UNIT 1: TAXATION OF CORPORATE 1 BUSINESS PROFITS

Key unit competence: Compute corporate income tax (CIT)

Introductory activity

John is tax consultant who works with different companies in providing

advisory services regarding to taxes matters and do the declaration of their

taxes as well. For the year ended 30 June 2022, John had many clients andamong matters that dealt with are shared below:

1. One of his clients called KIGALI CITY, a government entity, has made

a surplus of FRW 500,000 and wants John to advice on tax that is

required to comply

2. Rweru Ltd another client, has prepared its financial statements for

the year ended 30th June 2022 and approved, wants John to assess

and file its annual return to Revenue Authority.

3. Rubengera company Ltd, a parent company, during the year ended

30th June 2022, acquired 65% of share in Rutsiro Investment Ltd

and wants John also to advice on the implication of taxes on the

investment made in Rutsiro Investment Ltd.

4. XYZ company Ltd has made a huge investment in construction of

factory, and during the year ended 30 June 2022, it made a loss of

FRW 2billion and as the new company has approached also John as

tax expert to advise them on the implication of taxes on this issue.

Suppose you are John, advice your clients on these matters noted

above. What do you think John would base on to advice and drawnconclusion to the above matters?

1.1: Relevant legislation, Chargeable and exempt entities

1.1.1: Relevant legislation

The legislation on income tax is established by law no

027/2022 of 20/10/2022.

The legislation covers both personal income tax and corporate income tax (CIT)

besides withholding tax, capital gain tax and tax on gaming activities. In this

unit we will focus on the calculation of corporate income tax, which is coveredin Chapter III of the legislation.

The processes related to calculating both personal income tax and corporate

income tax, including filing and paying taxes, are very similar and you will haveseen certain aspects of this unit in Units 4 and 6 in Senior Four.

Corporate income tax is levied on business profits received by taxpayers otherthan individuals.

Therefore, in this unit we will consider how we calculate the profits on whichcompanies are charged to tax.

1.1.2: Chargeable and exempt entities

Any company that receives taxable income must register and pay corporateincome tax unless the company is exempt.

1. Taxpayers

The following entities will be liable to corporate income tax:

a) A Ccompany established in accordance with Rwandan law and a

foreign company registered in Rwanda;

b) A cooperative society;

c) A State-owned company;

d) Trustee, enforcer or protector of a trust;

e) A foundation;

f) A protected cell company or a cell of a protected cell company depending

on the choice of the investor at the time of company registration;

g) A non-resident in Rwanda person with a permanent establishment;

h) An entity established by a District or the City of Kigali if that entity

performs an income generating activity;

i) An association or entity that is established to realize profits regardlessof its nature.

2. Entities exempted from corporate income tax

The following entities are exempted from corporate income tax:

a) The Government of Rwanda;

b) The City of Kigali;

c) The district;

d) The National Bank of Rwanda;

e) Organisations that carry out only faith-oriented activities,

humanitarian, charitable, scientific or educational character unless

the revenue received exceeds the corresponding expenses or if those

entities conduct a business;

f) International organisations or agencies of technical cooperation

if such exemption is provided for by international agreements or

an agreement concluded between these organisations and the

Government of Rwanda;

g) Qualified pension funds;

h) Public institutions in charge of social security;

i) Development Bank of Rwanda « BRD »;

j) Agaciro Development Fund Corporate Trust;

k) Business Development Fund limited “BDF Ltd”.

l) Special purpose vehicle, unless the revenue received exceeds the

corresponding expenses;

m) Common benefit foundations;

n) Resident trustee for income earned by a foreign trust.

However, entities exempted from corporate income tax are required to submit

to the tax administration their financial statements not later than 31st March

following the tax period or three (3) months following specific tax period

granted to taxpayers who have made an application in accordance with

provisions of Article 9 of the law No027/2022 of 20/10/2022.

Entities resident in Rwanda will be liable to corporate income tax on their

worldwide business profits. However, dividends paid between resident

companies that have not been subject to withholding tax (as the recipient

company, being registered with the tax administration, will be exempt fromWHT) are not included in corporate taxable income.

This is because the paying company would have already paid the relevant

amount of Rwandan CIT on the profits out of which the dividend is paid. Note

that dividends from overseas companies (for example a foreign subsidiary of

a Rwandan parent company) are liable to CIT in Rwanda; the amount gross of

overseas taxes should be included in taxable profit and then the overseas taxsuffered can be deducted from the CIT liability (as double taxation relief).

