Topic outline

UNIT 1: THE NATURE OF BUSINESSES TRANSACTION TO ACCOUNTING SYSTEM

Key unit competence: Explain the nature of organization businesses transaction in relation to its accounting system.

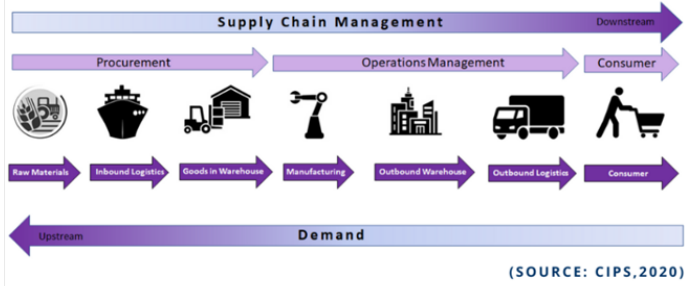

Introductory activity

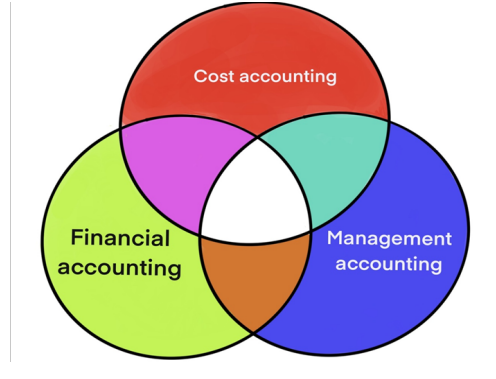

1. Analyse the picture below and answer the questions that follow:

i) Identify the different activities shown on above picture.

ii) Which kind of agents intervening in the specified activities?

iii) Are all agents having the same intention?

iv) Which accounting sciences involved in the above activities?

v) Refer to the knowledge acquired from Entrepreneurship subject (Initial accounting entries for a business in senior 2 ordinary level).

Explain why is necessary to record the accounting information.

1.1 Definition of concepts

Activity 1.1

NYIRABYATSI PLC is profit oriented business, producing many products for sales in Rwanda. The products produced in that enterprise are juice, biscuits, yoghourt, water, all of which were experiencing sharp decreases in sales, and loss to the whole business.

In 2021 there was an economic crisis caused by Covid-19, General Manager announced a plan to cut off FRW 15million in cost and raise FRW 5 million through the sales of business assets; (motor vehicles, trucks and pickup).” We’re cutting to the bone”, said by General Manager. However, given the situation, we think that’s appropriate. It was appropriate, but it wasn’t enough. By November 2021, “NYIRABYATSI PLC had lost more than FRW 18 million” said General Manager. From this economic hazardous situation, the government loaned the NYIRABYATSI PLC FRW 20million to continue operations. Ultimately, its restructuring effort fell short and finally NYIRABYATSI PLC felt into bankruptcy. In court papers, NYIRABYATSI PLC claimed FRW 82 million in asset and FRW 172million in debt. As the story of NYIRABYATSI PLC illustrated, managers must understand costing in order to interpret and act on accounting information and generate a report containing a variety of cost concepts and terms. Managers must understand these concepts and terms to effectively use the information provided for running their businesses. Those cost and management concepts/terms that are the basis of accounting information used for internal and external reporting.

1. According to the story of NYIRABYATSI PLC explain the problems faced up to bankruptcy.

2. Name the accounting terms used in NYIRABYATSI PLC story.

1.1.1 Accounting

It is the art and science of recording and classifying financial transactions in the books, summarizing and communicating financial information’s through production of financial statements/reports and interpretations of operating results portrayed in financial statements/reports to facilitate decision making.

1.1.2 Management

It is a comprehensive function of planning, organizing, forecasting coordinating, leading, controlling, motivating the efforts of others to achieve specific objectives.

1.1.3 Costing

It is any system for assigning cost to an element of a business. Costing is typically used to develop costs structure for customer’s satisfaction, distribution channels, employees and entire companies.

Or Costing means the ascertainment of costs to the produced commodity or provided service.

1.1.4 Management accounting

Management accounting is the practice of identifying, measuring, analysing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals. It varies from financial accounting because the intended purpose of management accounting is to assist internal users to the company in making well-informed business decisions.

1.1.5 Cost accounting

It is accounting branch that measures, analyses, and reports financial and nonfinancial information relating to the costs of acquiring or using resources in an organization.

1.1.6 Financial accounting

It is accounting branch concerning with the recording of accounting data, classifying, summarising the recorded data and communicating the results to interested parties/accounting information users.

1.1.7 Cost

It is the value of economic resources used as a result of the production of any commodity or performing any services. Or, Cost is resource value used for future benefits.

1.1.8 Expense

It is cost expired. Or Expense is resources given up that have no future potential benefits.

1.1.9 Cost centre

Cost Centre is a particular department, a function or items of equipment in respect of which cost may be ascertained and related to cost units for control purposes.

Cost centres are collecting places for costs before they are further analysed. Costs are further analysed into cost units once they have been traced to cost centres.

1.1.10 Income

It is a gain or recurrent benefit derived from capital use, or labour force sacrificed. It is usually measured in monetary terms.

Application activity 1.1

1. What is the meaning of management accounting?

2. Define the following concepts:

• Costing

• Business

• Cost center

3. What is the difference between cost and expense?

1.2 Types of business

Activity 1.2

The Rwandan economy relies on different sectors including agricultural, services, livestock, tourism, and industries/companies operations. Agribusiness becomes the cornerstone of national production and industries activities take the second rank from which manufacturing companies accounted for 11.5% of GDP. The examples of manufacturing companies in Rwanda are Rwanda Foam, Sulfo Rwanda Industries Ltd, etc.

Other companies are services like MTN, AIRTEL, RITCO, HOSPITALS, HOTELS, etc, and other companies purchase the goods and resell to the customers. Those businesses can operate either in private and public frameworks that facilitate the management of their companies to achieve the goals.

1. From the above outline 3 sectors of the Rwandan economy.

2. From the above give the types of business discussed in the above story.

1.2.0 Introduction

Business is a legally recognized organization or enterprise that operates with the objectives of profit maximization. Or It is also defined as an economic activity which involves regular production or exchange of goods and services with the main purpose of earning profits through the satisfaction of human wants. A business can be set up in a variety of different ways depending upon its nature, size and organization structure.

1.2.1 Types of business according to ownership

a. Sole trade

Is a business owned by a single person. Usually he/she provides all the capital and run the business. A sole trader owns and runs a business on their own, perhaps employing one or two assistants and controlling their work. The individual's business and personal affairs are, for legal and tax purposes, identical.

Examples include local grocery shops, carpentry shops, pharmaceutical shops, etc.

The simplest type of business is that of a sole trader. A sole trader is someone who trades under their own name. Many businesses are sole traders, from small subsistence farmers through to accountants. Being a sole trader does not mean that the owner is the only person working in the business. Some sole traders are the only person in the business, but many will also employ several other staff. Even so, in most cases the owner will oversee most business functions, such as buying and selling the goods or services, doing the bookkeeping, and producing accounts. In some instances, however, the sole trader will employ an external bookkeeper, who may also be a sole trader, to update the accounting records regularly.

The owner of the business is the one who contributes the capital to the business, although it might also have loans, either commercial or from friends. The owner is also the only party to benefit from the profits of the business and this will normally be done by the owner taking money or goods out of the business, known as drawings.

b. Partnership

A partnership is a business owned by two or more people. In most forms of partnerships, each partner has unlimited liability for the debts incurred by the business. The three most prevalent types of for-profit partnerships are: general partnerships, limited partnerships, and limited liability partnerships.

Partnerships are arrangements between individuals to carry on business in common with a view to profit. A partnership, however, involves obligations to others, and so a partnership is usually governed by a partnership agreement. Unless it is a limited liability partnership (LLP), partners will be fully liable for debts and liabilities, for example if the partnership is sued.

A partnership is a group of individuals who are trading together with the intention of making a profit. Partnerships are often created as a sole trader's business expands and more capital and expertise are needed within the business. Typical partnerships are those of accountants, solicitors and dentists and usually comprise between about 2 and 20 partners. As partnerships tend to be larger than sole traders, there will usually be more employees and a greater likelihood of a bookkeeper being employed to maintain the accounting records.

Each of the partners will contribute capital to the business and will normally take part in the business activities. The profits of the business will be shared between the partners, and this is normally done by setting up a partnership agreement where the financial rights of each partner are set out. Just as with sole traders, the partners will withdraw part of the profits that are due to them in the form of drawings from the business although, in some cases, partners may also be paid a salary by the business.

c. Corporation

The owners of a corporation have limited liability and the business has a separate legal personality from its owners. Corporations can be either government-owned or privately owned. They can organize either for profit or as nonprofit organizations. A privately owned, for-profit corporation is owned by its shareholders, who elect a board of directors to direct the corporation and hire its managerial staff. A privately owned, for-profit corporation can be either privately held by a small group of individuals, or publicly held, with publicly traded shares listed on a stock exchange.

d. Cooperative

A cooperative is a private business owned and operated by the same people that use its products and or services. The purpose of a cooperative is to fulfil the needs of the people running it. The profits are distributed among the people working within the cooperative, also known as user-owners.

There is typically an elected board that runs the cooperative, and members can buy shares to be apart of decision-making processes.

1.2.2 Types of business according to share

a. Limited Liability Companies (LLC),

The main difference between the trading of a sole trader and a partnership on the one hand and a limited company on the other is the concept of limited liability. If the business of a sole trader or a partnership runs out of money and is declared bankrupt, then the sole trader or partners are personally liable for any outstanding debts of the business. However, the shareholders of a company have limited liability which means that once they have fully paid for their shares they cannot be called upon for any more money if the company runs out and is declared insolvent. All that they will lose is the amount that they have paid for their shares.

b. A company limited by guarantee

This is a company used primarily for non-profit organizations and having the liability of its members limited to the amount as the members may agree.

c. A company limited by shares

This is a company in which the liability of its shareholders is limited to the amount paid or unpaid on the shares held by them.

d. A company limited by shares and by guarantee

This is a company in which liabilities of the shareholders are limited to paid or unpaid amount on their shares, there may also limited by guarantee, where liabilities of members are limited to the amount that the members undertake to contribute to the assets of the company in case of winding up.

e. An unlimited company

This is a company for which the legal liability of its members or shareholders is not limited, where all members or shareholders have total and joint liability to cover all contingent debts.

1.2.3 Types of business according to function

a. Manufacturing company

It refers to a kind of business that buys raw materials for transformation into finished goods.

A manufacturing business buys products with the intention of using them as material in making a new product. Thus, there is a transformation of the products purchased. A manufacturing business combines raw materials, labor, and factory overhead for production process.

Example: CIMERWA,SULFO RWANDA INDUSTIES Ltd, BRALIRWA,SKOL,etc.

b. Services company

A services company is a business that provides intangible products (products with no physical form). It is a company that provides service to the customer.

Examples:

1. Transport (RITCO, VIRUNGA, HORIZON, VOLCANO, STELLA, MATUNDA, CAPITAL)

2. Communication (MTN, AIRTEL)

3. Hotel ( FATIMA, EPIC, SERENA, FAUCON, IBIS, MARRIOTT)

4. Health(CHUB, CHUK, LEGACY CLINICS, KING FAYSAL ) etc ….

c. Merchandazing/ Retail company

This is a type of business that buys products at wholesale price and resells the same products (without changing its form) at retail price. They are known as buy and sell businesses. They make a profit by selling the products at higher prices than purchase costs.

Application activity 1.2

1. With reference to services companies:

a) What is meant by a services company?

b) State 3 examples of services companies operating in Rwanda.

2. Describe, with supporting examples, two types of businesses according to their ownership.

3. What is the main different between a sole trader and a partnership on one side and a limited liability on the other side?

1.3 Transaction

Activity 1.3

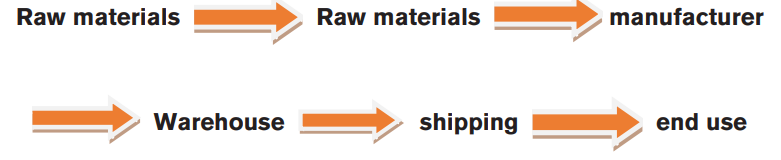

Analyze the picture below and answer the question that follows:

1. List different activities being carried from the above pictures.

1.3.1 Understanding a transaction

A transaction is a completed agreement between a buyer and a seller to exchange goods, services, or financial assets in return for money.

An example is a sales transaction between a buyer and a seller. Person A pays person B in exchange for a product or service. When they agree on the terms, money is exchanged for the good or service and the transaction is complete.

1.3.2 Types of Transaction

a. Cash transaction

Cash transactions occur where payment is made or received immediately. A cash transaction is not limited to payments and receipts made in notes and coins, as they are also made by cheque, debit card or automated payment. The important factor is the timing of the payment.

b. Credit transaction

Credit transactions, by contrast, are transactions in which the goods or services are given or received now but it is agreed that payment is to be made or received at a future date. This will normally involve the issue or receipt of an invoice and the creation of a trade receivable (the person who owes the business money ie the credit customer) or a trade payable (the person to whom the business owes money ie the credit supplier).

c. Capital transaction

Capital transactions are the purchase and sale of items that are to be used in the business for a considerable period rather than being purchased for immediate use or resale. This might include the purchase of buildings, machinery, office furniture or motor vehicles. These non-current assets of the business can be purchased either for cash or more usually on credit. Capital transactions should not be confused with the initial capital that the owners of a business pay into the business.

Non-current assets usually have economic benefits over a number of accounting periods. Because of this, it would be inappropriate to charge any single period (eg the period in which the asset was acquired) with the whole of the expenditure. Instead, some method must be found of spreading the cost of the asset over its useful life. Depreciation is the process of allocation of the cost of an asset over several accounting periods. For the purposes of this syllabus, you just need to have a basic understanding of what depreciation is.

