:……..

TO BAMBA Ltd

P.O BOX ………

Date: October 19th, 2008

* GOODS RECEIVED NOTES (GRN)

The Good Received notes is a document issued by a receiver (buyer) of goods to record receiving of goods purchased.

For goods control purposes, a receiving is used to record the details of receiving goods:

• The date of receiving;

• The name and the address of supplier

• The delivery order number

• The description of goods purchased

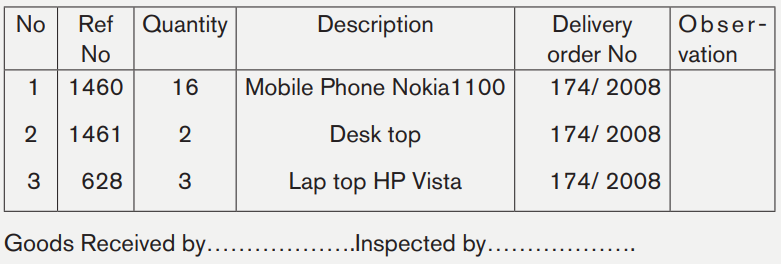

Eg: Mr KALIMANDA received the following goods from his supplier, Mr KAMANA Ali from Muhanga :

- 16 Items mobile phone No 1100, Nokia Ref 1460

- 2 Desktop, Ref No 1461

- 3 Laptop HP Vista, Ref No 628

- Date of delivery: December 14th, 2008

- Number of delivery Order 174 / 2008

Required: prepare the goods received Notes (GRN)

Answer

MR. KALIMANDA

P.O BOX 3752 MUHANGA

GOODS RECEIVED NOTE

FROM: MR KAMANA Alii G.R.N. No: ……

Date: December 14th, 2008

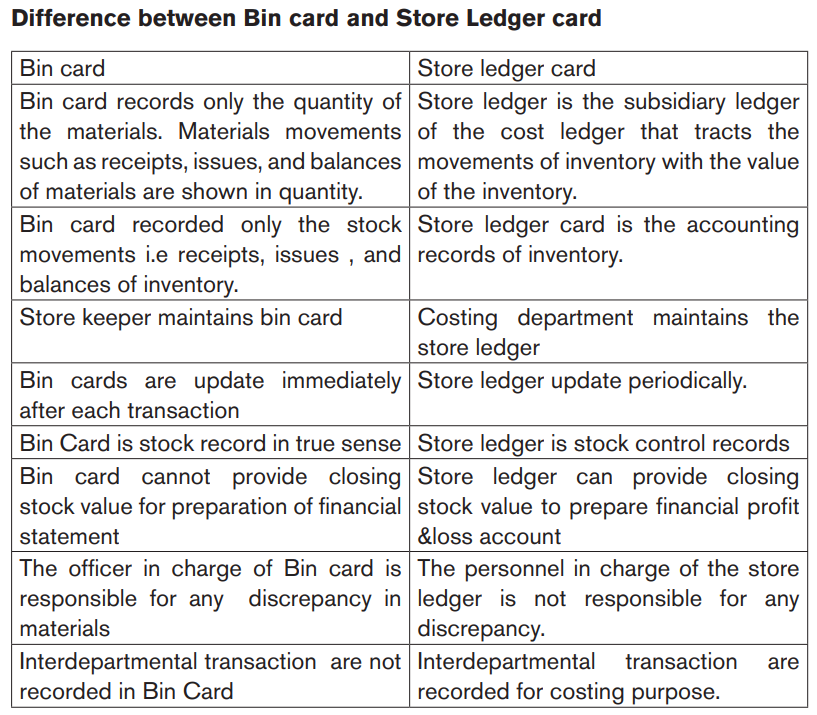

Discrepancies between Bin card balances and store ledger card balance.

Same documents are used to make entry in bin card and store ledger card. So, the balance (quantity) in the two records should be equal.

Any discrepancy may be raised due to the following reasons:

• Wrong entry made in both record

• Wrong casting in balance in any or both Missing of documents.