Application activity 1.1

1. The Government of Rwanda, the City of Kigali, the Districts, the

National Bank of Rwanda are exempted from corporate income tax,

however if they perform an income generating activity are liable to

corporate income tax.

On that context, with convincing reasons explain which of the

following entities are not subject to Corporate Income tax?

A. Keza Co Limited that imports sugar, cooking Oil and salt and sell

them to the retail and wholesalers.

B. Navigation Co that provides Human resource services to the

different clients in Rwanda

C. Gasabo District’s conference hall with its unique TIN that is rented

to the staff of the district and other people in the country.

D. None of the above

2. Tick to show whether the following are taxable or exempt for thepurposes of corporate income tax:

1.2: Income tax

1.2: Income tax

Learning Activity 1.2

Muhire is a business man who used to sell the home appliances. He started

his business in 2018, after 1 year, 2 years and 3 years in business. He made

a total revenue of FRW 5,000,000, FRW 10,000,000 and FRW 15,000,000

respectively. As the business was growing, Muhire recruited an accountant

to facilitate him in preparing the financial statements and declaration of

taxes. During the year ended 31st December 2022, Muhire’s profit or loss

account shown a total revenue of FRW 50,000,000 and expenses of FRW

30,000,000 but included in the expenses were personal expenses of FRW20,000,000.

Question:

As student of taxation, advice Muhire on the income tax to pay1.2.1: The income tax regimes

Different income tax regimes apply to calculate corporate income tax for

companies’ dependent on their level of turnover. For companies with turnover

exceeding FRW 20,000,000 the real regime applies which means that companies

will need to calculate their taxable trading profits. This is done by adjusting theaccounting profits in exactly the same way as we saw for a sole trader.

As you saw in Unit 6 in Senior Four, income tax has three rules (regimes) for

taxpayers based on their annual sales. These rules apply equally to corporate

taxpayers. The calculation of corporation tax under flat rate taxation and sales

tax/lump sums has been summarized in Senior Four’s Unit 6. Businesses with

annual sales (annual turnover) of more than FRW20,000,000 must apply the

real regime and pay corporation tax at 30% on their taxable income. The

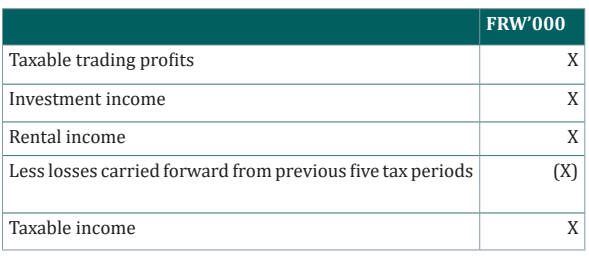

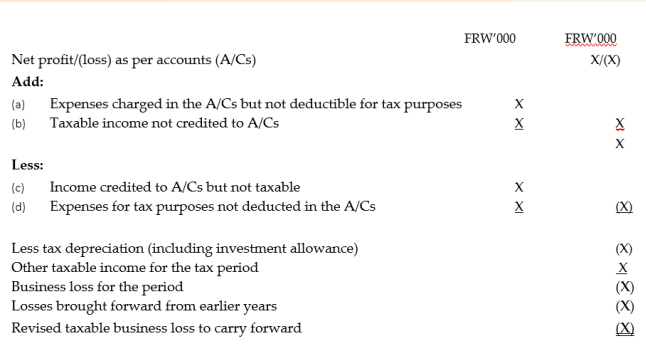

calculation of taxable income is covered in this unit.1.2.2: Taxable income

The taxable income is the amount on which a company will be liable to corporate

income tax.Taxable income for companies is calculated as

In this topic we look at the calculation of taxable trading profits. The other

income to be included is covered in sub-heading 1.3 and losses are covered insub-heading 1.6

1.2.3: Taxable trading profits

In exactly the same way as for a sole trader business, the accounting profit of thecompany must be adjusted for tax purposes to give the taxable trading profits.

The adjustments made for companies are identical to those for a sole traderand are covered in Unit 6 of senior four.

Companies are entitled to the same tax depreciation as we saw in Unit 4 in

senior four and the same adjustment is made for the difference between

the amount charged as depreciation in the accounts and the amount of taxdepreciation which is deductible.

