UNIT3:ANALYSIS OF TYPES OF BUDGET ACCORDING TO FUNCTION

Key unit competence: To be able to analyze the rationale behinddifferent types of budget

Introductory activity:

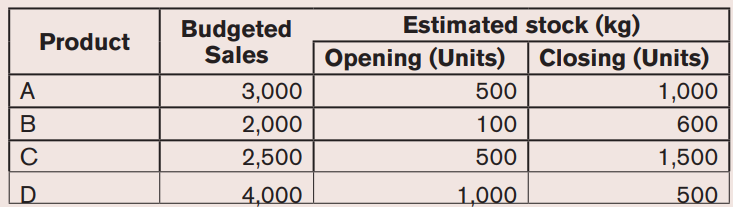

From the following’ information you are required to prepare a sales budgetfor the half year ending 30th April 2019

Questions:

Required: Prepare the following functional budgetsi) Sales budget

3.1. Sales budget analysis

Learning Activity 3.1

The Morning Businesses PLC develops and manufactures two agri-products

(A and B). To achieve the high performance and satisfying the customers’

needs and wants; the Morning Businesses prepares the budgets to

identify, plan, track and allocate personnel and financial resources across

their operations. Company prepares a sales budget to determine how much

revenue expected to generate from their products and services and howmuch to spend for specific period of time.

Accounting Management | Student Book | Senior Six

Questions:

1. Explain the two main contents of sales budget2. Enumerate the reasons of cash budget preparation.

3.1.1. Factors of sales budget

The preparation and implementation of sales budget is subject of certain number

of variables that lead to the fluctuations of this budget. Those factors include

production costs, taste and preferences of customers, Expansion or contraction

of the investment, Increase or decrease in stocks and debtors, Rate of inflation

anticipated, Policy decisions like credit control, dividends and taxation.

3.1.2. Calculation/ presentation of sales budget

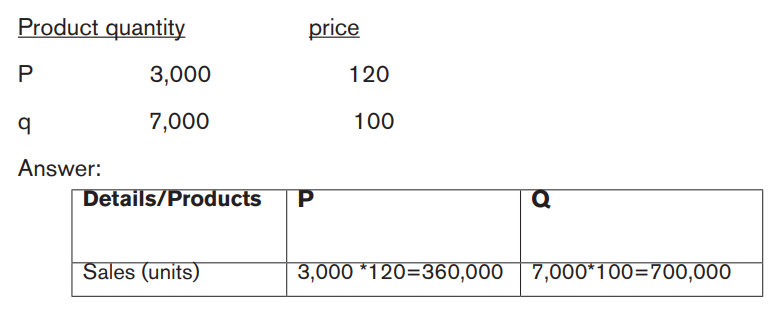

Illustration

ABARCO Plc sales two types of products for the printing industry. For better

of maximizing the profit Budgeted sales of the products, known as P and Q for

2024 are:

Question:Prepare sales budget

3.1.3. Interpreting results and advising the management

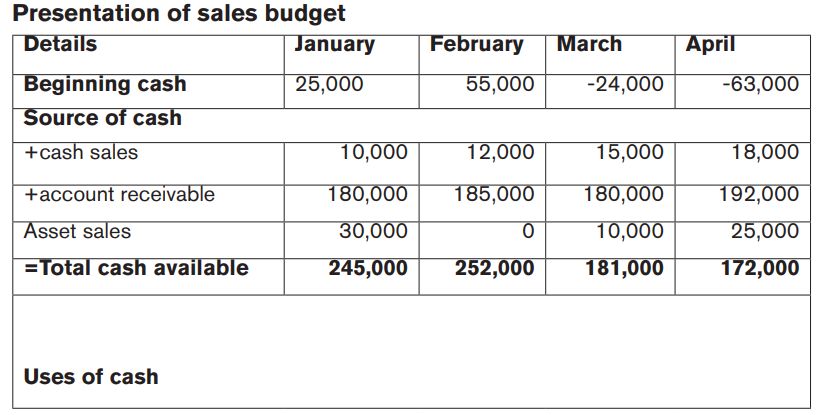

There is no format for a cash budget and no regulations regarding how it

should be set out but whatever the format, cash budget includes necessary thesources of cash receipts and the total cash receipts for the period, source of

Management Accounting | Experimental Version | Student Book | Senior Six

cash payments and the total cash payments for the period, net cash flow for the

period, bank balance brought forward and bank balance carried forward.

