UNIT8: BANK RECONCILIATION

Key unit competence: Prepare the bank reconciliation usingQUICKBOOKS

Introductory Activity

KANYANA is hired as an account clerk at IGIHOZO super market. At the end

of the month she finds that there is disagreement between the bank account

balance in cash book and the bank account balance on the bank statement.

a) What do you thing are the reasons behind those discrepancies?

b) What do you suggest as an answer for those discrepancies to

ensure that the balance to be reported in financial statement istrue and fair?

8.1. Meaning of Bank reconciliation

Reconciling a bank statement is an important step to ensuring the accuracy of

financial data. To reconcile bank statements, carefully match transactions on the

bank statement to the transactions in accounting records. With QuickBooks,

the user can easily reconcile bank accounts to ensure that the amount record isconsistent with the amount reported by the bank.

Learning Activity 8.1.

The businesses prepare the cash book to record all receipts and payments

concluded either by cheque or by cash. At the end of and financial period,

this record is compared to the statement of the account by checking the bank

column.What is the document that the business uses to match the two documents?

The cashbook for cash at bank records all the transactions taking place at

the bank i.e. the movements of the account held with the bank. The bank will

send information relating to this account using a bank statement for the firm to

compare.

Ideally, the records as per the bank and the cashbook should be the same and

therefore the balance carried down in the cashbook should be the same as the

balance carried down by the bank in the bank statement.

In practice however, this is not the case and the two (balance as per the bank

and firm) are different. A bank reconciliation statement explains the difference

between the balance at the bank as per the cashbook and balance at bank asper the bank statement.

8.2. The Purposes and causes of a bank reconciliation

statement

1. What is the meaning of bank statement?8.2.1. Purposes

Application Activity 8.1.

2. List the two document involved in preparation of bank reconciliationstatement.

The bank reconciliation statement is prepared for the reasons below:To update the cashbook with some of the items appearing in the bank statement

Learning Activity 8.2.

The accountant of any business has to ensure that the additions and

deductions on the bank statement are compared (or reconciled) with the items

that are entered in company's general ledger, if there are differences, such

as outstanding payments or deposits in transit, they can be noted as timing

differences.

1. How do you think the accountants can deal with this situation?2. Who do you think is committing the errors that cause the differences?

e.g. bank charges, interest charges and dishonored cheques and make

adjustments for any errors reflected in the cashbook.

To detect and prevent errors or frauds relating to the cashbook.

To detect and prevent errors or frauds relating to the bank.

8.2.2. Causes of the differences

The causes of differences are the following:

Items appearing in the cashbook and not reflected in the bank statement.

The following are the causes of imbalance between cash books and bank

statement

Unpresented Cheques: Cheques issued by the firm for payment to the

creditors or to other supplies but have not been presented to the firm’s bank for

payment.

Uncredited deposits/cheques: These are cheques received from customers

and other sources for which the firm has banked but the bank has not yet availed

the funds by crediting the firm’s account. Errors made in the cashbook. These

include:

Payments over/understated

Deposits over/understated

Deposits and payments miss posted

Overcasting and under casting the Bal c/d in the cashbook.

Items appearing in the bank statement and not reflected in the

cashbook.

The items that appear in bank statement but not reflected in cash book ere:

Bank charges: These charges include service, commission or cheques.

Interest charges on overdrafts.

Direct Debits (standing orders)

Dishonored cheques

Direct credits

Interest Income/Dividend incomes

Errors of the Bank Statement (Made By the Bank).

Such errors include:

– Overstating/understating.

– Deposits– Withdrawals

8.3. Steps of reconciliation in QuickBooks

8.3.1. Import transactionsQuickBooks has to be connected to the bank, for importing transactions relating

Application Activity 8.2.

1. What is Bank reconciliation?

2. Complete the following sentences:

a) ……………………………… are cheques issued by the firm for

payment to the creditors or to other supplies but have not been

presented to the firm’s bank for payment.

b) The cheques received from customers and other sources for which

the firm has banked but the bank has not yet availed the funds by

crediting the firm’s account are called ………………………………….

3. In which cases the bank can dishonor a cheque? Mention at least 4

cases.

