UNIT6:UNDERSTANDING LOAN / CREDIT POLICY

Key unit competence: To be able to explain the loan/credit procedures

Introductory activity:

Mr. Nkundurwanda is a business man operating his business in Rwanda in

small scale business. Apart of his main activity Mr. Nkundurwanda has family

responsibilities which require him more finances. The capital amount of his

business amounted to Frw 10,000,000, Due to the progress of his business

he is in need of Frw 10,000,000 more which will help his business to grow

and continue to expand and operate in different countries. In this process

there are many alternatives to deal with this issue and Mr. Nkundurwandaneeds to find the best one which will meet his needs.

Questions;

What is the activity of Mr. Nkundurwanda?

What are the challenges do you think that Mr. Nkundurwanda is facing?

What are the potential alternatives Mr. Nkundurwanda needs to think about

to overcome those challenges?

Among alternatives which one you can you advise Mr. Nkundurwanda to

take?What will be the importance of alternative chosen by Mr. Nkundurwanda?

Accounting Management | Student Book | Senior Six

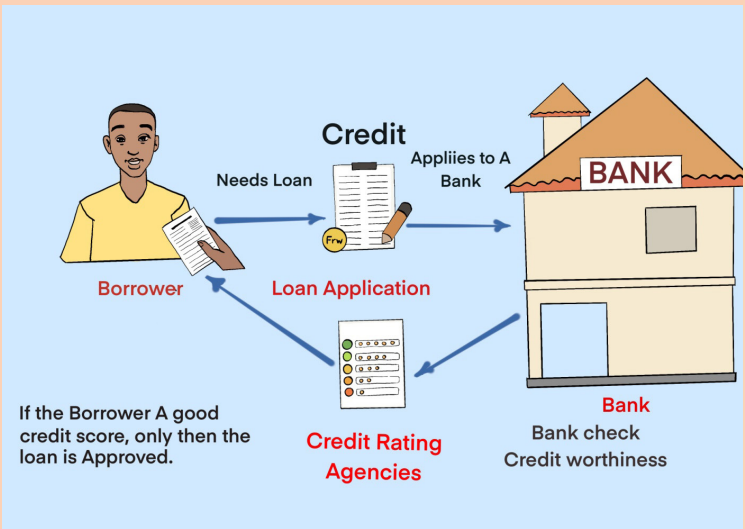

Learning Activity 6.1

Answer the following questions

1) What do you understand about this picture?

2) What is the role of the bank in this picture?3) What is the relationship between bank and borrower

6.1.1. Definition of concepts related to the credit

a. Credit

“By credit, we mean the power which one person has to induce another to put

economic goods at his deposal for a time on promise or future payment. Credit

is thus an attribute of power of the borrower.” Prof. Kinley.

“Credit is purchasing power not derived from income but created by financial

institutions either as on offset to idle income held by depositors in the bank oras an addition to the total amount or purchasing power.” Prof. Cole.

Management Accounting | Experimental Version | Student Book | Senior Six

“The term credit is now applied to that belief in a man’s probability and solvency

which will permit of his being entrusted with something of value belonging to

another whether that something consists, of money, goods, services or even

credit itself as and when one may entrust the use of his good name and

reputation.” Prof. Thomas.

On the basis of those definitions it can be said that credit is the exchange

function in which, creditor gives some goods or money to the debtor with a

belief that after sometime he will return it. In other words Trust ‟is the Credit‟.

b. Credit policy

A credit policy includes detailed guidelines for the size of the loan portfolio,

the maturity period of the loan, security against loan, the credit worthiness of

the borrower, the liquidation of loans, the limits of lending authority, the loan

territory, etc.

Credit policy provides some directions for the use of funds, to control the size

of loans and influences the credit decision of the bank. So, the loan policy is a

necessity for a bank.

In formulating the loan policies, the policy formulators must be very cautious

because the lending activity of the bank affects both the bank and the public

at large. All the influencing factors should be considered such as Size of loan

account; Credit for infrastructure; Types of loan portfolio; Acceptable security;

Maturity of the loan; Compensating balance; Lending criteria; Loan territory;

Limitations of lending authority.

c. Credit monitoring

A good lending is that the amount lent, should be repaid along with interest

within the stipulated time. To ensure that safety and repayment of the funds,

banker is necessary to follow-up the credit, supervise and monitor it. Credit

monitoring is an important integral part of a sound credit management. The

bank should always be careful for that fund properly utilized for what it has

been granted. Banker keeps in touch with the borrower during the life of the

loan. There are some steps from the banker’s point of view, to ensure the safety

of advance which are documentation, disbursement of advance, inspection,

submission of various statements, annual review and market information.

d. Credit services

It is the business of providing loans, other forms of credits and information aboutcredits to people and companies.

Management Accounting | Experimental Version | Student Book | Senior Six

e. Credit delivery

In credit delivery, the borrowers are allowed to draw funds from the account

to the extent of the value of inventories and receivables less stipulated margin

within the maximum permissible credit limit granted by the bank.

6.1.2 Types of credit

The credit assistance provided by a banker is mainly of two types, one is fund

based credit support and the other is non-fund based. The difference between

fund based and non-fund based credit assistance provided by a banker lies

mainly in the cash out flow. Banks generally allow fund based facilities to

customers in any of the following manners.

