UNIT 6: THE METHODS OF CALCULATING LABOUR PAYMENT

Key unit competence: Calculate labor payment

Introductory activity

After analyzing the above picture answer the following questions :

1. What is about the picture?

2. What is the difference between works done by these employees from picture?

3. Do you think these people working in this industry will gain the same salary? If yes or not explain.

4. What are the reasons behind these people stand-up and writing?

5. What do you think may be the basic elements that may help them to know the salary of each employee?

6. When can we say that any employee is working overtime?

7. What the company may do when an employee uses abnormal time or produces more items than expected or finishes the work before the time expected?

6.1 Definition of terms used in labor management

Question

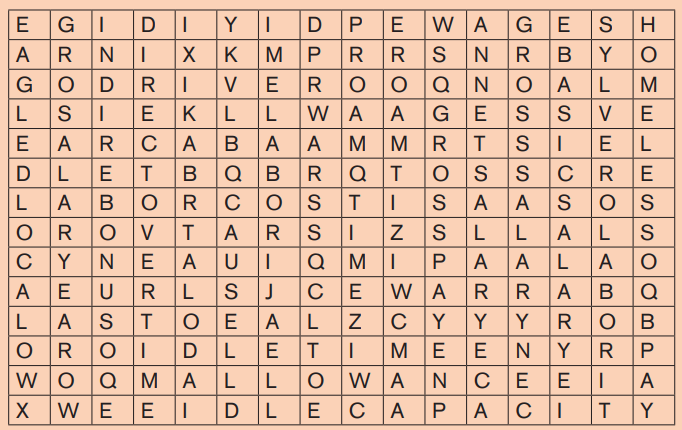

1. Analyze the alphabets in the above cross-cutting letters and find the concepts related to labor.

a. Labour

Labour is the physical or mental effort expended in manufacturing a product. Labour is defined as a group of workers who are under the authority and control of individual or group of individuals called employers entitled to an amount of money called remuneration after an elapsed unit of time (an hour, a day, a month, etc).

b. Labour costing

Labour cost is the price paid for using human resources. The compensation paid to employees who engage in production related activities represents factory labour cost.

Labour costs can be determined according to some prior agreement, the amount of time worked, or the quantity or quality of work done.

Labour costs could be said to include any or all the following items:

• The gross amount due to an employee

• Employer benefit contributions (payments made by an employer towards employees' pensions and other benefits)

• Amounts paid to recruit labour

• Amounts paid for staff welfare

• Training costs

• The costs of benefits like company cars

There are three ways in which labour costs can be determined.

a) According to some prior agreement, for example an annual fixed salary for work.

b) According to the amount of time worked, based on an hourly rate.

c) According to the amount and/or quality of work done ('piecework' or performance-based remuneration).

Payment for many occupations is by a combination of methods (a) and (b). There will be a basic wage or salary which is agreed when the appointment is made. There will be a set number of hours per week during which the employee is expected to be available for work. There will be extra payments for time worked over and above the set hours, or deductions for time when the employee is not available beyond an agreed limit.

c. Wage

A wage is a payment usually of money for labor or services usually according to contract and on an hourly, daily, or piecework basis.

d. Salary

A salary is a fixed amount of money or compensation paid to an employee by an employer in return for work performed. Salary is commonly paid in fixed interval, for example, monthly payments.

Employees on a monthly salary are paid one-twelfth of their agreed annual salary each month. Overtime, bonuses, and commissions on sales, for example, can be paid on top of this. Salaries tend to relate to indirect cost such as office staff and factory supervisors. In the service sector, though, many salaried staff are a direct cost of providing the service, such as solicitors and accountants.

Example:

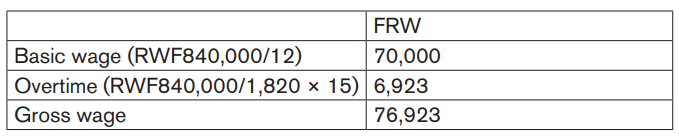

Didier works in the sales office of a food distribution company. His contract of employment specifies a 1,820-hour year and an annual salary of FRW 840,000 per year. Any hours worked in excess of the contractual weekly amount are paid at Didier's basic time-rate. In the month of November he works a total of 15 hours overtime.

Didier's gross wage for November is his basic wage plus overtime:

In this case, we had to work out a basic hourly time-rate by dividing the annual salary by the total number of contractual hours in a year under the contract. This was then used to work out how much Didier could be paid for overtime

e. Overtime

Overtime is the amount of time someone works beyond normal working hours. The term is also used for the pay received for this time.

If an employee works for more hours than the basic daily requirement many organizations pay an extra amount. The overtime payment may simply be at the basic rate. If an employee earns RWF5,000 an hour he will get an extra RWF5,000 for every hour worked in addition to the basic hours. If he earns RWF10,000,000 a year an hourly rate can be calculated by multiplying the basic hours per day by the normal number of days worked per week by the 52 weeks in the year. For example, 7 hours x 5 days x 52 weeks = 1,820 hours and the hourly rate is approximately RWF5,490.

Overtime can also be paid at a premium rate. You will hear expressions like 'time and a third', 'time and a half' and so on. This means that the hourly rate for overtime hours is (1 + 1/3)x basic rate or (1 + 1/2) x basic rate.

Overtime premium is the additional cost of overtime hours above the basic time-rate for those hours.

Example:

Eustache Manzi's total overtime in the case of Olive Ltd is RWF2,400. This comprises two elements:

a) The basic element is the basic wage at the basic time-rate × additional hours worked, in this case 4 hours × RWF450 = RWF1,800.

b) The overtime premium is the extra paid on top of the basic rate for the additional hours worked.

In this case the hourly premium is RWF450 × 1/3 = RWF150. The total overtime premium is therefore 4 hours × RWF150 = RWF600. It is this amount that some businesses may treat as an indirect cost, with the remainder of gross wage – RWF17,550 – treated as direct cost.

Note, however, that if the overtime is worked at the request of a customer so that an order can be completed within a certain time, the overtime premium is a direct cost of that particular order.

f. Idle time

When the employees are paid on the basis of time rate system, normally there will be a difference between the time for which the employees are paid and the time actually spent by them in production. The difference is termed as idle time, therefore, represents, the loss of time for which the company pays wages to the employees but obtains no benefits or work from them (i.e, from employees). It is, therefore, necessary to minimize the idle time, it is necessary to understand the reasons for idle time.

In many jobs there are times when, through no fault of their own, employees cannot get on with their work. A machine may break down or there may simply be a temporary shortage of work.

Idle time has a cost because employees will still be paid their basic wage or salary for these unproductive hours and so there should be a record of idle time. This may simply comprise an entry on time sheets coded to 'idle time' generally, or separate idle timecards may be prepared. A supervisor might enter the time of a stoppage, its cause, its duration, and the employees made idle on an idle time record card. Each stoppage should have a separate reference number which can be entered on time sheets or job cards as appropriate.

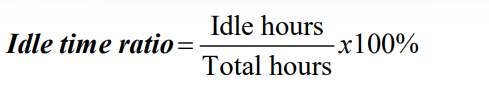

A useful ratio for the control of idle time is the idle time ratio.

This ratio is useful because it shows the proportion of available hours which were lost because of idle time.

• Reasons for idle time

Normal causes

• Time required for going from factory gate to workplace

• Time taken to take up the day’s work

• Lapse of time between the completion of one job and the commencement of another job

• Time required for setting up of the machine

• Time taken for personal needs

• Time lost on account of normal tiredness, etc.

Abnormal causes

• Break-down of machinery on account of inefficiency of repairs and maintenance staff

• Power failure

• Shortage of raw materials on account of inefficiency of the purchase and /or store department

• Non-availability of proper instructions

• Waiting for tools,

• Strikes, lockouts, etc.

In order to minimize the idle time expenses, proper preventive steps should be taken as listed below.

- Proper and systematic plan for all the works in hand in such a way that the employees complete them in sequential order and do not waste time in waiting for getting the work.

