Unit 1: Ledgers and Trial Balance

Key unit competence

To be able to prepare ledger accounts and trial balance.

Introduction

It’s likely that you have heard the saying, “It costs money to make money.”

A businessperson contributes money and, ideally, makes good use of it to

create even more value.

You were introduced to Accounting prime books in Senior Five unit 10, for

you to acquire the necessary skills from this unit; whenever you attempt

a question in arithmetic, you try to verify whether your answer is correct.

Similarly, an accountant also wants to be sure that the ledger accounts she

or he has prepared are correct regarding the amount, side, balance, etc. To

determine whether the debit or credit amounts recorded in the ledger are

correct, you must prepare the trial balance. This unit will teach you how toprepare ledgers and a trial balance.

Introductory Activity

In Senior 5 unit 10, you studied accounting prime books, in which you

recorded a variety of transactions carried out by various businesses as

well as those for your club activities in different prime books (Purchases

journal, Sales journal, Sales returns journal, Purchases returns journal, Cash

book and General journal). As a result, it is important to continue posting

transactions to the respective accounts for the business’s financial status

to make more sense and assist the entrepreneur in making an appropriate

decision.

Use your previous experience and accounting skills to answer the following

questions.

a) Where do you think the information from journals is posted?

b) Why is posting accounting information important in business?

c) On 1st. June.2023, John started a business with 200,000FRW, of which

100,000FRW was at the bank account.

2nd June.2023 he purchased a machine to use in his business and paid cash80,000FRW.

Required:

i) Journalize the transactions above.

ii) Post the information to the appropriate ledger.iii) Prepare a trial balance for John’s business.

1.1. Ledger

Learning Activity 1.1

The average businessperson has so many matters to attend to, and his/her

transactions are so numerous that it is impossible to remember everything

that happens chronologically in journals. Using your prior knowledge

related to transactions.

a) What is meant by a term ledger and posting?b) Show the different classifications of ledgers.

1.1.1. The meaning and types of ledgers

A ledger is a collection or a set of accounts of a business. While the

journal records all transactions chronologically, ledger accounts classify the

transactions and record those of similar nature in one account. The process

of transferring information from the books of original entry to the ledger

accounts is called posting.

For instance, all transactions related to cash movement must be recorded

together under one statement called “Cash account”,

There are several types of ledgers in accounting. In this unit, focus is put on

three types of ledgers which include:a) General ledger: is a ledger that contains all accounts of the business

except sales and purchases. E.g., assets, liabilities, incomes, expenses,

and capital.

b) A sales ledger/ Debtors ledger is a collection of all accounts of people

or businesses to whom the business has sold goods on credit (debtors).

c) Purchases ledger/Creditors ledger is collection of accounts of people

or businesses from whom the business has bought goods on credit(creditors).

Skills Lab Activity

Case study:

Mupenzi, a businessman that deals in fruits, visits an organization that

offers rural business owners small grants to expand their businesses. The

review panel conducted a short interview to gather some information

about Mupenzi’s business to determine if he qualifies.

Panel: How much have you spent on equipment and materials for your

business so far?

Mupenzi: It’s quite some amount. More than 100,000.

Panel: How much have you sold this last quarter?

Mupenzi: Business hasn’t been good because of the heavy rains. A bit

lower than last year.

After the interview, Mupenzi learnt that he did not qualify for the grant.1. Why do you think Mupenzi failed to get the grant?1.1.3. Preparation of ledgers

2. What should Mupenzi have done differently to qualify him for thegrant?

After recording accounting transactions in appropriate accounting prime

books i.e.: general journal, purchases journal, sales journal, return inwards

and return outwards journals, as well as different forms of cash books in

chronological order, the next important step is to post accounting information

from different prime books listed earlier to respective ledgers. It is in the

ledger, that all transactions of similar nature are recorded together under one

account.

