UNIT 1:FORECAST INCOME AND EXPENDITURE

Key unit competence: To be able to forecast an income and expenditure for an accounting period.

Accounting Management | Student Book | Senior Six

1.1.2.Definition of concepts

• Forecasting

It refers to the practice of predicting what will happen in the future by taking into

consideration events in the past and present. Basically, it is a decision-making

tool that helps businesses cope with the impact of the future’s uncertainty by

examining historical data and trends. It is a planning tool that enables businesses

to chart their next moves and create budgets that will hopefully cover whatever

uncertainties may occur.

• Financial forecasting

It is predicting a company’s financial future by examining historical performance

data, such as revenue, cash flow, expenses, or sales. This involves guesswork and

assumptions, as many unforeseen factors can influence business performance.

Common types of forecasts include cash flow forecast, projected profit and

loss and balance sheet forecast.

• Difference between Budgeting and Forecasting

Budgeting and forecasting are both tools that help businesses plan for theirfuture. However, the two are distinctly different in many ways:

Management Accounting | Experimental Version | Student Book | Senior Six

• Budgeting

It involves creating financial statements for a specific period, such as projected

revenue, expenses, cash flow and investments. It is usually conducted with input

from many different departments in order to come up with a holistic and detailed

report. Therefore, the budgeting process takes time to complete. The company

uses the budget to guide it in its financial activities. In other words, a budget is

a plan for a company’s future.

While budget are usually made for an entire year, forecasts are usually updated

monthly or quarterly. Through forecasting, a company can project where it’s

going, and it may adjust its budget and allocate more or less funds to an activity,

depending on the forecast. In summary, budgets depend on the forecast.

Forecasting is a common statistical task in business, where it helps to inform

decisions about the scheduling of production, transportation and personnel,

and provides a guide to long-term strategic planning. However, business

forecasting is often done poorly, and is frequently confused with planning and

goals. They are three different things.

• Forecasting

It is about predicting the future as accurately as possible, given all of available

the information , including historical data and knowledge of any future events

that might impact the forecasts.

Goals are what business would like to have happen. Goals should be linked to

forecasts and plans, but this does not always occur. Too often, goals are set

without any plan for how to achieve them, and no forecasts for whether they are

realistic.

Planning is a response to forecasts and goals. Planning involves determining

the appropriate actions that are required to make your forecasts match your

goals.

Forecasting should be an integral part of the decision-making activities of

management, as it can play an important role in many areas of a company.

Modern organizations require short-term, medium-term and long-term forecasts,

depending on the specific application.

1.1.2. Source of information in forecasting

The data used for forecasting methods can either come from primary sources

or secondary sources. Primary sources provide first-hand information, collected

directly by the person or organization that is doing the forecasting, Secondary

sources provide information that has already been gathered and processed byManagement Accounting | Experimental Version | Student Book | Senior Six

a third-party organization.

Collection of data is a first step in any statistical investigation. It is the basis

for any analysis and interpretations. Before collection of data, planner needs

to know the source in which you can get information. Below is key source of

information in forecasting

a) Market or industry data: Market or industry is Secondary source

supplying information that has been collected and published by other

entities. Examples of this type of information might be industry reports,

growth rate of economy, inflation, interest rate, tax incentives, etc. These

data are useful for predicting future. As this information has already been

compiled and analyzed, it makes the process quicker.

b) Competitors: A competitor is a person, business, team, or organization

that competes against you or your company. If somebody is trying to

beat you in a race, that person is your competitor. Information like sales

quantity, competitor’s price, market share, financial performance and

position will help business to predict future

c) Key customers: A customer is a person or business that buys goods

or services from another business. Customers are crucial because they

generate revenue. Without them, businesses would cease to operate.

Any decision and forecast that business need to make it is necessary to

first look at customer’s capacity to pay, quality needed, volume needed.

For example, in forecasting sales volume you need to know how much

customer is willing and able to buy.

d) Suppliers: A supplier is a person, company, or organization that sells or

supplies something such as goods or equipment to you. In forecasting

any company needs to gather information from suppliers to know how

many resources you are going to receive, the willingness of suppliers to

continue to serve you and financial capabilities of supplier to continue to

serve in future.

e) Procurement department: Also called the purchasing or sourcing

department, the procurement department is where the procurement

process starts and finishes. This is the place where the procurement

manager discusses the time for procurement process, list of goods, list of

suppliers, products price levels and tender awarded should go with the

other team members. This is also where each member of the procurement

team does its respective assignments. That is why it is very important for

the company to do forecast after consulting procurement department.

f) Humana resource department: Human resources (HR) department is

the division of a business that is charged with finding, screening, recruiting,

and training job applicants. It also administers employee-benefit programs.Human resource department is key source of information for forecasting

Management Accounting | Experimental Version | Student Book | Senior Six

the labor cost and the availability of human contribution. Leaves, needed

skills labor, capacity building cost, tasks and responsibilities, salaries and

wages, fringe benefits, labor turnover, labor contracts.... )

g) Financial goal and objectives: Financial objectives are the goals or

targets related to the financial performance of a business. There are six

types of financial objectives: revenue objectives, cost objectives, profit

objectives, cash flow objectives, investment objectives and capital

structure objectives. Those objectives offer information to budgetingdepartment to be based on in forecasting future.

