Unit 5: Taxes and Customs Procedures

Key unit competence

To be able to interpret tax computations and declare goods/services from

customs.

Introduction

You were introduced to taxes and customs procedures in O-level, this implies

that the knowledge, skills, and values acquired in relation to taxes will help

you to understand the concepts throughout the unit. This unit will concentrate

more on the different types of taxes collected locally and on cross-border

trading activities and their computations.

Introductory Activity

Read the following extract and answer the questions that follow.

A tax is a fee without a direct exchange requested to the members of the

community by the State according to the law, to financially support the

execution of the government tasks and taking into account the contributive

capacities of the payer.

Taxation in Rwanda dates way back to 1912 when property tax was

introduced. Since then, different taxes have been born and reformed to

broaden the tax base, reduce tax rates, and reduce tax evasion among

others.

Comprehensive tax reforms as approved by the cabinet (april 21st 2023)

Cabinet approved comprehensive tax reforms following directives issued

by the President of the Republic in January 2023, and in line with the revised

Medium-Term Revenue Strategy (MTRS) passed in May 2022.

Focusing on Corporate Income Tax (CIT), Value Added Tax (VAT), and Excise

Duty, the tax reforms will reduce tax rates, broaden the tax base, improve

tax compliance, and curb tax evasion while ensuring that tax revenues

increase by 1% of GDP by FY 2025/26. Additionally, a review has also

been conducted of the existing taxes and fees collected by decentralized

entities.

Key Changes to the Tax Code

VAT: Government will exempt VAT on rice and maize flour for both domestic

trade and imports. The move is expected to improve food security and the

school feeding program.

Corporate Income Tax: The Government is reducing the corporate income

tax statutory rate from 30% to 28% with an eventual target of 20% in the

medium term. This will improve Rwanda’s competitiveness and position

the country as a preferred African investment destination.

Excise Duty: To boost Rwanda’s tourism and MICE industry, the Government

has adopted changes on the taxation of high-end products, especially

beverages. For instance, under the new reforms wine will be taxed up to

FRW 50,000 of value meaning that the excise duty cannot exceed FRW

35,000 per liter (70% of FRW 40,000).

Property tax and rates on land tax: According to the approved tax reforms,

the new rate applied on land tax has been set between FRW 0 to 80

FRW per square metre from the initial FRW 0 to FRW 300 rate. A second

residential house will be taxed at 0.5% of the combined market value of

the house and land. The Tax rate for commercial buildings is reduced from

0.5 % to 0.3% of its market value on both building and land. Tax charges

on commercial buildings are capped at FRW 30 billion.

Tax on sale of immovable property: This levy will be applied at 2% of

the property value for registered taxpayers and 2.5% for non-registered

taxpayers. The first five million of the sale of every immovable property

will be tax-exempt.

Trading License: Businesses and traders will pay a single trading licence

tax, that combines market and public cleaning fees. Businesses with more

than one branch will pay only one licence per district.

Waived fees: Some fees previously charged by decentralised entities (on

documents, or services) have been scrapped. The government has put in

place a number of measures to ensure that the proposed changes lead to

a stable revenue growth path in the medium term.

Note to editors: The MTRS aims to implement several reforms that

contribute towards the sustainable development of the country by

mobilising adequate domestic resources (taxes) while creating a modern,

equitable, and efficient.

Questions

a) Given that taxes in Rwanda date back to 1912, why do you think

people and businesses have to pay taxes?

b) Mention some of the taxes that have been reformed according to the

extract.

c) Name any other taxes being paid in Rwanda that are not identified

above in the extract.

d) Classify the above taxes identified in c & d as direct or indirect taxes.

5.1. Meaning of concepts and classification of taxes in Rwanda

Learning Activity 5.1

Analyse the following dialogue and use it to answer the questions

thereafter:

Paul: Hello Juliet, do you have some time?

Juliet: Yes.

Paul: Thank you. Since you work with Rwanda Revenue Authority, I need

some help from you.

Juliet: I have heard of the tax reforms. But before you tell me about tax

reforms, what is the meaning of a tax, and what types of taxes are paid

in Rwanda?

Paul: Ooh, a tax is a mandatory financial charge imposed by the government

on individuals and businesses to fund public expenditures and programs.

Juliet: Thank you, Paul. But may you also talk about the types of taxes.

Paul: Okay. Let us start with the simple ones. There are taxes paid on:

land, employees, goods and services, exports and imports, among others.

Next time when we have enough time, I will tell you more about taxes in

Rwanda.

Juliet: Alright, thank you so much. This was very informative. But before

you go, what are direct and indirect taxes?