- Proper and adequate instructions should be given to the employees on time so that the employees do not waste time for non-availability of instructions.

- Raw materials should be made available to the employees, and regular repairs and maintenance of plant and machinery should be undertaken to avoid the loss of productive hours on account non-availability of raw materials and break down of plant and machinery.

g. Idle capacity

Idle capacity is the remaining amount of capacity left in a company after productive capacity and protective capacity have been eliminated from consideration.

Productive capacity is that portion of a work centre’s total capacity needed to process currently schedule production, while protective capacity is additional capacity held in reserve to ensure that sufficient quantity of parts can be manufactured to adequately feed the bottleneck operation.

h. Basic salary

Basic salary or pay refers to the amount of money that an employee receives prior to any extras being added or payments deducted. It excludes bonuses, over time pay or any other potential compensation from an employer. The whole amount of basic salary is part of the take home salary.

Levels of basic pay are ultimately decided by senior management who will take into account what other employers are paying for similar work, what they consider the work to be worth, how easy it is to recruit labour and any agreements with trade unions.

The basic pay due to an individual worker will be mentioned in his or her letter of appointment and included in his or her contract of employment. The main on going record, however, will probably be kept on an employee record card held in the personnel department. This will also show subsequent increases in the wage rate or salary level and much other information.

Much of the information on the employee record card is confidential and there is no need for staff in the payroll department or the costing department to know about it.

Ideally, therefore, details of basic pay for all employees are compiled on separate lists which are given to payroll and costing. A fresh list should be issued whenever the pay rates are revised.

In a computerised wage system, the basic rates are usually part of a database, and payroll and costing are only able to access information that is relevant to their tasks. Costing, for example, does not need to know the names of individual employees: in fact it is more efficient for workers to be coded according to the department they work in and the type of work that they do.

i. Allowance

Allowance is any monetary benefit offered by the employer to his/her employees for meeting expenditures, over and above the basic salary. The employers offer various kinds of additional benefits in monetary terms to their employees over and above the basic salary, which are known as salary allowances.

j. Gross pay (gross salary)

Gross salary is the term used to describe all the money an employee has made working for the company. It is the salary which is without any deductions like income tax, medical insurance etc. Gross salary is however, inclusive of bonuses, overtime pay, holiday pay, and other differential. Some of the components of gross salary include basic salary, house rent allowance, transport allowance, communication etc.

k. Net salary

Net salary, or more commonly referred to as a take home salary, is the income that an employee actually takes home after tax, provident fund and other such as deduction are subtracted from it. Net salary is usually lower than gross salary. It can be equal in case where income tax is zero (0) and when the salary is less than the government tax slab limits.

i. Pay slip

Payslip or salary slip is a document record that employers give to employees each time they receive their earnings. The payslip mainly informs the employee of the gross pay, deductions done and the remaining net pay. The payslip also provides evidence of earnings and proof of employment.

m. Payroll

Payroll is a list of all employees showing the details of their gross wages, deduction, and net wages due to them. The payment list provides an efficient way to review all payments that have been established for a specific account. The payment list which is displayed in alphabetical order, allows for additional payments to be added.

n. Remittance slip

Remittance slip is a document sent with payment to the employees, giving him the details of what invoices are being paid and credits, if any being taken and it shows the net pay (salary, wage) of an employee. (It is used in the process of sending money to the employees at distance either by using an e-mail address or another kind of transfer).

o. Bonus

Bonus is a sum of money added to a person’s wage or salary as a reward for good performance.

To increase the productivity of employees, an employer will often set up a bonus scheme whereby the employee can earn additional pay over and above their basic wage if they work more efficiently. Bonus schemes may be on an individual basis or for a group of employees if they all work together on a particular task.

The bonus payment is usually charged as part of the cost of labour for the cost centre although some organizations include it as an expense/overhead for the relevant cost centre.

Application activity 6.1

1. What do you understand by labor cost?

2. Discuss the differences between wages and salary.

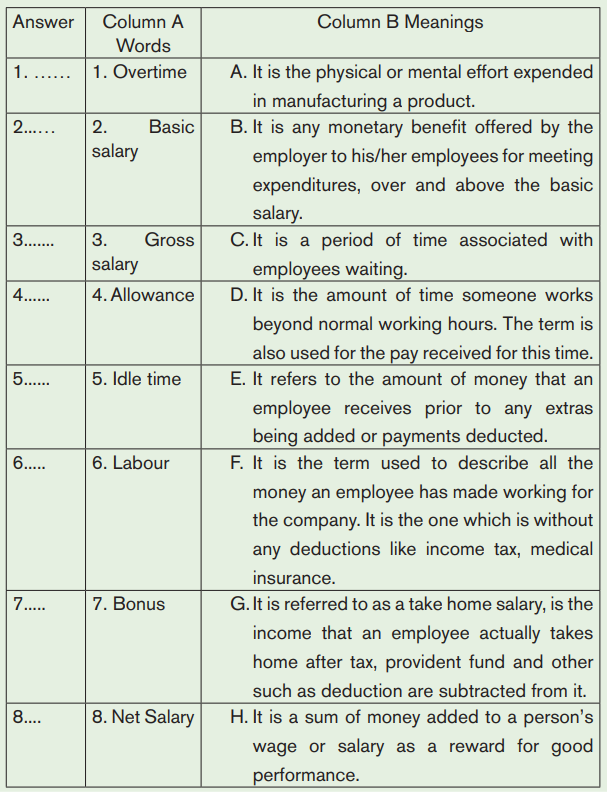

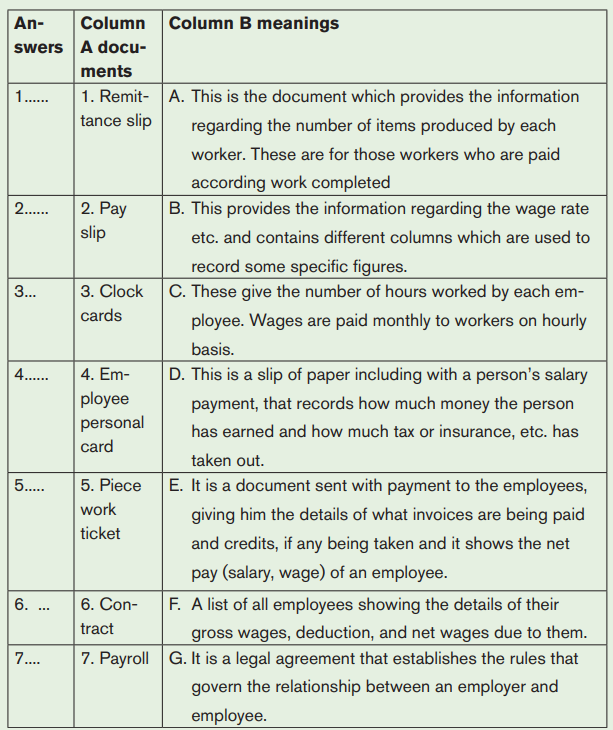

3. Match words in column A with their meanings in column B. Use each letter only once and write it in the blank space provided.

6.2 Objectives of the labor cost accounting

Cost accounting for labor has five primary objectives:

• Determination of labor costs in the cost of product or service

• Reporting labor costs for planning and control

• Reporting labor costs for decision making

• Setting standards of cost for the purpose of control and provision of relevant data for planning of manpower requirements

• To maintain the efficiency in the process of manufacturing any product.

