UNIT 4: CUSTOMS AND 4 CONSUMPTION TAX

- Key unit competence: Compute the Customs and consumption taxes

Mr. KAMARI, an importer located in Musanze District, imported Irish

potatoes from Uganda Kabare District and had a consignment with vehicle

RAC 407P for bringing 3 tons When he reached Kisoro district near Cyanika

border the vehicle got a mechanical problem which required a spare partfrom Nairobi-Kenya.

1. From the above picture which things are you seeing?4.1: EAC origin, objectives

2. Considering Mr. KAMARI’s scenario, what do you think Mr. KAMARIwill present to border for his.

Learning Activity 4.1

Many years ago businessmen from Rwanda traded with people from

Uganda, Congo, Kenya and Tanzania but due to security and tax policies

and international relations most of their companies were operating at a

loss and some time they lost their products while crossing from Rwanda

to these countries and they even faced the problem of not getting trade

facilities while getting to the frontiers. These problems affected not only

the Rwandan side, but almost all countries in the region. For the above

scenario, what things have been done in this country to solve the aboveproblems?

4.1.1: EAC customs union origin

1. Meaning of the East African Community Customs Uniona) The East African Community (EAC) Customs Union

Meaning of customs union

The Customs Union is the first Regional Integration milestone and critical

foundation of the East African Community (EAC), which has been in force since

2005, as defined in Article 75 of the Treaty for the Establishment of the EastAfrican Community.

It means that the EAC Partner States have agreed to establish free trade (or

zero duty imposed) on goods and services amongst themselves and agreed on

a common external tariff (CET), whereby imports from countries outside theEAC zone are subjected to the same tariff when sold to any EAC Partner State.

Goods moving freely within the EAC must comply with the EAC Rules of Origin

and with certain provisions of the Protocol for the Establishment of the EastAfrican Community Customs Union

The East African Community (EAC) Customs Union is formed of Kenya, Tanzania,Uganda, Burundi, Rwanda, Democratic Republic of Congo and South Sudan

b) Trade related aspectsRules of Origin are the laws, regulations and administrative procedures which• Rules of Origin

determine a product’s country of origin.

The protocol provides that trade within the EAC will be conducted in accordancewith agreed East African Rules of origin.

- National treatment:

treatment that they give to domestic or “national” products, i.e. there should be

no discrimination. In this respect, Partner States agreed not to enact legislation,

or apply administrative measures, which directly or indirectly discriminate

against the same or similar products of other Partner States.- Anti-dumping measures:

exported) at less than the normal value of the merchandise, i.e. a price that is

less than the price at which the merchandise is sold in its home market. PartnerStates recognized the challenges dumping imposes on the domestic market.

- Subsidies:

competition are required to notify the other Partner States in writing.- Countervailing measures:

levied on any product of any foreign country imported into the Customs Union.

- Safeguard measures:

is a sudden surge of a product imported into a Partner State, under conditionswhich cause or threaten to cause injury to domestic producers.

- Restriction and prohibitions to trade:

involving: the application of security laws and regulations; the control of arms

and ammunition; the protection of human life, the environment and natural

resources, public safety, public health and public morality; the protection of

animals and plants It was agreed that goods to be restricted and prohibitedfrom trade be specified in the Management Act..

- Re-exportation of goods:

exempt from the payment of import or export duties.

- East African Community Committee on Trade Remedies:

matters relating to the rules of origin, anti-dumping measures, subsidies and

countervailing measures and any safeguarding measures that are provided forunder the East African Community Customs Union.

2. The main features of EAC Customs union

.A shared set of import duties applied on goods from countries outside

the EAC. This is referred to as the Common External Tariff (CET)Zero rate of import duty, and no quotas, applied on goods from countrieswithin the EAC with valid certificate of origin.Shared procedures, safety measures, valuation methods, trade policyand terminology governed by the EAC Customs Management Act

(CMA).

Rwanda is also a member of the Common Market for Eastern and

Southern Africa (COMESA) free trade area.