Paul: Okay, Direct taxes are taxes paid on profit or any income. For

example: Pay As You Earn (PAYE), Corporate Income Tax (CIT), Capital Gain

Tax, Personal Income Tax (PIT), Rental Income Tax, etc… Indirect taxes are

levied on consumption of good and services. Basically, in Rwanda we have

two types of indirect taxes: Value Added Tax (VAT) and Excise Duty

Juliet: Thank you so much, this has been very helpful.

Paul: It has been a pleasure meeting you, Juliet.

Questions

1. According to the dialogue, what do you think a tax is?

2. With examples, make the difference between direct tax and

indirect tax

5.1.1. Meaning of concepts

Tax is a mandatory financial charge imposed by the government on individuals

and businesses to fund public expenditures and programs. It can also refer to

a fee without direct exchange requested to the members of the community

by the State according to the law, to financially support the execution of the

government tasks.

Taxation refers to the act of levying or imposing taxes by the tax authority.

It can also be defined as a legally compulsory transfer of money from the

public to the government mainly as a source of government revenue. It is

also defined as the compulsory payment to the government for the payment

or provision of voluntary consumption of goods and services.

Customs are government agencies responsible for regulating and facilitating

the movement of goods across borders. They are a crucial part of international

trade, as it ensures that goods entering or leaving the country comply with

relevant laws and regulations, including those related to tariffs, duties, taxes,

and safe standards.

5.1.2. Classification/ types of taxes imposed on business in Rwanda

In Rwanda taxes are classified as below:

A. Direct taxes

Direct taxes are taxes charged on the income or profits of the person to the

government.

It is the tax where the liability as well as the burden to pay resides on the

same individual and . In general, direct taxes are levied on profit and income.

Examples of Direct taxes

i) Corporate income tax: Is a tax that must be paid by an entity or

a corporation based on the amount of profit generated. Corporate

income tax is deducted by the state on industrial and commercial

income achieved by the firms working as commercial companies.

The corporate income tax is paid by:

◾ Companies established in accordance with Rwandan law or foreign

law;

◾ Cooperative societies and their branches;

◾ Legal persons and public institutions with autonomy of management

As of April 21st 2023 the Government reduced the corporate income

tax statutory rate from 30% to 28% with an eventual target of 20%

in the medium term. This will improve Rwanda’s competitiveness and

position the country as a preferred African investment destination.

ii) Trading license

◾ It is a tax paid by everyone who commits himself to do income-

generating activities, organizations with legal personality, or

organizations subject to corporate income tax.

◾ It is paid before starting activities.

◾ It is paid every year not later than 31st March with ongoing

business.

Businesses and traders pay a single trading license tax that combines

market and public cleaning fees. Businesses with more than one branch

pay only one license per district.

iii) Personal income tax is a tax imposed on the income earned by

individuals. It is a direct tax levied by the government on various

sources of income, such as salaries, wages, self-employment earnings,

rental income, investment gains and other forms of personal income.

For example PAYE (Pay-As-You-Earn

Broadly, PIT is charge on the following sources of income:

◾ Income generated from performing services (including

employment)

◾ Activities of a craft person, singer, artist or player

◾ Sports, cultural or leisure activities

◾ Income of Rwanda permanent establishment

◾ Income from the use, lease and disposal of movable assets by

Rwandan business

◾ Sale, lease and free transfer of immovable Rwandan business

assets

◾ Farming, fishing and forestry

◾ Usufruct (right of use of asset) and other rights attached to

Rwandan Business assets

◾ Income from investment in share (i.e., dividends)

◾ Sales or transfer of shares and debentures (capital gains tax)

◾ Change of partnership profit into shares, such that a partner’s

interest increases

◾ Distributions of partnership profits to partners

◾ Income from lending and deposits(interest)

◾ Transfer, sales and lease of intellectual property

◾ Other income generating activities that are not classified as exempt

iv) Withholding tax: This is a tax that is deducted or withheld from an

individual’s income or payment by a third party and paid directly to the

government on their behalf.

Withholding taxes are composed of: Pay as you earn, dividends,

interests, performance payments made to an artist, musician, or an

athlete;

Apart from the withholding tax on salary (PAYE) paid according to

above mentioned, others are paid on a rate of 15%;

The rate of the tax withheld on commodities from abroad is 5%.

This tax can be exonerated (temporary exemption) to taxpayers in

detention of a quitus fiscal.

A quitus fiscal is a certificate issued by RRA. It is issued to taxpayers

who have manifested high integrity in their transactions.

A withholding tax on public tenders is 3%.

