UNIT 2: WITHHOLDING TAXES

Key unit competence: Use different percentages to compute relatedwithholding taxes.

Introductory activity 2.1

ALICE from Bugesera District, last year 2022 she was given FRW

200,000,000 from expropriation and that money was invested in Bugesera

Town and then she has invested in different projects. Buying shares from

Bank of Kigali (BK) and buying Machine Tractors construction roads in

that District. ALICE has imported construction materials to be used in roadconstruction.

Q1. Based on above case, is ALICE liable to pay taxes? Which type of tax?Q2. Based above case, which goods and services will be taxable?

2.1: The feature of withholding taxes, imports and publictenders

Learning Activity 2.1

Ms. Kevine, legal expert, importer and a businessman who bids public

tenders has been given a contract for law writing services for Rwandan

central government for a value of FRW 500,000 plus VAT at 18%. Kevine was

registered by the tax administration and she complies with all regulationsrelating to tax declarations and record-keeping.

Question

From the above scenario, identify the careers of Kevine that are related towithholding tax.

2.1.1: The features of withholding taxes

Definition of withholding taxes: Withholding taxes is a deduction of tax levied

at source of income as advance payment on income. Within the Rwandan tax

system, certain types of payment are liable to withholding taxes. Withholding

taxes is due to be paid on or before the15th days of the month following therelevant payment that is subject to WHT.

Sometimes withholding taxes is the only tax suffered by the recipient of the

payment these are referred to as final taxes and nothing further will be due to

the tax authorities in respect of this source of income. This would be the case

if the recipient of the payment was not resident in Rwanda. It would also be

the case if the recipient were a Rwandan resident individual whose only otherincome was employment income.

However, if the law does not specify that a WHT is a final, the recipient of the

payment that has been subject to the withholding tax must declare the income

on their tax declaration, usually grossed up for the withholding tax, and then

the withholding tax may be deducted in arriving at their tax payable. Most

Rwandan withholding taxes are not final taxes, and therefore Rwandan resident

person will be required to include the relevant income on their tax declaration.

The main exception to this is for dividends paid out of the profits of a Rwandan

company, which have already suffered corporate income tax (CIT).2.1.2: Import and Public Tenders

a) Withholding tax on goods imported for commercial use

An import is the name for the purchases from another’s country. When goods

are imported into Rwanda for commercial use, they are held at customs untilthe trader collects them.

The importer has to pay 5% of the CIF value of the goods purchased at the firstentry port into East Africa Customs Union.

b) Withholding tax on public tenders

When a public body requires goods or services, it will usually get several quotes

from different suppliers. This is called public tender. The public body will awardthe tender to a supplier and pay the quoted fee.

Besides VAT, the public body will deduct withholding tax from the payment at

a rate of 3% of the VAT-exclusive value of the contract. This withholding tax is

not a final tax for a business liable to rwandan income taxes, the grossed-up fee

paid will be included within taxable income on the tax declaration, and the 3%withholding tax can then be claimed as a deduction from the tax liability.

Application activity 2.1

Q. 1 a) Define withholding taxes?

b) Distinguish between Withholding taxes 5% and Withholding taxes3%.

2.2: Person exempted from withholding taxes and others

payment subject to withholding tax.

Learning Activity 2.2

Uwineza, was discussing with her classmates: “In Senior four we have

studied types of tax and taxpayers and if you remember last week our

teacher tough us about withholding taxes so now I wondering whether all

taxpayers are supposed to pay withholding taxes or not, mates may youshare me what you know about this?” Said by Uwineza.

Question,

In context with taxation, what are the expected answers that you think herclassmates will share about exemptions of withholding tax?

2.2.1. Persons exempted from withholding taxes

The following taxpayers are exempted from withholding taxes:

1. those whose business profit is exempted from taxation;

2. those who have tax clearance certificate issued by the Tax Administration;

3. those who are newly registered during the concerned annual tax period.

The Tax Administration issues a tax clearance certificate to taxpayers who have

filed their tax declarations on their business activities; paid the tax due on a

regular basis, and have no tax arrears. The certificate is valid in the year in

which it was issued.