Depreciation is the allocation of the depreciable amount of an asset.

d. Revenue transaction

Revenue transactions are day-to-day revenue and expenses.

Revenue transactions are the everyday income and expenses of the business. These will include sales, the purchase of goods for resale, the general running expenses of the business and the payment of wages. Again, these transactions can either be for cash or on credit.

Application activity 1.3

1. Clearly explain the meaning of a transaction.

2. Distinguish between revenue transactions and capital transactions.

1.4 Distinguish the branches of accounting

Activity 1.4

AGAHOZO Company Ltd is manufacturing company located in Kigali city at Kimironko Road with subcore objective of making the best possible use of its resources. The operations are done through different departments including Production department, Selling and Distribution , and Financial departments.

AGAHOZO Company Ltd wants to know the annual results of its efforts. From the results it needs to compare the results (production) and efforts (resources) invested. This comparizon leads to know if the AGAHOZO Company Ltd met the deficiencies and improvements can be identified for the achievement of goals.

Different groups of agents such as managers, investors, bankers, creditors, tax authorities, regulatory agencies, labor unions, and the general public have their interests in AGAHOZO Company Ltd financial information. They need information concerning for diverse purposes. Accounting is a specialized information system that provides information to these different groups of people. Internal Managers of AGAHOZO Company Ltd need the annual results from different departments for making decisions. You are engaged as a professional accountant and asked to help in explaining some basic accounting theories in different types of accounting.

1. From the above scenario, what do you understand by accounting?

2. According to the information of AGAHOZO Company td., State the different branches of accounting as used in different operations from this company.

1.4.1 Branches of Accounting

1. Financial Accounting

Financial accounting is a specific branch of accounting involving a process of recording, summarising, and reporting a company’s business transactions through financial statements. Financial statements include the balance sheet, income statement and cash flow statement, that record the company's operating performance over a specified period.

It is important to understand that financial accounting has an external focus, involved in reporting accounting and other information to those outside the business such as investors, lenders and the regulatory authorities.

In the financial statements the business's costs incurred in the past are classified by their function; that is, production, selling and distribution, administration, and finance.

Limitations of Financial Accounting

i) Review only overall performance

The approach of financial accounting is totalitarian in nature, it does not make any attempt to evaluate the performance, more particularly the cost effectiveness of department, process, product, functions, sales territories, etc, which is very essential for cost control and improve the segmentation of and overall performance.

ii) It is historical in nature

Financial accounting is basically as post - mortem exercise. That means, it summarizes the data and ascertains the result and financial position only after the completion of the accounting period. Hence, there is no scope for taking timely action.

iii) Comparison of performance is not made

Under financial accounting, no norms and /or standards against which actual cost and performance can be compared and developed.

iv) No cost control

Under financial accounting, it is not possible to exercise control over different elements of costs viz., material cost, labor cost and overhead expenses including store losses, idle time and its cost, overtime work and its cost, under-utilization and /or non-utilization of plant capacity, etc.

v) Non Proper classification of cost

In financial accounting, there is no system for classification of costs by department, products, processes, functions, etc. and also into controllable and non-controllable costs, direct and indirect costs, variable, and fixed costs, etc. as result control of costs becomes very difficult.

vi) Fail to furnish relevant information to Management

As is known very well, the management has to take a number of decision such as product diversification, sell or further process, make or purchase, price revision, equipment replacement, for this purpose, it needs relevant information which the financial accounting fails to furnish.

vii) Fail to help in price fixation and /or revision

Financial Accounting fails to provide the necessary information (such as, the extent to which costs have increased on account of hike in the price of input factors) to the management to fix the price for its new product and /or to revise the price of its existing products.

viii) No analysis of losses

Financial accounting fails to make a comprehensive analysis of losses on account of idle time, non-utilization and /or underutilization of plant capacity, use of substandard material, increases in loss of material in production processes, etc.

That means, no distinction is made between avoidable loss and unavoidable loss which is very important for fixing responsibility with the individual.

ix) Inefficient segments are not identified

Since Financial Accounting discloses only the overall net result, it fails to assess and report the segmental performance like the performance of each division, process, function, product, territory, etc. as result it is not possible to ascertain the extent to which the company’s loss is caused by the inefficiency of each department, division, etc.

2. Management accounting

Management accounting is the practice of identifying, measuring, analysing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals.

Management accounting takes the same information used in financial accounting and uses it to provide people inside the business with regular and focused financial information to run it efficiently today and into the future. Management accounting can analyse past costs incurred by element to determine how much it will cost in future to produce any unit of product, broken down into materials, labour and expenses or overheads. Management accounting collects similar costs together so that they can be further analysed and used internally.

Unlike financial accounting, management accounting has an internal focus, involved in reporting accounting and other information to those inside the business such as managers.

3. Cost accounting

This is a branch of accounting concerned with the accumulation and determination of costs within the business.

Advantages of Cost accounting or utilities of Cost accounting

Cost accounting is primarily designed to serve the management in decision making task which in turn will benefit the company and others.

i) By analyzing in deep the total expenses recorded in the Financial accounting, Cost accounting is able to ascertain the functional and department cost or process-wise cost and finally, to ascertain both the total and unit cost of the products.

This helps to identify the departments, process, products, etc. which are incurring higher costs than the understands and to identify the probable reasons for the same. This facilitates the management to exercise control over the cost. This ways, costing system helps to ascertain and control cost.

ii) By evaluating the performance of the departments, activities, products, (both physical performance and financial performance, both cost effectiveness and revenue realization, etc,), the system is able to identify the profitable and unprofitable, efficient and inefficient departments, functions, products, etc.on the basis of the report which contains this analysis and also the probable reasons and suggestions, management can take appropriate steps to put them on the right path.

iii) Cost accounting, through its reports and evaluation, is able to identify the areas where in the company is working below its capacity. Further, it draws the attention of the management about its impact on cost and profit. It, therefore, helps in optimum utilization of materials, human resources, plant capacity.

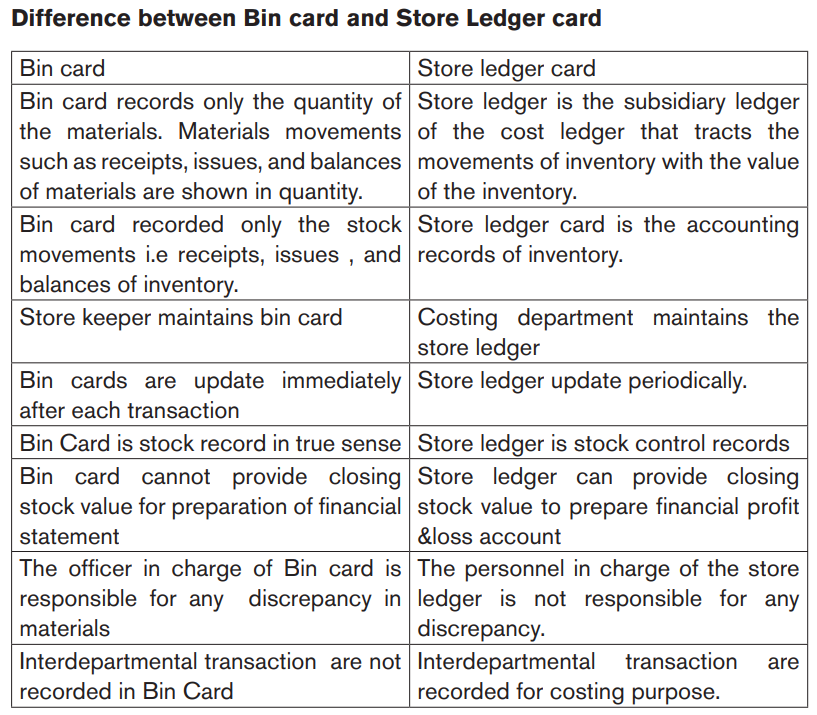

iv) Through store ledger and material abstracts, it provides an effective check on the materials consumed.

v) By identifying whether the company’s performance is in accordance with the planned, and by identifying the reasons for poor performance, if any, cost accounting helps the management to take proper steps to improve profit and profitability.

vi) By providing timely reports containing only the relevant information, cost accounting helps management in big way in decision making task.

The important decisions which are influenced, to greater extent, by the cost reports are:

* Whether to diversify or not the company’s product lines;

* Fixation and/ or revision of selling price;

* To decide about whether a part is to be manufactured internally or to be purchased from outsiders;

* Whether the joint and/or by-products are to be sold at split-off point or after further processing;

* About the profitable sales mix;

* About the optimal level of activity;

* To decide about the discontinuation of activities of sale branch, temporarily, or to drop a product, purely on temporary basis, till the demand rises for the product;

* To decide about scarce resource allocation; etc.

Limitation of cost Accounting

a. Cost accounting is not an exact science

Because, though cost accounting system aims at ascertaining cost, it is uncertain to ascertain the actual cost of the goods and services. Because, in order to ascertain the cost of goods and services, it is necessary to use a number of estimates, bases for apportionment, etc. Further, a number of accounting methods are available for each of a number of costing problems. Hence, the cost of goods and services is influenced by all these. Therefore, it is said that it is hard to compute the exact actual cost.

b. Availability of a number of accounting treatments for each of a few major elements of costs results in the operation performance influenced even by the accounting methods and treatments.

Because the companies are free to use any of these accepted accounting treatments. This also makes the results not comparable (for both trend analysis and inter-firm comparison).

c. Cost accounting identifies the deficiencies in the performance of the company

It also identifies the probable reasons and suggests remedial measures. But it does not ensure the result.

d. A number of bases are available for the classification of costs

The classification of costs for one purpose based on one base will not normally be suitable for other purposes; there is therefore a considerable increase in clerical work.

e. One cost figure will not serve all purposes and is not suitable to all circumstances

For instance, for quoting a special business offer, only incremental costs are to be reckoned for the purpose of regular pricing, the total cost is to be considered, this way, the cost is to be ascertained, usually, a fresh for each decision considering only items of expenses that are most pertinent to the decision under consideration. It results in considerable increase in clerical work.

f. Cost accounting excludes some of the items of expenses though they are accounted for in the financial accounting system.

1.4.2 Similarities of branches of accounting

At least some of the information used in management accounting comes from the same source as the information used for financial accounting, namely the recording of the business's transactions via bookkeeping. It is simply classified and collected in a different manner.

The managers within a business need particular types of information about its activities to plan, make decisions and control the business now and in the future. Providing this information is the function of management accounting.

Not all management accounting information can be taken straight from the bookkeeping system,

because some of it is based on estimates of future costs and revenues. It is still important to realise, however, that at least some of the information used in management accounting comes from exactly the same source as the information used for financial accounting, namely the recording of the business's transactions via bookkeeping. It is simply classified and collected in a different manner. The similarities between financial accounting and management accounting are given below:

- Both are the parts of total accounting information system.

- Economic events are dealt in the both system of accounts.

- The economic events are qualified only in terms of rupees.

- Both are concerned with financial statements, revenues, expenses, assets, liabilities and cash flows.

- Both the system of accounts are accumulating and classifying the accounting information for the preparation of financial statements.

- Some database is used for preparing financial statements and reports under both system of accounts.

- Both are determining and measurement of costs for different accounting periods and even for different departments and sections.

- The same accounting principles and concepts are used in both system of accounts for the purpose of cost accumulation and cost allocation.