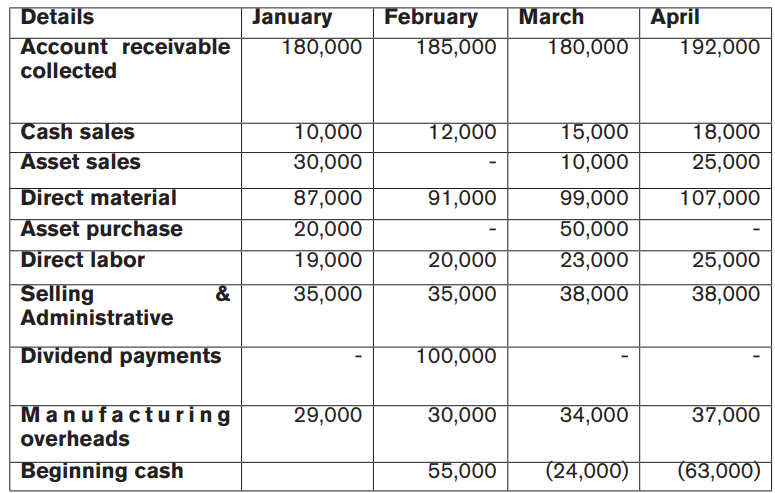

Illustration:

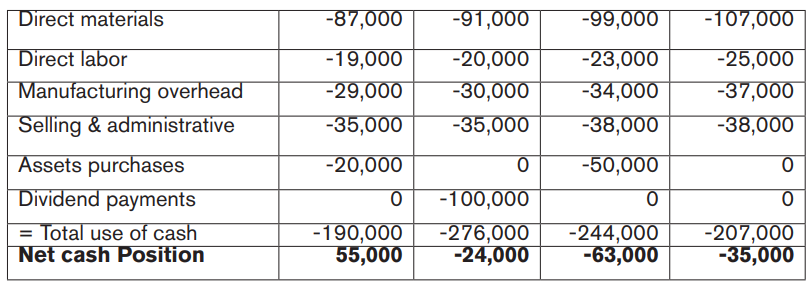

RWANDEKO PLC is a business located in Muhanga District and producing

different goods. The business plan for first four months 2023 is presented in thefollowing table and opening balance for the specified period is Frw 25,000 .

With the above data, the sales Manager of RWANDEKO PLC is in responsible

to prepare sales budget for not only meeting the business objective but alsosatisfying the consumers and maximizing the profit.

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

Application activity 3.1

3. Umulisa plc has started a business 10 years ago investing Frw

15,000,000 allocated in building society. She maintains a bank

account showing a small credit balance and she plans to approach

her bank for the necessary additional finance. She asks the planning

officer for advice and provides the following additional information.

• Arrangements have been made to purchase non-current

assets costing Frw 8million These will be paid for at the end

of September and are expected to have a five-year life, at the

end of which they will possess a nil residual value.

• Inventories costing Frw 5 million will be acquired on 28

September and subsequent monthly purchases will be at a

level sufficient to replace forecast sales for the month.

• Forecast monthly sales are Frw 3million for October, Frw

6million for November and December, and Frw 10.5 million

from January 2024 onwards.

• Selling price is fixed at the cost of inventory plus 50%.

• Two months’ credit will be allowed to customers but only one

month’s credit will be received from suppliers of inventory.

• Running expenses, including rent but excluding depreciation

of non-current assets, are estimated at 1.6 million FRW per

month.

• Umulisa PLC intends to make monthly cash drawings of Frw

1million.Prepare sales budget for six months for Umulisa Plc

Management Accounting | Experimental Version | Student Book | Senior Six

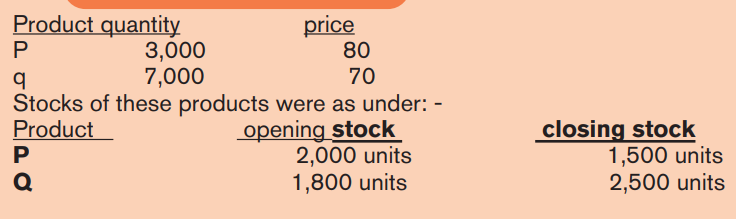

3.2. Purchase budget analysis

Learning Activity 3.2

ABARCO Plc manufactures two types of product for the printing industry.

