UNIT 3:COMPONENT OF COST IN ORGANIZATION

Key unit competence: Explain material, procurement process, labor, expenses and Centres

Introductory activity

The unit three allows us to discuss the source of income and expenditure information for business. The income received is used to buy materials of the appropriate quality and specification and should be purchased only when material is required and appropriately authorized. The suppliers chosen should represent an appropriate balance between quality, price and delivery. However; the materials properly received are inspected, favorably stored and physically checked on regular basis. In addition, the stock record typically shows various control levels which relate to the particularly inventory control system. In some firms, several stock records may be kept electronically regarding a particularly materials other businesses record the stocks in manual systems using Bin Cards and Stock Record Cards.

In most manufacturing companies and especially in the services sector, the operations/activities are carried out by mainly human being whose recruitment requires institutional policy and organizational expenses.

Manufacturing business even other business spends the income for its different departments or centers in which the output is produced. The production is obtained with direct and indirect expense added to raw material cost and labor cost for prime cost at a given cell of business. In order to produce any commodity or provide any service some amount is spent by an organization. These are referred as costs.

It is important to determine and analyze total costs incurred for the production of any commodity or for providing a service toward unit cost calculation. These costs must be properly recorded and charged to relevant jobs or activities. These costs are presented to the management for making decisions and evaluating the performance of the organization.

The business owners/ managers use their knowledge in costs and expenses to guide decisions about product innovation, quality and satisfaction of costumers.

1. How the product is manufactured?

2. Explain the process of recruitment.

3.1 Material

Activity 3.1

1. After analyzing the above photo, outline the different materials being used by producer.

2. Classify the available materials according to their nature.

3.1.1 Definition of material

Material refers to all commodities or equipment that are consumed in the process of manufacturing. In other word material means all kinds of substance used for the production of a product or rendering any service.

3.1.2 Categories of material

Materials can be classified according to the substances that make them up, how they are measured, or their physical properties.

There are several different ways in which materials can be classified. The three main ways of classifying materials are as follows:

• They can be classified according to the substances that make them up

• They can be classified according to how they are measured

• They can be classified according to their physical properties

Materials may be made of one or more substances. For example, when classifying materials according to the substances that make them up, they may be classified as either wood, plastic, metal, wool and so on. Many items may be made up of a combination of substances.

Materials can also be classified according to how they are measured. This may be by litre, metre or kilogram. In practice however, it may also be in bags, packets or by the thousand.

Finally, materials may also be classified by one or more of their physical properties. The same basic piece of material may be distinguished by one or more of the following features:

• Colour

• Shape

• Fire resistance

• Water resistance

• Abrasiveness

• Flexibility

• Quality

a. Raw material

Raw materials are goods purchased for incorporation into products for sale. Raw materials are a direct cost.

Raw materials is a term which you are likely to come across often, both in your studies and your workplace. Raw materials are a direct cost of production as they are easily identifiable with a unit of production.

Examples of raw materials include:

• Clay for making terracotta garden pots

• Timber for making dining room tables

• Paper for making books

b. Work in progress

Work in progress is a term used to represent an intermediate stage between the manufacturer purchasing the materials that go to make up the finished product and the finished product.

Work in progress is another term which you are likely to come across often, and valuing work in progress is one of the most difficult tasks in costing.

Work in progress means that some work has been done on the materials purchased as part of the process of producing the finished product, but the production process is not complete.

Examples of work in progress include:

a) Terracotta pots which have been shaped, but which have not been fired, and are therefore unfinished.

b) Dining room tables which have been assembled, but have not been polished, and are therefore not ready for sale.

c) Paper which has been used to print books, but which has not yet been bound. The books are therefore not yet assembled, and not yet ready for sale.

c. Finished goods

A finished good is a product ready for sale or despatch. Did you notice how all the examples of work in progress were items which were not ready for sale? It therefore follows that examples of finished goods are as follows:

• Terracotta pots ready for sale or dispatch

• Dining room tables ready for sale or dispatch

• Books ready for sale or dispatch

The examples in the previous paragraph show terracotta pots which have now been fired, dining room tables which have now been polished, and books which have now been bound.

These final processes have transformed our work in progress into finished goods.

d. Direct and indirect materials costs

Materials are either a direct or indirect cost, depending upon how easily they can be traced to a specific unit of production.

• Direct materials are materials that are easily identifiable with a specific unit of production, such as raw materials.

• Indirect materials are materials that are not easily identifiable with a specific unit of production.

In general, indirect materials do not form part of the final product but do make the manufacture of that product possible. There are some exceptions to this, for example, nails used in the production of a cupboard can be identified specifically with the cupboard and form part of the final product. However, because the cost is likely to be relatively insignificant, the expense of tracing such costs does not justify the possible benefits from calculating more accurate direct costs.

Indirect materials are often referred to as 'consumables' and include such things as cleaning products, oil and grease for machines, protective clothing, disposable tools, and stationary supplies. Indirect material costs are an overhead cost.

e. Business containers/package A container or wrapper is any material used for wrapping a consumer-product in order to serve, to contain, to identify, describe, protect and displaying the product. They include Returnable container (eg: crate of some beer) and Nonreturnable container (eg: small bottle of water).

* Reasons or Functions of packaging

• To protect from spoilage and contamination. Packaging protects products from atmospheric conditions like too much sunshine, germs, dust, rain.

• Make the products look attractive to the consumers/ buyers which most cases induce them to buy.

• Packaged products are safe to handle.

• Packed products are easy to stock in shops.

• Packaging helps promote a product. Packed goods are always branded.

• Packed product can be sold self-service.

* Conditions of packaging

• Cost of material packaging

• Environmental factors (legal issues)

Type /nature of the product to be packaged

• Availability of materials packaging

* Mode of packaging

• Box board or paper board cartons

• Paper bags and sacks

• Corrugated boxes

Application activity 3.1

1. Define the following terms as used in accounting:

• Material

• Raw material

• Container

2. List at least three modes of packaging.

3. Why packaging is important to customer?

3.2 Procurement process

Activity 3.2

KANKAZI Ltd is a manufacturing company located in Nyagatare District. The company’s procurement team is responsible for buying materials to be used. They help draft specifications, secure approvals, and deal with suppliers of materials to ensure the company’s production department is stocked up.