6.3. Documents used in labor management

Activity 6.3

Analyze the above picture then answer the following questions:

1. What is about the picture?

2. What do you see on the top documents?

3. According to what you see on the top documents, what do you think those documents are about?

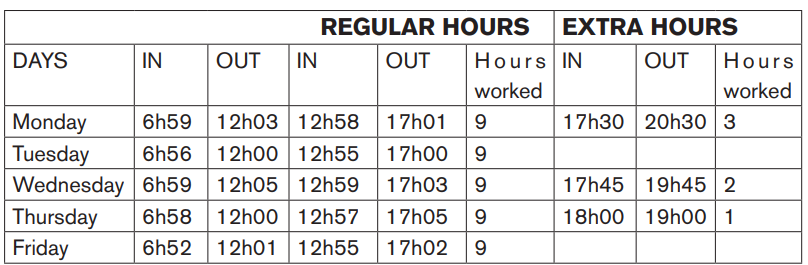

a. Clock cards (timecards)

The document that shows the number of hours worked by each employee. Wages are paid monthly to workers on hourly basis. Their hours worked are recorded on clock cards issued to them. These clock cards contain the information regarding names, clock numbers, and the time an employee enters and leaves the work place, hours worked on different dates of the month and 145 so on. From these cards, the numbers of hours worked showing normal time and over time are transferred to the payroll. If magnetic cards are used the time clock data for each worker is sent electronically to the time keeping department via the computer.

Illustrative Example

The time card for the week ending on 30th June 2022, for SEMUHUNGU Alexis working in SULFO PLC is presented below:

NAME: SEMUHUNGU Alexis

N0:01

Week ending June, 2022

The above time card shows that SEMUHUNGU Alexis, worked nine regular hours per day and he worked all the five week days. This means the total regular hours worked by Alexis is 45 hours per week and the total extra hours are 6 hours as it is shown in the above table (Three hours on Monday, two hours on Wednesday, one hour on Thursday).

b. Contract

A labour contract is a legal agreement that establishes the rules that govern the relationship between an employer and employee. Also known as labour agreement, a labour contract is binding legal agreement that establishes the rules and regulations that will govern the relationship between an employer and an employee.

c. Piecework ticket

This is the document which provides the information regarding the number of items produced by each worker. These are for those workers who are paid according to work completed.

d. Employee personal card

This provides the information regarding the wage rate etc. Employee personal card contains different columns which are used to record some specific figures; one line is used for one worker. The names of workers are arranged alphabetically or according to the serial numbers of their clock cards.

Application activity 6.3

1. Match documents in column A with their meanings in column B. Use each letter only once and write it in the blank space provided.

Analyze the above picture, then answer the following questions:

1. What is about the picture?

2. What is the difference between the first picture and the second picture?

3. Do you think the salary of these two first employees may be calculated using the same way? If YES or NOT explain.

4. What is the point of difference between the two first employees and other two remaining employees?

5. Is it possible that an employee who normally works the day in the normal days of week, to work the night and in the weekend days?

6. How can the company treat those employees who work in abnormal conditions of the work?

6.4 Methods of computing wages

Activity 6.4

Analyze the above picture, then answer the following questions:

1. What is about the picture?

2. What is the difference between the first picture and the second picture?

3. Do you think the salary of these two first employees may be calculated using the same way? If YES or NOT explain.

4. What is the point of difference between the two first employees and other two remaining employees?

5. Is it possible that an employee who normally works the day in the normal days of week, to work the night and in the weekend days?

6. How can the company treat those employees who work in abnormal conditions of the work?

6.4.1 Introduction

This refers to the basis of determining what is to be paid to an employee for his services. In this section we shall concentrate on methods of remuneration for factory workers, because production personnel involved in management of production in different capacities like, foremen, supervisors, factory managers, production engineers etc. are paid monthly salaries and fringe benefits according to the rules of organization.

As stated earlier, basic wages of the workers are determined by then classification into different pay scales by means of job evaluation. But the wages actually earned by the workers may be computed either on flat time-rate basis or under some form of incentive wage system.

Basically, wages are paid according to performance or according to time spent by an employee on employer’s work.

6.4.2 Time rate method

Under this method, workers are paid basing on the time spent on the job that may be an hour, a day, a week or a month. Mostly, the workers are paid according to number of hours worked during a particular week or month. Mostly, the workers are paid according to number of hours worked during a particular week or month. Hourly rate is determined in advance at the time a worker is employed. This hourly rate is multiplied by the number of hours worked during a particular month and the resultant figure is the wage for that month.

* Advantages of time rate method

• It is a convenient method and wages can be calculated easily.

• Under this method employee can forecast their income, and they are ensured to receive this income.

• This method eliminates the need to measure the performance of the worker.

• This is more suitable for such jobs where work cannot be divided into smaller units. Example: The works of a driver, a typist or any other office worker.

* Disadvantages of time rate method

• This method discourages the more efficient workers because they receive the same amount which is received by inefficient workers and lazy employees.

• This method requires close supervision of employees; otherwise they do not show interest in their work.

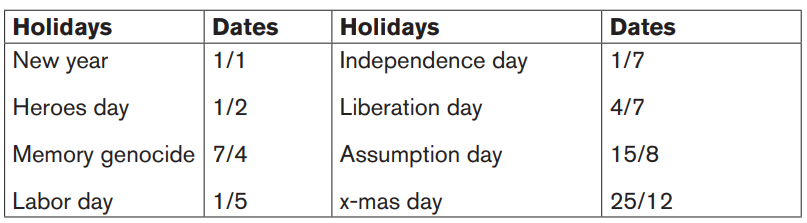

* Holiday pay

Official holidays shall be determined by the presidential order and for every public holiday. The worker benefits from his/ her full salary. Public holidays are known:

The workers have the right to an unplanned (incidental) leave in case of good or unfortunate event which may occur in their family. Incidental leaves shall be determined by an order of the minister in charge of labor.

6.4.3 Piece Rate Method (Piece work payment)

Under this method, employees are paid according to the units produced, articles or per job completed. This method is used only if the work can be divided into uniform pieces as is often possible for factory jobs.

The piece rate method can be applied in different forms.

• Straight piece work plan,

• Differential piecework plan, and

• Piece rate with guaranteed time rate.

a. Straight piece work plan:

Here workers are paid straight to the unit produced, regardless of output quantity.

Hence, Total gross pay= output quantity ×rate per unit

Example: ISIMBI works on a hat assembly line. She gets paid at a straight piece work rate of Frw350 per hat. Pay for last week if she produced 1,655 hats.

Solution

Total gross pay= output quantity ×rate per unity

Total gross pay= 1,655×Frw350= Frw579,250

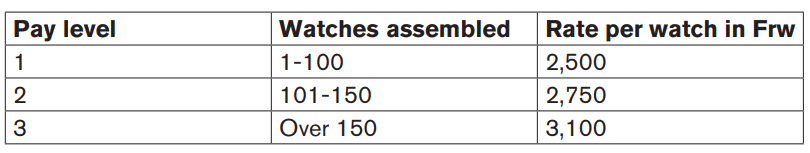

b. Differential piece work plan:

It is a greater incentive method of compensation than straight piece work, where payment per unit increases as output goes up.

Example: SUSAN is working in ABC PLC that produces the watches. From the production department manager officer, the information bellow can be analyzed and calculate the total pay of SUSAN.

She is supposed to assemble 190 watches last week. Calculate her total gross pay based on the following differential piece work schedule.

Solution

To find out SUSAN’s total gross earnings, we calculate her earnings at each level of the schedule and add the totals. She will be paid for all of level I, all of level II, and 40 watches at level III (190-150).

Level pay= output×rate per piece

Level I= 100×Frw2,500= Frw250,000

Level II= 50×Frw2,750= Frw137,500

Level III= 40×3,100 = Frw124,000

Total gross pay= Level I+ Level II+ Level III

Total gross pay= Frw250,000+Frw137,500+Frw124,000= Frw511,500

c. Piece rate with guaranteed time rate

Under this method, a specific is paid to the worker on daily or monthly basis irrespective of units produced by him/her during that period but if his/her output exceeds beyond a minimum limit then he/she is paid according to piece rate method.