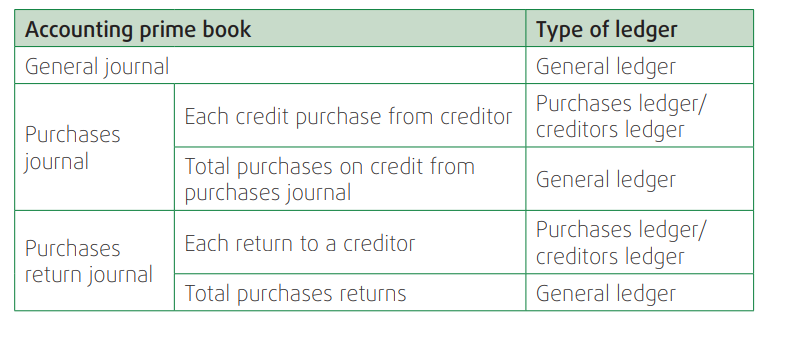

The table below summarises how and what to post from prime books toledgers

A. Purchases ledger/ Creditors’ ledger

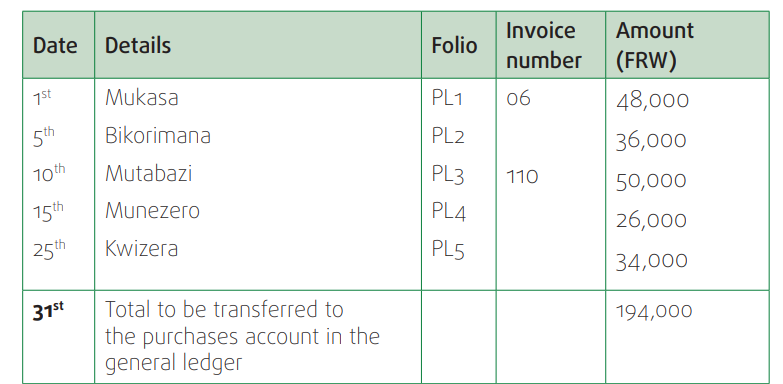

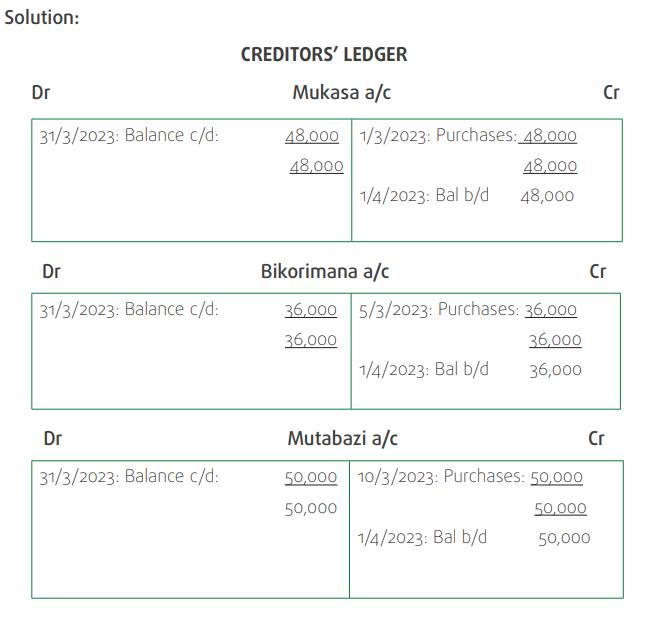

The creditors’ ledger accumulates information from the purchases journal.

The purpose of the creditors’ ledger is to provide knowledge about which

suppliers the business owes money to, and how much. This is achieved by

posting information from the purchases journal to creditors’ ledger.

Normally, every account should be balanced off at the end each month.

Balancing an account off is the adding of both the debit and credit sides

in order to make the two sides equal. When balancing off an account the

following steps are put into consideration:

Step 1: Add the two sides separately to find out the total of each

Step 2: Subtract the smaller side total from the bigger side

Step 3: Record the differences on the smaller side and call it balance carried

down (bal c/d) or balance carried forward (bal c/f) using the last date of the

month.

Step 4: Now both sides are equal.

Step 5: Put balance c/d on the opposite side (bigger side) of the account and

call it balance brought down (bal b/d) or balance brought forward (bal b/f),

using first date of the next month or period

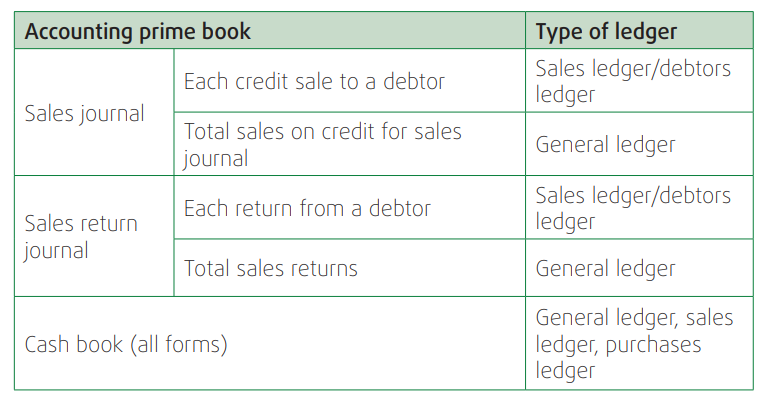

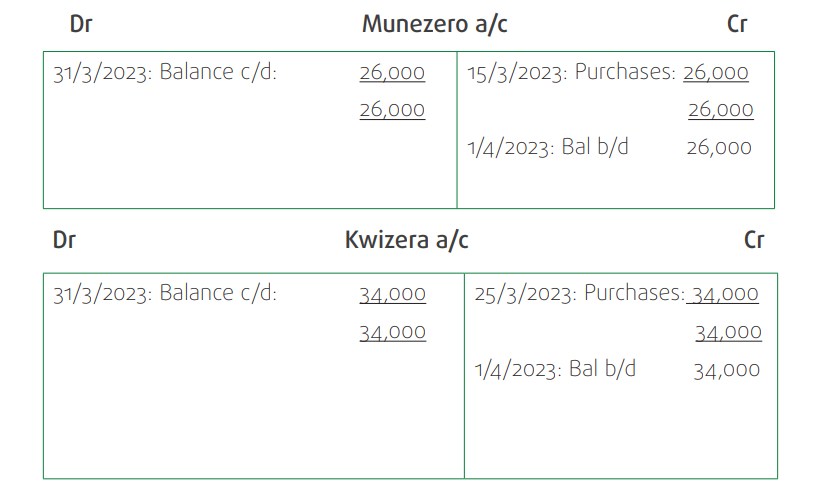

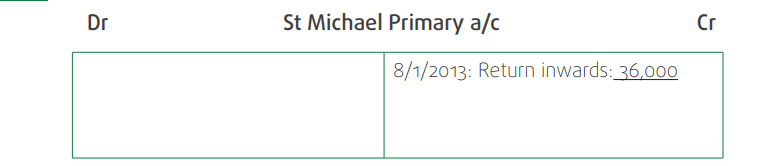

Example 1:

Given the following Akeza’s purchases journal, post the information to the

creditors’ ledger.UNIT 1

AKEZA’S PURCHASES JOURNAL FOR THE MONTH OF MARCH 2023

Note: The total of credit purchases is debited in the purchases account

which is opened up in the general ledger.

