UNIT7: ACCOUNTING METHODS

Key unit competence: Operate using either cash or accrualmethods of accounting in QUICKBOOKS

Introductory Activity

MAHORO, a young entrepreneur in MUSANZE district is willing to prepare the

financial reports through QuickBooks and the issue is that he does not know

exactly which accounting method to use and why to use such method.

He always deal with a number of suppliers and customers, paid and unpaid

expense, income paid, unpaid and accrued.

Help him to understand the accounting methods so that he can choose one ofthem to use in his business.

Cash-basis or accrual-basis accounting are the most common methods for

keeping track of revenue and expenses. Yet, depending on your business

model, one approach may be preferable. You will need to determine the bestbookkeeping methods and ensure your business model meets requirements.

7.1. Accrual basis accounting

Learning Activity 7.1.

MUGWANEZA, a sole trader in GATSIBO uses to record the financial

transactions using accrual accounting method. He records every transaction

even the ones which do not flow cash out and in. This affects its final statements

in one way or another. What do you thing is the importance and disadvantagesof this system of recording?

Businesses that use accrual accounting recognize income as soon as they

raise an invoice for a customer. And when a bill comes in, it’s recognized as an

expense even if payment won’t be made for another 30 days.

7.1.1. Benefits of accrual accounting method

The accrual accounting method helps the users in the following ways:

• You have a much more accurate picture of business performance and

finances

• You can make financial decisions with far more confidence

• It can sometimes be easier to pitch for long-term finance

7.1.2. Downsides of accrual accounting

In the other ways, the accrual method should have the disadvantages to

the users:

• It’s more work because you have to watch invoices, not just your bank

account

• You may have to pay tax on income before the customer has actually

paid you

• If the customer reneges on the invoice, you can claim the tax back onyour next return

Application Activity 7.1.

1. Explain the accounting accrual method.

2. List down the advantages and disadvantages of accrual accountingmethod.

7.2. Use accrual methods to Display statements

Learning Activity 7.2.

It is necessary that the accountant prepares the final statements and present

them to the different users. The company should choose the accounting

method to use while presenting such report. Advise to the company manageron the accrual method of accounting.

In quick books software, the reports are prepared and when are to be presented,

the user will select which accounting method to use depending on the business

policy.

Example: TOM AND DON Ltd, RWAMAGANA DISTRICT, PO BOX 1245

RWAMAGANA, and Tel; 0788393737, had the transactions below:

The company started the business with 5,000,000 Frw on bank of Kigali

Purchase of 200 kgs of rice by cheque of 1,000,000 Frw

Credit purchase from creditor Tom 4,000,000Frw

Sales: cash: 1,200,000 Frw, Cheque: 345,000 and credit sales to BUNANI:

2,387,500

Bought land by cash 1,800,000 Frw

Returning goods of 1,000,000 Frw to Tom

Paid 10, 000 Frw of salaries by cheque

Cash drawings Frw120,000

Received rent income by cheque: Frw 31,200,000

Required: Present the income statement and balance sheet using Accrual

method.

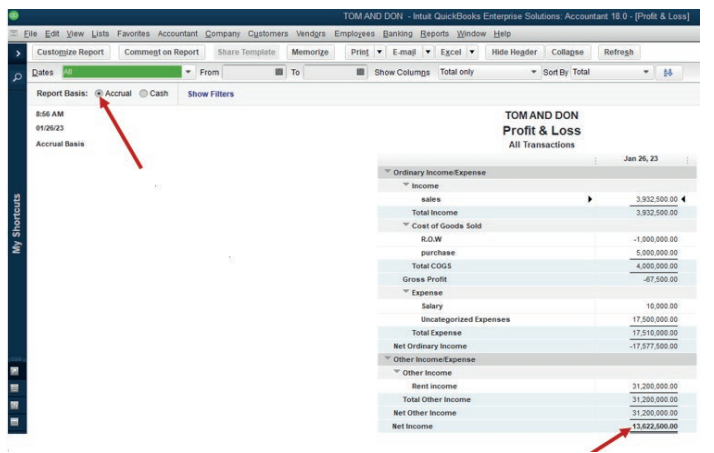

For Income statement presentation, Click on Reports, Company & Financials

then Profit & Loss Standard. From these transactions, quick books reports are

presented as here under: (Accrual method).Accrual method, TOM AND DON Trading, profit and loss account.

Figure 7.1 Income statement

The statement of profit and loss account shows the net income of 13,622,500

as revenues and expenses are recognized once they occur.

This income statement is prepared with consideration of paid and unpaid

expenses, received and not yet received income.

