UNIT 5:MONEY MANAGEMENT

Key Unit competence: To be able to manage money responsibly and to keep

financial records.

Introductory activity

Case study:

Elizabeth and Kabayiza are married with two children, aged three and five.

Kabayiza works full-time in manufacturing and Elizabeth works four days a

week as a nurse. When they got married, they were renting and maintained

two separate accounts as well as a joint account for bills. Now they own a

home and are paying off a mortgage and saving determinedly for the future

so that they can afford private education for their children by the time they

enter high school.

Referring to the story above and your knowledge about entrepreneurship

skills learnt and competences developed before, answer the questions below.

a. Why do Elizabeth and Kabayiza need money?

b. What are the best ways of the couple to save money?

c. Why do they need to save money?

d. Explain the moral lesson that you learn from the above case study

5.1. Meaning of money, savings and saving goals

Activity 5.1

Using the knowledge acquired in O’level, explain the meaning of the

following terms as used in entrepreneurship:

a) Money

b) Savingsc) Saving goal

A. Money

Money is anything that is generally accepted as a medium of exchange and

repayment of debts.

Money is one of the most important inventions of modern times. It has

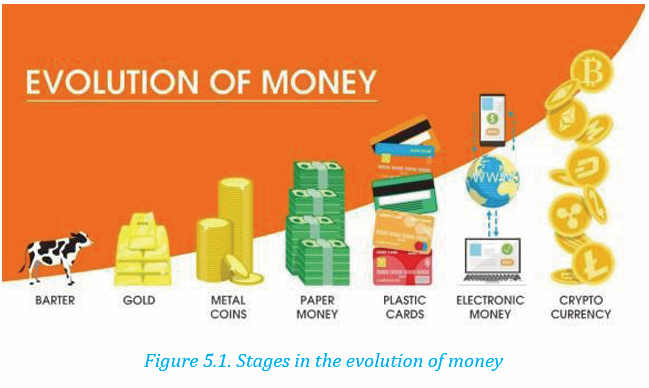

undergone a long process of historical evolution.Stages in the evolution of money

1st Stage: Barter trade: Human beings passed through a stage when money

was not in use and goods and services were exchanged directly for goods

and services. Such exchange of goods or services for goods or services iscalled Barter Exchange.

2nd Stage: Commodity money: The inconveniences and drawbacks of

barter trade led to the gradual use of a medium of exchange. In the historical

study of money it is found that all sorts of commodities like seashells, pearls,

precious stones, tea, tobacco, cow, leather, cloth, salt, wine, etc. have beenused as a medium of exchange (i.e. money).

3rd Stage: Metallic money: Inadequacy of commodity money led to the

evolution of metallic money (gold and silver). The problem of uniformity ofweight and purity of precious metals led to private and public coinage.

4th Stage: Paper money: This process was finally taken over by the state

as one of its essential features and ultimately commodity money gave way

to paper money which means currency notes. Nowadays, the use of paper

money has almost become universal along with coins made of copper, bronzeor nickel, etc.

5th Stage Bank money: The process of evolution of some better medium

of exchange still continues. As the volume of transactions increased, even

paper money started becoming inconvenient because of the time involved in

its counting and space required for its safe keeping. This led to bank money

or credit money in the form of cheques, drafts, bills of exchange, credit cards, etc.B. Savings

Savings is the portion of income not spent on current expenditures. Because

a person does not know what will happen in the future, money should be

saved to pay for unexpected events or emergencies. An individual’s car may

breakdown, their dishwasher could begin to leak, or a medical emergency

could occur. Without savings, unexpected events can become large financial

burdens. Therefore, savings helps an individual, family or business becomefinancially secure.

C. Saving goals

Money can also be saved to purchase expensive items that are too costly

to buy with monthly income. Buying a new house, clothes, purchasing anautomobile, or paying for a vacation, etc. can all be accomplished by saving a

portion of income. We usually save for:

• Basic needs

• Household expenses

• Education

• Emergencies/safety

• Retirement/security

• Family wellbeing

• Esteem• Self-actualization

Application Activity 5.1

Using the knowledge and skills acquired in year 1, Unit 3: Settingentrepreneurial goals, set a SMART saving goal.