Questions:

1. What do you understand by procurement?

2. Where are materials taken to after purchasing them as suggested in the case?

3. Explain the process of procurement.

4. State any four documents used in procurement.

3.2.1 Meaning of procurement process

Procurement is the process of finding and agreeing to terms, and acquiring goods, services, or works from an external source, often via a tendering or competitive bidding process.

3.2.2 Type of purchase

a. Centralized purchase

Centralized purchasing is a procurement system in which one department manages the purchasing of goods and services for the entire organization. The purchasing department is usually located in the organization’s headquarter, where it handles the purchasing for all the branches of the firm.

b. Decentralized purchase

Decentralized procurement is a procurement system that allows individual stakeholders (department manager) to make purchases for their respective departments.

3.2.3 Procurement system and procedure

This means the sequential steps organized for getting the materials or goods in stock.

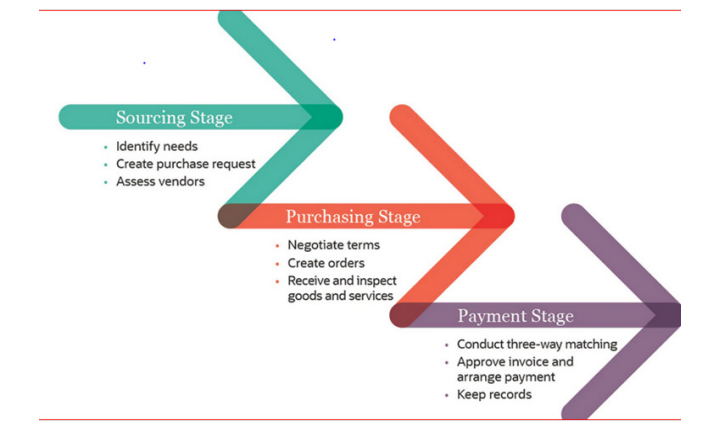

Every procurement process involves several elements, including requirements determination, supplier research, value analysis, raising a purchase request, reviewal phase, conversion to purchase order, contract administration, monitoring/evaluation of received order, three-way matching, payment fulfilment, and record keeping. Here are the 8 steps involved in procurement process:

- Step 1: Needs Recognition

- Step 2: Purchase Requisition

- Step 3: Requisition review

- Step 4: Solicitation process

- Step 5: Evaluation and contract

- Step 6: Order management

- Step 7: Invoice approvals and disputes

- Step 8: Letter of inquiry

- Step 9: Quotation

- Step 10: The purchase order

- Step 11: Receipts of goods

- Step 12: Goods delivery note

- Step 13: Rejection or return of goods

- Step 14: Invoice

- Step 15: Payment

- Step 16: Recording of purchase

Step 1: Needs Recognition

The needs recognition stage of a procurement process enables businesses to sketch out an accurate plan for procuring goods and services in a timely manner and at a reasonable cost.

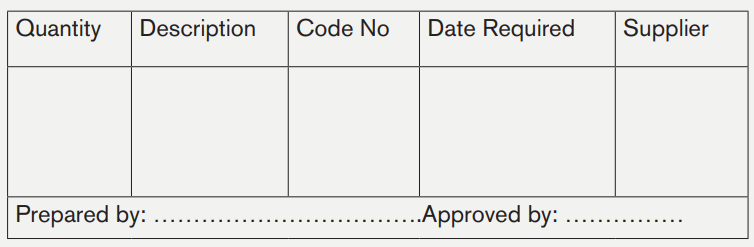

Step 2: Purchase Requisition

Purchase requisition are written or electronic documents raised by internal users/customers seeking the procurement team’s help to fulfill an existing need. It comprises key information that is required to procure the right goods, services, or works.

The format of purchase requisition

URUGWIRO MANUFACURING PLC

PURCHASES REQUISITION

No: ....................................

DATE:...............................

Dept/ Section:..............................

Please arrange to purchase the following items:

Step 3: Requisition review

The procurement process will officially commence only after the purchase requisition is approved and cross-check for budget availability. In the review stage, functional managers or department heads review the requisition package and double-check if there is a genuine need for the requested goods or service and verify whether necessary funding is available.

Approved purchase requests become purchase orders (POs), while rejected requests are sent back to the requisitioner with the reason for rejection. All these tasks can be handled by a software.

Step 4: Solicitation process

Once a requisition is approved and PO is generated, the procurement team will develop an individual procurement plan and sketch out a corresponding solicitation process. The scope of this individual solicitation plan depends ultimately on the complexity of the requirement.

Once the budget is approved, the procurement team forwards several requests for quotation (RFQ) to vendors with the intention to receive and compare bids to shortlist the perfect vendor.

Step 5: Evaluation and contract

Once the solicitation process is officially closed, the procurement team in conjunction with the evaluation committee will review and evaluate supplier quotations to determine which supplier will be the best fit to fulfill the existing need. Once a supplier or vendor is selected, the contract negotiation and signing are completed, and the purchase order is then forwarded to the vendor. A legally binding contract activates right after a vendor accepts a PO and acknowledges it.

Step 6: Order management

The vendor delivers the promised goods/services within the stipulated timeline. After receiving them, the purchaser examines the order and notifies the vendor of any issues with the received items.

Step 7: Invoice approvals and disputes

This is a crucial step in the procurement process. At this stage, a three-way matching between GRN, Supplier Invoice and PO is performed to check if you have received the order correctly and there aren’t any discrepancies. Once three-way matching is complete, the invoice is approved and forwarded to payment processing.

Step 8: Letter of inquiry

The letter of inquiry is a letter written by the purchasing department and sent to various suppliers requesting them some information concerning the prices, conditions and quality of goods which can be supplied.

Step 9: Quotation

Quotation is an offer to supply goods according to the terms and conditions stated. These terms and conditions include for what period the prices stated are valid, rates of discount offered, mode of delivery, terms of payments, etc. Quotations are received from different suppliers in response to letter of inquiry.

