UNIT6: FINDING AND CORRECTING OMISSION AND MISSTATEMENTS

Key unit competence: Correct errors in the account balancesusing QUICKBOOKS

Introductory Activity

Mr NGOGA Frank is an accountant in ABC Ltd. During the month of November

2022, he recorded and posted the following transactions:

• Purchase of goods valued at 34,000 Frw by cash and he debited both

purchase and cash account.

• Taking goods worth 12,500 Frw for his own use and no entry has been

made

• The company sold the unused part of its land, the accountant debited

land and credited sales account.

• Cash banked FRw. 390 had been credited to the bank column and

debited to the cash column in the cashbook.

• Cash drawings of FRw. 400 had been credited to the bank column of

the cashbook.

In preparation of final report, some imbalances occurred.

a) For each case, show whether the transaction is posted correctly

b) What do you think is the causes of the imbalance?c) How can this be solved?

Recording transactions, posting to the various accounts and extraction of list of

account balances, it is possible for errors to be committed. Such errors may or

may not affect the totals of the list of account balances. Recall that if the totals

of the list of account balances equal, then this shows arithmetical accuracy in

recording and posting of transactions.

Now it should be said, this does not mean non-existence of errors. It is possible

for some errors not to affect the totals being equal for the list of account

balances. Some errors can affect too the total of list of account balances. For

those errors that affect the trial balance, quick books detect them before endingthe recording process.

6.1. The errors that do not affect the trial balance: Error ofomission, Error of Commission, Error of principle

Learning Activity 6.1.

After all transactions have been posted from the journal to the ledger, it is a

good practice to prepare a trial balance. A trial balance is simply a listing of the

ledger accounts along with their respective debit or credit balances for self check to determine that debits equal credits.

Do you agree with the statement that if the debit side of trial balance is equal

to the credit side of trial balance, there is no error committed in postingtransactions? Discuss your answer.

In Accounting, errors refer to the common mistakes made while recording

or posting accounting entries. These discrepancies are not fraudulent and

generally unintentional. Errors that do not affect the List of account balances

(trial balance) are the ones that totals of the list of account balances equal each

other.

However, on taking a close check on the balances and transactions posted,

errors may have been made and therefore the balances shown on the list of

account balances may be incorrect. Quick books cannot detect such errors.The following errors will not affect the totals of list of account balances

6.1.1. Error of omission

Here, a transaction is completely omitted from the accounts and therefore the

double entry is not made.

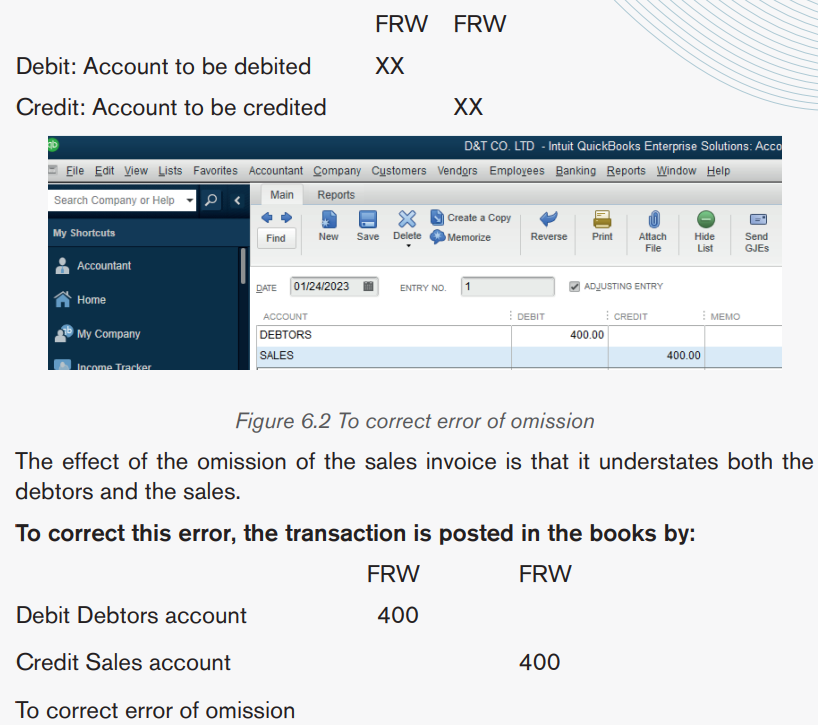

For example, a sales invoice of Frw 400 is not posted in the sales journal

therefore no entry is made in the debtor’s account and the sales account. That

is both debit of Frw 400 in debtor’s account and credit of Frw 400 in the salesaccount.

