Unit 2: Financial Statements

Key Unit Competence

To be able to prepare a balance sheet, income statement, and cash flow

statement.

Introduction

Business enterprises in today’s world take it as a requirement to ascertain

their performances at the end of every year (trading period). This can only be

attained by preparing different financial statements (final accounts).

The knowledge and skills acquired from the previous unit will enable you to

better understand the source of information used in financial statements.

This unit will enable you to prepare a balance sheet, income statement and

cash flow statement.

Introductory Activity

Read the scenario below and use it to answer the questions that follow.

James is a local entrepreneur in Huye town. He is so passionate and

committed to solving community problems in his hometown and the

nation at large. This made him start a crafts business. He travels to villages

and collects crafts from women groups to sell in his shop. His shop is

strategically located to attract tourists visiting Nyungwe Forest. James

has a book to record all daily sales, supplies, and operating expenses. He

thought it was the best way to keep track of all business transactions.

He desired to expand the business and believes that 5 million Francs would

be enough. His sister Uwera, a student of entrepreneurship, advised him to

approach investors and banks and pitch his business to convince them to

provide funding to enable him meet the business’s growth needs.

The investors only gave him 10 minutes to explain the profitability of his

business, the net financial position, and the financial projections he needed

for the next two years, but this presented a challenge because the book

he kept could not easily provide this information in the given time, so hefailed to convince the investors and missed out on the funding.

James realised he needed to organise the financial information he was

keeping in a specific order so that he could make quick decisions and make

it more presentable and easier to explain to investors.

Questions.

1. What types of documents would James have used to organise his

business’s financial data before presenting it to investors?

2. Do you think it was necessary for James to prepare those

documents? Justify your answer

3. What key information should be included in those documents?

2.1. Meaning and importance of Financial Statements

Learning Activity 2.1Study the quote below and respond to the questions that follow

Questions. a) What does the quote above mean to you as a student of2.1.1. Meaning of Financial Statements

a) What does the quote above mean to you as a student of2.1.1. Meaning of Financial Statements

entrepreneurship?

b) Why does the author of the quote emphasise the reliability of the

financial statements?

c) What do you mean by financial statements?

d) Why should entrepreneurs prepare financial statements for theirbusinesses?

Financial statements are the reports prepared by a company’s management

to present the financial performance and position at a point in time. External

users of accounting information like investors and creditors are more interestedin financial statements than books of accounts.

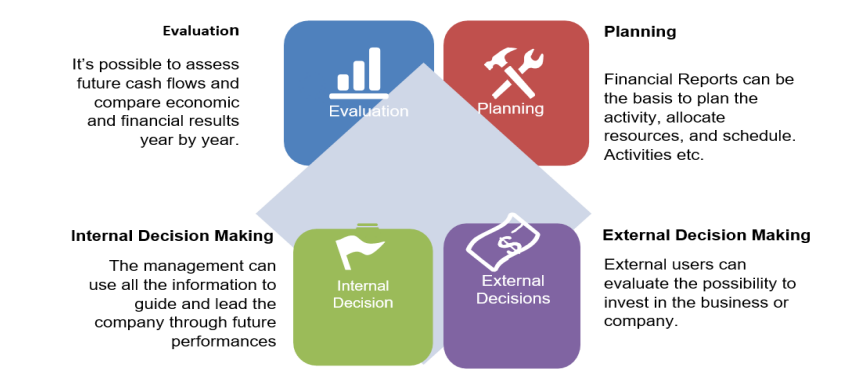

2.1.2. Importance of Financial Statement

Other importance of financial statements may include.

◾ To determine whether a business can pay back its debts.

◾ To track financial results on a trend line to spot any looming profitability

issues.

◾ To derive financial ratios from the statements that can indicate the

condition of the business.

◾ To investigate the details of certain business transactions, as outlinedin the statements’ disclosures.

Application Activity 2.1

JYAMBERE cooperative is a cooperative of 3,000 rice farmers that was

established in 2016. The cooperative collects and sells the members’

produce at a competitive price, allowing them to generate a lot of revenues

of over 50,000,000FRW every month. The money generated is used to

meet all the necessary costs. Their annual incomes and expenses reports

portray a lot of profits made by the cooperative. Using the scenario of the

JYAMBERE cooperative,

a) What do we call those reports in business?b) Why is it important to make those financial reports?

2.2. Types of financial statements

Learning Activity 2.2

a) Refer to your school business club and identify some items that may

be considered as expenses, revenues, assets, and liabilities.

b) Which financial reports does your business club prepare when

preparing for a general business club assembly? What do they include?

There are four main types of financial statements: Income Statement, Balance

Sheet, Cash Flow Statements and Statement of Owners Equity.

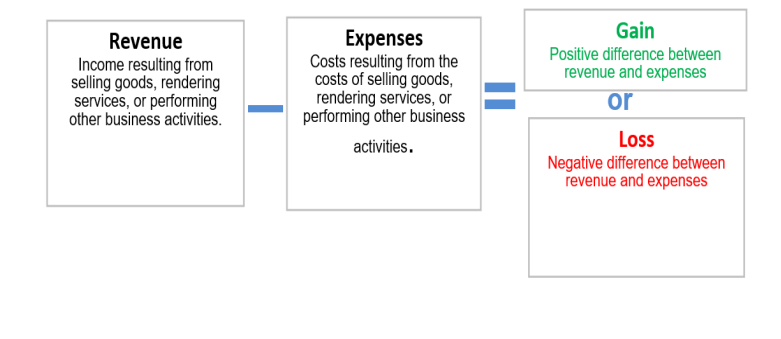

a) Income statement: this is a financial statement that reports a company’s

financial performance over a specific accounting period. Financial

performance is assessed by giving a summary of how the business incurs

its revenues and expenses through both operating and non-operating

activities. This statement is composed of two sections namely trading

account, and profit & loss account.

