Topic outline

INTRODUCTION

INTRODUCTION

This textbook is part of school curriculum reform in Rwanda in particular how

the curriculum is taught. It is hoped that this change will make what you learn

in school more useful both at school and when you leave school.

In the past, the main reason for schooling was to obtain knowledge – that is

facts and ideas about each subject. But nowadays the main reason due to

changes that are happening in the environment and the job market is becoming

more competitive therefore you should be able to use the knowledge you

will obtain from this text book to develop competencies. These competencies

include, ability to think for yourself, ability to communicate with others and to

explain what you have learnt, as well as being creative in developing your own

ideas, not just following those of the Tutor and the textbook. In this textbook,

different approaches are used to help you to develop competences and make

this textbook user friendly. Among these approaches are the following:

Activity-based learning

These activities present you with instructions to follow that will help you to

learn and discover others for yourself. You already have knowledge and many

ideas based on the experiences you have had and your life within community.

Some of the activities, therefore, require you to use the knowledge and ideas

you already have.

In using this book, therefore, it is essential that you do all the activities and

follow all the instructions. You will not learn very well unless you complete

these activities provided. They are the most important part of the Textbook.

In some ways this makes learning more of a challenge. It is usually challenging

to think for yourself than to copy what the Tutor tells you. But if you take up

this challenge you will become a better person and become more productive

and successful in your life.

Group work

You can also learn a lot from other people in your class. If you have a problem,

it can often be solved by sharing it with others. Many of the activities in the

book, therefore, involve discussion. Your tutor will help to form and organize

these groups in a conducive learning environment facing each other. You cannot

discuss properly unless you are facing each other.

Research

One of the objectives of the new curriculum is to help you discover for yourself.

Some activities, therefore, require you to do research using Textbooks in

the library, the internet if your school has access, or any other source such

as newspapers and magazines etc. This means that you will develop skills

of learning for yourself that can help you both when still in school and after

school. Your tutor will help in case your school does not have a fully equipped

library or internet.

Skills lab

Entrepreneurship subject is more practical than theoretical that is why it

requires time for skills lab which is a regular time on normal time table when

student-teachers are required to complete learning activities working in

manageable groups.

During skills lab activity student-teachers are given an opportunity to talk

more and get more involved in the lesson than tutors. Student-teachers receive

constructive feedback on work done (Tutor gives quality feedback on student

presentations).

The Skills Lab prepares student-teachers to complete portfolio assignments on

their own after classes. So, classroom activity should connect directly to the

portfolio assignment and during the skills lab the tutor makes sure that he/

she links the unit with the portfolio assignment, student’s business club and

back home projects.

Icons

To guide you, each activity in the book is marked by a symbol or icon to show

you what kind of activity it is. The icons are as follows:

This indicates thinking for yourself or groups discussion. You are expected to

use your own knowledge or experience, or think about what you have read in

the book, and answer questions individually or as a group activity.

Thinking icon/Learning activity icon

This icon reminds you to link your previous knowledge with the topic you

are going to learn. As a student feel free to express what you already know

about the topic. What is most important is not giving the right answer but the

contribution you are making towards what you are going to learn.

Application Activity icon

Some activities require you to complete them in your exercise book or any other

book. It is time for you to show if you have understood the lesson by answering

the questions provided.

Skills lab icon

This icon indicates a practical activity, such as a role play to solve a problem or

complete an activity, participating in a debate and following the instructions

provided by the teacher. These activities will help you to obtain practical skills

which you can use even after school.

End unit Assessment icon

This icon requires you to write down the responses to activities including

experiments, case studies and other activities which assess the attainment

of the competences. Tutors are expected to observe the changes in you as astudent teacher.

UNIT 1 : BUSINESS IDEAS AND OPPORTUNITIES

Key Unit Competence: To be able to generate viable business ideas.

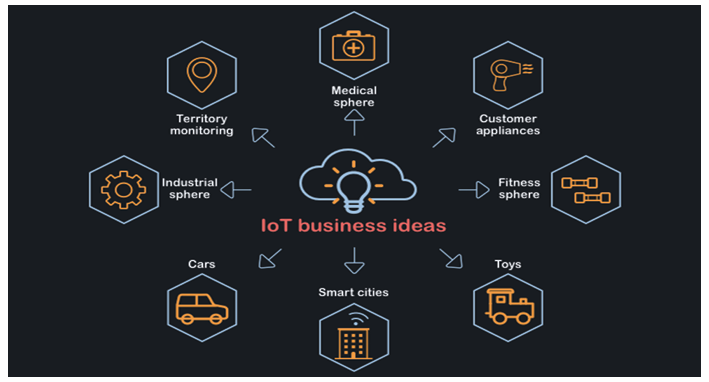

Introductory activityAnalyze the photo below and answer the following questions

Observe the picture above and identify different sources of business

ideas.

1. Generate different business ideas from the above environment.

2. Notall business ideas are business opportunities. Is this statement true or

false? Give reasons to justify your response.

1.1 Business, business idea and a business opportunity

1.1.1. Meaning of a business idea

Business refers to any economic activity that involves the production, selling

of goods and services, covering risks with the aim of getting profits.

An idea is called an opportunity if there is evidence that the entrepreneur’s

idea can be turned into reality.

A business idea simply refers to any thought that the entrepreneur may

come up with as a result of scanning the environment with the possibility

of developing it into a business opportunity. It requires the entrepreneur to

exercise creativity and innovativeness in order to come up with the successful

business ideas for the environment.

Examples of business ideas in Rwanda include; Real estate, clothing and

textiles, food processing, E-Commerce, technology products.

1.1.2. Meaning of a business opportunity

A business opportunity can be defined as an identified situation or chance

that can be turned into a real and profitable business.

An opportunity is a favorable set of circumstances that creates a need for a new

product, service, or business. Such opportunities are determined by customer

requirements and lead to the provision of a product or service which creates or

adds value for its buyers or end-users.

A business opportunity is any situation that can be turned into a possible and

profitable business activity.

An opportunity is a situation in which it is possible for you to do something

that you want to do. A business opportunity is said to be viable, when it has the

ability to grow and expand.

Examples of business opportunity and their business idea

-Lack of sufficient safe water in your community is a business opportunity.

Provision of JIBU, NIL, AKANDI or INYANGE water can be a business ideas.

-High demand for charcoal as a source of energy in your community is

business opportunity. For that opportunity, many business ideas can be

generated like provision cooking gas, making charcoal in wastes, planting

trees, buying big vehicle to transport charcoal from far forest…

A business idea may not necessarily be a profitable business opportunity; one

needs to filter and sift through these ideas to realize whether they are realopportunities.

Application Activity 1.1Case study: A reality T.V. Show

Rwiyemeza is a prominent entrepreneur dealing in growing and

processing of Mushrooms in Kicukiro district. One day she was invited

to give an interview on Rwanda Broadcasting Agency (RBA) about her

business to the whole nation by Mr. Makuru.

Read through the excerpts from the interview

Makuru: How did you decide to get into mushroom growing and

processing? How did you start?

Rwiyemeza: It was during my school time when I joined a school

business club. I got the idea when our club mentor told us that we canstart a backhome.

business, we used to call it a ‘BHB’. I introduced the idea to my parents

and I was lucky that they supported me. It was not a very easy task with

everyone telling me different things about growing mushrooms. Actually

many people that I talked to focused on the challenges but about three

people told me that I can overcome the challenges if I plan in advance.

I therefore decided to take on the business of Mushroom growing and

processing.

Makuru: What was the biggest challenge while starting your Mushroom

business? How did you overcome it?

Rwiyemeza: There were so many challenges such as unsure market,

competition, pests, but deciding on turning my business idea into a

profitable business was most challenging. I had to make a lot of research

from existing entrepreneurs, sector offices, and financial institutions.

I also had to do personal evaluation. I found that I could market my

product very widely to beat the market problem, and ensure much

cleanliness and timely watering to avoid pests.

Makuru: What are the benefits of your business to the community?

