UNIT 5: VALUE ADDED TAX (VAT)

Key unit competence: Compute VAT and file returns in a timely manner

Mr HABANA has a super market operating in Rwanda and he complies

Mr HABANA has a super market operating in Rwanda and he complieswith tax law and regulations, in HABANA supermarket there are clients, Accountants, cashier.

He imported his products from China and in his super market he also sellseducational materials.

In HABANA SUPERMARKET there is a fixed phone used by receptionist forreceiving orders from customers but sometimes HABANA uses that phoneby calling his family.

Questions1. Which type of tax that will be paid by that client who is shopping?And why is that client who is supposed to pay that tax not HABANA?2. At the end of the month, accountant make some computationsrelated to tax for complying, which computations do you think anaccountant is supposed to do?3. In above image cashier is giving a paper to client, what is the type ofthat paper and try to list information appear on that paper.4. Within products sold by HABANA Supermarket, are there anyproducts exempts to the tax? Which type of that tax?5.1: Description of the value added tax

Learning Activity 5.1

VAT payable or the amount of VAT to be remitted by Tax payers to theRwanda Revenue Authority is computed by deducting the input VAT fromthe output VAT. The seller of goods of service passed on the end usersthe liabilities to pay tax who in turn may credit their liability from thepayment they received from the final consumer. This is because Credit isa consumption tax levied on sales to be home consumer with seller actingsimply as tax collectors. For the above scenario differentiate VAT Inclusiveand VAT Exclusive5.1.1: Definition of the value added tax and key terminology for VAT1. Definition of the value added tax• VAT is the tax charged on turnover at each stage in a production process,but in such a way that the burden is borne by the final consumer. VATwas introduced just before the First World War; there was a gradualimprovement in the tax system, which came up with a global taxationsystem of business with VAT which was the main element. This tax wasintroduced in Rwanda in January 2001 by the law No. 06/2001.• VAT is a tax on the consumption of goods and services. It is indirectlypaid by the final consumer of the goods or service. However, it ispaid on their behalf by taxpayers on the value added at each stage of

VAT payable or the amount of VAT to be remitted by Tax payers to theRwanda Revenue Authority is computed by deducting the input VAT fromthe output VAT. The seller of goods of service passed on the end usersthe liabilities to pay tax who in turn may credit their liability from thepayment they received from the final consumer. This is because Credit isa consumption tax levied on sales to be home consumer with seller actingsimply as tax collectors. For the above scenario differentiate VAT Inclusiveand VAT Exclusive5.1.1: Definition of the value added tax and key terminology for VAT1. Definition of the value added tax• VAT is the tax charged on turnover at each stage in a production process,but in such a way that the burden is borne by the final consumer. VATwas introduced just before the First World War; there was a gradualimprovement in the tax system, which came up with a global taxationsystem of business with VAT which was the main element. This tax wasintroduced in Rwanda in January 2001 by the law No. 06/2001.• VAT is a tax on the consumption of goods and services. It is indirectlypaid by the final consumer of the goods or service. However, it ispaid on their behalf by taxpayers on the value added at each stage ofproduction.

VAT is applied to as wide a range of products as possible to ensure fairness

across business sectors. However, there are some goods and services that are

exempt or zero-rated for VAT. This is usually because tax on these goods and

services may be unfairly burdensome on the poor or because those goods andservices have benefits to efficiency across the rest of the economy.

VAT registered taxpayers are required to have at least one Electronic Invoicing

System (EIS), such as an EBM, each of their sales locations, and use these toprovide EIS invoices for all sales transactions.

2. The tax rate of VAT

The normal rate of VAT is 18%. There is also a zero-rate (0%) and exemptionsapplicable for certain types of goods and services.

3. Characteristic of VATa) VAT is a consumption tax i.e. the consumer of taxable goods or servicespays VAT.b) VAT is an indirect tax.c) VAT is a multi-stage tax of transaction from importer or manufacturerto a wholesaler and finally to the consumer.d) VAT is tax levied on supply of goods made in Rwanda, on the supply ofservices, and on importation of goods or services.e) VAT is a tax on the value added to a commodity or services. It is imposedon the value added at each stage from the stage of production to retailstage.f) VAT is imposed on the value that business firms add to the goods andservices the purchased from other firms.g) Its standard rate is 18% in Rwandah) It is proportional taxCollection of VAT in Rwanda

in Rwanda VAT is collected by two departments, they are; Domestic Taxes

Department for domestic VAT and Customs Service Department for VAT on allimported goods and services.

5.1.2: Key terminology for VAT

1. Tax period Value added tax period is calendar month or quarter.2. The deadline to declare and pay VAT

VAT is declared and paid on a monthly basis. Alternatively, taxpayers with

annual turnover below FRW 200,000,000 may request to declare on a quarterlybasis.

Whether monthly or quarterly, the VAT declaration must be submitted andpaid by the 15th of the month following the end of the tax period.

