Topic outline

UNIT 1: INTERNATIONAL TRADE THEORIES.

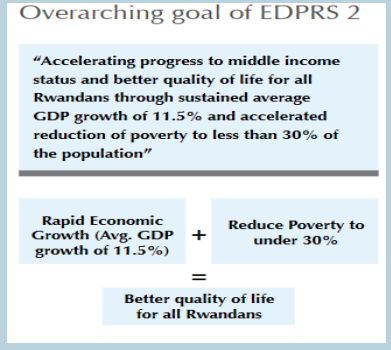

Key unit competence:

Analyze the importance of international trade to the development of the

economy.

Introductory Activity

International trade is in principle, not different from domestic trade as the

motivation and the behaviour of parties involved in a trade do not change

fundamentally regardless of whether trade is across a border or not.

However, in practical terms, carrying out trade at an international level is

typically a more complex process than domestic trade. The main difference

is that international trade is typically more costly than domestic trade. This

is due to the fact that a border typically imposes additional costs such as

tariffs, time costs due to border delays, and costs associated with country

differences such as language, the legal system, or culture (non-tariff

barriers). (Source: https://en.wikipedia.org 10/12/2019)

Required:

i) iWhat do you understand by the terms international trade and

domestic trade?

ii) What makes the two types of trade different?

iii) How do countries get involved in international trade?

iv) From the above extract, what makes international trade costlier than

domestic trade?

v) According to the extract above, if in practical terms, carrying out

trade at an international level is typically a more complex process

than domestic trade, why then, do countries go ahead to take part

in it?

1.1. International trade

Activity 1.1

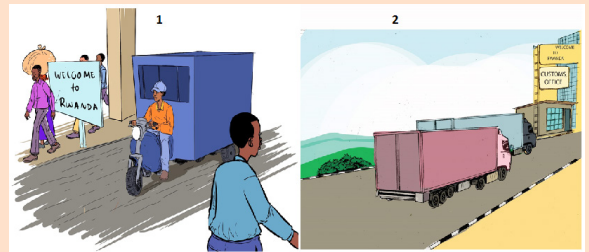

Analyse the images below and answer the questions that follow.

Category A

Category B

Required:

a. In terms of trade, how are the two categories above different?

b. Supposing those commodities shown in the categories above are

either entering or leaving out of the country, what specific name is

given to each case?

c. How do we call that trade in such commodities, in case they are

exchanged;

i) Within the boundaries of a country where they are produced?

ii) Across the borders of the country of production?

d. What makes it different to trade within the country’s boundaries and

across her territories?

1.1.1: Meaning of International trade.

International trade is the exchange of capital, goods, and services across

international borders or territories, which could involve the activities of

the government, companies and individuals. In most countries, such trade

represents a significant share of gross domestic product (GDP). Almost every

kind of product can be found on the international market: food, clothes, spare

parts, oil, jewelry, wine, stocks, currencies and water. Services are also traded:

tourism, banking, consultancy and transportation. Therefore, trading globally

gives consumers and countries the opportunity to be exposed to new markets

and products.

A product that is sold to the global market is an export, and a product that

is bought from the global market is an import. Without international trade,

nations would be limited to the goods and services produced within their own

borders. Whereas International trade constitutes those activities involving the

exchange of goods and services across national boundaries, domestic trade

involves exchange of commodities within the boundaries of a country. Therefore,

international trade differs from domestic trade in the following aspects:

- Transactions in domestic trade involve the use of one currency, normally

the national currency or legal tender. While for international trade though,

various currencies may be involved.

- Trade within a country is not subjected to barriers restricting the movement

of goods internally. On the contrary, movements of goods across national

boundaries are subjected to varying degrees of restrictions, i.e. tariffs,

quotas.

- Goods exchanged in domestic trade tend to be more standardized than

goods in international trade. For instance, they are legally all measured

either in metric or imperial standard measurement. If they are vehicles, they

may have to conform to either being left-hand or right-hand drive vehicles.

Hence, local production is for a standardized market. But in international

trade, producers are confronted with different markets and may have a

variety of different standards for different markets to fulfill.

- The paper work involved in domestic trade is normally less voluminous

compared to that involved in international trade. There is hardly any paper

work involved in the domestic trade.

- International trade is typically costlier than domestic trade. The reason is

that a boarder typically imposes additional costs such as tariffs, time costs

due to boarder delays and costs associated with country differences such

as language, the legal system or culture which isn’t the case with domestic

trade.

- Factors of production such as capital and labour are typically more mobile

within a country than across countries.

1.1.2: Forms of international trade:

Activity 1.2

Visit the library or any other economics resource Centre, make research on

international trade and thereafter, answer the following questions herein.

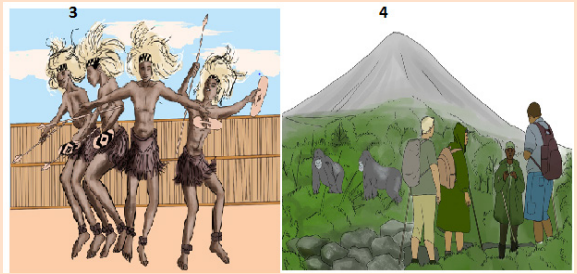

Basing on the photos above:

i) Describe the trade relations involved in the images A, B, C and D.

ii) Identify the countries involved in the trade relations according to

images A, B C and D.

iii) Identify and explain different terms used in international trade.

There are majorly two forms of international trade, namely;

a) Bilateral trade;

Bilateral trade or clearing trade or side deal is the exchange agreement between

two nations or trading groups that gives each party favored trade status

pertaining to certain goods obtained from the signatories. Or the exchange

agreement of goods and services between two nations promoting trade and

investment. The two countries will reduce or eliminate tariffs, import quotas,

export restraints, and other trade barriers to encourage trade and investment. It

varies depending on the type of agreement, scope, and the countries that are

involved in the agreement.

Examples of bilateral trade agreements in Rwanda include,

The United States and Rwanda signed a Trade and Investment Framework

Agreement (TIFA) in 2006, and a Bilateral Investment Treaty (BIT) in 2008.

Rwanda has active bilateral investment treaties with Germany (1969), Belgium-

Luxemburg Economic Union (1985), and the Republic of Korea (2013). Rwanda

signed bilateral investment treaties with Mauritius (2001), South Africa (2000),

Turkey (2016), Morocco (2016), the United Arab Emirates (2016), and Qatar

(2018). The goals of bilateral trade agreements are to expand access between

two countries’ markets and increase their economic growth.

b) Multilateral trade;

Multilateral trade refers to the exchange of commodities among more than 2

countries or multilateral agreements are commerce treaties among three or

more nations. The agreements reduce tariffs and make it easier for businesses

to import and export. Since they are among many countries, they are difficult to

negotiate. That same broad scope makes them stronger than other types of

trade agreements once all parties sign. Some regional trade agreements are

multilateral, for example, The African Continental Free Trade Area (AfCFTA), The

East African Community (EAC), The Common Market for Eastern and Southern

Africa (COMESA) and all global trade agreements are multilateral. The most

successful one is the General Agreement on Trade and Tariffs [GATT].

1.1.3: Terminologies used in international trade.

i) Exports; these are commodities sold from one country to other countries.

ii) Imports; these are commodities that are bought from one country to

another country.

iii) Export trade; this is the selling of commodities from one country to

another.

iv)Import trade; this is the buying of commodities from one country to

another.

v) Visible trade; this is the exchange of commodities that involve only

goods. i.e. exchange of tangible or physical commodities between or

among countries.

vi)Invisible trade; this is the exchange that involves only services. i.e.

exchange of intangible commodities like education, insurance, health,

tourism etc.

vii) Entrepot trade; this is the type of trade where goods are imported by a

country for purposes of re-exporting them to another country.

viii)Balance of trade; this is the relationship between visible exports and

visible imports. The relationship can be positive, thus favourable balance

of trade or negative, thus unfavourable balance of trade.

ix)Vent for surplus; this refers to the theory which emphasizes increased

exploitation of domestic idle resources so as to increase exports or foreign

exchange hence increasing country’s GDP.

x) Open economy; this is an economy which is involved in international

trade.

xi)Closed economy; this is an economy which is not engaged in

international trade at all.

xii) Gains from trade; these are advantages which accrue from international

trade.

