UNIT 5:EXCHANGE RATES.

Key unit Competency:

Analyse the various forms of exchange rate determination and their impacton economic development.

Introductory activity.

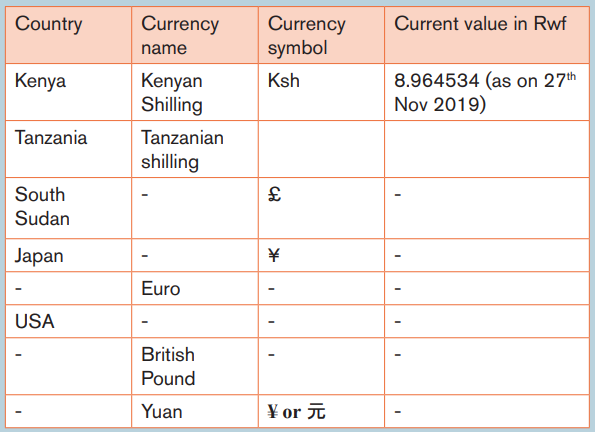

The table below shows different countries, their currencies and symbolsand exchange rate.

Study the data in the table above. Make research and fill the table.

i) In your own view, who determines the exchange rate between theRwandan franc and other currencies?

ii) Considering the exchange rate between Rwf and Kenyan Shilling

given in the table above, how much Kenyan Shillings can one getfrom 100,000Rwf?

iii) Supposing the Rwf gained more value against a Ksh, shall the abovevalue in the exchange rate (8.964534) go above or below?

iv) What do you think shall happen to the price in Rwf of goods Rwandaimports from Kenya if the Ksh gains more value against the Rwf?

v) Supposing Rwanda imports goods with inelastic demand from

Kenya. What do you think shall happen to their quantity demandedin Rwanda if the Ksh gains more value against the Rwf?

5.1. Exchange rates

5.1.1: Meaning of Foreign Exchange

Activity 5.1.

Agasaro is a Rwandan Import and export trader. She buys handcraft products

from Rwandan Women Cooperative Society and exports them to Chinese

consumers in China. On her way back from China, she buys Kitchen Ware fromDubai which she sells to Super market in Kigali, Rwanda.

vi) Which currency do you think Agasaro uses to buy the handcraftproducts from Rwanda Women Cooperative society?

vii)In which currency do you think she is paid when she sells herproducts in China?

viii) Which currency do you think Agasaro uses to pay for theKitchenware in Dubai markets and how does she get it?

Activity 5.1.

Countries in international trade use currencies other than their own. This is

because not every currency is acceptable in the world market. Payment of

transactions among countries is carried out in hard or convertible currencieslike US dollars, Japanese Yen, pound starlings etc.

Foreign exchange is the conversion of one currency into another currency.

Foreign exchange market refers to the global market where currencies are traded

virtually around the clock. The term foreign exchange is usually abbreviated as“forex” and occasionally as “FX.”

Foreign exchange transactions encompass everything from the conversion of

currencies by a traveler at an airport kiosk to billion-dollar payments made by

corporations, financial institutions and governments. Increasing globalisation

has led to a massive increase in the number of foreign exchange transactions inrecent decades.

5.1.2: Terms used in foreign exchange.

Activity 5.2.

Make research and find the meaning of the following terms used in foreignexchange markets.

Foreign exchange rate; Exchange rate regime; Floating exchange rate;

Fixed exchange rate; Pegged float exchange rate; Spot Market; Floating

currency; Forward Market; International Currency Exchange; Currency

Pairs; Foreign Exchange Market; Foreign Exchange Reserves; ForeignExchange Risk.

The foreign exchange market has a number of basic terms used some of whichinclude the following:

- Foreign exchange rate. The rate/price at which given currencies areexchanged for each other in the foreign exchange market

- Exchange rate regime: This is way in which an authority manages itscurrency in relation to other currencies in the foreign exchange market.

- Floating exchange rate: This is a system where the value of currency in

relation to others is freely determined by the market forces of demand andsupply for the currency.

- Fixed exchange rate: This is a system where a currency’s value is tied

to the value of another single currency, to a basket of other currencies, orto another measure of value, such as gold.

- Pegged float exchange rate: A currency system that fixes an exchange

rate around a certain value, but still allows fluctuations, usually withincertain values, to occur.