• Bin cards and store ledger should be reconciling independently on the basis of documents that were used for entry.

5.1.6 Conditions of good stocking

For storing goods in stock the following rules should be taken into account:

• Most frequently used materials are placed nearest the entrance.

• Big and very heavy materials are placed nearest the entrance at the bottom so that they should be movable easily.

• Small and easier movable goods are placed up of the storage hall

• Goods storage Hall must be equipped with necessary conditions for goods stored (not to be very hot, cold….)

Application activity 5.1

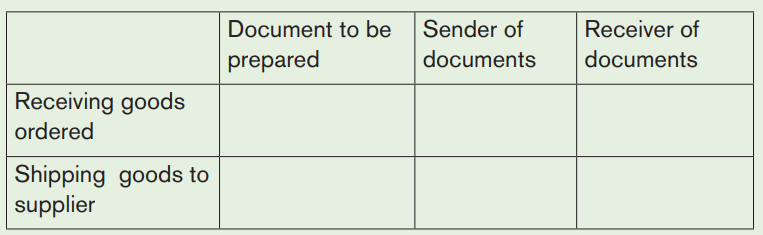

Athanasie is a trader in Ruhango district with a very big business. She uses different documents in her daily activities for instance for incoming product, transferring goods from one department to other departments, store ledger cards helping her in controlling inventory.

a) Mention three (3) documents that can be used for proper stock management in Athanasie’s business.

b) Identify five(5) elements include in store ledger cards.

c) Fill the following table :

5.2 Stock control

Activity 5.2

UWERA is Director Manager of Remera Rukoma Hospital having a big number of customers who normally come at different time of intervals which owns different materials and assets used in provision of its services. Since, these assets have to be kept safely for the purpose of costumers’ satisfaction, and realization of organization’s objectives. Stock control is a great important function in any business organization. Hence, Remera Rukoma Hospital would like to hire a professional accountant to control stock including various goods e.g. raw materials, semi-finished goods and finished goods, equipment, components, office stationery, goods purchased for resale etc.

Stock control means making sure that the business has the right quantity of goods, in the right place and at the right time. Stock level must be either too high or too low since there is factors affecting stock levels. Since, these properties have to be kept securely for the purpose of client’s satisfaction, and realization of organization’s objectives. Some documents and books are required to maintain stock control management.

1. With the above statement:

a) What is stock control?

b) Mention factors that affect stock level.

c) Mention types of material stocks.

5.2.1 Definition of stock control

Inventory/stock control is the regulation of inventory levels, which includes putting a value to the amounts of inventory issued and remaining. Inventory control also includes ordering, purchasing, receiving, and storing goods.

5.2.2 Objectives of stock control

• To ensure the availability of goods when required.

• To account for the goods which have been purchased.

• To reduce storage cost as much as possible.

• To minimise the risk of deterioration, wastages and theft.

• To maintain accurate records.

• To avoid over-stocking and under-stocking.

5.2.3 Inventory system

An inventory management system (or inventory system) is the process by which you track your goods throughout your entire supply chain, from purchasing to production to end sales. It governs how you approach inventory management for your business.

Stocktaking involves counting the physical inventory on hand at a certain date and then checking this against the balance shown in the clerical records. There are two methods of carrying out this process.

a. Periodic inventory

This is usually carried out annually and the objective is to count all items of inventory on a specific date.

b. Continuous inventory

This involves counting and checking several inventory items on a regular basis so that each item is checked at least once a year, and valuable items can be checked more frequently. This has several advantages over periodic stocktaking. It is less disruptive, less prone to error, and achieves greater control.