Example: We assume the guaranteed wage of KALISA is frw 150,000 and he is paid Frw500 per unit produced. Find out his monthly wage on the assumptions that he produced in a month:

a) 500 units

b) 270 units

Solution

Total wage for 500 units is 500 ×Frw500= Frw 250,000. This wage is more than the guaranteed wage, so he will receive Frw 250,000

Total wage for 270 units is 270× Frw500= Frw135,000. This wage is less than the guaranteed wage, so he will receive Frw150,000.

* Advantages of piece work method

• It provides incentives to more efficient workers. They are paid according to work done so they get more income.

• It does not require close supervision of employees.

• It provides the employer an easy way of determining labor cost per unit of a product.

* Disadvantages of piece work method

• The workers can produce inferior or poor quality products in order to produce greater quantity in short time.

• This method cannot be applied to those jobs which are not easy to divide in small pieces.

• This method does not ensure a stable monthly income of works

* High time rate for overtime

Under this method, normal working hours are paid at the normal time rate but for overtime worked during week days and at weekends, a higher rate is paid in order to induce to the workers to work for more hours. Usually, normal working hours from Monday to Friday are 9 hours per day. It means weekly normal working hours are 45. During week days, for extra time worked, hourly rate is 50% higher than the normal hourly rate. For weekend days (Saturday and Sunday) and public holidays, it is double than the normal hourly rate.

Note: In Rwandan labor law, the ordinary/normal working hours are forty five hours (45). In each Institution, after consultation with staff representatives, every employer draws a timetable complying with 45working hours, indicating hours at which the working period commences and ends. For extra time worked, hourly rate is not commonly fixed; there must be agreement between employer and workers.

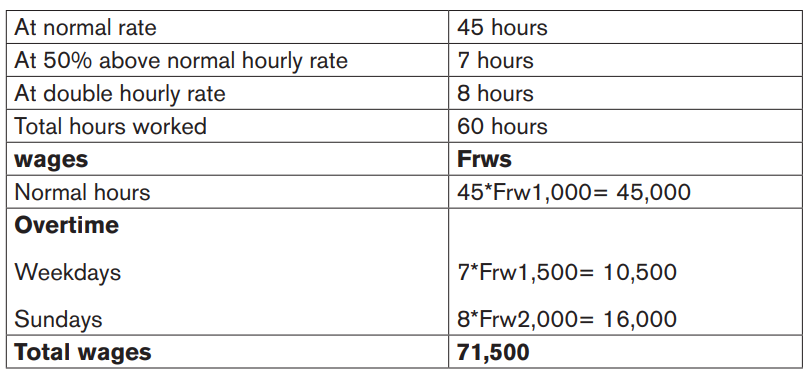

Example: We assume A. ROBERT’s hourly rate is Frw 1,000. During a particular week, he worked for 60 hours including 8 hours on Sunday. His wages for this particular week is:

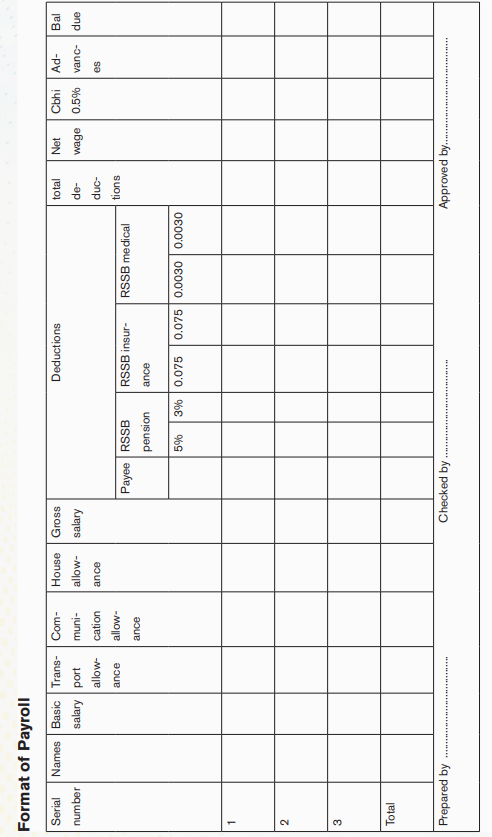

6.4.4 Presentation of payroll

The following are steps and procedures which are adopted to prepare a payroll. The number of hours worked are multiplied by wages rate per hour. Over time worked is multiplied by wage rate which is applicable to the overtime worked to get the over premium pay.

Calculation of the gross pay (employee’s gross pay) is the amount an employee earns before any deduction for taxes and other items such as social security fund (RSSB)…the employee’s gross pay is equal to regular pay amount plus overtime premium pay and fringe benefits. (FB: Benefit that you get because your job which is additional to your pay but not in the form of money (example: a car)

• Computation of all deductions on employee’s wage

The amount earned by employees are called “wages or salaries” and the gross salary (gross pay) is subjected to some deductions. Such deduction has direct effect on employee’s gross pay because automatically reduce the gross pay.

The following deductions are retained:

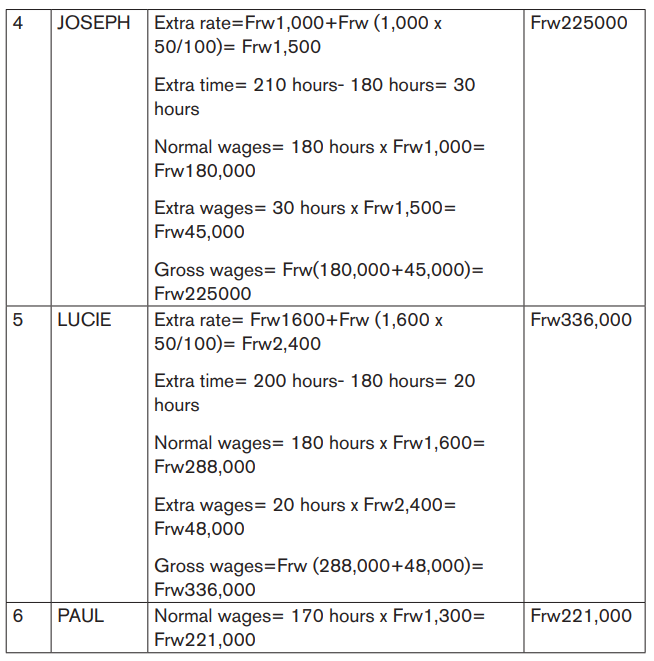

PAYE (Pay As You Earn)

It is the professional tax that an employee must pay to the tax administration. The rate of PAYE is applied to the gross pay to obtain the amount to be paid as professional income tax. The tax administration in Rwanda is called Rwanda Revenue Authority (RRA).

For tax

FRW 0 Frw 30,000 (0% or Zero rate)

FRW 30,001 Frw 100,000 (20%)

FRW 100,001 above (30%)

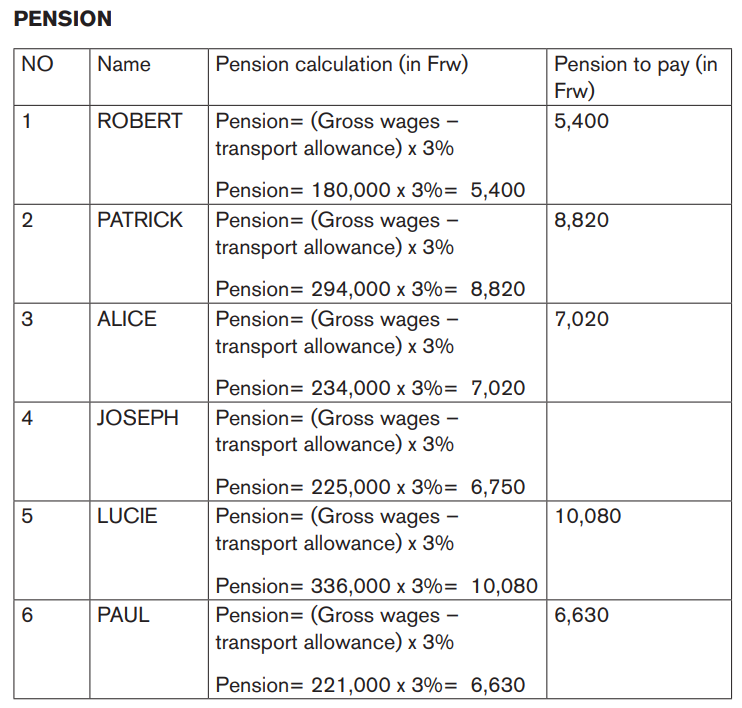

Rwanda Social Security Board (RSSB): On gross pay of every employee must be deducted the contribution for the purpose of retirement age (65 years in Rwanda).

