UNIT 9: TAX ADMINISTRATION

Key unit competence: Identify tax administration according to rulesand regulations

Introductory activity

Scenario

Taxpayers have the obligation to report and pay taxes, and thus contribute

to the economic growth and development of their Countries. The actions

of taxpayers – whether due to ignorance, carelessness, recklessness, or

deliberate evasion, as well as weaknesses in the tax administration mean

that instances of failure to comply with the tax law are inevitable. Therefore,

tax administration should have in place strategies and structures to ensure

that non-compliance with tax laws is kept to a minimum. The art of good tax

administration is based on vision and mission of Rwanda Revenue Authority,

enumerate the importance of Rwanda Revenue Authority and the purposeof tax audit to the government

9.1: Description of the Tax administration (Rwanda RevenueAuthority)

Learning Activity 1.3

Scenario:

Any person who sets up a business or other activities that may be taxable

is obliged to register with the Tax Administration within a period of seven

(7) days from the beginning of the business activity, Tax administration

have the ability to collect taxes for increasing country’s capacity to finance

social services such as health and education, critical infrastructure such as

electricity and roads, and other public goods with research. Outline Corevalues of RRA.

9.1.1: General introduction of tax administration: Rwanda

Revenue Authority

1. Official mandate

The Rwanda Revenue Authority was established under Law No 15/97 of 8

November 1997 as a quasi-autonomous body charged with the task of assessing,

collecting, and accounting for tax, customs and other specified revenues. This is

achieved through effective administration and enforcement of the laws relating

to those revenues. In addition, it is mandated to collect non-tax revenues.

2. Vision

“To become a world-class efficient and modern revenue agency, fully financing

national needs.”

3. Mission

“Mobilize revenue for economic development through efficient and equitable

services that promote business growth.”

4. Core values

We are Customer-Focused:

• We treat our customers with fairness and equity,

• We cater for our customer needs when delivering services,

• We are open to customer concerns, ideas and criticism for our

continuous improvement.

We act with Integrity:

• We are honest, sincere and have high ethical standards,

• We are fair and considerate in our treatment to others,

• We show respect, courtesy and tolerance to the views of others,

• We are open and work with clarity and consistency in dealing with our

customers.

We are Accountable:

• We embrace our government given mandate and trust for revenue

collection and endeavour to deliver on it

• We assume responsibility for our decisions and actions as they affect

our customers,

• We are open, reliable and transparent in dealings with our customers.

We work as a Team:

• We empower our people

• We involve our staff

• We value team work

• We are engaged.

We are Professional:

• We commit to provide quality services to our clients

• Our work always aims to provide solutions to our clients

• We embrace best practice and innovations for continuous improvement,

• We demonstrate confidentiality in dealing with our customers,

• We commit to work with Passion

• The Structure

This includes the shape and type of the logo in a rose form. The structuresymbolizes three elements:

• Colors

The Colors to the logo which are Green, Blue and Orange symbolizes the

following

Green: Health environment, Harmony, Growth and Prosperity;

Blue: Universal, Light Friendly and Calm;

Orange: Essential, Sincere, Commitment and Strength.

The change logo shall be reflected change in attitude, service delivery,

opportunities, best practices and approaches of the tax administrators towards

taxpayers.

5. RRA strategic principles

The strategic principles to support core values and explain the way we design

RRA’s services are as follows:

a) Efficiency

We collect more revenue with less resource. Our customers experience our

services to be efficient. Our services and products meet international standards.

b) Fairness

We are fair, even-handed and consistent in our treatment of staff and customers.

There is transparency in our decision-making, which leads to a stable and

predictable environment for our stakeholders. We respond to feedback in a

flexible and timely manner.

c) Customer-centered

We take time to understand how customers operate and we tailor our services

so that it is easy, simple and cost-effective for our customers to comply.

d) Data and Technology driven

We use data, evidence, and technology to drive our decision-making and inform

our operations. We are resilient to threats through the internal controls webuild.