Rwiyemeza: Apart from earning a living for me and my family, my

business employs three ladies and 2 gentlemen who earn a monthly

salary. Important to note also, is that I have inspired a lot of other young

entrepreneurs especially women to start their own businesses.

Makuru: What advice would you give to the young people who may

want to start businesses?

Rwiyemeza: My advice would be that all around us are opportunities

of business ideas but one has to be careful because NOT all business

ideas can be turned into profitable businesses. Before I finally decided

to start mushroom growing and processing, I had tried a number of

business ideas which failed because they were not viable. So, I again

advise the young people to take time and research about the business

ideas before investing money since “Not all business ideas are businessopportunities”.

Questions:

Referring to the case study (A reality T.V. Show) above, answer the

following questions:

a) What do you understand by a business and what is Rwiyemeza’s

business?

b) Explain what you understand by a business idea. Mention any

sources of business ideas for Rwiyemeza’s business activity.

c) Rwiyemeza says it was not easy for her to start up the business

activity. Explain what you understand by a business opportunity

and identify some challenges Rwiyemeza faced.

d) Why do you think it is very important to do a research and personal

evaluation before deciding to start a business activity?

e) Looking at the situation at school and in your home community,

what two best business ideas can you possibly take on? Why doyou think those two are the most viable ones?

1.2. Reasons for generating business ideas

Activity 1.2

1) Why do you think that it is important to generate business ideas?

2) In your own words, explain why the following Entreprises Urwibutso,Inyange, Mara phone, Volkswagen have been generated.

The simplest purpose of business is to solve a customer’s problem or meet

the customers’ needs. By providing the goods and services that meet the

customer’s needs, the business owner may realize profits. Businesses exist to

impact on people’s lives. This happens by businesses providing people with

goods and services they desire to meet their needs. While the people buying the

business’ products (goods and services) are meeting their needs, the business

owners expect to realize profits. Businesses serve as conductors of economicactivity and development.

Business may be done by private individuals, government, companies, cooperatives or non-governmental organizations (popularly known as NGOs).

Hereafter are many reasons why entrepreneurs would need to generatebusiness ideas:

To start a sustainable business: a good idea is essential for a successful

business venture – both when starting a new business or expanding it.

To respond to market needs: markets are made up essentially of

customers who have needs and wants waiting to be satisfied.

To meet changing fashions and requirements: provide opportunities

for entrepreneurs to respond to demand with new ideas, products and

services.

To stay ahead of the competition: Remember, if you do not come up

with new ideas, products and services, a competitor will. So the challenge

is to be different or better than others.

To exploit technology – do things better: Technology has become a major

competitive tool in today’s markets and for one to be better with changing

technology, generation of business ideas is crucial.

Because of product life cycle: All products have a finite life. The firm’s

prosperity and growth depends on its ability to introduce new products

and to manage their growth.

To diversify risks and overcome failure: It is necessary for firms to try

to diversify their risks and overcome failures that may occur from time totime by constantly generating new ideas.

Application Activity 1.2

Identify a number of different needs and wants in your community

that are not yet being met by the existing businesses and suggest the

business you would come up with.

1.3 Sources of Business Ideas.

Activity 1.3

Referring to your community and beyond, explain at least 5 business

ideas that you can generate from the different sources.

The following are some of the sources of business ideas:

-Looking within you and examining skills, talent and passion: The very

first place to start looking for business ideas and opportunities is to look

within yourself. Self-examination is an important thing that can help in

reaching to different decisions. It is important to examine your own skills,

talent or passion that can fit into the business. Therefore, such businesses,

which corresponds according to your skills is the most appropriate andare expected to be successful in the future.

-Inventing a new product or service: Another great source of business

opportunity is inventing a new product or service. Different people are

creative with a mindset of thinking out of the box and solving problems

with the best appropriate solution. One needs to think like great

entrepreneurs such as SINA Gerald of Urwibutso enterprise, Zulphat

Mukarubega proprietor of Rwanda Tourism University College, etc.

However, for winning ideas you need to be specific on your target marketand analyse the problem.

-Adding value to an existing product(Innovation): Rather than inventing

a product, one can also add value to existing products. These kinds of

innovations can be proved as a great source of business opportunities.

Since most of the inventions have already taken place, so it is prevailingas innovation.

-Franchising: A continuing relationship in which a franchisor provides a

licensed privilege to the franchisee to do business and offers assistance

in organizing, training, merchandising, marketing and managing in

return for a monetary consideration. Franchising is a form of business

by which the owner (franchisor) of a product, service or method obtainsdistribution through affiliated dealer (franchisees).

By looking on the demographics and the need for a particular service or

product, one can also start a franchising business. It can be really profitable

since much of business modeling is not required because a person usesthe rights of another retailer.

Mass Media: Mass media has become comprehensive from past few

years. Magazines, TV, Newspapers etc. are a great source of ideas and

opportunities. Different businesses are on sale and different commercial

advertisements are available to choose from.

Attending Exhibitions: Trade shows and Expos helps to develop a strongbusiness network.

Industrial Survey: Another important source for a business ideas can

be industrial surveys. Since, the main point of a business is to fulfill the

needs of a customer. Therefore, surveying and analyzing the underlying

need of a customer can help in reaching a rational decision that addressesthe customer’s problem and result in a profitable business.

Listening to customer complaints: Complaints are a part of customers’

relationship that led into the development of new or improved products

and services. Whenever customers report badly, it means that the

customer satisfaction is not being achieved and there is some issues

with the product. This can help in generating new business ideas foraddressing problems of customers.

Application Activity 1.3

Describe the qualities of a good business idea in your home communitythat can be turned into a Back-Home Business.

1.4. Steps of generating business ideas

Activity 1.4

Referring to your community and beyond, explain at least 5 business

ideas that you can generate from the different sources.

a. What would you have to do in order to take on the best business

opportunity?

b. Would you advise a friend on how to assess business ideas andopportunities? If yes, how? If not, what would you do?

1. Start thinking/get your brain at work

The first thing to do when you get a business idea is determine whether it’s

a good idea. Not every idea that seems good at first is practical. And some

business ideas have no market.

You will need to do some research to evaluate your business idea. Here is a

checklist of questions to use as a guide:

-Is there a need for this product or service? Some of the most popular

products and services meet a need that people currently have. The

product or service may improve upon or complement an existing product

or service, or your idea may be a completely new approach to meeting a

need.

-Is there a desire for this product or service? Admittedly, some of the

most popular products are desire-based rather than need-based. That

means that someone is purchasing the product because they want to. A

few needs-based reasons for a purchase include to increase status or to

follow a trend.

-Who is currently meeting the need for this product or

service? Answering this question gives you a start on evaluating your

competition. You need to know not only who your competitors are, but

also how many are they? Don’t forget to consider indirect competition.

-Who will buy this product or service? Find out who your typical

customer is likely to be. This may involve conducting surveys, testing the

waters, finding a focus group, and more. The better your understanding

your potential customer, the more likely you are to create a successful

business.

-How big is that market? You may have a great business idea. It may even

be brilliant. But, if the market for your idea is very small, your business

might not be viable–that is unless people are willing to pay a premium for

your product or service. This brings us to the next question.

-How much are people willing to pay for your product or service? Your

intake from your product or service needs to cover your costs and should

include a healthy profit. Remember, that even a small niche market can

be profitable if potential customers are willing to pay you enough money.

-How hard will it be to implement the idea? Let’s face it, some ideas

are easier to implement than others. When answering this question, take

into consideration the amount of time it will take you to launch your

business as well as whether or not you will need to hire someone to help.

After doing your research, you should be able to tell whether you want tocontinue on ,and develop your business idea.

2. Buy a notebook (Think on paper)

Now that you know how to stimulate your brain and get started with the creative

thinking process, you need to keep count on your ideas and make sure that you

can document them to study and examine them further. Every business you

can think of started with a small idea somewhere, from a small observations,

a frustrating situation, or while taking a shower. You never know when the

inspiration comes, so keep a notebook close to you at all times to write theseideas down whenever they come.