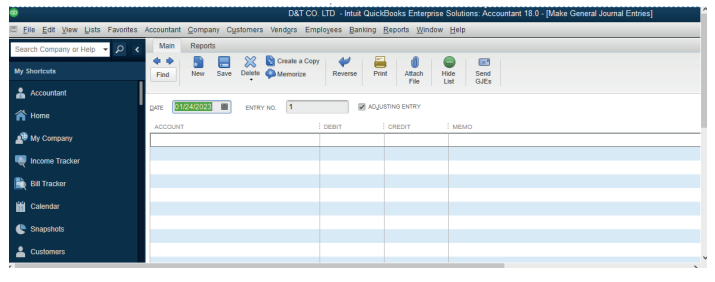

Figure 6.1. Error of omission. No entry is made.

6.1.2. Error of Commission

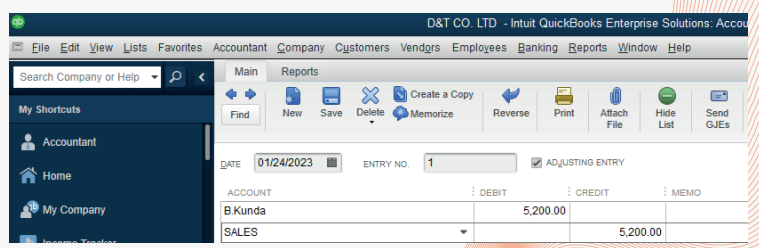

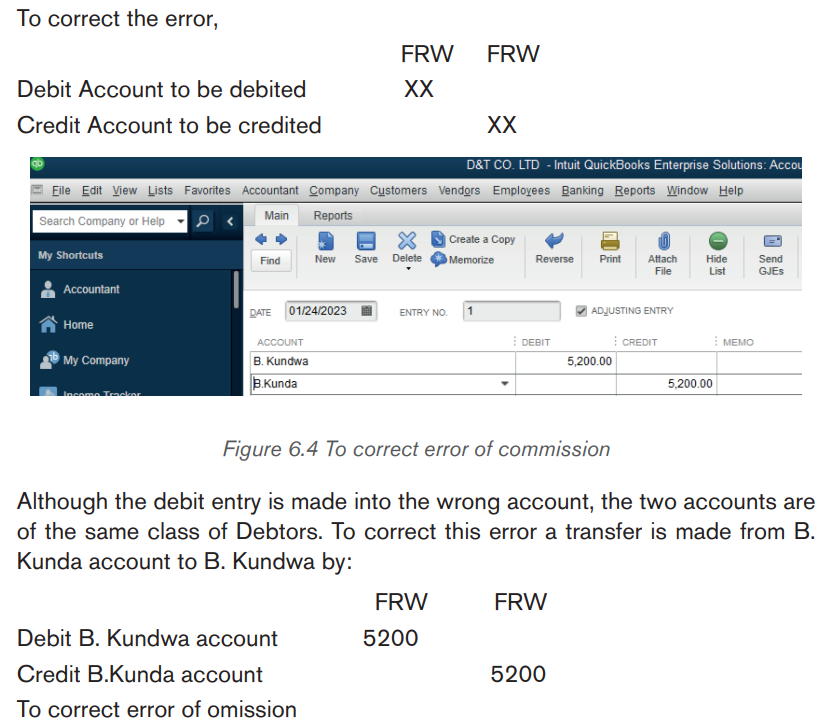

This error occurs when a transaction is posted to a wrong account but the

account is of the correct class of account. Example: A credit sale to B. Kundwa

is posted to B. Kunda’s account for an amount of Frw 5200. Instead of a debit

to B. Kundwa account it is made to B. Kunda’s account and the corresponding

credit in the sales account is correct.

