UNIT 1: THE NATURE OF BUSINESSES TRANSACTION TO ACCOUNTING SYSTEM

Key unit competence: Explain the nature of organization businesses transaction in relation to its accounting system.

Introductory activity

1. Analyse the picture below and answer the questions that follow:

i) Identify the different activities shown on above picture.

ii) Which kind of agents intervening in the specified activities?

iii) Are all agents having the same intention?

iv) Which accounting sciences involved in the above activities?

v) Refer to the knowledge acquired from Entrepreneurship subject (Initial accounting entries for a business in senior 2 ordinary level).

Explain why is necessary to record the accounting information.

1.1 Definition of concepts

Activity 1.1

NYIRABYATSI PLC is profit oriented business, producing many products for sales in Rwanda. The products produced in that enterprise are juice, biscuits, yoghourt, water, all of which were experiencing sharp decreases in sales, and loss to the whole business.

In 2021 there was an economic crisis caused by Covid-19, General Manager announced a plan to cut off FRW 15million in cost and raise FRW 5 million through the sales of business assets; (motor vehicles, trucks and pickup).” We’re cutting to the bone”, said by General Manager. However, given the situation, we think that’s appropriate. It was appropriate, but it wasn’t enough. By November 2021, “NYIRABYATSI PLC had lost more than FRW 18 million” said General Manager. From this economic hazardous situation, the government loaned the NYIRABYATSI PLC FRW 20million to continue operations. Ultimately, its restructuring effort fell short and finally NYIRABYATSI PLC felt into bankruptcy. In court papers, NYIRABYATSI PLC claimed FRW 82 million in asset and FRW 172million in debt. As the story of NYIRABYATSI PLC illustrated, managers must understand costing in order to interpret and act on accounting information and generate a report containing a variety of cost concepts and terms. Managers must understand these concepts and terms to effectively use the information provided for running their businesses. Those cost and management concepts/terms that are the basis of accounting information used for internal and external reporting.

1. According to the story of NYIRABYATSI PLC explain the problems faced up to bankruptcy.

2. Name the accounting terms used in NYIRABYATSI PLC story.

1.1.1 Accounting

It is the art and science of recording and classifying financial transactions in the books, summarizing and communicating financial information’s through production of financial statements/reports and interpretations of operating results portrayed in financial statements/reports to facilitate decision making.

1.1.2 Management

It is a comprehensive function of planning, organizing, forecasting coordinating, leading, controlling, motivating the efforts of others to achieve specific objectives.

1.1.3 Costing

It is any system for assigning cost to an element of a business. Costing is typically used to develop costs structure for customer’s satisfaction, distribution channels, employees and entire companies.

Or Costing means the ascertainment of costs to the produced commodity or provided service.

1.1.4 Management accounting

Management accounting is the practice of identifying, measuring, analysing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals. It varies from financial accounting because the intended purpose of management accounting is to assist internal users to the company in making well-informed business decisions.

1.1.5 Cost accounting

It is accounting branch that measures, analyses, and reports financial and nonfinancial information relating to the costs of acquiring or using resources in an organization.

1.1.6 Financial accounting

It is accounting branch concerning with the recording of accounting data, classifying, summarising the recorded data and communicating the results to interested parties/accounting information users.

1.1.7 Cost

It is the value of economic resources used as a result of the production of any commodity or performing any services. Or, Cost is resource value used for future benefits.

1.1.8 Expense

It is cost expired. Or Expense is resources given up that have no future potential benefits.

1.1.9 Cost centre

Cost Centre is a particular department, a function or items of equipment in respect of which cost may be ascertained and related to cost units for control purposes.

Cost centres are collecting places for costs before they are further analysed. Costs are further analysed into cost units once they have been traced to cost centres.

1.1.10 Income

It is a gain or recurrent benefit derived from capital use, or labour force sacrificed. It is usually measured in monetary terms.

Application activity 1.1

1. What is the meaning of management accounting?

2. Define the following concepts:

• Costing

• Business

• Cost center

3. What is the difference between cost and expense?

1.2 Types of business

Activity 1.2

The Rwandan economy relies on different sectors including agricultural, services, livestock, tourism, and industries/companies operations. Agribusiness becomes the cornerstone of national production and industries activities take the second rank from which manufacturing companies accounted for 11.5% of GDP. The examples of manufacturing companies in Rwanda are Rwanda Foam, Sulfo Rwanda Industries Ltd, etc.

Other companies are services like MTN, AIRTEL, RITCO, HOSPITALS, HOTELS, etc, and other companies purchase the goods and resell to the customers. Those businesses can operate either in private and public frameworks that facilitate the management of their companies to achieve the goals.

1. From the above outline 3 sectors of the Rwandan economy.

2. From the above give the types of business discussed in the above story.

1.2.0 Introduction

Business is a legally recognized organization or enterprise that operates with the objectives of profit maximization. Or It is also defined as an economic activity which involves regular production or exchange of goods and services with the main purpose of earning profits through the satisfaction of human wants. A business can be set up in a variety of different ways depending upon its nature, size and organization structure.

1.2.1 Types of business according to ownership

a. Sole trade

Is a business owned by a single person. Usually he/she provides all the capital and run the business. A sole trader owns and runs a business on their own, perhaps employing one or two assistants and controlling their work. The individual's business and personal affairs are, for legal and tax purposes, identical.

Examples include local grocery shops, carpentry shops, pharmaceutical shops, etc.