4.1.2: Objectives of EAC Customs union

The objectives of the East African Community are broader and cover almost all

spheres of life. The main objective of the Customs Union is formation of a single

customs territory. Therefore, trade is at the core of the Customs Union.

It is within this context that internal tariffs and non-tariff barriers that could

hinder trade between the Partner States have to be eliminated, in order to

facilitate formation of one large single market and investment area

Customs Union focuses on facilitating trade on the following:

Removal of tariff on goods from partner states;

• Application of a Common External Tariff;

• Removal of other barriers to trade;

• Customs Union focuses on trade facilitation through:– Removal of non-tariff barriers;documentation;

– Simplifying and standardizing trade formalities and customs– Exchange of customs/ trade information;

– Adopting and implementing international best practices in customs

and trade;– Common and uniform application of Customs laws.

Application activity 4.1

1. Define the terms “rules of origin and mention types of rules of4.2: Description of customs duties

origin

2. True or false question on the features of EAC Customs union

a) A shared set of import duties applied on goods from countries

outside the EAC. This is referred to as the common External Tariff

(CET)

b) Zero rate of import duty, and no quotas, applied on goods from

countries within the EAC with valid certificate of origin

c) Removal of other barriers to trade

3. Explain the purpose of rules of origin

4. In East African Community (EAC) rules of origin criteria, goods

shall be accepted as originating in a Partner State where the goods

are wholly produced in the Partner State among others.

For the purposes of rules of origin, what products that shall beregarded as wholly produced in a partner state?

Learning Activity 4.2

The student from Munezero girls’ schools were on a study tour in Dar -Es

-Salam being hosted by Institute of Tax Administration (ITA) in collaboration

with Tanzania Freight Forwarders Association (TAFFA). Initially students

had planned to visit Dar-Es-Salam port and discuss customs issues with the

team on the part of TAFFA, during the visit, head of the delegates asked the

following questions that need your answers as S5 student who are studyingtaxation.

Q1. What is Customs Duties?

Q2. With research, explain the exemption of customs tax for products usedin export processing zones

4.2.1: Definition of customs duties and the person who can import or export1. Definition of customs duties

Customs duties are defined as all taxes, duties, levies and fees that are required

to be paid to Revenue Authority like Rwanda Revenue Authority (RRA) in

Rwanda on imported or exported goods.

Customs duties ensure that local and foreign business can compete fairly, by

ensuring a level playing field (VAT and Excise Duty), encouraging intra-regional

trade (Import Duty), ensuring compliance of Income Tax (WHT 5%), funding

beneficial projects (IDL, SRL and AUL) and supporting domestic manufacturing

industries (Export Duty on Raw Hides and Skins).

2. Meaning of importation and exportation and the person who can

import or export

a) Meaning of importing and exporting

• Importing is when goods are brought into Rwanda from an external

country.

• Exporting is when goods are taken from Rwanda into an external

country.b) The person who can import or export

Any taxpayer may import or export goods. No additional registration is required,

but individuals or businesses without Taxpayer Identification Number (TIN)

must register with RDB or RRA as normal.

The majority of importing and exporting procedures are carried out by licensedcompanies called Clearing Agents on behalf of the taxpayers

4.2.2: Types of Customs duties

1. Taxes paid on imports that are also paid on domestic goods• Value Added Tax (VAT)2. Taxes that are specifically paid on imports

• Excise Duty• Import Duty

• Withholding Tax of 5% (WHT 5%)

• Infrastructure Development Levy (IDL)

• Strategic Reserves Levy (SRL)• African Union Levy (AUL).3. Taxes that are specifically paid on exports• Export Duty on Raw Hides and Skins4. Small fees on imports and exports• Computer Processing Fee4.2.3: Valuation of imported and exported goods• Quality Inspection Fee (QIF)

Imports are valued as Cost, Insurance and Freight (CIF). This is equal to the cost

of the goods, the cost of any insurance paid on the goods and the freight costs

of transporting the goods transport the consignment to the first point of entry

of the EAC. Exports are valued as Free On board (FOB). This is equal to the cost

of the goods only. Whether using the CIF or FOB valuation, the declared value

must be supported by commercial invoices, as well as insurance and freightinvoices where applicable.