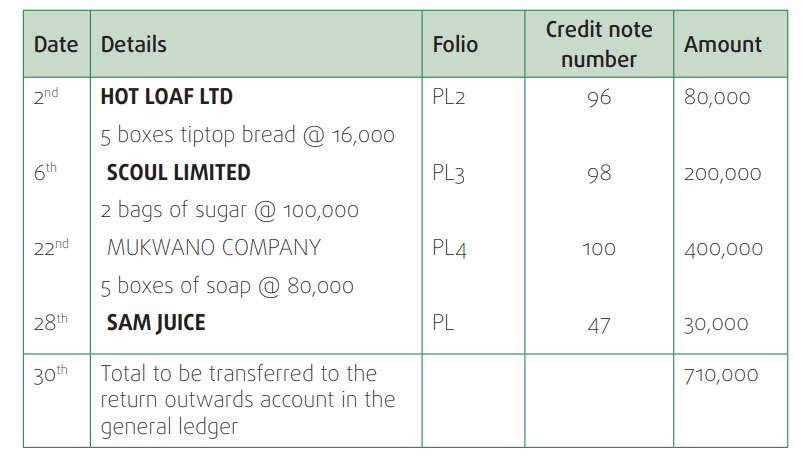

Example 2:

Given the following Kimironko wholesalers’ purchases returns journal, post

the information to the creditors’ ledger.

KIMIRONKO WHOLESALERS’ PURCHASES RETURNS JOURNAL FOR THEMONTH OF NOVEMBER 2022

Note: The total of purchases returns is credited in the return outwards

account which opened in the general ledger.

