UNIT 7: GLOBALISATION

Unit Competency:

Analyse the impact of globalisation on Rwandan economy.

Introductory activity

Since ancient times, humans have sought distant places to settle, produce and

exchange goods enabled by improvements in technology and transportation. But

not until the 19th century did global integration take off. Following centuries of

European colonization and trade activity, that first “wave” of globalization was

propelled by steamships, railroads, the telegraph, and other breakthroughs, and

also by increasing economic cooperation among countries. The globalization

trend eventually waned and crashed in the catastrophe of World War I, followed

by postwar protectionism, the Great Depression, and World War II. After World

War II in the mid-1940s, the United States led efforts to revive international

trade and investment under negotiated ground rules, starting a second wave of

globalization, which remains ongoing, though buffeted by periodic downturnsand mounting political scrutiny. Source: https://www.piie.com

Analyse the above extract, base on it to carry out research and;

a) Explain what you understand by the term globalisation.b) Describe what has sparked off globalisation in the modern world?

7.1: Meaning and forms of Globalization:

Activity 7.1

Base on the figures above to;

a) Explain what you understand by the term globalisation

b) Identify and explain the forms of globalisation portrayed.

c) Describe other different forms which globalisation can take, apartfrom those forms identified above,

7.1.1: Meaning of Globalisation:

Globalisation is the growing interdependence of the world’s economies,

cultures, and populations, brought about by cross-border trade in goods

and services, technology, and flows of investment, people, and information.

Economically, globalization involves goods, services, the economic resources

of capital, technology, and data. With the increased global interactions comes

the growth of international trade, ideas, and culture. Globalization is primarily an

economic process of interaction and integration that’s associated with social

and cultural aspects. Current globalization trends can be largely accounted for

by developed economies integrating with less developed economies by means

of foreign direct investment, the reduction of trade barriers as well as othereconomic reforms and, in many cases, immigration.

7.1.2: Forms of Globalisation:

Globalisation may take the following forms:

1. Economic Globalisation

Economic globalization is the increasing economic interdependence of national

economies across the world through a rapid increase in cross-border movement

of goods, services, technology, and capital. Economic globalization involves

the process of increasing economic integration between countries, leading

to the emergence of a global marketplace or a single world market. It also

involves worldwide economic system that permits easy movement of goods,

production, capital, and resources. No national economy is an island now.

To varying degrees, national economies influence one another. One country

which is capital-rich invests in another country which is poor. One who has

better technologies sells these to others who lack such technologies. Example:Multinational corporations.

2. Technological Globalisation.

This is the connection between nations through technology such as television,

radio, telephones, internet, etc. This was traditionally available only to the rich

but is now far more available to the poor. Much less infrastructure is needed

now. Technological globalization makes it possible for countries to connect in

other ways, such as financially through sending loved ones money across theglobe or culturally by watching movies from other nations.

3. Political Globalisation.

Political globalization refers to the growth of the worldwide political system, both

in size and complexity. It includes national governments, their governmental and

intergovernmental organizations as well as government-independent elements

of global civil society such as international non-governmental organizations and

social movement organizations. It is the expansion of a global political system,

and its institutions, in which inter-regional transactions e.g. trade are managed.

Political cooperation between different countries is a form of globalization that

is used to prevent and manage conflict. For example, global organizations such

as the United Nations and the World Trade Organization were created to diffusepolitical issues and maintain order on an international scale.

4. Cultural Globalisation.

Cultural globalization refers to the transmission of ideas, meanings, and values

around the world in such a way as to extend and intensify social relations. It involves

the merging or “watering down” of the world’s cultures e.g. food, entertainment,

language, etc. This process is marked by the common consumption of cultures

that have been diffused by the Internet, popular culture media, and international

travel. Cultural globalisation has been facilitated by the information revolution,

the spread of satellite communication, telecommunication networks, information

technology and the Internet etc. This global flow of ideas, knowledge and

values is likely to flatten out cultural differences between nations, regions andindividuals.

5. Financial globalisation

This is the interconnection of the world’s financial systems e.g. stock markets,

more of a connection between large cities than of nations.

6. Ecological Globalisation

This refers to seeing the Earth as a single ecosystem rather than a collection

of separate ecological systems because so many problems are global in nature

e.g. International treaties to deal with environmental issues like biodiversity,climate change or the ozone layer, wildlife reserves that span several countries.

7. Sociological Globalisation

This is a growing belief that we are all global citizens and should all be held

to the same standards and have the same rights e.g. the growing international

ideas that capital punishment is immoral and that women should have all thesame rights as men.

8. Environmental globalisation:

This refers to the internationally coordinated practices and regulations (often in

the form of international treaties) regarding environmental protection. An example

of environmental globalization would be the series of International Tropical

Timber Agreement treaties (1983, 1994, 2006), establishing International

Tropical Timber Organization and promoting sustainable management of tropical

forests. Environmental globalization is usually supported by non-governmental

organizations and governments of developed countries, but opposed by

governments of developing countries which see pro-environmental initiatives

as hindering their economic development. Environmental globalization is

related to economic globalization, as economic development on a global scale

has environmental impacts on such scale, which is of concern to numerousorganizations and individuals.

9. Military globalisation:

Military globalization is defined by David Held as “the process which embodies

the growing extensity and intensity of military relations among the political units

of the world system. It reflects both the expanding network of worldwide military

ties and relations, as well as the impact of key military technological innovations

(from steamships to satellites), which over time, have reconstituted the world

into a single geostrategic space. Military globalization implies firmer integrationof armed forces around the world into the global military system.

Application Activity 7.1.

What indicates that the world is globalized?

7.1.3: Causes and effects of Globalisation:

Activity 7.2

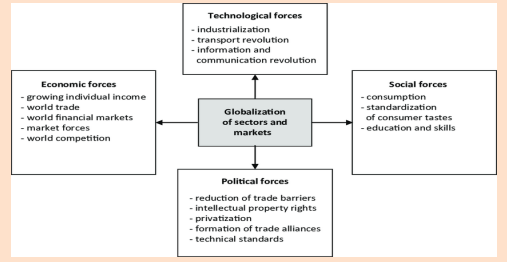

a) From the image above, categorize the different factors that have given

rise to globalisation.

b) Other than the above mentioned factors, carry out research about

globalisation, and cite what factors have given rise to globalisation in therecent past.

