Topic outline

General

Key unit Competency: Analyse the operation of firms under different market structures.

INTRODUCTORY ACTIVITY

Rwanda has many industries operating in different forms. Given the table below, analyze these industries in terms of their number, the nature of products they produce and the degree of advertisment, arrange your findings in a table to enable you categorize according to their similarities.

INDUSTRIES:

Air travel industry; Hotel industry; Banking industry; Water and sanitation services; Petroleum products industry; Newspaper industry; Hydro power industry; Telecommunication industry;

1.1. Introduction to market structure

ACTIVITY 1.1

Analyse the activities taking place in the pictures below. Identify the commodities being sold in there.

Do you notice any relationship between the markets in the pictures in terms of nature of commodities sold and the number of firms dealing in these commodities etc. Then identify the type of market structures in the picture shown below.

1.1.1. Meaning of market structures.

A market is any arrangement that brings buyers and sellers into close contact

to transact business with an aim of making profits. It may be a physical place,

communication through telephone, fax and mail. Different markets have

different characteristics, participants and conditions; thus markets differ in

many ways. The conditions that prevail in the market which determine how

the market players operate are what we call the market structures. Therefore,

market structure is a range of unique features or characteristics which

influence the behaviour, conduct and performance of firms which operate in a particular market.

1.1.2. Categories of market structures.

Market structures are classified into two categories:

1. Perfect markets: These are markets where buyers and sellers are

numerous and price cannot be manipulated. These include perfect

competition markets.

2. Imperfect markets: These are markets where individual buyers and

sellers can influence prices and production. These include monopoly,

oligopoly, monopolistic competition etc.

The market structures mentioned above differ depending on:

- The number of firms in the market; either one, few or many.

- Nature of the product dealt with; whether homogeneous or differentiated or heterogeneous.

- Entry and exit restrictions; either free entry, limited or highly restricted.

- Cost conditions.

- Degree of market information; Consumer informed or not informed about the market.

- Firms ability to influence demand through advertising.

- Degree of government interference.

APPLICATION ACTIVITY 1.1

1. a) Identify the firms operating in the banking sector.

b) Which types of products do they offer?

c) What means do they use to attract customers?

2. a) Identify the firms operating in the energy sector?

b) Which types of product do they offer?

c) What means do they use to attract customers?

3. Determine the difference in the structure of the two sectors above.

ACTIVITY 1.2

Considering market conditions in Rwanda, Describe the firms in which the features in the chart below exist.

1.2.1 Meaning of perfect competition.

Perfect competition is a market structure where there are several buyers and

sellers (firms) dealing with homogeneous commodity and possessing perfect

information of market conditions at that particular time.

At times a distinction is made between pure competition and perfect competition.

Pure competition Perfect competition is a market structure where there are

several buyers and sellers (firms) dealing with a homogeneous commodity but

consumers and sellers do not possess perfect knowledge of market conditions

and there is no perfect mobility of factors of production.

Perfect competition, on the other hand, requires the fulfilment of two

additional conditions: Perfect mobility of factors of production and perfect knowledge of market conditions.

Therefore, perfect competition is a wider term than pure competition.

1.2.2. Features of perfect competition.

Perfect competition is said to exist where there are the following conditions or features:

- There are many buyers and sellers in the market. Firms are many such

that none of them controls the market conditions independently. Each firm

in the market is free to put to the market as much output as it can or wishes

at the ruling market price but cannot independently influence the price of

the commodity. Therefore, firms under perfect competition are price takers

i.e. they take the price that is determined by automatic forces of demand and

supply.

- There is product homogeneity i.e. all the commodities supplied in the market

are identical (the same). All firms in the industry produce homogeneous or the

same product such that no consumer has preference for the product of one firm over the other.

- There is free entry and exit in the market. Any firm with capital is free

to enter the market and start producing and any existing firm is free to stop

production and leave the market if it so wishes. On expectation of making

profits, firms can freely join the industry and can also freely leave the industry if they make losses.

- There is no government intervention in form of fixing prices. All participants in the market abide by the price that is set by forces of demand and supply. Such a price rules all over the market.

- There is stiff competition among firms such that less efficient firms are always kicked out of the business.

- The major aim of firms is profit maximization. This is attained at a point where the marginal cost is equal to the marginal revenue (MC= MR) as the necessary condition though not sufficient at lower levels of output, but becomes sufficient at higher levels of output.

- The firms under perfect competition do not incur transport costs. Under perfect competition it is assumed that the raw materials, the firm, the consumers, are all found in the same place or locality.

- There is perfect mobility of factors of production from one production unit

to another. Factors of production can easily move from low paid economic

activities to high paid economic activities.

- Buyers and sellers have perfect (complete) information about the

market conditions. It is assumed that the price, quality, quantity and the

location of the product in question are known by all the participants in

the market. If one firm charges a higher price than others, it would not

make any sales.

- There is no persuasive advertising since firms are producing homogeneous

products and the consumers have perfect knowledge about the market

conditions. However, there may be some informative advertisements to make

the consumers aware of the products.

- Under perfect competition, AR=MR because selling an extra unit of output

adds the same amount to the total Revenue since price is constant, In other

words; for the firm to sell an extra unit of output, has to sell it at the same

price like previous one..

- The demand curve of a perfect competitive firm is perfectly elastic. This

indicates a constant price for the whole industry. At this point the demand curve

is equal to marginal revenue (MR), equals to average revenue (AR) which is

equal to the price. (DD=MR=AR=P). Therefore, the firms in the industry are

price takers not price makers. No any firm in the industry can set its own price

but they all sell at the constant price set by forces of demand and supply.

NOTE: Entry barriers refer to economic, procedural, regulatory, or

technological factors that restrict entry of new firms into market. Such barriers may take the form of:

1. Clear product differentiation, necessitating heavy advertising expenditure to introduce new products.

2. Economies of scale necessitating heavy investment in large plants to achieve competitive pricing.

3. Restricted access to distribution channels.

4. Collusion on pricing and other restrictive trade practices by the producers or suppliers.

5. Limit pricing i.e. fixing the price so low to avoid entry of new competitors.

6. Well established brands. A brand is a name, term, design, symbol, or

any other feature that identifies one seller’s good or service as distinct from those of other sellers.

Barriers to exit also serve as barriers to entry because they make it difficult for a firm that make losses to exit the industry.

Examples of perfect competition;

In the real world, it’s hard to find examples of industries which fit all the criteria of ‘perfect information’. However, some industries are close and these may include:

1. Foreign exchange markets. Here currency is all homogeneous and traders will have access to many buyers and sellers and there will be good information about relative prices.

2. Agricultural markets. In some cases, there are several farmers selling identical products to the market e.g. potatoes, cassava, pineapples, Irish potatoes, tomatoes, maize, bananas etc. and many buyers.

3. Internet related industries. It is easy to compare prices quickly and efficiently and entry barriers are lower.

1.2.3. The demand curve for a firm under perfect competition

Each firm in a perfectly competitive market faces a perfectly elastic demand curve

because variations in the firm’s output have no noticeable effect on price. The

perfectly elastic demand curve does not indicate that the firm could actually sell

an infinite amount at the prevailing price. It only indicates that the variations in

production will leave price unchanged because their effect on total industry output

will be negligible. The firm’s output variation has only a tiny percentage effect

on industry output. The price is determined by the industry through forces of demand and supply

As shown in the figure above, the demand curve is equal to the average revenue

curve and equal to marginal revenue curve. (AR=MR=D) The AR curve is the

same as MR curve under perfect competition. This is because selling an extra

unit of output adds the same amount to the total revenue since price is constant.