Application activity 1.1

1. Why do you think Rwanda participates in international trade?

2. Examine the arguments for and against each trade relations named

above.

1.2. Advantages, disadvantages and limitations of

international trade.

Activity 1.3

International trade allows countries, states, brands, and businesses to buy

and sell in foreign markets; this diversifies the products and services that

domestic customers can receive. However, international trade is not without

its problems. One country can profit greatly from it by exporting, but not

importing goods and services. It can also be used to undercut domestic

markets by offering cheaper, but equally valuable goods. (https://vittana.org)

Required:

c) Identify some of the benefits and costs of international trade cited

above.

d) What other benefits and costs are likely to come out of international

trade.

e) Explain what you think might be the hindrances to smooth international

trade.

1.2.1: Advantages or arguments for International Trade.

International trade is a basic feature of economic activities in every country. At the

same time, nearly every country in the world seeks to participate in international

trade. Ideally, participation in international exchange confers several benefits

or advantages to the participants and these may include among others the

following;

- It permits and fosters international specialization in order to maximize

output and minimize costs of production. This therefore leads to increased

national income, savings, investment and employment opportunities for

the participating countries.

- It overcomes shortages i.e. if a country engages in international trade it

overcomes such shortages brought by for example natural disasters.

- Market expansion; i.e. international trade widens markets for the

participating countries e.g. LDCs raw materials thus assured markets for

their raw materials. This has encouraged LDCs to move from subsistence

production to a monetary one.

- Vent for surplus; International trade enables a country to utilize her

resources thus full utilization of resources due to assured markets.

- International trade offers an opportunity to a country to sell a surplus of

products and to make use of available land and labour. Many countries

have products, which are surplus to their own requirements. It is only by

exporting these products that they have any value at all. Without trade, the

land and the labour used in their production would be idle. International

trade therefore gives the country the opportunity to sell these products

and to make use of the available land and labour.

- International trade stimulates competition and forces home producers

to become more efficient which leads to better quality, lower prices and

more output.

- It leads to introduction of new ideas, technologies, knowledge and skills,

entrepreneurship and social change. Thus, the dynamic effects of trade

which stimulate economic development in the long run.

- International trade provides revenue to the government from import and

export duties. This revenue can be used to finance different development

activities in the economy.

- Creation and maintenance of employment i.e. once countries specialize

for international trade in production of certain goods for export, it follows

that there will be employment in those sectors.

- Promotes cultural and political ties between or among countries since

there is understanding among trading partners which creates global peace

and harmony among countries.

- International trade avails wide variety of commodities which increase the

choice of consumers and their standard of living.

- It increases capital inflow i.e. foreign exchange which it can use to pay off

its foreign debts, pay contributions to international organizations and carry

out development programs.

- It enables a country to get relief supplies by importing from other countries

e.g. in case it is hit emergencies like drought, floods and earthquakes.

- It enables factor mobility which promotes exchange of ideas and information

thus increase labour efficiency, solves unemployment problems and brings

about development in the long run.

1.2.2: Disadvantages/ Arguments against International

Trade

Despite the above-mentioned advantages of international trade, it comes with

several demerits which include among others the following;

- It encourages dumping which causes price instabilities in the domestic

country/ market.

- Development of local industries is retarded i.e. local industries may be

outcompeted by more efficient foreign firms and this leads to increased

unemployment in the domestic economy.

- If a country trades with another that is affected by inflation, this may result

into imported inflation by the importing country.

- Loss of social economic and political sovereignty or independence

especially by LDCs because MDCs always dictate unfair trading terms to

LDCs.

- Loss of culture through demonstration effect as consumers of imported

goods adapt to foreign consumption habits and cultures.

- International trade may result into over exploitation of domestic resources

due to wider markets.

- Dangerous commodities may find their way into the country e.g. guns,

drugs etc. which may worsen health and standard of living of people.

- Balance of Payment position may worsen where import expenditure may

exceed export revenue.

- It may limit employment opportunities in the country by the domestic

people who are outcompeted by foreigners who might have superior skills

over locals.

1.2.3: Limitations of International Trade

A number of both social economic and political factors can hinder a country to

participate fully in international trade. These factors are either internal or external

influences and can be avoidable and or inevitable. These include among others

the following;

- Rapid depletion of exhaustible natural resources: It could lead to

a more rapid depletion or exhaustible of natural resources. As countries

begin to rise up their production levels, natural resources tend to get

depleted with the time and it could pose a dangerous threat to the future

generation.

- Import of harmful goods: Foreign trade may lead to import of harmful

goods like cigarettes, drugs, etc., which may harm the health of the

residents of the country.

- It may exhaust resources: International trade leads to intensive

cultivation of land. Thus, it has the operations of law of diminishing returns

in agricultural countries. It also makes a nation poor by giving too much

burden over the resources.

- Over specialization: Over specialization may be disastrous for a country.

A substitute may appear and ruin the economic lives of millions.

- Danger of starvation: A country might depend for its food mainly on

foreign countries. In times of war, there is a serious danger of starvation

for such countries.

- One country, gains at the expense of others: One of the serious

drawbacks of foreign trade is that one country may gain at the expense of

other due to certain accidental advantages.

- May lead to war: Foreign trade may lead to war; different countries

compete with each other in finding out new markets and sources of raw

material for their industries and frequently come into clash. This was one

of the causes of first and Second World War.

- Language diversity: Each country has its own language. As foreign

trade involves trade between two or more countries, there is diversity of

languages. This difference in language creates problem in foreign trade.

- Differences in laws and regulations i.e. different countries have

different laws and regulations that govern trade that do not coincide

with laws of other countries which make it hard for traders from different

countries to cope with those laws from other countries thus hindering

international trade.

- Competition to domestic producers: since goods are not only

exported but also imported people are usually attracted to foreign goods

and prefer to buy them instead of goods that have been produced within

the nation. Domestic producers face a loss due to this.

- Cost incurred for exporting: a lot of money on transportation facilities

has to be incurred when goods are exported to other countries.

- Too much dependence: when countries develop a habit of importing

certain kinds of goods from another country they usually reduce the

amount of production of the same good within the country so if the country

that exports has a problem and is unable to export goods then the country

that imports goods will suddenly face a shortage of goods.

- Differences in standards of measurement. Different countries use

different weights and measures.

- Lack of standard currency to exchange commodities for i.e. there

is no convenient means for buyers and sellers to exchange commodities

since they both have different currencies. Exchanging to convertible

currencies may distort the relative prices.

- Inadequate information about goods available, their prices, quality etc.

which hinders smooth international trade.

- Trade barriers which governments normally impose on flow of international

commodities like tariffs, quotas, foreign currency, self-sufficiency etc. all

limit international trade.

1.3: Theories of international trade.

Application activity.1.2

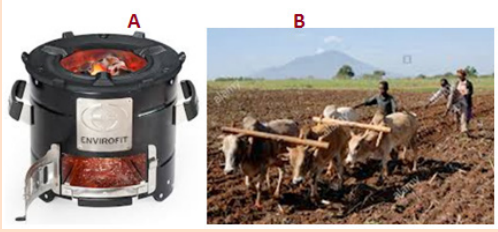

Study the images below and answer the questions that follow;

With reference to Rwanda’s economy based on the photos above;

a) Name what each photo portrays.

b) Identify the exports and imports of Rwanda shown in the above

photos.

c) Analyze the impact of international trade to her development process.

There are different theories of international trade as put forward by different

economists trying to explain the gains from international trade between or among

countries involved. There are two basic principles or theories of international

trade, and these include the following;

- Theory of absolute advantage

- Theory of comparative advantage

1.3.1: Theory of absolute advantage:

Activity 1.4

Analyse the case study below, use it to undertake research on international

trade theories and answer the questions that follow:

Rwanda and Kenya can both produce washing soap, but Kenya can

produce it with a higher quality and at a faster rate with greater profit

than Rwanda. In the same context, both countries can both produce juice,

but Rwanda can produce it with a higher quality and at a faster rate with

greater profit than Kenya.

a) What theory of international trade is portrayed in the case study

above? Justify your answer.

b) How will international trade between the two countries be made

possible?

c) Describe how the two countries will benefit from trade?