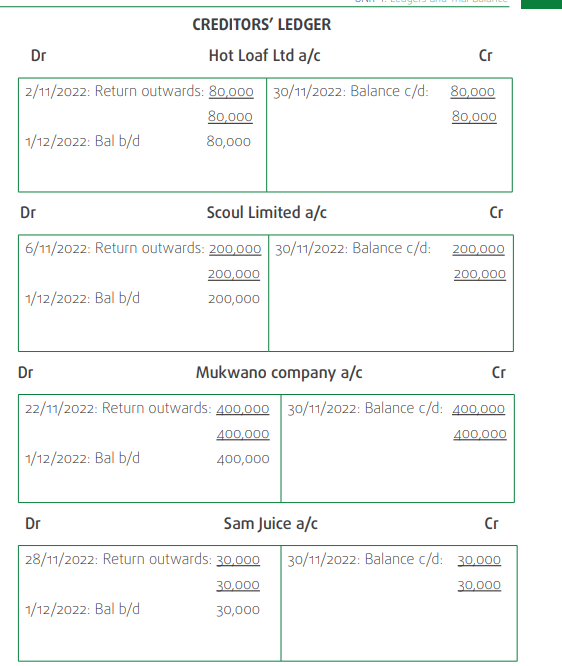

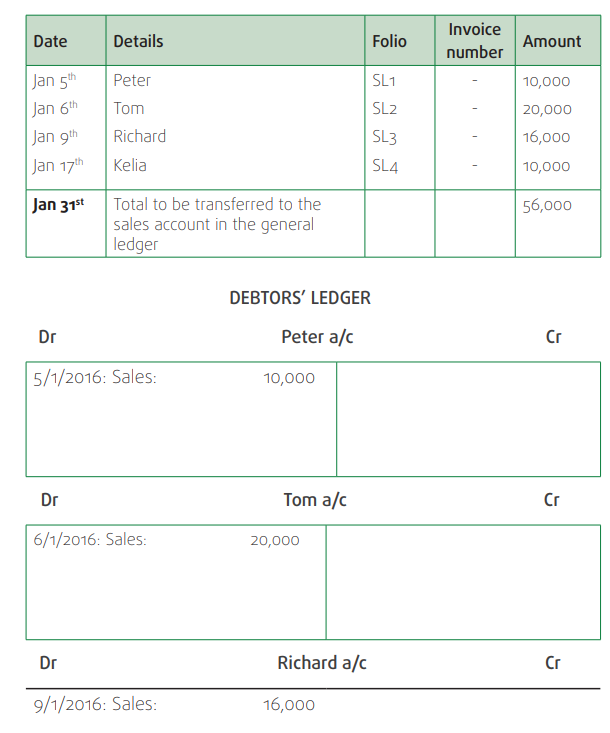

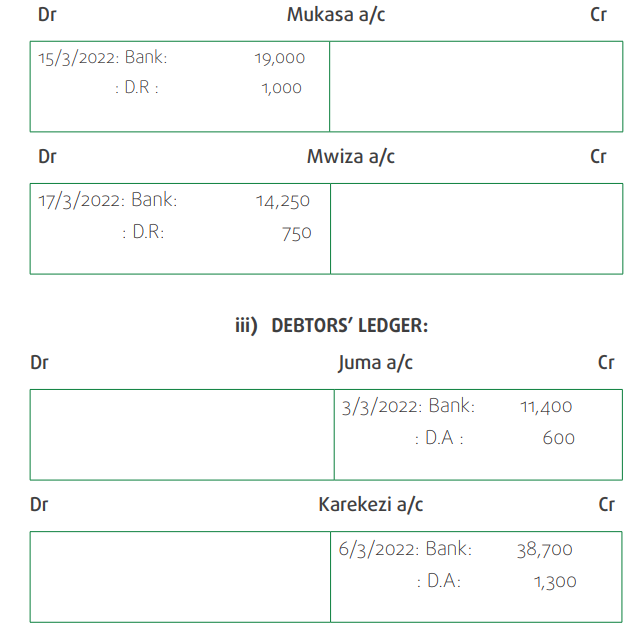

B. Sales ledger/Debtors’ ledger

The debtors’ ledger accumulates information from the sales journal. The

purpose of the debtors’ ledger is to provide knowledge about which customer

owes money to the business, and how much. This is achieved by postinginformation from the sales journal to debtors’ ledger.

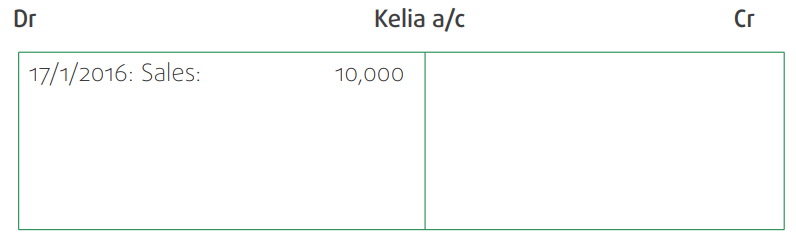

Example 3:

Given the following Alain’s sales journal, post the information to the debtors’ledger.

ALAIN’S SALES JOURNAL FOR THE MONTH OF JANUARY 2016

Note: The total of credit sales is credited in the sales account which

opened in the general ledger.

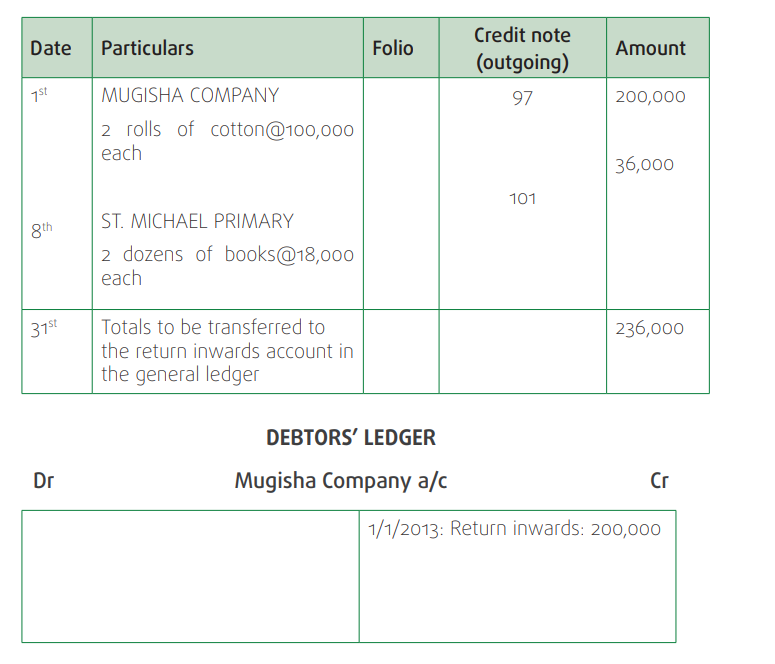

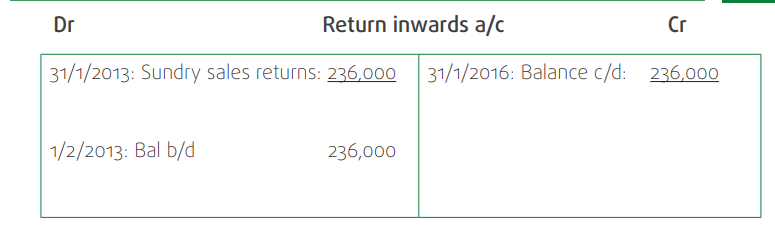

Example 4:

Given the following Gakuba’s sales returns journal, post the information to

the debtors’ ledger.

GAKUBA WHOLESALERS’ SALES RETURN JOURNAL FOR THE MONTH OFJANUARY 2013

Note: The total of sales returns is debited in the return inwards account

which opened in the general ledger.