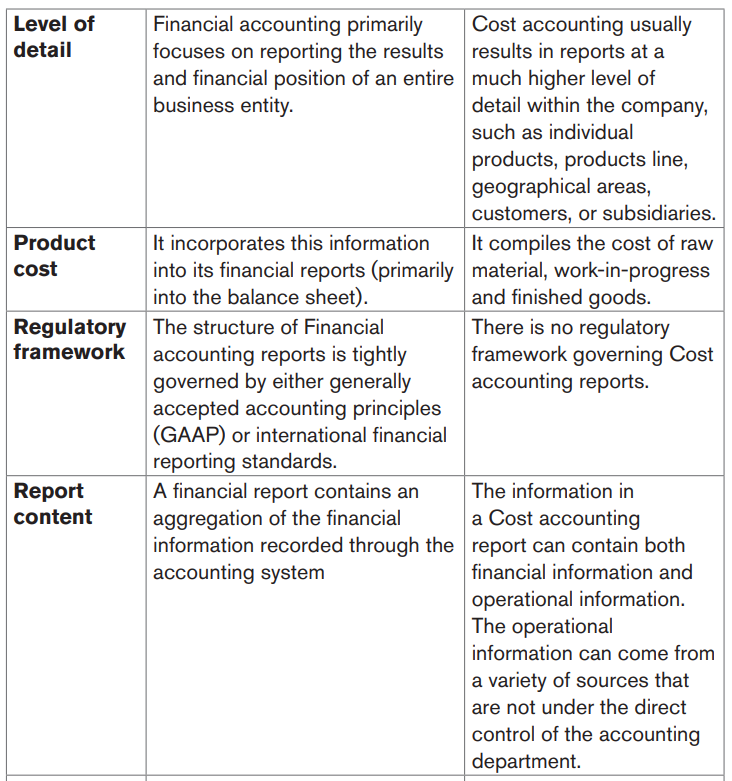

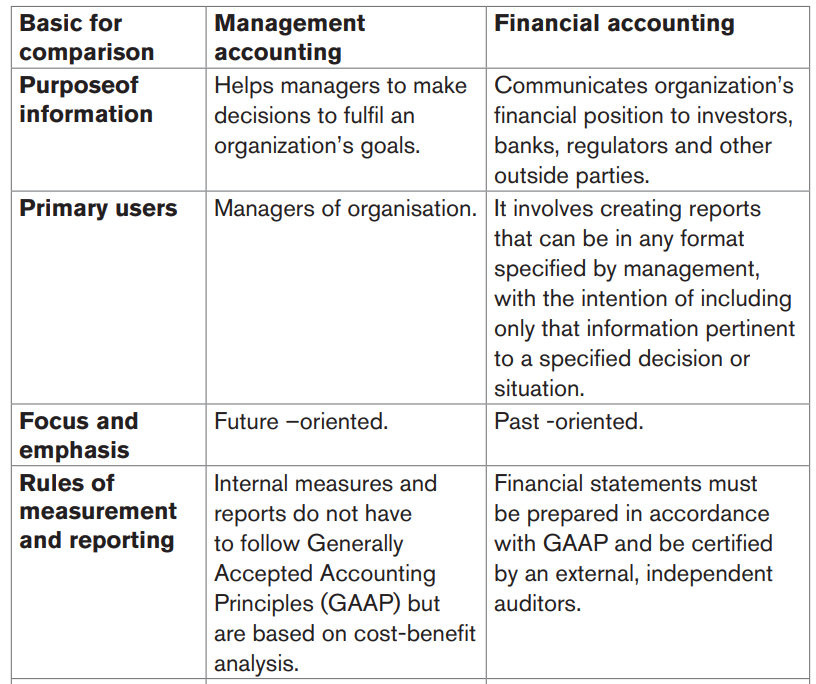

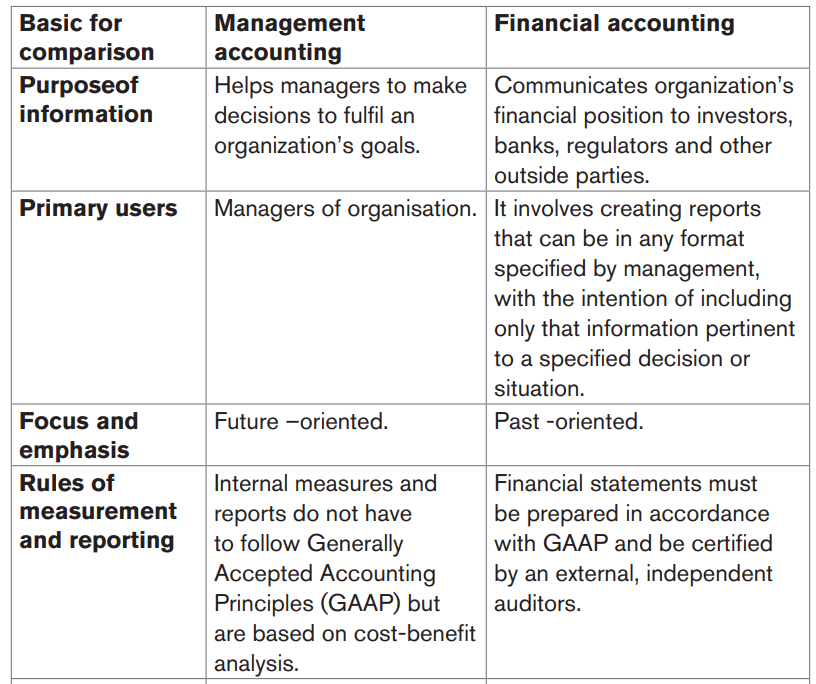

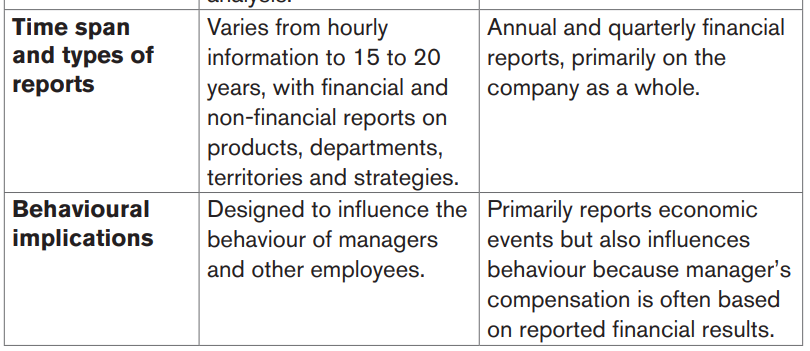

1.4.3 Difference between branches of accounting

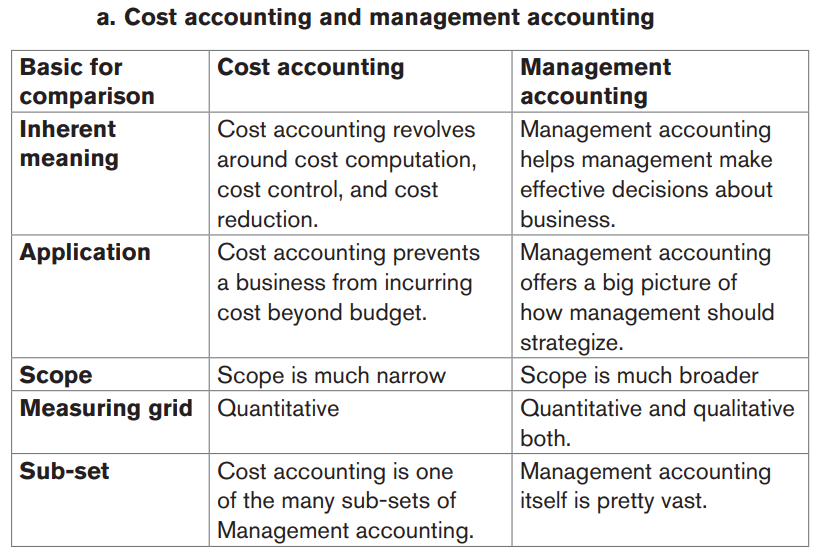

Differences between Financial, Cost and Management accounting can be assessed by understanding how their accounts would be different from one to another:

Note:

Both Cost accounting vs Management accounting help management bodies to make effective decisions. But their scope and tools are completely different. As Management accounting depends a lot on Cost accounting to prepare reports, Cost accounting happens to be a sub-set of Management accounting. But if we look at the usage, estimation process, data points used, and utility, Cost accounting has much narrower scope than Management accounting.

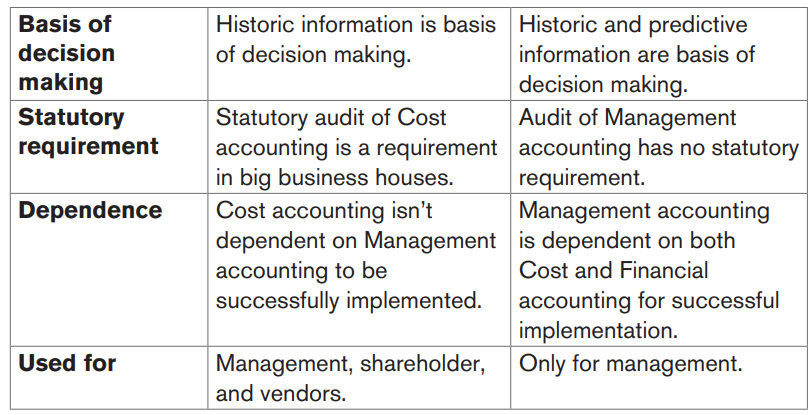

b. Cost accounting and Financial accounting

c. Financial accounting and Management accounting

Differences between financial and management accounting can be assessed by understanding how financial accounts would be different from management accounts:

Application activity 1.4

1. Define the following accounting branches:

a) Management accounting

b) Cost accounting

c) Financial accounting

2. List the three similarities between Financial accounting and Cost accounting.

3. Describe how Management accounting differ from Financial accounting in rules of measurement and reporting?

1.5 Purpose of Cost and Management accounting

Activity 1.5

AKARABO Company Ltd. is a manufacturing company located at Karongi District that has different departments for different operations. They include manufacturing department, selling and distribution department, marketing department, purchase department and administration department.

During senior management meeting at the AKARABO Company Ltd, some department’s managers have complained about the lack of information about cost represented in manufacturing department. “Better to have financial information and good effective communication between top management for improving the decision making” said Chairman of Board of Directors (BOD). Use of financial data aiming to planning, decision making, cost ascertainment, selling price fixing, monitoring and controlling of finance is the one of important responsibilities of managers.

1. From the above scenario, what do you understand about decision making?

2. According to the information of AKARABO Company Ltd, state at least different 5 objectives of Cost and Management accounting.

3. Develop how a decision-making interact with those objectives

1.5.1 Introduction

The main objective /purpose of Cost and Management accounting is the analysis of the various costs and decision making about the production of any commodity and ensuring that these costs are controlled adequately and making decision.

The next section explains the purpose of cost and management accounting.

1.5.2 Explanation of purpose for Cost and Management accounting

a. Cost ascertainment

The costs of producing different commodities or providing services must be ascertained accurately. These costs consist of material cost, labor cost and overheads. The cost must be kept at the minimum possible level. The detailed information helps the management to make some important decisions and to evaluate the performance of the organization.

b. Disclosure of waste

The costs incurred for the production of any commodity can be determined in advance in view of the past experience. If actual costs are higher than the expected costs then this excessive cost can be analyzed. This excessive cost may be due to wastage of raw material or idle labor time. Cost accounting is an important aid to disclose wastes.

c. Decision making

The management is responsible to make decision regarding what goods should be produced and in how much quantity. Cost accounting provides necessary information to the management for making the decisions.

d. Cost control

Cost control is an important function of the management. Material cost, labor cost and overheads must be maintained at desirable levels. Cost accounting principles are used to eliminate unnecessary costs.

e. Planning

The management prepares plans for the expansion of business activities. The installation of new machinery and plant is needed to increase the production capacity of a manufacturing concern in view of greater demand for its products. The past experience and cost data are used to prepare and implement future plans.

f. Measurement of efficiency

Cost data are used to measure the efficiency of an organization. If there are various departments of a business enterprise then it is important to determine the relative performance of these departments. More efficient departments must be given greater incentives and appropriate steps must be taken to improve the performance of less efficient departments.

g. Setting selling prices

It is difficult for a business concern to set selling prices of its products. Selling price of a product must be reasonable. If selling price is too high then due to competition from rivals, a firm’s sale can be affected adversely. Similarly; if selling price is too low then a firm can go into loss. It is more advisable that a business concern should ascertain its costs and then add its profit into cost of sales. The cost data are also helpful to set a selling price.

h. The evaluation of profitability

Profitability measurement is an important purpose of Cost accounting. Profitability can be measured in number of ways, example: profit as a percentage to sale, profit percentage to capital employed, profit per unit of output and so on. The profitability information serves as guide to the management to make some strategic decisions regarding the introduction of new products and increasing or decreasing the volume of production.

i. The pricing of products and projects

Pricing involves determination of prices of new products, adjustment in prices of existing products as well as determination of bid prices for contracts.

j. Inventory management

Cost accounting assists in inventory management by keeping a complete record of materials from the time they enter the premises till the time they are sold in the form of finished goods. This also enables stock valuation to be given quickly for preparing periodic financial statements without any need of physical stock taking.

k. Analysis of financial statements

Cost accounting assists management in such analysis by providing detailed information about sources of profit or loss as revealed by the financial statements.

l. Controlling Activity

Controlling is the process by which management makes sure that intended and desired results are consistently and continuously achieved.

Application activity 1.5

1. State at least 10 purposes of Cost and Management accounting.

1.6 Principles of Cost accounting

Activity 1.6

Gahanga Ltd is a manufacturing enterprise using different accounting systems. It seems the Cost accounting is the best due to its mission. Cost accounting is a type of accounting process that is aiming at capturing a production company’s cost by assessing the input costs at each step of production process as well as fixed costs such as depreciation of non current assets. Cost accounting will first measure and record these costs individually, then compare input to actual results to aid a company for measuring financial performance.

You are engaged as a Cost Accountant and you are asked to help all company’s departments and staff on how the cost accounting system is elabourated and implemented.

Questions:

1. From the above case, what do you understand by cost accounting?

2. What should be followed as principles of Cost accounting in business?

a. Cause-Effect relationship

Each item of cost should be related to its cause as minutely as possible and the effect of the same on various departments should be ascertained. This cost should be shared only by those units for which cost has been incurred.

b. Charge cost only after its incurrence

Cost should include only those cost which has been actually incurred, for example, unit cost should not be charged with selling cost while it is still in the factory.

c. Ignore the convention of prudence

Cost accounting statement should give a factual picture of the profitability of the project. If some contingencies need to be made, they should be shown distinctly and separately.

d. Past costs should not form part of future costs

Past costs which could not be recovered in past should not be recovered from future costs as it will not only affect true results of the future period but will also distort other statements.

e. Exclusion of abnormal costs from Cost accounts

All costs incurred because of abnormal reasons like theft, negligence, etc, should not be taken into consideration while computing the unit cost. If done so, it will distort the cost figures and mislead the management resulting in wrong decisions.

f. Principle of double entry should be followed preferably

To lessen/reduce the chances of any mistake or error, cost ledger and cost control accounts, as far as possible, should be maintained on the double entry principle. This will ensure the correctness of sheet and cost statements prepared for cost ascertainment and cost control.

Application activity 1.6

1. Briefly explain at least two principles of Cost accounting applied in business.

Skills Lab Activity 1

Scan the environment of your home locality, analyze different businesses operating in it and draw examples which belong in each of the following categories:

1. Public enterprises

2. Private businesses

3. Service businesses and

4. Manufacturing businesses

Give reasons for your classification.

End unit assessment 1

1. Which of the following would be classsed as a credit transaction ?

a) Sale of goods paid for by credit card

b) Purchase of printer paper accompanied by an invoice

c) Sales of goods paid for by cheque

d) Purchase of printer paper by cheque

2. A. Which of the following would be classified as capital expenditure?

a) Purchase of a computer for resales to a customer by a computer retailer

b) Purchase of a computer by a computer retailer for use in the sales office

c) Payment of wages by an accounting firm

d) Purchase of a building by a property developer to serve as the head office

i) a and b

ii) b and c

iii) c and d

iv) b and d

B. Two of the following are characteristics of Management accounting?

1. It helps with decision making inside the business

2. Its end product consists of statements for external publication

3. It focuses on costs

4. It focuses on asset evaluations

i) i.1 and 2

ii) ii.2 and 3

iii) iii.1and 3

iv) iv.2 and 4

3. Management accounting deals only with costs ‘. Do you agree?

Discuss.