1.3.1.1: Meaning of absolute advantage:

The theory of absolute advantage, was put forward by Adam Smith to explain the

gains from international trade as a result of specialization between countries. The

law of absolute advantage states that “Given two countries and same amount

of resources, a country is said to have an absolute advantage over another

in production of a given commodity if it can produce that commodity more

efficiently at a lower input cost”. According to Adam Smith, the law of absolute

cost advantage for international trade, operates in such a way that countries

will benefit if one of them has an absolute (cost) advantage in producing one

commodity while the other has an absolute (cost) advantage in producing the

other commodity.

A country that can produce a good at a lower cost than another country is

said to have an absolute advantage in the production of that good. Absolute

advantage is therefore, the ability of an individual, a household or a firm or a

country to produce some particular good or service with a smaller total input of

labor, capital, land, etc. per unit of output than other economic actors.

When two countries have absolute advantages in different goods, there are gains

from trade to be reaped. According to the absolute cost advantage doctrine

of Adam Smith, each country produces those goods for whose production is

especially suited on account of its climate, fertility of its land and its natural

resources, and acquired capacity of its people, such as plants, buildings,

means of transport, education and health. It will concentrate on the production

of such commodities, producing more than its requirement, getting the surplusexchanged with goods and commodities from other countries.

The principle of absolute advantage involves comparing the quantities of a

specific product that can be produced using the same quantity of resources

in two different countries. For example, Rwanda is said to have an absolute

advantage over Uganda in the production of Tea when an equal quantity of

resources can produce more of Tea in Rwanda than in Uganda. Suppose that

Rwanda has an absolute advantage over Uganda in one product, while Uganda

has an absolute advantage over Rwanda in another, this is a case of reciprocal

absolute advantage. This implies that each country has an absolute advantage

in one product. In such a situation, the total production of both countries can

be increased (relative to a situation of self-sufficiency) if each specialises in theproduct in which it has an absolute advantage.

1.3.1.2: Assumptions of absolute advantage.

The assumptions underlying the principle of absolute advantage include thefollowing:

- Lack of Mobility for Factors of Production: Adam Smith assumes

that factors of production cannot move between countries implying that

the Production Possibility Frontier of each country will not change afterthe trade.

- Trade Barriers: There are no barriers to trade for the exchange of goods.

Governments do not implement trade barriers to restrict or discourage theimportation or exportation of a particular good.

- Trade Balance: Smith assumes that exports must be equal to imports.

This assumption means that we cannot have trade imbalances, tradedeficits, or surpluses.

- Constant Returns to Scale: Adam Smith assumes that we will get

constant returns as production scales, meaning there are no economies

of scale. However, if there were economies of scale, then it would become

cheaper for countries to keep producing the same good as it producedmore of the same good.

Given the above assumptions, an exchange of goods will occur (assuming a

two-country two-commodity case), if each of the two countries can produceone commodity at an absolutely lower labour cost of production than the other.

Let us take a two-country two-commodity case. E.g. Rwanda and Kenyaproducing Tea and Cooking oil respectively.

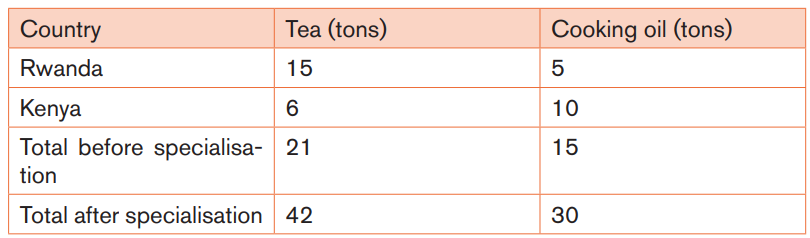

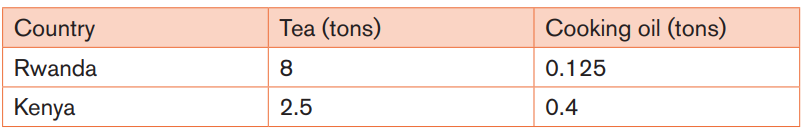

Table 1: Reciprocal absolute advantage production schedule.

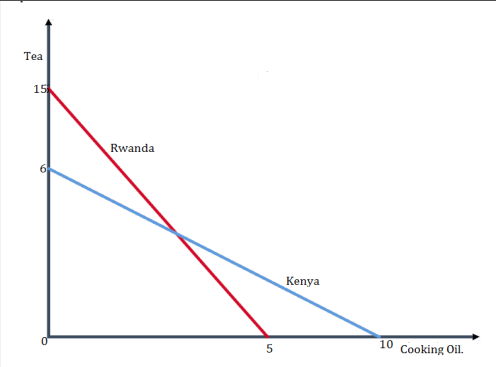

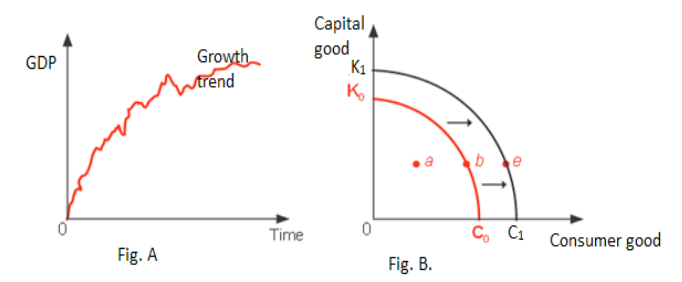

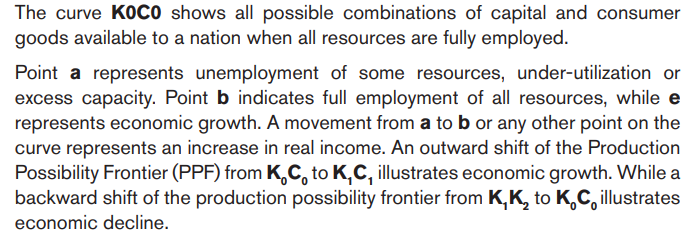

This information can be represented using production possibilities curve as

below;

Figure 1: Absolute advantage between Rwanda and Kenya using a productionpossibilities curve.

In our Absolute Advantage example, we assume that there are two countries e.g.

Rwanda and Kenya, which are represented by a red and blue line respectively.

We also assume that only two goods are produced e.g. Tea and cooking Oil.

From the table 1 above; we can determine how many units of each commodityeach country produces using the same resources.

Rwanda has an Absolute Advantage in the production of Tea (15 tons) because

it incurs less input costs to produce a unit of Tea than Kenya, which produces 6tons of the same commodity, using the same input costs.

Kenya has an Absolute Advantage in the production cooking oil (10 tons) thanRwanda which produces 5 tons, using the same input costs.

As a result, Rwanda will be better off if it specializes in the production of Tea

and Kenya will be better off if it specializes in production of cooking oil. This isthe case of reciprocal absolute advantage.

As you can see from our example, it makes sense from businesses and countries

to trade with one another. All countries engaged in open trade benefit fromlower costs of production.

On the other side, given equal quantity of resources one country can produce

both commodities better than another. Thus one country can have absolute

advantage in production of both commodities than the other.This indicates acase of non-reciprocal absolute advantage.

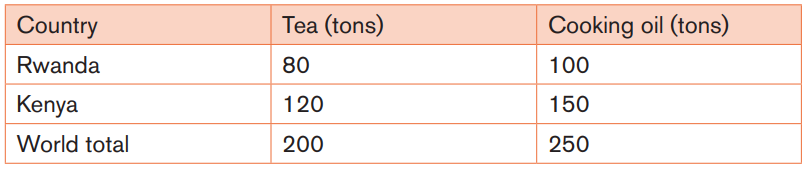

Table2: non-reciprocal absolute advantage between Kenya and Rwandaproduction schedule.

The above information can be illustrated on the graph as below;

Figure 2: Absolute advantage between Kenya and Rwanda using a productionpossibilities curve.

From the above information in the table and graph, it can be seen that if Kenya

decided to produce only Tea, it would produce 120 tons and if it decided to

produce only Cooking oil, it would produce only 150 tons. Similarly, if Rwanda

decided to produce only tea, it would produce only 80 tons, and if it decided to

produce only cooking oil, it would produce 100 tons. Each country has several

possible combinations of tea and cooking oil it can produce as shown along theproduction possibilities curve.

