UNIT 7: FORMS OF BUSINESS ORGANIZATIONS

Key unit competence: To be able to classify different forms of

businessesIntroductory Activity

Mukamana is one of the ladies involved in handicraft activities in her

area. She makes baskets, mats, hats, necklaces and other related

products. Of recent they had to register as individuals so as to obtain

a trading license but Mukamana and the other ladies face challenges

when buying raw materials for making their products. Marketing their

finished products is also difficult as they work individually. Sometimes

they travel to Kigali in search for customers to buy their products and

when they are away, they have to close their work places and open them

for work when they return from Kigali.

Questions;

1. What benefits would Mukamana and the other ladies enjoy if

they decided to do their handicraft work together?

2. Identify the advantages they also enjoy working individually

3. Using your knowledge of entrepreneurship, identify the

classification of enterprises to which they belong.

4. Explain the reasons why Mukamana and other ladies decided

to register their business.

5. Which advice would you give to Mukamana in order to benefit

more from their activities

7.1. Meaning of business organisation and classifications

of business organisations

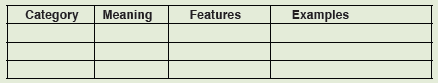

Activity7.1

Visit your Library or use the internet to research on the categories ofenterprises according to life span and fill in the table below:

Business is any economic activity done by any person or a group of persons

with the purpose of making profits. It involves the exchange of goods or

services for money. The main purpose of carrying out business is to make

profits.

A business organisation is a group of people who form a business together

in order to achieve a particular aim usually making profits.

An enterprise is a business or company set up with an aim of making profit.

An enterprise is basically set up to provide goods and services at a profit.

It’s a financially independent organism that produces marketable goods and

services with an aim of making profit.

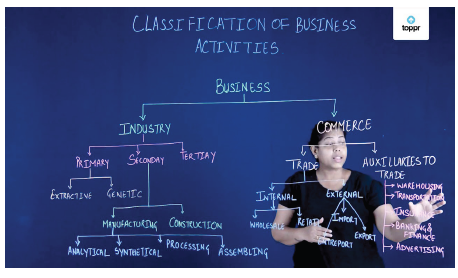

Business organisations can be classified according to sector of activities,

size, legal status and lifespan.

Business organizations are numerous and vary widely in the nature and

types of goods or services provided. Their classification can therefore take

many forms. The major bases upon which enterprises can be classified are

by:

• Sector or activities

• Size

• Legal status and

• Life span

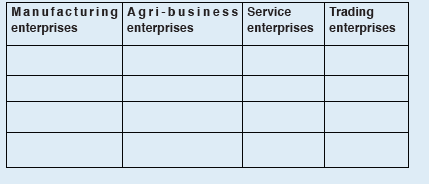

7.1.1. Classification of Enterprises According to Sector or

Activities

Enterprises can be classified on the basis of the goods they produce or

activities they do.

On this basis, they can be classified as follows;

1. Agri-business Enterprises

Agri-business enterprises are business enterprises involved in the growing

of crops and rearing of animals with the aim of making profits. Agri-business

is basically carried out with the aim of producing food, meat, milk, eggs and

wool for sale.

The term “agribusiness” is also used to describe businesses that are involved

in the marketing of farm products, such as warehouses, wholesalers,

processors, retailers and more.

There are different types of agri-businesses that are carried out in different

parts of the country. These include:

a. Crop production: This deals with the growing and selling of crops.

Crops that may be grown for sale include: coffee, tea, cotton, tobacco,

fruits and so on.

b. Livestock farming: This is the rearing of animals for sale. Animals

that are kept under livestock farming include: cattle for dairy or beef,goats, pigs, horses and sheep.

Cattle and pigs are examples of animals under livestock farming in Rwanda.

c. Poultry farming: This is the rearing of birds for sale. Birds rearedunder poultry farming include chicken, pigeons and ducks.