9.1.2: Description of recruitment, registration andde-registration

1. Recruitment

Recruitment in taxation is the process of actively seeking out, finding Tax payer

for a given time by making sensibilization of tax and improving awareness of

tax to the citizens.

This sensibilization and awareness is done through different ways, such

Publicity, Entertainments, Sponsors of public events.

2. Registration

a) Meaning of Registration

Registration means to put information, especially your name, into an official list

or record

b) Registered person in Tax Administration

Any person who sets up a business or other activities that may be taxable is

obliged to register with the Tax Administration within a period of seven (7)

days from the beginning of the business activity.

Registering a company owned by an individual or group of people is done by

Rwanda Development Board (RDB) via online services. This service is immediate

and free of charge. After company registration, the certificate is issued by RDB.

For individual businesses, registration can be done by RRA, and Tax Identification

Number (TIN) certificate is issued freely at countrywide spread RRA branches.

There is an RRA office in all 30 districts of Rwanda.

Every taxable business activity with a turnover exceeding Twenty Million

Rwanda Francs (Rwf20m) in the previous fiscal year or Five Million (Rwf5m) in

the preceding quarter is required by law to register for Value Added Tax (VAT)

within seven (7) days from the end of the year or quarter respectively.

Based on the above point, a business that has registered for VAT is legally

obliged to acquire an EBM with immediate effect because issuing any other

invoice other than the electronic one or not issuing it attracts penalties.

Businesses not meeting the above requirements may register for VAT voluntarily

and thus acquire EBM to meet the law provisions.

Any changes, whether related to the taxpayer or line of business shall be notified

in writing to the tax administration within seven (7) days from the day of the

notice of the change.

For example; if ownership of the business is transferred from Mr. A to B or

changes from trading in business to hardware. Failure to make the nonfictions

contravenes the law and attracts penalties.

The Commissioner General issues instructions regarding the registration

and cancellation of registration on persons who no longer carry out business

activities.

c) Rights of a registered business:

• Base of application for tax clearance certificate to participate in income

enhancing activities such as bidding, obtaining a loan

• Base of application for Quitus Fiscal

• Base of interaction with Tax Administration, benefiting for trainings on

tax matters

• Base of transfer of title for movable assets

d) Obligations of a registered business:

i. Centralized Taxes:

• Must file tax returns such as Personal Income Tax (PIT), Corporate

Income Tax (CIP), VAT (for those registered for VAT), PAYE (for those

qualifying), Consumption Tax (for those qualifying), Withholding Tax

of 3% and 15% for those qualifying.

• Each tax declared must be paid immediately as provided by the law.

ii. Decentralized Taxes:

Must file these taxes and Fees: Trading License Tax, Fixed Assets Tax, Rental

Income Tax and Cleaning Fees.

3. De-registration

a) meaning of de-registration

De-registration is where a taxpayer is removed from the obligations to declare

a certain tax.

Non-filing of returns is not an automatic condition for de-registration. RRA

must be satisfied that the taxpayer is not operating at all or is operating to the

required level to continue being registered for a given type of tax.

De- registration is decided on a tax-by-tax basis. For example, a taxpayer could

remain registered for PAYE while being de-registered for VAT.

De-registration becomes effective when RRA is satisfied that the taxpayer is not

at the time of application for de-registration, operating at a level that makes it

liable to a particular tax. De-registration becomes effective when the taxpayer

is issued a de-registration letter confirming that he/she is deactivated for a

specific head tax as mentioned above.

b) The documents are needed for de-registration

In the cases of both de-registration of a specific tax type and full de-registration,

RRA may request any documents of proof as necessary. The documents that are

required may differ depending upon the nature of the request.

c) The time taxpayer de-register for a specific tax type

If a taxpayer is no longer required to declare a specific tax type, they may

request for de-registration from that tax type. This can be due to a permanent

or temporary change in circumstances of the taxpayer.

It is important to note that a taxpayer must continue to submit declarationsuntil he/she receives confirmation that RRA has approved the de-registration.

In addition, a taxpayer cannot be de-registered for a tax type if they still have

arrears due for that tax type.