This means that monthly declarations concerning the tax period between

March 1st and March 31st must be declared to RRA and paid by April 15th. Then

declarations concerning the tax period between April 1st and April 30th must be

declared to RRA and paid by May 15th and so on throughout the year.

The quarters for taxpayers declaring VAT on a quarterly basis concern the taxperiod between:

January 1st to end March must be declared and paid by 15th April.– April 1st to end June must be declared and paid by 15th July.– July 1st to end September must be declared and paid by 15th October– October 1st to end December, must be declared and paid by 15th Januarythe following year.

3. Tax point

A tax point is the date on which VAT becomes due on a particular transaction.

The tax point depends on several factors, such as:• Whether the business is invoice accounting or cash accounting for VAT.• When the goods were supplied or the services carried out.• When the VAT invoice was issued to the customer.The taxation point for the supply of goods and services shall be the one that is

the earliest among the following:i. The date on which the invoice is issued;ii. The date on which payment of goods and services, including a partialpayment is made. However, this Paragraph does not concern the advancepayment made to the constructors who later re-imburse it by deducting itfrom the invoices presented to the client;iii. The date on which goods are either removed from the premises of the supplieror when they are given to the recipient;iv. The date on which the service is delivered. In case of electricity, water orany other supplies, goods or services measured by meter or any othercalibration, the taxation period shall be the time when the meter or anyother calibration reads the number that follows the previous consumptionof the supply. The taxation period to a person who suspends registrationof the value added tax occurs immediately before the registration iscancelled.4. Tax base

The taxable value of each good or service is determined as follows:

1º except where the Law provides otherwise, the taxable value of goods or

services is the consideration paid in money by the recipient;

2º the taxable value on goods and services is the fair market value, exclusive of

the value added tax, if goods or services are supplied for:a) a non-monetary consideration;b) a monetary consideration for one part and non-monetary for the other;5. VAT Inclusive and VAT Exclusivec) consideration that is less than the market value of the goods or services.

a) VAT InclusiveThe VAT inclusive price means the price of the goods or service including VAT.

Goods and services supplied by VAT registered taxpayers must always be soldat the VAT inclusive price.

b) VAT ExclusiveThe VAT exclusive price means the price of the goods or service that is not the

final cost, to which VAT has not yet been added.

The invoice supplied to the customer must show the VAT exclusive price,amount of VAT and VAT inclusive price.

Application of VAT inclusive or VAT exclusive price of taxable goods and

servicesa) VAT inclusive

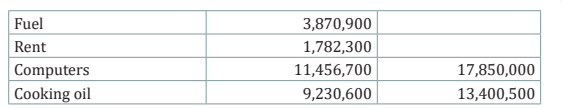

Example: XYZ CO bought the 10000 kgs of beans for resale for FRW 1,000,000

with VAT inclusive. Calculate the amount of VAT paid.Formula

b) VAT exclusive

Example: Manzi buy the 500 Kgs of rice for resale for FRW 100,000 with VAT

exclusive. Calculate the amount of VAT payable and total amount paid.Formula

Total amount paid= cost of goods or services + VAT payable

Total amount = 100,000 + 18000= FRW 118,000

5.1.3: Goods and services

According to Law no 37/2012 of 09/11/2012 establishing the value added

(Article 8 of law no37 /2012 of 09/11/2012 on the code of VAT) :The following acts shall constitute the supply of taxable goods or services:

1. sale, exchange or other transfer of the right to dispose of goods by theowner;2. lease of goods under a leasing agreement.Any operation other than the supply of goods or money shall be considered asan act of service delivery which includes:

1. the transfer or surrender of any right to any other person;2. the provision of any means for facilitation;3. the lease of goods under operating leasing agreement aiming mainly atWhen there is a supply of goods or services by a taxpayer, even occasionally,lease.

with or without consideration:1. for his/her own benefit;

2. for the benefit of himself/herself and others;

3. for the benefit of the business partners or of any director or person

employed in the business; (Article 3 of law no02 /2015 of 25/02/2015 on

the code of VAT)

4. for the benefit of customers of the business, except bonuses on telephone

communications approved by the institution in charge of public utilities

regulation, the supply of such goods or services shall be taxable. (Article

3 of law no 02/2015 of 25/02/2015 modifying and complementing law no

37 /2012 of 09/11/2012 on the code of VAT)5.1.4: Compensation

A payment for harm or compensation may be subject to VAT. This depends on

the precise purpose of the payment. It will be exempt from VAT if it is only

compensating. For VAT purposes, the payment will be a supply if the recipient

(the claimant) provides something in exchange.

It’s crucial to get the treatment right, just like with any payment that can be

subject to VAT. The claimant will ask the defendant to pay VAT in addition to the

principal payment of damages or compensation if the payment is VAT-eligible.

If the payment is made pursuant to a settlement agreement, the agreement

must state that any applicable VAT is payable in addition to the main amount; ifit does not, the payment will be viewed as made under a different set of rules.