If goods have been purchased in a foreign currency, declare the value in the

currency of the invoice. Rwanda electronic Single Window (ReSW) system then

uses the National Bank of Rwanda (BNR) exchange rate to convert this into

Rwandan francs.Example

Rukundo is importing a consignment of mobile phones from Japan. The cost

of the mobile phones was USD 30,000 (thirty thousand US dollars). He paid an

additional USD 400 (four hundred US dollars) to transport the consignment to

the first point of entry of the EAC, in this case, the port of Mombasa in Kenya.

He also paid USD 150 to insure the goods during transportation to the port

of Mombasa. On the day of declaration, the exchange rate is USD 1: FRW 850.

Therefore, the CIF value of his import declaration is:

CIF = (USD 30,000 + USD 400 + USD 150) * 850 = FRW 25,967,500.

4.2.4: The documents required when importing or exporting

The importing or exporting taxpayer must provide the Clearing Agent withvalid documents proving the value and authenticity of their consignment.

A. The mandatory documents that taxpayers importing goods originating

from within the EAC must provide are:

1. Commercial Invoice or equivalent document

Showing the value and description of all goods within the consignment.

2. Packing List

Lists the goods being transported within the consignment.

B. There are two additional mandatory documents that taxpayers

importing goods originating from outside the EAC must provide to RRA:1. Freight Invoice

Showing the cost of transport and insurance for the consignment, if not includedin the commercial invoice.

2. Bill of Lading / Airway Bill

A contract between the owner of the ship / plane transporting the consignmentand the importing taxpayer.

C. The only mandatory document that taxpayers exporting goods must

provide to RRA:

Commercial Invoice or equivalent document showing the value and descriptionof all goods within the consignment.

Additional documents that taxpayers may be required to provide when

importing or exporting depend upon the type of goods and their origin. Clearing

Agents are trained to inform taxpayers which documents are necessary for

their consignment. Without the required documents, Customs Officials will

not permit the goods to be imported or exported. Examples of goods that may

require additional documents include:– Goods produced within the EAC or COMESAThe documents required to prove that goods being imported were

– Agricultural goods and inputs including food

– Chemicals and cosmetics

– Medical equipment and pharmaceuticals– Worn clothes

produced in the EAC or COMESA?

Imported goods that are produced within the EAC or COMESA can be subject to

exemptions. In addition, imported goods that are produced within the EAC only

are granted automatic access to the pre-clearance facility

These benefits require a Certificate of Origin delivered by the exporting country.

The EAC Rules of Origin document explains the criteria that goods should meet

to be considered as originating from EAC partner states.Other important points:

a) The way Rwandan exporters certify that goods being exported

were produced in Rwanda

Rwandan exporters can apply for a Certificate of Origin through their Clearing

Agent. The Clearing Agent applies on the Rwanda electronic Single Window

ReSW) and provides the required evidence at any Border Post or Dry Port.

There are different fees and requirements depending upon the country to

which the goods are exported. There is also a Simplified Certificate of Origin

available for smaller value consignments

There are many incentives that Rwandan exporters can benefit from, depending

on the country being exported to. This includes EAC, COMESA, the EuropeanUnion (EU) and the United States of America (USA).

ion (EU) and the United States of America (USA).

b) The different Customs channels

After import or export declarations have been submitted and paid, the Rwanda

electronic Single Window (ReSW) system assigns the consignment to a Customs

channel. The Customs channel refers to the level of verification from Customs

Officers required for that consignment.

c) Harmonized System (HS) Codes

Harmonized System (HS) Codes is an internationally standardized to classify

traded products. The taxpayer provides a description of the type of goods to

the Clearing Agent, who is trained to select the correct HS Code. Selecting the

correct HS Code is important for ensuring the correct amount of tax is declaredand paid.

Application activity 1.2

Q1. State the types of Customs Duties

Q2. What is the Rwanda electronic Single Window (ReSW)?

Q3. Briefly explain why the government imposes tax on importation?