4. It is normal that the bank makes some mistakes that leads to the differencebetween cash book and bank statement. List three of these mistakes.

to the bank. When the user receives the bank statement or account statement

at the end of the month, he can start reconciling the accounts. QuickBooksorganizes all data for making bank reconciliation easily.

Learning Activity 8.3.

To reconcile the bank balance as shown in the bank statement (pass book)

with the balance shown by the cash book, Bank Reconciliation Statement is

prepared. After identifying the reasons of difference, the Bank Reconciliation

statement is prepared without making change in the cash book balance.

You are required to discuss the process in which the bank reconciliationstatement should be prepared.

8.3.2. Reconcile accounts

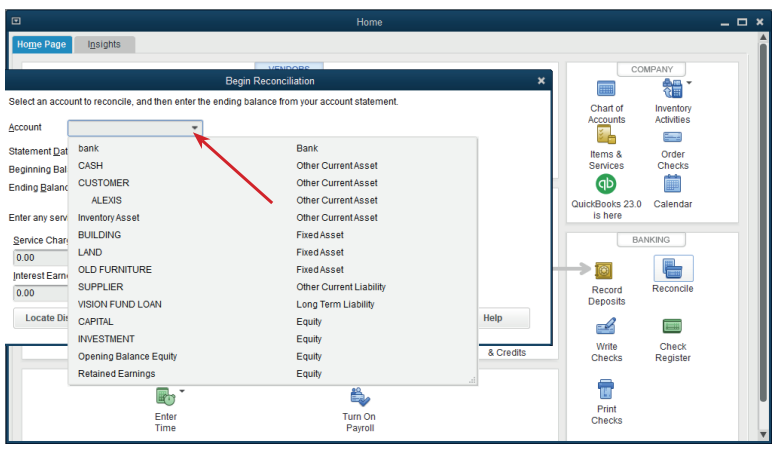

To reconcile the accounts, the user clicks on Reconcile icon on QuickBooksHome Page. It gives the following window.

Through this window, the user selects the account to be reconciled by clicking

on the account field. A list of account appears.

In QuickBooks, choose the account to reconcile.

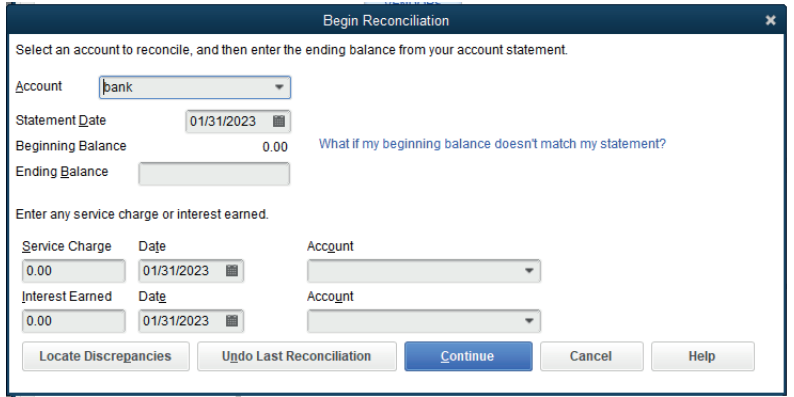

The bank account is selected to be reconciled, the window below appears:

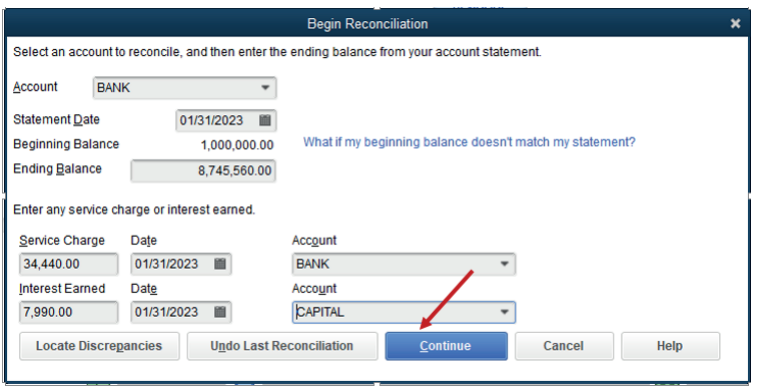

From this window, the user fills the required field including selection of date

at which the reconciliation is taking place, Beginning and Ending balance,

Service charge and the Account which is charged, Interest earned if anyand the Account that receives the interest.