5.1.5: Exempted and zero-rated goods and services

1. Zero-rated goods and services

Article 5 of Law No37/2012 of 09/11/2012 establishing the value added tax is

modified and complemented as follows:The following goods and services shall be zero-rated:

1. exported goods and services;

2. minerals that are sold on the domestic market;

3. international transportation services of goods entering Rwanda and

transportation services of goods in transit in Rwanda to other countries,

including related services;

4. goods sold in shops that are exempted from tax as provided for by the law

governing customs (Article1 of law no 02/2015 of 25/02/2015 modifying

and complementing law no

37 /2012 of 09/11/2012 on the code of VAT) ;

5. services rendered to a tourist for which value added tax has been paid;

6. the following goods and services intended for persons of a special

category (Article1 of law no 02/2015 of 25/02/2015 modifying and

complementing law no 37 /2012 of 09/11/2012 on the code of VAT ) :a) Goods and services intended for diplomats accredited to Rwanda that

are used in their missions;b) goods and services intended for international organizations that have2. Exempted goods and services

signed agreements with the Government of Rwanda;

c) goods and services donated to local non-governmental organizations,

which have been acquired through funding by countries or international

organizations that have signed agreements with the Government of

Rwanda and for being used for agreed upon purposes;

d) Goods and services intended for projects funded by partners that havesigned agreements with the Government of Rwanda.”

Article 6 of Law No37/2012 of 09/11/2012 establishing the value added tax asmodified and complemented to date is modified and complemented as follows:

The following goods and services are exempted from value added tax:1. Services of supplying clean water and ensuring environment treatment

for non-profit making purposes with the exception of sewage pump- out

services;

2. goods and services for health-related purposes:Institutions eligible for exemption under item 2° b) of this Article must bea) Health and medical services;b) Equipment designed for persons with disabilities;c) Goods and drugs appearing on the list established by the Minister incharge of health and approved by the Minister in charge of taxes.

recognized by Rwandan laws as public institutions, social welfare organizations

and any other form of voluntary or charity organizations

For natural persons, an authorized medical Doctor ascertains whether the

equipment provided under item 2º b) relates to their disability;3. educational materials, services and equipment appearing on the list

established by the Minister in charge of education and approved by the

Minister in charge of taxes;

4. books, newspapers and magazines;

5. transportation services by licensed persons:

a) Transportation of persons by road in vehicles which have a seating

capacity of fourteen (14) persons or more;

b) Transportation of persons by air;

c) Transportation of persons or goods by boat;

d) Transportation of goods by road;6. lending, lease and sale:

a) Sale or lease of land;

b) Sale of whole or part of a building for residential use;

c) Renting or grant of the right to occupy a house used as a place of residence

of one person and his/her family, if the period of accommodation for a

continuous term exceeds ninety (90) days;

d) Lease of a movable property made by a licensed financial institution;

7. financial and insurance services:

a) Premiums charged on life and medical insurance services;

b) Bank charges on current account operations;

c) Exchange operations carried out by licensed financial institutions;

d) Interest charged by the bank on credit and deposits;

e) Operations of the National Bank of Rwanda;

f) Fees charged by the bank on vouchers and bank instruments;

g) g) Capital market transactions for listed securities and fees or expenses

charged to investors a regulated collective investment scheme;

h) Transfer of shares;

8. precious metals: sale of gold in bullion form to the National Bank of

Rwanda;

9. any goods or services in connection with burial or cremation of a body

provided by an Order of the Minister;

10. energy supply equipment appearing on the list established by the

Minister in charge of energy and approved by the Minister in charge of

taxes;

11. trade union subscriptions;

12. leasing of exempted goods;

13. all agricultural and livestock products, except processed ones. However,

milk processed, excluding powder milk and milk derived products, is

exempted from this tax;

14. services of agriculture insurance;

15. services, agricultural inputs, and other agricultural and livestock

materials and equipment appearing on the list established by the

Minister in charge of agriculture and animal resources and approved by

the Minister in charge of taxes;16. gaming activities taxable under the Law establishing tax on gamingRequirements for an industry to be entitled to exemption are determined by an

activities;

17. personal effects of Rwandan diplomats returning from foreign postings,

Rwandan refugees and returnees entitled to tax relief under customs

laws. The period of twelve (12) months required for tax relief for vehicles

provided under customs laws shall not apply to Rwandan diplomats

returning from foreign postings;

18. goods and services meant for Special Economic Zones imported by a

zone user holding this legal status;

19. mobile telephones and SIM cards;

20. information, communication and technology equipment appearing

on the list established by the Minister in charge of information and

communication technology and approved by the Minister in charge

of taxes; (Article 2 of law no 40/2016 of 15/10/2016 modifying and

complementing law no

37 /2012 of 09/11/2012 on the code of VAT )

21. all goods, including materials, supplies, machinery and motor vehicles

intended for public institutions in charge of national defense or security;

22. machinery and capital goods of industries as well as raw materials used

in industries appearing on the list established by the Minister in charge

of industry and approved by the Minister in charge of taxes.

