UNIT 3: TAXES IN BUSINESS

Key unit competence: To be able to analyze the role of tax towards economic

development of the country and pay taxes.

Introductory activity: A case study

Why Do You Have to Pay Taxes

Every year around, before and after June 15, everybody especially business

people will be discussing about tax changes in the national budget. This is

because tax reforms and new taxes introduced are announced on that day.

However, have you ever wondered why you and businesses need to pay taxes?

In Rwanda, there are arms of the government (ruling bodies) from the

village, sector, district, provincial and national levels. These bodies comprise:

Legislature (who make laws), Executives (who enforce laws) and Judiciary

(who exercise laws). The salaries that public servants receive to do their jobs

come from taxes. Paying taxes is considered a civic duty, although doing so isalso a requirement of the law.

Taxes take many forms too. When you work at a job to make money, you pay

income taxes. Depending on how much money you earn, a certain percentage

(part) of the money you make is withheld (kept out of your paycheck andsent to the government).

When you buy things at a store, you also usually pay sales tax, which is a

percentage of the cost of the item charged by the store. If you own property,you also pay property taxes on the value of your property.

Paying your taxes is considered a civic duty, although doing so is also a

requirement of the law. If you do not pay your taxes, the government agency

that oversees taxes — the Rwanda Revenue Authority or RRA - will requireyou to pay your taxes or else face penalties, such as fines or going to jail.

The money you pay in taxes goes to many places. In addition to paying the

salaries of government workers, your tax also help to support commonresources, such as police and firefighters.

Tax money helps to ensure the roads you travel on are safe and well

maintained. Taxes fund public libraries and parks. Taxes are also used to fund

many types of government programs that help the poor and less fortunate,as well as many schools!

Each year as the “tax day” rolls in, adults of all ages and businesses must

report their income to the RRA, using special tax forms. There are many laws

that set forth complicated rules about how much tax is owed and what kinds

of special expenses can be used (“written off”) to lower the amount of taxesyou need to pay.

For the average worker, tax money has been withheld from paychecks

throughout the year. On “tax day,” each worker reports his or her income andexpenses to the RRA.

Employers also report to the RRA how much they paid each worker. The RRA

compares all these numbers to make sure that each person pays the correctamount of taxes.

If you have not had enough tax money withheld from your checks throughout

the year to cover the amount of tax you owe, you will have to send more

money (“pay in”) to the government. If, however, too much tax money was

withheld from your paychecks, you will receive a check (get a “refund”) fromthe government.

From the passage answer the following questions:

What are the major changes expected by people especially business people

on June 15, every year?

What makes the business people so anxious to know the changes mentionedabove in a)?

Why do you think it is important for businesses to pay taxes to the government?

How do the following benefit from taxes?

i) Entrepreneur.

ii) Government.

iii) Society.

a) Identify and briefly explain at least two types of taxes paid in Rwanda?

b) What happens to businesses or people who do not pay taxes?c) What is the difference between tax and taxation?

3.1. Tax and business tax

Activity 3.1

1. Explain the meaning of the following terms used in taxation:

a) Tax b) Business tax

2. In your community, you have probably heard people and business

people complaining about the taxes they pay or charged to different

or similar items. Identify any 5 things you have heard normally

people complain about.

3. If you were the one determining or imposing taxes to people andbusinesses, mention any five things you would put into consideration.

3.1.1. Meaning of taxation concepts

Tax is a fee without direct exchange requested to the members of the community

by the State according to the law, to financially support the execution of the

government tasks.

Business tax refers to compulsory and non-refundable payments made by

the business to the government or local authority to raise revenue to finance

public expenditures.

Taxation is a system of raising money or revenue by the government from

individuals/businesses and companies by law through taxes.

Taxation is a system/practice of government collecting money from its citizens

to pay for public services.

Tax avoidance is a situation where a business person does not pay tax because

s/he has avoided the product or activity on which the tax is imposed. It is the

taxpayer’s exploitation of loopholes in the tax system there by paying less tax

than what they are supposed to pay.

Example of Tax Avoidance:

• Taking legitimate tax deductions to maximize business expenses and

thus lower your business tax bill.

Tax evasion is the illegal practice of not paying taxes by either not reporting

income, reporting expenses not legally allowed, or by not paying taxes owed. In

businesses, tax evasion can occur in connection with income taxes, employment

taxes, sales, etc.