7.1.3.1: Causes of Globalisation:

Globalization is driven by various new development and gradual changes in

the world economy. Generally, organizations go global for expanding their

markets and increasing their sales and profits. The process of globalization has

accelerated in the recent past due to a variety of factors, among which includethe following;

- Improved transport, making global travel easier. As transportation

technology improved, travel time and costs decreased dramatically between

the 18th and early 20th century. Today, modern aviation has made long-distance

transportation and movement of people and goods across theglobe, quick and affordable.

- Increased rise in International education: More and more students

are seeking higher education in foreign countries and many international

students now consider overseas study a stepping-stone to permanent

residency within a country. The contributions that foreign students make to

host nation economies, both culturally and financially has encouraged major

players to implement further initiatives to facilitate the arrival and integration

of overseas students, including substantial amendments to immigration andvisa policies and procedures, hence promoting globalisation.

- Transnational marriages: There has been a growing rise in marriages

between people from different countries thus spearheading globalization.

A growing number of people have ties to networks of people and places

across the globe, rather than to a current geographic location, thus, people

are increasingly marrying across national boundaries making it easier to

travel to different parts of the world since it’s become “a single village”,hence globalisation.

- Improved technology: Technological advances allows states to learn

of others’ existence and this makes it easier to communicate and share

information around the world. E.g. through internet. Also, the advancement

in technology and improved communication network has facilitated the

exchange of goods and services, resources, and ideas, irrespective of

geographical location. In this way, advanced technologies have led toeconomic globalization.

- Globalization has been spread by Global journalism which provides

massive information and relies on the internet to interact, “makes it into an

everyday routine to investigate how people and their actions, practices,problems, life conditions etc. in different parts of the world are interrelated.

- Increased inter-dependency, stability, and regularity among world

economies. If states were dependent on their own production and

resources to work then there is no way for any state to be mutually affected

by the other. Therefore, interdependence is one of the driving forces behindglobal connections and trade.

- The rate of globalization has also increased under the framework of

the General Agreement on Tariffs and Trade and the World Trade

Organization, in which countries gradually cut down trade barriers and

opened up their current accounts and capital accounts. This recent boom

has been largely supported by developed economies integrating with

developing countries through foreign direct investment, lowering costs of

doing business, the reduction of trade barriers, and in many cases cross-border migration.

- Growth of multinational companies with a global presence in manydifferent economies.

- Growth of global trading blocs which have reduced national barriers.(e.g. European Union, NAFTA, ASEAN)

- Improved mobility of capital. In past few decades there has been a

general reduction in capital barriers, making it easier for capital to flow

between different economies. This has increased the ability for firms to

receive finance. It has also increased the global interconnectedness ofglobal financial markets.

- Increased mobility of labour. People are more willing to move between

different countries in search for work. Global trade remittances now play alarge role in transfers from developed countries to developing countries.

- Increase in Consumer Demand acts as a main driver to facilitate

globalization. Over the years, with increase in the level of income and standard

of living, the demand of consumers for various products has also increased.

Apart from this, nowadays, consumers are well aware about products and

services available in other countries, which impel many organizations to work

in association with foreign players for catering to the needs of the domesticmarket.

- High Competition: Organizations generally strive hard to grain competitive

edge in the market. The frequent increase in competition in the domestic

market compels organizations to go global. Thus, various organizations

enter other countries (for selling goods and services) to expand their marketshare.

- Reduction in Cross-trade Barriers: Gradual relief in the cross-border

trade restrictions by most governments has induced free trade, which, inturn, has increased the growth rate globalisation.

7.1.3.2: Effects of Globalisation:

Activity 7.3

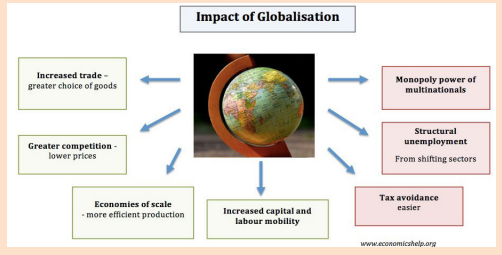

From the image above,

a) Identify the positive and negative impact of globalisation.

b) Discuss other effects of globalisation on world economies not mentionedin the image above.

The aim of globalization is to benefit individual economies around the world

by making markets more efficient, increasing competition, limiting military

conflicts, and spreading wealth more equally. The wide-ranging effects of

globalization are complex and politically charged. As with major technological

advances, globalization benefits society as a whole, while harming certain

groups. Understanding the relative costs and benefits can pave the way for

alleviating problems while sustaining the wider payoffs. Therefore, the effects ofglobalisation to global countries may include among others the following.

Positive effects of globalisation.

Globalisation can create new opportunities, new ideas, and open new markets

that an entrepreneur may have not had in their home country. As a result, thereare a number of positives associated with globalisation:

- Inward investment by Trans-National corporations (TNCs) has helpedcountries by providing new jobs and skills for local people.

- Foreign direct investment (FDI) have increased at a much greater rate than

the growth in world trade, helping boost technology transfer, industrial

restructuring, and the growth of global companies. They, therefore, have

brought wealth and foreign currency to local economies as they buy

local resources, products and services. The extra money created by this

investment has been spent on education, health and infrastructure for

development purposes.

local resources, products and services. The extra money created by this

investment has been spent on education, health and infrastructure fordevelopment purposes.

- It has enabled the sharing of ideas, experiences and lifestyles of people and

cultures. People have experienced foods and other products not previouslyavailable in their countries.

- Increased competition from globalization has helped stimulate new

technology development, particularly with the growth in FDI, which hashelped improve economic output by making processes more efficient.

- Globalisation has increased awareness of events in far-away parts of the

world. This has helped to make people more aware of global issues such

as deforestation and global warming and alerted them to the need forsustainable development

- Globalization has tended to bring people into contact with foreign people

and cultures. This has reduced the issue of xenophobia and its negativeeffects.

- Open world trade has increased economic growth and raised livingstandards of people in different countries across the world.

- Globalization enables large companies to realize economies of scale that

reduce costs and prices, which in turn supports further economic growth,

although this can hurt many small businesses attempting to competedomestically.

- Economic globalization has given governments of developing nation’s

access to foreign lending. When these funds are used on infrastructure

including roads, health care, education, and social services, the standard

of living in the country increases. If the money is used only selectively,however, not all citizens will participate in the benefits.