Note: Those who have the obligation to withhold withholding taxes

are required to pay withheld taxes within 15 days counted from the

day of withholding.

v) Rental income tax:,

Rental income tax is paid by any individual who earns income from

renting out fixed assets located in Rwanda, including land, buildings,

and improvements.

In Rwanda, rental income tax is calculated progressively by revenues

brackets as follows: 0% on the bracket lower than 180,000 Rwf ; 20%

from 180,001 Rwf to 1,000,000 Rwf ; 30% above 1,000,000 Rwf.

vi) Property tax and rates on land tax -the rate applied on property and

land is as follows:

◾ Land tax is FRW 0 to 80 FRW per square meter.

◾ A second residential house will be taxed at 0.5% of the combined

market value of the house and land.

◾ The Tax rate for commercial buildings is 0.3% of its market value

on both buildings and land.

◾ Tax charges on commercial buildings are capped at FRW 30 billion.

Other types of taxes that are not levied in Rwanda:

◾ Inheritance tax is determined by who owns the property after the

decedent. It is also known as death tax.

◾ Gift tax is when someone transfers certain valued property to another

person. It could be cash or in-kind.

B. Indirect tax

A tax imposed on consumption, sales, shipping, or production, rather than

directly on the property or income of the consumer. Indirect taxes are

generally included in the price of goods and services. In this case, the burden

of the tax is on final users of the product or service, the consumer.

Examples of Indirect tax;

i) Value Added Tax (VAT)

VAT was introduced in Rwanda in 2001. VAT is a tax on the consumption

of goods and services. It is indirectly paid by the final consumer of the

goods or services. However, it is paid on their behalf by taxpayers on

the value added at each stage of production.

In Rwanda, the normal rate of VAT is 18%. There is also a zero rate

(0%) and exemptions applicable for certain types of goods and

services. A taxpayer must register for VAT if his turnover is above FRW

20,000,000 for any twelve-month period or above FRW 5,000,000 for

three consecutive quarters. In addition, any taxpayer may choose to

register voluntarily for VAT if he doesn’t meet the threshold

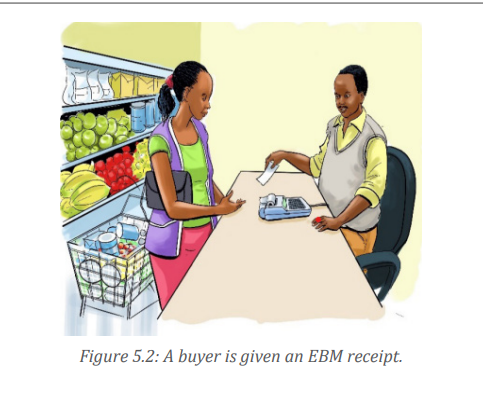

VAT-registered taxpayers are required to have at least one Electronic

Invoicing System (EIS), such as an Electronic Billing Machine (EBM) in

each of their sales locations, and use these to provide EIS invoices for

all sales transactions.

In addition to other products, on April 21st 2023, the government

exempted VAT on rice and maize flour for both domestic trade and

imports. The move is expected to improve food security and the school

feeding program.

ii) Customs duties: This is the tax imposed on imports and exports. They

include:

◾ Import duty: This is the tax imposed on imported goods to;

a) Get government revenue

b) Discourage imports so as to protect domestic industries

c) Discourage imports so as to conserve foreign exchange

◾ Export duty: This is a tax imposed on exports to raise revenue and

discourage the exportation of certain goods in order to satisfy the

local market demand.

◾ Excise duty: Excise tax is imposed on specified goods /service

produced locally or imported to be consumed in the country. Excise tax

was established in Rwanda in 1960 and is levied on locally produced

beers, lemonades, mineral water, juices, liquors, wines, fuel, vehicles,

powdered milk, as well as on cigarettes, etc… and their imported

counterparts if appearing on the list published in the consumption

tax law. Excise tax is also levied on telephone communication since

year 2007.

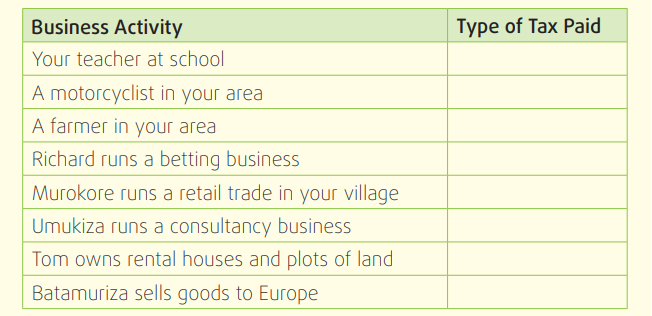

Application Activity 5.1

Read the following business activities in Rwanda and name the types of

taxes they pay

5.2. Role of taxes, and computation of VAT and personal

income tax

Learning Activity 5.2

Paying taxes plays a great role in the social and economic development of

the country. Using the specific examples from the photo below, explain the

contribution of taxes to Rwanda’s social economic development.