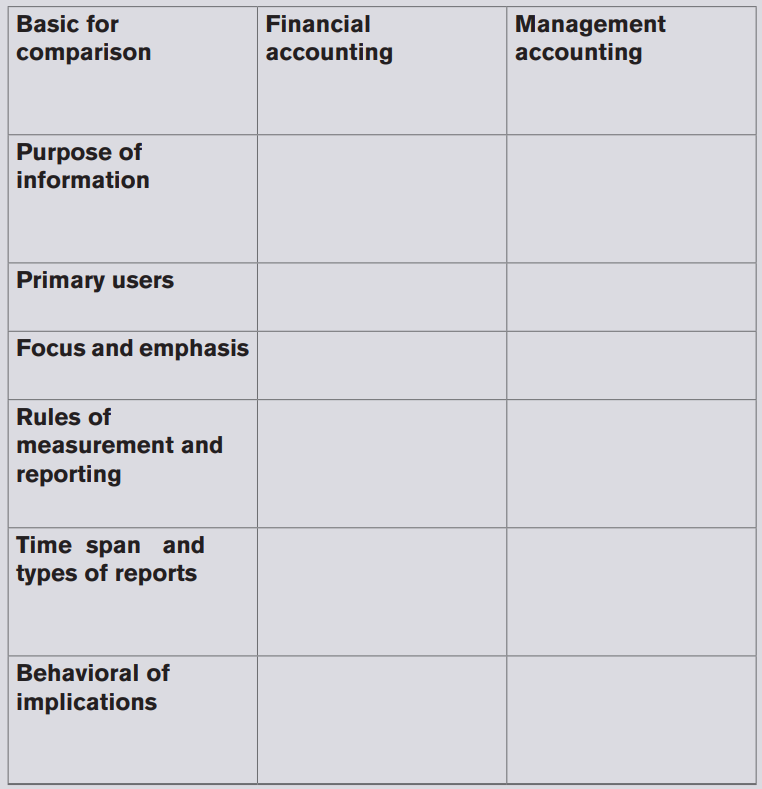

4. By completing the following table clarify the difference between Financial accounting and Management accounting.

UNIT 2:THE SOURCE OF INCOME AND EXPENDITURE INFORMATION

Key unit competence: Identify source of income and expenditure information

Introductory activity

IKIREZI PLC has started a poultry project two years ago with the aim of solving the problem of chicken meat in Rubavu town. When starting this business, it invested in his/her own money and other types of assets to buy everything needed in the business. Throughout business operations, IKIREZI PLC purchased different materials including drinkers, mangers and motor vehicle. IKIREZI PLC also paid a rent of one year immediately.

At the beginning, IKIREZI PLC bought 700 chicks at 1000 Frw each, and those chicks had to be vaccinated each seven days during their first 21 days. IKIREZI PLC company also purchased chicken foods and vitamins to make them grow faster. Even if IKIREZI PLC made more efforts to make their business successful during full year, IKIREZI PLC forgot to record the money spent and money generated from sales. This resulted into IKIREZI PLC ’s losses and disputes between IKIREZI company its suppliers and customers.

At the beginning of the second year, IKIREZI took new measures to avoid the loss. Hence IKIREZI company decided to hire a professional accountant who will help managers to record all the accounting information’s about purchasing and selling activities. At the end of the second year, IKIREZI PLC got profit and now IKIREZI PLC is predetermining to issue the shares on stock market.

1. What is the scenario above talking about?

2. What do you think is the main purpose of doing a business activity?

3. How do we call all those activities which involve IKIREZI PLC in the purchasing of materials and equipment?

4. What are the challenges that IKIREZI PLC faced in the 1st year of their business activity?

5. Diagnose the possible solutions to the above challenge faced by IKIREZI PLC?

6. Suggest the appropriate responsibilities of hired accountant in IKIREZI PLC?

7. Develop and show where do you think this accountant will find the data or accounting information to record.

2.1 Definition of concepts

Activity 2.1

Mr RUGERO is a person with A0 Bachelor Degree in Finance from Kigali Independent University (ULK-Kigali Campus). At the end of his studies, he started merchandizing activities with low capital. Suddenly, he got a financial support (Capital) from his nephew who lives in Canada. From the financial support, he started the business activity given the fact that he has learnt how to operate a business at the university. And after five year in the business, he received the RRA Award of the year as the good taxpayer. This Award is from not only good recording system of all income and expenditure transactions in their respective and efficient accounting system but also the declaration and payment of taxes on time. His business is still growing up and Mr RUGERO is planning to expand his business into import export sector on international markets.

1. Specify the name of money generated in business.

2. What is the name of money spent from the business to be returned after year?

2.1.1 Income

Income is the inflow of cash or its equivalents from sale of a good, a service or an asset.

Example :

• From work (wage or salary),

• From capital (interest or profit),

• From land (rent).

Income is defined in different ways depending on the context—for example, for purposes of taxation, financial accounting, or economic analysis. For individuals and businesses, income generally means the value or amount that they receive for their labour and products.

2.1.2 Expenditure

Expenditure is funds used by a business, organization, or corporation to acquire a new asset, improve existing ones, or reduce a liability. In other words, it is the use of a resource in the operation of a business.

Briefly, Expenditure means the use of cash or cash equivalents to purchase assets, pay down debt, or fund operation.

Main features of Income and Expenditure Account are:

• Income and Expenditure Account is a nominal account. Therefore, the rule of nominal account (debit all expenses and losses and credit all incomes and gains) is followed.

• The opening and closing balances of cash in hand and cash at bank are not recorded in it. It has no opening balance,

• While preparing it, only items of revenue nature are recorded and all items of capital nature are ignored. For example, the profit earned or loss suffered on the sale of an asset will be recorded in it but the amount received from the sale of an asset will not be recorded in it the

• Income and Expenditure Account is prepared at the end of an accounting period,

• Income and Expenditure Account contains revenue items only.

Application activity 2.1

1. Which of the following statement is not true regarding the expenditure meaning?

a) It is the use of fund by a business

b) It is the use of resources

c) It is the fund of operation

d) Use of cash equivalent

e) No one of the above

2. Which one of the following is not considered as income:

a) Salary from work done

b) Pocket money

c) Profit from sales

d) Assets improvement

e) No one of the above

3. All of the following are features of income and expenditure account except:

a) Income and Expenditure Account is prepared at the end of an accounting period

b) Income and Expenditure Account contains revenue items only.

c) Income and Expenditure Account is prepared on an nature basis

d) Income and Expenditure Account is a nominal account

e) No one of the above

4. Differentiate income from expenditure.

5. Explain the rule used when preparing nominal account

6. Explain how the income can increase in economic benefit during an accounting period.

2.2 Types of income

Activity 2.2

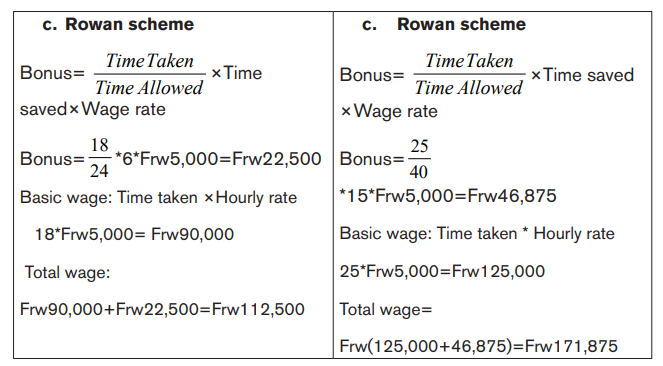

Analyse the picture above then answer the following questions :

1. What is about the image ?

2. Is it possible that those people may gain the same icome? if Yes or Not explain.

3. How do we call the income received by those people.

4. Classify the following incomes according to their main types : salary, wage, profit, rental income.

There are three types of income:

• Earned income (active income)

• Portfolio income

• Passive income

a. Earned income

Earned income (active income) is the money earned from working. It is compensation of human efforts.

Example: Salary; wages; bonuses; contract work

The different tasks are:

a. Working a job

b. Consulting

c. Any other activity that pays based on time/effort spent.

While earned income is the most common mechanism for making money, it is obvious downside is that once you stop working, you stop making money.

Additionally, because the amount of money that is made through earned income is directly proportional to the time and effort you spend working. It is difficult for someone to make more earned income without either learning a new (or more valuable) skill or working longer hours. Additionally, earned income is taxed at a higher rate than any other type of income.

One huge benefit of earned income over the other income types is that you generally don’t need any start-up capital in order to make earned income, which explains why most people rely on earned income from the start of their working file. In fact, earned income is a great way to start your investing career, as it allows you to save up cash that will help you generate the other two types of income.

b. Portfolio/ Investment income

This is the income that is generated by selling investments that were made earlier. In simpler words, this represents an increase in the value of the investment or capital gain as it is known in common terms. For instance, if a person buys shares and sells at a higher price or if they buy a house and sell it for a profit, the difference is called a capital gain.

This income has no relation to the number of hours worked. Also, this income is not received periodically. It keeps on accruing over a period and is paid out when the investor decides to liquidate it. Also, this type of income is more tax efficient as compared to earned income. This is true only if the investments have been held for a long period of time. Most countries in the world separate long term capital gains from short term capital gains and tax them at a lesser rate.

Example: Stocks, bonds, mutual funds, interest, etc.; money from buying/ selling real estate or other assets, such as automobiles.

Some activities that generate portfolio income include:

a) Trading (buying/selling) Paper and Assets Paper refer to things like stocks, bonds, mutual funds, T-bills, currencies or other types of futures/derivatives.

b) Buying and Selling Real Estate (specifically the profit from the sale)

c) Buying and Selling of any other Antique Asset or cars for example. Or other types of collectibles that have an appreciating value

Portfolio income certainly has some advantages over earned income. Once you have the knowledge and experience to generate portfolio income on a consistent basis, you can continually reap the benefits (compound your return) by reinvesting after each sale.

c. Passive Income

Passive income is another important source of income. It shares the characteristics of earned income and investment income. Just like earned income, it is paid for every period. However, the quantum of income does not depend upon the number of hours invested. Rather, it depends upon the capital invested. This is where passive income is like investment income.

Typical examples of passive income are rent, interest, and dividends, which are paid by shares and debentures. The taxes on this type of income are also less as compared to the earned income. Some incomes like dividends are totally tax-free in the hands of the investor. For other incomes like rent, there are tools such as depreciation, which can be used to lower the income and, therefore, the tax payable.

Some activities that generate passive income include:

• Rental Income or rent Income from Real Estate

• Business Income (assuming it’s not earned based on amount of time/ effort suent that would be Earned Income)

• Creating and Selling Intellectual Property, Books, Patents, Internet Content, etc

• Affiliate or Multi-Level Marketing

Application activity 2.2

1. List three (3) activities that can generate portfolio income

2. What is the main benefit of earned income over the other income types? At least one.

3. Explain the reason why Some peoples refer to portfolio income as “capital gains”.

4. By using typical examples, explain the passive income.

5. Discuss, interpret and present how is it possible for someone to make more earned income without either learning a new (or more valuable) skill or working longer hours? (answer by YES or NO)

2.3 Types of expenditure

Activity 2.3

Analyze the above picture then answer the following questions:

1. What about the image?

2. Explain the relationship presented on the above picture.

3. Which kind of transactions on which people are spending money?

4. How can one differentiate these expenses according to the ways in which these people spent money?

There three classes of expenditure

a. Capital Expenditure

Capital expenditure is an amount incurred for acquiring the long term assets such as land, building, equipments which are continually used for the purpose of earning revenue. These are not meant for sale. These costs are recorded in accounts namely Plant, Property, Equipment. Benefits from such expenditure are spread over several accounting years.

Example: Interest on capital paid, Expenditure on purchase or installation of an asset, brokerage and commission paid.

b. Revenue Expenditure

Revenue expenditure is the expenditure incurred in one accounting year and the benefits from which is also enjoyed in the same period only. This expenditure does not increase the earning capacity of the business but maintains the existing earning capacity of the business. It included all the expenses which are incurred during day to day running of business. The benefits of this expenditure are for short period and are not forwarded to the next year. This expenditure is on recurring nature.

Example: Purchase of raw material, selling and distribution expenses, Salaries, wages etc.

c. Deferred Revenue

Expenditure Deferred revenue expenditure is a revenue expenditure which is incurred in the present accounting period but its results or impacts on profitability are incurred in the following or the future accounting periods. This expenditure might be written off in the same financial year or over a period of a few years

Example: Development expenditure, Advertisement expenditure etc.

Application activity 2.3

1. Explain the types of expenditure

2. With typical examples differentiate capital expenditure from deferred revenue expenditure.

3. In which accounts capital expenditure must be recorded?

4. Classify the following expenditures according to their types:

• Purchase the sugar for a bread manufacturing company

• Payment of salary

• Give gifts to potential customers

• Offer end year rebate

• Purchase company shelves

2.4 Sources of income and expenditure information

Activity 2.4

Analyze the picture then provide answers to the following questions:

1. What is on the picture?

2. What do you think is recorded on these documents?

3. Why the person on the picture is recording the information on these documents while they are already recorded on these documents?

4. How do we call those documents that serve as the source of accounting information?

A source document is a document which contains information to be recorded in the books of account. They are properly written source of accounting information relating to various transactions like buying and selling of goods, return of goods bought or sold, settling of debts, etc. These documents must always be present to support whatever records or transactions have been made. They are hence called supporting documents.