Application activity 1.1

1. Define the following concepts:

A. Forecasting.

B. Budgeting

C. Financial Forecasting

2. Manager of XYZ Ltd has planned to forecast future sales but he

is unsure on where he can get reliable information to be based on

while making prediction. Advise him five key sources of informationfor forecasting.

Management Accounting | Experimental Version | Student Book | Senior Six

1.1.Forecasting Methods for income and expenditure

Learning Activity 1.2

i) What are two variables shown on above image?

ii) What come to your mind once you see image above?

There are two primary categories of forecasting: quantitative and qualitative.N = Total number of periods

Management Accounting | Experimental Version | Student Book | Senior Six

A.Quantitative Methods

When producing accurate forecasts, business leaders typically turn to

quantitative forecasts, or assumptions about the future based on historical data.

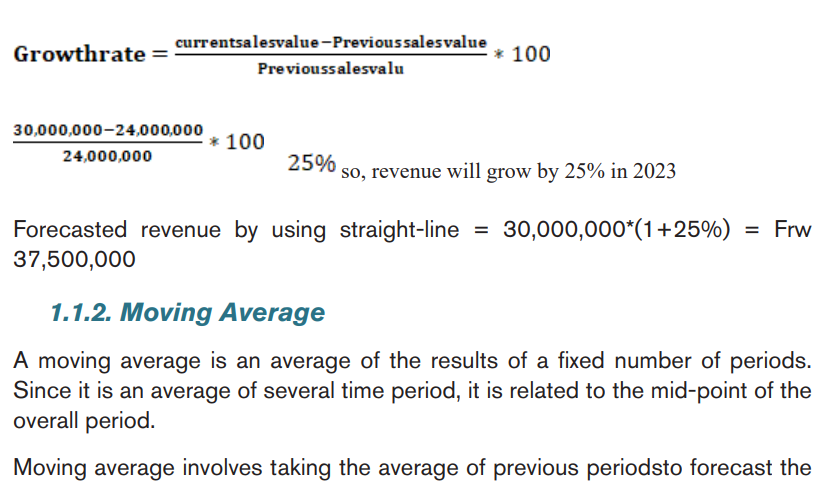

1.1.1.Straight Line

The straight-line method assumes a company’s historical growth rate will

remain constant. Forecasting future revenue involves multiplying a company’s

previous year’s revenue by its growth rate. Although straight-line forecasting is

an excellent starting point, it doesn’t account for market fluctuations or supply

chain issues.

For arriving to the forecasted future revenue or cost the following step will be

followed:

1. The first step in straight-line forecasting is to determine the sales/cost

growth rate that will be used to calculate future revenues.

2. To forecast future revenues, take the previous year’s figure and multiply

it by the growth rate.

For example, Total income of Akeza Ltd for year ended 31 December 2021 and

2022 is Frw 24,000,000 and Frw 30,000,000 respectively. Compute growth

rate and forecast revenue for the year ended 2023if the calculated will continueto grow by same growth.

Solution:

Management Accounting | Experimental Version | Student Book | Senior Six

future. This method involves more closely examining a business’s high or low

demands, so it’s often beneficial for short-term forecasting. For example, you

can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most

commonly applied to future stock prices, it’s also used to estimate future

revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

1.1.3.Time series

This is a sequence of variable values like sales or production that change over a

uniform set of time. The variable values represent statistical data while time can

be in seconds, hours, days, weeks, etc.

Time series analysis is a specific way of analyzing a sequence of data points

collected over an interval of time. In time series analysis, analysts record data

points at consistent intervals over a set period of time rather than just recording

the data points intermittently or randomly.

All-time series contain at least one of the following four components:

1. Secular trend: The general underlying tendency of the time series data

to increase, decrease or remain constant for a long period of time.