Because the Production possibilities frontier for Kenya is above that of Rwanda,

it means that Kenya has absolute advantage over Rwanda in production of both

tea and cooking oil. In this case of non-reciprocal absolute advantage, gains

from trade can be realized when countries specialize basing on the opportunity

cost of producing each commodity. This is explained by the theory/ principle ofcomparative advantage.

1.3.2: The theory of comparative advantage:

Activity .1.5

Analyse the case study below and answer the questions that follow.

Consider a college principal and his secretary. The College Principal is

better at administering and managing college affairs than the secretary

and is also a faster typist and organizer. In this case, the College Principal

has an absolute advantage in both the administration and management

services and secretarial work. Suppose the College Principal produces

Rwf100, 000 per day in administration and management services and

Rwf40,000 per day in secretarial duties. The secretary can produce Rwf0

in administration and management services and Rwf30,000 in secretarialduties in a day.

a) Which theory of international trade is manifested in the case studyabove? Justify your answer.

b) How will service delivery be possible?

c) Between the College principal and his secretary, who shouldspecialize in which service and why?

d) What is the basis of specialisation by the two parties named above?

e) To what extent is the theory applicable in real life experience?

1.3.2.1: Meaning of comparative advantage.

Theory of comparative advantage was advanced by David Ricardo in 1817.

It followed Adam Smith’s theory of absolute advantage and said that even in

the absence of absolute cost advantage, international trade was possible.

He postulated that even where one country had an absolute advantage in the

production of both commodities, both countries would benefit, if the first country

concentrated only on the production of the most advantageous commodity,

leaving the second country to produce the other commodity. Comparative

advantage is the ability of a country to produce a commodity at less opportunity

or real cost than another. Thus, a country has comparative advantage over

another when it incurs less opportunity cost than another in the production of agiven commodity.

The theory thus states that “Given 2 countries and 2 commodities, with a given

amount of resources, a country should specialise in producing a commodity

where it has a least opportunity cost compared to another country”. The

specialising country would benefit from trade if it exchanges the surplus of itsproducts for other products in which it has a higher opportunity cost.

1.3.2.2: Assumptions underlying comparative cost advantage

The theory of comparative cost advantage is based on the following assumptions:

- There is no intervention by the government in economic system, meaningthere is free trade between two countries.

- Perfect competition exists both in the commodity and factor markets.

- There are static conditions in the economy. It implies that factor supplies,

techniques of production, exchange rates and tastes and preferences aregiven and constant.

- Production is governed by constant returns to scale; i.e. Production

function is homogeneous which implies that output changes exactly in thesame ratio in which the factor inputs are varied.

- Labour is the only factor of production and the cost of producing acommodity is expressed in labour units.

- Labour is perfectly mobile within the country but perfectly immobile amongdifferent countries.

- Transport costs are absent so that production cost, measured in terms oflabour input alone, determines the cost of producing a given commodity.

- There are only two commodities to be exchanged between the twocountries.

- Money is non-existent and prices of different goods are measured by theirreal cost of production.

- There is full employment of resources in both the countries.

- Trade between two countries takes place on the basis of barter. Thus, the

two countries have a double coincidence of wants with barter system oftrade.

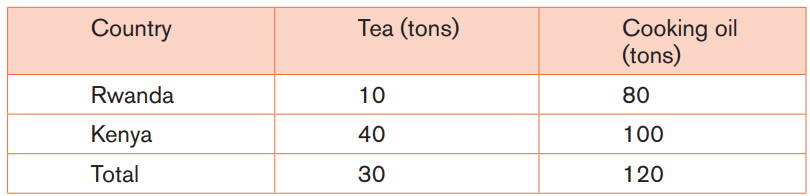

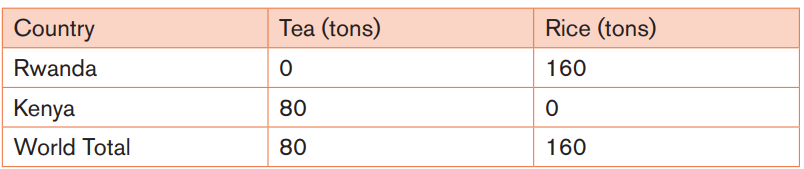

Table 3: Example; production possibilities between Rwanda and Kenya.

Kenya has absolute advantage in the production of both commodities, Tea

and cooking oil over Rwanda. Kenya has the absolute advantage in Tea than

Rwanda (4:1) and it has an absolute advantage in cooking oil than Rwanda

(5:4). However, if we examine the domestic opportunity cost ratios, it is clear

that each country has a relative or comparative advantage in the production ofone commodity.

To get to know of who should specialise in what, we must calculate theopportunity cost of one commodity for the other. This is done by the formula;

Opportunity cost=

From the above example it can be calculated as;

i. In Rwanda to produce Tea they forego cooking oil

Thus = quantity of cooking oil/ quantity of tea = 80/10= 8

ii. In Rwanda to produce cooking oil, they forego Tea,

Thus = quantity of Tea/ quantity of cooking oil = 10/80= 0.125

iii. In Kenya to produce Tea, they forego cooking oil,

Thus = quantity of cooking oil/ quantity of tea = 100/40= 2.5

iv. In Kenya to produce cooking oil they forego Tea,

Thus = quantity of tea/ quantity of cooking oil = 40/100= 0.4

This can be tabulated as;

Table 4: production schedule showing opportunity cost between Rwanda andKenya

In Rwanda, the domestic opportunity cost ratio is such that only 8 tons of

cooking oil must be given up for each ton of Tea produced. The opportunity cost

of producing one unit of cooking oil is 0.125 tons of Tea that must be foregone.

However, in Kenya, the domestic opportunity cost ratio is such that 2.5 tons of

cooking oil must be given up for each ton of Tea produced. The opportunity costof producing one ton of cooking oil is 0.4 tons of Tea.

Rwanda therefore has a comparative advantage in the production of cooking

oil since for each ton of cooking oil that is produced fewer units of tea are

sacrificed than in Kenya. Similarly, Kenya, has a comparative advantage in the

production of Tea since, for each ton of Tea that is produced; less cooking oil issacrificed than in Rwanda.

If now Kenya concentrates on Tea and Rwanda on Cooking oil, then the two

countries are bound to benefit assuming that the value of one ton of Tea is thesame as that of one ton of cooking oil.

After specialization, the situation looks as indicated in the table below. Theassumption is that resources have doubled in each country.

Table 5: Production after specialization.

The production of Tea has increased by 50 and the production of cooking oil

has increased by 40 tons.

1.3.2.3: Relevance/applicability of the comparative costadvantage.

- Developing countries have tended to specialize in producing primary

products where they have a least opportunity cost e.g. Rwanda exportsraw materials.

- Developing countries still have barter trade among arrangementsthemselves.

- Developing countries use labour intensive technology while developed

countries use capital intensive technology so the assumption of no changein technology is realistic.

- There is some degree of mobility of factors of production among developingcountries especially labour.

- Developing countries import manufactured commodities where they havea high opportunity cost.

- There are some cases of free trade among developing countries especiallyin economic integrations.

1.3.2.4: Criticisms/ limitations of the comparative cost advantage.

Though the theory of comparative advantage appears to explain the basis of

choice for a country in terms of what to produce, what to export and import from

others, it has been criticized by a number of writers on a number of the followingaccounts;

- The model deals only with the situation in which trade takes place between

two countries and in two commodities. However, this is a hypothetical

situation which does not exist in real life since international trade takes

place among more than two countries and in more than two commodities.

The world of only two countries producing only two commodities is a very

unrealistic assumption. The real world is made up of a large number ofcountries engaged in production of a wide range of commodities.

- The theory assumes that people all over the world have similar tastes. But

this is untrue. People belonging to different levels of income have different

tastes. In addition, the tastes also change according to the growth of an

economy and with the opening of world markets and development of traderelations.

- The theory does not recognise the role of technological innovations

in international trade. Which help in decreasing the cost of goods

and increasing their supply not only in inter-regional trade but also ininternational trade.