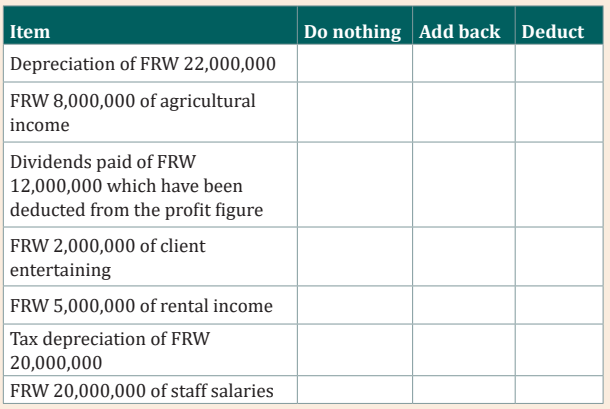

Application activity 1.2

Which of the following correctly states the adjustments to be made to a

company’s trading profits for tax purposes? (Tick one column for eachitem)

1.3: Other income for companies

Learning Activity 1.3

Muhanga Enterprise Ltd, is company located in Muhanga district that

do farming activities. During the board members’ meeting, the chair

suggested to expand the investment as the accumulated profit presented

by the management showed that the company has so far generated more

reserves. From the suggestion of chair, the meeting resolved the following:

1. To buy 10% of share in Shyongwe Ltd one company specialized in

bookkeeping.

2. To deposit some money in one commercial bank under the fixed

term deposit at the annual interest rate of 12%.

3. To construct residential houses near Muhanga city and start rentingthem to the visitors.

Question

Apart from the income Muhanga Enterprise Ltd generating from its main

business of doing farming activities, what else do you think as other

incomes that are going to be generated if the resolutions of Board meetingare implemented by Muhanga Enterprise Ltd’s management.

1.3.1: Taxable income

In addition to the taxable trading profits, companies will also be taxed on theirinvestment income and rental income receivable during the year.

After the taxable trading profits are calculated, other income must be broughtin to calculate the company’s taxable income.

1.3.2: Investment income

Dividends received by Rwandan companies from another Rwandan entity will

be non-taxable and should be excluded from the taxable income calculation.Only overseas dividends would be included in the calculation of taxable profits.

From the investment income any investment expenses can be deducted. Thiswill include any carrying charges and interest expense.

The net investment income is then included in the taxable income calculationalthough when submitting a corporate income tax declaration, the investment

income and investment expenses will actually be entered in different rows ofthe declaration.

Be reminded that, all investment income in the form of interest, dividends

and royalties must be included unless these are non-taxable. These may have

been received net of withholding tax but the gross amount must be declared as

taxable income and then the tax withheld will be included in the calculation ofthe tax due.

1.3.3: Rental income

Rental income from buildings is included in taxable income. Related expenses

are allowable, including tax depreciation on the building and any relatedinterest on loans to acquire/improve the building.

A deduction can be made for rental income from machinery, equipment, landand livestock.

The deduction can include:

10% of the rental income as wear-and-tear expense

Interest paid on loans to purchase the rented itemsTax depreciation according to the usual rules (as per Unit 4 of senior four)

Note that rental income for personal income tax purposes of taxpayers (i.e.

individuals) is declared separately from corporate profits, while rental income

for a corporation is included in the calculation of taxable income. This includes

rental income from the rental or leasing of machinery, equipment, land,

buildings and livestock. The special regulations for calculating the amountssubject to rental income tax for buildings do not apply to companies.

Application activity 1.3

1. Mwiza Ltd prepares its accounts to the year ended 31st December.

In the year its financial statements show the following:

– Interest income of FRW 680,000, which is received net of 15%

withholding tax

– Royalty income of FRW 595,000, also received net of 15%

withholding tax

– Expenses of managing the investments at FRW 50,000.

Calculate the investment income which will be included in Mwiza Ltd’staxable income.

2. Mugonero Ltd bought a tractor for FRW 1,000,000 in the year ended

31 December 2021 which it rents out. During the year ended 31

December 2022 it received monthly rental income of FRW 20,000.

When it bought the tractot Mugonero Ltd took out a loan of FRW

800,000 to help purchase the tractor and it pays interest on this

loan at a rate of 4% per annum.

Required: What is Mugonero Ltd’s rental income to be included in its

taxable income calculation?

