UNIT 7: COST CLASSIFICATION AND COMPUTATION

Key unit competence: Classify and compute the cost

Introductory activity.

AKARWA COMPANY LOCATED

Analyze the picture above and classify the cost according to different factors.

7.1 The concept “cost”

Activity 7.1

1. According to the picture above, distinguish the cost due to traceability,

2. What should be the direct costs to the specified product?

3. Describe the total cost of producing one table

7.1.1 Definition of cost

Cost is a resource sacrificed or foregone to achieve a specific objective.

A cost is the value of economic resources used in the production of any commodity or performing any service.

Example: 5000 Frw are spent to produce 100 units of juice then this amount is referred to as cost.

The expenses are also used to denote almost the same meaning. The difference between these two concepts is that when the benefits of resources given up can be realized in the future we refer to them as cost. But when the resources given up have no future potential benefits, we call them expenses.

* Elements of cost:

• raw material

• labor

• overheads

Raw material: goods that are yet to be introduced into the production process. Raw materials are converted into finished goods by manufacturing enterprises. The amounts spent on the purchase of raw materials are referred to as raw material costs.

Eg: Woods for producing chair.

Labour: are the wage, benefits, and insurance that are paid to employees who are involved (directly and indirectly) in the manufacturing or production of the goods. Labour represents a human contribution to production. Labor costs must be also analysed against the various jobs completed by workers. It means that the workers should not sit idle during working hours and they should contribute effectively to increasing production.

Example: Salaries of permanent staff

Overheads: means all indirect costs. The aggregate of indirect materials cost, indirect labor cost, and indirect expenses. The term indirect denotes “that which cannot be allocated, but which can be apportioned to, or absorbed by cost centres or cost units.

” Overheads, therefore, refer to those items of cost which cannot be identified with particular products, jobs, or processes.

Eg: rent

Note:

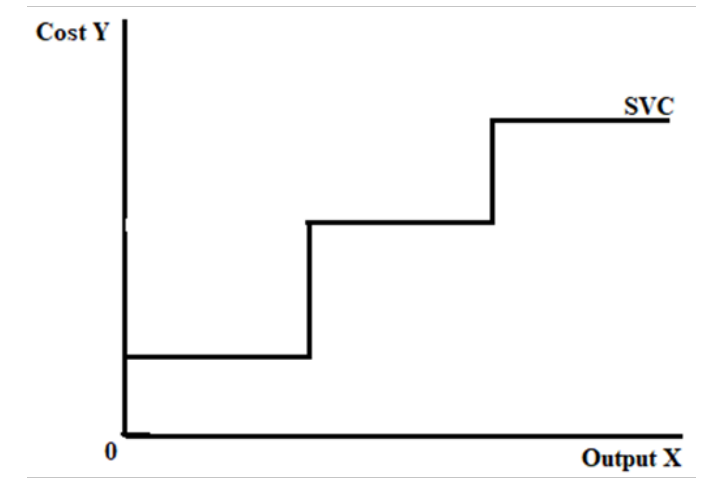

a) Prime cost: it is all direct costs, it is an aggregate of direct material cost, direct labor (wage) cost, and direct expenses.

b) Conversion cost: it is the cost of converting raw material into finished goods.

c) Total cost: it is the sum of all the items of cost which have been incurred, irrespective of whether they are paid or not, to produce and/or sell the product or to generate and render service to a customer.

d) Cost unit: A cost unit has been defined as unit of quantity of produce, service or time in relation to which cost may be ascertained or expressed.

Eg: A meter of clothes, a litre of milk, a kilogramme of sugar.

e) Expense is an amount of money spent by a company during a period of time for producing single unit of a particular product or rendering a service.

Application activity 7.1.a

1. Define the following accounting concepts:

a) Cost

b) Expenses

c) Prime cost

d) Total cost

2. State the elements of cost.

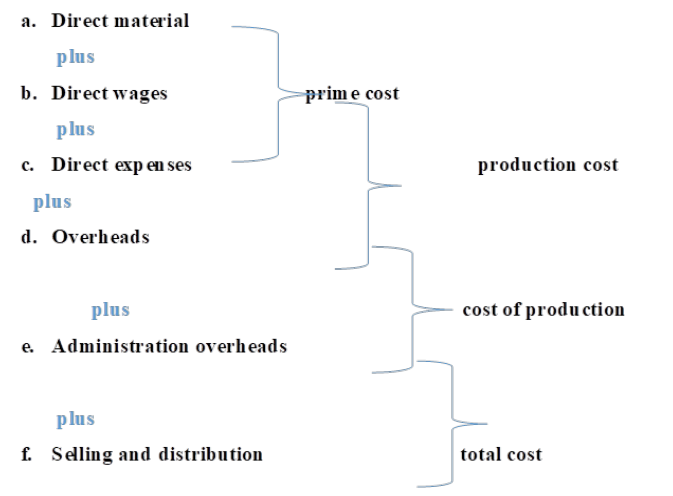

7.1.2 Cost classification

It refers to a systematic process of grouping cost items into two or more categories on the basis of their common characteristics. However, there are a number of bases for the classification of costs; hence the selection and use of a particular base or method for the classification of costs depend upon a number of factors including the objective of classification.

a. Classification of cost by nature

On the basis of the nature or elements of cost, the cost can be classified into three broad categories.

