UNIT 3:TAXES AND FEES OF 3 DECENTRALIZED ENTITIES

Key unit competence: To compute taxes and fees collected by

decentralized entities

Q1. Describe the role of that person in the photo?

Q2. Are there any taxable activities in those areas?

3.1: Definition of key terms used in decentralized taxes and fees

Learning Activity 3.1

A person having houses in one of urban area in Rwanda and rents one of

the houses to another person in the year 2022. He receives a gross rental

income of FRW 4,800,000 during the tax year. On the above scenario who

is liable to pay tax.

3.1.1. Key terms used in decentralized taxes and fees

The Rwandan tax structure is categorised into two that is, the decentralised tax

structure and the centralised tax structure. The centralised tax structure is the

one that is collected by the central government whereas the decentralised tax

structure is the one that is collected by the local administration.

In this unit three, the following terms shall have the following meanings:1. Market value: amount of money for which property would be sold onA general/fiscal/revenue tax is levied to raise public funds for government service. Therefore, property tax is based on the value of property such as land, houses, shopping centers and factories. This tax is imposed by municipalities on owners of property within their jurisdiction based on the value of such property. In Rwanda, local government taxes were collected by the districts but in 2014 this task was delegated to the RRA.the market on a given date;

2. Small and medium enterprises: businesses which include micro, small

and medium enterprises that fulfil at least two of three conditions basedon net capital investments, annual turnover and number of employees,

as follows:

a) Micro enterprise: business having less than five hundred thousand

Rwandan francs (FRW 500,000) as net capital investments, less thanthree hundred thousand Rwandan francs (FRW 300,000) as annual

turnover and having between one (1) and three (3) employees;

b) Small enterprise: such business having from five hundred thousand

Rwandan francs (FRW 500,000) to fifteen million Rwandan francs

(FRW 15,000,000) as net capital investments, from three hundred

thousand Rwandan francs (FRW 300,000) to twelve million Rwandan

francs (FRW 12,000,000) as annual turnover and having from four (4)

to thirty (30) employees;

c) Medium enterprise: business having from fifteen million Rwandan

francs (FRW 15,000,000) to seventy million Rwandan francs (FRW

70,000,000) as net capital investments, from twelve million Rwandan

francs (FRW 12,000,000) to fifty million Rwandan francs (FRW

50,000,000) as annual turnover and having from thirty-one (31) to one

hundred (100) employees.

3. Basic infrastructure: activities that are made available to the population

by the government for the purposes of boosting their social development,

including roads, schools, health facilities, water, electricity, etc…

4. Improvements: immovable structures or amenities that are not

buildings but increase the actual value of a plot of land or a building;

5. Title deed: a written legal document confirming a person’s right to

property which is delivered by the competent authority in accordance

with the law;

6. Assessment cycle: a repetitive period of five (5) years that commences

on 01 January of the first year after the commencement of this Law for

which assessment of tax is done;

7. Plot of land: a registered piece of land with clear boundaries owned by

one or several persons;

8. Public institution: Government-owned commercial or non-commercial

entity having legal personality and enjoying financial and administrative

autonomy and which is established by a specific law;

9. Building: a house or other similar structure used on a permanent or

temporary basis;

10. Residential building: a house intended for occupancy for dwelling

purposes;

11. Industrial building: a house for which the competent authority has

authorized the construction for industrial purposes;

12. Commercial building: a house for which the competent authority has

authorized the construction for commercial purposes;

13. Decentralized entities: local administrative entities having legal

personality and enjoying administrative and financial autonomy;

14. Owner of a property: a person registered as owner of an immovable

property or a holder of other rights on the property and whoever is

considered to be the owner of the property thereof in accordance with

Rwandan law;

15. Usufruct: right to use and benefit from the proceeds from property of

another person in the same way as its owner on conditions of preserving

its substance;

16. Undeveloped land: land that is not utilized for the intended purpose as

provided for by laws governing land use and management;

17. Person: any individual, entity, government institution, company or any

other association;18. Taxpayer: any person who is subject to tax in accordance with this Law;

19. Immovable property tax: tax levied on property that has a fixedlocation and cannot be moved elsewhere and improvements thereto;

20. Rental income tax: tax levied on income derived from rented immovable

property;21. Trading license tax: a tax levied on business activities carried out in

defined boundaries of decentralized entities;22. Tax administration: institution in charge of assessment and collectionof taxes on behalf of decentralized entities.

Application activity 3.1

1. With examples, differentiate

a) Micro enterprise and Medium enterpriseb) Commercial building and Residential building2. What do you think is the purpose of decentralized entities?

3.2: Sources of revenue and property of decentralized entities

Learning Activity 3.2

In this context, which revenues are collected by RRA on behalf of localgovernment entity?