Order of the Minister in charge of taxes.”

Application activity 5.1

Q1. a) What is Value Added Tax? Who is liable to pay it?

b) Highlight the Characteristics of VAT

Q2. Suppose that the price of the commodity is FRW1, 416,000 and it is

VAT inclusive.

Calculate the VAT.

Q3. For purposes of Value Added Tax, state two (2) categories of zero

rated goods and services and there (3) exempted goods and services

5.2: VAT registration compliance

Learning Activity 5.2

The Rwandan tax laws require any business person who fulfils the

conditions provided by law to register for value added tax (VAT). What is

the threshold (turnover) required for a business person to register for VAT,respectively on quarterly and annual basis?

5.2.1: Registration laws related on VAT

1. Registration for VAT

A person can be registered for VAT by voluntary but the following persons

are enforced by law to be registered, a person whose taxable transaction in

the preceding calendar year or preceding quarter has reached at least FRW

20,000,000 (Twenty million) or FRW 5,000,000 (Five million), respectively, is

required to register with the tax Administration for VAT and must obtain a VAT

certificate. The registration must be accomplished within 7 days from the end

of that calendar year or quarter.

If the business is newly formed, it may operate up to 3 months without registering

for VAT. However, as soon as the taxable transactions reach FRW 5,000,000 or

more, it must be registered any time before the end of the 3 months’ period. If

a person has different businesses in the same or different locations, he shallcombine all the activities and register as one single taxable unit.

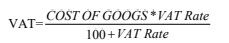

ExampleNduwayezu commenced business on 1/1/2018. His monthly sales are as below:

When should Nduwayezu register for the VAT?

Quarterly Registration Rule

Since Nduwayezu reaches FRW 5,000,000 in the second quarter, he must

register for VAT in seven days of month June.

Annual Registration Rule

Using the annual registration rule, Nduwayezu reaches RWF 20,000,000 in the

month of September; therefore, he must register for VAT in the first seven days

of January

2. Form of business required for Registration

Registration is done in the following:• In the name of the sole proprietorThe commissioner General, if he sees that it is fit, he may direct those two or

• In the name of the firm

• In the name of a company• In the name of the organization

more persons be registered and treated as a single entity.

The person who has been registered for VAT is the only one has the right to

levy VAT when he sells goods to his customers. Tax payers registered for VAT

recovers the tax levied on them and profit more sales compared to those whodid not register.

3. Obligation of VAT registration

Obligations of a VAT registered taxpayer include the following:

i. Must clearly display the VAT registration certificate in a plain view at

the entrance of his place of business for his clients to see.

ii. Must issue a VAT invoice to his customers’ every time they purchase

goods or services from him.

iii. Must file a monthly or quarterly VAT return on the appropriate form

iv. Must be available at all times to receive VAT officers and to make

available to the officers’ books of accounts ascertaining to the business.

v. Must use EBM

4. Other registration issues

When determining the value of a person’s taxable supplies for the purposes

of registration, supplies of goods and services that are capital assets of the

business are to be disregarded, except for non-zero rated taxable supplies ofinterests in land.

When a person is liable to register in respect of a past period, it is his

responsibility to pay VAT. If he is unable to collect it from those to whom he

made taxable supplies, the VAT burden will fall on him. A person must start

keeping VAT records and charging VAT to customers as soon as it is known

that he is required to register. However, VAT should not be shown separately

on any invoices until the registration number is known. The invoice should

show the VAT inclusive price and customers should be informed that VAT

invoices will be forwarded once the registration number is known. Formal

VAT invoices should then be sent to such customers within 30 days of

receiving the registration number.

5. Deregistration

Every registered taxpayer is de-registered when the commissioner general

is satisfied that they ceased to make taxable supplies or is not a person to

whom the conditions of registration apply. Any registered person ceasing

to be liable for registration notifies the tax administration, within a period

of 7 days of the time when he is no longer required to be registered. The

tax administration, when satisfied that the person is no longer liable to be

registered, may cancel the registration. A trader may deregister voluntarily if

he expects the value of his taxable supplies in the following one-year period

will not exceed the minimum. Alternatively, a trader who no longer makes

taxable supplies may be compulsorily deregistered.

6. The Consequences of Deregistration

VAT is chargeable on all goods and services at hand on the date of deregistration.

On deregistration, VAT is chargeable on all stocks and capital assets in a business

on which input tax was claimed, since the registered trader is in effect makinga taxable supply to himself as a newly unregistered trader.