ACTIVITY 1.3

Basing on your knowledge about the perfect competition,

Explain the meaning of the following terms and illustrate their curves.

i. MC

ii. MR under perfect competition.

iii. Illustrate the two curves on the same graph and identify the point

where they meet to determine the equilibrium.

1.2.4.1. Equilibrium position of the firm under Perfect competition.

Equilibrium can be defined as a state of balance when variables under

consideration have no tendencies to change. A firm is in equilibrium at the

point where MC= MR at this point, the firm is able to determine the output to

be produced and the price of that output. The firm maximises its profits by

equating its MC with its MR i.e MC= MR.

Conditions of Equilibrium of the firm and industry under Perfect competition

i. The MC curve must equal to MR curve. This is the first order and necessary

condition. But this is not a sufficient condition at lower output levels but

becomes sufficient condition at a higher output levels.

ii. The MC curve must cut the MR curve from below and after the point of

equilibrium it must be above the MR. This is the second order condition.

As shown in figure above at point A (output 0Q1), the firm is in equilibrium

i.e. MC = MR. However, this is not sufficient. It therefore requires the firm to

increase output to a higher output e.g. 0Q2 in order to fetch more revenue compared to the cost incurred in its production.

At point B the firm fulfils the sufficient condition of equilibrium by producing a

high output 0Q2 where MC= MR and MC is rising. Therefore, the equilibrium is at

point “B” where MC=MR and MC is rising thus fulfilling the necessary condition.

At equilibrium, the firm may either make abnormal profits or incur losses (subnormal

profits) depending on the level of average cost (AC).

1.2.4.2. Short run profit maximisation under perfect competition.

The firm will be in equilibrium at a point where marginal cost (MC) is equal to

marginal revenue (MR) and it will come under the following conditions:

- The average revenue (AR) must be greater than average cost (AC) i.e.

Average cost curve must be below the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs to the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Illustration of short run profit maximisation under perfect competition

Output: The output that the firm produces is determined at the equilibrium

point where MC=MR at the biggest level of output. Thus output 0qo is the

equilibrium output.

Cost: The average cost of producing each unit of output 0qo is determined at a

point where the output line meets the AC curve. Thus 0co is the average cost of

producing each unit of output 0qo.

Price: The price at which the firm sells its output is determined at a point where

the output line meets the AR. Thus price 0po is the equilibrium price.

Profit: Along the equilibrium, AR is greater than AC and therefore the firm

earns Abnormal profits in the short run, as shown by the shaded area C0P0AZ

above

Example:

The marginal cost of paper bag making industry in Kayonza is given by,

MC = 20+2Q (which is always rising), where Q=100 paper bags.

Find the cost-maximizing quantity if P=30 or P=40

Answer:

P=D=AR=MR=MC

PC=MC, P-30

30=20+2Q

30-20=2Q

10=2Q

5=Q

P=MC, 40

40=20+2Q

10=Q

1.2.4.3. Long run equilibrium position under perfect competition.

Because of freedom of entry of new firms into the industry, in the long run, new

firms enter the market being attracted by the abnormal profits enjoyed in the

short run. As new firms enter, supply of the commodity increases leading to a reduction in the price level.

The increase in the number of firms will also result into increased competition

for factors of production which will cause the costs of production to rise. This

will push AC and MC curves upwards in the long run.

As prices in the market fall, abnormal profits will continue to reduce. Thus

firms make normal profits in the long run where AR=AC.

Long run situation comes under the following conditions;

- The average revenue (AR) must be equal to the average cost (AC) i.e.

Average cost curve must be tangent to the Average revenue line.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs to the

vertical axis. Since this time AC and AR are equal, the price line is the same as the costs line.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Output: The output that the firm produces is determined at the equilibrium

point where MC=MR at the point x, at the biggest level of output. Thus output

0qo is the equilibrium output.

Cost: The average cost of producing each unit of output 0qo is determined at a

point where the output line meets the AC curve. Thus 0co is the average cost of

producing each unit of output 0qo.

Price: The price at which the firm sells its output is determined at a point where

the output line meets the AR. Thus price 0po is the equilibrium price.

Profit: Along the equilibrium, AR is equal to AC (C0=P0) and therefore the firm earns Normal profits in the long run.

1.2.5. Loss making under perfect competition.

The firm can be in equilibrium under perfect competition but when making

losses making firm. Some firms can be able to make abnormal profits while some

others are likely to earn losses. Losses come under the following conditions:

- The average revenue (AR) must be less than average cost (AC) i.e. Average

cost curve must be above the Average revenue curve (AR).

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs to the

vertical axis. This time the price-output line is prolonged to meet/ touch the AC curve since its higher above the AR curve.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

As shown in the figure above, the firm produces output 0Q1 at Total cost

0CeXQ1 and sales it at price 0Pe getting Total Revenue 0PeYQ1 hence making

losses PeCeXY because the AC is greater than the AR.

Losses = TR- TC. Thus from the above curve, losses= 0PeYQ1- 0CeXQ1 = PeCeXY.

Example

Given the firm’s total cost function as TC = 100+20Q+Q2.

a. Calculate the firm’s supply curve

b. If firm’s market price is 25Frw, calculate firm’s production.

c. Calculate firm’s profit/loss if P=25

Answer

TVC= 20Q+Q2

AVC= 20+Q

MC= 20 + 2Q

a. Therefore,

P = MC

P = 20+2Q

qs = ½P - 10

b. If P=25, therefore,

qs = ½P - 10

qs = ½(25) – 10

qs = 2.5

c. Profit/loss

qs = 2.5

π= TR-TC

π= PQ-(100 + 20q + q2)

π= (25)2.5-(100 + 20(2.5) + (2.5)2)

π= 62.5-(100 + 50 + 6.25)

π=-93.75Frw

In long run, firms push their profit to zero and sometimes, they start making losses.

1.2.6. Breakeven and shut down points of a firm.

Breakeven point is a point where the firm is neither earning abnormal profits

nor making losses. i.e. it is earning normal profits where the average revenue

is equal to average cost (AR =AC). The firm can only cover the costs of production without earning any profit.

Example

Assume an industry producing 1000 kg (Q) of biscuits daily, and selling at price

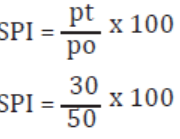

50Frw per kg. Calculate the profit of the firm, and interpret what will happen to the firm.

P= 50, Q = 1000

TR = P x Q

TR 50x1000= 50000

TC = ATC x Q

ATC=50,

Q=100TC = 50 X 1000 = 50000

Profit = TR - TC = 50000 – 50000 = 0

Therefore the industry is at breakeven point where AC=AR and the industry is making 0 profits.

When normal profits are earned, no more firms will be attracted to the industry and

the existing firms will have no desire to leave. As new firms may enter the industry

more would be supplied to the market. Prices will fall even further and firms will

begin to incur losses. Firms may continue to operate even when they are incurring

losses so long as they can pay for variable costs of production. This implies that

firms can operate even below the breakeven point until such a point when they may

be forced to close down. This point of a firm is referred to as Shut down point of a firm.