• Trading account

A trading account is an account which is prepared to determine the

gross profit or the gross loss of a trading business. It involves the

treatment of:

– Sales

– Stock (opening and closing stock balances)

– Purchases– Direct expenses i.e. purchase wages, carriage inwards

• Profit and loss account

The profit and loss account is prepared to determine the net profit

or loss after all expenses have been charged. It is prepared after the

trading account is completed. It is prepared in the following flow:– It starts with the gross profit figure from the Trading Account.

– It then lists any items of additional revenue raised by the as well

as any expenses incurred by the business not directly linked to

trading. Business. The sum of a gross profit or loss and additional

revenues is called “Gross income”,

– It shows the net profit (or loss) for the reporting period (the net

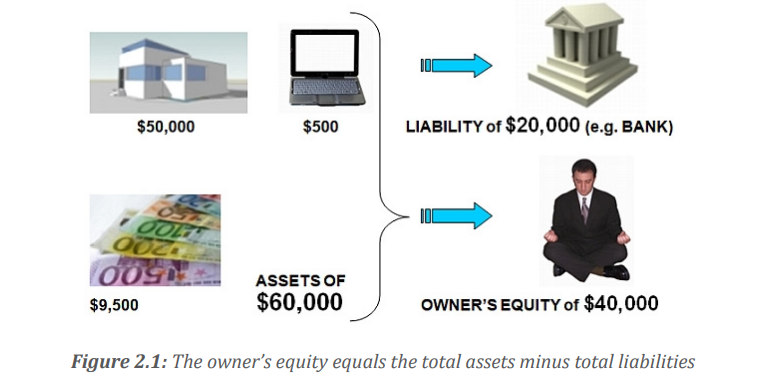

profit equals the gross income minus all expenses.b) Balance sheet/statement of financial position: this is a statement which

reflects the financial position of the firm at the end of the financial year.

The balance sheet helps to ascertain and understand the total assets,

liabilities and capital of the business. One can understand the strength

and weakness of the business with the help of the balance sheet.

The balance sheet is composed of the following three main parts:

– Assets

– Liabilities

– Capital

Assets

These are possessions owned by the business and have got money value.

They are grouped into fixed assets and current assets.

While fixed assets are the possessions of the business which are of a durable

nature bought for use in the business for a long period of time usually above

one year. E.g. land, equipment, machinery, motor vehicle etc. current assets

are possessions or properties of the business which last for a short time and

can easily be changed into cash. Current assets keep on being converted

from one form to another e.g. stock of goods, debtors, and cash at hand,

cash at bank, prepaid expenses or expenses paid for in advance, outstanding

income etc.

Liabilities

These are debts or amount of money that the business owes the outsiders.

They are claims of outsiders on the business’ assets. Properties/possessions

that are used by the business and which must be paid back in future. They

are grouped into long term liabilities and short term liabilities.

While long term liabilities refer to debts of the business that are expected to

be paid after a long time usually after one-year e.g. bank loans, debentures,

short term liabilities/current liabilities are debts of the business to be paid

within a short time usually within a year.

Owner’s equity

This is defined as the proportion of the total value of a company’s assets thatcan be claimed by its owners.

Mr. DUSABE and his wife KEZA are in agribusiness. They grow tomatoes on

a small farm. They paid labourers 4,500,000 FRW, transported tomatoes

to the market at 1,000,000 FRW, bought seeds at 200,000 FRW, and leased

land for 1,000,000 FRW. This season, the harvest was good with 45 Tons

of tomatoes harvested.

a) How much did DUSABE and KEZA pay for their farming activities?

b) How much did DUSABE and KEZA earn from sales of their Tomatoes,

if 1 kg of tomatoes was sold at 200 FRW?

c) What is the difference between their income received and expenses

incurred from selling tomatoes in their farming activities?

d) What do you understand by an income statement?e) Why is an income statement important for a business?

After extracting a trial balance, the next step is to determine the profit the

business has made during the trading period. This is done by preparing two

accounts, namely:

◾ Trading account where the value of the gross profit is determined by

deducting the cost of goods sold from net sales, i.e., gross profit = net

sales – the cost of goods sold.

◾ Profit and loss account where the value of net profit or net loss is

calculated by deducting expenses from the gross income, i.e., Gross

income – Total expenses.Where Gross income = gross profit or loss + additional revenues