7. Pre-Registration Input Tax

VAT incurred before registration can be treated as input tax and recovered from

RRA subject to certain conditions. If the claim is for input tax suffered on goods

purchased prior to registration, then the following conditions must be satisfied:a) The goods were acquired for the purpose of the business which either8. Pre-Registration Services

was carried on or was to be carried on by him at the time of supply.

b) The goods have not been supplied onwards or consumed before the

date of registration (although they may have been used to make other

goods which are still held).

C) The VAT must have been incurred in the four years prior to the date of

registration.

If the claim is for input tax suffered on the supply of services prior to registration,

then the following conditions must be satisfied:a) The services were supplied for the purposes of a business which either

was carried on or was to be carried on by him at the time of supply.

b) The services were supplied within the six months prior to the date of

registration. Input tax attributable to supplies made before registration

is not deductible even if the input tax concerned is treated as havingbeen incurred after registration.

Application activity 5.2

Q1. The Rwandan tax laws require any business person who fulfils the

conditions provided by law to register for value added tax (VAT). What is

the threshold (turnover) required for a business person to register for VAT,

respectively on quarterly and annual basis?

Q2. True or false question for obligation of VAT Registrationi. Must clearly display the VAT registration certificate in a plain view at

the entrance of his place of business for his clients to see.ii. In the name of the firm

iii.In the name of a company

iv. Must file a monthly or quarterly VAT return on the appropriate form.

5.3. VAT Computation

Learning Activity 5.3

Value added tax is theoretically a tax paid by an economic unit for the value

of which one adds to goods or services during the stages of production

or distribution of those goods or services. However, in effect, VAT is a tax

on the amount spent by the final consumers of goods or services. It is

collected whenever goods or services are transferred for value production

or wholesale or retail processes respectively. Whenever a trader pays for

commodity liable to VAT, he/she must pay the supplier a price which include

the appropriate rate of VAT on chargeable price. For the above scenario

Q1. Differentiate input vat from output vat

Q2. Specify in which case there is VAT payable/Refundable and VATClaimable

5.3.1: Input and output vat

1. Input vat

Input VAT is the VAT on purchases

Purchases of goods and services include the value of all goods and services

purchased during the accounting period for resale or consumption in theproduction process.

When a taxpayer supplies goods or services to another taxpayer, the supplier

of those goods or services will levy VAT.? The VAT levied by the supplier is the

Input VAT of the tax payer who receives those goods or services. On other hand

when the vendors in turn supplies goods or services to other tax payers, VAT

must be included in the price charged for those goods or services. This is theOutput VAT of the taxpayer.

2. Output Vat

Output VAT is the VAT on the sales.

A transaction that includes an exchange of services or goods for a certain

amount of money is known as a sale.Turnover is an income received from sales of goods and services

Quantity *selling price =Revenue

Note: When output VAT exceeds input VAT, the difference is the VAT payable toRwanda Revenue Authority

VAT payable or claimable = output VAT – input VAT• Value added tax refund

If, during a particular prescribed taxation period, the input tax exceeds output

tax, the Commissioner General shall refund the supplier the due amount to

which the supplier stands in credit by reason of the excess, on receipt of therelevant tax return document within thirty (30) days:

1. after one day from the expiry of the prescribed period for tax declaration;However, the value added tax paid by registered investors shall be refunded

2. after receipt of proof of the last outstanding tax declaration.

within a period not exceeding fifteen (15) days after receipt by the RevenueAuthority of the relevant application.

Prior to payment, the Commissioner General may order for verification of the

claim for refund or deduction submitted to him/ her. In such a case, the period

for the response to be communicated shall not exceed three (3) months fromthe date of submission of the claim”.

Example Related on VAT payable:

Rukundo sells wood to a furniture maker for FRW 100,000 VAT, the furniture

maker uses this wood to make a table and sells the table to a shop for FRW

150,000 VAT. The shop then sells the table to the final consumer for FRW

300,000 plus VAT of 18%. Determine the VAT payable to RRA.

Solution

Cost will be FRW 100,000 and FRW 150,000 respectively

Input VAT will be 18% * FRW 100,000 = FRW 18,000 and FRW 150,000 *18%

= FRW 27,000

Output VAT will be 18% * FRW 100,000, and FRW 150,000 * 18% and FRW

300,000 *18%

VAT Payable RRA will be the value added at each stage

The first stage FRW 18,000 Second stage (FRW 27,000 – FRW 18,000) and the

third stage it will be (FRW 54,000 - FRW 27,000) Total VAT payable will be FRW18,000 + FRW 9,000+ FRW 27,000 = FRW 54,000

Practical Example

XYZ Ltd is a registered VAT tax payer in Rwanda. Deals in both exempt and

standard taxable supply.