For better of maximizing the profit Budgeted sales of the products, knownas P and Q for 2024 are:

Learning Activity 3.2

Questions:

a) Prepare purchase budget

3.2.1. Factors of purchase budget

However, there are a number of additional considerations that can make the

purchases budget considerably more complex including inventory beginning

balance, desired service level, process of product / services of production,

availability of cash (cash liquidity), labor turnover, season variables, availability

of raw materials, number of employees, investment in plant and equipment,

materials and supplies, utilities, cost of transportation to market, costs associated

with administration and manufacturing.

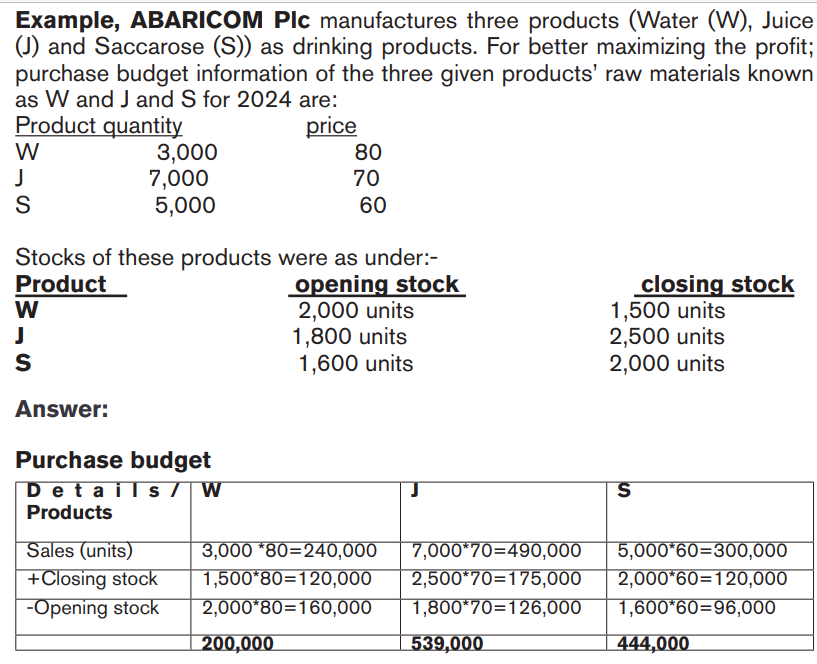

3.2.2. Calculation/ presentation of purchase budget

The units of materials to be purchased are expressed in terms of costs by

multiplying materials purchase price by units involved.

• Units needed = raw material units needed for production

desired closing inventory of raw materials- opening stock of raw

materials

• Labor cost = Labor cost per person * rate per worker per period.

However,The purchase is cost of sales + ending inventory –opening inventory.

Management Accounting | Experimental Version | Student Book | Senior Six

3.2.3.Interpreting results and advising the management

For any business, the purchase budget is purely linked to production and

production cost budget. Referring to example 3.2.2, the purchase manager

would present the cash outflow of Frw 200,000, Frw 539,000 and Frw 444,000

respectively to products W, J and S for achieving the business objective.

As shown @3.2.2, during the period purchases of 1,183,000 are required in

order to be able to sell goods costing Frw 240,000, Frw 490,000 and Frw

300,000 respectively to W, J and S. (cost of sales) and to increase inventory

levels by 160,000, 126,000 and 96,000 (beginning inventory) to Frw 120,000,Frw 175,000 and Frw 120,000 (ending inventory).