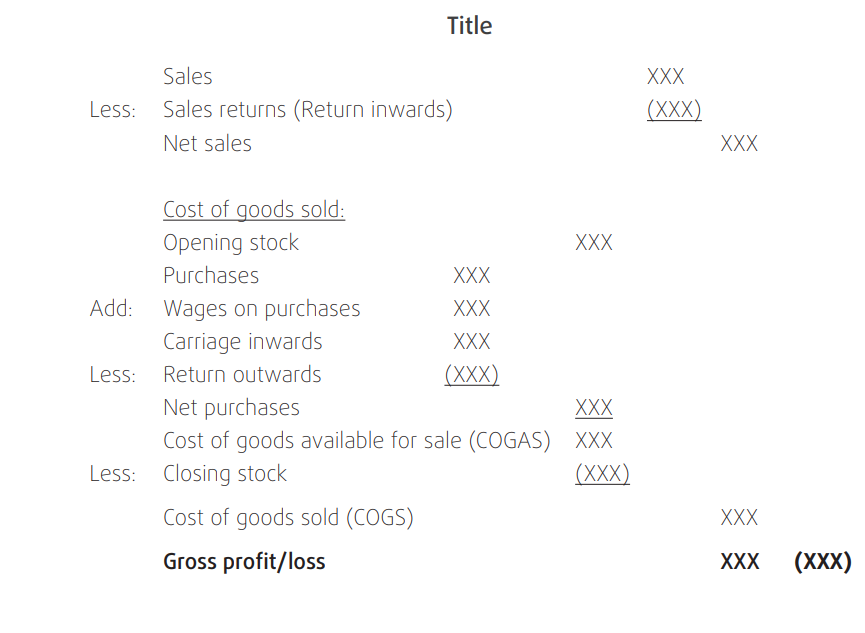

a) Trading account

It is an account prepared to determine the gross profit or loss of the business

concern. It shows the revenues from sales, the cost of those sales or goodssold, and the gross profit

Items found in a trading account

◾ Sales: refer to the revenues collected from goods sold by the

business. It is revenue earned from goods sold. They are entered into

the trading account to calculate gross profit or loss.

◾ Sales return goods that were previously sold but have been returned

to the business.

◾ Net sales = sales – return inwards/ sales return

◾ Opening stock: unsold goods in the business available at the beginning

of the new trading period

◾ Purchases: goods bought by the business for resale

◾ Purchases return: goods previously bought by the business for sale

but have been sent back to the suppliers. This value is treated in the

trading account and is subtracted from the purchases to get the net

purchases i.e., net purchases = purchases – return outwards/purchase

returns

◾ Carriage inwards: refers to the cost of transporting the goods or

bringing the goods up to the premises. It forms part of the goods

bought and hence added to purchases in the trading account.

◾ Net purchases = purchases + carriage inwards – purchases return

◾ Closing stock: goods not sold by the business at the end of a trading

period. It’s included in the trading account, and it is subtracted from

the goods available for sale to get cost of sales◾ Drawings of goods: sometimes an entrepreneur may take physical

items out of the business for private use; this must be subtracted

from the goods available for sale in the trading account. It should be

noted that only drawings in the form of goods must be treated in the

trading account.

◾ Gross profit: excess of net sales over the cost of goods sold or cost of

sales. It also refers to the total profit obtained by an enterprise before

paying off the operating expenses. Thus

◾ Gross profit = net sales – the cost of sales

◾ Gross loss: this is the excess of the cost of sales over the net sales

of the business.

Format of a trading account

There are two formats used to prepare a trading account. i.e.

◾ Horizontal

◾ Vertical formatHowever, this unit will use the vertical format only.

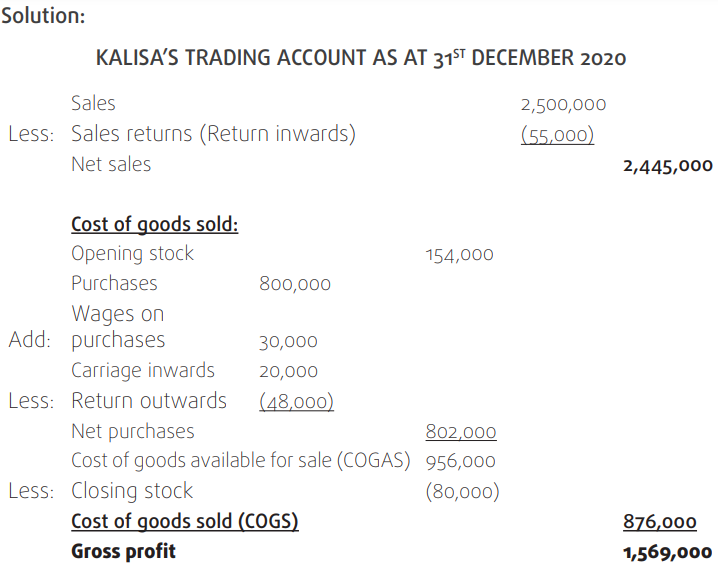

Example

a) The following information was extracted from the books of Kalisa Limited.

Opening stock------------------------154,000 FRW

Purchases------------------------------1,800,000 FRW

Sales------------------------------------2,500,000 FRW

Return inwards-----------------------55,000 FRW.

Return outwards---------------------48,000FRW

Closing stock--------------------------80,000 FRW

Wages on purchases------------------30,000FRW

Carriage on purchases----------------20,000FRW

Required; Prepare KALISA’s trading account for the month ending 31st

December 2020 using a vertical method.

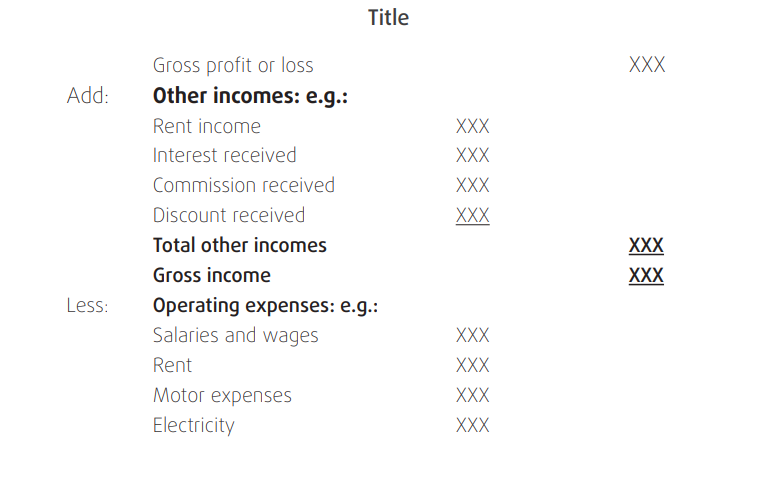

b) Profit and loss account

This is the final account or statement prepared by the business at the end

of the trading period to determine the business’s net profits or net losses.