2. Seasonal variations: Are periodic movements of the data where the

duration is less than a year. The factors that mainly cause these variations

are:

a) Climatic changes

b) The customs and habits that people follow at different times

3. Cyclical variations: Are periodic movements within the time series

data where the duration is more than a year. They are not as regular as

the seasonal variations but their sequence of change is the same. The

causes of the cyclical variations are the four phases of an economic cycle

which include: the boom/peak, decline/downturn, depression/trough and

recovery/upswing.4. Random/ irregular erratic variations: These are completely

Management Accounting | Experimental Version | Student Book | Senior Six

unpredictable variations within the data caused by unpredictable events

like sickness, machine breakdown, weather conditions, strikes etc. They

are non-recurring influences which cannot be mathematically captured

yet they have profound consequences on a time series.The equation for trend is:

Y = a+ bx

Formula breakdown:

Y= Dependent variable (the forecasted number)

b = line’s slopex = Independent variable (time numbered from 0 upwards)

Management Accounting | Experimental Version | Student Book | Senior Six

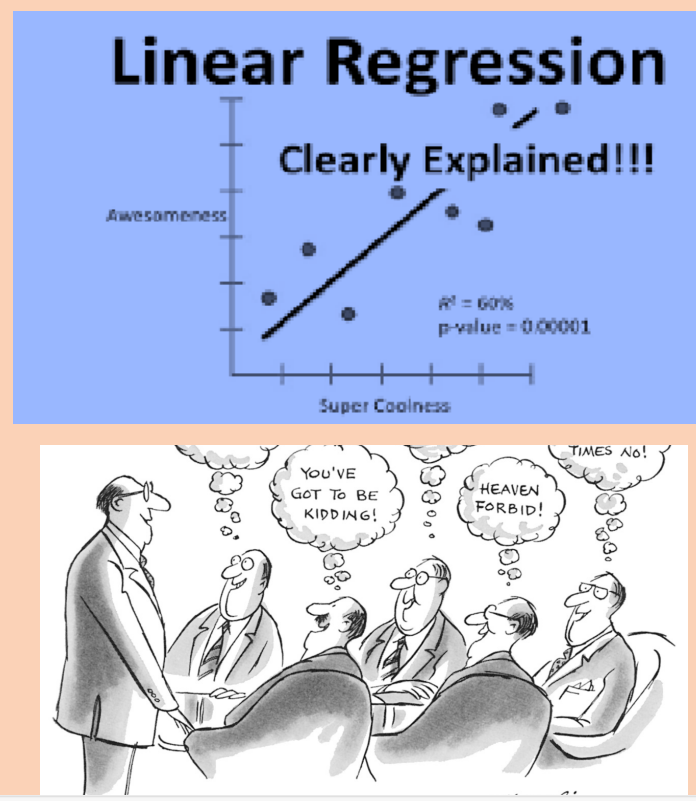

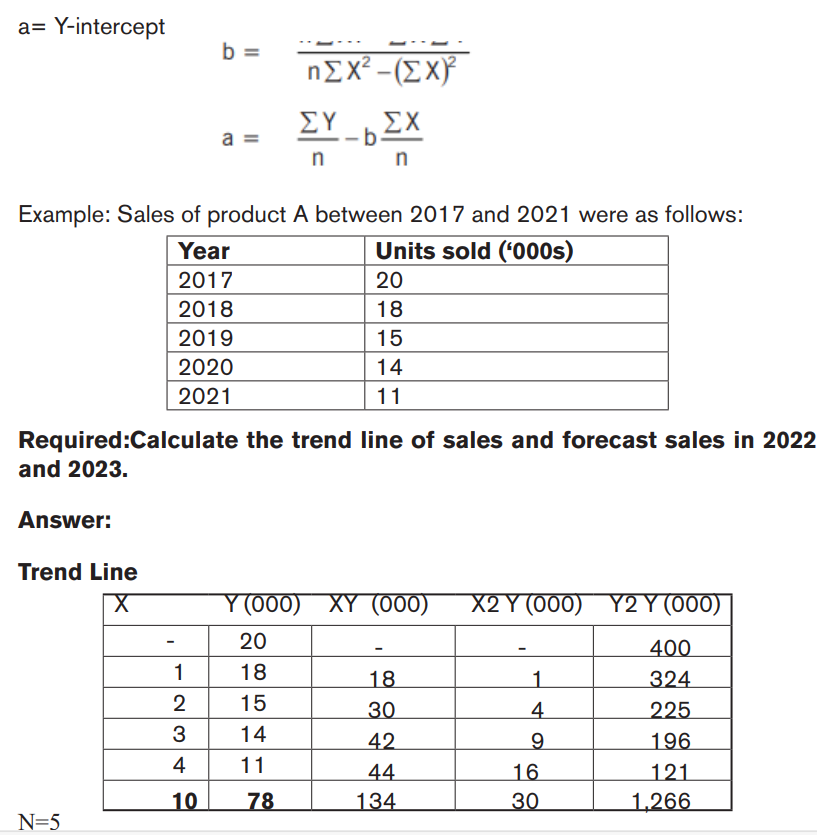

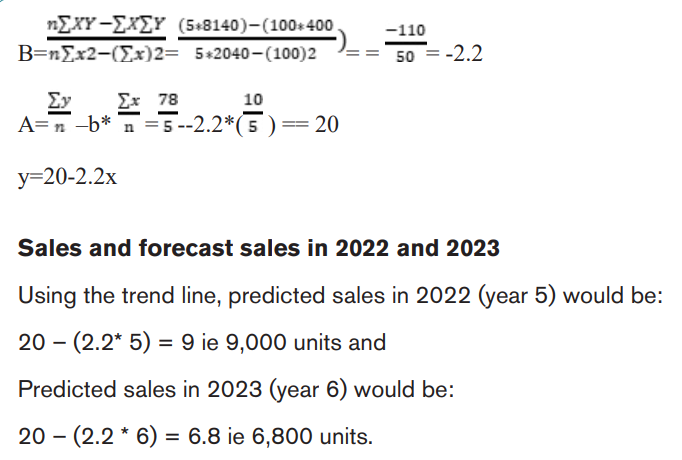

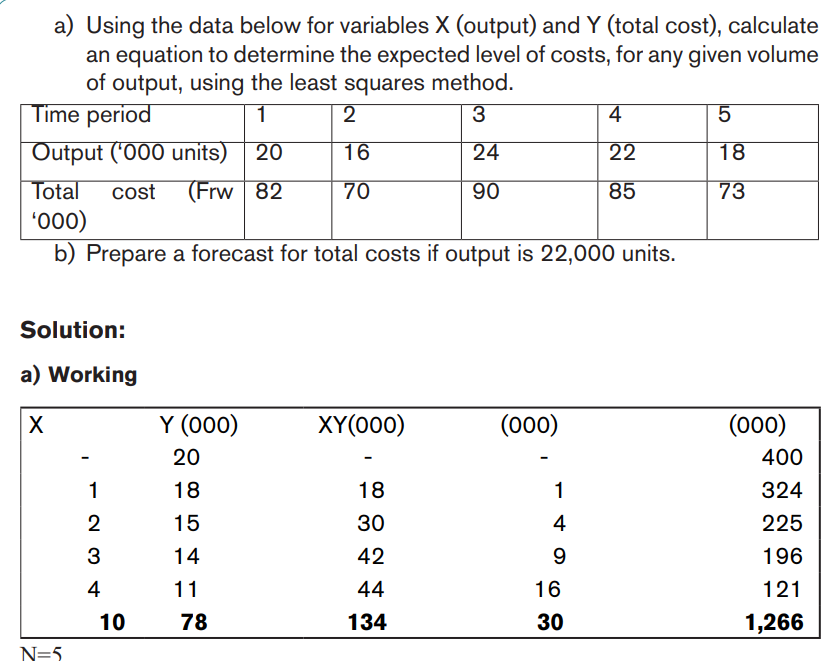

1.1.4.Simple Linear Regression/least squares method

Linear regression analysis (the least squares method) is one technique for

estimating a line of best fit. Once an equation for a line of best fit has been

determined, forecasts can be made. Simple linear regression forecasts metrics

based on a relationship between two variables: dependent and independent. The

dependent variable represents the forecasted amount, while the independent