- Spot Market. This is where the price of a currency is established on thetrade date but money is exchanged on the value date.

- Floating currency. This is a currency that uses a floating exchange rate

- Forward Market. A forward market/ trade is any trade that settles furtherin the future than spot.

- International Currency Exchange. This is a rate at which two currenciesin the market can be exchanged.

- Currency Pairs. These are two currencies with exchange rates that aretraded in the retail market.

- Foreign Exchange Market. This is a market where participants buy,sell, and exchange currencies daily.

- Foreign Exchange Reserves: These are reserves assets in foreignexchange that are held by a central bank.

- Foreign Exchange Risk: Foreign exchange risk is the chance that an

investment’s value will decrease due to changes in currency exchangerates.

Sources of Foreign Exchange

- Export of goods and services

- Transfer payments e.g. grants and aid

- Remittances and transfers of nationals working abroad

- Selling of public assets abroad

- Capital inflow through direct and foreign investments

- Profits, dividends and interests repatriated from investments abroad

- Funds from charitable organizations e.g. UNICEF

- Private foreign bank deposits in the local banks- Borrowing from international countries, companies and individuals.

5.1.3: Forms/ types of exchange rates/ exchange ratesystems/ regimes

Activity 5.3.

In line with a liberalized current and capital account of the balance of

payments, NBR pursues a flexible exchange rate policy regime. In this

regime, the price of Rwandan francs vis-a-vis the US dollar and other

foreign currencies is determined by the market forces of demand and

supply. NBR’s involvement in the foreign exchange market is limited to

occasional interventions (purchase or sale of US dollars) only to dampen

excessive volatility in the exchange rate. Stable exchange rate movements

in either direction (appreciation or depreciation), enable proper planning

by all market players. NBR does not sell and/or purchase foreign exchange

in the retail market. Intervention involves the process of purchasing and/

or selling foreign exchange to the Foreign Exchange Interbank Market to

stem the volatility of the currency when the Rwandan francs is appreciating

and/or depreciating, respectively. It is done through the foreign exchangeinterbank market that comprises mainly commercial banks.

From the above case study,

(i) What do you think is meant by

(a) Flexible exchange rate policy?

(b) Foreign exchange interbank market?

(ii) What do you think will happen to the price/value of a Rwandan francwhen NBR sells more of it on the foreign exchange interbank market?

(iii) Apart from flexible exchange rate system, what do you think are theother types of foreign exchange rate systems?

Some of the major types of foreign exchange rates are as follows:

1. The gold standard exchange rate system

2. Fixed Exchange Rate System (Pegged Exchange Rate System).

3. Flexible Exchange Rate System (Floating Exchange Rate System).

4. Managed Floating Rate System.

5.1.3.1. The gold standard

Under the gold standard, a country’s government declares that it will exchange

its currency for a certain weight in gold. In a pure gold standard, a country’s

government declares that it will freely exchange currency for actual gold at the

designated exchange rate. This “rule of exchange” allows anyone to go the

central bank and exchange coins or currency for pure gold or vice versa. The

gold standard works on the assumption that there are no restrictions on capitalmovements or export of gold by private citizens across countries.

Because the central bank must always be prepared to give out gold in exchange

for coin and currency upon demand, it must maintain gold reserves. Thus, this

system ensures that the exchange rate between currencies remains fixed. The

main argument in favor of the gold standard is that it ties the world price level

to the world supply of gold, thus preventing inflation unless there is a golddiscovery.

a) Advantages of the gold standard

- It solves the BOP problems automatically because of the automaticadjustment mechanism.

- There is neither currency appreciation nor currency depreciation sinceevery unit of currency is tied to gold.

- There is economic stability because of a stable exchange rate system.

- Liquidity problem is easily solved because of free flow of gold.

- There is smooth international trade because gold is used as a medium ofexchange.

b) Disadvantages of the gold standard exchange rate system

- It is difficult for the central bank to control money supply.

- When gold is in excess supply, it loses exchange value.

- It does not favour economic growth in countries with small quantities ofgold.

5.1.3.2. Fixed Exchange Rate System:

Activity 5.4.

Make research and discuss the view that the foreign exchange rate should be

fixed by the forces of demand and supply of the currency and not the centralbank.