Examples of practices considered as tax evasion:

• It is considered tax evasion if you knowingly fail to report income.

• Under-reporting income (claiming less income than you actually received

from a specific source).

• Providing false information to the RRA about business income or expenses, etc.

3.1.2 Characteristics or principles of a good taxation system

A good taxation system can contribute a lot to the economic development of a

country and its national treasury. Equitable taxation system bears a significant

role in bringing harmony in the lifestyle of the population of the country. A good

tax system should consist of taxes which conform to the canons of taxation. Thecanons or principles of taxation are explained as follows:

1) Convenience: Places, periods and seasons in which the tax dues are

collected should be convenient to the taxpayer. For example, the convenient

time to a trader is when s/he has made a profit. For a farmer, is when s/she

has sold his/her products.

2) Simplicity: The type of tax and the method of assessment and collection

must be understandable by both the taxpayer and tax collectors.

Complicated taxes may lead to disputes, delays and high costs of collection

in terms of time and resources.

3) Certainty: The taxpayer must know the nature, base and amount of tax

without doubt. Unpredictable taxes discourage investment and reduce

work effort. Simply the tax should not be arbitrary.

4) Economy: The cost of collection and administration of tax must be much

lower than the tax collected

5) Elasticity: A tax should change directly with a change in the tax base. If the

tax base increases, the tax charged on the tax base should also increase.

6) Productivity: The fiscal authorities should be able to predict and forecast

accurately the revenue a particular tax would generate and at what rate it

would flow in.

7) Equity: Tax assessment should be in such a way that taxpayers bear a

proportionately equal burden. I.e. people who earn more income should

be taxed more than those who earn less income.

8) Diversity: This canon requires that there should be a number of taxes of

different varieties so that every class of citizen may be called upon to paysomething towards the national priorities

Application Activity 3.1

1. Why is it important to have principles of taxation?

2. Referring to the principles (characteristics) of a good taxation system

you know, briefly explain why each is important to the taxpayer and

tax authority (RRA).

3. With examples, differentiate

a) Tax and Taxation

b) Tax avoidance and Tax evasion

4. Do you think tax evasion is good? Give reasons to support your response

3.2. Importance of paying taxes

Sources: http://www.kigalicity.gov.rw

Figure 3.2 Taxes help the government to build infrastructures

Activity 3.2

1. With examples from your community or Rwandan community at

large, why do you think people and business enterprises need to pay

taxes to the government?

2. As an entrepreneur to be or referring to the activities of entrepreneurs

in your community, how do you think businesses or entrepreneurs

benefit from paying taxes?

3. In general, how does your society benefit from paying taxes? Give

examples to support your views.3.2.1. Importance of paying taxes to an entrepreneur

• Paying taxes by the entrepreneur helps the business activity to continue,

as it does not face penalties and associated costs from the RRA for non

payment.

• When an entrepreneur pays taxes, it improves his/her reputation or

public image which may result in increased customers and better services

from the government.

• To avoid inconveniences of closure of the business and its associated

costs: when entrepreneur fails to pay assessed taxes, his/her business is

subject to penalty even closure to some cases.

• Business needs certain infrastructures to operate successfully such as

roads to move raw materials, finished goods, workers; security for their

enterprises, among others, and all these are provided by the government

from taxes.

• Paying taxes means contributing money to government agencies or

departments such as Development Bank of Rwanda (BRD), Business

Development Fund (BDF), which support entrepreneurs to operatebusiness activities through soft loans and other financial support.

3.2.2. Importance of paying taxes to the government

• Source of government revenue: taxes are the main source of government

revenue to finance its public expenditure. So taxes enable the government

to pay its workers, construct roads, maintain security, provide health care,

education among others.

• Taxes benefit the Rwandan government to meet its objectives and goals

such constructing affordable houses to the citizens which helps improve

the standards of living

• Taxes help the government to finance its policies especially on poverty

alleviation through programs such as “GIRINKA”, “VUP”, “UBUDEHE”

among others.

• Taxes enable the government to regulate the prices of goods and services

in the country hence ensuring a low cost of living and maintaining the

standards of living of the citizens.

• Taxes enable the government to maintain a balance between the poor

and rich. The government uses the taxes from business people to provide

services needed by the poor, which otherwise the rich could not provide.

• Taxes enable the government to promote its policy industrialization

through reducing products from other countries that would otherwise

outcompete the home industries.