5.2. Need for money

Activity 5.2Observe the following figures and answer the questions that follow:

a. Describe at least five household expenses.

b. Discuss different sources of income (money).

In everyday life, human beings have different needs. Money is used in exchange

when selling and purchasing different products and services. Money is not only

needed to be used personally but also in business activities.

Money is most especially needed for the following reasons:

• Investment: Money is used to purchase goods that are not consumed

but are used in the future to create wealth. It is used for things that can

generate more money in the future.

• Personal needs: Money is used to make personal expenditure including,

but not limited to, the need for food, clothing, shelter, health care and

safety.

• Emergency: Some money is put set aside to specifically cover any

unexpected expenses that may come up. An emergency fund may cover

unexpected car repairs, medical bills or other emergency situations.

• Education: Money is used for the purpose of completing the education.

• Retirement: Retirement is the years that an individual is able to enjoy

after spending a majority of his/her life devoted to career. One should

put aside a portion of the income to help him or her after working age, etc.

Application Activity 5.2

1.As a student of entrepreneurship, come up with different ways of

getting money.2. Make the total cost of all household expenses in your family.

5.3. Obstacles to achieving saving goals

Activity 5.3

Assess your home community and describe any five obstacles for people

in that community to achieving saving goals.

Saving is a conscious and deliberate way of setting aside a portion of the

personal income for future use.

The following are some of the hindrances to achieving saving goals:

• Procrastination: Delaying savings or putting savings off for another time.

• Poor spending habits: It includes spending on unnecessary items;

Impulse buying; hedonistic lifestyle.

• Culture of dependency: Being over dependent on others.

• Lack of financial literacy: Spending on liabilities or items that

decrease in value over time; not knowing how your money will grow

or work for you.

• Not budgeting: A budget is the bedrock of your personal finances.

Without a budget, your money may be standing on shaky ground.

Why? A budget helps you see how much money you have coming inand going out. And, having a budget in place can help you save money.

Application Activity 5.3

Youth are a rapidly growing percentage of the Sub-Saharan African

population, and many are economically vulnerable. Financial inclusion

for youth, particularly the promotion of savings behavior is associated

with a number of positive social and economic outcomes and is an

international priority. However, the majority of youth in Sub-SaharanAfrica are not saving.

Question:

According to the extract above, discuss any ten reasons why majority ofyouth of sub-Saharan Africa do not save.

5.4. Where to save

Activity 5.4

In your community, you have probably heard people and business

people talking about where they save a portion of their earnings. Identify

where to save money according to what you have heard normally peopletalking about.

Banks provide savings account services

Some savers place their money in a jar, coffee can or a piggy bank which all is

not safe and not encouraged. . It is wise to store money in financial institutions

like banks depository institution. The following are examples of where to savemoney:

• Banks: Through opening up different savings account, one can save his/

her money. For instance, if you find a bank or credit union that offers a free

savings account, you can open up several savings accounts. Then every

time you get an income, you can put money into each of these accounts

for every specific thing that you are saving for. This way you can keep your

money safe from accidentally being spent, and it will be there when youneed it.

• Assets: Individuals can save money through investing in fixed assets.

A good example can be when someone invests his/her money in rental

houses (real estates). The stock market may be down, but your tenantswill still be paying some rent every month.