TRADITIONAL CREDIT PRODUCTS

• Cash credit

Cash credit is a credit that given in cash to business firms. It is an arrangement by

which, a bank allows its customers to borrow money up to a certain limit against

tangible securities or share of approved concern. Cash credits are generally

allowed against the hypothecation of goods/ book debts or personal security.

Depending upon the nature of requirements of a borrower, bank specifies a

limit for the customer, up to which the customer is permitted to borrow against

the security of assets after submission of prescribed terms and conditions and

keeping prescribed margin against the security.

• Overdraft:

A customer having current account, is allowed by the banks to draw more

than his deposits in the account is called an overdraft facility. In this system,

customers are permitted to withdraw the amount over and above their balances

up to extent of the limit stipulated when the customer needs it and to repay it

by the means of deposits in account as and when it is convenient. Customer

of good standing is allowed this facility but customer has to pay interest on the

extra withdrawal amount.

• Demand loans

A demand loan has no stated maturity period and may be asked to be paid on

demand. Its silent feature is, the entire amount of the sanctioned loan is paid to

the debtor at one time. Interest is charged on the debit balance.

• Term loans

Term loan is an advance for a fixed period to a person engaged in industry,

business or trade for meeting his requirements like acquisition of fixed assetsetc. The maturity period depends upon the borrower’s future earnings. Next to

Management Accounting | Experimental Version | Student Book | Senior Six

cash credit, term loans are assumed of great importance in an advance portfolio

of the banking system of country.

• Bill purchased

Bankers may sometimes purchase bills instead of discounting them. But this

is generally done in the case of documentary bills and that from approved

customers only. Documentary bills are accompanied by documents of title to

goods such as bills of lading or lorry and railway receipts. In some cases, banker

advances money in the form of overdraft or cash credit against the security of

such bills.

• Bill discounted

Banker lends the funds by receiving a promissory note or bill payable at a future

date and deducting that from the interest on the amount of the instrument. The

main feature of this lending is that the interest is received by the banker in

advance. This form of lending is more or less a clean advance and banks rely

mainly on the creditworthiness of the parties.

INNOVATIVE CREDIT PRODUCTS

Since the liberalization period there have been drastic changes in the way loans

have been granted to individual customers and businessmen. The changing

pattern of banks from universal to branch banking after the liberalization period

also forced banks to adopt easy lending. Technology has supported the

development of financial service industry and reduced the cycle of money to the

shortest possible duration.

• Credit cards

Credit cards are alternative to cash. Banks allow the customers to buy goods

and services on credit. The card comprises different facilities and features

depending on the annual income of the card holder. Plastic money has played

an important role in promoting retail banking.

• Debit cards

Debit card can be used as the credit card for purchasing products and also for

drawing money from the ATMs. As soon as the debit card is swiped, money is

debited from the individual’s account.

• Housing loans

Various types of home loans are offered by the banks these days for purchasing

or renovating house. The amount of loan given to the customer depends on

the lending policies and repayment capacity of the customer. These loans areusually granted for a long period.

Management Accounting | Experimental Version | Student Book | Senior Six

• Auto loans

Auto loans are granted for the purchase of car, scooter and others. It may be

granted for purchasing vehicle.

• Personal loans

This is an excellent service provided by the banks. This loan is granted to the

individuals to satisfy their personal requirements without any substantial security.

Many banks follow simple procedure and grant the loan in a very short period

with minimum documents.

• Educational loans

This loan is granted to the student to pursue higher education. It is available for

the education within the country or outside the country.

• Loans against securities

These loans are provided against fixed deposits, shares in the market, bonds,

mutual funds and life insurance policy.

• Consumption loans for purchase of durables

Banks fulfill the dreams and aspirations by providing consumer durable loans.

These loans can be borrowed for purchasing television, refrigerator, laptop,mobile, etc.

6.1.3. Importance of loan

Credit plays an important role in the gross earnings and net profit of commercial

banks and promotes the economic development of the country. The basic

function of credit provided by banks is to enable an individual and business

enterprise to purchase goods or services ahead of their ability. Today, people

use a bank loan for personal reasons of every kind and business venture too.

The following are other importance of loan;

• Exchange of ownership

Credit system enables a debtor to use something which does not own completely.

• Employment encouragement

With the help of bank credit, people can be encouraged to do some creative

business work which helps increasing the volume of employment.

• Increase consumption

Credit increases the consumption of all types of goods. By that, large scaleproduction may be stimulated which leads to decrease cost of production. In

Management Accounting | Experimental Version | Student Book | Senior Six

turn also it lowers the price of product which in result rising standard of living.

• Saving encouragement

Credit gives encouragement to the saving habit of the people because of the

attraction of interest and dividend.

• Capital formation

Credit helps in capital formation by the way that it makes available huge

funds to unable people to do something. Credit makes possible the balanced

development of different regions.

• Development of entrepreneurs

Credit helps in developing large scale enterprises and corporate business. It

has also helped the different entrepreneurs to fight against difficult periods of

financial crisis. Credit also helps the ordinary consumers to meet requirements

even in the inability of payment.

• Priority sector development

Credit helps in developing many priority sectors including agriculture. This

has greatly helped in rising agriculture productivity and income of the farmers.