• Taxes enable the government to ensure that the citizens have enough

products. This can be through taxes charged to reduce products moving

out of the country or removing taxes on goods needed in the country. Thishelps maintain a high standard of living.

3.2.3. Importance of paying taxes to Society

• There are reduced rates of poverty among the community due to a

significantly equal distribution of income through various activities and

projects set by the government.

• Improved wellbeing among the vulnerable and elderly as they benefit

from the different government programs financed through taxes.

• Reduced infant mortality rates and increased life expectancy due to

improved access to health facilities and services.

• Increase in the percentage of the population that completes secondary

and TVET education, reducing the literacy levels, improving on the

peoples’ skills through programs such as 12YBE.

• Increased community/social solidarity, general happiness, life satisfaction,

and a significant more trust among the community members and for

public institutions.

• Taxes are charged on some products to discourage their production

and usage hence controlling over-exploitation of resources as well asprotecting the environment which is vital for the existence of the society.

Application Activity 3.2

1. By giving specific examples from your community, how does your

society benefit from taxes?

2. What do you think would happen in the country if taxes were not paid?

3.3. Calculation of taxes

Activity 3.3

1. Do you think it is important for an entrepreneur to know how to

compute the amount of tax he/she is supposed to pay? Give reasons.

2. What do you think the term “Pay-As You-Earn (PAYE) tax means”?And how is it calculated?

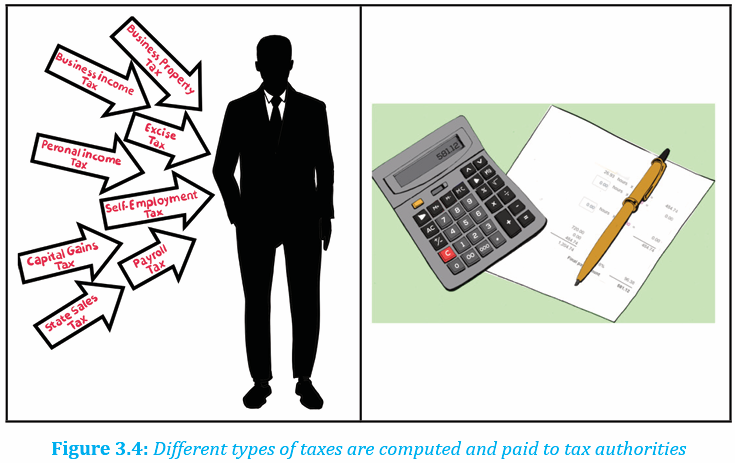

There is a variety of taxes that a business has to pay such as corporate income

tax, trading license tax, professional income tax or PAYE (Pay-As-You-Earn),

rental income tax, fixed asset tax, Value Added Tax (VAT), Sumptuary tax, etc.

but here, an emphasis is made on:

1. Pay- As- You Earn (PAYE) and

2. Value Added Tax (VAT

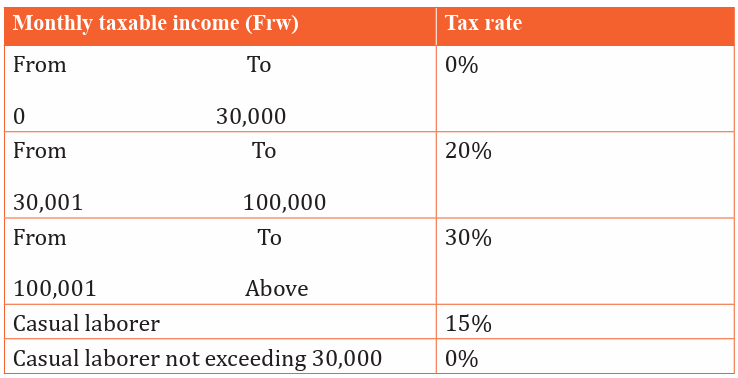

3.3.1. Pay-As -You-Earn (PAYE) tax or professional income tax

The tax law requires that when an employer makes available employment

income to an employee the employer must withhold, declare, and pay the PAYE

tax to the Rwanda Revenue Authority within 15 days following the end of the

month for which the tax was due.