Management Accounting | Experimental Version | Student Book | Senior Six

1. CALISONITH Plc is a business producing the cassava bread located

in Ruhango District. The following accounting record of payment

information has been made available from the purchase department

for the last six months of 2019 (and of only sales for January 2020).

i) The units to be sold in different months are:

• July: 2,200

• August: 2,200

• September: 3,400

• October: 3,800

• November: 5,000

• December: 4,600

• January 2020: 4,000

ii) There will be no work-in- progress at the end of any month.

iii) Finished units equal to half the sales for the next month will be in

stock at the end of every month (including June 2019)

iv) Budgeted production and production costs for the year ending

December 2019 are as following:

• Production units: 44,000

• Direct materials per unit: FRW 10.00

• Direct Wages per unit: FRW 4.00

• Total factory overheads apportioned to the product: FRW 88,000

Prepare:

a) Production budget for the last six months of 2019

b) Production cost budget for the same period of 20193.3. Cash budget analysis

Management Accounting | Experimental Version | Student Book | Senior Six

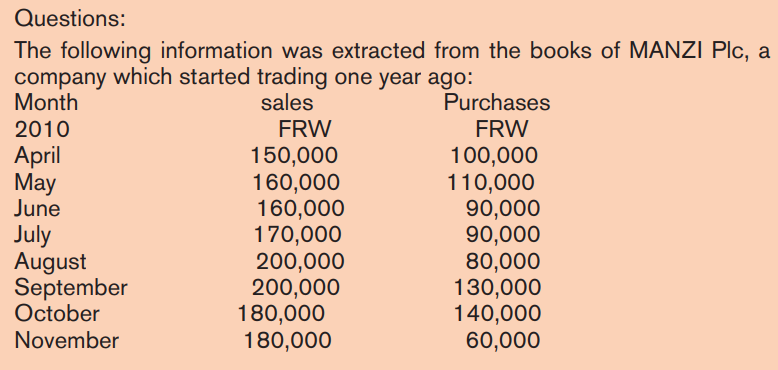

Learning Activity 3.3

The following information is available:

Cash in hand at the end of May 2010 will be Frw 180,000

1. 60% of the sales proceeds are received in the current month, 30%

in the following month and the balance is received in two months

after sales

2. Suppliers are paid one month after delivery of goods.

3. Corporation tax for 2009 amounting to FRW 20,000 will be paid on

30th September 2010

4. Contractor’s retention monies amounting to FRW 50,000 will be

paid on 30thJune 2010

5. The shareholders at their last extraordinary general meeting increased

the share capital by FRW 70,000 and the first call of FRW 40,000

will be received in October 2010

6. In October 2010, the company is due to receive FRW 20,000 as

compensation for civil suit

7. The monthly administration expenses amounting to Frw 33,000

include factory depreciation charge of FRW 4,000 and preliminary

expenses of FRW 3,000

8. Office equipment worth FRW 13,000 will be paid for in November

2010

Required:Prepare a cash budget for the period 1st June to 31st December 2011

Management Accounting | Experimental Version | Student Book | Senior Six

3.3.1. Factors of cash budget

Cash budget is an estimate of cash receipts and their payment during a

future period of time. It deals with other budgets especially materials, labor,

overheads and research and development budget. It estimates cash inflows

and use of cash during a specific period of time. It provides on one hand the

sources of cash including receipts from debtors, interest on loan, dividends

on shares, and other incomes from the sales of fixed assets, bill receipts and

on other hand cash utilization including payment to creditors, payment of fixed

assets purchased and daily routine payments such as wages, rent, postages,

telephone and entertainment expenses. The cash budget is also changed due

to expansion or contraction of the investment, increase or decrease in stocks

and debtors, rate of inflation anticipated, policy decisions like credit control,

dividends and taxation.