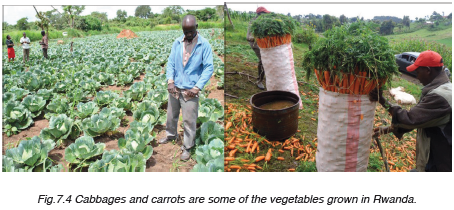

d. Horticulture: This is the growing of vegetables such as cabbages,

carrots, greens, and tomatoes for sale.

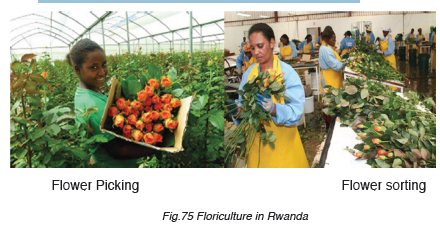

e. Floriculture: This is the growing of flowers for sale

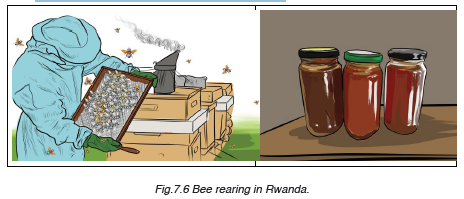

f. Apiculture: This is the rearing of bees.

2. Manufacturing/Secondary enterprises

Manufacturing process raw materials into finished goods. They take raw

materials from agri-business enterprises and process them into more

refined/finished goods or services that can be used by the final consumer.

The process of converting raw materials into finished products is known as

manufacturing or processing. Manufacturing enterprises can be categorized

as:

a. Textile manufacturing: These process clothing materials into

finished clothes.Examples of textile manufacturing enterprises in Rwanda include UTEXRWA.

b. Beverage manufacturing: These enterprises are involved in the

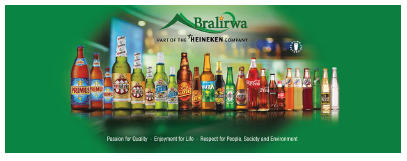

production of alcohols and soft drinks. Examples include: BRALIRWA,SKOL, INYANGE, COCA-COLA, SULFO and so on.

c. Agro-processing enterprises: These process agricultural products

into finished goods such as Agashya which processes fruits intojuice, Akabanga, Sorwatom, Gashumba posho and so on.

d. The extractive industry consists of any operations that remove

metals, minerals and aggregates from the earth. Examples of

extractive processes include: oil and gas extraction, mining, dredging

and quarrying. Examples of extractive enterprises in Rwanda include

Ruliba enterprises and Cemerwa.

3. Trading Enterprises

Trading enterprises are also known as commercial enterprises. They deal

in the buying and selling of goods. These enterprises are also involved indistribution facilitates. Trading enterprises are of two types

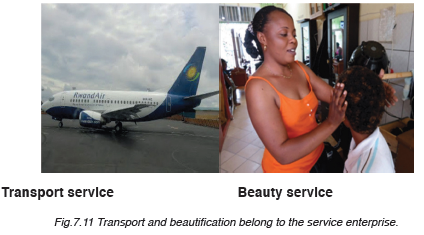

4. Service Enterprises

Service enterprises are business organizations that provide intangible

products or benefits that satisfy customer needs in exchange of an acceptable

compensation.

A business that specializes in some form of service provision usually needs

to have qualified staff members that are regularly available to provide

services to the clients in time of need. Examples of services that may be

rendered include; transport, warehousing, insurance, banking, beautification,communication and legal services.

7.1.2. Classification of Enterprises According to Size

1. Micro Business

Micro businesses are very small businesses which employ less than five

people. Examples of micro businesses include: hawkers, kiosks, groceries,roadside vendors and so on.

Features of micro businesses include:

a. Mainly use very simple technology or simple methods of production.

b. Mainly employ unskilled people.

c. They depend on skills of their owners who may be assisted by family

members.

d. Their sales are usually low in quantity and value because of limited

capital.

e. They don’t own permanent premises; some rent premises, while

others use temporary structures yet others are mobile.

f. They normally serve a small number of clients, so their market is

small.