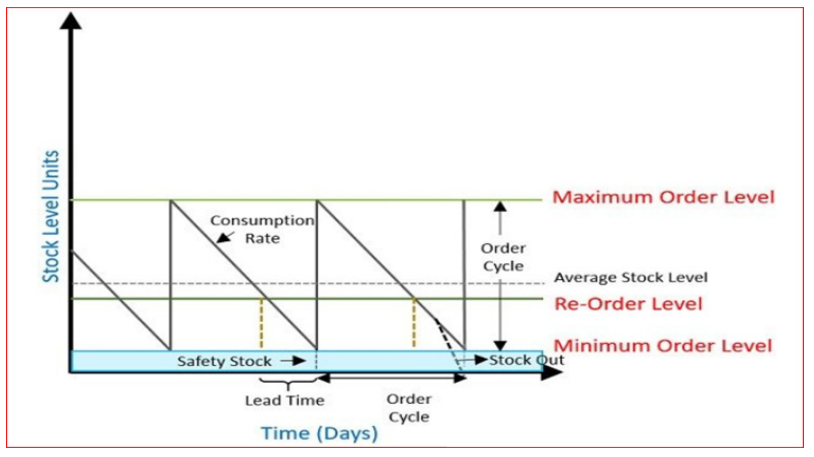

5.2.4 Stock levels

Stock control levels can be calculated to maintain inventories at the optimum level. The three critical control levels are reorder level, minimum level, and maximum level.

Based on an analysis of past inventory usage and delivery times, inventory control levels can be calculated and used to maintain inventory at their optimum level (in other words, a level which minimises costs). These levels will determine 'when to order' and 'how many to order'.

a. Maximum stock level

The maximum level also acts as a warning level to signal to management that inventories are reaching a potentially wasteful level.

Maximum level = reorder level + reorder quantity – (minimum usage x minimum lead time)

b. Minimum stock level

The minimum level is a warning level to draw management attention to the fact that inventories are approaching a dangerously low level and that stockouts are possible.

Minimum level = reorder level – (average usage x average lead time)

c. Reorder Level

When inventories reach the reorder level, an order should be placed to replenish inventories. The reorder level is determined by considering:

• The maximum usage

• The maximum lead time

The maximum lead time is the time between placing an order with a supplier, and the inventory becoming available for use. Reorder level = maximum usage x maximum lead time

d. Reorder Quantity

This is the quantity of inventory which is to be ordered when inventory reaches the reorder level. If it is set to minimise the total costs associated with holding and ordering inventory, then it is known as the economic order quantity.

e. Average stock level

The formula for the average inventory level assumes that inventory levels fluctuate evenly between the minimum (or safety) inventory level and the highest possible inventory level (the amount of inventory immediately after an order is received, ie safety inventory + reorder quantity).

Average inventory= safety inventory + ½ reorder quantity.

5.2.5 Factors affecting stock levels

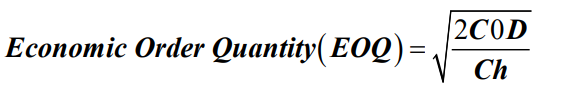

a. Economic order quantity (EOQ)

The economic order quantity (EOQ) is the order quantity which minimises inventory costs.

Economic order theory assumes that the average inventory held is equal to one half of the reorder quantity (although, if an organisation maintains some sort of buffer or safety inventory then average inventory = buffer inventory + half of the reorder quantity). We have seen that there are certain costs associated with holding inventory. These costs tend to increase with the level of inventories, and so could be reduced by ordering smaller amounts from suppliers each time.

On the other hand, as we have seen, there are costs associated with ordering from suppliers:

documentation, telephone calls, payment of invoices, receiving goods into stores and so on. These costs tend to increase if small orders are placed, because a larger number of orders would then be needed for a given annual demand.

where

Ch = cost of holding one unit of inventory for one time period

C0 = cost of ordering a consignment from a supplier

D = demand during the time period

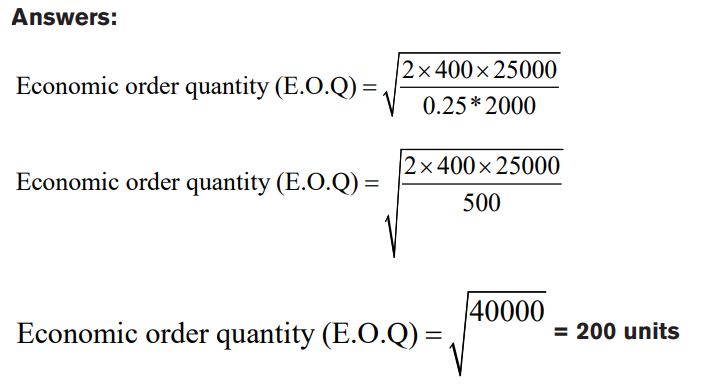

Example:

A company has an annual demand for material of 25,000 tons per annum. The cost price per ton is FRW 2,000 and stock holding is 25% per annum of the stock value. Delivery cost per batch is FRW400.

Required:

Calculate the economic order quantity.

It means that 200 units must be purchased at one time. If the batch size is more than or less than 200 units, the stock holding, and ordering costs will be higher.

b. Reorder quantity

This is the quantity of inventory which is to be ordered when inventory reaches the reorder level. If it is set to minimise the total costs associated with holding and ordering inventory, then it is known as the economic order quantity.

c. Availability of materials

If an item of material is easily available through out of the year, the stock level should be low and vice versa.d. Lead time

Lead time means the period between the date of order and the date of delivery.

If lead time is more the stock must be maintained at higher level and vice versa.

e. Stock holding cost

Stock holding cost means the cost of keeping the material into stores. If stock holding cost is high, then stock level must be low and vice versa.

f. Consumption

If any item of materials is consumed in greater quantity, then it must be maintained at high level and vice versa.

g. Trade

discount Sometimes, the suppliers offer higher discounts for large quantities. If the benefit of trade discount is greater than stock holding cost, then stock level must be maintained at higher level.

h. Durability of material

The stock level of durable goods can be maintained at higher level but in case of perishable goods like fish and fruit, it should be kept at low level.

Stock levels structure

Application activity 5.2

1. The consumption of certain type of ball bearing is 120 pieces per

year. The price of each ball bearing is Frw 100. If the inventory

carrying cost is 20% per annum and the cost of procurement per

order is Frw 20.

a) Calculate economic ordering quantity.

2. In respect of material, the following data are available:

Budgeted consumption:

Maximum = 300 units per month, lead time=2-4

Minimum =50 unit per month, storage costs are 25% p.a of average stock value

Average = 150 units per month, ordering cost are Frw 2 per order

Annual = 1800 units price per unit of material is Frw 0.32

Calculate:

a) Re- order level,

b) Minimum level

c) Maximum level

d) Average stock level

e) Re –order or economic order quantity

5.3 Methods of material issues

Activity 5.3

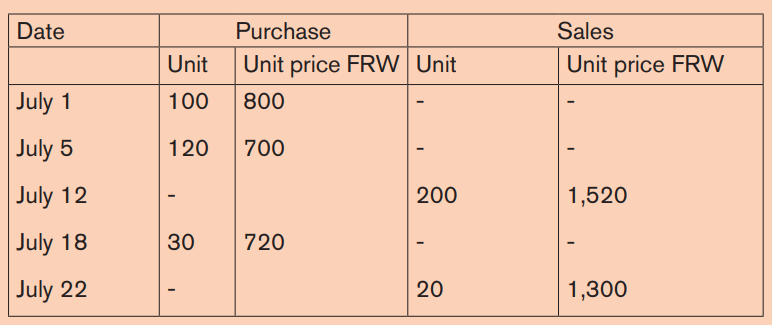

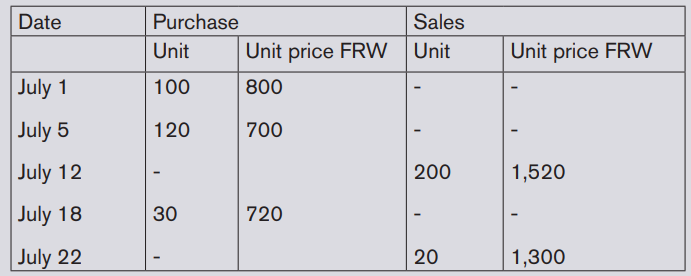

MUHIRE is a business person, selling different Agri-products from NGOMA District. During the month of July, 2019 his purchases and sales is extracted from the ledgers books and presented from the following store ledger card.