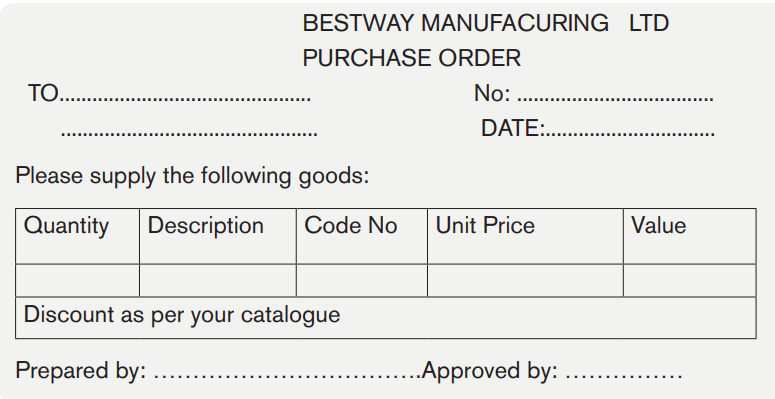

Step 10: The purchase order

A purchase order is a commercial document written and signed by buyer to be sent to a seller indicating merchandises or goods to be sold and the delivery and payment’s conditions.

After receiving the quotations, the purchasing department will select the supplier from whom the goods are to be bought.

Normally, the selected supplier is the one whose price is lowest or terms and conditions are most favorable. A purchase order indicates the description and quantity of goods ordered. If a purchase order is issued to supplier within a country then it may be called as “Local Purchase order” (L.P.O).

The format of purchase order

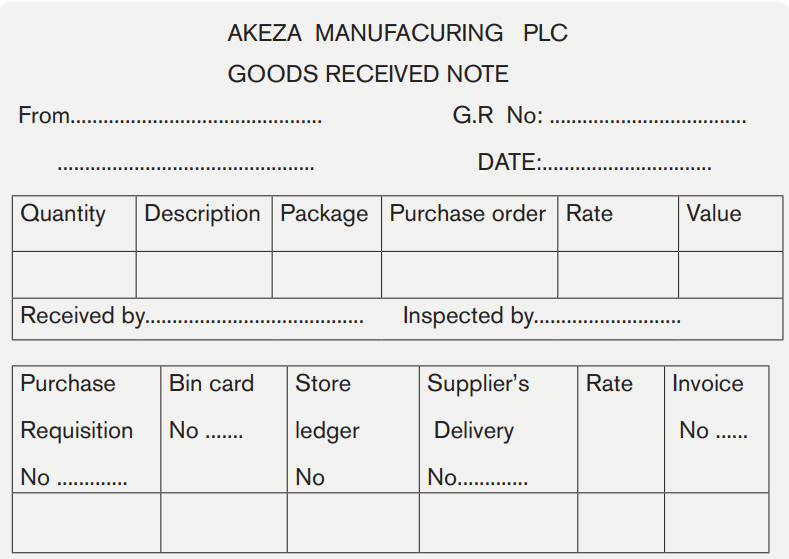

Step 11: Receipts of goods

It is also called Goods Received Note (GRN) that is a document issued by a receiver (buyer) of goods to record receiving of goods purchased or ordered. After receiving the purchase order, the supplier makes the arrangement to deliver those goods. On receipt of goods in the buying organization, a Goods Received Note is prepared. This document shows the name of the supplier, the details of goods received and so on.

The format of good received note

Step 12: Goods delivery note

It is a commercial document sent by the supplier together with goods. It proves that the goods have already been delivered to the buyer organization. If goods are being delivered through public transport, then an Advice Note may be prepared by the supplier and sent direct to the buying organization. The main purpose of an advice note is to inform to the buyer that the goods have been dispatched.

Step 13: Rejection or return of goods

If goods received do not match with specified quality or these goods are not according to description given in the purchase order then the receiving department can refuse to accept these goods. In this case, a Rejection Note may be prepared giving the reasons for rejection. If the goods are accepted first and these goods are returned at a later date then a Goods Returned Note may be prepared. This note contains the reasons for the return of those goods.

Step 14: Invoice

After delivering the goods, the supplier sends an invoice to the buying firm. Invoice is a document which gives the quantity, quality, unit price, total value of goods dispatched, any discount allowed, transport charges if any etc.

Step 15: Payment

After receiving the invoice, the buyer checks the amount due to the supplier. If he/she finds that amount owing to the supplier is correct then he makes arrangements to remit money or the cheque to the supplier. When money is received by the supplier from the buyer, he/she issues a receipt to him showing the details of cash or cheque received. These receipts are the proof of this thing that the money owing to seller has already been received by him.

Step 16: Recording of purchase

The goods purchased are recorded in the accounting books of organization. The entries in the cost accounts are made from the Goods Received Notes. The entries in the financial accounts are made from invoices. It is essential to reconcile the entries in the cost accounts with the entries in the financial accounts that will be learned by “Cost account” in senior six”.

* Component Parts of Procurement

While purchasing is the overarching process of obtaining necessary goods and services on behalf of an organization, procurement describes the activities involved in obtaining them. The procurement process in an organization is unique to its context and operations. Regardless of the uniqueness, every procurement management process consists of 3 Ps’, namely Process, People, and Paperwork.

a. People

The procurement process is generally initiated and authorized by people who are responsible for controlling all steps. In addition to procurement specialists, the people involved include other stakeholders, such as accountant payable and the business groups that request the goods and services. The number of people involved often depends on the value of the goods and services.

Examples:

People clarify the missing materials, goods or equipment in business

People plan for full line of procurement

People control the implementation of procurement

b. Process

An effective procurement process can help a company succeed by keeping costs down and ensuring supplies arrive when the business needs them. A well designed and methodical process helps to promote accuracy and timeliness because every person involved knows exactly what they need to accomplish and how long they have to complete the tasks. In contrast, a disorganized procurement process results in inefficiencies and potentially costly errors.

Example: Wrong procurement process leads to:

• Over payments that can impact the bottom line.

• Late payments negatively affect relationships with suppliers.

c. Paperwork

Itis important to maintain records for every stage of the procurement process and ensure they are easily accessible. These records act as a store of organizational knowledge about payment terms and supplier performance, helping the business maintain an efficient procurement process even if the procurement staff changes over time.