• Material cost; is the cost of raw material consumed in the process of manufacturing and marketing a commodity.

• Labor cost: represents the wages, salaries, etc., payable to the employees of a corporate entity.

• Overheads (expenses): refer to the costs, other than material and labor costs (but including the notional cost of the use of owned assets) of other services provided and used in manufacturing and marketing the goods and services of the company.

b. Classification of cost by degree of traceability of the product.

• Direct cost: is the cost which can be identified for the production of some specific goods. Raw material and direct labor costs are direct costs because these can be charged and identified to the production of some specific output of goods.

• Indirect cost: is cost that cannot be conveniently and economically identified with cost objective. In other words, indirect cost is cost that cannot be identified to the production of some specific goods.

c. Classification of cost by function:

• Production cost: is cost of materials introduced into the manufacturing process, cost of converting the raw materials into finished goods. Production cost = [prime cost + factory overheads] = [direct material cost + direct labor cost +direct expenses+ factory overheads]

• Administration cost: which is also called administrative overheads or office-on-cost are expenses an organization incurs that are not directly tied to a specific core function such as manufacturing, production.

• Selling and distribution costs: are those costs that are incurred to promote the sale of goods and deliver these goods to the customers.

d. Classification of cost by controllability

• Controllable cost: a cost that can be influenced by the action of a specified member of an undertaking.

• Uncontrollable cost: a cost that cannot be influenced by the action of a specified member of an undertaking

e. Classification of cost by relationship with accounting period

• Historical cost: is that cost which is ascertained after it has been incurred.

• Pre-determined cost: is a future cost which is ascertained in advance of production on the basis of specification of all the factors affecting cost. They are extensively used for the purpose of planning and control.

f. Classification of cost by Association with the Product.

• Product cost: is that cost which is necessary for production and which will not be incurred if there is no production. For example, cost of direct materials, direct labor, and factory overheads.

• Period cost: is that cost which is not necessary for production process and is incurred even if there is no production. For example, showroom rent, salary of company’s executives, etc.

g. Classification of cost by behavior:

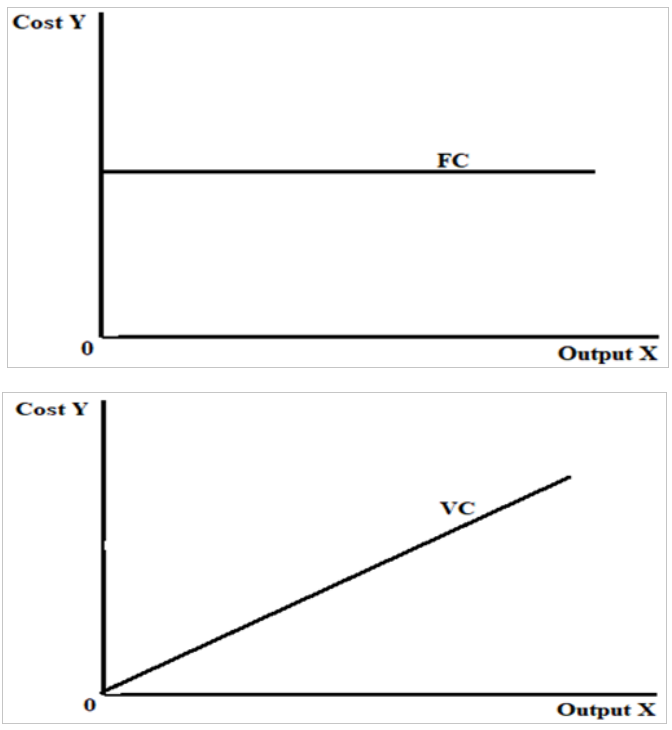

• Fixed cost: is cost which remains the same at different levels of activity. It is the costs which, in aggregate, tend to be unaffected by the changes in the levels of activity. They remain constant irrespective of the level of activity.

• Variable costs: are those costs that vary with the levels of activity in the same direction and more or less in the same proportion.

• Semi variable costs: are partly variable and partly fixed costs.