3.2.1. Sources of revenue and property of decentralized entities

The revenue and property of decentralized entities come from the followingsources:

i. Taxes and fees paid in accordance with the decentralized tax structure

ii. Funds obtained from issuance of certificates and their extension by

decentralized entities;

iii. Profits from investment of decentralized entities and interests from their

own shares and income-generating activities;

iv. Administrative fines;

v. Loans;

vi. Government subsidies;

vii. Donations and bequests;

viii. Fees from partners;

ix. Fees from the value of immovable property sold by auction;

x. Funds obtained from rent and sale of land of decentralized entities;

xi. All other fees and administrative fines that can be collected by decentralized

entities according to any other Rwandan law

Application activity 3.2

Burera District has a project plan of building a football stadium that will

cost 4 billion, Ministry of Finance has allocated 3 billion under Burera

District Budget

Burera district need other revenue to increase the budget for all planneddistrict activities.

Question:

Apart from the budget from Ministry of Finance, what are other Sources ofrevenues for Burera District?

3.3: Types of Taxes to be paid to Decentralized Entities

Learning Activity 3.3

Mr Robert rent a house owned by three siblings who are orphans, that

house was left by their parents

On 31st January 2023 is the deadline of property tax.

Both Robert and those siblings do not know about Property tax.

Suggest them who is liable to pay property tax among Robert and siblings.3.3.1: Immovable property tax

Immovable Property Tax is a tax levied on the market value of a building and

the surface of a plot of land. The land and buildings are referred to as the

‘Immovable Property’. In order to facilitate taxpayers, the market value of the

building only needs to be assessed every five years, unless major changes in the

building and structures occur.

1. Tax payers of immovable property tax

According to Article 6 of Law 75/2018, the immovable property tax is assessed

and paid by the owner, the usufructuary or any other person considered being

the owner. The owner who lives abroad can have a proxy in Rwanda. Such

a proxy must fulfil the tax liability that this Law requires from the owner.

Misrepresentation is considered as if it is done by the owner. The tax liability on

immovable property is not terminated or deferred by the disappearance of an

owner of immovable property, or if the owner has disappeared without leaving

behind a proxy or other person to manage the immovable property on his or

her behalf.

2. Commencement of the Tax Liability for the Usufructuary

Article 7 of Law 75/2018 stipulates that the tax liability for the usufructuary

runs from the date of commencement of the usufruct.

3. Co-ownership of Immovable Property

According to Article 8 of Law 75/2018, if immovable property is owned by

more than one (1) co-owner, the co-owners appoint and authorize one of themor any other person to represent them jointly as a group of taxpayers.

If co-owners of immovable property have not appointed a co-owner or a proxy

to represent them jointly as a group of taxpayers, the tax obligations related tothe immovable property will be settled in accordance with laws regulating coowned property

4. Persons considered being Owners of Property

According to Article 9 of Law 44/2018, the following persons are considered to

be owners of property:

i. The holder of immovable property where the property title deed has not

yet been transferred in his/her own name;

ii. A person who occupies or who has used the immovable property for a

period of at least two (2) years as if he/she is the owner as long as the

identity of the legally recognized owner of such property is not known;

iii.A proxy who represents an owner of property who lives abroad;

iv. A usufructuary;

v. An administrator of an abandoned property.5. Change of Ownership of Property

Article 10 of Law 75/2018 stipulates that in case there is a transfer of ownership

of an immovable property for any reason within the tax period, the acquirer of

immovable property is liable for tax from the date of the transfer. If the former

owner of the immovable property fails to meet his/her tax obligations, he/she

is liable for payment of the fines and late payment interests in accordance withthe provisions of the decentralized tax Law.

6. Immovable Property Tax Base

According to Article 11 of Law 75 2018, the immovable property tax is levied

on the market value of a building and surface of a plot of land. If the immovable

property consists of a plot of land that is not built, the tax on immovable

property is calculated on each square meter of the whole surface of the plot of

land. Where the immovable property consists of a plot of land, a building and

its improvements, the tax on immovable property for a plot of land is calculated

separately in accordance with the provisions of Paragraph 2 of Article 11, whilethe tax on the building and its improvements is based on the market value.

7. Immovable Property Exempted from Immovable Property Tax

The following immovable properties are exempted from the immovable

property tax as per Article 12 of Law 75/2018

i. One building whose owner intends for occupancy for dwelling purposes

and its annex buildings located in a residential plot for one family. That

building remains considered as his/her dwelling even when he/she does

not occupy it for various reasons;

ii. Immovable property determined by the District Council and donated to

vulnerable groups;

iii.Immovable property belonging to the State, Province, decentralized

entities as well as public institutions except if they are used for profitmaking activities or for leasing;

iv. Immovable property belonging to foreign diplomatic missions in Rwanda

if their countries do not levy tax on immovable property of Rwanda’s

diplomatic missions;

v. Land used for agricultural and livestock activities which area is equal to

or less than two hectares (2ha);

vi. Land reserved for construction of houses in rural areas but where nobasic infrastructure has been erected;

The exemption referred to under item 1 of Paragraph One of this section equally

applies to each individually owned portion of a condominium. All owners in

condominium are commonly liable for the tax on commonly owned portions

of plots of land on which a condominium is built. However, commonly ownedportions of the building are totally exempted from the tax.