3. Follow your passion

Once you start your business, you will spend most of your day for several

years doing that business. So make sure you choose a business that you feel

passionate and excited about. If you don’t like the business you are doing , you

might not succeed in that business, probably not because you don’t have what

it takes, but mostly because you might lose interest too easily in the face of thechallenges that will come your way.

4. Keep your eyes open

New business opportunities get born from new situations every day. Keep an

eye on what is happening around you, make it a habit to read the newspaper

and identify new opportunities. You may read that people are complaining from

poor health services in your area, or the lack of schools in your neighborhood.

Talk to your neighbors and the people you know, what is frustrating them?

What would they want to change in your neighborhood? Is your neighbor

complaining that he/she needs to drive long distances to get to the nearest dry

cleaner? Or is your other neighbor complaining about the lack of groceries in

close proximity to where you live? Are your coworkers frustrated that there areno restaurants close to your work building?

5. Capitalize on your strengths

Most people are good at something. Look at your experiences and career, what

is it that you can do well? Have you been working in project management for 15

years and know the ins and outs of the business, this is often the best place to

start. Instead of focusing on the things you cannot do well, focus on the things

you are good at. What can you do better than others? How are the others doingit? And how can you do it differently?

6. Explore new things

As mentioned earlier, change is one of the biggest stimulators to the brain. Even

if you don’t want to open your own coffee shop, next time you are in one, look

at how things are done and think of new ways to improve it. Often this thinking

might lead you to new ways to improve on your business ideas in your chosenfield.

7. Check your bank account

Starting and running your business requires money. Depending on your

situation, you need to think of businesses that suit your budget. Everyone’s

finances are limited, so make sure whatever business idea you come up with is

doable. If you have a small amount of money, then look into business ideas thatare not cash hungry, maybe start small and then grow with the business.

8. Know what you want in life

Aside from your business goals, think about the reasons why you want to start

a business in the first place. What is it that you are looking for? What are your

goals in life? Are you starting a business to be able to spend more time with

your family? To make more money? To be respected among your peers?

Whatever your goals are, make sure that your business idea complements these

goals and help you to achieve them. If your goal is to find more time to spend

with your family and do other things, then starting a business that requires youto work 16 hours a day or travel constantly might not be the best idea.

9. Choose a business that suits your personality.

Are you a morning person or a night creature? Each person has his/her own

peak hours of the day. You will find very few successful bakers or newspaper

owners that don’t like to wake up in the morning. If you are not a morning

person, avoid businesses that will need you to work in the early hours of

the morning. If you are a night person, then maybe running a nightclub or a

restaurant that stays open till late hours is more suitable for you. Conversely, if

you sleep early, running a business that requires you to stay late might not be

suitable for you.

Are you an indoor or outdoor person? Do you like working in an office for long

hours or can’t stand the office and feel that you need on the move all the time?

If you like the office quiet environment, then pick a business that can be done

from an office. If you like to be on the move, pick a business that requires you to

go to different places and meet new people.

Are you brainy or handy person? People do things differently, some people like

to do things that involve thinking and working their brains, other people like to

do things that involve craftsmanship and handy work.

Are you shy or outgoing person? If you are a shy person, then becoming a public

speaker might not be the best idea for you. If you are an outgoing person and

like to meet new people all the time, having an internet based business might

deprive you from that joy.

I think you get the idea, think of your personal traits and attributes and pick abusiness idea that suits your personality.

10. Read about other people that started their own business

A large part of becoming successful involves looking at other successful people

and learning how they achieved their success. Reading autobiographies about

prominent and successful business figures and learning how they started their

journey will give you great insight on how they did things and what exactly they

did to become successful.

You find that most of them started from nothing. Many of them failed in

several businesses and had to listen to people that told them they will never be

successful. But they stood up and tried again and again until they succeeded. It

is not whether you fail that makes you the man you are, it is how you stand up

after the fall.

Study their characters, what do successful entrepreneurs have in common?

How did they achieve their vision? What challenges did they have to overcome?

Look for similarities between their stories and your situation right now. You

will find that it is a great source of inspiration and motivation. If others just likeyou did it, then you can do it too.

1.5 Business opportunities

Activity 1.5

1) What do you understand by a viable business opportunity?

2) What business opportunities can you think of? Among those, whichones are viable for you and why?

1.5.1. Meaning of business opportunities

A business opportunity can be defined as an identified situation or chance

that can be turned into a real and profitable business.

An opportunity is a favorable set of circumstances that creates a need for a new

product, service, or business. Such opportunities are determined by customer

requirements and lead to the provision of a product or service which creates or

adds value for its buyers or end-users.

A business opportunity is any situation that can be turned into a possible andprofitable business activity.

1.5. 2. Characteristics of a good business opportunity

1. Demand

Demand is the first thing that one ought to take into account before planning

to start a business is to ask themselves where there is a significant demand for

the particular product or services they intend to launch i.e. is there a gap in the

market? If the answer is NO then that idea isn’t a viable business opportunity. It

would also be profitable to target a specific niche as this increases the chancesof you becoming a dominant player for that specific niche.

2. Return On Investment (ROI)

If the business opportunity you have in mind has the potential of bearing fruits

within a set period of time and which can cover the capital that was used in

addition to bearing profits there is a high chance that you have got a winner

but if it only requires more and more capital to be injected in with minimal

or no possibility of having any returns any time soon then you ought to treadcarefully.

3. Availability of resources

You should have all the resources needed to take advantage of that particular

business opportunity as well as a time frame for implementing it, lest someoneelse beats you to it.

4. Skill

You need to have the experience required to tap into that particular business

opportunity e.g. if you want to start a bakery but don’t know a thing about

baking ,then that is not a viable business opportunity. It is therefore important

that you have the required skill i.e. experience and expertise, for the businessyou would like to start.

5. Scalability

Can the business grow gradually within a given period of time and can it adapt

to the changing times i.e. is it flexible enough? If the answer is NO then that ideaisn’t a viable business opportunity.

6. Healthy Profit Margin

Does the business have a good profit margin that will ensure the business

remains profitable even as it meets the gap in the market? If the answer is NOand you’re not in it for charity then that idea isn’t a viable business opportunity.

7. Customer Retention

It’s said that customers are the lifeblood of any business but if you can’t retain

your customers then your business won’t last very long. You therefore need to

put in place mechanisms that will ensure you prolong your customers stay withyou i.e. that they will keep buying from you for as long as possible.

8. Low capital requirement

A good business opportunity should be cheap to finance. Access to capital is a

major obstacle to entrepreneurship implying that entrepreneurs should focus

on ideas that are cheap to finance. Entrepreneurs exploit financing methods

such as loans, venture capitalists and contributions from friends and family

among others. Capital suppliers are reluctant to finance new businesses withhuge capital requirements.

9. Aligns with your passion

A good business opportunity is one that aligns with the individual’s passion.

The founder’s motivation is a key determinant of the success of a start-up.

A passionate founder has an internal motivation towards building a bright

future for the business. If you are like this leader, you will create a clear vision

and mission statements and use them to motivate stakeholders towards theorganizational goals.

Application Activity 1.5

Suggest a project you need to start in your students business club andidentify the requirements you need to start your project.

1.6. Factors to consider when generating and evaluating

viable business ideas and opportunities

Activity 1.6

1) What do you understand by a viable business opportunity?

2) What business opportunities can you think of? Among those, which

ones are viable for you and why?

Discuss different ways in which you can use to learn about existing business

ideas and opportunities both in your community and elsewhere.

It is very important to examine and evaluate your business opportunity

and determine your potential for success before you spend time and money

developing a business plan.

Entrepreneurs need to determine whether the business opportunity they

have identified is viable or not. When evaluating the viability of the businessopportunity, the following factors need to be taken into consideration:

1. Market

Business evaluation process goes through analyzing the market. If there isn’t a

big enough market for your product or service, you should rethink whether this

business opportunity makes sense.

• Who will be your target consumer?

• Is there a need for your business idea?• Can you meet that market need?

For instance, you might think of a great business idea to produce a carbonated

beverage flavored with roots, berries, and other natural flavors.

