UNIT9: FINAL REPORTS

Key unit competence: Prepare the final reports after making therequired adjustments using QUICKBOOK

Introductory Activity

Mrs. INEZA, The new accountant of MUSANZE INVESTMENT GROUP (MIG)

is wondering what is expected from her exactly, especially at the end of financial

period. She is used to record company transactions in different journals and

prepare the ledger accounts through QuickBooks accounting software.

Finally, the reports are to be submitted to the different users for coming up with

rational decisions. These decision are based on final financial reports prepared

by INEZA. It means that the bright future of MIG depends on these report.

1. Assist to Mrs. INEZA to understand the process of documenting and

communicating financial report of MIG performance over a time period.

2. Suggest the important reports that should be prepared and

communicated to the users3. List the further importance of final reports to the company.

Final reports are a set of documents that show the financial situation of

a company at the end of a particular period of time. They are compilations

of financial information that are derived from the accounting records of abusiness. There are different types of final reports:

9.1. Statement of Cash Flows

Learning Activity 9.1.

The business day to day activities are concerned with purchasing and selling,

receiving and paying, investing and financing the operations of the business. It

means that there is a kind of flow of business cash in and out.

1. Suggest the financial report in which business cash in and out can be

shown.

2. Enumerate the purpose of this report3. Explain the different parts of this report

The cash flow statement is a financial statement that show the business cash

inflow and cash outflow for a certain period.

Purpose of a statement of cash flows:

To provide information about the cash inflows and outflows of an entity during

a period.

To summarize the operating, investing, and financing activities of the business.

The cash flow statement helps users to assess a company’s liquidity, financial

flexibility, operating capabilities, and risk.

The statement of cash flows is useful because it provides answers to the

following important questions:

– Where did cash come from?

– What was cash used for?

– What was the change in the cash balance?

Specifically, the information in a statement of cash flows, if used with information

in the other financial statements, helps external users to assess:

– A company’s ability to generate positive future net cash flows,

– A company’s ability to meet its obligations and pay dividends,

– A company’s need for external financing,

The reasons for differences between a company’s net income and associatedcash receipts and payments.

Both the cash and noncash aspects of a company’s financing and investing

transactions.

In cash flow, Cash inflows, cash outflows and finally the deficit or surplus are

discussed as follow:

9.1.1. Cash inflows

Cash inflow refers to the revenue generated or income received by the

business. In simple terms, it is the cash that comes into the organisation due to

its operating, financial or investing activities. Cash Inflow includes the following:

Cash Inflows from operating activities

Operating activities are all the things a company does to bring its products and

services to market on an ongoing basis. Cash inflow from operating activities

indicates the amount of money a company brings in from its ongoing, regular

business activities, such as:

– Cash receipts from sale of goods,

– Cash receipts from the rendering of services,

– Cash receipts from royalties,

– Cash receipts from fees,

– Cash receipts from commissions,

– Cash receipts customers;

– Cash receipts from recovery of trade debts;

– Covered insurance claims;

– Cash receipts from sales of non-current assets;

Cash Inflows from Investing Activities

Cash inflows from investing activities is a section of the cash flow statement that

shows the cash generated relating to investment activities. Investing activities

include:

– Cash receipt from disposal of fixed assets including intangibles.

– Cash receipt from the repayment of advances or loans made to third

parties (except in case of financial enterprise).

– Cash receipt from disposal of shares.

– Interest received in cash from loans and advances. Dividend received

from investments in other enterprises.– Cash receipts from sales of non-current assets (except for held-for resale);

Cash Inflows from financing activities

It is the net amount of funding a company generates in a given time period. It

includes the followings:

– Cash proceeds from issuing shares (equity or/and preference).

– Cash proceeds from loans, bonds and other short/long-term borrowings.

– Cash receipts from borrowing (irrespective of maturity) from third

parties (including credit institutions).

QuickBooks itself identifies the activities following the recording command and

produces the statement.

9.1.2. Cash outflows

Cash Outflow refers to the amount that a business disburses or the expenditure

incurred by a company during the financial year, which means that it is the

amount which goes out of the business.

Cash Outflows from operating activities:

Cash payments to acquire materials for providing services and manufacturing

goods for resale. It includes:

– Cash payments to suppliers for goods and services.

– Cash payments to and on behalf of the employees.

– Cash payments to an insurance enterprise for premiums

– Taxes paid;

– Cash payments to purchase current investments;

Cash Outflows from investing activities

Cash out flows from investing activities is a section of the cash flow statement

that shows the cash.

It includes:

– Cash payments to acquire fixed assets including intangibles and

capitalized research and development.

– Cash payments to acquire shares, warrants or debt instruments of other

enterprises other than the instruments those held for trading purposes.

– Cash advances and loans made to third party

– Cash payments to build, reconstruct or repair non-current tangible

assets– Cash payments to acquire securities.

Cash Outflows from financing activities

Cash outflow from financing activity measures the movement of cash between

a firm and its owners, investors, and creditors. It includes:

– Cash repayments of amounts borrowed (long term loan)

– Interest paid on debentures

– Dividends paid on equity and preference capital.

– Cash payments to acquire own shares;

Example

Mrs. APENDEKI, started her shop with a balance carried down of FRw

12,500,000.

She also got a bank loan from VISION FUND worth FRW 2,000,000 for

increasing the business capital.