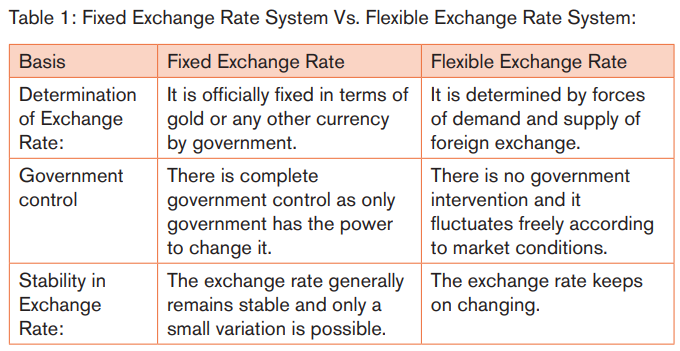

Fixed exchange rate system refers to a system in which exchange rate for

a currency is fixed by the government at a specific rate in relation to a specific

foreign currency for a period of time. Once this rate is fixed, it becomes illegalto exchange a currency at a parallel rate.

The basic purpose of adopting this system is to ensure stability in foreign trade

and capital movements. To achieve stability, government undertakes to buy

foreign currency when the exchange rate becomes weaker and sell foreign

currency when the rate of exchange gets stronger. For this, government has to

maintain large reserves of foreign currencies to maintain the exchange rate atthe level fixed by it.

Under this system, each country keeps value of its currency fixed in terms

of some ‘External Standard’. This external standard can be gold, silver, other

precious metal, another country’s currency or even some internationally agreed

unit of account. When value of domestic currency is tied to the value of anothercurrency, it is known as ‘Pegging’.

The fixed exchange rate may be undervalued or overvalued i.e. undervalued

exchange rate is where the exchange rate is fixed below the market or

equilibrium value of the currency. For example, if the equilibrium rate is 600frw

for a dollar and the rate is fixed at 300frw for a dollar, this leads to cheap importsand expensive exports hence BOP deficits.

Overvalued exchange rate is where the exchange rate is fixed above the

market or equilibrium value of the currency. This leads to undervalued local

currency which makes exports cheap and imports expensive hence improvedBOP position.

In a fixed exchange rate system when the external value of the currency is

increased, we refer to this as revaluation (increase in the value of domestic

currency by the government) and when the external value of the currency is

reduced, we refer to this as devaluation (reduction in the value of domesticcurrency by the government)

Countries can either choose a single currency to peg to, or a “basket” consistingof the currencies of the country’s major trading partners.

The pegged float exchange rate can be;

- Crawling bands. The market value of a national currency is permitted

to fluctuate within a range specified by a band of fluctuation. This band

is determined by international agreements or by unilateral decision by the

central bank. Generally, the bands are adjusted in response to economiccircumstances and indicators.

- Crawling pegs. This is an exchange rate regime, usually seen as part

of a fixed exchange rate regime that allows gradual depreciation or

appreciation in an exchange rate. The system is a method to fully utilize

the peg under the fixed exchange regimes as well as the flexibility underthe floating exchange rate regime.

- It is designed to peg at a certain value but, at the same time, to “glide” inresponse to external market uncertainties.

- Pegged with horizontal bands: This system is similar to crawling

bands, but the currency is allowed to fluctuate within a larger band ofgreater than one percent of the currency’s value.

a) Advantages of fixed exchange rate system

- It encourages international trade by ensuring certainty and predictability ofprices with goods involved in international trade

- It ensures stability in foreign exchange markets by avoiding constant

appreciation and depreciation with in the currency which ensures confidencein the domestic market

- It minimizes speculation in the economy by both goods and foreign exchangemarkets and it is negative effects

- It reduces exploitation and cheating of foreign exchange buyers and holdersby money markets and foreign exchange markets.

- It facilitates planning since income in form of foreign exchange assessedand predicted according to the rate of exchange.

- The government can easily use foreign exchange rate to minimize BOP

deficits i.e. by rising the exchange rate and devaluing the domestic currency

which makes exports cheap and imports expensive hence improvement inthe BOP position

- Encourages long term capital inflows in an orderly manner thus encouraginginvestment

- Fixed exchange rates impose a price discipline on nations with higher

inflation rates than the rest of the world, as such a nation is likely to facepersistent deficits in its balance of payments and loss of reserves.

b) Disadvantages of fixed exchange rate system

-It is expensive to maintain because it requires a lot of foreign exchangereserves.

-It requires strict monitoring of the economy which is affected by insufficientpersonnel.