For social security funds:

• Gross pay – Transport allowance

• 3% of the above balance is paid by the employee

• 5% of that balance is paid by the employer.

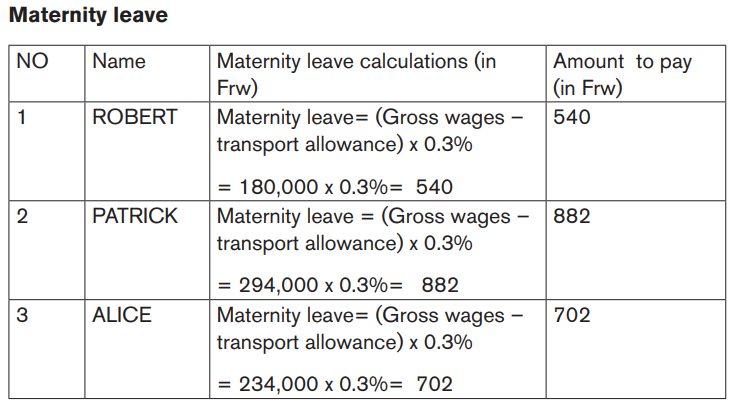

Maternity leave: The law requires all employers and employees to each contribute 0.3 of the employee’s gross remuneration towards a maternity fund. The fund is also administered by Rwanda Social Security Board (RSSB)

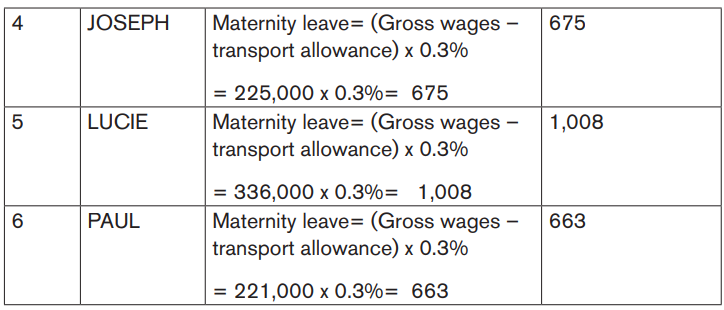

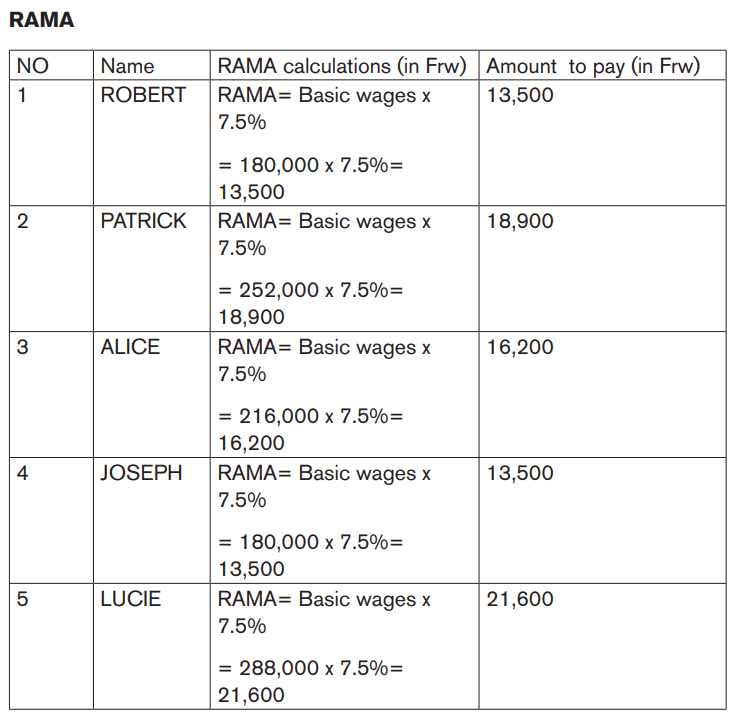

Medical Insurance (RAMA= Regime d’Assurance Maladie des agents de l’ Etat/ Rwanda medical insurance): it is the amount to be paid to the employee’s wage to meet the role of protecting him/her against illness. For RAMA the rate is like:

– 7.5% is paid by the employee

– 7.5% is paid by the employer

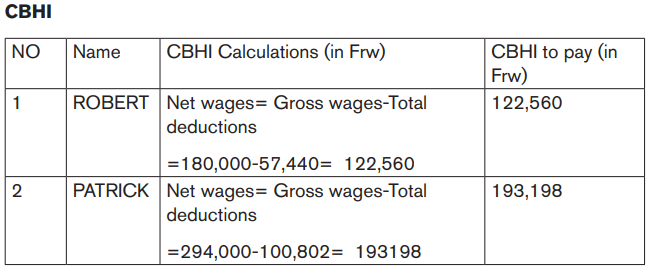

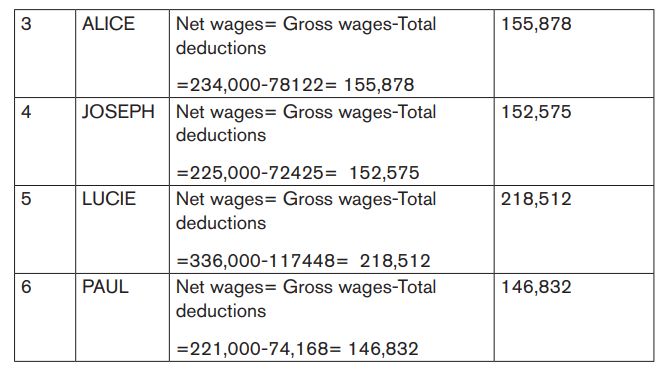

CBHI (Community Based Health Insurance): This order has introduced a statutory deduction of 0.5% from every employee’s net salary to be contributed to the community based health insurance scheme.

Union duties: This is a contribution of employees to their unions and associations.

Other deductions: Like advance taken by the employee, loan repayment, etc.

• Computation of “Net pay”

The net pay is the amount of money to be paid to the employee after deducting all deductions from the gross pay. This means that, the total deductions are subtracted from the gross wages and the net wages are interred into another column. Any advance taken by employees or loan repayments are subtracted to find out the wages payable.

