UNIT 6: FINANCIAL INSTITUTIONS

[

Key unit competence: To be able to choose suitable financial institutions for

business transactions.

Introductory activity

Today, people with full time jobs or part time jobs who use debit cards,

credit cards are most likely to have a close relationship with financial

institutions. Basing on the knowledge and the community you live in,

a) Identify any financial institutions known to you.

b) Do you think those financial institutions are important in managing localbusinesses? Support your answer.

6.1. Meaning of financial institutions

Activity 6.1

i) Read the case study and answer the questions that follow;

Keza started up a project of making paper bags at school having seen that

a lot of paper was trashed and littered around the school compound. She

sold these paper bags to the neighboring shops. She got a lot of money

and felt insecure to keep it in the dormitory, so she thought of opening

an account in the nearby bank. She also thought of saving the money in

the bank so that it accumulates interest and also in the long run acquire a

loan and expand her business by making flower vases, artefacts.

a) Do you think Keza took a wise decision? Why?

b) If it were you, what would you do to feel secure with the money

while at school and why?

c) How would you define financial institutions?ii) Differentiate banking from non-banking financial institutions.

Financial institutions are institutions that deal in providing financial services

to their clients. They offer both short- and long-term finance to entrepreneurs

for their business operations. Financial institutions include; Central bank,

commercial banks, microfinance institutions, merchant banks, development

banks, Savings and Credit Societies and insurance companies etc.

Financial institutions provide a variety of financial services to the public which

include deposits and withdraw services, loan services and financial advice toentrepreneurs among others.

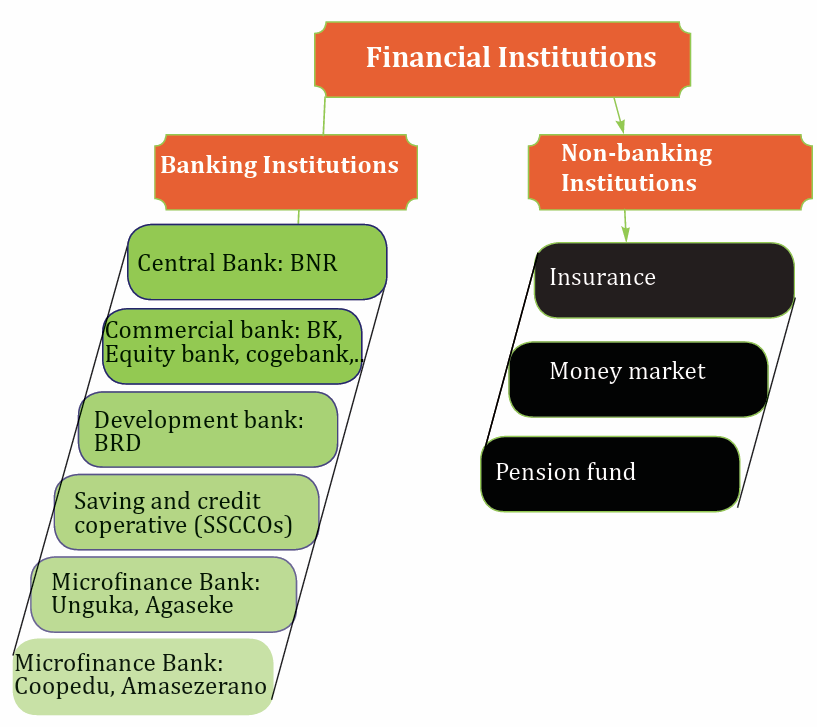

Types of financial institutions

a) Banking financial institutions are financial institutions that are authorized

to receive deposits and create credit. These banking institutions include:

1. Central bank,

2. Commercial Banks

3. Other Banks:

• Development Banks

• Savings and Credit cooperatives (SACCOs)• Micro finance institutions and Microfinance banks. etc

b) Non- banking financial institutions these are institutions that accept

deposits but don’t create credit and offer other bank related services such as

investment and risk pooling.

Examples include:

-Insurance companies

-Building societies

-Pension funds-Capital markets

Application Activity 6.1

Imagine you are to start up a business in your community.

a) Which type of financial institution will you work with closely and why?

b) Why would you insure your business?

6.2. Factors for selecting suitable financial institutions to deal with

Activity 6.2

Analyse the factors that would be considered to choose a suitable

financial institution to work with.

There are several factors considered while selecting suitable financial

institutions which include the following:

i. Interest rate: In case of borrowing money from the banks. Entrepreneurs will

opt for banks with lower interest rate and when it comes to entrepreneurs

saving their money in banks, they will prefer a relatively higher interest rate.

ii. Proximity: Most people will prefer banks that can easily be accessed. This

means institutions that have many branches.

iii. Customer care: Financial institutions which provide good customer care

are normally liked than those without.

iv. Payback period: Refers to the time taken to recover the initial investment.

Financial institutions that give a long pay back period are normally considered

preferable than those that give short payback period.

v. Terms and Conditions of issued loans: Financial institutions that provide

soft loans are chosen faster than those that give hard loans. Soft loans are

loans with low interest rate or not at all.

Vi. Legal procedures: The financial institutions that have licenses to operate

and are recognized by the central bank are always preferred.

vii. Time of operation: It is better to deal with a well-established financial

institution than a newly established one. In other words, it is better to deal

with those that have been in operation for a longer period than new ones.

viii. Collateral Security required: Banks which don’t require a lot of collateralsecurity are always considered by most people.