Shut down point is a point below where the firm only covers variable costs and

below this point, the firm cannot continue operation. At shut down point AR= AVC.

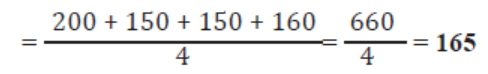

Example

Given that the firm is producing 7500 kg(Q) of maize floor, and selling at price

30Frw per kg, given also that the ATC=50. Calculate the profit of the firm, and interpret what will happen to the firm.

P = 30,

Q = 7500

TR = P x Q

TR = 30x7500 = 22500

Given, ATC = 50

So,

TC = ATC x Q

50 x 7500 = 375000

Profit = TR - TC = 225000 - 375000 = -150000

A firm will be at shutdown point since it will be making loss at AVC point.

As shown in the figure above, In the long run, many firms join the business

because of the abnormal profits in the short run (at point A in the above

figure). As new firms enter the industry, supply of the commodity increases

creating more competition in the market leading to a reduction in the price. In

the end all firms get normal or zero profit at point (B). They are only able to

cover costs of production as shown by the AC curve. Point B is the breakeven

point where the firm earns normal profits and AR=AC.

Other firms will still join the business up to when the firm is not able to cover

all the costs of production but only covers variable costs as shown by the AVC

curve. (Point C in the above figure)

Point C is the shutdown point where the firm only covers variable costs. Below

this point, the firm cannot continue operation.

Example

Fill in the missing cells. Assume the firm operates in a perfectly competitive environment in both, the input and output markets. Calculate the profit (loss) when the firm receives 0.40Frw for the product.

APPLICATION ACTIVITY 1.2.

Equilibrium of a firm is at point where MC = MR and the optimum point is the lowest point of the AC.

i. Using the following below, determine the equilibrium and optimum output.

ii. Illustrate the MR and MC curves of the above firm.

Why firms continue to operate even when it is not covering all the costs.

ACTIVITY 1.4

Make research around. Look for a firm that has not been performing well

in the recent years. It may be a firm loosing market to a competitor or

has run out of resources. Find out the reasons for its poor performance

and why it has not yet closed?

A firm may continue to operate even if total costs of production are not covered because of the following factors:

- Some firms may not want to lose their good customers thus they continue

to operate even when total costs are not covered in order to keep such customers.

- Firms continue to operate because they fear to lose their suppliers of raw materials for their industry.

- Some firms may fear to lose their suppliers of raw materials for their

industry thus they continue to operate even when total costs of production are not covered.

- The firm may be newly established when it is still at its infancy stage

and expects to make profits in the long run thus it accepts to continue to operate even when total costs are not covered.

- Some firms fear to lose their skilled man power which it would have trained

at a high cost, which labour may be necessary in the near future thus they continue to operate.

- Firms may be expecting to get loans the nearby in future from the financial institutions to boost its business.

- Some firms fear to be taken over by the state through nationalization

when they stop operating thus they continue to operate even when the total costs are not covered.

- The firm may be newly established when it is still at its infancy stage

and expects to make profits in the long run thus it accepts to continue to operate even when total costs are not covered.

- The firm may have invested heavily in fixed assets like buildings, machines

and land which it cannot leave idle thus continue to operate when even total costs are not covered.

- Some firms keep operating when they hope to change or restructure management, if it

- believes current losses are due to poor management

- A loss making firm may be a branch of a bigger firm (subsidiary firm)

which is making profits and the losses can be shared by the other firms so as to cover the costs.

- Some firms are not meant to be making profits but to give services like welfare improvement, in case of government organizations.

- Some firms may be set up for research/ experimental purposes so they operate even if they are making losses.

- If a firm had earned abnormal profits before and is still surviving on them.

- Difficulties might be short run and therefore hope to make improvements in the long run.

- Some firms keep operating when they fear to lose their reputation or good name in society.

Under certain conditions, a firm may decide to close business because of;

- Appearance of new and strong firm thus out competed.

- Exhaustion of raw materials.

- Persistent labour unrest or inadequate labour supply.

- Absence of spare parts or failure to get them.

- New government regulations e.g. total ban of production of a given commodity.

- Change in fashion and design hence demand shifts to fashionable goods.

- Lack of raw materials e.g. during war times and economic decline.

1.2.7. Advantages and disadvantages of perfect competition.

Perfect competition has the following advantages:

- Encourages optimum use of resources because factors of production

can freely move from one place to another

- Production of better quality goods because of high levels of competition within the industry

- No wastage of resources because of no advertisement costs incurred. This reduces prices for final commodities.

- There is no consumer exploitation because prices are determined by the forces of demand and supply.

- There is a lot of output because of many suppliers and buyers.

- Producers are able to expand their firms and use modern technology because of the abnormal profits in the short run.

- Eliminates income inequality because in the long run all firms earn normal profits. On the other hand, everyone with capacity if free to join production.

- The plant is used to full capacity in the long run. This is mainly because firms

operate at the least average cost and so there is no resource wastage.

- There is price stability due to homogeneous products and all producers selling at the same price.

Disadvantages or shortcomings of perfect competitive firms:

- No variety of commodities since they are homogeneous; this limits consumers’ choice.

- The existence of perfect knowledge doesn’t motivate firms to incur expenses on research and development.

- Unemployment is likely to occur because of the inefficient firms leaving the production after being outcompeted.

- Consumers have little or no choice because the goods produced are the same.

- There are no abnormal profits in the long run so expansion of the firm is hard.

- Research is difficult because of little of no profits in the long run.

- Firms aim at profit, maximization and this discourages the production of public utilities like water supply which are vital for society but are non-profit making

- Profits are reduced because the seller is supposed to sale at the same price as others.

- Perfect competition cannot exist in reality and so cannot be relied upon for development.

- Sellers cannot carryout price discrimination since demand is perfectly elastic and prices tend to be constant and this limits the profit levels of the firm.

APPLICATION ACTIVITY 1.3

Identify a firm that declined and eventually closed. Make research and find

out the cause of its decline and closure.

1.3. Monopoly

ACTIVITY 1.5

REG is composed of EUCL and EDCL as its subsidiaries.

Write down what you know about EUCL and EDCL.

Why do you think REG is the only firm responsible for handling all electricity issues in the country?

1.3.1. Meaning and characteristics.

Under imperfects there are many market situations including:

- Monopoly.

- Monopolistic competition.

- Oligopoly.

Monopoly is a market situation where there is one producer or supplier of a product, which has no close substitutes and entry into the market is highly restricted.

Examples of monopoly firms include;

- Water and Sanitation Corporation Limited (WASAC)

- Rwanda Energy Group (REG)

- National Bank of Rwanda (BNR)

Extreme forms/ types of monopoly may include;

- Pure /absolute monopoly: This is a market situation where there is single seller or producer of a commodity that has no substitutes at all. In practice, there is no pure monopoly because people can always forge substitutes for that commodity.

- Monopsony: This is market situation where there is only one buyer of a commodity or a factor of production. E.g. one employer.

- Bilateral monopoly: This is a market situation consisting of a single seller and a single buyer of a commodity.

- Imperfect/ simple monopoly: this is a market situation where there is a single firm which produces a commodity that can be substituted to some extent though they are not perfect substitutes.