A. FRW 134,000

B. FRW 240,000

C. FRW 184,000D. FRW 158,000

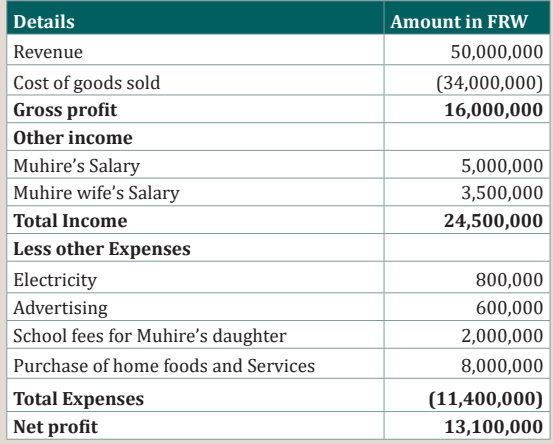

1.4: Total taxable income for companies

Learning Activity 1.4

Muhire is Managing Director and founder of Urumuri Ltd and he is looking

for an expert in tax to help his company to prepare the taxable income. The

following is the extract of the profit or loss account of Urumuri Ltd for theyear ended 31st December 2022.

Suppose Muhire has approached you as an expert, help Urumuri Ltd to

prepare the total taxable income for the year ended 31st December 2022.

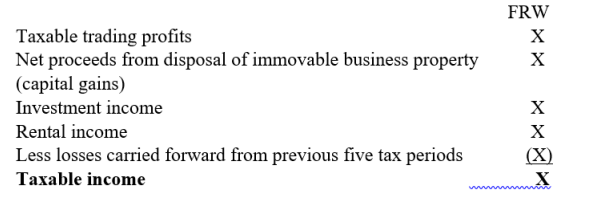

1.4.1: Calculation of total taxable income for companies

The taxable income is calculated by bringing together all the sources of taxableincome as below:

Application activity 1.4

Turakize Plc is a Rwandan company registered with the tax administration

and trading in furniture manufacturing. Its audited profit or loss accountfor the tax period is shown below:

Notes

1. Rental income was earned by letting out spare items of machinery

that cost FRW 150,000,000. These items are included in the other

plant and machinery pool (see Note 3).

2. This interest did not suffer withholding tax as it was derived from a

long-term bank deposit.

3. There were no acquisitions or disposals of assets in the period.

4. Tax written down values of fixed assets at 1st January are as follows:

5. Buildings: FRW 300,000,000 (original cost FRW 500,000,000)

6. Other plant and machinery pool: FRW 60,000,000

7. This bad debt was written off in the period after the customer was

declared insolvent by a court. The income was taxed in the previous

accounting period.

8. This represents a proportion of the value of all goods sold.

9. The company has paid the correct PAYE on all amounts included as

wages and salaries.

10. Legal and professional fees include a fine for breaching safety

regulations of FRW 1,500,000. The remaining FRW 2,500,000

relates to accountancy and debt collection services.

11. Interest payable is on a business loan used to invest in working

capital.

Required: Compute the total income chargeable to corporate tax onTurakize Plc for the tax period.

1.5: Corporate restructuring and tax on liquidation

Learning Activity 1.5

Karangazi Ltd is a company specialized in producing and selling Maize flour,

during the year ended 31st December 2022, the shareholders of Karangazi

Ltd decided to transfer their 70% of assets and liabilities to Kiramuruzi Ltdafter assessing the performance of the company.

Question

1. On your understanding, what do you think was happened in

Karangazi Ltd?

2. Assuming, you have been appointed to assess the implication of

taxes on the above decision made by Karangazi Ltd’s shareholders,what is your recommendation?

1.5.1: Definition of restructuring

A corporate reorganization occurs when one of the following events occurs:

• A merger of two or more Rwandan resident companies

• The acquisition of 50% or more of a company in exchange for shares in

the purchasing company

• The acquisition of 50% or more of the assets and liabilities of a company

in exchange for shares in the purchasing company.

• The purchase of all of a company’s assets so that it is replaced by

another company

• The splitting up of a Rwandan resident company into two or moreseparate companies

1.5.2: Implications of restructuring

The transfer of assets by a company during restructuring is exempt fromcorporate income tax.

In case of restructuring of companies, the transferring company is exempt from

tax in respect of capital gains and losses realized on restructuring. The receiving

company values the assets and liabilities involved at their book value in the

hands of the transferring company at the time of restructuring. The receiving

company depreciates the business assets according to the rules that would have

applied to the transferring company as if the restructuring did not take place.

In case of restructuring, the receiving company is entitled to carry over the

reserves and provisions created by the transferring company, subject to the

conditions that would have applied to the transferring company as if the

restructuring did not take place. The receiving company assumes the rights

and obligations of the transferring company in respect of such reserves andprovisions.