However, in your evaluation you might find that this type of product is already

saturated in the market. The idea is good and a market exists, but if the marketis flooded with competitors it would not likely be profitable.

2. Business plan

The bottom line of any business is to make money. Without positive cash flow,

you won’t succeed. Business owners with the best of intentions often fail

because the financial potential isn’t big enough.

• Will there be sufficient financial reward?

• Do you see a potentially growing market for the product?

• Do you have others who believe in your business ideas?

• Are there other businesses that are similar (which is a validation that

this potential business opportunity could be worth pursuing)?

You as an entrepreneur have a lot of thinking to do. Come up with great business

ideas. Be creative and get enthusiastic about your ideas. However, always take

the time to plan for a sound business because the better the business plan, thehigher chances for your idea to succeed.

3. Technology and other requirements

The business should be evaluated in terms of whether there is an appropriate

technology that can be used in production. Factors to be looked into include;

Appropriateness of the technology, the cost of the technology, the possibility

of the business suffering in case the technology becomes outdated/obsolete,availability of raw materials and other resources.

4. Infrastructure

Easy access to infrastructure such as roads, water, electricity, telephone and

postal services among others enables business enterprises easily make orders

for goods and deliver them hence reducing operating expenses. With lowoperating expenses, profits can be maximized.

5. Government policy

An entrepreneur should consider the requirements of the government before

starting a business e.g. the government may require certain businesses to belocated in certain areas only.

6. Amount of capital required

The capital required to run and maintain the business should be considered i.ethe source of capital.

7. SecurityAvailability of security should be considered.

8. Impact of the business operations on the environment

Some business operations on the environment lead to environmental

degradation and should be located in appropriate environment.

Are the political, economic, geographical, legal, and regulatory contexts

favorable? Will the business do any damage to the physical environment?

The above questions are typical of the type of issues that need to be addressed.

Responses to these questions will determine the attractiveness of any businessopportunity.

9. Competition and competitive advantage

Competition is regarded as a threat to business of similar kinds operating in a

similar location. Although competition is a threat, it is healthy in the sense that

it goes along the way in controlling the price of goods offered. It is crucial for

entrepreneurs to consider opportunities where competition is not high as thiswill enable them to get reasonable market.

10. Length of the window of opportunity

For example, one may inform you of an upcoming workshop for educators in

your area, you realize that there is an opportunity for you to supply water,

food and airtime among others, but for you to determine whether you should

invest in this, you need to know how many people are coming, the length of the

workshop, such that you know how much stock is needed, you also base on thatto determine whether you will get back your money or not

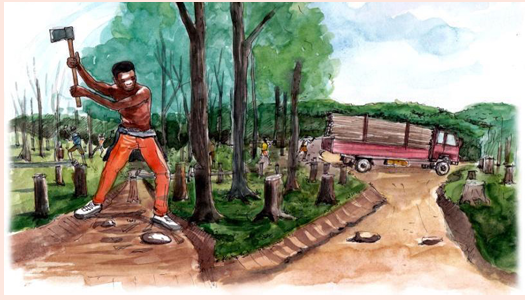

Application Activity 1.6Analyze the photo below and answer the questions that follow;

1) What kind of activity is represented in the photo?

2) What are the effects of such business ideas to the community?

3) As an entrepreneur, suggest any two business ideas you may

generate in response to the effects of the activity above.

4) Picking one idea, give the factors you will base on while choosing

that idea.

5) What advice would you give to potential entrepreneurs whilegenerating business ideas in relation to the photo above?

Skills lab

Choose 2 businesses/ business ideas and conduct a viability test to

find out which one is better in terms of; 1. Potential for growth, 2.

Infrastructure, 3. Market for the goods/services (real demand),

4. Profitability, 5. Competition and competitive advantage, 6.

Financial viability. Make posters indicating how each of the above

factors favors or limits their business ideas with clear examples.

Recommend the most viable business ideas the Business club should

continue/ start running basing on the results of the viability tests andsuggest action steps for the implementation.

End of unit 1 Assessment

1. Read the following scenario:

Mr. and Mrs. Kaberu visited their friend Kambanda who lives in Kigali.

They were surprised to see how Kambanda’s business of Coca-Cola

wholesaling was booming. They didn’t even ask him how and why he

chose to do that business.

When they went back home in Nyagatare, they sold all their cows and

opened x because they were kept for long. The landlord chased them

out of the house because they couldn’t pay rent any more.

Out of frustration, Mr. Kaberu had to sell all his stock at half price because

he had nowhere else to keep them. On hearing this, his wife Mrs. Kaberu

cried the whole day and night to the extent that she collapsed and was

taken to the hospital at the mercy of the neighbours because her andher husband couldn’t afford the medical bills.

Questions

a) Explain whether the business idea was good or bad.

b) Write a letter to Mr. and Mrs. Kaberu advising them on the importance

of assessing a business idea or opportunity in case they have anotherone.

2. There are many business opportunities that we can get from our

communities, why should we always assess a business opportunity

before investing our resources and time? To answer this, discuss in

your groups and raise at least 5 business opportunities that you can

think of. Assess each one of them and choose the best two viableones which you will present to the class.

UNIT 2: DRAFTING A VALID BUSINESS CONTRACT

Key Unit Competence: To be able to make a valid contract in business

operations.

Introductory activity

Sam met with a businessperson on a football match who requested him to be

supplied with beans at a price of 500 Frws per kilogram. When Sam delivered

200kgs, he was not paid the full amount of money they had agreed upon.

a) Has such a situation ever happened to you? When and what happened?

b) What mistake did Sam do?

c) Assume you were the one in such a situation, what would you do?

d) What advice would you give to Sam and the businessperson?e) What lessons do you learn from the above situation?

2.1. Meaning and Forms of Business contracts

Activity 2.1

Bayigana operates a small medium enterprise in Huye and wants

Ishimwe to supply his business with goods. Bayigana tells her to start

right away and supply the goods they will discuss other issues later.

She insists that she needs an agreement between the two especially on

issues of price, mode of payment, delivery period, quantity and quality,

among others.

a) How do you call an agreement that Ishimwe insists to be between them?

b) Do you think she is right to have the agreement before starting the

supply of goods? Give reasons to support your answer.

c) In which way/form may the agreement be made between the two?

Support your answerd) What do you understand by the term contract and business contract?

2.1.1 Meaning of contract and Business contract

A contract is a legally binding agreement between two or more parties which

can be enforced by law.

Example in marriage the woman and man make a contract during civil marriage.

The three parties are woman, man and witness will come to testify before thelaw represented by Executive secretary of sector.

Before starting a job, the employer and employee make a contract. In this case

there are two main parties and the law is now represented by official labor law

because it is not possible to make a job contract which is against the labor law.

A business contract is a legal binding between two or more persons/ entities

to perform an agreed business transaction and can be enforced by law. The

day today running of the business involves making contractual obligations withsuppliers, buyers etc.

Example: A farmer can make a contract of supplying chicken to the hotel. In

most cases this contract is written and two parties should sign to that document.

This contract should follow the official law like the right person who represents

the hotel and the farmer should have maturity age. The two parties should sign

with free consent. Once signed it becomes a document which binds the twoparties.

2.1.2 Forms of business contracts

Oral contract is an agreement between two or more parties by use of words.

They are non-written contracts. They rely on the good faith of the parties but

can be difficult to prove. Once the contract is verbal, the wittiness is mandatoryand provides evidence.

Application Activity 2.1

Read the following statements and answer the questions that follow:

- Nkusi wants to lend his car to Niragire for 5,000Frw per day for

five days.

-Niragire agrees with a handshake to borrow the car from Nkusi

and pay the money in witness of Rukundo.

-Ntezimana promises to take his girlfriend Bagirishya for an outing

to Lake Kivu.

-Niyokwizerwa promises to pay 10,000Frw to whoever finds her lost phone.

-Gato puts on paper his commitment to provide printing services

to Umutoni on agreed terms.

-Mutesi promises to pay for her brother’s school fees and puts it inwriting.

Which of the above statements are?

a) Contracts.

b) Not contracts.c) Business contracts.