- Discriminatory monopoly: this is a type of monopoly where the seller has the ability to charge different prices from different customers for basically the same commodity.

- Collective monopoly: this is a market situation where a few firms producing similar products decide to come together so as to determine price and output.

- Natural monopoly: this is a market situation where a firm exclusively owns and controls a source of raw material and it is impossible for other firms to produce similar commodities that require similar raw materials. i.e. such firms become monopolies because other firms cannot enter the industry.

- The market demand for such an industry is only sufficient for one firm to operate at its minimum efficiency.

- Statutory monopoly: this refers to a type of monopoly which is set up by

an act of the parliament to provide a certain economic product/service

and such a service or product cannot be duplicated by firms.

- Spatial/local monopoly: This is a type of monopoly which arises from distance between the producers of a given product. Therefore, this when a firm becomes a monopoly due to the long distance between that firm and others firms.

Characteristics (features/assumptions) of monopoly market conditions.

Under monopoly market conditions,

- There is only one single seller/ producer and many buyers.

- The commodity produced has no close substitutes.

- Entry of new firms in the market is restricted/ highly blocked.

- There is no persuasive advertising instead there is informative advertising where the public is just informed about the existence of the commodity but not being persuaded to purchase it.

- The firm aims at profit maximization.

- Firms are price makers but not price takers. I.e. they can determine the price at which to sale their products

- The demand curve of a monopolist is inelastic because its products have no close substitutes. In other words, a big percentage increase in prices of such products lead to a small percentage reduction in the quantity demanded.

1.3.2. Sources of monopoly power.

- Patent rights: this where a firm/ producer has exclusive knowledge of a given production technique and the law forbids other firms/ producers to deal in the same commodity. e.g. authors, artists, inventors etc. copy rights and patent rights prevent other firms or producers from imitating

the products of others which leads to temporary monopolies.

- Strategic ownership or control of a source of raw materials which makes it impossible for other firms or producers to produce similar product that require similar raw materials. Thus such firms become monopolies because other firms cannot enter the industry leading to natural monopoly.

- Long distance among producers where each producer monopolizes the market in his/her locality. This leads to spatial monopoly.

- Advantages of large-scale production which do not allow small firms to compete successfully with large firms.

- Protectionism: This is where trade barriers are imposed on the product to exclude foreign competitors. In such cases, the home producer may become a monopolist.

- Take over and mergers: Take-over’ is when one firm takes over the assets and organization of another whereas mergers are formed when firms combine their assets and organizations into one to achieve strong market position. Both situations may result into a monopolist firm.

- Collective monopoly or collusive e monopoly: This is where firms come together in a formal or informal agreement (cartel) to achieve monopoly power. Such firms can fix quotas (maximum output each may put on the market). They may also set the price very low with the objective of preventing new entry of other firms. This is called limit pricing.

- Small market: where the market demand is small or limited, a single seller or supplier is most appropriate In other words, a firm becomes a monopoly because the market size is too small to allow more than one firm to operate in it.

- Long-time of training/acquiring skills: where entry into business or rofession is restricted by long-time of training, it means that a person who joins the profession will remain the sole supplier for some time e.g. doctors, judges etc.

- Talent: Individuals with talent tend to develop peculiar products or services hence development of monopoly in marketing of such commodities. E.g. designers, musicians etc.

1.3.3. Equilibrium position and profit maximization under monopoly. The demand curve under monopoly is downward sloping from left to write. It is inelastic because of lack of competition.

Under monopoly:

- The firm produces at excess capacity both in the short run and long run because it must restrict output to charge a high price especially when it a private monopoly that aims at maximising profits. State monopolies created to provide strategic services to the population may optimally utilise their resources to provide more services.

- There is no supply curve under monopoly because the producer bases his production plans on the demand curve which is fixed and known to him/ her.

- There is no difference between a firm and an industry.

- The firm is in equilibrium when the marginal cost curve is equal to the marginal revenue curve. (MC=MR)

The AR and MR curves under monopoly

The AR and MR curves under monopoly are downward sloping from left to right. Marginal revenue curve is below the Average revenue curve because for monopoly firm to increase revenue, it has to lower the price

The equilibrium position under monopoly.

In the short run period, the monopolist behaves like any other firm. It will maximize profits or minimize losses by producing that output for which marginal cost (MC) equals marginal revenue (MR). Whether a profit or loss is made or not depends upon the relation between price and AC. It may be made clear here that a monopolist doesn’t necessarily make profits. The firm may earn super normal profits or normal or even produce at a loss in the short run.

Conditions for the equilibrium of a monopoly firm are that,

The firm under monopoly will still earn abnormal profits because it is the only firm in the production process. The firm will be in equilibrium where the marginal cost curve is equal to marginal revenue curve. (MC=MR). This is shown below:

Conditions:

- The average revenue (AR) must be greater than average cost (AC) i.e.

Average cost curve must be below the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs to the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

At point E, MR =MC and there that is the equilibrium point.

Short-run profit maximisation under monopoly

In the short run period, if the demand for the product is high, a monopolist increases the price and quantity of output. He can increase output by increasing labour, using more raw materials, increasing working hours etc. In case demand falls, he can reduce the use of variable inputs.

A monopolist is a price maker; therefore the firm can set a price which earns profits i.e a price greater than AC.

Conditions for short run normal profits under monopoly:

- The firm is in equilibrium where MC=MR.

- The average revenue (AR) must be equal to average cost (AC)

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis. However, since AC=AR, the price line is the same as the costs line.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Illustration of normal profits under monopoly

The firm is in equilibrium at a point where MC=MR. The price is tangent to the AC. The firm charges OP0 price per unit for units of output 0Q. The firm earns only normal profits and keeps on operating.

Losses under monopoly in the short run

A monopolist can also make losses in the short run, provided the variable costs of the firm are fully covered. The loss minimizing condition in the short run can happen under the following conditions;

Conditions

- The average revenue (AR) must be less than average cost (AC) i.e. Average cost curve must be above the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis. Since AC is greater than AR, the price-output line is extended up to touch the AC curve so as to determine the costs to the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Losses of a firm under monopoly in the short run

As shown in figure above, the firm produces the best short run level of output which is given by point where MC=MR. A monopolist sells output 0Qo at price 0Po. Total revenue of the firm equal to 0P0BQ0 and total cost of producing it is 0C0AQ0. The monopoly firm suffers a net loss equal to the area P0C0AB. The firm in the short run prefers to operate and reduce its losses to P0C0AB only. In the long run, if the loss continues, the firm shall have to close down

Equilibrium position of a firm under monopoly in the long run.

In the long run the firm under monopoly will still earn abnormal profits because it is the only firm in the production process. The firm will be in equilibrium where the long run marginal cost curve is equal to long run marginal revenue curve. (LMC=LMR). This is shown below:

Conditions

- The average revenue (AR) must be greater than average cost (AC) i.e. Average cost curve must be below the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs to the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Illustration of Equilibrium position of a firm under monopoly in the long run.

In the figure above, the firm is in equilibrium at point “E” where it produces output 0Qe at Total cost 0C0NQe and sells it at price 0P0 getting Total revenue 0P0MQe hence getting abnormal profits C0P0MN.

Profits = TR-TC. I.e. 0P0MQe - 0C0NQe = C0P0MN.