9.1.3: Registration and De-registration procedures

1. Registration procedures

Step-by-Step Guide to Business Registration

Step 1: Register on the RDB business registration system

Access the RDB business registration system at

http://org.rdb.rw/busregonline.

The RDB business registration login page is shown below.

New users must first register an account by clicking on ‘Register Here’. This

leads to the ‘Create New Online User’ screen. Enter the required personal

details and click submit to register an account.

The RDB system will then send an email to the given email address containing

a website link. Click on the link provided to validate and activate this account.

Once the account has been activated, return to the RDB business registration

system and enter the chosen login details to begin the business registration

process.

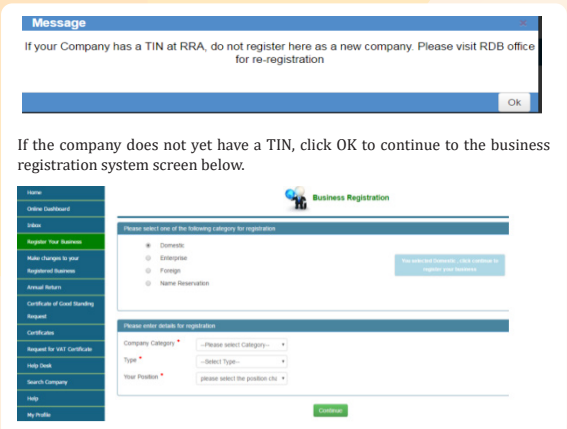

Step 2: Choose the business category to be registered

Once logged in, an initial message advises that if the company already has a

unique Taxpayer Identification Number (TIN), then do not use this system toregister.

The business registration system first requires selection of the type of business

being registered.

Note that the ‘Name Reservation’ option does not register a business, but can

be used to reserve a business name for registration in the future. For each of

the categories, ‘Your Position’ within the business must be noted. In addition,

‘Domestic’ requires a choice of ‘Company Category’ which can be public or

private and ‘Type’.

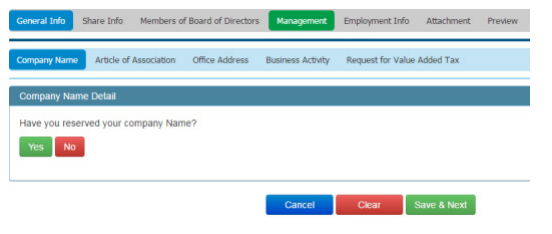

Step 3: Complete the business registration application

Depending upon the business type selected, the details that must be completed

differ slightly. The screen below shows the tabs after selecting a domestic,

private, limited by shares company registration.

Note that each of the major tabs (‘General Info’, ‘Share Info’ etc.) has separate

minor tabs (‘Company Name’, ‘Articles of Association’ etc.) Ensure to complete all

tabs before submitting the registration. Once all tabs are completed, click the

‘Preview’ tab to check that all the details entered are correct, before

clicking ‘Submit’ to submit the business registration application.

After submitting, RDB will validate that the information entered is correct. If

this is approved, an SMS will be sent to inform the taxpayer that the application

has been sent to RRA to issue a Taxpayer Identification Number (TIN). Once

the TIN is issued, another SMS will be sent to inform the taxpayer that their

business has been registered.

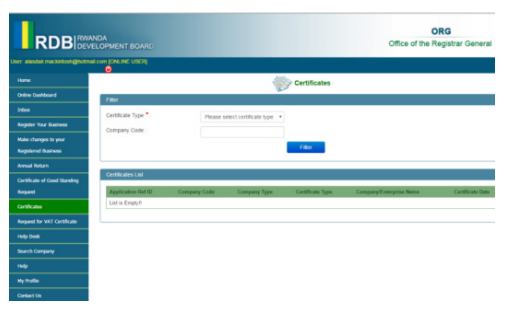

Step 4: Print Certificates

After receiving the second SMS, confirming that RDB has validated the business

registration application and RRA has issued a TIN, the taxpayer must log back

in to the RDB Business Registration system.