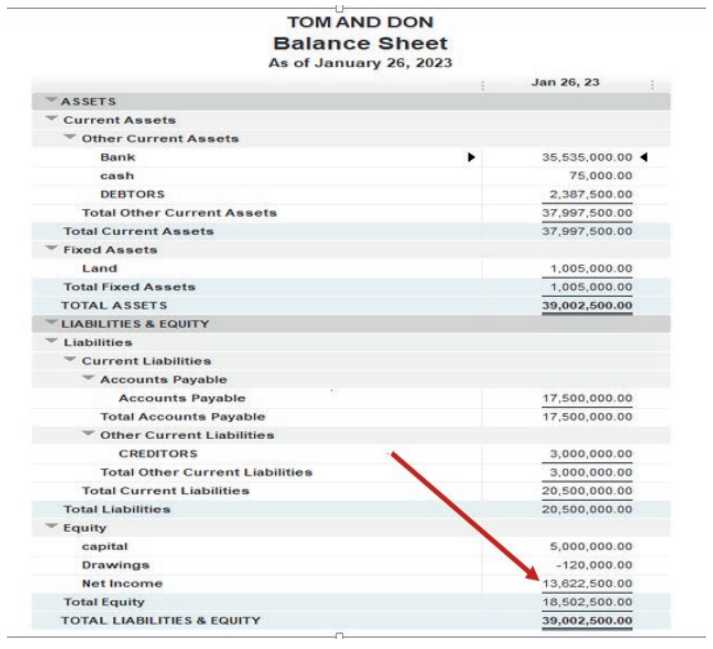

Under the same method, the net income is transferred to the balance sheet in

equity section. It may appear as here under:TOM AND DON, Accrual method balance sheet

Figure 7.2 Accrual method balance sheet

Application Activity 7.2.

The following transactions are for BERWA LTD for the month of October

2021.

Oct. 1: Started business with FRW 20,000,000 cash

Oct. 2: Purchase land for the business at FRW 3,000,000 by cash

Oct.4: Purchased office equipment on credit from Equipment Suppliers

Ltd at FRW 2,000,000

Oct. 5: Obtained bank loan of FRW 8,000,000 it was deposited to a

bank A/C

Oct.15: Made part payment of FRW 1,500,000 to Equipment Suppliers

Ltd by cheque.

Oct. 17: Bought motor vehicle from TOYOTA RWANDA at a cost of FRW

15,000,000

Present BERWA LTD Balance sheet and income statement displayed usingaccrual method.

7.3. Cash method

Learning Activity 7.3

In accounting, sometimes business owner decides to use cash method in

recording business financial transactions.Businesses that use cash basis accounting recognize income and expenses• Discuss the reason behind this decision.

only when money changes hands. They don’t count sent invoices (debtors) as

income, or bills not yet paid as expenses until they’ve been settled.

Despite the name, cash basis accounting has nothing to do with the form of

payment you receive. You can be paid electronically (cheques or debit and

credit cards) and still do cash accounting. The cash method is most-commonly

used by sole proprietors and businesses with no inventory.The cash accounting method helps the users in the following ways:7.3.1. Benefits of cash accounting

It’s simple and shows how much money you have on hand

You only have to pay tax on money you’ve received, rather than on invoices

you’ve issued, which can help cash flowIn the other ways, the accrual method should have the disadvantages to the7.3.2. Downsides of cash accounting

users

It’s not accurate: it could show you as profitable just because you haven’t paidyour bills

It doesn’t help when you’re making management decisions, as you only have a

day-to-day view of finances

The accounting repots are always prepared through one of these methods. The

results of the reports prepared from the same transactions but the different

methods are different due to the income and expenses considered once accrual

accounting method is used, which may not appear in the reports prepared using

cash accounting method. Let’s use the same transactions, but cash accounting

method to prepare income statement and balance sheet of TOM AND DON Ltd.

Example: TOM AND DON Ltd, RWAMAGANA DISTRITC, PO BOX 1245

RWAMAGANA, Tel; 078304050, had the transactions below:

The company started the business with 5,000,000 Frw on bank of Kigali

Purchase of 200 kgs of rice by cheque of 1,000,000 Frw

Credit purchase from creditor Tom 4,000,000Frw

Sales: cash: 1,200,000 Frw, Cheque: 345,000 and credit sales to BUNANI:

2,387,500

Bought land by cash 1,800,000 Frw

Returning goods of 1,000,000 Frw to Tom

Paid 10, 000 Frw of salaries by cheque

Cash drawings Frw120,000

Received rent income: Frw 31,200,000

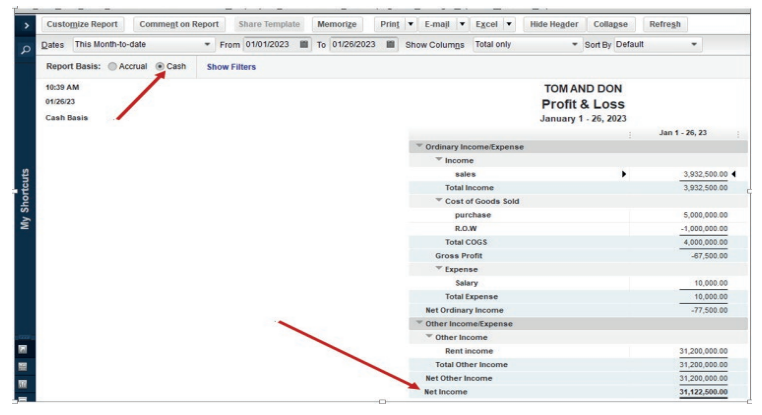

Required: Present the income statement and balance sheet using Cash methodTOM AND DON, Trading, profit and loss account cash method

Figure 7.3 Income statement with Cash method

The statement of profit and loss account shows the net income of 31,200,000

as revenues and expenses are recorded once received or paid.