variable is the factor that influences the dependent variable.The equation for simple linear regression is:

Y = a+ bx

Formula breakdown:

Y = Dependent variable (the forecasted number)

b = Regression line’s slope

x = Independent variable

a= Y-intercept

Management Accounting | Experimental Version | Student Book | Senior Six

Management Accounting | Experimental Version | Student Book | Senior Six

Qualitative forecasting relies on experts’ knowledge and experience to predict

performance rather than historical numerical data.

These forecasting methods are often called into question, as they’re more

subjective than quantitative methods. Yet, they can provide valuable insight into

forecasts and account for factors that can’t be predicted using historical data.

1.1.5.Market Research

Market research is essential for organizational planning. It helps business leaders

obtain a holistic market view based on competition, fluctuating conditions,

and consumer patterns. It’s also critical for start-ups when historical data isn’t

available. New businesses can benefit from financial forecasting because it’s

essential for recruiting investors and budgeting during the first few months of

operation.

When conducting market research, begin with a hypothesis and determine

what methods are needed. Sending out consumer surveys is an excellent way

to better understand consumer behavior when you don’t have numerical data to

inform decisions.

1.1.6. Delphi Method

This method incorporates both judgmental and subjective factors. It is an

iterative process that allows experts to make an objective forecast. There are 3

groups of participants involved namely:

1. Decision makers: group usually consists of 5 - 10 experts who will be

making the actual forecast.

2. Staff personnel: assist the decision makers by preparing, distributing,

collecting and summarizing a series of questionnaires and survey results.