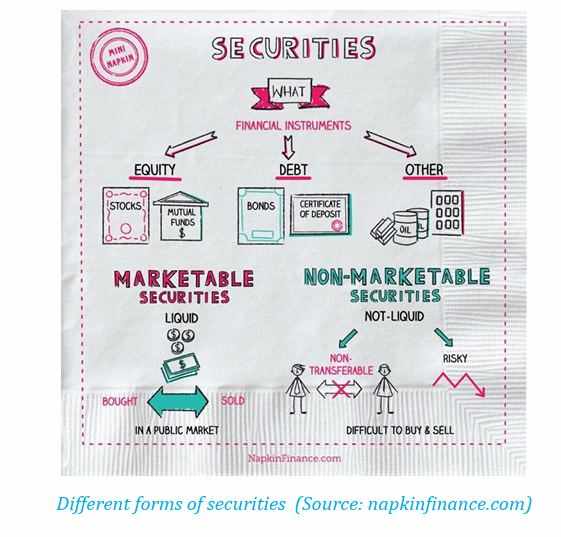

• Securities: Securities are generally classified as either equity securities

such as stocks and debt securities such as bonds and debentures. The sale

of securities to investors is one of the primary ways that publicly-traded

companies drive new capital for operations. People or businesses cansave their money through buying available securities at the market.

• Small savings groups: This is when someone joins a group comprised of

15-25 self-selected individuals who save together and take small loans

from those savings. Savings groups provide members the opportunity

to save frequently in small amounts, access to credit on flexible terms, etc.

• Starting a business: Saving can be through starting up a business thatmay generate incomes and profits in future time.

Application Activity 5.4

KABASHA won entrepreneurship competition. He received a cheque

of 5,000,000Rwf as a reward, but he doesn’t have a ready plan for that

money won.

Required:

Advise KABASHA to identify where to save his money to avoid needlessexpenditure.

5.5. Managing money

Activity 5.5

Extract (Money management-How to make your money go further)

The way you spend your money today will determine what you have

in six months from now, a year from now, five years from now, and in

your lifetime. You control your financial destiny. You are responsible for

the amount of money you earn and for the amount of money you spend.

Successful money managers control the way they spend their money.

They use money to accomplish the things that are important to them.

Good money managers manage their money rather than letting it dribbleaway from them.

Required:

1. Do you have control of the way you spend your money? If yes, how

do you do it?

2. Do you live within your income, or do you have to borrow money or

use savings to meet your regular monthly expenses? Yes/No. Explain

your answer.

Money management is the process of budgeting, saving, investing, spending or

otherwise overseeing the financial usage of an individual or group. The ability

to manage money has to be learned, developed, and practiced on a daily basis.There are eight steps to successful money management:

1. Get organized.

2. Decide what you want to do with your money.

3. Look at all available resources.

4. Decide how much money you are worth.

5. Find out how much money you make.

6. Find out how much money you spend.

7. Set up a plan for spending your money and stick to it.

8. Evaluate your spending plan

The following are essentials for good money management:

• Keeping financial records

• A simple cash book

• Financial forecast

• A simple cash flow plan

• Practicing money management habits E. g. re-use, recycle, repair andreduce.

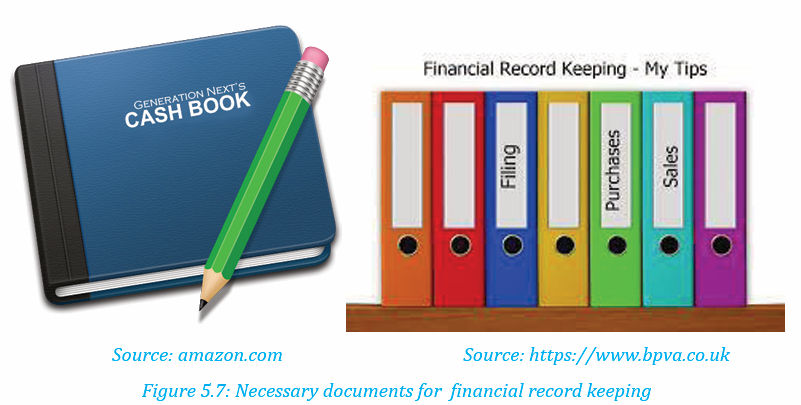

KEEPING FINANCIAL RECORDS

Good financial recordkeeping enables business organizations to plan properly

and also check for misappropriations of resources. Everyone in business must

keep records. Keeping good records is very important to your business. A simple

cash book, financial forecast and a simple cash flow plan are very important formoney management.