2. Small Scale Business

Small scale businesses are businesses bigger than micro businesses.

Examples include: retail shops, restaurants, bookshops, bakeries and maizemills.

Features of small-scale businesses include: Small Scale businesses

a. Mainly use simple technology and produce goods mostly for the local

market.

b. They normally employ between 2 to 20 people.

c. Small Scale businesses are mainly started as sole proprietorships

and others as partnerships.

d. Their sales are relatively higher in quantity and value than micro

businesses.

e. They usually operate from fixed premises that are owned by theproprietor

3. Medium scale businesses

Medium scale businesses are bigger than small scale businesses. Examples

include: big bakeries, milk processing plants, packaging businesses, coffee

hulling factories and so on.

Features of medium scale businesses

a. They directly employ between 20-100 people some of whom are

skilled in specific areas of the business.

b. They are mainly registered as joint stock companies or operate as

partnerships.

c. Medium scale businesses mainly operate from large fixed premises

usually owned by the business and fitted with electricity, water and

telephone facilities.

d. They basically use sophisticated machinery and equipment operated

by skilled operators.

e. Their output is usually high and they are able to produce for the local

market and even export some surplus products.

4. Large-scale businesses

Large-scale businesses are business enterprises that require huge sums

of capital to start operation. Examples include: banks, telecommunication

companies, textiles, soft drinks manufacturers, cement factories and so on.

Features of large-scale businesses

• They directly employ over 100 people some of whom are highly skilled

personnel like managers, accountants, engineers, technicians.

• They are registered as joint stock companies. Some are registered as

joint ventures between private and government.

• They use a lot of equipment and sophisticated machinery; they use

some of the latest production methods.

• Large-scale businesses produce goods and provide services on largescale for the local and foreign markets.

7.1.3. Classification of Enterprises According to Life Span

Organizations can also be classified according to the length or period of time

they are designed or intended to be in existence. Some businesses may

be formed to last for a short time and come to an end. These are known as

temporary business enterprises.

There are also businesses which are formed to last as long as it is practically

possible. These are known as permanent business enterprises. Temporary

and permanent businesses are further explained below:

1. Temporary or short-term businesses

Temporary or short-term businesses are formed to provide goods or services

for a short period of time, after which they are dissolved, i.e. they cease to

exist.

The period of time of their existence may be determined either by their

owners or by the period they need to accomplish the task they are formed to do. For example;

i. A school may wish to construct a new staff house and advertise

inviting quotations from builders interested in undertaking the work.

In response, two technical people; a mason and a carpenter may

team together forming an enterprise where the mason builds the

house while the carpenter carries out the furnishing of the house

such as fixing doors, windows and wardrobes. At the end of the work

when the house is complete, they are paid for the work and their

relationship ends.

ii. Two students of a technical training institute coming from different

parts in Rwanda may find themselves together in a hostel in Kigali,

where they may have to stay for at least six months before they

return to their colleges to complete their courses. While in Kigali for

the six months, they may agree to form a business enterprise and do

business jointly for that period. At the end of the period, the enterprise

will be dissolved as they return to their colleges.

2. Permanent or long-term businesses

Permanent or long-term businesses are businesses formed to last for as

long as possible. There is no intention to bring it to an end within a specific

period nor is it imagined that the nature of activities the business is intended

to do have a time limit. Such businesses are referred to as permanent or

long-term businesses.

Enterprises can exist temporarily or permanently depending on their purposes

or what they are meant to serve. But sometimes businesses exist temporarily

when they fail to stand competition from others and end up closing.