Banks in developing countries are providing credit for development of SSI inrural areas and other priority sectors too.

6.1.4. Importance of liquidity management

Liquidity refers to the ability of an organization to pay its suppliers on time,

meet its obligation costs, such as wages and salaries and to pay longer-term

outstanding amounts such as loan repayment. Adequate liquidity is often a key

factor in contributing to the success of failure of a business. For example liquid

assets include cash, short term deposits, trade receivables and inventories.

Those are called Working capital of a business.

Cash is the most liquid of assets and it is part of working capital of the business.

However, the time taken to convert trade receivables into cash and the time

taken to pay creditors affect the liquidity position of the business.

Liquid assets are current asset items that will, or could soon, be converted into

cash, and cash itself. Two common definitions of liquid assets are all current

assets or all current assets with the exception of inventories.

The main source of liquid assets for a trading company is Sales. A company can

obtain cash from sources other than sales, such as the issue of shares for cash,a new loan or the sale of non current assets but company cannot rely on these

Management Accounting | Experimental Version | Student Book | Senior Six

and in general, obtaining the liquid funds depends on making sales and profits.

The management needs to carefully consider the level of investment in working

capital and to consider the impact that this is having on a company’s liquidity

position; an overview of this is given by the cash operating cycle/working capital

cycle.

Cash operating cycle/working capital cycle is the period of time between

the outflow of cash to pay the raw materials and the inflow of cash from

customers. The number of days credit taken by accounts receivable has a direct

effect on the amount of time money is tied up for in working capital. Therefore,

managing the period of credit customers take is vital to the management of the

organization’s liquidity.

6.1.5. Granting loan

Granting credit to customers is essential for many organizations and brings

many benefits to both organizations and the customers. However, the risks

associated with granting credit should be monitored and managed carefully.

a. Applicant profile

To make prudent credit decision, bank essentially should know well the borrower

well. Without these information bank cannot judge the loan application.

Creditworthiness of the applicants is evaluated to ensure that the borrower

conforms to the standards prescribed by the bank. It can be said that a loan

properly made is half-collected. So, a bank should make proper analysis before

making any credit decision. With increasing credit risks, banks have to ensure

that loans are sanctioned to „safe‟ and „profitable‟ projects. For this, they need

to fine tune their appraisal criteria.

b. Application form

It is a document on which the lender bases the decision to lend. A loan

application is neither a pledge by the applicant nor a commitment by the lender.

It contains essential financial and other borrower information. Detailed business

plan, projected income statements showing profit and loss, balance sheet, and

cash flow statement are required for a business loan. Loan amount and purpose,

period and means of repayment, and guaranties and/or collateral offered are

required of a company applying for a loan. Banks generally use standard forms

for the applicant to fill-in. It is also known as credit application.

c. Information required for granting credit

When assessing the credit status of either on established or a new customer

there are a range of sources of information that the credit controller can use.

Management Accounting | Experimental Version | Student Book | Senior Six

Some are external to the business and others are internal to the business.

The credit controller needs to consider the customer’s ability and willingness

to pay within the stated credit terms and also that the customer will remain

solvent. No single source of information can guarantee either of these but there

are varieties of sources which can be pooled for a final decision on credit status

to be made

External sources: Bank Reference, Trade reference, Credit reference agencies,

Office of Register General, Management accounts from the customer, Media

publication, Internet searches.

Internal sources: Staff knowledge communicated by conversations, emails,

meetings, customer visit, financial analysis of either external published financial

statements or internal management and previous trading history.

6.1.6. Evaluating credit worthiness

The purpose of analyzing the financial statements for credit control assessment

is to find the indicators of the customer’s performance and position in four main

areas as follow:

Profitability Indicators; Liquidity indicators; Debt indicators; Cash flow indicators

Profitability Ratios

When credit has been granted one major concern will be the profitability of the

customer. If the customer is not profitable in the long term then it will eventually

go out of the business and this may mean a loss, in the form of an irrecoverable

debt, if it has been granted credit.

Gross profit margin: Gross profit/Revenue*100% It shows how profitable the

trading activities of business are.

Net profit margin: PAT/Revenue*100%. It indicates the overall profitability of

the business

Return on capital employed (ROCE): Net profit/Capital employed*100%

Net asset turnover: Capital employed/Revenue. It measures the number of

times that revenue represents capital employed (or net assets).

Liquidity Ratios

The purpose of calculating liquidity ratio is to provide indicators of the shortterm and

medium-term stability and solvency of the business. It is also to assessif the business can pay its debts when they fall due. There are two overall ratios:

Management Accounting | Experimental Version | Student Book | Senior Six

Current ratio: Current assets /Current Liabilities. Ideal ratio is 2:1

Quick ratio or acid ratio: (Current assets-Inventory)/Current liabilities. Ideal ratio

is 1:1

Gearing Ratios

When assessing a customer’s credit status, the credit controller will also be

concerned with the longer-term stability of the business. One area of anxiety

here is the amount of debt in the business ‘ capital structure and its ability to

service this debt by paying periodic interest charges.

Main measures are:

Gearing ratio= Long term debt/ (Long term debt + Equity)*100%. Is a measure

of the proportion of interest-bearing debt to the total capital of the business.

