UNIT 4:BALANCE OF PAYMENT (BOP).

Unit Competency:

Learners will be able to analyse the balance of payment position of LDCs.

Introductory activity

Country ‘Z’ revealed its capacity to save to pay for its imports in 2018. It

also showed how much economic output it produced to pay for her growth

for that particular year. In 2017, it had shown that it had experienced her

imports of goods, services and capital being greater than its exports

while in 2018, it showed that her exports of goods, services and capital

were more than its imports. For all the positions of country ‘Z’ in the years

mentioned, however, she would endeavor to bring back her economy toequilibrium.

Required: Analyse the case study above and use it to carry out researchfrom any economics related resource to;

i) Explain the economic term that is given to the document that Country

‘Z’ used to present her capacity to save for the payment of its imports andher output produced to pay for her growth.

ii) Describe economic situation in 2017 and 2018 respectively as statedin the case study.

iii) Explain the resultant outcome for each position mentioned in ii) above.

iv) Explain what, according to the case study, is described as ‘equilibrium’.

iv) Identify the likely measures country ‘Z’ would put to bring her economyback to equilibrium.

4.1. Meaning and terminologies used in Balance ofPayment (BOP).

Activity 4.1

Use the knowledge and understanding gained from the research carriedout in the introductory activity above, to;

a) Describe what you understand by the term Balance of payment

b) State the economic terms given to the situations where there is;

i) Import expenditure being greater than export earnings

ii) Import expenditure being less than export earnings

iii)Import expenditure and export earnings are equal.

iv) Trade in only goods

v) Trade in only services.

vi)Relationship between trade in goods only and services only respectively.

vii) Statistical record of the character and dimensions of the country’seconomic relationships with the rest of the world.

4.1.1: Meaning of Balance of Payment (BOP)

Balance of payment (BOP) also known as balance of international payments,

is a statement that summarizes an economy’s transactions with the rest of

the world for a specified time period. It is a summary statement of a nation’s

financial transactions with the outside world. It shows the relationships between

a country’s total expenditure abroad with its total income from abroad. It

encompasses all transactions between a country’s residents (individuals, firms

and government bodies) and its nonresidents (individuals, firms and government

bodies) involving goods, services and income; financial claims on and liabilities

to the rest of the world; and transfers such as gifts. Thus, the balance of

payments includes all external visible and non-visible transactions, together with

their respective receipts and expenditures, of a country.

4.1.2: Terminologies used in BOP:

a) Balance of trade; this refers to the difference between visible exports

and imports.

b) Balance of invisible trade; this refers to the difference between

invisible exports and imports.

c) BOP deficit or unfavourable BOP; this is where total expenditure

abroad is greater than total receipts from abroad.

d) BOP surplus or favourable BOP; this is where total receipts from

abroad are greater than total expenditure abroad.

e) BOP disequilibrium; this is where receipts from abroad are not equal

to expenditures abroad i.e. either there is a BOP deficit or a BOP surplus.

f) BOP equilibrium; this is a situation where revenues from abroad are

equal to expenditures abroad.

g) BOP accounts; this refers to the statistical record of the character and

dimensions of the country’s economic relationships with the rest of the

world.

h) Visible trade; this involves the exchange of goods only

i) Invisible trade; this involves the exchange of services only.

4.2: Structure of BOP Accounts.

Activity 4.2

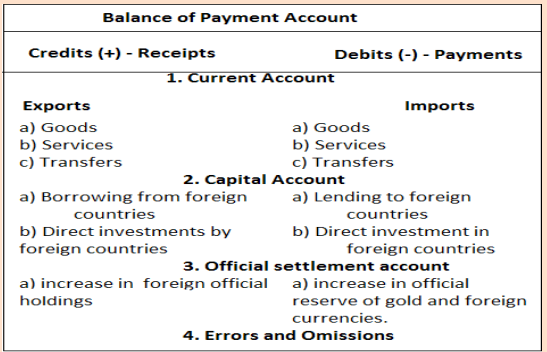

Analyse the information in the table above and answer the questions that follow.

a) What does the table portray?

b) Why are some items recorded on the credit items while others on the

debit side?

c) What examples can you give on transfers on either side?

d) What does direct investment by foreign countries and direct

investment in foreign countries mean?

e) Describe how each account works.