Q4. XYZ enterprise is a business that offers customers a wide variety

of products at inexpensive prices. Customers can buy from the shop on

the online website. Owner, KAMANZI, employs more than 2000 people.

The business had humble beginnings, but today it sells fruits, flowers,

vegetables and meat to both the local market and abroad.a) Does XYZ enterprise sell to the local market or regional market?4.3: The taxes that are specifically paid on imports

Explain your answer.

b) List the advantages of selling products to the local market

c) Which challenges do you think that KAMANZI needs to overcome

to sell fresh flowers to other countries?

Learning Activity 4.3

Analyze the photos above and answer the question that follow:

Q1. With research, give the different Import Duty rates or Common External

Tariff (CET) rates allow for certain types of goods to be prioritized.4.3.1: Import duty

1. Meaning of import duty

Import Duty is a tax paid specifically on imported goods originating from

outside of the EAC.

The EAC Customs Union ensures a zero (0%) rate of import duty on all imports

on goods originating from within the EAC

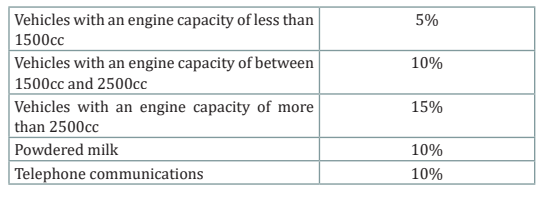

The EAC customs union means that the rates of import duty are agreed in the

common external tariff (CET).

The different import duty rates also allow for certain types of goods to be

prioritized. In general, CET rates are:– Capital goods and raw materials = 0%The amount of import duty to be paid is calculated as follow:

– Intermediate goods = 10%

– Finished goods = 25%

– Sensitive Goods = Varying rate

Import Duty = CIF * import duty rate- Handling fees (HF)

calculations. HF is calculated by: Handling fees (HF) = Gross weight (kg) * FRW

10

Gross weight (kg) refers to the weight of the goods in the consignment inkilograms, including the weight of the containers or transporting equipment.

4.3.2: Withholding tax of 5% and infrastructure development levy1. Withholding Tax of 5%

WHT 5% is a tax paid specifically on imported goods.

WHT 5% is paid by all taxpayers except for taxpayers with a valid Quitus Fiscalcertificate

Quitus Fiscal is a privileged status available, upon request to taxpayers who

have a good compliance record with RRA. Quitus Fiscal certificates are proof ofthis status. There are two types of Quitus Fiscal, for withholding tax on public

tenders of 3% (WHT 3%) and for withholding tax on imports of 5% (WHT 5%).

Taxpayers with Quitus Fiscal certificates are not required to pay WHT 5%, or

have WHT 3% withheld and paid on their behalf, depending upon the type ofQuitus Fiscal certificate.

2. Infrastructure development levy

Infrastructure development levy (IDL) is a tax paid specifically on imported

goods from outside of the EAC.

IDL contributes to regional trade facilitation infrastructure projects. IDL is paid

on all imported goods, with the exception of those detailed in Article 5 of Law

N°34/2015 of 30/06/2015, including:– Goods originating from within the EAC4.3.3: Strategic reserves levy and African union levy

– Reproductive animals and plants

– Pharmaceuticals

– Veterinary products

– Medical equipment

– Industrial machinery

– Solar energy equipment

– Duty remission products

– The IDL to be paid on imported goods is calculated by: Infrastructure

development levy (IDL) = CIF * 1.5%

1. Strategic reserves levy

SRL is a tax paid specifically on imported fuel and petroleum products.SRL

funds the purchase and safe maintenance of greater reserves of fuel. The SRL

is paid at a specific rate per litre of fuel, calculated by: Strategic reserves levy