Once logged in, click on the ‘Certificates’ option on the left hand side. There are

two certificates that must be printed and kept securely.

Firstly, choose the ‘Certificate Type’ that matches the application type, for

example ‘Domestic’ if the business type that was registered was a domestic

company. Once selected, download and print this certificate. Secondly, choose

the ‘Certificate Type’ titled ‘Memorandum’ and also download and print this

certificate. If there are any other applicable certificates, for example a ‘Value

Added Tax’ certificate, then these should also be printed at this stage

Once registered, the business can operate and declare and pay taxes as normal.

The immediate obligations of the taxpayer.

Step 5: Register, declare and pay all required taxes

The taxpayer is automatically registered for Income Tax. Visit RRA offices to

register for any additional required taxes, including visiting LGT tax centers

immediately to register for Trading License Tax and Public Cleaning Service

Fees.

2. De-registration procedures

Once de-registration has been requested by a taxpayer, or concerned parties,

there are four steps to de-registration:

• RRA checks the information and reasons.

• RRA checks if the taxpayer has any arrears.

• If the reasons are approved, and there are no arrears, RRA may

deregister the taxpayers. At this time, RRA will provide a letter to the

taxpayer confirming the de-registration and stating they no longer

need to submit declarations.

• RRA may audit the taxpayer at any time, taxpayers should keep allrelevant documents for a minimum of five (5) years.

Application activity 9.1

Q1. True or false for the following which step guide to business

registration

a) Choose the business category to be registered

b) Complete the business registration application

c) Interaction with Tax Administration

Q2. Give the meaning of de-registration

Q3. How much does it cost to register a business?

Q4. Match the element in column A to the corresponding one in column

B so as to get a correct meaning of each element in column A for Mission,Vision and official mandate of RRA (Rwanda Revenue Authority).

9.2: Self-assessment

Learning Activity 1.3

Scenario:

Tax administration allow tax payer alone to assess the tax to be paid without

intervention of tax administration and after computing tax payable a tax

payer takes next step of paying that tax and file proof of Payment. Any time

tax administration can conduct tax audit to examine true and fair of tax

computation done by tax payer, this is done by performing re-assessment

of tax. In case tax administration find out miscomputation of tax, tax payeris liable to pay understated tax together with fines and penalties.

9.2.1: Self-assessment

Tax administration is the system of assessment, declaration, payment and

collection of taxes.

1. Tax Assessment

This is the calculation of the amount of taxable income and gains after deducting

relief and allowances; a calculation of income tax payable after taking into

account tax deducted at source and tax credits on dividends.

Tax assessment is composed of two systems that are a self-assessment system

and assessment by Rwanda revenue authority.

A. Self-assessment system

The self-assessment system relies upon the company or individual completing

and filing a tax return and paying the tax due. The system is enforced by

a system of penalties for failure to comply within the set time limits, and by

interest for late payment of tax. Dormant companies and companies which

have not yet started to trade may not be required to complete tax returns. Such

companies have a duty to notify RRA when they should be brought within the

self-assessment system.

B. Notice of Assessment

The notice of assessment constitutes full legal basis for the recovery of tax,

interest, penalties and all costs incurred collection.

• Reasons for Issuance of a Notice of Assessment

A notice of assessment is issued when:

1. the tax declared on time has not been paid;

2. the audit by the Tax Administration indicates an additional tax to be paid;

3. there are serious indications that the taxpayer has the intention to evade

tax Issuance of the notice of tax assessment and written notification of

an administrative fine

• Content of the Notice of Assessment

The notice of assessment mentions:

i. The taxpayer’s name, taxpayer identification number and address;

ii. The modalities of calculation of the tax and the amount of tax to be paid;

iii. The tax declaration or its rectification note, the assessment notice on

which the declaration is based;

iv. The date of issuance of the notice of assessment;