2.2 Valid contract2.2.1. Parties to a contract

Activity 2.2

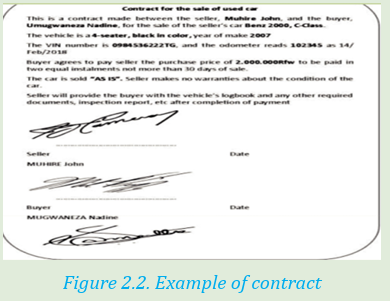

1) Analyze the figure below and answer the following questions.

a) Do you think the above sample is a contract? Give reasons to

support your answer.

b) Name the key elements of the written contract above.

c) Do you think the sample above is a valid contract? Support your

response by mentioning the elements of a valid contract in the

sample provided. (If any?)

2) Describe different parties to a valid contract.

3) Kamaliza’s 16-years old son, who looks a bit older, he signed a

contract joining a health club. He has dues of 15000 Frws. Is thiscontract valid?

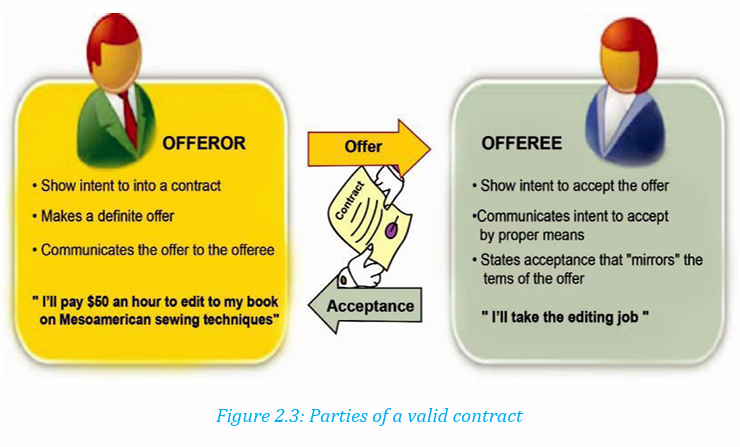

Parties of contract are persons who can sign the contract. For a contract to be

considered valid, it should include three parties. These are; Offeror/promisor

who makes an offer, Offeree/promisee to whom an offer is made and Witnesswho sees an event happening.

For example, in the above template Mr. John Muhire Offeror/promisor agreesto sell his car to Umugwaneza Nadine Offeree/promisee at 2 millions.

Two parties to contract Offeror/promisor and Offeree/promisee must have

“capacity”, legal ability to make valid contract. Assent of parties is a must. If

either party is deprived, use of his understanding or deemed by law not have

attained consent, then such an agreement shall not bind him. All parties shouldhave should be mature, sound mind and qualified for contract by law.

The information of two parties in contract should be clear, complete and

concise. In any case, the names are not enough, it should be better to include

other information like number of identification card, the location where those

documents are issued. Ensure that all information is well reflected on the

contract. For example in above contract there is a mistake in writing names.

Umugwaneza Nadine who sells the car is not the same Mugwaneza Nadine whosigns the contract. These slit mistakes can disqualify the contract.

Witness is a person who sees an event happening. In a legal contract, a witness

is someone who watches the document be signed by the person they are being

a witness for and who verifies its authenticity by signing their own name on the

document as well. However, if you have a legal document such as a mortgage or

a Will the chances are that you will want a witness to attest to your signature.

Generally, the person you choose to witness a document should have no financialor other interest in an agreement. A neutral third party is the best choice.

2.2.2. Elements of a valid contract

For a contract to be valid and therefore enforceable by law, it must have the

following elements:

Intention to be bound by the contract: the two parties should have intended

that their agreement be legal. Domestic agreements between husband and wife

are not taken as valid

Offer and acceptance: there must be an offer and the two parties must lawfully

come to acceptance leading to a valid contract. Until an offer is accepted, it’s not

a valid contract

Consideration/price: this is the price agreed upon by the parties to the

contract and paid by one party for the benefit received or promise of the other

parties.

Capacity of the parties: the parties to the contract must have contractual

capacity for the contract to be valid, i.e. should be sober, above 18years, not

bankrupt, not insane, properly registered.

Free Consent: parties to the contract must agree freely without any of the

parties being forced to accept or enter the contract.

Legality/lawful object: the object and the consideration of the contract must

be legal and not contrary to the law and public policy.

Possibility of performance: if the contract is impossible to be executed in

itself either physically or legally, then such contract is not valid and cannot be

enforced by law.

Certainty: the terms of the contract must be clear and understandable for a

contract to be valid. If the terms are vague or ambiguous, where even the courtmay not be able to tell what the parties agreed, then it will be declared invalid.

Application Activity 2.2

Imagine if you make a contract without considering the elements of avalid contract, what will happen if the person/ business refuses to pay?

2.3. Importance of business contracts

Activity 2.3

Why is it essential to prepare business contracts?

Referring to the activities in the previous lessons, do you think it is

important to have contracts in business operations? Give reasons tosupport your answer.

In business life, contracts are important because they outline expectations

for both parties, protect both parties if those expectations aren›t met and lock

in the price that will be paid for services. There are so many relationships that

affect the way the business operates such as customers or clients, employees,

suppliers, government, financiers. Contracts are then important in the followingways:

- Contracts reduce business risks by compelling business partners to

perform what they have agreed to as per contract.

- Business contracts specify terms and conditions of business

transactions including price, quantities, quality, date of delivery, etc.

which avoids misunderstandings.

-Contracts help entrepreneurs to get the goods on credit because

the suppliers are aware that the entrepreneur is bound by contract and

therefore will make effort to pay the agreed amount.

-Written contracts act as evidences. They are important because it is easy

to forget details you have agreed upon verbally and therefore provide apermanent record.

-Contracts may be used by entrepreneurs to convince bankers that the

entrepreneur has a business that will generate income so as to obtainloans.

Application Activity 2.3

Demonstrate the importance of business contracts to the schoolbusiness club.

2.4 Designing a contract sample

Activity 2.4Prepare a sample contract with suppliers for your school business club.

2.4.1 Sample of Employee contract

Employee Contract Template:

Employment Contract

This contract, dated on the ____ day of ______________ in the year 20____, is made

between [company name] and [employee name] of [city, state]. This contract

constitutes an employment agreement between these two parties and is

governed by the laws of [state or district].

WHEREAS the employer desires to retain the services of the employee, and the

employee desires to render such services, these terms and conditions are set forth.

IN CONSIDERATION of this mutual understanding, the parties agree to the

following terms and conditions:

Employment

The employee agrees that he or she will faithfully and to the best of his/her

ability to carry out the duties and responsibilities communicated to him/her by

the employer. The employee shall comply with all company policies, rules andprocedures at all times.

Position

As a [job title], it is the duty of the employee to perform all essential job functions

and duties. From time to time, the employer may also add other duties withinthe reasonable scope of the employee’s work.

Compensation

As compensation for the services provided, the employee shall be paid a wage of

___________ [per hour/per annum] and will be subject to a[quarterly/annual]

performance review. All payments shall be subject to mandatory employment

deductions (State taxes, Social Security, Medicare).

Benefits

The employee has the right to participate in any benefits plans offered by the

employer. The employer currently offers

benefits will only be possible after the probationary period has passed.

Probationary Period

It is understood that the first [time frame] of employment constitutes a

probationary period. During this time, the employee is not eligible for paid time

off or other benefits. During this time, the employer also exercises the right to

terminate employment at any time without advance notice.

Paid Time Off

Following the probationary period, the employee shall be eligible for the

following paid time off: • [length of time for vacation] • [length of time for sick/

personal days] • Bereavement leave may be granted if necessary.

The employer reserves the right to modify any paid time off policies.

Termination

It is the intention of both parties to form a long and mutually profitable

relationship. However, this relationship may be terminated by either party at

any time provided [length of time] written notice is delivered to the other party.

The employee agrees to return any employer property upon termination.

Non-Competition and Confidentiality

As an employee, you will have access to confidential information that is the

property of the employer. You are not permitted to disclose this informationoutside of the company.