(SRL) = FRW 32.73 per litre of fuel

2. African union levy (AUL)

AUL is a tax paid specifically on imported goods. AUL contributes to the financing

of African Union activities.The AUL paid on imported goods is calculated as

follow: African union levy (AUL) = CIF * 0.2%

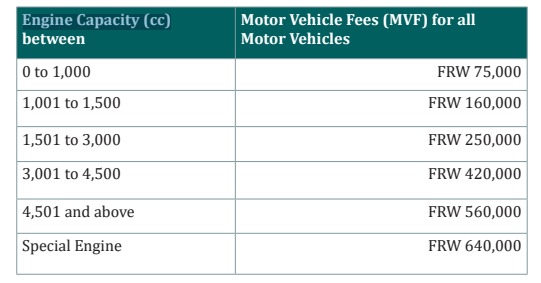

4.3.4: Motor vehicle registration fees (MVF) and Road Toll

1. Motor vehicle registration fees (MVF)

MVF are paid specifically on imported motor vehicles. MVF must be paid

regardless of the type of vehicle or the exemptions available to the importing

taxpayer.

MVF vary depending upon the engine capacity of the vehicle as measured in

cubic centimeters (cc):Engine Capacity (cc)

The special engine category includes semi-trailers, construction vehicles and

other very heavy vehicles.

2. Road toll

Road toll is a fee paid specifically on foreign registered trucks entering Rwanda.

Road toll contributes to the road maintenance fund (RMF) in Rwanda.

It is important to note that the road toll is paid per truck entering Rwanda, not

per declaration. Therefore, this is paid separately to other customs duties.

The road toll has two different rates, depending on the size of the trucks. The

road toll must be paid by trucks every time they enter Rwanda. The rate of road

toll is:– $76 USD for simple trucks4.3.5: Fuel levy and export duty on raw hides and skins– $152 USD for heavy commercial trucks

1. Fuel levy

Fuel levy is a tax paid specifically on imported fuel and petroleum products.

Fuel levy contributes to the road maintenance fund (RMF) in Rwanda. The fuel

levy is paid at a specific rate per litre of fuel.

The Fuel Levy to be paid on imported fuel is calculated by:

Fuel Levy = FRW 115 per litre of fuel

As with the Fuel Levy, Road Toll is referred to as ‘FER’ in import declarations

and assessment notices

2. Export duty on raw hides and skins

Export duty on raw hides and skins is paid on all exports of unprocessed hides

and skins to outside of the EAC. The rate of export duty on raw hides and skins

is either:– 80% of FOB, or $0.52 per Kg, whichever is higher. In export declarations4.3.6: Computer Processing Fee, Quality inspection fees (QIF)

and assessment notices, Export Duty on raw hides and skins is referredto as code ‘EX1’.

and warehousing fees

1. Computer processing fee

The computer processing fee is a fee paid for every import or export declaration

that is submitted.

The computer processing fee is:– FRW 3,000 per regular declaration2. Quality inspection fees (QIF)

– FRW 500 per simplified declaration

Quality inspection fees (QIF) are fees paid on specific imported products.

Rwanda Standards Board (RSB) is the institution which both designates which

products are required to be inspected and carries out the inspections.

RRA collects QIF on behalf of RSB. The QIF to be paid on imported goods is

calculated by:

Quality Inspection Fees (QIF) = FOB * 0.2%

In import declarations and assessment notices, QIF are referred to under code

‘QIF’

3. Warehousing fees

Warehousing fees are paid when storing consignments in warehouses. It is

important to note that these are paid directly to the warehouses and not to

RRA. Rates may vary according to the warehouse, the size and weight of theconsignment and how long it has been stored for.

Application activity 4.3

Q1. Rukundo is importing a consignment of mobile phones from Japan. The

cost of the mobile phones was USD 30,000 (thirty thousand US dollars).

He paid an additional USD 400 (four hundred US dollars) to transport the

consignment to the first point of entry of the EAC, in this case, the port

of Mombasa in Kenya. He also paid USD 150 to insure the goods during

transportation to the port of Mombasa. On the day of declaration, the

exchange rate is USD 1: 850 FRW. Find the CIF value of his import declared

Q2. Mugisha bought different products from England valued 6,000

pounds. He pays transport cost of 1000 pounds up to MOMBASSA port

and assurance of 300 pounds. He also paid 25% of import duty. If these

goods weight 500kg, determine the amount of VAT that RRA will tax Mr.