The simplest type of business is that of a sole trader. A sole trader is someone who trades under their own name. Many businesses are sole traders, from small subsistence farmers through to accountants. Being a sole trader does not mean that the owner is the only person working in the business. Some sole traders are the only person in the business, but many will also employ several other staff. Even so, in most cases the owner will oversee most business functions, such as buying and selling the goods or services, doing the bookkeeping, and producing accounts. In some instances, however, the sole trader will employ an external bookkeeper, who may also be a sole trader, to update the accounting records regularly.

The owner of the business is the one who contributes the capital to the business, although it might also have loans, either commercial or from friends. The owner is also the only party to benefit from the profits of the business and this will normally be done by the owner taking money or goods out of the business, known as drawings.

b. Partnership

A partnership is a business owned by two or more people. In most forms of partnerships, each partner has unlimited liability for the debts incurred by the business. The three most prevalent types of for-profit partnerships are: general partnerships, limited partnerships, and limited liability partnerships.

Partnerships are arrangements between individuals to carry on business in common with a view to profit. A partnership, however, involves obligations to others, and so a partnership is usually governed by a partnership agreement. Unless it is a limited liability partnership (LLP), partners will be fully liable for debts and liabilities, for example if the partnership is sued.

A partnership is a group of individuals who are trading together with the intention of making a profit. Partnerships are often created as a sole trader's business expands and more capital and expertise are needed within the business. Typical partnerships are those of accountants, solicitors and dentists and usually comprise between about 2 and 20 partners. As partnerships tend to be larger than sole traders, there will usually be more employees and a greater likelihood of a bookkeeper being employed to maintain the accounting records.

Each of the partners will contribute capital to the business and will normally take part in the business activities. The profits of the business will be shared between the partners, and this is normally done by setting up a partnership agreement where the financial rights of each partner are set out. Just as with sole traders, the partners will withdraw part of the profits that are due to them in the form of drawings from the business although, in some cases, partners may also be paid a salary by the business.

c. Corporation

The owners of a corporation have limited liability and the business has a separate legal personality from its owners. Corporations can be either government-owned or privately owned. They can organize either for profit or as nonprofit organizations. A privately owned, for-profit corporation is owned by its shareholders, who elect a board of directors to direct the corporation and hire its managerial staff. A privately owned, for-profit corporation can be either privately held by a small group of individuals, or publicly held, with publicly traded shares listed on a stock exchange.

d. Cooperative

A cooperative is a private business owned and operated by the same people that use its products and or services. The purpose of a cooperative is to fulfil the needs of the people running it. The profits are distributed among the people working within the cooperative, also known as user-owners.

There is typically an elected board that runs the cooperative, and members can buy shares to be apart of decision-making processes.

1.2.2 Types of business according to share

a. Limited Liability Companies (LLC),

The main difference between the trading of a sole trader and a partnership on the one hand and a limited company on the other is the concept of limited liability. If the business of a sole trader or a partnership runs out of money and is declared bankrupt, then the sole trader or partners are personally liable for any outstanding debts of the business. However, the shareholders of a company have limited liability which means that once they have fully paid for their shares they cannot be called upon for any more money if the company runs out and is declared insolvent. All that they will lose is the amount that they have paid for their shares.

b. A company limited by guarantee

This is a company used primarily for non-profit organizations and having the liability of its members limited to the amount as the members may agree.

c. A company limited by shares

This is a company in which the liability of its shareholders is limited to the amount paid or unpaid on the shares held by them.

d. A company limited by shares and by guarantee

This is a company in which liabilities of the shareholders are limited to paid or unpaid amount on their shares, there may also limited by guarantee, where liabilities of members are limited to the amount that the members undertake to contribute to the assets of the company in case of winding up.

e. An unlimited company

This is a company for which the legal liability of its members or shareholders is not limited, where all members or shareholders have total and joint liability to cover all contingent debts.

1.2.3 Types of business according to function

a. Manufacturing company

It refers to a kind of business that buys raw materials for transformation into finished goods.

A manufacturing business buys products with the intention of using them as material in making a new product. Thus, there is a transformation of the products purchased. A manufacturing business combines raw materials, labor, and factory overhead for production process.

Example: CIMERWA,SULFO RWANDA INDUSTIES Ltd, BRALIRWA,SKOL,etc.

b. Services company

A services company is a business that provides intangible products (products with no physical form). It is a company that provides service to the customer.

Examples:

1. Transport (RITCO, VIRUNGA, HORIZON, VOLCANO, STELLA, MATUNDA, CAPITAL)

2. Communication (MTN, AIRTEL)

3. Hotel ( FATIMA, EPIC, SERENA, FAUCON, IBIS, MARRIOTT)

4. Health(CHUB, CHUK, LEGACY CLINICS, KING FAYSAL ) etc ….

c. Merchandazing/ Retail company

This is a type of business that buys products at wholesale price and resells the same products (without changing its form) at retail price. They are known as buy and sell businesses. They make a profit by selling the products at higher prices than purchase costs.

Application activity 1.2

1. With reference to services companies:

a) What is meant by a services company?

b) State 3 examples of services companies operating in Rwanda.

2. Describe, with supporting examples, two types of businesses according to their ownership.

3. What is the main different between a sole trader and a partnership on one side and a limited liability on the other side?

1.3 Transaction

Activity 1.3

Analyze the picture below and answer the question that follows:

1. List different activities being carried from the above pictures.

1.3.1 Understanding a transaction

A transaction is a completed agreement between a buyer and a seller to exchange goods, services, or financial assets in return for money.