3. Respondents: The respondents are a group of people whose views

and judgments are valued and are being sought. This group provides

input to the decision makers before the forecast is made. In this method,

it is crucial to select participants from different functional fields due to the

following reasons:

– To get diverse opinions

– To have diversity of ideas and experience

– To reduce prediction error– To improve on quality of final results

Management Accounting | Experimental Version | Student Book | Senior Six

1.2. Forecasting Models for income and expenditure

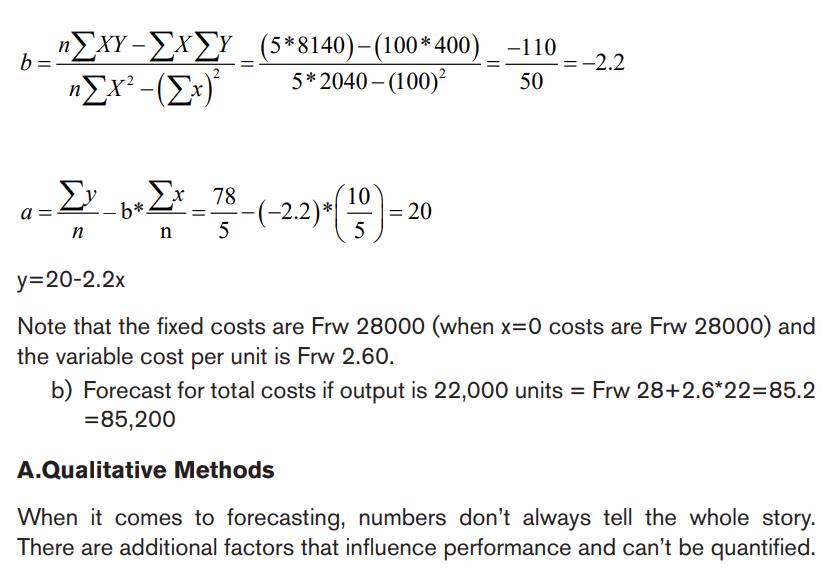

Application activity 1.2

Alex Mugabo is Budget manager of MG factory a company based in Kigali to

produce and sales furniture to household. The following table shows the actualunits sold from 2010 to 2016 by MG factory

Required

d) Take a moving average of the annual sales over a period of three

yearse) Based on calculated moving value in a) Advice Alex on future sales

Management Accounting | Experimental Version | Student Book | Senior Six

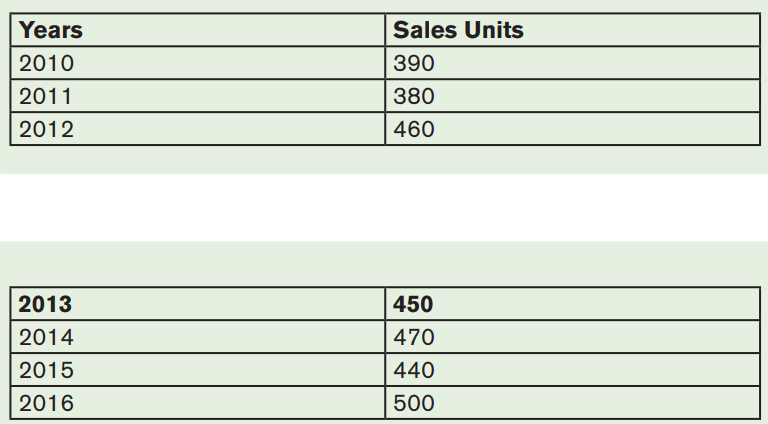

vi. Based on knowledge acquired from previous methods of forecasting

what is method identified in the image above?vii.What the participants in this image trying to do?

Forecasting models are one of the many tools’ businesses use to predict

outcomes regarding sales, supply and demand, consumer behavior and more.

These models are especially beneficial in the field of sales and marketing. There

are several forecasting methods businesses use that provide varying degrees

of information. From the simple to the complex, the appeal of using forecasting

models comes from having a visual reference of expected outcomes.

There are numerous ways to forecast business outcomes; there are four main

types of models that companies use to predict revenue and expenditure in the

future.

1.2.1. Time Series Model

This type of model uses historical data as the key to reliable forecasting. You’ll

be able to visualize patterns of data better when you know how the variables

interact in terms of hours, weeks, months or years. Time series has four main

components which are trend, seasonal variations, cyclical variations and random

variations.

1.2.2. Econometric Forecasting ModelEconometric forecasting models are systems of relationships between variables

Management Accounting | Experimental Version | Student Book | Senior Six

such as GNP, inflation, exchange rates etc. Their equations are then estimated

from available data, mainly aggregate time series. Econometric models attempt to

quantify the relationship between the parameter of interest (dependent variable)

and a number of factors (explanatory variables) that affect the dependent

variable. A simple example of an econometric model is one that assumes that

monthly spending by consumers is linearly dependent on consumers’ income in

the previous month.