She bought a building of FRW 12,000,000

One of her old customer paid the amount due of FRW 345,650.

Payment of loan in full with an interest of FRW 350,000

She sold some of her old furniture on FRW 500,000 and received commission

or FRW 45,000.

She paid FRW 940,650 to acquire her own shares in I&M Bank Rwanda

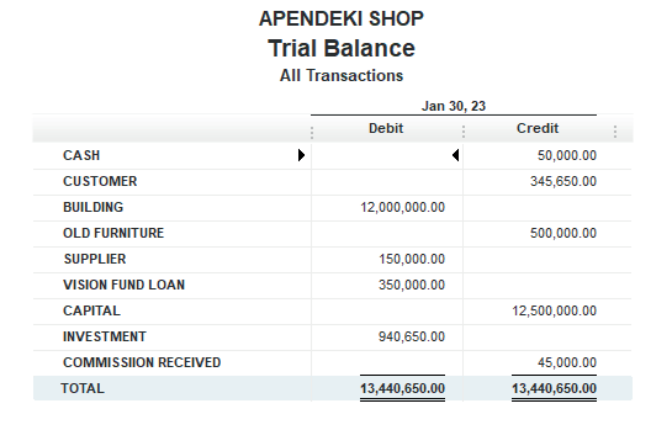

FRW 150,000 paid to suppliersThe Mrs. APENDEKI TRIAL BALANCE will be displayed as below:

Figure 9.1 Trial Balance

Steps to present the cash flow statement

Company file is created

Charts of accounts are created

Transactions are recorded in the journal

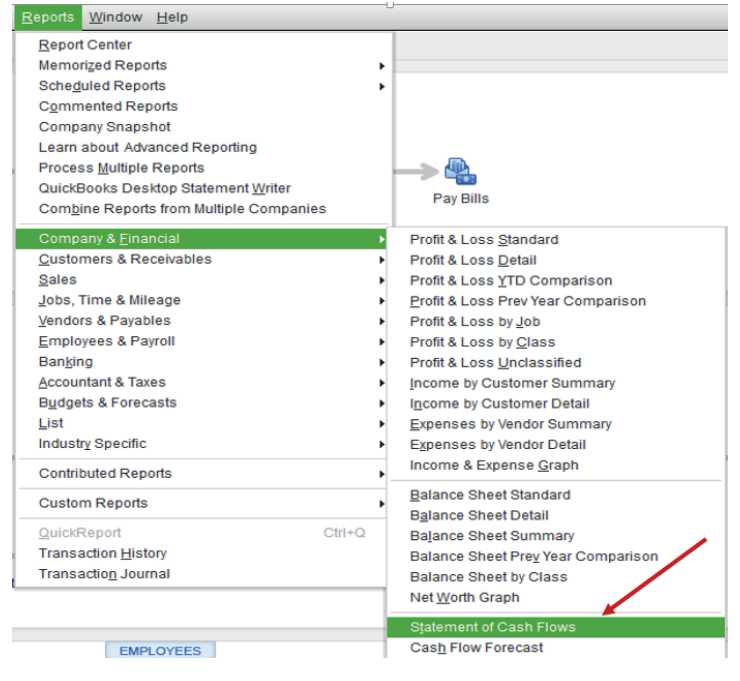

Click on Report on QuickBooks Home page, Company& Financial, thenStatement of Cash Flow.

Figure 9.2 Selection of Cash Flows Statement

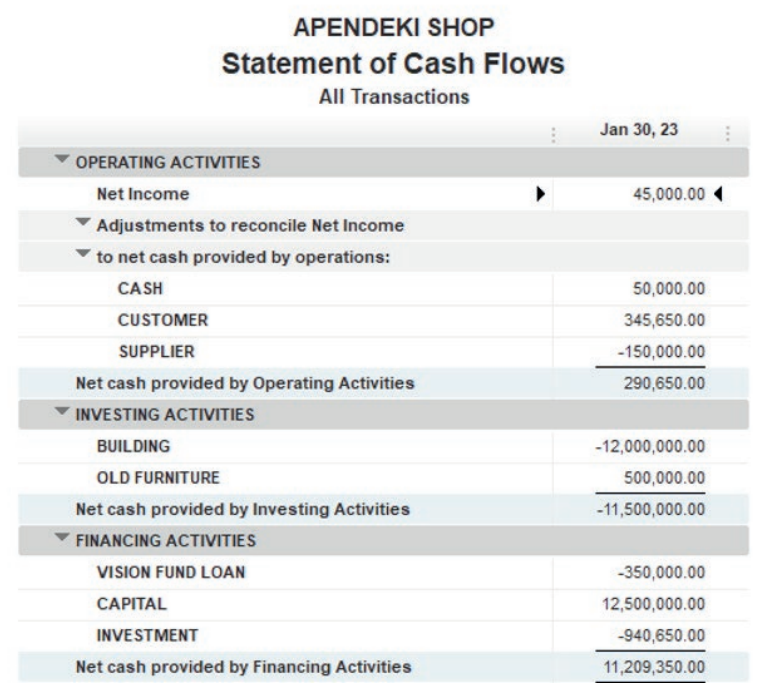

In preparation of cash flow statement, QuickBooks considers the credit side

of trial balance as income (Cash Receipts or cash in). While the debit side

of the trial balance is considered as expenses (Payment or cash out). In cash

flow statement, receipt or income amount are positive figures while payments

or expenses amount have negative figures. The difference between the total

receipt and total payment is NET INCOME. So, the net income for the periodis FRW 45,000.

