UNIT 13 TRADE AND COMMERCE IN THE WORLD

UNIT 13: TRADE AND COMMERCE IN THE WORLD

Key Unit Competency:

By the end of this unit, I should be able to evaluate the impact of trade and commerce

on the sustainable development of different countries in the world.

Introductory activity:

For different reasons, many countries come together and create regional

bloc such as European Union or East African Community. Conduct your own

research and answer the following questions.1. Identify different regional integrations operating with Rwanda.13.1. Definition, types of trade and factors influencing international

2. What advantages does a country benefit from being a member of atrading bloc?

trade.

Learning activity13.1

Madame Kayitesi buys goods in large quantities from Inyange Industry. She

owns one of the biggest shops in her village. Her products are bought by the

local people and she takes some to the nearest markets in her district. Some

of the products made by Inyange industry are exported overseas.

1. Identify the major imports of Rwanda

2. Mention the types of trade indicated in the passage.

3. Explain the factors influencing trade between Inyange industry and

overseas countries.

13.1.1. Definition of key terms

Trade: Is the activity of buying and selling or exchange of goods and services within

a country or between countries. It also occurs between two individuals through the

exchange. Trade is part of commerce.

Commerce: Is the activity of buying and selling of goods and services, especially

on a large scale or quantity. It goes along with the activities such as insurance,

transportation, warehousing, advertising that completes that exchange. Commerce

stands as a wide system that includes legal, economic, political, social, cultural and

technological systems that are in operation in any country or internationally.

Trade is simply the exchange of commodities, and this can take place at many

levels. The earliest form of trade was probably “barter trade” in which one type of

commodity was exchanged for another of equal value.

The present trade is based on the exchange of goods and services for money. It

includes the following forms:

a. Internal trade: This is the exchange of commodities within a country. It

is also known as domestic trade. Traders normally need to exchange what

they have with what they don’t have. It includes:

• Whole sale

This occurs when traders buy goods in bulky from both the manufacturers and

importers. They then break them into smaller units and sell them to kiosk owners,

hawkers, shopkeepers and supermarket;

• Retail trade

This is where traders buy goods from the wholesalers and sell them in detail to

the individual customers.

b. International trade: This type of trade occurs between different nations of

the world, on a global scale. Its rationale lies in the fact that no country can

produce everything that it needs. It therefore has to acquire what it cannot

produce from others through trade. It involves:

• Bilateral trade: it is a trade between two countries.

• Multilateral trade: it is a trade between many countries, through the exchanging

imports where goods and services bought and brought into the country, and

exports where goods and services are transferred to another country for sale.

13.1.2. Factors influencing international trade

The type and volume of trade that takes place at any level in any place is influenced

by a number of factors. The most important factors are:

• Capital: This is the greatest single factor influencing trade. Money is the engine

that runs trade. Traders require capital to establish their businesses, purchase

their wares and transport the commodities. Where capital is inadequate the

volume of trade will also be low.

• Demand and supply: For trade to take place there must be sufficient demand

and good chain of supply of the items.

• Transport and communication: Trade depends highly on efficient means of

transport and communication. For example, manufactured goods and other

trade items need to be transported to the market. Traders also need to move

from one place to another to effect various trade related transactions. Traders

have to further communicate while placing orders and while establishing the

market situation.

• Trade barriers: This includes the quota system for international trade, where

a country may impose limits on imports and exports. They also include tariffs

and duties levied on goods, which if increased may discourage the importation

and exportation of some goods.

• Government policy: This is where the government influences trade in certain

commodities through taxation. For example, the government levies heavy

taxes on certain goods such as cigarettes and alcohol.

• Creation of trading blocs: The creation of regional common trading markets

enhances trade due to increased cooperation between the member countries.

Trade is further promoted because the market is usually expanded.

• Political climate of a country: Political problems such as wars affect both

internal and external trade because wars discourage foreign investors and

at times destroy industries; whereas good diplomatic relationship between

countries encourages foreign investments.

• Population factors: population size, structure, distribution and the diversity

between peoples affect the types of goods traded and the volume of

international trade.

• Differences in natural resources: Natural resources are not evenly distributed in

the world. This is mainly due to differences in climate, sols, relief and geologicalfactors.