Interest cover = Profit before interest and tax / Interest. It is calculated as the

number of times that the interest could have been paid, it represents the margin

of safety between the profits earned and the interest that must be paid to service

the debt capital.

Credit scoring

Credit scoring is a method of assessing the credit worthiness of an individual

or organization using statistical analysis and is used by the organizations such

as banks, utility companies, insurance companies and landlords to assess the

ability of an individual or organization to repay any loans or pay for services or

goods.

A credit score is a number ranging from 300-850 that depicts a consumer’s

creditworthiness. The higher the credit score, the more attractive is the borrower.

A credit score is based on credit history such as number of open accounts, total

levels of debt, and repayment history.

Lenders use credit scores to evaluate the probability that an individual will repay

loans in a timely manner.

Your credit score, a statistical analysis of your creditworthiness, directly affects

how much or how little you might pay for any lines of credit you take out.

Illustration

A company has share capital of Frw 200million, resources totaling Frw 188million

and a loan of Frw 100 million . The net profit for the year is Frw 45million, afterdeducting depreciation of Frw 12 million and interest of Frw 6million.

Management Accounting | Experimental Version | Student Book | Senior Six

Solution:

Opening a new customer account

Once a decision has been made to grant credit to a customer then a file and

account in the trade receivable ledger must be set up.

The following information will be required: Business name of the customer; the

contract name and title within the customer’s business; business address and

telephone number; the credit limit agreed upon; the payment terms agreed.

Refusal of credit

The credit controller may decide that it is not possible to trade with a new

potential customer on credit terms.

It is a big decision for the credit controller as the business will not wish to lose

this potential customer’s business but the credit controller will have taken a

view that the risk of non- payment is too high for credit terms to be granted.

It simply means that on the evidence available to the credit controller, the chance

of non-payment is too high for the company to take the risk.

The reasons are the following:

A non-committal or poor bank reference

Poor trade references

Concerns about the validity of any trade references submitted

Adverse press comment about the potential customer

Poor credit agency report

Indications of business weakness from analysis of financial statements

Lack of historical financial statements available

Information from a member of the business’s credit circle

The credit controller will consider all the evidence available about a potential

customer and the reason for the refusal of credit may be due to a single factor

noted above or a combination of factors.

Communication of changes or refusal

If a credit facility is to be changed or not granted to a potential customer thenthis must be communicated in a tactful and diplomatic manner. The reason for

Management Accounting | Experimental Version | Student Book | Senior Six

the change or refusal of credit must be politely explained and any future actions

required from potential customer should also be made quite clear.

Communication method

It is common to communicate the reasons for the refusal of credit in a letter

initially. In the letter the credit controller may suggest that a telephone call may

be appropriate in order to discuss the matter and any future actions.

6.1.7. Terms and conditions associated with Overdraft and

loan

Most of us are familiar with the concept of an overdraft, which is a form of

short-term borrowing from the bank, available to both business and personal

customers. The overdraft allows the account holder to continue withdrawing

money even when the account has no funds in it or has insufficient funds to cover

the amount of withdrawal. If a bank is approached for an overdraft, then it will

normally agree an overdraft facility. This is the amount by which the business’s

account is allowed to be overdrawn. It is then up to the customer to determine

how much of this overdraft facility is to be used by having an actual overdraft.

And loan is credit facility under which a bank allows funds withdrawn to exceed

fund deposited in accordance with specified terms and conditions

Among the terms and conditions associated with overdraft and loan application,

it should be disposed within a reasonable period of time and state specific time

period from the date of acknowledgement, within which the decision on loan

request will be conveyed to the borrower.

In case of rejection, specific reasons should be conveyed in writing. Credit limits

which may be sanctioned may be mutually settled.

Terms and conditions governing credit facilities such as margin security should

be based on due diligence and creditworthiness of borrower.

Lender should ensure timely disbursement of loans sanctioned.

Lender should give notice of any change in the terms and conditions including

interest rates and service charges.

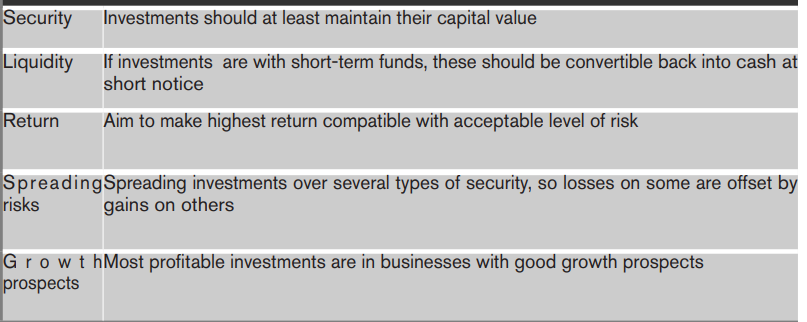

6.1.8. Types of investments, risks and their terms and conditions

There are five major factors to be considered when any investor choosesinvestments

Management Accounting | Experimental Version | Student Book | Senior Six

a. certificate of deposit (CD)

A certificate of deposit is a document issued by a bank or building society

which certifies that a certain sum, has been deposited with it, to be repaid on a

specific date. The term can range from seven days to five years but is usually for

six months. CDs are negotiable instruments which means, they can be bought

and sold. Therefore, if the holder does not want to wait until the maturity date,

the CD can be sold in the money market. CDs offer a good rate of interest, are

highly marketable and can be liquidated at any time at the current market rate.