v. The address of the Commissioner General to which an appeal has to be

sent;vi. The conditions to be fulfilled in order to lodge an appeal

Application activity 9.2

Q1. Define Tax assessment.Q2. Outline content of the notice of assessment

9.3: Tax auditLearning Activity 9.3

An audit involves performing procedures to obtain audit evidence about

the amounts and disclosures in the financial statements. The procedures

selected depend on the auditor’s judgment, including the assessment of

the risks of material misstatement of the financial statements, whether

due to fraud or error. In making those risk assessments, the auditor

considers internal control relevant to the preparation and fair presentation

of the financial statements in order to design audit procedures that are

appropriate in the circumstances but not for the purposes of expressing

an opinion on the effectiveness of the entity’s internal control. Why at the

end of financial report Tax administration comes in the business in order

to be sure that the activity done related to the tax computation has been

done properly according to tax laws and regulations provided by revenueauthority.

9.3.1: General introduction on tax audit1. Meaning of tax audit

Tax audit is an examination of whether the taxpayer has correctly assessed and

reported the tax liability and fulfils other obligations.

Tax audit is one of the methods Tax Administration uses to ensure that

taxpayers are correctly declaring and paying their taxes. Audits involve Tax

Administration checking the relevant documents concerning a taxpayer’s tax

obligations for any tax period(s) within the past five years.

If there is evidence of non-compliance, the taxpayer will be issued with an

assessment notice. This contains details of the offence(s), and the unpaid tax

due, as well as additional penalties or fines that must be paid. It is important

to note that being selected for an audit does not necessarily mean that RRA

suspects the taxpayer of non-compliance.

It simply means that RRA wishes to check taxpayer’s declarations and

payments in more detail, to encourage a high level of voluntary compliance

across all taxpayers. The processes for audits is similar for domestic taxes,

Local Government Taxes (LGT) and fees, and for Post-Clearance Audits (PCAs)

regarding customs duties.

2. Audit notice

The Tax administration informs the taxpayer in writing, at least seven (7)

working days before conducting an audit, about the following:

1. the audit to be conducted;

2. the place where the audit is to be conducted and the possible duration

of the audit;

3. any document required to be audited or any information required.

If the taxpayer is not ready for audit, he or she writes to the Tax administration

requesting for a postponement which should not exceed thirty (30) days and

can only be allowed once.

• Contents of the notice of tax assessment

The notice of tax assessment indicates the following information:

1. name, identification number and address of a taxpayer;

2. calculation of the tax and the amount of the tax to be paid;

3. the tax declaration or the audit closure report on which the tax

assessment notice is based;

4. the date of establishment of the tax assessment notice;

5. the taxpayer’s right to lodge an appeal to the Commissioner General;

6. the conditions for lodging an appeal;

7. time limit for payment of the tax.

3. Obligations of the taxpayer during audit

During audit, the taxpayer must:

1. provide tax auditors with appropriate working environment;

2. provide tax auditors with books and records prescribed by this Law and

other related documents and provide them with their copies.

4. Unique audit principle

The Tax administration audits a taxpayer only once on a type of tax and for a

tax period.

However, the Tax administration may conduct a new audit only once in case of

one of the following circumstances:

1. complicity of the taxpayer and the tax auditor to evade taxes or commit

any other act intending to non-payment of required tax;

2. if the first audit was based on forged documents;

3. if the first audit was issue-oriented and the Tax administration wants to

conduct a comprehensive audit,

4. when the Commissioner General cancels the first audit based on appeal.

5. Purpose of tax audit

i. To exam in whether taxpayer fulfils his/her required obligation

ii. To maximize revenue collected from taxpayer inform of tax

iii.To reduce tax fraud (tax evasion)

iv. To detect error and fraud committed in the books of accounts

v. To verify the accuracy of the books of accounts

6. Matter examined in a tax audit

i. Tax liability

ii. Tax value

iii. Financial statements

iv. Accounting record

v. Third parties’ information

7. The required from the taxpayers

– Declaration form

– Acknowledgement receipts

– Accounting source document

– Audit reports of previous years

8. Instruction, guideline for source a tax audit

• Tax Law

• Ministerial orders

• International auditing standard (IAS) and IFRS (International reporting

standard)

• What types of taxpayers are subjected?