- The theory rests upon the assumption that there is complete specialisation

or division of labour. However, in the real world, complete specialisation is

not possible. Let us take an example of two countries; one small and the

other large in terms of total output. The small country can specialise in the

production of one good, but the large country will have to produce both

goods, because the small country can neither supply the full requirements

of the larger country nor can it absorb the surplus output of the largercountry.

- It is wrong to assume the existence of free world trade. Countries do not

always trade freely with each other. Different countries have always imposed

different restrictions on the free movement of goods to other countries

from time to time. This has certainly affected the volume and direction of

imports and exports and thus limiting the scope for specialisation betweenor among countries.

- In his theory, Ricardo has shown no consideration for transport costs,

which play an important role in determining the profitability and pattern of

international trade. However big the difference between the cost ratios of

the two commodities entering into trade may be, if it is narrowed down by

the high cost of transporting the commodities, trade may not occur. The

existence of transport costs gives rise to another class of goods besides

those entering into trade, known as ‘domestic goods.’ Some writers

have, therefore, suggested that the cost of production should include thetransportation cost.

- The prevalence of perfect competition in international trade is also an

unrealistic assumption. The conditions of perfect competition cannot beachieved in the real world.

- The assumption that all units of factors of production are equally efficient

is too simplistic. It is very difficult to find factors of production, which areequally efficient.

- The theory assumes that countries can shift resources from the production

of one good to the production of another good. In practice, there is likely

to be a certain amount of factor immobility, which prevents this, especiallyin the short run.

- The theory assumes the operation of the law of constant costs or returns

which is entirely unrealistic. In practice, the usual rule in the production

of goods is the operation of the law of increasing costs or diminishing

returns, that is, beyond a certain point additional output can be obtained

only at an increasing per unit cost. When the production takes place under

the operation of this law, the cost ratios in both countries will not remainconstant.

- The theory assumes similar needs. E.g. Uganda must want Rwanda’s Tea,

and Rwanda must want Uganda’s Rice. This, however, may not be true in

reality. For one reason or another, the cheapest source may not appeal

to the customer country such that the customer prefers to buy from an

expensive source. It should also be noted that two different currencies areused. However, the theory mentions nothing about them.

- It is possible that the two countries may incur the same cost in the

production of certain commodity. In such a case, it is hard to find whichcountry should specialise in a particular commodity.

- The principle of comparative advantage has been criticized by developing

countries on the grounds that if adhered to, it would perpetually commit

them to being producers of raw materials. Hence, condoning them toeternal poverty.

1.3.2.5: Factors and benefits of comparative cost advantage:

Activity 1.6

Carry out research from any economic source about theories of international

trade, examine and discuss together in class the;

i) Factors for comparative advantage.ii) Benefits of comparative advantages.

Factors that determine comparative advantage.

Comparative Advantage is when a country may produce goods at a lower

opportunity cost, but not necessarily have an absolute advantage in producing

that good. This simply means that a country can produce a good at a lower cost

than another country. Having a comparative advantage is not the same as being

the best at something. In fact, someone can be completely unskilled at doing

something, yet still have a comparative advantage at doing it! Comparative

advantage is a dynamic concept meaning that it changes over time. Comparative

advantage is what actually determines whether it pays to produce a good or

import it. For a country, some of the factors below are important in determiningthe relative unit costs of production:

- The quantity and quality of natural resources available for example

some countries have an abundant supply of good quality soils, waterbodies,

minerals farmland, oil and gas, or easily accessible fossil fuels which

makes them able to have a comparative advantage than other countries

which don’t have or have little quantities or poor quality of such resources.

The more available quantity and quality natural resources a country has,the more the comparative cost advantages and vice versa.

- Demographics: A country that has a bigger and highly educated and

skilled working-class group with a higher participation of women in

productive activities, has a more comparative advantage than another

which has an ageing or young population, high net outward and less

educated and skilled labourforce and few women’s participation in the

labour force. This has an effect on the quantity and quality of the labour

force available for industries engaged in international trade hence affectinga country’s comparative advantage.

- Rates of capital investment including infrastructure: Greater public

infrastructure investment can reduce trade costs and hence increasing

supply capacity of a country hence its comparative advantage over another

country which does not have such infrastructures. Investment in roads,

ports and other transport and ICT infrastructure strengthens productive

and competitive capacity of a country for internal and internationalexchange.

- Market levels: Rising demand/market helps countries to encourage

specialisation, higher productivity and internal and external economies

of scale. These long-run scale economies give regions and countries a

significant unit cost advantage than those countries with less demand ormarket for their commodities.

- Investment in research & development which can drive innovation

and invention. A country that invests much in research and development,

promotes mushrooming production techniques hence giving a greatercomparative advantage than another which doesn’t.

- Foreign exchange rate stability: Fluctuations in the exchange rate

affect the relative prices of exports and imports and cause changes in

demand from domestic and overseas customers hence putting such

affected countries at a less comparative advantage than another whoseexchange rate is stable for long period of time.

- Import controls such as tariffs, export subsidies and quotas –

these can be used to create an artificial comparative advantage for acountry’s domestic producers.

- Non-price competitiveness of producers - covering factors such

as the standard of product design and innovation, product reliability,

quality of after-sales support. These help a country to win market for

their commodities hence giving such countries products a comparative

advantage than others. Many countries are now building comparative

advantage in high-knowledge industries and specializing in specificknowledge.

- Institutions: Availability of institutions that facilitate production are

important for comparative advantage and for growth of a given country.

E.g. banking systems needed to provide capital for investment and export

credits, legal systems that help to enforce contracts, political institutions

and the stability of democracy is a key factor behind decisions about where

international capital flows. These institutions provide a strong milestone

to a country’s production capacity hence its comparative advantage thananother which has weak or non-existent institutions.

- Size of entrepreneurial class: A bigger size of entrepreneurs in a country

develops a new comparative advantage in a product either because they

find ways of producing it more efficiently or they create a genuinely new

product that finds a growing demand in home and international marketsthan a small size entrepreneurial class.

- Trade Barriers: Subsidies and taxes implemented by the government

create an artificial comparative advantage in a sense that a subsidy makes

exports more competitive and a tax would discourage imports thus givingcountries comparative advantage.

- Inflation: An increase in the rate of inflation would make exported goods

more expensive and imported goods cheaper thus putting the affectedcountry at a lesser comparative advantage than the other.

- Tradition: Sometimes comparative advantage maybe largely the result of

acquired skills and tradition. People get used to doing a thing and keep

on doing it, generation after generation. For example, the Swiss have

a tradition of making watches, the Norwegians of operating a far-flung

merchant fleet, and the French, of producing cheeses. Each of these

traditions is certainly consistent with the resource endowment of thecountry in question, but it is not an inevitable outcome of it.

- Technology: Technological differences between countries account for

differences in labour productivity. The countries with the most advanced

technology will have a comparative advantage with regard to those goodsthat can be produced most efficiently with modern technology.

- Factor Abundance: Goods differ in terms of the resources, or factors

inputs, required for their production. Countries differ in terms of the

abundance of different factors of production: land, labour, capital and

entrepreneurial ability. So, it is quite obvious that countries would have

an advantage in producing those goods that use relatively large amounts

of their most abundant factor of production. Certainly, countries with a

relatively large amount of farmland e.g. developing countries, would have a

comparative advantage in agriculture, and countries with a relatively large

amount of capital i.e. developed countries, would tend to specialise in

the production of manufactured goods. Or Countries with a huge supply

of relatively cheap labour would specialise in labour-intensive products

and countries with abundant capital would specialise in the production ofcapital-intensive products.

- Human Skills: Countries with a relatively abundant stock of highly-skilled

labour will have a comparative advantage in producing goods that require

relatively large amount of skilled labour. Likewise, developing countries

would be expected to have a comparative advantage in industries requiring

a relatively large amount of unskilled labour.

- Product Life Cycles: The product-life-cycle theory is related to

international comparative advantage in that a new product will be the

first produced and exported by the nation in which it was invented. As

the product is exported elsewhere and foreign firms become familiar with

it, the technology is copied in other countries by foreign firms seeking

to produce a competing version. As the product matures, comparative

advantage shifts away from the country of origin, if other countries have

lower manufacturing costs for using the now-standardised technology.