8. Period of Immovable Property Valuation

As per Article 13 of Law 75/2018, the date of valuation of immovable property

is 1st January of the first taxable year. The value of immovable property is

determined for a cyclical period of five (5) years. This means that every 5 years

the property is revalued. It includes the market value of the building and the

plot of land. For the five (5) years assessment cycle to enable the taxpayer to

assess the market value of the immovable property, the following must be takeninto account:

i. In the beginning of the second assessment cycle which commences after

five (5) years and in the beginning of every next assessment cycle, a

general revision of market value takes place;

ii. A global fluctuation of the market value between two (2) general revisions

is not a reason for a new assessment of immovable property.

However, the value of immovable property can be reviewed before the end ofthe assessment cycle due to increase or decrease of its value.

9. Methodology of Valuation of Immovable Property

Article 14 of Law 75/2018 provides the following methods for evaluating the

market value of the immovable property.

If the immovable property was valued within the previous five (5) years and

no major changes in the buildings and structures, leading to an increase or

decrease of the immovable property value by more than twenty percent (20%),

have occurred, this value is regarded as the market value.

In this case, the taxpayer must provide the certificate of valuation

to the tax administration for verification purposes;

iii.If the immovable property was bought within the previous five (5) years

in the free market and no major changes in the buildings and structures,

leading to an increase or decrease of the immovable property value by

more than twenty percent (20%) have occurred, the purchase price is

regarded as the market value. In this case, the taxpayer must provide the

acquisition contract for verification purposes to the tax administration;

iv. If the taxpayer’s self-assessment on value of property is believed to be

under valuated, the tax administration will proceed to a counter-valuation.

If the value difference between the taxpayer’s self-assessment and the

tax administration’s counter-valuation is more than twenty percent

(20%), the value from counter-valuation will be regarded as the final

market value. Otherwise, the taxpayer’s self-assessment value applies.

The taxable value should be rounded up to the next full one thousand

(FRW 1,000) in Rwandan francs.Illustrative Example

Mwubatsi owns a property in Bugesera valued at 100,000,000 FRW during the

year ended 31st December 2022, he extended his building by

a) 10,000,000

b) 30,000,000In each of the above cases show the tax base of the asset

c) Appreciation of the asset: 10%, since the increase in the value of the

asset is below 20%, the tax base will remain the same. d) Appreciation of the asset: 30%, since the appreciation in the value of

the asset is above 20%, the new tax base of the asset will be 100,000,000

+ 30,000,000 = FRW 130,000,000 10. Tax Rate on Buildings

According to Article 16 of Law 75/2018, the tax rate on buildings is determined

as follows:i. One per cent (1%) of the market value of a residential building;According to Article 17 of Law 75/2018, except for the tax rate of zero point one

ii. Zero point five per cent (0.5%) of the market value of the building for

commercial buildings;

iii. Zero point one per cent (0.1%) of the market value of industrial

buildings, buildings belonging to small and medium enterprises and

those intended for other activities not specified in this section.

11. Application of Tax Rate on Buildings

per cent (0.1%), the tax rates prescribed by Article 16 of this Law are applied

progressively as follows:

1. For residential buildings a progressive rate is applied as follows:

a) Zero point twenty-five percent (0.25%) from the first year after the

commencement of this Law;

b) Zero point fifty percent (0.50%) from the second year after the

commencement of this Law;

c) Zero point seventy-five percent (0.75%) from the third year after the

commencement of this Law;

d) One percent (1%) from the fourth year after the commencement of

this Law;

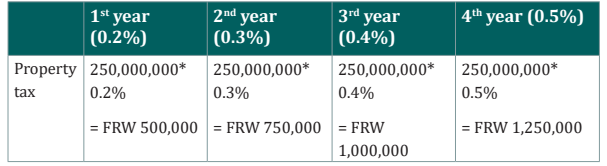

2. For commercial buildings a progressive rate is applied as follows:

a) Zero point two percent (0.2%) of the market value of the building is

applied in the first year of the commencement of this Law;

b) Zero point three percent (0.3%) during the second year of the

commencement of this Law;

c) Zero point four per cent (0.4%) during the third year of the

commencement of this Law;

d) Zero point five percent (0.5%) during the fourth year of the

commencement of this Law.

Residential apartments having a minimum of four floors,

including basement floors, benefit from reduction of tax rates,

equivalent to fifty percent (50%) of the ordinary rate.