Mugisha at the entrance border of RUSUMO. (The exchange rate is 1 Pound= FRW1400)

4.4: The excise duty (consumption tax)

Learning Activity 4.4

The Government of Rwanda has implemented some tobacco control

measures, including regulations to protect passive smokers from exposure to

second-hand smoke; use of warning label on every cigarette pack’’ Smoking

is harmful to your health’ “that is intended to reduce smoking and provide

information about the danger of smoking. Additionally, banning tobacco

advertising in electronic media in order to discourage smocking especially

among the youth; establishment of no-smoking areas in public places like

government and business offices, hospitals, restaurants and buses but

these efforts too have been slow in reducing smoking consumption.

In July 2015, government changed the tax policy for the Excise on Tobacco

where the policy change was expected to maximize revenue collections

and minimize tobacco consumption in Rwanda.

Excise taxes should be designed according to those costs or risks as a way

to account for the negative externality. Thus, a good excise tax accounts not

for the value of a product, but for the costs of the externality. For alcohol

products, this means that the alcohol content determines the tax. This,

fortunately, is common practice across the Organization for Economic Cooperation

and Development (OECD an excise tax aimed at reducing vehicle

emissions should be targeted at heavier pollutants a practice which is not

common for taxation of motor fuel. This principle is well-established in

some countries where cigarettes are taxed at higher rates while other less

harmful products are taxed at lower rates. Some governments, however,

tax all tobacco products at equal rates despite their different harm profiles.

Suppose that YXZ Ltd produce and sell wine from the local input and as

Taxation student, answer the following question;a) Which type of tax YXZ should pay?

b) Give the rate of excise duty for this product4.4.1: Definition of excise duty and the person required to register for excise duty

1. Definition of excise duty

Excise duty is a tax applied to specific products. This means that it is able to

discourage consumption with negative social impacts. This can reduce the

costs of healthcare and policing, whilst raising significant revenues for further

government spending. As excise duties are charged on the consumption of

certain products, it is also referred to as a ‘consumption tax’.

2. The person required to register for excise duty

Any manufacturer of a product that is subject to Excise Duty is required to

declare and pay Excise Duty. There is no threshold on company size for Excise

Duty. A taxpayer who manufactures taxable products must declare and payExcise Duty regardless of the size of the business.

4.4.2: The obligations of excise registered taxpayers and valuation methods of excise duty

1. The obligations of excise registered taxpayers

The obligations of excise duty registered taxpayers are detailed in Section 2 of

Law N° 26/2006 of 27/05/2006. Excise duty registered taxpayers must:- Submit an excise duty declaration and pay tax due within 5 days after the end of the tax period

The inventory register shall indicate the quantity exported, sold for

domestic consumption, and destroyed, discarded or burnt, so that

at any time, the quantities within the factory can be established and

verified.

• Keep a register of the sales of all taxable products manufactured.

The sales register shall indicate the price and quantity sold to every

customer as well as the customer’s name and address.

. Keep a register of raw materials to be used in manufacturing of taxableproducts.

• Keep a register of the activities of the manufacturer. The activities

register shall indicate the date and time of starting and ending work,

the type names and the nature of the equipment used, the type and

quantity of the raw materials used and the batch number of production,

the quantity of the goods produced.

. Notify RRA of any changes to business premises.

• Notify RRA, within ten (10) days, of any interruption to manufacturing

activities• Attach appropriate products with a tax stamp

2. Valuation methods of excise duty

The rates of excise duties can be charged on a ‘specific’, ‘ad valorem’ or ‘mixed’basis.