- Globalization has led to free trade between countries. This is one of its

largest benefits to developing nations. Homegrown industries see trade

barriers fall and have access to a much wider international market. The

growth this generates, allows companies to develop new technologies andproduce new products and services.

- It has allowed businesses in less industrialized countries to become part

of international production networks and supply chains that are the mainconduits of trade.

- Globalisation has led to more access to capital flows, technology, humancapital, cheaper imports and larger export markets.

- Access to new markets; It creates greater opportunities for firms in less

industrialized countries to tap into more and larger markets around theworld

- Reduced tariff barriers encouraging global trade. Often this has occurredthrough the support of the WTO.

- Globalisation has helped build a global economic order governed by

mutually accepted rules and overseen by multilateral institutions. This

has created a better world with countries seeking to cooperate with one

another to promote prosperity and peace. Free trade and the rule of law

being the mainstays of the system, have helped to prevent most economic

disputes from escalating into larger conflicts. E.g. International Monetary

Fund (IMF), World Bank (WB), United Nations (UN), North Atlantic TreatyOrganisation (NATO), World Trade Organisation (WTO) etc.

- Globalization encourages each country to specialize in what it produces

best using the least amount of resources, known as comparative

advantage. This concept makes production more efficient, promotes

economic growth, and lowers prices of goods and services, makingthem more affordable especially for lower-income households.

- Larger markets enable companies to reach more customers and get a

higher return on the fixed costs of doing business, like building factories

or conducting research. Technology firms have taken special advantageof their innovations this way.

- Competition from abroad drives different firms in different countries

to improve their products. Consumers have better products and morechoices as a result.

- Expanded trade spurs the spread of technology, innovation, and the

communication of ideas. The best ideas from market leaders spreadmore easily globally.

- Better-paying positions have opened up in manufactured exports,

especially in high-tech areas, such as computers, chemicals, and

transportation equipment and other high-skill work, notably in businessservices, such as finance and real estate.

- Globalization has helped narrow inequality between the poorest and

richest people in the world. By outsourcing their services to developing

countries, Transnational companies have saved money and changed

people’s lives. Because of this, poverty rates have declined worldwideover the past decades.

- One of the primary advantages of globalization is the free trade of goods

and resources. For instance, a country that specializes in motor vehicles

will produce cars and accessories in a location that achieves the lowest

costs possible, and sell them on both local and foreign markets. This

means that people living in other countries will be able to purchase these

vehicles for less. At the same time, they will have access to a wider rangeof brands and models.

- Globalization has allowed people to relocate to wealthier countries and

start their own business or find work. This has led to higher incomes and

more opportunities in life. Additionally, migrants have always sent moneyhome without paying exorbitant fees.

- The free movement of information and technology has enabled trade

unions to fight for workers’ rights worldwide. As new policies and

regulations were enforced, labor rights increased. Additionally, sensitive

issues, such as equal pay and gender equity, are becoming less andless prevalent.

- Multinational corporations are constantly expanding and hiring people in

the countries where they operate. Others implement exchange programs

to offer their employees the chance to work abroad. This furtheraccelerates globalization and promotes economic growth.

Negative effects of globalisation

No matter how much economists are quick to commend the universal benefits

of globalization, some politicians and other economist demonize globalization

as a force that takes away domestic sovereignty of all sorts. These conflicting

viewpoints have created a turbulence of opinions and policies across developed

countries that range from extreme protectionism through trade barriers, like

President Trump’s example, to complete openness. Therefore, like everythingelse, globalization has its drawbacks and the following are some of them.

-The free trade of goods, services and information set the world economy into

a cycle of income and employment growth. However, This, has led to decliningmoney flows and tight credit across local and national economies.

-Furthermore, employees in developed countries are losing their jobs due to pay

cuts. More and more companies are choosing to outsource work and export

jobs as a means to keep the costs low, and this has led to unemployment inmost countries.

-Large enterprises are now able to exploit tax havens worldwide, which hasaffected the local economy.

-The growth of international trade is worsening income inequalities, both

between and within industrialized and less industrialized nations.

-The practice of outsourcing for cheaper labor is exploitative and widens thegap between the world’s rich and the world’s poor.

-Globalization has led to the interdependence between nations, which has

caused regional or global instabilities where local economic fluctuations haveended up impacting a large number of countries relying on them.

-Political globalization has led to declining importance of the nation-state andthe rise of other actors on the political scene.

-Globalization has often been criticized for taking away jobs from domestic

companies and workers. Domestic industries go out of business because

imports from other countries drive down prices, even if consumption increases.

Small companies have found it difficult to compete and thus shut down,

leaving workers unemployed, while the larger industries have experienced asignificant protracted decline.

-In addition, it has contributed to job displacement especially low-wage workers

in certain regions. Many of them other than facing lower earnings have been

dropped out of the workforce. This is due to use of labor-saving technologies,like automated machines and artificial intelligence.

-Globalization has led to the increase in wages for workers, which has hurt

corporate profitability. For example, rich countries which have a high comparative

advantage in developing software, have driven up the price of software

engineers around the world, thus making it difficult for foreign companies tocompete in the market.

-The benefits of globalization have been unfairly sloped towards rich nations or

individuals, creating greater inequalities and leading to potential conflicts bothnationally and internationally as a result.

-Globalisation has increased Capital flight especially in developing where

assets or money rapidly flow out because of there is increase in unfavorable

financial conditions such as taxes, tariffs, labor costs, government debt andcapital controls as a result of sharp drop in the exchange rate.

-Globalisation has moved taxation away from corporations, and onto individual

citizens. Corporations have the ability to move to locations where the tax rate is

lowest. Individual citizens have much less ability to make such a change. Also,

with today’s lack of jobs, each community competes with other communitieswith respect to how many tax breaks it can give to prospective employers.

-Globalisation has set up a currency “race to the bottom,” with each country

trying to get an export advantage by dropping the value of its currency. Because

of the competitive nature of the world economy, each country needs to sell

its goods and services at as low a price as possible. This has been done

in various ways like paying its workers lower wages; allowing more pollution;

using cheaper more polluting fuels; or debase the currency by Quantitative

Easing (also known as “printing money,”) in the hope that this will produceinflation and lower the value of the currency relative to other currencies.

-Globalisation has encouraged dependence on other countries for essential

goods and services. With globalization, goods can often be obtained cheaply

from elsewhere. Countries have come to believe that there is no point in

producing their own food and clothes which they can obtain cheaply from other

countries. It has become easy to depend on imports and specialize in somethingelse and become dependent on other countries for essential commodities.