The firm under monopoly, in the long run, still operates at excess capacity since

its equilibrium output (0Qe) is less than optimum output (0Qo).

1.3.4. Advantages, disadvantages and control of monopoly.

ACTIVITY 1.6.

Discuss the view that monopoly market is better than a perfectly competitive market.

1.3.4.1. Advantages of monopoly.

Monopoly has the following advantages.

- There is no duplication of services and this saves resources e.g. if there is one energy firm providing power, there may not be the need to set up another one in the same area

- Economies of scale can be enjoyed by the firm because it is capable of expanding using the abnormal profits earned.

- There is a possibility of price discrimination. (Parallel pricing). This refers to the selling of the same commodity at different prices to different customers which benefits the low-income earners.

- Research can easily be carried out using the abnormal profits which in turn leads to an increase in the quality and quantity of goods produced.

- There is no wastage of resources in persuasive advertising which may increase leads the prices.

- Public utilities like roads, telephones, etc, are easily controlled by the government as a monopolist

- Infant industries can grow up when they are monopolies and are protected from foreign competition.

- It encourages innovations by protecting copyright and patent owners.

1.3.4.2. Disadvantages of monopoly

- Because there is no competition, the firm can become inefficient and

produce low quality products.

- Monopoly firms produce at excess capacity i.e. they under utilize their

plants so as to produce less output and sell at a high price.

- Monopoly firms may charge higher price than firms in perfect competition.

- In case a monopolist stops operating, there would be shortage of the commodity.

- Monopoly firms tend to exert pressure on the government and sometimes they can influence decision making because they are the controllers of production.

- Discrimination of consumers. This may be based on political or religious affiliation other than the factors respected by economics

- Leads to income inequality. The monopolies who over charge earn more compared to others

- Restriction of choices. A monopolist normally produces one type of commodity thus consumers are denied a chance to choose among alternatives

1.3.4.3. Measures to control monopoly

Because of the above disadvantages of monopolies, the following methods can be used to control their activities.

- The government can fix prices of commodities through price legislation.

- Anti-monopoly (antitrust) Legislation i.e. laws imposed to control monopolies. Such laws can prohibit monopolization, and collusion among firms to raise prices or inhibit competition.

- Nationalization of monopoly firms by the government so as to lower the prices.

- Subsidization of new firms. This can help them to compete with the already established firms favorably.

- Resale price maintenance where by the producers set prices at which sellers should sale the goods to avoid charging high prices

- Encouraging imports to compete with the commodities of monopoly firms in the country.

- Setting up government owned firms to compete with the monopoly firms.

- Removal of deliberate monopoly bases like protectionism and taxation to encourage competition among the firms.

- Taxation. The government can impose taxes to reduce the profits of the monopolists. Such taxes may include:

1. Surtax. This refers to the tax charged on producers or people who earn more than a particular large amount. This helps to reduce on the profit levels of a monopoly firm which reduces monopoly power.

2. Advalerem tax. This is a tax levied on the value of the commodity

3. Specific tax. This is a tax charged per unit of output and will therefore vary as output varies. It will increase the cost of production of additional unit (MC) and AC of every unit.

4. Lump sum tax. This is a tax charged especially on monopolists regardless to their level of outputs or any circumstance.

1.3.5. Price discrimination

ACTIVITY 1.7

Mutamuliza is an entrepreneur operating a number of enterprises in Gatsibo district. She runs a poultry firm where she produces eggs for sale. When traders from Kigali come, she sells to them at 5000rwf a tray while those from Gatsibo she charges them 3000rwf per tray.

She also produces pineapples and sells each at 1000rwf. But when Students from a nearby secondary school come to buy, she sells to them at 500rwf each. Some times during bumper harvest she exports some to Tanzania and sells each at 700rwf in Tanzania markets.

a. In your opinion, why do you think i. She charges Kigali traders more than what she does to those from Gatsibo for a tray of eggs?

ii. She sells pineapples to students at a lower price than others?

iii. She sells pineapples in Tanzanian markets at lower prices than what she charges in domestic markets?

1.3.5.1. Meaning

It is where the producer sells a commodity to different customers at different prices irrespective of the costs of production. It can also be referred to as parallel pricing. Price discrimination takes place at the following degrees of price discrimination,

Price discrimination occurs in the following degrees:

- First degree discrimination where a producer is able to charge each customer the maximum price he/ she is prepared to pay for the good or service depending on consumers’ demand.

- Second degree of price discrimination where a firm sells off excess output or supply that could be remaining at a lower price than normal price.

- Third degree price discrimination where the producer sells / separates markets according to elasticity of demand and charge a high price where there is inelastic demand and a low price where there is elastic demand.

1.3.5.2. Forms of price discrimination.

- Discrimination according to personal income. For example, income differentiation among buyers, e.g. doctors charging low prices on the poor and high prices on the rich for the same services.

- Discrimination according to age: e.g. charging low prices on the young people than old people on tickets to watch football or for a film show.

- Discrimination according to sex: where different prices are charged to females and males e.g. for discotheques where for ladies’ nights, ladies enter for free and males are made to pay.

- Discrimination according to geographical e.g. dumping where commodities are sold cheaply in other countries compared to prices in the home country.

- Discrimination according to the time of service e.g. tickets for video shows charged high prices in afternoons when there are many people than in morning hours when there are few people.

- Discrimination according to nature of the product e.g. a soft cover book may be cheaper than a hard cover book.

- Discrimination according to the number of uses of the product e.g. electricity used for industrial purposes is cheaper to electricity for domestic use.

- Discrimination by differentiation of commodities e.g. high prices on travellers in first class in the train and low charges of other classes like the economy class.

1.3.5.3. Conditions for Price Discrimination to be successful.

- The commodity must be sold by a Monopolist so that even when the price is increased, the buyer has nowhere else to go

- Elasticity of demand should be different in different markets. A higher price should be charged in the market where elasticity of demand is low than where elasticity of demand is high.

- The cost of dividing the markets should be very low e.g. in case of dumping costs of transport should be low.

- Buyers should not know how much is charged on others. This is possible especially where goods are sold on orders with no advertising.

- It should be impossible for buyers to transfer the commodity from where the price is low to where the price is high. This is possible especially with services of doctors, teachers, etc.

1.3.5.4 Advantages and disadvantages of price discrimination.

ACTIVITY 1.8

Discuss the view that customers with different income status should be charged different prices for the same commodities.

Advantages of price discrimination

- It enables the poor to get essential services at low prices e.g. cheap houses to civil servants and doctors charging low prices on poor patients.

- To the sellers, it increases total revenue because output sold increases.

- It is one way in which the rich subsidize the poor thus a method of income distribution. The rich are charged highly on commodities while the poor are subsidized on the same commodities

- It increases sales and consumption e.g. for air time, the first units, may be charged higher price than other extra units. Therefore, the more units of air time you use, the less the charges you pay for any extra units.

- It helps producers to dispose-off surplus and poorly manufactured commodities e.g. dumping.

- Increased efficiency. The increased profits from the higher charges make the firms efficient and such profits are reinvested

Disadvantages of price Discrimination

- It may encourage consumption of some commodities in undesirable excessive amounts. For example, when children are charged less for entrance in film halls, they may spend more time watching films than on studies or leisure.