1.2.3. Judgmental forecasting Model

Various forecasting models of the judgmental kind utilize subjective and intuitive

information to make predictions. For instance, there are times when there is no

data available for reference. Launching a new product or facing unpredictable

market conditions also creates situations in which judgmental forecasting

models prove beneficial.

Product life cycle and market knowledge: Management should know that,

most products have a limited product life cycle which will show different sales

and profitability patterns at different stages of the life cycle.

In time series method, analysis makes the assumption that the sales figures

will continue to change in line with the trend. Such statistical projections are

helpful in forecasts but a manager should not ignore knowledge of the market

or product itself.

The trend will not continue unchanged in practice as most products have a

limited product life cycle which will show different sales and profitability patterns

at different stages of the life cycle.

The product life cycle is generally thought to split naturally into five separate

stages: Development, Launch, Growth, Maturity and Decline.

So, a business has to consider not only its products’ sales trends but also

the stage of the life cycle of each product and the state of the market for that

product.

However, the analysis could go even further, into the general state of the

environment in which the business operates. This can often be efficiently done

by carrying out a PEST analysis. This examines the following factors: Political,Economic, Social, And Technological.

Management Accounting | Experimental Version | Student Book | Senior Six

1.2.4. Delphi Model

This method is commonly used to forecast trends based on the information

given by a panel of experts. It assumes that a group’s answers are more useful

and unbiased than answers provided by one individual. The total number of

rounds involved may differ depending on the goal of the company or group’s

researchers.

These experts answer a series of questions in continuous rounds that ultimately

lead to the “correct answer” a company is looking for. The quality of information

improves with each round as the experts revise their previous assumptions

following additional insight from other members in the panel.

Application activity 1.3

Most products have a limited product life cycle which will show different

sales and profitability patterns at different stages of the life cycle.

Required :List and explain four cycles of products

Management Accounting | Experimental Version | Student Book | Senior Six

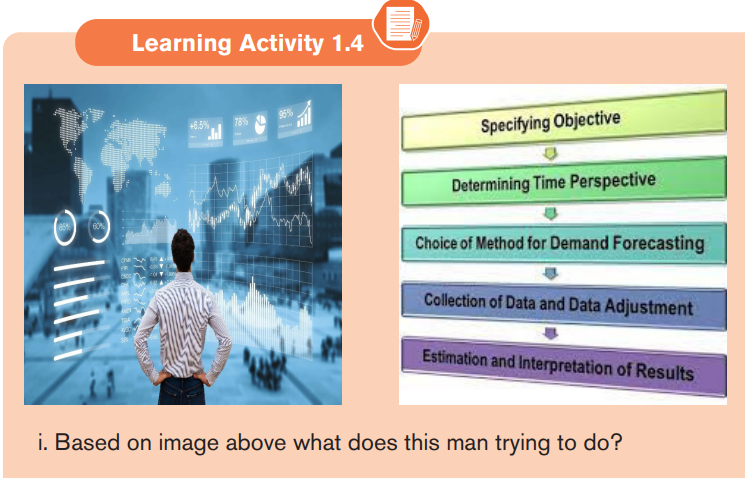

1.3. The Process /Step of Forecasting

Management of institutions/ company needs to follow carefully the process in

order to get accurate results. Below is the process for forecasting

1.3.1. Determine what the forecast is for

The first step in the process is to determine what kind of forecast you need to

make. Remember that forecasts are made in order to plan for the future. To do

so, we have to decide what forecasts are actually needed. This is not as simple

as it sounds. For example, do we need to forecast sales or demand? These

are two different things, and sales do not necessarily equal the total amount of

demand for the product. Both pieces of information are usually valuable.

1.3.2. Select the items for the forecast.

This step involves identifying what data are needed and what data are available.

This will have a big impact on the selection of a forecasting model. For example,

if you are predicting sales for a new product, you may not have historical sales

information, which would limit your use of forecasting models that require

quantitative data.

1.3.3. Select the time horizon.

A time horizon is a fixed point of time in the future at which point certain

processes will be evaluated or assumed to end. Forecasts in Business are

classified according to period, time and use. There are long term forecasts and

short-term forecasts. Operation managers need long range forecast for making

strategic decisions related to products, processes and facilities. They also need

short term forecasts to assist them in making decisions about production issues

that span, only few weeks. Forecasting forms an integral part of planning thatwhy production managers must be aware about the horizon of forecasts.

Management Accounting | Experimental Version | Student Book | Senior Six

1.3.4. Select the forecast model, type and method.

Based on what you want to forecast for, you should select appropriate model

and type that will give you reliable results, there are number of factors that

will influence you in choosing right forecasting model, amount and types of

available data, degree of accuracy required, forecast time horizon and kind

of data. Appropriate method of sales forecasting is selected by the company

taking into account all the relevant information, purpose of forecasting and the

degree of accuracy required.