-Globalisation ties countries together, so that if one country collapses, the

collapse is likely to ripple through the system, pulling many other countries withit. This is because countries are increasingly interdependent.

-Cultural uniqueness has been lost in favor of homogenization and a “universal

culture” that draws heavily from the western culture. As a result of globalisation,

the values and norms of developed countries are gradually rooted in developing

countries. This has led to the growth of a monoculture - the culture of the north

(developed countries) being imposed on the South (developing countries). Thishas led to erosion of the cultures and loss of identity of developing countries.

-Global commerce is increasingly dominated by transnational corporations

which seek to maximize profits without regard for the development needs ofindividual countries or the local populations

-Competition among developing countries to attract foreign investment leads

to a “race to the bottom” in which countries dangerously lower environmentalstandards.

Application activity 7.2

Analyse the impact of globalisation on Rwanda’s economy.

7.2: Multinational corporations (MNCs)

Activity 7.4

Analyse the images above and answer the questions that follow.

i) What activities does each photo portray?

ii) Where do they originate from?

iii)Identify different other companies that operate in Rwanda that don’t

belong to such activities named above and which are not of Rwandanorigin.

iv)How have they impacted Rwanda’s development trend?

7.2.1: Meaning and examples of MNCs.

A multinational corporation or worldwide enterprise is an enterprise

operating in several countries but managed from one (home) country. OR it is

an organization that owns or controls production of goods or services in one or

more countries other than their home country. It can also be referred to as an

international corporation, a “transnational corporation”, or a stateless

corporation. Generally, any company or group that derives a quarter of its

revenue from operations outside of its home country is considered a multinationalcorporation.

A multinational corporation is usually a large corporation which produces orsells goods or services in various countries. MNCs can get involved in;

- Importing and exporting goods and services

- Making significant investments in a foreign country

- Buying and selling licenses in foreign markets

- Engaging in contract manufacturing i.e. permitting a local manufacturer in aforeign country to produce their products

- Opening manufacturing facilities or assembly operations in foreign countries

Foreign Multinational Corporations in Rwanda

- Korea Telecom Rwanda Networks (KTRN)- the wholesaler of fourthgeneration long-term evolution (4G LTE)

- Liquid Telecom- independent data, voice and IP provider and supplier of

fibre optic, satellite and international carrier services to Africa’s largestmobile network operators, ISPs and businesses of all sizes.

- Petroleum companies like Kobil Petroleum Rwanda, Engen etc.

- Mobile network providers like MTN and Airtel-Rwanda

- Financial institutions like Eco Bank, GT Bank, Bank of Africa, I &M bank etc.

- Construction companies like SMEC Rwanda, NITSAL INTERNATIONAL,Roko Construction Limited, STRABAG / ZÜBLIN INTERNATIONAL.

7.2.2: Effects of Multinational Corporations

Positive effects

- MNCs bridge the forex gap in developing countries by increasing forex inflow.

- They increase employment opportunities for citizens of the host countriessince they operate on large scales.

- They close the investment gap through forex investment abroad.

- They lead to improvement in domestic technology through transfer of superiortechnology to developing countries based on research and development.

- MNCs produce more output especially processed or manufactured whichincrease exportation of manufactured goods hence more forex to developing.

- MNCs promote capital accumulation in developing countries through transferof capital and building infrastructure.

- MNCs produce better quality products which help to improve standards ofliving of people in the society.

- They bring new marketing techniques developing countries markets researchand promotional methods which encourage competition and efficiency.

- They provide revenue to the government through taxes imposed on activitiesof the MNCs.

- They help to train labor in the management basic skills and entrepreneurability in developing countries.

- MNCs make a lot of profits which are ploughed back leading to the expansionof the economy there by promoting economic growth.

- They under take high risks and can invest in long term projects like mining

plantation and agricultural industries that bring about rapid economic growthand development.

- They are financially strong and hence provide large and cheap capital todeveloping countries by way of direct investment.

- They increase infrastructural development through construction oftelecommunication etc.

- MNCs increase the exploitation of domestic resources which increase volumeof productivity hence increasing export exchange.

- They promote international cooperation through consortiums hence increasingthe volume of trade.

- They encourage competition which leads to efficiency and better-qualityproducts.

- They help in filling the skilled manpower gap through exportation of expatriatesor trained personnel to the recipient countries.

Negative effects of MNCs

-MNCs repatriate their profits to their mother countries which lead to resourcesoutflow from developing countries thus disabling their development potentials.

-They are given tax exemption and holidays which reduce net governmentrevenue from them.

-MNCs usually use capital intensive technology and therefore may not help

to reduce their problems of unemployment in developing countries since arelabor surplus economies.

-They create social costs like quick exhaustion of natural resources,environmental degradation etc. since they operate on large scale.

-MNCs influence internal policies of developing countries by bribing the

legislature for example offering employment to the relatives of politicians in

their companies and at times they subvert domestic fiscal policies which resultinto low standards of living.

-MNCs accelerate regional or sector imbalances e.g. urban and rural areas

since they mostly set up their production activities in urban areas whereinfrastructure is already developed.

-MNCs cause income inequalities because they reserve top jobs for their

national who are highly paid and low paying jobs to the national of investmentcountries.

-They promote external dependency of host countries on the countries wherethey originate.

-They reduce domestic initiative in technological and manpower development.

-MNCs can bring about discontent and unrest among workers employed by

the government and indigenous firms due to the wage differentials betweenthe workers in MNCs and other workers.

Application activity 7.3

With specific examples of multinational financial institutions that operate

in Rwanda, assess their contribution towards the development process ofyour country.

7.3: Foreign direct investments (FDIs)

Activity 7.5

Analyse the photos above and answer the questions that follow;

a) Identify the type of activities they deal in.

b) State their countries of origin.

c) What economic term is given to such companies?

d) Cite different other examples of companies that are not of Rwandan origin thatextend their services to Rwanda.

e) Analyse the contribution of such companies to the development process ofRwanda.

f) How do you think Rwanda has been able to attract these investments in hereconomy?

7.3.1: Meaning and examples of Foreign DirectInvestments in Rwanda.