* Principles of procurement

These principles can be regarded as an ethical code of conduct that holds the business for their purchases. Some of the principles may also be beneficial to private-sector organizations not public institutions and vice versa; in other word the principles vary somewhat depending on the organization.

Value for money: The organization must manage funds efficiently and economically when procuring goods and services. This may include conducting cost-benefit analyses and risk assessments. Itis worth noting that low cost does not necessarily equate to greater value; characteristics such as quality and durability also factor into determining whether the purchase represents value for money.

Fairness: Procurement should not provide preferential treatment to individuals or suppliers. All bids should be assessed objectively, based on how well they meet the organization’s needs.

Competition: Organizations should seek competitive bids from multiple suppliers, unless there are specific reasons not to do so, such as a sole-source provider where the good or service is only available from a single vendor.

Efficiency: Procurement processes must be carried out efficiently to help maximize value and avoid delays.

Transparency: Organizations should make relevant procurement information available to everyone, including the public as well as suppliers. Information should be kept confidential only when there are legal or other valid reasons to do so.

Integrity: Those who practice public procurement should always strive to be perceived as trustworthy, reliable, honest and responsible. Funds must be used for their intended purpose and in the public interest.

Accountability: People involved in the procurement process are accountable for their actions and decisions. They are required to report procurement activities accurately, including any errors.

3.2.4 Sourcing and supply chain

Definition of Sourcing

According to the Chartered Institute of Procurement and Supply, sourcing seeks to find, evaluate, and engage suppliers to achieve cost savings and best value for goods and services which can be done through a tender process. Factors such as reliability, quality, flexibility, and capacity are considered in the tendering process alongside price.

Sourcing is the process of vetting, selecting, and managing suppliers who can provide the inputs an organization needs for day-to-day running. Sourcing is tasked with carrying out research, creating and executing strategy, defining quality and quantity metrics, and choosing suppliers that meet these criteria.

Definition of Supply chain

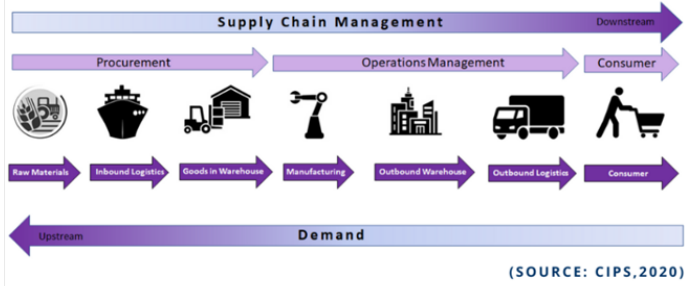

According to the Chartered Institute of Procurement and Supply, a supply chain is the activities required by the organisation to deliver goods or services to the consumer. A supply chain is a focus on the core activities within our organisation required to convert raw materials or component parts through to finished products or services.

A supply chain is a network between a company and its suppliers to produce and distribute a specific product or service. The entities in the supply chain include producers, vendors, warehouses, transportation companies, distribution centers, and retailers.

In a traditional manufacturing environment the activity of interfacing with suppliers is generally supported by “Procurement”, the materials will then pass through goods in warehouses (if products) through the manufacturing site and onto the finished goods warehouse, this activity is the core activity of “Operations

Management”, throughout the supply chain logistics will play an integral role in the movement of inbound materials and outbound goods in order to ensure the finished product flows downstream to our consumer.

The figure below demonstrates supply chain management:

A supply chain can take on the form of a product based supply chain or that of a service, where services come together to offer an overall customer service as opposed to a finished product, an example of this would be the shipping of customers goods, staff, supply of vessel and fuel are all required in order to provide the shipping service to the consumer.

When our supply chain relates to that of our suppliers and consumers, we start to build a supply chain network, where we can then go onto understand the flow of both materials and information in a much more complex way.

* Stages Within a Supply Chain

In its simplest form the stages in a supply chain are summarized below:

• Logistics

• Operations

• Marketing and Sales

• Services

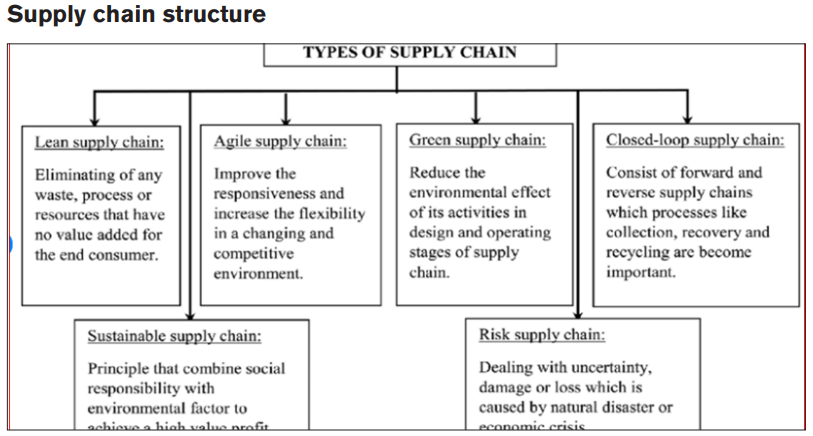

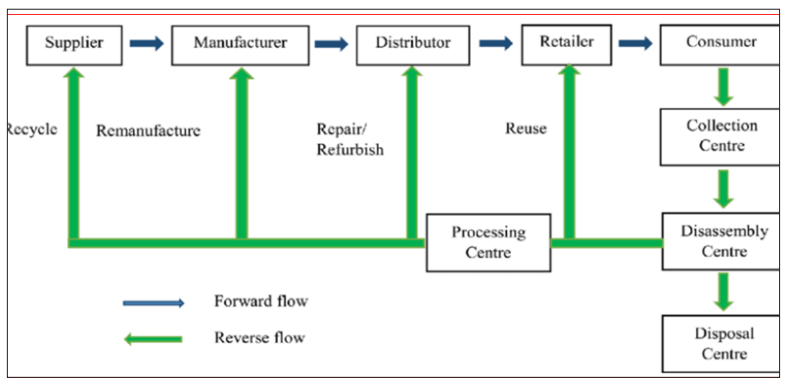

* Types of supply chain

For different business, the supply chain is a network process containing

* Types of distribution

- Intensive Distribution

Intensive distribution aims to provide saturation coverage of the market by using all available outlets. For many products, total sales are directly linked to the number of outlets used (e.g., cigarettes, beer). Intensive distribution is usually required where customers have a range of acceptable brands to choose from. In other words, if one brand is not available, a customer will simply choose another.