Required: After analyzing the store ledger card from MUHIRE business documents, suggest the methods to be used by his accountant for material issues.

5.3.1 Introduction

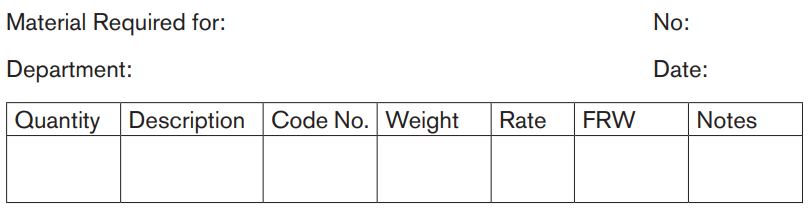

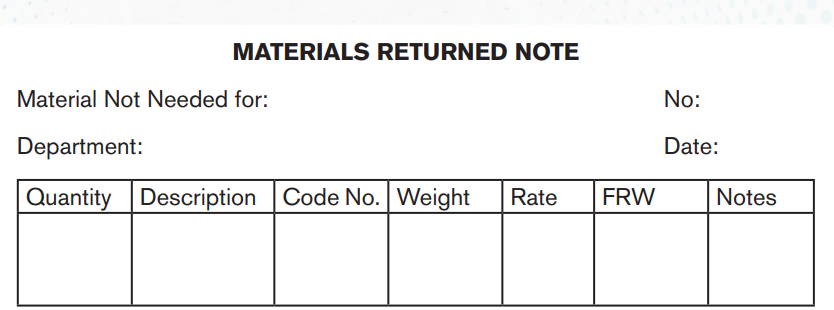

The sole point of holding inventories is so that they can be used to make products. This means that they must be issued from stores to production departments. This transaction will be initiated by production that will complete a materials requisition note and pass it to the warehouse.

MATERIALS REQUISITION

Foreman:

The stores department will locate the inventory, withdraw the amount required and update the bin card as appropriate. The stores ledger account will also be updated.

If the amount of materials required is overestimated the excess should be put back into store accompanied by a materials returned note. The form in our illustration is almost identical to a requisition note. In practice it would be wise to colour code the two documents (one white, one yellow, say) to prevent confusion.

Foreman:

There may be occasions when materials already issued but not required for one job can be used for another job in progress. In this case there is no point in returning the materials to the warehouse. Instead, a materials transfer note can be raised. This prevents one job being charged with too many materials and another with too little.

You will note that all the forms shown above have spaces for cost information (that is, monetary values). This will be inserted either by the stores department or in costing, depending upon how the system is organized.

5.3.2 Methods of material issue

Materials issued from inventory can be valued using several methods such as FIFO, LIFO and weighted average methods.

a. First In First Out (FIFO)

FIFO (first in, first out) is an inventory valuation method that assumes that items purchased earliest are issued first. Inventory on hand is valued at the latest prices, issues are costed at the earliest relevant prices.

First in, first out (FIFO) assumes that the first items bought are the first items issued.

So:

• Items issued are costed at the earliest invoice prices related to the inventory held, working forwards through to the later prices, and

• Inventory on hand is valued at the latest prices, working back.

FIFO is most appropriate in businesses where the oldest items are actually issued first, which is the case with perishable goods such as food, but actually this is a very popular method in many types of business.

Note that in a time of rising prices generally, FIFO values inventory at the highest amounts. This leads to a high value of closing inventory at the end of an accounting period, which can make that period's profit look better.