The formula to compute the gross pay and the net pay are: Gross pay = Regular pay+ Overtime premium pay+ Fringe benefits Net pay= Gross pay-Total deductions Summary of these steps:

Regular pay=Regular hours*Regular pay rate

+ Overtime premium pay=Over time hour*Overtime premium rate

+ Fringe benefits (transport + communication + accommodation)

Gross pay

-Deductions

Net wage to be paid to employee

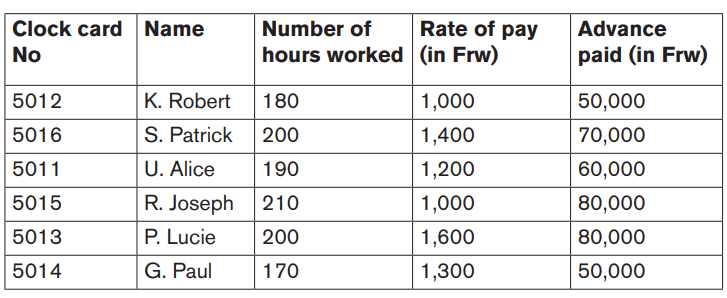

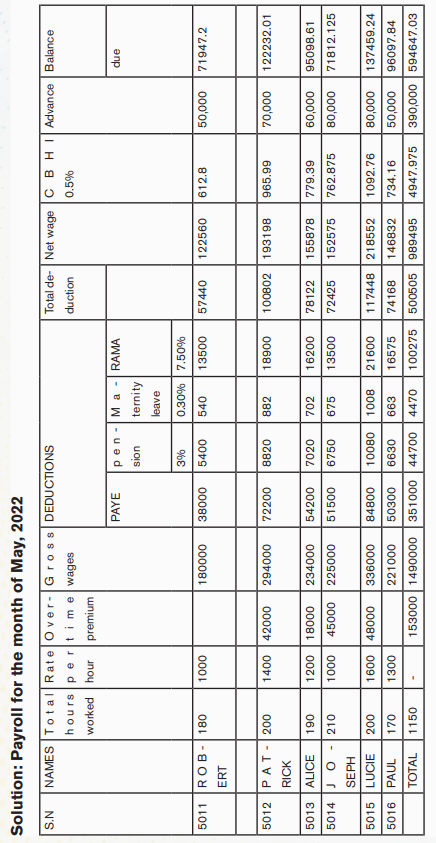

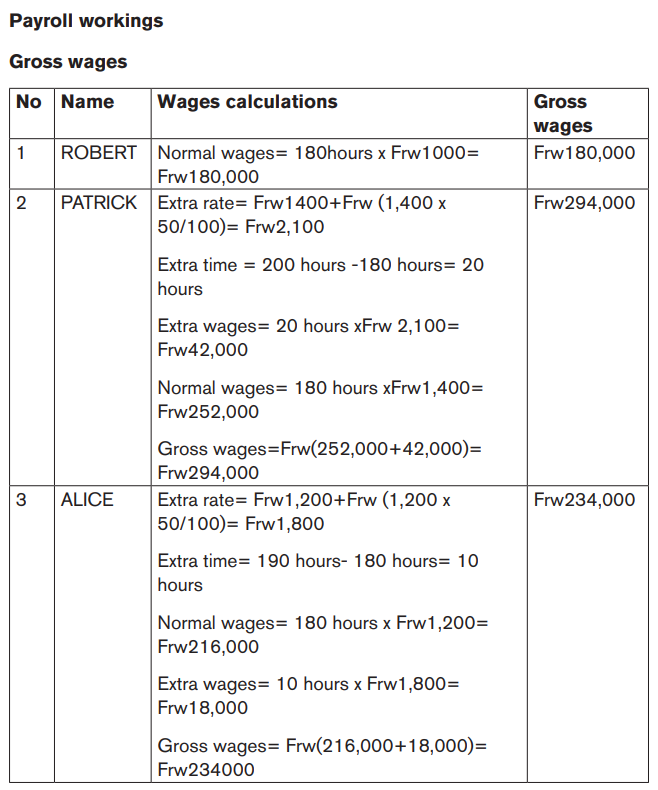

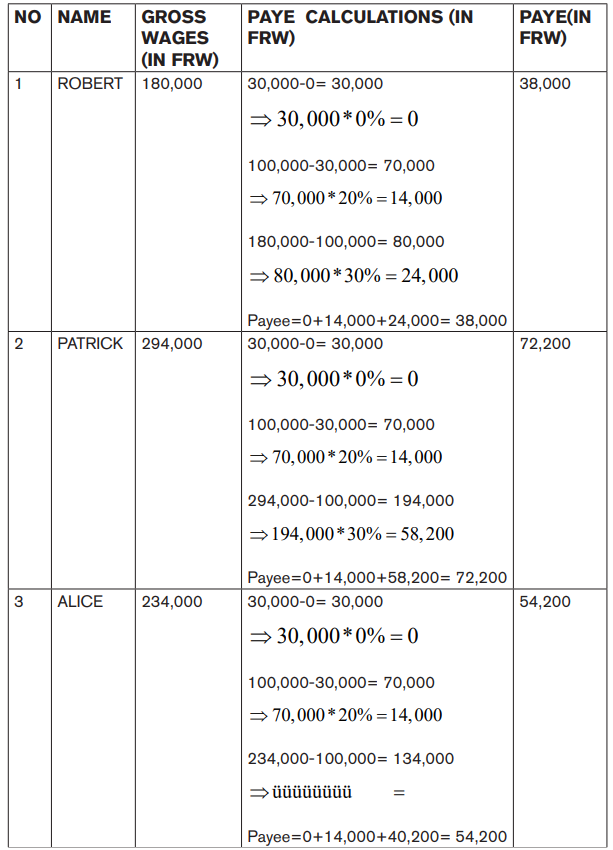

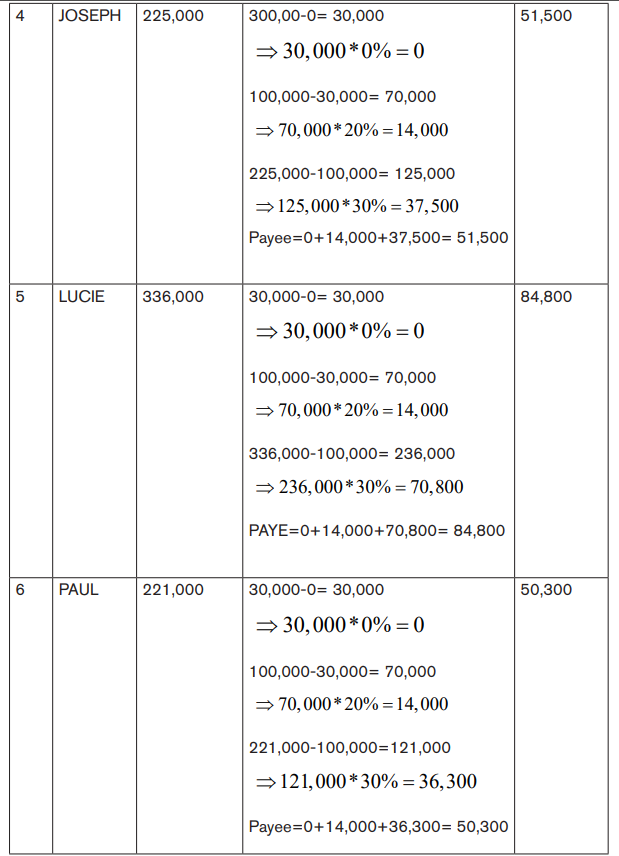

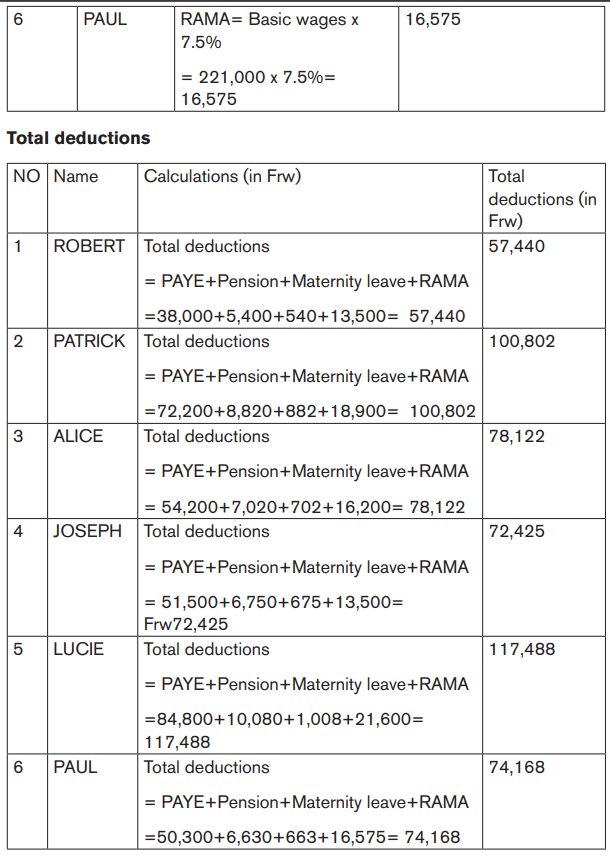

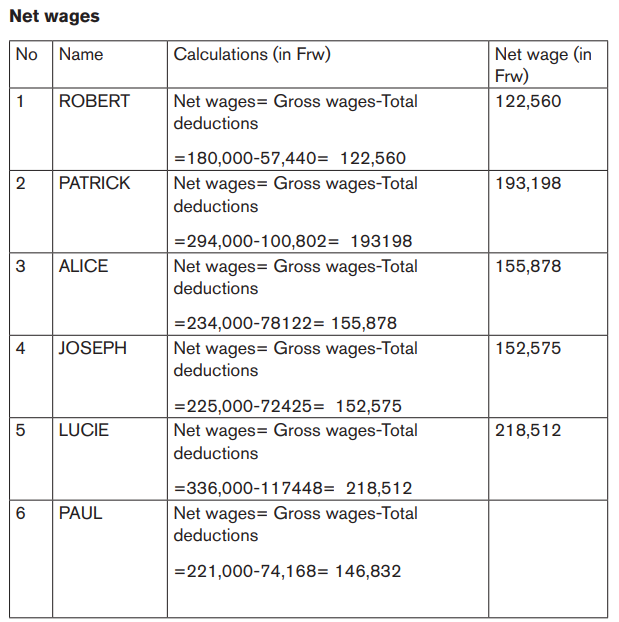

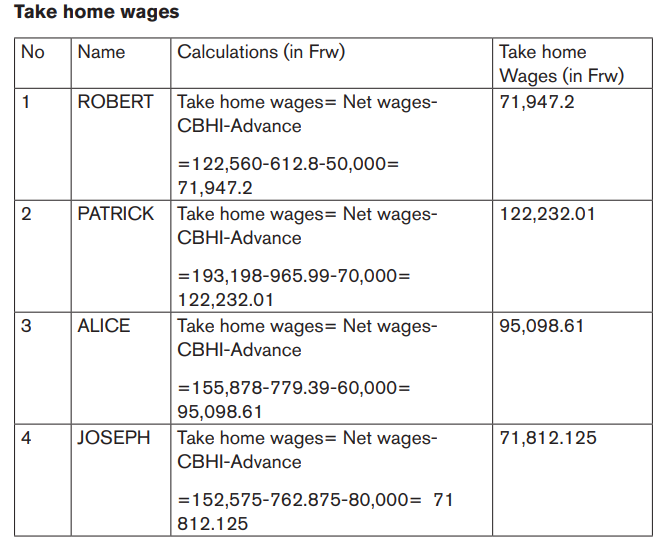

Example: CIMERWA PLC has different departments including Human Resource, Production department, Purchase department, Marketing department, Selling and Distribution department and Finance department. At the end may, 2022; Human Resource department provides to Finance department the list of six personnel with their times spent on work place. From the provided following information, prepare a payroll for the month of May, 2022.

Additional information

Normal working hours per month are 180. Over time payable for extra hours at the rate of 50% above normal pay rate.

Required: Prepare the payroll using the Rwandan format by calculating the following:

a) The Gross wages of all employees.

b) The total deduction (PAYE, Pension, Maternity leave, RAMA and CBHI).

c) The Net wages and the take home wages.

Application activity 6.4

1. Explain various methods of salary calculation.

2. Simon worked 180 hours during the month of June and he was paid at the rate of Frw10,000 per hour. During the month, he completed three jobs:

Calculate the labor cost chargeable to these three jobs on the assumption that they were completed only by Simon.

3. Companies A and B are remunerating Grade III employees on hourly basis. A pays Frw1200 an hour and B Frw1500 an hour. If X and Y, employees of A and B respectively, work for 8 hours each in a day, what are their earning?

4. Mr. ALEX is paid Frw500 per unit up to 100 units, Frw600 per unit for 101 to 200 units and Frws700 per unit produced in excess of 200 units.

Required: Calculate the gross pay.