5.2.1. Role of taxes

Taxes paid by entrepreneurs, corporations, organizations play several

important roles in the economy and society. Here are some key roles of taxes:

To an entrepreneur

◾ Paying taxes by the entrepreneur helps the business activity to

operate smoothly, as it does not face penalties and associated costs

from the RRA for non-payment.

◾ When an entrepreneur pays taxes, it improves his/her reputation or

public image which may result into increased customers and better

services from the government

◾ To avoid inconveniences of closure of the business and its associated

costs: when an entrepreneur fails to pay assessed taxes, his/her

business is subject to penalty or even closure in some cases.

◾ Entrepreneurs benefit from infrastructures to successfully operate

such as roads to move raw materials, finished goods, workers; security

for their enterprises, goods, among others, which are provided by the

government.

◾ Paying taxes means contributing money to government agencies or

departments such as Development Bank of Rwanda (BRD), Business

Development Fund (BDF), which support entrepreneurs to operate

business activities through soft loans and other financial support.

To the government

◾ Source of government revenue: taxes are the main source of

government revenue to finance its public expenditure. Thus taxes

enable the government to pay it workers, construct roads, maintain

security, provide health care, education among others

◾ Taxes benefit the Rwandan government to meet its objectives and

goals such constructing affordable houses to the citizens which helps

improve the standards of living

◾ Taxes help government to finance its policies especially on poverty

alleviation through programs such as ―GIRINKA, ―VUP, ―UBUDEHE

among others

◾ Taxes enable the government to regulate the prices of goods and

services in the country hence ensuring a low cost of living and

maintaining the standards of living of the citizens

◾ Taxes enable the government to maintain a balance between the

poor and rich. The government uses the taxes from business people

to provide services needed by the poor, which otherwise the rich

could not provide.

◾ Taxes enable the government to promote its industrialization policy

through reducing products from other countries that would otherwise

out compete the home industries.

◾ Taxes enable the government to ensure that the citizens have enough

products. This can be through taxes charged to reduce products

moving out of the country or removing taxes on goods needed in

the country. This helps maintain a high standard of living

To the Society

◾ There is reduced rates of poverty among the community due to a

significantly equal distribution of income through various activities

and projects set by the government

◾ Improved wellbeing among the vulnerable and elderly as they benefit

from the different government financed through taxes

◾ Reduced infant mortality rates and increased life expectancy due to

improved access to health facilities and services

◾ Increase in the percentage of the population that completes secondary

and TVET education, reducing the literacy levels, improving on the

peoples‘ skills through programs such as 12YBE.

◾ Increased community/social solidarity, general happiness, life

satisfaction, and a significant more trust among the community

members and for public institutions.