For example, the history of colour-television production shows how

comparative advantage can shift over the product life cycle. It was invented

in the US, and US firms initially produced and exported them. Over time,

as the technology manufacturing them became well-known, countries like

Japan and Taiwan came to dominate the business and had a comparative

advantage over US firms in the manufacture of colour TVs. Once the

technology is widely available, countries with cheaper assembly lines, due

to lower wages, can compete effectively against the higher-wage nationthat developed the technology.

Benefits of comparative advantage.

- It encourages competition and improvement in efficiency so as to reducecosts of production.

- It encourages specialisation and exchange.

- It increases global output of commodities due to specialisation.

- It encourages economic cooperation and free trade among countries.

- It encourages mass production and reaping of economies of scale.

- It discourages duplication of industries i.e. setting up of industries whichalready exist in other countries.

- It widens market for exports between o among countries.

- It enables countries to get commodities which they cannot produce, thusincreasing consumers choice.

- It enables countries to get foreign exchange through increased exportsand other form of capital inflow.

- Specialisation results into effective utilisation of resources some of whichwould be idle.

Application activity 1.3

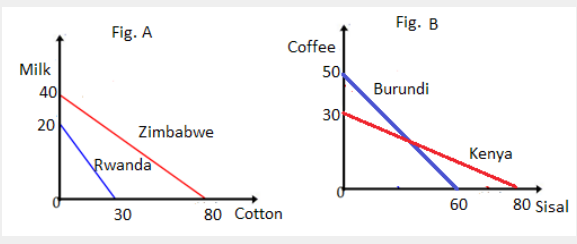

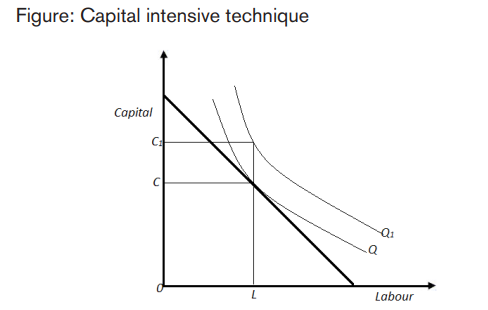

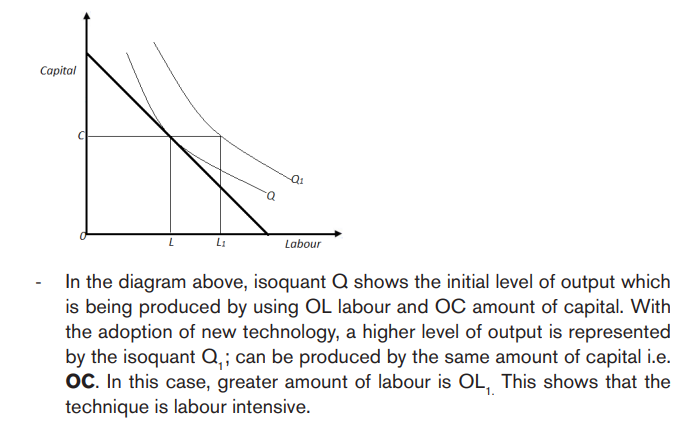

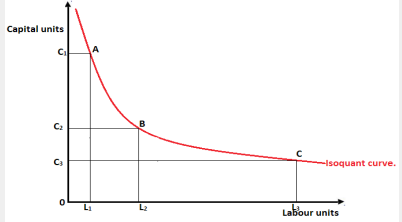

Analyse the figures below and answer the questions that follow.

a) In each figure, identify the theory of international trade portrayed with

supporting reason.

b) What makes a difference between the two figures above?

c) In which commodity should each country specialise and why?

d) Why do you think, based on the comparative cost advantage

developing countries are not able to benefit from international tradeas much as developed countries?

End unit assessment

1. Why would you advise your country to engage in internationaltrade?

2. Why do we buy goods from abroad if we can make them locally?

3. Discuss the view that where there is no comparative advantagethere is nothing to gain from international trade.

4. Consider the view that gains from international trade are biased infavour of advanced industrial countries.

Files: 2UNIT 2: TERMS OF TRADE.

Unit Competency:

Learners will be able to describe the terms of trade in LDCs.

Introductory activity

Using the case study below, visit the library or the internet or any economics

source and research about international trade, using the gained knowledge

and understanding, share and discuss the questions that follow.

In 2017, Rwanda exported her tea to Brazil and in turn imported guns from

there. The price of tea per ton was 800 dollars while that of a gun was

1,700 dollars. The next year i.e. 2019, tea prices in the world market fellby 20% while that of guns remained constant.

a) What economic term do we call the relationship between Rwanda’sexport prices and import prices?

b) Calculate the terms of trade for Rwanda in 2017 and 2019 respectively.

c) Describe the nature of terms of trade of Rwanda in 2017 and 2019respectively. Support your answer.

d) How can terms of trade be expressed?

2.1: Meaning and Forms of Terms of Trade:

Activity 2.1

Analyse the case study below, undertake research from any relevant economicsource within your reach and discuss the questions that follow;

In 2018, to purchase laptops from China, it required Rwanda to export 200 tonsof coffee there. Suppose each ton of coffee cost $20 and that of laptop is $60;

i) How many laptops did Rwanda purchase from China using her tons of coffee?

ii) What economic term is given to relationship between the value of Rwanda’scoffee and China’s laptops?

iii) Describe what the term named above means to an economy.

iv) Describe how the different forms of terms of trade can be expressed.

2.1.1: Meaning of terms of trade:

Terms of trade (TOT) refers to the relative price of exports in terms of imports.

It is the ratio of export prices to import prices. It can be interpreted as the

amount of import goods an economy can purchase per unit of export goods.

I.e. import purchasing power of exports. For example, if an economy is only

exporting Flowers and only importing telephones, then the terms of trade are

simply the price of flowers over the price of telephones. In other words, how

many telephones can you get for a unit of flowers sold? Since economies

typically export and import many goods, measuring the terms of trade requiresdefining price indices for exported and imported goods and comparing the two.

A rise in the prices of exported goods in international markets would increase

the terms of trade, while a rise in the prices of imported goods would decrease

it. For example, countries that export oil products will see an increase in their

terms of trade when oil products’ prices go up, while the terms of trade of

countries that import oil products would decrease. An improvement of a nation’s

terms of trade benefits that country in the sense that it can buy more imports for

any given level of exports. The terms of trade may be influenced by the exchange

rate because a rise in the value of a country’s currency lowers the domestic

prices of its imports but may not directly affect the prices of the commodities it

exports. Terms of trade is the ratio of a country’s export price index to its importprice index, multiplied by 100.

Terms of trade can be expressed as;

TOT= ×100 or TOT= 100

Where; Px = average price index for exports, Pm = average price index forimports

Basically, TOT is Export Price over Import price times 100. If the percentage

is over 100% then an economy is doing well (Capital Accumulation) thus

favourable terms of trade. When this persists year after year, a country issaid to have ‘improving terms of trade’.

If the percentage is under 100% then an economy is not going well (More

money going out than coming in) thus unfavourable terms of trade. When

this persists year after year, a country is said to have deteriorating terms oftrade.

2.1.2: Forms of Terms of Trade

Terms of trade are categorized into two, namely;

a) Barter / commodity terms of trade

b) Income/ monetary terms of trade

c) Barter/ commodity terms of trade.

Barter / commodity terms of trade is the relationship between export prices

and import prices. I.e. the ratio of average price index of exports to theaverage price index of imports. Symbolically, it can be expressed as:

Barter terms of trade= 100

Where P = price, the subscript x =exports and m =imports.

Taking 2018 as the base year and expressing Rwanda’s both export prices

and import prices as 100, if we find that by the end of 2019 its index of

export prices had fallen to 80 and the index of import prices had risen to180. The terms of trade had changed as follows:

Barter TOT =100= 100 = 44.4

It implies that Rwanda’s terms of trade declined by about 55.5 per cent in

2019 as compared with the 2018, thereby showing worsening of its termsof trade.

If the index of export prices had risen to 190 and that of import prices to

185, then the terms of trade would beBarter TOT =100= 100 =102.7.