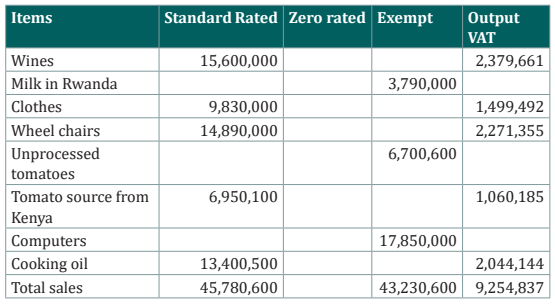

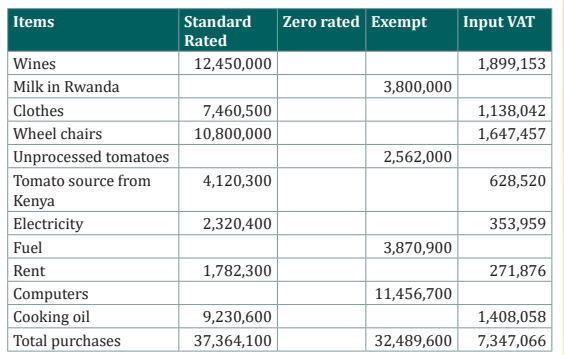

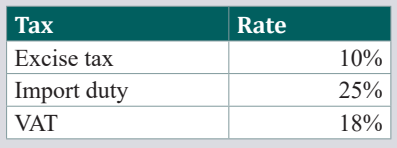

Her transactions for the month May 2022 are as shown below. Compute VATpayable

Output VAT

Input VAT

VAT payable/claimable = Output VAT – Input VAT = 9,254,837 – 7,347,066 =

1,907,771

5.3.2: General apportionment method

Value added tax paid on such business overheard as in the case of telephones

and electricity whose use cannot be practically separable from private and

business use shall be equal to 40% on the input tax

The commissioner General shall determine deniable input tax on taxable goodsacquired or taxable goods imported.

Example

A businessman has invested in hospitality, he has hotel and he live in that hotel,

the hotel accountant has declared VAT. The hotel has made input VAT on water

consumption bill of FRW 100,000

The tax administration will allow hotel an input vat of FRW 100,000 * 0.40 =

FRW 40,000

5.3.3: Attribution method

If a taxpayer purchased in the country or imported taxable goods or services

which are directly or indirectly related, on one hand partly to taxable goods or

services and partly to exempted goods or services on the other, the sum of the

input tax is a portion of the tax paid to the taxable goods or services in relation

with his/her taxable business. As per article 15 allowance of input tax in Vat

Law.

Application activity 5.3

Q1. ABC business is registered as VAT taxpayer. It sells today 800,000Rwf of

taxable goods (VAT inclusive)

Calculate the VAT output for this business

Q2. EVA’s purchases on credit from EDWIN 50 Kg of flours at FRW 500/Kg

VAT excluded.

– 100Kg of rice at FRW 600 with VAT excluded.

– AKANDI 24 cartons each one contains 12 bottles at FRW 300 with

VAT included.Fill invoice by showing VAT for each product and total invoice to be paid

Q3. XYZ Ltd imported goods for sales from the buyer whose acquisition

value was FRW 2,450,000. Customs duty was charged at the rate of 10%.

Other charges included: transport to the company’s premise: FRW 110,000

and a commission of 5 % of the good’s value paid to the clearing agent. Thenormal VAT rate of 18%.

Required: Determine the amount of VAT payable

Q4. A company is registered for VAT. During a period, they have sales of FRW

7,080,000 including VAT at 18% and purchases of FRW1, 100,000 excludingVAT. What is the VAT payable by the company at the end of the period?

5.4: VAT offences, VAT penalties and fines

Learning Activity 5.4

Analyze the photos above and answer the question that follow:

Outline the VAT Tax related offences punishable by Tax Law

5.4.1: VAT offences

1. VAT evasion

A person who, while intending tax evasion, commits one of the following

acts:1. Use of forged documents in his or her accounts;2. VAT avoidance

2. Counterfeit and use of documents or materials of the tax administration

used for taxation;

3. Hiding taxable goods or assets related to business;

4. Making a declaration indicating that the taxpayer has not made sales;

5. Changing the trade name by a person prosecuted in relation to tax;

6. Fraudulent registration of trade under the name of another person;

7. Hiding accounting documents from the tax administration or damaging

them;

8. Use of forged accounting records; Commits an offence of tax evasion.

Upon conviction, he or she is liable to imprisonment for a term of not less than

two (2) years and not more than five (5) years.

This is where tax payer uses legal/ legitimate means to escape paying part

of the whole tax liability expected of him. The tax payer avoids tax by using

loopholes or weaknesses in the tax system. A person can for example avoid

graduated tax by going back to school since students don’t pay graduated tax or

avoid indirect taxes such as VAT by refusing to by commodities on which they

are taxed.

5.4.2. VAT penalties and fines

Interest on late payment and penalties1. Interest for late payment

If the taxpayer fails to pay tax within the period provided for by the Law, he or

she must pay late payment interest on the amount of principal tax.

The interest rate is fixed at one point five percent (1.5%). Interests for late

payment are calculated on a monthly basis, non-compounding, counting from

the first day after the tax should have been paid until the day of paymentinclusive. Every month that begins is considered as a complete month.