Foreign direct investments are the net inflows of investment to acquire a

lasting management interest in an enterprise operating in an economy other than

that of the investor. It refers to direct investment equity flows in the reporting

economy. It is the sum of equity capital, reinvestment of earnings, and other

capital. Direct investment is a category of cross-border investment associated

with a resident in one economy having control or a significant degree of influence

on the management of an enterprise that is resident in another economy. Direct

foreign investment involves the transfer of productive resources or capital by

foreign individuals, companies and MNCs to operate in an economy other thanthat of the investor.

Examples of FDIs in Rwanda

Some of the registered foreign direct investments in Rwanda include; Movit

Uganda Ltd, JKK International from Dubai, which started a construction

company; Mukwano Industries, Roofing Uganda, China Electronics, Lifan

moto taxi-Chinese, ALINK Technologies, and Yvonne Exclusive Design, an

upmarket fashion store, Egyptian House of Kitchenware, which opened a shop

in Kimironko – Gasabo district for general trading, and Tanzania’s Dodoma thatmakes mattresses.

7.3.2: Advantages of Foreign Direct Investments

- They increase the stock of capital in LDCs thus help break the cycle of povertywhich enables LDCs to achieve rapid economic growth.

- Provide managerial, administrative and technical personnel, new technology,

research and innovation in LDCs. this help to improve LDCs technics ofproduction hence more employment opportunities.

- Increase government revenue from taxes imposed on production activitiesunder taken by foreign investments.

- Increase productivity and efficiency due to high levels of technology used

which leads to more export earnings and improvement in the Balance ofpayment position.

- Encourages entrepreneurial development in the country due to competition

thus would lead to the citizens of that country to invest in their country hencemore foreign exchange earnings.

- Create employment opportunities in the recipient countries.

- Increase savings thus closing the savings investment gap in LDCs.

- Due to the inflow capital assets, foreign investment promotes capitalaccumulation in LDCs.

- Help in the exploitation of idle resources in LDCs thus promoting economicgrowth and development.

- Increase consumer choice due to production of wide variety of quality productsdue massive productions.

- Increase the exploitation of domestic infrastructure e.g. transport facilities,communication facilities etc.

- It accelerates industrial growth through manufacturing and provision ofservices.

- Promotes international cooperation hence increase the volume of imports andexports.

- Local firms become efficient through competition.

- It fills the manpower gap through importation of expatriates’ manpower.

7.3.3: Disadvantages Foreign Direct Investments

-It leads to profit repatriation and capital outflow thus worsening the balance ofpayment deficits in LDCs.

-Increased government expenditure in form of provision of basic facilities like

land, power and other basic facilities as well as tax concessions, tax holidays,subsidized inputs etc.

-Cause income inequality in the recipient countries because top posts are

reserved for their national and pay them very highly while citizens of therecipients’ country occupy low status and low paying posts.

-Foreign investors at times exert pressure on the government and may influence

the decision made by the government of the recipient country which bringsabout dependency and of autonomy in the recipient country.

-They bring about instabilities in the recipient country due to re-allocation oftheir investments into other countries.

-Foreign countries use capital intensive technology which creates technologicalunemployment thus may not help in solving the problem of unemployment.

-Increase demonstration effect in the recipient country due to increased

number of foreigners who impose life style of developed countries in LDCsthus starting copying the consumption habits and lifestyle of the foreigners.

-Most of the private foreign investments are urban based and this creates theproblems of rural urban migration and its negative effects.

-It leads to loss of government revenue through tax holidays, concessions etc.

-Causes dumping through importation of outside products or low-qualityequipment.

-May lead to loss of markets of products from indigenous enterprises.

-May lead to irrational and exhaustion of domestic resources.

7.3.4: Ways of attracting foreign investors in Rwanda.

The Government of Rwanda (GoR) understands that private sector development

is critical if Rwanda is to achieve its aim to reach middle-income status by

2020, and reduce the country’s reliance on foreign aid. Over the past decade,

the Government of Rwanda has undertaken a series of pro-investment policy

reforms intended to improve the investment climate, expand trade in productsand services, and increase levels of foreign direct investment. These include;

-In 2006, the Government of Rwanda consolidated multiple investment-related

government agencies, including the Office of Tourism and National Parks,

and the Rwanda Investment and Export Promotion Agency, to establish the

Rwanda Development Board (RDB), which serves today as the country’schief investment promotion agency.

-There is no difficulty obtaining foreign exchange in Rwanda or transferring

funds associated with an investment into a usable currency and at a legal

market-clearing rate. In 1995, the government abandoned the dollar peg

and established a floating exchange rate regime, under which all lending and

deposit interest rates were liberalized. The central bank holds daily foreignexchange sales freely accessed by commercial banks.

-The government has maintained a high-profile anti-corruption effort and senior

leaders articulate a consistent message emphasizing that fighting corruption

is a key national goal. The government investigates corruption allegationsand generally prosecutes and punishes those found guilty.

-Rwandan law provides permanent residence and access to land to investors

who deposit USD 500,000 in a commercial bank in the country for a minimum

of six months. There are neither statutory limits on foreign ownership or

control, nor any official economic or industrial strategy that discriminatesagainst foreign investors.

-Rwanda is a stable country with low violent crime rates. A strong police and

military provide a security umbrella that minimizes potential criminal activityand political disturbances.

-Rwanda is a member of the East African Community (EAC), and participates

in a customs union that helps facilitate the movement of goods produced in

the region and allows EAC citizens with certain skills to work in any memberstate.

-Rwanda has also established a free trade zone outside the capital, Kigali,

which includes current and planned future communications infrastructure.

Bonded warehouse facilities are now available both in and outside of Kigalifor use by businesses importing duty free materials.

-RDB offers one of the fastest business registration processes in Africa:

new investors can register online at RDB’s website and receive approval

to operate in less than 24 hours, and the agency’s “one-stop shop” helpsforeign investors secure required approvals, certificates, and work permits.

-The Government of Rwanda established the Privatization Secretariat and the

Rwanda Public Procurement Agency to ensure transparency in government

tenders and divestment of state-owned enterprises. Rwanda’s ranking in

Transparency International’s “Corruption Perception Index” has improved

significantly, falling from 102 in 2008, to 49 in 2013, the top ranked countryin eastern Africa.

-The government reserves the right to expropriate property “in the public

interest” and “for qualified private investment” under the expropriation law

of 2007. The government and landowner negotiate compensation directly

depending on the importance of the investment and the size of the expropriated

property. RDB may facilitate expropriation in cases where the expropriationis potentially controversial.