Application activity 7.1.b

1. Define the following concepts:

a) cost unit

b) unit cost

2. Define prime cost. What are its elements?

3. What is meant by direct cost and explain how does it differ from indirect cost?

7.2 Overheads

Activity 7.2

Construction projects become complicated and fragmented so that many specialty contractors are involved. In such changing environments, a general contractor's overhead costs are increasing comparable to direct costs. In addition to an increase of volume, activities consisting of overhead costs play an important role in coordinating different participants who include different specialty contractors and client. “We are interested in strategies of overhead control and critiques problems thereof” said CEO of construction agency. Through literature review, interviews with professionals, and data collection the business will maintain the current customers and increase the general profit.

With the above scenario what the business would do to maintain the increase of profit?

7.2.1 Definition of overheads

Overheads: refer to all indirect costs. Overheads, therefore, may be defined as costs that do not result solely from a particular activity. In other words, all those costs which are incurred by the organization as a whole and not for some specific activities are known as overheads. Overheads must be reasonable and adequate.7.2.2 Overheads classification

• Production overheads

• Administrative overheads

• Selling and distribution overheads.

a. Production overheads

Production overheads are also called work overheads, factory overheads, manufacturing overheads or works-on-cost. all are manufacturing costs other than direct material and direct labour which are collectively termed as factory overheads.

Examples: indirect materials, power, light, depreciation, repairs, cleaning, and maintenance etc.

b. Administrative overheads

They are also called office overheads, office-on-cost; all the expenses incurred for providing control, direction, and management of the enterprise are known as administration overheads. Examples: rent, insurance, water, power, electricity charges for the factory.

c. Selling and distribution overheads

They are also called selling and distribution costs.

Selling and distribution overheads may be taken together or separately. Most organizations find it more convenient to take these overheads together.

d. Selling overheads:

Are those expenses that are incurred to secure orders and to increase sales for the enterprise. These also be called marketing costs. Selling overheads consist of advertisement expenses, sales travel, salaries of salesmen and commission of sales agents, sales correspondence expenses and cost of preparing catalogues and price-lists, rent of salerooms and offices, water and electricity expenses of salerooms.

e. Distribution overheads:

Are those expenses that are incurred on the movement of finished goods from factory to warehouse and then in delivering these goods to the customers. Distribution overheads consist of the cost of warehousing the finished goods, transport charges in respect of movement of finished goods from factory to warehouse and from warehouse to customer’s premises.

The analysis of total cost

The total cost incurred by a manufacturing company concern may be analysed:

Application activity 7.2

1. Write a note on a variable cost, fixed cost, and semi-variable cost.

2. What is meant by production cost and how does differ from the cost of production?

3. What is works-on-cost? How does it differ from works costs?

7.3 Computation of cost

Activity 7.3

The following information are extracted from ABC PLC organization. The ABC PLC manufactures the tables and the costs of production are given below:

Variable cost is Frw 2 500 and fixed cost Frw 15 000, the labor cost per table is Frw 1 800. The production per month is 8 tables.

How much ABC PLC did spend on production of one table?

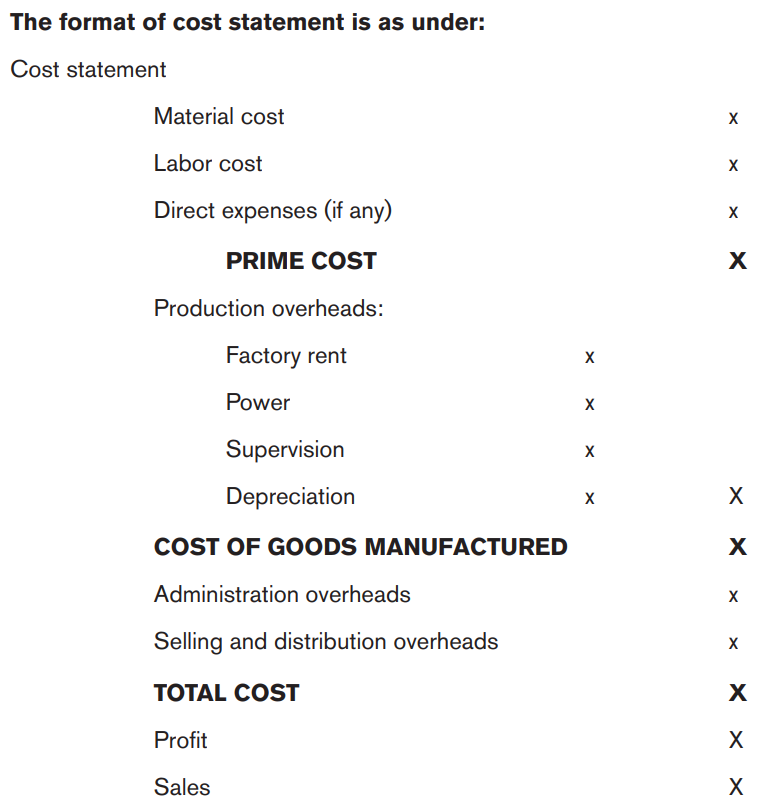

7.3.1 Cost statement/ sheet

A cost sheet means the presentation of cost data in the form of statement. This statement shows costs incurred under appropriate headings. A cost statement is prepared to show:

• Prime cost

• Production cost or factory cost

• Total cost of sales;

• Total cost of sales,

• Profit or loss.