• A simple cash book

The simple cash book (also known as single column cash book) is a cash book

that is used to record only cash transactions of a business. It is very identical to

a traditional cash account in which all cash receipts are recorded on left hand

(debit) side and all cash payments are recorded on right hand (credit) side in a

chronological order.

The single column cash book has only one money column on both debit and

credit sides titled as “amount” which is periodically totaled and balanced like a

T-account. As stated earlier, a single column cash book records only cash related

transactions. The entries relating to checks issued, checks received, purchases

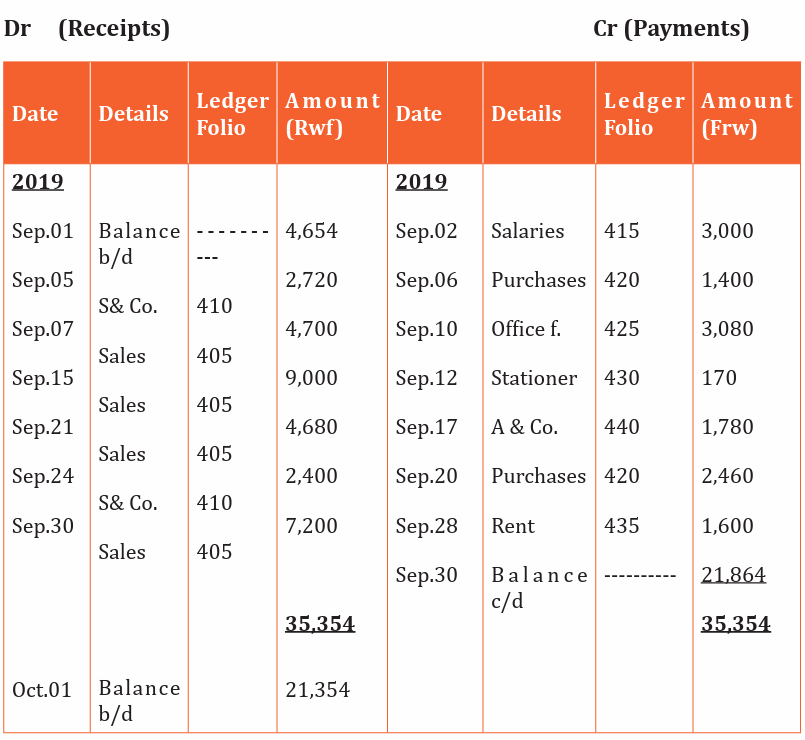

discount, and sales discounts are not recorded in single column cash book.Format of Simple Cash Book:

The purpose of four columns used on both sides of a single column cash book

is briefly explained below:

• Date: The date column of the cash book is used to record the year,

month and actual date of each cash transaction. This column ensures the

chronological record of each business transaction involving receipt or

payment of cash.

• Details: The details column is used to record the account titles to be

debited or credited as a result of each cash transaction. This column is

sometimes titled as “particulars”.

• Ledger Folio: This column is used to write the page number of each

ledger account named in the description column of the cash book.

• Amount: The amount column of single column cash book is used to

record the money value of each cash transaction.

• Note: The debit side (receipt side) of a single column cash book is always

heavier than the credit side (payment side) because we cannot pay more

cash than what we receive during a period.

Example:

The Student business club at one of TTCs uses a single column cash book to

record all cash transactions. It engaged in the following cash transactions

during the month of September 2019.

• Sep.01: Cash in hand at the beginning of the month Rwf 4,654.

• Sep.02: Paid salaries to employees for the last month Rwf 3,000.

• Sep.05: Cash received from S & Co. for a previous credit sale Rwf 2,720.

• Sep.06: Merchandise purchased for cash Rwf 1,400.

• Sep.07: Merchandise sold for cash Rwf 4,700.

• Sep.10: Office furniture purchased for cash Rwf 3,080.

• Sep.12: Stationery purchased for cash Rwf 170.

• Sep.15: Merchandise sold for cash Rwf 9,000.