During your time of employment with the employer, you may not engage in any

work for another employer that is related to or in competition with the company.

You will fully disclose to your employer any other employment relationshipsthat you have and you will be permitted to seek other employment provided

that (a.) it does not detract from your ability to fulfill your duties, and (b.) youare not assisting another organization in competing with the employer.

It is further acknowledged that upon termination of your employment, you will

not solicit business from any of the employer’s clients for a period of at least[time frame].

Entirety

This contract represents the entire agreement between the two parties and

replaces any previous written or oral agreement. This agreement may be

modified at any time, provided the written consent of both the employer andthe employee.

Legal Authorization

The employee agrees that he or she is fully authorized to work in [country name]

and can provide proof of this with legal documentation. This documentationwill be obtained by the employer for legal records.

Severability

The parties agree that if any portion of this contract is found to be void or

unenforceable, it shall be removed from the record and the remaining provisionswill retain their full force and effect.

Jurisdiction

This contract shall be governed, interpreted, and construed in accordance withthe laws of [State, province].

In witness and agreement whereof, the employer has executed this contract

with due process through the authorization of official company agents and withthe consent of the employee, given here in writing.

Employee Signature

Date

Company Official Signature

Source: www.betterteam.com/employee-contract-template

2.4.2. Sample of a sales contract

PRIVATE CAR SALES CONTRACT

The Car Details

Make: Toyota

SOLD FOR:……… frws

Model……… Registration Number…….. Registration document

completed by buyer/seller ..Yes/No . Mileage………. Registration document (V5)

exchanged ....Yes/No .

Additional notes and comments agreed on this sale

SELLER’S DETAILS: Name…………….. Address………………

CERTIFICATE of PURCHASE: I am the undersigned buyer of the above car.

I have purchased it from the seller named above for the amount of cash also

mentioned above (SOLD FOR). This is the final price agreed. I have paid for this

car in full and I am in receipt of this car and all the relevant documents to it. The

Seller above also acknowledges being in full receipt of all the total amount but I

do accept that full title to the car does not fully pass from the seller to purchaser

until all cash is paid. Any cheques will need to be cleared before full title passes

to myself. It is fully understood that this vehicle is sold as seen. I the buyer agree

that I have tried, tested and approved this car as suitable for my personal needs

without any representations, warranties or conditions expressed or implied

whatsoever.

Buyer’s Name:………………………

Buyer’s Address: …………

Buyer’s Signature in agreement: …………

Seller’s Signature in agreement: …………Date: …………

Application Activity 2.4

Assume, your parents have houses to rent at home, help them design arental contract that will be signed by the tenants.

2.5 Termination/discharge of business contracts

Activity 2.5

What do you think would lead you to terminate a contract with your

suppliers?

To terminate a contract means to end the contract. Contract may be terminated

under the following circumstances:

By performance: If the contract is performed and fulfilled as expected under

the terms and conditions of the contract and both parties are satisfied, then the

contract may be terminated.

By agreement: The parties to the contract may freely agree to end the contract

if both consent to end the contract.

By destruction of the subject matter: The contract may be put to an end

when the subject matter of the contract ceases to exist such as being destroyed,

stolen or died.

By operation of the law: The contract may be terminated by law if it is illegal,

if one party becomes bankrupt, insane or dies.

By frustration: A contract can be put to an end when a condition set in hinders

one of the parties from performing his/her contractual obligations.

For convenience: Where the contract allows a party to terminate the contract

at any time by providing notice to the other party for example employment

contract.

Due to a breach: Where one party has not complied with an essential contract

condition, the other party may decide to terminate the contract and seek

compensation for damages.

By lapse of time: If the offeror fails to perform and the offeree fails to take

action within this specified period, then the latter cannot seek remedy through

law. It discharges the contract due to the lapse of time. For example, Ngabo

takes a loan from Kamikazi and agrees to pay instalments every month for the

next three years. However, he does not pay even a single instalment. Kamikazi

calls him a few times but then gets busy and takes no action. Four years later,

she approaches the court to help her recover her money. However, the court

rejects her suit ,since she has crossed the time-limit of three years to recoverher debts.

Application Activity 2.5

1) Read the following paragraph and answer the questions that follow:

Musoni started a business selling general merchandise in his

community. He is renting the place where his business operates. He

buys his goods from a nearby town through a fellow businessperson.

He says he trusts his friend, so they never write down anything when

sending for goods but just gives him the money. He always sells

goods to his customers on credit but rarely make any record of such

transactions. Recently, after some advice from a friend, he contracted

a construction company to build for him a two-roomed building from

where he will shift his shop.

a) Mention some of the mistakes Musoni is doing in his business

activities?

b) What are the likely consequences of Musoni’s actions mentioned

above?

c) What advice would you give to Musoni to avoid the consequences

above and why?

d) What may cause Musoni to terminate the contract with the

construction company?

2)Kizito offered 10,000Frw for the return of his lost dog, but then he

refused to pay because he thought the person who brought the dog

back had stolen it.

Was there a valid contract in the scenario above?

Do you think Kizito is right? Give reasons to support your answer.

What advice would you give to the person who brought the dog back?

Skills lab 2

With reference to the knowledge of Business contracts, design contract

templates to be used in the school business club when dealing with; a)suppliers. b) Customers, c.) Employees of the club, d.) Club members.

End of unit 2 Assessment

1) Read the case study below and answer the questions that follow:

Shine Business club

Shine business club wanted 3crates of soda which they wanted to sell

to their school that was organizing a visiting day. Chantal an active

member of the club having been close to Bizimungu an entrepreneur

dealing in retail business convinced the club to deal with him. The

club paid him and agreed he would deliver the sodas to the club after

three days but unfortunately after the agreed time, he didn’t deliver

the sodas as expected. When the club contacted him for the sodas, he

denied to have entered into any dealing with them that if he did, he

would be having at least a formal document to prove that. The club

reported the matter to the school administration, but it couldn’t help

them since it was not notified of that dealing.

a) What are some of the essential elements of a valid contract

observed in the above case study?

b) Was there a valid contract in the above case study? Support your

answer

c) What advice do you give to shine business club?

d) How would you approach the situation or the above problem if it

was your business club?

2) Analyze the example below and answer the questions that follow:

Nkusi and Mukarutesi are capable adults. Nkusi is in the need for a

new car. it is on a budget, so he scans the classified advertisements

and finds Mukarutesi, who is selling an old Toyota Carina for

2,000,000Frw. Nkusi calls Mukarutesi and offers 1,800,000Frw.

Mukarutesi accepts Nkusi’s offer and they decide to meet. At the

meeting, Nkusi hands over 1,800,000Frw and Mukarutesi handsover the keys for the Toyota Carina.

a) Is there a valid contract in the above example?

b) Referring to the elements of a valid contract, support your

response;

c) Which form of business contract would you advise Nkusi to sign

with Mukarutesi?

d) What do you think may lead the contract in the example above tobe terminated?

3) Read the following passage and answer the questions that follow.

Ntwali started a business selling general merchandise in his community.

He is renting the place where his business operates. Ntwali paid his

property owner three months’ rent in advance but never asked for

receipt. After two months, his property owner says he wants the rent for

the two months. Ntwali is frustrated and tries to remind the property

owner that he paid his rent for three months. The property owner denies

and asks Ntwali for proof of the payment which he does not have. Ntwali

is stuck, does not know what to do while the property owner threatensto evict him if he does not pay his rent.

a) What is the cause of the conflict in the example above?

b) Advise Ntwali on how he can resolve the conflict with the property

owner

c) What are the disadvantages of the form of contract between Ntwali

and the property owner?

d) Help Ntwali design a written contract that he can sign with hisproperty owner to avoid such conflicts again.

UNIT 3: TAXES IN BUSINESS

Key unit competence: To be able to analyze the role of tax towards economic

development of the country and pay taxes.

Introductory activity: A case study

Why Do You Have to Pay Taxes

Every year around, before and after June 15, everybody especially business

people will be discussing about tax changes in the national budget. This is

because tax reforms and new taxes introduced are announced on that day.