The Tax Administration may revoke a tax clearance certificate at any time if theconditions required by the tax administration are not fulfilled.

2.2.2 Other payments subject to withholding taxesA. Conditions required for WHT

For withholding tax to apply to any of the following payments (or any others

method of extinguishing an obligation, for example a payment made in goods

rather than cash), the following circumstance must be met:

– The withholding agent must be Rwandan resident (note however that

they may be a tax-exempt body) or the permanent establishment of anon-resident company

– The recipient is either:

– (i) not register with the Rwandan tax administration(ii) or registered but without a recent income tax declaration.

B. Types of payment subject to withholding tax

Payments subject to the withholding tax of fifteen percent (15%) are relatedto the following:

a) Dividends

Dividend income includes income from shares in any societies, other similar

income that may be generated by all entities that pay corporate income tax, as

well as the outstanding balance after the taxation of income from the correction

made by the Tax Administration in the transfer pricing.

All dividends are taxable except those paid between resident companies and

income distributed to the holders of shares or units in collective investmentschemes.

b) Financial interests

Financial income includes:

1. incomes from loans, debentures or other debt securities;

2. incomes from deposits;

3. incomes from guarantees;

4. incomes from government securities, negotiable securities issued by the

Government, securities issued by companies or other persons as well asincome from cash negotiable securities.

All financial interests are taxable except:

i. interests on deposits in financial institutions for at least a period of one

(1) year;

ii. interests on loans granted by a foreign development financial institution

exempted from income tax under applicable law in the country of origin;

iii. interests that banks or deposit-taking microfinance institutions operating

in Rwanda pay to banks or other foreign financial institutions;c) Royalties

Royalty income includes all payments of any kind received or receivable:

1. on the use of or the right to use any copyright of literacy, craftsmanship

or scientific work including cinematograph films, films or tapes used for

radio or television broadcasting;

2. on the use, right to use or exploitation of a trademark or a trade name, a

design or a Model, a computer application, a software and a patent;

3. as the price or consideration of using, or of the right to use industrial,

commercial or scientific equipment or for using information concerning

industrial, commercial or scientific knowledge or formula;4. on the right to exploit or explore natural resource.

a) Service fees including management and technical service fees exceptN.B: However, the withholding tax is five percent (5%) if levied on the following

transport services;

b) performance payments made to a crafts person, a musician, an artist, a

player, sports, cultural or leisure activities irrespective of whether paid

directly or indirectly;

c) Goods sold in Rwanda;

d) Profit after tax or retained earnings that are converted into shares,

except for financial institution with paid-up capital below the minimum

requirement set by the National bank of Rwanda;

e) Profits repatriated from Rwanda;

f) Payments made in cash or in kind by a resident person in Rwanda on

behalf of a non-resident in Rwanda contracted person provided for

under the contract in addition to contractual remuneration;

g) Re-insurance premiums paid to a non-resident insurer except premiums

paid to insurers that have signed agreements with the Government ofRwanda.

interests:1. dividends and interest on securities listed on capital market if the

beneficiary of the dividends or interest is a resident taxpayer of Rwanda

or of the East African Community;

2. interests derived from treasury bonds with a maturity of at least three(3) years.

Application activity 2.2

Q1. The group INTORE won the award of PRIMUS GUMA GUMA. The value of that award is twenty-four million (FRW 24, 000,000) excluded tax laws.

a) What is the type of income earned by INTORE group?b) Calculate the tax to be paid by that group?

Q2. MUGISHA is hired by Modern Business Ltd as a technical consultant

on a short-term contract. MUGISHA gross income for this contract is FRW

3,500,000. As the source of this income, Modern Business Ltd must declare

and pay withholding tax on this income.Calculate the withholding tax to be paid

2.3: Withholding taxes on gaming activities and DoubleTaxation Agreement (DAT).

1. Withholding tax on gaming activities.

The fifteen per cent (15%) tax is withheld by a company that carries out

gaming activities on the difference between winnings of the player and amount

invested by the player.

2. Double Taxation Agreement (DTA)

Definition of DTA: Double Taxation Agreement in international taxation involves

taxation which is cross border.