This alternative involves all the possible outlets that can be used to distribute the product. This is particularly useful in products like soft drinks where distribution is a key success factor. Here, soft drink firms distribute their brands through multiple outlets to ensure their easy availability to the customer.

-Selective Distribution

Selective distribution involves a producer using a limited number of outlets in a geographical area to sell products. An advantage of this approach is that the producer can choose the most appropriate or best-performing outlets and focus effort (e.g., training) on them. Selective distribution works best when consumers are prepared to “shop around” – in other words – they have a preference for a particular brand or price and will search out the outlets that supply.

This alternative is the middle path approach to distribution. Here, the firm selects some outlets to distribute its products. This alternative helps focus the selling effort of manufacturing firms on a few outlets rather than dissipating it over countless marginal ones.

It also enables the firm to establish a good working relationship with channel members. Selective distribution can help the manufacturer gain optimum market coverage and more control but at a lesser cost than intensive distribution. Both existing and new firms are known to use this alternative.

- Exclusive Distribution

Exclusive distribution is an extreme form of selective distribution in which only one wholesaler, retailer or distributor is used in a specific geographical area.

When the firm distributes its brand through just one or two major outlets in the market, who exclusively deal in it and not all competing brands, it is said that the firm is using an exclusive distribution strategy. This is a common form of distribution in products and brands that seek a high prestigious image.

Typical examples are of designer ware, major domestic appliances and even automobiles. By granting exclusive distribution rights, the manufacturer hopes to have control over the intermediaries’ price, promotion, credit inventory and service policies. The firm also hopes to get the benefit of aggressive selling by such outlets.

3.2.5 Contracts

A contract is a legally binding agreement between two or more parties which can be enforced by law.

Example:

a) Job contract; before starting a job, the employer and employee make a contract. In this case there are two main parties and the law is now represented by official labor law because it is not possible to make a job contract which is against the labor law.

b) Procurement contracts—often called purchase contracts—are contracts that establish a legally binding relationship between buyers and sellers that protects both entities throughout the procurement process.

Establishing the foundation of the business relationship, procurement contracts set forth the parameters of the deal, including:

• Vendor selection

• Product selection

• Vetting

• Payment terms and conditions

• Contract negotiation

• Product management (ordering, payment, and delivery) And set the stage for a mutually satisfying business relationship overall.

The significance of the procurement contract

An effective procurement contract solidifies business relationships by protecting both the buyer and seller.

By including agreed-upon details — including the quality of the materials to be used, the parameters of the services to be provided, delivery times, fees, costs, etc. — procurement contacts provide a solid blueprint that allows both parties to collaborate confidently. In addition, procurement contracts allow businesses to diversify and use resources more effectively. Companies can outsource specific actions and processes to vendors who can fulfil their needs more cost effectively by using procurement contracts.

A business contract

It is a legal binding between two or more persons/ entities to perform an agreed business transaction and can be enforced by law. The day to-day running of the business involves making contractual obligations with suppliers, buyers etc.

* Forms of business contracts

Oral contract is an agreement between two or more parties by use of words. They are non-written contracts. They rely on the good faith of the parties but can be difficult to prove. Once the contract is verbal, the wittiness is mandatory and provides evidence.

Written contract is a contract documented on paper, signed by the contracting parties and witnessed by a third person (the witness).

* Parties of valid contract

For a valid contract the following elements must be considered:

- Intention to be bound by the contract

The two parties should have intended that their agreement be legal. Domestic agreements between husband and wife are not taken as valid.

- Offer and acceptance

There must be an offer and the two parties must lawfully come to acceptance leading to a valid contract. Until an offer is accepted, it is not a valid contract.

- Consideration/price

This is the price agreed upon by the parties to the contract and paid by one party for the benefit received or promise of the other parties.

- Capacity of the parties

The parties to the contract must have contractual capacity for the contract to be valid, i.e. should be sober/moderate, above 18years, not bankrupt, not insane, and properly registered.

- Free Consent

Parties to the contract must agree freely without any of the parties being forced to accept or enter the contract.

- Legality/lawful object

The object and the consideration of the contract must be legal and not contrary to the law and public policy.

- Possibility of performance

If the contract is impossible to be executed in itself either physically or legally, then such contract is not valid and cannot be enforced by law.

- Certainty

The terms of the contract must be clear and understandable for a contract to be valid. If the terms are vague or ambiguous, where even the court may not be able to tell what the parties agreed, then it will be declared invalid.

3.2.6 E-procurement

E-procurement, also known as electronic procurement or supplier exchange, is the purchase and sale of supplies, equipment, works, and services through a web interface or other networked system.

The technology is designed to centralize and automate interactions between an organization, customers, and other value chain partners to improve the speed and efficiency of procurement practices.

It boasts a suite of innovative features – all designed to bolster the efficiency, effectiveness, and total cost of procurement.

Benefit of E-procurement

E-Procurement offers significant benefits for your organization and the most common are listed below:

• Optimize spent by reducing maverick purchases.

• Seize discounts by combining orders and purchasing in volume.

• Increase overall transaction speed.

• Standardize the purchasing experience.

• Negotiate more favourable contracts with strategic suppliers.

• Strengthen supplier relationships.

• Safeguard against risk and supply chain disruption.

• Alleviate routine tasks so procurement teams can focus on strategic initiatives.

• Minimize fraudulent purchases.

Main functions of eProcurement

The primary functions of e-Procurement are far-reaching, offering a range of benefits for a company’s day-to-day operation and supply chain activities.

Below, we list the main functions of eProcurement for business:

• Automates processes to free up resources and reduce errors.

• Improves communication between stakeholders and partners to streamline the procurement cycle.