However, have you ever wondered why you and businesses need to pay taxes?

In Rwanda, there are arms of the government (ruling bodies) from the

village, sector, district, provincial and national levels. These bodies comprise:

Legislature (who make laws), Executives (who enforce laws) and Judiciary

(who exercise laws). The salaries that public servants receive to do their jobs

come from taxes. Paying taxes is considered a civic duty, although doing so isalso a requirement of the law.

Taxes take many forms too. When you work at a job to make money, you pay

income taxes. Depending on how much money you earn, a certain percentage

(part) of the money you make is withheld (kept out of your paycheck andsent to the government).

When you buy things at a store, you also usually pay sales tax, which is a

percentage of the cost of the item charged by the store. If you own property,you also pay property taxes on the value of your property.

Paying your taxes is considered a civic duty, although doing so is also a

requirement of the law. If you do not pay your taxes, the government agency

that oversees taxes — the Rwanda Revenue Authority or RRA - will requireyou to pay your taxes or else face penalties, such as fines or going to jail.

The money you pay in taxes goes to many places. In addition to paying the

salaries of government workers, your tax also help to support commonresources, such as police and firefighters.

Tax money helps to ensure the roads you travel on are safe and well

maintained. Taxes fund public libraries and parks. Taxes are also used to fund

many types of government programs that help the poor and less fortunate,as well as many schools!

Each year as the “tax day” rolls in, adults of all ages and businesses must

report their income to the RRA, using special tax forms. There are many laws

that set forth complicated rules about how much tax is owed and what kinds

of special expenses can be used (“written off”) to lower the amount of taxesyou need to pay.

For the average worker, tax money has been withheld from paychecks

throughout the year. On “tax day,” each worker reports his or her income andexpenses to the RRA.

Employers also report to the RRA how much they paid each worker. The RRA

compares all these numbers to make sure that each person pays the correctamount of taxes.

If you have not had enough tax money withheld from your checks throughout

the year to cover the amount of tax you owe, you will have to send more

money (“pay in”) to the government. If, however, too much tax money was

withheld from your paychecks, you will receive a check (get a “refund”) fromthe government.

From the passage answer the following questions:

What are the major changes expected by people especially business people

on June 15, every year?

What makes the business people so anxious to know the changes mentionedabove in a)?

Why do you think it is important for businesses to pay taxes to the government?

How do the following benefit from taxes?

i) Entrepreneur.

ii) Government.

iii) Society.

a) Identify and briefly explain at least two types of taxes paid in Rwanda?

b) What happens to businesses or people who do not pay taxes?c) What is the difference between tax and taxation?

3.1. Tax and business tax

Activity 3.1

1. Explain the meaning of the following terms used in taxation:

a) Tax b) Business tax

2. In your community, you have probably heard people and business

people complaining about the taxes they pay or charged to different

or similar items. Identify any 5 things you have heard normally

people complain about.

3. If you were the one determining or imposing taxes to people andbusinesses, mention any five things you would put into consideration.

3.1.1. Meaning of taxation concepts

Tax is a fee without direct exchange requested to the members of the community

by the State according to the law, to financially support the execution of the

government tasks.

Business tax refers to compulsory and non-refundable payments made by

the business to the government or local authority to raise revenue to finance

public expenditures.

Taxation is a system of raising money or revenue by the government from

individuals/businesses and companies by law through taxes.

Taxation is a system/practice of government collecting money from its citizens

to pay for public services.

Tax avoidance is a situation where a business person does not pay tax because

s/he has avoided the product or activity on which the tax is imposed. It is the

taxpayer’s exploitation of loopholes in the tax system there by paying less tax

than what they are supposed to pay.

Example of Tax Avoidance:

• Taking legitimate tax deductions to maximize business expenses and

thus lower your business tax bill.

Tax evasion is the illegal practice of not paying taxes by either not reporting

income, reporting expenses not legally allowed, or by not paying taxes owed. In

businesses, tax evasion can occur in connection with income taxes, employment

taxes, sales, etc.

Examples of practices considered as tax evasion:

• It is considered tax evasion if you knowingly fail to report income.

• Under-reporting income (claiming less income than you actually received

from a specific source).

• Providing false information to the RRA about business income or expenses, etc.

3.1.2 Characteristics or principles of a good taxation system

A good taxation system can contribute a lot to the economic development of a

country and its national treasury. Equitable taxation system bears a significant

role in bringing harmony in the lifestyle of the population of the country. A good

tax system should consist of taxes which conform to the canons of taxation. Thecanons or principles of taxation are explained as follows:

1) Convenience: Places, periods and seasons in which the tax dues are

collected should be convenient to the taxpayer. For example, the convenient

time to a trader is when s/he has made a profit. For a farmer, is when s/she

has sold his/her products.

2) Simplicity: The type of tax and the method of assessment and collection

must be understandable by both the taxpayer and tax collectors.

Complicated taxes may lead to disputes, delays and high costs of collection

in terms of time and resources.

3) Certainty: The taxpayer must know the nature, base and amount of tax

without doubt. Unpredictable taxes discourage investment and reduce

work effort. Simply the tax should not be arbitrary.

4) Economy: The cost of collection and administration of tax must be much

lower than the tax collected

5) Elasticity: A tax should change directly with a change in the tax base. If the

tax base increases, the tax charged on the tax base should also increase.

6) Productivity: The fiscal authorities should be able to predict and forecast

accurately the revenue a particular tax would generate and at what rate it

would flow in.

7) Equity: Tax assessment should be in such a way that taxpayers bear a

proportionately equal burden. I.e. people who earn more income should

be taxed more than those who earn less income.

8) Diversity: This canon requires that there should be a number of taxes of

different varieties so that every class of citizen may be called upon to paysomething towards the national priorities

Application Activity 3.1

1. Why is it important to have principles of taxation?

2. Referring to the principles (characteristics) of a good taxation system

you know, briefly explain why each is important to the taxpayer and

tax authority (RRA).

3. With examples, differentiate

a) Tax and Taxation

b) Tax avoidance and Tax evasion

4. Do you think tax evasion is good? Give reasons to support your response

3.2. Importance of paying taxes

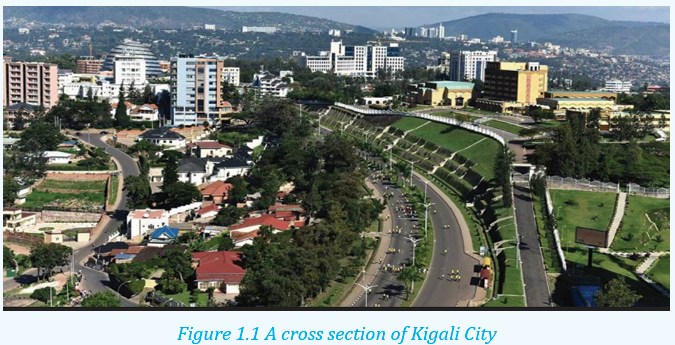

Sources: http://www.kigalicity.gov.rw

Figure 3.2 Taxes help the government to build infrastructures

Activity 3.2

1. With examples from your community or Rwandan community at

large, why do you think people and business enterprises need to pay

taxes to the government?

2. As an entrepreneur to be or referring to the activities of entrepreneurs

in your community, how do you think businesses or entrepreneurs

benefit from paying taxes?

3. In general, how does your society benefit from paying taxes? Give

examples to support your views.3.2.1. Importance of paying taxes to an entrepreneur

• Paying taxes by the entrepreneur helps the business activity to continue,

as it does not face penalties and associated costs from the RRA for non

payment.

• When an entrepreneur pays taxes, it improves his/her reputation or

public image which may result in increased customers and better services

from the government.

• To avoid inconveniences of closure of the business and its associated

costs: when entrepreneur fails to pay assessed taxes, his/her business is

subject to penalty even closure to some cases.

• Business needs certain infrastructures to operate successfully such as

roads to move raw materials, finished goods, workers; security for their

enterprises, among others, and all these are provided by the government

from taxes.

