Unit 6: Financial Market

Unit 6: Financial Market

Key unit competence

To be able to manage their finances responsibly and invest in capital markets.

Introduction

You have got prior knowledge and skills related to financial institutions in

Senior four. This unit will help you on how to invest your financial resources

in long term financial investments in an easy way particularly by investing in

capital markets. Therefore, by the end of this unit you must have the ability

to make decisions of managing your finances well and investing in financial

markets.

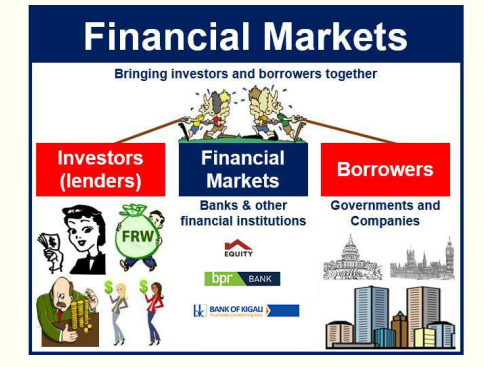

Introductory ActivityAnalyze the Illustration below and answer the questions that follow

a) What are financial markets?

b) Who are the key players in the financial markets?

c) What are the functions of financial markets?

d) What steps would one go through in order to invest in the financial

markets?

e) How do people invest in financial markets in Rwanda?

6.1. Meaning, functions and types of financial markets

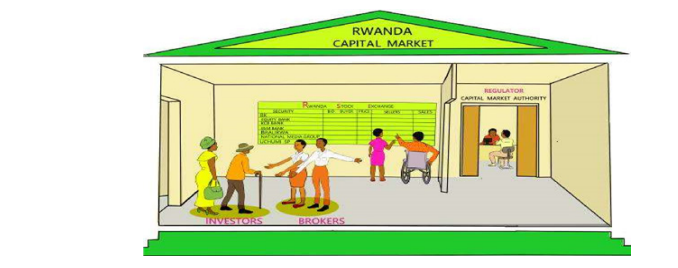

Learning Activity 6.1

The picture below is from the Rwanda Stock Exchange website. Study itand answer the questions that follow.

Questions:

a) Describe what the people in the picture are doing?

b) How does the activity above promote investment in the country?

c) What do you understand about the financial market?d) How do you differentiate primary from secondary financial markets?

6.1.1. Meaning

A financial market is a marketplace where individuals and organizations

engage in buying and selling of securities, commodities and other tangible

assets. These transactions occur with low transaction costs and the prices are

determined based on the interaction of supply and demand forces. Securities

include stocks and bonds, and commodities include precious metals or

agricultural goods.

Financial Markets are used to match those who want capital to those who

have it. Typically, a borrower issues a receipt to the lender promising to pay

back the capital. These receipts are securities which may be freely bought or

sold. In return for lending money to the borrower, the lender will expect some

compensation in the form of interest or dividends. This return on investmentis a necessary part of markets to ensure that funds are supplied to them.

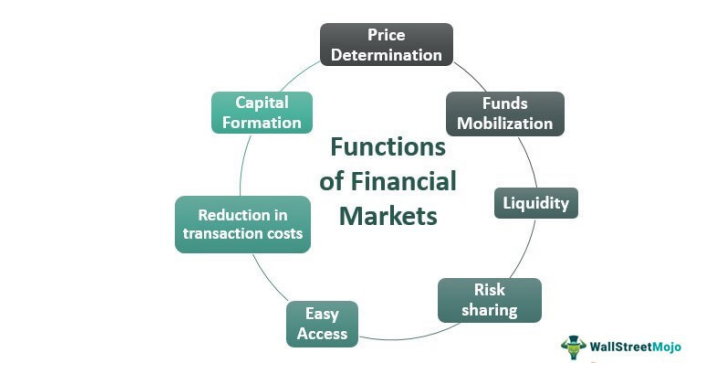

6.1.2. The functions of financial markets

There are several functions of financial markets as explained below:

i) Price determination: The financial market performs the function of

price determination of the different financial instruments traded

between the buyers and the sellers on the financial market.

ii) Funds mobilization: Funds available from the lenders or the investors

of the funds will get allocated among the persons who need the funds

or raise funds through the means of issuing financial instruments in the

financial market

iii) Liquidity: Investors can sell their securities readily and convert them

into cash in the financial market, thereby providing liquidity.