An example is a sales transaction between a buyer and a seller. Person A pays person B in exchange for a product or service. When they agree on the terms, money is exchanged for the good or service and the transaction is complete.

1.3.2 Types of Transaction

a. Cash transaction

Cash transactions occur where payment is made or received immediately. A cash transaction is not limited to payments and receipts made in notes and coins, as they are also made by cheque, debit card or automated payment. The important factor is the timing of the payment.

b. Credit transaction

Credit transactions, by contrast, are transactions in which the goods or services are given or received now but it is agreed that payment is to be made or received at a future date. This will normally involve the issue or receipt of an invoice and the creation of a trade receivable (the person who owes the business money ie the credit customer) or a trade payable (the person to whom the business owes money ie the credit supplier).

c. Capital transaction

Capital transactions are the purchase and sale of items that are to be used in the business for a considerable period rather than being purchased for immediate use or resale. This might include the purchase of buildings, machinery, office furniture or motor vehicles. These non-current assets of the business can be purchased either for cash or more usually on credit. Capital transactions should not be confused with the initial capital that the owners of a business pay into the business.

Non-current assets usually have economic benefits over a number of accounting periods. Because of this, it would be inappropriate to charge any single period (eg the period in which the asset was acquired) with the whole of the expenditure. Instead, some method must be found of spreading the cost of the asset over its useful life. Depreciation is the process of allocation of the cost of an asset over several accounting periods. For the purposes of this syllabus, you just need to have a basic understanding of what depreciation is.

Depreciation is the allocation of the depreciable amount of an asset.

d. Revenue transaction

Revenue transactions are day-to-day revenue and expenses.

Revenue transactions are the everyday income and expenses of the business. These will include sales, the purchase of goods for resale, the general running expenses of the business and the payment of wages. Again, these transactions can either be for cash or on credit.

Application activity 1.3

1. Clearly explain the meaning of a transaction.

2. Distinguish between revenue transactions and capital transactions.

1.4 Distinguish the branches of accounting

Activity 1.4

AGAHOZO Company Ltd is manufacturing company located in Kigali city at Kimironko Road with subcore objective of making the best possible use of its resources. The operations are done through different departments including Production department, Selling and Distribution , and Financial departments.

AGAHOZO Company Ltd wants to know the annual results of its efforts. From the results it needs to compare the results (production) and efforts (resources) invested. This comparizon leads to know if the AGAHOZO Company Ltd met the deficiencies and improvements can be identified for the achievement of goals.

Different groups of agents such as managers, investors, bankers, creditors, tax authorities, regulatory agencies, labor unions, and the general public have their interests in AGAHOZO Company Ltd financial information. They need information concerning for diverse purposes. Accounting is a specialized information system that provides information to these different groups of people. Internal Managers of AGAHOZO Company Ltd need the annual results from different departments for making decisions. You are engaged as a professional accountant and asked to help in explaining some basic accounting theories in different types of accounting.

1. From the above scenario, what do you understand by accounting?

2. According to the information of AGAHOZO Company td., State the different branches of accounting as used in different operations from this company.

1.4.1 Branches of Accounting

1. Financial Accounting

Financial accounting is a specific branch of accounting involving a process of recording, summarising, and reporting a company’s business transactions through financial statements. Financial statements include the balance sheet, income statement and cash flow statement, that record the company's operating performance over a specified period.

It is important to understand that financial accounting has an external focus, involved in reporting accounting and other information to those outside the business such as investors, lenders and the regulatory authorities.

In the financial statements the business's costs incurred in the past are classified by their function; that is, production, selling and distribution, administration, and finance.

Limitations of Financial Accounting

i) Review only overall performance

The approach of financial accounting is totalitarian in nature, it does not make any attempt to evaluate the performance, more particularly the cost effectiveness of department, process, product, functions, sales territories, etc, which is very essential for cost control and improve the segmentation of and overall performance.

ii) It is historical in nature

Financial accounting is basically as post - mortem exercise. That means, it summarizes the data and ascertains the result and financial position only after the completion of the accounting period. Hence, there is no scope for taking timely action.

iii) Comparison of performance is not made

Under financial accounting, no norms and /or standards against which actual cost and performance can be compared and developed.

iv) No cost control

Under financial accounting, it is not possible to exercise control over different elements of costs viz., material cost, labor cost and overhead expenses including store losses, idle time and its cost, overtime work and its cost, under-utilization and /or non-utilization of plant capacity, etc.

v) Non Proper classification of cost

In financial accounting, there is no system for classification of costs by department, products, processes, functions, etc. and also into controllable and non-controllable costs, direct and indirect costs, variable, and fixed costs, etc. as result control of costs becomes very difficult.

vi) Fail to furnish relevant information to Management

As is known very well, the management has to take a number of decision such as product diversification, sell or further process, make or purchase, price revision, equipment replacement, for this purpose, it needs relevant information which the financial accounting fails to furnish.

vii) Fail to help in price fixation and /or revision

Financial Accounting fails to provide the necessary information (such as, the extent to which costs have increased on account of hike in the price of input factors) to the management to fix the price for its new product and /or to revise the price of its existing products.

viii) No analysis of losses

Financial accounting fails to make a comprehensive analysis of losses on account of idle time, non-utilization and /or underutilization of plant capacity, use of substandard material, increases in loss of material in production processes, etc.