- It can lead to low quantity of products/services for example in some airlines, travellers in the economy class (where fares are lower) are sometimes not well treated like those in the first class (where fares are higher) by airline staff.

- Discrimination in form of dumping discourages local industries.

- It increases monopoly powers of firms by limiting entrance of other firms

in the market. One firm serves all categories of customers irrespective of

their incomes, ages or sex cause consumers’ exploitation.

- Poor quality output normally arises; such output is sold to the less privileged who yearn for the less prices

- Misallocation of resources. Price discrimination may bring about divergence of resources from their socially optimal uses to produce for those who can reward highly because producers aim at profit maximisation.

APPLICATION ACTIVITY 1.4

The table below shows electricity tariffs from REG. Analyse the tariffs

and answer the questions that follow

Tariffs for non-industrial customers.

a. In your own view, why do you think

i. REG charges low tariffs for residential customers using below

15 kWh and higher tariff for those using 50 and above kWh?

ii. Water treatment plants are charged lower tariffs than telecom towers.

b. How is the above system of charging different tariffs by REG helpful to

i. REG.

ii. The customers

1.4. Monopolistic competition

1.4.1. Meaning and characteristics.

ACTIVITY 1.9.

Identify the 3 star and 4 star hotels in Rwanda. Make research on them in terms of

i. Their number.

ii. The means they use to compete against each other.

iii. Their services and their quality.

iv. Their prices.

Make class presentations on your discoveries.

Monopolistic competition market structure has characteristics similar to that of perfect competition except that the commodity dealt with in monopolistic competition is not homogeneous. It is a market structure in which a large number of firms sell differentiated products that are close substitutes.

Because of product differentiation, the seller has some control over the market price thus the firm is a price maker. Examples of monopolistic firms include:

- Soap industry.

- Bread industry

- Hotel industry

- Hair salons

- Restaurants etc.

Characteristics of firms under monopolistic competition

There are many firms in the industry.

- Firms deal in differentiated products though they remain close substitutes.

- There is freedom of entry and exit of new firms into and out of the industry.

- There is stiff competition due to production of close substitutes.

- There is a lot of intensive persuasive and informative advertising.

- The firms exercise a lot of non-price competition due to the stiff competition.

- There is production at excess capacity.ie production less than the required

output so as to charge at a high price.

- The firms in the industry are large but none of them dominates the market.

- The major aim is to maximize profits and this done at a point where marginal revenue is equal to marginal cost (MR=MC)

- There exists brand loyalty/ fidelity ie consumers exercise a lot of loyalty/fidelity by sticking on a particular commodity believing that a particular brand is superior.

- The demand curve is fairly elastic in nature because of the presence of many substitutes. When a firm makes a small increase in the price of the commodity, there is big reduction in quantity demanded because of the existence of many other firms in the market.

- The AR curve is greater than the MR curve, i.e. the MR curve is below the AR curve because the firm gets marginal revenue when it sells extra units of the commodity at the low price than the previous one.

1.4.2. Short run and long run profit maximisation under monopolistic competition.

1.4.2.1. The demand curve, AR and MR curve under monopolistic competition.

The demand curve under monopolistic competition is elastic because of competition. MR is below the AR

Equilibrium position of a firm under monopolistic competition

The firm under monopolistic competition is in equilibrium when the MC=MR and in the short run the firm will either make abnormal profits or losses. The supernormal profits will exist in the short-run because new firms cannot enter the industry. In the short run, the firms may attempt to maximize their profits by changing the quality and the nature of the product and by increasing advertisement expenditure.

Point E in the figure above shows the equilibrium point where MC=MR

1.4.2.2: Price and output determination of a firm under monopolistic competition in the short run.

Price and output determination of a firm under monopolistic competition in the short run.

To determine price and output under monopolistic competition, we need to first determine equilibrium where profits are maximized. Thus, unit cost curves are super imposed on the unit revenue curves to determine where MC=MR (equilibrium point). From there, a perpendicular line is dropped to the horizontal axis to determine output and to the vertical axis, another line is dropped to determine price.

A firm under monopolistic competition in the short run the firm can either make abnormal profits or losses. Abnormal Profits are made as seen below

Conditions

- The average revenue (AR) must be greater than average cost (AC) i.e. Average cost curve must be below the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Abnormal profits of a firm under monopolistic competition in the short run.

Output: The output that the firm produces is determined at the equilibrium point

(point E) where MC=MR at the biggest level of output. Thus output 0qo is the equilibrium output.

Cost: The average cost of producing each unit of output 0qo is determined at a point where the output line meets the AC curve (Point B). Thus 0co is the average cost of producing each unit of output 0qo.

Price: The price at which the firm sells its output is determined at a point where the output line meets the AR (Point A). Thus price 0po is the equilibrium price.

Profit: Along the equilibrium, AR is greater than AC and therefore the firm earns Abnormal profits in the short run represented by area C0P0AB.

NOTE: Firms under monopolistic competition produce at excess capacity/below their optimum point (point X) i.e equilibrium output oq0 is less than optimum output oq1

1.4.2.3. Losses under monopolistic competition in the Short run.

- The firm can also make losses. This is shown below.

Conditions

- The average revenue (AR) must be less than average cost (AC). I.e. The AC curve is higher above the AR curve.

- The average revenue curve determines the price while the Average cos curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis. Since AC is greater than AR curve, the price-output line is extended up to touch the AC curve so as to determine the costs to the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Losses of a firm under monopolistic competition in the short run

From the figure above, the firm produces output 0Q0 at cost 0C0 and sells it at lower price 0P0 getting total revenue 0P0BQ0. Hence the firm makes losses P0C0AB because total cost (AC) is greater than Total revenue (AR)

1.4.2.4. Equilibrium of the firm under monopolistic competition in the long run

Due to the supernormal profits in the short run, new firms join the industry with new brands, output increases, product differentiation increases, consumer choice widens and the firms reduce the level of their output since the market has remained the same.

The firms that were previously incurring losses leave the industry. Therefore, the demand curve would keep on shifting to the left until a point is reached where the demand curve is tangent to the long run average cost curve (LAC).

Equilibrium is attained at point where long run marginal cost curve (LMC) is equal to long run marginal revenue (LMR).

Conditions

- The average revenue (AR) must be equal to average cost (AC). I.e. The AC curve is tangential to the AR curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis. Since AC is equal to AR curve, the price line is the same as the AC curve.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Normal profits of a firm under monopolistic competition in the long run:

Output: The output that the firm produces is determined at the equilibrium point (point E) where MC=MR at the biggest level of output. Thus output 0qo is the equilibrium output.

Cost: The average cost of producing each unit of output 0qo is determined at a point where the output line meets the AC curve. Thus 0co is the average cost of producing each unit of output 0qo.

Price: The price at which the firm sells its output is determined at a point where the output line meets the AR. Thus price 0po is the equilibrium price.

Profit: Along the equilibrium, AR is equal to AC and therefore the firm earns Normal profits in the long run. The firm is operating at excess capacity since equilibrium output (0Q0) is less than optimum output 0Q1.

1.4.3. Advantages and disadvantages of monopolistic competition.

ACTIVITY 1.10

Discuss the view that monopolistic competitive market conditions are suitable for the Rwandan economy.

Advantages of monopolistic competition

- Product differentiation enables consumers to get a variety of products to choose from.