Application Activity 13.1:

Discuss how the following factors influence international trade in Rwanda:

1. Regional integration

2. Government policy3. Population

13.2. Causes of low levels of international trade in Developing Countries

and importance of international trade in the development

Learning activity 13.2

Most of the industrial products used in developing countries are imported

from Europe, USA, ASIA etc. African countries also export agricultural

products to the rest of the world but the gap between imports and exports

in less developed countries still remains big.

1. Identify the products exported by European countries in Africa.

2. Outline the major exports of Rwanda to the developed countries.

3. Explain the causes of this inequality between exports and imports.

13.2.1. Causes of low levels of international trade in Developing Countries

The following are the major factors causing the low levels of international trade in

Developing Countries:• Access to foreign markets: The foreign markets are dominated by the goods

and services from developed countries because they have better quality and

produce more quantity of goods.

• Inadequate and insufficient domestic supply on the international market: this

causes the increase in prices and this affects the final consumers.

• Most of the developing countries export unprocessed products due to

shortage of industries or low level of technology. These unprocessed products

also called raw materials are undervalued on international markets.

• Most of the developing countries and other low-income countries export bulk

products such as horticulture products, fruits, vegetables and animal products.

These perishable products account the risks to be damaged in transport

process.

• Developing countries have also been concerned with the growing importance

of free trade areas and customs unions in recent years, which now cover

virtually all their major export markets, including Europe and North America

since most of the major regional trading arrangements do not include them,

• Implications of anti-competitive practices by private enterprises in restricting

the market access of developing countries to industrialized countries.

• Quota policy on the international market is negotiated only among the

developed countries and developing countries must follow their resolutions.

• Capital inflows: the growing constraints on foreign aid and the difficulties in

attracting increased foreign private financing and investment are affecting thegrowth prospects of countries lagging behind in global integration.

• Financial liberalization in developing countries has mainly comprised the13.2.2. Importance of international trade in development

reduction or removal of allocative controls over interest rates and lending, the

introduction of market-based techniques of monetary control and the easingof entry restrictions on private capital

International trade helps in development as follows:• Foreign trade and economic development: Foreign trade plays a very important

role in the economic development of any country. Therefore, economic

development of a country depends in part on foreign trade.

• Foreign exchange earnings: Foreign trade provides foreign exchange which

can be used to reduce poverty. The foreign earnings are obtained through

exportation of products especially agricultural products by developing

countries.

• Market expansion: The demand factor plays very important role in increasing

the production of any country. The foreign trade contributes to expand the

market and encourages producers.

• Foreign investment: Besides the local investment, foreign trade encourages

investors to invest in those countries where there is a shortage of investment.

• Increase in national income: Foreign trade increases the scale of production

and national income of a country. To meet the foreign demand, we increase

the production on large scale so Gross National Product (GNP) also increases.

• Price stability: Foreign trade helps to bring stability in price level. All goods

which are not sufficient, have high prices. Those goods are imported and

goods which are surplus can be exported. This stops fluctuation in prices.

• Specialization: There is a difference in the quality and quantity of various factors

of production in different countries. Each country adopts the specialization in

the production of specific commodities, in which it has comparative advantage.

So all trading countries enjoy profit through international trade.

• To improve quality of local products: Foreign trade helps to improve quality of

local products and extends market through changes in demand and supply as

foreign trade can create competition with the rest of the world. The country

competes with the foreign producers in foreign trade so it improves the quality

and reduces the cost of production.

• Import of capital goods and technology: The inflow of capital goods and

technology in the less developed countries has increased the rate of economic

development, and this is due to foreign trade. Foreign trade is also responsible

for spreading of knowledge and learning from developed countries to underdeveloped countries.

• Better understanding: Foreign trade provides an opportunity to the people ofApplication activity13.2:

different countries to meet, discuss, and exchange views and ideas related to

their social, economic and political problems.1. Assess the role of international trade in the economic development of13.3. Major financial centers and trading blocs of the world

Rwanda

2. Suggest ways of reducing the gap between low exports and highimports in developing countries.

Learning activity 13.31. Make research and explain the objectives of International Monetary Fund13.3.1. Major financial centers

(IMF).