4.2.1: The BOP accounts.

The balance of payments account of a country is constructed on the principle

of double-entry book-keeping. Each transaction is entered on the credit

and debit side of the balance sheet. In balance of payments accounting,

the practice is to show credits on the left side and debits on the right side of

the balance sheet. The balance of payment represents a summation of country’s

current demand and supply of the claims on foreign currencies and of foreign

claims on its currency. It is prepared in a single currency, typically the domesticcurrency for the country concerned.

When a payment is received from a foreign country, it is a credit transaction

while payment to a foreign country is a debit transaction. The principal items

shown on the credit side (+) are exports of goods and services, unrequited (or

transfer) receipts in the form of gifts, grants etc. from foreigners, borrowings

from abroad, investments by foreigners in the country and official sale of reserve

assets including gold to foreign countries and international agencies. Therefore,

sources of funds for a nation, such as exports or the receipts of loans andinvestments, are recorded as positive or surplus items.

The principal items on the debit side (-) include imports of goods and services,

transfer (or unrequited) payments to foreigners as gifts, grants, etc., lending

to foreign countries, investments by residents to foreign countries and official

purchase of reserve assets or gold from foreign countries and international

agencies. Therefore, uses of funds, such as for imports or to invest in foreigncountries, are recorded as negative or deficit items.

These credit and debit items are shown vertically in the balance of payments

account of a country according to the principle of double-entry book-keeping.

Horizontally, they are divided into the following categories: the current account,

the capital account, the official settlements account or the official reserve assetsaccount and the errors and omission account as explained below.

1. Current Account:

The current account of a country consists of all transactions relating to trade in

goods and services and unilateral (or unrequited) transfers. Service transactions

include costs of travel and transportation, insurance, income and payments of

foreign investments, etc. Transfers relate to gifts, foreign aid, pensions, private

remittances, charitable donations, etc. received from foreign individuals andgovernments to foreigners.

In the current account, merchandise, exports and imports are the most important

items. Exports are shown as a positive item and are calculated f.o.b. (free on

board) which means that costs of transportation, insurance, etc. are excluded.

On the other side, imports are shown as a negative item and are calculated c.i.f.(costs, insurance and freight) and included.

The difference between exports and imports of a country is its balance of visible

trade or merchandise trade or simply balance of trade. If visible exports exceed

visible imports, the balance of trade is favourable. In the opposite case whenimports exceed exports, it is unfavourable.

It is, however, services and transfers or invisible items of the current account

that reflect the true picture of the balance of payments account. The balance of

exports and imports of services and transfer payments is called the balance ofinvisible trade.

The invisible items along with the visible items determine the actual current

account position. If exports of goods and services exceed imports of goods and

services, the balance of payments is said to be favourable. In the opposite

case, it is unfavourable. The net value of these visible and invisible tradebalances is the balance on current account.

2. Capital Account:

The capital account of a country consists of its transactions in financial assets

in the form of short-term (between three months and less than one year) and

long-term (one year or more) lending and borrowings and private and official

investments. In other words, the capital account shows international flows of

loans and investments, and represents a change in the country’s foreign assetsand liabilities.

There are two types of transactions in the capital account—private and

government. Private transactions include all types of investment: direct, portfolio

and short-term. Government transactions consist of loans to and from foreignofficial agencies.

In the capital account, borrowings from foreign countries and direct investment

by foreign countries represent capital inflows. They are positive items or

credits because these are receipts from foreigners. On the other hand, lending to

foreign countries and direct investments in foreign countries represent capital

outflows. They are negative items or debits because they are payments to

foreigners. The net value of the balances of short-term and long-term direct and

portfolio investments is the balance on capital account. The sum of currentaccount and capital account is known as the basic balance.

3. The Official Settlements Account or official financing account (cash

or monetary account).