The Mrs. APENDEKI cash flow statement on 30th January 2023 will be displayed as below:

Figure 9.3 Cash flow statement on 30th January

9.1.3. Surplus and deficit

Surplus: A surplus in cash flow statement is the cash that exceeds the cash

required for day-to-day operations. If cash received by the business during a

certain period is greater than cash paid for the same period, the difference is

positive (positive balance), it is called “surplus”

Deficit: This is a negative cash flow. It is when the business has more outgoing

than incoming money. It indicates that a company has more money moving outof it than into it.

a) How to deal with surplus

Positive cash flow indicates that a company has more money flowing into the

business than out of it over a specified period. This is an ideal situation to be in

because having an excess of cash allows the company to:

– Expand business activities

– Settle debt payments

– Reinvest in itself and its shareholders

– Acquire new fixed assets

– Increase credit sales and decrease cash sales

– Increase cash purchases and decrease credit purchases

Positive cash flow does not necessarily translate to profit, however the business

can be profitable without being cash flow-positive, and you can have positive

cash flow without actually making a profit.

b) How to deal with deficit?

• Increase cash sales and decrease credit sales.• Increase credit purchases and decrease cash purchase

Application Activity 9.1.

1. Define a cash flow statement

2. Differentiate:

a) Surplus from deficit

b) Operating activities from Investing activities

3. Nadine had the following transactions during the year 2020

a) Cash received from customers 32,900

b) Cash paid to suppliers 17,950,000

c) Cash paid to employees 11,250

d) Interest paid 2,100

Required: Prepare Nadine’s cash flow statement for the year ended 31December 2020.

9.2. Statement of profit & loss

Learning Activity 9.2.

To start any business activity, the owner has to invest his money and he

expects the returns from this investment within a certain period. To achieve

this, a number of expenses to run day to day business activities is incurred. The

owner can sometime get additional income from other activities out of the mainbusiness. All of these should be well managed for achieving targets.

1. What do you think will be the components of the statement in which the

owner prepares the results of his investment?2. Discus the effects of this results on the owner investment

It is a financial statement that shows the net profit or net loss that the business

that has been made from all the activities during a financial period. The net profit

(or loss) is determined by deducting all the expenses from all the incomes of

the same financial period. In practice, the trading account is combined togetherwith the net profit and loss account into one report the income statement

9.2.1. Purpose of profit and loss account statement

The main reason why people set up businesses is to make profits. Of course, if

the business is not successful, it may well incur losses instead. The calculation

of such profits and losses is probably the most important objective of the

accounting function. The owners will want to know how the actual profits

compare with the profits they had hoped to make.

Knowing what profits are being made helps businesses to do many things,including:

Planning ahead

• Obtaining loans from banks, other businesses, or from private individuals

• Telling prospective business partners how successful the business is

• Telling someone who may be interested in buying the business how

successful the business is

• Calculating the tax due on the profits so that the correct amount of taxcan be paid to the tax authorities.

9.2.2. Trading account

One of the most important uses of trading and profit and loss accounts is

that of comparing the results obtained with the results expected. In a trading

organization, a lot of attention is paid to how much profit is made, before

deducting expenses, for every sales revenue.

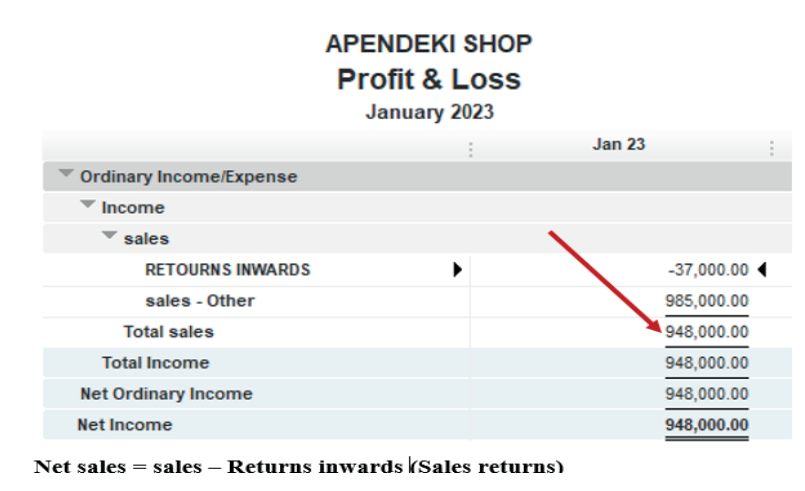

This part consists of Net Sales (The difference between total sales and returns

inwards.) and Cost of goods sold.