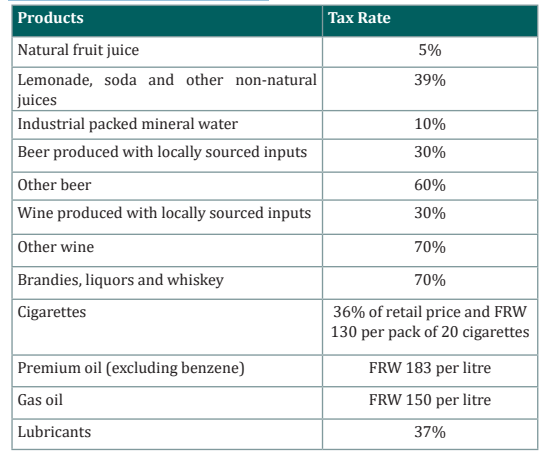

A specific excise duty charges a certain amount of tax per unit of the product.

For example, Excise Duty is charged on premium oil in Rwanda at a rate of FRW

183 per litre

An ad valorem excise duty charges a percentage of the taxable value of the

product. For example, excise duty is charged on beer in Rwanda at 60% of the

taxable value.

A mixed excise duty charges both a certain amount of tax per unit and as a

percentage of the taxable value of the product. For example, excise duty is

charged on cigarettes in Rwanda at a rate of 36% of the retail price in additionto FRW 130 per pack of 20 individual cigarettes.

4.4.3: Identify the taxable products, rates of excise duty andCompute Excise duty

1. Identify the taxable products, rates of excise dutyThe tax rates for Excise Duty vary depending upon the product.

The taxable products and tax rates are:

The taxable base for ad valorem excise duty on locally manufactured products

is calculated according to the selling price, excluding all other taxes.

Note: The rates of excise duty are the same for both domestic and imported

products.

2. Compute Excise duty

The excise duty to be paid on a specific basis is calculated by an amount of tax

per unit of the product. The excise duty to be paid on an ad valorem basis is

calculated by:

Excise duty = (CIF + Import Duty + HF) * Excise Rate

In import declarations and assessment notices, excise duty is referred to undercode ‘E’, for example ‘E01’.

Example:

1. Ubumwe produces cigarettes. In one tax period he manufactures and

sells 400 packs (of 20 cigarettes) for a pre-tax selling price of FRW 300

each

Required:a) Total taxable sales during that tax periodSolution

b) Excise Dutya) Total taxable sales during that tax period = 400 packs * FRW300 =FRW2. Lucie produces banana wine using ingredients sourced in Rwanda.

120,000

b) Ubumwe must pay mixed Excise Duty of: (FRW 120,000 * 36%) + (400* FRW 130) = FRW 95,200.

Inone tax period she manufactures and sells 200 bottles for a pre-tax

selling price of FRW 850

Required:a) Total taxable sales during that tax periodSolution

b) Excise Dutya) Total taxable sales during that tax period = 200 bottles * FRW 850=FRW4.4.4: The exemptions for excise duty

170,000

b) Lucie must pay ad valorem Excise Duty of: FRW 170,000 * 30% = FRW51,000

The following goods are exempt from Excise Duty– Goods for charitable organizationsNote: Should Excise Duty be paid on exports?

– Vehicles assembled in Rwanda

– One personal vehicles of a returning Rwandan diplomat

– One vehicle of a Rwandan refugee returning from a foreign country as

which the individual has personally owned and used for at least twelve

months

– Vehicles intended for the purpose of passenger (more than 14 people),

goods transport, tourist transit, and those designed for the transport

of disabled people

– Products which are specifically manufactured for export

– Products which are sold to duty free shops

Taxable products are exempt from Excise Duty if they are exported outside

Rwanda. However, proof is required that the products were actually exported.

In terms of the declaration, exports are included in the ‘Tax Due’ calculation but

then refunded in the ‘Tax Payable’ calculation. This is an implied refund, on the

presumption that proof of export will be provided.

4.4.5: The deadline to declare and pay excise duty

1. The deadline to declare excise duty

For the purposes of Excise Duty declaration, each month is divided into three

tax periods:– Tax Period 1 – From 1st to 10th of each monthExcise Duty must be declared and paid within five days of the end of each tax

– Tax Period 2 – From 11th to 20th of each month

– Tax Period 3 – From 21st to the end of each month

period. This means it must be declared and paid by the 15th, 25th of that monthand 5th of the following month.

