UNIT 4: BUSINESS AND MONEY

Key unit competence: To use the language learnt in the context of businessand money

INTRODUCTORY ACTIVITY

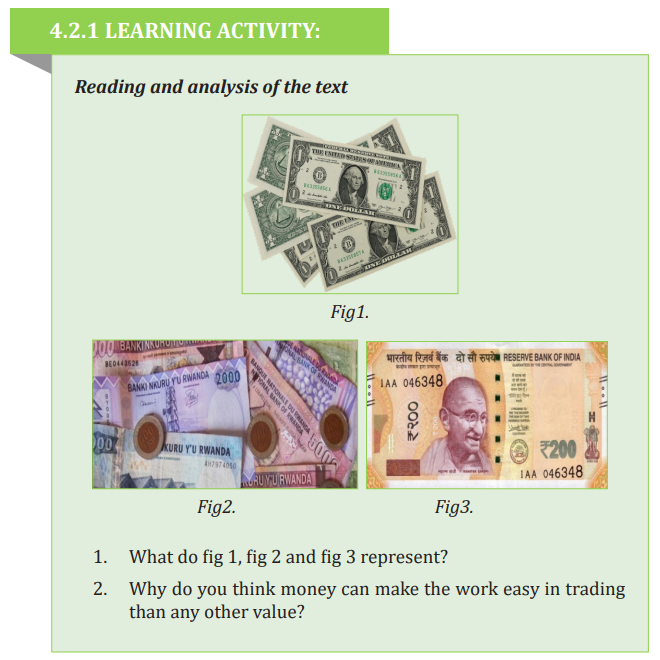

Picture observation and interpretation

1. Based on the fig above, explain different activities that can be done

using money.

2. Examine the role money has in business operations.

3. Do you think marketing is important in business? Explain4. How would you explain what people need to start lasting businesses?

4.1 Describing business and money

Text: Business and money

Someone once described the age we live in as that of a vanishing world, one in

which the familiar is constantly disappearing forever and technological change

is often difficult to cope with. So it should come as no surprise to most of us to

hear that yet another part of everyday life is about to go forever. Still, when I

read recently that in the next decade money as we know it will probably cease

to exist in technologically advanced countries.

According to Professor Gerry Montague, of the Institute of economic reform,

the familiar coins and banknotes will soon be replaced entirely by credit cards

of various kinds. And the shop of the future (the ‘retail outlet’-as Professor

Montague puts it) will be linked to the network of banking computers. The

assistant will only key in your bank account code number and the amount you

have spent, and thank you politely. You won’t have to dig deep in your pocket or

wallet for change or pretend at the pub that you have left your money at home.

You may not even have a number for your account as such, as the computer may

by the end be able to read your handprint. So, no more credit card frauds either.

But I am afraid that I shall waste money. I have felt strongly attached to it, ever

since I received my first pocket money when I was five, and kept it in a money box.

Even if my credit card of the future will be able to tell me exactly how much

spending power I have left in the computer file, even if it lights up and plays a

happy or sad tune at the same time, nothing will be able to replace the sheer

pleasure I gained from rattling the coins in my money-box. Not to mention the

other obvious problems which will be caused by a shortage of real money – likehow to start a football match for example!

Extracted from Advanced Language Practice by Michael Vice, p.196

Comprehension questions

1. Examine the impact of current technological advancement on our

concept of money according to the first and second paragraphs.

2. Do you think the progress made in the banking system will end credit

card frauds? Justify your answer.

3. Why do you think that the technological advancement in banking will

lead to the wastage of money.

4.1.2 APPLICATION ACTIVITIES

Vocabulary and sentence and composition writing

1. Use a dictionary and thesaurus to look up the missing meanings of the

words or phrases below.

a. Vanishing

b. Rattling

c. Waste

d. Handprint

e. Fraud

f. Spending power

g. Cope with

h. Credit card

2. Using the words above, write meaningful sentences related to the use

of money.