The source documents may be income or expenditure source of accounting information.

Source document that serve as sources income information

• Sales order

• Bank statement

• Goods received note

• Credit note

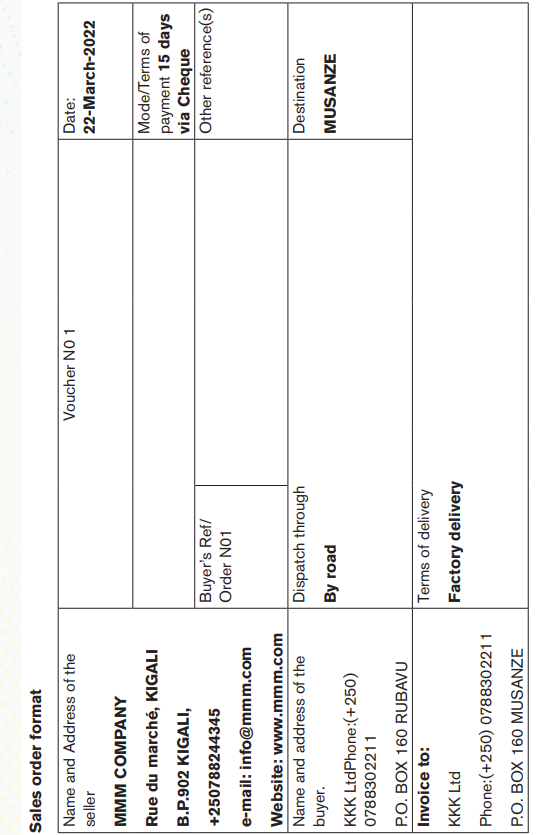

a. Sales order

A sales order is a document generated by the seller specifying the details about the product or services ordered by the customer. Along with the product and service details, sales order consists of price, quantity, terms and condition etc.

* Components/elements of sales order document

A sales order usually carries information such as customer’s name, shipping address, transaction date, products ordered, description, units of measure, quantities, price, taxes, etc. The key details of the sales order are listed below.

• Name and contact information of the company (seller)

• Name and contact information of the customer

• Customer billing information

• Customer shipping information

• Information about product or service

• Price before taxes

• Tax, delivery and shipping charges

• Total price after taxes

• Terms and conditions

• Signature

• Any other relevant information as needed

b. Bank statement

The bank statement is a statement issued periodically ( monthly or quarterly) by a banker to his/her customer informing him/her of the statement on his/her financial situation of affairs at the bank account. It is a customer’s account in his/ her banker’s books.

A good bank statement generally shows the name of the account holder along with sensitive information such as a bank account number and branch number or name. It also contains a summary table that shows the time period, opening balance, deposits, withdrawals, and closing balance.

Here’s what’s generally on a bank statement:

• Account number

• Home address

• Statement period

• Bank’s customer service number

• Beginning and closing balance for the time period

For each item, you’ll also see a transaction date and the payer or payee name. Each statement covers a certain period, such as a financial quarter or one month, but it might not begin on the first day of the month. For instance, your statement might run from September 6 to October 5.

If you find any inaccuracies on your statement, you should report them to your financial institution. Typically, disputes are done in writing, so be sure to provide any supporting documentation you have.

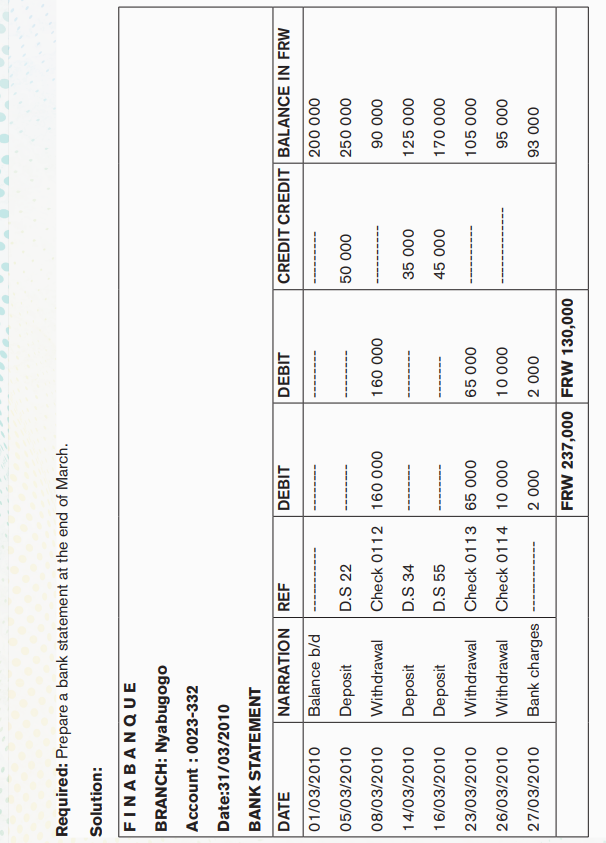

Example

The following information concerns ALL’s account held in FINABANQUE during the month of March and whose the balance at the beginning of that month were 200 000Rwf.

05/03/2010 deposit of money (deposit slip No 22) 50 000Rwf

08/03/2010 withdrawal (Check 0112). 160 000Rwf

14/03/2010 deposit of money (deposit slip No 34) 35 000Rwf

16/03/2010 deposit of money (deposit slip No 55) 45 000Rwf

23/03/2010 withdrawal (Check 0113) 65 000Rwf

26/03/2010 withdrawal (Check 0114) 10 000Rw

27/03/2010 bank charges 2 000Rwf

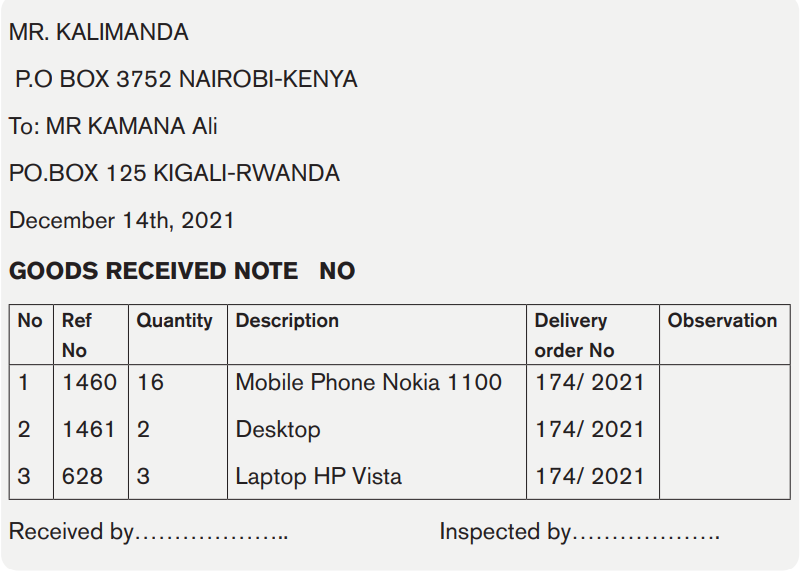

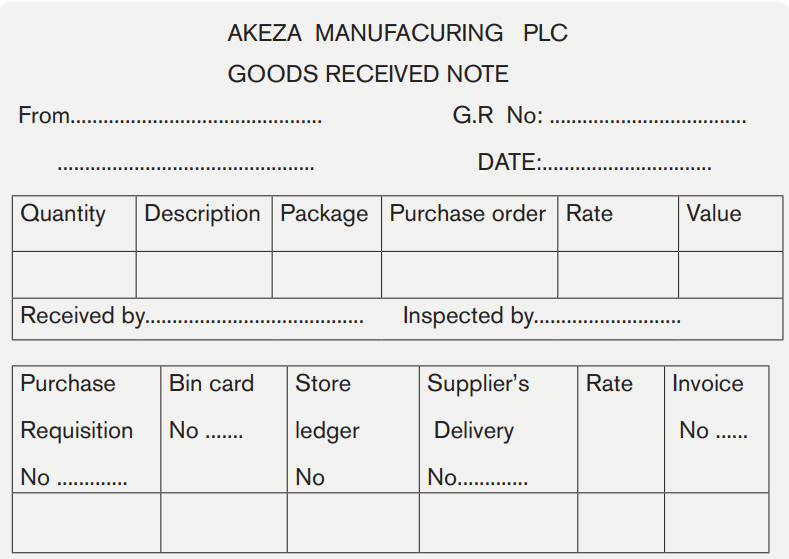

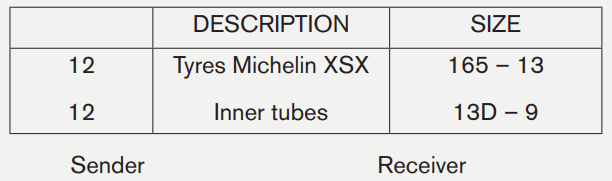

c. Goods received note (GRN)

The GRN is a document issued by a receiver (buyer) to seller indicating the goods received. The following are its characteristics:

• The date of receiving;

• The name and the address of supplier

• The delivery order number

• The description of goods purchase

Example

Mr KALIMANDA received the following goods from his supplier, Mr KAMANA Ali from KIGALI:

- 16 Items mobile phone No 1100, Nokia Ref 1460

- 2 Desktop, Ref No 1461

- 3 Laptop HP Vista, Ref No 628

Date of delivery: December 14th, 2021

Number of delivery Order: 174 / 2021

Required: Prepare the goods received note.

Solution:

d. Debit note

A debit note, or a debit memo, is a document issued by a seller to a buyer to notify them of current debt obligations. You’ll commonly come across these notes in business-to-business transactions — for example, one business may supply another with goods or services before an official invoice is sent. The debit note ‘makes note’ of the transaction for documentation purposes.

Debit notes are also used in business-to-customer transactions, such as when a customer returns goods to a business received on credit. In this case, the buyer issues the debit note to the seller.

This note is issued by a seller in goal:

• To rectify a favorable mistake to buyer which it has been clearly fixed only after the sending of an invoice.

• To request additional payment as interests due a delay period made by the buyer in the payment of this invoice.

• To charge the customer who fails to return the packaging cases or containers not charged for in an invoice.

- Incoming debit notes are received from creditors; Outgoing debit notes are sent to debtors. Return outwards day books is written up from incoming credit note.

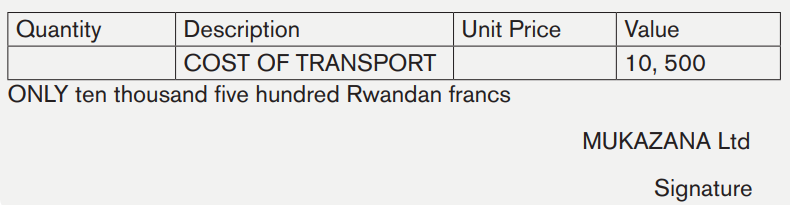

Example

MUKAZANA Ltd sent debit note concerning the transport cost to Mr MURENZI Samson. This amount (10, 500Rwf) was not charged to the customer (MURENZI) at the moment of issuing of the invoice.

Required: Prepare the debit note

Answer:

MUKAZANA Ltd

P.O BOX :……….

DATE:…………

DEBIT NOTE No ………………

TO:

Mr MURENZI Samson

Source documents that serve as source of expenditure information

• Purchase order

• Invoice

• Receipt

• Goods delivery note

• Quotation

• Payroll

• Credit note

• Purchase requisition

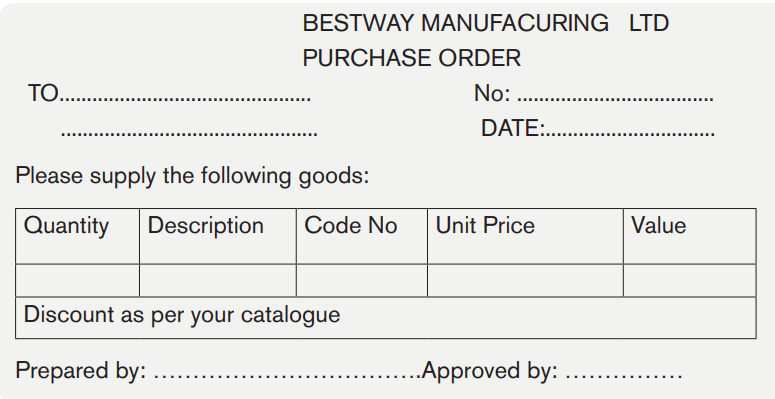

a. Purchase order (PO)

A purchase order is a commercial source document that is issued by a business’ purchasing department when placing an order with its vendors or suppliers. The document indicates the details on the items that are to be purchased, such as the types of goods, quantity, and price. In simple terms, it is the contract drafted by the buyer when purchasing goods from the seller.