PAYE: is composed of Wages, salaries, leave pay, sick pay, medical allowances,

pension payment etc. Pay-As-You-Earn tax is computed as follows:

Example:

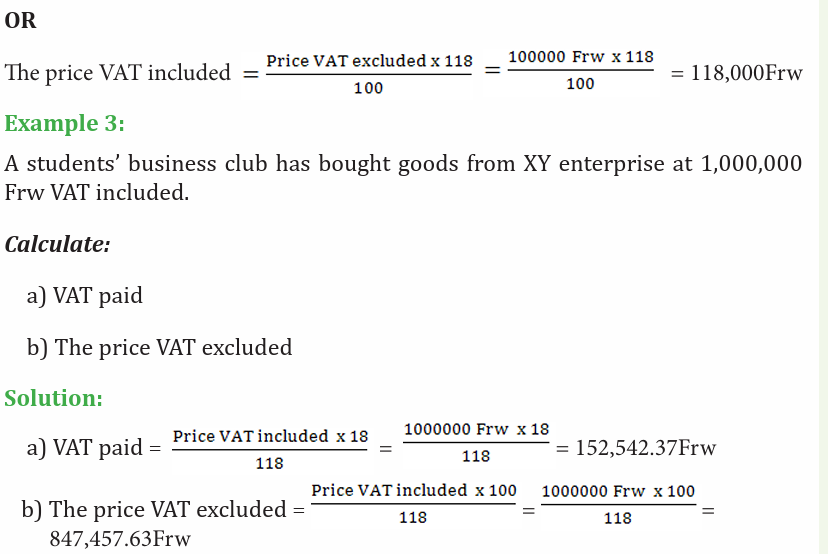

The following relate to monthly salaries of Kanyarwanda enterprise employeesfor year 2018.

a) Rukundo earns 450,000Frw

b) Karinganire earns 89,000Frw

c) Keza earns 28500Fwd) Buzima earns 12,5000Frw

Required:

Calculate the total PAYE for above employees that Kanyarwanda enterprisepays to RRA every month.

Solution:

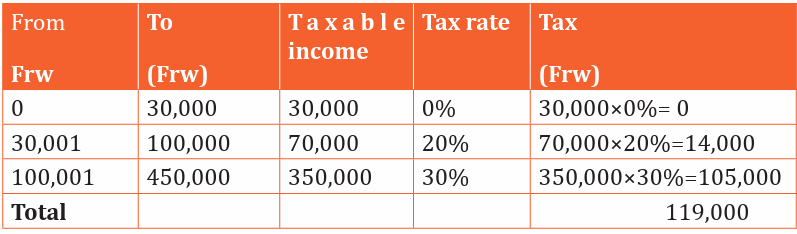

a) Rukundo :

Total TAX for Rukundo = 14000+105000= 119,000Frw

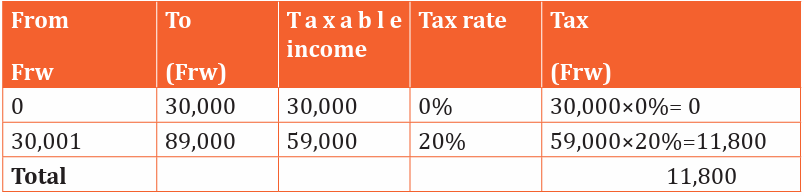

b) Karinganire:

Total tax for Karinganire is 11,800Frw

c) Since Keza earns less than 30000Frw she does not pay PAYE. Her total tax =0(28500*0)

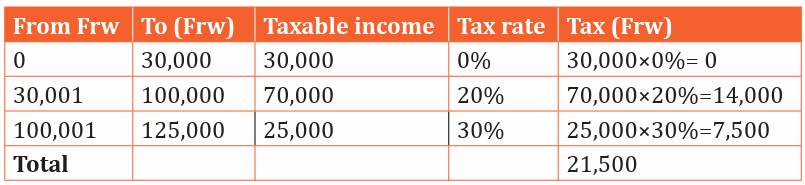

d) Buzima:

Total tax for Buzima =14000+7500=21,500Frw

Total PAYE for Kanyarwanda enterprise every month

= (119,000+11,800+21,500)Frw= 152,300Frw

Note:

Exemption for PAYE is that every person who earns income less than 30000

does not pay PAYE to RRA.

The “casual laborer” means an employee or worker who performs unskilled

labour activities, who does not use machinery or equipment requiring special

skills, and engaged by an employer for an aggregate period not exceeding thirty(30) days during the tax period.

3.3.2. Value Added Tax (VAT)

Value Added Tax was introduced in Rwanda in 2001. VAT is a tax on the added

value achieved by a firm. This is the difference between the buying price (ofraw materials) and the selling price of the product in whatever forms it is sold.