• Sep.17: Cash paid to A & Co. for a previous credit purchase Rwf 1,780.

• Sep.20: Merchandise purchased for cash Rwf 2,460.

• Sep.21: Merchandise sold for cash Rwf 4,680.

• Sep.24: Cash received from S & Co. for a previous credit sale Rwf 2,400.

• Sep.28: Cash paid for office rent Rwf 1,600.

• Sep.30: Merchandise sold for cash Rwf 7,200

Required: Record the above transactions in a single column cash book (simple

cash book) Solution:

The Student business club’s simple cash book for the month of September 2019

Financial forecast

‘Forecast’ means to form an opinion beforehand i.e. to make a prediction. Thus

financial forecasting means a systematic projection of the expected action of

finance through financial statements. It is a kind of plan which will be formulated

at a future date for a specified period.

The merits of the financial forecasting are noted below:

(i) It can be used as a control device in order to fix the standard of performances

and evaluating the results thereof

(ii) It helps to explain the requirement of funds for the firm together with the

funds of the suppliers.

(iii) It also helps to explain the proper requirements of cash and their

optimum utilization is possible and so surplus/excess cash, if any,

invested otherwise.

Elements of Financial Forecasting:

Financial forecasting involves preparation of proforma financial statements

and also the preparation of Cash Budget.

Therefore, it includes the preparation of:

A. Pro-forma Income Statement: Pro forma income statement is the statement

prepared by the business entity to prepare the projections of income

and expenses which they expect to have in the future by following certain

assumptions such as competition level in the market, size of the market,

growth rate

B. Pro-forma Balance Sheet: This summarizes the projected future status

of a company after a planned transaction, based on the current financial

statements.

C. Cash Budget: A cash budget is an estimation of the cash flows for a business

over a specific period of time. This budget is used to assess whether the

entity has sufficient cash to operate

A simple cash flow plan

Cash flows statement is a statement that provides valuable information about

a company’s gross payments and receipts and allows insights into its future

income needs. Cash flow statement is important because:

• Cash from operating activities can be compared to the company’s net

income to determine the quality of earnings. If cash from operating

activities is higher than net income, earnings are said to be of “high

quality.”

• This statement is useful to investors because, under the notion that

cash is king, it allows investors to get an overall sense of the company’s

cash inflows and outflows and obtain a general understanding of its

overall performance.

• If a company is funding losses from operations or financing investments

by raising money (debt or equity) it will quickly become clear on the

statement of cash flows

Why is it necessary for an entrepreneur to make a Cash flow statement?

• It helps to identify the source of cash inflows in the business and also

identify how cash was used

• It helps management in proper cash planning to avoid excess cash or

cash deficits in the business

• It reports the total amount of cash used during a given period in long

term investment activities such as purchase of fixed assets

• It shows the amount of cash received from various financing sources

such as long term loans and sale of shares

• It helps management to avoid liquidity problems by anticipating when

cash is expected to flow in and plan payments accordingly

• It helps investors to understand how a company’s operations arerunning, where its money is coming from and where it is spent.