That means, no distinction is made between avoidable loss and unavoidable loss which is very important for fixing responsibility with the individual.

ix) Inefficient segments are not identified

Since Financial Accounting discloses only the overall net result, it fails to assess and report the segmental performance like the performance of each division, process, function, product, territory, etc. as result it is not possible to ascertain the extent to which the company’s loss is caused by the inefficiency of each department, division, etc.

2. Management accounting

Management accounting is the practice of identifying, measuring, analysing, interpreting, and communicating financial information to managers for the pursuit of an organization's goals.

Management accounting takes the same information used in financial accounting and uses it to provide people inside the business with regular and focused financial information to run it efficiently today and into the future. Management accounting can analyse past costs incurred by element to determine how much it will cost in future to produce any unit of product, broken down into materials, labour and expenses or overheads. Management accounting collects similar costs together so that they can be further analysed and used internally.

Unlike financial accounting, management accounting has an internal focus, involved in reporting accounting and other information to those inside the business such as managers.

3. Cost accounting

This is a branch of accounting concerned with the accumulation and determination of costs within the business.

Advantages of Cost accounting or utilities of Cost accounting

Cost accounting is primarily designed to serve the management in decision making task which in turn will benefit the company and others.

i) By analyzing in deep the total expenses recorded in the Financial accounting, Cost accounting is able to ascertain the functional and department cost or process-wise cost and finally, to ascertain both the total and unit cost of the products.

This helps to identify the departments, process, products, etc. which are incurring higher costs than the understands and to identify the probable reasons for the same. This facilitates the management to exercise control over the cost. This ways, costing system helps to ascertain and control cost.

ii) By evaluating the performance of the departments, activities, products, (both physical performance and financial performance, both cost effectiveness and revenue realization, etc,), the system is able to identify the profitable and unprofitable, efficient and inefficient departments, functions, products, etc.on the basis of the report which contains this analysis and also the probable reasons and suggestions, management can take appropriate steps to put them on the right path.

iii) Cost accounting, through its reports and evaluation, is able to identify the areas where in the company is working below its capacity. Further, it draws the attention of the management about its impact on cost and profit. It, therefore, helps in optimum utilization of materials, human resources, plant capacity.

iv) Through store ledger and material abstracts, it provides an effective check on the materials consumed.

v) By identifying whether the company’s performance is in accordance with the planned, and by identifying the reasons for poor performance, if any, cost accounting helps the management to take proper steps to improve profit and profitability.

vi) By providing timely reports containing only the relevant information, cost accounting helps management in big way in decision making task.

The important decisions which are influenced, to greater extent, by the cost reports are:

* Whether to diversify or not the company’s product lines;

* Fixation and/ or revision of selling price;

* To decide about whether a part is to be manufactured internally or to be purchased from outsiders;

* Whether the joint and/or by-products are to be sold at split-off point or after further processing;

* About the profitable sales mix;

* About the optimal level of activity;

* To decide about the discontinuation of activities of sale branch, temporarily, or to drop a product, purely on temporary basis, till the demand rises for the product;

* To decide about scarce resource allocation; etc.

Limitation of cost Accounting

a. Cost accounting is not an exact science

Because, though cost accounting system aims at ascertaining cost, it is uncertain to ascertain the actual cost of the goods and services. Because, in order to ascertain the cost of goods and services, it is necessary to use a number of estimates, bases for apportionment, etc. Further, a number of accounting methods are available for each of a number of costing problems. Hence, the cost of goods and services is influenced by all these. Therefore, it is said that it is hard to compute the exact actual cost.

b. Availability of a number of accounting treatments for each of a few major elements of costs results in the operation performance influenced even by the accounting methods and treatments.

Because the companies are free to use any of these accepted accounting treatments. This also makes the results not comparable (for both trend analysis and inter-firm comparison).

c. Cost accounting identifies the deficiencies in the performance of the company

It also identifies the probable reasons and suggests remedial measures. But it does not ensure the result.

d. A number of bases are available for the classification of costs

The classification of costs for one purpose based on one base will not normally be suitable for other purposes; there is therefore a considerable increase in clerical work.

e. One cost figure will not serve all purposes and is not suitable to all circumstances

For instance, for quoting a special business offer, only incremental costs are to be reckoned for the purpose of regular pricing, the total cost is to be considered, this way, the cost is to be ascertained, usually, a fresh for each decision considering only items of expenses that are most pertinent to the decision under consideration. It results in considerable increase in clerical work.

f. Cost accounting excludes some of the items of expenses though they are accounted for in the financial accounting system.

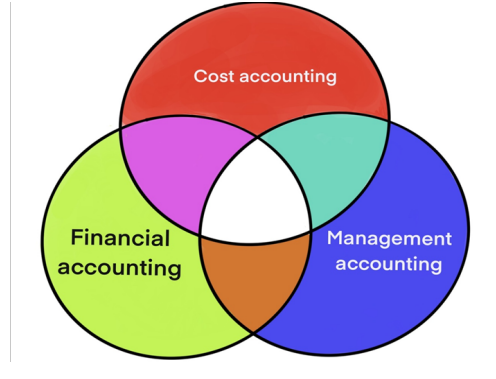

1.4.2 Similarities of branches of accounting

At least some of the information used in management accounting comes from the same source as the information used for financial accounting, namely the recording of the business's transactions via bookkeeping. It is simply classified and collected in a different manner.