Net sales

To find a Net sale in Quick Books, follow these steps:

Company file is created

Charts of accounts are created

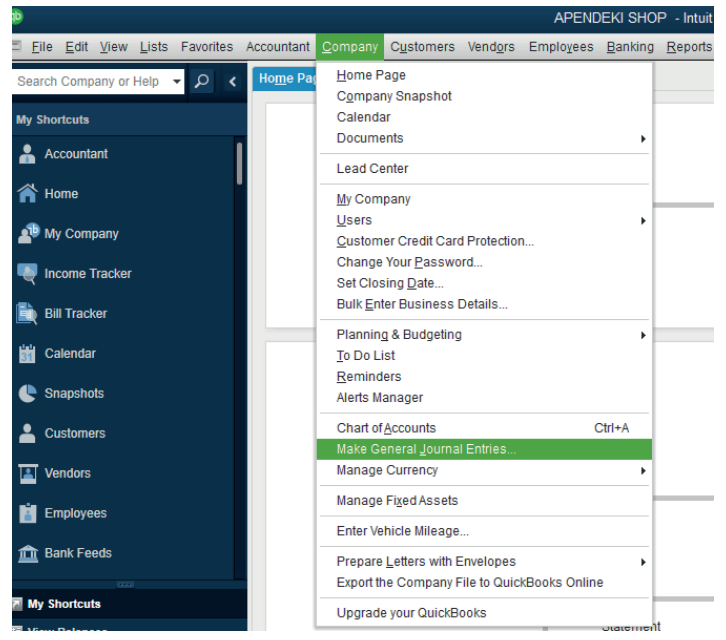

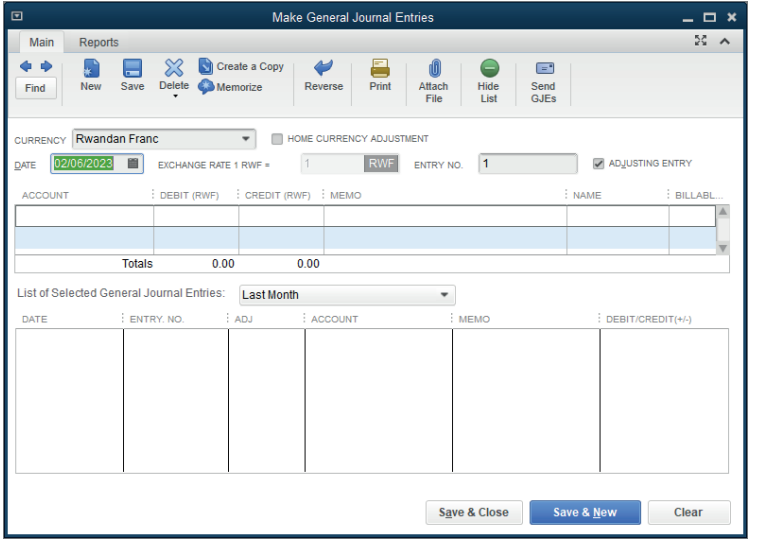

Transactions are recorded in the journalClick on Company and Make General Journal Entries

Figure 9.4 Selection of General Journal Entries

The QuickBooks general journal recording window appears and the userrecords transactions by respecting the rule of double entry.

Figure 9.5 Empty General Journal

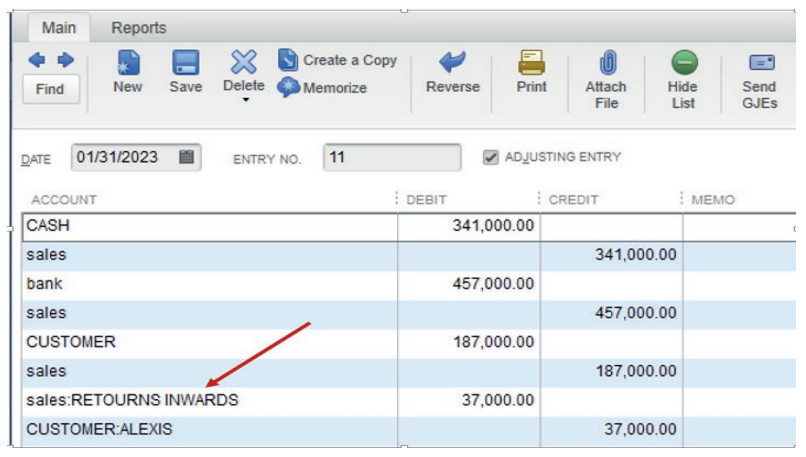

Example:

Mrs. APENDEKI, started her shop with a balance carried down of FRw

12,500,000 cash.

She sold goods as follow:

– Cash: FRW 341,000

– Bank: FRW 457,000

– Credit to Alexis: FRW187,000

– Alexis returned goods valued at FRW 37,000.

Required: Record the transactions above and present the net sales.The records of transactions in the General journal

Figure 9.6 Filled general Journal

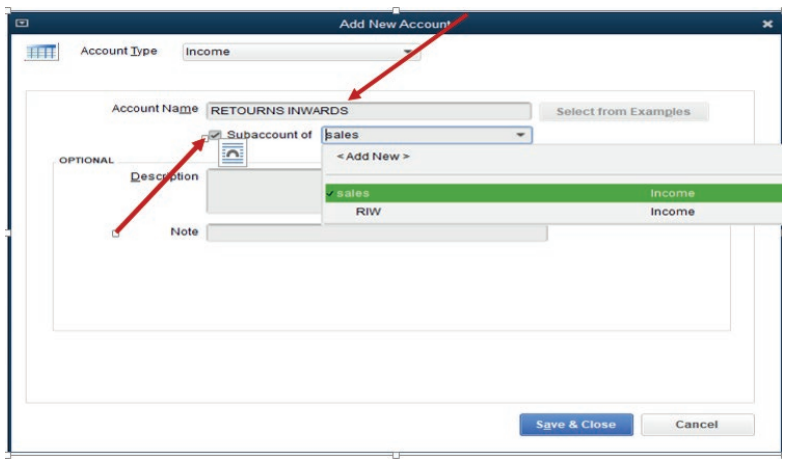

Note: To insure that returns in wards from customer is deducted from Total

sales of APENDEKI, it requires that the account is created in type of Income,Account Name is Returns inwards of course and Sub account of Sales.