-It may lead to inflation if it is fixed above the market price or deflation if it isfixed below the market price.

-It reduces speculation which reduces business profitability.

-It discourages competition in foreign exchange markets which leads toinefficiency.

-The announced exchange rate may not coincide with the market equilibriumexchange rate, thus leading to excess demand or excess supply.

-The central bank needs to hold stocks of both foreign and domestic currencies

at all times in order to adjust and maintain exchange rates and absorb theexcess demand or supply.

-The cost of government intervention is imposed upon the foreign exchangemarket.

-It fails to identify the degree of comparative advantage or disadvantage of thenation and may lead to inefficient allocation of resources throughout the world.

-Fixed exchange rate does not allow for automatic correction of imbalances

in the nation’s balance of payments since the currency cannot appreciate/

depreciate as dictated by the market. It is too rigid so that the exchange rate

system cannot respond to the changes in the economy. For example, whenthere is BOP surplus or deficit

-There exists the possibility of policy delays and mistakes in achieving externalbalance

5.1.3.3. Flexible /floating/free/market/ fluctuating Exchange RateSystem:

Flexible exchange rate system refers to a system in which exchange rate

is determined by forces of demand and supply of different currencies in the

foreign exchange market. The value of currency is allowed to fluctuate freely

according to changes in demand and supply of foreign exchange. There is noofficial (Government) intervention in the foreign exchange market.

The exchange rate is determined by the market, i.e. through interactions of

thousands of banks, firms and other institutions seeking to buy and sell currencyfor purposes of making transactions in foreign exchange.

When the supply of foreign exchange is equal to the demand for it, thenequilibrium exchange rate is determined.

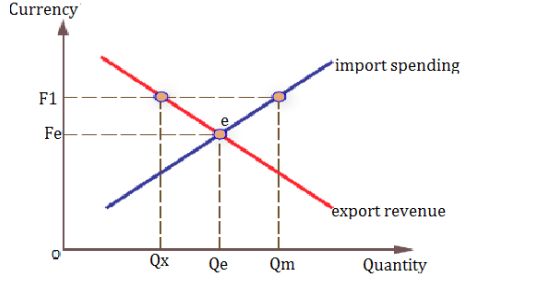

Figure 2: Exchange rate Equilibrium

From the figure above, forex equilibrium is obtained when import spending

is equal to export revenue. i.e. at point ‘e’ in the above diagram. This means

that the demand for forex is equal to its supply. Fe is equilibrium currency rate

while Qe is equilibrium quantity demanded and supplied of currencies. Below

or above Fe, the demand for and supply of currencies isn’t equal thus causingdisequilibrium in the forex market (forex shortages or excess).

In a floating exchange rate system, when the external value of the currency

increases, then this is called currency appreciation (low exchange rate) and

when the external value declines, this is called currency depreciation (highexchange rate)

a) Advantages of flexible exchange rate

- The system is automatic and therefore does not need a lot of governmentinvolvement and expenditure on foreign exchange rate monitoring

- Trade imbalances i.e. surpluses and deficits are corrected automaticallyby the forces of demand supply

- It responds to the rapid economic changes quickly since it is automatic

- It encourages proper resource utilization into their optimal use

- It increases the volume of international trade because of the freedom inthe foreign exchange markets

- It encourages efficiency and competition in the money market

b) Disadvantages of the flexible exchange rate

- It creates uncertainty as it fluctuates and discourages international tradeand capital movements

- It creates instabilities in the foreign exchange rate thus affecting planningand hence discouraging economic growth and development

- It encourages speculation in the foreign exchange where foreign exchangebuyers may be cheated

- It is inefficient in correcting BOP deficits as the domestic demand forexports and imports remain inelastic

- It leads to fluctuations in export earnings which affects budgeting of thegovernment

- It discourages long term contracts between borrowers and lenders whichmay discourage investments and economic growth and development

- In case there is no understanding between governments about manipulation

of exchange rates, it may result into war of exchange rates with eachcountry trying to establish favourable rates with other countries

c) Causes of Currency depreciation in LDCs

- Decline in the volume and value of exports (primary products)

- Decline in foreign exchange inflow due to political instabilities

- Decline in international payments in the domestic banks

- Reduction in the volume of grants, aid and loans

- Increase in demand for imports especially capital inputs and essentialconsumer goods

- Increase in foreign exchange expenditure e.g. on embassies, official tripsabroad etc.