◾ Taxes are charged on products which are harmful to discourage their

usage hence controlling the over-exploitation of resources hence

protecting the environment which is vital for the existence of society

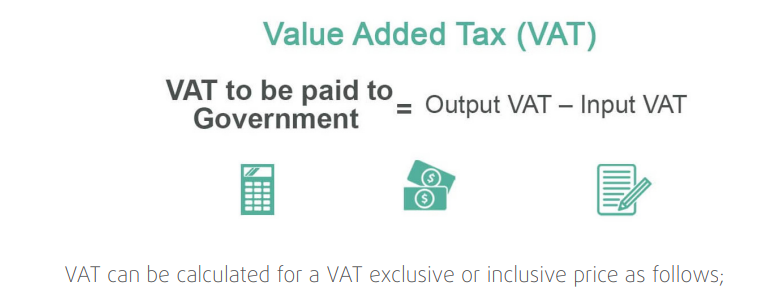

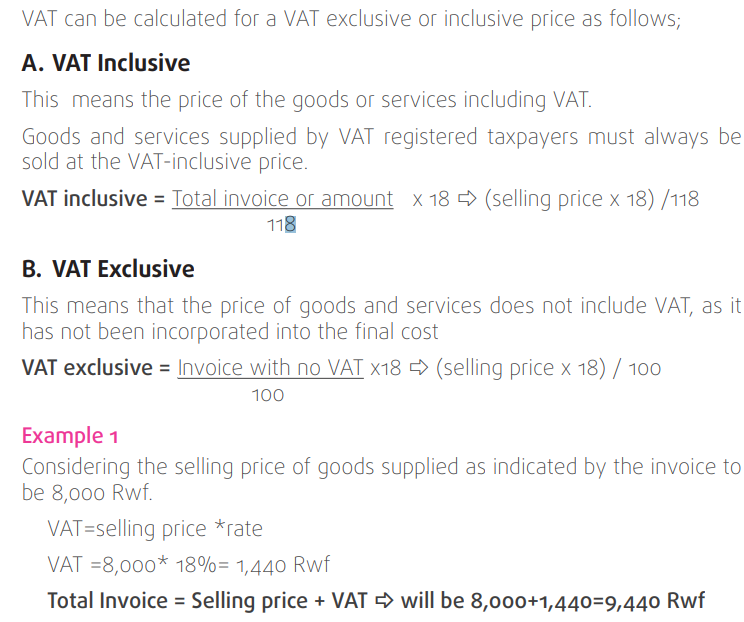

5.2.2 Computation of VAT

Example 2

UTEXRWA Industry bought cotton from a local farmer worth FRW 1,200,000 to

manufacture 170 blankets. All the blankets were sold to a wholesaler based

in Kigali City at a cost of FRW 4,000,000. The same blanked were supplied at

FRW 8,000,000 to Lemigo Hotel for its daily hotel services. You are required

to compute the following with consideration that invoices are VAT inclusive:

◾ VAT payable by UTEXRWA Industry◾ VAT payable by the wholesaler

Solution:

◾ At UTEXRWA level, VAT = (4,000,000 x 18) / 118 = 610,169.49

◾ At the level of the wholesaler, we must consider two VATs: VAT on

purchase and VAT on sale:

AT on purchase = (4,000,000 x 18) / 118 = 610,169.49

VAT on sale = (8,000,000 x 18) / 118 = 1,220,338.98

Thus, VAT due from the wholesaler is 1,220,338.98 – 610,169.49 = 610,169.52

Example 3

A students’ business club has sold goods to XY enterprise at 100,000 FRW

VAT exclusive.

Calculate:

a) VAT to be paid

b) The price VAT inclusive

Solution

a) VAT received= 18,000FRW

b) The price VAT inclusive=100,000FRW+18,000FRW=118,000FRW

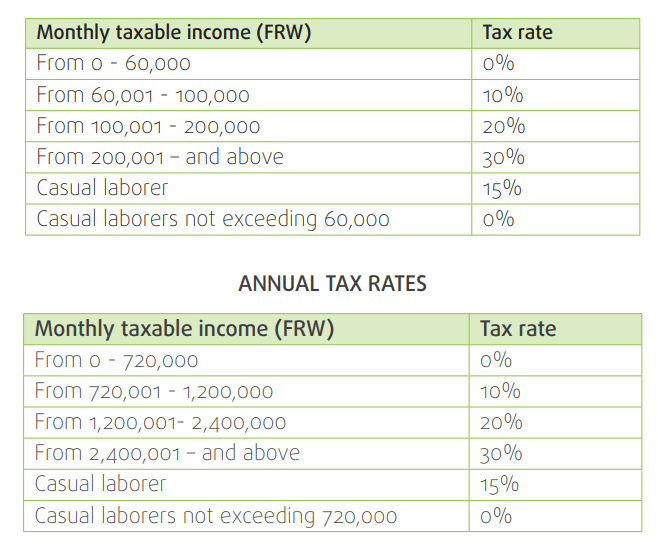

5.2.3. Computation of personal income tax

The tax rates and income tax brackets can vary depending on the country

and its tax system.Personal income tax in Rwanda is calculated as below ;

Note: During 2023 as per income tax law in force (Law No

027/2022 of 20

October 2022, the tax rates on employment income are as follows;

◾ RWF 0 to 60,000 - 0%

◾ RWF 60,001 to 100,000 - 20%

◾ RWF 100,001 and above - 30%

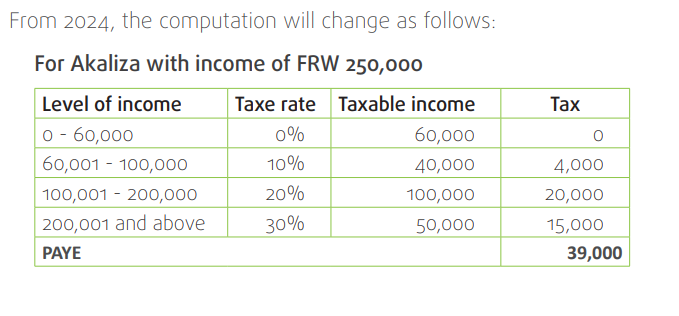

From 2024 and the following years as per the new tax policy(April 2023), the

tax rates on employment income will be as follows;