One of the main purposes of cost sheet, to management, is to set prices and prepare the quotations regarding various products.

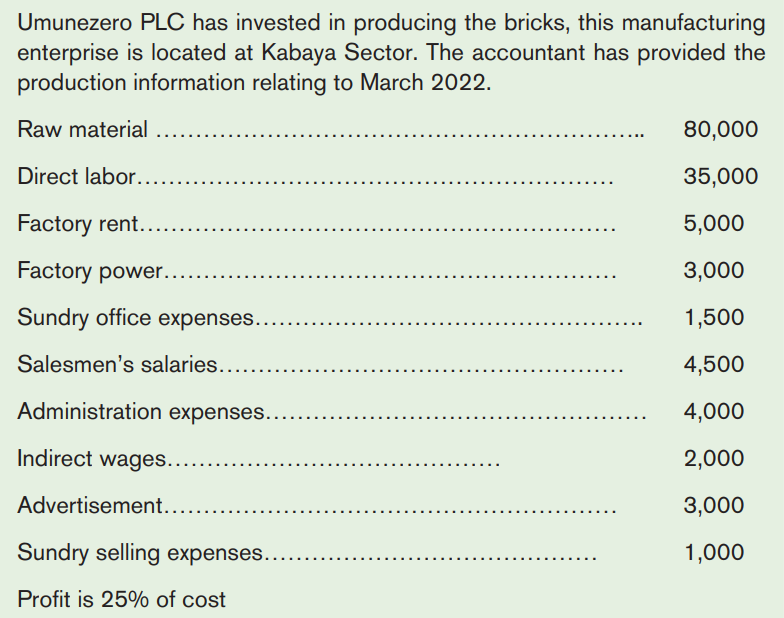

Application activity 7.3.a

From the following information prepare a cost statement showing prime cost, factory cost, total cost and also determine sales revenue.