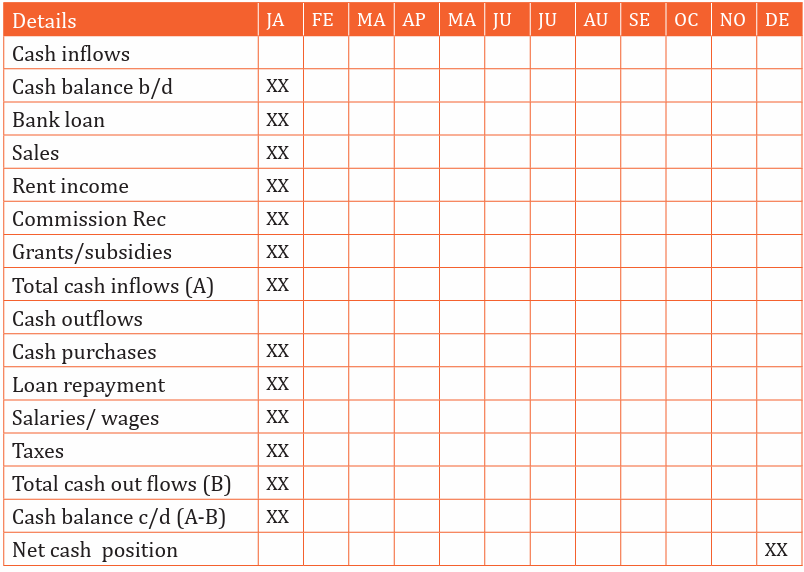

FORMAT OF CASH FLOW STATEMENTCash flow statement for the year ended as at……/ …… /……...

At the end of that given period, the business will have a surplus if cash inflows

are more than the cash outflows or deficit if cash inflows are less than the cashoutflows.

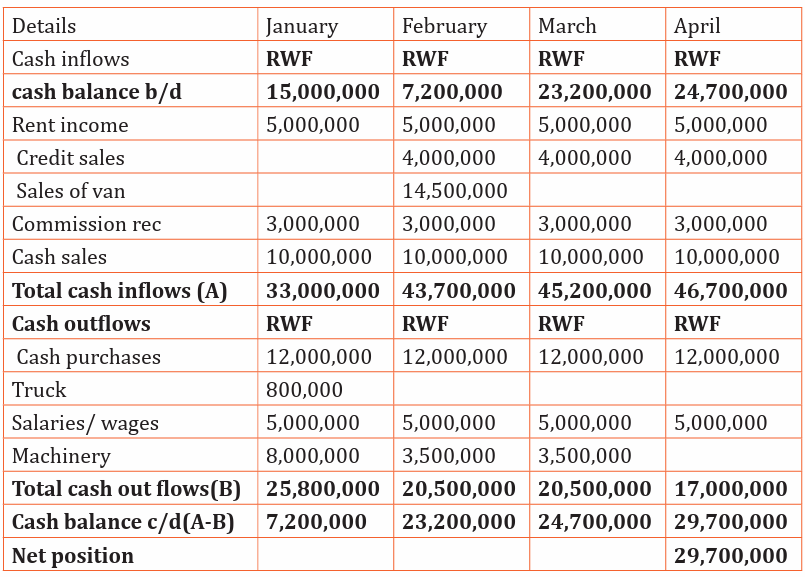

Example: Prepare Didi’s cash flow for the month of January, February, March

and April 2006, given the following information below:

Cash balance b/d or b/f in January was 15000,000Rwf

Monthly rent income was 5000,000Rwf

Monthly credit sales to be paid in the next month were 4000,000 Rwf

Sold a business van in February 14,500,000 Rwf

Monthly commission received was 3000,000Rwf

Monthly cash sales 10,000,000 Rwf

Monthly cash purchases 12,000,000Rwf

Bought a truck in January 800,000 Rwf

Monthly salaries and wages 5000,000Rwf

Bought machinery worth 15,000,000Rwf, payment of 8,000,000 Rwf was

made in January and the balance was paid in two equal installments duringthe month of February and March.

Solution

DIDI’S CASH FLOW STATEMENT FOR JANUARY, FEBRUARY, MARCH AND APRIL

PRACTICING MONEY MANAGEMENT HABITS

With the cost of goods and materials rising, using resources efficiently and

reducing your business’ waste makes good financial sense. It’s also better for

the environment. The cost of sending waste to landfill is increasing, and so

are the restrictions on what you can send. You can face penalties if you do not

handle waste appropriately or have the right paperwork before it leaves your

premises.

You can save money and make your business more efficient by focusing on how

you reduce, reuse, recycle or recover and repair in your business, and how you

deal with the waste that remains.

1. Reducing waste

• Cutting the amount of waste your business has to handle is the most cost

effective and environmentally-friendly method of dealing with waste.

• There are a number of areas you could focus on:

-Procure carefully - buy only what you need, control stock and

streamline processes across departments. Buy equipment in bulk to

reduce packaging and consider the product›s durability and lifespan -

replacing equipment less often will reduce the waste you create.