The advantages and disadvantages of the FIFO method are as follows.

a. Advantages

i) It is a logical pricing method which probably represents what is physically happening: in practice the oldest inventory is likely to be used first.

ii) It is easy to understand and explain to managers.

iii) The closing inventory value can be near to a valuation based on the cost of replacing the inventory.

b. Disadvantages

i) FIFO can be cumbersome to operate because of the need to identify each batch of material separately.

ii) Managers may find it difficult to compare costs and make decisions when they are charged with varying prices for the same materials.

a. Last In, Fist Out (LIFO)

LIFO (last in, first out) is an inventory valuation method that assumes that items purchased latest are issued first. Inventory on hand is valued at the earliest relevant prices and issues are costed at the latest prices.

Last in, first out (LIFO) is the opposite of FIFO: it assumes that the last items bought are the first items issued. So:

• Items issued are costed at the latest invoice prices, working backwards through to the earlier prices, and

• Inventory on hand is valued at the earliest prices related to the inventory held, working forward.

LIFO is appropriate if new deliveries are physically piled on top of existing inventories, and goods issued are picked from the top of the pile. In fact, from a financial accounting point of view, LIFO is not a permitted method of inventory valuation, so in practice it is rarely seen.

Note that in times of general price inflation, LIFO means a lower value of inventory at the end of a period than FIFO, so that period's profit tends to look worse.

The advantages and disadvantages of the LIFO method are as follows.

a. Advantages

i) Inventories are issued at a price which is close to current market value. This is not the case with FIFO when there is a high rate of inflation.

ii) Managers are continually aware of recent costs when making decisions, because the costs being charged to their department or products will be current costs.

b. Disadvantages

i) The method can be cumbersome to operate because it sometimes results in several batches being only part-used in the inventory records before another batch is received.

ii) LIFO is often the opposite of what is physically happening and can therefore be difficult to explain to managers.

iii) As with FIFO, decision making can be difficult because of the variations in prices.

b. Simple price average (SPA)

A simple price average of all consignments in stock is calculated on average price issued to value materials issued. When the first consignment is exhausted then the price of that consignment is eliminated, and simple average of remaining price is calculated and so on.

In case of simple average method, quantities are not taken into consideration.

This method is simple, but it is difficult to determine which price should be taken to calculate the average. Under this method, the price is not the actual cost of the material so profit or loss arises out of each issue and is difficult to account for it.

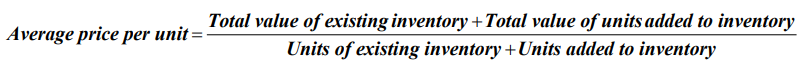

c. Weighted average (WA)

Weighted average means weighted average price. Under this method, the total value of goods in stock divided by the number of units of stock. The resultant figure is weighted average price.

This method is simple and logical, but it is not close to current value of goods. Under this method also, profit or loss may arise on the materials issued.

WA is most appropriate if inventories received at different times are mixed when they are stored, for example chemicals stored in a vat, but again in practice this is a common method of valuation whatever the nature of the inventory.

When prices are generally rising, WA distorts period profits less than FIFO or LIFO, since it uses an average of the prices at which the actual inventory was purchased.

The advantages and disadvantages of weighted average pricing are as follows.

a. Advantages

i) Fluctuations in prices are smoothed out, making it easier to use the data for decision making.

ii) It is easier to administer than FIFO and LIFO, because there is no need to identify each batch separately.

b. Disadvantages

i) The resulting issue price is rarely an actual price that has been paid and can run to several decimal places.

ii) Prices tend to lag a little behind current market values when there is gradual inflation.

d. Base stock

Under this method, a fixed quantity is carried as base stock. It is as summed that a fixed minimum stock of the material is always carried at original cost. The minimum stock is known as base stock because it is kept for emergencies. The stock is not allowed to fall below this level.

Base stock method is similar to the FIFO method because after deducting the base stock figure, the remaining issues are valued at FIFO basis. This method has these same advantages and disadvantages which are of the FIFO method.

e. Replacement cost (RC)

Under this method, material issues are valued at replacement cost or market value. It means that materials issued are valued according to cost incurred replace those materials.

This method ensures the valuation of material issues at materials at market or current prices.