The market in CDs is large and active; therefore they are an ideal method for

investing large cash surpluses.

b. Government securities

• Bills of exchange

A bill of exchange can be defined as an unconditional order in writing from

one person to another, requiring the person to whom it is addressed to pay a

specified sum of money, either on demand (a sight bill) or at some future date (a

term bill). A cheque is a special example of a type of bill of exchange.

• Trading in bills of exchange

Most bills of exchange are term bills with a duration or maturity of between two

weeks and six months and can be in any currency. If one company draws a bill

on another company, this is known as a trade bill. However, the market in these

is small. Most bills are bank bills, which are bills of exchange drawn and payable

by a bank, the most common of these is known as a banker’s acceptance. There

is an active market in such bills and a company with surplus cash could buy a

bill of exchange at a discount and either hold it to maturity or sell it in the market

before maturity again at a discount. The difference between the price at which

the bill is purchased and the price at which it is sold or it matures is the returnto the investor. Commodities (Gold) are physical products such as gold. They

arQuestions:

What do you observe on the above picture?

Explain the function of each image found in this picture

After watching careful this picture is there any relationship between the

images in the picture?e traded on commodity exchanges where standard contracts are bought and

sold.

c. Shares Equity

An Equity investment is generally the purchase of shares in another company.

Often this takes place through a stock market. Income is from dividend payments

and capital gains on the increase in the share value.

Investments in companies that are traded on a stock exchange are very easily

sold, so these are a relatively liquid form of investment. However, unless

the investment is a speculative one, in anticipation of a rapid increase in the

company’svalue, investments in equity are normally held for longer periods.

Property and land

Investing in property and land is generally a very safe investment. However,

the costs of maintaining and generating an income from property and land are

higher than for other forms of investment.

These are generally long-term investments due to the costs and time associated

with purchasing and selling land and property.

Diversification and types of investment

A business should aim to create a diversified portfolio of investments, with

a spread of risk and return. Marketable securities can be ranked in order of

increasing risk and increasing expected return.

Government securities Low risk

Other ‘public’ corporation stocks

Company loan stocks

Other secured loans

Unsecured loans

Convertible loan stocksPreference shares

Equities High risk

Management Accounting | Experimental Version | Student Book | Senior Six

Government stock

The risk of default is negligible and hence, this tends to form the base level for

returns in the market. The only uncertainty concerns the movement of interest

rates overtime, and hence, longer dated stocks will tend to carry a higher rate

of interest.

Company loan stock

Although there is some risk of default on company loan stock (also called

corporate bonds), the stock is usually secured against corporate assets.

CDs and Bills of Exchange

The riskiness of CDs and bills of exchange varies with the creditworthiness

of the issuers. They are riskier than government securities, but less risky thanshares.

Application activity 6.1.

Questions

8. Give and explain the types of loans

9. What is the purpose of analyzing financial statements in evaluating

the credit worthiness?

10. Discuss the importance of liquidity management

11. List external sources of available external information which help to

understand creditworthiness?12. What do you understand by A certificate of deposit (CD)?

Management Accounting | Experimental Version | Student Book | Senior Six

6.2. Effect of legislation to credit control

Learning Activity 6.2

Questions:

What do you observe on the above picture?

Explain the function of each image found in this picture

After watching careful this picture is there any relationship between theimages in the picture?

6.2.1. Law legislating the credit and remedies for breaches

a. Relevant contract law and remedies for breaches

• What is a contract?

A contract is a legally enforceable agreement between two or more parties.

Main elements of contract: Agreement; Consideration and Intention to create

legal relations• The importance of contract

Management Accounting | Experimental Version | Student Book | Senior Six

The importance of contract law is that if a contract is made between two parties

and if one party does not satisfactory carry out its side of the agreement, the

other party can take the defaulting party to court for breach of contract.

The following are the main legal contract elements

a) Offer: An offer is the beginning of a contract.

b) Acceptance. An offer can be accepted in writing, in person or over

the phone. Volunteer of each group to operate or Free Consent of each

group.

c) Consideration. Consideration is something of value that the parties are

contracting to exchange.

d) Mutuality of obligation; each contracted party has reciprocal duties

and responsibilities, one to another.

e) Competence/Capacity: Competent parties who have the legal capacity

to contract. By this each party legally assign what is able to do to another

and to the business concerned.f) Legality: all job contracts must be legal tender.

An invitation to treat

Care must be taken to distinguish between an offer and the invitation to treat.

An invitation to treat is an invitation by the seller of goods for the buyer to make

an offer to buy them at that price. Examples are advertisements, catalogues, and

the price tickets displayed on goods.

Duration of an offer

If an offer is made then it does not have to remain in place indefinitely. There are

a number of ways in which an offer can be brought to an end:

If there is a set time period for an offer, then the offer will lapse at the of time

period. If there is no express time period set then the offer will lapse after a

reasonable period of time.

An offer can be revoked by the offeror at any point in time before it has been

accepted. Revocation of an offer means that the offer is at cancelled.