For example, declarations concerning the tax period between March 1st and

March 10th must be declared to RRA and paid by March 15th. Then declarations

concerning the tax period between March 11th and March 20th must be declared

to RRA and paid by March 25th. Then declarations concerning the tax period

between March 21st and March 31st must be declared to RRA and paid by April

5th and so on throughout the year.

4.4.6: Excise duty penalties and fines

The penalties and fines for Excise Duty are similar to other domestic taxes,

This includes penalties and fines for:• Late declarationExcise Duty has an additional set of penalties and fines, which are applied for

• Late payment

• Declaring less than the correct tax due

violations to the law concerning tax stamps.

Note: Meaning of tax stamps

A tax stamp is a sign affixed on a product subject to Excise Duty to show retailers

and consumers that tax has been paid. The products requiring tax stamps are

cigarettes (each pack of 20 cigarettes), wines and liquors (each bottle). Tax

stamps can be purchased (at cost price) from RRA.ps can be purchased (at cost price) from RRA.

- The penalties for failing to keep a tax stamp register

– Stamp registers, records or related documentsIs subject to an administrative fine between one million Rwandan francs (FRW

– Stamp reconciliation statements

1,000,000) and two million Rwandan francs (FRW 2,000,000).

• Things for domestic producer or importer of products who

applying incorrectly tax stamps– Does not affix tax stamps to appropriate productsApplication activity 4.

– Does not affix tax stamps incorrectly

– Affixes tax stamps to products in a manner contrary to rules set

forth by the Authority

– Defaces tax stamps

– Submits an incorrect or incomplete tax stamp reconciliation

statement

– Applies tax stamps to products for which they are not intended

– Sells products which are subject to excise duty without tax stamps

Is, upon conviction, subject to a fine of between one million Rwandan francs

(FRW 1,000,000) and two million Rwandan francs (FRW 2,000,000) or to

imprisonment for a term of six (6) months to one (1) year.

Q1. Amahoro produces natural fruit juice. In one tax period she

manufactures and sells 10,000 small bottles for a pre-tax selling price

of FRW 400 each for a total taxable sale during that tax period of FRW

4,000,000.

Which amount Amahoro must pay ad valorem excise duty?

Q2. Outline the valuation methods of excise duty

Q3. Mr. Mugisha bought different products from England valued 6,000

pounds. He pays transport cost of 1000 pounds up to MOMBASSA port and

assurance of 300 pounds. He also paid 25% of import duty. If these goods

weight 500kg, determine the amount of VAT that RRA will tax Mr. Mugishaat the entrance border of RUSUMO. (Exchange rate 1POUND = FRW1400)

Skills Lab Activity 4

Through internet or after visit to RRA for customs officer, students are

required to compute customs duties and excise duty (consumption tax)for imported liquor from France.

End of unit assessment 4

Q1. Define the followinga) Rules of originQ2. Mary imported wines from France and the CIF to Mombasa was 50,000

b) Certificate of origin

c) Country of origin

d) Risk management

e) Customs offence

f) Import duties

USD. The exchange rate was 1USD = FRW880

Required: Compute the excise tax; assume the import duty of 25%

Q3. Sportsman limited produced 2,000,000 packets of cigarette. The factory

price is 700 and the retail price is 1000 per packet. Compute the excise tax.

Q4. List at least three example of certificate of origin

Q5. Identify the six categories of economic integration

Q6. How do you relate customs union from common market?

Q7. Discuss reasons why rules of origin are needed

Q8.a) List six different types of duties and fees with their corresponding

rates collected by RRA’s Customs Service Department on

importation of goods?

b) Provide a computation of import taxes assuming value of goods

imported (i.e. Cost Insurance and Freight) is equivalent to FRW

100,000. Assuming also a 25% import duty, 5% consumption tax,

18% VAT, 5% Withholding Tax, 1.5% Infrastructure Development

Levy, 0.2% Quality Inspection Fees and Africa Union Levy are

applicable on the imported goods.

c) Explain the features of the East African Customs Union.

d) Define rule of origin and explain the nature of goods that are

accepted under the rule of origin.