The managers within a business need particular types of information about its activities to plan, make decisions and control the business now and in the future. Providing this information is the function of management accounting.

Not all management accounting information can be taken straight from the bookkeeping system,

because some of it is based on estimates of future costs and revenues. It is still important to realise, however, that at least some of the information used in management accounting comes from exactly the same source as the information used for financial accounting, namely the recording of the business's transactions via bookkeeping. It is simply classified and collected in a different manner. The similarities between financial accounting and management accounting are given below:

- Both are the parts of total accounting information system.

- Economic events are dealt in the both system of accounts.

- The economic events are qualified only in terms of rupees.

- Both are concerned with financial statements, revenues, expenses, assets, liabilities and cash flows.

- Both the system of accounts are accumulating and classifying the accounting information for the preparation of financial statements.

- Some database is used for preparing financial statements and reports under both system of accounts.

- Both are determining and measurement of costs for different accounting periods and even for different departments and sections.

- The same accounting principles and concepts are used in both system of accounts for the purpose of cost accumulation and cost allocation.

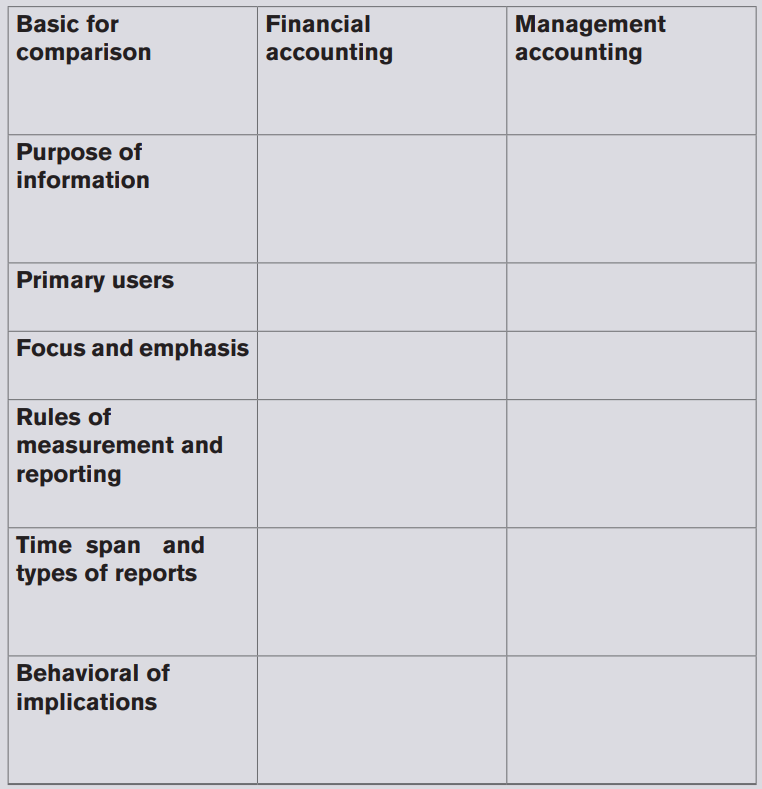

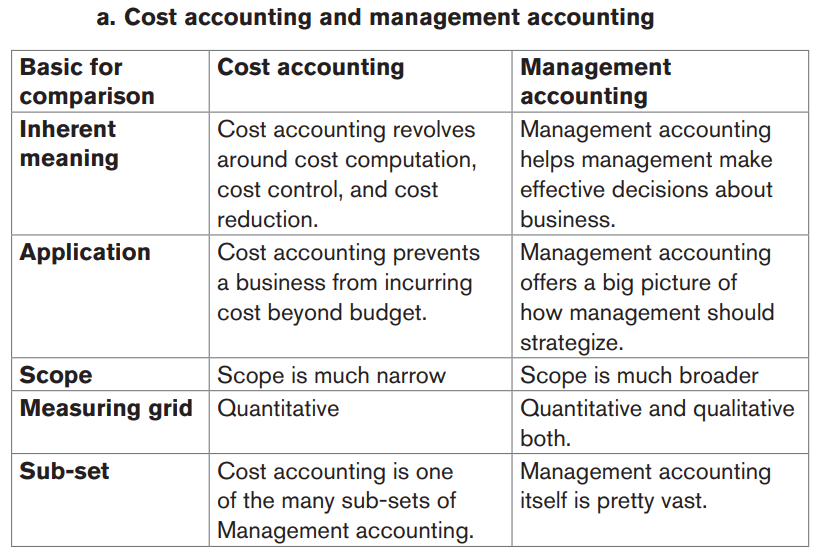

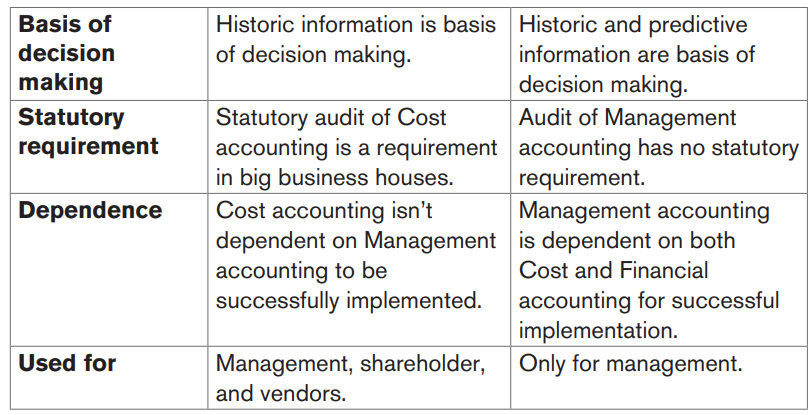

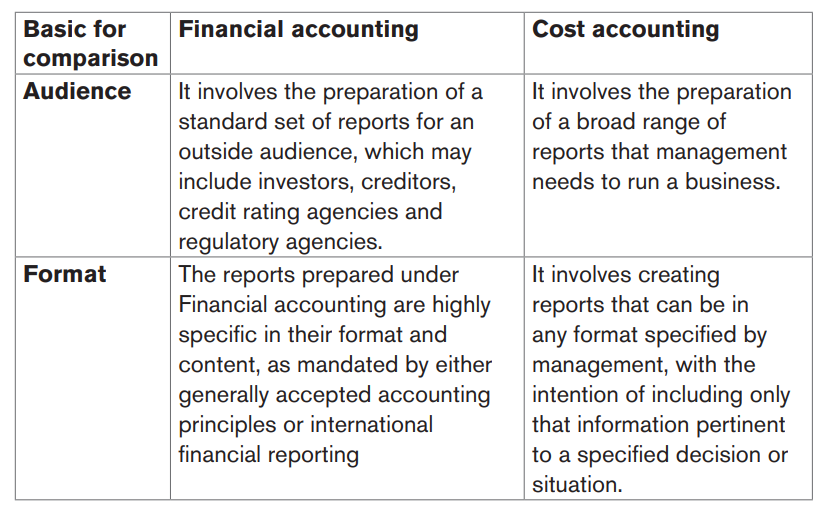

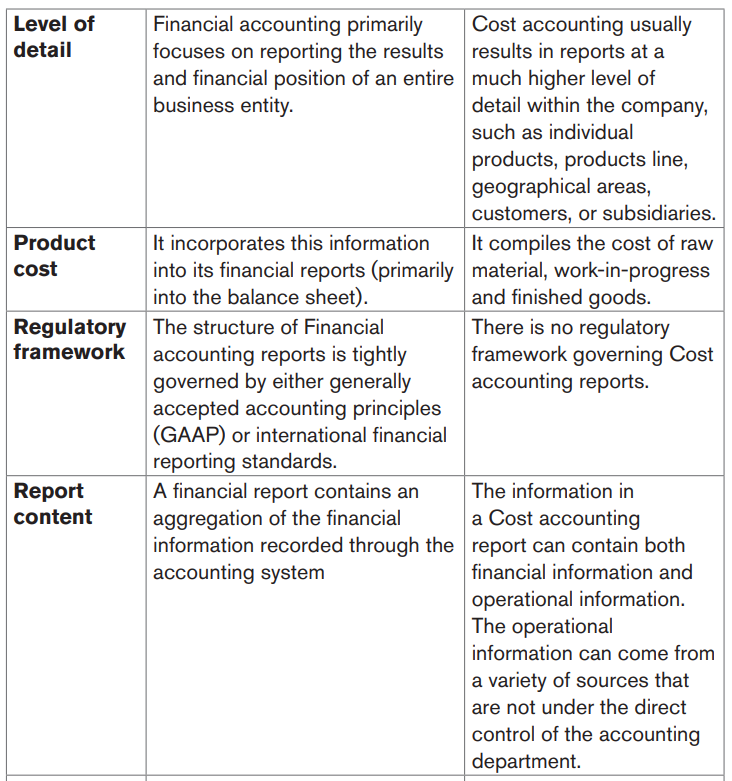

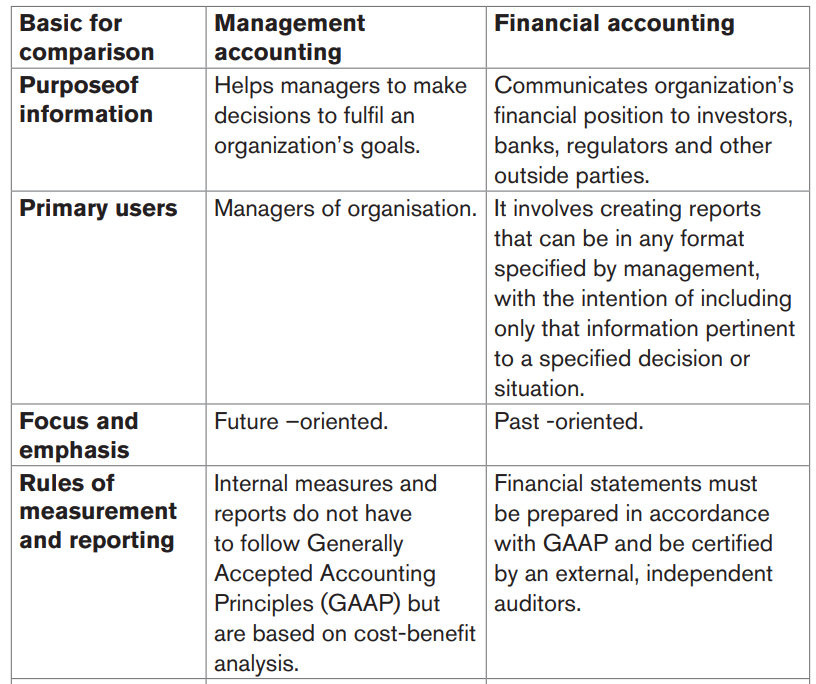

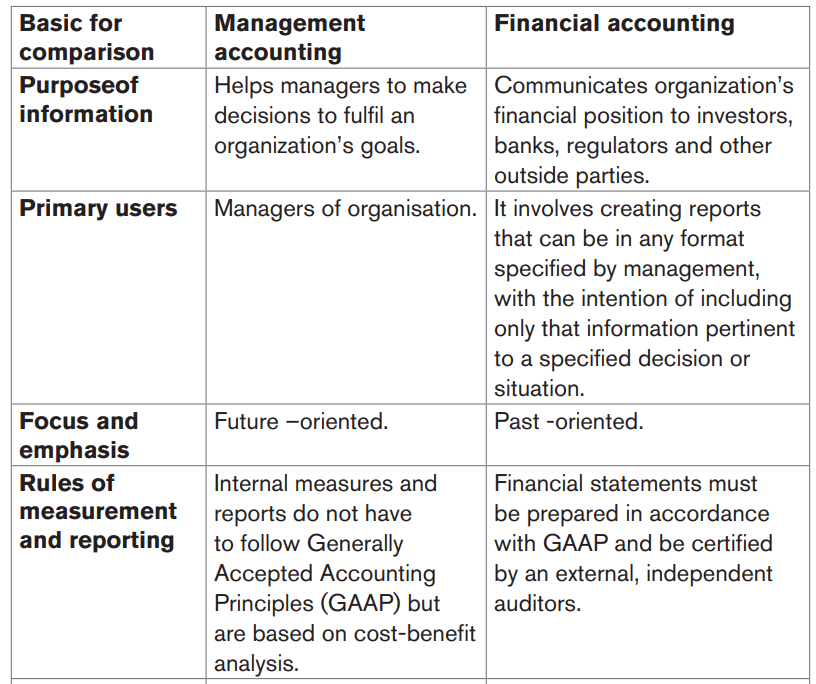

1.4.3 Difference between branches of accounting

Differences between Financial, Cost and Management accounting can be assessed by understanding how their accounts would be different from one to another:

Note:

Both Cost accounting vs Management accounting help management bodies to make effective decisions. But their scope and tools are completely different. As Management accounting depends a lot on Cost accounting to prepare reports, Cost accounting happens to be a sub-set of Management accounting. But if we look at the usage, estimation process, data points used, and utility, Cost accounting has much narrower scope than Management accounting.

b. Cost accounting and Financial accounting

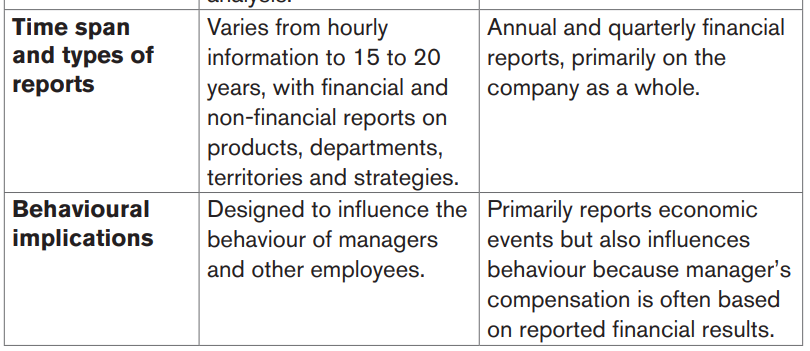

c. Financial accounting and Management accounting

Differences between financial and management accounting can be assessed by understanding how financial accounts would be different from management accounts:

Application activity 1.4

1. Define the following accounting branches:

a) Management accounting

b) Cost accounting

c) Financial accounting

2. List the three similarities between Financial accounting and Cost accounting.

3. Describe how Management accounting differ from Financial accounting in rules of measurement and reporting?

1.5 Purpose of Cost and Management accounting

Activity 1.5

AKARABO Company Ltd. is a manufacturing company located at Karongi District that has different departments for different operations. They include manufacturing department, selling and distribution department, marketing department, purchase department and administration department.

During senior management meeting at the AKARABO Company Ltd, some department’s managers have complained about the lack of information about cost represented in manufacturing department. “Better to have financial information and good effective communication between top management for improving the decision making” said Chairman of Board of Directors (BOD). Use of financial data aiming to planning, decision making, cost ascertainment, selling price fixing, monitoring and controlling of finance is the one of important responsibilities of managers.

1. From the above scenario, what do you understand about decision making?

2. According to the information of AKARABO Company Ltd, state at least different 5 objectives of Cost and Management accounting.

3. Develop how a decision-making interact with those objectives

1.5.1 Introduction

The main objective /purpose of Cost and Management accounting is the analysis of the various costs and decision making about the production of any commodity and ensuring that these costs are controlled adequately and making decision.

The next section explains the purpose of cost and management accounting.