It begins with the gross profit or loss transferred or brought down from thetrading account.

Elements of a profit and loss account

◾ Gross profits/loss: this is transferred from the trading account as

balance b/d

◾ Supplementary income refers to all income or revenue that the

business earns from sources other than sales. A company may earn

income from other sources apart from sales, which are treated in

the profit and loss account by adding them to gross profit. Examples

include; the discount received, the commission received, rent

received, and bad debts recovered. Etc.

◾ Operating expenses are the costs incurred by the business on services

that help in the regular operation and running of the company. Such

expenses include; transport, electricity, rent, insurance/premium,

carriage outwards salaries, water bills, postage discount allowed,

advertising, and communication. In the profit and loss account the

total operating expenses are subtracted from the total income or

gross income to get net profit or a net loss.

◾ Net profits/loss: excess of gross profits over the business’s expenses

at a given period. Therefore, Net profit= gross profit + supplementary

income – total expenses.

There are two formats used to prepare a profit and loss account i.e.

◾ Horizontal

◾ Vertical formatHowever, in this unit will use the vertical format only.

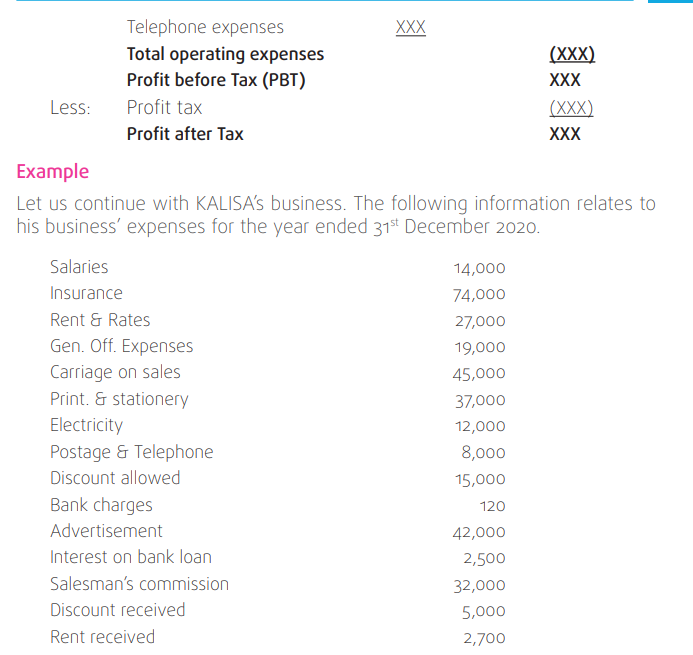

Required: Prepare the profit and loss account for the year ended 31st December

2020 using vertical format.

Note: when both the trading account and profit and loss account are prepared

within one statement, the statement is referred to as “Income statement” or“Trading, profit & loss account”.

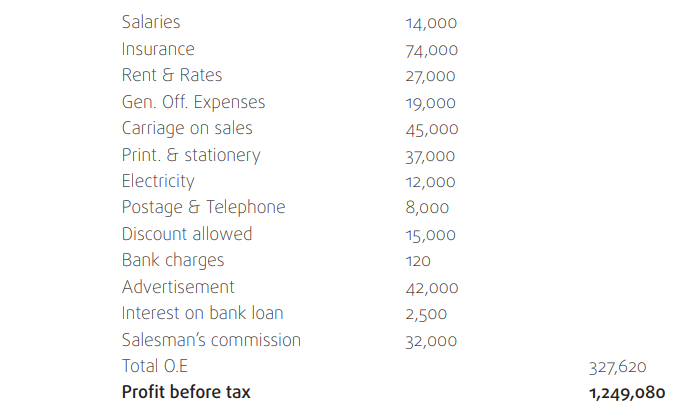

Application Activity 2.3

The following is the Trial Balance of the company M&N Ltd for the year

ended 31 December, 2017:M&N Ltd Company Trial Balance as on 31.12.2017

Additional information:

Closing Inventory 8,000 FRWRequired: Prepare the company’s income statement using a vertical format.

2.4. Preparation of a balance sheet

Learning Activity 2.4

Nyirawimana’s business had the following transactions during the

last month:

• Started business with cash 2,000,000 FRW.

• Purchase goods for cash 500,000 FRW and for credit from Uwineza

600,000 FRW.

• Purchased office equipment for cash 80,000 FRW.

• Paid office rent 10,000 FRW.

• Sold goods for cash 1,000,000 FRW

• Sold goods on credit to Kalisa for 160,000 FRW

• Bought insurance on cash for 50,000 FRW

• Salary due to her employee was 15,000 FRW

• The stock at the end of the month was 300,000 FRW

Questions

Using Prior knowledge on prime books you acquired from Unit 10 in Senior 5,

a) Identify what the business owns as at the end of the month.

b) Identify what a business owes to outsiders at the end of the month.

c) What do we call what a business owns?

d) What do we call what a business owes to outsiders?

e) How is a balance sheet different from an income statement?

f) What do you understand by the term balance sheet?

g) Why do you think it is important for a business to prepare a balance

sheet?