Figure 9.7 Returns inwards and Sub account of sales.

Figure 9.8 Result of Net Sales

Cost of goods sold

Cost of goods sold is the total amount the business paid as a cost directly

related to the sale of products. Depending on your business, that may include

products purchased for resale, raw materials, packaging, and direct labor related

to producing or selling the good.

It includes the opening stock, purchase associated with wages and carriage

inwards, minus returns outwards and closing stock. QuickBooks has a type of

account called Cost of Goods sold. The above mentioned are the sub accounts

of Cost of goods sold account.

Example: Let’s add some transactions on the PAENDKI business:

Purchase: By cheque: FRW 25,000, by credit FRW440,000

Purchase return FRW 100,000

Required: Prepare the cost of goods sold and Gross profit

To find the cost of goods sold in Quick Books, follow these steps:

Company file is created

Charts of accounts are createdTransactions are recorded in the journal

Click on Company and Make General Journal Entries

Record the transactions by respecting the rules of double entryClick on Reports, Company and Financials then Profit and Loss Standards

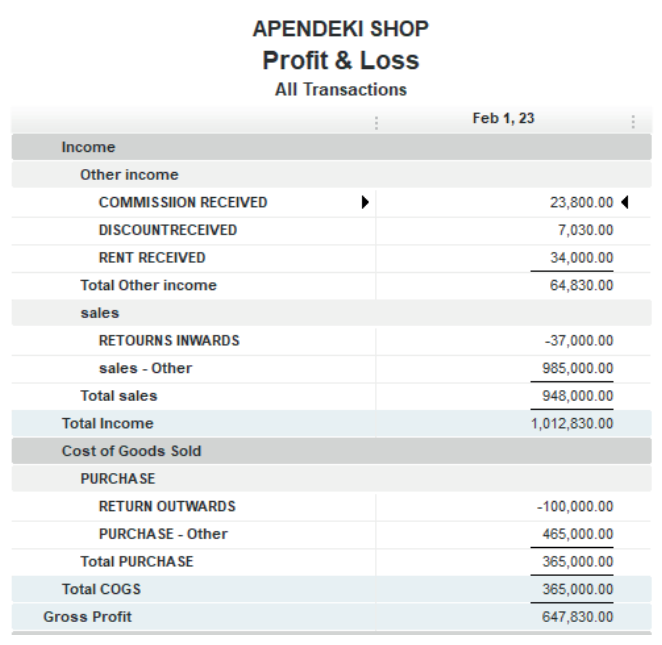

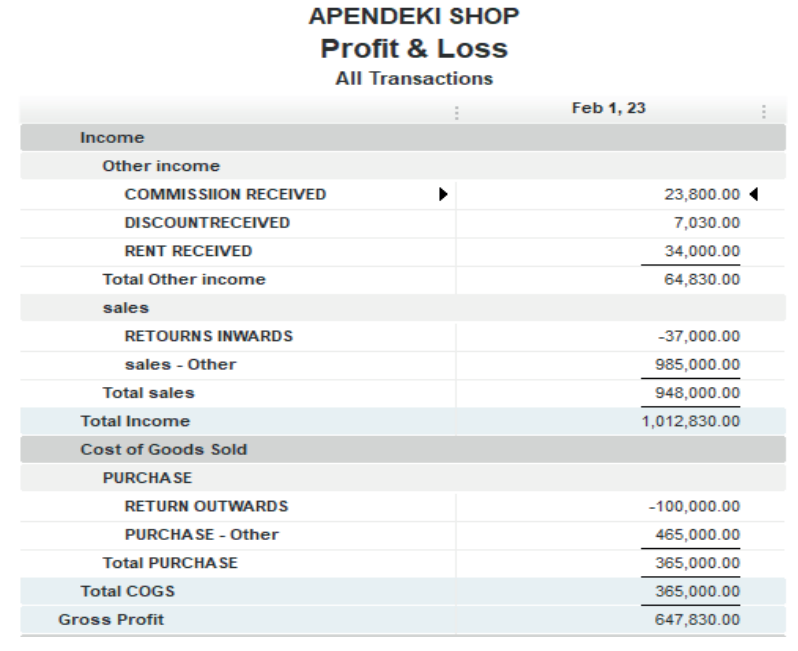

Figure 9.9 Cost of Goods Sold

Gross profit:

The gross profit of a company is the total sales of the firm minus the total cost

of the goods sold. The total sales are all the goods sold by the company. The

total cost of the goods sold is the sum of all the variable costs involved in sales.

Gross profit is the excess of sales revenue over the cost of goods sold. Where

the cost of goods sold is greater than the sales revenue, the result is a gross

loss. By taking the figure of sales revenue less the cost of goods sold to generate

that sales revenue, it can be seen that the accounting custom is to calculatea trader’s profits only on goods that have been sold.