• Paying taxes means contributing money to government agencies or

departments such as Development Bank of Rwanda (BRD), Business

Development Fund (BDF), which support entrepreneurs to operatebusiness activities through soft loans and other financial support.

3.2.2. Importance of paying taxes to the government

• Source of government revenue: taxes are the main source of government

revenue to finance its public expenditure. So taxes enable the government

to pay its workers, construct roads, maintain security, provide health care,

education among others.

• Taxes benefit the Rwandan government to meet its objectives and goals

such constructing affordable houses to the citizens which helps improve

the standards of living

• Taxes help the government to finance its policies especially on poverty

alleviation through programs such as “GIRINKA”, “VUP”, “UBUDEHE”

among others.

• Taxes enable the government to regulate the prices of goods and services

in the country hence ensuring a low cost of living and maintaining the

standards of living of the citizens.

• Taxes enable the government to maintain a balance between the poor

and rich. The government uses the taxes from business people to provide

services needed by the poor, which otherwise the rich could not provide.

• Taxes enable the government to promote its policy industrialization

through reducing products from other countries that would otherwise

outcompete the home industries.

• Taxes enable the government to ensure that the citizens have enough

products. This can be through taxes charged to reduce products moving

out of the country or removing taxes on goods needed in the country. Thishelps maintain a high standard of living.

3.2.3. Importance of paying taxes to Society

• There are reduced rates of poverty among the community due to a

significantly equal distribution of income through various activities and

projects set by the government.

• Improved wellbeing among the vulnerable and elderly as they benefit

from the different government programs financed through taxes.

• Reduced infant mortality rates and increased life expectancy due to

improved access to health facilities and services.

• Increase in the percentage of the population that completes secondary

and TVET education, reducing the literacy levels, improving on the

peoples’ skills through programs such as 12YBE.

• Increased community/social solidarity, general happiness, life satisfaction,

and a significant more trust among the community members and for

public institutions.

• Taxes are charged on some products to discourage their production

and usage hence controlling over-exploitation of resources as well asprotecting the environment which is vital for the existence of the society.

Application Activity 3.2

1. By giving specific examples from your community, how does your

society benefit from taxes?

2. What do you think would happen in the country if taxes were not paid?

3.3. Calculation of taxes

Activity 3.3

1. Do you think it is important for an entrepreneur to know how to

compute the amount of tax he/she is supposed to pay? Give reasons.

2. What do you think the term “Pay-As You-Earn (PAYE) tax means”?And how is it calculated?

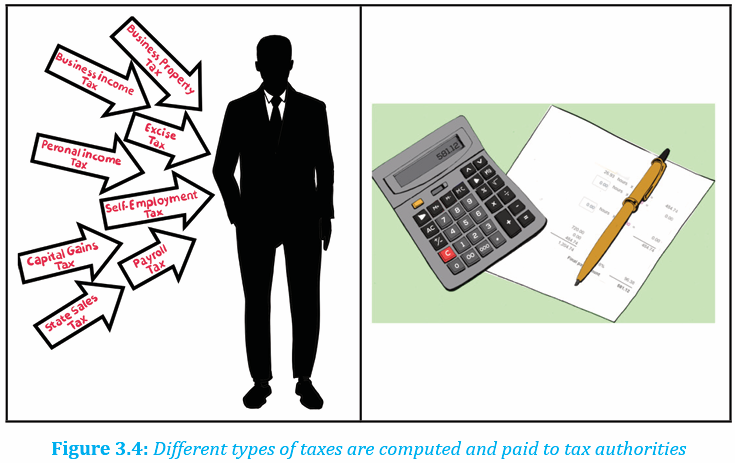

There is a variety of taxes that a business has to pay such as corporate income

tax, trading license tax, professional income tax or PAYE (Pay-As-You-Earn),

rental income tax, fixed asset tax, Value Added Tax (VAT), Sumptuary tax, etc.

but here, an emphasis is made on:

1. Pay- As- You Earn (PAYE) and

2. Value Added Tax (VAT

3.3.1. Pay-As -You-Earn (PAYE) tax or professional income tax

The tax law requires that when an employer makes available employment

income to an employee the employer must withhold, declare, and pay the PAYE

tax to the Rwanda Revenue Authority within 15 days following the end of the

month for which the tax was due.

PAYE: is composed of Wages, salaries, leave pay, sick pay, medical allowances,

pension payment etc. Pay-As-You-Earn tax is computed as follows:

Example:

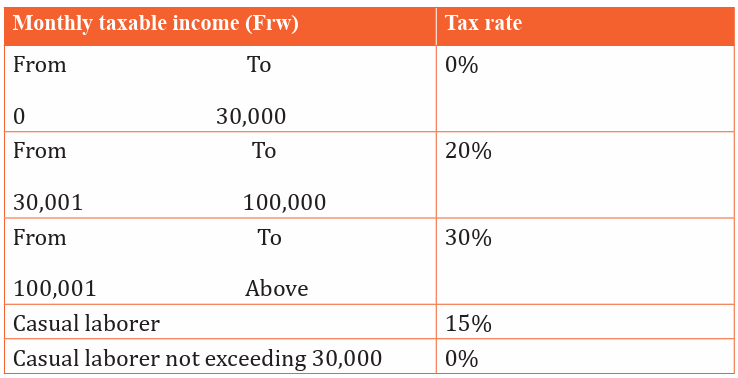

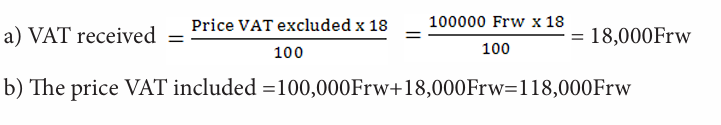

The following relate to monthly salaries of Kanyarwanda enterprise employeesfor year 2018.

a) Rukundo earns 450,000Frw

b) Karinganire earns 89,000Frw

c) Keza earns 28500Fwd) Buzima earns 12,5000Frw

Required:

Calculate the total PAYE for above employees that Kanyarwanda enterprisepays to RRA every month.

Solution:

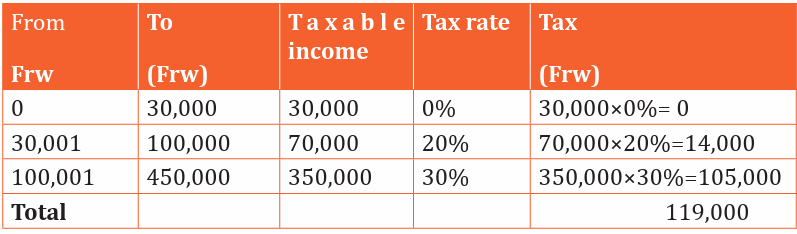

a) Rukundo :

Total TAX for Rukundo = 14000+105000= 119,000Frw

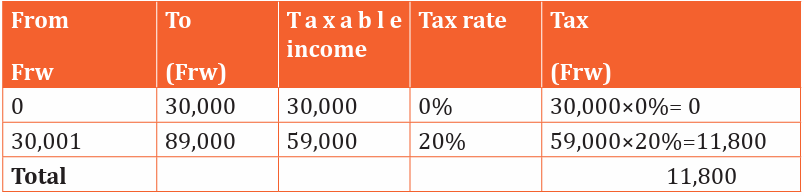

b) Karinganire:

Total tax for Karinganire is 11,800Frw

c) Since Keza earns less than 30000Frw she does not pay PAYE. Her total tax =0(28500*0)

d) Buzima:

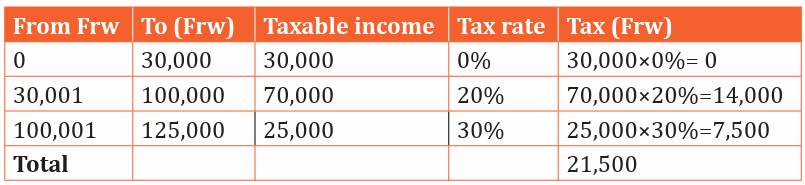

Total tax for Buzima =14000+7500=21,500Frw

Total PAYE for Kanyarwanda enterprise every month