Application Activity 6.2

Role play on the factors for choosing a suitable financial institution to

deal with.

Visit a nearby financial institution to identify services offered by thatinstitution

6.3. Services offered by financial institutions

Activity 6.3

Examine the services offered by:

a) Commercial banks

b) Central bank

c) Insurance companies

Various services offered by financial institutions:

Central Bank (National Bank) Eg: BNR- National Bank of Rwanda

• Issuing of currency: The National Bank is the only bank that is authorized

to issue and renew the old notes and coins of a given country.

• It is a banker to all other commercial banks.

• It stabilizes the country’s currency in circulation by using various

monetary policies.

• It acts as an advisor to the government on issues regarding the economic

situations like how to control inflation, etc

• It acts as a lender of last resort to commercial banks.

• It manages the government debts that is both internal and external

debts.

• It licenses, controls and supervises all the banking activities of

commercial nature.

• It’s a banker to international institutions working in the country e.g.

FAO, Red Cross, WHO, UNICEF etc.

Y2_Entrepreneuship_SB.indd 91 22/07/2020 04:44:43

Commercial Banks ( Eg: BK, Equity Bank, KCB, I&M Bank, etc)

• They accept customer’s deposits.

• They also advance short and long term-loans to the public in order to

generate interest as profit.

• They facilitate easy transfer of money nationally and internationally

and from one account to another.

• They facilitate international trade through offering or selling travelers

cheques.

• They provide foreign exchange services where one can easily exchange

one currency to other currencies.

• They provide overdrafts to clients that is, where one can withdraw

money which is in excess of his / her bank account balance. .

• Most commercial Banks provide financial training.

• They provide a variety of accounts to the public to be used when

depositing or withdrawing their money each with varying benefits

such as savings accounts, fixed deposit accounts, current accounts etc.

• They act as referees or trustees where one can trust them to safeguard

valuable items like land titles, car log books, Wills and other valuable

items.

• They act as agents of stock exchange. They buy/sell shares of different

limited companies on behalf of their clients.

• They provide foreign exchange to the customers operating foreign

exchange accounts e.g. dollar accounts.

• They also protect business properties.

Insurance companies (Non Banking Financial institutions)

An insurance company refers to a business that provides coverage, in the form

of compensation resulting from loss, damage, injury, treatment or hardship in

exchange for premium payments. The company calculates the risk of occurrence

then determines the cost to replace (pay for) the loss to determine the premium

amount. Eg: RADIANT, CORAR, SAHAM, UAP, BRITAM, etc

The following services are offered by insurance companies:

• Business Insurance,

• Professional Indemnity,

• Property Insurance. ...

• Motor Insurance,

• Home & Contents Insurance,

• Cyber Insurance, etc

Application Activity

a) Carryout research on any two financial institutions that are near your

school and evaluate the services they offer.

b) Select an appropriate financial institution to deal with in your school

business club. Give reasons to justify.

6.4. Role of financial institutions in social economic development

Activity 6.4

Describe the role of financial institutions in social economic development

Financial institutions play an indispensable role in the overall development of

a country. They include the following;

a. Financial institutions play a key role in creating employment in an

economy. Many people are employed in different financial institutions thus

improving their wellbeing.

b. They help to control inflation in the country by use of the monetary policy

tools.

c. They provide loans to the public which are used to start-up businesses

hence improving their standards of living.

d. They offer a safe custody for the public finances thus reducing cases of

theft.

e. Financial markets help in boosting economic growth. They encourage

people to save by buying shares and bonds and then use it to invest in large

projects and industries.

f. Financial institutions do offer loans to businesses at substantial interest

rates. This helps businesses to increase their production and distribution

activities.

g. They promote foreign exchange markets through supporting entrepreneurs

in exporting and importing goods and services. Businesses can receive and

transfer funds in other currencies.

h. Economic growth depends on the growth of infrastructural facilities of the

country. These infrastructures require a lot of funds which are funded by

these financial institutions.

i. They also help to facilitate domestic and international trade.

j. They help to balance economic growth since all the different sectors in an

economy rely on financial institutions. The primary, secondary and tertiary

sector industries all need sufficient funds from these institutions.

k. They help to attract foreign capital through the capital market authority.

Foreign companies can buy shares, stocks in another country. Such as KCB,

IM bank, equity bank among others.

l. Financial systems of different countries can promote economic integration.

This is when common economic policies, such as common employment

laws, commercial laws are applied. For example, the East African

Community (EAC).

m. They also help in the development of new technology to be used. For

instance, computers and other new technologies to be used in recording

information.

In general, financial institutions play a key role in social economic development

of any economy and no economy can run successfully without a sound financialsystem.

Application Activity 6.3

Write an essay on the following statement: “Financial institutions arethe key engine to the development of the country”

Skills lab 6

a) As future entrepreneurs, discuss the financial needs you have in your

school business club.

b) Research on the internet and through resource persons in your

community for the terms and services offered by other financial

institutions as much as savings and credit cooperatives are concerned.

Then, compare with those discussed in this book and choose the one

that is more appropriate to your business club. Give clear reasons asto justify your choice.

End of unit 6 Assessment

1) As an entrepreneurship student, choose two suitable financial

institutions to work with in the school business club and give reasons

why you chose the above institutions?

2) Why is the government of Rwanda encouraging people to invest incapital markets?