The official settlements account or official reserve assets account is, in fact, a

part of the capital account. It measures the change in nations’ liquidity and non-liquid

liabilities to foreign official holders and the change in a nation’s official

reserve assets during the year. It includes a country’s gold stock, holdings of

its convertible foreign currencies and SDRs, and its net position in the IMF”. Itshows transactions in a country’s net official reserve assets.

This account records all the transactions related to the change in the country’s

foreign exchange reserves and also shows the official foreign reserves in

response to current and capital accounts. If there is a surplus on the combined

current and capital accounts, this means that the foreign exchange reserves

of a country have increased. If there is a deficit on the combined current and

capital accounts, this means that the foreign exchange reserves of a countryhave decreased.

4. Errors and Omissions:

This is a balancing item so that total credits and debits of the three accounts

must equal in accordance with the principles of double entry book-keeping so

that the balance of payments of a country always balances in the accounting

sense. In theory, the Capital and Financial Account balance should be equal and

‘opposite’ to the Current Account balance so that the overall Account balances,

but in practice this is only achieved by the use of a balancing item called net

errors and omissions. This device compensates for various errors and

omissions in the balance of payments data, and which brings the final balanceof payments account to zero.

The errors may be due to statistical discrepancies & omission may be due to

certain transactions may not be recorded. For e.g.: A remittance by a Rwandan

working abroad to Rwanda may not get recorded, or a payment of dividend

abroad by an MNC operating in Rwanda may not get recorded or so on. The

errors and omissions amount, equals to the amount necessary to balance boththe sides.

Application activity 4.1

1. With examples, distinguish between credit and debit items on the BOP

account.

2. What do the following mean on the BOP accounts?

i) A “+” placed on the credit entry.

ii) A “-” placed on the debit entry.

3. Fill in the gaps below.

i) Any time an item (good, service or asset) is exported from a country,

the value of that item is recorded as a ………………… (…) entry on thebalance of payments, while

ii)Any time an item (good, service or asset) is imported into a country,

the value of that item is recorded as a ……………… (…) entry on thebalance of payments.

4. a) If credits are Rwf5, 000,000 and debits are Rwf4, 000,000, what isthe net balance on the BOP account? Interpret your answer.

b) If exports are Rwf80bn and imports are Rwf100bn then how muchare net exports? Interpret your answer.

4.2.2: How to offset a BOP deficit and surplus.

Activity 4.3

Fill in the following gaps

1. a) If excess demand for foreign currency in some periods is balanced

with excess supply in other periods, then falling reserves in some periods

will be offset with rising reserves in other periods leading to ……………

………………………………………………………………………………

………………….

b) When the central bank buys domestic currency and sells the foreign

reserve currency in the private Forex, the transaction indicates a ………

……………………………………………………………………………

c) When the central bank sells domestic currency and buys foreign

currency in the Forex, the transaction indicates a …………………………

………………………………………………………………………………

…

2. What should be done to rectify the two situations mentioned in b and

c above?

4.2.2.1 Financing deficits/ How to correct a BOP deficit.

A BOP deficit is a situation where aggregate demand for foreign exchange

exceeds aggregate supply for foreign exchange. Or a situation where a

country’s expenditure abroad is greater than her receipts from there. Methods

to offset a BOP deficit should aim at reducing foreign exchange expenditure,

increasing foreign exchange earnings and simultaneous reducing foreign

exchange expenditure and increasing foreign exchange earnings. The financing

of a deficit is achieved by:

- Selling gold or holdings of foreign exchange, such as US dollars, yen or

euros,

- Borrowing from other Central Banks or the International Monetary Fund

(IMF)

- Using of foreign exchange reserves available

- sale of public assets abroad

- Seeking aid and grants from other countries

- Attracting foreign investments into the country

- Import substitution strategy

- Restrictive monetary policy i.e. reduces the amount of money in circulation

- Improving the service industry e.g. tourism

- Devaluation.

- Export promotion strategy — increase the volume of exports and improve

the quality of exports.