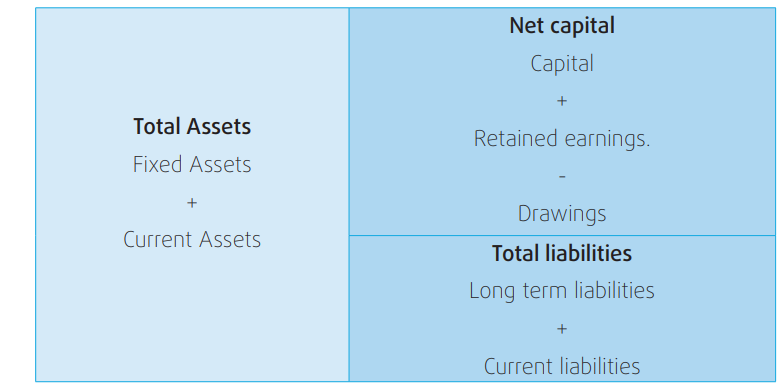

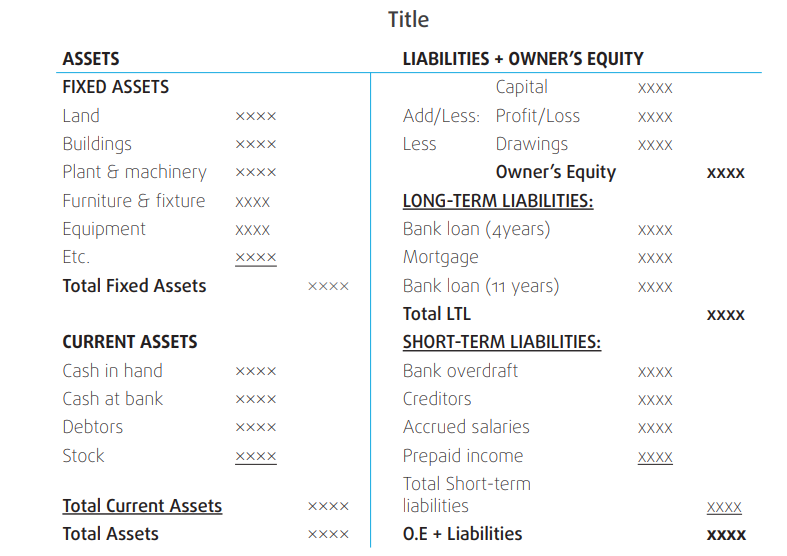

The balance sheet is prepared following the preparation of the income

statement. A balance sheet is not an account, therefore, not part of the

double entry, but it is prepared based on the ACCOUNTING EQUATION, which

states that: Assets =capital + liabilities

Parts of a balance sheet

There are three major parts of a balance sheet. i.e., Assets, Liabilities, Capital

Assets

These are possessions of the business and have got money value.

They are grouped into two.

◾ Fixed assets

◾ Current assets

Fixed assets: These are the business’s durable possessions, usually above

one year. E.g., land, equipment, machinery, fixtures and fittings, motor

vehicles, etc.

Current assets: Possessions or properties of the business which last for a

short time and are usually changed into cash. Current assets keep being

converted from one form to another, e.g., stock of goods, debtors, cash at

hand, prepaid expenses or expenses paid in advance, outstanding income,

etc.

Liabilities

These are debts or money that the business owes the outsiders. They are

claims of outsiders on the business’ assets. There are two types of liabilities:

◾ Long term liabilities◾ Short term liabilities

Long-term liabilities: These are debts of the business that are expected

to be paid after a long time, usually after one-year, e.g., bank loans or

debentures.

Short-term liabilities/current liabilities: These are business debts to be

paid within a short time, usually within a year. e.g., trade creditors, bank

overdrafts, outstanding expenses, prepaid income, etc.

Capital

These are the resources invested by the owner or the entrepreneur in the

business. Capital is also known as owner’s equity. To start any business, a

person requires capital in the form of money or other physical resources. The

capital increases or decreases over time.

There are two formats used to prepare a balance sheet i.e.

◾ Horizontal

◾ Vertical formatHowever, this unit will use the horizontal format only.

There are two ways of arranging items in the balance sheet: Order of

permanency, which involves recording items that the business will keep

for a long time first. E.g., fixed assets, current assets on the debit side and

capital, long-term liabilities, and current liabilities on the credit side.

Order of liquidity; items that the business will keep items for a short time

are written first. E.g., Current assets, then fixed assets on the debit side and

current liabilities, long-term liabilities, and capital on the credit side.