3. Write a short composition describing the future use of money basedon the current technological progress.

4.2 Describing the role of money

Text: The function of money

Money can be defined as anything that people use to buy goods and services.

Money is what many people receive for selling their own things or services.

There are many kinds of money in the world. Most countries have their own

kind of money, such as the United States dollar or the British pound. Money

is also called many other names, like Francs, currency or cash and (in India)

‹rupee›.

The idea of bartering things is very old. A long time ago, people did not buy or

sell with money. Instead, they traded one thing for another to get what they

wanted or needed. One person who owned many cows could trade with another

person who had a lot of wheat. Each would trade a little of what he had with the

other. This would support the people on his farm. Other things that were easier

to carry around than cows also came to be held as valuable. This gave rise to

trade items such as jewelry and spices. When people changed from trading in

things like, for example, cows and wheat to using money instead, they needed

things that would last a long time. They must still have a known value, and

could be carried around. The first country in the world to make metal coins was

called Lydia.

Money is often defined in terms of the three functions or services that it

provides. Money serves as a medium of exchange, as a store of value, and as

a unit of account.

Money’s most important function is as a medium of exchange to facilitate

transactions. Without money, all transactions would have to be conducted

by barter, which involves direct exchange of one good or service for another.

The difficulty with a barter system is that in order to obtain a particular good

or service from a supplier, one has to possess a good or service of equal value,

which the supplier also desires. In other words, in a barter system, exchange

can take place only if there is a double coincidence of wants between two

transacting parties. The likelihood of a double coincidence of wants, however,

is small and makes the exchange of goods and services rather difficult. Money

effectively eliminates the double coincidence of wants problem by serving

as a medium of exchange that is accepted in all transactions, by all parties,

regardless of whether they desire each other’s goods and services.

In order to be a medium of exchange, money must hold its value over time;

that is, it must be a store of value. If money could not be stored for some period

of time and still remain valuable in exchange, it would not solve the double

coincidence of wants problem and therefore would not be adopted as a medium

of exchange. As a store of value, money is not unique; many other stores of value

exist, such as land, works of art, and even baseball cards and stamps. Money

may not even be the best store of value because it depreciates with inflation.

However, money is more liquid than most other stores of value because as a

medium of exchange, it is readily accepted everywhere. Furthermore, money is

an easily transported store of value that is available in a number of convenient

denominations.

Money also functions as a unit of account, providing a common measure of the

value of goods and services being exchanged. Knowing the value or price of a

good, in terms of money, enables both the supplier and the purchaser of the

good to make decisions about how much of the good to supply and how much

of the good to purchase.

Adapted from: https://www.cliffsnotes.com/study-guides/economics/

money-and banking/functions-of-money

Comprehension questions

1. How would you define the term money according to the text?

2. plain how people could exchange different goods in trading before the

introduction of the use of money.

3. How do we call the money used in United States and india?

4. According to the text, what was the first country in the world to make

metal coins?

5. What are the functions of money mentioned in the passage?

6. Discuss different ways of using money as described in the text.

7. Justify the reason why medium of exchange is considered as most

function of money?

4.2.2 APPLICATION ACTIVITIES

Vocabulary, sentence writing and debate

1. Use a dictionary and thesaurus to look up the missing meanings of the

words or phrases in the table below.

a. Purchaser

b. depreciates

c. barter

d. double coincidence

e. convenient denominations

f. inflation

g. liquid money

2. Using the above words, construct grammatically correct sentences.

3. Debate the following topic ‘Money is everything in life.’4. Write a paragraph describing the role of the money in doing business.

4.3 Describing marketing

Text: Marketing

Nowadays, people tend to define marketing as the development along with the

industrial revolutionduring18thand 19thcenturies, which was a period of rapid

fundamental social change driven by scientific innovation and technology.

