UNIT5: PURCHASES AND PAYABLES

Key unit competence: Apply the rules of cash, cheques, credit

sales and account receivable transactionsin QUICKBOOKS

Introductory Activity

Mr. MUGISHA has a shoes shop. He uses to purchase from different suppliers

on credit basis and then pay after selling.

1. Explain the credit purchase

2. Advise him on process of recording transaction be recorded inQuickBooks?

5.1. Credit purchase transactions

Learning Activity 5.1.

DUFATANYE SOTRE is engaged in sales of fruit and vegetables in

KIMISAGARA market. The customers in the morning purchase on credit for

paying in the evening after selling.

• Advise the DUFATANYE SOTRE on the ways of recording its daily sales

• If DUFATANYE SOTRE needs to use QuickBooks in recording, explainto its accountant the steps of creating a sales invoice

The term “credit purchase” refers to a situation where a buyer or a customer

conclude a purchase of goods or service from the supplier and promises to pay

on future date. It is a purchase transaction on the side of the buying entity but asales transaction on the side of the seller.

When goods or services are bought by a business on account or on credit

for reselling later, we can then say that Credit Purchases have taken place in

accounting. As with purchases, credit purchases can be used to by goods and

services however these are on credit or on the account.

Due to the credit purchase, an account receivable and an account payable are

then created. The account payable is the current liability for the buyer, and they

will pay the supplier at an agreed later date. The buyer should record it as a

Credit Purchase.

From the viewpoint of the supplier, they should record it as an account receivable,

it will be considered a current asset and it should be recorded in AccountsReceivable Subsidiary Ledger.

5.1.1. Record a credit purchase

A credit purchase transaction starts with the purchase order. A purchase order

is a document written buy the buyer to the seller just ordering him/her to supply

ordered good or services. A supplier who receives a order from the buyer try

to deliver goods or services which can be paid either directly or in future date.In QuickBooks, a credit purchase transaction is recorded as here under:

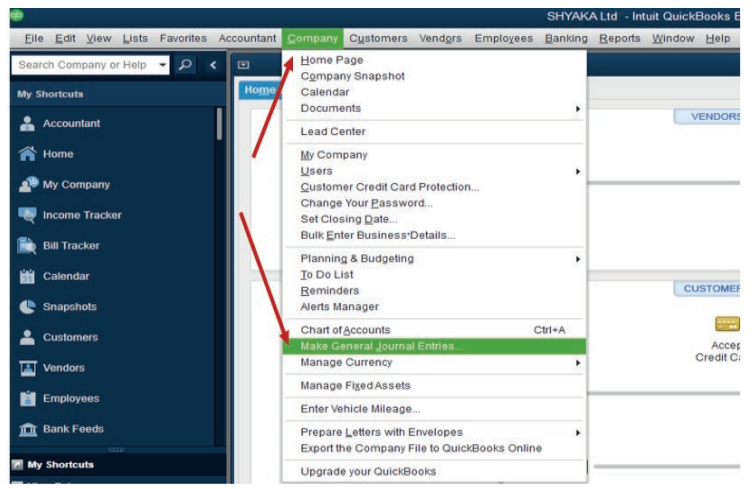

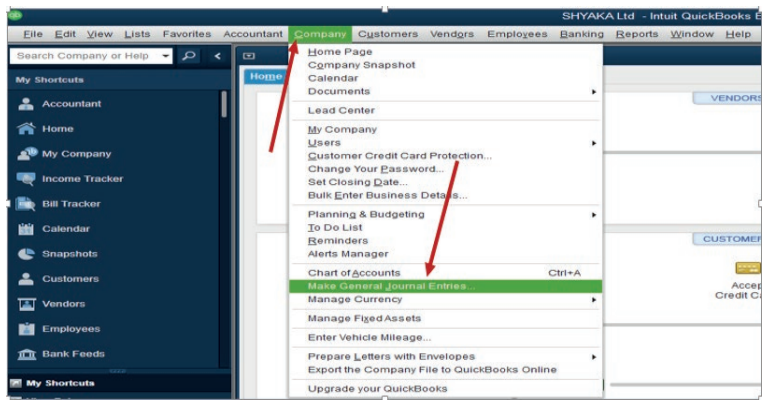

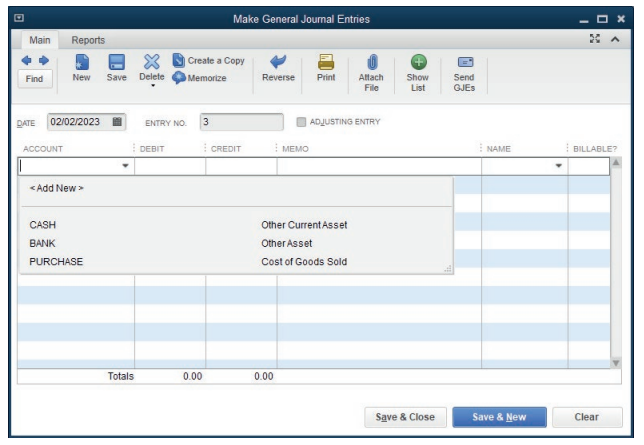

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries.

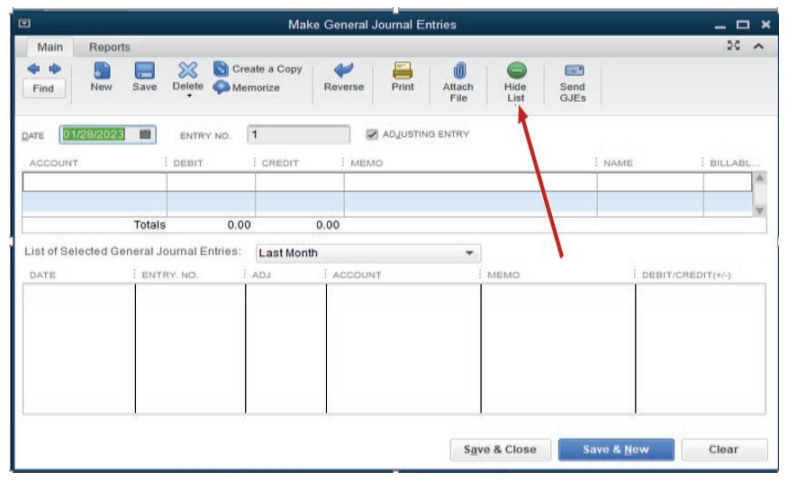

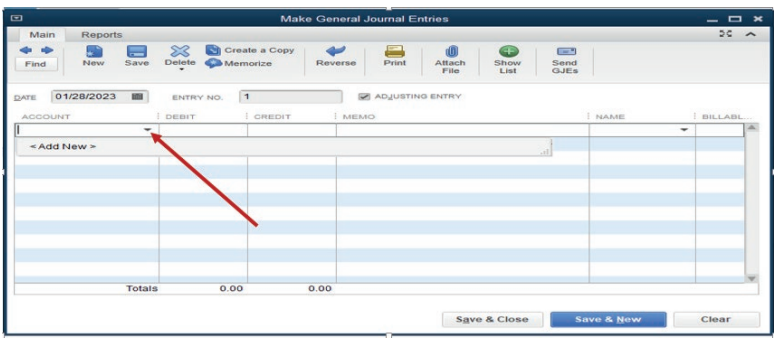

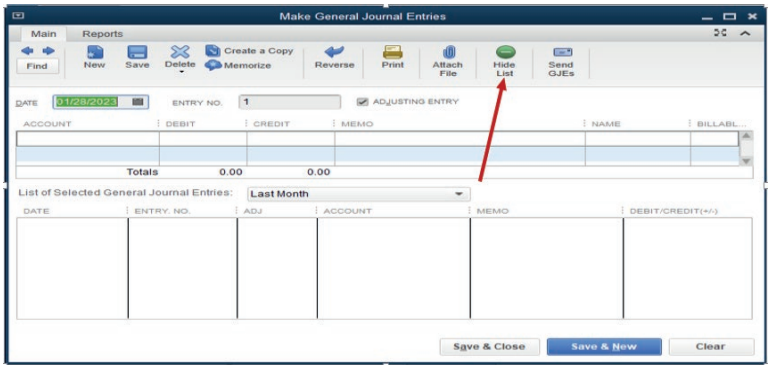

Step2. Complete the general journal

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear space for recording, thebottom part should be hidden by clicking Hide List