- Due to existence of many sellers in the market as a result of free entry of new firms, there are high quantities in the market. This makes prices lower than monopoly.

- Due to high level of competition, firms produce better quality output which improves people’s welfare.

- In case one firm collapses, substitutes are available for the consumers.

- Consumers buy at a lower price because of the presence of close substitutes which makes it difficult for sellers to charge very high prices.

- The freedom of entry gives a chance to any willing entrepreneur to enter the industry which creates employment opportunities in the country.

- Individual firms gain a lot of popularity due to specialization in their own brands.

- In the short run abnormal profits earned are used to improve on the quality of products, undertake research and expand the size of the firm.

- Disadvantages of monopolistic competition

- Advertising may mislead the public into paying higher price for the commodity when there is no improvement on the quality of the product.

- Firms produce at excess capacity in the short run and long run as they operate at less than optimum. Thus there is resource under utilisation.

- In the long run, there is no profit to make improvements because the firm earns normal profits. So it may not expand to enjoy economies of scale.

- The wide variety of commodities in the market often confuses consumers who may not make right choices in the end.

- The price charged on buyers is higher than in perfect competition which reduces consumers’ welfare.

- In the long run, there are no profits to invest in research since the firm earns normal (zero) profits.

- To maintain the market share, the seller has to persuasively advertise and this may increase costs and the price.

- There are limited employment opportunities as firms operate at excess capacity

- The output produced is less than that in perfect competition

1.4.4. Product differentiation under monopolistic competition

Product differentiation is a situation where a firm is in position to make its products appear different from other products of other firms. It may take the following forms; Packaging. Design/shape. Branding. Colour. Scent. Labelling, Salesmanship. Size. Quality, Advertising, Blending, Giving credit etc.

It is intended to win market for a firm by trying to make its commodities superior than those of rival firms. Therefore, there is need for persuasive advertising in monopolistic competition.

APPLICATION ACTIVITY 1.5

List down the mineral water producing firms you know.

i. Which one do you think takes the largest market share? Why?

ii. Which methods has it used to out-compete others?

iii. Are their products different? If yes, what makes them different?

1.5. Oligopoly

1.5.1. Meaning and features of oligopoly.

ACTIVITY 1.11

Identify the petroleum companies operating in Rwanda.

i. How many are they?

ii. Which one do you like and why?

iii. Is the petrol they sell different?

iv. Do they sell their products at the same price?

v. Are the lubricant oils they sell the same?

vi. What means do they use to compete against each other?

It is a market structure that is dominated by few, unequal and interdependent firms producing either a homogeneous product or a differentiated product.

a. Forms of oligopoly:

1. Perfect oligopoly occurs where there are few, unequal and interdependent firms in the industry producing a homogeneous product for instance Petroleum firms in the sale of petrol.

2. Imperfect oligopoly occurs when there are few, unequal and interdependent firms in the industry producing differentiated products for instance soft drinks firms.

3. Duopoly. This is an extreme form of oligopoly where there are only two firms in the market. For example in the telecommunication industry in Rwanda where Airtel and MTN are the only companies.

4. Duopsony. This is a form of oligopoly where there are two buyers in the market.

5. Oligopsony. This is a form of oligopoly where there are a few buyers in the market.

Examples of firms under oligopoly are;

- Mobile telephone companies: like MTN, Airtel.

- Petroleum companies like Kobil, SP, Mount Meru, Hass etc.

- Soft drink companies like Bralirwa Ltd, Azam Bakhresa Group etc.

- Newspaper firms. TAALIFA RWANDA, DOVE MAGAZINE LIMITED, Igihe Ltd., Rwanda Printing and publishing company, Nonaha Ltd, Inyarwanda Ltd, The Kigali Today group, Mucuruzi Online Market, Muhabura Ltd, The

New Times Publications, Umuseke Ltd, Digital Focus Limited.

b. Features/ characteristics of oligopoly.

Oligopoly markets have the following main features.

- There are few, unequal, competing firms. Each firm, though faced with competition from other firms, has enough market power and therefore cannot be a price taker.

- There is non-price competition such as advertising, quality of services etc. if one firm reduces the price, others would do the same and all firms would end up losing.

- There is interdependence among firms. Each firm is concerned with the activities of other firms so as to act accordingly, e.g. it can reduce the price when others reduce the price.

- In most cases there is product differentiation where firms produce similar products but each firm makes its product appear different from other firms’ products by using different colours, size, shape, labeling, quality etc.

- Presence of monopoly power. There are very few oligopoly firms and this makes it easy for collusion as a form of price determination leading to monopoly.

- Uncertainty. There is a lot of uncertainty in oligopoly industry, as one firm takes a decision say to increase the price, it cannot be certain of the reaction of other firms

- There is limited entry into the production process because most oligopoly firms operate at large scale, therefore this requires a lot of capital which others firms may not have.

- There is price rigidity. I e prices tend to be stable for a long period of time.

- There are price wars i.e. when one firm reduces the price other firms reduce theirs even lower.

- The demand curve under oligopoly is kinked. i.e. a curve that has a bend (kink) and it is elastic above the kink and inelastic below the kink.

c. The demand curve of an oligopoly firm

The demand curve is kinked because the demand for their products largely depends on the behaviors of other rival firms. This brings in uncertainties in the industry because no single firm can predict reaction of another firm in case they take their own decision. The kinked demand curve is elastic above the kink and inelastic below it.

It is drawn on the assumption that there is an administered price, asymmetry in the behavior of oligopoly firms such that if one firm reduces its price, other firms will reduce their prices even further and if one raises its price others will not follow. Therefore, above the administered price, demand is fairly elastic while below the administered price demand is fairly inelastic. That is why demand curve has two parts joined together at the administered price (at the kink) i.e. one fairly elastic and another fairly inelastic. This is shown below

Illustration of the demand curve of an oligopoly firm:

From the curve above, P is the market price or administered price. Should any firm increase its price above that price, it would lose its customers to other firms. If a firm decides to set price below P, other firms will react by reducing their price even further or lower to win more customers hence increase in quantity sold will be lower than the reduction in price. Hence the demand curve

has a kink (at point E) meaning that the prices will remain rigid/ stable for a long period of time.

d. The MR curve under oligopoly

The MR curve will also have a kink with 3 parts. It will be fairly elastic before the kink and inelastic after the kink. Below the kink, MR curve is discontinuous and straight indicating that MR is falling although the price is constant. When the price remains rigid for a long time, there will be other changes in the market that may lead to changes in costs of production.

MR curve under oligopoly

The figure above shows the MR curve which has three parts i.e. a part which is fairly elastic when AR is fairly elastic (before the kink),, a part that is vertical at the kink and a part that is fairly inelastic when AR is fairly inelastic (after the kink)..

e. Equilibrium position under oligopoly

The equilibrium under oligopoly occurs at a point where MR = MC. The MC cuts the MR in the vertical section of the MR. the position of the MC does not affect the equilibrium output as long as the MC passes through the vertical section of MR as illustrated below.

From the above figure, equilibrium is at any point between the vertical part of MR curve “R” to “Z”. The position of MC in the vertical MR doesn’t affect the equilibrium. At any point on this part of MR, MC=MR and there is equilibrium.