Its characteristics are:

• The name and address of the company purchasing the goods or services,

• The name and address of the seller

• The date,

• Purchase order number,

• The description and quantity of the goods or services required,

• Unit Price

• Total amount of goods ordered

• Payment information

• Delivery mode

• Delivery term

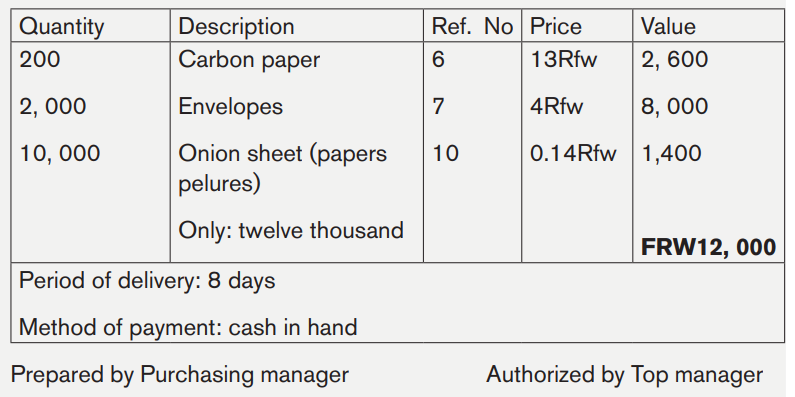

Example

On February 1st 2019, KANDAMO MANUFACTURING LTD (P.O BOX 54781 KIGALI) orders to KANYANDEKWE (P.O BOX: 23000 KIGALI) the following items:

* 200 items of carbon paper ref no 6 at FRW 2,600

* 2 000 items of envelopes ref. no 7 for FRW 8, 000

* 10 000 items of Onion sheet (papers pelures) no 10 for FRW 1, 400

Time of delivery: 8 days; Method of payment: in cash

Required: Prepare purchase order

Answer:

KANDAMO MANUFACTURING LTD

P.O BOX 54781 KIGALI

PURCHASE ORDER No: 435

TO: KANYANDEKWE COMPANY

P.O BOX 23000 KIGALI

Date February 1st 2019

Please supply the following goods:

b. Invoice

This is a document which is issued by the seller to the buyer when goods have been sold on credit. An invoice or bill is a commercial document issued by a seller to the buyer, indicating the products, quantities, and agreed prices for products or services the seller has provided the buyer. Invoices generally outline payment terms, unit costs, shipping, handling, and any other terms outlined during the transaction.

Types of invoices may include a paper receipt, a bill of sale, debit note, sales invoice, or online electronic record.

Characteristics of invoice

To the heading:

The heading of the invoice contains:

• The word "invoice"

• A unique reference number (in case of correspondence about the invoice)

• Date of the invoice

• Name and contact details of the seller

• Name and contact details of the buyer

• Date that the product was sent or delivered

• Purchase order number (or similar tracking numbers requested by the buyer to be mentioned on the invoice)

The body:

• Description of the product(s)

• Unit price(s) of the product(s) (if relevant)

• Various reductions

• Total amount charged (optionally with breakdown of taxes, relevant)

• Payment terms (including method of payment, date of payment, and details about charges late payment)

Types of invoice

a. Pro-forma invoice

It is a document that states a commitment from the seller to provide specified goods to the buyer at specific prices. It is often used to declare value for customs. It is not a true invoice, because the seller does not record a pro-forma invoice as an account receivable and the buyer does not record a pro forma invoice as an account payable.

b. Commercial invoice

A custom declaration form used in international trade that describes the parties involved in shipping transaction, the goods being transported, and the value of the goods. It is the primary document used by customs, and must meet specific customs requirements, such as the harmonized system number and the country of manufacture. It is used to calculate tariff.

c. Sales invoice or outgoing invoice

It is an invoice from the point of seller. The sales day book is written from outgoing invoice.

d. Purchase invoice or incoming invoice

It is an invoice from the point of buyer. The purchases day book is written from incoming invoice.

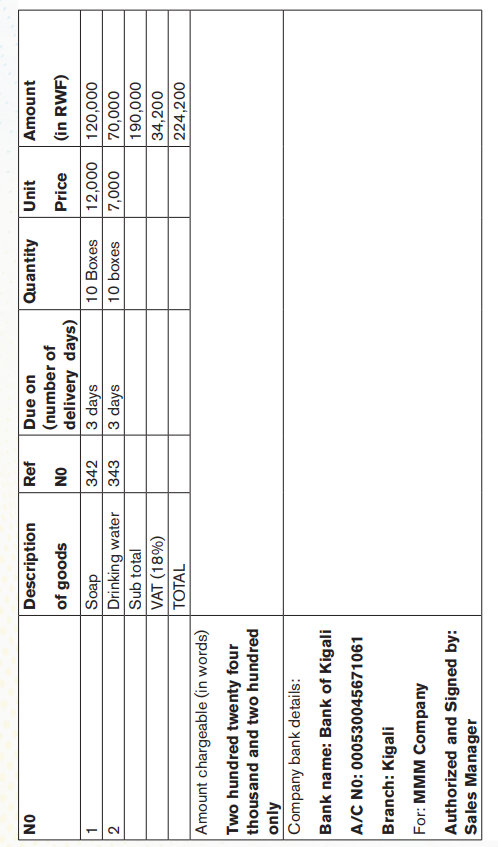

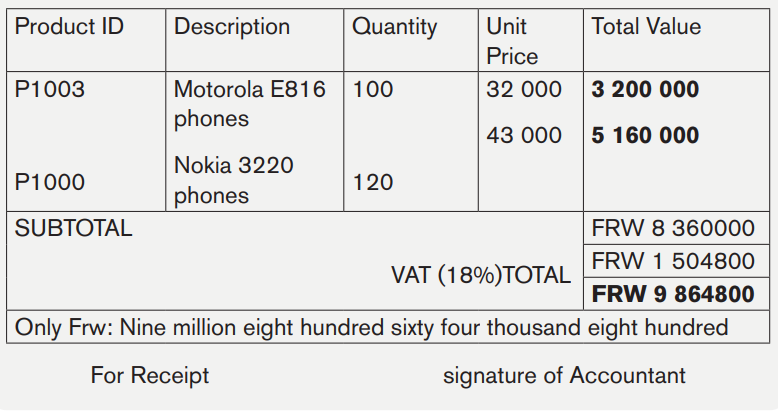

Example

On November 28th 2021, KAPAKO RWANDA Company (Phone + 250 518646; P.O BOX 5053 Kigali; E-mail: kapako123@ yahoo.com), send to the MMM Company (Phone (+250) 0788302211; P.O BOX 160 Kigali), the invoice no 131/06 for furniture of:

* 100 items of Motorola E816 phones (product ID: P1003; unit price: Frw 32 000) and

* 120 items Nokia 3220 phones (product ID: P1000; unit price: Frw 43 000) VAT rate 18%

Required: Prepare invoice

Solution

KAPAKO RWANDA COMPANY

B.P 5053 KIGALI –RWANDA Date: November 28th 2021

PHONE + (250) 518646

E-mail:kapako123@yahoo.com

BILL TO: MMM Company INVOICENO131/06

P.O BOX: 160 KIGALI-RWANDA

PHONE: (+250) 0788302211

c. Receipt

The receipt is a written acknowledgement that something such as money or goods has been given to the person who issues the acknowledgement.

It is a written proof showing that the payment or deposit of goods or money has been done. This document contains:

• The name and address of the depositor

• The word in latter “Receipt”

• The number of the document

• The nature (description) deposited (if it is money, you must specify the sum in figures (digit) and Letters)

• The name and signature of the receiver

• The date and reason of payment or deposit.

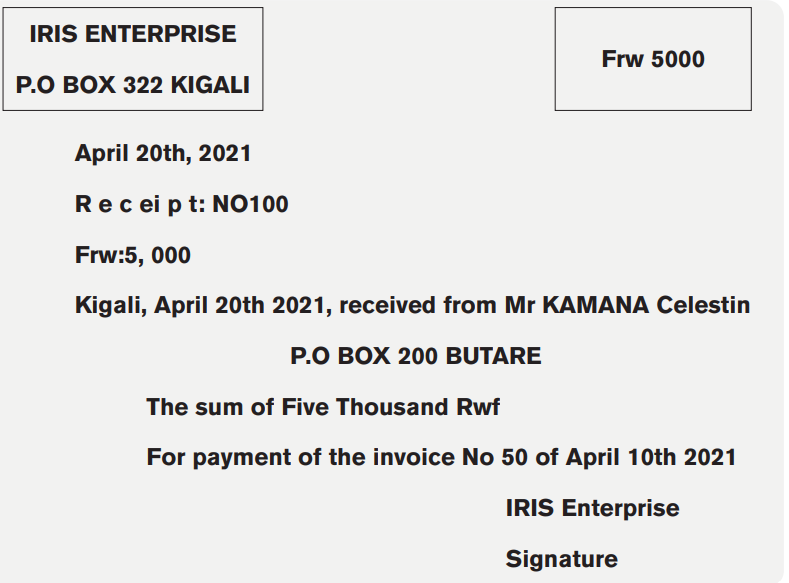

Example

Miss KEZA Cecile (P.O BOX 200 BUTARE) pays to IRIS Enterprise, (shop specialized in selling of flowers and gift items, P.O BOX 322 KIGALI), the sum of 5, 000 Rwf in cash on 20 April 2021 for settlement of his invoice No 50 of April 10th, 2021.

Required: Prepare receipt No100.

Solution:

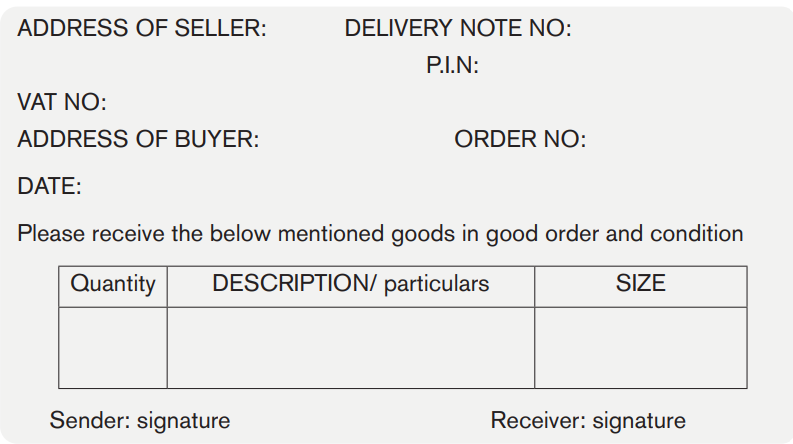

d. Goods delivery note

The delivery note is a document issued by a seller and sent to a buyer at the moment of the delivery of goods, when the invoice will be sent subsequently. It serves to verify if the goods delivered are conform with the order. It gives the details of the transactions such as:

• The date of delivery

• The name of the buyer

• The nature and quantity of delivered goods

• The name of the ship

Example

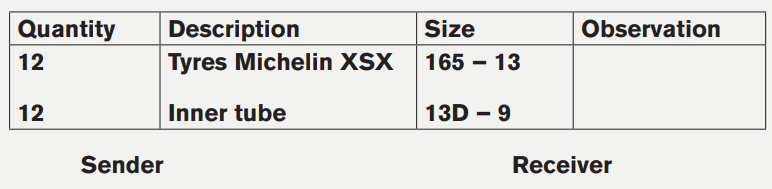

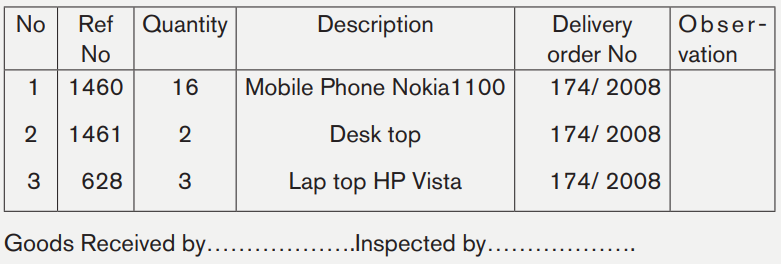

On October 19th 2019, BAMBA Ltd had ordered to BESTWAY MANUFACTURING LTD the following goods:

* 12 tyres Michelin xzx – size: 165 – 13

* 12 inner tubes, size 13D – 9

After receiving this purchased order, BESTWAY MANUFACTURING LTD, supplier makes the arrangement to deliver those goods.

Required: Prepare the delivery note on October 20th, 2019

Solution:

BESTWAY MANUFACTURING LTD

P.O BOX 54781 KIGALI

GOODS DELIVERY NOTE No:……..

TO: BAMBA Ltd

P.O BOX ………

e. Quotation (Proforma invoice)

Quotation is an offer to supply goods according to the terms and conditions stated. Quotations are received from different suppliers in response to letter of inquiry. A quotation is an offer to supply goods according to the terms and conditions stated.

These terms and conditions include for what period the prices stated are valid, rates of discount offered, mode of delivery, terms of payments etc.

Example

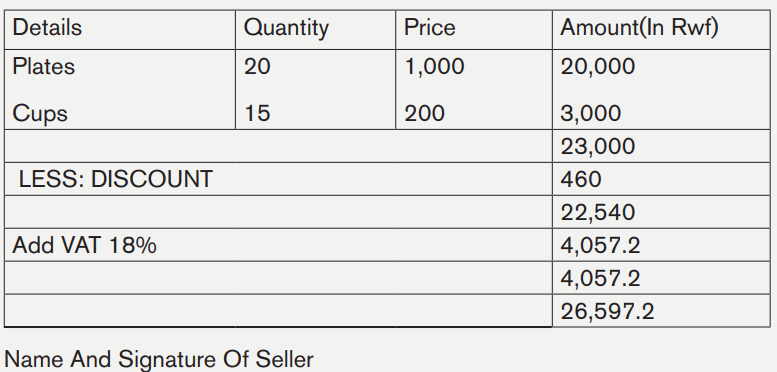

On 31st January 2020, the procurement department of Ms Ihogoza requested for a quotation from the sales manager of KARANGA Plastic Ltd (P.O BOX: 1020

about 20 plates and 15 cups as she is preparing to get married. KARANGA Plastic Ltd has presented the following information:

20 Plats Frw 1000 each

15 Cups Frw 200 each

All discount of plates and cups equal to 2%, and the VAT is equal to 18% Prepare a Quotation NO 024/1020 from from KARANGA Plastic Ltd to Ms Ihogoza.