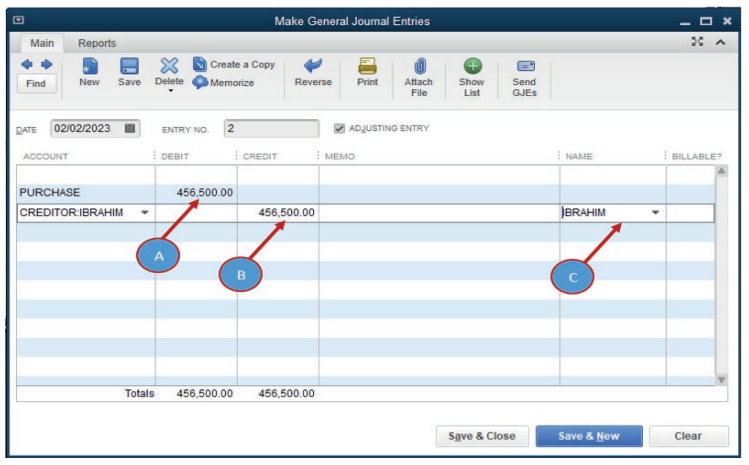

Example: SHYAKA Ltd started its business activities in January 2022. During

January the purchase transactions concluded with all of its creditors is valued

at FRW 456,500. To record this transaction in the general journal, of course the

creditors and purchase account are already created in the chart of account. Ifnot QuickBooks gives an option to add new account while recording.

Debit purchase account: 456,500Credit creditors account: 456,500

As there is no debtors and sales accounts created in chart of account, we

can add them by the normal way of account creation, account type, continue,

account name then Save&Close or Save&New. Through this, a debtor

account is created and debited with FRW 125,000. Sales account is createdand credited with the equivalent amount.

A. A debited account (purchase)

B. A credited account (Creditor)C. Name of supplier

In case there is specific customer name, it can be added on the name column

for clarifying who is the debtor.A purchase transaction is recorded, then Save &Close

5.1.2. Purchase invoice

A purchase invoice is an invoice used to record the purchase of goods or

services by a company. The purchase invoice will include the same information

as a regular invoice, but it will also list the terms of the purchase agreement and

any discounts that were negotiated.

An invoice is issued by the seller (or vendor) upon completion of the terms as

outlined in the purchase order. An invoice includes the previously agreed uponprice that the buyer should pay now that the order has been completed.

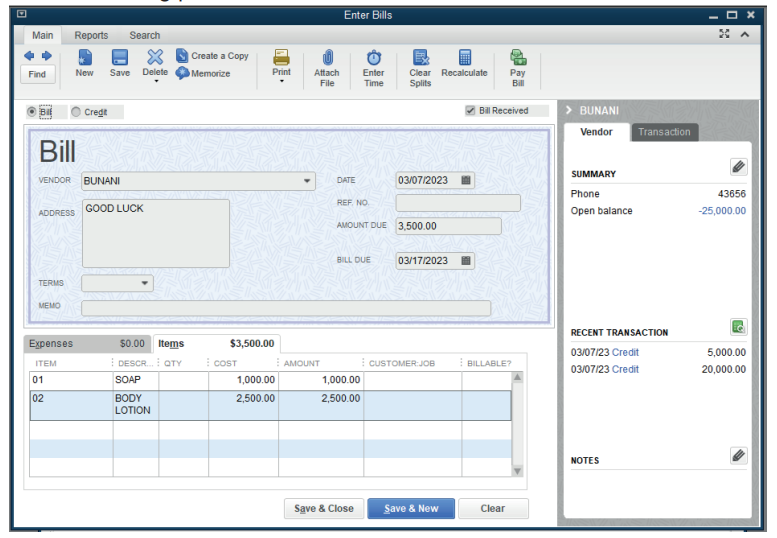

In QuickBooks, if goods or services are received by the company from the

vendor, an invoice is checked for ensuring the conformity with order and paid

later. The following is the purchase invoice from vendor that details the itemsreceived for being paid.

This is a purchase invoice entered in the QuickBooks for being paid.

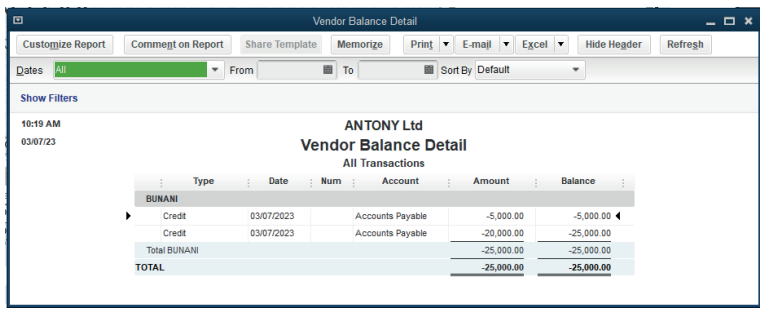

The company keeps the purchase invoice valued at 25,000FRW to be paid to

ANTONY Ltd for soaps and body lotion purchased on credit.