An offer comes to an end if it is rejected. An offer can be rejected by a counter

offer. Eg. If an offer is made to sell an item for Frw 1M and the offeree replies

to say that he will buy at Frw 0.9M this is a rejection of the original offer to seller.

The offer comes to an end when a valid acceptance is made.Acceptance of an offer

Management Accounting | Experimental Version | Student Book | Senior Six

The acceptance of an offer must be absolute and unqualified

Acceptance can be made verbally or in writing

If an offer requires a particular form of acceptance (such as verbal, in writing or

by fax) then this is the form in which the acceptance must be made.

It must be unqualified- if any additional conditions or terms are included in an

acceptance then takes the form of counter-offer, which rejects the original offer.

Value

The second required element of a contract is that of there being some value.

The basis of contract law is that we are dealing with a basis of contract law is

that we are dealing with a bargain of some sort, not just a promise by one of the

parties to a contract to do something.

What is required for there to be a valid contract is known in legal terms as

consideration. Consideration can be thought of as something given, promised

or done in exchange for the action of the other party.

In terms of business transactions, the consideration given for a sale of goods is

either the money paid now or the promise by a receivable to pay at a later date.

Both parties must bring something of value to the contract for it to be legally

binding i.e. valid. It can be item or service.

Unilateral Contracts

Most contracts are known bilateral Contracts meaning that two persons or

parties have taken action to form a contract. Unilateral Contracts involve an

action undertaken by one person or a group alone. In contract law, Unilateral

Contracts allow one person to make a promise, so only they are under an

enforcement obligation

A common example is with the insurance contracts, the insurance company

promises it will pay the insured person a specific amount of money if certain

event happens. If the event doesn’t happen, the company won’t have to pay. The

insured party doesn’t make any promise and to his part of the deal, only needs

to pay the insurance premium.

Defective contracts

There are situation in which an apparent contract will only have limited legal

effect or even no legal effect at all.

A void contract is not a contract at all. The parties are not bound by it and if they

transfer property under it, they can sometimes recover their goods even from a

Management Accounting | Experimental Version | Student Book | Senior Sixthird party. This normally comes about due to some form of common mistakes

on a fundamental issue of the contract.

A voidable contract is contract which one party may set aside. Property

transferred before avoidance is usually irrecoverable from a third party. Such

contracts may be with minors, or contracts induced by misrepresentation, duress

or undue influence. In these cases, it can be deemed that a party did not have

legal capacity to consent to a contract. For instance here can be intoxication,

mental health impairment or being too young to enter into contract. A contract

may be voidable due to coercion; this is where one party to the contract may be

using behaviors towards the other party.

An unenforceable contract is a valid contract, property transferred under it cannot

be recovered, even from the other party to the contract. However, it either party

refuses to perform or to complete their part of the performance of the contract,

the party cannot compel them to do so. A contract is usually enforceable when

the required evidence of its terms, for example written evidence of a contract

relating to land, is not available.

Terms in a contract

Legally, different terms of a contract have different effects.

Express terms are terms that are specifically stated in the contract and are

binding on both parties.

Conditions are terms that are fundamental to the contract and if they are broken

then the party breaking them will be in breach of contract and can be sued for

damages. The injured party can regard the contract as is ended.

Warranties are less important terms in a contract. If any of these are not fulfilled

then there is a breach of contract but the contract remains in force. The injured

party can still claim damages from the court for any loss suffered but he cannot

treat the contract as is terminated.

Implied terms are terms of a contract which are not specifically stated but are

implied in such a contract, either by trade custom or by law.

Remedies for breach of contract

A breach of contract arises where one party to the contract out of its side of the

bargain, such as a credit customer who does not pay. The following are some

of the remedies:

Action for the price- a court action to recover the agreed price of the goods/services

Management Accounting | Experimental Version | Student Book | Senior Six

Monetary damages- compensation for loss

Termination-one party refusing to carry on with the contract

Specific performance-a court order that one of the parties must fulfill its

obligations

Quantum merit -payment ordered for the part of the contract performed

Injunction- one party to the contract being ordered by the court not to do

something

In terms of credit customer not having paid for goods or services provided, the

most appropriate remedy would normally be an action for the price.

6.2.2. Terms and conditions associated with granting credit

The credit terms offered to a customer are part of the agreement between the

business and the customer and as such should normally be in writing. The terms

of credit are the precise agreements with the customer as to how and when

payment for the goods should be made. The most basic element of the terms

of credit is the time period in which the customer should pay the invoice for the

goods. There are a variety of ways of expressing these terms as follow:

Net 10/14/30 days- Payment is due 10 or 14 or 30 days after delivery of the

goods.

Weekly credit-all goods must be paid for by a specific date in the following

week.

Half-monthly credit-all the goods delivered in one-half of the month must be

paid for by a specified date in the following half-month.

Monthly credit-all goods delivered in one month must be paid for by a specified

date in the following month.

Settlement and cash discounts

In some cases customers may be offered a settlement discount or cash discount

for payment within a certain period which is shorter than the stated credit period.

The terms of such a settlement discount may be expressed as:

Net 30 days, 2% discount for payment within 14 days. This means that the

basic payment terms are that the invoice should be paid within 30 days of its

date but that if the payment is made within 14 days of the invoice date a 2%

discount can be deducted. It is up to the customer to decide whether or not totake advantage of the settlement discount offered.