Figure 9.10 Gross Profit

9.2.3. Profit and Loss account

A profit and loss statement (P&L), also known as an income statement, is a

financial report that shows a company’s revenues and expenses over a given

period of time, usually a fiscal quarter or year. It is one of four major statements

in the financial reporting process, and it shows the organization›s net profit or

loss during that time

QuickBooks will provide this financial statement by adding business other income

on the gross profit and subtracting the business total operating expenses.

Business other income

The business can get more additional income which is not from its main activities.

This will be added to the gross profit before subtracting all expenses incurred

during a period. This include:

• Rent received

• Commission received• Discount received…

Let’s add other income on APENDEKI business as follow;

Rent received FRW 34000

Commission received FRW 23800

Discount received FRW 7030

All of other income has been received by cash.

To record the other income in Quick Books, follow these steps:

• Company file is created

• Charts of accounts are created

• Transactions are recorded in the journal

• Click on Company and Make General Journal Entries

• Record the transactions by respecting the rules of double entry

• Click on Reports, Company and Financials then Profit and LossStandards

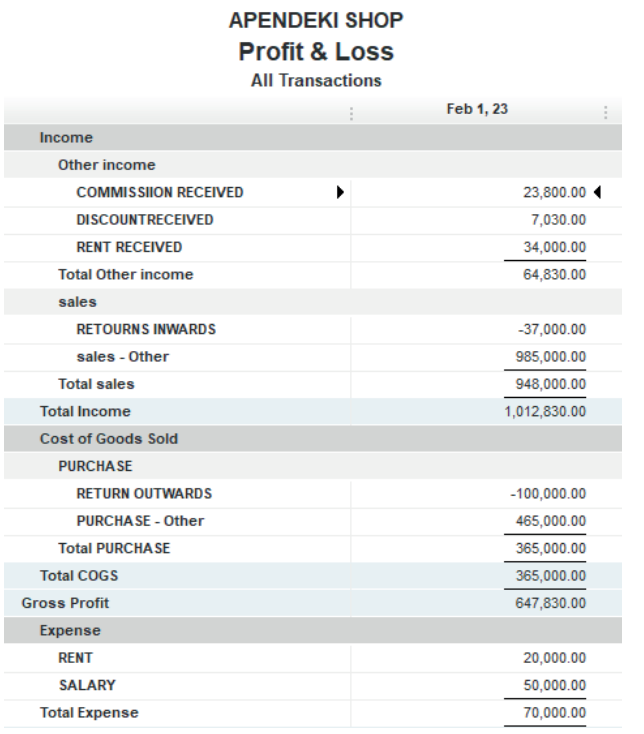

Business operating expenses

Operating expenses, operating expenditures, or refers to the costs incurred

by a business for its operational activities. In other words, operating expenses

are the costs that a company must make to perform its operational activities.

It includes: Salaries, wages, stationeries, bad debts, carriage outwards, rent

expenses, insurance …

Let’s add some expenses on APPENDEKI business

Example: Paid rent of FRW 200,000by cash and salary of her assistant 0f

FRW 50,000 by cheque.

To insert the expenses in Quick Books, follow these steps:

• Company file is created

• Charts of accounts are created

• Transactions are recorded in the journal

Click on Company and Make General Journal Entries

Record the transactions by respecting the rules of double entry (Debiting

expenses and crediting the corresponding account)

Click on Reports, Company and Financials then Profit and LossStandards

The expenses will appear in the income statement as follows:

Figure 9.11.Expense in Income Statement

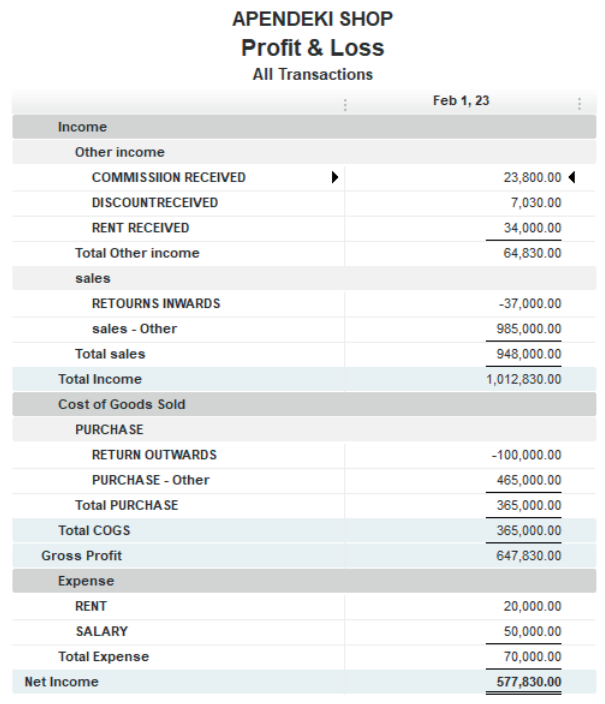

Business Net Income (Profit/Loss)

Net income is gross profit minus all other expenses and costs as well as any

other income and revenue sources that are not included in gross income. Profit

and loss is calculated by taking the total revenue derived from an activity andtaking away the total expenses.

It looks like this: Profit and loss = total revenue – total expenses.

If the resulting figure is negative, the business has made a loss. If it is a positive,

the business has made a profit. Net loss is the excess of expenses overrevenues while Net income is the excess of revenues over expenses.

Figure 9.12 Net Income with the excess of revenues over expenses

The business Net Income is transferred to the statement of financial position.