- Government policy of devaluation

- High rates of inflation which reduces domestic production

d) Effects of currency depreciation

Positive effects

- It increases the volume of exports hence foreign exchange earnings

- It encourages export promotion and import substitution industrializationwhich reduces foreign exchange expenditure

- It encourages domestic investments because the cost of production islow at home if inputs are not imported.

- It reduces the BOP problems because the expenditure on imports reduces

- It increases capital inflow and foreign investments

- It encourages exploitation of domestic resources because it is cheap toproduce at home

Negative effects

- It reduces the volume of imports which might lead to scarcity of goods andservices in the economy

- It makes projected planning difficult and distorted

- It increases the cost of production at home because of expensive importedinputs

- It increases the country’s indebtedness abroad

- It worsens BOP problems since imports become expensive than exports

- It leads to loss of confidence in the local currency

- It may lead to over exploitation of resources since it is cheaper to produceat home.

5.1.3.4. Mixed/multiple/Managed/ Dirty Floating Rate System:

This refers to a system in which foreign exchange rate is determined by market

forces and central bank influences the exchange rate through intervention in the

foreign exchange market. It is a hybrid of a fixed exchange rate and a flexibleexchange rate system.

In this system, central bank intervenes in the foreign exchange market to restrict

the fluctuations in the exchange rate within certain limits. The aim is to keep

exchange rate close to desired target values. For this, central bank maintains

reserves of foreign exchange to ensure that the exchange rate stays within thetargeted value.

When the exchange rate rises above the upper limit, the central bank intervenes

and buys off the surplus or excess foreign exchange. When the exchange rate

falls below the lower limit, the central bank supplies the needed foreign exchange.However, this depends on the purpose on which the foreign exchange is needed

a) Advantages of the managed floating exchange rate system

- It helps a country to export and import commodities of national priority

- Government can reduce unfair competition of foreign currencies overdomestic currencies

- It reduces excessive foreign exchange fluctuations in the foreign exchangemarket

- It reduces speculation hence reducing hoarding and scarcity of foreignexchange

b) Disadvantages of the managed floating exchange rate system

- It is expensive for the government to supervise and maintain maximum andminimum margins

- It limits free convertibility of currencies hence limiting the flow of exportsand imports

- It doesn’t allow free exchange of currencies to determine the real value

- It might lead to malpractices such as over invoicing imports and underinvoicing exports.

Application activity 5.1.

From your knowledge of exchange rates, carry out research on the factors that

determine the exchange rate in a foreign exchange market and make classpresentations.

5.2. Devaluation.

5.2.1. Meaning and reasons for devaluation.

Activity 5.5.

Make research and find the meaning of the following terms.

Currency devaluation. Currency depreciation. Currency appreciation.

Given the following as the exchange rate between a Rwf and US $ is such that

US $ 1 is equal to 900 Rwf, the price of a car from an Auto market in Japan is

1000 US $ while the price of Made in Rwanda Cotton fabric is 27000Rwf permetre.

Determine

i) The price of the same car from the Auto market in Japan in Rwf?

ii) The price of Made in Rwanda cotton fabric in US$?

Because of changes in demand and supply of a dollar and Rwf, the dollar

gains more value against the Rwf such that the exchange rate changesand US$ 1 is equal to 1200Rwf.

Basing on the new exchange rate, determine

(i) The price of the above car in Rwf.

(iI) The price of the Made in Rwanda cotton fabric in US$.

Compare the prices above before and after the changes. Derive a suitableconclusion.

Devaluation refers to deliberate government policy of reducing the value of

domestic currency in the terms of other currencies i.e. the domestic currency

becomes cheaper in relation to other countries’ currencies.

Devaluation is only possible under the fixed exchange rate system. It takes

place when there is fundamental disequilibrium in the balance of payment. Thedevaluating country has no supply rigidities but it is facing marketing difficulties.

LDCs devalue their currencies due to the following reasons;

- To make exports cheap and hence lead to more export, there by leading toincrease in foreign exchange earnings.

- To collect balance payment problems by reducing imports by making them

expensive. This is because importers need more of the local currency in

order to obtain foreign exchange they thus either have to import less orcharge high prices hence low quantity demanded for them.