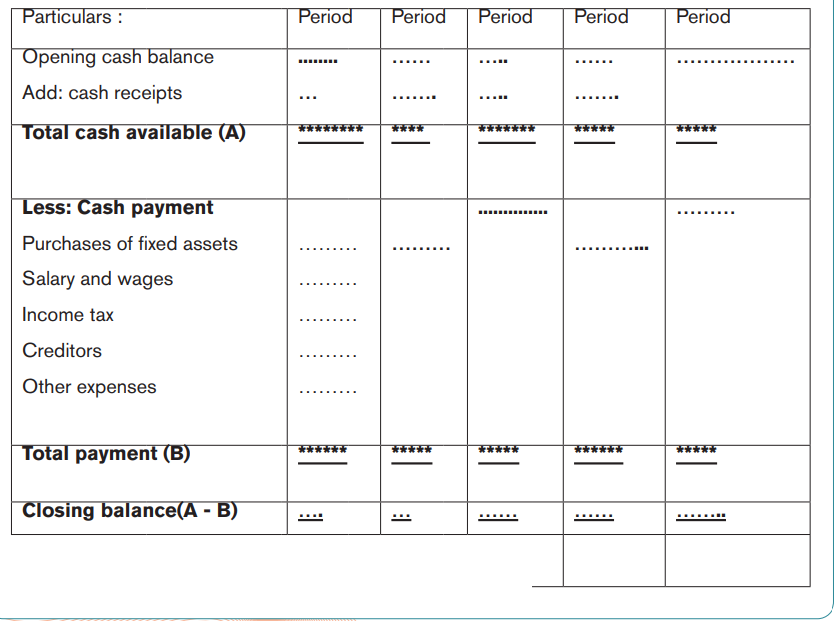

3.3.2. Calculation/ presentation of cash budget

Whatever the type of business is, the important objective is more liquidity

obtained from more sales, it is from this assumption that cash budget must

be prepared at the first rank from other business budget. The following is howbusiness cash budget looks like

Management Accounting | Experimental Version | Student Book | Senior Six

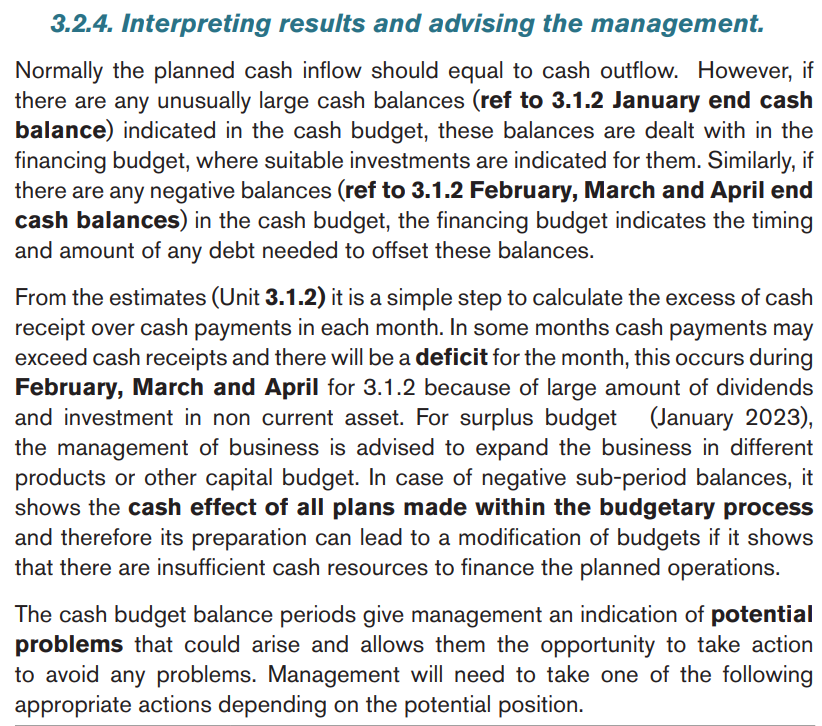

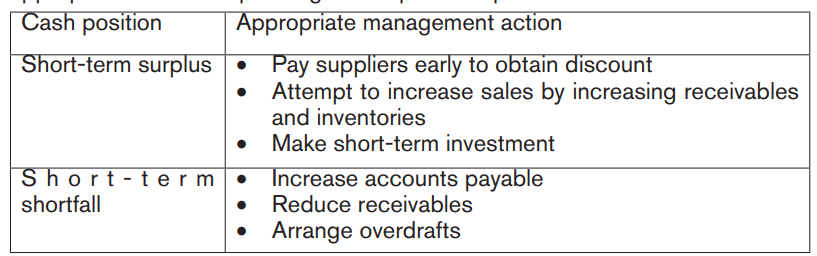

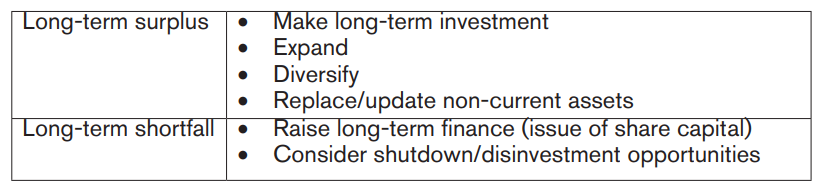

3.3.3. Interpreting results and advising the management

The cash budget allow managers to ensure that cash is available for revenue

expansion, to indicate when, where and how much cash will be needed (activity),

to preserve the cash throughout the year (saving), to guide management

on financing capital expenditure (efficiency) and revealing surplus cash forinvestment (effectiveness).