12. Tax Rate on Plots of Land

Article 18 of Law 75/2018, provides that the tax rate on plot of land varies

between zero (0) and three hundred Rwandan francs (FRW 300) per square

meter. The tax rate determined by the District Council per square meter of land

in accordance with the provisions of Article 18 of this Law is increased by fifty

percent (50%) applicable to land in excess to standard size of plot of land meant

for construction of buildings. This is per Article 19 of the Law 75/2018. Any

undeveloped plot of land is subject to additional tax of one hundred percent

(100%) to the tax rate referred to in Article 18 of this Law.

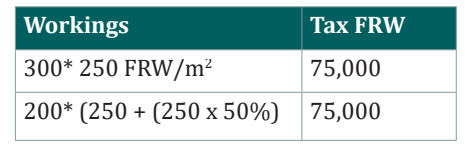

Example

Haguma owns a property which is located on 500m2

; the district council

approved a tax of FRW 250 per square meter. Required: Compute property taxSolution:

Since the standard plot is 300m2, the first 300m2, will be taxed at FRW 250, theexcess to 200m2, the tax will be increased by 50%.

13. Tax Declaration on Immovable Property by the Taxpayer

According to Article 21 of Law 75/2018, the taxpayer must file the declaration

to the tax administration not later than 31st December of the year that

corresponds to the first tax period. The taxpayer files to the tax administration

his/her declaration of the immovable property tax determined in accordancewith provisions of the Order of the Minister in charge of taxes.

14. Declaration of Appreciation and Depreciation

If, due to changes to immovable property, the value of that property increases

or decreases by more than twenty percent (20%) within an assessment cycle,

the taxpayer submits within a period of one (1) month, a new tax declaration to

the tax administration with all changes thereof and the value of the immovableproperty.

15. Review and re-assessment of tax by the tax administration

Tax Administration reviews the tax declaration on immovable property within a

period of six (6) months starting from 1st January of the year following the year

for which the tax declaration was made. If the tax declaration on immovable

property was filed late, the six (6) months period starts from the date on whichthe tax administration received the declaration.

The review of the tax declaration on immovable property is based on the natureand general state of the immovable property, its location and its actual use.

16. Tax Assessment Notice

The tax assessment notice of the tax administration to be addressed to a failing

tax declarant contains at least the following details:

i. Tax base calculation outline;

ii. Calculation of the value of the concerned immovable property;

iii. Calculation of the tax;

iv. Names of the owner, his/her proxy or usufructuary;

v. Address of the owner, the proxy or the usufructuary;

vi. The due date for tax payment;

vii. Mode of payment;

viii. Consequences of late payment or non-payment of tax;ix. A reference to the taxpayer’s right to complain and appeal

17. Waiver of Tax Liability

According to Article 31 of the Law 75/2018, the concerned District Council can

only waive the due immovable property tax in the following cases:

a) The taxpayer has provided a written statement of an inventory of his

property justifying that he/she is totally indebted so as a public auction

of his/her remaining property would yield no result;

b) The taxpayer proves that he/she is not able to pay immovable property

tax. The taxpayer applying for waiver of immovable property tax liability

must write to the tax administration. When the request is found valid,

the tax administration makes a report to the executive committee of

the competent decentralized entity which also submits it to the District

Council for decision. The waiver of immovable property tax liability

cannot be granted to a taxpayer who understated or evaded taxes.18. Late Submission or Incomplete or Misleading Tax Declaration

Apart from collecting the actual amount of the tax due, the decentralized entity

shall levy a fine not exceeding 40% of the tax due where:

1. The fixed asset tax declaration form is not submitted;

2. The fixed asset tax declaration form is submitted late;

3. The fixed asset tax declaration form contains incorrect or fraudulent

information with intent to evade tax.

4. The fixed asset tax declaration form is substantially incomplete;19. Valuation of Fixed Asset

As mentioned in Article 6 of the Rwanda Tax Law, the fixed asset tax base is the

market value of such fixed asset. If the fixed asset constitutes a parcel of land

that is not built, the market value constitutes as per square meter value times

the size of that parcel of land. Where the fixed asset consists of a parcel of land

and a building and improvements, the aggregate value of the land, the building

and improvements constitute the market value of such fixed asset.

Where a parcel of land, building, improvement and usufruct have been

purchased, the purchase price shall be taken as the tax base, unless it is patently

clear that the purchase price is below the market value. The taxable valueshould be rounded up to the next full one thousand Rwandan francs.

Example 1

Bagirayabo is located in Gisenyi town. He owns the properties below which

are used for commercial purposes; the residential property which he dwells

with his family, and a commercial building. The market value of the residential

building is FRW 130,000,000 and the market value of the commercial buildingis FRW 250, 000,000

Required: Compute the property tax Bagirayabo should pay to RRA.