According to (Pride and Ferrell, 2008; Cooper and Argyris, 1998), there are

three orientation eras cross between the 18th till 20th centuries, the production

orientation era which emphasize on distribution of production and cost; sales

orientation era, which focuses on advertising, communication and branding,

and lastly marketing orientation era, which concentrates on competitors.

Marketing is managing cost-effective consumer relationships. Marketing does

not just focus on products, it is the satisfaction off customers matters the most.

For instance, the most successful company rely on the returning purchase of

the customer, and so the common goal for the company is to deliver long term

satisfaction to the consumer but not ‘deceiving them’ in a short run.

Therefore, it is of paramount importance to make researches on customer

case studies so as to understand their needs, which is different from the old

traditional way of justselling and advertising. (Drucker, 2001) Hence, advertising

has become the only part of tools for building customer relationships through

marketing process.

There are steps in the marketing process. (Huber, 2006; Kotler and Armstrong,

2008) The first one is marketplace and customer needs understanding. This

step focuses on human needs, market offering and customer satisfaction.

According to Maslow (1954), hierarchy of needs, it include basic needs of food

and shelter, safety needs, love and belonging needs, esteem needs and the lastly

self-actualization. By understanding consumer needs and wants, marketer can

offer a specific service and product into the market which is required by the

consumer. By prioritizing their needs, company will receive recognition from

the public, as well as to help marketer in frame up their consumer relationships.

Next is the customer driven marketing strategic designed. In this section,

marketer should be very clear that which group of customers are they serving,

and what more they can do to serve them better.(Kotler and Armstrong, 2009)

So the first thing that marketer need to do is market segmentation. (Huber,

2006) Dividing the market into several groups will make it easier for marketer to

search target. After decided a target market, it is necessary to have a proposition

value in the market, which is very important as it helps to differentiate yourself

from other company. On the other hand, there are five concepts from marketing

management to help build a commercial relationship with target market.

First is the production concept, which emphasises on large scale and lower

cost. Second is the product concept, which focuses on product quality, selling

concept, such as ideas to tempt the customers into buying by offering some

discounts or promotion. The other concept is the marketing concept, which

focuses on knowing the needs and wants of target consumer and delivering

value to them. Lastly is the societal marketing concept, a concept which focuses

on customer and society’s interest in long run apart from just considering the

needs and wants of the customers.

All in all, marketing has been changed from ‘inward looking’ discipline era,

which always focus on the organization produced to the ‘outward looking’

discipline era, which bring a greater understanding of market and consumerinto the organization.

https://www.ukessays.com/essays/marketing/what-does-marketing

-mean-marketing essay.php

Comprehension questions

1. What would you tell about three orientation eras between the 18th till

20th centuries in terms of marketing as described in the passage?

2. Apart from focusing on products, what else does marketing focus on as

described in the text?

3. Say and justify why in marketing, people should make researches on

customer case studies.

4. Explain the different steps taken in the marketing process as discussed

in the text.

5. What would you suggest about marketing activities as long as today’sbusinesses are concerned?

4.3.2 APPLICATION ACTIVITIES

Vocabulary, sentence writing and speaking

1. Use a dictionary and thesaurus to look up the meanings of the

words or phrases below.

a. branding

b. marketing

c. fascinate the consumer

d. discipline era

e. market segmentation

f. in ward looking

g. out ward looking

2. Using the above words and phrases, write different grammatically

correct sentences and present them to the class.

3. Discuss about what we find in your community and act out a role

play marketing them to other people during classroom activities.