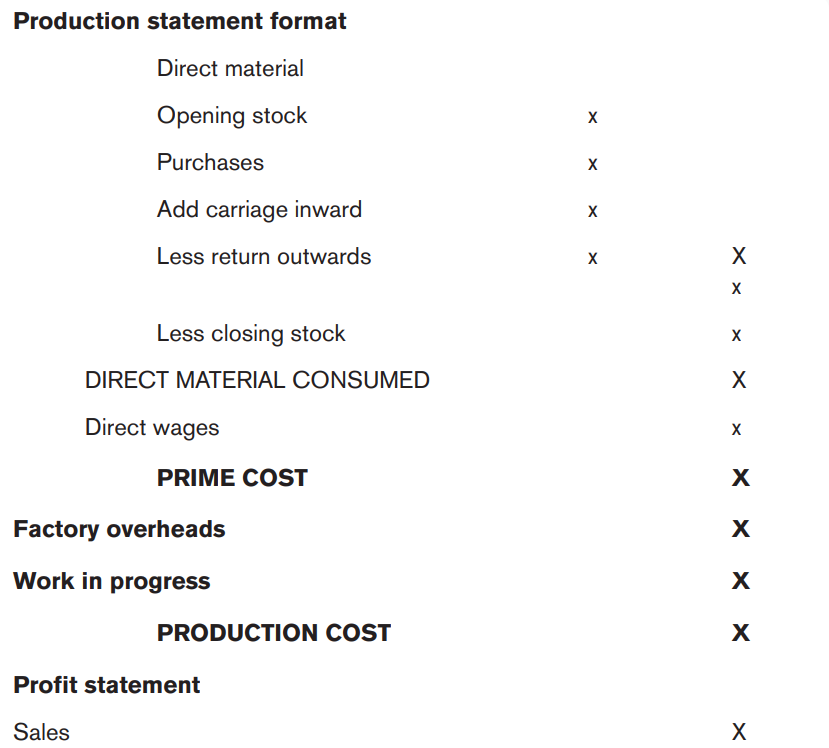

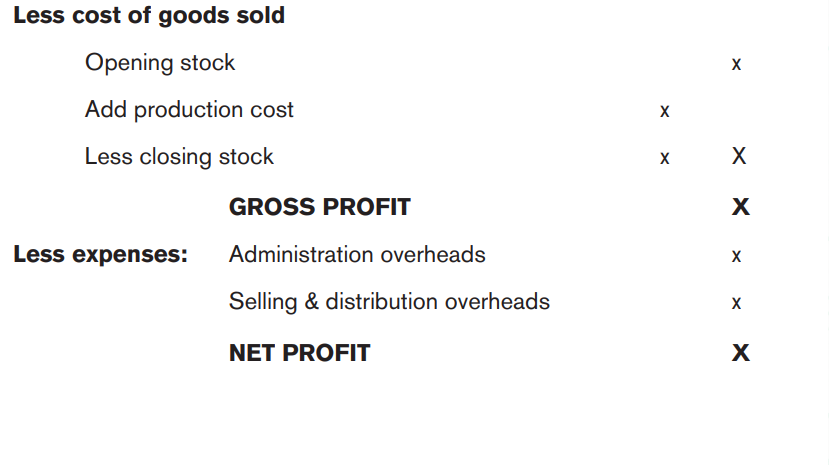

The cost statement doesn’t always show the full picture of manufacturing process system for better decision making. Hence, management accounting necessitates the presentation of production statement that allows to know how much invested in production and the value of each unit cost.

Application activity 7.3.b

1. ABC manufacturing company provides the information for the month of May 2010 as:

Stock on 1st May 2010

• Raw materials …………………………….40,000

• Work in progress…………………………12,000

• Finished goods ………………………… 20,000

Stock on 31st May 2010

• Raw materials ………………….…… 35,000

• Work in progress ……………………… 17,000

• Finished goods ……………………… 23,000

Purchases of raw materials for May ………….. 250,000

Carriage inwards………………………………… 10,000

Factory wages ………..... 80,000

Supervisor salary…..….. 30,000

Returns of raw materials……….. 10,000

Factory rent……… 10,000

Office salaries………….. 13,000

Sundry office expenses………………… 7,000

Sundry selling expenses………………… 6,000

Factory power…………………………........................ 5,000

Salesman salary……………………………….. 18,000

Sales………………………………………….. 500,000

Prepare a production cost statement

7.4 Allotment and absorption of overheads

Activity 7.4

AGAHINGA Plc is a manufacturing business located at Bugesera- Kayonza Road and producing juice. The Director Manager would like to know the total cost per unit produced. Overhead costs are defined as aggregate of indirect costs that include indirect material costs, indirect labor costs and indirect expenses. Such costs cannot be identified to the production of some specific goods or with cost centre and cost unit. The overhead characteristics confuse the manager about the decision making in production process.

What manager should do to facilitate the Director Manager in decision making?

7.4.1 Classification of overheads

a) Production overheads: These include indirect material, indirect wages, factory rent and rates, depreciation of factory plant and other indirect expenses.

b) Administration overheads: These include office salaries, office rent, depreciation of office equipment and other office equipment.

c) Selling and distribution Overheads: These include advertisement, salaries of salesmen, rent of sales warehouse, delivery van expenses, depreciation of delivery vans and other sundry selling and distribution expenses.

Note: The above types of overheads can be classified:

a) Fixed overheads: These overheads remain the same at various levels of output. These are incurred on time basis. The main example is factory rent and rates.

b) Semi-fixed overheads: These remain the same up to a specific level of output and beyond that level these may increase by a specific amount. For example, supervision cost may be 50,000Rwf up to 10,000 units of outputs, 60,000rwf for 10,000 to 15,000 units of outputs and 70,000Rwf from 15,000 to 20,000 units.

c) Variable overheads: These are those overheads which increase with the increase in production and vice versa. The main examples are indirect material and indirect wages.

7.4.2 Overheads allotment

Overheads allotment means the charging of overheads to cost units or cost centres. Overheads are incurred for a specific department or organization as whole. These are charged to cost centres and cost units in order to ascertain total costs of a job or product.

* Stages of Overheads allotment:

• Collection of overheads

• Overhead analysis

• Overheads absorption

- Collection of overheads

This involves the sourcing or gathering of common costs from different sources. Overheads are collected from costing and financial records. For example, indirect wages are obtained from wages analysis book, indirect materials are given in the stores requisitions, factory rent and other expenses paid are recorded in the financial ledger and so on. The collected overheads are grouped into different categories for better analysis. Factory overheads can therefore be grouped as fixed overheads, semi-variable costs and variable costs.

- Overhead Analysis

An overhead analysis is an analysis that charges overheads to cost centres. A cost centre is defined as “A location, person, or item of equipment (or group of these) in respect of which costs may be ascertained and related to cost units”. It is a particular part of enterprise. For example, production department “A” is a cost centre and all overheads incurred in respect of this department should be ascertained.