1.5.2: Profit maximization abnormal profits under oligopoly

A firm under oligopoly both in the short run and long run markets abnormal profits.

Conditions

Abnormal Profits are made in the following conditions as seen below:

- The average revenue (AR) must be greater than average cost (AC) i.e. Average cost curve must be below the Average revenue curve.

- The average revenue curve determines the price while the Average cost curve determines the cost of the firm.

- Where AC curve meets the price-output line, we determine costs from the vertical axis.

- Marginal cost curve cuts the Average cost curve at the lowest point to mark the optimum point of the firm.

Illustration of profit maximisation by an oligopoly firm.

Output: The output that the firm produces is determined at the equilibrium

point (at point E), where MC=MR at the biggest level of output. Thus output

0qo is the equilibrium output.

Cost: The average cost of producing each unit of output 0qo is determined at a point where the output line meets the AC curve. Thus 0co is the average cost of producing each unit of output 0Qo.

Price: The price at which the firm sells its output is determined at a point where the output line meets the AR. Thus price 0po is the equilibrium price.

Profit: Along the equilibrium, AR is greater than AC and therefore the firm earns Abnormal profits in the short run and the long run shown by C0P0AB in the above figure.

1.5.3. Advantages and disadvantages of oligopoly

ACTIVITY 1.12

Discuss the view that oligopoly market is better than a monopolistic market.

Advantages of oligopoly.

- Stable prices are charged due to presence of price rigidity.

- The high level of competition leads to better quality commodities.

- There are low prices to the consumers due to existence of intensive competition and fear of other firm’s reaction.

- Eases consumer budgeting due to due to price stability.

- Most oligopoly firms operate on large scale which enables the firm to enjoy economies of scale. This together with stiff competition reduces price in the market.

- Widens consumer choice due to production of a variety especially with imperfect oligopoly due to branding and product differentiation.

- Increase innovation and inventions in the economy due to competition and use on non-price competition measures to win market share.

- Provision of gifts by different competitive firms to customers improves people’s welfare.

- There is increased output due to production on large scale.

- Consumer awareness of the commodity is high due to extensive advertising.

- A lot of abnormal profits earned are spent on research and development which leads to technological advancement and a high standard of living in the country.

- Branding and product differentiation gives the consumer a wide variety of commodities to choose from.

Demerits of oligopoly firms:

- Consumers are denied a variety to choose from in case of perfect oligopoly.

- Consumer exploitation through over charging due to collusion.

- Profits are limited due to price rigidity and this may affect further expansion.

- There is a lot of duplication of commodities due to stiff competition hence wastage of resources and losses.

- Collapse of small firms when they are out competed due to stiff competition leading to unemployment.

- There is under exploitation of resources due to production at excess capacity which reduces the chances of firms to enjoy economies of scale.

- Industries with large firms exert pressure on government due to their large capital base and large market share.

- Distorts consumer choices due to excessive advertisements thus may end up consuming unwanted commodities.

- Worsens income inequality due to limited entry of other firms.

- Some firms at times engage in price wars where each firm keeps on reducing on prices of its products to outcompete rival firms which results into losses

- Firms incur high costs on advertising which increases on the price of the commodity.

- The market structure is characterized by uncertainties about the reactions and activities of other firms which limit the ability of an individual firm to make independent decision.

- Due to limited entry of firms, there may be lack of competition leading to inefficient and poor-quality products

1.5.4. Non price competition under oligopoly.

ACTIVITY 1.13

Identify the means used by the two firms below to attract more customers

Non price competition refers to the situation where firms in the industry compete using other means other than price. The price is kept constant but firms use other means of attracting customers. This can be done through,

- Persuasive advertisement using various media like radios, television, newspapers etc. to make people aware of the commodity and attracted to it

- Branding and blending i.e. use of appealing brand names like Rwanda tea……

- Offering credit facilities to customers to encourage them keep buying

- Offering gifts and free samples to encourage them buy more like petrol stations giving soap to customers

- Opening many branches in different locations in the country

- Offering after sales services like free transport to customer’s premises, guaranteeing spare parts all which attract customers to the firm involved

- Sponsoring social events like sports and music thus winning market etc.

- Organizing promotions through raffle draws which are intended to increase the number of customers who are attracted to buy the commodity in order to join the draw.

- Organizing trade fairs and exhibitions to make their products known to customers.

- Offering mobile shops. This is where the firm puts its products in a vehicle/ bicycle and moves from place to another selling its products e.g. bread firms

- Renovation of premises of customers by rival firms e.g. telecommunication networks (MTN, Airtel), beer firms (primus, Skol)

- Use of stop shopping centres at fuelling stations

- Use of differentiated attractive packaging and convenient designs of products by firms to outcompete each other.

- Quality improvement and introduction of new variables in order to increase their market share.

- Use of appealing slogans which attract commodities customers to their products e.g. MTN- everywhere you go, Airtel- express yourself, Coca- Cola- taste the feeling etc.

- Free distribution of samples and large purchases to customers’ premises.

1.5.5. Advantages and disadvantages of non-price competition.

Advantages.

1. It ensures quality products on the market. If consumers must choose between two products of the same price but they can see that one is of a higher quality, they generally pick the product of higher quality.

2. It increases total sales. Consumers may even pay more for goods perceived as higher quality with similar outward features. For instance Apple, makers of iPhones, and producers of organic food benefit from this phenomenon.

3. It encourages producers to reduce costs through innovations. If a firm can figure out how to produce an item at a cost comparable to what its competitor incurs, it widens its profit margins.

4. Perception and branding creates market for the commodity. A number of producers compete by manufacturing a perception of high quality with their brands. This allows some companies to charge higher prices for seemingly identical products because consumers see value in the brand itself.

5. Competition by product differentiation helps to widen market. By offering a range of similar products geared toward different market sectors firms can expand their market base.

Disadvantages of non-price competition

1. Competing by improving quality requires more time and resources. The problem with this approach is that it may take some time for consumers to realize any difference in quality.

2. It may be difficult to compete through maintaining brand loyalty. Long-term sustainability of a brand name may be difficult because, as such brand advantages arise through consumer trends, consumer trends may also lead to their demise. For instance, if consumers no longer see a clothing brand as fashionable, the market share may reduce.

3. Competing through product differentiation can result in significantly higher overhead costs for production.

APPLICATION ACTIVITY 1.6

Fill the table below with a summary of the difference and similarities between the following market structures.

END UNIT ASSESSMENT

1. With the help of illustrations, explain how profits are maximized under monopolistic competition in the

i. Short run.

ii. Long run.

2. Examine the differences between perfect competition and oligopoly.

3. Describe the factors that may make a firm to continue in operation though it is operating below the breakeven point.

UNIT 2 MEASURING NATIONAL INCOME

Key unit Competency: Analyse the importance of measuring national income in an economy.

INTRODUCTORY ACTIVITY

Case study of Murwanashyaka

Murwanashyaka is a resident in Nyamasheke and practices farming (crop

production, cattle rearing and poultry farming), fishing and has small

boutique in a nearby trading centre. He wakes up in the morning together

with his wife Kantengwa, milks the cow as the wife is collecting eggs from

the poultry farm. When they finish, they keep both milk and eggs and then

the wife goes to the garden and Murwanashyaka goes to the Lake for fishing.

In the afternoon they take all their products to the market to get money that