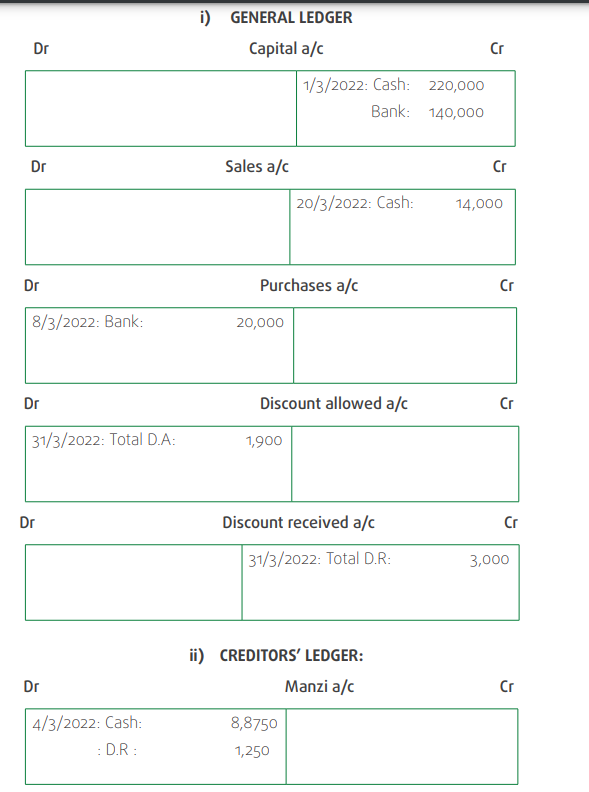

C. General ledger

The general ledger contains all other accounts that are not kept in any other

ledger e.g., buildings, furniture, and stock account.

Note: personal accounts of debtors or creditors who do not arise out of sale

or purchase of goods on credit are kept in the general ledger e.g. debtors as

a result of sale of fixed assets on credit and expenses creditors.

Let us first of all post the totals of purchases journal, purchases return journal,sales journal, and sales returns journal used above:

It is good time to remember that the records in the cashbook are posted to

the general ledger, creditors’ ledger, and debtors’ ledger depending on what

transaction took place.

Notes:

◾ When transactions are recorded in the cashbook, cash and bank

accounts are not opened up in the ledger. Because the recording of

transactions in the cash book takes the shape of a ledger account.

The cash book serves the purpose of a ledger account as well as a

journal for cash and bank accounts.◾ Contra entry transactions are not posted to the ledger because theirExample 5:

double entry is completed within the cashbook.

◾ Discount allowed and discount received are posted to discount

allowed account and discount received account respectively in the

general ledger

◾ While posting information from any type of cash book,

i) Details from the debit side are names of accounts to be opened

in the ledger and credited; and

ii) Details from the credit side are names of accounts to be opened

in the ledger and debited.

◾ The balance brought down (bal b/d) or balance brought forward (balb/f) is posted to the capital account in the general ledger.