7.1.4. According to legal status/ According to ownership

The following are the classifications of business organizations

1. According to legal status.

• Sole proprietorship

• Partnership

• Joint stock company

• Cooperative

• State owned enterprises (SEO) parastatals

Sole proprietorship/ sole trade business

Sole proprietorship is a business started and owned by one person. The

sole proprietor makes a decision alone, takes all the business profit and in

case of losses he/she suffers them alone. Eg: Restaurant, Internet cafes,

boutiques, etc…

Characteristics of a sole proprietorship

• The trader owns the business alone

• He/ she is responsible for financing the business alone

• Decision making is by one person

• Limited government interference

• The business is very flexible, it can be easily changed

• Sometimes employs family members

Merits of sole proprietorship

• The owner enjoys profits alone

• It requires little capital to start and operate

• Close or direct contact between the owner and the customers

• Easy coordination of activities

• Independence in decision making

• Easy to set up the business since there are no formal procedures

required.

• The sole proprietor is self-motivated

• The sole-trader has enough time for the business

• Minimizes cost through employing family members

• Etc…

Demerits of sole proprietorship

• Chances of expanding are minimal due to limited capital

• The business may be closed when the owner is sick or absent

• The owner suffers from long hours of work ever holidays.

• It is difficult to obtain loans from banks due to lack of collateral security

• Unlimited liability

• Poor competitive edge towards large businesses

• Limited capital

• No specialization since the owner deals with all items sold on very

small scale

• No separate legal entity

• Poor or lower technology used

• Personal attitudes affect the business

• The business may collapse when the owner dies.

Partnership

A partnership is a business unit formed by two or more individuals (ranging

from 2 to 20 people) with the aim of making profits.

Characteristics of a partnership

• It is owned by more than one person

• Profits are shared among partners,

• Capital is contributed by partners,

• Members are responsible for all business losses and debts/risks,

• Partnership deed is required before starting the partnership,

• The burden of running the business is shared by all partners,

• The admission of a new partner requires general consent.

Types of partners

1. According to Roles played:

• Active/acting/working or managing partners: Partners who

contribute capital and participate in daily running of the business. They

have unlimited liability.

• Dormant/ sleeping or financing partners: Partners who contribute

capital but do not participate in the daily running of the business. Their

liability is limited to their capital.

2. According to age:

• Minor partners: Partners who are below 18 years of age.

• Major partners: Partners above 18 years of age. They are liable for all

the business debts.

3. According to liability:

• Limited partners: Partners whose liability for the debts is limited to the

capital contributed.

• Unlimited partners/general partners: Those whose liability for the

debts is unlimited

4. According to capital contributed:

• Real partners: Partners who contribute capital, share profits and

losses and are responsible for the debts of the business.

• Quasi partners: Partners who do not contribute capital to the business

but allow their name to be used by the business. They are usually of

high social status like celebrities, lawyers, ministers, etc…

Advantages of a partnership business

• Encourages specialization and division of labour

• More capital is raised

• Continuity of the business

• Wise decisions are made

• More skills applied and there is specialization

• Increase in transparency and reduction in the misuse of resources

• Losses are shared by all partners.

Disadvantages of a partnership business

• There is no secrecy in the business because all the partners have

access to all business documents and records.

• The liability of the partners is unlimited

• Profits from the business are shared

• In case an active partner dies, the business may be greatly affected

• Misunderstandings can easily come up because partners have different

interests that may result into the dissolution (end) of the partnership.

• There is slow decision making since partners have to first consult each

other.

Joint stock companies

A joint stock company is at times called a limited liability company or simply

a company.

This is a type of business formed and owned by a group of people called

shareholders who have a separate legal identity. It is an artificial person

created by law with capital divided into transferable shares.

Characteristics of a joint stock company

• Legal personality: A company is an artificial person or entity recognized

by law. It can own a property, enter into contracts, sue or be sued in a

court of laws.

• Raises Capital through shares.

• Limited liability.