Solution

Since the residential house is dwelled by the owner, it is exempted from theproperty tax.

The commercial building will be taxed in the following ways:

3.3.2: Trading License Tax

Trading License Tax, also informally known as ‘patente’, is a tax levied on any

person or business conducting profit-oriented activities. Trading License Taxmust be declared and paid for each business branch or premises.

a) Tax Year

The tax period for the trading license tax starts on January 1st and ends on

December 31st of that same year. If taxable activities start in January, the

trading license tax must be paid for a whole year. If such activities start after

January, the taxpayer must pay trading license tax equivalent to the remaining

months including the one in which the activities started. As regards to persons

conducting seasonal or periodic activities, the trading license tax must be paid

for a whole year, even though the taxable activities do not occur throughout thewhole year.

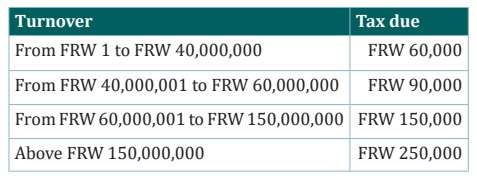

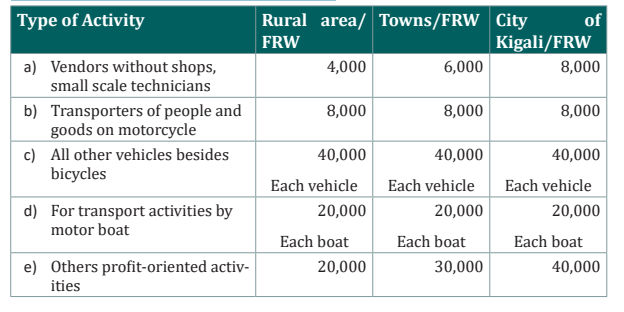

b) Trading license tax rate

The trading license tax is calculated on the basis of the following tables

Table I. All value added tax (VAT) registered profit-oriented activities

Table II. Other profit-oriented activities

Taxpayers who sell goods or services exempted from value added tax but

whose turnover is equal or greater than twenty million Rwandan francs (FRW

20,000,000) pay the trading license tax in the same manner as taxpayersregistered for value added tax.

The basis for the calculation of trading license tax in table I above is the turnoverof the previous year.

c) Tax Exemption

– Non-commercial State organs,

– Small and medium enterprises during the first two (2) years following

their establishment or 24 months of establishment, are exempted from

trading license tax. After expiration of the 24 months, the taxpayer

must declare and pay Trading License Tax within seven days.d) Trading license tax declarationAny taxpayer files a tax declaration to the decentralized entity where his/her

activities are undertaken not later than 31st January of the year that corresponds

to the tax period. If a taxpayer has branches, a trading license tax declaration is required for the

head office as well as for each branch of his/her business activities basing on

the turnover of the previous year for the head office and for each branch.

In case a branch does not have or cannot determine its turnover, the tradinglicense tax is declared based on the turnover of the head office.

If a taxpayer carries out different business activities in different buildings, he/

she files a trading license tax declaration for each business activity.

When a business is made of several activities carried out by the same person in

the same building, only one trading license tax certificate is required and onlyone tax declaration for all business activities is filed.

In case a business is spread across more than one District, the taxpayer fileshis/her declaration of trade license tax in each District where he/she operates.

e) Trading license tax payment

The trading license tax assessed by a taxpayer himself/herself is paid to the taxadministration not later than 31st January of the tax year.

If the trading license tax is not paid by the due date, the taxpayer is not allowed

to start or to continue his/her business activities without having paid such tax.

Business activities undertaken while the taxpayer is in arrears with the payment

of his/her trading license tax are illegal. The tax administration has the powerto stop such activities.

f) Posting of the trading license tax certificate

The trading license tax certificate is displayed clearly at the entrance of the

business premises or affixed to the car, boat or any other vehicle for which thetax was paid.

was paid.

g) Presentation of the trading license tax certificate

Whenever necessary, the holder of a trading license tax certificate presents such

a certificate with documents identifying him/her or his/her business activitiesto the tax administration.

Failure to present the trading license tax certificate is punishable by an

administrative fine of ten thousand Rwandan francs (FRW 10,000). The

taxpayer’s obligation to pay the trading license tax is not affected by theimposition of a fine.

If a trading license tax certificate is lost or damaged, a duplicate is issued by theh) Replacement of the trading license tax certificate

tax administration for a fee equivalent to five thousand Rwandan francs (FRW5,000).