This implies an improvement in the terms of trade by 2.7 per cent in 2019over 2018.

a) Income/ monetary terms of trade

This refers to the ratio of the value of exports (revenue from exports) to the price

index of imports. This index is calculated by dividing the index of the value of

exports by an index of the price of imports. This is called the “Export Gainfrom Trade Index.”

It can be expressed as;

Income TOT= or

Example 1:

Taking 2017 as a base year and expressing Rwanda’s both export prices and

import prices as 100, if in 2019, the price of exports (PX) is 140, price ofimports (Pm) is 90 and quantity of exports is 80 then income terms of trade is;

= 124.4.

It implies that there is improvement in the income terms of trade by 24.4percentin 2019 as compared with 2018.

Example 2:

Taking 2018 as a base year again, and expressing Rwanda’s both export prices

and import prices as 100. If in 2019 Price of exports = 80, Price of imports=180 and Quantity of exports =120, then

Income TOT = 53.3

It implies that the income terms of trade have deteriorated by 46.7% percentin2019 as compared with 2018.

A rise in the index of income terms of trade implies that a country can import

more goods in exchange for its exports. A country’s income terms of trade may

improve but its commodity terms of trade may deteriorate. Taking the import

prices to be constant, if export prices fall, there will be an increase in the sales

and value of exports. Thus, while the income terms of trade might have improved,the commodity terms of trade might have deteriorated.

The income terms of trade, is called the capacity to import. In the long-run,

the total value of exports of a country must equal to its total value of imports, i.e.,or . Thus determine which the total volume that a country can import is.

Application activity 2.1

a) Under what circumstances may the capacity of a country to import

i) Increase.

ii) Decline.

b) Describe the different directions the terms of trade position of a countrycan take.

c)If in 2019 Rwanda exports 1000 tons of hides and skin to Brazil each atUS$ 500 in exchange for cars each at US$2000

i) What are we aiming at in looking at prices of imports and exports plustheir quantities?

ii) Describe the relationship between Rwanda’s export and import values.

iii)Calculate the income terms of trade and barter terms of trade in 2019and interpret your findings.

2.2: Nature and how to improve the terms of terms of tradefor developing countries.

Activity 2.2

Developing countries are always interested in the trend in export and import

prices and also more concerned about the trends in their export earnings

and import payments. This is because these trends in turn determine

the long-term trend in the balance of payments on current account and

indicate whether future balance-of-payments difficulties are likely to arise.

a) From the extract above, why do developing countries mind aboutkeeping track of the trend of export and import prices?

b) Basing on the extract above, carry out research to identify anddescribe the trend of export and import prices for developing countries.

c) What causes the trend mentioned above for developing countries?

d) Suggest possible measures that developing countries shouldundertake to streamline its export import price relationship.

2.2.1: Nature of terms of trade for developing countries:

Most LDCs have unfavourable and deteriorating terms of trade. The

following are the main reasons for unfavorable and declining terms of trade ofless developed countries:

Causes of deteriorating Terms of Trade in LDCs

- The less developed countries are mainly primary producing countries.

Their exports mostly include primary products which are price and income

inelastic, but their imports include capital goods which are expensive. Thus,

the terms of trade for LDC’s are always unfavourable and deteriorating yearafter year.

- Adoption of raw-material saving techniques by developed countries whichreduces the demand for LDC’s export.

- Most of the international trading policies are influenced by MDCs which

favour them however disfavor LDCs. For example, LDCs are price takers in

the world market hence their export prices are usually low, making them tohave unfavourable terms of trade year after year.

- Discovery of substitutes such as synthetic fibers e.g. plastics, nylon, which

replace natural fibers in LDCs. This reduces on the volume of exports forLDCs.

- Price movements through business cycles: The prices of primary products

rise sharply in the prosperous periods and fall in the downswing of the

business cycle. Thus, over successive cycles, the prices of the primary

products have always fluctuated, and the primary producing countries havesuffered an unfavourable movement in their terms of trade.

- Long-term disparity in demand for manufactured and primary products. In

the industrial countries, the income elasticity of demand for primary products

is inelastic (i.e., less than one), while in the poor countries, the incomeelasticity of demand for manufactured goods is more elastic (exceeds one).

This brings about unfavorable terms of trade year after year.

- The less developed countries use backward technology as compared to

the developed countries. As a result, their relative productivity is low, cost

ratios are high, and price structure is also relatively high. This leads to the

adverse terms of trade for the poor country, placing it at a disadvantageousbargaining position.

- Most of the less developed countries experience overpopulation and high

population growth. As a result, there is high internal demand for the goods

and low exportable surplus. Moreover, the import demand of these countriesis highly inelastic. This causes their terms of trade to fall.

- Lack of Import Substitutes: Poor countries are greatly dependent on

the advanced countries for their imports and have not developed import

substitutes. On the other hand, the advanced countries are not so much

dependent on the poor countries because they are capable of producing

import substitutes. Thus, the poor countries have weak bargaining positionin the international trade.

- High transport costs: Most LDCs are land locked countries, this makes

it difficult to link to regional or international markets make it difficult for

trade development in the country. Therefore, making it costly to transport

commodities to and from international markets, adversely affecting theirterms of trade.

- Unlike, the advanced countries, the less developed countries cannot quickly

adapt their supply of goods which are high in demand and whose prices are

rising. The reasons for this are: backward technology, market imperfections,

immobility of factors of production, etc. Thus, the terms of trade of less

developed countries tend to deteriorate and these countries fail to reap

gains by increasing their supplies of exports during inflation due to Lack ofadaptability.

- Most LDCs produce more less the same products which leads to limited

market among themselves. They therefore tend to increase their export

shares to MDCs by reducing prices, yet they have to continue importingmanufactured goods from MDCs which are highly priced.

- Most LDCs lack a considerable manufacturing sector as a result of political

instability and insecurities, thus reduce the volume of manufacturedcommodities that would be exported.

- Lack of diversification in production in LDCs; Most LDCs depend on a few

traditional cash crops like tea, coffee, cotton tobacco, sisal, cocoa etc. which

limits the amount of income they get from exports compared to developedcountries that export to LDCs a wide variety of manufactured goods.

2.2.2: How to improve Terms of Trade for LDCs

Most LDCs face unfavourable terms of trade, an indication that LDCs do not

favourably enjoy the benefits from international trade. This implies they always

export much and get little imports. LDCs should adopt any of the following

policies in order to improve their terms of trade so as to enjoy more benefitsfrom international trade.

- Carry out adequate market research so as get enough information to

widen markets for their commodities. This enables them to access new

clients and overcome supply constraints domestically, regionally andinternationally.

Human resource development through education and training so as toreduce expenditure on imported labour force which is always expensive.

- Promote peace and security in all parts of their countries so as to instill

confidence, for their security and property as well, among both local andforeign investors.

- Ensure good governance for example, by fighting against all forms of

financial indiscipline like corruption and embezzlement of government

funds in all sectors which promotes transparency and efficiency thusincreased gains from trade.

- Promote regional integration and economic cooperation among

developing countries. by trading among themselves in order to avoid

exploitation by developed countries. For example, Rwanda is already a

member to regional and international bodies like East African Community

(EAC), Common Market for Eastern and Southern Africa (COMESA)

and its free trade area and is able to access the whole market withoutany barriers to trade.

- Promote the development of private sector so as to promote efficiency

in production and increase the exploitation of idle resources whichincreases export volume thus increasing gains from international trade.

- Make all possible efforts to establish business legal reform task force

mandated to reform all business laws which will create conducive legal

environment for trade by both local and foreign investors and increasethe gains from international trade among themselves.

- Establish financial sector task force with the mandate of solving all

problems in the financial sector. This will help avail easy and cheap

credit facilities to potential investors and business class which booststheir productive levels thus increasing the export base.

- Establish the trade points which will provide all trade related information;

this becomes an opportunity as trade information will be easily obtained

in one place. This attracts different investors from within and outside the

country’s economy thus promoting production directed towards exportand or reducing import expenditure.

- Enhance the establishment of permanent national and international trade

fair grounds which creates an opportunity for trade development as it

gives business men a chance of regular expositions which helps them insell and advertisements of their products.