Interests for late payment accrue shall not exceed one hundred percent (100%)of the amount of tax.

Interests for late payment are always payable, even when the taxpayer haslodged an administrative or judicial appeal against the assessment.

Interests for late payment do not apply on a taxpayer who discloses himself orherself

And pays the due taxes before he or she is notified of imminent audit. The

disclosure leads to exemption from interests only if it is done by a taxpayer who

is not registered with the Tax administration and who discloses himself/herselfin a period not exceeding one (1) year starting from the date the tax was due.

When the taxpayer pays, the payment is used to pay tax liability in the following

order:1. principal tax;2. Administrative fine

2. administrative fine;3. interests for late payment.

A. General fixed administrative fine

• Wrongful acts punished with fixed administrative fine

A taxpayer or any other person is subject to an administrative fine if he or she

does one of the following:1. Not to submit a tax declaration on time;governing taxes if no provision of such laws provides for a sanction.

2. Not to submit a withholding tax declaration on time;

3. Not to withhold tax;

4. Not to provide proofs required by the Tax administration;

5. Not to cooperate with a tax audit;

6. Not to communicate on time powers or appointment entrusted to him

or her referred to in Item 2 of Paragraph One of Article 10 of the Law

related to Tax procedures 2019

7. not to comply with the obligation to register;

8. not to keep books and records of controlled transactions;

9. to obstruct or attempt to obstruct the activities or duties of the Tax

administration;

10. not to comply with any requirements provided for in specific laws

With the exception of cases of failure referred to in Items 8° and 9°,

administrative fine related to violations of provisions is established as

follows:1. one hundred thousand Rwandan francs (FRW 100,000) for a naturalIf the taxpayer commits the same fault twice in five (5) years, the basic fine is

person not engaged in any commercial activity or a taxpayer whose

annual turnover is equal to or less than twenty million Rwandan

francs (FRW 20,000,000);

2. three hundred thousand Rwandan francs (FRW 300,000) if the

taxpayer is a public institution or a non-profit making organization

and if the taxpayer’s annual turnover exceeds twenty million Rwandan

francs (FRW 20,000,000);

3. five hundred thousand Rwandan francs (FRW 500,000) if the taxpayer

was informed by the Tax administration that he or she is in the category

of large taxpayers;

4. five hundred thousand Rwandan francs (FRW 500,000) if taxpayer

fails to submit his or her certified annual tax declarations and financial

statements as required by law; the fine is paid every month until he orshe submits them.

doubled. In case the same violation is committed again within those five (5)

years, the fine is four (4) times the basic administrative fine.

In case of failure to keep books and records of controlled transactions as

provided for in Articles 13, 14 and 15 of this Law, the applicable administrative

fine referred to in this Article is doubled.

Any qualified professional approved by the Tax Administration who obstructs

the activities or duties of the Tax administration is liable to an administrative

fine of two hundred thousand Rwandan francs (FRW 200,000). The qualified

professional approved by the Tax Administration may also be suspended by

the Commissioner General.

B. Non-fixed administrative

• Administrative fine for non-declaration and non-payment of taxon time

If a taxpayer has neither declared nor paid tax in the required time limits provided

by law, he or she pays the tax he or she did not declare and pay and is liable to anadministrative fine as follows:

1. Twenty percent (20%) of due tax, when the taxpayer exceeds the time

limit for declaration and payment for a period not exceeding thirty (30)days;

2. Forty percent (40%) of tax the taxpayer should have declared and paid,

if he or she pays within a period ranging from thirty-one (31) to sixty

(60) days from the time limit for the payment;

3. Sixty percent (60%) of due tax, if the taxpayer exceeds the time limit fordeclaration and payment by more than sixty (60) days.

The taxpayer who has declared due tax in the required time limits provided by

law but did not pay that tax in such time limits, pays the principal tax and anadministrative fine as follows:

1. Ten percent (10%) of due principal tax, when the taxpayer exceeds the

time limit for payment for a period not exceeding thirty (30) days from

the fixed date of payment;

2. Twenty percent (20%) of the principal tax due, when the taxpayer

exceeds the time limit for the payment of a period ranging from thirtyone (31) to sixty (60) days from the fixed date of payment;

3. Thirty percent (30%) of due principal tax, when the taxpayer exceeds

the time limit for payment by more than sixty (60) days from the fixed

date of payment;

The taxpayer is not subject to the administrative fine if the CommissionerGeneral gave him or her an extension for submitting tax declaration.

• Administrative fine for understatement of tax levied after audit orinvestigation

If an audit or investigation shows that there is the understatement of the

amount on a tax declaration is at least ten percent (10%) but doesn’t exceed

twenty percent (20%) of the tax liability, the taxpayer must pay the non-paid

tax and also be subject to an administrative fine of ten percent (10%) of theamount of the understatement.