4.4 Describing business

Text: Business operations

A variety of operations keep businesses, especially large corporations running

efficiently and effectively. Common business operation divisions include

production, marketing, finance and human resource management. Production

includes those activities involved in conceptualizing, designing, and creating

products and services. In recent years there have been dramatic changes

in the way goods are produced. Today, computers help monitor, control, and

even perform work. Flexible, high-tech machines can do in minutes what it

used to take people hours to accomplish. Another important development

has been the trend toward just-in-time inventory. The word inventory refers

to the amount of goods a business keeps available for wholesale or retail. In

just-in-time inventory, the firm stocks only what it needs for the next day or

two. Many businesses rely on fast, global computer communications to allow

them to respond quickly to changes in consumer demand. Inventories are thus

minimized and businesses can invest more in product research, development,

and marketing.

Marketing is the process of identifying the goods and services that consumers

need and want and providing those goods and services at the right price, place,

and time. Businesses develop marketing strategies by conducting research to

determine what products and services potential customers think they would

like to be able to purchase. Firms also promote their products and services

through such techniques as advertising and personalized sales, which serve to

inform potential customers and motivate them to purchase. Firms that market

products for which there is always some demand, such as foods and household

goods, often advertise if they face competition from other firms marketing

similar products. Such products rarely need to be sold face-to-face. On the other

hand, firms that market products and services that buyers will need to see, use,

or better understand before buying, often rely on personalized sales. Expensive

and durable goods - such as automobiles, electronics, or furniture benefit from

personalized sales, as do legal, financial, and accounting services.

Finance involves the management of money. All businesses must have enough

capital on hand to pay their bills, and for-profit businesses seek extra capital to

expand their operations. In some cases, they raise long-term capital by selling

ownership in the company. Other common financial activities include granting,

monitoring, and collecting on credit or loans and ensuring that customers

pay bills on time. The financial division of any business must also establish a

good working relationship with a bank. This is particularly important when a

business wants to obtain a loan. Businesses rely on effective human resource

management (HRM) to ensure that they hire and keep good employees and that

they are able to respond to conflicts between workers and management. HRM

specialists initially determine the number and type of employees that a business

will need over its first few years of operation. They are then responsible for

recruiting new employees to replace those who leave and for filling newly created

positions. A business’s HRM division also trains or arranges for the training of

its staff to encourage worker productivity, efficiency, and satisfaction, and to

promote the overall success of the business. Finally, human resource managerscreate workers’ compensation plans and benefit packages for employees.

Adopted from: Jones Leo, Alexander Richard, (2003). New International Business

English Cambridge University Press, http://portal.tpu.ru:7777/departments/otdel/mediateka/pix/Tab1/BusinessEnglish_1.pdf

Comprehension questions

1. Referring to the text, define the word ‘business.

2. Distinguish between profit and non-profit organizations. Support your

answer with relevant examples.

3. How would you define the term production and marketing?

4. Explain the contributions of technology in business operations.

5. Explain how business can develop marketing activities.6. Evaluate the role of HRM division in business related activities.

4.4.2 APPLICATION ACTIVITIES

Vocabulary, sentences and essay writing

1. Use a dictionary and thesaurus to look up the meanings of the words

or phrases below.

a. Corporations

b. Conceptualizing

c. Human resource

d. Dramatic

e. Wholesale

f. Firm

g. Stocks

h. Inventories

i. Granting

2. Use the words given above to construct grammatically correct sentences.

3. Discuss about what people need to create businesses.

4. Write an essay on different businesses that people in community havecreated.

4.5 Describing documents used in business

Text: Business tool

Payments are essentially transportation tasks as funds are transferred from

payer to payee following established payments flows that are characteristic

of a given payment instrument. Generally the payee has provided some kind

of service or goods to the payer, who will in return pay an agreed amount of

money against a request for payment, usually an invoice document, as part of

the invoicing process. The following are different types of payments to facilitate

the smooth of the business.

The first type is cash (bills and change). This is one of the most common ways

to pay for purchases. Both paper money and coins are included under the larger

category of “cash.” While cash has the advantage of being immediate, it is not

the most secure form of payment since, if it is lost or destroyed, it is essentiallygone. There is no recourse to recoup those losses.