- Increase taxes and reduce government expenditure i.e. fiscal policy.

- Direct control — tariffs; quotas; exchange controls; complete ban, i.e.

import restrictions.

Establishing BOP balance by using the above measures is called

accommodating BOP and the items used to get rid of a BOP deficit are

known as settlement or accommodating or compensatory or induceditems.

4.2.2.2: Financing surplus/ How to offset a BOP surplus.

A BOP surplus is a situation where aggregate supply of foreign exchange

exceeds aggregate demand for it. Or a situation where a country’s receipts

from abroad are greater than her expenditure there. A surplus will be disposedof by:

- Buying gold or currencies.

- Paying off debts.

- Building a stock of foreign exchange reserves

- Lending to foreign countries

- Providing aid and grants to other countries

- Purchase and storage of durable goods

- Opening current account deposits in foreign banks

- Purchase of short- and long-term securities from abroad

- Direct investments abroad.

The expenditure aiming at getting rid of the BOP surplus through the above

means is known as autonomous expenditure and the items used areknown as autonomous items.

Application activity 4.2

1. A balance of payments surplus means;

a) A country’s export earnings are less than her expenditures on imports.

b) A country’s export earnings are more than her expenditures on imports.

c) A country’s earnings from exports are equal to what it spends on

imports.

d) Only exports but does not import at all.

2. The balance of payments always balances in the accounting sense

because of the following except;

a) Total domestic expenditures (C + I + G) must equal current income

(C + S + T)

b) Domestic saving (Sd) must equal domestic investment (Id).

c) An export surplus on current account (X > M) must be offset by an

excess of domestic saving over investment (S > Id).

d) Inflows must always be greater than outflows.

3. Explain how a deficit or surplus is measured in the balance of payments.

4. Fill in the gaps below;

a) If the total debits are more than total credits in the current and

capital accounts, including errors and omissions, the net debit balance

measures……………………………………………

b) If total credits are more than total debits in the current and capital

accounts, including errors and omissions, the net debit balance

measures…………………………………

4.2.3: Causes and Solutions to BOP deficits/problems indeveloping countries.

Activity 4.4

With reference to activity 4.3, we saw that at a certain point of time, a

country can experience either of the two situations; i.e. where aggregate

demand for foreign exchange exceeds aggregate supply for foreign

exchange or, where aggregate supply of foreign exchange exceeds

aggregate demand for it.

i) Describe what is commonly experienced in your country with a clear

justification.

ii) Analyse the causes of such a situation in your country.

iii) What practical measures does your country normally take to rectify

such a position in international market?

4.2.3.1: Causes of BOP deficits in developing countries.

During transactions a country may register a deficit or surplus. If a country runs

a deficit for a long time and for successive years, such a country is said to face

BOP problems. Developing countries commonly register BOP deficit for a long

time and for successive years, therefore, have always faced BOP problems dueto the following socio-economic and political reasons.

- Narrow Export Base: Most developing countries have a narrow export

base, basically agricultural commodities. They concentrate in relatively lowvalue-added products which fetch low prices hence less earnings in return.

- Consumption oriented society: Due to rapid rise in population

and increased consumption habits in most developing countries, the

domestic manufactured goods are mostly consumed in the country. The

exportable surplus reduces; therefore, government has to import more in

order to support the alarming population thus causing much expenditureabroad leading to BOP deficits.

- Poor technology in less developed countries: There is less

modernisation, balancing and replacement of machinery in the industrial

sector in most developing economies. This has led to fall in production anddecline in the quality of products thus has adversely affected exports.

- Production of primary products: Most developing countries produce

and export primary products which are both price and income inelastic thus

earning less from international trade. The share of value-added goods must

increase to earn foreign exchange and turn the trend of adverse balance

of payment. The production of value-added goods is at basic stage indeveloping countries that leads to adverse BOP.

- Devaluation: The repeated devaluation of developing countries’ currencies

has not helped in the increase of exports. It has made the imported inputs

costlier. The demand for their goods in the international market is inelastic.

As such, due to devaluation, as tool for boosting exports is not effective.