-Rwanda is a signatory to the Convention on the Settlement of Investment

Disputes (ICSID) and African Trade Insurance Agency (ATI). ICSID seeks

to remove impediments to private investment posed by non-commercial

risks, while ATI covers risk against restrictions on import and export activities,

inconvertibility, expropriation, war, and civil disturbances. Rwanda is a

member of the East African Court of Justice for the settlement of disputes

arising from or pertaining to the East African Community (EAC). Rwanda hasalso acceded to the 1958 New York Arbitration Convention.

-Investors who demonstrate capacity to add value and invest in priority

sectors have generally enjoyed more tax and investment incentives, including

Value Added Tax (VAT) exemptions on all imported raw materials, 100

percent write-off on research and development costs, five-to-seven percent

reduction in corporate income tax for firms whose exports are worth at least

USD 3 million, duty exemption on equipment, and a favorable accelerated

rate of depreciation of 50 percent in the first year. The government also

offers grants and special access to credit to investors who develop in ruralareas

-RDB has been successful in developing investment incentives and publicizing

investment opportunities abroad. Registered foreign investors have obtained

benefits in the past, including exemption from value-added tax and dutieswhen importing machinery, equipment, and raw materials

-Protection of Property Rights; the law protects and facilitates acquisition and

disposition of all property rights. Investors involved in commercial agriculture

have leasehold titles and are able to secure property titles, if necessary. A

property registration and land titling effort, the result of a 2005 land law, wascompleted in 2013.

-The Government of Rwanda has implemented transparency of the regulatory

system; the government generally employs transparent policies and effective

laws to foster clear rules consistent with international norms. Institutions such

as the Rwanda Revenue Authority, the Ombudsman’s office, Rwanda Bureau

of Standards (RBS), the National Public Prosecutions Authority (NPPA), the

Rwanda Utilities Regulatory Agency, the Public Procurement Agency, andthe Privatization Secretariat all have clear rules and procedures.

-Rwandan law allows private enterprises to compete with public enterprises

under the same terms and conditions with respect to access to markets,

credit, and other business operations. Since 2006, the government has

made an effort to privatize State-Owned Enterprises (SOEs), to reduce

the government’s non-controlling shares in private enterprises, and attract

FDI, especially in the information and communications, tourism, banking, andagriculture sectors.

-There is a growing awareness of corporate social responsibility (CSR),

but only a few companies – chiefly foreign-owned – have implemented

sustainable programs. In recognition of the firm’s strong commitment to

CSR, the U.S. Department of State awarded Sorwathe, a U.S.-owned tea

producer in Kinihira, Rwanda, the Secretary of State’s 2012 Award forCorporate Excellence for Small and Medium Enterprises.

-Rwanda is eligible for trade preferences under the African Growth and

Opportunity Act (AGOA), which the United States enacted to extend duty-free

and quota-free access to the U.S. market for nearly all textile and handicraft

goods produced in eligible beneficiary countries. The U.S. and Rwanda

signed a Trade and Investment Framework Agreement (TIFA) in 2006, and a

Bilateral Investment Treaty (BIT) in 2008. Rwanda has also signed bilateralinvestment treaties with Germany (1967) and Belgium (1985).

-The Export-Import Bank (EXIM) continues its program to ensure short-term

export credit transactions involving various payment terms, including open

accounts that cover the exports of consumer goods, services, commodities,

and certain capital goods. Rwanda is a member of the Multilateral Investment

Guarantee Agency (MIGA) which issues guarantees against non-commercial

risks to enterprises that invest in member countries and the African TradeInsurance Agency (ATI).

-Rwanda attempts to adhere to International Labor Organization (ILO)

conventions protecting worker rights. Policies to protect workers in special

labor conditions exist, but enforcement remains inconsistent. The government

encourages, but does not require, on-the-job training and technology transferto local employees

Application activity 7.4

1. Examine the hindrances to Foreign Direct Investments in Rwanda?

7.4: Global financial systems (GFS) and internationalfinancial institutions (IFI)

Activity 7.6

Undertake a documentary research about Global financial systems andinstitutions and share your views in class about.

i) What global financial system and international financial institutionsmean..

ii) What is the role of Global financial system?

iii) What are the components of Global financial system?

7.4.1: Global Financial Systems and international financialinstitution (IFI)

The global financial system is the worldwide framework of legal agreements,

institutions, and both formal and informal economic actors that together

facilitate international flows of financial capital for purposes of investment and

trade financing. Since emerging in the late 19th century during the first modern

wave of economic globalization, its evolution is marked by the establishment of

central banks, multilateral treaties, and intergovernmental organizations aimed

at improving the transparency, regulation, and effectiveness of internationalmarkets.

While the global financial system is edging toward greater stability, governments

must deal with differing regional or national needs. Some nations are trying

to systematically discontinue unconventional monetary policies installed to

cultivate recovery, while others are expanding their scope and scale. Emerging

market policymakers face a challenge of precision as they must carefully institute

sustainable macroeconomic policies during extraordinary market sensitivity

without provoking investors to retreat their capital to stronger markets. Nations’

inability to align interests and achieve international consensus on matters

such as banking regulation has perpetuated the risk of future global financialcatastrophes.

The Global financial system has;

2 main functional components:

- The global capital market.

- The foreign exchange market.

There are two global institutions (Bretton woods institutions).

- The world Bank.

- The international monetary fund. (IMF)The global financial system main components

An international financial institution (IFI) is a financial institution that

has been established (or chartered) by more than one country, and hence are

subjects of international law. Its owners or shareholders are generally national

governments, although other international institutions and other organizations

occasionally figure as shareholders. The best-known IFIs were established after

World War II to assist in the reconstruction of Europe and provide mechanisms

for international cooperation in managing the global financial system. Theyinclude the World Bank, the IMF, and the International Finance Corporation.

7.4.2: International Monetary Fund (IMF) and World Bank (WB)

Activity 7.7

Undertake a documentary research on IMF and discuss amongstyourselves in class about

a) What led to the establishment of IMF?

b) The objectives of IMF

c) The functions of IMF

d) IMF conditionalities.

7.4.2.1: International monetary fund (IMF):

The International Monetary Fund (IMF) is an organization of 189 countries,

working to foster global monetary cooperation, secure financial stability, facilitate

international trade, promote high employment and sustainable economic growthand reduce poverty around the world.