In addition to cash, personal cheque is the other type. Personal chaques are

ordered through the buyer’s account. They are essentially paper forms the

buyer fills out and gives to the seller. The seller gives the cheque to their bank,

the bank processes the transaction, and a few days later the money is deducted

from the buyer’s account. With the increasing trend towards fast payment,

cheques are seen as slow and somewhat outdated.

Other types of payment include debit card and credit card. Paying with a debit

card takes the money directly out of the buyer’s account. It is almost like writing

a personal cheque, but without the hassle of filling it out. Credit cards look like

debit cards. But paying with a credit card temporarily defers the buyer’s bill.

At the end of each month, the buyer receives a credit card statement with an

itemized list of all purchases. Therefore, rather than paying the seller directly,

the buyer pays off its bill to the credit card company. If the entire balance of

the bill is not paid, the company is authorized to charge interest on the buyer’s

remaining balance. Credit cards can be used for both online purchases and at

physical retailers. In bank account-based systems the funds move from the

payer’s account to the payee’s account within the books of financial institutions

providing payment services. The need for physical transportation of cash

has changed to transporting payment instructions for making the required

bookings.

With card, the machine reads information on the card and then enters a pin

(Personal Identification Number) that only you know. Entering your pin is good

security because nobody else should know what your pin is and will not be able

buy anything with your card. You should never give your pin to anybody. You

can set the pin on your card using the ATM-bank machine. If you are unsure

how to do this you can ask the bank teller and they will assist you.

Cash-based payments are manual and prone to inefficiencies and fraud.

Bank account based instruments require electronic transfers of payments to reap

all the benefits. With the development of information technology and the

wide adoption of computers, networks, mobile telephones and other e-based

solutions, methods for payment have moved to a new level of efficiency. In

particular, electronic applications offer possibilities to simplify and facilitate

payment procedures. Initiation, transportation and bookings of payments can

currently be made immediately to anywhere in the world. Payments can be

finalized without any manual or paper-based routines.

For all payment instruments, the payment service providers must be

connected to each other in order to facilitate the transportation of funds

between the different institutions. The instruments should be harmonized

and thus use inter-operable procedures. Be very careful when using a creditcard because it is very easy to spend too much and end up owing a lot of money!

http://tfig.unece.org/contents/payments-types.htm

Comprehension questions

1. Referring to the text, describe what happens with invoicing process.

2. Why do you think cash as one of the types of payment is the most

commonly used way for purchase?

3. What do you think make personal cheque to be seen as slow and

somewhat outdated?

4. How would you differentiate between personal cheque and debit card?

5. Evaluate the role of the development of information technology inregards to payment methods.

4.5.2 APPLICATION ACTIVITIES

Vocabulary, speaking, sentence writing and survey

1. Use a dictionary and thesaurus to look up the meanings of the words or

phrases below.

a. Invoice

b. Fraud

c. physical retailers

d. recoup

e. ATM

f. Cheque

g. Credit cards

h. Debit cards

2. Based on the words given above, write different grammatically correct

sentences.

3. Make a survey of different business tools or documents used by most

people in your community.

4. Debate on the advantages and disadvantages of using electronic bankingtools in business.

4.6 Describing entrepreneurship terminologies

Text: Entrepreneurship terms

Entrepreneurship is the process of designing, launching and running a new

business, which is often initially a small business. The people who create these

businesses are called entrepreneurs.

Entrepreneurship has been described as the “capacity and willingness to

develop, organize and manage a business venture along with any of its risks

to make a profit.” While definitions of entrepreneurship typically focus on the

launching and running of businesses, due to the high risks involved in launching

a start-up, a significant proportion of start-up businesses have to close due to

“lack of funding, bad business decisions, an economic crisis, lack of market

demand, or a combination of all of these.”