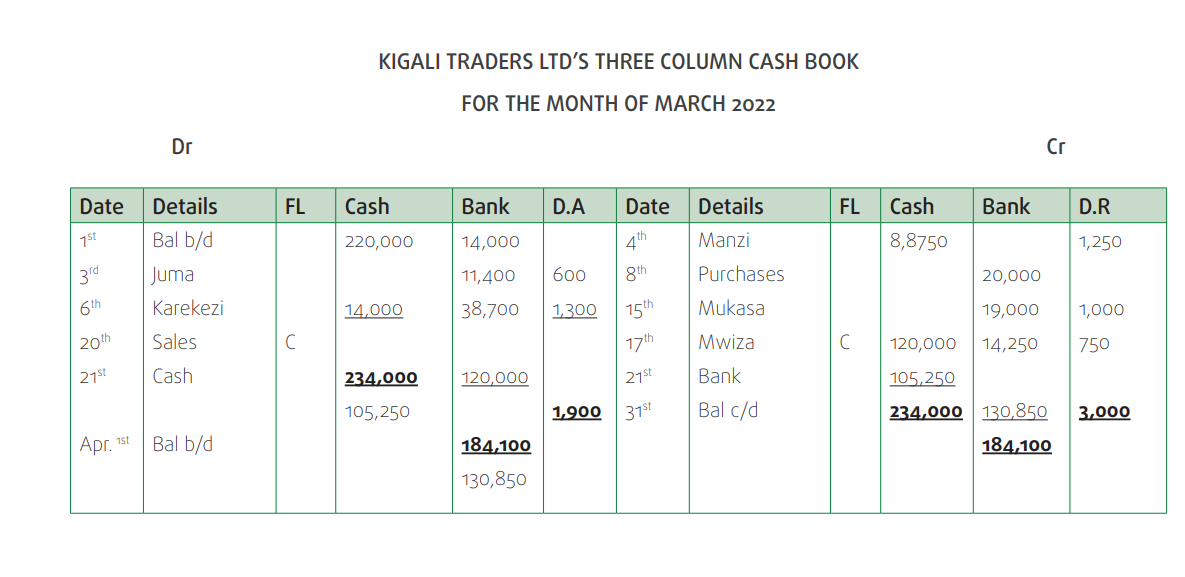

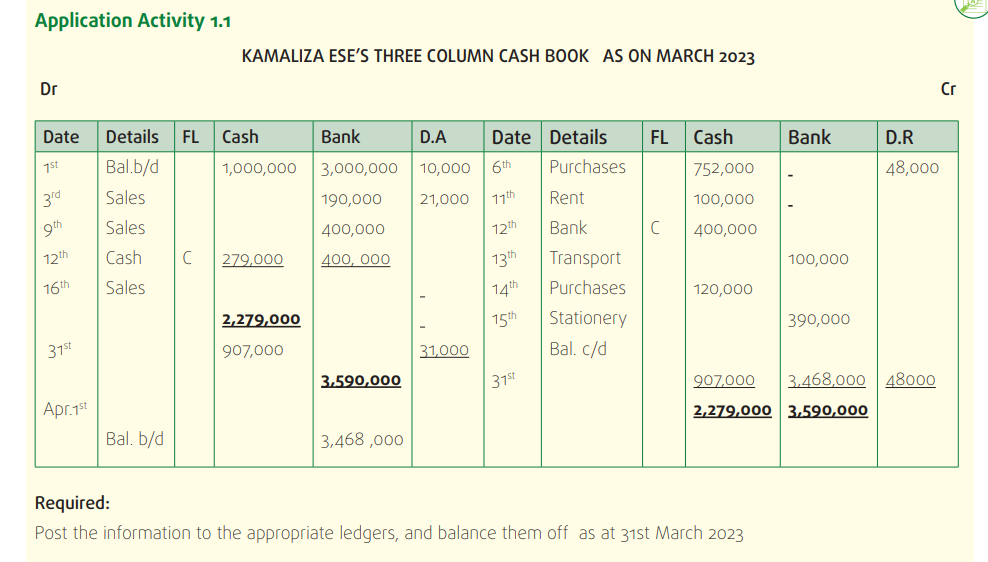

Given the cash book below of Kigali Traders Ltd, post the information to the

respective ledgers. Personal accounts appearing in the cash book below are

for businesses that one-time transacted goods on credit with Kigali TradersLtd.

Exercise:

Following the clear steps of balancing accounts, balance off accounts in allthe above ledgers.

1.2 Trial Balance

Learning Activity 1.2

1. At the end of every month, Mukamana draws a list of accounts to

check whether her records are properly recorded with arithmetical

accuracy or otherwise; she passes necessary accounting records

to correct detected errors in her books of accounts in case they

are not appropriately recorded.

i) Referring to what Mukamana does at the end of e each month,

what do we call that exercise in accounting?

ii) What do you understand by the term trial balance?

2. Do you think it is important to extract a trial balance? Justify your

answer.

1.2.1. Meaning of a trial balance

A trial balance is a list of the debit and credit balances extracted from the

ledgers at a particular date.

It is referred to as a tool to prove the arithmetical accuracy of the entries

made in the ledger. If the records have been correctly maintained based on

a double entry system, the totals of the credit and debit would be equal to

each other.

1.2.2. Importance of a trial balance

◾ It is used as proof of the arithmetical accuracy of the entries made

in the ledger.

◾ The trial balance helps to know the assets and liabilities of a business

by just looking at it.

◾ Easy preparation of final accounts to determine the profit or losses

of the business.

◾ One may rely on the results derived from the trial balance when the

total of debits equals the total of credits.

◾ Arithmetical errors made during recording and posting of transactionsare easily detected by preparing a trial balance.

1.2.3. Preparation of a trial balance

Trial Balance is not an account. It is only a list or schedule of balances of

ledger accounts. it I prepared following the steps below:

Step 1: Post all the journal entries to the appropriate ledgers.

Step 2: Balance off all ledger accounts and determine the credit or debit

balances for each ledger account.

Step 3: List all the accounts with their debit or credit balances. Ensure the

debit balances are in one column and the credit balances are in another.

Step 4: Add up all the credit balances and add up all the debit balances.

Step 5: The total of the debit balances should be equal to the total of the

credit balances. If the totals are unequal, recheck the process to identify and

correct the errors.

Note: The accounts having a debit balance are entered in the debit amount

column, and the accounts having a credit balance are entered in the credit

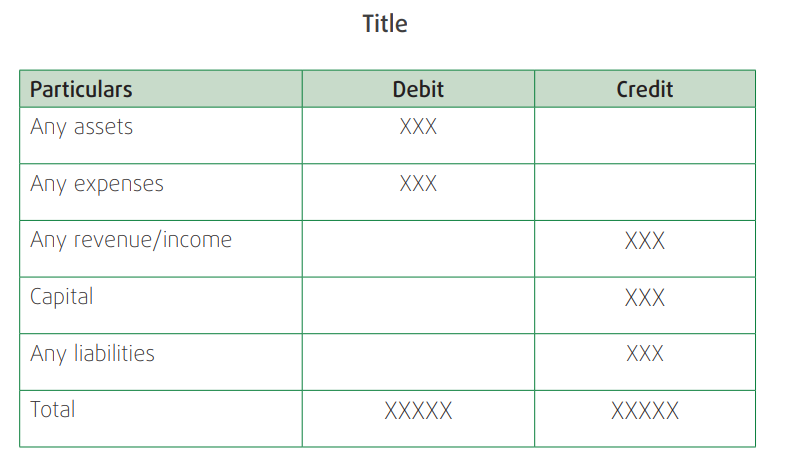

amount column.Format of a trial balance

Note: All expense and asset accounts normally have debit balances and are

listed in the debit column, and all liability and income accounts normally have

credit balances and are listed in the credit column.