1.3.5. Gather data to be input into the model

There are generally two kinds of information available for forecasting: statistical

data which is generally historic numerical data and the accumulated judgment and

expertise of key personnel. Also, other relevant data such as the time and length

of any significant production downtime due to equipment failure or industrial

disputes may prove useful and therefore may also be collected in gathering

data they will consider primary source of information (information collected

from internals) and secondary source of information (information collected from

externals) all that information will give required data in forecasting.

1.3.6. Make the forecast.

Perform initial analysis of the data to see if it is usable. Check trends and patterns

shown in the data to see if they are helpful. Cut out any unwanted data. Using

your chosen model, run the data, analyze it, and make the forecast.

1.3.7. Verify and Implement the results

Every step is checked, refinements and modifications are made at the end you

will get outcomes from the forecasting model and plan accordingly. Forecasting

isn’t a measure just to get the business up and running. Successful companies

use their market forecast to calculate their progress and use it as a managementtool to run the business better.

Management Accounting | Experimental Version | Student Book | Senior Six

Application activity 1.4

The General Manager of AOB Limited is planning to launch a new product

Urwiwacu which is new product to Rwanda market and the rest of east Africa

but is unsure on profitability of Urwiwacu. CEO convening meeting with

chief operation Manager, Sales Manager and budget manager to discuss

the feasibility of the proposal to launch Urwiwacu. The following concerns

were raised by the participants: the budget manager has concern of timing

the launch of Urwiwacu due to the lack of sufficient information related to

the cost, revenue and profitability. He has concern over the method that

AOB can use to estimate the profit expected from Urwiwacu. The Chief

Operation Manager tells the meeting that the raw materials needed for

production will be available at a high cost and this is due to the lack of local

supplier. The sales manager says that the department has been trying to

collect data related to Urwiwacu and tells the participants that the product

is needed on market and customer will be happy to buy product but he was

not sure of price to be charged in order to cover cost and remain with profit.

General manager requests all participants to take one month and come up

with forecasted revenue and cost from Urwiwacu product.

Required: You have completed senior six and you are hired by AOB ltd in

department of budgeting. Referring to the case above Apply first 4 steps offorecasting

Management Accounting | Experimental Version | Student Book | Senior Six

1.4. Challenges to forecasting

Learning Activity 1.5

a) What do you think about the problems this man would have after

looking above photo?

Every large businesses or medium perform financial forecasting for various

reasons such as projecting future sales, understanding working capital needs,

launching new product and more. With accurate financial forecasting, businesses

can easily achieve both their short-term and long-term goal but forecasting has

its challenge:

a) Forecasting Time Period

Shorter the period more is the accurate financial forecasting. Longer the period

less is the accurate and difficult financial forecasting. Mostly, less difficulty

comes for a short span and more difficulty comes for a long span. In simple

words, we say the shorter forecasting period will always be more accurate as

compared to the larger prediction time.

b) Data Collections

Collecting and gathering all the business finance data to proceed further can

never be easy. This task can take a week to weeks to gather all the information

to build the cash flow projection and revenue forecast. Collecting these data for

forecasting is one of the huge financial forecasting problems.

c) Problems with the Input data

Forecasts using linear analysis can be common, but this type of forecasting

fails to account for the uncertainty in the future. In statistics, the assumptionof linearity is necessary when certain assumptions are made about the future.

Management Accounting | Experimental Version | Student Book | Senior Six

However, there is no assurance that a relationship between two variables

will continue in the future. Many factors come into play when you’re making

a forecast, especially when it’s on an important matter. Human error which is

common can mean the difference in wrong predictions.

d) Unforeseeable Events

Another financial forecasting problem is unforeseeable. In spite of the businesses

achieve the quantitative and qualitative forecasting techniques to make their

prediction accurate, unforeseeable can never be achieved. These components

can vary inherently, and reach the risks of forecasting. For example, let us take

an example of supermarket that opens the store with the pillar financial growth.

It leads to affecting the other supermarket in the particular area. It can never be

forecasted.

e) Accuracy of past data

Financial forecasting is performed based on past business data to predict the

future. Take an instant that your business average growth as 10% as a stable

one for the past 4 years, you could predict your business finance for the next 4

years as 10%. While you use this kind of system wider, then you are on the way

to financial forecasting problems.

If a company has variable results year over year, using the previous period data

is worthless. Additionally, the financial data will not be available for the startups,

as they should go by approximate estimation without any accurate idea.

Note, Apart from the above-mentioned challenges there are many other

challenges such as Social changes, Technological advances, Environmental

changes, Political and economic changes, No easy way to capture forecast

assumptions of all managers, Lack of tools to analyze historical trends, etc.