- To attract foreign and domestic investors as it becomes cheaper to invest

in the economy as little foreign exchange can be exchanged for a lot of the

local currency. Again due to devaluation there is export promotion leadingto increased market for output produced by investors.

- To protect domestic infant industries from competition by cheap importsby making similar imports expensive.

- To promote self-sufficiency by encouraging import substitution industriesand reduce dependency on imports from other countries.

- To conserve foreign exchange as it discourages imports and minimizes

foreign exchange out flow and therefore can reduce on the problem oftrade shortage.

- To increase on the level of productivity and thus domestic resourceutilization this calls for employment of idle resource.

- To increase on employment opportunities at home through increaseddomestic production.

- Some LDCs undertake devaluation in order to fulfill IMF conditionalities inorder to receive loans.

- To check on imported inflation because after devaluation, the inflation hitimports are too expensive and this discourages importers.

- To increase the nominal income of the producers of primary products thatare exported

5.2.2 Conditions necessary for devaluation to besuccessful

Activity 5.6

Make research and find the factors that can make devaluation succeed or fail.

A number of conditions have to be made for devaluation to be successful

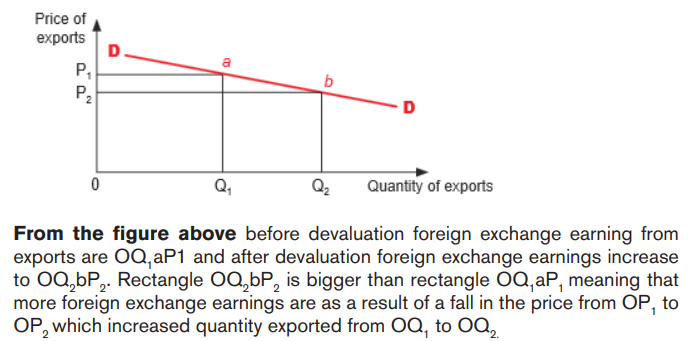

- The demand for exports must be price elastic. That is, a small price

reduction resulting from devaluation will lead to a proportionately largeincrease in their purchase and more foreign exchange will be earned.

Devaluation and foreign exchange earnings.

- The demand for imports should be price elastic so that imports appear to

be expensive after devaluation and less of them are demanded hence lessforeign exchange expenditure.

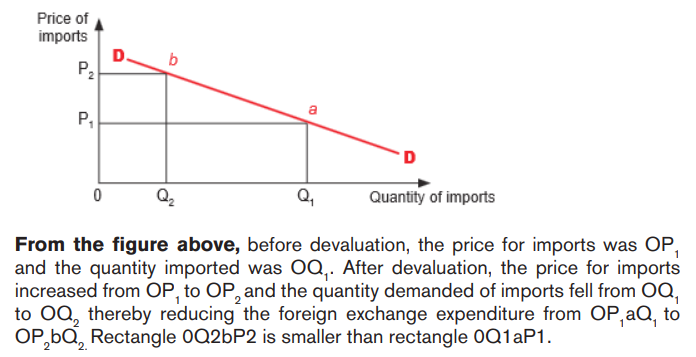

Devaluation and foreign exchange expenditure.

- The supply of export in the devaluating country should be elastic such that

as demand for export increases then more quantity of exports should besupplied

- The supply of imports should be price elastic in that when there is

devaluation and there is a decrease in demand for imports, the quantitysupplied for them should be able to reduce greatly.

- There should be no inflation in devaluing country so that after devaluation

exports will be cheap and attractive to foreign importers hence more willbe imported.

- There should be no restrictions on exports from the devaluing countriesotherwise this would limit exports and hence earnings from exports.

- There should be no counter devaluation or other countries should not

retaliate by devaluing their currency because this will neutralize theintention of devaluing countries.

- There should not be trade union to put pressure on wages and increasethe cost of production.

- There should be excess capacity in devaluing country such that as exports

are produced, imports are discouraged and more output is produced tosubstitute import.

- The marginal propensity to import in devaluing country should be low.

- The devaluing country should be able to compete favorably in the worldmarket

- The devaluing country should be politically stable so as to ensure stableproduction

- There should be stability in the exchange rate system i.e. fixed exchangerate regime.

5.2.3: Effects of devaluation.

Activity 5.7

Make research and discuss the view that developing economies should usedevaluation as a tool to bring out economic growth and development.

Positive effects

- It increases the volume of exports by making them cheap.