Tough Competition: Stiff competition from the foreign value-added goods

which has reduced the volume of foreign trade in developing countries.

There is availability of higher standard goods at lower prices in international

market. It causes reduction in developing countries’ exports, which result in

deficit in BOP. Increase in Prices of Inputs: The increase in the prices

of fuel, electricity, high capital costs of imported machinery, exchange rates

etc. have inflated developing countries’ product prices. The high costs of

both imported capital goods and industrial raw materials, on which domestic

industries are heavily dependent, and the inflationary impact of the rise in

the prices of inputs are not helping in achieving the export targets set ineach financial year which results into deficit in BOP.

- Heavy protectionist policies by Developed countries: Protectionist

policies by developed countries on developing countries like imposition of

tariff and non-tariff barriers have adversely affected developing countries’

exports. The advanced countries of the world have imposed technical

barriers such as patents, copyrights, trade-marks and designs etc. on their

imports. Developing countries have to upgrade the standard of purity and

quality to compete for their products in the international market thereby

leading to less foreign exchange earnings by Developing countries andconsequently BOP deficits.

- Fall in Terms of Trade: The import unit values are higher than the export

unit values for most Developing countries. A decline in terms of tradecauses imbalance in the balance of payment.

- Foreign Debts Servicing: High expenditure on debt servicing since

most Developing countries are poor and mostly rely on foreign resourcesespecially through borrowing.

- Import of Capital Goods: Most Developing Countries import expensive

capital goods for rapid industrialization of their countries in order to build up

the economy. The heavy import of machinery has considerably increasedthe import bill and has adversely affected balance of payment.

- High demonstration effect: Most developing countries have Import

oriented economies through demonstration effect leading to high demand

for capital and luxurious goods thus leading to high foreign exchangeexpenditure which adversely affect BOP position.

- Rise in Oil Prices: The sharp rise in the prices of oil in the recent past is

taking a big amount of the foreign exchange earnings. Developing countries

import bill of petroleum group increases year after year leading to BOPproblems in Developing Countries.

- Political instabilities and insecurity: Experience shows that political

instability and disturbances in Developing countries cause large capital

outflows and hinder Inflows of foreign capital. For example, the wide

spread political instabilities and insecurity in most Developing countries

discourages production which reduces on the volume of exports. On the

other hand, Developing Countries have to purchase modern weapons for

their defense at a very high cost from different countries, which increasesburden on their BOP and it becomes adverse.

- Fluctuations in the prices of exports of Developing Countries:

Since Developing Countries normally export primary products, their prices

keep on fluctuating in the international market therefore BOP deficit whenexport prices fall.

- Imported inflation.: Since most Developing Countries import expensive

capital goods, it makes them to produce expensively thus leading to

expensive exports which reduces their demand in the external markets thusless foreign exchange earnings from them.

- High population growth in Developing Countries: High population

growth in poor countries adversely affects their BOP because it increases

the needs of the countries for imports and decreases their capacity toexport.

- Natural calamities in Developing Countries: Natural calamities like

bad weather reduce the yields from the agricultural sector as their dominantexport sector thus leading to adverse BOP.

- Poor infrastructure in most Developing Countries: Most Developing

countries have poorly developed and insufficient socio-economic

infrastructure which has led to supply rigidities thus less export volume andtherefore less earnings from them.

- Changes in fashions, tastes and preferences in the world market:

This has reduced on the demand for Developing countries’ exports thusadversely affecting their BOP position.

- Unfair International Commodity Agreement (ICA): Weak ICA leading

to less bargaining powers in the international markets leading to low export

prices and low earnings from exports hence BOP deficits.

- Insufficient export promotion institutions to promote export sectorthrough encouraging vent for surplus in most Developing Countries.

- Inflation in most Developing Countries’ economies: Most Developing

countries’ economies are hit by inflation which makes their exports expensive

leading to low demand for them in the international markets thus earningless from them.

- Depreciation of Developing countries’ currencies: Persistent

depreciation of Developing countries’ currencies has made their products

(exports) cheap while imports expensive thus high foreign exchangeexpenditure.