2. Using specific examples, explain how the trading blocs improve theeconomic development of member countries.

A financial centre is a location that is home to a cluster of nationally or internationallya. The main global financial centres

significant financial services providers such as banks, investment managers, or

stock exchanges. A prominent financial centre can be described as an International

Financial Centre (IFC) or a global financial centre and is often also a global city.

Today, the two largest financial centres of the world in terms of volumes of capital

circulating are London and New York. In 2017, the top ten world financial centre

were London, New York City, Hong Kong, Singapore, Tokyo, Shanghai, Toronto,

Sydney, Zürich and Beijing.

The power of a financial centre depends on its history, role and significance in

serving national, regional and international financial activity. There are three prime

factors for success as a financial centre: a pool of money to lend or invest; a decent

legal framework; and high-quality human resources. The big financial centres alsohost the world biggest financial institutions like IMF, World Bank, etc.

• Amsterdam. Amsterdam is well known for the size of its pension fund market. It

is also a centre for banking and trading activities. Amsterdam was a prominent

financial centre in Europe in the 17th and 18th centuries and several of the

innovations developed there were transported to London.

• Chicago. The Illinois city has the «world’s largest [exchange-traded] derivatives

market» Dubai. The second largest emirate in the United Arab Emirates is a

growing centre for finance in the Middle East, including for Islamic finance.

• Dublin. Dublin, in Ireland, is well known because of its International Financial

Services Centre, “IFSC”). It is a specialized financial services centre with a focus

on fund administration and fund domiciling. It also conducts activities such as

securitization and aircraft leasing.

• Frankfurt. Frankfurt attracts many foreign banks which maintain offices in the

city.

• Hong Kong. As a financial centre, Hong Kong has strong links with London and

New York City. It developed its financial services industry. Most of the world’s

100 largest banks have a presence in the city. Hong Kong is a leading location

for initial public offerings, competing with New York City.

• London. London has been a leading international financial centre since the

19th century, acting as a centre of lending and investment around the world.

London continues to maintain a leading position as a financial centre in the

21st century, and maintains the largest trade surplus in financial services

around the world. London is the largest centre for derivatives markets,

foreign exchange markets, money markets, issuance of international debt

securities, international insurance, trading in gold, silver and base metals and

international bank lending. London benefits from its position between the Asia

and U.S. time zones, and has benefited from its location within the European

Union.

• Luxembourg. Luxembourg is a specialized financial services centre that is the

largest location for investment fund domiciliation in Europe, and second in

the world after the United States. Three of the largest Chinese banks have their

European hub in Luxembourg (ICBC, Bank of China, China Construction Bank).

• Madrid. Madrid is the headquarters to the Spanish company Bolsas y Mercados

Españoles, which owns the four stock exchanges in Spain, the largest being

the Bolsa de Madrid. As a financial centre, Madrid has extensive links with

Latin America and acts as a gateway for many Latin American financial firms to

access the EU banking and financial markets

• Milan. The city is Italy’s main centre of banking and finance.

• New York City. Since the middle of the 20th century, New York City, represented

by Wall Street, has been described as a leading financial centre. New York

City remains the largest centre for trading in public equity and debt capital

markets, driven in part by the size and financial development of the U.S.

economy. The NYSE and NASDAQ are the two largest stock exchanges in the

world. Several investment banks and investment managers and the three

major global credit rating agencies which are Standard and Poor’s, Moody’s

Investor Service, and Fitch Ratings, have their headquarters in New York City.

• Paris. It is home to the Banque de France and the European Securities and

Markets Authority. Paris has been a major financial centre since the 19th

century. The European Banking Authority is also moving to Paris in March 2019.

• Seoul. South Korea’s capital has developed significantly as a financial centre

since the late-2000s recession. Seoul has continued to build office space with

the completion of the International Financial Center Seoul in 2013. It ranked

7th in the 2015 Global Financial Centres Index, recording the highest growth

in rating among the top ten cities.

• Shanghai. This is one of Chinese and world financial centre. It competes with

New York and London. China is generating tremendous new capital and stateowned

companies in places like Shanghai.

• Singapore. With its strong links with London,[82] Singapore has developed into

the Asia region’s largest centre for foreign exchange and commodity trading,

as well as a growing wealth management hub. It is one of the main centres for

fixed income trading in Asia.