It arises from individual having taxable income or assets in two countries or a

business operating in two (or more) countries. Due to increased globalization,

the growing level of business trading international around the globe andincreased personal mobility, international taxation is becoming prevalent.

What is international taxation?

It should be clear from the onset that laws are not “international”. Laws are

creations of sovereign states. What is referred to as international tax law is the

international aspect of the income tax law of particular country. It is the taxationof foreign-related transactions (taxation of international transactions).

International tax system is made of specific, piecemeal response to the way

investment of business operations are carried out across national boundaries.

Many of the most important international tax rules are designed to mitigate oreliminate double taxation.

Jurisdiction to Tax“Source of Income Taxation “inbound” and Residence Taxation “Outbound”.

From the perspective of the Rwandan tax system, there are two broad classes in

which international economic activity falls:a) Investments or business undertakings of foreign persons in RwandaThis is what is referred to as taxation basing on the “source of income” or

b) Investments or business undertakings of Rwandans abroadtaxation basing of the residence of the person.

1. Source Jurisdiction

The term “Source of income” is the location of the property or business from

which income is derived. (Look at the Article on Business income is treated as

having its source in Rwanda only if the income is earned through a permanent

establishment. (Look at the Article defining PE in Rwandan law, it confers to theOECD Model, Article 7)

It is also referred to as “territorial taxation”, which refers to taxation of limitedto income from source within the boundaries, no matter who derives it.

2. Residence Jurisdiction

Under Article 4(1) of the OECD Model Treaty, “resident) of a country for

purposes of the treaty is a person taxable in that country “by reason of his

domicile, residence, place of management or any other criterion of a similarnature.”

The UN Model Treaty adds “place of incorporation” to that list.

Article 4(2) provides a series of tie-breaker rules to give residence jurisdiction

to one country. These are;• Place where an individual has a permanent home;These tie-breakers are ineffective in making the individual of a residence of

• Country in which the centre of the individual’s vital interest is located

• Place of individual’s habitual dwelling;• Country of citizenship

only one country for treaty purposes, certain officials of the two countries ( the

“competent authorities” are mandated to determine a residence by mutualagreement.

For legal entities, resident in two countries, Article 4(3), of the OECD Model

Treaty makes the entity a resident of the country where its effective management

is located.

Note that some countries use a place-of-incorporation test as the sole test of

residence for corporation.

What is the Rwandan definition of a residence?

An individual is considered to be a resident in Rwanda if he or she fulfils one of

the following conditions:1. he or she has a permanent residence in Rwanda;

2. he or she has a habitual abode in Rwanda;

3. he or she is a Rwandan representing Rwanda abroad;4. he or she is present in Rwanda during the tax period for a period or

periods amounting in aggregate to one hundred and eighty-three (183)

days or more;5. he or she is present in Rwanda during the tax period of assessmentAs far as double taxation agreement is concerned, its main objective is “the

and has been present for periods averaging more than one hundred and

twenty-two (122) days in each of the two (2) preceding tax periods.

• A person other than an individual is considered to be a resident in Rwanda

during a tax period where it fulfils one of the following requirements:

a) where it is established according to Rwandan laws;

b) it has a place of effective management in Rwanda at any time during

that tax period.

• A Ministerial Order determines the person’s permanent residence andthe location of the effective place of management.

avoidance of double taxation with respect to taxes on income and on capital”.

“International double taxation” has been defined as the imposition of

comparable income taxes by two or more sovereign countries on the same

item of income of the same taxable person for the same taxable period (OECDdefinition)

The double taxation arises due to the inconsistent rules of source of income

in different countries imposing overlapping taxes. For example, one country

may consider origin of payment source of income while another country mayconsider where the work was performed as source of income.

U.S.A taxes its citizens on worldwide income irrespective of source of income.

Inconsistent residence rules also lead to double taxation. Some countries

consider the entity a resident of the country where its effective management

is located. While other countries use a place-of-incorporation test as the soletest of residence for corporation.

Double taxation risks typically arise when two or more country claim the right toimpose tax on the same item of income.

In short the basic causes for double taxation are;

1. Source-source conflict; Two countries asserting the right to tax the

same income of a taxpayer because they both claim the income is sourced

in their country.