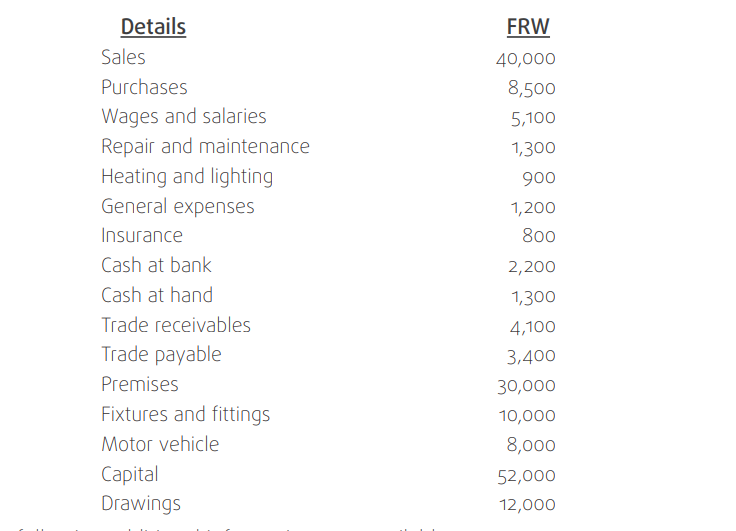

Example

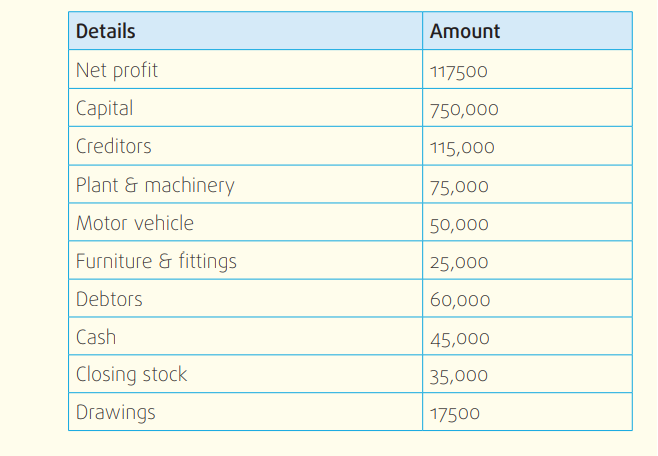

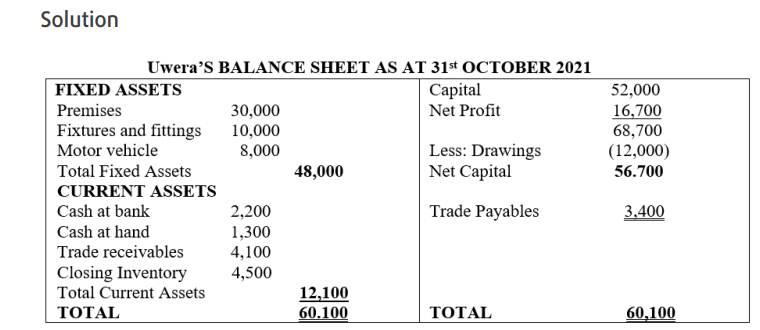

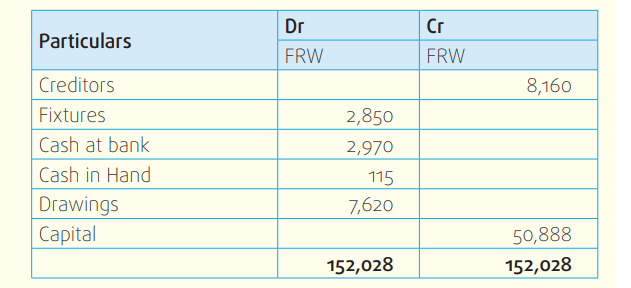

The following balances were extracted from the books of UWERA’s businesson 31st Dec 2021

The following additional information was available:

Inventory as of 31st December 2021 was valued at 4,500 FRW

Required.

Prepare Uwera’s balance sheet as of 31st Dec 2021 using the order permanencyand horizontal method.

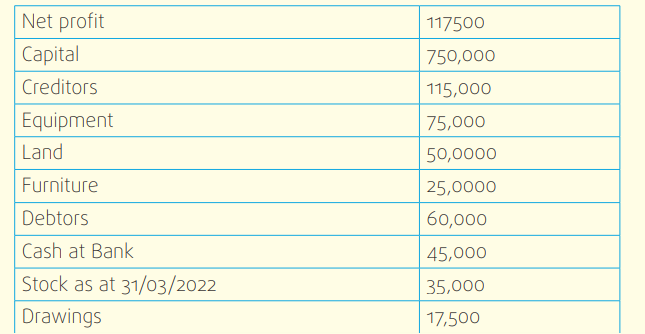

Application Activity 2.4

The following information was obtained from the books of savannabusiness club as of 31 March 2022.

Required.

Prepare savanna’s balance sheet using a horizontal format.

2.5. Cash Flow Statements

Learning Activity 2.5Analyze the case study and answer the questions that follow.

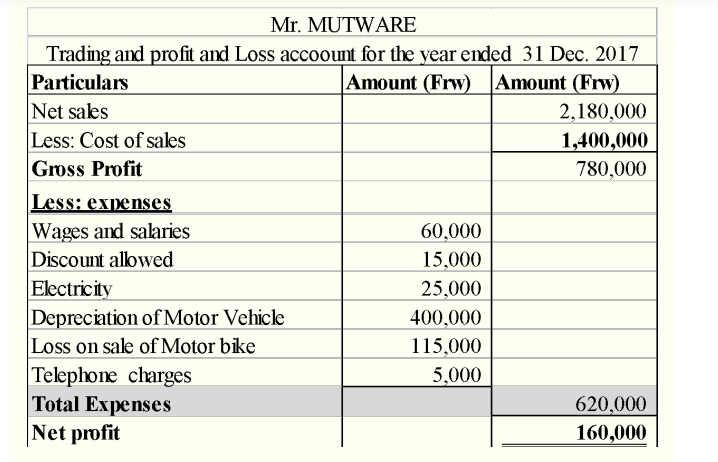

Mr. MUTWARE has been in business for the last year. At the end of the

year, he received financial statements from his accountant, a graduate

from one of the reputable business colleges in Rwanda. The following washis income statement as at December 31, 2022.

Mutware is confused by this report because he was told that he made a

profit of only 160,000FRW and needs more explanations.

a) Identify what money was spent on and how much?

b) Identify where the business got money from and how much it got?

c) Calculate the difference between money received and expenses

incurred. Is there any difference in the business’ profit?

d) What is a cash flow statement?e) Why do you think it is important for a business to prepare a cash flow statement?