This income statement is prepared with consideration of paid expenses, and

received income. There is an increase in net income, from FRW 13, 6322,500

to FRW 31,122,500 due to the fact that there is an unpaid cash as long as the

method considers to record cash out once it is transferred to the payee.

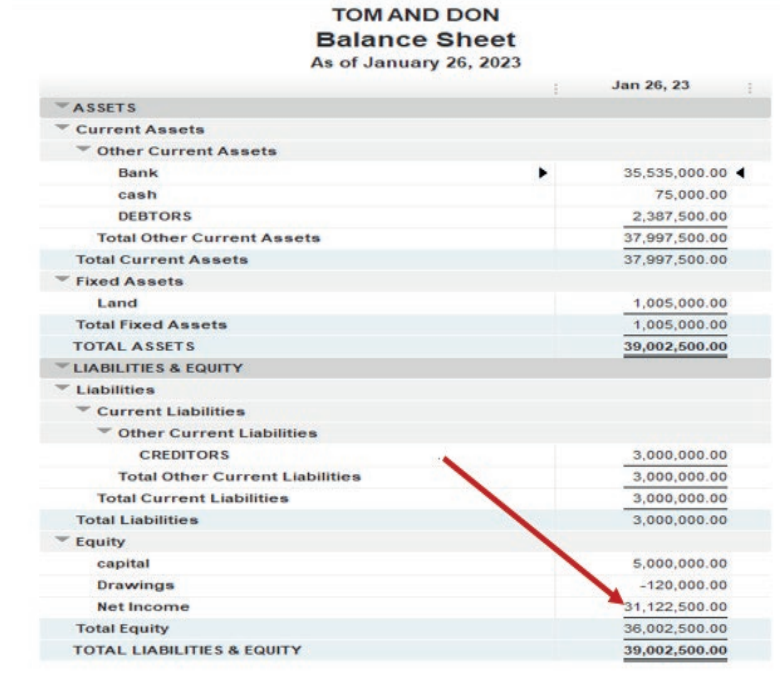

Under the same method, the net income is transferred to the balance sheet in

equity section. It may appear as here under:Cash method, TOM AND DON Trading, Balance sheet

Figure 7.4 Balance sheet with cash method

Completing reconciliations is a critical monthly task that ensures that QuickBooks

company records match the banking records. This gives the confidence that

business books are accurate so that the user can trust the reports created forthe business and others.

Application Activity 7.3.

HOPE SHOP started with its operations with 100,000 Frw on bank of Kigali.

During the month, the following transactions took place.

• Purchase of goods by cheque of 70,000 Frw and purchase on credit

of 60,000 FRW from MUNYABARAME

• Credit sales to Peter of 50,000 FRW

• Cash sales of 55,000 FRW

• Sales by cheque of 65,000 FRW

• Returning goods of 25,000 FRW to MUNYABARAME and at the same

date, Peter returned goods of 15,000 FRW to us.

• Paid 1, 000 FRW of salaries by cheque

Required:

Present HOPE SHOP Balance sheet and income statement prepared

using cash method.

Present the general journal, trial balance, income statement andbalance sheet.

End of Unit Assessment

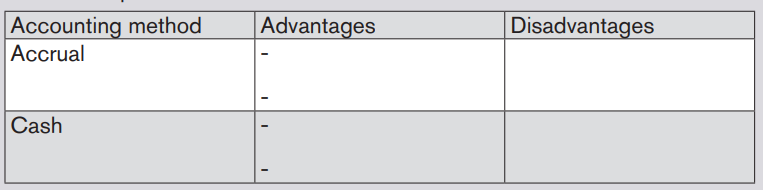

1. Differentiate between cash and accrual method of accounting2. Complete the table below:

3. The following transactions have been extracted from the book of

MANEMATALE Ltd

a) Starting the business with

i. Cash: 12,000,000

ii. Bank: 8,000,000

b) Getting a loan from BK 4,000,000

c) Bought goods on credit from Anna valued at 8,000,000

d) Sales of goods on credit to worth 2,000,000 to Ruth

e) Returning goods of 2,000,000 to Anna

f) Payment of the total amount due to Anna by cheque

g) Ruth returned goods to us valued at 1,000,000

h) Cash payment from Ruth for the total amount due from her.

• Present the income statement and balance sheet using cash

method of accounting

• Present the income statement and balance sheet using accrual

method of accounting