After filling these fields, the user can click on Continue

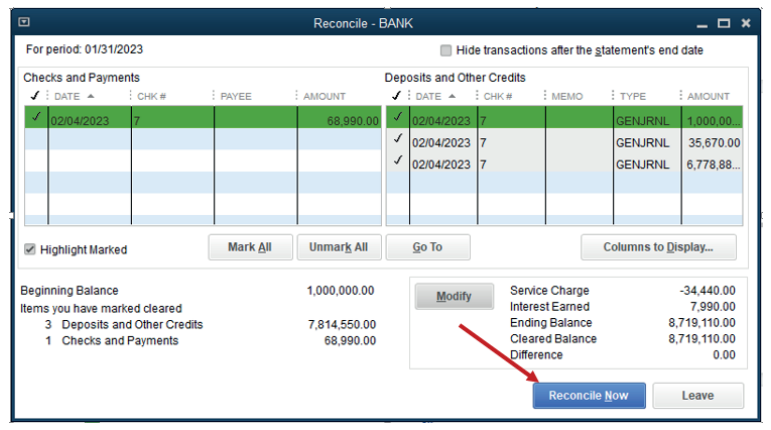

QuickBooks will let the user check data on his bank account and asks to

reconcile.

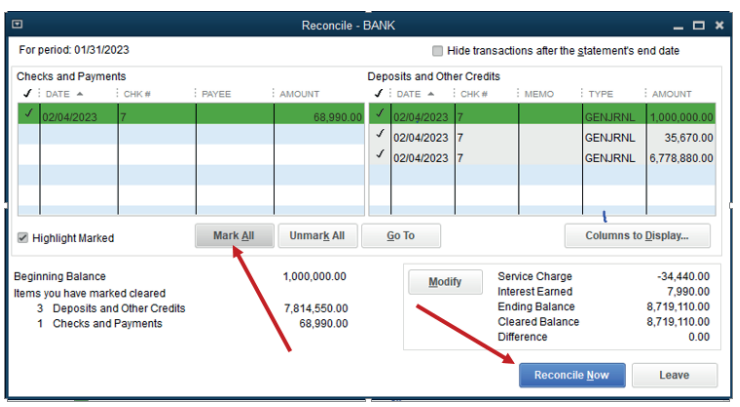

Before reconciliation, the user will make sure that all transactions are selectedby clicking on Mark All.

With bank statement in-hand, the user can systematically check off matching

transactions one-by-one by clicking their boxes.

The bottom of the screen contains a running total of items checked off, and

thus have been reconciled. This is useful for comparing the totals in books to

the totals on bank statement. To complete the reconciliation, make sure thedifference shown is zero.

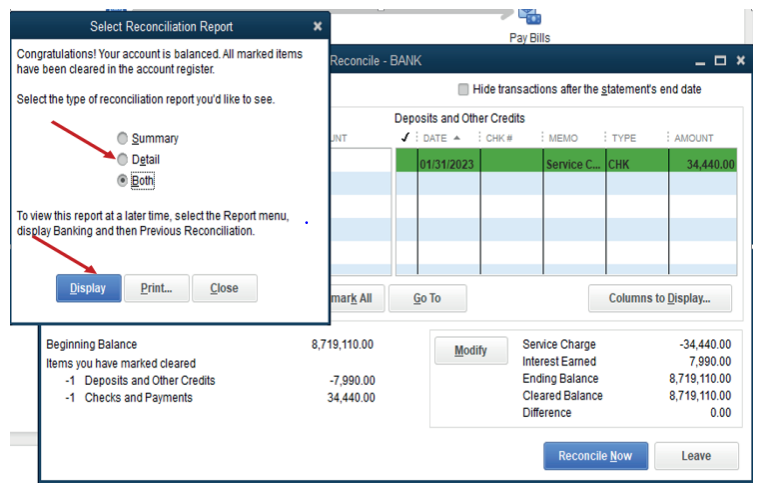

Here, a click on reconcile Now, QuickBooks gives to the user an option to

Here, a click on reconcile Now, QuickBooks gives to the user an option to

Display the reconciliation report. The user can also choose the type of reportto display being either Summary, Details or Both.