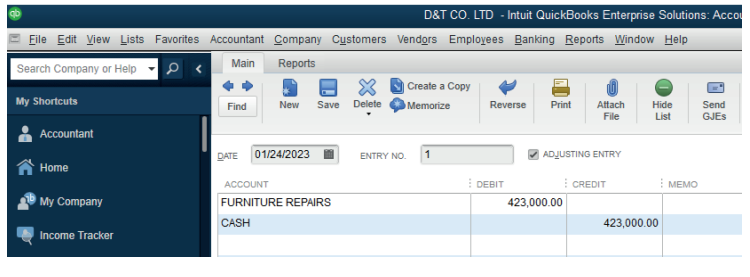

6.1.3. Error of principle

This type of error occurs when a transaction is posted to the wrong class of

account. For example, Furniture purchased for FRw 423,000 cash is debited

to the Furniture repairs account instead of debiting Furniture account, and thecredit entry in the cashbook is correct.

Figure 6.5: Error of principle

The furniture is a non-current asset, and a furniture repair is an expense.

Therefore a capital expenditure has been posted as revenue expenditure.

To correct such an error, the amount in the wrong class of account has to beremoved and transferred to the right class of account.

Figure 6.6 To correct the error of principle

Application Activity 6.1.

1. Explain;

a) Error of omission

b) Error of commission

c) Error of principle

2. The information bellow is from the books of Nelly. You are required to

record them in the journal of Nelly by correcting the errors committed.

a) Cash sales worth 29,000 FRW has never been recorded

b) Cash Payment of stationary has been recorded correcting in cash

and debited in salary account: 10,000 Frw

c) Furniture purchased for FRw 423,000 cash is debited to the

Furniture repairs account instead of debiting Furniture account, andthe credit entry in the cashbook is correct.

6.2.The errors that do not affect the trial balance: Completereversal, Error of Original entry, Compensating Errors

Learning Activity 6.2.

It is human nature to commit some errors especially in recording financial

transactions. This causes the imbalance in some list of account and requiresadjustment. Suggest some of such errors

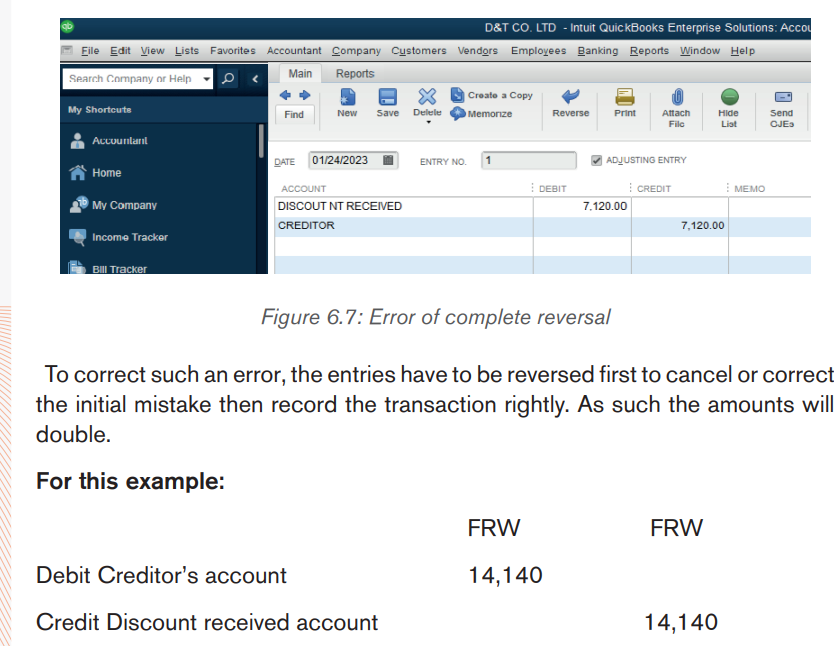

6.2.1. Complete reversal

A transaction is posted to the correct accounts but to the wrong sides of the

accounts. That is a debit posted as a credit and a credit is posted as a debit in

the right accounts. For example, discount received of FRw 7,120 is debited inthe Discount received account and credited in the Creditor’s account.

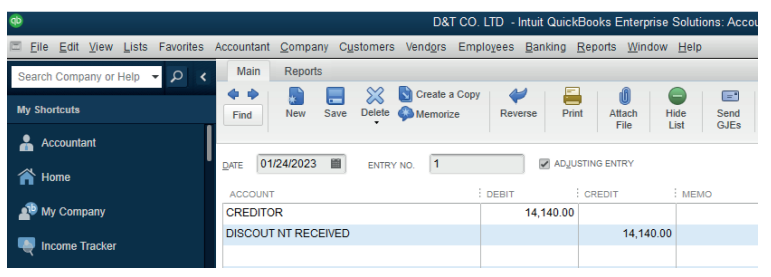

Figure 6.8 To correct error of complete reversal.