9. The objectives and contents of the tax audit report

a) Objective

– To show for view of taxpayer

– To prove if a taxpayer is evader

– To detect and prevent error and fraud

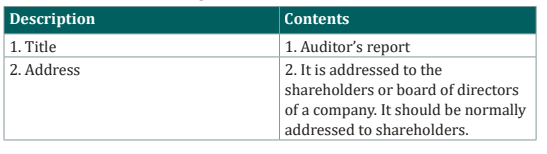

b) Contents of audit reports

Contents of an audit report

Main contents of the audit report are:

10. Action to be taken after and closed tax audit

• Advice taxpayer

• Proposed punishment

• Taxpayers’ business can be closed

• Fine and penalties

• Taxpayer can be appreciated

9.3.2: Importance of audit function

1. Importance of the audit

For the shareholders:

a) Audit ensures to them if management is acting on their behalf

b) They use audit to determine amount to be paid to dead partner

c) They use audit to admit a new partner by examining his businessd) Audit ensures that regulations and statutory requirements are followed

For the employees:

a) Audit keeps accounting staff vigilant and careful in their work

b) Employees ensure their job security and continuity of good

remuneration by the audited company

c) Act as a detective and preventive measure against errors and frauds

For the state:

a) Audited companies ensure the accomplishment of fiscal duties

regarding companies (payment of taxes and social contributions)

b) The government is assured that public funds are being well used

a) The government ensures continuity of business for the purpose of

general interest of the people

a) The state ensures that books of accounts are maintained according to

legal requirements and companies act

For the management of an enterprise and third parties in general:

a) Audit provides assurance and credibility to the accounts for interested

parties

b) Third parties not taking active part in the organization are protected

against risks

c) Audited accounts minimize disputes between parties

d) Audited accounts are acceptable as the basis of ascertaining tax liability

e) The auditor promotes general management efficiency by advising

management

f) Audited accounts are used as a basis for asking loans banks and

procurement

9.3.3: Types of tax audits

1. Types of audits

There are three main types of audit:

– Desk audit

– Issue-oriented audit

– Comprehensive audit

Desk audits are conducted by RRA staff using information that has already

been submitted to RRA.

Issue-oriented audits are usually focused on a single tax type, single aspect

or single tax period. Refund audits are a type of issue audit, focused on tax

declarations claiming refunds from RRA. Issue audits may be desk-based or

involve visits to the taxpayer’s business premises.

Comprehensive audits are more in-depth and time intensive. These are

usually conducted by RRA staff whilst visiting the taxpayer’s business premises

and reviewing all relevant documents.

2. The time taxpayers informed about audits

In the case of desk audits, taxpayers may not be informed about the audit

unless a specific problem is identified. Taxpayers will always be invited to offer

explanations before being issued with assessment notices.

In the case of issue-oriented audits, taxpayers will be notified at least three

days beforehand. The postponement of such an issue-oriented audit cannot

exceed seven (7) working days.

In the case of comprehensive audits, taxpayers will be notified at least seven

days beforehand. If the taxpayer is not ready, they may write to RRA requesting

an extension, up to a maximum of thirty days.

9.3.4: Features of an effective audit plan

1. Systematic Process

Auditing is a systematic and scientific process that follows a sequence of

activities, which are logical, structured, and organized.

2. Three-party Relationship

The audit process involves three parties: shareholders, managers, and auditors.

3. Subject Matter

Auditors give assurance on a specific subject matter. However, the subject matter

may differ considerably, such as – data, systems or processes, and behavior.

4. Evidence

The auditing process requires collecting the evidence, that is, financial and

non-financial data, and examining thereof

5. Established Criteria

The evidence must be evaluated regarding established criteria, which include

International Accounting Standards, International Financial Reporting

Standards, Generally Accepted Accounting Principles, industry practices, etc.

6. Opinion

The auditor has to express an honest and professional opinion as to

the reasonable assurance of the entity’s financial statements.

Conclusion on Audit Features

The most important feature of any audit is that; it is a systematic process of

expressing a professional opinion on financial position of a company based on

gathering and evaluating the evidence.