• Provides a single platform for all procurement activity, giving stakeholders and managers a centralized platform for managing and auditing.

• Offers real-time updates for vendors, management, stakeholders, and partners, as well as the chance to curate and store procurement data.

• Allows for streamlined negotiation between multiple partners and stakeholders.

Application activity 3.2

AMAHORO PLC is the manufacturing business of bread in Muhanga District. It is producing monthly 25,386,214 breads; 8,457,612 Cakes; 5,689,234 sandwiches. For producing all above products AMAHORO PLC purchases different items including wheat, sugar, kitchen oil, salt, water, gas, etc. From 2019 it faces the covid-19 negative impacts (challenges) including lack of materials, increase of price on market, increase of transport expenses leading to violating the verbal contract and high demand on market. You are nominated as manager of AMAHORO PLC with responsibility mainly of improving the process of production and achieve the satisfaction of customers.

1. What are the goods produced by AMAHORO PLC?

2. What are the elements/materials needed by AMAHORO PLC for production?

3. List the challenges facing the AMAHORO PLC nowadays.

4. Suggest the different solutions/strategies to use for overcoming the challenges.

5. What should be done for maintaining the suppliers for avoiding production interruption?

3.3 Labour

Activity 3.3

Every enterprise or organization must have a group of persons who are involved in producing channel or rendering the services. To achieve its objectives, each enterprise should have qualified workers (labor ) or employees who are offering services and must be necessarily paid some amount of money as compensation of his/her personnel efforts. Recall that like other expenses paid by the business or enterprise, the salaries or wages are the largest expenses incurred by a firm while the salaries amount is an expense to employer, it is an income to employees.

In other word, labor represents cost of services of human resources and it is the most valuable asset of an organization. Effective utilization of all resources of an organization depends on quality of its manpower. Labor is a living thing and it is the point which makes the main difference between labor and other elements of product cost. Labor is the most mobile factor of production. It shifts from uses to uses; not only in consideration of price but many psychological factors affecting job-satisfaction and motivation also contribute towards labor turnover.

1. What do you expect to be core elements of cost in production process?

2. Explain the stages of recruitment process.

3. List the challenges of labor recruitment.

4. Is always labor maintained /hold in the same organization?

3.3.1 Meaning of labour

Labour is defined as a group of workers who are under the authority and control of individual or group of individuals called employers entitled to an amount of money called remuneration after an elapsed unit of time (an hour, a day, a month, etc).

Or

Labour is the physical or mental effort expended in manufacturing a product or rendering a service.

3.3.2 Labor recruitment

a. Definition

It is the process of actively seeking out, finding, hiring and integrating new candidates for a specific position or job. The recruitment definition includes the entire hiring process, from inception to the individual recruit's integration into the company.

b. Recruitment stage/process

Employees have a direct effect on the success of an organisation. The different stages of recruitment and selection must be considered when choosing people to work within an organisation.

The following are steps involved in recruitment:

• Definition of a post • Definition of the candidate’s profile

• Identification of recruitment sources • Integration

• Recruitment campaign • Selection

• Pre-selection • Tests of selection

• Interview • Recruitment decision

• Implementation of recruitment means

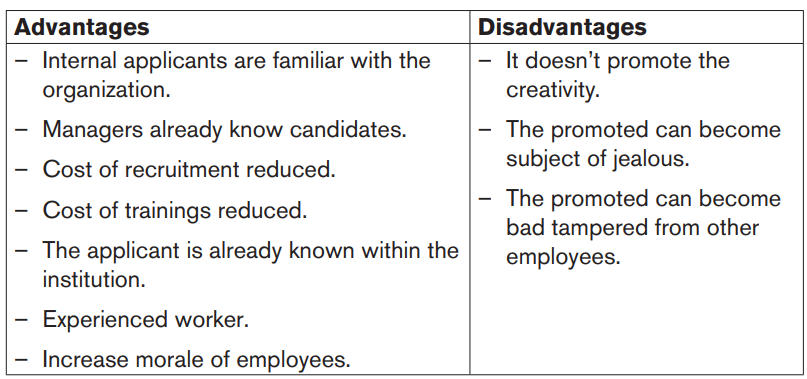

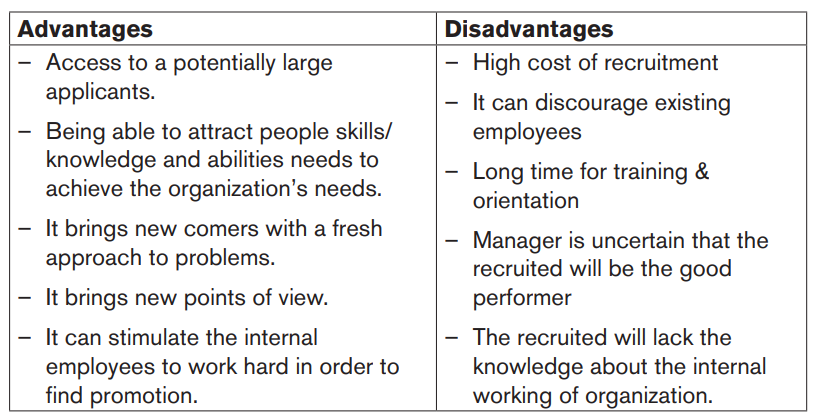

Types of recruitment

- Internal recruitment

It refers to a recruiting method where managers turn to the existing employees to fill open position.

The advantages and disadvantages of internal recruitment.

- External recruitment

It refers to a recruiting method where managers look outside the firm for people who have not worked at the firm before to fill open position.

The advantages and disadvantages of external recruitment

c. Factor to consider when recruiting an employee in an organization

• The nature of the job/task

• Skills and abilities required to do the job

• Size of the organization

• Age of the employee

• Working experience

• Cost of the employee

d. Importance of labour

• Labour is an essential and active factor of production. This is because the capital, land and organisation cannot produce goods and services independently.

• The gifts of nature will remain unused without labour. Only labour can utilise the natural resources more efficiently and can develop the economic well-being of the people which in turn improve the economic development of an economy.

• All other factors of production will remain without any use if there is no demand for goods from labour side. Only when there is demand for good, more goods will be produced to satisfy their demand and hence investment will be encouraged in this process.