This method is logical but it is difficult to ascertain the price of next purchase. In this case, also, profit and loss arises as result of material issues.

f. Standard price (SP)

Standard price means predetermined price. A standard price is ascertained taking into consideration several factors. The factors consumption material expected changes in the price of the material and so on. Under this method, all material issues are valued at standard price.

This method is simple, stable and provides a check on the efficiency of the enterprise.

The main drawbacks of this method are disregard of actual price changes and differences between actual cost and standard cost. In this case also, profit or loss arises. The transactions in example 1 are recorded under standard price method in a stores ledger cards.

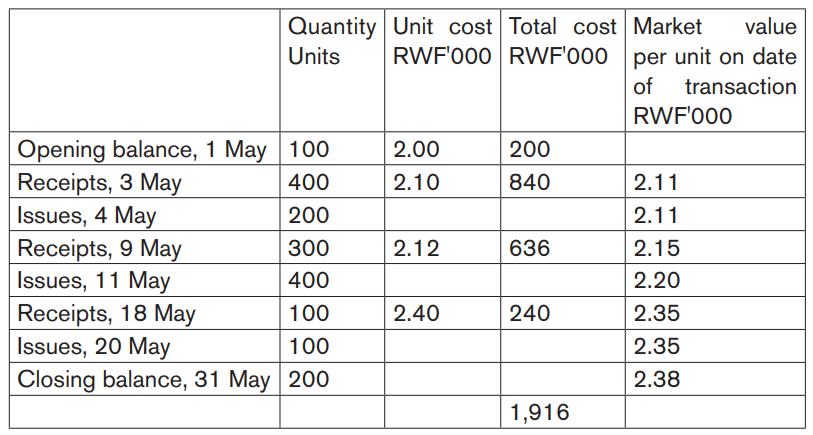

Example: FIFO, LIFO, and weighted average pricing methods

The following transactions should be considered to demonstrate FIFO, LIFO, and weighted average pricing methods.

TRANSACTIONS DURING MAY 20X3

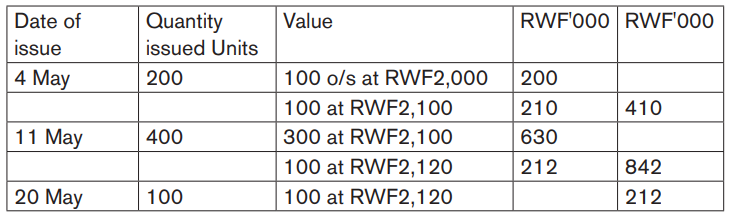

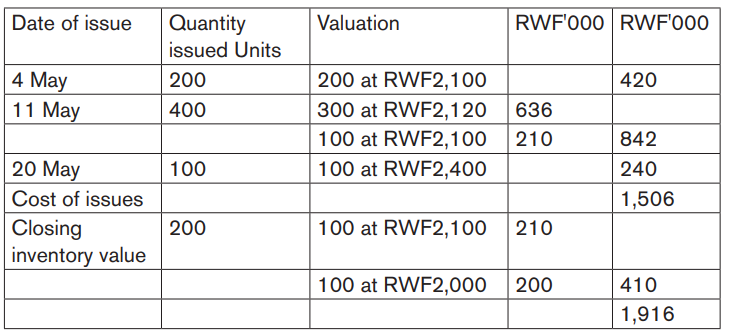

a. Using FIFO

FIFO assumes that materials are issued out of inventory in the order in which they were delivered into inventory: issues are priced at the cost of the earliest delivery remaining in inventory.

Using FIFO, the cost of issues and the closing inventory value in the example would be as follows:

* The cost of materials issued plus the value of closing inventory equals the cost of purchases plus the value of opening inventory (RWF1,916,000).

* The market price of purchased materials is rising dramatically. In a period of inflation, there is a tendency with FIFO for materials to be issued at a cost lower than the current market value, although closing inventories tend to be valued at a cost approximating to current market value.