2. Residence-Residence conflict; Two countries asserting the right to tax

the same income of a taxpayer because they both claim the income is

sourced in their country.

3. Residence-source conflict; One country asserts the right to tax foreign

source income of a taxpayer because the taxpayer is a resident of that

country, and another country asserts the right to tax the same incomebecause the source of income is that country.

Note that double tax agreements are used to avoid non taxation of income.

Double tax relief mechanism:

To eliminate the double taxation effect, there are different methods for granting

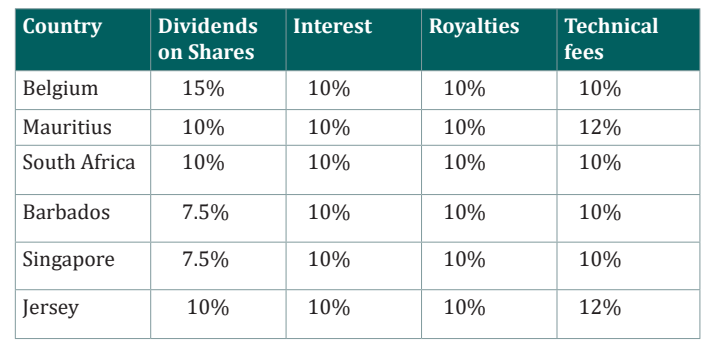

relief from international double taxation.a) Deduction method. Resident taxpayer is allowed to claim a deductionAs noted in the table below, a double taxation agreement (DTA) can override

for the taxes paid in foreign country

b) Exemption method. The resident country provides its taxpayers with

an exemption for foreign-source income

c) Credit method. The resident country provides its taxpayers with a

credit against taxes payable for income tax paid to foreign country

the normal 15% rate of WHT. The following rates of WHT apply under existing

Rwandan DTAs:

The application of the DTA rates is subject to the recipient of the payments

meeting certain conditions. Professional advice should be sought beforeapplying the above rates. Application activity 2.3

Application activity 2.3

Q1. Defining Double Taxation Agreement.Q2. State the purpose of Double Taxation Agreement.

In group discussion, invite a resource person from RRA to share with

students on the calculation of withholding tax for imports and public

tenders and ask students to apply using an illustration to computewithholding taxes then share findings.

End of unit assessment 2

Q1. Which TWO of the following statement are true in relation to withholding

taxes?1. Withholding taxes are paid to the tax administration by the recipientQ2. Which of the following payment by government bandies under public

of a payment.

2. If a withholding tax is a final tax, no further tax is due from the

recipient.

3. Income that has sulfured withholding tax will never be required to

be included in a tax declaration.

4. Withholding taxes at 15% are deducted from taxable income in

preparing the income tax declaration.

5. Withholding taxes at 15% may be deducted from the tax payable fora tax period.

tenders would be liable to withholding taxes of 3%?A. Payment to an overseas business that is not registered with the taxQ3. What is the rate of withholding tax on royalty made by Rwandan

administration.

B. Payment to a Rwandan registered business that does not hold a tax

clearance certificate.

C. Payment to a Rwandan business that is new and not yet registered

with the tax administration.

D. Payment to a Rwandan registered company that holds a taxclearance certificate.

taxpayers to countries which a double taxation agreement is in place?

A. 0%B. 5%Q4. Which Two of the following interest payments would not incur

C. 10%D. 15%

withholding tax at 15%?

1. Interest paid to a Rwandan resident individual on a short-term bank

deposit does not hold a tax clearance certificate.

2. Interest paid to a Rwandan individual on a four-year rwandan

treasury bond.

3. Interest paid by a Rwandan bank to a company resident in Mauritius.4. Interest paid by a Rwandan bank to a French individual on a shortterm bank deposit.

A. 1 and 4Q5. You work for a large company with many Rwandan and overseas

B. 2 and 3

C. 1 and 3D. 2 and 4

shareholders. The company listed on the Rwandan capital market and hasrecently declared a dividend to its shareholders.

List the factors you need to consider when determining the rate of

withholding tax to deduct on the dividends, and how these will impact thewithholding tax rate.