• Labour is the main source of wealth of our economy.

e. Challenges of recruitment

• Organization policy can make recruitment complicated

• Recruitment agents may hire staff that are not aligned to the business needs

• It is costly

• It takes time to go through the recruitment process

3.3.4 Labor turnover

a. Definition of labor turnover

Labour turnover is the rate at which employees leave a business and this rate should be kept as low as possible. The cost of labour turnover can be divided into preventative and replacement costs.

b. The reasons for labour turnover

There are many reasons why employees will leave their job. It may be because they wish to go to work for another organisation. Alternatively, it may be for one of the following unavoidable reasons.

• Illness or accidents

• A family move away from the locality

• Marriage, pregnancy or difficulties with child care provision

• Retirement or death

In addition to the above examples, other causes of labour turnover are as follows:

• Paying a lower wage rate than is available elsewhere

• Requiring employees to work in unsafe or highly stressful conditions

• Requiring employees to work unsociable hours

• Poor relationships between management and staff

• Lack of opportunity for career enhancement

• Requiring employees to work in inaccessible places

• Discharging employees for misconduct, bad timekeeping or unsuitability

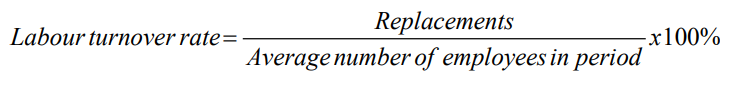

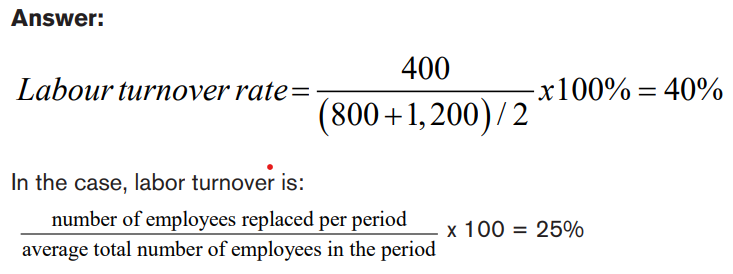

c. Measuring labour turnover

Labour turnover is a measure of the number of employees leaving/being recruited in a period of time (say one year) expressed as a percentage of the total labour force.

Example: Labour turnover

FL Ltd had a staff numbering 800 at the beginning of 20X1 and 1,200 at the end of that year. Four hundred employees resigned on 30 June and were immediately replaced by 400 new employees on 1 July. 400 extra employees were also recruited at that time.

What is the labour turnover rate?

d. The prevention of high labour turnover

Labour turnover will be reduced by the following actions.

• Paying satisfactory wages

• Offering satisfactory hours and conditions of work

• Creating good relations between fellow workers, supervisors, and subordinates

• Offering good training schemes and a well-understood career or promotion ladder

• Improving the content of jobs to create job satisfaction

• Proper planning to avoid redundancies

• Investigating the cause of high labour turnover rates

Application activity 3.3 1.

1.Define the following terms:

a) Labor

b) Labor turnover

c) Labor turnover rate

d) Recruitment

2. Enumerate the challenges faced the recruitment process.

3. Why is important to business to avoid the labor turnover?

3.4 Cost

Activity 3.4

Management accountants help managers track performance of competitor on the key success factors. Competitive information serves as benchmark and alerts managers to market changes. Companies are always seeking to continuously improve their operations. These improvements include ameliorating the services delivery, increasing the quality of good, ameliorating the transport means, installing the online transactions and cost reduction on housing products. Sometimes, more fundamental changes in operations, such as redesigning a manufacturing process to reduce costs, may be necessary.

What would be the basic of process of production?

3.4.1 Definition of cost

Cost is the amount that a business incurs in order to make goods and/or provide services. Costs are important to business because they are the thing that drains away the profits made by a business.

Or

Cost is the monetary value of expenditures for supplies, services, labor, products, equipment and other items purchased for use by a business or other accounting entity.

Or

Cost is the value of economic resources used as a result of production of any commodity or performing any service.

3.4.2 Classification of cost

A business will incur many different types of cost from day to day. For accounting purposes it is useful to group or classify these costs. There are, however, several different ways of doing this.

Costs are recorded and analysed in accordance with the organisation's costing procedures. Below are classifications of costs:

a. Direct cost

A direct cost is a cost that can be directly attributed to a cost unit.

Example: Raw materials costs.

b. Indirect Costs

Indirect costs are costs that cannot be attributed directly to a cost unit but are initially attributed to a cost centre.

Example: wages, electricity.

c. Fixed Costs

Fixed costs are costs which are not affected by the level of activity.

Fixed costs are not affected by changes in production level. They remain the same in total whether no units or many units are produced. They are incurred in relation to a period of time rather than production level and are often referred to as period costs. This may include the rent of a factory or straight-line depreciation of plant and machinery.

In practical terms fixed costs are only truly fixed over the relevant range. For example, the rent of the factory will only remain constant provided that the level of activity is within the production capacity of the factory. If production levels increase above the capacity of the current factory, then more factory space must be rented thus increasing the rent cost for this level of production.

The relevant range of a fixed cost is the range of activity within which the cost does not change.

d. Variable Costs

A variable cost is a cost which varies in total directly with the volume of output. The variable cost per unit is the same amount for each unit produced.

Variable costs are costs that vary directly in line with changes in the volume of output (also known as the level of activity). Direct materials are often viewed as variable costs. For example, if 1kg of a material is needed for each cost unit then 100,000 kg will be required for 100,000 units of production and 500,000 kg for 500,000 units of production.

The total variable cost can be expressed as:

Total variable cost = Variable cost per unit × number of units

e. Semi-variable Costs

Semi-variable costs are costs which contain both fixed and variable components and so are partly affected by the level of activity.

Semi-variable costs (also known as semi-fixed costs) are costs that have a fixed element and a variable element. For example, a telephone bill includes a fixed element being the fixed line rental for the period and a variable element that will increase as the number of calls increase.