- Enhance the establishment of business development centers (BDS)

which facilitate easy coordination of business activities in rural areas topromote continuous and coordinated production.

- Establish Export processing zone which facilitate trade development

in particular and development in general. This helps transform their

commodities into finished products so as to increase the export valueand gains from trade as well.

- Form producer cooperatives and associations to bargain for higher prices

for their exports. Governments should take initiative in cooperatives

development so as to create an opportunity for trade development, asfrom a strong cooperative movement trade is improved.

- Take up strong measures to control population growth e.g. through family

planning campaigns so as to increase on the level of exports and reducethe volume of exports as well.

- Diversify domestic production so as to reduce dependency on few

traditional exports where terms of trade are unfavourable and keep onfluctuating.

- Adopt Import substitution strategy so as to minimize import expenditure

- Research innovations and inventions so as to promote technological

development and use of intermediate technology to reduce expenditureon expensive capital.

Application activity 2.2.

a) Examine the possible causes of changes in the terms of trade fordeveloping countries.

b) Explain the effects of deteriorating terms trade in your country.

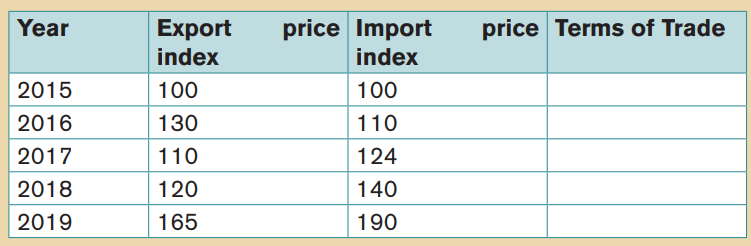

End unit assesment

1 a. What distinguish barter terms of trade from income terms oftrade?

b. Study the table below showing terms of trade for a country(2012-2016) and answer the questions that follow;

Calculate the terms of trade for the years 2015 to 2019

ii) Explain the nature of terms of trade between 2016 and 2019and support your answer.

2. a) Why have terms of trade tended to move against developingcountries’ economies?

b) Does favourable terms of trade mean favourable balance oftrade?

UNIT 3:FREE TRADE AND TRADE PROTECTIONISM

Key unit competence:

Analyze the impact of free trade and trade protectionism in an economy.

Introductory activity

Following the opening of the African continental Free Trade Agreement in

Kigali, Rwanda in March 2018, Africa is about to become the world largest

free trade area; 54 countries merging into a single market of around 1.3

billion people with a combined GDP of 2.5 trillion Us Dollars. The major goal

of this agreement was to establish a single market for goods and services

across the continent, allow the free movement of business travelers and

investments and also create a continental customs to streamline trade- and

attract long term investments. The agreement between countries required

members to remove tariffs from 90% of goods allowing free access tocommodities, goods and services across the continent.

Basing on the above agreement

a) What do you think is free trade?

b) What are benefits and costs of such trade?

c) Explain the measures that can be used to protect a country from thecosts of such trade.

3.1. Free Trade

Activity 3.1

a). What is meant by the term free trade

(b) Briefly explain the term free trade according to Adam smith.

3.1.1. Meaning of tree trade

Free trade refers to the unrestricted purchase and sale of goods and services

between two or more countries. Under a free trade policy countries agree to

buy or sell goods and services across international boundaries with little or no

government tariffs, quotas, subsidies and other forms of restriction.

According to Adam Smith, the term “free trade” is used to mean “the system

of commercial policy which draws no distinction between domestic and foreign

commodities and, therefore, neither imposes additional burdens to the latter,

nor grants any special favour to the former”

In other words, free trade implies complete freedom of international trade

exchange. In this situation, there are no barriers to movement of commoditiesamong countries and exchange can take its perfectly natural course.

3.1.2: Advantages of free trade

Activity 3.2.

Make research and discuss the view that free trade does more good thanharm on the economy.

Free trade is the term given to trade between nations that takes place without

the imposition of barriers in the form of tariffs, quotas or other measures by

governments or international organizations. Free trade is generally considered

by economists to be beneficial to international trade by encouraging competition,

innovation, efficient production and consumer choice etc. Its advantages includeamong others the following

- Improves consumers’ welfare. Free International trade avails

consumers in a particular country with a wider choice of goods and

services because it makes easy for them to find both imported and

locally produced goods and services cheaply. Thus Free trade permits

large varieties of consumption goods which later improve consumer’swelfare.

- Reduced costs of production by domestic businesses. With

free trade, domestic businesses may also have a chance to reduce

their costs of production by buying imported raw materials or new

technology without restrictions and this in turn leads to reduction ingeneral price levels in the country.

- Encourages specialization among countries. With free trade, a

country is able to specialize in the production of a commodity where

they incur lower costs than other countries and cheaply get buy

commodities where they incur higher costs from other countries. In

other words, countries are also be export those goods or services that

they are most efficient in producing and import the items which othercountries may produce more efficiently.

- Encourages competition between domestic and foreign

industries: Free International trade increases competition as

domestic industries must compete with foreign firms in the same

industry in their own country. This compels domestic industries to

look for ways to keep costs down by operating more efficiently and

gives them an incentive to Innovate and look for improved products,

processes and marketing methods. Thus, this constant search for

new ideas and technology induces domestic producers to improve

their efficiency which enables them to compete on the internationalmarket.

- Increased earnings for the factors of production. Under free

trade, factors of production will also be able to earn more, as they

will be employed for better use i.e. optimally utilized. In other words;

free trade creates many job opportunities in the country especially for

the importers and exporters which in turn increases wages, interest,profits and rent

- Imports become Cheaper. Free trade enables the country to get

imports at cheap rates since it is becomes easy for the country to get

goods and services from other countries with little or no restriction

and this reduces prices in the domestic market which later favourscustomers.

- Enlarges a country’s market in other countries: Free trade

widens the size of the country’s market in the way that a country is

able to sell their products in other countries without any restriction.

This also favours specialization because a wide market will encourage

the country to concentrate in the production of commodities where

they incur lower costs and the surplus will be sold to other countries.

- Restricts consumers’ exploitation by domestic monopolists:

Free trade prevents grow of domestic monopolies who always exploit

the consumers through charging high prices. This trade makes it

hard for the domestic producers to increase prices in the market

due to high levels of external competition where goods can easily beimported into the country at cheapest prices possible.

- Promotes international cooperation among countries and

mutual understanding as well. It is also known that the more

countries work together in terms of buying and selling goods and

services even their relationships tend improve in the same direction.

This helps to increase the atmosphere of peace and good will amongsuch countries hence increasing the volume of international trade.

- Widens tax base in the economy as a result of variety of goods

and services produced and exchanged. This increases a country’s tax

base which in turn increases a country tax revenue used for furtherdevelopment.

- Reduces administrative costs of protectionism such as enforcing

quotas, foreign exchange control, subsidies etc. The government

to enforce such policies incurs a lot of administrative costs such as

supervision costs etc. Therefore, free trade makes it easy because ittakes place between countries with either little or no such costs.

- Eliminates possibilities of trade malpractices like smuggling

with its negative effects. Free trade gives all people an opportunity to

with little or no government restrictions and this helps people to tradefreely without getting involved in such malpractices.

3.1.3: Disadvantages of free trade

-Unemployment increases. Free trade makes it becomes easy to import

some products at a cheaper price than the domestic ones and this causes

some industries to be out competed and pushed out of business by suchcheap foreign products hence causing unemployment.

-Increases uneven distribution of income among countries. As

a result of free international trade, some countries will be able to take

advantage of their natural resources, skilled workforce or economies of

scale to sell their goods and services internationally on more favorable

terms than other countries without such advantages and then get morerevenue compared to other.

- Prices fluctuation on the global market. Most developing countries

always export semi or unprocessed products whose prices are always

fluctuating on the global market hence making such countries to gain lessfrom free trade.

- Increases dumping of goods. Free trades enables other countries to sell

their surplus products in our countries at lower prices compared to their

home prices. This has a number of negative effects on the economy like

reducing market for domestically produced goods, causes unemploymentand narrowing a country’s tax base and many others.

- Degradation of natural resources. Since free trade expands a

country’s market in other countries this leads to over exploitation of natural

resources like timber, minerals and other natural resources as the way of