-Look for easy wins - seemingly trivial changes can produce significant

savings, such as printing and photocopying double-sided, refilling

printer cartridges, switching off lights and electrical equipment, and

using rechargeable batteries.

-Review your processes - ensure that equipment and materials are

used efficiently and packaging is kept to a minimum.

-Product design - keep the amount of materials you use in products to

a minimum.

-Packaging design and use - make sure you use as little packaging as

possible to achieve an adequate level of protection for your products.

2. Reusing waste

You may be able to reuse materials and equipment in your own business or

another organization.

For example, consumers can refill a purchased bottle of water with water from

home to minimize the number of plastic bottles being discarded.

Reusing your own business waste can reduce your costs as you won’t need to buy

raw materials or pay to dispose of the waste. You may also be able to generate

income from materials and goods that are valuable to another organization.

3. Recycling waste

Recycling is the third-best waste management option for your business, after

reducing and reusing waste. Even so, recycling is important because it reduces

the amount of waste sent to landfill and reduces the need to use new raw

materials. Recyclables include glass, newspaper, aluminum, cardboard and a

surprising array of other materials.

4. Repair

The business can repair broken materials and equipment such as lampsinstead of buying new ones

Application Activity 5.5

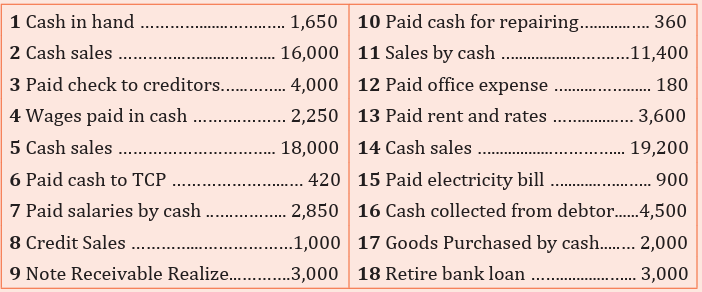

1. Write up a single column cash book of UBUMWE Enterprise forthe month of April 2015, from the following?

Requirement: Prepare cash book at April 30, 2015:

2. Given the information below on Central Trading Company Ltd for

the month of April, May & June

• On 1st April, 2005 Central Traders Company Ltd had a cash

balance of 10,000,000 Frw.

• It expected monthly cash sales of 5000,000 Frw.

• Credit sales were 3,500,000 Frw per month and the payments

• would be made in the following months.

• Monthly rent income from some of its properties was expected

to be 1,000,000 Frw

• Monthly cash purchases were 6,000,000 Frw.

• Monthly salaries and wages bills were projected at 800,000 Frw.

• A loan from Umwalimu Sacco was 10,000,000 Frw was received in May.

• Monthly interest payment of 100,000 Frw on the loan.

• Monthly raw material for 5000,000 Frw.

Required: Prepare central trading company’s cash flow statement for

the month of April, May, and June

Skills lab 5

Discuss and suggest strategies or how you will cut costs/expenses

using the 4Rs (reducing, recycling, repairing and reusing) in your

student business club. Prepare a new projected cash flow statement

after applying the suggested strategies.

End of unit 5 Assessment

1. Read the following dialogue and answer the questions that follows;

Peter: Does what you know now about money management affect

your future?

Peace: Of course what you know today affects tomorrow. You

couldn’t drive a car without a license, and that is why you need to

begin learning about how to spend your money wisely today.

Peter: How does your attitude towards money change as you age?

Peace: Five-Year-Old: Come On mom, can I have some money to buy

that ring?

Fourteen-year-old: Mom, I want 10,000Frw to buy designer label

top and those cool pants.

Eighteen-Year-old: Shoot, I know how i can get money for college.

I will ask mom.

Forty-Year-Old: I need to save for my retirement. No excessive

spending.

Questions

i. With examples explain how your money management affects your

future wellbeing.ii. Where do you think a person can save?