◾ RWF 0 to 60,000 - 0%

◾ RWF 60,001 to 100,000 - 10%

◾ RWF 100,001 to 200,000 - 20%◾ RWF 200,001 and above - 30%

A professional income tax or PAYE (Pay-As-You-Earn)MONTHLY TAX RATES

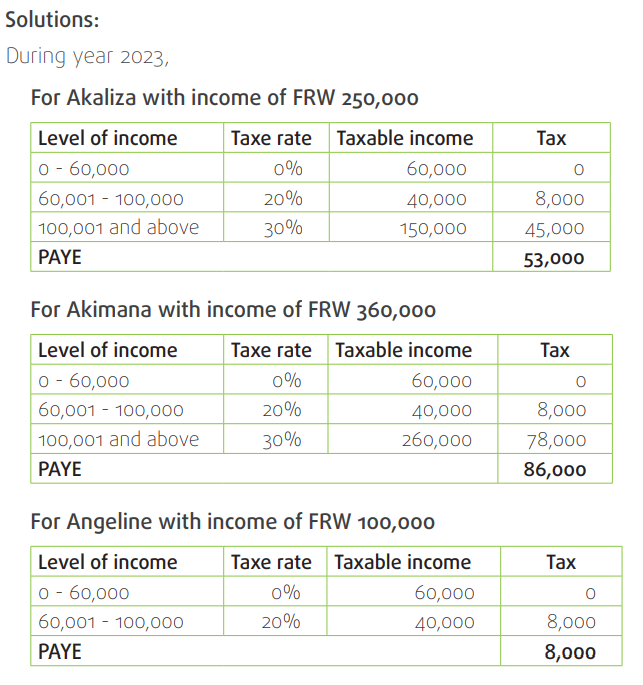

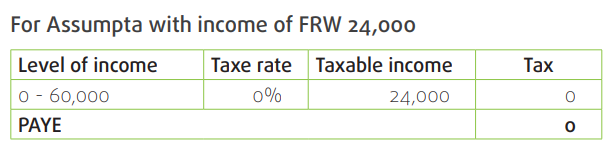

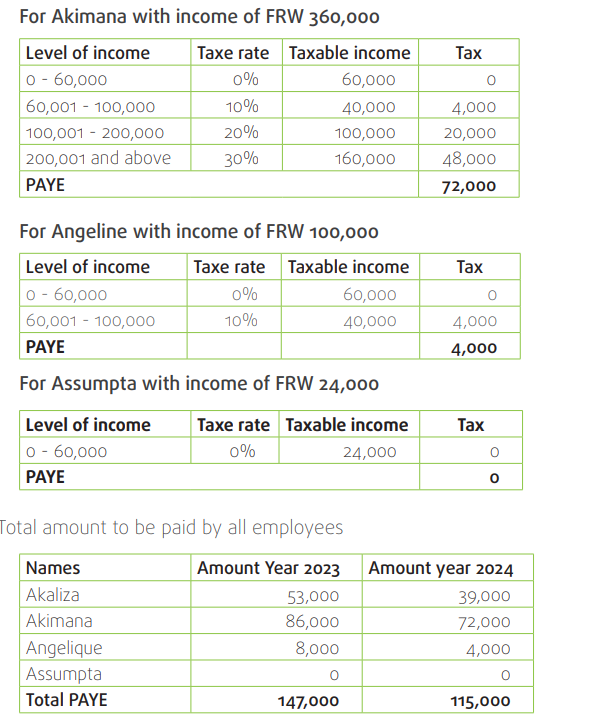

Example 1

AKAGERA BUSINESS GROUP has made a list of employees indicating their

monthly income:

AKALIZA gets FRW 250,000

AKIMANA gets FRW 360,000

ANGELINE gets FRW 100,000

ASSOUMPTA gets FRW 24,000

Required: Compute the following:

i) The amount of professional income tax to be deducted on the salary

of each employee.ii) The total amount of tax on all employees to be paid

Skills Lab Activity

From what you have learnt;

1. Identify taxes that your club will pay based on the project

activities?

2. Assuming that your future back home business employs an

accountant who will be paid 300,000FRW per month, How muchtax is to be paid to the government every month?