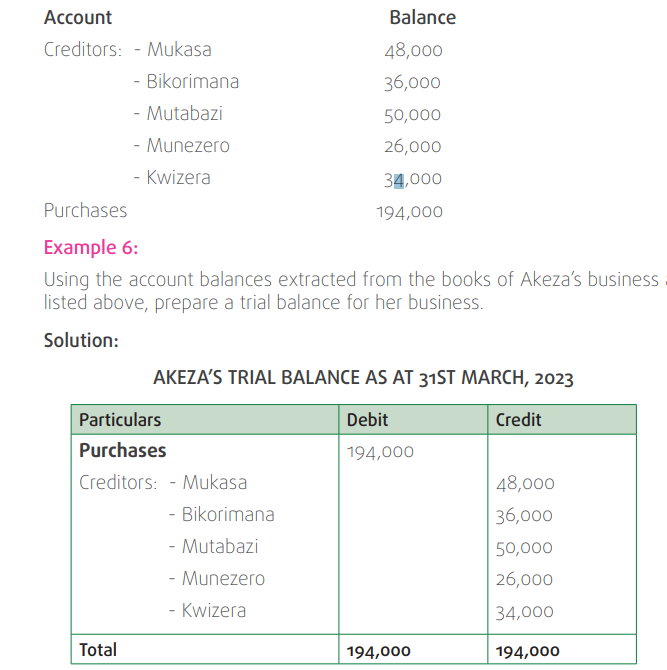

Let us use the example on page 4 to make a list of accounts of Akeza’sbusiness as at the end of March, 2023

Note: when details about opening and closing stock balances are given, the

opening stock balance is used in the trial balance while the closing stock

balance is used to prepare the income statement and balance sheet.

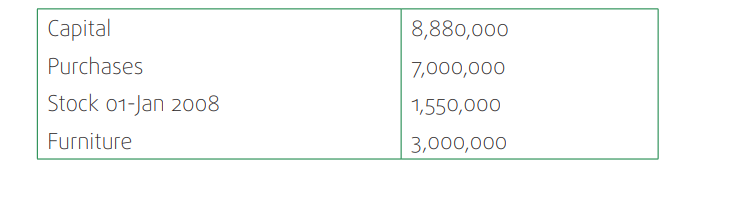

Example 7:

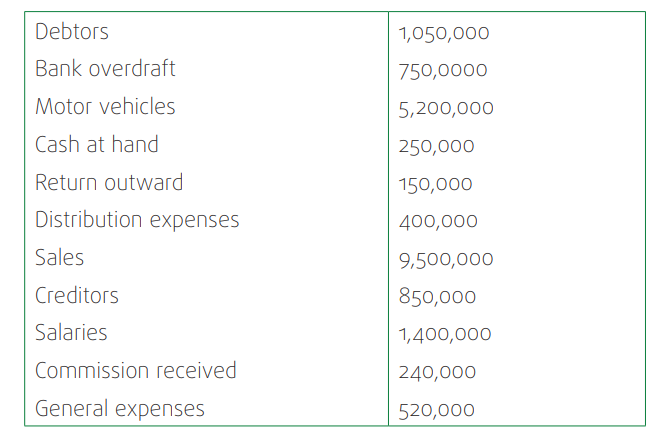

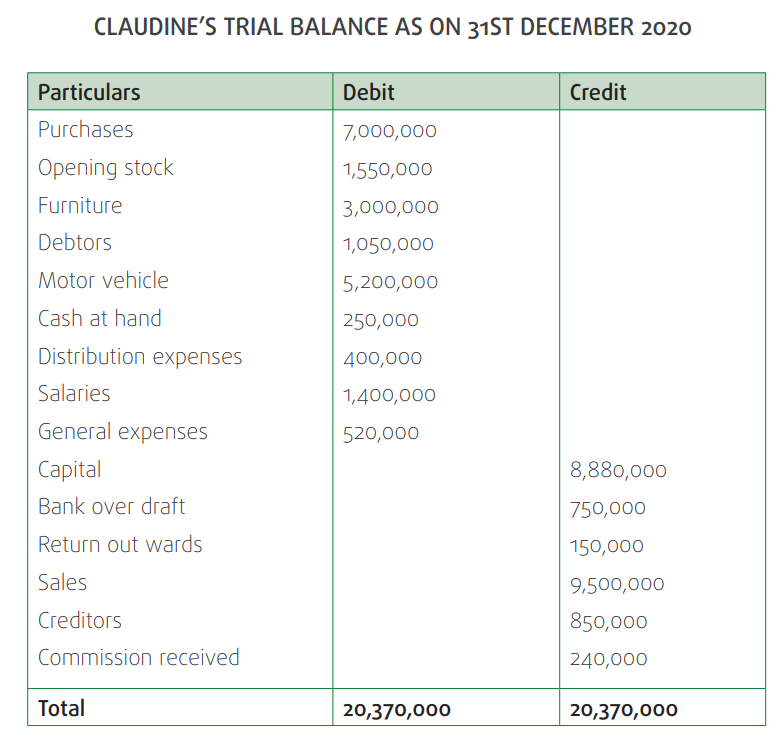

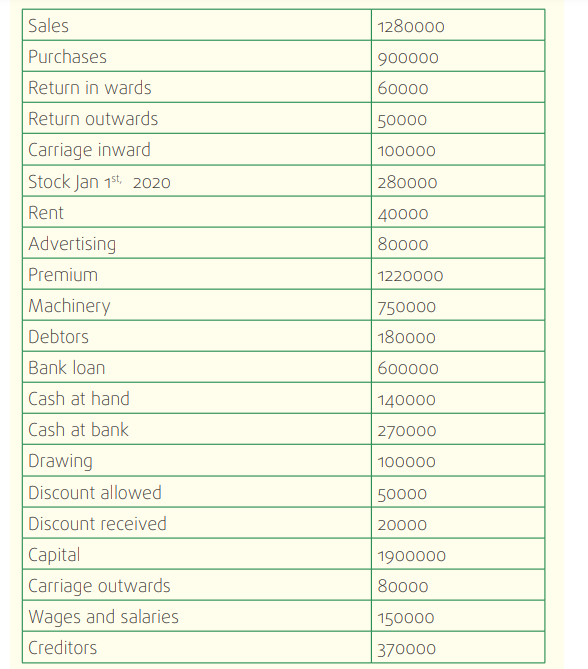

The following balances were extracted from Claudine Enterprises’ books as ofDecember 2020. Extract the trial balance.

Application Activity 1.2

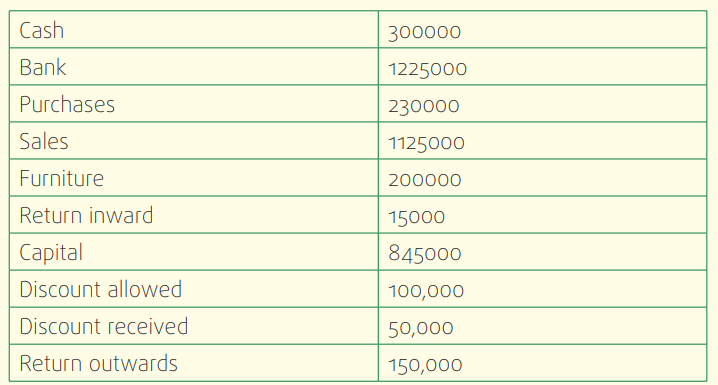

The following balances were extracted from the books of Umucyo BusinessClub as at the end of December 2020. Prepare the trial balance.

Additional information:

The closing stock as at 31st December 2023 was 28, 000FRW.

End of Unit Assessment

I. Project Activity

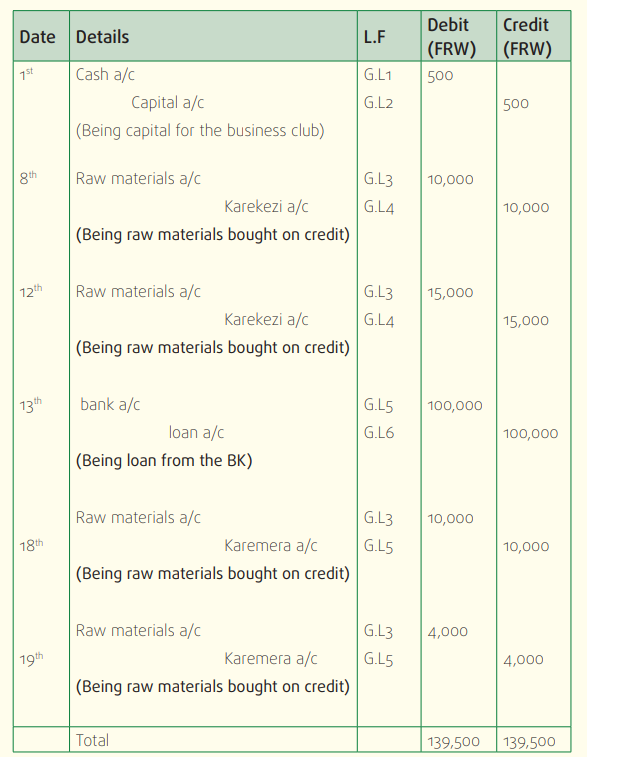

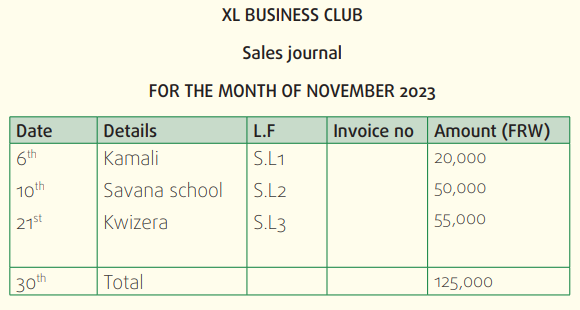

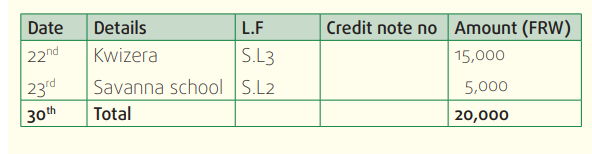

Given the following prime books extracted from XL business club’s

accounting books as at 30th November 2023, post the information torespective ledgers and there after extract a trial balance

XL BUSINESS CLUB

General journalFOR THE MONTH OF NOVEMBER 2023

XL BUSINESS CLUB

Return inwards journal

FOR THE MONTH OF NOVEMBER 2023

2. Explain the following terms:

i) Ledger

ii) Trial balance

3. Why is important to prepare trial balance.

4. Explain the steps that are taken to prepare a Trial Balance

5. Explain the term ‘Posting’?

6. The following information was extracted from the books of Kezalimited on 31st December 2020.

Required: Prepare the Keza limited’ trial balance as on 31st December 2020