The administrative fine referred to doubles if the understatement rate exceeds

twenty percent (20%) of the principal tax liability the taxpayer ought to have

paid.

However, if a taxpayer voluntarily declares and pays the due tax after required

time limits but before he or she is notified of imminent audit, is liable to an

administrative fine as follows:1. twenty percent (20%) of due tax, when the taxpayer exceeds the timeHowever, a taxpayer who rectifies his or her tax declaration and pays relevant

limit for declaration and payment for a period not exceeding thirty (30)

days;

2. thirty percent (30%) of tax the taxpayer should have declared and paid,

if he or she pays within a period ranging from thirty-one (31) to sixty

(60) days from the time limit for the payment;

3. forty percent (40%) of due tax, if the taxpayer exceeds the time limit for

declaration and payment by more than sixty (60) days.

tax before he or she is notified of imminent audit of his or her tax is not subjectto the administrative fine.

• Administrative fine for non-declaration and non-payment of thetax levied after audit or investigation

If an audit or investigation shows that a taxpayer has neither declared nor

paid tax in the required time, the taxpayer is liable to an administrative fineequivalent to sixty percent (60%) of due principal tax

C. Special administrative fine related to the Value Added Tax: VATA person who does not comply with provisions of Value Added Tax is subject toviolations

an administrative fine as follows:1. an administrative fine of fifty percent (50%) of the amount of valuePublic institution which fails to withhold the value added tax or which withheld

added tax output for the entire period of operation without value added

tax registration, where Value Added Tax registration is required;

2. an administrative fine of one hundred percent (100%) of the value

added tax indicated in the invoice and payment of that tax as indicated

on that invoice, for a person who issued a value added tax invoice whenhe or she is not registered for value added tax.

value added tax and failed to pay the tax withheld to the Tax Administration,

must pay the Tax Not withheld or not paid, fines and default interests asprovided for by the Law.

Application activity 5.4

Q1. Define the following terms:

a) Penalties

b) Fines

Q2. Taxes and fines still have to be paid when appealing?

Q3. What are the penalties for late lodgment of VAT returns by taxableperson?

Q4. Ubumwe declared his monthly Value Added Tax (VAT) for the tax

period of January 2019 late. Instead of declaring by the 15th February

2019, he declared and paid on 25th February 2019. The VAT Due for this

tax period was FRW 80,000. Ubumwe is a small taxpayer. This was the

first time that Ubumwe had declared late. Compute Ubumwe’s penalty fordeclaring late

Skills Lab Activity 5

Via visit of resource person (RRA), students write a note on the following:– Description of VAT

– Registration for VAT– Calculation of VAT

End of unit assessment 5

Q1. What are the obligations of VAT registered taxpayers?

Q2. Determine the requirements of a valid tax invoice

Q3. Give the difference between Exempt supplies and Zero-rated supplies

Q4. KAKA is trader at Kigali. He has purchased the goods on the price of FRW 950,000

excluding VAT and he sold it on the price of FRW 1,062,000 including VAT. Calculate the payable VAT.

Q5. Shamlan is a business man in Kigali during the quarter ended 31/8/2018;

he hired a foreign consultant to train the employees on the accounting software

for 20,000,000 inclusive of VAT.; No similar service is available in Rwanda.

Required: Compute the VAT

Q6. AMANI is a business man in Kigali, during the month of June he imported

30,000Kg of powdered milk from Denmark. The FOB was 30,000USD,

marine insurance 4,500USD and transport to Mombasa was 8,000USD. Theexchange rate for the period was 1USD = FRW 830.

Required Compute the VAT

Q7. During January 2017 UWIMANA LTD Company made the following

transactions (VAT exclusive):• January 1st bought goods on credit from MUKIZA LTD FRW 200,000Additional information:

• January 2nd sold goods on credit GASABO District FRW 150,000

• January 3rd credit sales to DUBAI SHOP LTD FRW 250,000

• January 4th purchased goods by cash from MUGISHA LTD FRW

120,000

• January 20th sold goods to GANZA FRW 100,000

• January 31st sold goods on credit to MUSONI FRW 250,000• Vat is applied at 18%REQUIRED:

• On 2nd January UWIMANA LTD Company imported office equipment

for FRW 100,000 and paid telephone bills worth FRW 70,000.

• UWIMANA LTD Company is VAT registered.

• At the end of the month electricity bills used by UWIMANA LTD

Company worth FRW 200,000 were paid.

• Only 90% of telephone bills are accepted by RRA as used for

Business purpose.a) Prepare and present the VAT accountQ8. HARERA declares his VAT on time as on 15 February 2021. Three

b) Show the amount of VAT refunded to RRA

months after, the RRA discovers that the amount of FRW 120,000 paid by

HARERA was understated by 10% of the correct amount he should pay.

Determine the amount of fine and penalty that HARERA has to pay to RRA

if he was notified by RRA as small taxpayer.