Created in 1945, the IMF is governed by and accountable to the 189 countries

that make up its near-global membership. The IMF’s primary purpose is to

ensure the stability of the international monetary system; the system of exchange

rates and international payments that enables countries (and their citizens) to

transact with each other. The Fund’s mandate was updated in 2012 to includeall macroeconomic and financial sector issues that bear on global stability.

The IMF’s fundamental mission is to ensure the stability of the international

monetary system. It does so in three ways: keeping track of the global economy

and the economies of member countries; lending to countries with balance of

payments difficulties; and giving practical help to members. IMF is headquarteredin Washington, D.C.

A) Objectives of IMF.

- Establish International Monetary Cooperation amongst the various member

countries through a permanent institution that provides the machinery for

consultation and collaborations in various international monetary problemsand issues.

- Ensure stability in the foreign exchange rates by maintaining orderly exchange

arrangement among members and also to rule out unnecessary competitiveexchange depreciations/ devaluation.

- Promote international trade so as to achieve its required expansion and

balanced growth. This would ensure development of production resources

and thereby promote and maintain high levels of income and employmentamong all its member countries.

- Eliminate or relax exchange controls imposed by almost each and every

country before Second World War as a device to deliberately fix the

exchange rate at a particular level. Such elimination of exchange controlswas made so as to give encouragement to the flow of international trade.

- To establish a multilateral trade and payment system in respect to current

transactions between members in place of the old system of bilateral tradeagreements was another important objective of IMF.

- Help the member countries, especially the backward countries, to attainbalanced economic growth by exchange the level of employment.

- Help the member countries in eliminating or reducing the disequilibrium or

maladjustments in balance of payments. Accordingly, it gives confidence

to members by selling or lending Fund’s foreign currency resources to themember nations.

- Promote Investment and flow of Capital from richer to poorer or backward

countries so as to help the backward countries to develop their own

economic resources for attaining higher standard of living for its people, ingeneral.

- To ensure there is sufficient international liquidity and total means of paymentacceptable for international payment.

- To stabilize prices so as to increase the rates of economic growth anddevelopment among poor countries.

- To harmonize policies pursued by different countries so as to create peaceamong member nations.

B) Functions of the International Monetary Fund

- Maintains Exchange Stability thereby discouraging any fluctuations in

the rate of exchange. It does so by making necessary arrangements like

enforcing declaration of par value of currency of all members in terms

of gold or US dollar, enforcing devaluation criteria, up to 10 per cent or

more by more information or by taking permission from IMF respectively,

forbidding members to go in for multiple exchange rates and also to buyor sell gold at prices other than declared par value.

- The Fund is helping the member countries in eliminating or minimizing

the short-period equilibrium of balance of payments either by selling or

lending foreign currencies to the members. It also helps its members

towards removing the long period disequilibrium in their balance of

payments. In case of fundamental changes in the economies of its

members, the Fund can advise its members to change the par values ofits currencies.

- IMF enforces the system of determination of par values of the

currencies of the members countries. As per the Original Articles of

Agreement of the IMF every member country must declare the par value

of its currency in terms of gold or US dollars. The members are given

autonomy to float or change exchange rates as per demand supply

conditions in the exchange market and also at par with internal pricelevels.

- IMF is exercising surveillance to ensure proper working and balance in

the international monetary system, i.e., by avoiding manipulation in the

exchange rates and by adopting intervention policy to counter short-termmovements in the exchange value of the currency.

- The IMF has an important function to advise the member countries on

various economic and monetary matters and thereby to help stabilizetheir economies.

- IMF is maintaining various borrowing and credit facilities so as to help

the member countries in correcting disequilibrium in their balance of

payments. These credit facilities include-basic credit facility, extended

fund facility for a period of 3 years, compensatory financing facility,

stock facility for helping the primary producing countries, supplementary

financing facility, special oil facility, trust fund, structural adjustment

facility etc. The Fund also charges interest from the borrowing countrieson their credit.

- IMF is also entrusted with important function to maintain balance between

demand and supply of various currencies. Accordingly, the fund can

declare a currency as scarce currency which is in great demand and

can increase its supply by borrowing it from the country concerned or bypurchasing the same currency in exchange of gold.

- Maintenance of Liquidity of its resources by providing for the member

countries to borrow from IMF by surrendering their own currencies in

exchange. Again, for according accumulation of less demand currencies

with the Fund, the borrowing countries are directed to repurchase theirown currencies by repaying its loans in convertible currencies.

- Providing Technical Assistance to the member countries; by granting

the member countries the services of its specialists and experts and also

by sending the outside experts. Moreover, the Fund has also set up two

specialized new departments: Central Banking Services Department and

Fiscal Affairs Department for sending specialists to member countries soas to manage its central banks and also on fiscal management.

- Reducing tariffs and other restrictions imposed on international trade by

the member countries so as to cease restrictions of remittance of fundsor to avoid discriminating practices.

- The IMF is also keeping a general watch on the monetary and fiscal

policies followed by the member countries to ensure no flouting of theprovisions of the charter.

- Buying and selling currency of the member countries and this assists

debtor countries to purchase forex or to use SDRs in order to pay its

debts. (SDRs are international reserve assets created by the IMF to

supplement its member countries official reserves.) Its value is based on

the basket of the currencies and it can be exchanged and freely usable by

all countries. It is rather a potential claim on the freely usable currenciesof the IMF members.

- It is a reservoir of the currencies of all the member countries from whicha borrower nation can borrow the currency of other nations.

- It is a sort of lending institution in foreign exchange. However, it grantsloans for financing current transactions only and not capital transactions.

- The Fund contributes to the promotion and maintenance of high levels of

employment and real income and to the development of the productiveresources of all member nations.

- Assist countries to restructure their economies through SAPs facility.

- The IMF works with governments around the world to modernize their

economic policies and institutions, and train their people. This helpscountries strengthen their economy, improve growth and create jobs.

- The IMF provides loans to member countries experiencing actual

or potential balance of payments problems to help them rebuild their

international reserves, stabilize their currencies, continue paying for

imports, and restore conditions for strong economic growth, whilecorrecting underlying problems.

- The IMF oversees the international monetary system and monitors the

economic and financial policies of its 189 member countries. As part of

this process, which takes place both at the global level and in individual

countries, the IMF highlights possible risks to stability and advises onneeded policy adjustments.