• Long life: The death or retirement of a shareholder cannot affect the

company. The company is separate from its members

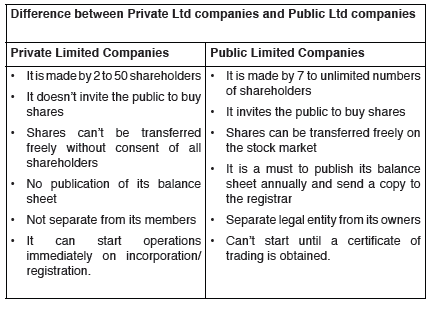

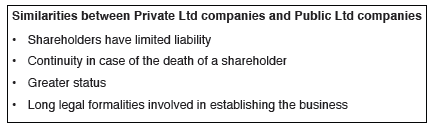

Types of joint stock companies

i. Statutory companies: These are companies which are owned by

the State and are created under parliament Act. The parliament

chooses and appoints the Board of Directors to run the business.

ii. Registered companies: These are formed by shareholders andregistered with the Registry of companies under the Company’s Act.

Advantages of a limited company

• Limited liability: The liability of each shareholder is limited.

• Expert management: It employs professional managers in different

fields.

• Boosting the economy of the country: Companies pay more taxes

• Transferability of shares: Members can transfer their shares freely

without any consent of other members in case of Public Ltd Company.

• Shareholders are safeguarded against frauds

• More job opportunities

• Higher profits

• Large scale production

• Probability to raise huge capital

• The company enjoys continuity even if all its members may die

• It is a separate legal entity. It can sue or be sued since it differs from

its owners.

Disadvantages of a limited company

• Long procedures to start: The Company requires many documents to

start operations

• Excessive government control

• Delays in decision making because of several management levels

• Lack of secrecy: It is necessary for companies to disclose and publish

all information about its operations to the public.

• Lack of motivation since the management is separate from ownership.

• Shareholders who have more shares influence/ dominate the decision

making.

• Risk of selling shares to rivals (competitor) companies: Competing

companies can buy shares within the company which may lead to

undermining the company and consequently to the collapse.

N.B: Private companies cannot engage in the business of Banking, Insurance,

Finance and Leasing. Investors wishing to engage in these businesses are

required to set up Public companies. For a Public limited company: A part

from the above documents, it requires a minimum initial share capital of a

hundred million Rwandan Francs (100,000,000Rwf).

The article and memorandum of association must be notarized. The cost of

notarizing is arrived by applying the following formula: (Rwf 800 X number of

pages X number of copies + Rwf 2500). One copy is retained at the notary’s

office, one at the registrar generals’ office at RDB and one at the office of

Official Gazette for publication. It takes 30 minutes for a public notary to

notarize the articles.

After all requirements are fulfilled and the registration fees have been

paid, the company is given a certificate of incorporation or certificate

of company registration that allows it to start operations if it is private Ltd

company, but a public Ltd company is required to seek an additional Public

corporation

iii. Parastatals/ state owned enterprises/public corporations

These are organizations that are fully nationalized (state owned). The money

used to form them is raised from tax payers. Some are run on commercial

basis while others give social services to the public. Those that carry out

economic activities like Rwanda Airlines, EWASA, etc…aim at making

reasonable profits.

Advantages of public corporations/ parastatals

• Basic goods are made available to the public at a subsidised cost e.g.

water and electricity

• Prices may be lower

• Creation of employment opportunities

• Source of income to the government.

• Economies of large-scale production are enjoyed by both the nation

and citizens

• They foster development e.g. construction of roads

Disadvantages of public corporations

• Dis-economies of scale occur because of poor administration

• Poor customer care

• There is limited competition. This may lead to production of poor

• quality goods and services

• Tax payers are always over burdened

• Mismanagement of funds/embezzlement/corruption is common

Co-operatives

A co-operative enterprise or a society is a form of business made by a group of

people who join efforts in the production or distribution of goods and services

with the purpose of sharing profits among themselves. A cooperative is an

organization owned by the people who work in it and share the profit or with

the purpose of benefiting its members.

Features of a co-operative society

• The association operates in a democratic way.