Management Accounting | Experimental Version | Student Book | Senior Six

6.2.3. Data Protection law

Data Protection law is becoming increasingly onerous in the modern, digital

world. For instance, in Europe, the new General Data Protection Regulation

legislation(GDPR) places significant responsibilities on companies to safeguard

the data they use, and only to keep personal data that is authorized to be kept

,and is current, complete and accurate.

Due to mounting international regulation, pressure is being exerted on Rwandan

economy to improve regulations, to in turn protect its key export markets.

Recently adopted legal frameworks in Rwanda exclusively focus on security

and confidentiality of electronic communication data, leaving aside all other

categories of personal data. In Rwanda, there is information and communication

Technology law that provides that ‘Every subscriber or user’s voice or data

communications carried by means of an electronic communication network or

service must remain confidential to the subscriber and or user for whom the

voice or data is intended (ICT, 2016:art 124), but development of the law and

regulation is ongoing.

General Data Protection Regulation (GDPR) is the latest European regulation

relating to data protection, which more strictly enforces data subject rights and

significantly increases the potential fines for breaches.

What follows may be considered best practice based on the General Data

Protection Regulation requirements:

What is personal data?

The GDPR applies to the processing data that is:

Wholly or partly by automated means or

The processing other than by the automated means of personal data which

forms part of, or is intended to form part of, a filing system.

What are identifiers and related factors??

An individual is ‘identifiable’ if you can distinguish him from other individuals.

A name is the most common means of identifying someone. However, whether

any potential identifier actually identifies an individual depends on the context.

GDPR provides non-exhaustive list of identifiers, including:

NameIdentification number, location, data and

Management Accounting | Experimental Version | Student Book | Senior Six

An online identifier

An online identifier includes IP address and cookie identifiers which may be

personal data. Other factors can identify an individual.

There will be circumstances where it may be difficult to determine whether data

is personal data. If this is the case as a matter of good practice, you should treat

the information with care, ensure that you have a clear reason for processing the

data and, in particular, ensure you hold and dispose of it securely.

Inaccurate information may still be personal data if it relates to an identifiable

individual

Eight principles of good practice

Information should be:

Fair and lawfully processed

Processed for limited purposes

Adequate, relevant and not excessive

Accurate and up to date

Not kept for longer than necessary

Processed in line with the data subject’s rights

No transferred to countries elsewhere unless such data is adequately protected

in those countries

6.2.4. Legal and administrative procedures for debt collection

Restitutionary and compensatory damages

Restitutionary damages aim to strip from a wrongdoer, any gains made by

committing a wrong or breaching a contract. They are concerned with the

reversal of benefits that we have been earned unjustly by the defendant at the

expense of the claimant.

If the monetary remedy or damages is to be the loss made by the claimant, these

are known compensatory damages and are intended to provide the claimant

with the monetary amount necessary to replace what was lost and nothingmore. Common examples are loss of wages or income.

Management Accounting | Experimental Version | Student Book | Senior Six

Bringing a dispute to court

If it is decided that the only course of action to recover money owed by a credit

customer is that of legal action, then the first step is to instruct a solicitor. The

solicitor will require details of the goods or services provided, the date the liability

arose, the exact name and trading status of the customer, any background

information( Such as disputes in the past) and a copy of any invoices that are

unpaid.

Which court?

Outstanding amounts owed to an entity are civil claims. Uncomplicated claims

with a similar value will be dealt with in the local district court. Larger and more

complex claims will be heard provincial courts.

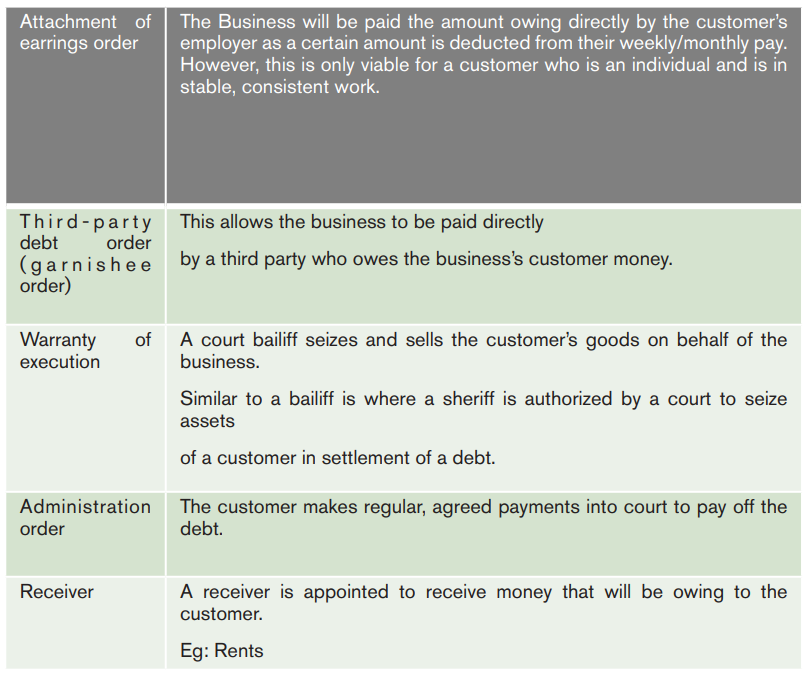

Methods of receiving payment under a court order

Once there has been a court order that the money due must be paid, there area number of methods of achieving this.