In case of profit, it increases the owner’s equity while the loss decreases the

owner’s equity.

The APENDEKI SHOP made a profit and it will be transferred to the balancesheet in the next lesson.

Application Activity 9.2.

The transactions below have been extracted from the books of MULINDI

Ltd during the month of February 2020

a. Starting the business with 200,000,000 FRW. A half of it at bank, the

remaining amount cash in hand.

b. Receiving 10,000,000 FRW from BK deposited at the account.

c. Purchasing goods valued at 4,500,000frw by cash.

d. Credit purchase worth 7,800,000frw from supplier JEF.

e. Cash sale worth 12,800,000frw

f. Bought furniture of 364,000 FRW and paid by cash. Carriage inward

was 5,000rwf

g. Returning goods valued at 1,398,000FRWto JEF

h. Payment to JEF worth 3,120,000frw. A discount of 2.5 per cent is

received.

i. Sale on credit to KANYAMANZA WORTH 2,387,500 FRW

j. KANYAMANZA returned goods worth 1,000,000 FRW, he also paid

1,000, 000FRWon the remaining amount and he is allowed a discount

of 5 per cent.

k. Paid wages by cash of 250,500 FRW

l. The insurance is paid by cheque 740,000FRW.

m. Rent received by cheque is 90,450 FRWRecord these transactions and prepare the statement of profit and loss.

End of Unit Assessment

1. What is a statement of Profit and loss2. Complete the table below:

3. List the purpose of statement of profit and loss account

4. The transactions below have been extracted from the file of JYAMBERE

Ltd.

i) Starting the business with Cash: FRW 12,000,000

ii) Bought goods on credit from Anna valued at FRW 8,000,000

iii) Sales of goods on credit to worth FRW 2,000,000

iv) Purchase goods of FRW 2,000,000 to Anna

v) Payment of FRW 2,500 for insurance by cheque

vi) Sales return valued at FRW 1,000,000

vii)Rent received in cashPresent the statement of profit and loss

9.3. Statement of financial position

Learning Activity 9.3.

MUKAMANA, a sole trader at NYAGATARE has the file with the following

information

– Land 4,000,000

– Motor vehicle 5,000,000

– Machinery 4,000,000

– Capital 10,000,000– Long term loan 3,000,000

You are asked to:

1. Show the accounting equation from the given information

2. Which financial statement in which the accounting equation isapplied?

A business owns properties. These properties are called assets. The assets

are the business resources that enable it to trade and carry out trading. They arefinanced or funded by the owners of the business who put in funds.

9.3.1. Assets

An asset is a resource controlled by a business entity/firm as a result of past

events for which economic benefits are expected to flow to the firm.

An example is if a business sells goods on credit then it has an asset called a

debtor. The past event is the sale on credit and the resource is a debtor. This

debtor is expected to pay so that economic benefits will flow towards the firm

i.e. in form of cash once the customers pays. Assets are classified into two

main types:

• Fixed (Noncurrent) assets

• Current assets.

Noncurrent assets: are acquired by the business to assist in earning revenues

and not for resale. They are normally expected to be in business for a period of

more than one year.

Major examples include:

– Land

– Buildings

– Plant and machinery

– Fixtures,

– Furniture & fittings

– Equipment

– Vehicles, …

Current assets: They are not expected to last for more than one year. They

are in most cases directly related to the trading activities of the firm. Examples

include:

– Stock of goods (for purpose of selling).

– Trade debtor’s/accounts receivables (owe the business amounts as a

resort of trading).

– Other debtors (owe the firm amounts other than for trading).

– Cash at bank.– Cash in hand.

In QuickBooks, the assets of the business are presented in balance sheet as

long as the records of transaction took place following the rule of double entry.

Once the user needs to check the business assets, he/she must ensure that:

The company profile is created of course

The charts of account and sub accounts relating to the assets

The proper records

Presentation of the report through reports, Company and Financials then

balance sheet standard

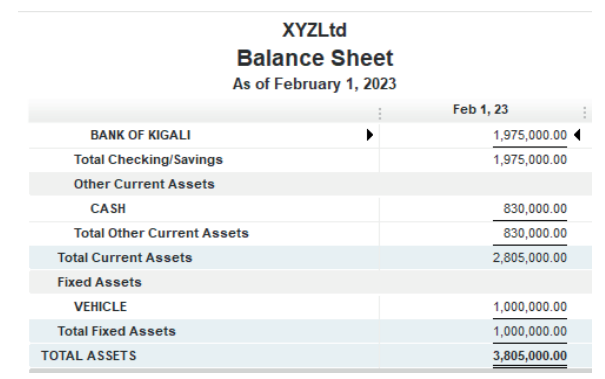

Example: Consider the following transactions extracted from the books on XYX

Ltd as they took place during the month of January 2022.

• FRW 1,780,000 cash invested in business

• Receiving a loan from BANK OF KIGALI: FRW 2,000,000

• Bought vehicle for delivery: FRW 1,000,000 paid by cash

• Drawings from bank: FRW 25,000

• Credit purchase of FRW 45,000 from MUTESI

• Sales on credit worth FRW 98,000 to AGNES

Required: Prepare the balance sheet by showing the total assets, equity and

liabilitiesXYZ Ltd TOTAL ASSETS

Figure 9.13 current assets and Fixed assets

9.3.2. Equity

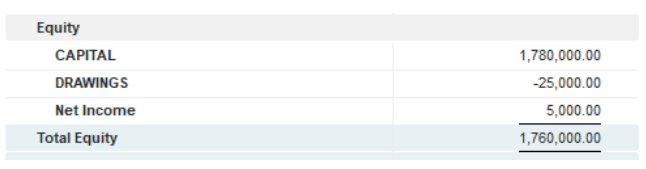

Equity is the net amount of funds invested in a business by its owners, plus any

retained earnings (Net profit): Owner’s equity = capital plus net profit minus

drawings.