Application Activity 5.1.

1. Define a credit purchase transaction

2. What are the account affected by any business credit purchase

transaction?

3. MUGEMANA, a sole trader in Bushenge market purchased goods

valued at 743,980FRW on credit from supplier GATO.Record this transaction in his general journal.

5.2. Cash/ Cheque purchase transactions

Learning Activity 5.2.

JACKY SHOP uses to purchase goods and services and pays directly for

keeping its current assets free from liabilities.

• Is there advantages of purchasing by cash? Explain to Jacky.• Advise her to the recording of cash purchase.

A cash purchase transaction is a transaction where there is an immediate

payment of cash for the purchase of goods or services.

The common definition of a cash transaction is an immediate payment for

the goods or services bought. However, the term can have diverse meanings

because some time cheques or payment cards are used to pay goods orservices and it is always considered as a cash transaction.

5.2.1. Record a cash purchase

A cash purchase transaction affects two accounts: Cash /bank which is debited

as it is an increase in current asset and the sales account which is credited as

it is an income.

In QuickBooks, a cash purchase transaction is recorded as here under:

Step 1. Click on company menu on QuickBooks home page, then select MakeGeneral Journal Entries

Step2. Complete the general journal

The first part of the window is for double entry and the bottom part shows the

number of transactions concluded. For having a clear field for recording, thebottom part should be hidden by clicking. Hide List

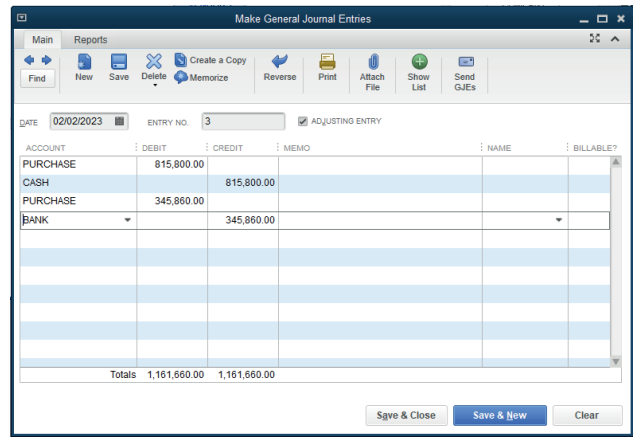

Example: SHYAKA Ltd started its business activities in January 2022. During

January the cash and cheques purchase transactions concluded with all of itssuppliers are valued at FRW 815,800 and FRW 345,860 respectively.

To record this transaction in the general journal, of course the cash, bank and

purchase account are already created in the chart of account. If not QuickBooks

gives an option to add new account while recording. Here all the accounts arecreated in chart of account.

The next step is to debit the account to be debited and credit the account to be

credited respecting the rule of double entry. It means:

Debit Purchase account: 815,800

Credit Cash account: 815,800

Debit Purchase account: 345,860Credit Sales account: 345,860

A purchase transaction is recorded, then Save & Close

5.2.2. Paying the bill

The following steps will be followed for paying vendor bill:

1. Go to the Vendors menu, then select Pay Bills.

2. Select the correct accounts payable account from the dropdown.

3. Select the checkboxes of the bills you want to pay from the table.

Note: To unmark or mark all the bills in the list, select Clear

Selections or Select All Bills.

4. Set any discount or credit that you want to apply to the bills.

• Discount - Select this if your vendor gave you a discount for this

transaction.

• Credit - Select this if you received a credit from your vendor, and you

used it to reduce your total bill amount.

5. Enter the date you paid the bill.

6. Select the payment method:

• Check Select Assign check number if you plan to manually write

the check. Select To be Printed to print the check or add it to the

list of checks to print.

• Credit Card - You can use credit cards to pay bills, then print a

payment stub.

• Online Bill Payment - You can directly pay your vendor bills in

QuickBooks. It also records your payment automatically so your

reports are accurate.