• Each member has rights as per memorandum of association.

• The start-up capital is solicited from members, who agree the

contribution of each one.

• The responsibility of each member is limited to the amount of share

capital contributed.

• All members have one vote at important meetings.

• Members can contribute to the running of the business.

Types of co-operatives

• Consumer co-operatives: These enable consumers buy goods and

services at a fair cost.

• Producer co-operatives: These aim at collectively marketing their

products at competitive prices.

• Savings and Credit co-operatives (SACCOs): These carry out savings

for their members and also provide cheap credit facilities to them eg:

Umwalimu SACCO

• Transport co-operatives

• Workers co-operatives

Principles of cooperative societies

• Open and voluntary membership: Any person above 18 years can be

a member if he/she fulfills regulations governing the society.

• Democratic administration: Leadership is based on one person one

vote regardless of the number of shares one holds.

• Payment of limited capital: Each member contributes a minimum

share capital hat is agreed upon.

• Dividend payment: Profits made are divided among members as

dividends.

• Promotion of education to all members: Every member acquires new

skills through taking part in daily business operations.

Problems faced by co-operative societies in Rwanda

• Limited capital

• Limited securities

• Poor administration

• Embezzlement of funds

• Lack of interest of members:

• Disputes and misunderstanding between members

• Nepotism / Tribalism

• High competition from similar co-operatives

• Lack of government support

• Government interference

• Mismanagement of funds

• Lack of storage facilities

• Poor transport facilities

Application activity 7.1

Give examples of enterprises from your community and Rwanda at largeby filling in the table below.

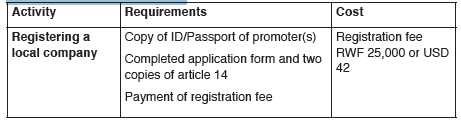

7.2. Registering a business in Rwanda

Activity7.2

1. Suppose you intend to start a small business in your vacation

out of your pocket money savings that you have accumulated

over time suggest the major steps that you are to follow before

starting

You can register your business Online or at the office of the Registrar General

which is a department within the RDB located in Kigali, the capital city of

Rwanda. The registration process has been covered after each business

form.

7.2.1. Business Registration Process

For Sole Proprietorship business, an entrepreneur can start the business

with few legal procedures. There are no formal procedures such as registration

and document, an entrepreneur only pays a trading license and starts the

business. But if he/she needs to register the business in the commercial

registry, he/she is required to submit an application letter indicating;

• Personal names, place and date of birth, domicile and residence,

nationality, sex;

• Name of the spouse in case he/she is married; and their matrimonial

regime

• Consent of the spouse if their regime is based on joint ownership;

• Name of the business and its trademark if applicable;

• Commercial activities to be carried out;

• Headquarters of the business enterprise.

Partnership business may register with the registrar of companies. In this

case, they will be required to submit partnership deed agreement (containing

information discussed earlier in this unit). In the absence of an agreement

between partners, the partnership cannot be registered.

Joint Stock Company/ Limited Liability Company, or a Cooperative, the

following steps are normally followed:

• The promoters prepare a memorandum of association which outlines

the activities the firm is to be engaged in, its objectives and its general

organization.

• Preparing the Articles of association of the company that lays down

the rules and regulations which will govern the internal organization of

the company.

• A minimum initial share capital for companies is required. For Limited

Liability Company it is 500,000Rwf, for Public limited company it is

100,000,000Rwf.

• The registration can be processed by the promoters themselves or

through a lawyer.

• An application form is filled and deposited with the records assistant in

the registrar’s office.

A search will be conducted to confirm that firm uses similar names as those

chosen by the promoters of the company.

The application forms are then passed on to the registrar of companies for

endorsement and approval.

If all the required documents are in order; the registrar of companies will

issue a Certificate of Incorporation. This document allows the owners to

commence the business. If it is a public company, it is required to get a

Certificate of Trading in order to commence operations. It puts the company

into existence and the company becomes a separate legal entity.