Application Activity 5.2

1. The following figures relate to the monthly salaries of

DUKUNDANE company ltd employees for 2019:

a) Director Kagabo John earns 350,000FRW

b) Accountant Mukama James earns 150,000FRW

c) Security Muhire Damien earns 30,001FRW

d) Secretary Keza Joana earns 77,000FRW

e) Casual laborer Ishimwe Anitha earns 150,000FRW

Required: Determine the total PAYE for the above employees that

DUKUNDANE company ltd pays to RRA every month

2. A students’ business club has bought goods from XY enterprise at

1,000,000 FRW VAT included.

Calculate:

a) VAT paidb) The price VAT excluded

5.3. Customs DeclarationLearning Activity 5.3

Fig 5.3: People clearing at the customs office in Rwanda (Source: www.newtimes.rw

Analyze the photo above and respond to the following questions:

1. What is happening in the photo?

2. Where in Rwanda do such activities / operations take place?3. Mention some documents that are used in such activities above.

5.3.1. Customs declaration

Customs declaration refers to the practice used by customs offices to clear

goods into a country and levy tariffs including clearance procedures such as

documentation and inspection, method of determination of goods clarification,

and method of assigning its value as the base for taxation. This declaration

happens at border posts and other customs offices like MAGERWA.

5.3.2. Customs Offices in Rwanda

Rwanda Revenue Authority (RRA) that was established by law N0 15/15 of

8th November 1997, therefore, all border areas of Rwanda with neighboring

countries and airports are gazetted as customs offices.

The Current operational One Stop Border Posts (OSBP) are located at the

Kigali International Airport, Rusumo, Kagitumba, Nemba, Gatuna and Ruhwa.

Other active border posts are located in Cyanika, Rusizi I, Rusizi II, Bugarama,

Akanyaru, La Corniche & Petite Barrière in Rubavu and others.

All in all, Rwanda Revenue Authority has got the following Customs Officescountrywide:

5.3.3. Documents used in customs declaration

These are documents that are used during the declaration process of exports

and imports as some may have limit or customs excise duty or are banned

from entry. These may include:

1. Transaction Invoices: is a non-negotiable commercial document issued

by a seller to a buyer.

2. Transport documents: These are documents which show information

about cargo that is being transported. Transport documents lie at the

heart of international trade transactions. These documents are issued

by shipping line, airline, international trucking companies, railroad,

freight forwarder and all logistics companies. For example:

◾ CMR: the CMR (Convention relative au Contract de transport

international de Merchandise Par Route) transport document is

an international consignment note used by drivers, operators and

forwarders that govern the responsibility and liabilities of the parties

to a contract for the carriage of goods by road internationally.

◾ Air waybill: is a transport document used for air freight. An air

waybill (AWB) is a non-negotiable transport document covering

transport of cargo from the airport. It indicates only acceptance of

goods for carriage. This document is prepared by IATA Transport

Agent or the airline itself and is addressed to the exporter, the

airline and the importer.

◾ Bill of Lading is a transport document for sea freight. Bill of lading

B/L is used by the agent of a carrier to shipper, signed by the

captain, agent, or owner of the vessel.

3. Import license: An import license is a document issued by a national

government authorizing the importation of certain goods into its

territory.

4. Packing list is a more detailed version of the commercial invoice but

without price information.

5. Certificate of origin: show that goods in particular shipment have been

wholly obtained, produced, manufactured or processed in a particular

country.

6. Certificate of analysis is a document which confirms that specific goods

have undergone specified testing with specified results and adhere to

product specification and standard of production.

7. Goods arrival notice: is a document sent by a carrier or agent to the

consignee to inform about the arrival of the shipment and number of

packages, description of goods, the weight, and collection charges (if

any)

8. Assessment Notice: is a document issued by a taxing authority

specifying the assessed value of a property.

9. Certificate of Fumigation: is the proof that wooden packing materials

issued in international sea freight shipping e. g wooden pallets and

crates, wood, wool etc. Have been fumigated or sterilized prior to

international shipment to ensure proper handling as some can be

harmful.

10. Goods invoice: is a document sent by a seller to a buyer. It specifies

the amount and cost of goods that have been provided by a seller.

11. Payment receipt: is a simple document that shows that payment was

received in exchange for goods or services.

12. Phytosanitary certificate: is a certificate stating that a specific crop

was inspected a predetermined number of times and a specified

disease was not found or a certificate based on an area surveillance

stating that a specific disease, as far as known, does not occur in the

area of production.

13. Warehouse handling fees invoice: is a document given by a

warehouseman for items received for storage in his or her warehousewhich has evidence of title to the stored goods.

Application Activity 5.3

Analyze the following transactions and identify the documents used during

their declaration.