• Sydney. Australia’s most populous city is a financial and business services hub

not only for Australia but for the Asia-Pacific region. Sydney is home to two

of Australia’s four largest banks, the Commonwealth Bank of Australia and

Westpac Banking Corporation and to the Australian Securities Exchange.

• Tokyo. Tokyo emerged as a major financial centre in the 1980s as the Japanese

economy became one of the largest in the world. As a financial centre, Tokyo

has good links with New York City and London.

• Toronto. The city is a leading market for Canada’s largest financial institutions

and large insurance companies.

• Zurich. Zurich is a significant center for banking, asset management including

provision of alternative investment products, and insurance. Switzerland is not

a member of the European Union, then Zurich is not directly subject to EU

regulation.

• Other emerging financial centers are cities such as Mumbai, São Paulo, Mexico

City and Johannesburg, etc.

b. Examples of the financial institutions that make a city a powerful financial

center

The International Monetary Fund

The International Monetary Fund (IMF) was created in1945 and has Washington D.C.

as the Headquarter. It began with 45 members.

The aims of IMF are to promote international economic cooperation and international

trade, strives to help stabilize exchange rates among member countries. IMF takes

a lead in advising member countries and ultimately helps to avoid financial crises.

This includes developing standards that member countries follow, such as providing

adequate foreign exchange reserves in good times to help provide for increased

spending during recessions. The IMF also provides loans to help its members tackle

balance of payments problems, stabilize their economies and restore sustainable

economic growth.

The World Bank

The World Bank or the International Bank for Reconstruction and Development

(IBRD) was founded in 1944. Its headquarter is in Washington D.C.

It was set up with the aim of reconstructing the war-affected economies of Europe

(during the Second World War) and assisting in the development of the less

developed countries of the world.

Today, the World Bank is more concerned with the development of member

countries especially the developing ones. It gives loans for the purchase of capital

goods necessary for development. In so doing, the World Bank concentrates on

loans for projects that are clearly profitable. The World Bank’s current focus is onachievement of the Millennium Development Goals (MDGs)

13.3.2. Trading blocs and regional integration

A trade bloc is a type of inter-governmental agreement, often part of a regional

inter-governmental organization, where regional barriers to trade,

(tariffs and nontariffs barriers)

are reduced or eliminated among the member states.

a. Advantages of trading blocs and regional integration

• Foreign direct investment: An increase in foreign direct investment results

from trade blocs and benefits the economies of participating nations. Larger

markets are created, resulting in lower costs to manufacture products locally.

• Economies of scale: The larger markets created via trading blocs permit

economies of scale. The average cost of production is decreased because mass

production is allowed.

• Competition: Trade blocs bring manufacturers in numerous countries

closer together, resulting in greater competition. Accordingly, the increased

competition promotes greater efficiency within firms. Generally, increased

competition leads to increased volume of trade.

• Trade effects: Trade blocs eliminate tariffs, thus driving the cost of imports down.

As a result, demand changes and consumers make purchases based on the

Geography Senior Six Student Book 365

lowest prices, allowing firms with a competitive advantage in production to

thrive. All these advantages translate into greater economic strength for the

block.

• Market efficiency: The increased consumption experienced with changes in

demand combines with a greater amount of products being manufactured to

result in an efficient market.

• Increased regional specialization.

• Strengthens political unity among member states.

b. Disadvantages of trading blocs and regional integration

Limited fiscal capabilities: Some regional integration agreements that involve

the creation of a common currency most notably the European Union’s lead to

fiscal crises. Without regional integration, individual countries can control the

supply of their own currency to suit the nation’s economic conditions. When a

higher entity controls that currency -- as is the case with the EU’s Euro, individual

countries have no power to vary the strength of their currency when their

economy weakens.

Cultural centralization: Regional integration has a final non-economic

disadvantage. Especially strong integration like the European Union can lead

to the loss of unique minority cultures within a region. The European Union

has a series of languages that it deems to be the official languages of the EU

government. These do not include minority languages spoken by remote

communities in Europe.