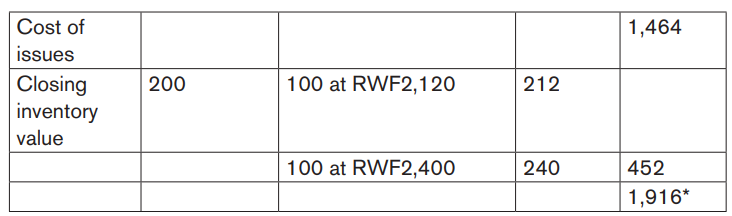

b. Using LIFO

LIFO assumes that materials are issued out of inventory in the reverse order to which they were delivered: the most recent deliveries are issued before earlier ones and are priced accordingly.

Using LIFO, the cost of issues and the closing inventory value in the example above would be as follows:

Notes

a) The cost of materials issued plus the value of closing inventory equals the cost of purchases plus the value of opening inventory (RWF1,916,000).

b) In a period of inflation there is a tendency with LIFO for the following to occur.

i) Materials are issued at a price which approximates to current market value.

ii) Closing inventories become undervalued when compared to market value.

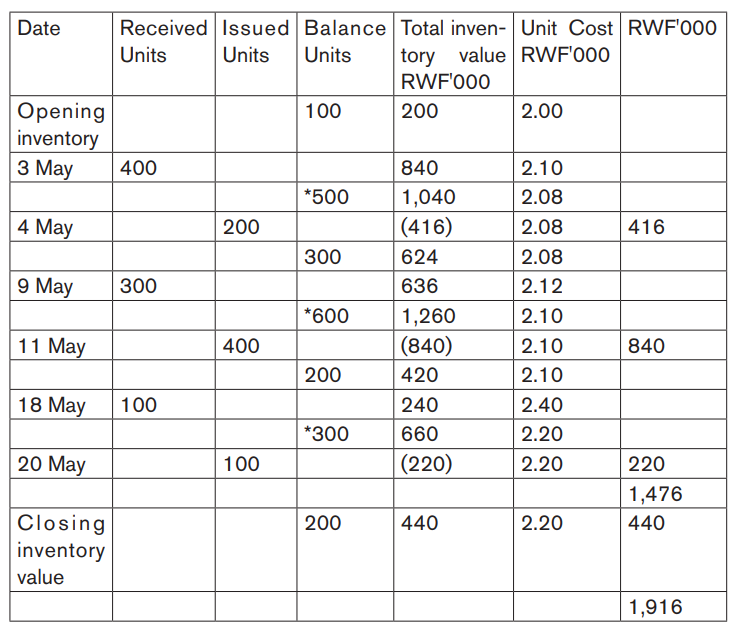

c. Using Weighted Average Pricing Methods

The cumulative weighted average pricing method calculates a weighted average price for all units in inventory. Issues are priced at this average cost, and the balance of inventory remaining would have the same unit valuation. The average price is determined by dividing the total cost by the total number of units.

A new weighted average price is calculated whenever a new delivery of materials into store is received. This is the key feature of cumulative weighted average pricing.

In our example, issue costs and closing inventory values would be as follows:

* A new inventory value per unit is calculated whenever a new receipt of materials occurs.

Notes

a) The cost of materials issued plus the value of closing inventory equals the cost of purchases plus the value of opening inventory (RWF1,916,000).

b) In a period of inflation, using the cumulative weighted average pricing system, the value of material issues will rise gradually, but will tend to lag a little behind the current market value at the date of issue. Closing inventory values will also be a little below current market value.

Application activity 5.3

What are the different methods of material issues to be used in Muhire business shop?

Skills Lab Activity 5

Have a resource person (Accountant of School) to share with students about:

a) Payroll process and ask students to prepare the payrolls,

b) The payment methods of payroll preparation at home / in club then let students present their findings.

End unit assessment 5

MUHIRE is a business person, selling different Agri-products from Ngoma District. During the month of July, 2019 his purchases and sales is extracted from the ledgers books and presented from the following store ledger card.

Required:

Prepare stock valuation card using:

i) LIFO method store card

Q2. Identify correctly two disadvantages of using LIFO valuation