A broader definition of the term is sometimes used, especially in the field

of economics. In this usage, an Entrepreneur is an entity which has the ability

to find and act upon opportunities to translate inventions or technologies into

products and services: “The entrepreneur is able to recognize the commercial

potential of the invention and organize the capital, talent, and other resources

that turn an invention into a commercially viable innovation.” In this sense,

the term “Entrepreneurship” also captures innovative activities on the part of

established firms, in addition to similar activities on the part of new businesses.

The term “entrepreneur” is often conflated with the term “small business” or

used interchangeably with this term. While most entrepreneurial ventures

start out as a small business, not all small businesses are entrepreneurial in the

strict sense of the term. Many small businesses are sole proprietor operations

consisting solely of the owner or they have a small number of employees and

many of these small businesses offer an existing product, process or service

and they do not aim at growth.

In contrast, entrepreneurial ventures offer an innovative product, process or

service and the entrepreneur typically aims to scale up the company by adding

employees, seeking international sales and so on, a process which is financed

by venture capital and angel investments. In this way, the term “entrepreneur”

may be more closely associated with the term “startup”. Successful entrepreneurs

have the ability to lead a business in a positive direction by proper planning,

to adapt to changing environments and understand their own strengths and

weakness.

Theorists Frank Knight and Peter Drucker defined entrepreneurship in terms

of risk-taking. The entrepreneur is willing to put his or her career and financial

security on the line and take risks in the name of an idea, spending time as

well as capital on an uncertain venture. However, entrepreneurs often do not

believe that they have taken an enormous amount of risks because they do not

perceive the level of uncertainty to be as high as other people do.

The ability of entrepreneurs to work closely with and take advice from early

investors and other partners (i.e. their coachability) has long been considered

a critical factor in entrepreneurial success.

At the same time, economists have argued that entrepreneurs should not simply

act on all advice given to them, even when that advice comes from well-informed

sources, because entrepreneurs possess far deeper and richer local knowledge

about their own firm than any outsider. Indeed, measures of coachability are

not actually predictive of entrepreneurial success (e.g. measured as success

in subsequent funding rounds, acquisitions, pivots and firm survival). Indeed,

entrepreneurship is all about being to face failure manage failure and succeedafter failing.

https://en.wikipedia.org/wiki/Entrepreneurship

Comprehension questions

1. Explain how risks and profit are key things in regards with

entrepreneurship.

2. Give at least four reasons that can make a start-up business close.

3. What do you think are abilities one has to possess to be called an

entrepreneur?

4. How would you differentiate between entrepreneurial ventures and

small businesses?

5. Explain this statement: “entrepreneurship is all about being ready toface failure, manage failure and succeed after failing”

4.6.2 APPLICATION ACTIVITIES

Vocabulary, sentence writing and survey

1. Use a dictionary and thesaurus to look up the meanings of the words

or phrases below.

a. entrepreneurship

b. small business

c. business venture

d. risk

e. profit

f. running of businesses

g. lack of funding

h. coach ability

i. firm

j. scale up

k. sole proprietor

l. Uncertainty

m. Ventures

n. commercial potential

o. capital

p. economics

q. market demand

r. economic crisiss. lack of funding

4.7 Language structure: Phrasal Verbs

Phrasal verbs are multiple-word verbs. They are made up of the verb and one or

two particles. A particle can be either an adverb or a preposition. The majority

of phrasal verbs have a fixed meaning; they are idiomatic expressions. Often,

the meaning of a phrasal verb is not a sum of the meanings of the words in the

phrase. You cannot derive the meaning from the meaning of each individual

word. For example, keep up does not mean ‘keep in a high place’.

Examples

a) The assistant will only key in your bank account code number.

b) Jimmy trained up most of his workers.

c) A successful business man is one who pays off all his debts.

d) The loan from the bank helped us set up the shop.

e) Jimmy and I built up a joint business for five years.

f) We were advised to pay back our loan on time.

g) Mkami cashed out part of her earnings for personal use.

h) My brother and I set up a good business plan before starting ourcommercial activities.