2.5.1. Meaning of cash flow statement

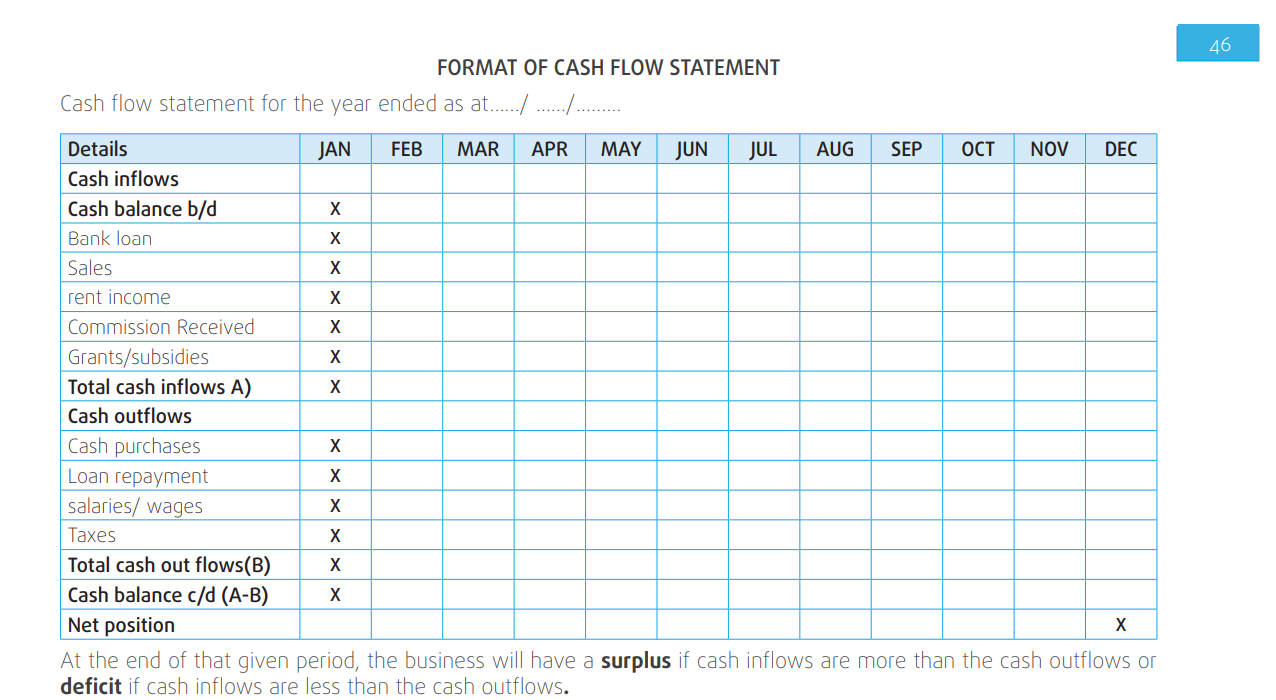

This statement shows the cash inflows and outflows of the business. The

cash flow statement is composed of four components.

Cash inflows show activities that result in cash coming into the business

enterprise, i.e., sources of cash. For example, balance b/d, cash sales, debtors,

share capital, interest earned, and loans. At the same time,

Cash outflows show activities that result in cash going out of the business

enterprise, i.e., uses of cash. For example, cash purchases, salaries, drawings,

licences, rent, taxes, etc.

Balance brought forward (b/f)

Net cash position

2.5.2. Importance of Cash flow statement

◾ It helps to identify the source of cash inflows in the business and how

cash was used.

◾ It helps management properly plan cash to avoid excess cash or

deficits.

◾ It reports the total amount of cash used in long-term investment

activities such as purchasing fixed assets.

◾ It shows the amount of cash received from various financing sources,

such as long-term loans and the sale of shares.

◾ It helps management to avoid liquidity problems by anticipating when

cash is expected to flow in and plan payments accordingly.

◾ It helps investors understand how a company’s operations arerunning, where its money is coming from, and how it is spent.

2.5.3. Preparation of Statement of Cash Flows

While preparing the cash flow, we will look at each section of the statement

of cash flows and put them all together. There are two methods of cash flow

statements.

Direct method

The direct method for creating a cash flow statement reports major classes ofgross cash receipts and payments (Cash inflow and cash outflow)

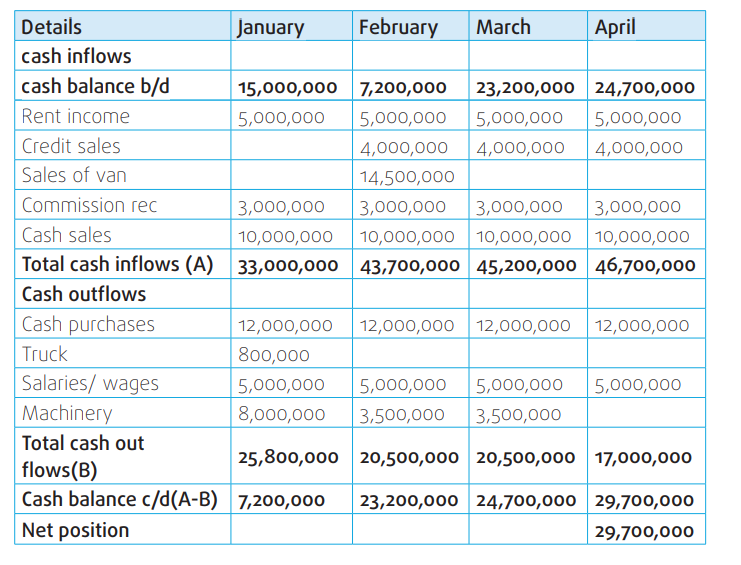

Example

Prepare Dudu’s cash flow for the month of January, February, March, and April

2006, given the following information below:

◾ Cash balance b/d or b/f in January was 15000, 000FRW.