Overhead analysis sheet is prepared to show how the various overheads have been allocated and apportioned among different cost centres or departments.

This sheet contains the following:

1. The first column shows the name of overhead to be allocated or apportioned

2. The second column shows the bases of apportionment. If, it is to be allocated then the word ‘allocation’ is written in this column.

3. The third column shows the total amount of the overhead which is to be apportioned.

4. The fourth shows the number of total units in respect of any specific overhead

5. The fifth shows the rate of overheads per unit.

6. In addition to above five columns; some more columns are used according to number of departments or cost centres.

However, there are two ways of charging overheads to cost centres:

• Allocation of overheads

• Apportionment of overheads

7.4.3 Allocation of overheads

Allocation means assigning of indirect costs to cost centres or departments. For example, all indirect materials used in department ‘A’ must be charged to this department only. Similarly, the salaries of supervisors of department ‘A’ are expense of this department and these must be allocated to this centre only. It means the overheads which are incurred for one cost centre only, the charging of these overheads to that cost centre is known as allocation of overheads.

Note: The overheads are allocated when the following conditions are fulfilled:

• The cost centre must have caused the overhead to be incurred

• The exact amount of the overhead must be known

7.4.4 Apportionment of overheads

Apportionment of overheads refers to the distribution or the sharing of indirect costs by different cost centres using appropriate bases. The overheads which are incurred for the organization as a whole must be charged to various cost centres of that organization.

We assume there are four departments of an enterprise. The rent is paid monthly for the whole enterprise. This rent must be shared among four departments of this enterprise. This process of sharing of rent among four departments is known as apportionment of overheads.

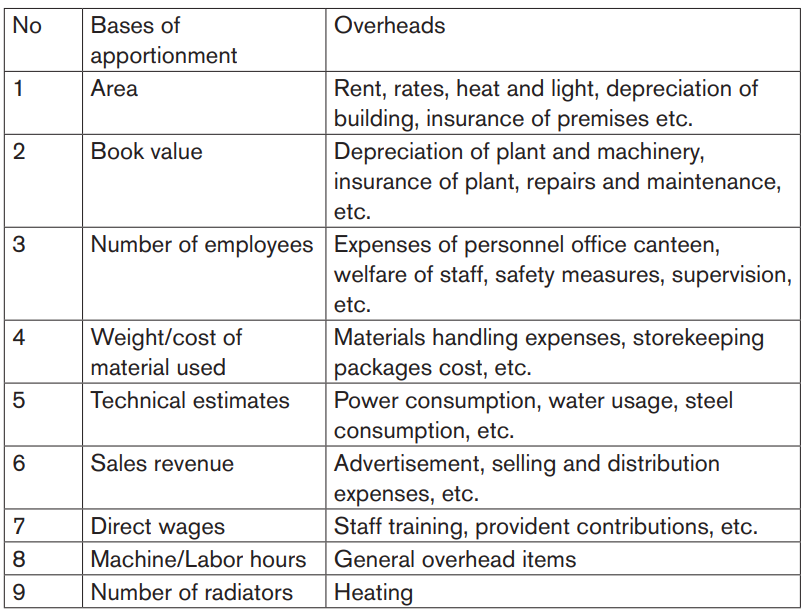

BASES OF APPORTIONMENTS

The following are common bases of apportionments:

A company may decide any basis of apportioning overheads according to its own circumstances. The above bases of apportionments are given in order to provide a guideline. The qualities of bases of apportionment should be:

1. Equitable

2. Practicable

3. Economical

4. Reasonable

5. Accurate

Primary distribution: this apportions all overheads to the different departments or cost centres. It is however important to further assign service department costs to production departments. This is due to the reason that service departments do not themselves manufacture anything and it is the production departments or cost centres which are involved in manufacturing activities.

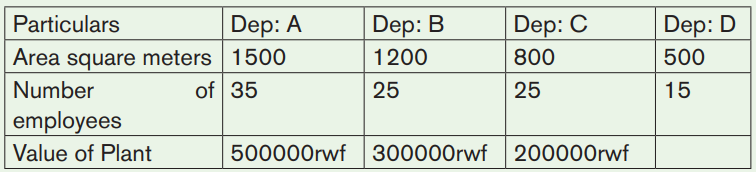

Exercise

MUKAGASANA PLC is the trading company located at Kamonyi-Muhanga road. The business has the following information relates to a factory four departments:

- Overhead: Rent 80,000rwf; Repairs to plant 50,000rwf; Depreciation of Plant 40,000rwf; Light & heat 20,000rwf; Supervision 60,000rwf; Repairs to building 30,000rwf.