1.5.3: Implications of liquidation

When a company goes into liquidation, its assets are sold and the money is

used to pay off all of the company’s debts. The remaining money is then paid

out to the shareholders and treated as a dividend (for personal income tax andwithholding purposes) in the last taxable period of the company’s existence.

1.5.4: Impact on losses

A restructuring is likely to lead to a transfer of over 25% of a company’s share

capital; in this case losses being carried forward may no longer be permitted tobe offset against profits

Application activity 1.5

Mibabaro Plc, a Rwandan company, transfers its trade and all of its assets

to Gakire Plc, an unconnected Rwandan company, in exchange for sharesin Gakire Plc on 30th November 2022.

One of the assets transferred was a factory used in the trade that originally

cost FRW 40,000,000 six years ago and had a written down value of FRW

28,000,000 for tax purposes. Its market value was FRW 50,000,000 at 30thNovember 2022.

Which one of the following statements is true in relation to the taxtreatment of the transfer of the building?

A. The building will be transferred at its market value of FRW

50,000,000 and Mibabaro Plc will pay corporate income tax on

the gain of FRW 22,000,000.

B. The building will be transferred at its original cost of FRW

40,000,000 and Gakire Plc will claim 5% tax depreciation on the

FRW 40,000,000.

C. The building will be transferred at its written down value of FRW

28,000,000 and Gakire Plc will claim 5% tax depreciation on the

original cost of FRW 40,000,000.

D. The building will be transferred at its written down value of FRW

28,000,000 and Gakire Plc will claim 5% tax depreciation on theFRW 28,000,000

1.6: Business loss reliefs

Question

The photo above showing the decline of profit and as far as taxation is

concerned, what do you think the company should do in case the profitdropped down until resulting into loss?

1.6.1: When does a business loss arise?

Not all companies are profitable. In this lesson, we look at how a company can

use a loss to reduce the income tax it owes. In addition, there is a loss on a longterm

contract, we see that there are special rules on how this loss can be usedto save income tax.

A company makes a loss when its accounting profit or loss is adjusted for tax

purposes, the tax depreciation is deducted and the resulting figure is a loss.

The corporation’s taxable profits for the period of the loss are nil and the loss is

carried forward to be used against future corporate taxable profits in the nextfive tax periods.

Where a business makes a loss, Article 31 of Law No

027/2022 sets out the rules

as to how that loss can be utilised to save income tax. The rules are the samewhether the business in question is a sole trader, partnership or company.

A loss arises when the taxable business profits show as a negative figure after

the adjustment to profit and after the deduction of tax depreciation. It does

not matter whether there is a profit or loss in the accounts at the start of the

adjustment. What matters is that once the profit or loss has been fully adjustedfor tax purposes, it is a negative number.

1.6.2: What can be done with a business loss?

If a company makes a loss, this negative amount is included in the calculation

of taxable income (because the taxable income is less than the deductibleexpenses).

The legislation provides that business loss is carried forward and offset against

business profits within the next five tax periods. But on request, you can begranted more than five years if you fulfill the requirements.

Remember that, if there are losses incurred in more than one period, thelegislation states that the losses of earlier periods must be deducted first.

Note that while the law requires the loss to be offset against business income,

the offset is actually against all taxable income received by the individual or

by the company receives, as all income is reported on their income tax return

(personal or corporate). A business loss is the loss arising from all of the taxableactivities of the individual or company, not just their trading.

However, if the loss is from a foreign source, this loss cannot be used to offsetagainst Rwandan sourced business profits.

1.6.3: Losses on long-term contracts

A loss incurred on a long-term contract can be offset against previous profit

recognised on that same contract, if it cannot be used against other businessprofits of the period.

Carry back of losses on long-term contracts

As seen in Unit 6 (Senior four taxation book), the income and expenses relating

to a long-term contract are charged to the accounts on the basis of the percentageof costs actually incurred relative to the total expected costs of the project.

When a project is expected to be profitable it means that a percentage of profit

is recognized in each period in relation to the percent completion of the project.

It is possible that the contract could then incur some unexpected costs. This

could result in the contract becoming loss-making despite taxation of profitstaxed in previous periods.

The loss incurred will reduce the company’s taxable profit of the business in the

relevant year. If the loss incurred is large enough that it cannot be absorbed by

other profits of the period in which the contract is completed, the excess loss

may be “carried back” and used against profits previously recognised for that

contract. While the legislation does not specify settlement order, it is assumedthat losses are offset against the most recent contract profits first.

Any remaining losses are then carried forward in the normal way.