Loss of sovereignty: A trading bloc, particularly when it is coupled with a political

union, is likely to lead to at least partial loss of sovereignty for its participants

Concessions: No country wants to let foreign firms gain domestic market share

at the expense of local companies without getting something in return. Any

country that wants to join a trading bloc must be prepared to make concessions.

Interdependence: Because trading blocs increase trade among member

countries, a natural disaster, conflict or revolution may have severe consequences

for the economies of all participating countries.

c. Factors affecting regional integration• Homogeneity of the goods produced among the member states can hinderd. Problems affecting international trade

trade. If countries produce the same goods, there is no need to trade amongst

each other. This situation is seen among East African countries which produce

almost the same agricultural products such as maize, sugar etc. this undermines

trade among them.

• Some countries may have experienced a shortage in foreign exchange. They

may not have enough foreign money to trade and buy from other countries.

This may be because they do not earn enough from their exports.

• Countries may have different ideologies. They may not be comfortable with

their cultures or opinions. This makes it difficult to synchronize / harmonize

their economic strategies.

• In the trading blocs, trade is undermined by poor transport and communication.

This is experienced mainly in developing countries. This makes it difficult to

trade and move from one country to another.

• For business to flourish there must be a peaceful environment. Therefore, if a

member state is experiencing political instability, it will affect trading relations

in the whole bloc. This undermines trade among the member states.

• Some countries have trading partners who are not in the trading bloc. They

prefer to trade with them rather than the member states of the bloc. These

outside partner could be former colonial master which member states have

closer trading ties with.

• Member states could experience lack of funds or capital. They are unable to

pay for goods ordered. This interferes with the functionality of the trading bloc.

• Member states may not use the same language. There will be a language

barrier among them making it difficult to communicate. This will make trading

in the block more difficult and hinder economic integration.

• Countries in the bloc may have different levels of development. Countries

that are more developed will benefit more from the common market. The less

developed countries will feel unfair trading practices against them.

• In trading blocs, especially Africa, the member countries sell unprocessed

primary goods. This limits trade because there are limited manufactured

goods in the market.

• There is interference from developed countries that are not in the trading bloc.

They impose conditions that limit trade among the member states. This willundermine the union.

Trade, like other human activities faces some problems which may occur at regional

as well as international level. They could be economic, social, political, environmental

and cultural in nature.

• Protectionisms: There are ways of implementing a protectionist policy, and

every country in the world protects some of its goods.

• Tariffs: The effect of high tariffs is to make imported goods equally or more

expensive than home-produced articles.

• Quotas: If tariffs are ineffective in halting the inflow of cheap foreign goods,

countries may resort to imposition of quotas. By a quota system a country

refuses to import more than a specified quantity of a certain commodity.

• Subsidies: The government of a country may pay subsidies or give tax relief, in

order to stabilize home prices. This involves assistance to home industry rather

than penalization of foreign producers.

• Trading blocs: In recent times trade has been modified by the formation of

economic unions such as EEC (European Economic Community). Though

tariffs are broken down between the member nations and there is greater flow

of the trade amongst them.

e. Possible solutions to problems of international trade.

• Joining and enforcing trading blocs like EAC, EEC.

• Common market or grouping which not only reduces tariffs and other

restrictions within the group but at the same time raises tariff barriers against

outsiders.

• Construction and rehabilitation of infrastructure.

• Political negotiations and discussions to reduce and ultimately end political

instability and insecurity so that a favorable trading atmosphere is created.

• Improving the quality of manufactured goods so that they are attractive and

competitive on the international market.

• Foreign investment to diversify domestic economy within countries. This may

overcome the problem of similarity of goods on the market.

• Tariffs: The effect of high tariffs is to make imported goods equally or more

expensive than home-produced articles.

• Quotas: If tariffs are ineffective in halting the inflow of cheap foreign goods,

countries may resort to imposition of quotas. By a quota system a country

refuses to import more than a specified quantity of a certain commodity.

• Subsidies: The government of a country may pay subsidies or give tax relief, in

order to stabilize home prices. This involves assistance to home industry rather

than penalization of foreign producers.

• Trading blocs: In recent times trade has been modified by the formation of

economic unions such as EEC (European Economic Community). Though

tariffs are broken down between the member nations and there is greater flow

of the trade amongst them.

e. Possible solutions to problems of international trade.