- Information in respect of four departments:

Prepare an overhead analysis sheet showing clearly the bases of apportionment.

Within organization no independent department, in other words all business ‘sections work interdependently. Service departments serve production department and vice versa. Recall management decision is subject of cost unit and unit cost; hence the calculation of total cost obtained from summation of costs incurred in production department is the first step after cost allocation and apportionment.

7.4.5 Cost Apportionment

When some service departments provide services to production departments as well as to other service departments then a part of the overhead costs of one service department should be charged to another service department. We assume, the maintenance department provides some services to the stores department and similarly, the stores department provides some services to the maintenance department. In this case, the overhead cost of the maintenance department should be charged partly to stores department and the overhead cost of stores department should be charged partly to the maintenance department.

There are two common methods which can be adopted to transfer the overheads of service departments to the production departments in respect of service departments providing services to other service departments.

These methods are:

a) Repeated distribution b) Simultaneous equations.

Application activity 7.4

URWEREREZA PLC is a manufacturing company that has three production departments and two service departments and is involved in producing Wheat flour (A), Rice flour(B), Maize flour (C) . You are required to show the total overheads chargeable to the three production departments. use the method known as continued allotment or repeated distribution of apportioning service department costs between the two service departments.

Overheads of these departments for a period are as follows:

Production departments: A 150,000 Service Departments: X 30,000

B 270,000 Y 50,000

C 190,000

A technical assessment for the apportionment of the costs of the service departments shows:

Departments

A B C X Y

X 40% 20% 30% - 10%

Y 50% 20% 20% 10% -

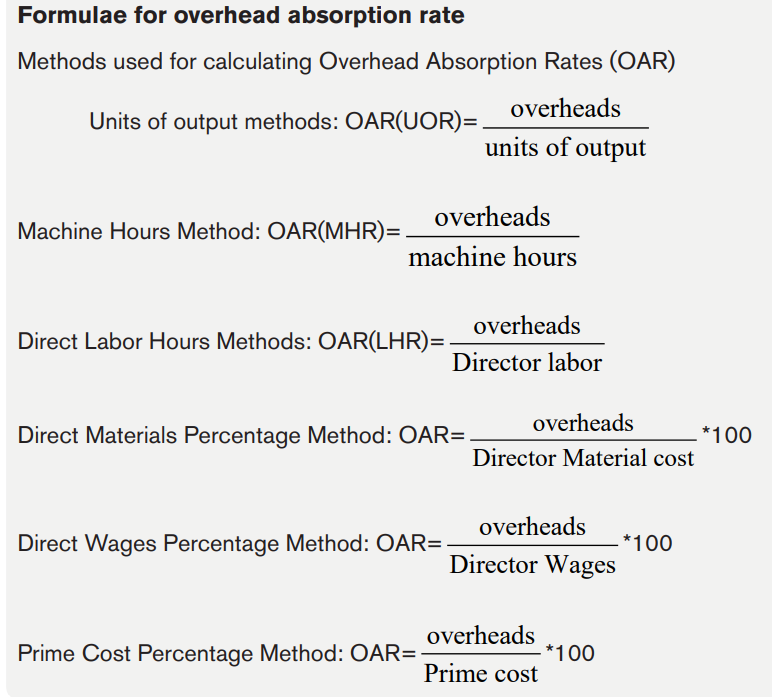

7.5 Absorption of overheads rate

Overhead absorption is defined as “the allotment of overhead to cost units”. This means the overhead incurred in production become or constitute part of the product or service provided.

After all departments’ overhead costs have been apportioned to production departments, the next step is to spread overheads to different products or cost units or jobs. This is termed as “overhead absorption” in Cost accounting.

The overhead absorption involves two stages process include:

i) Calculation of overhead absorption rates (OAR)

ii) Charging of overheads to cost units/products.

Application activity 7.5

Calculate six different OARs for a production department based on the following data:

- Labor hours for the period 2,000

- Direct Wages for the period 1,000,000Rwf

- Direct Material for the period 3,000,000Rwf

- Machine Hours for the period 1,600

- Units Produced during the period 500

- Total Overhead of the department 1,000,000Rwf

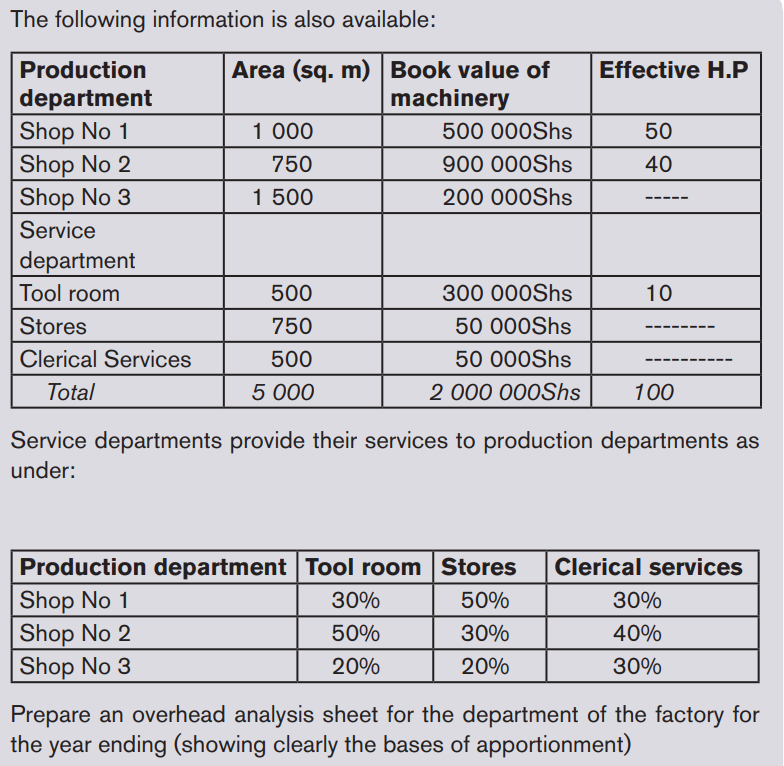

End unit assessment 7

AGAHOZO PL Company shows the accounting documents with the following information at year ending 31st December 2008 are as follows:

Indirect Material (Shs) Indirect wages (Shs)

Shop No: 1 40 000 42 000

Shop No: 2 60 000 58 000

Shop No: 3 20 000 54 000

Tool room 12 000 37 000

Stores 16 000 15 000

Clerical services 6 000 22 000

Other expenses: Rent and Rates : 100 000Shs ;

Insurance: 20 000Shs ;

Depreciation: 300 000Shs

Power: 90 000Shs;

Light and Heat: 40 000Shs

Bibliography

Bouquin, H. (Aout 2006). Comptabilité de gestion. Paris: Economics loterry.

Bwisa, P. H. (2011). Entrepreneurship theory and practice. Kenyan perspective Nairobi

Kenya.: Jomo Kenyatta foundation.

Charles T.Horngren, S. M. (Eleventh Edition, 2003). Cost Accounting (Managerial

Emphasis). Prentice hall.

D, W. (2008). Foundation of Accounting. Nairobi: East African Education

Publisher Ltd.

Drury, C. (2001). Costing-An introduction (Vol. fourth edition ). Oxford: Aden group,.

George Manu, R. N. (2008). Know About Business. Turin, Italy: International Training Centre of the ILO.

Grandguillot, B. &. (2001). Comptabilité analytique (Vol. 4eme edition ). Gualino eduteur.

Grandguillot, B. (2001). Comptabilité analytique . Gualino editeur.

Groves, M. P. (2006). Company accounts,(Analysis,interpretation and understanding) . Etienno.

Icpar . (December 2018). Managing Costs and Cashflows . London :: BBP

Learning Media Ltd.

Icpar. (August 2018,2019). Management Accounting, Certified Accounting

Technician (CAT). BPPLearning Media ltd.

ICPAR. (2018). Principles of Costing / Stage 1. London : BBP Learning Media ltd.

J.Madegowda. (2007). Cost Accounting . Mumbai:: Himalaya Publishing Ltd.

Jourdain, L. D. (2003). Comptabilité Analytique de gestion. 4 eme édition: édition DUNOD.

Kennedy, J.-Y. E. (1998). Lexique bilingue de la comptabilité et de la finance.

ED,POCKET.

Lynne Butel, L. C. (1998). Business functions an active learning approach.

oxford.United Kingdom:: Blacwell Publishers ltd.

Maheshwari, S. M. ( ninth edition 2005). Advenced accountancy. VIKAS

Publishing house: PVT LTD.

Mary, G. (2010). Ways of Thinking About Our Values in Work place”. Giving Voice to Values. Babson College .

MHL. (2004). Production services limited,couventry zrinski. sixth edition.

N.A.Salemi. (2013). Cost Accounting Simplified. Nairobi: Salemi Publication Ltd.

Peter Hagan, A. B. (2003). Higher Business Management . Scotland. UK:: J&L composition.

Sangster, F. &. (2002,2005). Business accounting. ninth edition: Prentice hall.

Ssempija, M. (2011). Entrepreneurship Education for Advance level and

business institutions. Kampala. Uganda: Book shop Africa.

T.Horngren, C. ( 2003). Cost Accounting(Managerial emphasis). eleventh edition : prentice hall.