Exercise

Fill in the blank space with the correct response:

1. We have decided ………. pursuing this course of action

i. Against ii. Out iii. Off

2. If we……… this option, our business will certainly fail.

i. write up ii. Rule out iii. Sort out

3. It will take a long time for the board to ………. This mess

i. Turn around ii. Put in iii. Sort out

4. Barack has a plan to ………. out the automotive industry

i. Give ii. Bail iii. Make

5. Why didn’t Tracy ………. up at the meeting

i. Turn ii. Come iii. Set

6. Our suppliers have ……….new offices outside the capital in a very ugly

industrial estate

i. Get up ii. Set up iii. Got up

7. Last month’s sales results ……….much better than expected.

i. Turned out ii. Turned on iii. Turned in

8. Don’t ………. till tomorrow what you can do today.

i. Put off ii. Put on iii. Put out

9. We had to ……….off the meeting because of the bad weather

i. Put ii. Call iii. Take

10. It’s not such a terrible thing! Don’t worry! ……….i. Cheer out ii. Laugh out iii. Cheer up

4.8 Spelling and pronunciation

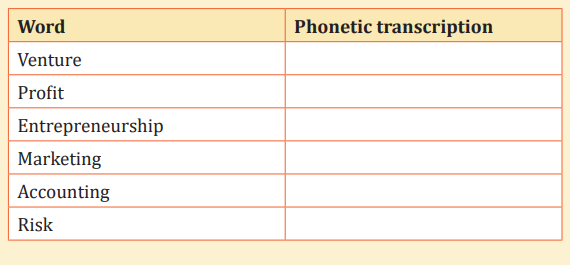

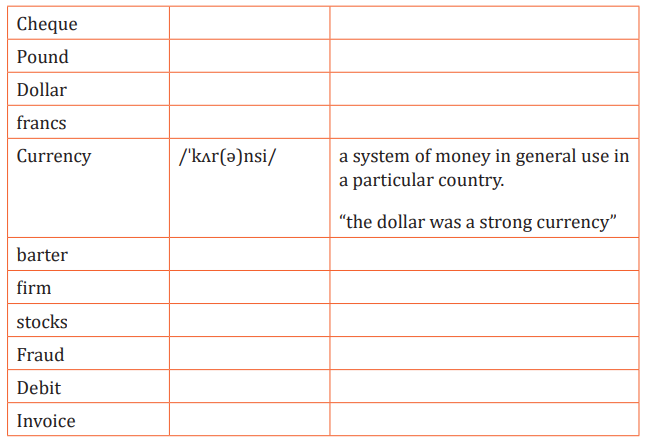

Use dictionaries and thesaurus to find the missing pronunciations and meaningsof words in the following table.

4.9 END UNIT ASSESSMENT

1. Write a 250 word composition about strategies to start a successful

business.

2. Construct one meaningful sentence with each of these phrasal verbs.

a) Count on b) Sell off c) Pay back d) Set up e) Cash out

f) Carry out g) Pay off h) Cash out i) Rule out j) Step in

3) Put in the correct phrasal verb in accordance with the meanings

shown in brackets.

a) Can you ……….. (think of an idea) a better idea.

b) I wish I hadn’t ……… (become responsible for) so much working

b) this industry.

c) She ………. (showed/mentioned) that all the shops would be closed.

d) I ………. (went to an event) for a dinner with my business partners.

e) Where did you ………. (become adult)?

f) I’d love to……….. (arrange/create) my own business.

g) I thought the conference was going to be boring as the operations

manager was absent, but it ………. (in the end we discovered) to be

quite useful for each of us.

h) Would anybody like to ……….. (become responsible for) this new

client ?

i) What’s ……….. (‘s happening) in the conference hall?

j) Can we ………. (arrange/create) another business meeting next

week?

4) Give the phonetic transcription of each word in the table below. Put thestress