7.4.2.2.: The World Bank (WB):

Activity 7.8

Undertake a documentary research on World bank, and discuss amongstyourselves in class about

a) Why was the World Bank established?

b) The objectives of World Bank

c) The functions of WB

d) What is the major difference between IMF and World Bank?

The World Bank is an international organization dedicated to providing

financing, advice, and research to developing nations to aid their economic

advancement. The bank predominantly acts as an organization that attempts to

fight poverty by offering developmental assistance to middle- and low-income

countries. Currently, the World Bank has two stated goals that it aims to achieve

by 2030. The first is to end extreme poverty by decreasing the number of people

living on less than $1.90 a day to below 3% of the world population. The second

is to increase overall prosperity by increasing income growth in the bottom 40%of every country in the world.

The World Bank was created in 1944 out of the Bretton Woods Agreement,

which was secured under the auspices of the United Nations in the latter days

of World War II. Since their founding both the World Bank and the InternationalMonetary Fund have worked together toward many of the same goals.

Though titled as a bank, the World Bank, is not necessarily a bank in the traditional,

chartered meanings of the word. The World Bank and its subsidiary groups

operate within their own provisions and develop their own proprietary financial

assistance products, all with the same goal of serving countries’ capital needs

internationally. The World Bank is headquartered in Washington, D.C. Currentlyit has more than 10,000 employees in more than 120 offices worldwide.

a) Objectives of World Bank:

- To help in the reconstruction and development of member countries by

facilitating the investment of capital for the productive purposes, includingthe restoration and reconstruction of economies devastated by war.

- To encourage the development of productive resources in developingcountries by supplying them investment capital.

- To promote private foreign investment through guarantees and participationin loans and other investment made by private investors.

- To supplement private foreign investments by direct loans out of its owncapital for productive purposes.

- To promote long term balances growth of international trade and the

maintenance of equilibrium in the balance payments of member countriesby encouraging long term international investments.

- To bring about an easy transition from a war economy to a peace timeeconomy.

- To help in raising productivity, the standard of living and the conditions oflabour in member countries.

b) Functions of World Bank (IBRD)

The principal functions of the IBRD following.

- To assist in the reconstruction and development of the territories of itsmembers by facilitating the investment of capital for productive purposes.

- To promote private foreign investment by means of guarantee of participation

in loans and other investments made by private investors and when private

capital is not available on reasonable terms to make loans for productivepurposes out of its own resources from funds borrowed by it.

- To promote the long-term balance growth of international trade and the

maintenance of equilibrium in balances of payments by encouraging

international investments for development of productive resources ofmembers.

- To arrange loans made guaranteed by it in relation to international loans

through other channels so that more useful projects, large and small alike,will be dealt with first.

7.4.2.3: Structural Adjustment Programs (SAPs) / IMF

Conditionalities.

Structural Adjustment Programs (SAPs) sometimes labeled as the Washington

Consensus refers to a set of economic policies often introduced as a condition

for gaining a loan from the IMF. SAPs are created with the goal of reducing the

borrowing country’s fiscal imbalances in the short and medium term or in order

to adjust the economy to long-term growth. The bank from which a borrowing

country receives its loan depends upon the type of necessity. The IMF usually

implements stabilization policies and the WB is in charge of adjustment

measures. Structural adjustment policies usually involve a combination of free-

market policies such as privatisation, fiscal austerity, free trade and deregulation.

Structural adjustment policies have been controversial with detractors arguing

the free market policies are often unsuitable for developing economies and

lead to lower economic growth and greater inequality. Supporters of structural

adjustment (IMF and World Bank) argue that these free-market reforms are

essential for promoting a more open and efficient economy, which ultimately

help to improve living standards and reduce relative poverty. SAPs therefore,

are supposed to allow the economies of the developing countries to become

more market oriented. This, then forces them to concentrate more on trade

and production so it can boost their economy. They include among others thefollowing;

Structural Adjustment Policies

To be eligible for a loan from IMF, developing countries often have to implementsome or all of the following policies.

-Cutting Government Spending to reduce the budget deficit. Also known as

‘fiscal austerity’ e.g. reducing on government expenditure on education and

health in order to reduce the size of the work force to reduce on governmentexpenditure hence a balanced budget.

-Raising tax revenues and trying to improve tax collection by clamping downon tax avoidance.

-Control of Inflation. Usually through Monetary policy (higher interest rates)and fiscal austerity which have the effect of depressing aggregate demand.

-Privatisation of state-owned industries. This raises money for the government,

but also, in theory, can help improve efficiency and productivity becauseprivate firms have a profit incentive to be more efficient.

-De-regulation of markets to encourage competition and more firms to enter

the industry. Opening the economy to free trade by removing tariff barriers

which protect domestic industries. i.e. avoid government control of priceswhich lead to inefficiency and to allow private producers to compete.

-Ending food subsidies. i.e. Raising food and petroleum prices to cut the

burden of subsidies. This, can distort the market and lead to over-supply

and hold back diversification of the economy to a more industrial basedeconomy.

-Devaluation of currencies to restore competitiveness, increase forex andreduce current account deficit. This usually leads to higher import prices.

-Retrenchment of the civil servants and demobilization of the army in order to

reduce on the size of the work force and government expenditure as wellas ensure efficiency.

-Introduction of policies that attract both foreign and domestic investors. Forexample, reduction in borrowing rates and having an open economy.

-Infrastructural development in order to improve productivity thus promotingeconomic growth and development.

-Emphasizes on the improvement of productivity through research andadoption of modern technology.

-Market expansion through economic integration in order to increase exportearnings.

-Ensure political stability and security in the economy.

-Forex liberalization and granting autonomy to the central bank to pursue onappropriate monetary policy.

-Focusing economic output on direct export and resource extraction.

-Improving governance and fighting corruption

-Enhancing the rights of foreign investors vis-à-vis national laws

-Increasing the stability of investment (by supplementing foreign directinvestment with the opening of domestic stock markets)

-Creating new financial institutions

Application activity 7.5.

Describe how the SAPs policies have impacted Rwanda.

End unit assesment

1. a) What role has the IMF played in economic development of yourcountry

b) What structural adjustment programs have been implemented inyour country?

2. a) Giving examples in Rwanda, analyse the role played by FDI’s inRwanda’s development struggle.

b) Although Rwanda has tried her level best to attract Foreign DirectInvestments, their inflow is still low. Why?

3. a) Explain the roles of World Bank.

b) Identify different sectors supported by World bank in Rwanda.