Management Accounting | Experimental Version | Student Book | Senior Six

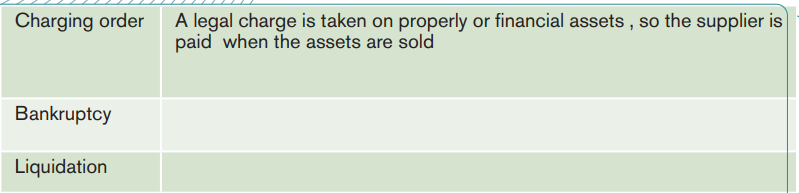

6.2.5. Bankruptcy and insolvency

Bankruptcy arises when an individual cannot pay his or her debts and is declared

bankrupt. Insolvency is where a company cannot pay its debts as they fall due.

Petition for bankruptcy

A statutory demand can be issued for a payment of the amount due within a

certain period of time. This may result in the customer offering a settlement.

If, however, there is no settlement offer from the customer a petition for a

bankruptcy will be received from the court.

Once the individual has received the statutory demand they have 21 days, either

to pay the debt or reach an agreement to settle the outstanding amount.

There are time limits in making a statutory demand and these are:

The demand should be made within four months of the debts. If the debt is older

than four months a court has to be contracted to explain the reasons behind

the delay.

Normally a statutory demand cannot be made after six years have elapsed.

Consequences of a petition for Bankruptcy

The consequences of a petition for bankruptcy against receivables

If the customer pays money to any other suppliers or disposes of any property

then these transactions are void.

Any other legal proceedings relating to the customer’s property or debts are

suspended.

An interim receiver is appointed to protect the estate.

Consequences of a bankruptcy order

The following are among others:The official receiver takes control of assets

Accounting Management | Student Book | Senior Six

A statement of the assets and liabilities is drawn up-this is known as statement

of affairs.

The receiver summons a meeting of creditors of the individual within 12 weeks

of the bankruptcy order.

The creditors of the individual appoint a trustee in bankruptcy.

The assets are realized and a distribution is made to the various creditors.

The creditor who presented the petition does not gain any priority for paymentover other creditors.

Order of distribution of assets

The assets of the bankrupt will be distributed in the following order:

Secured creditors

Bankruptcy costs

Preferential creditors such as employees, pension schemes, government taxes

payable

Unsecured creditors, such as trade payables

The bankrupt’s spouse

The bankrupt

Insolvency

The process of insolvency for a company that cannot pay its debts as they

fall due is similar to that of a bankrupt individual; there are 2 main options for

companies

Liquidation

Administration

Liquidation

In liquidation the company is dissolved and the assets are realized, within

debts being paid from the proceeds and any excess being returned to their

shareholders. This process is carried out by a liquidator on behalf of shareholders

and/or creditors. The liquidator’s job is simply to ensure that the creditors are

paid and once this is done the company can be wound up. Again, unsecured

creditors are a long way down the list of who is paid first, therefore there maybe little left in the pot.

Management Accounting | Experimental Version | Student Book | Senior Six

Administrative receivership

An alternative to liquidation is that the shareholders, directors or creditors can

present a petition to the court for an administration order. The effect of this is that

the company continues to operate but an insolvency practitioner (administrator)

is put in control of it, with the purpose of trying to save the company from

insolvency, as going concern - or at least achieve a better result than liquidation.

Administrative receivership is a process whereby a creditor can enforce security

against a company’s assets in an effort to obtain repayment of the secured

debt. It used to be the most popular method of obtaining payment by secured

creditors, but legislative reforms have reduced its significance.

Administrative receivership differs from liquidation in that an administrative

receiver is appointed over all of the assets and undertakings of the company.

This means that an administrative receiver can normally only be appointed by

the holder of a floating charge. Usually an administrative receiver will be an

accountant with considerable experience of insolvency matters.

Retention of title clause

A ‘retention of title’ clause can be written into agreements with customers.

Such a clause expressly states that the buyer doesn’t obtain ownership of the

goods unless and until payment is made. Accordingly, if the buyer goes out of

business before paying for the goods, the supplier can retrieve them. If payment

is not made goods can be stopped in transit and a lien secured on the goods

by the seller.

Official receivers do not need the authority of an insolvency practitioner to

determine if a claim is valid. If an official receiver sells goods that are subject to

a valid retention of title claim then the supplier can sue the official receiver fordamages as ownership of the goods still belong to the supplier

Application activity 6.2

1. Describe the role of a contract in law legislating the credit

2. Discuss on Terms and conditions associated with granting credit3. Enumerate Legal and administrative procedures for debt collection

Skills Lab 6

Student will visit a bank operating nearest the school especially in the

credit department and ask questions related to the credit with the aim of

knowing the procedure or the process of offering the credit and the lowlegislating the credit.

End of unit assessment 6

Question :

Discuss on Importance of liquidity management

What is the purpose of analyzing the financial statements evaluating credit

worthiness?

It is known that the relationship between a seller of goods and a buyer of

goods is a contract what is a contract and what is its importance in Law

legislating the credit and remedies for breaches?Discuss on Bankruptcy and insolvency in