The total of a semi-variable cost can be expressed as:

Total cost = Fixed element + (variable cost per unit × number of units)

f. Step-fixed Costs

Step fixed costs are costs which are fixed in nature but only within certain levels of activity.

Step-fixed costs are costs that are fixed over a relatively small range of activity levels but then increase in steps when certain levels of activity are reached. For example, if one production supervisor is required for each 30,000 units of a product that is made then three supervisors are required for production of 90,000 units, four for production of 120,000 units, five for production up to 150,000 units and so on.

Step-fixed costs are really a fixed cost with a relatively short relevant range.

Application activity 3.4 1.

1. Define the term Cost.

2. Explain the types of cost according to behavior.

3.5 Expenses

Activity 3.5

After analyzing the picture, give the function or the use of money from business.

3.5.1 Definition of expense:

An expense is the money that something costs someone or that someone needs to spend in order to do something. Example: Food paid.

Or

It can be again defined as an expenditure the benefits from which do not extend beyond the present. Example: Depreciation.

Or

It is expired cost. 3.5. 2

Types of expenses a.

Direct expense Direct expenses are expenses that are identifiable with each unit of production, such as patent royalties payable to the inventor of a new product or process.

b. Indirect expense

Indirect expenses are expenses that are not spent on individual units of production (eg rent and rates, electricity and telephone).

c. Joint expense

A joint expense is an expenditure that benefits more than one product, and for which it is not possible to separate the contribution to each product.

Often the expenses of an organisation are incurred by a number of cost centres jointly. For example, when the rent is paid for the factory this will be an expense of all the cost centres that are housed in the factory. In these cases the expense must be split between the relevant cost centres and this is known as apportionment of costs.

How the expense is split between the cost centres that have incurred it depends on the policies of the organisation, using a fair basis to determine the split. For example, with the rent expense this may be apportioned between the various factory cost centres according to the amount of floor space that each cost centre uses.

Application activity 3.5

1.Define the term expense.

2. Explain the types of expenses in organization.

3.6 Responsibility centres

Activity 3.6

IKIREZI PLC has started a poultry project two years ago with the aim of solving the problem of chicken meat in Rubavu town. When starting this business, IKIREZI PLC invested money and other types of assets to buy everything needed in his/her business. As long as investment goes on IKIREZI PLC purchased different materials including drinkers, mangers and motor vehicle. IKIREZI PLC also paid a rent of one year immediately.

At the beginning, IKIREZI PLC bought 700 chicks for Frw 1000 each, and those chicks had to be vaccinated after each seven days during the first 21 days. IKIREZI Company also purchased chicken foods and vitamins to make them grow quickly. Even if IKIREZI PLC made more efforts to make his/her business successful during full year, IKIREZI PLC forgot to record the money spent and money generated from sales that resulted to IKIREZI PLC‘s loss and dispute between IKIREZI PLC and his/her suppliers/ customers.

At the beginning of the second year, IKIREZI PLC took new measures to avoid the loss. Hence IKIREZI PLC decided to hire a professional accountant who will help manager to record all the accounting information about purchasing and selling. At the end of the second year, IKIREZI Company got profit and now IKIREZI PLC is predetermining to issue the shares on market.

1. What is the scenario above talking about?

2. What do you think is the main purpose of doing a business activity?

3. How do we call all of those activities that involve IKIREZI PLC in the purchasing of material and equipment?

4. What are the challenges that IKIREZI PLC faced in the 1st year of their business activity?

5. What was the answer to the challenge faced by IKIREZI PLC?

6. Suggest the responsibilities of hired accountant in IKIREZI PLC?. Structure how you do think this accountant will find the data to record?

3.6.1 Understanding responsibility centres

Responsibility centres are areas of the business for which costs or revenues are gathered and compared to budgets for control purposes. There are a variety of different types of responsibility centre depending upon the type of cost and/or revenue that the centre deals with.

A manufacturing business is likely to split naturally into a variety of different areas or departments.

Typical examples may be:

• Cutting

• Assembling

• Finishing

• Packing

• Warehouse

• Stores

• Maintenance

• Administration

• Selling and distribution

• Finance

The precise split of a business will depend upon its nature and the nature of its activities and transactions. However, the business is split, managers need to k now the costs and/or income of each department to be able to make decisions, plan operations and control the business.

3.6.2 Types of responsibility centres

a. Cost centre

A cost centre is an area of the business for which costs are to be gathered.

It can also be refined as an area of the business, maybe a department such as the factory or restaurant, for which costs are incurred that cannot be directly attributed to the cost units. These costs are known as indirect costs or overheads.

Some of these cost centres are areas of the business that produce the products that the business sells – cutting, assembling, finishing etc. These are known as production cost centres.

Other cost centres do not actually produce goods but are necessary to ensure that both production and sales take place – warehouse, stores, maintenance etc. These are known as service cost centres as they provide a necessary service to the production cost centres.

b. Revenue centre

A revenue centre is the business operation responsible for generating a company's sales revenue. These centres may be departments, divisions or business units.

c. Profit centre

A profit centre is an area of the business for which both revenues and costs can be ascertained and therefore a profit or loss for a period can be determined.

Application activity 3.6

1. Explain the term center as used in Management accounting.

2. Differentiate the main types of centers found in manufacturing business.

Skills Lab Activity 3

Interview a resourceful person such school bursar, or accountant about the procurement process using the following questions:

1. Why does the business/school get into the procurement process when they are buying materials?

2. What are the necessary documents involved in the procurement process?

3. What process does the business/school follow or go through during procurement?

4. Why does the business/school manager control a business inventory/ stock?

5. What advice would you give me as an inspiring accountant/entrepreneur to be on the procurement process?

End unit assessment 3

1. Define the following Management accounting terms:

a) Raw material

b) Labor cost

c) Revenue Centre

d) Procurement

e) Cost unit

2. How the raw material stock is different from working in progress stock?

3. Give the four reasons of labor turnover in a given organization.

4. Discuss the importance of procurement in manufacturing business.

5. Explain the limitations of procurement system.

6. Explain at least three types of costs.

7. List and explain the three documents used in procurement process.

8. Perfect recruitment process is a vital phase of organizational operations. Structure a case study, propose the possible procurement process and give comments on it can work properly.