6.5 Bonus schemes

Activity 6.5

Analyze the above picture, then answer the following questions:

1. What is about the picture?

2. What is the difference between these three employees?

3. Do you think the company has given them the number of bags to be produced per day? How many?

4. Is it possible that these employees may earn the same salary? If YES or NO explain.

5. How do we call that amount of money added to the standard remuneration because of additional production?

6.5.1 Introduction

The premium bonus scheme is paid to the workers according to the over time worked and to the hours saved. The employee assigns some jobs to the workers to complete within a specific number of hours. If the workers complete these jobs in less than time allowed then there are some savings to the employers. The workers are paid according to hours worked. According to premium bonus schemes, the savings accruing to the employers out of time saved by the workers should be shared between the employer and workers.

Over time worked: According to the federal law, the amount of money is paid to an employee for each hour worked over 45 hours per week.

STEP:

a) Calculation on employee’s regular gross pay for working 45 hours or less.

Regular pay= Hour rate*Regular hour worked

b) Calculate an employee’s overtime pay.

Overtime pay = Hour rate*Overtime hours worked

c) Calculate total gross pay.

Total gross pay= Regularly pay+ Overtime pay

Example: Mr. Kanyandekwe earns Frw 8,000 per hour as checker on an assembly line. If his overtime rate is time and a half above normal hour rate, what is his total gross pay for working 56 hours’ week?

Solution

- Regular pay= Hourly rate×Regular hours worked

- Regular pay=Frw8,000×45= Frw 360,000

- Overtime pay= Overtime rate ×Overtime worked

- Overtime rate= Frw[8,000+ ((8,000 )/2)]= Frw12,000

- Overtime pay= Frw12,000×11=Frw132,000

- Total gross pay= Regular pay + Overtime pay

- Total gross pay= Frw360,000+Frw132,000= Frw492,000

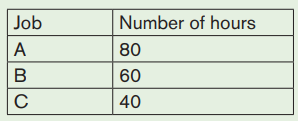

Time saved

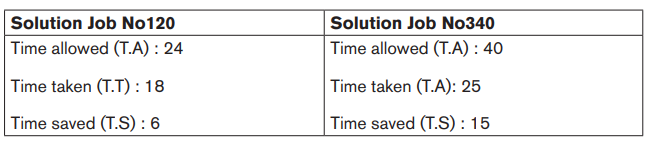

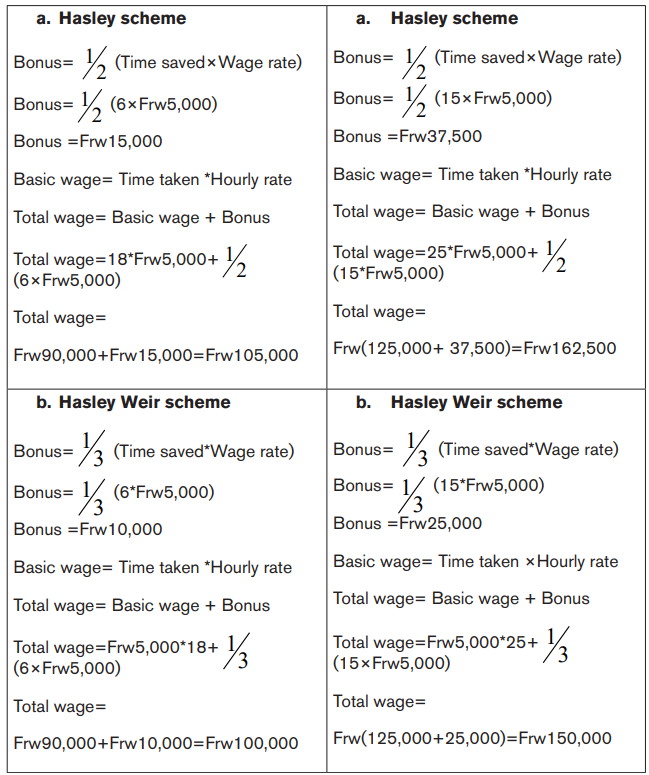

The premium bonus is paid to the workers according to the hours saved. They are three common bonus schemes theories namely, Hasley, Hasley Weir and Rowan schemes.