• Joining and enforcing trading blocs like EAC, EEC.

• Common market or grouping which not only reduces tariffs and other

restrictions within the group but at the same time raises tariff barriers against

outsiders.

• Construction and rehabilitation of infrastructure.

• Political negotiations and discussions to reduce and ultimately end political

instability and insecurity so that a favorable trading atmosphere is created.

• Improving the quality of manufactured goods so that they are attractive and

competitive on the international market.

• Foreign investment to diversify domestic economy within countries. This mayovercome the problem of similarity of goods on the market.

Application activity 13.3

a. Discuss why should Rwanda make trade with other countries.

b. Analyse the challenges faced by Rwanda in carrying out trade with other

countries.

c. “Gains from international trade are mostly beneficial to rich countries”.

Discuss.

d. Suggest what the city of Kigali can do to become an international financial

center?

13.4. Case studies

13.4.1. Regional integration

Learning Activity13.4:

1. Describe the major objectives of EAC.

2. Analyse the challenges faced by ECOWAS member states in implementing

its objectives as a regional bloc.

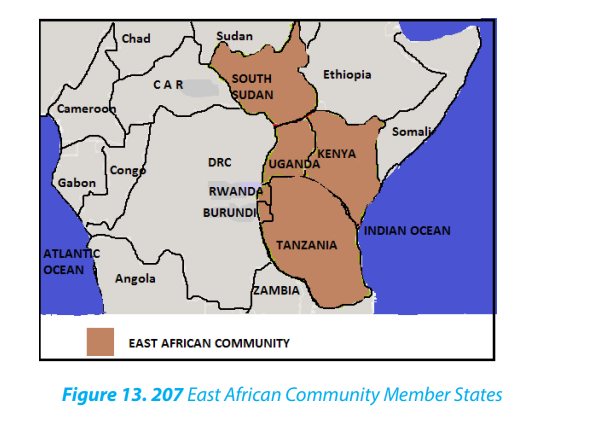

a. The East African Community

The East African Community (EAC) is an intergovernmental organization composed

of six countries in the African Great Lakes Region of Eastern Africa. The country

members are: Burundi, Kenya, Rwanda, South Sudan, Tanzania, and Uganda. The

headquarters of EAC is at Arusha in Tanzania.

The organization was founded in 1967, collapsed in 1977, and was revived on 7 July

2000. In 2008, after negotiations with the Southern Africa Development Community

(SADC) and the Common Market for Eastern and Southern Africa (COMESA), the EAC

agreed to an expanded free trade area including the member states of all three

organizations. The EAC is an integral part of the African Economic Community.

In 2010, the EAC launched its own common market for goods, labour and capital

within the region, with the aim of creating a common currency and eventually a full

political federation. In 2013, a protocol was signed outlining their plans for launchinga monetary union within 10 years.

Aims of EAC

• To revive free movement of people, goods, money, and services.

• To create common (tax) tariff.

• To create large market for goods and services.

• To promote regional cooperation.

• To improve communication.

• To share electricity.