Solution

FROM: KARANGA Plastic Ltd

P. O. BOX 1020

KIGALI

QUATATION NO024/1020

TO: Ms Ihogoza

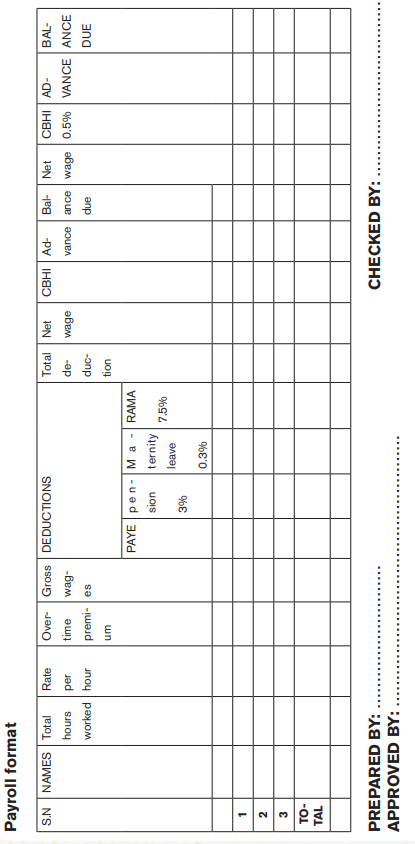

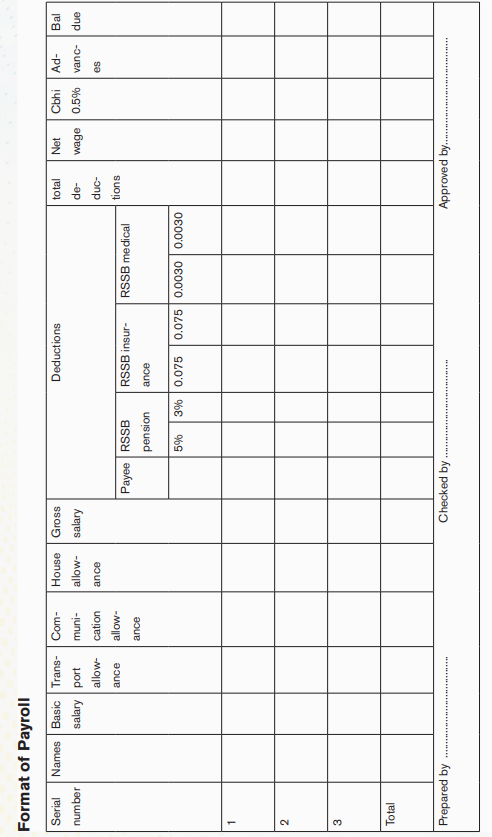

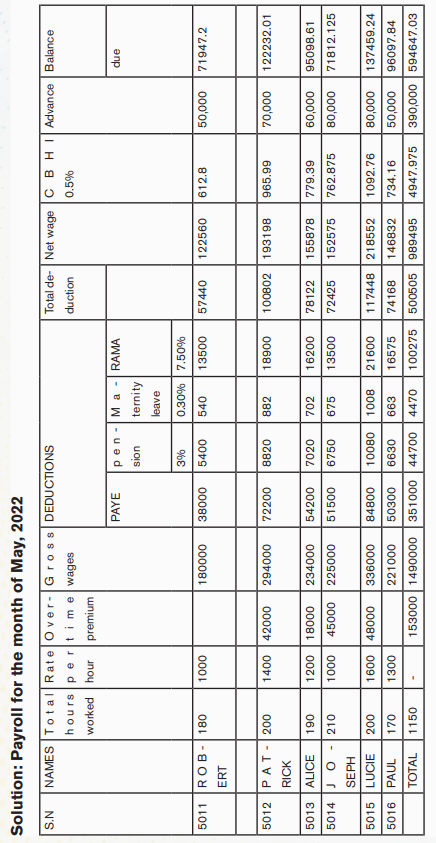

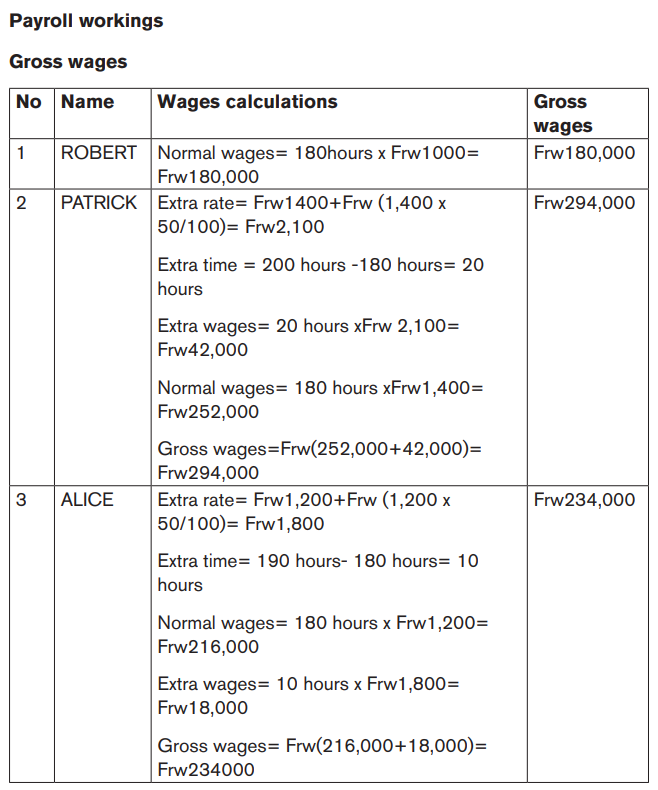

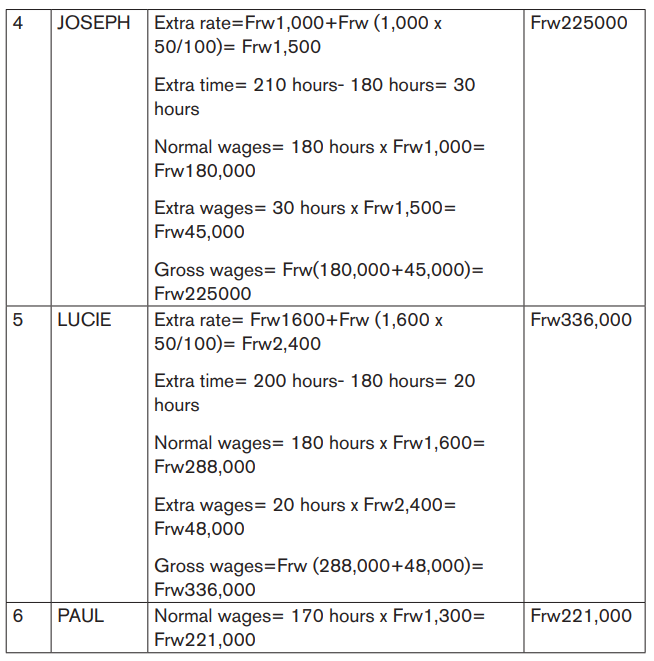

f. Payroll

The term ‘payroll’ means a list of employees within a company and how much they are to be paid. A payroll is the process of paying a company’s employees, which includes tracking hours worked, calculating employees’ pay, and distributing payments via direct deposit to employee bank account or by cheque.

The payroll process can include tracking hours worked for employees, calculating pay, and distributing payments via direct deposit or check. However, companies may also perform accounting, record-keeping, and set aside funds for medical insurance, Social Security, and employment taxes.

Main elements to consider while preparing payroll

a. Employee details

Before you’re able to run payroll, you’ll need to access to your employees’ details such as their name, address, national insurance number and salary.

b. Time or hour used on workplace by Employee

If you pay your employees on an hourly rate, you’ll need to have a system in place to monitor the hours they work, so you can ensure they are paid the correct amount. For employees that are on a salary, you may choose to monitor when they’re working to ensure they are adhering to their contracted hours.

c. Salaries, wages and net gross pay

You need to keep a record of whether your employees are on a salary or an hourly wage, as this will determine how you calculate their pay.

• A salary is a pay packet that an employee receives on a monthly basis. These payments are based on a yearly amount that is divided into 12 individual payments. But depending on the nature of your business, you may choose to pay your employees a wage instead of a salary.

• A wage is an amount based on hours worked rather than a yearly fixed amount. You’ll set an hourly wage and multiply this by the number of hours worked to calculate their total pay in a particular period. On your employees’ payslips you’ll need to indicate their gross and net pay.

• Gross pay is an employee’s total pay within that period.

• Net pay is the amount they receive after tax and any other deductions.

d. Tax and deductions

By law, every employee has to pay tax and national insurance from their total gross pay. The tax rate can vary depending on the total amount an employee has earned and their circumstances. Regardless, it is the employer’s responsibility to ensure the correct amount is deducted in payroll and paid to Rwanda revenue authority (RRA) each month. It’s important, you complete this on time each month or you could be charged a penalty.

g. Credit note

A credit note is a document issued by a seller to a buyer to notify that credit is being applied to their account. You might notice these referred to as credit memos, too. As a seller, you may issue a credit note when there’s a need to cancel all or part of an invoice for a variety of reasons, including:

• Changes to an order after an invoice is issued

• Goods returned or services rejected

• Goods were damaged during shipping

• Pricing mistakes on the original invoice

No actual money is exchanged with a credit note; rather, it’s used to offset a previous invoice that’s already been paid.

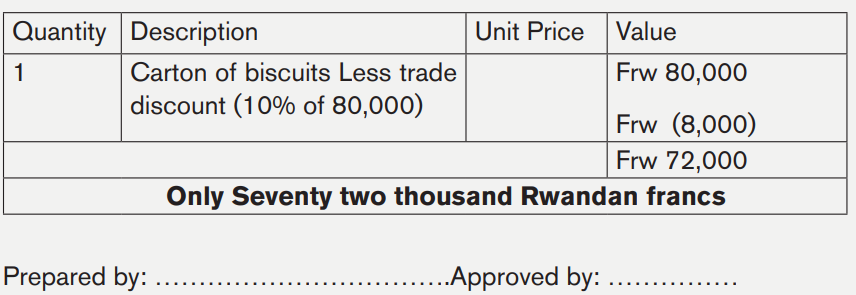

Example

On 24 March 2020, BABU Company (Tel: 0788288444), located in RWANDA bought 10 000 cartons of biscuits on credit from MMM manufacturing Ltd (E-mail: mmm@yahoo.fr; 0722233311) for 800 000Rwf and a trade discount of 10% was given.

The following day, BABU Company returns 1 carton of biscuit to MMM manufacturing Ltd. that had been damaged.

Required: Prepare credit note No795

Answer:

M.M.M MANUFACTURING Ltd.

E-MAIL : mmm@yahoo.fr

Tel: 0722233311

DATE: 25./.03../2010.

CREDIT NOTE No 795

TO :

BABU Company

Tel: 0788288444

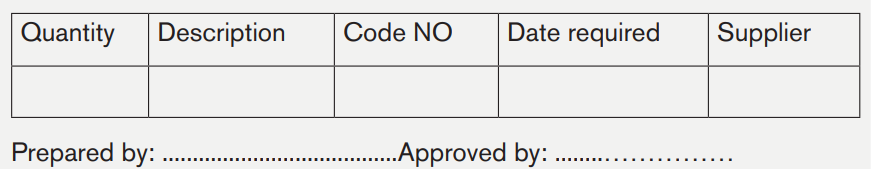

h. Purchase requisition

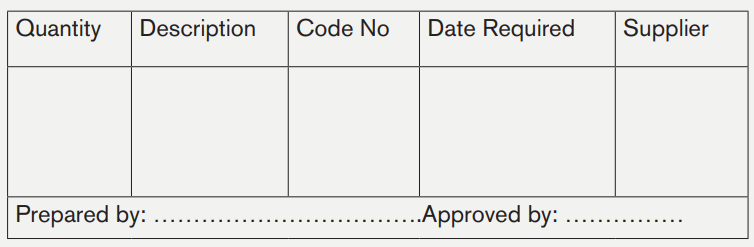

The purchasing department is responsible for buying goods which are required by any business enterprise. For this purpose, written requests are sent by all departments for goods required by them to the purchasing department. These written requests are called purchase requisitions.

These purchase requisitions contain the description of goods required, quantity required and when required. These requisitions must be signed by an authorized person of the department that need these goods.

If the material involved is held in stock by the stores department then the purchase requisition would be prepared and signed by the head of stores department. If some specific items are required by the production department then the purchase requisition would be signed by the works manager.

Format

BESTWAY MANUFACTURING LTD

PURCHASE REQUISITION NO ..... DATE: ………….

DEPARTMENT/ SECTION: …………

Please arrange to purchase the following items: ……

Application activity 2.4

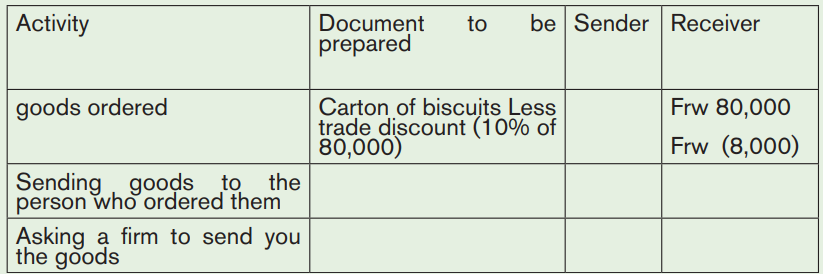

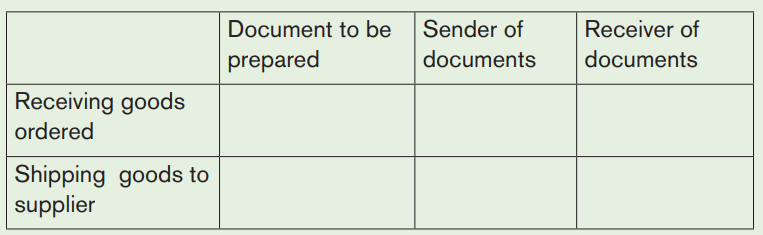

1. Complete the following table :

2. The EPRA, P.O BOX 115 Kigali sells on March 15th 2020, 400 baskets of eggplant to LUMAPLANT, P.O BOX 112 BUTARE, seller of flowers and vegetable, P.O BOX 542 BUTARE. Gross weight of each basket is 15kg, Tare 0.5kg per basket, price per kg is frw 500; trade discount 2%; packing cost FRW10 per basket. Transport paid by seller but chargeable to customer FRW2000. Debt payable before April 20th.