Application activity 1.5

You are employed by ABZ company as sales officer. Budget department

sent to you target sales value for first quarter but you are not sure if you will

achieve target.

You know that forecasts are subject to error, but the likely errors vary from

case to case due to:

a) The further into the future the forecast is for; the more unreliable it is

likely to be.

b) The less data available on which to base the forecast, the less reliable

the forecast.

c) The pattern of trend and seasonal variations cannot be guaranteed to

continue in the future.

d) There is always the danger of random variations upsetting the patterns.Required: Explain 3 main challenges of forecasting.

Skills Lab 1

The students visit one of the nearest manufacturing industries. Let us take

MUTEXRWA Industry as our case study.

Let us approach production departmental manager and share us the

methods used in forecasting their production volume and the challenges

they face with. We have selected one kind of products they produce

which is Uniforms clothes for secondary schools. The Sales departmental

manager is about sharing how forecasting is most useful in their prediction

of production sales level. “We collect forecasting information from Ministry

of education to know school calendar year and new schools are about

opening.

We mostly use time series method based on the calendar year set by

Ministry of Education as it is the key determinant of our uniform clothes

demand, this where the method of time series comes as the time series has

a component called seasonal variation,

For previous academic terms we have much data recorded in our financial

statements and their trend analysis report is there, we base on the above

historical trends data and we use time series mathematical calculations to

predict the production demand for the future.

Let Sales production manager also tells us about the challenges

MUTEXRWA faces in forecasting,

“There are less data available to be based on, this lead less reliability on

forecast because in our sector the demand of uniform clothes is limited,

the many customers demand diversity design of clothes, We also meet

with challenges of Technology changes, here I want to mean that the past

is not a reliable indication of likely future events. For example, the availability

of faster machinery may make it difficult to use current output levels as the

basis for forecasting future production output, there many other factors out

of our control such Economical and political factors

Management Accounting | Experimental Version | Student Book | Senior Six

Also as in forecasting uncertainty future events there are many assumptions

used, this become challenge to our company because each manager has

his/ her own assumption. Apart from the above challenges, I would like to

conclude by saying that forecasting is the useful tool in company as it is

used to predict company future operations” Said by MUTEXRWA Sales

departmental manager.

Before leaving this industry, let us also have a short interview with

MUTEXRWA Production departmental Manager. Let us ask him whether

forecasting is the recommendable basing on its result to their industry.

“Yes, forecasting is highly recommendable to all companies as it helps of

predicting what will happen in the future by taking into consideration events

in the past and present and this enables businesses to predict their next

moves and create budgets that will hopefully cover whatever uncertaintiesmay occur” said by Production departmental manager.

End of unit assessment 1

Question 1

Time series is method for forecasting where independent variable is time.

What do you understand by time series? Give examples of time series.

Question2

If manager wants to forecast; he will need to collect information to be based

on, those collected information are either primary source or Secondary

source.

Advise him 5 sources of forecasting information and specify whether that

source is primary or secondary.

Question 3

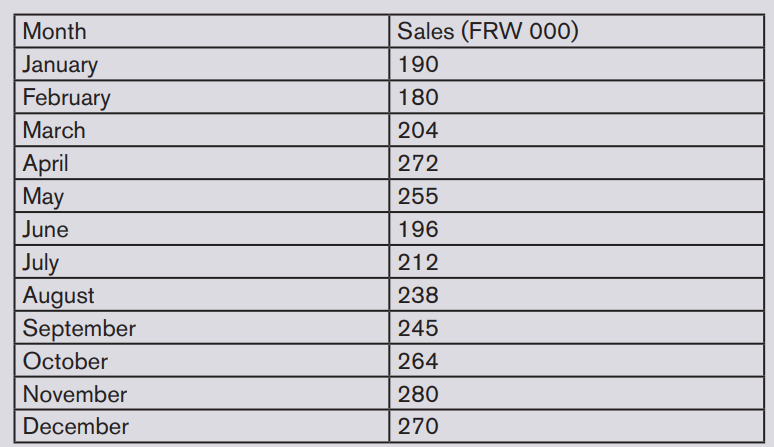

The data below shows the monthly sales (Frw million) made by Mukungwa

ltd. for the year 2020.Month

Management Accounting | Experimental Version | Student Book | Senior Six

Required

c) Calculate the moving average of order 3

Question 4

Methods for forecasting are classified into Quantitative and Qualitative.

Explain 2 qualitative methods.

Question5

Most of time forecast and actual results differ significantly. Elaborate clearly

3challenges of forecasting.

Question 6

In forecasting steps there is time horizon, Explain three forecasting timehorizons in forecasting

Management Accounting | Experimental Version | Student Book | Senior Six