In case the taxpayer terminates or changes his/her business activities duringi) Replacement of the trading license tax certificate

a taa) Payment of Rental Income TaxRental income tax is charged on income generated by individuals from rented

fixed assets located in Rwanda. The natural person who receives such an

income is the taxpayer. The income taxable year for calculating the tax starts on

January 1st and ends on December 31st of the previous year which shall be the

income taxable year.x year, he/she is, after an audit, refunded the paid trading

license taxdepa) Payment of Rental Income Tax Rental income tax is charged on income

generated by individuals from rented fixed asseta) Payment of Rental Income Tax

Rental income tax is charged on income generated by individuals from rented

fixed assets located in Rwanda. The natural person who receives such an

income is the taxpayer. The income taxable year for calculating the tax starts onJanuary 1st and ends on December 31st of the previous year which shall be the

income taxable year.s located in Rwanda. The natural person who receives

such an income is the taxpayer. The income taxable year for calculating

the tax starts on January 1st and ends on December 31st of the previous

year which shall be the income taxable year.ending on the remaining

months until 31st December of that tax period.

3.3.3: Rental Income Tax

Rental Income Tax is a tax levied on the income generated from rented land and

buildings. The land and buildings are referred to as the ‘Immovable Property’

and Rental Income Tax must be declared and paid on rented immovableproperties in addition to Immovable Property Tax.

a) Payment of Rental Income Tax

Rental income tax is charged on income generated by individuals from rented

fixed assets located in Rwanda. The natural person who receives such an

income is the taxpayer. The income taxable year for calculating the tax starts on

January 1st and ends on December 31st of the previous year which shall be theincome taxable year.

b) Taxable Rental Income

Rental income tax is charged to the following:

1. Income from rented buildings in whole or in part;The rental contract in respect of immovable property is in writing and signed

2. Income from rented improvements in whole or in part;3. Income from any other rented immovable property located in Rwanda.

c) Rental Contract

by the contracting parties. A copy of this contract is submitted to the tax

administration within fifteen (15) days following the date the contract was

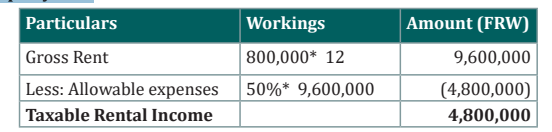

signed. The taxable rental income is obtained by deducting from the gross rental incomed) Rental income tax computation method

fifty percent (50%) considered as the expenses incurred by the taxpayer on

maintenance and upkeep of the rented property.

When the taxpayer produces the proof of bank interest payments on a loan for

the construction or purchase of a rented property, the taxable rental income

is determined by deducting from gross rental income fifty percent (50%)

considered as the expenses incurred for upkeep of the property plus actual

bank interest paid from the beginning of the rental period within the tax period.e) Rental income tax rate

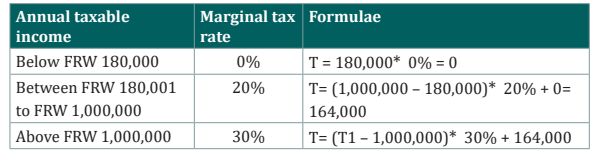

Rental Income Tax is a progressive tax. This means that there are different

tax rates depending on taxpayer’s taxable income, as described above. The

groupings of taxable rental income are called tax brackets. The tax rates foreach tax bracket are:

1° The bracket part of the annual income generated through rental of a building

from one Rwandan franc (FRW 1) to one hundred eighty thousand Rwandanfrancs (FRW 180,000) shall be taxed at zero percent (0 %);

2° The bracket part of the annual income generated through rental of a building

from one hundred eighty thousand and one Rwandan francs (FRW 180,001) to

one million Rwandan francs (FRW 1,000,000) shall be taxed at twenty percent(20 %);

3° the bracket part of the annual income generated through rental of a building

above one million Rwandan francs (FRW 1,000,000) shall be taxed at thirtypercent (30 %).

It is important to note that these tax rates are marginal. This means that for each

taxpayer in each year: the first FRW 180,000 that the taxpayer earns is taxed at

0%, the next FRW 820,000 earned is taxed at 20% and any remaining income

is taxed at 30%. This means that no taxpayer is made worse off by receivingincome in a higher tax bracket.

Illustration Example

Munyantore owns two properties in Remera which he rents to various business

men. In Property one he receives a monthly rent of FRW 800,000 starts on

05-January-2021 and in Property two he receives a monthly rent of FRW

1,250,000, same period as above. Property two was constructed using a loan of

FRW 13,000,000 from the bank at an interest rate of 16% per annum.

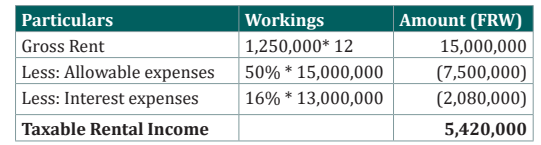

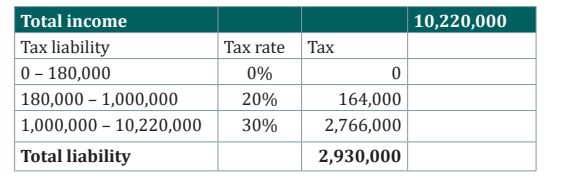

Required:a) Calculate His taxable rental incomeSolutionb) Determine His Tax liability and the Tax Payable.