• To promote industrialization in the region

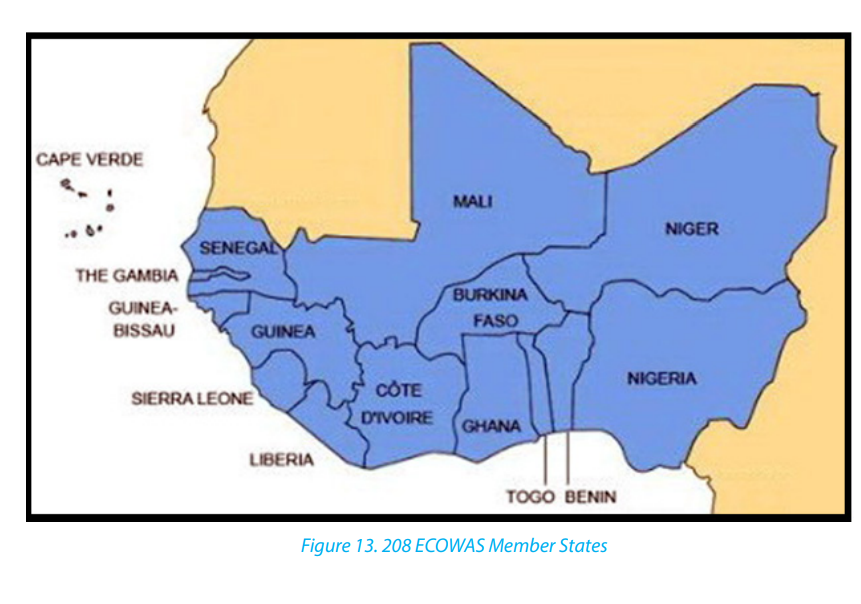

b. Economic Community of West African States

The Economic Community of West African States (ECOWAS). Established on May

28 1975 via the treaty of Lagos, ECOWAS is a regional grouping with a mandate of

promoting economic integration in all fields of activity of the constituting countries.

Member countries of ECOWAS include Benin, Burkina Faso, Cape Verde, Cote d’

Ivoire, The Gambia, Ghana, Guinea, Guinea Bissau, Liberia, Mali, Niger, Nigeria, SierraLeone, Senegal and Togo

• It has increased technological exchange among the member states. Objectives of ECOWAS

Objectives of ECOWAS

• To promote economic cooperation

• To uplift living standards of member states

• To achieve and maintain economic stability of member countries

• To enhance free movement in member states without immigration formalities.

This regional organization has achieved the following:

• ECOWAS has frozen all customs and tariffs on goods originating within West

African and this has led to industrial growth, pooling of resources through

joint ventures by certain member states.

• It has decreased prices among the member states of some products like

petroleum.

• There has been an improvement of communication in the region.

13.4.2. Trading Blocs

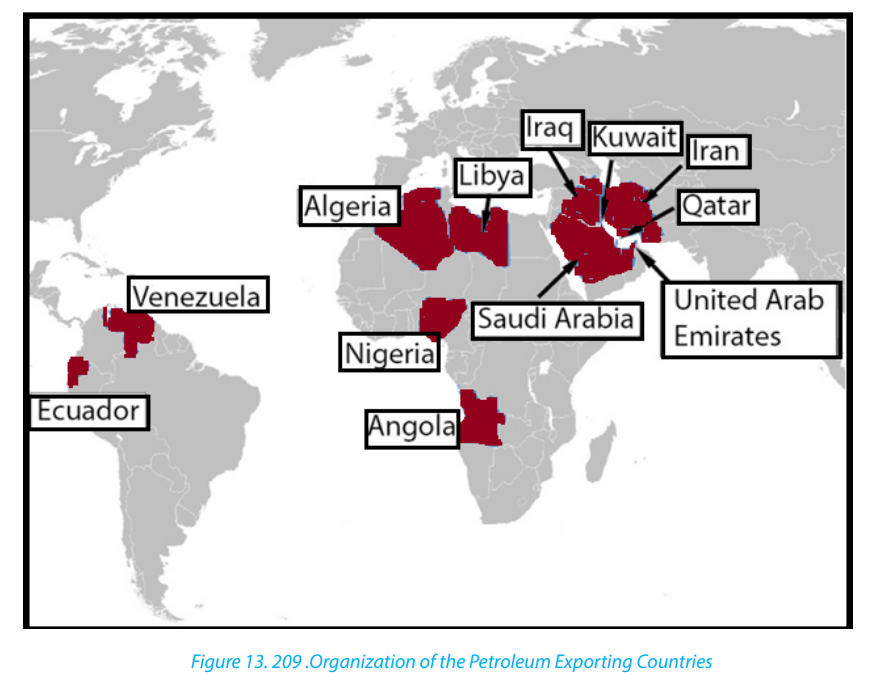

1. Organization of Petroleum Exporting Countries

The Organization of Petroleum Exporting Countries (OPEC) is an organization

of oil-producing countries. It controls 61 percent of the world’s oil exports and

holds 80 percent of the world›s proven oil reserves. OPEC’s decisions have a

huge impact on prices. The country members are: Algeria, Angola, Ecuador,

Gabon, Indonesia, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United

Arab Emirates and Venezuela.

OPEC’s three goals

• To keep prices stable. It wants to make sure its members get what a good

price for their oil. Since oil is a fairly uniform commodity, most consumers base

their buying decisions on nothing other than price.