1. Bought goats from Uganda

2. Sold coffee to Japan

3. Boughts woods from China4. Bought Rice and Maize flour from Tanzania

5.4. Declaration procedures

Learning Activity 5.4

You have been employed as the export manager of TAM TAM industries

producing cosmetics products and in your exportation plans, you intend toexport 6 tonnes of products in one week’s time to South Sudan.

Rearrange the processes you will take to clear your products under customs

1. Obtain an invoice for warehouse handling fees.

2. Pay import tax.

3. Submit goods arrival notice for verification from Rwanda

Standards Board.

4. Obtain goods exit note

5. Obtain manifest Requirements.

6. Submit import documents to the clearing agent for tax calculation.

7. Obtain notice of arrival of the goods.

8. Pay warehouse fees for goods handling.

Customs declaration may be done both for exports or imports. Although the

procedures may slightly differ based on the type of declaration, the general

procedure when declaring imports or exports is as follows:

Step 1: Taxpayer prepares all necessary documents and contracts a Clearing

Agent.

Step 2: The Clearing Agent prepares and submits an import or export

declaration to RRA using the Rwanda electronic Single Window (ReSW).

Step 3: The Clearing Agent receives assessment notices, containing the

amounts of customs duties due. The taxpayer pays all customs duties due,

either directly or through the Clearing Agent. The assessment notice may

contain different ‘Doc IDs’ for different tax types. If so, these must each be

paid separately.

Step 4: The ReSW system allocates the consignment to a certain Customs

channel. If verification is required, Customs Officers will request the

necessary documents and/or access to the consignment. If there are any

problems, further action may be required.

Step 5: After successful verification, the Customs Officer provides the

taxpayer with a release order.

Step 6: The taxpayer pays any due warehousing fees, if applicable, to the

warehouse owner.

Step 7: The taxpayer receives an exit note and may leave with their

consignment.

Imports declaration procedures

1. Obtain notice of arrival of goods: The requirements for goods arrival

notice are set by internal procedures of Magasins Généraux du Rwanda(MAGERWA) or any other wharehouse / logistics organization.

2. Submit goods arrival notice for verification by Rwanda standards

board(RSB). Requirements are set by internal procedures of Rwanda

bureau of standards import inspection procedures.

3. Obtain manifest: Rwanda revenue tally officer verifies whether the

goods indicated on the import documents match the actual goods on

the goods arrival notice. This is to make sure that the importer pays

the right amount of taxes.

4. Submit import documents to the clearing agent for tax calculation. It

is at this stage that the taxes to be paid on the goods is calculated and

the importer is informed of how much taxes they have to pay.

5. Pay import tax: The clearing agencies have a system whereby goods

are assigned different codes and once this code is entered into the

system and the country of origin of the goods, taxes are calculated

automatically. Large importers who had been previously paying taxes

well may be exempted from withholding taxes.

6. Obtain an invoice for warehouse handling fees: The requirements

are set by the internal procedures of Magasins Généraux du Rwanda

instructions.

7. Pay warehouse fees for goods handling: Warehouse handling fees

are set by MAGERWA management. The fees depend on the quantity

of the goods and the time spent in the warehouse. Within 7 days, each

kilogram is charged 10 RWF per day. From 7 days and above, an extra

1 RWF is charged per kilogram/day. VAT (18%) and parking fees are

added on the total cost.

8. Obtain goods exist note: Once the taxes and warehouse storage

fees have been paid, Rwanda Revenue Authority and MAGERWA tally

officers verify the goods physically to make sure they correspond to

the declared goods and the client issued with the goods exit note. It

is the goods exit note that the client uses to take his goods from thewarehouse.

Application Activity 5.4

Imagine that you had to export raw materials for your business to Dubai.Describe the procedure you would go through.

End of Unit Assessment

1. Project Activity

Imagine that after S.6 you have been provided with capital of 1000,

000FRW by your parents or relatives to begin the business of importing

Rice from Tanzania. This involves different procedures to have your

Rice reach Rwanda especially in clearing under customs. Using the

knowledge and experience acquired from the previous lessons, make

a report on the process of declaring taxes under Customs.

II. Other Assessment Questions

1.

a) Differentiate between customs and customs procedures

b) Give three examples of Rwanda’s imports and exports

c) List examples of exempted goods that are imported into

Rwanda.

2. A business club at one of the schools has 3 regular employees

namely KALISA, Ingabire, and BERWA with monthly salaries of

35,000FRW, 40,000FRW, and 20,000FRW respectively. On top

of that, the business made sales of 300,000FRW VAT exclusive,

and the input VAT was 34,000FRW.

a) Calculate the total amount of tax that the business club has

to pay to RRA

b) Advise the above business on how the above taxes would bepaid.