The formula for:

Worker’s total pay=Day rate wage+ Bonus based on time saved

Time saved= Time allowed –Time taken

Note: If time taken exceeds the time allowed then there is no time saved. In this case, there is no bonus and wages rate is only paid for the time taken.

Required:

Calculate the labor cost chargeable to the job in respect of an employee who is paid according to:

• Hasley scheme

• Hasley Weir scheme

• Rowan scheme

Application activity 6.5

1. Total output of KARENZI for one week was 480 units. He was allowed 8 minutes per unit. He completed these unit in 52 hours.

His wage rate per hour is Frw1,800.

Calculate KARENZI ‘s total wage according to:

a) Hasley scheme

b) Hasley Weir scheme

c) Rowan scheme

6.6 Group incentive scheme

Activity 6.5

Analyze the above picture then answer the following questions:

1. What is about the picture?

2. What do you think is the goal of these employees?

3. Is there any advantage these workers can get from working together?

4. What kind of reward do you think these employees can get from the company?

6.6.0 Introduction

Sometimes, the group incentive scheme is introduced by the management of different organizations. The main Purpose of group incentive schemes is to induce workers to participate effectively to increase the production of any organization. In addition to individual bonus incentives, the workers may be given some share of profit and co-ownership.

• Profit sharing is payment to employees of a portion of the company’s trading profit.

• Co-ownership relates to a scheme under which employees own shares in the company. These shares may be bought by the workers or given to them without any payment. These two schemes aim to make employees partners in the enterprise but the employees mostly prefer to be paid well instead of becoming partners.

6.6.1 Principles of Labor Incentive Schemes

Labor incentive scheme is a scheme that relates remuneration to the performance of laborers. The main principles of labor incentive schemes are:

• These must be fair to the employee and employer.

• These must be stable.

• The standard of performance must be reasonable.

• There must be no limits of earnings.

• There must be proper measurement of employee’s effort.

Advantages of labor incentive schemes

• The rate of production is increased.

• These are beneficial for employees and employers.

• These help to reduce labor turnover.

Disadvantages of incentive schemes

• These involve extra work.

• There is possibility of exploitation.

• The disputes may become source of friction.

Application activity 6.6

1. Explain the main purpose of the group incentive schemes.

2. What are the types of group incentive schemes?

3. Differentiate share of profit from co-ownership group inventive schemes.

4. Discuss five (5) principles of labor incentive schemes.

5. Explain advantages and disadvantages of labor incentive schemes.

6.7 Allocation of Labor Cost

Activity 6.7

Analyse the above picture then answer the following questions:

1. What is on the image?

2. What do the people and images represent in the circle?

3. What does the sum of Frw20,000,000 represents in the circle?

4. Why is the sum of money mentioned in the big circle divided into 4 parties in the small circle?

Allocation of labor cost: Labor cost is allocated to the respective jobs or products. Labor cost being a direct cost can be identified and charged to the products which are produced by a specific worker. The allocation of labor cost to the right jobs or products is required to ascertain the total costs of those jobs or products.

Example:

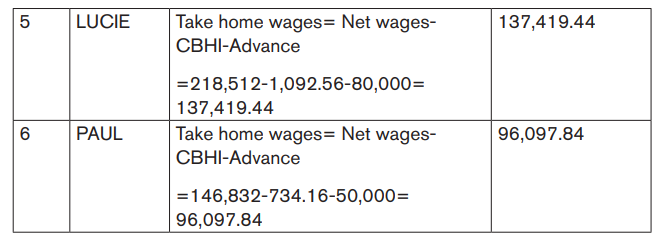

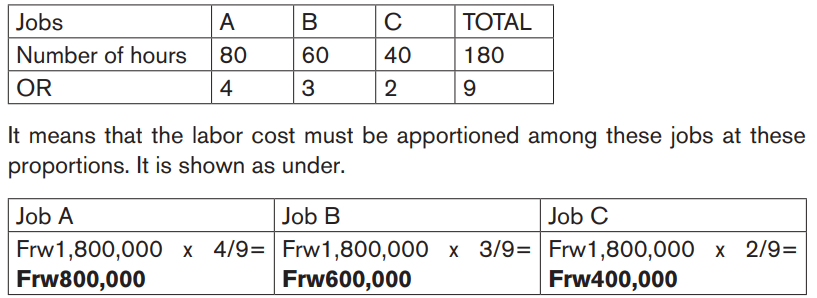

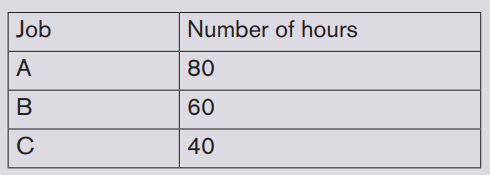

N. SIMON worked 180 hours during the month of June, 2020 and he was paid at the rate of Frw10,000 per hour. During the month, he completed three jobs. The following additional information was also given:

Job Number of hours

A 80

B 60

C 40

Calculate the labor cost chargeable to these three jobs on the assumption that these jobs were completed only by N. Simon.

Answer

Total wage of Simon= Frw10,000×180= Frw1,800,000

Proportion of time for these three jobs

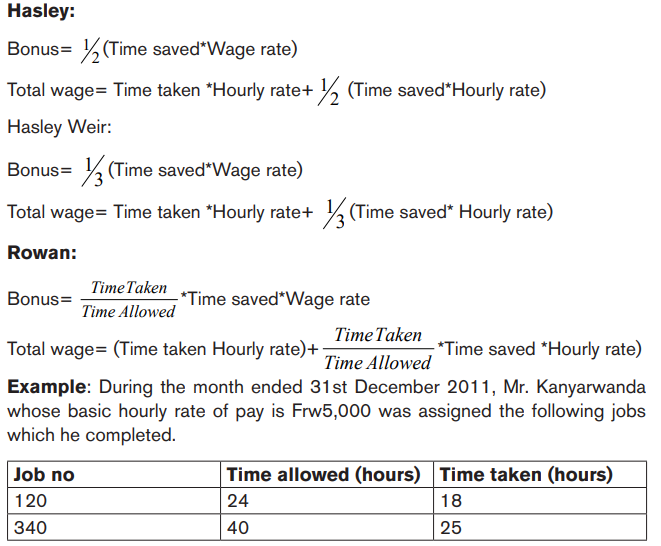

Application activity 6.7

K. PATRICK worked 360 hours during the month of June, 2019and he was paid at the rate of Frw20,000per hour. During the month, he completed three jobs. The following additional information was also given:

Job Number of hours

X 160

Y 120

Z 80

Calculate the labor cost chargeable to these three jobs on the assumption that these jobs were completed only by K. PATRICK.

Skills Lab Activity 6

Have a resource person (Accountant of School) to share with students about:

a) Payroll process and ask students to prepare the payrolls,

b) The payment methods of payroll preparation at home / in club then let students present their findings.

End unit assessment 6

1. Discuss the objectives of labor cost management.

2. Explain the preventive measures of idle time.

3. Compute the earnings of employees A, B and C under straight piece rate system. The applicable wage rate is Frw 1,200 a unit. On Monday, they produced 10 units, 12 units, and 8 units respectively.

4. SIMON worked 180 hours during the month of June, 2020 and he was paid at the rate of Frw1,000 per hour. During the month, he completes three jobs. The following additional information was also given :

Required:

Calculate the labor cost chargeable to these three jobs on the assumption that these jobs were completed only by SIMON.

5. The standard time (time allowed) for a particular job is 10hours. The wages for this job are paid at Frw2000 per hour. Calculate the wages and the effective rate of earnings per hour under Halsey, Halsey Weir, and Rowan schemes if the job is completed in A (8hours), and B (6 hours).