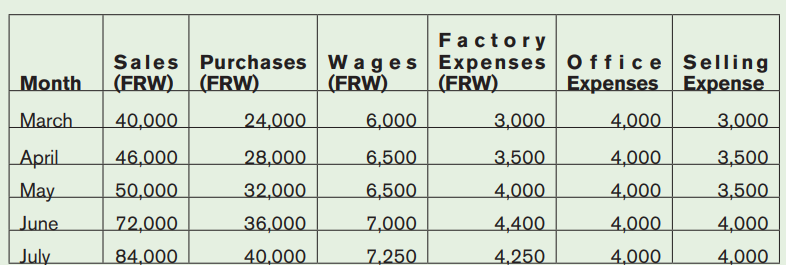

Application activity 3.3

A firm expects to have Frw 30,000 as opening balance on 1st May, 2018

and requires you to prepare an estimate of the cash position for threemonths May to July 2018. The following information is supplied to you.

Management Accounting | Experimental Version | Student Book | Senior Six

Skills Lab 3

The students accompanied with their trainers, visit the business operating in area

of school. They focus their journey to selling and purchase departments where

are shown data of purchase, stocking and selling purchased or manufactured

products. They ask different questions regarding the planning and budgetingthe cash, purchase and sales budgets.

End of unit assessment 3

1. Describe the budget according to the functional factor

2. Explain what is meant by incremental budgeting and discuss its

suitability for a government department budgeting for office rental

costs and for advertising expenditure on a new health initiative.

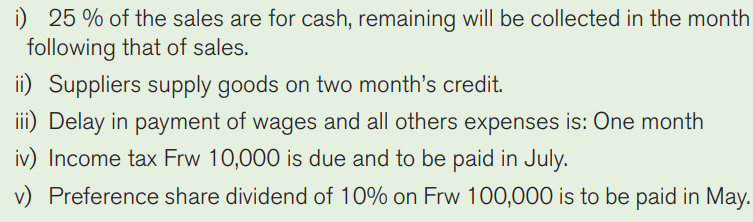

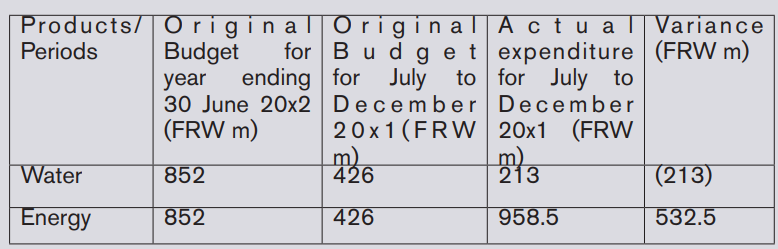

3. The government’s Education department has a budget of Frw 1,704m

for utilities for the year ending June 20x2. Two contracts are in place for

water and energy, with fixed amount for the year if usage remains within

agreed limits. The water contract, comprising one quarter of the total

utilities budget, is paid in equal amount each month. Energy is paid in

four equal instalments in July, September, December, and March.The

budget holder has received the following budget monitoring report for

the six months July to December 20x1 which shows the water budget

to be under spent by Frw 213m and the energy budget to be overspent by Frw 532,5m.

Management Accounting | Experimental Version | Student Book | Senior Six

The budget holder says the payments are fixed and the expenditure for the year

to date has been in accordance with expectations of the contracts. Water and

energy usage remained within the agreed limits of the contracts for the period.

Prepare a revised budget monitoring report, using a profiled budget based onthe information provided for the utility contracts.

Management Accounting | Experimental Version | Student Book | Senior Six