4.2.3.2: Solutions to BOP deficits in developing countries:

Sustained or prolonged deficit has to be settled by short term loans or depletion

of capital reserve of foreign exchange and gold. The following remedial measuresare recommended:

- Export promotion: Export promotion agencies, Export Development

Fund and Export Processing Zones etc. should be made more active toincrease export and to correct the BOP

- Import restrictions and Import Substitution. Governments

should increase import duties on commodities similar to those produced

at home, encouraging domestic industries to use local raw materials so

as to manufacture Import substitutes in the country. If home production

is increased e.g. chalk, fertilizer, paper, steel, edible oil and electricalgoods, there will be less need for such imports.

- Use restrictive monetary policy to control inflation which

discourages exports and encourages imports. This lowers the prices in

the country for domestic commodities thus raising their demand in andout of the country.

- Government should control foreign exchange by ordering all exporters to

surrender their foreign exchange to the central bank and then ration outforeign exchange among licensed importers.

- Devaluation of domestic currency which makes domestic goods

cheaper for the foreigners. However, care should be taken that devaluationshould not cause rise in internal price level.

- Encouraging investors through establishing institutions that help andadvise investors on investment prospects in the country.

- Opening new markets and making regional groupings to widenmarkets for their exports.

- Ensuring political stability and security in all parts of the country

so as to attract investors, easy exploitation of resources which increases

production activities thus increase the volume of exports and as wellreduce on the expenditure on importation of military hard ware.

- Training local manpower e.g. through universal primary and secondary

education and setting up different training institutions so as to increaseskills of indigenous manpower and reduce foreign expatriates.

- Seeking and being granted a debt relief so as to reduce expenditureon debt servicing.

- Population Control so as to reduce on foreign exchange expenditureon imported commodities to cater for the alarming population.

- Innovations and inventions to improve on technology so as to improve

on productivity, increase the volume of exports and foreign exchange

earnings as well. This also improves the quality of products according tointernational standard.

- Strengthening the tourism industry as an export diversifier.

- Strengthening the ICA so as to increase the export volume andbargaining power as well.

- Economic legalization so as to increase domestic productivity andexport volume.

- Developing countries should process their primary products which addsvalue to them thus more foreign exchange earnings.

- Labour intensive industries should be established, because labour is

cheaper in Rwanda, these industries can be set up at lower cost. Theproducts of these industries can be exported.

- Reduction in export duties which makes developing countries’

export competitive in the international market. Foreigners will prefer toimport from developing countries because of low prices.

- Joint Venture: Establishing industries with joint venture of foreign

investors can also push up the export sector. The products of theseindustries can be sold in the foreign market.

- Import of Only Essential Items: Only essential items should be

imported which are needed for our industrial production. Import of

luxuries should be banned. People should be educated to come out fromthe complex of foreign goods.

- Infrastructural development: Rehabilitate and develop socio-economic

infrastructure to increase production and exchange of goods

and services across national borders to increase foreign exchangeearnings.

- Exchange Control so to minimize the imports. Exchange control should

be followed, so that there is no wastage of foreign exchange to import ofun-necessary commodities and luxuries.

Application activity 4.3

Analyse the impact of BOP problem in developing nations’ economies.

Skills Lab

Based on the knowledge, understanding and skills gained from this unit,

as a business club in your school, make a financial statement at the end

of the term showing your business transactions, based on the double

entry basis. From the accountability, identify whether there is a surplus or

shortage; in case of any position, describe how you will be able to disposeit off so as to attain equilibrium.

End unit assesment

1. a) To what extent is inflation a cause of BOP in LDCs.

b) What policy measure would you suggest to reduce BOP problems inRwanda?

2. (a) What fiscal and monetary measures may be employed to reduceinflationary pressures on the external balance of payments?

(b) What is the relationship between the domestic economy and thebalance of payments?

3. Balance of payments must always “balance”. With reference to your

country, explain the

Existence of either “favourable or unfavourable” balance of paymentsposition.