iv) Risk sharing: The financial market performs the function of risk sharing

as the person who is undertaking the investments is different from the

persons who are investing their fund in those investments.

v) Easy access: The industries require the investors to raise funds, and

the investors require the industries to invest their money and earn

the returns from them. So, the financial market platform provides the

potential buyer and seller easily, which helps them save their time and

money in finding potential buyers and sellers.

vi) Reduction in transaction costs and provision of information: The

trader requires various types of information when doing the transaction

of buying and selling the securities. For obtaining the same time and

money is required. But the financial market helps provide every type

of information to the traders without the requirement of spending anymoney by them.

vii) Capital formation:

Financial markets provide the channel through which the new

investments savings flow into the country, which aids in the country’s

capital formation.

6.1.3. Types of financial markets

Normally, all the types of financial markets can be classified as:

a) The primary market is the market for new issuers or where new capital

is raised . It is the market where securities are sold for the first time.

b) The secondary market is the market for trading securities that have

been sold or issued in the primary market and already in the hands of

the public.

The types of financial markets include:

◾ Physical asset markets versus financial assets markets:

Physical assets markets are for physical products such as wheat,

autos, real estate, computers, and machinery whereas financial

asset markets, on the other hand, deal with stocks, bonds, notes,

and mortgages.

◾ Spot markets versus futures markets:

Spot markets are markets in which assets are bought or sold for

“on-the-spot” delivery (literally, within a few days) whereas futures

markets are markets in which participants agree today to buy or sell

an asset at some future date.

◾ Money markets versus capital markets:

Money markets are the markets for short-term, highly liquid debt

securities whereas

Capital markets are the markets for intermediate or long-term debtand corporate stocks.

Application Activity 6.1

Read and answer the following question:

Imagine you are the leader of the Youth forum in your area. You have

invited fellow youth and you want to talk to them about investing through

capital markets. Write the ideas you would tell them relating the functionsof Capital markets

6.2. Benefits and instruments of capital markets

Learning Activity 6.2

Read and answer the questions below

a) What do you understand by “Capital market”?

b) What are the benefits of investing in capital markets?

c) What do the following terms mean in financial markets• Shares

• Bonds

• Debentures• Stocks

6.2.1. Meaning of capital markets

Capital market is a place where long term financial securities are traded by

individuals and institutions/organizations. In other words, they are financial

markets where buyers and sellers together trade stocks, bonds, currenciesand other financial assets.

6.2.2. Benefits of investing through capital market

The following benefits apply both to the primary and secondary markets:

◾ Access to capital: By issuing shares or debt directly to the public

through the Rwanda stock exchange (RSE), private sector businesses

and the government can raise funds for expansion of existing business

or new projects.

◾ Discover the value of your business: By listing on the RSE issuers or

owners of business are able to discover the price of their securities

and therefore the value of their business. This enables them to realize

the market worth of their wealth.

◾ Strengthens the company’s status: Raise a company’s visibility and

therefore, enhancing its status with customers and suppliers at home

and overseas: A listing on the capital market raises the profile of a

company through continuous media coverage. This is free publicity

and enhances the product presence of the issuer among its customers.

◾ It improves bargaining power: Have a better bargaining position

with financiers.

◾ Enhance management practices: The capital market requires a

minimum level of disclosure and corporate governance and this

encourages the quality of management practices.

◾ Foster employee motivation: Listed companies may easily employ

executives using stock option techniques.

◾ Benefits from Capital Market incentives: New issuers take advantage

of incentives provided to listed companies. This comes in the form

of low costs and tax advantages to shareholders and owners of the

business.

◾ Use of shares as currency: Listed companies with known market

value can use their shares as currency instead of cash when taking

over others.

◾ Savings accumulation: Investing in securities that are listed in the

capital or stock market encourages investors to accumulate their

savings in small amounts over time.

◾ Source of income: Investment in the stock market provides a source

of income. In every transaction made, the investors have higher

chances of earning profits therefore, being able to increase their

financial base.

◾ Improving investment value: Whenever the prices of securities go

up, the value of investment of shareholders increases.

◾ Easy to get loans: Listed securities are easily accepted as collateral

security against loans from financial institutions.