Notice: The account to be debited is debited twice and account to be creditedis credited twice too.

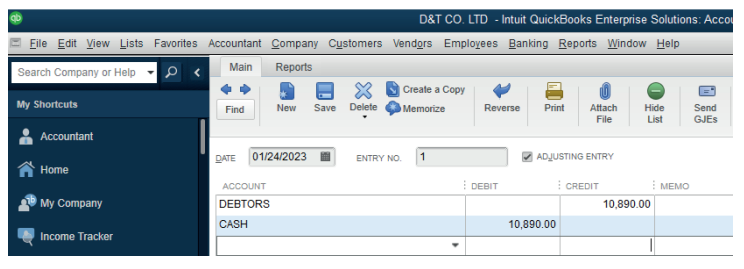

6.2.2. Error of Original entry

Here a transaction is posted to the correct accounts but the amount posted is

not correct. That is, it is either under/over stated. It is possible that the figure in

the amount might be interchanged. Such is a transposition error.

For example, cash received from a debtor of Frw 10,980 is posted to both

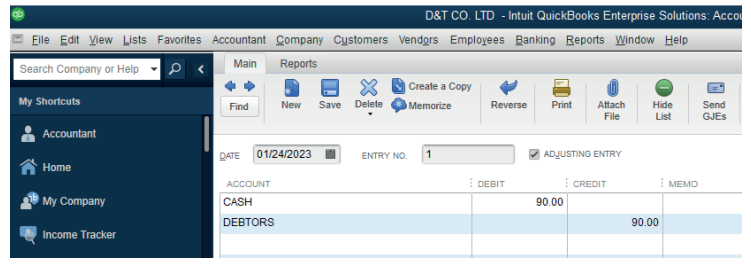

debtor and cash account as Frw 10,890. The amounts were understated byFrw 90

Figure 6.9 error of original entry

To correct this error, the amount understated or overstated is posted to these

accounts so as to increase or reduce the amounts in the accounts to get theright amount.

For this example:

FRw FRw

Debit Cash account 90Credit Debtors’ account 90

Figure 6.10 To correct the error of original entry

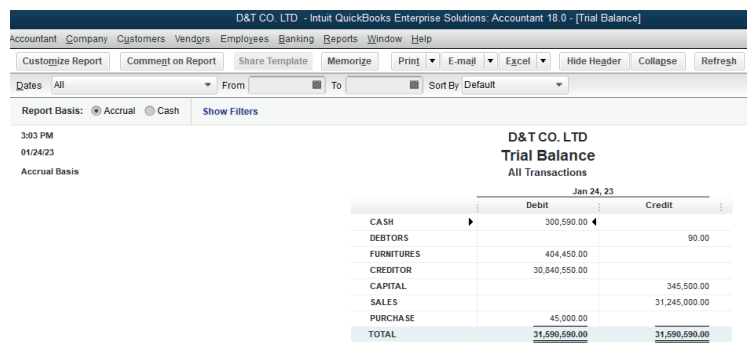

6.2.3. Compensating Errors

These are errors that have the effect that tend to cancel out each other in

amounts. That is, if the effect of one error is to understate the debits or credits

then another error may take place to overstate the debits or credits by the same

amount, hence canceling out each other.

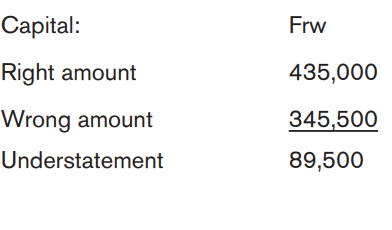

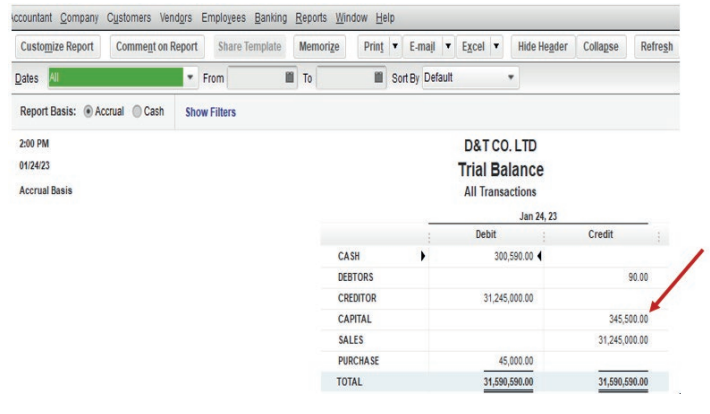

For example, if the balance of bank account is Frw 435,000 but shown in thetrial balance as FRw 345,500.