7.2.2. Registering a Non-Governmental Organization (NGO) in

Rwanda

1. Local Non-Governmental Organization

A local NGO is required to get an approval from the district where it plans

to undertake its activities, provide its constitution as well as register with

Ministry of Local Government (MINALOC).

2. International Non-Governmental Organization

An INGO is registered by department of Immigration and Emigration. The

applicant makes an application letter addressed to Director General of

Immigration and Emigration and attaches;

• A detailed action plan.

• A memo indicating the source of funding of INGO

• Its annual budget

• Evidence of collaboration of the district where it operates

• Recommendation letter from the line Ministry (ies)

• Articles of INGO

• A memo linking relationship between its program with Community

Development Plan (CDP)

• A correctly filled inventory form

• Summary of business Registration process in Rwanda

• To register a local enterprise or a foreign subsidiary, RDB

provides a quick and efficient registration service allowing

you to have your business incorporated within 24hours.

The process ends simultaneously by obtaining the certificate of

incorporation (business registration), Tax Identification Number (tax

registration) and the Social Security Registration for Employee Pension

Submission.

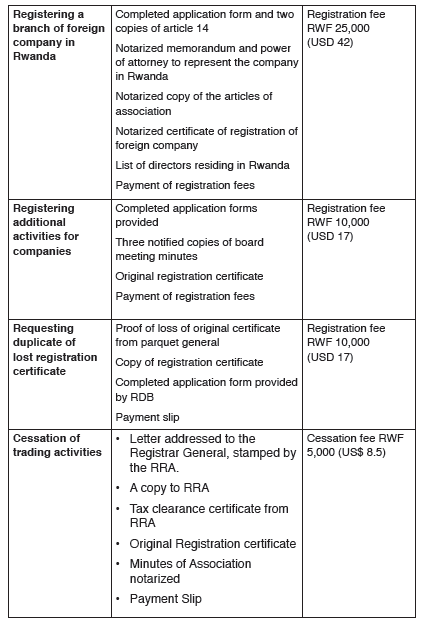

Take a look on the table below to see how you can start, add or ceasebusiness activities in Rwanda.

Application activity 7.2

1. Discuss the various procedures followed in registering a domestic

company following Rwandan setting today.

7.3. Benefits of registering and consequences of not

registering a business

Activity7.3

Discuss the importance of registering a business and also suggest

possible dangers of operating a business that is not registered

Benefits of registering a business

• It enables the business to acquire a trade license and a permit to

commence its activities

• After registration, a business will be entitled to protection by the

country’s business legal framework

• Obtaining licenses and permits

• It helps a business to protect its brand: Trademarks are patented.

• It safeguards the business name.

• The business has guaranteed continuity as a result of registration

• The business is versatile.

• It avoids fines and penalties form the government

Consequences of not registering the business

• Being fined due to not paying tax by the government

• Suspension of operations: The government may close down such a

business

• Inability to issue official documents, invoices to suppliers and other

partners, …

• Operating outside official system stipulated by the government

• Limitation to financial services. It’s hard to access funds from financial

institutions for investment

Application activity 7.3

Read the case study. Then answer the questions that follow.

Register your business – it is the law Government has threatened

to close all unregistered businesses as it steps up efforts to make

all business operations in the country formal and to increase its tax

revenue base. The move is also aimed at enforcing the Company

Act, which was passed in April 2009. This requires all companies to

register with the Registrar of Companies at the Rwanda Development

Board (RDB). The government introduced a two-year grace period

to allow all unregistered businesses to register. Businesses that had

registered using the old law also needed to re-register. The law was

passed as government wants to encourage small businesses to grow.

To implement the law, the Ministry of Trade and Industry embarked on

a sensitization (learning) process where the relevance of this law was

explained to the business community.

Question: Identify the consequences of running an unregistered

business in Rwanda today.