• To adjust the world’s oil supply in response to shortages. For example, it

replaced the oil lost during the Gulf Crisis in 1990. Several million barrels of

oil per day were cut off when Saddam Hussein›s armies destroyed refineries

in Kuwait. OPEC also increased production in 2011 during the crisis in Libya.

• To coordinate and unify the petroleum policies of its member countriesand ensure the stabilization of oil markets.

2. The European Union

The European Union (EU) is a union of 28 independent states based in Europe.

It is the largest single common market in the world. The European Union has a

common currency, the euro, which is acceptable in all member states. EU helps

in promoting trade, agriculture and creation of employment.

Member states of the EU are Austria, Netherlands, Hungary, Belgium, Portugal,

Latvia, Denmark, Spain, Lithuania, Finland, Sweden, Malta, France, Poland,

Slovakia, Germany, Slovenia, The United Kingdom, Greece, Ireland, Italy, TheCzech Republic, Estonia, Luxembourg and Cyprus.

13.4.3. The Patterns of World Trade

The volume of trade, the direction of trade and the types of goods involved in the

trade vary greatly between different continents and individual countries.

i. Main Commodities involved in the World trade:• Food stuffs; grains, beverages, fruits, meat, spicesWestern Europe, North America and Japan are the major importers of raw materials

• Raw materials; fibres, rubber, timber, vegetable oils, metals and other minerals

• Fuels; coal, petroleum, natural gas

• Manufactured goods; textiles, machines, chemicals etc.

and foodstuffs. They are the major producers and exporters of manufactured goods.

These developed countries have invested heavily in developing countries which arethe main suppliers of agricultural raw materials, minerals and oil.

ii. Major Trading Zones of the World:Application activity 13.4.

The world’s major trading zones are:

• Western Europe: this is the most industrialized and the most densely populated

regions of the world. Its annual volume of trade is the largest in the world. More

than a third of the world trade is concentrated in European Union member

states.

• North America: Its foreign trade is second only to that of Western Europe. USA

has the largest economy in the world. The country has varied economy, rich

mineral resources, large concentration of industries and has heavily invested

in many developing countries. The other notable country of North America

which has been expanding its trade with USA and Western Europe is Canada.

• China: Has the second largest economy in the world after the USA. The country

has also one of the fastest growing economies in the world. It has expanded

its foreign trade in recent years. China has greatly increased its investments in

developing countries.

• Latin America: It is a major producer of food stuffs, minerals and a major

importer of manufactured goods

• Africa; The continent is less industrialized than other continents. Its main

exports to the industrialized countries are minerals and tropical raw materials.

Major imports are; manufactured products, consumer goods and mining

equipment.

• Southern continents: Australia and New Zealand are highly developed but

with a relatively small volume of world trade. The main exports are agricultural

products.

• Japan: It has the third largest economy in the world. The country is highly

industrialized. Its main exports include; manufactured goods, including steel,

ships, electrical goods and machinery, automobiles and chemicals. Its main

imports are oil from the Middle East, raw materials from Africa, Asia, Australia

etc.

• South-East Asia: This is an important trading zone. It produces tropical raw

materials such as; tin, rubber, timber, palm oil, petroleum from Malaysia and

Indonesia. Other important raw material producing areas from this region are;

Philippines, Burnei, Burma and Thailand.

• Middle Eastern states; This region possess more than half of the world’s

petroleum reserves. Crude oil and Natural gas are the main exports. In somecountries of the region oil represents 85 to 95 per cent of exports.

1. Describe the major aims of OPEC.End unit assessment2. Explain how ECOWAS member states have benefited from this integration.

1. Draw the map showing the member countries of E.A. C.

2. Conduct your own research to identify different regional integrations

operating with Rwanda and show their main objectives.

3. Examine the role of regional integration in the social, economic development

of Rwanda.

4. Analyse the reasons for low level of international trade in developing

countries.

5. What types of major commodities are involved in the international trade?

With reference to any two major commodities from different parts of the

world, explain geographical conditions which favour their production

and state two major countries for each of the commodities which import

them in large quantities.

6. With reference to either Western Europe or Africa discuss the geographicalbackground of its export trade.