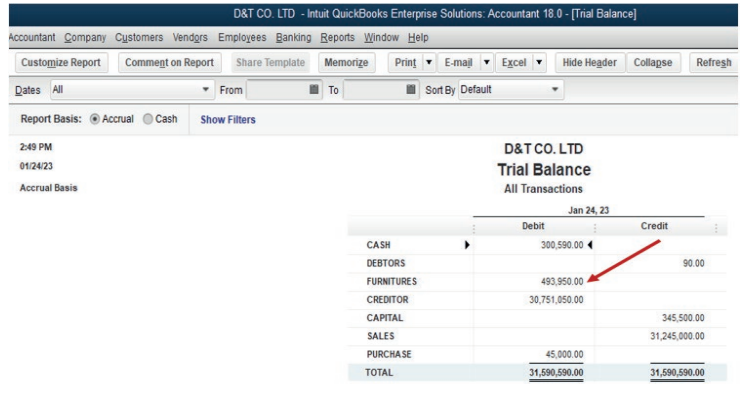

Figure 6.11 Company trial balance capital account overstated.

The balance C/D of capital is Frw 435,000 but it is recorded in the general

journal as Frw 345,000. It has been under casted by Frw 89,500. This undercast

affected both the capital account on its credit side and the debit side of cash

account with the same amount.

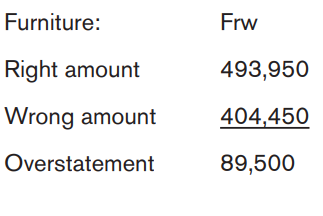

Another error carried to the trial balance of furniture account amounting to FRw493,950 instead of Frw 404,450

Company trial balance. Furniture account overstated.

The balance of furniture account is Frw 404,450 but it is recorded in the

general journal as Frw 493,950. It has been overstated by Frw 89,500. This

overstatement affected both the furniture account on its debit side and the

credit side of creditors account with the same amount.

The overall effect is nil on the debit side. Notice that the two accounts involved

have debit balances. It is possible to have canceling effect even accounts with

credit balances or even a mixture. The main thing is that, the effect on totals is

nil.

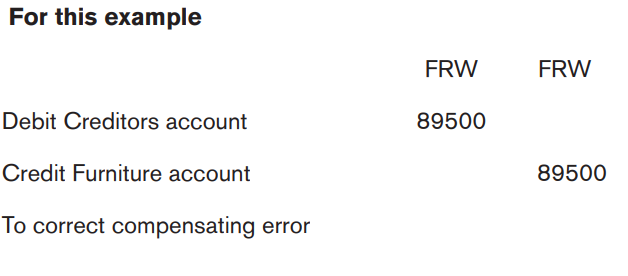

To correct such errors, the accounts involved have to be corrected to take careof the amounts overstated.

The corrected trial balance will look like the following:

Figure 6.12 Corrected trial balance

Application Activity 6.2.

Give the journal entries needed to record the corrections of the following.

i) Extra capital of FRw. 10,000 paid into the bank had been credited to

Sales account.

ii) Goods taken for own use FRw. 700 had been debited to General

Expenses.

iii) Private insurance FRw. 89 had been debited to Insurance account.

iv) A purchase of goods from C Kelly FRw. 857 had been entered in the

books as FRw. 587.

v) Returns inwards FRw. 168 from M McCarthy had been entered in error

in J Charlton’s account.vi) A sale of a motor van FRw. 1,000 had been credited to Motor Expenses.

6.3. Errors that affect the trial balance

Learning Activity 6.3.

After all transactions have been posted from the journal to the ledger, it is a

good practice to prepare a trial balance. A trial balance is simply a listing of the

ledger accounts along with their respective debit or credit balances for self

check to determine that debits equal credits.