Value added = F.P – I.C where F.P is final product, IC is intermediate costs

Tax rate

The VAT rate is applied to duty-free goods. Several rates can be applieddepending on the nature of products. The standard rate is usually 18%

Example 1:

UTEXRWA industry bought cotton from a local farmer worth 1200, 000Frw to

use in production of blankets;170 blankets were manufactured and sold to a

wholesaler at a cost of 4,000,000Frw who later supplied it to LEMIGO hotel

at a value of 8,000,000Frw VAT included. Calculate the value of VAT paid onblankets.

Possible solution

Step 1 VAT paid by local farmer:

VAT =1,200,000Frw*18% = 216,000Frw

Step 2 VAT paid by wholesaler:

VAT = FP -IC where FP is final product and IC is intermediate cost

Value added =4,000,000Frw-1,200,000=2,800,000Frw

VAT paid by wholesaler =2,800, 000Frw*18%= 504,000Frw

Step 3 VAT paid by LEMIGO hotel:

VAT paid by LEMIGO hotel= 8,000,000-4,000,000Frw=

(4,000,000Frw*18%)=720,000Frw

Therefore, total VAT =216,000+504,000+720,000 =1440, 000Frw

Alternative:

VAT is calculated on sales.

VAT =sales *18%

Which is equal 8,000,000Frw*18%=1,440,000Frw

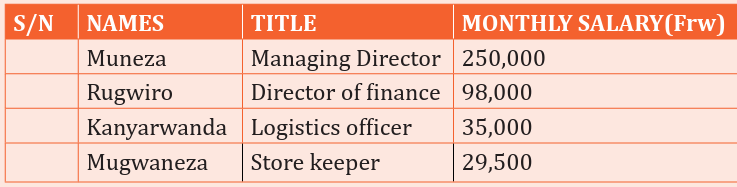

Example 2:

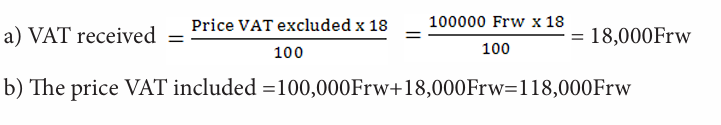

A students’ business club has sold goods to XY enterprise at 100,000 Frw VAT

excluded.

Calculate:

a) VAT receivedb) The price VAT included

Solution:

OR

The price VAT excluded= Price VAT included-VAT paid= 1,000,000Frw- 152,542.37Frw = 847,457.63Frw

Exemptions on Value Added Tax

The following goods and services shall be exempted from value added tax:

1. Services of supplying clean water and ensuring environment treatment

for nonprofit making purposes with the exception of sewage pump- out

services;

2. Goods and services for health-related purposes: (health and medical

services, equipment designed for persons with disabilities, goods and drugs

appearing on the list made by the Minister in charge of health and approved

by the Minister in charge of taxes.

3. Educational materials, services and equipment; books, newspapers and

journals

4. Transportation services by licensed persons:

5. Lending, lease and sale: (sale or lease of land, sale of a whole or part of a

building for residential use, renting or grant of the right to occupy a house

used as a place of residence of one person and his/her family) etc.

6. Financial and insurance services:

7. Precious metals: sale of gold in bullion form to the National Bank of Rwanda;

8. Any goods or services in connection with burial or cremation of a body

provided by an Order of the Minister in charge of finance;

9. Energy supply equipment appearing on the list made by the Minister in

charge of energy and approved by the Minister in charge of taxes;

10. Trade union subscriptions;

11. Leasing of exempted goods;

12. All agricultural and livestock products, except processed ones. However,

milk processed, excluding powder milk and milk derived products, is

exempted from this tax;

13.Agricultural inputs and other agricultural and livestock materials and

equipment appearing on the list made by the Minister in charge of agriculture

and livestock and approved by the Minister in charge of taxes.

14. Gaming activities taxable under the Law establishing tax on gaming

activities;

15. Personal effects of Rwandan diplomats returning from foreign postings,

Rwandan refugees and returnees entitled to tax relief under customs laws.

16. Goods and services meant for Special Economic Zones imported by a zone

user holding this legal status;

17. Mobile telephones and SIM cards;

18. Information, communication and technology equipment appearing on the

list made by the Minister in charge of information and communicationtechnology and approved by the Minister in charge of taxes.