Computation of Rental income for Munyantore for the Year Ended

31/12/2021Property One:

Property Two:

Taxable income from two properties: FRW 4,800,000 + FRW 5,420,000 = FRW

10,220,000Computation of Tax Payable of the Year Ended 31/12/2021

3.3.4: Local Government Fees

a) What are local government fees?

There are a wide range of local government fees. These can be for taxpayers who

conduct profit-oriented activities or who require services or authorizationsfrom District Offices.

b) Third parties which also collect local government fees

Ngali Holdings Ltd is mandated to support RRA in collecting all local government

fees. Millennium Savings and Investment Cooperative (MISIC) also collectsparking fees.

In addition, the declaration and payment of the following local government

fees is now processed through the e-Government platform known as Irembo orRwanda Online:

– Civil status certificates, including Birth, Marriage and Death certificates.– Transfer of land titles.

c) Deadlines to declare and pay different types of local governmentThe deadline to declare and pay local government fees depends upon the basis

fees

of the fee. Fees charged for a service, such as fees on official certificates and

documents to be notified by the public notary, must be declared and paid before

the service is delivered.

Fees payable on a monthly basis, such as Public Cleaning Service Fees, must be

declared and paid no later than the 5th of the following month. Fees payable on

an annual basis, such as fees on advertising, must be declared and paid no laterthan 31st December of that year.

d) Types of different local government fees and rates

The rates of many local government fees are variable, within certain thresholds,

depending upon certain factors such as the location, i.e. urban, trading centre, or

rural, or the vehicle details. The exact rate, within the thresholds, is determinedby the District Council on an annual basis by the 30th June.

The list of local government fees, detailed in the Presidential Order Determining

Fees Levied for Public Services and Certificates Delivered by Decentralized Entitiesare displayed below.

The processes for declaring these fees varies, depending upon the type of fee.

Note that vulnerable people may request a waiver from fees by the DistrictCouncil for all of the following fees.

Market fees– For traders in designated market areas.Fees charged on public cemeteries

– Up to FRW 10,000 per month.– For entombing a corpse in a public cemetery.Fees charged on parking

– FRW 500 – FRW 5,000 per tomb.

– Depend upon the cemetery.– For motor vehicles parking in lots under the authority of the District.

– FRW 100 per hour – FRW 20,000 per month

– Depend upon the size of the vehicle and duration of the parking.

– Collected by Millennium Savings and Investment Cooperative (MISIC).

– Exemptions for vehicles on official duty owned by State, Embassy, UNorganizations and international organizations having an agreementFees charged on public parking

with the Government of Rwanda; special vehicles for disabled people.– For transport vehicles (buses and taxis) entering public bus/taxi parks.Parking fees on boats

– FRW 500 – FRW 10,000 per day, multiple entry.– Depend upon the size of the transport vehicle.

– For boats used for profit making activities.

– FRW 100 per day – FRW 5,000 per month.

– Depend upon the carrying capacity of the boat in tones, and whether it

has an engine.

Public Cleaning Fees

– Payable by each branch of a business or institution, excluding:• Households

• Orphanages / vulnerable persons’ houses

• Government institutions which are not profit oriented

• Churches and faith-based organizations not involved in profitoriented activities

• United Nations institutions and embassies

• People carrying out their activities in market places paying marketfees

– FRW 500 – FRW 10,000 per month.Fees on civil marriage done not on official business days– Depends upon the location and nature of activity.

– Up to FRW 10,000 per marriage.Fees on services related to the documents of immovable property

– District Council determines the official business days for civil marriage.– A range of services including changing official ownership, map requests

and building permits.

– FRW 1,200 – FRW 60,000.– Depend upon the service requested. Building permits depend upon theFees on official certificates and documents to be notified by the public notary

floor area in square meters.

– Vulnerable people may request to be exempted from building permit

fees by the District Council.– For official certificates (such as civil status, birth or death) or theFees on authorization to make or burn bricks and tiles

notification of documents.

– FRW 500 – FRW 5,000.

– Depends upon the type of certificate or document to be notified.– Any person intending to make or burn bricks and tiles must requestauthorization from the District.– FRW 10,000 per year.– Any person putting up advertising billboards and banners must requestauthorization from the District.– FRW 10,000 – FRW 20,000 per square meter for each side of regularbillboards per year.– FRW 60,000 – FRW 100,000 for billboards using information technologyper year.– FRW 5,000 – FRW 10,000 per day for banners– Exemptions include:Fees on boat number plates• Advertising on buildings and vehicles owned by a company.• Billboards or signposts showing the direction of a given activitybut no other commercial advertising message.– For the number plate required to operate a boat.Fees on bicycle number plates

– FRW 5,000 – FRW 15,000 per number plate.