This is the residual amount on the owner’s interest in the firm after deducting

liabilities from the assets. It includes: Items like introduced capital, profit/loss

and drawings appear under equity.

Owner’s equity= capital +Net profit/- Loss - Drawings.

The XYZ Ltd equity consists of the capital with it the owner started the business,

the net income from statement of profit & loss and the drawings. It appears asfollows:

Figure 9.14. Total Equity

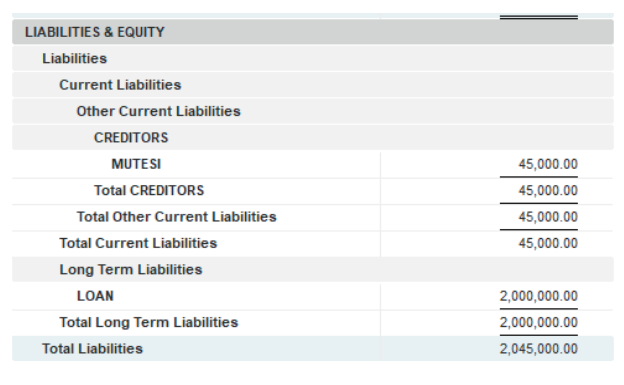

9.3.3. Liabilities

These are obligations of a business as a result of past events settlement of

which is expected to result to an economic outflow of amounts from the firm.

An example is when a business buys goods on credit, then the firm has a liability

called creditor. The past event is the credit purchase and the liability being the

creditor the firm will pay cash to the creditor and therefore there is an out flow

of cash from the business.

– Liabilities are also classified into two main classes.

– Non-current liabilities (or long term liabilities)

– Current liabilities (or short term liabilities

Non-current liabilities: are expected to last or be paid after one year. This

includes long-term loans from banks or other financial institutions.

Example: 4 years loan

Current liabilities: last for a period of less than one year and therefore will bepaid within one year. Major examples:

Trade creditors/ or accounts payable: owed amounts as a result of business

buying goods on credit.

Other creditors: owed amounts for services supplied to the firm other than

goods.

Bank overdraft: (Sundry) amounts advanced by the bank for a short-term

period.

Unearned revenues

Prepaid income

According to the transactions above, XYZ Ltd has a LOAN as long term liabilityand CREDITOR AGNES as current liability. The total liability appears as below:

Figure 9.15. Current liabilities and non-current liabilities

Accounting equation:

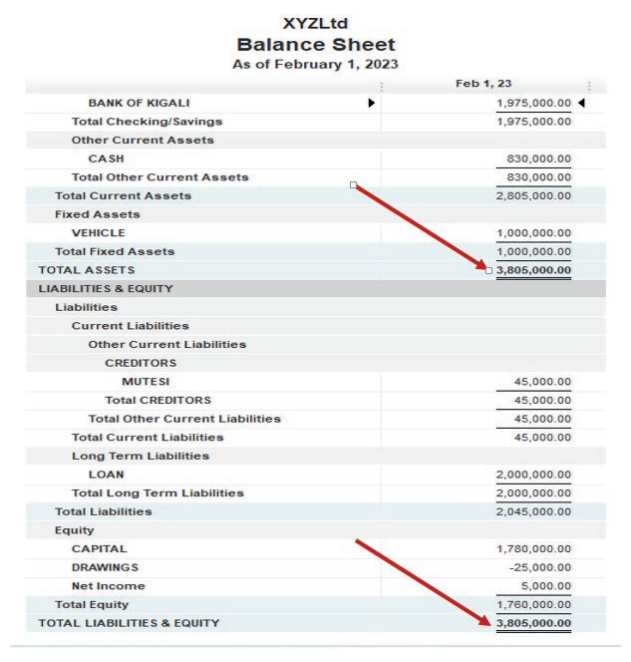

Assets = Liabilities + Owner’s Equity (3,805,000 = (2,045,000 + 1,760,000)

Figure 9.16. Total Liabilities and Equity

Application Activity 9.3.

1. Define the balance sheet

2. Give the main parts of balance sheet3. Explain the effects of Profit or loss on owners’ equity

End of Unit Assessment

1. Define the balance sheet

2. Give the main parts of balance sheet

3. Explain the effects of Profit or loss on owners’ equity

4. The following transactions have been extracted from the books of

ASIFIWE Trading Company:

– On 1st February, 2022 Starting business with RWF 60,000,000 cash

– 2nd February, 2022 Receiving a loan from KCB of RWF 20,000,000

– 8th February, 2022 Buying premises for RWF 1,100,000 by cheque

– 10th February, 2022 Purchasing goods on credit from Peter for

RWF 4,500,000

– 11th February, 2022 Selling goods on credit to KALISA for RWF

6,500,000

– 12th February, 2022 receiving cash from KALISA (full payment

of his debt)Required: Prepare the statement of financial position of the business