- It increases the volume of foreign exchange earnings by increasing onthe volume of exports.

- It increases the capital inflow e.g. through foreign investment because itbecomes cheaper to produce in the devaluing country.

- It improves balance of payment position due to increased foreignexchange earnings and reduced foreign exchange expenditure on import.

- Increase in domestic investments which increase exploitation of idleresources.

- It increases employment opportunities at home, e.g. through exportpromotion and import substitution industries.

- It leads to development of domestic infant industries by making similarimports expensive.

- It promotes self-sufficiency by encouraging exports and reducing thevolume of imports.

Negative effects

- It worsens the balance of payment position because external market forproducts from developing economies is poor.

- It leads to imported inflation since devaluation increases prices of importsyet imports in developing economies have inelastic demand.

- It leads to capital flight by nationals because they will tend to investoutside to earn high value foreign currency.

- Due to inflation that may result from devaluation imported inputs become

expensive which discourages production yet developing economiesheavily depend on imported capital.

- It increases borrowing rate and debt servicing burdens by developing

economies since they need a lot of income in terms of domesticcurrencies in form the foreign resources.

- It leads to persistent government budgetary deficit as a result of increased

expenditure on imports which increases expenditure due to devaluationthat makes import expensive.

- Saving levels can decline in economy because of liquidity preference tomeet high price of imported commodities thus causing inflation.

- It affects fixed income earners because where as prices are increasingdue to devaluation their income remains constant hence low real incomes.

- If it is common, it may discourage investors who lose confidence in thelocal currency.

- It may reduce the standards of living of people due to shortage of

commodities in the economy as a result of restricting imports yetdeveloping economies heavily depend on imports.

- 11. It also discourages competition by protecting infant industries which

may provide low quality commodities yet charging high prices.12. It

may hinder technological transfer because of the increase in the cost ofimported commodities and inputs.

5.2.4: Success of devaluation policy in LDCs.

Activity 5.8.

Analyse the statements below and answer the questions that follow;

1. Under AGOA arrangement, African products have an opportunity to access

American markets without strict tariff restrictions. And this implies that African

producers would reap highly from this arrangement since their currencies have

lower value in comparison to the US dollar. However, most African countrieshave not enjoyed maximum benefit from this?

2. Most developing countries import commodities that are price and income

inelastic, for instance medicine. Even the supply of their products is also inelasticbecause of supply rigidities.

In reference to the above statements, discuss why devaluing currencies indeveloping countries may not easily benefit them.

Most developing economies which have tried devaluation as a measure to solvetheir BOP problems have not succeeded due to the following reasons

- Domestic elasticity of demand of their imports is low because of highpopulation growth rate

- Developing economies import commodities that are price and incomeinelastic because they are mainly essential commodities

- There is protectionism by developed economies on products fromdeveloping economies so as to increase employment in MDCs.

- The elasticity of supply of products from developing economies is lowbecause of domestic supply rigidities.

- Developing economies have competitive supply i.e. supply of similarcommodities; they therefore tend to carry out competitive devaluation.

- Developing economies have inadequate co-operant factors especiallycapital and entrepreneur hence low production for exports.

- Most developing economies experience high rates of inflation whichdiscourage export due to high costs of production

- Developing economies pursue unfavorable economic policies like tradelegalization which increase the inflow of imports.

- There is high degree of malpractice for example smuggling because

of inefficient administrative machinery hence increasing the volume ofimports.

- Political instability and insecurity in developing economies discouragedomestic production and foreign investment.

- There is counter devaluation among developing economies i.e. othercountries retaliate by devaluing their currency.

- There is high marginal propensity to import due to the desire for essentialcapital input and imported raw materials.

- Developing economies exports are limited by low export quotas in theinternational commodity Agreement (ICA)

- There are weak export promotion institutions in developing economieswhich reduce the benefits of devaluation.

- Developing economies face foreign exchange instabilities because ofadapting liberal exchange rate systems.

Application activity 5.2.

The Kenyan shilling has a relatively higher value than the Rwandan franc.Assess the impact of this on the trade between Rwanda and Kenya.

End unit assesment

1. a) When and why is devaluation carried out?

b) How is devaluation of a currency supposed to address an economy’sbalance of payments current account deficit?

2. Under what circumstances may devaluation fail to achieve its intendedobjectives in an economy?

3. Explain the merits and demerits of floating exchange rate system.