1.5.2 Explanation of purpose for Cost and Management accounting

a. Cost ascertainment

The costs of producing different commodities or providing services must be ascertained accurately. These costs consist of material cost, labor cost and overheads. The cost must be kept at the minimum possible level. The detailed information helps the management to make some important decisions and to evaluate the performance of the organization.

b. Disclosure of waste

The costs incurred for the production of any commodity can be determined in advance in view of the past experience. If actual costs are higher than the expected costs then this excessive cost can be analyzed. This excessive cost may be due to wastage of raw material or idle labor time. Cost accounting is an important aid to disclose wastes.

c. Decision making

The management is responsible to make decision regarding what goods should be produced and in how much quantity. Cost accounting provides necessary information to the management for making the decisions.

d. Cost control

Cost control is an important function of the management. Material cost, labor cost and overheads must be maintained at desirable levels. Cost accounting principles are used to eliminate unnecessary costs.

e. Planning

The management prepares plans for the expansion of business activities. The installation of new machinery and plant is needed to increase the production capacity of a manufacturing concern in view of greater demand for its products. The past experience and cost data are used to prepare and implement future plans.

f. Measurement of efficiency

Cost data are used to measure the efficiency of an organization. If there are various departments of a business enterprise then it is important to determine the relative performance of these departments. More efficient departments must be given greater incentives and appropriate steps must be taken to improve the performance of less efficient departments.

g. Setting selling prices

It is difficult for a business concern to set selling prices of its products. Selling price of a product must be reasonable. If selling price is too high then due to competition from rivals, a firm’s sale can be affected adversely. Similarly; if selling price is too low then a firm can go into loss. It is more advisable that a business concern should ascertain its costs and then add its profit into cost of sales. The cost data are also helpful to set a selling price.

h. The evaluation of profitability

Profitability measurement is an important purpose of Cost accounting. Profitability can be measured in number of ways, example: profit as a percentage to sale, profit percentage to capital employed, profit per unit of output and so on. The profitability information serves as guide to the management to make some strategic decisions regarding the introduction of new products and increasing or decreasing the volume of production.

i. The pricing of products and projects

Pricing involves determination of prices of new products, adjustment in prices of existing products as well as determination of bid prices for contracts.

j. Inventory management

Cost accounting assists in inventory management by keeping a complete record of materials from the time they enter the premises till the time they are sold in the form of finished goods. This also enables stock valuation to be given quickly for preparing periodic financial statements without any need of physical stock taking.

k. Analysis of financial statements

Cost accounting assists management in such analysis by providing detailed information about sources of profit or loss as revealed by the financial statements.

l. Controlling Activity

Controlling is the process by which management makes sure that intended and desired results are consistently and continuously achieved.

Application activity 1.5

1. State at least 10 purposes of Cost and Management accounting.

1.6 Principles of Cost accounting

Activity 1.6

Gahanga Ltd is a manufacturing enterprise using different accounting systems. It seems the Cost accounting is the best due to its mission. Cost accounting is a type of accounting process that is aiming at capturing a production company’s cost by assessing the input costs at each step of production process as well as fixed costs such as depreciation of non current assets. Cost accounting will first measure and record these costs individually, then compare input to actual results to aid a company for measuring financial performance.

You are engaged as a Cost Accountant and you are asked to help all company’s departments and staff on how the cost accounting system is elabourated and implemented.

Questions:

1. From the above case, what do you understand by cost accounting?

2. What should be followed as principles of Cost accounting in business?

a. Cause-Effect relationship

Each item of cost should be related to its cause as minutely as possible and the effect of the same on various departments should be ascertained. This cost should be shared only by those units for which cost has been incurred.

b. Charge cost only after its incurrence

Cost should include only those cost which has been actually incurred, for example, unit cost should not be charged with selling cost while it is still in the factory.

c. Ignore the convention of prudence

Cost accounting statement should give a factual picture of the profitability of the project. If some contingencies need to be made, they should be shown distinctly and separately.

d. Past costs should not form part of future costs

Past costs which could not be recovered in past should not be recovered from future costs as it will not only affect true results of the future period but will also distort other statements.

e. Exclusion of abnormal costs from Cost accounts

All costs incurred because of abnormal reasons like theft, negligence, etc, should not be taken into consideration while computing the unit cost. If done so, it will distort the cost figures and mislead the management resulting in wrong decisions.

f. Principle of double entry should be followed preferably

To lessen/reduce the chances of any mistake or error, cost ledger and cost control accounts, as far as possible, should be maintained on the double entry principle. This will ensure the correctness of sheet and cost statements prepared for cost ascertainment and cost control.

Application activity 1.6

1. Briefly explain at least two principles of Cost accounting applied in business.

Skills Lab Activity 1

Scan the environment of your home locality, analyze different businesses operating in it and draw examples which belong in each of the following categories:

1. Public enterprises

2. Private businesses

3. Service businesses and

4. Manufacturing businesses

Give reasons for your classification.

End unit assessment 1

1. Which of the following would be classsed as a credit transaction ?

a) Sale of goods paid for by credit card

b) Purchase of printer paper accompanied by an invoice

c) Sales of goods paid for by cheque

d) Purchase of printer paper by cheque

2. A. Which of the following would be classified as capital expenditure?

a) Purchase of a computer for resales to a customer by a computer retailer

b) Purchase of a computer by a computer retailer for use in the sales office

c) Payment of wages by an accounting firm

d) Purchase of a building by a property developer to serve as the head office

i) a and b

ii) b and c

iii) c and d

iv) b and d

B. Two of the following are characteristics of Management accounting?

1. It helps with decision making inside the business

2. Its end product consists of statements for external publication

3. It focuses on costs

4. It focuses on asset evaluations

i) i.1 and 2

ii) ii.2 and 3

iii) iii.1and 3

iv) iv.2 and 4

3. Management accounting deals only with costs ‘. Do you agree?

Discuss.

4. By completing the following table clarify the difference between Financial accounting and Management accounting.