Required: Prepare the invoice

3. On 20th March, 2021, the student IRAKOZE David has paid the school fees of Frws50,000 for the second term to the accountant of RRR school, P.O BOX 234 KIGALI, phone number +250788233456, e-mail : rrr@gmail.com.

Required : Prepare the Receipt NO 046

Skills Lab Activity 2

Visit the school bursar and interview him/her about the different accounting documents used on daily basis. From the information discovered, respond to the following questions:

a) What different sources of income and expenditure information documents have you discovered?

b) What are their roles?

c) From those identified above, what documents do you think would be most useful for your business club?

End unit assessment 2 1.

1.All of the following are not income except:

a) Gift from a friend

b) Pocket money

c) Petty cash

d) Resources

e) B and C are correct answers

f) No one of the above

2. Choose the correct answer Earned income is:

a) Income from family

b) Income from all activity done

c) Money earned from working

d) Business income

e) B and C are correct answers

f) All of the above

3. Portfolio income involves the following except:

a) Money from all selling activities

b) Mutual funds

c) Money from buying real estate

d) A and C are correct answers

e) Money from stock selling

f) No one of the above

4. All of the following are expenses except:

a) Funds used by a business

b) Use of cash equivalents

c) Acquire new assets

d) Purchase assets,

e) Pay down debt,

f) Fund operation.

g) No one of the above

5. One of the following is not a type of expenditure:

a) Deferred revenue

b) Expenditure Company

c) Expenditure Revenue expenditure

d) Business expenditure

e) B and C are correct answers

f) C and D are correct answers

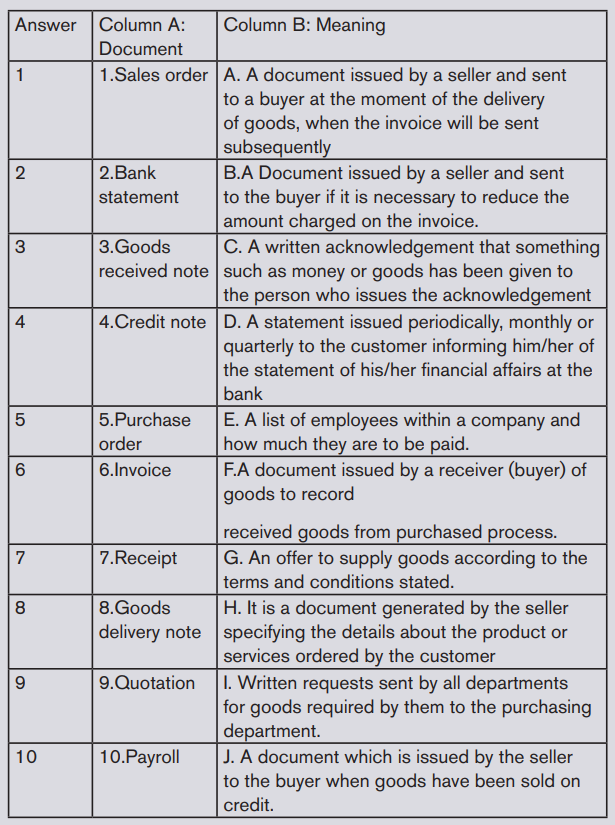

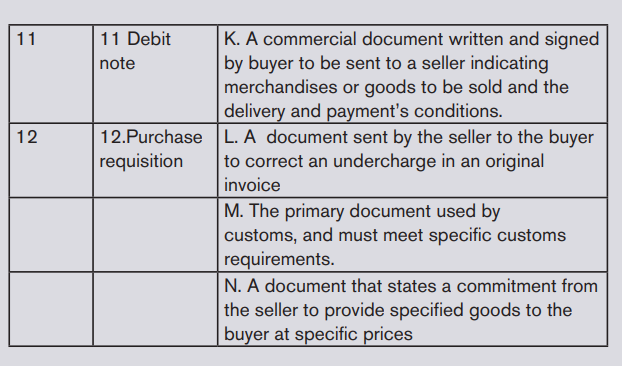

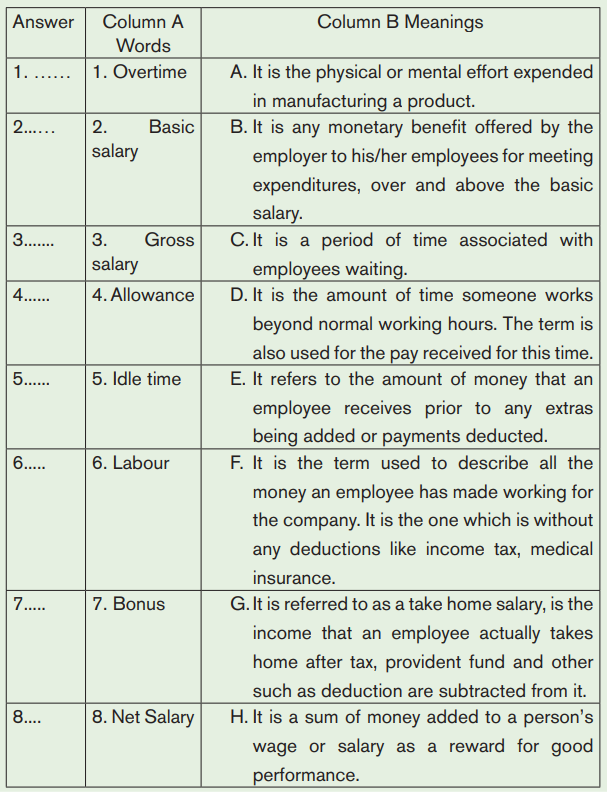

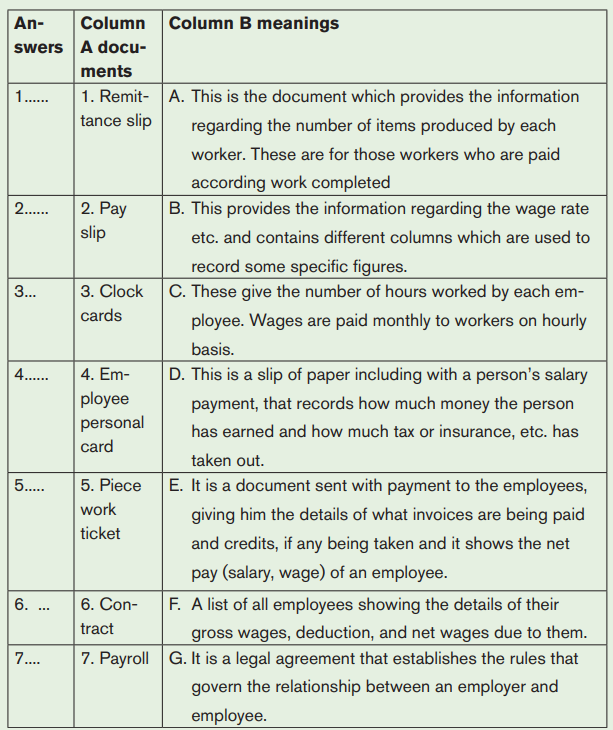

6. Match the document in column A with its meaning in column B, by putting the alphabet of the meaning against the number of the document then put the answer in the provided space.

UNIT 3:COMPONENT OF COST IN ORGANIZATION

Key unit competence: Explain material, procurement process, labor, expenses and Centres

Introductory activity

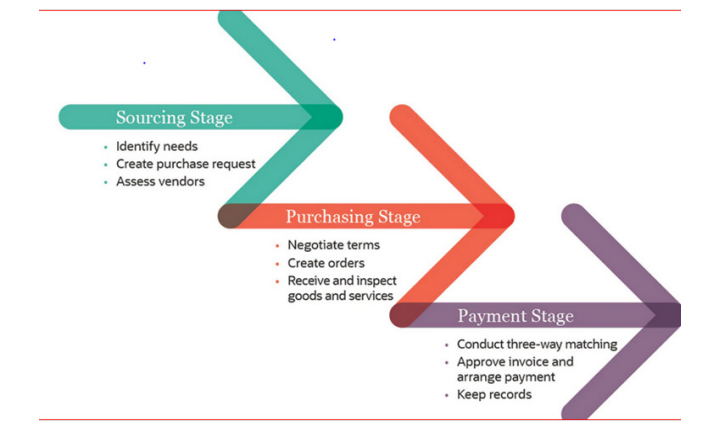

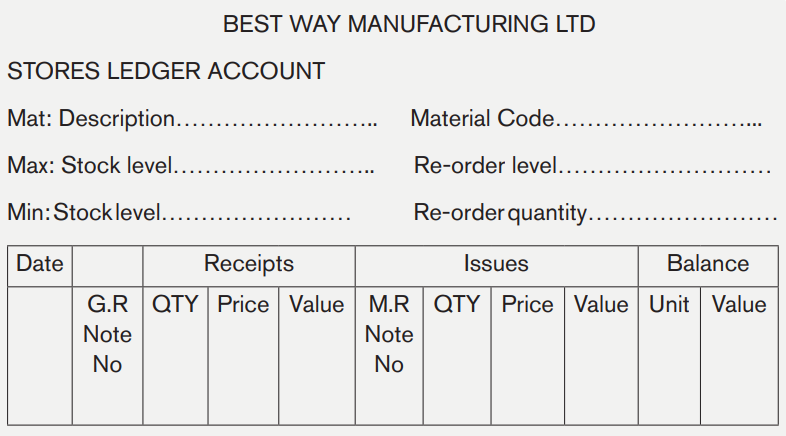

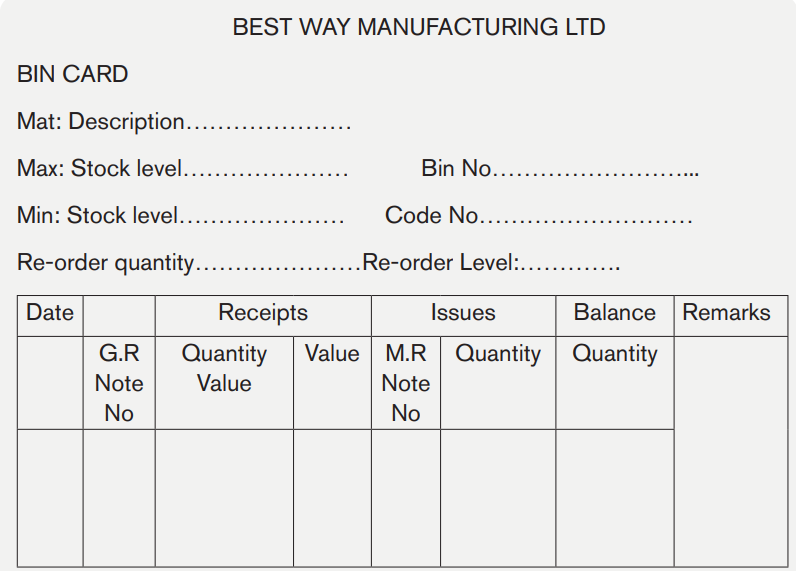

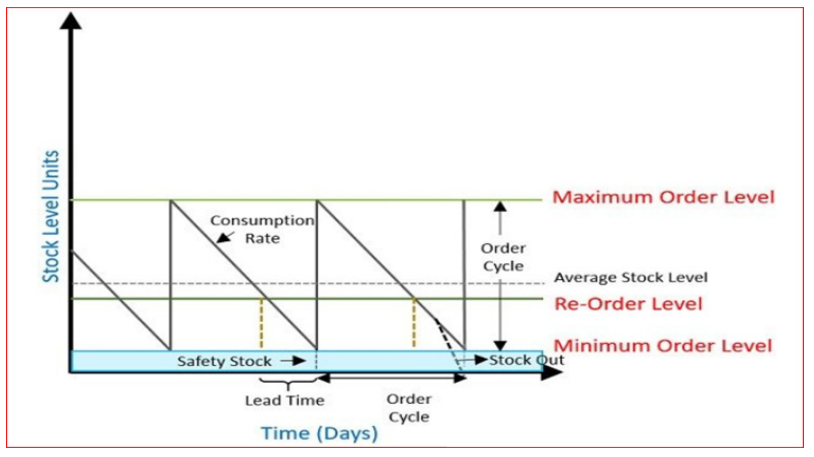

The unit three allows us to discuss the source of income and expenditure information for business. The income received is used to buy materials of the appropriate quality and specification and should be purchased only when material is required and appropriately authorized. The suppliers chosen should represent an appropriate balance between quality, price and delivery. However; the materials properly received are inspected, favorably stored and physically checked on regular basis. In addition, the stock record typically shows various control levels which relate to the particularly inventory control system. In some firms, several stock records may be kept electronically regarding a particularly materials other businesses record the stocks in manual systems using Bin Cards and Stock Record Cards.

In most manufacturing companies and especially in the services sector, the operations/activities are carried out by mainly human being whose recruitment requires institutional policy and organizational expenses.

Manufacturing business even other business spends the income for its different departments or centers in which the output is produced. The production is obtained with direct and indirect expense added to raw material cost and labor cost for prime cost at a given cell of business. In order to produce any commodity or provide any service some amount is spent by an organization. These are referred as costs.

It is important to determine and analyze total costs incurred for the production of any commodity or for providing a service toward unit cost calculation. These costs must be properly recorded and charged to relevant jobs or activities. These costs are presented to the management for making decisions and evaluating the performance of the organization.

The business owners/ managers use their knowledge in costs and expenses to guide decisions about product innovation, quality and satisfaction of costumers.

1. How the product is manufactured?

2. Explain the process of recruitment.

3.1 Material

Activity 3.1