Application Activity 3.3

1. A students’ business club (SBC) in one of the TTCs has the following

regular employees. Their salaries are in accordance with theirappointment as follows:

Calculate the PAYE tax on each individual employee

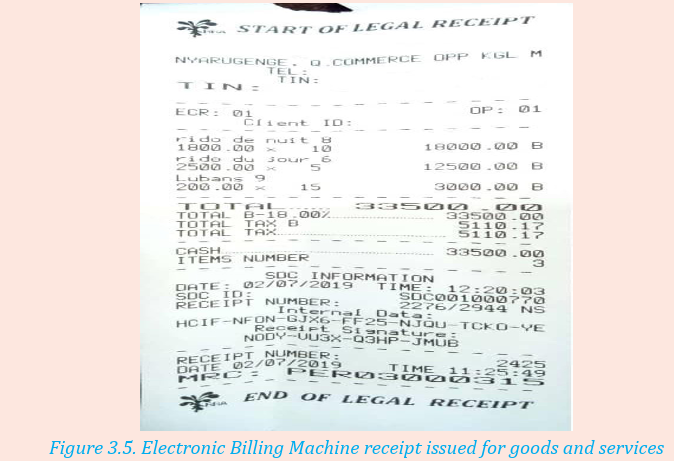

2. The PAYE tax to be withheld and paid by the business club to RRA2.

Using the information available on the below EBM issued receipt,

compute the following:

a) Price VAT excludedb) VAT to prove the amount appearing on the receipt.

3.4. Penalties of not paying tax

Activity 3.4

1. Identify instances through which a taxpayer may undergo various

penalties.

2. What do you think may happen to an entrepreneur if he/she does not

comply with the tax obligations?

The penalties of not paying tax include:

• Fines and interest: A taxpayer who fails to comply with the provisions

of law determining and establishing a tax shall be liable to a fine. The

fines will vary according to types of taxes.

Example of Penalties and Interest on not paying PAYE

A taxpayer who fails to pay tax within the due date is required to pay interest

on the amount of tax. Interest is calculated on a monthly basis at the inter-bank

offered rate of the National Bank of Rwanda plus 2 (two) percentage points. For

example, if the inter-bank rate is 9%, interest is imposed at 11% annually.

• Imprisonment: A tax fraud’s punishment in Rwanda, is the jail for a

period between six (6) months and two (2) years; even the Minister’s

order determines an award given to any person who denounces a

taxpayer who engages in that act. Failure to pay tax withheld: this

undertakes 100% penalty and 3months to 2years in jail.

• Closure of the business for 30 days;

• Cancellation or withdrawal of registration certificate;

• Banned from public tenders;• Exposure in the media

Application Activity 3.4

1. Discuss why RRA charges fines and penalties?

2. What do you think will happen if taxpayers don’t pay both taxesassessed and fines/penalties?

Skills lab 3

1. Justify the following statements with concrete examples:

• “Taxes are more of a benefit than a cost to an entrepreneur”• “ Tax evasion is a shortcut to business growth”

2. A business club at one of the TTCs has 3 regular employees namely

KALISA, KALIZA and BERWA with monthly salaries of 35,000Frw,

40,000Frw and 20,000Frw respectively. On top of that the business

made sales of 300,000Frw VAT exclusive, and the input VAT is

34,000Frw.

a) Calculate the total amount of tax that the business club has to pay

to RRAb) Advise the above business on how the above taxes would be paid.

End of unit 3 Assessment

1. It is said that “tax is the free money to central or local authorities from

taxpayers” do you agree with this statement. Justify your answer

2. Describe any four characteristics of a good taxation system.

3. How are taxes used by government to:

a) Support Entrepreneurs

b) Support the community

4. Fill in the missing gaps, with the most appropriate term:

a) …………. punishment is the jail for a period between six (6) months

and two (2) years; even the Minister’s order determines an award

given to any person who denounces a taxpayer who engages in that

act.

b) …………. is the compulsory and non-refundable payment made by

the business to the Government or Local Authority so as to raise

their revenues.

c) …………. is the one that is exempted from VAT.

d) …………. is one of the taxes vested to the local government (Districts).

e) The degree to which the taxpayers meet their tax obligations

as set out in the appropriate legal and regulatory provisions

is……………………….

f) The………………. means an employee or worker who performs

unskilled labour activities, who does not use machinery or

equipment requiring special skills, and engaged by an employer for

an aggregate period not exceeding thirty (30) days during the taxperiod.