◾ Monthly rent income was 5000, 000FRW.

◾ Monthly credit sales to be paid in the next month were 4000,000

FRW.

◾ Sold a business van in February 14,500,000 FRW

◾ Monthly commission received was 3000,000 FRW.

◾ Monthly cash sales of 10,000,000 FRW

◾ Monthly cash purchases of 12,000,00 FRW

◾ Bought a truck in January for 800,000 FRW

◾ Monthly salaries and wages 5000,000 FRW

◾ Bought machinery worth 15,000,000rwf, payment of 8,000,000

FRW was made in January and the balance was paid in two equalinstalments during the months of February and March.

SolutionDUDU’S CASH FLOW STATEMENT FOR JANUARY, FEBRUARY, MARCH AND APRIL

Exercise

Given the information below on central trading company ltd (for the month

of April, May & June)

◾ On 1st April 2005 Central Traders Company Ltd had a cash balance of

10,000,000FRW.

◾ It expected monthly cash sales of 5000,000 FRW.

◾ Credit sales were 3,500,000FRW per month, and the payments would

be made in the following months.

◾ Monthly rent income from some of its properties was expected to be

1,000,000 FRW

◾ Monthly purchases were 6,000,000 FRW.

◾ Monthly salaries and wages bills were projected at 800,000 FRW.

◾ A loan from Umwalimu Sacco was 10,000,000 FRW.

◾ Interest Monthly payment of 100,000 FRW on loan.

◾ Monthly raw material for 5000,000 RFW.

Required: Prepare the central trading company’s cash flow statement forApril, May, and June.

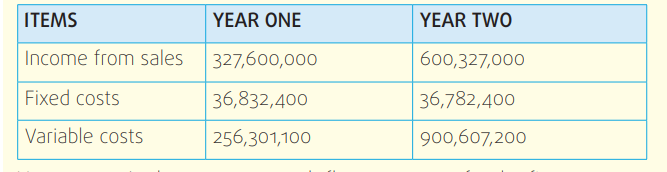

Application Activity 2.5

Melissa soft drinks dealers started business on 1st/august/2019 with

50,000,000FRWand a loan of 40,000,000FRW from BPR bank. All

the money was kept in the bank. Interest on the loan per year is

16% on a reducing balance basis over five years. The following arethe projected estimates (in FRW) for the first two years.

You are required to prepare a cash flow statement for the first two years

of operation.

Skills Lab Activity

From your business club activities, collect data from the transactions

carried out in the last year, then use it to calculate.

a) The Net profit/loss linking to the trading, profit, and loss account.

b) Balance sheet and make a report on how you will improve the financial

status of the school business club.End of Unit Assessment

I. Project Activity

Search for financial statements of a given business, interpret them,

and provide advice on what the business can do to improve financially.

II. Other Assessment Questions

1.

a) Which financial statement displays the revenues and expenses of

a company for a period?

i) Income statement

ii) Balance sheet

iii) Cash flow statement

iv) Statement of owners’ equity

b) What is the primary purpose of financial accounting?

i) Organise financial information

ii) Provide useful financial information to outsiders.

iii) Keep track of company expenses,

iv) Minimise company taxes

c) Which of these is not included as a separate item in the accounting

equation?

i) Assets

ii) Revenues

iii) Liabilities

iv) Stockholders’ equity

d) Which financial statement uses the expanded accounting equation?

i) Income statement

ii) Balance sheet

iii) Cash flow statement

iv) Owners’ equity

e) The account format that displays debits, credits, balances, and

headings.

i) General journal

ii) General ledger

iii) T account

iv) Ledger account

f) Asset accounts have what type of balance?

i) Credit

ii) Debit

iii) Contra

iv) All of the above.

g) Which account increases equity?

i) Expenses

ii) Withdrawals

iii) Stock

iv) Revenues

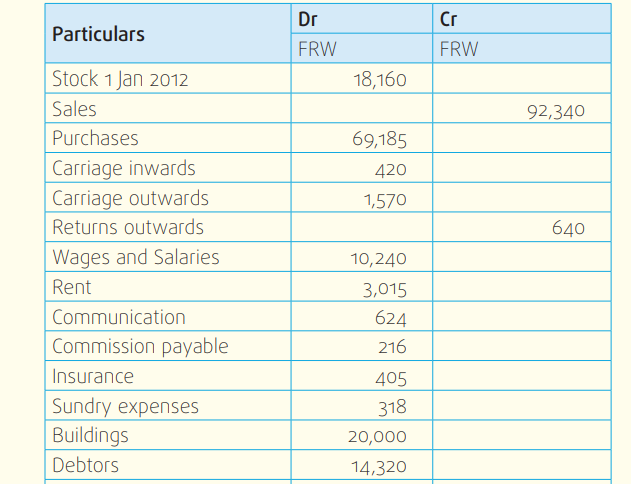

2. The following is the trial balance of KAMI Ltd as at 31 December

2012. Prepare the company’s trading, profit and Loss account anda balance sheet for the year ended 31 December 2012.

Closing stock is FRW 12,000

3. The following information was obtained from the books of Kanezaand Kamali Ltd Company as at 31 March 2010.