Application activity 1.6

Bibaho Ltd incurred a FRW 80,000,000 business loss in the year ended 31st

December 2020. In the year ended 31st December 2021 it makes taxable

trading profits of FRW 120,000.000 and has investment income (gross) of

FRW 2,500,000 and taxable rEntal income of FRW 5,000,000.

Calculate Bibaho Ltd’s taxable income for the year ended 31st December

2021.

Skills Lab 1

In group discussions, invite students to make research in library or on

internet about the calculation of taxable income for companies and

compute corporate income tax related to the income tax at home / in clubthen present their findings

End of unit assessment 1

1. Shakisha Plc is a small Rwandan company which sells scrap metal.The company prepares its accounts annually to 31st December.

For the year ended 31st December 2022, the company’s net profit in

the profit or loss account was FRW 74,500,000. This was arrived atafter accounting the following items:

a) FRW 6,000,000 incurred on repairs to their warehouse was

charged as an expense. The warehouse was purchased in March

2022 after it had been damaged in a flood and could not have been

used in the state it was in at the time of purchase.

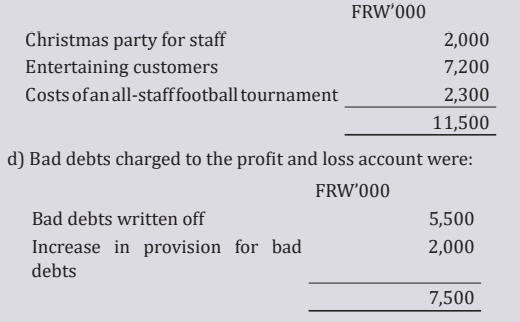

b) Depreciation on fixed assets of FRW 13,000,000.c) Entertainment expenditure charged to the accounts was as follows:

The bad debt relates to a sale which had been taxed in the year

ended 31 December 2021 and was written off during the year. This

was due to the debtor being declared insolvent and Shakisha Plchas taken all reasonable steps to recover the debt.

e) The amount of dividend received from Haza Ltd, a fellow Rwandan

company, recorded in the profit and loss account was FRW

5,200,000. Shakisha Plc paid dividends of FRW 2,000,000 whichhad been deducted in arriving at the net profit of FRW 74,500,000.

f) Shakisha Plc received royalty income of FW 4,250,000 during the

year. This was the amount received during the year. It also received

FRW 1,200,000 during the year from renting out spare warehousespace.

Tax depreciation for the year end has been correctly calculated atFRW 7,000,000.

Required: Calculate Shakisha Plc’s taxable income for the yearended 31st December 2022.

2. UB Ltd had initially agreed a contract for FRW 20,000,000 and had

estimated the costs to fulfill the contract at FRW 15,000,000. At the

end of Year 1, the contract was still in progress and costs incurred to

date were FRW 10,500,000. Accordingly, the contract was deemed

70% complete and FRW 3,500,000 of profit was recognized and

taxed during that year. The company generated FRW 3,000,000 oftaxable profit on its other business activities in Year 1.

In Year 2 the contract was completed, and UB Ltd incurred some

unexpected costs it had not initially anticipated. The total costs

actually incurred were FRW 22,000,000. This gave an overall lossof FRW 2,000,000.

The project was accounted for correctly, and a loss of FRW 5,500,000on this contract was recognized in Year 2.

UB Ltd has other business profits for Year 2 of FRW 2,750,000 plusinvestment income of FRW 250,000.

Assuming that UB Ltd wants to claim relief for the contract loss asearly as possible, how will the loss of FRW 5,500,000 be used?

A. It will be offset in full against total business profits of FRW

6,500,000 in Year 1.

B. It will be offset against total income in Year 2 of FRW 3,000,000,

and then the remaining FRW 2,500,000 will be offset against the

contract profit in Year 1.

C. It will be carried forward and used against future business profits

D. It will be offset against business profit in Year 2 of FRW 2,750,000,

and then the remaining FRW 2,750,000 will be offset against thecontract profit in Year 1.

3. Nakoze Ltd has incurred the following business profits and losses

over the last four tax periods:

Year ended 31st December 2016; Loss FRW (500,000,000)

Year ended 31st December 2017; Loss FRW (200,000,000)

Year ended 31st December 2018; Profit FRW 150,000,000

Year ended 31st December 2019; Profit FRW 400,000,000

No shares in Nakoze Ltd have been bought or sold over this period.

Show how the losses are used against profits, compute the

remaining losses to carry forward at 1st January 2020, and state towhich year they may be carried forward.