Audit features influence the objectives of the audit to refer to the security of

the information and systems, the protection of the personal data, and access to

some databases with a sensitive informational character.

9.3.5: Definition of tax arrears and Debt classification

1. Definition of tax arrears

Tax arrears refer to any amount owned by taxpayers to administration. This

includes any unpaid taxes after the deadline and unpaid penalties, fines and

interest.

Tax arrears is tax due to government but not paid

There are many enforcement actions legally available to the tax administration

for the collection for unpaid tax arrears. The typically process is in three steps.

Firstly, the tax payer receives a warning letter from the tax administration,

requesting them to visit tax office to discuss the arrears situation and repayment

options.

If there is no response within 15 days, the tax administration may begin

“garnishment” procedures. This means that the tax administration may work

with third parties, such as banks, to freeze the taxpayer’s accounts.

Finally, the tax administration may begin search and seizure of movable and

immovable assets and may sell these at public auction within eight days of

notification to the taxpayer.2. Debt classification

Debtors of the taxpayer and possessors of the taxpayer’s funds

In case the tax is not paid within the fifteen (15) days period, the Tax

administration may require any debtor, bank or any other party in possession

of the taxpayer’s funds to pay to the Tax administration the amount due to thetaxpayer against the tax liability.

Application activity 9.3

Q1. State the Obligations of the taxpayer during audit

Q2. state objective of audit to the countryQ3. List and explain the different types of audits

Skills Lab Activity 9

Via internet search, visit the RRA website and write a note on the following

aspects

1. RRA mandate, mission, vision and core value

2. Requirements for starting a business and how to register a business

3. Tax audit requirements

End of unit assessment 1

Q1. Discuss action to be taken after and closed tax audit

Q2. Outline types of tax audits

Q3. State the objectives and contents of the tax audit report

Q4. Give the condition for registered person in Tax Administration

Q5. Discuss about official mandate, vision and mission of Rwanda Revenue

Authority

Q6. State the instruction, guideline for source a tax audit

Q7. Describe the period tax authorities inform taxpayers about audits

Q8. Discuss RRA (Rwanda Revenue Authorities) strategic principlesREFERENCES

ICPAR. (2019). Taxation. London: BPP LEARNING MEDIA LTD.

ICPAR. (2020). Company Law. Kigali: Institute of Certified Public Accountants

of Rwanda.

Parliament of the Republic of Rwanda. (2015, March 28). Law No. 06/2015 of

28/03/2015 relating to investment promotion and facilitation. Official Gazette

No. Special of 27/05/2015, pp. 02-36.

Parliament of the Republic of Rwanda. (2018, August 30). Law No. 66/2018

of 30/08/2018 regulating labour in Rwanda. Official Gazette No. Special of

06/09/2018, pp. 02-104.

Parliament of the Republic of Rwanda. (2020, December 11). Ministerial Order

No.003/20/10/TC of 11/12/2020 establishing general rules on transfer

pricing. Official Gazette No. 40 of 14/12/2020, pp. 02-55.

Parliament of the Republic of Rwanda. (2021, February 05). No. 007/2021 of

05/02/2021 Law governing companies. Official Gazette No. 04 ter of 08/02/2021.

Parliament of the Republic of Rwanda. (2022, October 28). Law No. 027/2022of

28/10/2022 establishing taxes on income. Official Gazette No. 027 of

28/10/2022, pp. 12-101.

RRA. (2019). RRA Tax Handbook, 2nd Edition. Kigali: Rwanda Revenue Authority.

RRA. (2022, March 30). rra.gov.rw/index.php?id=32. Retrieved from rra.gov.rw:

http://www.rra.gov.rw

RSSB. (2018). Understanding Social Security, Edition 2018. Kigali: Rwanda Social

Security Board.

Rwanda Prime Minister’s Office. (2020, September 30). Oder No. 105/03

of 30/09/2020 related to the community-based health insurance scheme

contributions. Official Gazette No. Special of 01/10/2020, pp. 03-20