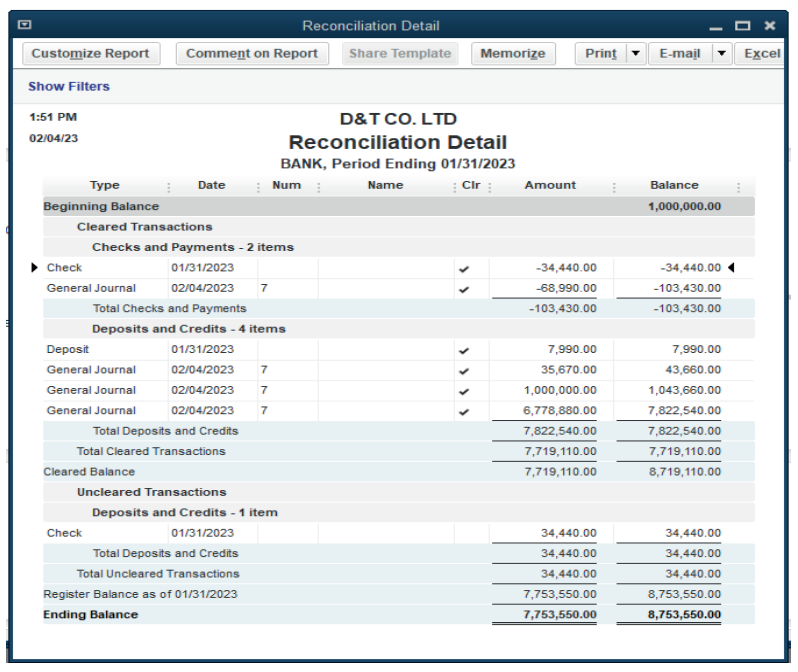

Let’s display a Details report here under:

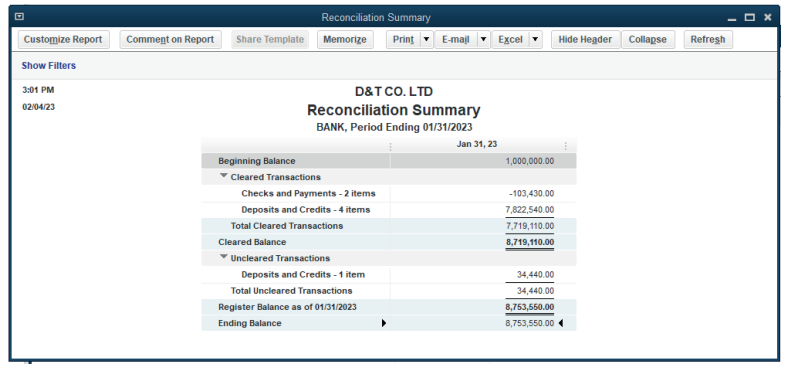

If the user selects to display the summary reconciliation, it appears as follow:

Sometime the user can reconcile and there is a remaining difference which is

not zero.Application Activity 8.3.

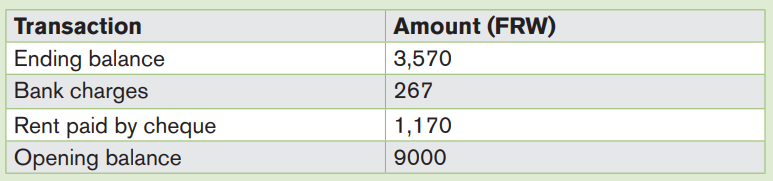

Form the information below, prepare and display the bank reconciliationDetails period ending at 31/01/2023

End of Unit Assessment

1. What is meant by a Bank Reconciliation statement?

2. What is the need of preparing Bank Reconciliation statement?

3. Enumerate the causes of difference in the balance of cash book and

bank statement.

4. From the following particulars, prepare Bank Reconciliation statement

as on December 31, 2022.

Opening bank balance: FRW 42,000

Ending balance:

The ending balance is a result of the transactions below:

i) Starting business with FRW 1,000,000 at bank

ii) Purchase of goods by cheque: FRW 550,000 FRW

iii) Sales by cheque: FRW 765,000

iv) Interest earned: FRW 90,150

v) Commission paid: FRW 12,490vi) Interest charges: FRW 4,215