• Online Bank Payment - The payment processor will print and

mail a check to the employee. You can select Include reference

number if you want the bill or credit reference number to be sent

along with your name and account number.

• Cash, Debit or ATM card, Pay pal, or EFT - You can select Check,

then Assign check number even when you’re not paying with an

actual check. Enter the type of payment in the check number field or

leave it blank.

7. Select Pay Selected Bills.

8. Select Done, or select Pay More Bills if you have other bills you needto pay.

Application Activity 5.2.

1. Define a cash purchase

2. List the steps followed in recording a cash purchase

3. Mr. Gashugi purchased goods valued at 2,00,500 FRW by cash.

He also paid 134,550 FRW by cheque for services rendered to him.Record the transaction in QuickBooks and display it.

5.3. Cash/ Cheque purchase transactions and paymentprocesses

Learning Activity 5.3.

Rurangwa is a sole trader who uses to purchase goods and services from

different suppliers. It is his policy to pay directly when goods are deliveredto his company. Discuss the importance of his policy.

A cash transaction refers to a transaction which involves an immediate outflow of

cash towards the purchase of any goods, services, or assets. Cash transaction

can be consumer-oriented or business-oriented. A cash transaction stands

in contrast to other modes of payment, such as credit transactions in

a business involving bills receivable. Similarly, a cash transaction is also differentfrom credit card transactions.

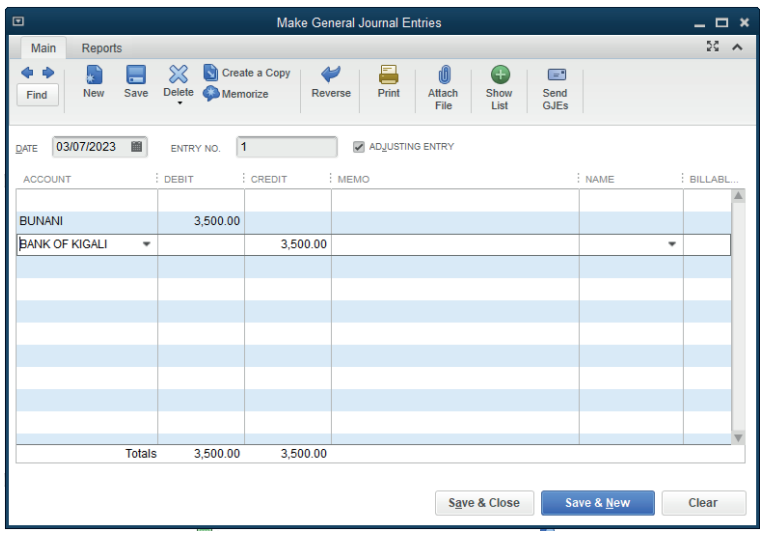

5.3.1. Recording the payment

In QuickBooks, the payment is done either by cheque or credit card. The

accounting entry for this transaction is as follow:

Debit: the vendor (Creditor)Credit: the bank or credit card

Cash or cheque purchase has the advantages below:

• Convenience for small purchases and tipping

• Lower transaction costs

• Negotiating power

• Buyer anonymity

• Budgeting and debt avoidance

• Preparing for emergencies

5.3.2. Payment receipt

This is a document kept by the company from the vendor as a proof of payment.

A copy of it is kept by the vendor. A payment receipt, also known as a receipt of

payment, is a document issued from a business to its customer when they have

received payment for provided goods or services.

This can apply either to partial or full payments, showing a clear record of how

much money has been received and what is still owed. Cash payment receipts

are useful documents both for the buyer and seller. Buyers can see where they

stand with payment, viewing a clear record of what they have paid for. Sellers

can verify the date and other details of a purchase, using this information to

create more detailed financial statements later. In the case of partial payments,receipts are also helpful as they serve as reminders for outstanding balances.

Application Activity 5.3.

1. What is a cash transaction?2. List the importance of cash os cheque purchase transaction

End of Unit Assessment

1. Make a clear difference between credit purchase and cash purchase

transactions

2. During the month of December 2022, B2C Co. Ltd concluded the

following Purchase transactions:

Purchase on credit to; Meddy: FRW 74,450, Modeste: FRW 645,000,

Arsine: FRW 245,000, Cash purchase: 357,450

Required:

• Record these transactions in the journal of B2C Co. Ltd• Prepare the sales receipt.