What can you do in case the credit side of trial balance totals does not matchwith the debit side total of credit balance?

6.3.1. Understanding the errors that do not affect the trial balance

These errors will affect the totals of the list of account balances. That means

that the arithmetical accuracy of accounts will be in doubt. The totals of debit

balances will not equal the totals of credit balances

The likely causes may be as follows:

Transaction amount is posted only on one side of the accounts.

A transaction is posted only on one side of both accounts.

A transaction is posted correctly following double entry but different amounts

Error on balances of accounts.

Balance on an account is shown on the wrong side of the account when opening

the ledger accounts or when taken up to the trial balance.

A balance is omitted from the trial balance.

6.3.2 Correction of errors that affect trial balance

To correct such errors, only one account will be needed. The other account to

fulfill double entry will be the suspense account.

Suspense account is a temporary account that is opened to take care of

differences between the total in the list of account balances. This account can

also be used in case a bookkeeper does not know the other account to debit or

credit. Once the other account is known then it is debited or credited and the

corresponding entry to be in the suspense account.

While correcting the error, the difference in the totals of the list of account

balances is placed in the suspense account pending correction. During

correction, one account to be corrected is debited or credited then the suspense

account is credited or debited respectively.

The balance to be shown on the suspense accounts depends on which side of

the list of account balances has the lower total.

If the debits totals exceed total credits, then an amount is included on the credit

side of the list of account balances so that the debits equal credits and is called

Suspense account. This is a credit balance and will be taken to the suspense

account on the credit side.

If the credits totals exceed total debits, then an amount is included on the debit

side of the list of account balances so that the debits equal credits. This is a

debit balance and will be taken to the suspense account on the debit side.

The errors that affect trial balance are automatically detected in quick booksoftware and it cannot allow the next step.

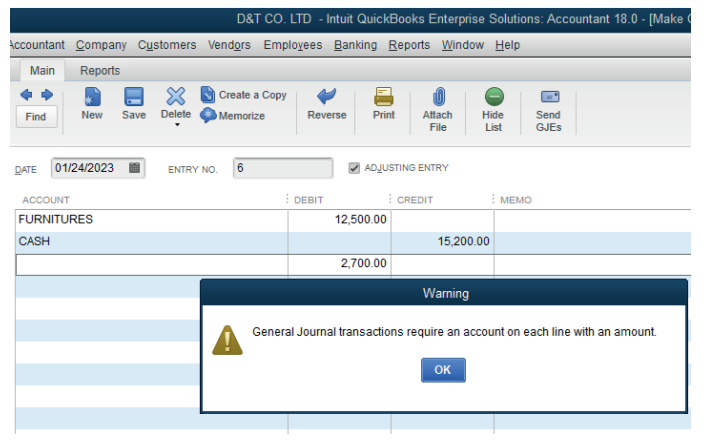

Example of recording the transaction with error

Purchase of furniture valued at Frw 12,500 by cash.

A transaction is posted correctly following double entry but different amounts.

It means:

Debit Furniture account by 12,500

Credit cash account by 15200

Click on save & close or Sane & new,

There is a difference of Frw 2,700 which the software requires to handle beforenext step.

Figure 6.13 Error affecting Trial Balance

Application Activity 6.3.

1. What is an error?

2. Give two examples of errors that do not affect trial balance.3. How do we handle the error that do not affect trial balance?

End of Unit Assessment

1. When posting an invoice for car repairs, FRW 870,000 was entered

on the correct side of the motor expenses account. The invoice was

for FRW 780,000. What correction should be made to the motor

expenses account?

i) Debit FRW 90,000

ii) Credit FRW 90,000

iii) Debit FRW 1,650,000

iv) Credit FRW 1,650,000

2. The following transactions have been extracted from the books of TBB

Ltd on 31 December 2020 that failed to agree.

In January 2021 the following errors made in 2020 were found:

a) Cash banked FRw. 390 had been credited to the bank column and

debited to the cash column in the cashbook.

b) Sales of Frw 2,500 to J Church had been debited in error to J Chane

account.

c) Returns inwards FRw. 168 from M McCarthy had been entered in

error in J Charlton’s account.

d) Discounts received account had been under cast by Frw 3,000.

e) The sale of a motor vehicle at book value had been credited in error

to Sales account Frw 3,600.You are required to show the journal entries necessary to correct the errors.