7.4. Factors considered in choosing people to work with in

a business organization

Smart business owners make hiring top talent a priority. After all, a company’s

productivity and profitability depend on the quality of its workers. When

reviewing candidates, business owners and managers consider a variety

of factors including academic credentials, work experience, personality and

skills as follows.

Activity7.3

The job market these days is becoming competitive. As a student of

entrepreneurship suggest the criteria considered while choosing people

to work in an organization

Factors considered when choosing people to work in an organization

include the following

Education and Credentials

The education background of the employee is important, some of the

positions they advertise might not require any advanced education, but

the possession of a high school diploma demonstrates the ability and work

contributed by the individual to complete an educational program.

Work Experience

Work experience might be one of the most important considerations for

particular jobs. Experience in particular areas such as answering busy

telephone lines or handling accounts, for example, can be essential for

specific staff roles. For other positions, work experience might not be

absolutely necessary, but a strong work background is always a good thing

as it exemplifies a good work ethic.

Possessing Self-Confidence

An applicant who approaches with a confident attitude makes a good first impression.

This is also probably the way this person will approach your clients. An applicant

who exudes self-confidence believes in himself/herself. S/he will believe s/he can

handle the job and exceed expectations.

Personality Compatibility and Warmth

Warmth and smiles indicate the type of employee will work well with others,

including your clientele. Personality is one of the most important traits of a

customer-oriented employee. Of course, an amenable person is one who

will also work well others.

Specific Skills Sets. The specific skills set of potential employees is a

critical factor e.g. computer skills

The age of the employee, some jobs usually consider a certain age bracket

as a determinant for recruitment e.g. recruitment into army or police requires

applicants to be less than 25yrs of age

Nationality. some jobs may require nationals while others prefer nonnationals

(foreigners)

The level of education of the employee e.g. Master’s degree or Doctorate

depending on the job, most prominent companies prefer employees with at

least a master’s degree for a highly paying job e.g. marketing manager MTN

Rwanda

The marital status of the employee. Some organizations prefer workers

who are married while others prefer those still single.

The sex of employee, sometimes organizations may prefer to employ

females than males or males than females in relation to the type of job

The physical ability of workers. Some jobs that require energy to perform

may require people who are physically strong as a requirement

The cost of the employee in terms of salary and training needs etc.

The size of the organization that is recruiting workers in terms of ability to

pay them

The level of confidence, personal value and esteem

The health status of the employee

Application activity 7.4

You have just started a small business in your holidays of selling airtime

and you wish to employ someone to help you when at school.

a. Suggest the factors you would put forward to recruit a worker

in your business?

b. Why did you decide to choose those factors amongst others?

Skills lab 7

Use business classification information and classify the projects the business

club is running or plan to run, identify procedures of registering each business

project basing on the class it falls into, Draw plans to register the business

with the right office and discuss how the business club can find opportunities

for each classification in terms of resources, technical capacity building to

make products or services, market partnerships among others.

End unit 7 assessment

Case study: Different forms of business organization/ enterprises

Read the case study below and answer the questions that follow:

Jean Paul Semana is a friend you have known for many years. He is a

computer expert. He has been working for a large computer supplies

company in Kigali for many years. The company supplies and services

computers. Most people and organizations are experiencing technical

problems with their computers, take them to the company where Jean

Paul is assigned to service the computers. He is now well known by

many people for his skills in handling technical problems relating to

computer breakdowns.

He informs you that he has been thinking of starting a business

enterprise dealing with servicing and maintenance of computers. He

has saved money for this purpose, but the amount is not quite sufficient

for the type of business he would like to start. However, the money is

sufficient to start a small size business.

He also tells you that he has two uncles who are very rich. Both have

a lot of money and have expressed their willingness to invest in the

business enterprise with him.

Semana would like to get your advice on various options of the type of

enterprise to invest in.

a. Advise him on the forms of enterprises he can choose citing

examples.

b. Analyze the advantages of each form of enterprise.c. Analyze the disadvantages of each for of enterprise.