– Depend upon whether the boat has an engine.– For bicycles used for profit making activities.Fees on communication towers– FRW 1,000 per number plate.Fees on transport of materials from quarries and forests– For erected communication towers.

– FRW 2,000 per vertical meter per year.

– FRW 1,000 per vertical meter per year for any underlying building or

structure.– For transport of materials from quarries and forests.

– FRW 1,000 per tone, payable on every loading.Application activity 3.3

1. Tubyine Fun Pub is established in 1st April 2021. As the pub is

considered a small enterprise, it will be exempted from Trading

License Tax. Show the date it will be required to pay its first trading

license and the deadline of paying its trading license for the second

year.

2. Dukore opens a small shop in Rubavu in March 2022. The tax due

for the full tax year for “other profit-oriented” activities in an urban

area is FRW 30,000.

Calculate the Trading License Tax to pay to the decentralized entity.

3. Mwiza is a resident of Rwanda. In 2022, She owns two commercial

properties in Gisozi which she rents to various individuals. Each

property is rented at FRW 1,200,000 per month. All properties

received tenants the whole year. In the construction of the first

property, Mwiza borrowed FRW 20,000,000 from EQUITY Bank

Rwanda and she pays annual interest rate of 17%. Compute herrental income and the rental tax liability.

4. Kazungu is a registered trader in Nyabugogo market. On every

Friday, he takes part of the goods to the newly constructed Shyorongi

market to attract more clients outside Kigali. In Nyarugenge district,

the threshold of market fees is fixed at FRW 10,000 per month and

per stall in Muhima, Nyarugenge and Gitega Sectors. The council of

Rulindo district have decided to fix at FRW 3,000 market fees per

stall in all constructed markets across the district.Required: Calculate the monthly market fees to be paid by Kazungu.

3.4: Other Sources of Revenue for Decentralized Entities

Learning Activity 3.4

In our previous lesson, we learned about different types of revenue streams

generated by decentralized entities. However, there may be other sourcesof revenue for local governments. Could you please explain some of them?

3.4.1: Loans

A decentralized entity can borrow money with prior approval of the Minister

in charge of finance in accordance with the Organic Law on State Finance andProperty.

Borrowings of a decentralized entity are only for investment according to thedevelopment plans of this entity.

3.4.2: Investments

A decentralized entity can invest in companies and financial institutions. The

authorization to invest in companies, commercial banks and other private

institutions is granted by the Minister in charge of finance after consultationwith the Minister in charge of Local Government.

An Order of the Minister in charge of finance determines regulations in relationto the amount for investment and other matters relating to investment.

3.4.3: Government Subsidies

Every year, the Government transfers to decentralized entities at least five

percent (5%) of the domestic revenue of the previous tax period in order tosupport their budgets.

Application activity 3.4

Q1. How much money the Government transfers to the decentralizedentities and why?

Skills Lab Activity 3

After a visit to the RRA office, students will have to produce a written

report on decentralized taxes and fees collection and explain the challenges

faced by the tax administration in collecting these taxes and they will

solve problems of citizens not registering their property/business for taxpurposes.

End of unit assessment 3

Question 1 Ntabwoba owns the following properties in Gasabo valued on 1st January2019

Question 2

Suppose Agaciro Bank, apart of its Headquarters, has six (6) branches

in Nyarugenge district, five (5) branches in Kicukiro district and four

(4) branches in Gasabo district. The following additional information isrelevant:

– The turnover of Agaciro Bank for the year 2022, according to theRequired:

information provided by RRA, is FRW 6,000,000,000;– The turnover of each branch is the average from the total turnover

a) Calculate the trading license tax belonging to each districtQuestion 3

b) Calculate the total trading license tax for Agaciro Bank;

Uwineza owns two properties in Kicukiro. The first property was

constructed in 2010 at a cost FRW 150,000,000. During the construction,

she borrowed FRW 50,000,000 from the bank and she pays an interest rate

of 15%. The property was occupied from 1/1/2015 to 31/12/2015. The

second property was constructed in 2014 at a cost of FRW 125,000,000

using her own money. The property was occupied from 1/5/2015 to

31/12/2015. Each property is rented at FRW 3,500,000 per month.

Uwineza incurred the following expenses on the two properties duringthe year.i. Salaries of the manager FRW 4,800,000Required

ii. Electricity FRW 2,500,000

iii. Painting FRW 4,500,000

iv. Water FRW 1,200,000

v. Depreciation FRW 10,500,000

vi. Security personal FRW 5,000,000Compute the taxable rental income and the tax liability for the year ended

31/12/2015