◾ Way of getting cash: Shares and bonds can easily be converted into

cash in the shortest time possible without losing much value.

6.2.3. Capital Market instruments

a) Shares: A share is considered as the unit of capital. It is also taken as a

unit of ownership in a limited company that gives the holder claim over

any dividends that the corporation/company may pay for it. Owners of

shares are called shareholders and receive dividends on their shares

from the company’s profits usually at the end of the financial year.

b) Debentures: A debenture is a type of debt instrument that is not secured

by physical assets or collateral. Debentures are backed only by the

general creditworthiness and reputation of the issuer. Both corporations

and governments frequently issue this type of bond to secure capital.

c) Bonds are debt instruments created for the purpose of raising capital.

They are essentially loan agreements between the bond issuer and an

investor, in which the bond issuer is obligated to pay a specified amount

of money at specified future dates.

◾ Government-owned capital market instruments

i) Treasury Bills: Treasury Bills (T-bills) are short-term debt securities

(one year or less) issued by the central bank in order to raise money

from the public.

In Rwanda; T-Bills are issued by auction on a weekly basis with maturity

dates of 28 days, 91 days, 182 days, and 364 days. T-Bills market is

announced via the BNR website, each Monday for auction on Thursday

(T), and settlements take place on Friday (T+1). The minimum purchase

is 100,000 FRW. T-bills market is open for all investors

(Banks, nonBanks, Insurance companies, Pension Fund, individuals, etc.)

ii) Treasury Bonds: A Treasury Bond/Government bond is a debt

instrument issued by a national government through the Central Bank

in its capacity as a government agent, generally with a promise to pay

periodic interest payments and to repay the face value on the maturitydate. This is a long-term security.

Skills Lab Activity

The Capital Market Authority in Rwanda played an important role in the

financial stability and economic development of the country. Discuss thecapital market instruments and role played by the Capital Market Authority

Application Activity 6.2

1. How does investing in a capital market benefit your back home

business?

2. How would you use the capital market to raise funds for yourbusiness?

6.3. How to invest in Rwanda stock exchange markets

Learning Activity 6.3

From the library resourceful person or computer lab, make research on

the requirements and process of investing in the Rwanda stock exchangemarkets (you can use this link: https://www.cma.rw

Requirements and process to join the Rwanda stock exchange

How to open an account and trade on the Rwanda stock exchange

markets

After the shares have been allocated to subscribers in the primary market, the

company that offered its shares to the public is listed on the Rwanda Stock

Exchange (RSE) where shares can only be bought and sold through licensed

stockbrokers (stockbrokers are professionals licensed by CMAC to buy and

sell shares on behalf of clients. For this service they charge a commission).

The secondary market is the market where already existing shares and bonds

are bought and sold through licensed stockbrokers who are members of the

RSE.

Step 1 Open an investment account with your stockbroker

◾ To buy securities, one must open an investment account with a

stockbroker for investment and trading in securities.

◾ To open this account one needs to provide 2 recent passport photos

and a copy of the ID card.

◾ The stockbroker will also open a central securities depository (CSD)

account into which your shares/bonds will be held electronically.

Step 2 Placing a buying or selling order to your stockbroker

◾ To buy shares or bonds you are required to discuss with your

stockbroker and then provide your account details.

◾ To buy or sell, you must give written instructions to your stockbrokers.

◾ The investor then completes a purchase order (or sale order)

giving personal particulars (including contact address etc) and the

instructions on the transactions (that is what security to buy/sell, the

transaction price, etc).

◾ Where the investor intends to sell securities, he will be required to

submit his security certificate.

◾ In the case of a purchase, the investor will be required to make a

deposit covering the value of the transaction.

Application Activity 6.3

Suppose you have a plan of investing the stock market, describe the stepsyou will be required to get through

End of Unit Assessment

I. Project Activity

As a S.6 student leaver, your father has been investing a lot of money

in you to access the education of your choice at all levels. Here comes

your father in need of advice on how and when he can invest in

capital markets as a way of securing his financial future and your

entire family. Using your knowledge as a student of entrepreneurship

regarding finances and investment, help your father to find out the

solution for his problem.

II. Other Assessment Questions

1. Describe/explain the process of joining Rwanda Stock

Exchange?

2. Discuss the benefits of investing in capital markets?

3. Describe the steps involved in investing in the stock exchange

markets